- CCL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Carnival Corporation & plc (CCL) DEF 14ADefinitive proxy

Filed: 11 Mar 21, 9:01am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

CARNIVAL CORPORATION

CARNIVAL PLC

(Name of Registrants as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount previously paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

NOTICE OF 2021 ANNUAL MEETINGS

OF SHAREHOLDERS AND

PROXY STATEMENT

Tuesday, April 20, 2021

at 8:30 a.m., local time

Carnival Place

3655 NW 87th Avenue

Miami, Florida 33178

United States

|  |  |  |

|

|

|  |  |

| i |

LETTER TO SHAREHOLDERS FROM THE CHAIR

|

Dear Fellow Shareholders:

You are cordially invited to attend our joint Annual Meetings of Shareholders at Carnival Place, 3655 NW 87th Avenue, Miami, Florida 33178, United States on Tuesday, April 20, 2021. The meetings will commence at 8:30 a.m., and although there are technically two separate meetings (the Carnival plc meeting will begin first), shareholders of Carnival Corporation may attend the Carnival plc meeting and vice-versa.

Details regarding the matters to be voted on are contained in the attached Notices of Annual Meetings of Shareholders and Proxy Statement. Because of the dual listed company arrangement, all voting will take place on a poll (or ballot).

As the current situation with COVID-19 evolves, we continue to closely monitor the public health advisors and governmental regulations and guidelines on holding large public events and gatherings, as well as travel bans. Based on this advice at the time of writing, the Boards have decided to make some changes to the format of the Annual Meetings of Shareholders this year. Please read the section “Safety and Security Measures” included in the Notices of Annual Meetings below for further details on how we plan to conduct the meetings to prioritize the safety and security of our employees, shareholders and other stakeholders.

While we welcome the opportunity to engage with our shareholders in person at the Annual Shareholders Meetings, we strongly encourage shareholders to follow public health advice before deciding whether to attend the meeting or not.

Your vote is important. We encourage you to vote as soon as possible to ensure your vote is recorded promptly, even if you plan to attend the Annual Meetings of Shareholders.

The Boards will continue to monitor the situation closely and may need to make further adjustments to how the Annual Shareholders Meetings are conducted. Shareholders planning to attend the meeting should therefore check the “Investor Relations” section of our website at www.carnivalcorp.com or www.carnivalplc.com for any updates. The Boards of Directors recommend that you vote in favor of Proposals 1 through 21 and consider their approval to be in the best interests of Carnival Corporation and Carnival plc and their shareholders.

Thank you for your ongoing interest in, and continued support of, Carnival Corporation & plc.

| March 11, 2021 |

Sincerely, | |||

| ||||

| Micky Arison | ||||

| Chair of the Boards of Directors |

| 1 |

|

Your vote is important. We encourage you to vote as soon as possible, even if you plan to attend the Annual Meetings of Shareholders.

Who is Eligible to Vote?

Carnival Corporation Shareholders

|

Carnival plc Shareholders

| |

You are eligible to vote if you were a shareholder

|

You are eligible to vote if you are a shareholder

|

How to Vote?

To make sure your vote is counted, please cast your vote as soon as possible by one of the following methods:

Carnival Corporation Shareholders*

|

Carnival plc Shareholders

| |||||

• |

Using the Internet at www.proxyvote.com

|

• |

Using the Internet at www.sharevote.co.uk | |||

• |

Calling toll-free 1-800-690-6903

|

• |

Using CREST electronic proxy appointment service (if you hold your shares through CREST)

| |||

•

|

Mailing your signed form

|

•

|

Mailing your signed proxy form

| |||

| * | If you are a record holder or your bank or broker utilizes Broadridge. Otherwise, your bank or broker will provide you with instructions on how to vote. |

All eligible shareholders may vote in person at the 2021 Annual Meetings of Shareholders. Please refer to details about how to vote in person in the “Question and Answers” section.

Important Note: If you plan to attend the 2021 Annual Meetings of Shareholders please see the Notice of Annual Meetings for important details on admission requirements. |

Directions

For directions to the 2021 Annual Meetings of Shareholders, you may contact Investor Relations at Carnival Corporation & plc, 3655 N.W. 87th Avenue, Miami, Florida 33178-2428, United States or via email at ir@carnival.com.

Enroll for Electronic Delivery

We encourage shareholders to sign up to receive future proxy materials electronically. If you have not already enrolled, please consider doing so as it is simple, saves time and money, and is environmentally friendly.

Carnival Corporation Shareholders

|

Carnival plc Shareholders

| |

www.investordelivery.com

|

www.shareview.co.uk

|

| 2 |  Carnival Corporation & plc 2021 Proxy Statement Carnival Corporation & plc 2021 Proxy Statement |

Carnival Place

3655 N.W. 87th Avenue

Miami, Florida 33178-2428

United States

NOTICE OF 2021 ANNUAL MEETING OF CARNIVAL CORPORATION SHAREHOLDERS

|

| When | Where | |

Tuesday, April 20, 2021 8:30 a.m., local time | Carnival Place 3655 NW 87th Avenue Miami, Florida 33178 United States | |

We are pleased to invite you to attend Carnival Corporation’s 2021 Annual Meeting of Carnival Corporation Shareholders.

Items of Business

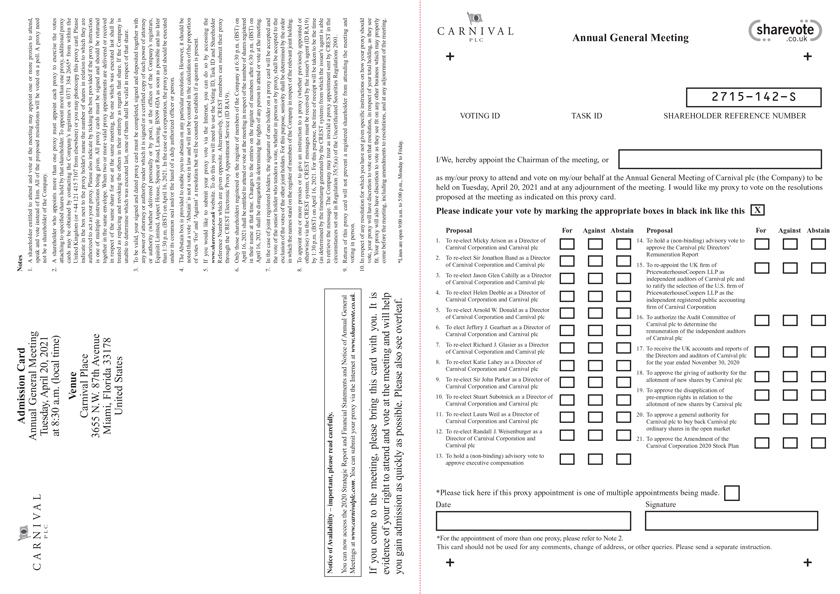

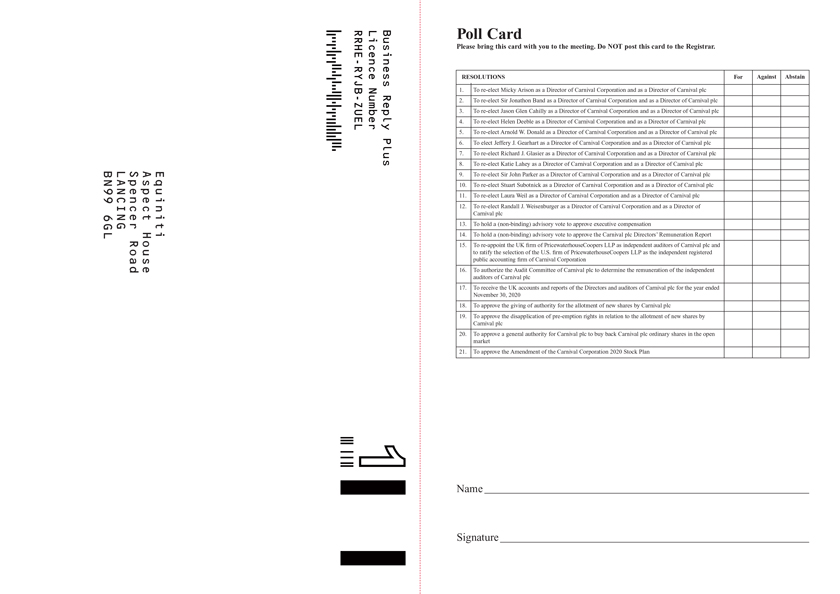

| 1. | To re-elect Micky Arison as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 2. | To re-elect Sir Jonathon Band as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 3. | To re-elect Jason Glen Cahilly as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 4. | To re-elect Helen Deeble as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 5. | To re-elect Arnold W. Donald as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 6. | To elect Jeffery J. Gearhart as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 7. | To re-elect Richard J. Glasier as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 8. | To re-elect Katie Lahey as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 9. | To re-elect Sir John Parker as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 10. | To re-elect Stuart Subotnick as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 11. | To re-elect Laura Weil as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 3 |

| 12. | To re-elect Randall J. Weisenburger as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 13. | To hold a (non-binding) advisory vote to approve executive compensation (in accordance with legal requirements applicable to U.S. companies). |

| 14. | To hold a (non-binding) advisory vote to approve the Carnival plc Directors’ Remuneration Report (in accordance with legal requirements applicable to UK companies). |

| 15. | To re-appoint the UK firm of PricewaterhouseCoopers LLP as independent auditors of Carnival plc and to ratify the selection of the U.S. firm of PricewaterhouseCoopers LLP as the independent registered public accounting firm of Carnival Corporation. |

| 16. | To authorize the Audit Committee of Carnival plc to determine the remuneration of the independent auditors of Carnival plc (in accordance with legal requirements applicable to UK companies). |

| 17. | To receive the UK accounts and reports of the Directors and auditors of Carnival plc for the year ended November 30, 2020 (in accordance with legal requirements applicable to UK companies). |

| 18. | To approve the giving of authority for the allotment of new shares by Carnival plc (in accordance with customary practice for UK companies). |

| 19. | To approve the disapplication of pre-emption rights in relation to the allotment of new shares by Carnival plc (in accordance with customary practice for UK companies). |

| 20. | To approve a general authority for Carnival plc to buy back Carnival plc ordinary shares in the open market (in accordance with legal requirements applicable to UK companies desiring to implement share buy back programs). |

| 21. | To approve the Amendment of the Carnival Corporation 2020 Stock Plan. |

| 22. | To transact such other business as may properly come before the meeting. |

Record Date

The Board of Directors set February 19, 2021 as the record date for the Annual Meeting of Carnival Corporation Shareholders. This means that our shareholders as of the close of business on that date are entitled to receive this notice of the meeting and vote their shares.

How to Vote

Your vote is important. Please review the proxy materials for the 2021 Annual Meeting of Carnival Corporation Shareholders and follow the instructions.

Meeting Admission Requirements

Attendance at the Annual Meeting of Carnival Corporation Shareholders is limited to shareholders and their duly appointed proxies or corporate representatives. Each attendee will be asked to present valid government-issued picture identification, such as a driver’s license or passport. Shareholders holding shares in brokerage accounts (“under a street name”) will need to bring a copy of a brokerage statement reflecting share ownership as of the record date (February 19, 2021).

| 4 |  Carnival Corporation & plc 2021 Proxy Statement Carnival Corporation & plc 2021 Proxy Statement |

Safety and Security Measures

In the interests of mitigating any risks from the ongoing COVID-19 pandemic and to prioritize the well-being of our employees, shareholders and other stakeholders, the following measures will apply at the Annual Shareholders Meetings:

| • | social distancing measures will be in place; |

| • | hand sanitizer will be provided on entry to the venue and must be used; |

| • | no refreshments will be provided; and |

| • | attendees will have to comply with the health and safety measures at the venue, including having their temperature taken and the requirement to wear a face mask covering your nose and mouth at all times. |

Attendees will be required to comply with any additional federal, state and/or local government guidance in force on the day of the Annual Shareholders Meetings. You should not attend the Annual Shareholders Meetings if you are suffering from any COVID-19 symptoms or you have come into close contact with someone who has tested positive for COVID-19 within the 14 days preceding the date of the Annual Shareholders Meetings. You will be asked to complete a Health Declaration Form upon arrival.

Due to security measures, all bags will be subject to search, and all persons who attend the meeting will be subject to a metal detector and/or a hand wand search. We will be unable to admit anyone who does not comply with these safety and security procedures.

The Boards will continue to monitor the situation closely and may need to make further adjustments to how the Annual Shareholders Meetings are conducted. Shareholders planning to attend the meeting should therefore check the “Investor Relations” section of our website www.carnivalcorp.com or www.carnivalplc.com for any updates.

On behalf of the Board of Directors

ARNALDO PEREZ

Secretary

Carnival Corporation is continuing to take advantage of U.S. Securities and Exchange Commission (“SEC”) rules that allow it to deliver proxy materials over the Internet. Under these rules, Carnival Corporation is sending its shareholders a one-page notice regarding the Internet availability of proxy materials instead of a full set of proxy materials, unless they previously requested to receive printed copies. If you receive this one-page notice, you will not receive printed copies of the proxy materials unless you specifically request them. Instead, this notice tells you how to access and review on the Internet all of the important information contained in the proxy materials. This notice also tells you how to submit your proxy card on the Internet and how to request to receive a printed copy of the proxy materials. All Carnival Corporation shareholders are urged to follow the instructions in the notice and submit their votes using one of the voting methods described in the proxy materials. If you receive a printed copy of the proxy materials, the accompanying envelope for return of the proxy card requires no postage. Any shareholder attending the Annual Meeting of Carnival Corporation Shareholders in Miami, Florida may personally vote on all matters that are considered, in which event any previously submitted proxy will be revoked.

| 5 |

THIS NOTICE OF ANNUAL GENERAL MEETING IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. IF YOU ARE IN ANY DOUBT AS TO ANY ASPECT OF THE PROPOSALS REFERRED TO IN THIS DOCUMENT OR AS TO THE ACTION YOU SHOULD TAKE, YOU SHOULD IMMEDIATELY CONSULT YOUR STOCKBROKER, BANK MANAGER, SOLICITOR, ACCOUNTANT OR OTHER INDEPENDENT FINANCIAL ADVISOR AUTHORIZED UNDER THE UK FINANCIAL SERVICES AND MARKETS ACT 2000.

IF YOU HAVE SOLD OR OTHERWISE TRANSFERRED ALL YOUR SHARES IN CARNIVAL PLC, PLEASE SEND THIS DOCUMENT AND THE ACCOMPANYING DOCUMENTS TO THE PURCHASER OR TRANSFEREE OR TO THE STOCKBROKER, BANK OR OTHER AGENT THROUGH WHOM THE SALE OR TRANSFER WAS EFFECTED FOR TRANSMISSION TO THE PURCHASER OR TRANSFEREE.

(incorporated and registered in England and Wales under number 4039524)

Carnival House

100 Harbour Parade

Southampton SO15 1ST

United Kingdom

NOTICE OF 2021 ANNUAL GENERAL MEETING OF CARNIVAL PLC SHAREHOLDERS

|

NOTICE IS HEREBY GIVEN that an ANNUAL GENERAL MEETING of Carnival plc will be held at Carnival Place, 3655 NW 87th Avenue, Miami, Florida 33178, United States on Tuesday, April 20, 2021 at 8:30 a.m. (local time), for the purpose of considering and, if thought fit, passing the resolutions described below:

| • | Proposals 1 through 18 and Proposal 21 will be proposed as ordinary resolutions. For ordinary resolutions, the required majority is more than 50% of the combined votes cast at this meeting and the Annual Meeting of Carnival Corporation Shareholders. |

| • | Proposal 19 and 20 will be proposed as special resolutions. For special resolutions, the required majority is not less than 75% of the combined votes cast at this meeting and the Annual Meeting Carnival Corporation Shareholders. |

Election or re-election of 12 Directors named in this Proxy Statement

| 1. | To re-elect Micky Arison as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 2. | To re-elect Sir Jonathon Band as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 3. | To re-elect Jason Glen Cahilly as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 6 |  Carnival Corporation & plc 2021 Proxy Statement Carnival Corporation & plc 2021 Proxy Statement |

| 4. | To re-elect Helen Deeble as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 5. | To re-elect Arnold W. Donald as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 6. | To elect Jeffery J. Gearhart as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 7. | To re-elect Richard J. Glasier as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 8. | To re-elect Katie Lahey as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 9. | To re-elect Sir John Parker as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 10. | To re-elect Stuart Subotnick as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 11. | To re-elect Laura Weil as a Director of Carnival Corporation and as a Director of Carnival plc. |

| 12. | To re-elect Randall J. Weisenburger as a Director of Carnival Corporation and as a Director of Carnival plc. |

Executive Compensation

| 13. | To hold a (non-binding) advisory vote to approve executive compensation (in accordance with legal requirements applicable to U.S. companies). |

Directors’ Remuneration Report

| 14. | To hold a (non-binding) advisory vote to approve the Carnival plc Directors’ Remuneration Report (as set out in the annual report for the year ended November 30, 2020). |

Re-appointment and remuneration of Carnival plc auditors and ratification of Carnival Corporation auditors

| 15. | To re-appoint the UK firm of PricewaterhouseCoopers LLP as independent auditors of Carnival plc and to ratify the selection of the U.S. firm of PricewaterhouseCoopers LLP as the independent registered public accounting firm of Carnival Corporation. |

| 16. | To authorize the Audit Committee of the Board of Directors of Carnival plc to determine the remuneration of the independent auditors of Carnival plc. |

Accounts and Reports

| 17. | To receive the UK accounts and the reports of the Directors and auditors of Carnival plc for the year ended November 30, 2020. |

Allotment of shares

| 18. | THAT the Directors of Carnival plc be and they are hereby authorized to allot shares in Carnival plc and to grant rights to subscribe for or convert any security into shares in Carnival plc: |

| (a) | up to a nominal amount of $101,719,355 (such amount to be reduced by the nominal amount allotted or granted under paragraph (b) below in excess of such sum); and |

| (b) | up to a nominal amount of $203,438,710 (such amount to be reduced by any allotments or grants made under paragraph (a) above) in connection with an offer by way of a rights issue: |

| • | to ordinary shareholders in proportion (as nearly as may be practicable) to their existing holdings; and |

| • | to holders of other equity securities as required by the rights of those securities or as the Directors of Carnival plc otherwise consider necessary, |

| 7 |

and so that the Directors of Carnival plc may impose any limits or restrictions and make any arrangements which they consider necessary or appropriate to deal with treasury shares, fractional entitlements, record dates, legal, regulatory or practical problems in, or under the laws of, any territory or any other matter, such authorities to apply until the end of next year’s Carnival plc Annual General Meeting (or, if earlier, until the close of business on July 19, 2022) but, in each case, during this period Carnival plc may make offers and enter into agreements which would, or might, require shares to be allotted or rights to subscribe for or convert securities into shares to be granted after the authority ends and the Directors of Carnival plc may allot shares or grant rights to subscribe for or convert securities into shares under any such offer or agreement as if the authority had not ended.

Disapplication of pre-emption rights

| 19. | THAT, subject to Proposal 18 passing, the Directors of Carnival plc be given power to allot equity securities (as defined in the UK Companies Act 2006 (the “Companies Act”)) for cash under the authority given by that resolution and/or to sell ordinary shares held by Carnival plc as treasury shares for cash as if Section 561 of the Companies Act did not apply to any such allotment or sale, such power to be limited: |

| (a) | to the allotment of equity securities and sale of treasury shares for cash in connection with an offer of, or invitation to apply for, equity securities (but in the case of the authority granted under paragraph (b) of Proposal 18, by way of a rights issue only): |

| • | to ordinary shareholders in proportion (as nearly as may be practicable) to their existing holdings; and |

| • | to holders of other equity securities, as required by the rights of those securities, or as the Directors of Carnival plc otherwise consider necessary, |

and so that the Directors of Carnival plc may impose any limits or restrictions and make any arrangements which they consider necessary or appropriate to deal with treasury shares, fractional entitlements, record dates, legal, regulatory or practical problems in, or under the laws of, any territory or any other matter; and

| (b) | in the case of the authority granted under paragraph (a) of Proposal 18 and/or in the case of any sale of treasury shares for cash, to the allotment (otherwise than under paragraph (a) above) of equity securities or sale of treasury shares up to a nominal amount of $15,257,903, |

such power to apply until the end of next year’s Annual General Meeting (or, if earlier, until the close of business on July 19, 2022) but, in each case, during this period Carnival plc may make offers, and enter into agreements, which would, or might, require equity securities to be allotted (and treasury shares to be sold) after the power ends and the Directors of Carnival plc may allot equity securities (and sell treasury shares) under any such offer or agreement as if the power had not ended.

General authority to buy back Carnival plc ordinary shares

| 20. | THAT Carnival plc be and is generally and unconditionally authorized to make market purchases (within the meaning of Section 693(4) of the Companies Act) of ordinary shares of $1.66 each in the capital of Carnival plc subject to the following conditions: |

| (a) | the maximum number of ordinary shares authorized to be acquired is 18,383,016; |

| (b) | the minimum price (exclusive of expenses) which may be paid for an ordinary share is $1.66; |

| 8 |  Carnival Corporation & plc 2021 Proxy Statement Carnival Corporation & plc 2021 Proxy Statement |

| (c) | the maximum price which may be paid for an ordinary share is an amount (exclusive of expenses) equal to the higher of: |

| • | 105% of the average middle market quotation for an ordinary share, as derived from the London Stock Exchange Daily Official List, for the five business days immediately preceding the day on which such ordinary share is contracted to be purchased; and |

| • | the higher of the last independent trade and the highest current independent bid for an ordinary share on the trading service venue where the purchase is carried out; and |

| (d) | unless previously revoked or renewed, this authority shall expire on the earlier of: |

| • | the conclusion of the Annual General Meeting of Carnival plc to be held in 2022; and |

| • | 18 months from the date of this resolution (except in relation to the purchase of ordinary shares, the contract of which was entered into before the expiry of such authority). |

Stock Plan

| 21. | To approve the Amendment of the Carnival Corporation 2020 Stock Plan. |

Safety and Security Measures

In the interests of mitigating any risks from the ongoing COVID-19 pandemic and to prioritize the well-being of our employees, shareholders and other stakeholders, the following measures will apply at the Annual Shareholders Meetings:

| • | social distancing measures will be in place; |

| • | hand sanitizer will be provided on entry to the venue and must be used; |

| • | no refreshments will be provided; and |

| • | attendees will have to comply with the health and safety measures at the venue including having their temperature taken and the requirement to wear a face mask covering your nose and mouth at all times. |

Attendees will be required to comply with any additional federal, state and/or local government guidance in force on the day of the Annual Shareholders Meetings. You should not attend the Annual Shareholders Meetings if you are suffering from any COVID-19 symptoms or you have come into close contact with someone who has tested positive for COVID-19 within the 14 days preceding the date of the Annual Shareholders Meetings. You will be asked to complete a Health Declaration Form upon arrival.

Due to security measures, all bags will be subject to search, and all persons who attend the meeting will be subject to a metal detector and/or a hand wand search. We will be unable to admit anyone to the venue who does not comply with these safety and security procedures.

| 9 |

The Boards will continue to monitor the situation closely and may need to make further adjustments to how the Annual Shareholders Meetings are conducted. Shareholders planning to attend the meeting should therefore check the “Investor Relations” section of our website at www.carnivalcorp.com or www.carnivalplc.com for any updates.

By Order of the Board

Arnaldo Perez Company Secretary January 26, 2021 | Registered Office:

Carnival House 100 Harbour Parade Southampton SO15 1ST United Kingdom |

Voting Arrangements for Carnival plc Shareholders

Carnival plc shareholders can vote in any of the following three ways:

| • | by attending the Annual General Meeting and voting in person or, in the case of corporate shareholders, by corporate representatives; |

| • | by appointing a proxy to attend and vote on their behalf, using the proxy form enclosed with this Notice of Annual General Meeting; or |

| • | by voting electronically as described below. |

Voting in person

If you come to the Annual General Meeting, please bring the attendance card (attached to the enclosed proxy form) with you. This will mean you can register more quickly.

In order to attend and vote at the Annual General Meeting, a corporate shareholder may appoint one or more individuals to act as its representative. The appointment must comply with the requirements of Section 323 of the Companies Act. Each representative should bring evidence of their appointment, including any authority under which it is signed, to the meeting. If you are a corporation and are considering appointing a corporate representative to represent you and vote your shareholding in Carnival plc at the Annual General Meeting, you are strongly encouraged to pre-register your corporate representative to make registration on the day of the meeting more efficient. In order to pre-register, please email your Letter of Representation to Carnival plc’s registrars, Equiniti Limited, at proxyvotes@equiniti.com.

Voting by proxy

A shareholder entitled to attend and vote at the meeting is entitled to appoint a proxy to exercise all or any of their rights to attend, speak and vote in his or her stead. A proxy need not be a shareholder of Carnival plc. A shareholder may appoint more than one proxy provided that each proxy is appointed to exercise the rights attached to a different share or shares held by that shareholder. To appoint more than one proxy, please follow the notes contained in the proxy form. A person who is nominated to enjoy information rights in accordance with Section 146 of the Companies Act, but who is not a shareholder, is not entitled to appoint a proxy.

If you are a person nominated to enjoy information rights in accordance with Section 146 of the Companies Act you may have a right under an agreement between you and the member by whom you

| 10 |  Carnival Corporation & plc 2021 Proxy Statement Carnival Corporation & plc 2021 Proxy Statement |

were nominated to be appointed, or to have someone else appointed, as a proxy for the meeting. If you have no such right, or you have such a right but do not wish to exercise it, you may have a right under such an agreement to give instructions to the member as to the exercise of voting rights.

To be effective, a duly completed proxy form and the authority (if any) under which it is signed, or a notarially certified copy of such authority, must be deposited (whether delivered personally or by post) at the offices of Carnival plc’s registrars, Equiniti Limited, Aspect House, Spencer Road, Lancing BN99 6DA, United Kingdom as soon as possible and in any event no later than 1:30 p.m. (BST) on April 16, 2021. Alternatively, a proxy vote may be submitted via the Internet in accordance with the instructions set out on the proxy form.

In the case of joint registered holders, the signature of one holder on a proxy card will be accepted and the vote of the senior holder who tenders a vote, whether in person or by proxy, shall be accepted to the exclusion of the votes of the other joint holders. For this purpose, seniority shall be determined by the order in which names stand on the register of shareholders of Carnival plc in respect of the relevant joint holding.

In order for a proxy appointment or instruction made using the CREST service to be valid, the appropriate CREST message (a “CREST Proxy Instruction”) must be properly authenticated in accordance with Euroclear’s specifications and must contain the information required for such instructions, as described in the CREST Manual, which can be viewed at www.euroclear.com. The message, regardless of whether it constitutes the appointment of a proxy or an amendment to the instruction given to a previously appointed proxy must, in order to be valid, be transmitted so as to be received by the issuer’s agent (ID RA19) by the latest time(s) for receipt of proxy appointments specified in the Notice of Annual General Meeting. For this purpose, the time of receipt will be taken to be the time (as determined by the timestamp applied to the message by the CREST Applications Host) from which the issuer’s agent is able to retrieve the message by enquiry to CREST in the manner prescribed by CREST. After this time any change of instructions to proxies appointed through CREST should be communicated to the appointee through other means.

CREST members and, where applicable, their CREST sponsors or voting service providers should note that Euroclear does not make available special procedures in CREST for any particular messages. Normal system timings and limitations will therefore apply in relation to the input of CREST Proxy Instructions. It is the responsibility of the CREST member concerned to take (or, if the CREST member is a CREST personal member or sponsored member or has appointed a voting service provider(s), to procure that his or her CREST sponsor or voting service provider(s) take(s)) such action as shall be necessary to ensure that a message is transmitted by means of the CREST system by any particular time. In this connection, CREST members and, where applicable, their CREST sponsors or voting service providers are referred, in particular, to those sections of the CREST Manual concerning practical limitations of the CREST system and timings.

Carnival plc may treat as invalid a CREST Proxy Instruction in the circumstances set out in Regulation 35(5)(a) of the Uncertificated Securities Regulations 2001.

Voting electronically

Shareholders are entitled to vote online at www.sharevote.co.uk. Shareholders voting electronically should vote as soon as possible, and in any event no later than 1:30 p.m. (BST) on April 16, 2021.

Shareholders who are entitled to attend or vote

Carnival plc, pursuant to Regulation 41 of the Uncertificated Securities Regulations 2001, specifies that only those shareholders registered in the register of members of Carnival plc at 6:30 p.m. (BST) on April 16, 2021 shall be entitled to attend or vote at the meeting in respect of the number of shares registered in their name at that time. Changes to the entries on the register of members after 6:30 p.m. (BST) on April 16, 2021 shall be disregarded in determining the rights of any person to attend or vote at the meeting.

| 11 |

Any shareholder attending the meeting has the right to ask questions. Carnival plc must cause to be answered any such question relating to the business being dealt with at the meeting, but no such answer need be given if:

| • | to do so would interfere unduly with the preparation for the meeting or involve the disclosure of confidential information; |

| • | the answer has already been given on a website in the form of an answer to a question; or |

| • | it is undesirable in the interests of Carnival plc or the good order of the meeting that the question be answered. |

Documents available for inspection

Copies of all service agreements (including letters of appointment) between each Director and Carnival plc will be available for inspection during normal business hours on any weekday (public holidays excluded) at the registered office of Carnival plc from the date of this notice until and including the date of the meeting and at the place of the meeting for at least 15 minutes prior to and during the meeting.

* * *

There are 21 Proposals that require shareholder approval at the Annual General Meeting this year. The Directors unanimously recommend that you vote in favor of Proposals 1 through 21 (inclusive). The Directors encourage you to submit your vote using one of the voting methods described herein. Submitting your voting instructions by any of these methods will not affect your right to attend the meeting in person should you so choose.

Website materials

This Proxy Statement and other information required by Section 311A of the Companies Act have been posted on our website at www.carnivalcorp.com and www.carnivalplc.com.

Under Section 527 of the Companies Act, shareholders meeting the threshold requirements set out in that section have the right to require Carnival plc to publish on a website a statement setting out any matter relating to:

| • | the audit of Carnival plc’s accounts (including the auditor’s report and the conduct of the audit) that are to be laid before the Annual General Meeting; or |

| • | any circumstance connected with an auditor of Carnival plc ceasing to hold office since the previous meeting at which annual accounts and reports were laid in accordance with Section 437 of the Companies Act. |

Carnival plc may not require the shareholders requesting any such website publication to pay its expenses in complying with Sections 527 or 528 of the Companies Act. Where Carnival plc is required to place a statement on a website under Section 527 of the Companies Act, it must forward the statement to Carnival plc’s auditor not later than the time when it makes the statement available on the website. The business which may be dealt with at the Annual General Meeting includes any statement that Carnival plc has been required under Section 527 of the Companies Act to publish on a website.

| 12 |  Carnival Corporation & plc 2021 Proxy Statement Carnival Corporation & plc 2021 Proxy Statement |

|

The Board of Directors of each of Carnival Corporation and Carnival plc (together, “Carnival Corporation & plc,” “we,” “our” or “us”) is providing these proxy materials to you in connection with our joint Annual Meetings of Shareholders on Tuesday, April 20, 2021. The Annual Meetings of Shareholders will be held at Carnival Place, 3655 NW 87th Avenue, Miami, Florida 33178, United States. The meetings will commence at 8:30 a.m., local time, and although technically two separate meetings (the Carnival plc meeting will begin first), shareholders of Carnival Corporation may attend the Carnival plc meeting and vice-versa.

We are furnishing the proxy materials to shareholders on or about March 11, 2021.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETINGS TO BE HELD ON APRIL 20, 2021 |

The Notice of Annual Meetings of Shareholders, Proxy Statement and the Annual Report are available at www.carnivalcorp.com and www.carnivalplc.com. |

| 13 |

|

We are committed to governance policies and practices so that shareholder and other stakeholder interests are represented in a thoughtful and independent manner. Sound principles of corporate governance are critical to obtaining and retaining the trust of investors. They are also vital in securing respect from other key stakeholders and interested parties, including our workforce, guests and suppliers, the communities in which we conduct business, government officials and the public-at-large.

Carnival Corporation and Carnival plc operate under a dual listed company (“DLC”) arrangement with primary stock listings in the United States (“U.S.”) and the United Kingdom (“UK”). Accordingly, we implemented a single corporate governance framework consistent, to the extent possible, with the governance practices and requirements of both countries. While there are customs or practices that differ between the two countries, we believe our corporate governance framework effectively addresses the corporate governance requirements of both the U.S. and the UK.

Our corporate governance principles are set forth in our Corporate Governance Guidelines and the charters of our Board Committees. The actions described in these documents, which the Boards have reviewed and approved, implement applicable requirements, including the New York Stock Exchange listing requirements and, to the extent practicable, the UK Corporate Governance Code published by the UK Financial Reporting Council in July 2018 (the “UK Corporate Governance Code”), as well our own vision of good governance. Fiscal 2020 was the first to which the UK Corporate Governance Code applied to Carnival plc.

We will continue to monitor governance developments in the U.S. and the UK to ensure a vigorous and effective corporate governance framework of the highest international standards.

Our Corporate Governance Guidelines, copies of the charters of our Board Committees and our organizational documents are available under the “Governance” section of our website at www.carnivalcorp.com and www.carnivalplc.com.

ELECTION OR RE-ELECTION OF DIRECTORS

The Boards are elected by the shareholders to exercise business judgment to act in what they reasonably believe to be in the best interests of Carnival Corporation & plc and its shareholders. The Boards select and oversee the members of senior management, who are charged by the Boards with conducting the business of the company.

Nominations of Directors

Carnival Corporation and Carnival plc are two separate legal entities and, therefore, each has a separate Board of Directors, each of which in turn has its own Nominating & Governance Committee. As the DLC arrangement requires that there be identical Boards of Directors, the Nominating & Governance Committees make one set of determinations in relation to both companies.

The Nominating & Governance Committees actively seek individuals qualified to become Board members and recommend to the Boards the nominees to stand for election as Directors at the Annual Meetings of Shareholders or, if applicable, at a Special Meeting of Shareholders.

| 14 |  Carnival Corporation & plc 2021 Proxy Statement Carnival Corporation & plc 2021 Proxy Statement |

GOVERNANCE

Election or Re-Election of Directors

When evaluating prospective candidates for Director, regardless of the source of the nomination, the Nominating & Governance Committees will consider, in accordance with their charter, such factors as they deem appropriate, including, but not limited to:

| • | the candidate’s judgment; |

| • | the candidate’s skill; |

| • | diversity considerations; |

| • | the candidate’s experience with businesses and other organizations of comparable size; |

| • | the interplay of the candidate’s experience with the experience of other members of the Boards; and |

| • | the extent to which the candidate would be a desirable addition to the Boards and any Committees of the Boards. |

Our Corporate Governance Guidelines dictate that diversity should be considered by the Nominating & Governance Committees in the director identification and nomination process. This means that the Nominating & Governance Committees seek nominees who bring a variety of business backgrounds, experiences and perspectives to the Boards. The Boards believe that the backgrounds and qualifications of the Directors, considered as a group, should provide a broad diversity of experience, professions, skills, geographic representations, knowledge and abilities, as well as race, ethnicity, age, gender and sexual orientation and identification, that will allow the Boards to fulfill their responsibilities and the Nominating & Governance Committees assess the effectiveness of this approach as part of the annual evaluations of our Boards of Directors.

As of the date of this Proxy Statement, 25% of the members of the Boards are women (being three of 12 members).

The Nominating & Governance Committees will also use their best efforts to see that the composition of the Boards adheres to the independence requirements applicable to companies listed for trading on the New York Stock Exchange and the London Stock Exchange. The Nominating & Governance Committees and the Boards utilize the same criteria for evaluating candidates regardless of the source of the referral. Other than the foregoing, there are no stated minimum criteria for Director nominees.

The Nominating & Governance Committees identify nominees by first evaluating the current members of the Boards willing to continue in service. As part of director succession planning, current members of the Boards with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Boards with that of obtaining a new perspective. If any member of the Boards does not wish to continue in service or if the Nominating & Governance Committees or the Boards decide not to re-nominate a member for re-election, the Nominating & Governance Committees identify the desired skills and experience of a new nominee in light of the criteria above. Current members of the Nominating & Governance Committees and the Boards are polled for suggestions as to individuals meeting the criteria of the Nominating & Governance Committees. The Nominating & Governance Committees may consider candidates proposed by management, but are not required to do so. The Nominating & Governance Committees may engage a third-party search firm to identify and attract potential nominees.

In 2019, we engaged Russell Reynolds Associates to assist us in identifying a Board candidate with significant compliance experience. Through this engagement, the Nominating & Governance Committees identified Jeffrey J. Gearhart, who they proposed to the Boards for appointment to the Boards, which was approved effective April 20, 2020.

| 15 |

GOVERNANCE

Election or Re-Election of Directors

2021 Nominees for Election or Re-Election to the Boards

The DLC arrangement requires the Boards of Carnival Corporation and Carnival plc to be identical. Shareholders are required to approve the election or re-election of Directors to each Board. There are 12 nominees for election or re-election to each Board of Directors. Each nominee currently serves as a Director of both companies. All nominees for Director are to be elected or re-elected to serve until the next Annual Meetings of Shareholders and until their successors are elected.

All of the nominees have indicated that they will be willing and able to serve as Directors.

With respect to each Board nominee set forth below, the information presented includes such person’s age, the year in which such person first became a Director, any other position held with Carnival Corporation and Carnival plc, such person’s principal occupations during at least the past five years, any directorships held by such nominee in public or certain other companies over the past five years and the nominee’s qualifications, including particular areas of expertise, to serve as a Director.

The Nominating & Governance Committees conducted performance evaluations of the members of our Boards of Directors serving during fiscal 2020 and reported the results to the Boards. The Boards determined that each nominee was an effective and committed member of the Boards and the Board Committees on which each serves. In addition, in 2019, the Nominating & Governance Committees engaged a third-party governance expert to perform an assessment of the effectiveness of the Boards. The third-party governance expert interviewed each Director and members of senior management who interact substantially with the Boards, reviewed the results of the assessment with the Senior Independent Director, and then organized and summarized the assessment for discussion with the full Boards.

Accordingly, the Boards of Directors unanimously recommend a vote FOR the election or re-election of each of the following Director nominees:

Micky Arison

| ||

Carnival Corporation Director since 1987

Carnival plc Director since 2003

Age: 71 | Mr. Arison has been Chair of the Board of Directors of Carnival Corporation since 1990. He has been Chair of the Board of Directors of Carnival plc since 2003. He was Chief Executive Officer of Carnival Corporation (formerly known as Carnival Cruise Lines) from 1979 to 2013 and was Chief Executive Officer of Carnival plc from 2003 to 2013.

Board Committees: Executive (Chair)

Other Public Company Boards: None

Qualifications: Mr. Arison’s qualifications to serve on the Boards include his decades of leadership experience with Carnival Corporation & plc, as well as in-depth knowledge of our business, our history and the cruise industry, all gained through almost 50 years of service with our companies.

| |

| 16 |  Carnival Corporation & plc 2021 Proxy Statement Carnival Corporation & plc 2021 Proxy Statement |

GOVERNANCE

Election or Re-Election of Directors

Sir Jonathon Band

| ||

Carnival Corporation Director since 2010

Carnival plc Director since 2010

Age: 71 | Sir Jonathon served in the British Navy from 1967 until his retirement in 2009, having served as First Sea Lord and Chief of Naval Staff, the most senior officer position in the British Navy, until 2009. He was a Director of Lockheed Martin UK Limited from 2010 to 2015.

Board Committees: Compliance, Health, Environmental, Safety & Security (“HESS”) (Chair) and Nominating & Governance

Other Public Company Boards: None

Qualifications: Sir Jonathon’s qualifications to serve on the Boards include his extensive experience in maritime and security matters gained through his 42 years of service with the British Navy. He also brings an international perspective of company and industry matters.

| |

Jason Glen Cahilly

| ||

Carnival Corporation Director since 2017

Carnival plc Director since 2017

Age: 50 | Mr. Cahilly is the Chief Executive Officer of Dragon Group LLC, a private firm, which provides capital and business management consulting and advisory services. Mr. Cahilly previously served as Chief Strategic and Financial Officer of the National Basketball Association, a North American professional basketball league, from 2013 to 2017, as well as a Director of the Board of NBA China. Prior to that, Mr. Cahilly spent 12 years at Goldman Sachs & Co., where he served as a partner and the global co-head of media and telecommunications.

Board Committees: Audit

Other Public Company Boards: Corsair Gaming, Inc. (since September 2020)

Qualifications: Mr. Cahilly’s qualifications to serve on the Boards include his more than 20 years’ experience in the global media, entertainment, sports, technology, leisure, communications and finance sectors in a variety of senior leadership roles.

| |

| 17 |

GOVERNANCE

Election or Re-Election of Directors

Helen Deeble

| ||

Carnival Corporation Director since 2016

Carnival plc Director since 2016

Age: 59 | Ms. Deeble was the Chief Executive Officer of P&O Ferries Division Holdings Ltd., a pan-European shipping and logistics business, from 2006 until 2017. She is also a Non-Executive Director of the Port of London Authority and a member the Supervisory Board of the UK Chamber of Shipping.

Board Committees: Compensation and HESS

Other Public Company Boards: None

Qualifications: Ms. Deeble’s qualifications to serve on the Boards include her more than 30 years’ experience in retail, transport, logistics and leisure sectors in finance and general management roles, including significant maritime operational and commercial experience gained through her service as a chief executive officer of a passenger shipping organization. She is also a UK Chartered Accountant.

| |

Arnold W. Donald

| ||

Carnival Corporation Director since 2001

Carnival plc Director since 2003

Age: 66 | Mr. Donald has been President and Chief Executive Officer of Carnival Corporation & plc since 2013. He was President and Chief Executive Officer of The Executive Leadership Council, a professional network of African-American executives of major U.S. companies, from 2010 to 2012. He previously served as President and Chief Executive Officer of the Juvenile Diabetes Research Foundation International from 2006 to 2008. From 2000 to 2005, Mr. Donald was the Chair of the Board of Merisant Company, a manufacturer and marketer of tabletop sweetener products, including the Equal® and Canderel® brands. From 2000 to 2003, he was also the Chief Executive Officer of Merisant Company. From 1998 to 2000, he was Senior Vice-President of Monsanto Company, a company which develops agricultural products and consumer goods, and President of its nutrition and consumer sector. Prior to that he was President of Monsanto Company’s agricultural sector. He previously served as a Director of Oil-Dri Corporation of America from 1997 to 2013, The Laclede Group, Inc. from 2003 to 2014 and Crown Holdings, Inc. from 1999 to April 2019.

Board Committees: Executive

Other Public Company Boards: Bank of America Corporation (since 2013)

Qualifications: Mr. Donald’s qualifications to serve on the Boards include his broad leadership and other executive skills gained through his prior executive leadership experience with a Fortune-100 science-based research and development, manufacturing and marketing company, a privately held company with global operations, and as head of a large international research-based not-for-profit corporation. He also has broad experience in corporate governance, having served as a Director, past and present, of a number of other publicly-traded companies.

| |

| 18 |  Carnival Corporation & plc 2021 Proxy Statement Carnival Corporation & plc 2021 Proxy Statement |

GOVERNANCE

Election or Re-Election of Directors

Jeffrey J. Gearhart

| ||

Carnival Corporation Director since April 2020

Carnival plc Director since April 2020

Age: 56 | Mr. Gearhart was the Executive Vice President, Global Governance and Corporate Secretary for Walmart, Inc. (“Walmart”), a global retailer, responsible for oversight of Walmart’s global legal, compliance, ethics and security and investigative functions, among others, until 2018. Mr. Gearhart joined Walmart in 2003 as Vice President and General Counsel, Corporate Division. In 2007, he became Senior Vice President and Deputy General Counsel, and then took over as the head of the company’s legal department when he was promoted to General Counsel in 2009. Mr. Gearhart was appointed corporate secretary in 2010, and in 2012 his responsibilities were expanded to include oversight of compliance, ethics and investigations, in addition to legal. Before joining Walmart, Mr. Gearhart was a partner with Kutak Rock LLP, practicing in the corporate, securities and mergers and acquisitions areas.

Board Committees: Compliance and HESS

Other Public Company Boards: Bank OZK (since 2018)

Qualifications: Mr. Gearhart’s qualifications to serve on the Boards include his experience as a lawyer and his leadership experience as general counsel at a global retail company, along with his expertise from having responsibility for global legal, compliance ethics, and security and investigative functions .

| |

Richard J. Glasier

| ||

Carnival Corporation Director since 2004

Carnival plc Director since 2004

Age: 75 | Mr. Glasier was President of Argosy Gaming Company, an owner and operator of casinos, from 2002 to 2005, and its Chief Executive Officer from 2003 until 2005. From 1995 to 2002, Mr. Glasier was Executive Vice President and Chief Financial Officer of Royal Caribbean Cruises Ltd., a global cruise company.

Board Committees: Audit (Chair), Compensation, Compliance and Nominating & Governance

Other Public Company Boards: None

Qualifications: Mr. Glasier’s qualifications to serve on the Boards include significant cruise industry experience as a senior financial officer of a major cruise line, as well as his managerial and corporate governance expertise acquired as the Chief Executive Officer of a New York Stock Exchange-listed operator of hotels and casinos, and as well as many years of public company board experience.

| |

| 19 |

GOVERNANCE

Election or Re-Election of Directors

Katie Lahey

| ||

Carnival Corporation Director since 2019

Carnival plc Director since 2019

Age: 70 | Ms. Lahey was the Chair of Korn Ferry Australasia, a leadership and talent firm, from February through October 2019, having served as its Executive Chair since 2011. She has been a Non-Executive Director of The Star Entertainment Group Limited, which owns and operates integrated resort destinations in Australia, since 2012, and was Chair of the Tourism and Transport Forum Australia, a tourism and transportation industry group, from 2015 until 2018. She was the Executive Chair of Carnival Australia, a division of Carnival plc, from 2006 to 2013. In 2013, she was named a Member of the Order of Australia for her significant services to business and commerce and the arts and in 2003 she was awarded a Centenary Medal for contributions to Australian society in the area of business leadership.

Board Committees: HESS

Other Public Company Boards: The Star Entertainment Group Limited (since 2012)

Qualifications: Ms. Lahey’s qualifications to serve on the Boards include her more than 30 years’ experience in the tourism, talent sourcing, cultural transformation, governmental, retail and the arts sectors in a variety of leadership roles, including within the cruise industry.

| |

| 20 |  Carnival Corporation & plc 2021 Proxy Statement Carnival Corporation & plc 2021 Proxy Statement |

GOVERNANCE

Election or Re-Election of Directors

Sir John Parker

| ||

Carnival Corporation Director since 2003

Carnival plc Director since 2000

Age: 78 | Sir John has been Non-Executive Chair of Laing O’Rourke, a multinational construction company, since 2017. He was the Non-Executive Chair of Pennon Group plc, an environmental utility infrastructure company from 2015 until July 2020, Lead Non-Executive Director for the UK Government Cabinet Office from 2017 to 2018, a Non-Executive Director of Airbus Group NV, an aeronautics, space and related services company, from 2007 to 2018, Non-Executive Chair of Anglo American plc, a multinational mining company, from 2009 until 2017, a Non-Executive Director of DP World Limited, a global supply chain and container handling company, from 2006 to 2015, Non-Executive Chair of Mondi plc from 2007 to 2009, Non-Executive Chair of National Grid plc from 2002 to 2012, Senior Non-Executive Director of the Court of the Bank of England from 2004 to 2009, and a Non-Executive Director of GKN plc from 1993 to 2002, Brambles Industries plc from 2001 to 2003 and BG Group plc from 1997 to 2000. He was Chair and Chief Executive Officer of Babcock International Group plc from 1994 to 2000, RMC Group plc from 2002 to 2005 and P&O Group plc from 2000 to 2003, a President of the Royal Institution of Naval Architects from 1996 to 1999, a member of the Prime Minister’s Business Council for Britain and Chancellor of the University of Southampton from 2006 to 2011. He was President of the Royal Academy of Engineering from 2011 until 2014. Sir John has been a member of the General Committee of Lloyds Register of Shipping since 1983 and was Chair of its Technical Committee from 1993 until 2002.

Board Committees: HESS and Nominating & Governance

Other Public Company Boards: None

Qualifications: Sir John’s qualifications to serve on the Boards include his extensive international background and wealth of corporate experience. His past and present service as a Non-Executive Director of a number of listed UK companies provides the Boards with invaluable knowledge and insight with respect to UK corporate governance policies and practices. In addition, Sir John, as a qualified naval architect and former head of a major shipbuilding company, is very experienced in the design, construction and operation of ships.

| |

| 21 |

GOVERNANCE

Election or Re-Election of Directors

Stuart Subotnick

| ||

Carnival Corporation Director since 1987

Carnival plc Director since 2003

Age: 79 | Mr. Subotnick has been President and Chief Executive Officer of Metromedia Company, a privately held diversified Delaware general partnership, since 2010, having previously served as its General Partner and Executive Vice President since 1986. He previously served as a Director of AboveNet, Inc. from 1997 to 2012.

Board Committees: Audit, Compliance, Executive and Nominating & Governance (Chair)

Other Public Company Boards: None

Qualifications: Mr. Subotnick’s qualifications to serve on the Boards include his significant experience in financing, investing and general business matters, as well as his past Board experience with us, which are important to the Boards when reviewing our investor relations, assessing potential financings and strategies, and otherwise evaluating our business decisions.

| |

Laura Weil

| ||

Carnival Corporation Director since 2007

Carnival plc Director since 2007

Age: 64 | Ms. Weil is the Founder and has been the Managing Partner of Village Lane Advisory LLC, which specializes in providing executive and strategic consulting services to retailers as well as private equity firms, since 2015. She was the Executive Vice President and Chief Operating Officer of New York & Company, Inc., a women’s apparel and accessories retailer, from 2012 to 2014. Ms. Weil was the Chief Executive Officer of Ashley Stewart LLC, a privately held retailer, from 2010 to 2011. Ms. Weil served as the Chief Executive Officer of Urban Brands, Inc., a privately held apparel retailer, from 2009 to 2010. Ms. Weil was the Chief Operating Officer and Senior Executive Vice President of AnnTaylor Stores Corporation, a women’s apparel company, from 2005 to 2006. From 1995 to 2005, she was the Chief Financial Officer and Executive Vice President of American Eagle Outfitters, Inc., a global apparel retailer. She previously served as a Director of Christopher & Banks Corporation from 2016 to June 2019.

Board Committees: Audit, Compensation and Compliance

Other Public Company Boards: Global Fashion Group, S.A. (since 2019)

Qualifications: Ms. Weil’s qualifications to serve on the Boards include her extensive financial, strategic information technology and operating skills developed over many years as an investment banker and senior financial operating executive. Ms. Weil also brings significant experience in global e-commerce and consumer strategies from her leadership experience with multi-billion dollar New York Stock Exchange-listed retailers.

| |

| 22 |  Carnival Corporation & plc 2021 Proxy Statement Carnival Corporation & plc 2021 Proxy Statement |

GOVERNANCE

Board and Committee Governance

Randall J. Weisenburger

| ||

Carnival Corporation Director since 2009

Carnival plc Director since 2009

Age: 62 | Mr. Weisenburger has been the Managing Member of Mile 26 Capital LLC, a private investment firm, since 2014. He was the Executive Vice President and Chief Financial Officer of Omnicom Group Inc., a Fortune-250 global advertising, marketing and corporate communications company, from 1998 to 2014.

Board Committees: Compensation (Chair), Compliance (Chair), HESS and Nominating & Governance

Other Public Company Boards: Corsair Gaming, Inc. (since September 2020), MP Materials Corp. (since November 2020) and Valero Energy Corporation (since 2011)

Qualifications: Mr. Weisenburger’s qualifications to serve on the Boards include his broad leadership and operational skills gained as a senior executive of a large multi-national corporation and his extensive financial and accounting skills acquired as an investment banker and senior financial operating executive. He also has broad experience in corporate governance, having served as a Director, past and present, of a number of other publicly-traded companies.

| |

BOARD AND COMMITTEE GOVERNANCE

Board Meetings

During the year ended November 30, 2020, the Board of Directors of each of Carnival Corporation and Carnival plc held a total of 36 meetings. Each Carnival Corporation Director and each Carnival plc Director attended either telephonically or in person at least 75% of all Carnival Corporation & plc Boards of Directors and applicable Board Committee meetings held during the period that he or she served in fiscal 2020.

Historically, all Board members are expected to attend our Annual Meetings of Shareholders. However, as a result of the COVID-19 pandemic, none of our incumbent Board members were in attendance at our 2020 Annual Meetings of Shareholders. At this time, we are unable to anticipate if our Board members will attend the 2021 Annual Meetings of Shareholders.

Board Leadership Structure

Our Boards of Directors are led by our executive Chair, Mr. Arison. The Chief Executive Officer position is currently separate from the Chair. The Boards maintain the flexibility to determine whether the roles of Chair and Chief Executive Officer should be combined or separated, based on what it believes is in the best interests of Carnival Corporation & plc at a given point in time. We believe that the separation of the Chair and Chief Executive Officer positions is appropriate corporate governance for us at this time, and that having Mr. Arison as our executive Chair enables Carnival Corporation & plc and the Boards to continue to benefit from Mr. Arison’s skills and expertise, including his extensive knowledge of our business.

Our Non-Executive Directors, all of whom are independent, meet privately in executive session at least quarterly. The Presiding Director leads those meetings and also acts as the Senior Independent

| 23 |

GOVERNANCE

Board and Committee Governance

Director under the UK Corporate Governance Code. In addition, the Presiding Director serves as the principal liaison to the Non-Executive Directors, reviews and approves meeting agendas for the Boards and reviews meeting schedules. Our Non-Executive Directors, acting in executive session, elected Randall J. Weisenburger as the Presiding Director and Senior Independent Director.

The structure of our Boards facilitates the continued strong communication and coordination between management and the Boards and enables the Boards to fulfill their risk oversight responsibilities, as further described below.

Board Committees

The Boards delegate various responsibilities and authority to different Board Committees. The Board Committees regularly report on their activities and actions to the full Boards. The Board of Directors of each of Carnival Corporation and Carnival plc has established standing Board Committees, which are each comprised of the same Directors for each company, as follows:

| • | Audit; |

| • | Compensation; |

| • | Compliance; |

| • | Executive; |

| • | HESS; and |

| • | Nominating & Governance. |

Each Board Committee periodically reviews its charter in light of new developments in applicable regulations and may make additional recommendations to the Boards to reflect evolving best practices. Each Board Committee can engage outside experts, advisors and counsel to assist the Board Committee in its work.

The current Board Committee members are as follows:

Name | Board Committees

| |||||||||||

Audit

| Compensation

| Compliance

| Executive

| HESS

| Nominating & Governance

| |||||||

Micky Arison

| —

| —

| —

| Chair

| —

| —

| ||||||

Sir Jonathon Band

| —

| —

| X

| —

| Chair

| X

| ||||||

Jason Glen Cahilly

| X

| —

| —

| —

| —

| —

| ||||||

Helen Deeble

| —

| X

| —

| —

| X

| —

| ||||||

Arnold W. Donald

| —

| —

| —

| X

| —

| —

| ||||||

Jeffrey J. Gearhart

| —

| —

| X

| —

| X

| —

| ||||||

Richard J. Glasier

| Chair

| X

| X

| —

| —

| X

| ||||||

Katie Lahey

| —

| —

| —

| —

| X

| —

| ||||||

Sir John Parker

| —

| —

| —

| —

| X

| X

| ||||||

Stuart Subotnick

| X

| —

| X

| X

| —

| Chair

| ||||||

Laura Weil

| X

| X

| X

| —

| —

| —

| ||||||

Randall J. Weisenburger

| —

| Chair

| Chair

| —

| X

| X

| ||||||

Number of Board Committee meetings in fiscal 2020

| 13

| 8

| 6

| 0

| 10

| 4

| ||||||

Audit Committees. The Audit Committees assist the Boards in their general oversight of our financial reporting, internal controls and audit functions, and our compliance with legal and regulatory requirements (other than health, environmental, safety and security matters). The Audit Committees are also responsible for the appointment, retention, compensation, and oversight of the work of our independent auditors and our independent registered public accounting firm. The Board of Directors of

| 24 |  Carnival Corporation & plc 2021 Proxy Statement Carnival Corporation & plc 2021 Proxy Statement |

GOVERNANCE

Board and Committee Governance

Carnival Corporation has determined that each member of the Audit Committees is both “independent” and an “audit committee financial expert,” as defined by SEC rules. In addition, the Board of Directors of Carnival plc has determined that each member of the Audit Committees is “independent” and has “recent and relevant financial experience” for the purposes of the UK Corporate Governance Code. The Boards determined that each member of the Audit Committees has sufficient knowledge in reading and understanding the company’s financial statements to serve on the Audit Committees. The responsibilities and activities of the Audit Committees are described in detail in “Report of the Audit Committees” and the Audit Committees’ charter.

Compensation Committees. The Compensation Committees have authority for reviewing and determining salaries, performance-based incentives, and other matters related to the compensation of our executive officers, and administering our stock incentive plans, including reviewing and granting equity-based grants to our executive officers and other employees. The Compensation Committees also review and determine various other compensation policies and matters, including making recommendations to the Boards with respect to the compensation of the Non-Executive (non-employee) Directors, incentive compensation and equity-based plans generally, and administering the employee stock purchase plans. For more information on the responsibilities and activities of the Compensation Committees, including the Committees’ processes for determining executive compensation, see “Compensation Discussion and Analysis” and “Executive Compensation” sections and the Compensation Committees’ charter.

Compliance Committees. The Compliance Committees assist with the Boards’ oversight of our ethics and compliance program. They receive regular reports from, and provide direction to, the Chief Ethics and Compliance Officer with respect to the implementation of the Ethics and Compliance Strategic Plan, including the adequacy of staffing and resources; monitoring, in coordination with the HESS Committees, implementation of our Environmental Compliance Plan; taking steps, in coordination with the Boards’ Audit and HESS Committees, reasonably designed to ensure that all significant allegations of misconduct by management, employees, or agents receive appropriate attention and remediation; promoting accountability of senior management with respect to compliance matters; and making recommendations to the Boards for the framework, structure, and design of the Boards’ oversight of our Ethics and Compliance Program. For more information on the responsibilities and activities of the Compliance Committees, see the Compliance Committees’ charter.

Executive Committees. The Executive Committees may exercise the authority of the full Boards between meetings of the Boards, except to the extent that the Boards have delegated authority to another Board Committee or to other persons, and except as limited by applicable law.

HESS Committees. The HESS Committees review and recommend policies relative to the protection of the environment and the health, safety and security of employees, contractors, guests and the public. The HESS Committees also supervise and monitor health, environmental, safety, security and sustainability policies and programs and review with management significant risks or exposures and actions required to minimize such risks. For more information on the responsibilities and activities of the HESS Committees, see the HESS Committees’ charter.

Nominating & Governance Committees. The Nominating & Governance Committees review and report to the Boards on a periodic basis with regard to matters of corporate governance, including succession planning. The Nominating & Governance Committees also review and assess the effectiveness of our Corporate Governance Guidelines, make recommendations to the Boards regarding proposed revisions to these guidelines, and make recommendations to the Boards regarding the size and composition of the Boards and their Committees. For more information on the responsibilities and activities of the Nominating & Governance Committees, see “Nominations of Directors” and

| 25 |

GOVERNANCE

Board and Committee Governance

“Procedures Regarding Director Candidates Recommended by Shareholders” sections and the Nominating & Governance Committees’ charter. Additional information with respect to Carnival plc’s corporate governance practices during fiscal 2020 is included in the Carnival plc Corporate Governance Report attached as Annex C to this Proxy Statement.

Board and Committee Independence

Under New York Stock Exchange standards of independence for directors, the Boards must determine that a Director does not have any material relationship with Carnival Corporation & plc or its subsidiaries (either directly or as a partner, shareholder or officer of an organization that has a relationship with Carnival Corporation & plc) and meet certain bright-line tests. The Boards of Directors have determined that each of Sir Jonathon Band, Jason Glen Cahilly, Helen Deeble, Jeffrey J. Gearhart, Richard J. Glasier, Katie Lahey, Sir John Parker, Stuart Subotnick, Laura Weil and Randall J. Weisenburger is an “independent director” in accordance with the New York Stock Exchange standards of independence for directors and that all members of the Audit Committees and Compensation Committees meet the heightened independence criteria applicable to Directors serving on those Committees under SEC rules and New York Stock Exchange listing standards. Accordingly, a majority of the Directors of each company, all of our Non-Executive Directors and all of the members of the Audit, Compensation, Compliance, HESS and Nominating & Governance Committees of each company are independent (as defined by the New York Stock Exchange listing standards, SEC rules and the UK Corporate Governance Code).

Risk Oversight

Our Boards use their Committees to assist in their risk oversight responsibility as follows:

| • | Our Audit Committees are responsible for oversight of our financial, operational and non-HESS controls and compliance activities, including those related to information technology operations, cybersecurity and privacy. In connection with its risk oversight role, the Audit Committees regularly meet privately with representatives from Carnival Corporation’s independent registered public accounting firm, the Carnival plc independent auditor, the Chief Audit Officer and the General Counsel. |

| • | Our Compensation Committees are responsible for oversight of risk associated with our executive compensation structure, policies and programs. |

| • | Our Compliance Committees are responsible for providing oversight of our ethics and compliance program. |

| • | Our HESS Committees are responsible for oversight of risk associated with the health, environment, safety and security of employees, contractors, guests and the public. |

| • | Our Nominating & Governance Committees are responsible for oversight of risk associated with Board processes and corporate governance, including succession planning. |

Each Committee Chair presents on its area of risk oversight to the full Boards for review.

Discussions between management and the Boards regarding the Carnival Corporation & plc strategic plan, consolidated business results, capital structure, and other business-related activities include a discussion of the risks associated with the particular item under consideration. In response to the significant operational and financial impact of COVID-19 on our organization, the Boards held weekly or bi-weekly meetings from March 2020 through November 2020 and received regular reports from management regarding our liquidity, repatriation of guests and crew, the development of health protocols, compliance status, plans to restart operations and other critical matters.

| 26 |  Carnival Corporation & plc 2021 Proxy Statement Carnival Corporation & plc 2021 Proxy Statement |

GOVERNANCE

Board and Committee Governance

The Boards believe that the structure and assigned responsibilities provides the appropriate focus, oversight and communication of principal risks faced by our companies.

Compensation Risk Assessment

Carnival Corporation & plc’s management, in conjunction with the Compensation Committees’ independent compensation consultant, Frederic W. Cook & Co., Inc. (“FW Cook”), conducted a thorough review of our compensation programs, including those programs in which our Named Executive Officers participate, to determine if aspects of those programs contribute to excessive risk-taking. Based on the findings from this review and the annual reassessment, the Compensation Committees continue to believe that our compensation policies and practices do not encourage excessive risk-taking and are not reasonably likely to have a material adverse effect on Carnival Corporation & plc.

To reach this conclusion, key elements of our compensation programs were assessed to determine if they exhibited excessive risk. These elements included pay mix (cash vs. equity) and pay structure (short vs. long-term focus), performance metrics, performance goals and ranges, the degree of leverage, incentive maximums, payment timing, incentive adjustments, use of discretion and stock ownership requirements. Our assessment reinforced the Compensation Committees’ belief that our compensation programs are not contributing to excessive risk-taking, but instead contain many features and elements that help to mitigate risk. For example: