united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number | 811-05010 |

| Mutual Fund and Variable Insurance Trust |

| (Exact name of registrant as specified in charter) |

| 36 North New York Avenue, Huntington NY | 11743 |

| (Address of principal executive offices) | (Zip code) |

| The Corporation Trust Company, Corporate Trust Center |

| 1209 Orange Street, Wilmington, DE 19801 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | 1-631-629-4237 |

| Date of fiscal year end: | 12/31 |

| Date of reporting period: | 6/30/2024 |

Item 1. Reports to Stockholders.

Rational Dynamic Brands Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational Dynamic Brands Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Rational Dynamic Brands Fund | Rational Dynamic Brands Fund - with load | S&P 500® Index | MSCI ACWI Gross (USD) |

|---|

| 06/30/14 | $10,000 | $9,525 | $10,000 | $10,000 |

| 06/30/15 | $9,783 | $9,318 | $10,742 | $10,123 |

| 06/30/16 | $8,974 | $8,548 | $11,171 | $9,802 |

| 06/30/17 | $9,513 | $9,061 | $13,170 | $11,706 |

| 06/30/18 | $11,672 | $11,118 | $15,064 | $13,030 |

| 06/30/19 | $12,306 | $11,721 | $16,633 | $13,854 |

| 06/30/20 | $15,553 | $14,814 | $17,881 | $14,220 |

| 06/30/21 | $22,800 | $21,717 | $25,175 | $19,890 |

| 06/30/22 | $14,698 | $14,000 | $22,503 | $16,833 |

| 06/30/23 | $17,880 | $17,031 | $26,912 | $19,717 |

| 06/30/24 | $23,703 | $22,577 | $33,521 | $23,646 |

Average Annual Total Returns

| 6 months | 1 Year | 5 Years | 10 Years |

|---|

| Rational Dynamic Brands Fund | | | | |

| Without Load | 13.24% | 32.56% | 14.01% | 9.01% |

| With Load | 7.86% | 26.27% | 12.90% | 8.48% |

S&P 500® Index | 15.29% | 24.56% | 15.05% | 12.86% |

| MSCI ACWI Gross (USD) | 11.58% | 19.92% | 11.28% | 8.99% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$71,562,493

- Number of Portfolio Holdings24

- Advisory Fee $267,352

- Portfolio Turnover181%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 99.8% |

| Money Market Funds | 0.2% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.3% |

| Money Market Funds | 0.2% |

| Health Care | 4.7% |

| Consumer Staples | 6.9% |

| Technology | 9.7% |

| Financials | 13.2% |

| Communications | 20.6% |

| Consumer Discretionary | 44.4% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Amazon.com, Inc. | 11.4% |

| Live Nation Entertainment, Inc. | 5.0% |

| Uber Technologies, Inc. | 4.9% |

| Netflix, Inc. | 4.9% |

| Apple, Inc. | 4.9% |

| Apollo Global Management, Inc. | 4.9% |

| DraftKings, Inc. - Class A | 4.8% |

| Chipotle Mexican Grill, Inc. | 4.8% |

| Microsoft Corporation | 4.8% |

| Eli Lilly & Company | 4.7% |

No material changes occurred during the period ended June 30, 2024.

Rational Dynamic Brands Fund - Class A (HSUAX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational Dynamic Brands Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational Dynamic Brands Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $108 | 2.15% |

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Rational Dynamic Brands Fund | S&P 500® Index | MSCI ACWI Gross (USD) |

|---|

| Jun-2014 | $10,000 | $10,000 | $10,000 |

| Jun-2015 | $9,734 | $10,742 | $10,123 |

| Jun-2016 | $8,895 | $11,171 | $9,802 |

| Jun-2017 | $9,387 | $13,170 | $11,706 |

| Jun-2018 | $11,425 | $15,064 | $13,030 |

| Jun-2019 | $11,962 | $16,633 | $13,854 |

| Jun-2020 | $15,007 | $17,881 | $14,220 |

| Jun-2021 | $21,842 | $25,175 | $19,890 |

| Jun-2022 | $13,990 | $22,503 | $16,833 |

| Jun-2023 | $16,892 | $26,912 | $19,717 |

| Jun-2024 | $22,233 | $33,521 | $23,646 |

Average Annual Total Returns

| 6 Months | 1 Year | 5 Years | 10 Years |

|---|

| Rational Dynamic Brands Fund | 12.81% | 31.62% | 13.20% | 8.32% |

S&P 500® Index | 15.29% | 24.56% | 15.05% | 12.86% |

| MSCI ACWI Gross (USD) | 11.58% | 19.92% | 11.28% | 8.99% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$71,562,493

- Number of Portfolio Holdings24

- Advisory Fee $267,352

- Portfolio Turnover181%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 99.8% |

| Money Market Funds | 0.2% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.3% |

| Money Market Funds | 0.2% |

| Health Care | 4.7% |

| Consumer Staples | 6.9% |

| Technology | 9.7% |

| Financials | 13.2% |

| Communications | 20.6% |

| Consumer Discretionary | 44.4% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Amazon.com, Inc. | 11.4% |

| Live Nation Entertainment, Inc. | 5.0% |

| Uber Technologies, Inc. | 4.9% |

| Netflix, Inc. | 4.9% |

| Apple, Inc. | 4.9% |

| Apollo Global Management, Inc. | 4.9% |

| DraftKings, Inc. - Class A | 4.8% |

| Chipotle Mexican Grill, Inc. | 4.8% |

| Microsoft Corporation | 4.8% |

| Eli Lilly & Company | 4.7% |

No material changes occurred during the period ended June 30, 2024.

Rational Dynamic Brands Fund - Class C (HSUCX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational Dynamic Brands Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational Dynamic Brands Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $60 | 1.19% |

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Rational Dynamic Brands Fund | S&P 500® Index | MSCI ACWI Gross (USD) |

|---|

| Jun-2014 | $10,000 | $10,000 | $10,000 |

| Jun-2015 | $9,806 | $10,742 | $10,123 |

| Jun-2016 | $9,033 | $11,171 | $9,802 |

| Jun-2017 | $9,597 | $13,170 | $11,706 |

| Jun-2018 | $11,793 | $15,064 | $13,030 |

| Jun-2019 | $12,465 | $16,633 | $13,854 |

| Jun-2020 | $15,793 | $17,881 | $14,220 |

| Jun-2021 | $23,216 | $25,175 | $19,890 |

| Jun-2022 | $15,016 | $22,503 | $16,833 |

| Jun-2023 | $18,312 | $26,912 | $19,717 |

| Jun-2024 | $24,339 | $33,521 | $23,646 |

Average Annual Total Returns

| 6 Months | 1 Year | 5 Years | 10 Years |

|---|

| Rational Dynamic Brands Fund | 13.36% | 32.91% | 14.32% | 9.30% |

S&P 500® Index | 15.29% | 24.56% | 15.05% | 12.86% |

| MSCI ACWI Gross (USD) | 11.58% | 19.92% | 11.28% | 8.99% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$71,562,493

- Number of Portfolio Holdings24

- Advisory Fee $267,352

- Portfolio Turnover181%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 99.8% |

| Money Market Funds | 0.2% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.3% |

| Money Market Funds | 0.2% |

| Health Care | 4.7% |

| Consumer Staples | 6.9% |

| Technology | 9.7% |

| Financials | 13.2% |

| Communications | 20.6% |

| Consumer Discretionary | 44.4% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Amazon.com, Inc. | 11.4% |

| Live Nation Entertainment, Inc. | 5.0% |

| Uber Technologies, Inc. | 4.9% |

| Netflix, Inc. | 4.9% |

| Apple, Inc. | 4.9% |

| Apollo Global Management, Inc. | 4.9% |

| DraftKings, Inc. - Class A | 4.8% |

| Chipotle Mexican Grill, Inc. | 4.8% |

| Microsoft Corporation | 4.8% |

| Eli Lilly & Company | 4.7% |

No material changes occurred during the period ended June 30, 2024.

Rational Dynamic Brands Fund - Institutional (HSUTX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational Equity Armor Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational Equity Armor Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $94 | 1.87% |

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Rational Equity Armor Fund | Rational Equity Armor Fund - with load | S&P 500® Index | S&P 500® Value Index |

|---|

| 06/30/14 | $10,000 | $9,525 | $10,000 | $10,000 |

| 06/30/15 | $9,923 | $9,452 | $10,742 | $10,457 |

| 06/30/16 | $10,537 | $10,037 | $11,171 | $10,810 |

| 06/30/17 | $10,222 | $9,736 | $13,170 | $12,524 |

| 06/30/18 | $10,073 | $9,594 | $15,064 | $13,474 |

| 06/30/19 | $9,282 | $8,841 | $16,633 | $14,642 |

| 06/30/20 | $10,523 | $10,023 | $17,881 | $13,983 |

| 06/30/21 | $12,299 | $11,715 | $25,175 | $19,512 |

| 06/30/22 | $11,511 | $10,964 | $22,503 | $18,564 |

| 06/30/23 | $11,393 | $10,851 | $26,912 | $22,274 |

| 06/30/24 | $12,964 | $12,348 | $33,521 | $25,681 |

Average Annual Total Returns

| 6 months | 1 Year | 5 Years | 10 Years |

|---|

| Rational Equity Armor Fund | | | | |

| Without Load | 9.19% | 13.79% | 6.91% | 2.63% |

| With Load | 3.97% | 8.39% | 5.87% | 2.13% |

S&P 500® Index | 15.29% | 24.56% | 15.05% | 12.86% |

S&P 500® Value Index | 5.79% | 15.29% | 11.89% | 9.89% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$33,002,112

- Number of Portfolio Holdings71

- Advisory Fee $124,589

- Portfolio Turnover86%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 76.4% |

| Exchange-Traded Funds | 16.8% |

| Money Market Funds | 4.8% |

| Purchased Options | 2.0% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 4.9% |

| Utilities | 0.6% |

| Industrials | 1.2% |

| Energy | 3.1% |

| Consumer Staples | 4.2% |

| Money Market Funds | 4.6% |

| Consumer Discretionary | 6.4% |

| Health Care | 8.1% |

| Communications | 11.5% |

| Financials | 12.0% |

| Equity | 16.3% |

| Technology | 27.1% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| NVIDIA Corporation | 4.9% |

| Amazon.com, Inc. | 4.2% |

| Apple, Inc. | 4.2% |

| Meta Platforms, Inc. | 4.1% |

| Microsoft Corporation | 4.0% |

| Berkshire Hathaway, Inc. | 3.7% |

| Berkshire Hathaway, Inc. | 3.7% |

| iShares S&P 100 ETF | 2.9% |

| VanEck Semiconductor ETF | 2.7% |

| JPMorgan Chase & Company | 2.6% |

No material changes occurred during the period ended June 30, 2024.

Rational Equity Armor Fund - Class A (HDCAX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational Equity Armor Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational Equity Armor Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $129 | 2.58% |

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Rational Equity Armor Fund | S&P 500® Index | S&P 500® Value Index |

|---|

| Jun-2014 | $10,000 | $10,000 | $10,000 |

| Jun-2015 | $9,879 | $10,742 | $10,457 |

| Jun-2016 | $10,437 | $11,171 | $10,810 |

| Jun-2017 | $10,076 | $13,170 | $12,524 |

| Jun-2018 | $9,882 | $15,064 | $13,474 |

| Jun-2019 | $9,023 | $16,633 | $14,642 |

| Jun-2020 | $10,165 | $17,881 | $13,983 |

| Jun-2021 | $11,788 | $25,175 | $19,512 |

| Jun-2022 | $10,964 | $22,503 | $18,564 |

| Jun-2023 | $10,763 | $26,912 | $22,274 |

| Jun-2024 | $12,168 | $33,521 | $25,681 |

Average Annual Total Returns

| 6 Months | 1 Year | 5 Years | 10 Years |

|---|

| Rational Equity Armor Fund | 8.83% | 13.05% | 6.16% | 1.98% |

S&P 500® Index | 15.29% | 24.56% | 15.05% | 12.86% |

S&P 500® Value Index | 5.79% | 15.29% | 11.89% | 9.89% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$33,002,112

- Number of Portfolio Holdings71

- Advisory Fee $124,589

- Portfolio Turnover86%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 76.4% |

| Exchange-Traded Funds | 16.8% |

| Money Market Funds | 4.8% |

| Purchased Options | 2.0% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 4.9% |

| Utilities | 0.6% |

| Industrials | 1.2% |

| Energy | 3.1% |

| Consumer Staples | 4.2% |

| Money Market Funds | 4.6% |

| Consumer Discretionary | 6.4% |

| Health Care | 8.1% |

| Communications | 11.5% |

| Financials | 12.0% |

| Equity | 16.3% |

| Technology | 27.1% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| NVIDIA Corporation | 4.9% |

| Amazon.com, Inc. | 4.2% |

| Apple, Inc. | 4.2% |

| Meta Platforms, Inc. | 4.1% |

| Microsoft Corporation | 4.0% |

| Berkshire Hathaway, Inc. | 3.7% |

| Berkshire Hathaway, Inc. | 3.7% |

| iShares S&P 100 ETF | 2.9% |

| VanEck Semiconductor ETF | 2.7% |

| JPMorgan Chase & Company | 2.6% |

No material changes occurred during the period ended June 30, 2024.

Rational Equity Armor Fund - Class C (HDCEX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational Equity Armor Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational Equity Armor Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $82 | 1.63% |

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Rational Equity Armor Fund | S&P 500® Index | S&P 500® Value Index |

|---|

| Jun-2014 | $10,000 | $10,000 | $10,000 |

| Jun-2015 | $9,948 | $10,742 | $10,457 |

| Jun-2016 | $10,590 | $11,171 | $10,810 |

| Jun-2017 | $10,298 | $13,170 | $12,524 |

| Jun-2018 | $10,176 | $15,064 | $13,474 |

| Jun-2019 | $9,388 | $16,633 | $14,642 |

| Jun-2020 | $10,688 | $17,881 | $13,983 |

| Jun-2021 | $12,518 | $25,175 | $19,512 |

| Jun-2022 | $11,756 | $22,503 | $18,564 |

| Jun-2023 | $11,657 | $26,912 | $22,274 |

| Jun-2024 | $13,291 | $33,521 | $25,681 |

Average Annual Total Returns

| 6 Months | 1 Year | 5 Years | 10 Years |

|---|

| Rational Equity Armor Fund | 9.28% | 14.01% | 7.20% | 2.89% |

S&P 500® Index | 15.29% | 24.56% | 15.05% | 12.86% |

S&P 500® Value Index | 5.79% | 15.29% | 11.89% | 9.89% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$33,002,112

- Number of Portfolio Holdings71

- Advisory Fee $124,589

- Portfolio Turnover86%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 76.4% |

| Exchange-Traded Funds | 16.8% |

| Money Market Funds | 4.8% |

| Purchased Options | 2.0% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 4.9% |

| Utilities | 0.6% |

| Industrials | 1.2% |

| Energy | 3.1% |

| Consumer Staples | 4.2% |

| Money Market Funds | 4.6% |

| Consumer Discretionary | 6.4% |

| Health Care | 8.1% |

| Communications | 11.5% |

| Financials | 12.0% |

| Equity | 16.3% |

| Technology | 27.1% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| NVIDIA Corporation | 4.9% |

| Amazon.com, Inc. | 4.2% |

| Apple, Inc. | 4.2% |

| Meta Platforms, Inc. | 4.1% |

| Microsoft Corporation | 4.0% |

| Berkshire Hathaway, Inc. | 3.7% |

| Berkshire Hathaway, Inc. | 3.7% |

| iShares S&P 100 ETF | 2.9% |

| VanEck Semiconductor ETF | 2.7% |

| JPMorgan Chase & Company | 2.6% |

No material changes occurred during the period ended June 30, 2024.

Rational Equity Armor Fund - Institutional (HDCTX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational Real Assets Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational Real Assets Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $78 | 1.56% |

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Rational Real Assets Fund | Rational Real Assets Fund - with load | S&P 500® Index |

|---|

| 08/18/21 | $10,000 | $9,425 | $10,000 |

| 06/30/22 | $9,141 | $8,616 | $8,713 |

| 06/30/23 | $9,759 | $9,198 | $10,420 |

| 06/30/24 | $10,919 | $10,291 | $12,979 |

Average Annual Total Returns

| 6 months | 1 Year | Since Inception (August 18, 2021) |

|---|

| Rational Real Assets Fund | | | |

| Without Load | 4.64% | 11.88% | 3.11% |

| With Load | | 5.41% | 1.01% |

S&P 500® Index | 15.29% | 24.56% | 9.53% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$2,976,636

- Number of Portfolio Holdings67

- Advisory Fee (net of waivers)$0

- Portfolio Turnover0%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 99.0% |

| Money Market Funds | 1.0% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.8% |

| Money Market Funds | 1.0% |

| Utilities | 11.1% |

| Real Estate | 13.1% |

| Materials | 16.5% |

| Industrials | 27.3% |

| Energy | 31.8% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Williams Companies, Inc. (The) | 2.3% |

| Targa Resources Corporation | 2.1% |

| ONEOK, Inc. | 2.0% |

| Cheniere Energy, Inc. | 2.0% |

| Freeport-McMoRan, Inc. | 1.9% |

| DuPont de Nemours, Inc. | 1.8% |

| Northrop Grumman Corporation | 1.8% |

| Ecolab, Inc. | 1.8% |

| Waste Management, Inc. | 1.8% |

| Republic Services, Inc. | 1.8% |

No material changes occurred during the period ended June 30, 2024.

Rational Real Assets Fund - Class A (IGOAX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational Real Assets Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational Real Assets Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $115 | 2.30% |

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Rational Real Assets Fund | S&P 500® Index |

|---|

| Aug-2021 | $10,000 | $10,000 |

| Jun-2022 | $9,085 | $8,713 |

| Jun-2023 | $9,619 | $10,420 |

| Jun-2024 | $10,677 | $12,979 |

Average Annual Total Returns

| 6 Months | 1 Year | Since Inception (August 18, 2021) |

|---|

| Rational Real Assets Fund | 4.31% | 11.00% | 2.31% |

S&P 500® Index | 15.29% | 24.56% | 9.53% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$2,976,636

- Number of Portfolio Holdings67

- Advisory Fee (net of waivers)$0

- Portfolio Turnover0%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 99.0% |

| Money Market Funds | 1.0% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.8% |

| Money Market Funds | 1.0% |

| Utilities | 11.1% |

| Real Estate | 13.1% |

| Materials | 16.5% |

| Industrials | 27.3% |

| Energy | 31.8% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Williams Companies, Inc. (The) | 2.3% |

| Targa Resources Corporation | 2.1% |

| ONEOK, Inc. | 2.0% |

| Cheniere Energy, Inc. | 2.0% |

| Freeport-McMoRan, Inc. | 1.9% |

| DuPont de Nemours, Inc. | 1.8% |

| Northrop Grumman Corporation | 1.8% |

| Ecolab, Inc. | 1.8% |

| Waste Management, Inc. | 1.8% |

| Republic Services, Inc. | 1.8% |

No material changes occurred during the period ended June 30, 2024.

Rational Real Assets Fund - Class C (IGOCX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational Real Assets Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational Real Assets Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $66 | 1.31% |

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Rational Real Assets Fund | S&P 500® Index |

|---|

| Aug-2021 | $10,000 | $10,000 |

| Jun-2022 | $9,165 | $8,713 |

| Jun-2023 | $9,806 | $10,420 |

| Jun-2024 | $11,006 | $12,979 |

Average Annual Total Returns

| 6 Months | 1 Year | Since Inception (August 18, 2021) |

|---|

| Rational Real Assets Fund | 4.90% | 12.24% | 3.40% |

S&P 500® Index | 15.29% | 24.56% | 9.53% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$2,976,636

- Number of Portfolio Holdings67

- Advisory Fee (net of waivers)$0

- Portfolio Turnover0%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 99.0% |

| Money Market Funds | 1.0% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.8% |

| Money Market Funds | 1.0% |

| Utilities | 11.1% |

| Real Estate | 13.1% |

| Materials | 16.5% |

| Industrials | 27.3% |

| Energy | 31.8% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Williams Companies, Inc. (The) | 2.3% |

| Targa Resources Corporation | 2.1% |

| ONEOK, Inc. | 2.0% |

| Cheniere Energy, Inc. | 2.0% |

| Freeport-McMoRan, Inc. | 1.9% |

| DuPont de Nemours, Inc. | 1.8% |

| Northrop Grumman Corporation | 1.8% |

| Ecolab, Inc. | 1.8% |

| Waste Management, Inc. | 1.8% |

| Republic Services, Inc. | 1.8% |

No material changes occurred during the period ended June 30, 2024.

Rational Real Assets Fund - Institutional (IGOIX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational Special Situations Income Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational Special Situations Income Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $100 | 2.00% |

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Rational Special Situations Income Fund | Rational Special Situations Income Fund - with load | Bloomberg U.S. Aggregate Bond Index | Bloomberg U.S. Mortgage Backed Securities Index |

|---|

| 06/30/14 | $10,000 | $9,522 | $10,000 | $10,000 |

| 06/30/15 | $10,631 | $10,123 | $10,186 | $10,228 |

| 06/30/16 | $10,753 | $10,239 | $10,797 | $10,672 |

| 06/30/17 | $12,099 | $11,521 | $10,763 | $10,666 |

| 06/30/18 | $13,848 | $13,186 | $10,720 | $10,682 |

| 06/30/19 | $15,186 | $14,461 | $11,564 | $11,346 |

| 06/30/20 | $15,360 | $14,626 | $12,575 | $11,989 |

| 06/30/21 | $16,343 | $15,562 | $12,533 | $11,939 |

| 06/30/22 | $15,892 | $15,133 | $11,243 | $10,861 |

| 06/30/23 | $16,916 | $16,107 | $11,137 | $10,696 |

| 06/30/24 | $17,988 | $17,128 | $11,430 | $10,922 |

Average Annual Total Returns

| 6 months | 1 Year | 5 Years | 10 Years |

|---|

| Rational Special Situations Income Fund | | | | |

| Without Load | 5.03% | 6.34% | 3.44% | 6.05% |

| With Load | 0.06% | 1.31% | 2.44% | 5.53% |

| Bloomberg U.S. Aggregate Bond Index | | 2.63% | | 1.35% |

| Bloomberg U.S. Mortgage Backed Securities Index | | 2.12% | | 0.89% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$847,180,748

- Number of Portfolio Holdings855

- Advisory Fee (net of waivers)$5,799,203

- Portfolio Turnover15%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 76.4% |

| Corporate Bonds | 18.2% |

| Money Market Funds | 4.9% |

| Preferred Stocks | 0.5% |

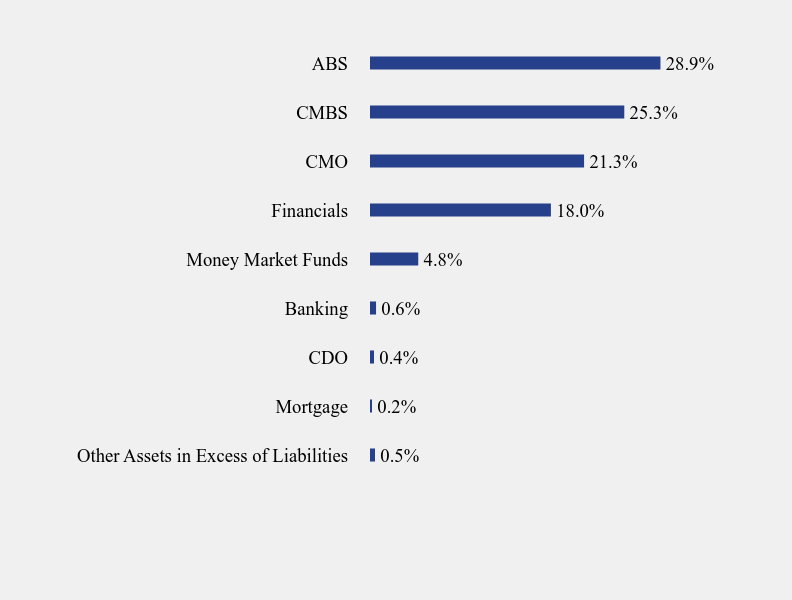

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.5% |

| Mortgage | 0.2% |

| CDO | 0.4% |

| Banking | 0.6% |

| Money Market Funds | 4.8% |

| Financials | 18.0% |

| CMO | 21.3% |

| CMBS | 25.3% |

| ABS | 28.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Ambac Assurance Corporation, –%, 06/07/69 | 12.7% |

| GS Mortgage Securities Trust, 6.572%, 08/10/43 | 1.9% |

| MBIA Global Funding, LLC, –%, 12/15/33 | 1.5% |

| GS Mortgage Securities Trust, 5.296%, 08/10/44 | 1.5% |

| MSP Deer Finance Syndicated Loan, 17.000%, 04/09/25 | 1.4% |

| JP Morgan Chase Commercial Mortgage Securities, 7.051%, 02/15/51 | 1.2% |

| JP Morgan Chase Commercial Mortgage Securities, 3.392%, 11/15/43 | 1.1% |

| Bear Stearns Asset Backed Securities I Trust, 11.460%, 10/25/34 | 1.1% |

| JP Morgan Chase Commercial Mortgage Securities, 5.360%, 02/15/46 | 1.0% |

| WFRBS Commercial Mortgage Trust, 3.964%, 06/15/46 | 0.9% |

No material changes occurred during the period ended June 30, 2024.

Rational Special Situations Income Fund - Class A (RFXAX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational Special Situations Income Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational Special Situations Income Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $137 | 2.74% |

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Rational Special Situations Income Fund | Bloomberg U.S. Aggregate Bond Index | Bloomberg U.S. Mortgage Backed Securities Index |

|---|

| Jun-2014 | $10,000 | $10,000 | $10,000 |

| Jun-2015 | $10,549 | $10,186 | $10,228 |

| Jun-2016 | $10,593 | $10,797 | $10,672 |

| Jun-2017 | $11,830 | $10,763 | $10,666 |

| Jun-2018 | $13,433 | $10,720 | $10,682 |

| Jun-2019 | $14,627 | $11,564 | $11,346 |

| Jun-2020 | $14,680 | $12,575 | $11,989 |

| Jun-2021 | $15,505 | $12,533 | $11,939 |

| Jun-2022 | $14,966 | $11,243 | $10,861 |

| Jun-2023 | $15,813 | $11,137 | $10,696 |

| Jun-2024 | $16,694 | $11,430 | $10,922 |

Average Annual Total Returns

| 6 Months | 1 Year | 5 Years | 10 Years |

|---|

| Rational Special Situations Income Fund | 4.66% | 5.57% | 2.68% | 5.26% |

| Bloomberg U.S. Aggregate Bond Index | | 2.63% | | 1.35% |

| Bloomberg U.S. Mortgage Backed Securities Index | | 2.12% | | 0.89% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$847,180,748

- Number of Portfolio Holdings855

- Advisory Fee (net of waivers)$5,799,203

- Portfolio Turnover15%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 76.4% |

| Corporate Bonds | 18.2% |

| Money Market Funds | 4.9% |

| Preferred Stocks | 0.5% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.5% |

| Mortgage | 0.2% |

| CDO | 0.4% |

| Banking | 0.6% |

| Money Market Funds | 4.8% |

| Financials | 18.0% |

| CMO | 21.3% |

| CMBS | 25.3% |

| ABS | 28.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Ambac Assurance Corporation, –%, 06/07/69 | 12.7% |

| GS Mortgage Securities Trust, 6.572%, 08/10/43 | 1.9% |

| MBIA Global Funding, LLC, –%, 12/15/33 | 1.5% |

| GS Mortgage Securities Trust, 5.296%, 08/10/44 | 1.5% |

| MSP Deer Finance Syndicated Loan, 17.000%, 04/09/25 | 1.4% |

| JP Morgan Chase Commercial Mortgage Securities, 7.051%, 02/15/51 | 1.2% |

| JP Morgan Chase Commercial Mortgage Securities, 3.392%, 11/15/43 | 1.1% |

| Bear Stearns Asset Backed Securities I Trust, 11.460%, 10/25/34 | 1.1% |

| JP Morgan Chase Commercial Mortgage Securities, 5.360%, 02/15/46 | 1.0% |

| WFRBS Commercial Mortgage Trust, 3.964%, 06/15/46 | 0.9% |

No material changes occurred during the period ended June 30, 2024.

Rational Special Situations Income Fund - Class C (RFXCX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational Special Situations Income Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational Special Situations Income Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $88 | 1.75% |

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Rational Special Situations Income Fund | Bloomberg U.S. Aggregate Bond Index | Bloomberg U.S. Mortgage Backed Securities Index |

|---|

| Jun-2014 | $10,000 | $10,000 | $10,000 |

| Jun-2015 | $10,656 | $10,186 | $10,228 |

| Jun-2016 | $10,805 | $10,797 | $10,672 |

| Jun-2017 | $12,192 | $10,763 | $10,666 |

| Jun-2018 | $13,982 | $10,720 | $10,682 |

| Jun-2019 | $15,375 | $11,564 | $11,346 |

| Jun-2020 | $15,596 | $12,575 | $11,989 |

| Jun-2021 | $16,633 | $12,533 | $11,939 |

| Jun-2022 | $16,215 | $11,243 | $10,861 |

| Jun-2023 | $17,301 | $11,137 | $10,696 |

| Jun-2024 | $18,442 | $11,430 | $10,922 |

Average Annual Total Returns

| 6 Months | 1 Year | 5 Years | 10 Years |

|---|

| Rational Special Situations Income Fund | 5.15% | 6.59% | 3.70% | 6.31% |

| Bloomberg U.S. Aggregate Bond Index | | 2.63% | | 1.35% |

| Bloomberg U.S. Mortgage Backed Securities Index | | 2.12% | | 0.89% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$847,180,748

- Number of Portfolio Holdings855

- Advisory Fee (net of waivers)$5,799,203

- Portfolio Turnover15%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 76.4% |

| Corporate Bonds | 18.2% |

| Money Market Funds | 4.9% |

| Preferred Stocks | 0.5% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.5% |

| Mortgage | 0.2% |

| CDO | 0.4% |

| Banking | 0.6% |

| Money Market Funds | 4.8% |

| Financials | 18.0% |

| CMO | 21.3% |

| CMBS | 25.3% |

| ABS | 28.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Ambac Assurance Corporation, –%, 06/07/69 | 12.7% |

| GS Mortgage Securities Trust, 6.572%, 08/10/43 | 1.9% |

| MBIA Global Funding, LLC, –%, 12/15/33 | 1.5% |

| GS Mortgage Securities Trust, 5.296%, 08/10/44 | 1.5% |

| MSP Deer Finance Syndicated Loan, 17.000%, 04/09/25 | 1.4% |

| JP Morgan Chase Commercial Mortgage Securities, 7.051%, 02/15/51 | 1.2% |

| JP Morgan Chase Commercial Mortgage Securities, 3.392%, 11/15/43 | 1.1% |

| Bear Stearns Asset Backed Securities I Trust, 11.460%, 10/25/34 | 1.1% |

| JP Morgan Chase Commercial Mortgage Securities, 5.360%, 02/15/46 | 1.0% |

| WFRBS Commercial Mortgage Trust, 3.964%, 06/15/46 | 0.9% |

No material changes occurred during the period ended June 30, 2024.

Rational Special Situations Income Fund - Institutional (RFXIX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational Strategic Allocation Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational Strategic Allocation Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $36 | 0.72% |

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Rational Strategic Allocation Fund | Rational Strategic Allocation Fund - with load | S&P 500® Index |

|---|

| 06/30/14 | $10,000 | $9,528 | $10,000 |

| 06/30/15 | $10,009 | $9,537 | $10,742 |

| 06/30/16 | $10,143 | $9,664 | $11,171 |

| 06/30/17 | $10,990 | $10,471 | $13,170 |

| 06/30/18 | $11,782 | $11,225 | $15,064 |

| 06/30/19 | $12,226 | $11,648 | $16,633 |

| 06/30/20 | $10,469 | $9,974 | $17,881 |

| 06/30/21 | $14,490 | $13,805 | $25,175 |

| 06/30/22 | $12,178 | $11,602 | $22,503 |

| 06/30/23 | $13,729 | $13,081 | $26,912 |

| 06/30/24 | $17,756 | $16,917 | $33,521 |

Average Annual Total Returns

| 6 months | 1 Year | 5 Years | 10 Years |

|---|

| Rational Strategic Allocation Fund | | | | |

| Without Load | 20.89% | 29.33% | 7.75% | 5.91% |

| With Load | 15.18% | 23.23% | 6.72% | 5.40% |

S&P 500® Index | 15.29% | 24.56% | 15.05% | 12.86% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$12,052,863

- Number of Portfolio Holdings5

- Advisory Fee (net of waivers)$0

- Portfolio Turnover18%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Money Market Funds | 2.3% |

| Open End Funds | 97.7% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 12.0% |

| Money Market Funds | 2.0% |

| Fixed Income | 6.2% |

| Alternative | 79.8% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Catalyst Systematic Alpha Fund | 79.8% |

| Catalyst/CIFC Senior Secured Income Fund | 5.3% |

| Rational/Pier 88 Convertible Securities Fund | 0.9% |

No material changes occurred during the period ended June 30, 2024.

Rational Strategic Allocation Fund - Class A (RHSAX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational Strategic Allocation Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational Strategic Allocation Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $73 | 1.46% |

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Rational Strategic Allocation Fund | S&P 500® Index |

|---|

| May-2016 | $10,000 | $10,000 |

| Jun-2016 | $10,135 | $10,026 |

| Jun-2017 | $10,902 | $11,820 |

| Jun-2018 | $11,600 | $13,519 |

| Jun-2019 | $11,946 | $14,928 |

| Jun-2020 | $10,140 | $16,048 |

| Jun-2021 | $13,948 | $22,594 |

| Jun-2022 | $11,641 | $20,196 |

| Jun-2023 | $13,024 | $24,153 |

| Jun-2024 | $16,723 | $30,084 |

Average Annual Total Returns

| 6 Months | 1 Year | 5 Years | Since Inception (May 31, 2016) |

|---|

| Rational Strategic Allocation Fund | 20.43% | 28.41% | 6.96% | 6.57% |

S&P 500® Index | 15.29% | 24.56% | 15.05% | 14.60% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$12,052,863

- Number of Portfolio Holdings5

- Advisory Fee (net of waivers)$0

- Portfolio Turnover18%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Money Market Funds | 2.3% |

| Open End Funds | 97.7% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 12.0% |

| Money Market Funds | 2.0% |

| Fixed Income | 6.2% |

| Alternative | 79.8% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Catalyst Systematic Alpha Fund | 79.8% |

| Catalyst/CIFC Senior Secured Income Fund | 5.3% |

| Rational/Pier 88 Convertible Securities Fund | 0.9% |

No material changes occurred during the period ended June 30, 2024.

Rational Strategic Allocation Fund - Class C (RHSCX )

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational Strategic Allocation Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational Strategic Allocation Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $24 | 0.47% |

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Rational Strategic Allocation Fund | S&P 500® Index |

|---|

| May-2016 | $10,000 | $10,000 |

| Jun-2016 | $10,137 | $10,026 |

| Jun-2017 | $11,014 | $11,820 |

| Jun-2018 | $11,842 | $13,519 |

| Jun-2019 | $12,310 | $14,928 |

| Jun-2020 | $10,564 | $16,048 |

| Jun-2021 | $14,665 | $22,594 |

| Jun-2022 | $12,357 | $20,196 |

| Jun-2023 | $13,968 | $24,153 |

| Jun-2024 | $18,092 | $30,084 |

Average Annual Total Returns

| 6 Months | 1 Year | 5 Years | Since Inception (May 31, 2016) |

|---|

| Rational Strategic Allocation Fund | 21.04% | 29.52% | 8.00% | 7.61% |

S&P 500® Index | 15.29% | 24.56% | 15.05% | 14.60% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$12,052,863

- Number of Portfolio Holdings5

- Advisory Fee (net of waivers)$0

- Portfolio Turnover18%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Money Market Funds | 2.3% |

| Open End Funds | 97.7% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 12.0% |

| Money Market Funds | 2.0% |

| Fixed Income | 6.2% |

| Alternative | 79.8% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Catalyst Systematic Alpha Fund | 79.8% |

| Catalyst/CIFC Senior Secured Income Fund | 5.3% |

| Rational/Pier 88 Convertible Securities Fund | 0.9% |

No material changes occurred during the period ended June 30, 2024.

Rational Strategic Allocation Fund - Institutional (RHSIX )

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational Tactical Return Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational Tactical Return Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $113 | 2.25% |

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Rational Tactical Return Fund | Rational Tactical Return Fund - with load | S&P 500® Index |

|---|

| 06/30/14 | $10,000 | $9,525 | $10,000 |

| 06/30/15 | $7,450 | $7,096 | $10,742 |

| 06/30/16 | $6,615 | $6,300 | $11,171 |

| 06/30/17 | $6,368 | $6,066 | $13,170 |

| 06/30/18 | $7,488 | $7,132 | $15,064 |

| 06/30/19 | $8,274 | $7,881 | $16,633 |

| 06/30/20 | $8,656 | $8,245 | $17,881 |

| 06/30/21 | $8,960 | $8,534 | $25,175 |

| 06/30/22 | $8,994 | $8,567 | $22,503 |

| 06/30/23 | $9,200 | $8,763 | $26,912 |

| 06/30/24 | $9,640 | $9,182 | $33,521 |

Average Annual Total Returns

| 6 months | 1 Year | 5 Years | 10 Years |

|---|

| Rational Tactical Return Fund | | | | |

| Without Load | 1.95% | 4.78% | 3.10% | |

| With Load | | | 2.11% | |

S&P 500® Index | 15.29% | 24.56% | 15.05% | 12.86% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$97,590,328

- Number of Portfolio Holdings19

- Advisory Fee (net of waivers)$917,551

- Portfolio Turnover0%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Money Market Funds | 44.1% |

| Purchased Options | 0.1% |

| U.S. Government & Agencies | 55.8% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 9.5% |

| Money Market Funds | 39.9% |

| U.S. Treasury Obligations | 50.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| United States Treasury Bill, 5.016%, 07/25/24 | 20.4% |

| United States Treasury Bill, 5.121%, 10/03/24 | 15.2% |

| United States Treasury Bill, 5.086%, 12/26/24 | 15.0% |

No material changes occurred during the period ended June 30, 2024.

Rational Tactical Return Fund - Class A (HRSAX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational Tactical Return Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational Tactical Return Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $150 | 3.00% |

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Rational Tactical Return Fund | S&P 500® Index |

|---|

| May-2016 | $10,000 | $10,000 |

| Jun-2016 | $10,055 | $10,026 |

| Jun-2017 | $9,605 | $11,820 |

| Jun-2018 | $11,235 | $13,519 |

| Jun-2019 | $12,307 | $14,928 |

| Jun-2020 | $12,770 | $16,048 |

| Jun-2021 | $13,112 | $22,594 |

| Jun-2022 | $13,070 | $20,196 |

| Jun-2023 | $13,260 | $24,153 |

| Jun-2024 | $13,797 | $30,084 |

Average Annual Total Returns

| 6 Months | 1 Year | 5 Years | Since Inception (May 31, 2016) |

|---|

| Rational Tactical Return Fund | 1.60% | 4.04% | 2.31% | 4.06% |

S&P 500® Index | 15.29% | 24.56% | 15.05% | 14.60% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$97,590,328

- Number of Portfolio Holdings19

- Advisory Fee (net of waivers)$917,551

- Portfolio Turnover0%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Money Market Funds | 44.1% |

| Purchased Options | 0.1% |

| U.S. Government & Agencies | 55.8% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 9.5% |

| Money Market Funds | 39.9% |

| U.S. Treasury Obligations | 50.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| United States Treasury Bill, 5.016%, 07/25/24 | 20.4% |

| United States Treasury Bill, 5.121%, 10/03/24 | 15.2% |

| United States Treasury Bill, 5.086%, 12/26/24 | 15.0% |

No material changes occurred during the period ended June 30, 2024.

Rational Tactical Return Fund - Class C (HRSFX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational Tactical Return Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational Tactical Return Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $100 | 2.00% |

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Rational Tactical Return Fund | S&P 500® Index |

|---|

| Jun-2014 | $10,000 | $10,000 |

| Jun-2015 | $7,470 | $10,742 |

| Jun-2016 | $6,600 | $11,171 |

| Jun-2017 | $6,355 | $13,170 |

| Jun-2018 | $7,504 | $15,064 |

| Jun-2019 | $8,292 | $16,633 |

| Jun-2020 | $8,709 | $17,881 |

| Jun-2021 | $9,016 | $25,175 |

| Jun-2022 | $9,076 | $22,503 |

| Jun-2023 | $9,306 | $26,912 |

| Jun-2024 | $9,778 | $33,521 |

Average Annual Total Returns

| 6 Months | 1 Year | 5 Years | 10 Years |

|---|

| Rational Tactical Return Fund | 2.07% | 5.07% | 3.35% | |

S&P 500® Index | 15.29% | 24.56% | 15.05% | 12.86% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$97,590,328

- Number of Portfolio Holdings19

- Advisory Fee (net of waivers)$917,551

- Portfolio Turnover0%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Money Market Funds | 44.1% |

| Purchased Options | 0.1% |

| U.S. Government & Agencies | 55.8% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 9.5% |

| Money Market Funds | 39.9% |

| U.S. Treasury Obligations | 50.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| United States Treasury Bill, 5.016%, 07/25/24 | 20.4% |

| United States Treasury Bill, 5.121%, 10/03/24 | 15.2% |

| United States Treasury Bill, 5.086%, 12/26/24 | 15.0% |

No material changes occurred during the period ended June 30, 2024.

Rational Tactical Return Fund - Institutional (HRSTX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational/Pier 88 Convertible Securities Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational/Pier 88 Convertible Securities Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $62 | 1.24% |

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Rational/Pier 88 Convertible Securities Fund | Rational/Pier 88 Convertible Securities Fund - with load | S&P 500® Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| 03/01/17 | $10,000 | $9,527 | $10,000 | $10,000 |

| 06/30/17 | $10,229 | $9,745 | $10,180 | $10,196 |

| 06/30/18 | $11,261 | $10,728 | $11,643 | $10,156 |

| 06/30/19 | $12,089 | $11,517 | $12,856 | $10,955 |

| 06/30/20 | $13,172 | $12,549 | $13,821 | $11,912 |

| 06/30/21 | $15,811 | $15,063 | $19,459 | $11,873 |

| 06/30/22 | $14,572 | $13,882 | $17,393 | $10,651 |

| 06/30/23 | $14,525 | $13,838 | $20,801 | $10,551 |

| 06/30/24 | $15,649 | $14,909 | $25,909 | $10,828 |

Average Annual Total Returns

| 6 months | 1 Year | 5 Years | Since Inception (March 1, 2017) |

|---|

| Rational/Pier 88 Convertible Securities Fund | | | | |

| Without Load | 2.75% | 7.74% | 5.30% | 6.30% |

| With Load | | 2.58% | 4.29% | 5.60% |

S&P 500® Index | 15.29% | 24.56% | 15.05% | 13.87% |

| Bloomberg U.S. Aggregate Bond Index | | 2.63% | | 1.09% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$138,496,341

- Number of Portfolio Holdings42

- Advisory Fee (net of waivers)$468,833

- Portfolio Turnover61%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 17.8% |

| Convertible Bonds | 62.0% |

| Money Market Funds | 1.2% |

| Preferred Stocks | 19.0% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.1% |

| Money Market Funds | 1.2% |

| Energy | 1.5% |

| Industrials | 3.6% |

| Health Care | 7.1% |

| Real Estate | 8.2% |

| Communications | 10.0% |

| Utilities | 12.7% |

| Consumer Discretionary | 14.4% |

| Financials | 14.5% |

| Technology | 26.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Welltower OP, LLC, 2.750%, 05/15/28 | 5.0% |

| Apollo Global Management, Inc. | 4.7% |

| Wells Fargo & Company | 4.6% |

| Ford Motor Company, –%, 03/15/26 | 4.5% |

| Bank of America Corporation | 4.5% |

| NextEra Energy, Inc. | 4.5% |

| Dexcom, Inc., 0.250%, 11/15/25 | 4.5% |

| Tyler Technologies, Inc., 0.250%, 03/15/26 | 4.4% |

| PPL Capital Funding, Inc., 2.875%, 03/15/28 | 4.2% |

| Booking Holdings, Inc. | 4.0% |

No material changes occurred during the period ended June 30, 2024.

Rational/Pier 88 Convertible Securities Fund - Class A (PBXAX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational/Pier 88 Convertible Securities Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational/Pier 88 Convertible Securities Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $100 | 1.99% |

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Rational/Pier 88 Convertible Securities Fund | S&P 500® Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| Mar-2017 | $10,000 | $10,000 | $10,000 |

| Jun-2017 | $10,200 | $10,180 | $10,196 |

| Jun-2018 | $11,147 | $11,643 | $10,156 |

| Jun-2019 | $11,870 | $12,856 | $10,955 |

| Jun-2020 | $12,868 | $13,821 | $11,912 |

| Jun-2021 | $15,339 | $19,459 | $11,873 |

| Jun-2022 | $14,020 | $17,393 | $10,651 |

| Jun-2023 | $13,882 | $20,801 | $10,551 |

| Jun-2024 | $14,852 | $25,909 | $10,828 |

Average Annual Total Returns

| 6 Months | 1 Year | 5 Years | Since Inception (March 1, 2017) |

|---|

| Rational/Pier 88 Convertible Securities Fund | 2.46% | 6.99% | 4.58% | 5.54% |

S&P 500® Index | 15.29% | 24.56% | 15.05% | 13.87% |

| Bloomberg U.S. Aggregate Bond Index | | 2.63% | | 1.09% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$138,496,341

- Number of Portfolio Holdings42

- Advisory Fee (net of waivers)$468,833

- Portfolio Turnover61%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 17.8% |

| Convertible Bonds | 62.0% |

| Money Market Funds | 1.2% |

| Preferred Stocks | 19.0% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.1% |

| Money Market Funds | 1.2% |

| Energy | 1.5% |

| Industrials | 3.6% |

| Health Care | 7.1% |

| Real Estate | 8.2% |

| Communications | 10.0% |

| Utilities | 12.7% |

| Consumer Discretionary | 14.4% |

| Financials | 14.5% |

| Technology | 26.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Welltower OP, LLC, 2.750%, 05/15/28 | 5.0% |

| Apollo Global Management, Inc. | 4.7% |

| Wells Fargo & Company | 4.6% |

| Ford Motor Company, –%, 03/15/26 | 4.5% |

| Bank of America Corporation | 4.5% |

| NextEra Energy, Inc. | 4.5% |

| Dexcom, Inc., 0.250%, 11/15/25 | 4.5% |

| Tyler Technologies, Inc., 0.250%, 03/15/26 | 4.4% |

| PPL Capital Funding, Inc., 2.875%, 03/15/28 | 4.2% |

| Booking Holdings, Inc. | 4.0% |

No material changes occurred during the period ended June 30, 2024.

Rational/Pier 88 Convertible Securities Fund - Class C (PBXCX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational/Pier 88 Convertible Securities Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational/Pier 88 Convertible Securities Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $50 | 0.99% |

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Rational/Pier 88 Convertible Securities Fund | S&P 500® Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| Mar-2017 | $10,000 | $10,000 | $10,000 |

| Jun-2017 | $10,241 | $10,180 | $10,196 |

| Jun-2018 | $11,296 | $11,643 | $10,156 |

| Jun-2019 | $12,158 | $12,856 | $10,955 |

| Jun-2020 | $13,266 | $13,821 | $11,912 |

| Jun-2021 | $15,956 | $19,459 | $11,873 |

| Jun-2022 | $14,738 | $17,393 | $10,651 |

| Jun-2023 | $14,729 | $20,801 | $10,551 |

| Jun-2024 | $15,968 | $25,909 | $10,828 |

Average Annual Total Returns

| 6 Months | 1 Year | 5 Years | Since Inception (March 1, 2017) |

|---|

| Rational/Pier 88 Convertible Securities Fund | 2.96% | 8.41% | 5.60% | 6.59% |

S&P 500® Index | 15.29% | 24.56% | 15.05% | 13.87% |

| Bloomberg U.S. Aggregate Bond Index | | 2.63% | | 1.09% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$138,496,341

- Number of Portfolio Holdings42

- Advisory Fee (net of waivers)$468,833

- Portfolio Turnover61%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 17.8% |

| Convertible Bonds | 62.0% |

| Money Market Funds | 1.2% |

| Preferred Stocks | 19.0% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.1% |

| Money Market Funds | 1.2% |

| Energy | 1.5% |

| Industrials | 3.6% |

| Health Care | 7.1% |

| Real Estate | 8.2% |

| Communications | 10.0% |

| Utilities | 12.7% |

| Consumer Discretionary | 14.4% |

| Financials | 14.5% |

| Technology | 26.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Welltower OP, LLC, 2.750%, 05/15/28 | 5.0% |

| Apollo Global Management, Inc. | 4.7% |

| Wells Fargo & Company | 4.6% |

| Ford Motor Company, –%, 03/15/26 | 4.5% |

| Bank of America Corporation | 4.5% |

| NextEra Energy, Inc. | 4.5% |

| Dexcom, Inc., 0.250%, 11/15/25 | 4.5% |

| Tyler Technologies, Inc., 0.250%, 03/15/26 | 4.4% |

| PPL Capital Funding, Inc., 2.875%, 03/15/28 | 4.2% |

| Booking Holdings, Inc. | 4.0% |

No material changes occurred during the period ended June 30, 2024.

Rational/Pier 88 Convertible Securities Fund - Institutional (PBXIX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational/Resolve Adaptive Asset Allocation Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational/Resolve Adaptive Asset Allocation Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $111 | 2.22% |

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Rational/Resolve Adaptive Asset Allocation Fund | Rational/Resolve Adaptive Asset Allocation Fund - with load | S&P 500® Index | MSCI ACWI Gross (USD) |

|---|

| 09/30/16 | $10,000 | $9,423 | $10,000 | $10,000 |

| 06/30/17 | $9,488 | $8,941 | $11,352 | $11,327 |

| 06/30/18 | $9,951 | $9,377 | $12,984 | $12,608 |

| 06/30/19 | $10,467 | $9,863 | $14,337 | $13,406 |

| 06/30/20 | $10,247 | $9,656 | $15,413 | $13,760 |

| 06/30/21 | $11,699 | $11,025 | $21,700 | $19,246 |

| 06/30/22 | $13,239 | $12,476 | $19,397 | $16,288 |

| 06/30/23 | $11,558 | $10,891 | $23,197 | $19,079 |

| 06/30/24 | $12,973 | $12,224 | $28,893 | $22,880 |

Average Annual Total Returns

| 6 months | 1 Year | 5 Years | Since Inception (September 30, 2016) |

|---|

| Rational/Resolve Adaptive Asset Allocation Fund | | | | |

| Without Load | 10.75% | 12.24% | 4.39% | 3.42% |

| With Load | 4.39% | 5.77% | 3.16% | 2.63% |

S&P 500® Index | 15.29% | 24.56% | 15.05% | 14.68% |

| MSCI ACWI Gross (USD) | 11.58% | 19.92% | 11.28% | 11.27% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$85,766,318

- Number of Portfolio Holdings69

- Advisory Fee (net of waivers)$695,552

- Portfolio Turnover0%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Money Market Funds | 34.7% |

| U.S. Government & Agencies | 65.3% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 13.3% |

| Money Market Funds | 30.1% |

| U.S. Treasury Obligations | 56.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| United States Treasury Bill, 4.968%, 07/18/24 | 29.0% |

| United States Treasury Bill, 5.144%, 10/10/24 | 19.8% |

| United States Treasury Bill, 5.158%, 09/12/24 | 7.8% |

No material changes occurred during the period ended June 30, 2024.

Rational/Resolve Adaptive Asset Allocation Fund - Class A (RDMAX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://rationalmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Rational/Resolve Adaptive Asset Allocation Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Rational/Resolve Adaptive Asset Allocation Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://rationalmf.com/literature-and-forms/. You can also request this information by contacting us at 1-800-253-0412.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $149 | 2.97% |

How has the Fund performed since inception?

Total Return Based on $10,000 Investment