Government contributed 35.3% to our total revenue with a dollar value of $571.8 million for the year ending in December 31, 2023, a 8.5% increase compared to the year ended December 31, 2022. Government contributed 35.0% to our total revenue with a dollar value of $587.2 million for the twelve months ended June 30, 2024.

Maritime:

We are a leading player in the Maritime communications services segment, providing voice, data and safety communications services to meet the connectivity needs of our customers, predominantly in commercial shipping, with a high penetration in L-band MSS broadband services, with over 65% market share, and a strong presence in broadband services (VSAT segment). Customers lease or buy terminals from us, or our distribution partners, then pay us a recurring fee for airtime.

The overall Maritime segment has been undergoing a structural transition from narrowband to broadband. This transition has been driven by increasing bandwidth demand resulting from continued digitalization with an increasing use of commercial applications such as real-time engine monitoring, which enables a more efficient operating environment for ship owners and fleet managers. Customers are also leveraging bandwidth to deliver Internet applications for crew, including entertainment streaming and social media platforms. We are well-placed to take advantage of this transition to VSAT through FX, our differentiated and integrated GX solution for Maritime and the newly-launched NexusWave, an industry-leading fully managed multi-band and multi-orbit service.

FX, which uniquely has FB integrated seamlessly within it, has grown from approximately 5,400 vessels at the beginning of 2019 to approximately 14,250 as of June 30, 2024, providing us an estimated market share of over 30%. The three largest value-added resellers (by volume of active vessels) are Navarino, Marlink and Tototheo.

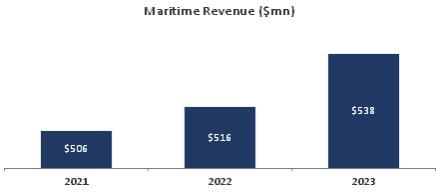

Maritime contributed 33.2% to our total revenue with a dollar value of $538.4 million for the year ended December 31, 2023, a 4.4% increase compared to the year ended December 31, 2022. Maritime contributed 30.6% to our total revenue with a dollar value of $513.8 million for the twelve months ended June 30, 2024.

Aviation:

Our Aviation business unit offers IFC services for commercial aircrafts, private jets, and narrowband safety, air traffic management and AOS.

IFC

In IFC, we offer on-board Wi-Fi to airline passengers. We have three major products: (i) GX, which provides global satellite-based broadband connectivity, (ii) EAN, which provides connectivity over European airspace through an integrated satellite/air-to-ground network, and (iii) our legacy, lower speed L-band services. Our blue-chip airline customers include Air France, Air New Zealand, International Airlines Group, Emirates, Korean Air, Lufthansa, Qatar Airways and Virgin Atlantic. Airlines typically sign orders on selected sub-fleets/ models for generally five- to 10-year contracts and are charged on a per-aircraft or usage basis. The IFC segment has particularly high switching costs owing to the high equipment and install cost as well as the downtime associated with installation.

With the commercial service introduction of our GX satellite constellation at the end of 2015 and the market introduction of the EAN in 2019, we have positioned ourselves as one of the world’s leading IFC providers. Our IFC business had over 1,000 aircraft installed as of June 30, 2024.

IFC contributed 5.9% and 7.8% to our total revenue for the year ended December 31, 2023 and the six months ended June 30, 2024, respectively.

Core Aviation

Core Aviation offers AOS and IFC for BGA. The AOS segment comprises Classic Aero and SwiftBroadband-Safety products, while the Aviation segment comprises SwiftBroadband and Jet ConneX products. Both core businesses provide services which are sold through distribution partners (and are consequently very high gross margin).