UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05084

Mutual of America Investment Corporation

(Exact name of registrant as specified in charter)

320 Park Avenue, New York, N.Y. 10022

(Address of principal executive offices) (Zip code)

Chris W. Festog

Chairman of the Board, Chief Executive Officer and Principal Executive Officer

Mutual of America Investment Corporation

320 Park Avenue

New York, NY 10022

(Name and address of agent for service)

Registrant’s telephone number, including area code:

(212) 224-1600

Date of fiscal year end: December 31

Date of reporting period: June 30, 2023

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The Semi-Annual Report to Shareholders follows:

JUNE 30, 2023

Semi-Annual Reports of Mutual of America

Investment Corporation Funds

CONTENTS

MUTUALOF AMERICA INVESTMENT CORPORATION

We are pleased to present the Mutual of America Investment Corporation (the “Investment Company”) Semi-Annual Report. This Report includes important information regarding the performance and financial position of the Investment Company’s Funds for the six months ended June 30, 2023.

Midyear Economic Perspective: Inflation Eases, Volatility Persists

At the midway point of 2023, there were clear signs that the Federal Reserve’s (Fed) efforts to ease inflation through ongoing interest rate increases were making inroads, but how much more the economy still needs to cool to tame inflation is up for debate. Inflation continues to steadily decline, although it remains above the Fed’s target rate of 2%. And consumers are still experiencing inflation’s effects through higher prices for various goods and services.

During the first quarter, the banking crisis heightened market instability and contributed to increased regulations on small and regional banks, tightened lending standards and weakened demand for loans. We believe one of the consequences of the Fed’s aggressive interest rate hikes will be a significant impact on lending activity and, ultimately, have a dampening effect on the economy.

Despite the slow decline, there are positive indicators that have eased some concerns about a recession. Even with job growth slowing, the labor market remains strong — by June, year-over-year gains in wages topped inflation levels for the first time since 2021. In addition, the equity markets have rebounded from a 20% decline in 2022, posting strong returns through June of 2023.

Inflation Remains Above Fed’s Target Rate

The latest reports from three prominent inflation indicators still show levels above the Fed’s 2.0% target, albeit with significant declines since the Fed began raising rates in early 2022, and since inflation reached its peak last summer.

We believe uncertainty in the economy and markets will likely remain elevated through 2023, continuing to impact consumers. In recent months, prices declined for certain essential services and goods, such as food, although a core inflation indicator that excludes food and fuel costs remained persistently high. Inflationary pressures still exist, though, in areas such as housing, healthcare and automobiles. With these and other factors in mind, we expect the Fed may raise interest rates at least once more this year.

Equities and Bonds Show Strength, but Concerns Remain

Major equity indexes showed positive performance in the first half of 2023. The S&P 500® Index rose 16.9% and the Nasdaq composite jumped 32.3%. The Nasdaq’s performance can be attributed to its focus on select technology-related companies, notably Nvidia and Apple. Mega-cap growth stocks thrived, benefiting from smaller interest rate hikes compared to 2022 and being considered safe-haven investments in a low-growth economic environment. These stocks drove the overall performance of the equity markets.

Despite a slight decline in bond prices since the end of the first quarter of 2023, the bond market showed strength on a year-to-date basis through June, largely driven by the slowing frequency and size of interest rate hikes starting in the latter part of 2022. The persistently inverted yield curve has raised concerns about a potential economic slowdown. Notably, an inverted yield curve has preceded the 10 most recent recessions, underscoring its historical correlation with economic downturns.

Strong Labor Market Beginning to Slow

While the labor market has shown resilience, there are concerns about the Fed’s ability to manage job market growth to curb inflation without significantly increasing the unemployment rate. The Fed’s objective is to prevent wage-price spiral inflation, where higher wages lead to increased costs for companies, which may then pass the burden on to consumers. As the impact of rate hikes continues to slow the economy, we expect to see the unemployment level gradually increase through the balance of 2023 and into next year.

As the Fed does everything within its control to curb inflation in the coming months, we expect market turbulence to remain. In times of uncertainty, investors should be encouraged to keep diversified portfolios and ensure their investments reflect their risk tolerance and financial goals.

1

The total return performance (net of investment management and other operating expenses) for each of the Investment Company Funds is reflected below:

| | | | |

| Total Returns — Six Months Ended June 30, 2023 | |

| |

Equity Index Fund | | | 16.82% | |

All America Fund | | | 13.13% | |

Small Cap Value Fund | | | 3.77% | |

Small Cap Growth Fund | | | 13.08% | |

Small Cap Equity Index Fund | | | 6.02% | |

Mid Cap Value Fund | | | 3.52% | |

Mid-Cap Equity Index Fund | | | 8.79% | |

Composite Fund | | | 8.91% | |

International Fund | | | 10.86% | |

Catholic Values Index Fund | | | 17.92% | |

Retirement Income Fund | | | 5.22% | |

2015 Retirement Fund | | | 5.85% | |

2020 Retirement Fund | | | 6.66% | |

2025 Retirement Fund | | | 7.87% | |

2030 Retirement Fund | | | 9.03% | |

2035 Retirement Fund | | | 10.25% | |

2040 Retirement Fund | | | 11.41% | |

2045 Retirement Fund | | | 11.96% | |

2050 Retirement Fund | | | 12.15% | |

2055 Retirement Fund | | | 12.11% | |

2060 Retirement Fund | | | 12.29% | |

2065 Retirement Fund | | | 12.37% | |

Conservative Allocation Fund | | | 6.19% | |

Moderate Allocation Fund | | | 8.95% | |

Aggressive Allocation Fund | | | 10.52% | |

Money Market Fund | | | 2.31% | |

Mid-Term Bond Fund | | | 1.15% | |

Bond Fund | | | 1.97% | |

For variable annuity owners or participants in a group variable annuity, the above performance figures do not reflect the deduction of respective Separate Account fees and expenses imposed by Mutual of America Life Insurance Company. All Fund performances presented throughout this report are historical, reflect the full reinvestment of dividends paid, and should not be considered indicative of future results.

The pages that immediately follow include brief discussions of each Fund’s performance for the six months ended June 30, 2023, compared to its relevant index.

Following the discussions are the graphical representations of the asset allocations of each Fund and an illustration of each Fund’s operating expenses. The portfolios of each Fund and financial statements are presented in the pages that follow.

Thank you for your continued investment in our Funds.

Sincerely,

Chris W. Festog

Chairman of the Board,

Chief Executive Officer and Principal Executive Officer

Mutual of America Investment Corporation

2

The views expressed in this Semi-Annual Report are subject to change at any time based on market and other conditions and should not be construed as a recommendation. This Report contains forward-looking statements which speak only as of the date they were made and involve a number of risks and uncertainties that could cause actual results to differ materially from those expressed herein. Readers are cautioned not to place undue reliance on our forward-looking statements, as we assume no obligation to update these forward-looking statements. Readers assume any and all responsibility for any investment decision made as a result of the views expressed herein.

S&P® and S&P 500® are trademarks of Standard & Poor’s Financial Services LLC.

3

EQUITY INDEX FUND (Unaudited)

The Equity Index Fund’s objective is to replicate the performance of the S&P 500® Index (S&P 500), which consists of 500 stocks chosen by Standard & Poor’s for market size, liquidity and industry group representation. The S&P 500 is a market-weighted index of 500 stocks traded on the New York Stock Exchange, American Stock Exchange and NASDAQ, with each stock’s weight in the index proportionate to its market value. The weightings make each company’s influence on the S&P 500’s performance directly proportional to that company’s market value.

The Equity Index Fund’s performance for the six months ended June 30, 2023, was 16.91% before expenses and 16.82% after expenses. The return of the S&P 500 was 16.89% over the same period. We note that the Equity Index Fund’s net performance reflects transaction fees and operating expenses, which the index does not incur.

ALL AMERICA FUND (Unaudited)

The investment objective of the All America Fund is to outperform the S&P 500® Index (S&P 500). The All America Fund is approximately 60% passively invested in the 500 stocks that comprise the S&P 500, with the remaining 40% actively managed, comprised of 20% mid-cap capitalization stocks and 20% small cap stocks, thus providing exposure to all levels of market capitalization among domestic stocks.

For the six months ended June 30, 2023, the S&P 500 of large capitalization stocks increased by 16.89% on a total return basis, while the Russell® Midcap Core Index was up 9.01% and the Russell Midcap® Value Index was up 5.23%. The Russell 2000® Growth Index increased 13.55% and the Russell 2000® Value Index increased 2.50%.

The All America Fund’s return for the six months ended June 30, 2023, was 13.13% net of expenses versus the benchmark return of 16.89%. The underperformance of the Fund versus the S&P 500 during the year was due to the underperformance of the small and mid-capitalization segments of the Fund as compared to the large capitalization benchmark. We note that the All America Fund’s net performance reflects transaction fees and operating expenses, which the index does not incur.

SMALL CAP VALUE FUND (Unaudited)

The investment objective of the Small Cap Value Fund is capital appreciation. The Small Cap Value Fund generally invests in companies that are below $3 billion in market capitalization and have lower price-to-book characteristics than the overall market.

For the six months ending June 30, 2023, the Small Cap Value Fund outperformed its benchmark, the Russell 2000® Value Index. An attribution analysis shows that the majority of the outperformance came from the Industrial and Consumer Staples sectors. Sectors detracting from performance include Healthcare and Consumer Discretionary. We would also note the S&P 500® 500 Index (+16.9%) outperformed the Russell 2000® Value Index (+2.5%) for the year-to-date period.

For the six months ended June 30, 2023, the Small Cap Value Fund returned 4.20% before expenses and 3.77% after expenses versus a 2.50% return for the Russell 2000® Value Index. We note that the Small Cap Value Fund’s net performance reflects transaction fees and operating expenses, which the index does not incur.

SMALL CAP GROWTH FUND (Unaudited)

The Fund seeks capital appreciation. That is, we invest for long-term growth of capital by investing in companies with small market capitalizations.

Our active small cap growth approach is to seek attractive returns without taking undue risk, which we seek to achieve by investment in companies that have strong fundamentals, a compelling and sustainable business model and are led by a proven management team that has demonstrated the ability to execute on a business plan. Successful investment of capital, we believe, is a significant determinant in a company’s future prospects.

Small cap stocks, as seen, by the Russell 2000® Growth Index, showed strong gains for the six-months ending June 2023. The Fund was competitive with its benchmark and its small cap growth peers. For the first half of 2023, the Russell 2000® Growth Index returned 13.55%, while the Small Cap Growth Fund showed 13.55% before expenses and 13.08% after expenses for the same period. We note that the Small Cap Growth Fund’s net performance reflects transaction fees and operating expenses, which the index does not incur.

Of the three traditional growth sectors, consumer discretionary and information technology showed double-digit returns and outperformed the small cap growth equity marketplace; Healthcare despite its attractive return did not outperform our Index. Nonetheless, our stock selection in the Materials, Healthcare and Industrial sectors contributed the most of any 3-sectors of the fund for the first six-months of the year.

4

Healthcare Equipment & Supplies and Industrial Machinery were the two areas that contributed the most to investment results whereas poor stock selection in the Technology Hardware and Aerospace & Defense industries detracted from overall performance.

For the six-month period, we were underweight non-earning companies. We outperformed in this area but our more conservative positioning did not benefit investment results.

Bottom-up, fundamental company research begins with ideas generation, which leverages the knowledge, depth, and scope of the investment professionals in our organization to identify candidates. We are long term investors with a 3- to 5- year time horizon. We employ a disciplined approach to portfolio construction through understanding and measuring risk.

SMALL CAP EQUITY INDEX FUND (Unaudited)

The Small Cap Equity Index Fund invests in the 600 stocks that comprise the S&P SmallCap 600® Index (S&P SmallCap 600). The S&P SmallCap 600 is a market-weighted index of 600 stocks traded on the New York Stock Exchange, American Stock Exchange and NASDAQ. The weightings make each company’s influence on the S&P SmallCap 600’s performance directly proportional to that company’s market value.

The Small Cap Equity Index Fund’s return for six months ended June 30, 2023 was 6.10% before expenses and 6.02% after expenses. The return of the S&P SmallCap 600 was 6.03%. We note that the Small Cap Equity Index Fund’s net performance reflects transaction fees and operating expenses, which the index does not incur.

MID CAP VALUE FUND (Unaudited)

The investment objective of the Mid Cap Value Fund is to outperform the Russell Midcap® Value Index. The Mid Cap Value Fund generally invests in companies that are between $5 billion and $30 billion in market capitalization and have lower price-to-book characteristics.

For the six months ending June 30, 2023, the Mid Cap Value Fund underperformed its benchmark, the Russel Midcap® Value Index. An attribution analysis shows that the majority of the underperformance came from the Consumer Discretionary and Information Technology sectors. Sectors adding to performance include Industrial and Communication Services. We would also note the S&P 500 (+16.9%) outperformed the Russell Midcap® Value Index (+5.2%) for the year-to-date period.

For the six months ended June 30, 2023, the Mid Cap Value Fund returned 3.88% before expenses and 3.52% after expenses versus a 5.23% return for the Russell Midcap® Value Index. We note that the Mid Cap Value Fund’s net performance reflects transaction fees and operating expenses, which the index does not incur.

MID-CAP EQUITY INDEX FUND (Unaudited)

The Mid-Cap Equity Index Fund invests in the 400 stocks that comprise the S&P MidCap 400® Index (S&P MidCap 400). The S&P MidCap 400 is a market-weighted index of 400 stocks traded on the New York Stock Exchange, American Stock Exchange and NASDAQ. The weightings make each company’s influence on the S&P MidCap 400’s performance directly proportional to that company’s market value. The companies included in the S&P MidCap 400 tend to be typical of this asset class, the medium-capitalized sector of the U.S. securities market.

The Mid-Cap Equity Index Fund’s performance for the six months ended June 30, 2023, was 8.88% before expenses and 8.79% after expenses. The return of the S&P MidCap 400 was 8.84% over the same period. We note that the Mid-Cap Equity Index Fund’s net performance reflects transaction fees and operating expenses, which the index does not incur.

COMPOSITE FUND (Unaudited)

The Composite Fund seeks capital appreciation and current income by investing in a diversified portfolio of common stocks, debt securities and money market instruments.

The primary investment objective of the fixed income portion of the Fund (i.e. the portion that invests in debt securities and money market instruments) is to provide a high level of current income, consistent with capital preservation, while minimizing volatility. It does this by investing primarily in investment grade publicly traded debt securities. The securities held include corporate, U.S. agency and mortgage-backed securities, all of which normally yield more than U.S. Treasury issues.

5

For the six months ended June 30, 2023, the fixed income portion of the Fund had a total return of 2.12% before expenses. The Bloomberg U.S. Aggregate Index returned 2.09% for the six months ended June 30, 2023.

The primary objective of the equity portion of the Composite Fund (i.e. the portion that invests in common stocks) is to provide exposure to a diversified portfolio of primarily large capitalization, domestic equity securities that have the potential to outperform their peer group over the medium to long term. The portfolio has a focus on dividend income and aims to continually earn a dividend yield that is higher than that of its benchmark without taking significant over or under weights in any sector.

For the six months ended June 30, 2023, the equity portion of the Fund had a total return of 13.54% (before expenses), underperforming the S&P 500® Index (S&P 500) which increased 16.89%.

The Fund’s aggregate performance for the six months ended June 30, 2023 was 9.20% before expenses and 8.91% after expenses, versus a 10.87% return in the blended benchmark. We note that the Composite Fund’s net performance reflects transaction fees and operating expenses, which the index does not incur.

INTERNATIONAL FUND (Unaudited)

The International Fund seeks capital appreciation by investing primarily in stocks of large and mid-cap companies in developed market countries located outside of the United States and Canada that are reflected or contained in the Morgan Stanley Capital International, Inc. Europe, Australasia and Far East® Index (MSCI EAFE® Index). The Fund may also invest in exchange traded funds within the general limitations of the Investment Company Act of 1940.

For the six months ended June 30, 2023, the International Fund returned 10.93% before expenses and 10.86% after expenses. The return of the MSCI EAFE benchmark was 11.67%. The slight underperformance of the Fund was due to a market preference for growth stocks, whereas the Fund tends to favor value and dividend paying stocks as part of its investment strategy. We note that the International Fund’s net performance reflects transaction fees and operating expenses, which the index does not incur.

CATHOLIC VALUES INDEX FUND (Unaudited)

The Catholic Values Index Fund’s objective is to replicate the performance of the S&P 500® Catholic Values Index (Catholic Values Index). The Catholic Values Index is designed to provide exposure to U.S. large capitalization stocks included in the S&P 500® Index (S&P 500) while maintaining alignment with the moral and social teachings of the Catholic Church. The Catholic Values Index is based on the S&P 500, and generally comprises approximately 500 or less U.S. listed common stocks. All index constituents are members of the S&P 500 and follow the eligibility criteria for that index. From this starting universe, constituents are screened to exclude companies involved in activities which are perceived to be inconsistent with Catholic values as outlined in the Socially Responsible Investment Guidelines of the United States Conference of Catholic Bishops, currently including the protection of human life, promotion of human dignity, reducing arms production, affordable housing and banking, protection of the environment and encouraging corporate responsibility. The Catholic Values Index then reweights the remaining constituents so that the Catholic Values Index’s sector exposures approximate the sector exposures on the S&P 500.

The Catholic Values Index Fund’s performance for the six months ended June 30, 2023, was 18.05% before expenses and 17.92% after expenses. The benchmark returned 18.06%. We note that the Catholic Values Index Fund’s net performance reflects transaction fees and operating expenses, which the index does not incur.

TARGET DATE (RETIREMENT) SERIES

All of the Funds in the Target Date Series had positive performance during the six month period and exceeded the return of their corresponding Morningstar benchmark. For the six months ended June 30, 2023, the return for the S&P 500® Index was 16.89%, for the Bloomberg U.S. Aggregate Bond Index was 2.09% and for the FTSE 3-Month Treasury Bill Index was 2.39%.

Compared to competitors, our relative underweight to International equities versus Domestic was a positive driver of performance, as U.S. equities outperformed. Our relative overweight to small and mid-capitalization equities relative to other providers was a headwind to performance, as these asset classes trailed large cap stocks.

The equity market had very strong returns in the first half, led by a small number of mega cap companies, as investors bid up stocks in the face of declining inflation and a continued strong labor market. Since the Fed will continue to raise rates until inflation has reached its target of around 2%, and given how far equities have come in the first half of the year, we believe that the second half of this year could be a more difficult investment environment. We continue to believe that our Funds are well positioned to continue delivering attractive long-term returns.

6

RETIREMENT INCOME FUND (Unaudited)

The objective of the Retirement Income Fund is current income consistent with the preservation of capital and, to a lesser extent, capital appreciation. The Retirement Income Fund invests primarily in the fixed-income Funds of the Investment Company and also invests in the equity Funds of the Investment Company. The Fund’s current target allocation is approximately 70% of net assets in fixed-income and money market Funds and approximately 30% of net assets in equity Funds.

Performance for the Retirement Income Fund is compared to the Bloomberg U.S. Aggregate Bond Index, the FTSE 3-Month Treasury Bill Index and the S&P 500® Index. In addition, we compare the performance of our Fund to an industry benchmark from Morningstar that corresponds to the particular objective of the Fund. For the six months ended June 30, 2023, the Fund returned 5.22% net of expenses, versus a 3.75% return for the Morningstar benchmark. We note that the Retirement Income Fund’s net performance reflects direct management fees and the expenses of the underlying funds in which the Fund invests, which the indices do not incur.

2015 RETIREMENT FUND (Unaudited)

The objective of the 2015 Retirement Fund is current income and capital appreciation appropriate for the asset allocation associated with a retirement in 2015. The 2015 Retirement Fund invests in Funds of the Investment Company. The Fund’s current target allocation is approximately 68% of net assets in fixed-income and money market Funds and approximately 32% of net assets in equity Funds.

Performance for the 2015 Retirement Fund is compared to the Bloomberg U.S. Aggregate Bond Index, the FTSE 3-Month Treasury Bill Index and the S&P 500® Index. In addition, we compare the performance of our Fund to an industry benchmark from Morningstar that corresponds to the particular objective of the Fund. For the six months ended June 30, 2023, the Fund returned 5.85% net of expenses, versus a 4.32% return for the Morningstar benchmark. We note that the 2015 Retirement Fund’s net performance reflects direct management fees and the expenses of the underlying funds in which the Fund invests, which the indices do not incur.

2020 RETIREMENT FUND (Unaudited)

The objective of the 2020 Retirement Fund is current income and capital appreciation appropriate for the asset allocation associated with a retirement in 2020. The 2020 Retirement Fund invests in Funds of the Investment Company. The Fund’s current target allocation is approximately 61% of net assets in fixed-income and money market Funds and approximately 39% of net assets in equity Funds.

Performance for the 2020 Retirement Fund is compared to the Bloomberg U.S. Aggregate Bond Index, the FTSE 3-Month Treasury Bill Index and the S&P 500® Index. In addition, we compare the performance of our Fund to an industry benchmark from Morningstar that corresponds to the particular objective of the Fund. For the six months ended June 30, 2023, the Fund returned 6.66% net of expenses, versus a 6.13% return for the Morningstar benchmark. We note that the 2020 Retirement Fund’s net performance reflects direct management fees and the expenses of the underlying funds in which the Fund invests, which the indices do not incur.

2025 RETIREMENT FUND (Unaudited)

The objective of the 2025 Retirement Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2025. The 2025 Retirement Fund invests in Funds of the Investment Company. The Fund’s current target allocation is approximately 49% of net assets in equity Funds and approximately 51% of net assets in fixed-income and money market Funds.

Performance for the 2025 Retirement Fund is compared to the S&P 500® Index, the Bloomberg U.S. Aggregate Bond Index and the FTSE 3-Month Treasury Bill Index. In addition, we compare the performance of our Fund to an industry benchmark from Morningstar that corresponds to the particular objective of the Fund. For the six months ended June 30, 2023, the Fund returned 7.87% net of expenses, versus a 6.70% return for the Morningstar benchmark. We note that the 2025 Retirement Fund’s net performance reflects direct management fees and the expenses of the underlying funds in which the Fund invests, which the indices do not incur.

7

2030 RETIREMENT FUND (Unaudited)

The objective of the 2030 Retirement Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2030. The 2030 Retirement Fund invests in Funds of the Investment Company. The Fund’s current target allocation is approximately 59% of net assets in equity Funds and approximately 41% of net assets in fixed-income and money market Funds.

Performance for the 2030 Retirement Fund is compared to the S&P 500® Index, the Bloomberg U.S. Aggregate Bond Index and the FTSE 3-Month Treasury Bill Index. In addition, we compare the performance of our Fund to an industry benchmark from Morningstar that corresponds to the particular objective of the Fund. For the six months ended June 30, 2023, the Fund returned 9.03% net of expenses, versus a 7.43% return for the Morningstar benchmark. We note that the 2030 Retirement Fund’s net performance reflects direct management fees and the expenses of the underlying funds in which the Fund invests, which the indices do not incur.

2035 RETIREMENT FUND (Unaudited)

The objective of the 2035 Retirement Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2035. The 2035 Retirement Fund invests in Funds of the Investment Company. The Fund’s current target allocation is approximately 71% of net assets in equity Funds and approximately 29% of net assets in the fixed-income and money market Funds.

Performance for the 2035 Retirement Fund is compared to the S&P 500® Index, the Bloomberg U.S. Aggregate Bond Index and the FTSE 3-Month Treasury Bill Index. In addition, we compare the performance of our Fund to an industry benchmark from Morningstar that corresponds to the particular objective of the Fund. For the six months ended June 30, 2023, the Fund returned 10.25% net of expenses, versus a 8.29% return for the Morningstar benchmark. We note that the 2035 Retirement Fund’s net performance reflects direct management fees and the expenses of the underlying funds in which the Fund invests, which the indices do not incur.

2040 RETIREMENT FUND (Unaudited)

The objective of the 2040 Retirement Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2040. The 2040 Retirement Fund invests in Funds of the Investment Company. The Fund’s current target allocation is approximately 81% of net assets in equity Funds and approximately 19% of net assets in the fixed-income and money market Funds.

Performance for the 2040 Retirement Fund is compared to the S&P 500® Index, the Bloomberg U.S. Aggregate Bond Index and the FTSE 3-Month Treasury Bill Index. In addition, we compare the performance of our Fund to an industry benchmark from Morningstar that corresponds to the particular objective of the Fund. For the six months ended June 30, 2023, the Fund returned 11.41% net of expenses, versus a 9.10% return for the Morningstar benchmark. We note that the 2040 Retirement Fund’s net performance reflects direct management fees and the expenses of the underlying funds in which the Fund invests, which the indices do not incur.

2045 RETIREMENT FUND (Unaudited)

The objective of the 2045 Retirement Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2045. The 2045 Retirement Fund invests in Funds of the Investment Company. The Fund’s current target allocation is approximately 86% of net assets in equity Funds and approximately 14% of net assets in the fixed-income and money market Funds.

Performance for the 2045 Retirement Fund is compared to the S&P 500® Index, the Bloomberg U.S. Aggregate Bond Index and the FTSE 3-Month Treasury Bill Index. In addition, we compare the performance of our Fund to an industry benchmark from Morningstar that corresponds to the particular objective of the Fund. For the six months ended June 30, 2023, the Fund returned 11.96% net of expenses, versus a 9.65% return for the Morningstar benchmark. We note that the 2045 Retirement Fund’s net performance reflects direct management fees and the expenses of the underlying funds in which the Fund invests, which the indices do not incur.

8

2050 RETIREMENT FUND (Unaudited)

The objective of the 2050 Retirement Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2050. The 2050 Retirement Fund invests in Funds of the Investment Company. The Fund’s current target allocation is approximately 88% of net assets in equity Funds and approximately 12% of net assets in the fixed-income and money market Funds.

Performance for the 2050 Retirement Fund is compared to the S&P 500® Index, the Bloomberg U.S. Aggregate Bond Index and the FTSE 3-Month Treasury Bill Index. In addition, we compare the performance of our Fund to an industry benchmark from Morningstar that corresponds to the particular objective of the Fund. For the six months ended June 30, 2023, the Fund returned 12.15% net of expenses, versus a 9.86% return for the Morningstar benchmark. We note that the 2050 Retirement Fund’s net performance reflects direct management fees and the expenses of the underlying funds in which the Fund invests, which the indices do not incur.

2055 RETIREMENT FUND (Unaudited)

The objective of the 2055 Retirement Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2055. The 2055 Retirement Fund invests in Funds of the Investment Company. The Fund’s current target allocation is approximately 91% of net assets in equity Funds and approximately 9% of net assets in the fixed-income and money market Funds.

Performance for the 2055 Retirement Fund is compared to the S&P 500® Index, the Bloomberg U.S. Aggregate Bond Index and the FTSE 3-Month Treasury Bill Index. In addition, we compare the performance of our Fund to an industry benchmark from Morningstar that corresponds to the particular objective of the Fund. For the six months ended June 30, 2023, the Fund returned 12.11% net of expenses, versus a 9.86% return for the Morningstar benchmark. We note that the 2055 Retirement Fund’s net performance reflects direct management fees and the expenses of the underlying funds in which the Fund invests, which the indices do not incur.

2060 RETIREMENT FUND (Unaudited)

The objective of the 2060 Retirement Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2060. The 2060 Retirement Fund invests in Funds of the Investment Company. The Fund’s current target allocation is approximately 93% of net assets in equity Funds and approximately 7% of net assets in the fixed-income and money market Funds.

Performance for the 2060 Retirement Fund is compared to the S&P 500® Index, the Bloomberg U.S. Aggregate Bond Index and the FTSE 3-Month Treasury Bill Index. In addition, we compare the performance of our Fund to an industry benchmark from Morningstar that corresponds to the particular objective of the Fund. For the six months ended June 30, 2023, the Fund returned 12.29% net of expenses, versus a 9.83% return for the Morningstar benchmark. We note that the 2060 Retirement Fund’s net performance reflects direct management fees and the expenses of the underlying funds in which the Fund invests, which the indices do not incur.

2065 RETIREMENT FUND (Unaudited)

The objective of the 2065 Retirement Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2065. The 2065 Retirement Fund invests in Funds of the Investment Company. The Fund’s current target allocation is approximately 95% of net assets in equity Funds and approximately 5% of net assets in the fixed-income and money market Funds.

Performance for the 2065 Retirement Fund is compared to the S&P 500® Index, the Bloomberg U.S. Aggregate Bond Index and the FTSE 3-Month Treasury Bill Index. In addition, we compare the performance of our Fund to an industry benchmark from Morningstar that corresponds to the particular objective of the Fund. For the six months ended June 30, 2023, the Fund returned 12.37% net of expenses, versus a 9.76% return for the Morningstar benchmark. We note that the 2065 Retirement Fund’s net performance reflects direct management fees and the expenses of the underlying funds in which the Fund invests, which the indices do not incur.

9

CONSERVATIVE ALLOCATION FUND (Unaudited)

The objective of the Conservative Allocation Fund is current income and, to a lesser extent, capital appreciation. The Conservative Allocation Fund invests primarily in the fixed-income Funds of the Investment Company and also invests in the equity Funds of the Investment Company. The Conservative Allocation Fund’s target allocation is approximately 65% of net assets in fixed-income Funds and approximately 35% of net assets in equity Funds.

Performance for the Conservative Allocation Fund is compared to the Bloomberg U.S. Aggregate Bond Index, which returned 2.09% for the six months ended June 30, 2023, and the S&P 500® Index, which returned 16.89% for the period. In addition, we compare the performance of our Fund to an industry benchmark from Morningstar that corresponds to the particular objective of the Fund. For the six months ended June 30, 2023, the Conservative Allocation Fund returned 6.19% net of expenses, versus a 7.09% return for the Morningstar benchmark. We note that the Conservative Allocation Fund’s net performance reflects direct operating expenses and the expenses of the underlying funds in which the Fund invests, which the indices do not incur.

MODERATE ALLOCATION FUND (Unaudited)

The objective of the Moderate Allocation Fund is capital appreciation and current income. The Moderate Allocation Fund invests in the equity and fixed-income Funds of the Investment Company. The Moderate Allocation Fund’s target allocation is approximately 60% of net assets in equity Funds and approximately 40% of net assets in fixed-income Funds.

Performance for the Moderate Allocation Fund is compared to the S&P 500® Index, which returned 16.89% for the six months ended June 30, 2023, and the Bloomberg U.S. Aggregate Bond Index, which returned 2.09% for the period. In addition, we compare the performance of our Fund to an industry benchmark from Morningstar that corresponds to the particular objective of the Fund. For the six months ended June 30, 2023, the Moderate Allocation Fund returned 8.95% net of expenses, versus a 9.79% return for the Morningstar benchmark. We note that the Moderate Allocation Fund’s net performance reflects direct operating expenses and the expenses of the underlying funds in which the Fund invests, which the indices do not incur.

AGGRESSIVE ALLOCATION FUND (Unaudited)

The objective of the Aggressive Allocation Fund is capital appreciation and, to a lesser extent, current income. The Aggressive Allocation Fund invests in the equity and fixed-income Funds of the Investment Company. The Aggressive Allocation Fund’s target allocation is approximately 80% of net assets in equity Funds and approximately 20% of net assets in the fixed-income Funds.

Performance for the Aggressive Allocation Fund is compared to the S&P 500® Index, which returned 16.89% for the six months ended June 30, 2023, and the Bloomberg U.S. Aggregate Bond Index, which returned 2.09% for the period. In addition, we compare the performance of our Fund to an industry benchmark from Morningstar that corresponds to the particular objective of the Fund. For the six months ended June 30, 2023, the Aggressive Allocation Fund returned 10.52% net of expenses, versus a 11.64% return for the Morningstar benchmark. We note that the Aggressive Allocation Fund’s net performance reflects direct operating expenses and the expenses of the underlying funds in which the Fund invests, which the indices do not incur.

MONEY MARKET FUND (Unaudited)

The Money Market Fund’s investment objective is to realize current income while maintaining liquidity, investment quality and stability of capital through investing in high-quality commercial paper issued by U.S. corporations and securities issued by the U.S. government and its agencies. For the six months ended June 30, 2023, the Money Market Fund returned 2.42% before expenses and 2.31% after expenses, compared to a 2.39% return for the FTSE 3-Month Treasury Bill Index. We note that the Money Market Fund’s net performance reflects management fees and operating expenses, which the index does not incur.

The Fund’s strategy will continue to focus on quality, liquidity, and maintaining a relatively short weighted average maturity. On June 30, 2023, the Fund held 53.1% in U.S. Treasury Bills, 7.6% in U.S. agency discount notes, and the remainder in commercial paper. The average maturity was 25 days.

The seven-day effective yield as of June 30, 2023, was 4.94%. As with all performance reporting, this yield is not necessarily indicative of future annual yields. Neither the Federal Deposit Insurance Corporation nor any other U.S. government agency insures or guarantees investments in shares of the Money Market Fund.

10

MID-TERM BOND FUND (Unaudited)

The Mid-Term Bond Fund is focused on both preservation of capital and providing a high level of current income consistent with prudent investment risk. The Fund invests primarily in investment grade publicly traded debt securities. The securities held by the Mid-Term Bond Fund include U.S. Treasury bonds and Investment Grade corporate bonds.

Over the longer term, the Mid-Term Bond Fund’s strategy is to provide return and income by harvesting the credit risk premium across credit sensitive asset classes and identifying relative value between the major asset classes of the Fund’s index, the Bloomberg Intermediate U.S. Government/Credit Bond Index. The Fund maintains a maturity profile similar to that of its index. The Fund’s corporate positions remain highly diversified to help manage the portfolio’s credit risks.

For the six months ended June 30, 2023, the Mid-Term Bond Fund returned 1.38% (before expenses) and 1.15% (after expenses) versus a 1.50% return of the Bloomberg Intermediate U.S. Government/Credit Bond Index. We note that the Mid-Term Bond Fund’s net performance reflects transaction fees and operating expenses, which the index does not incur. The Fund’s underperformance can be attributed to its underweight positions in both duration and corporate credit securities. As a result of the Fund’s smaller exposure to corporates, the Fund was outpaced by the benchmark due to the rally in credit that occurred to close the first half of 2023. We maintained our “up-in-quality” and shorter duration stance through this period.

2023 has thus far seen significant market volatility highlighted by the failure of several regional banks in the United States and the hastily arranged takeover of Credit Suisse by UBS. These events sent U.S. Treasury yields plummeting and conversely sent risk asset spreads to much wider levels before recovering to close the first half of the year.

The Treasury curve remains inverted across the Fed’s ‘preferred measure’ of yield curve measurement, the yield spread between the 3-month and 10-year Treasury, which remains in deeply negative territory. Yield curve inversion is considered a reliable indicator for potential recession, and we remain wary of the economic effects of the Fed’s fight against inflation.

The Federal Reserve Chair has maintained that combatting inflation remains one of the primary goals of this Fed and has consistently communicated that rates will need to remain high until the threat of inflation has well passed. As a result, the market has largely traded around inflation data, with rates reflecting the market’s pricing of the next incremental piece of inflation information and thus, the next potential hike by the Fed. We continue to believe that the Fed will remain committed in its fight against inflation.

BOND FUND (Unaudited)

The Bond Fund is focused on both preservation of capital and providing a high level of current income consistent with prudent investment risk. The Fund invests primarily in investment grade publicly traded debt securities. The securities held by the Bond Fund include U.S. Treasury, U.S. Agency and Mortgage-Backed securities, and Investment Grade corporate bonds.

Over the longer term, the Bond Fund’s strategy is to provide return and income by harvesting the credit risk premium across credit sensitive asset classes and identifying relative value between the major asset classes of the Fund’s benchmark, the Bloomberg U.S. Aggregate Bond Index (U.S. Treasuries, Mortgage-Backed Securities, and Investment Grade Corporate Credit). The Fund’s aim is to maintain a similar maturity profile to its benchmark. The Fund also stresses diversification to help mitigate or manage the risk of unexpected credit events.

The Fund’s benchmark, the Bloomberg U.S. Aggregate Bond Index, returned 2.09% for the six months ended June 30, 2023. The Bond Fund returned 2.19% (before expenses) and 1.97% net of expenses during the same period. We note that the Bond Fund’s net performance reflects transaction fees and operating expenses, which the index does not incur. The Fund’s outperformance (before expenses) can be attributed mainly to positive security selection in Mortgage-Backed securities, and an overweight position in U.S. Treasury securities relative to the benchmark. The Fund’s relative underweight allocation to Corporate Credit was a detractor from performance. Overall, we remain slightly shorter in duration than the benchmark.

2023 has thus far seen significant market volatility highlighted by the failure of several regional banks in the United States and the hastily arranged takeover of Credit Suisse by UBS. These events sent U.S. Treasury yields plummeting and conversely sent risk asset spreads to much wider levels before recovering to close the first half of the year.

The Treasury curve remains inverted across the Fed’s ‘preferred measure’ of yield curve measurement, the yield spread between the 3-month and 10-year Treasury, which remains in deeply negative territory. Yield curve inversion is considered a reliable indicator for potential recession, and we remain wary of the economic effects of the Fed’s fight against inflation.

11

The Federal Reserve Chair has maintained that combatting inflation remains one of the primary goals of this Fed and has consistently communicated that rates will need to remain high until the threat of inflation has well passed. As a result, the market has largely traded around inflation data, with rates reflecting the market’s pricing of the next incremental piece of inflation information and thus, the next potential hike by the Fed. We continue to believe that the Fed will remain committed in its fight against inflation.

12

MUTUAL OF AMERICA INVESTMENT CORPORATION

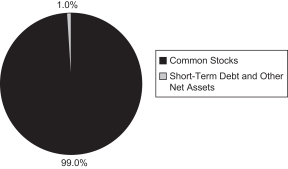

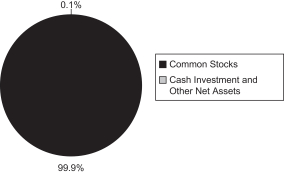

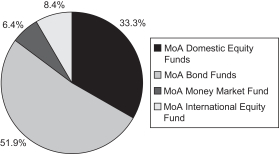

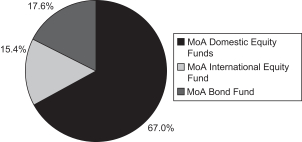

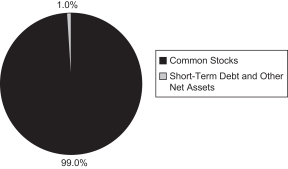

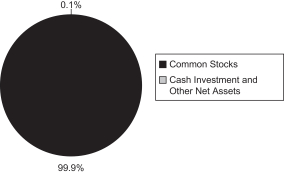

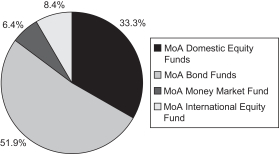

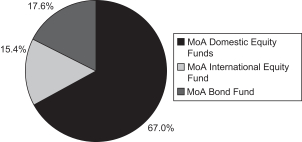

ASSET ALLOCATIONS AS OF JUNE 30, 2023 (Unaudited)

Equity Index Fund

All America Fund

Small Cap Value Fund

Small Cap Growth Fund

Small Cap Equity Index Fund

Mid Cap Value Fund

13

MUTUAL OF AMERICA INVESTMENT CORPORATION

ASSET ALLOCATIONS AS OF JUNE 30, 2023 (Unaudited) (Continued)

Mid-Cap Equity Index Fund

Composite Fund

International Fund

Catholic Values Index Fund

Retirement Income Fund

2015 Retirement Fund

14

MUTUAL OF AMERICA INVESTMENT CORPORATION

ASSET ALLOCATIONS AS OF JUNE 30, 2023 (Unaudited) (Continued)

2020 Retirement Fund

2025 Retirement Fund

2030 Retirement Fund

2035 Retirement Fund

2040 Retirement Fund

2045 Retirement Fund

15

MUTUAL OF AMERICA INVESTMENT CORPORATION

ASSET ALLOCATIONS AS OF JUNE 30, 2023 (Unaudited) (Continued)

2050 Retirement Fund

2055 Retirement Fund

2060 Retirement Fund

2065 Retirement Fund

Conservative Allocation Fund

Moderate Allocation Fund

16

MUTUAL OF AMERICA INVESTMENT CORPORATION

ASSET ALLOCATIONS AS OF JUNE 30, 2023 (Unaudited) (Continued)

Aggressive Allocation Fund

Money Market Fund

Mid-Term Bond Fund

Bond Fund

17

MUTUAL OF AMERICA INVESTMENT CORPORATION

EXPENSE EXAMPLE (Unaudited)

EXAMPLE

As a shareholder of one of the Mutual of America Investment Corporation Funds, you incur ongoing costs, including management fees and other Fund expenses. You do not incur transactional costs, such as sales charges (loads), redemption fees or exchange fees. Additionally, Mutual of America Capital Management LLC, the Funds’ Adviser, has contractually agreed to reimburse the direct non-advisory operating expenses of any Allocation or Retirement Fund (each a “Fund of Funds”) that has less than $50 million in average daily net assets for the prior calendar year. This contractual obligation remains in effect through April 30, 2024 and will continue for succeeding 12 month periods ending April 30th unless i) The Fund of Funds has at least $50 million in average daily net assets for the prior calendar year, ii) the Investment Company gives not less than 30 days written notice to the Adviser, or iii) the Adviser gives 45 days advance notice to the Investment Company before the next May 1 of a given year to terminate the agreement. In that case, the agreement will terminate on the next May 1 following the written notice. Furthermore, the Funds’ Adviser has contractually agreed to reimburse the non-advisory operating expenses of the Small Cap Equity Index and the Catholic Values Index Funds to the extent that such operating expenses exceed 0.07% of the respective Fund’s net assets. This contractual obligation remains in effect through April 30, 2024, and continues into successive 12 month periods ending April 30 unless i) the Investment Company gives not less than 30 days written notice to the Adviser, or ii) the Adviser gives 45 days advance notice to the Investment Company before the next May 1 of a given year to terminate the agreement. In that case, the agreement will terminate on the next May 1 following the written notice.

This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at January 1, 2023 and held for the entire period ending June 30, 2023 under the expense reimbursement agreement in effect during that period as described above.

For variable annuity owners or participants in a group variable annuity, the estimate of expenses does not include fees and charges associated with your variable annuity. If those fees and charges were included, the estimate of expenses for the period would be higher and your ending account value would be lower.

ACTUAL EXPENSES

The first line of the tables below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000=8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the tables below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning other non-Mutual of America funds, which may also charge transactional costs, such as sales charges (loads), redemption fees or exchange fees, which the Mutual of America Investment Corporation does not charge.

| | | | | | | | | | | | | | | | | | |

| | | Equity Index Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,168.25 | | | | $0.75 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,024.10 | | | | $0.70 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.14%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

18

MUTUAL OF AMERICA INVESTMENT CORPORATION

EXPENSE EXAMPLE (Unaudited) (Continued)

| | | | | | | | | | | | | | | | | | |

| | | All America Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,131.32 | | | | $2.70 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,022.27 | | | | $2.56 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.51%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | | | | | | | | | | | | | | | | | |

| | | Small Cap Value Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,037.66 | | | | $4.19 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,020.68 | | | | $4.16 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.83%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | | | | | | | | | | | | | | | | | |

| | | Small Cap Growth Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,130.79 | | | | $4.39 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,020.68 | | | | $4.16 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.83%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | | | | | | | | | | | | | | | | | |

| | | Small Cap Equity Index Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,060.20 | | | | $0.72 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,024.10 | | | | $0.70 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.14%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

19

MUTUAL OF AMERICA INVESTMENT CORPORATION

EXPENSE EXAMPLE (Unaudited) (Continued)

| | | | | | | | | | | | | | | | | | |

| | | Mid Cap Value Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,035.18 | | | | $3.53 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,021.32 | | | | $3.51 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.70%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | | | | | | | | | | | | | | | | | |

| | | Mid-Cap Equity Index Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,087.94 | | | | $0.78 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,024.05 | | | | $0.75 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.15%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | | | | | | | | | | | | | | | | | |

| | | Composite Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,089.06 | | | | $2.69 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,022.22 | | | | $2.61 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.52%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | | | | | | | | | | | | | | | | | |

| | | International Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,108.63 | | | | $0.73 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,024.10 | | | | $0.70 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.14% (reflecting direct expenses and the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

20

MUTUAL OF AMERICA INVESTMENT CORPORATION

EXPENSE EXAMPLE (Unaudited) (Continued)

| | | | | | | | | | | | | | | | | | |

| | | Catholic Values Index Fund | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,179.22 | | | | $1.19 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,023.70 | | | | $1.10 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.22%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | | | | | | | | | | | | | | | | | |

| | | Retirement Income Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,052.23 | | | | $2.49 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,022.36 | | | | $2.46 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.49% (reflecting direct expenses and the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | | | | | | | | | | | | | | | | | |

| | | 2015 Retirement Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,058.48 | | | | $2.65 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,022.22 | | | | $2.61 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.52% (reflecting direct expenses and the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | | | | | | | | | | | | | | | | | |

| | | 2020 Retirement Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,066.64 | | | | $2.15 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,022.71 | | | | $2.11 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.42% (reflecting direct expenses and the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

21

MUTUAL OF AMERICA INVESTMENT CORPORATION

EXPENSE EXAMPLE (Unaudited) (Continued)

| | | | | | | | | | | | | | | | | | |

| | | 2025 Retirement Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,078.68 | | | | $1.96 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,022.91 | | | | $1.91 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.38% (reflecting direct expenses and the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | | | | | | | | | | | | | | | | | |

| | | 2030 Retirement Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,090.29 | | | | $1.81 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,023.06 | | | | $1.76 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.35% (reflecting direct expenses and the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | | | | | | | | | | | | | | | | | |

| | | 2035 Retirement Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,102.55 | | | | $1.62 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,023.26 | | | | $1.56 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.31% (reflecting direct expenses and the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | | | | | | | | | | | | | | | | | |

| | | 2040 Retirement Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,114.13 | | | | $1.57 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,023.31 | | | | $1.51 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.30% (reflecting direct expenses and the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

22

MUTUAL OF AMERICA INVESTMENT CORPORATION

EXPENSE EXAMPLE (Unaudited) (Continued)

| | | | | | | | | | | | | | | | | | |

| | | 2045 Retirement Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,119.57 | | | | $1.47 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,023.41 | | | | $1.40 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.28% (reflecting direct expenses and the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | | | | | | | | | | | | | | | | | |

| | | 2050 Retirement Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,121.54 | | | | $1.53 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,023.36 | | | | $1.45 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.29% (reflecting direct expenses and the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | | | | | | | | | | | | | | | | | |

| | | 2055 Retirement Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,121.13 | | | | $1.63 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,023.26 | | | | $1.56 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.31% (reflecting direct expenses and the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | | | | | | | | | | | | | | | | | |

| | | 2060 Retirement Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,122.92 | | | | $1.79 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,023.11 | | | | $1.71 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.34% (reflecting direct expenses and the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

23

MUTUAL OF AMERICA INVESTMENT CORPORATION

EXPENSE EXAMPLE (Unaudited) (Continued)

| | | | | | | | | | | | | | | | | | |

| | | 2065 Retirement Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,123.66 | | | | $1.32 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,023.55 | | | | $1.25 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.25% (reflecting direct expenses and the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | | | | | | | | | | | | | | | | | |

| | | Conservative Allocation Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,061.95 | | | | $2.20 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,022.66 | | | | $2.16 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.43% (reflecting direct expenses and the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | | | | | | | | | | | | | | | | | |

| | | Moderate Allocation Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,089.54 | | | | $1.61 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,023.26 | | | | $1.56 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.31% (reflecting direct expenses and the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | | | | | | | | | | | | | | | | | |

| | | Aggressive Allocation Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,105.25 | | | | $1.67 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,023.21 | | | | $1.61 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.32% (reflecting direct expenses and the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

24

MUTUAL OF AMERICA INVESTMENT CORPORATION

EXPENSE EXAMPLE (Unaudited) (Continued)

| | | | | | | | | | | | | | | | | | |

| | | Money Market Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,023.05 | | | | $1.10 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,023.70 | | | | $1.10 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.22%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | | | | | | | | | | | | | | | | | |

| | | Mid-Term Bond Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,011.47 | | | | $2.29 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,022.51 | | | | $2.31 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.46%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | | | | | | | | | | | | | | | | | |

| | | Bond Fund | | | | |

| | | | | Beginning

Account Value

January 1, 2023 | | | Ending

Account Value

June 30, 2023 | | | Expense Paid

During Period*

January 1, 2023 to

June 30, 2023 | | | | |

| | | Actual | | | $1,000.00 | | | | $1,019.70 | | | | $2.20 | | | | | |

| | | Hypothetical

(5% return before expense) | | | $1,000.00 | | | | $1,022.61 | | | | $2.21 | | | | | |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 0.44%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

25

MUTUAL OF AMERICA INVESTMENT CORPORATION — EQUITY INDEX FUND

PORTFOLIO OF INVESTMENTS IN SECURITIES

June 30, 2023 (Unaudited)

| | | | | | | | |

| | | Shares | | | Value | |

| INDEXED ASSETS: | | | | | | |

| COMMON STOCKS: | |

| COMMUNICATION SERVICES (8.3%) | |

Activision Blizzard, Inc.* | | | 96,007 | | | $ | 8,093,390 | |

Alphabet, Inc. Cl A* | | | 797,281 | | | | 95,434,536 | |

Alphabet, Inc. Cl C* | | | 685,812 | | | | 82,962,678 | |

AT&T, Inc. | | | 959,394 | | | | 15,302,334 | |

Charter Communications, Inc. Cl A* | | | 13,943 | | | | 5,122,240 | |

Comcast Corp. Cl A | | | 558,189 | | | | 23,192,753 | |

Electronic Arts, Inc. | | | 34,961 | | | | 4,534,442 | |

Fox Corp. Cl A | | | 36,108 | | | | 1,227,672 | |

Fox Corp. Cl B | | | 18,337 | | | | 584,767 | |

Interpublic Group of Cos., Inc. | | | 51,806 | | | | 1,998,675 | |

Live Nation Entertainment, Inc.* | | | 19,314 | | | | 1,759,699 | |

Match Group, Inc.* | | | 37,370 | | | | 1,563,934 | |

Meta Platforms, Inc. Cl A* | | | 296,871 | | | | 85,196,040 | |

Netflix, Inc.* | | | 59,658 | | | | 26,278,752 | |

News Corp. Cl A | | | 51,124 | | | | 996,918 | |

News Corp. Cl B | | | 15,760 | | | | 310,787 | |

Omnicom Group, Inc. | | | 26,775 | | | | 2,547,641 | |

Paramount Global Cl B | | | 68,040 | | | | 1,082,516 | |

Take-Two Interactive Software, Inc.* | | | 21,277 | | | | 3,131,123 | |

T-Mobile US, Inc.* | | | 77,293 | | | | 10,735,998 | |

Verizon Communications, Inc. | | | 564,174 | | | | 20,981,631 | |

Walt Disney Co.* | | | 245,223 | | | | 21,893,509 | |

Warner Bros Discovery, Inc.* | | | 297,501 | | | | 3,730,663 | |

| | | | | | | | |

| | | | | | | 418,662,698 | |

| | | | | | | | |

| CONSUMER DISCRETIONARY (10.5%) | |

Advance Auto Parts, Inc. | | | 7,976 | | | | 560,713 | |

Amazon.com, Inc.* | | | 1,197,935 | | | | 156,162,807 | |

Aptiv PLC* | | | 36,302 | | | | 3,706,071 | |

AutoZone, Inc.* | | | 2,470 | | | | 6,158,599 | |

Bath & Body Works, Inc. | | | 30,725 | | | | 1,152,187 | |

Best Buy Co., Inc. | | | 26,118 | | | | 2,140,370 | |

Booking Hldgs., Inc.* | | | 4,957 | | | | 13,385,536 | |

BorgWarner, Inc. | | | 31,452 | | | | 1,538,317 | |

Caesars Entertainment, Inc.* | | | 28,880 | | | | 1,472,014 | |

CarMax, Inc.* | | | 21,231 | | | | 1,777,035 | |

Carnival Corp.* | | | 134,791 | | | | 2,538,115 | |

Chipotle Mexican Grill, Inc. Cl A* | | | 3,702 | | | | 7,918,578 | |

Darden Restaurants, Inc. | | | 16,229 | | | | 2,711,541 | |

Domino’s Pizza, Inc. | | | 4,743 | | | | 1,598,344 | |

DR Horton, Inc. | | | 41,653 | | | | 5,068,754 | |

eBay, Inc. | | | 71,762 | | | | 3,207,044 | |

Etsy, Inc.* | | | 16,554 | | | | 1,400,634 | |

Expedia Group, Inc.* | | | 19,138 | | | | 2,093,506 | |

Ford Motor Co. | | | 527,394 | | | | 7,979,471 | |

| | | | | | | | |

| | | Shares | | | Value | |

| INDEXED ASSETS (CONTINUED): | |

| COMMON STOCKS (CONTINUED): | |

| CONSUMER DISCRETIONARY (CONTINUED) | |

Garmin Ltd. | | | 20,537 | | | $ | 2,141,804 | |

General Motors Co. | | | 186,555 | | | | 7,193,561 | |

Genuine Parts Co. | | | 18,858 | | | | 3,191,339 | |

Hasbro, Inc. | | | 17,485 | | | | 1,132,503 | |

Hilton Worldwide Hldgs., Inc. | | | 35,513 | | | | 5,168,917 | |

Home Depot, Inc. | | | 135,900 | | | | 42,215,976 | |

Las Vegas Sands Corp.* | | | 44,102 | | | | 2,557,916 | |

Lennar Corp. Cl A | | | 34,056 | | | | 4,267,557 | |

LKQ Corp. | | | 34,076 | | | | 1,985,608 | |

Lowe’s Cos., Inc. | | | 80,031 | | | | 18,062,997 | |

Marriott International, Inc. Cl A | | | 34,604 | | | | 6,356,409 | |

McDonald’s Corp. | | | 97,979 | | | | 29,237,913 | |

MGM Resorts International | | | 40,523 | | | | 1,779,770 | |

Mohawk Industries, Inc.* | | | 7,093 | | | | 731,714 | |

Newell Brands, Inc. | | | 50,570 | | | | 439,959 | |

NIKE, Inc. Cl B | | | 165,347 | | | | 18,249,348 | |

Norwegian Cruise Line Hldgs. Ltd.* | | | 56,922 | | | | 1,239,192 | |

NVR, Inc.* | | | 409 | | | | 2,597,404 | |

O’Reilly Automotive, Inc.* | | | 8,170 | | | | 7,804,801 | |

Pool Corp. | | | 5,239 | | | | 1,962,739 | |

PulteGroup, Inc. | | | 29,957 | | | | 2,327,060 | |

Ralph Lauren Corp. Cl A | | | 5,515 | | | | 679,999 | |

Ross Stores, Inc. | | | 45,904 | | | | 5,147,216 | |

Royal Caribbean Cruises Ltd.* | | | 29,515 | | | | 3,061,886 | |

Starbucks Corp. | | | 153,847 | | | | 15,240,084 | |

Tapestry, Inc. | | | 31,108 | | | | 1,331,422 | |

Tesla, Inc.* | | | 361,544 | | | | 94,641,373 | |

TJX Cos., Inc. | | | 154,531 | | | | 13,102,683 | |

Tractor Supply Co. | | | 14,704 | | | | 3,251,054 | |

Ulta Beauty, Inc.* | | | 6,722 | | | | 3,163,340 | |

VF Corp. | | | 44,334 | | | | 846,336 | |

Whirlpool Corp. | | | 7,348 | | | | 1,093,309 | |