UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05251

Fidelity Concord Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Nicole Macarchuk, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | October 31 |

|

|

Date of reporting period: | October 31, 2024 |

Item 1.

Reports to Stockholders

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® SAI Global ex U.S. Low Volatility Index Fund Fidelity® SAI Global ex U.S. Low Volatility Index Fund : FSGJX |

| | | |

This annual shareholder report contains information about Fidelity® SAI Global ex U.S. Low Volatility Index Fund for the period July 25, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

Fidelity® SAI Global ex U.S. Low Volatility Index Fund A | $ 7 | 0.26% | |

A Expenses for the full reporting period would be higher.

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $2,804,473,796 | |

| Number of Holdings | 199 | |

| Total Advisory Fee | $120,708 | |

Portfolio TurnoverA | 204% | |

A Amount not annualized

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 20.5 | |

| Health Care | 13.3 | |

| Consumer Staples | 10.4 | |

| Communication Services | 10.1 | |

| Industrials | 9.9 | |

| Utilities | 7.6 | |

| Information Technology | 6.7 | |

| Consumer Discretionary | 5.5 | |

| Real Estate | 3.2 | |

| Energy | 2.7 | |

| Materials | 2.4 | |

| |

| Common Stocks | 92.3 |

| International Equity Funds | 4.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| Japan | 20.1 |

| United States | 15.2 |

| China | 11.0 |

| Taiwan | 9.6 |

| Canada | 9.1 |

| United Kingdom | 6.1 |

| Switzerland | 5.9 |

| Saudi Arabia | 3.7 |

| Denmark | 3.6 |

| Others | 15.7 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| iShares MSCI India ETF | 4.0 | |

| Novo Nordisk A/S Series B | 2.5 | |

| Novartis AG | 2.3 | |

| Roche Holding AG | 2.2 | |

| Astrazeneca PLC | 2.0 | |

| Nestle SA | 2.0 | |

| China Construction Bank Corp H Shares | 1.9 | |

| Industrial & Commercial Bank of China Ltd H Shares | 1.8 | |

| Bank of China Ltd H Shares | 1.8 | |

| RELX PLC | 1.8 | |

| | 22.3 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916855.100 7629-TSRA-1224 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity ZERO® International Index Fund Fidelity ZERO® International Index Fund : FZILX |

| | | |

This annual shareholder report contains information about Fidelity ZERO® International Index Fund for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity ZERO® International Index Fund | $ 0 A | 0.00%B | |

A Amount represents less than $.50

B Amount represents less than 0.005%

What affected the Fund's performance this period?

•International stocks achieved a strong gain for the 12 months ending October 31, 2024. Resilient global economic growth and a slowing in the pace of inflation in certain regions, as well as a shift to global monetary easing, contributed to a favorable backdrop, despite persistent geopolitical risk.

•Against this backdrop, Europe ex U.K. gained about 23% and contributed most to the fund's performance for the fiscal year, followed by emerging markets (+24%).

•By sector, financials gained about 36% and contributed most. Information technology, which gained 39%, also helped, as did industrials, which advanced about 32%. The consumer discretionary sector rose approximately 18%, while health care gained 20% and communication services advanced about 27%. Other contributors included the materials (+13%), utilities (+20%), real estate (+22%), consumer staples (+6%) and energy (+4%) sectors.

•Turning to individual stocks, the top contributor was Taiwan Semiconductor (+101%), from the semiconductors & semiconductor equipment group. In software & services, SAP (+76%) boosted the fund. Tencent Holdings (+42%), from the media & entertainment category, helped. In banks, Royal Bank Of Canada gained roughly 57% and boosted the fund. Lastly, Hitachi (+109%), a stock in the capital goods group, also lifted the fund.

•In contrast, the biggest detractor was Samsung Electronics (-11%), from the technology hardware & equipment industry. Nestle (-10%), a stock in the food, beverage & tobacco group, hurt the fund. BP, within the energy sector, returned approximately -17% and hindered the fund. Lastly, in pharmaceuticals, biotechnology & life sciences, Bayer (-37%) and Wuxi Biologics (-66%) also hurt the fund's performance.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

August 2, 2018 through October 31, 2024.

Initial investment of $10,000.

Fidelity ZERO® International Index Fund | $10,000 | $9,130 | $10,206 | $9,967 | $12,996 | $9,774 | $11,047 |

Fidelity Global ex U.S. Index℠ | $10,000 | $9,179 | $10,289 | $10,034 | $13,137 | $9,888 | $11,128 |

MSCI ACWI (All Country World Index) ex USA Index | $10,000 | $9,172 | $10,224 | $9,972 | $12,949 | $9,763 | $10,961 |

| | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | Life of Fund A |

| Fidelity ZERO® International Index Fund | 23.79% | 6.03% | 5.13% |

| Fidelity Global ex U.S. Index℠ | 24.74% | 6.17% | 5.38% |

| MSCI ACWI (All Country World Index) ex USA Index | 24.55% | 5.95% | 5.10% |

A From August 2, 2018

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $4,523,912,962 | |

| Number of Holdings | 2,256 | |

| Total Advisory Fee | $0 | |

| Portfolio Turnover | 5% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 23.1 | |

| Industrials | 14.2 | |

| Information Technology | 12.7 | |

| Consumer Discretionary | 10.6 | |

| Health Care | 8.6 | |

| Consumer Staples | 6.7 | |

| Materials | 6.6 | |

| Communication Services | 5.3 | |

| Energy | 4.7 | |

| Utilities | 2.6 | |

| Real Estate | 1.8 | |

| |

| Common Stocks | 96.6 |

| Preferred Stocks | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| Japan | 16.1 |

| United States | 8.9 |

| Canada | 7.4 |

| United Kingdom | 6.9 |

| China | 6.6 |

| Taiwan | 5.8 |

| France | 5.2 |

| Germany | 5.2 |

| Australia | 4.8 |

| Others | 33.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Taiwan Semiconductor Manufacturing Co Ltd | 2.8 | |

| Novo Nordisk A/S Series B | 1.3 | |

| Tencent Holdings Ltd | 1.1 | |

| ASML Holding NV | 1.0 | |

| Nestle SA | 0.9 | |

| SAP SE | 0.9 | |

| Roche Holding AG | 0.9 | |

| Astrazeneca PLC | 0.8 | |

| Toyota Motor Corp | 0.8 | |

| Novartis AG | 0.7 | |

| | 11.2 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914002.100 3228-TSRA-1224 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity ZERO® Large Cap Index Fund Fidelity ZERO® Large Cap Index Fund : FNILX |

| | | |

This annual shareholder report contains information about Fidelity ZERO® Large Cap Index Fund for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity ZERO® Large Cap Index Fund | $ 0 A | 0.00%B | |

A Amount represents less than $.50

B Amount represents less than 0.005%

What affected the Fund's performance this period?

•U.S. equities posted a strong advance for the 12 months ending October 31, 2024, driven by a resilient economy, the promise of artificial intelligence to drive transformative change and the Federal Reserve's long-anticipated pivot to cutting interest rates.

•Against this backdrop, information technology gained approximately 51% and contributed most to the fund's performance for the fiscal year. Financials, which gained about 47%, also helped, as did communication services, which advanced 48%, lifted by the media & entertainment industry (+48%). The consumer discretionary sector rose about 33%, while industrials gained about 40% and health care advanced 20%. Other contributors included the consumer staples (+24%), utilities (+38%), real estate (+34%), materials (+24%) and energy (+9%) sectors.

•Turning to individual stocks, the top contributor was Nvidia (+226%), from the semiconductors & semiconductor equipment industry. Apple (+33%), from the technology hardware & equipment industry, lifted the fund. In media & entertainment, Meta Platforms (+89%) and Alphabet (+38%) helped. Lastly, Microsoft (+21%), from the software & services industry, also lifted the fund.

•In contrast, the biggest detractor was Intel (-40%), from the semiconductors & semiconductor equipment group. Humana (-50%), a stock in the health care equipment & services category, hurt the fund's performance. Nike, within the consumer durables & apparel category, returned -24% and hindered the fund. Adobe (-10%), a stock in the software & services category, hindered the fund. Lastly, Boeing (-20%), a stock in the capital goods group, also detracted.

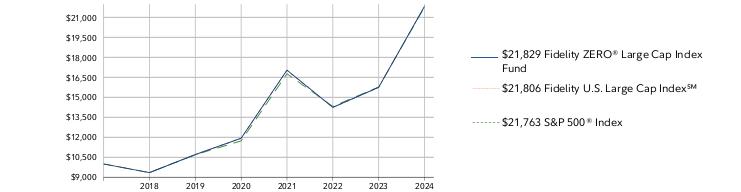

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

September 13, 2018 through October 31, 2024.

Initial investment of $10,000.

Fidelity ZERO® Large Cap Index Fund | $10,000 | $9,350 | $10,705 | $11,931 | $17,039 | $14,246 | $15,751 |

Fidelity U.S. Large Cap Index℠ | $10,000 | $9,347 | $10,695 | $11,927 | $17,029 | $14,235 | $15,740 |

S&P 500® Index | $10,000 | $9,353 | $10,693 | $11,732 | $16,766 | $14,316 | $15,769 |

| | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | Life of Fund A |

| Fidelity ZERO® Large Cap Index Fund | 38.58% | 15.31% | 13.56% |

| Fidelity U.S. Large Cap Index℠ | 38.54% | 15.31% | 13.55% |

| S&P 500® Index | 38.02% | 15.27% | 13.51% |

A From September 13, 2018

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $11,188,374,545 | |

| Number of Holdings | 512 | |

| Total Advisory Fee | $0 | |

| Portfolio Turnover | 3% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 32.0 | |

| Financials | 13.5 | |

| Health Care | 11.1 | |

| Consumer Discretionary | 9.9 | |

| Communication Services | 9.1 | |

| Industrials | 8.4 | |

| Consumer Staples | 5.6 | |

| Energy | 3.3 | |

| Utilities | 2.4 | |

| Real Estate | 2.2 | |

| Materials | 2.1 | |

| |

| Common Stocks | 99.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.4 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 99.8 |

| China | 0.1 |

| Switzerland | 0.1 |

| Canada | 0.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Apple Inc | 7.0 | |

| NVIDIA Corp | 6.7 | |

| Microsoft Corp | 6.2 | |

| Amazon.com Inc | 3.5 | |

| Meta Platforms Inc Class A | 2.5 | |

| Alphabet Inc Class A | 2.1 | |

| Alphabet Inc Class C | 1.7 | |

| Berkshire Hathaway Inc Class B | 1.7 | |

| Broadcom Inc | 1.7 | |

| Tesla Inc | 1.4 | |

| | 34.5 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914004.100 3231-TSRA-1224 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Series International Index Fund Fidelity® Series International Index Fund : FHLFX |

| | | |

This annual shareholder report contains information about Fidelity® Series International Index Fund for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Series International Index Fund | $ 1 | 0.01% | |

What affected the Fund's performance this period?

•International stocks achieved a strong gain for the 12 months ending October 31, 2024. Resilient global economic growth and a slowing in the pace of inflation in certain regions, as well as a shift to global monetary easing, contributed to a favorable backdrop, despite persistent geopolitical risk.

•Against this backdrop, Europe ex U.K. gained 23% and contributed most to the fund's performance for the fiscal year, followed by Japan (+23%).

•By sector, financials gained roughly 38% and contributed most. Industrials, which gained 36%, also helped, benefiting from the capital goods industry (+38%), as did health care, which advanced about 21%, lifted by the pharmaceuticals, biotechnology & life sciences industry (+20%). The information technology sector rose 29%, while consumer discretionary gained roughly 14% and communication services advanced 28%. Other contributors included the materials (+15%), utilities (+18%), real estate (+24%) and consumer staples (+5%) sectors.

•Conversely, from a sector standpoint, energy returned approximately -3% and detracted most.

•Turning to individual stocks, the biggest contributor was SAP (+76%), from the software & services category. In capital goods, Hitachi (+109%) and Schneider Electric (+71%) helped. Lastly, in banks, Commonwealth Bank of Australia (+59%) and HSBC (+41%) also boosted the fund.

•In contrast, the biggest detractor was Nestle (-10%), from the food, beverage & tobacco group. From the same group, Diageo (-16%) hurt. Another notable detractor was BP (-17%), a stock in the energy sector. In pharmaceuticals, biotechnology & life sciences, Bayer returned -37% and hindered the fund. Lastly, LVMH Moet Hennessy Louis Vuitton (-6%), from the consumer durables & apparel industry, also detracted.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

August 17, 2018 through October 31, 2024.

Initial investment of $10,000.

Fidelity® Series International Index Fund | $10,000 | $9,430 | $10,473 | $9,790 | $13,133 | $10,105 | $11,651 |

MSCI EAFE Index | $10,000 | $9,457 | $10,526 | $9,822 | $13,205 | $10,189 | $11,682 |

| | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | Life of Fund A |

| Fidelity® Series International Index Fund | 22.34% | 6.36% | 5.87% |

| MSCI EAFE Index | 23.25% | 6.46% | 6.04% |

A From August 17, 2018

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $510,853,383 | |

| Number of Holdings | 737 | |

| Total Advisory Fee | $0 | |

| Portfolio Turnover | 3% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 20.8 | |

| Industrials | 17.2 | |

| Health Care | 13.0 | |

| Consumer Discretionary | 10.7 | |

| Consumer Staples | 8.3 | |

| Information Technology | 8.3 | |

| Materials | 6.0 | |

| Communication Services | 4.1 | |

| Energy | 3.5 | |

| Utilities | 3.1 | |

| Real Estate | 1.9 | |

| |

| Common Stocks | 96.5 |

| Preferred Stocks | 0.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| Japan | 21.8 |

| United States | 12.0 |

| United Kingdom | 10.6 |

| France | 9.2 |

| Germany | 8.8 |

| Australia | 7.4 |

| Switzerland | 6.1 |

| Netherlands | 3.9 |

| Denmark | 3.3 |

| Others | 16.9 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Novo Nordisk A/S Series B | 2.2 | |

| ASML Holding NV | 1.6 | |

| Nestle SA | 1.5 | |

| SAP SE | 1.5 | |

| Astrazeneca PLC | 1.3 | |

| Roche Holding AG | 1.3 | |

| Novartis AG | 1.3 | |

| Shell PLC | 1.2 | |

| LVMH Moet Hennessy Louis Vuitton SE | 1.2 | |

| Toyota Motor Corp | 1.1 | |

| | 14.2 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914000.100 3226-TSRA-1224 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity ZERO® Extended Market Index Fund Fidelity ZERO® Extended Market Index Fund : FZIPX |

| | | |

This annual shareholder report contains information about Fidelity ZERO® Extended Market Index Fund for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity ZERO® Extended Market Index Fund | $ 0 A | 0.00%B | |

A Amount represents less than $.50

B Amount represents less than 0.005%

What affected the Fund's performance this period?

•U.S. equities posted a strong advance for the 12 months ending October 31, 2024, driven by a resilient economy, the promise of artificial intelligence to drive transformative change and the Federal Reserve's long-anticipated pivot to cutting interest rates.

•Against this backdrop, financials gained 50% and contributed most to the fund's performance for the fiscal year. Industrials, which gained approximately 37%, also helped, benefiting from the capital goods industry (+43%), as did consumer discretionary, which advanced 31%. The health care sector rose approximately 35%, while information technology gained approximately 30% and real estate advanced roughly 35%. Other contributors included the materials (+33%), utilities (+37%), communication services (+26%) and consumer staples (+19%) sectors.

•In contrast, energy returned -4% and detracted most.

•Turning to individual stocks, the top contributor was Carvana (+816%), from the consumer discretionary distribution & retail category. Coinbase Global (+174%), a stock in the financial services industry, lifted the fund. Super Micro Computer (+198%), from the technology hardware & equipment group, lifted the fund. Lastly, Vertiv Holdings (+91%) and Emcor (+116%), within the capital goods industry, also helped.

•Conversely, the biggest detractor was Apa (-39%), from the energy sector. Agilon health (-86%), from the health care equipment & services category, detracted. In consumer discretionary distribution & retail, Five Below returned roughly -45% and hindered the fund. Another notable detractor was Flagstar Financial (-63%), a stock in the banks industry. Lastly, in automobiles & components, Rivian Automotive (-38%) also hurt the fund.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

September 13, 2018 through October 31, 2024.

Initial investment of $10,000.

Fidelity ZERO® Extended Market Index Fund | $10,000 | $8,990 | $9,707 | $9,701 | $14,739 | $12,234 | $11,717 |

Fidelity U.S. Extended Investable Market Index℠ | $10,000 | $8,986 | $9,699 | $9,695 | $14,724 | $12,209 | $11,667 |

S&P 500® Index | $10,000 | $9,353 | $10,693 | $11,732 | $16,766 | $14,316 | $15,769 |

| | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | Life of Fund A |

| Fidelity ZERO® Extended Market Index Fund | 33.66% | 10.04% | 7.58% |

| Fidelity U.S. Extended Investable Market Index℠ | 33.58% | 9.95% | 7.50% |

| S&P 500® Index | 38.02% | 15.27% | 13.51% |

A From September 13, 2018

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $1,735,724,909 | |

| Number of Holdings | 2,066 | |

| Total Advisory Fee | $0 | |

| Portfolio Turnover | 8% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Industrials | 20.0 | |

| Financials | 17.7 | |

| Consumer Discretionary | 12.3 | |

| Health Care | 12.3 | |

| Information Technology | 11.1 | |

| Real Estate | 6.8 | |

| Materials | 5.4 | |

| Energy | 4.5 | |

| Consumer Staples | 3.8 | |

| Communication Services | 3.3 | |

| Utilities | 2.5 | |

| |

| Common Stocks | 99.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 98.4 |

| United Kingdom | 0.5 |

| Puerto Rico | 0.3 |

| Bermuda | 0.2 |

| Thailand | 0.1 |

| Sweden | 0.1 |

| Belgium | 0.1 |

| Argentina | 0.1 |

| Switzerland | 0.1 |

| Others | 0.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Carvana Co Class A | 0.6 | |

| Smurfit WestRock PLC | 0.5 | |

| Texas Pacific Land Corp | 0.5 | |

| Eqt Corp | 0.5 | |

| EMCOR Group Inc | 0.4 | |

| Lennox International Inc | 0.4 | |

| Live Nation Entertainment Inc | 0.4 | |

| Expand Energy Corp | 0.4 | |

| Snap-on Inc | 0.4 | |

| NRG Energy Inc | 0.3 | |

| | 4.4 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914003.100 3230-TSRA-1224 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® SAI Japan Stock Index Fund Fidelity® SAI Japan Stock Index Fund : FSJPX |

| | | |

This annual shareholder report contains information about Fidelity® SAI Japan Stock Index Fund for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® SAI Japan Stock Index Fund | $ 14 | 0.13% | |

What affected the Fund's performance this period?

•International stocks achieved a strong gain for the 12 months ending October 31, 2024. Resilient global economic growth and a slowing in the pace of inflation in certain regions, as well as a shift to global monetary easing, contributed to a favorable backdrop, despite persistent geopolitical risk.

•By sector, industrials gained approximately 33% and contributed most. Financials, which gained approximately 35%, also helped, as did information technology, which advanced about 29%. The health care sector rose roughly 25%, while consumer discretionary gained roughly 9% and communication services advanced 21%. Other contributors included the materials (+14%), consumer staples (+10%), real estate (+11%), energy (+22%) and utilities (+13%) sectors.

•Turning to individual stocks, the biggest contributor was Hitachi (+108%), from the capital goods industry. Within the same group, Mitsubishi Heavy Industries gained approximately 188% and helped. Recruit Holdings (+121%), from the commercial & professional services industry, lifted the fund. Mitsubishi UFJ Financial Group (+32%), from the banks industry, lifted the fund. Lastly, Tokio Marine Holdings (+71%), from the insurance industry, also lifted the fund.

•Conversely, the biggest detractor was Oriental Land (-24%), from the consumer services industry. Daikin Industries (-12%), a stock in the capital goods group, hindered the fund. Another notable detractor was Nippon Telegraph & Telephone (-14%), a stock in the telecommunication services group. In semiconductors & semiconductor equipment, Screen Holdings (-46%) hurt the fund. Lastly, Eisai (-33%), from the pharmaceuticals, biotechnology & life sciences group, also hurt the fund.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

May 27, 2021 through October 31, 2024.

Initial investment of $10,000.

Fidelity® SAI Japan Stock Index Fund | $10,000 | $10,180 | $7,653 | $9,044 |

MSCI Japan Index | $10,000 | $10,174 | $7,675 | $8,975 |

| | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | Life of Fund A |

| Fidelity® SAI Japan Stock Index Fund | 19.13% | 2.20% |

| MSCI Japan Index | 22.47% | 2.79% |

A From May 27, 2021

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $660,853,714 | |

| Number of Holdings | 202 | |

| Total Advisory Fee | $630,593 | |

| Portfolio Turnover | 47% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Industrials | 23.0 | |

| Consumer Discretionary | 17.3 | |

| Information Technology | 14.5 | |

| Financials | 14.4 | |

| Health Care | 8.5 | |

| Communication Services | 7.2 | |

| Consumer Staples | 5.5 | |

| Materials | 4.0 | |

| Real Estate | 2.5 | |

| Utilities | 1.1 | |

| Energy | 0.9 | |

| |

| Common Stocks | 98.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| Japan | 98.9 |

| United States | 1.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Toyota Motor Corp | 4.7 | |

| Mitsubishi UFJ Financial Group Inc | 3.2 | |

| Hitachi Ltd | 3.1 | |

| Sony Group Corp | 3.0 | |

| Recruit Holdings Co Ltd | 2.4 | |

| Keyence Corp | 2.4 | |

| Sumitomo Mitsui Financial Group Inc | 2.1 | |

| Tokio Marine Holdings Inc | 1.8 | |

| Shin-Etsu Chemical Co Ltd | 1.8 | |

| Tokyo Electron Ltd | 1.8 | |

| | 26.3 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914017.100 6418-TSRA-1224 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity ZERO® Total Market Index Fund Fidelity ZERO® Total Market Index Fund : FZROX |

| | | |

This annual shareholder report contains information about Fidelity ZERO® Total Market Index Fund for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity ZERO® Total Market Index Fund | $ 0 A | 0.00%B | |

A Amount represents less than $.50

B Amount represents less than 0.005%

What affected the Fund's performance this period?

•U.S. equities posted a strong advance for the 12 months ending October 31, 2024, driven by a resilient economy, the promise of artificial intelligence to drive transformative change and the Federal Reserve's long-anticipated pivot to cutting interest rates.

•Against this backdrop, information technology gained roughly 50% and contributed most to the fund's performance for the fiscal year. Financials, which gained approximately 48%, also helped, as did industrials, which advanced roughly 40%. The communication services sector rose 47%, boosted by the media & entertainment industry (+47%), while consumer discretionary gained about 32% and health care advanced approximately 21%. Other contributors included the consumer staples (+23%), real estate (+35%), utilities (+38%), materials (+26%) and energy (+7%) sectors.

•Turning to individual stocks, the biggest contributor was Nvidia (+225%), from the semiconductors & semiconductor equipment category. Apple, within the technology hardware & equipment industry, gained 33% and lifted the fund. Meta Platforms (+89%) and Alphabet (+38%), from the media & entertainment category, contributed. Lastly, in software & services, Microsoft gained 21% and also contributed.

•In contrast, the biggest detractor was Intel (-40%), from the semiconductors & semiconductor equipment industry. In health care equipment & services, Humana (-50%) detracted. Nike (-24%), a stock in the consumer durables & apparel group, detracted. Adobe (-10%), a stock in the software & services industry, detracted. Lastly, in capital goods, Boeing (-20%) also hindered the fund.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

August 2, 2018 through October 31, 2024.

Initial investment of $10,000.

Fidelity ZERO® Total Market Index Fund | $10,000 | $9,560 | $10,857 | $11,935 | $17,186 | $14,357 | $15,584 |

Fidelity U.S. Total Investable Market Index℠ | $10,000 | $9,562 | $10,850 | $11,926 | $17,178 | $14,343 | $15,573 |

S&P 500® Index | $10,000 | $9,636 | $11,017 | $12,087 | $17,274 | $14,750 | $16,246 |

| | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | Life of Fund A |

| Fidelity ZERO® Total Market Index Fund | 38.06% | 14.66% | 13.04% |

| Fidelity U.S. Total Investable Market Index℠ | 37.98% | 14.64% | 13.01% |

| S&P 500® Index | 38.02% | 15.27% | 13.79% |

A From August 2, 2018

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $23,896,621,668 | |

| Number of Holdings | 2,576 | |

| Total Advisory Fee | $0 | |

| Portfolio Turnover | 2% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 29.9 | |

| Financials | 13.9 | |

| Health Care | 11.2 | |

| Consumer Discretionary | 10.2 | |

| Industrials | 9.7 | |

| Communication Services | 8.5 | |

| Consumer Staples | 5.4 | |

| Energy | 3.5 | |

| Real Estate | 2.7 | |

| Materials | 2.4 | |

| Utilities | 2.4 | |

| |

| Common Stocks | 99.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 99.6 |

| China | 0.2 |

| Switzerland | 0.2 |

| United Kingdom | 0.0 |

| Canada | 0.0 |

| Puerto Rico | 0.0 |

| Bermuda | 0.0 |

| Thailand | 0.0 |

| Sweden | 0.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Apple Inc | 6.3 | |

| NVIDIA Corp | 6.0 | |

| Microsoft Corp | 5.6 | |

| Amazon.com Inc | 3.2 | |

| Meta Platforms Inc Class A | 2.3 | |

| Alphabet Inc Class A | 1.9 | |

| Berkshire Hathaway Inc Class B | 1.6 | |

| Alphabet Inc Class C | 1.5 | |

| Broadcom Inc | 1.5 | |

| Tesla Inc | 1.3 | |

| | 31.2 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914001.100 3227-TSRA-1224 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® SAI Canada Equity Index Fund Fidelity® SAI Canada Equity Index Fund : FSCJX |

| | | |

This annual shareholder report contains information about Fidelity® SAI Canada Equity Index Fund for the period July 11, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

Fidelity® SAI Canada Equity Index Fund A | $ 5 | 0.16% | |

A Expenses for the full reporting period would be higher.

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $2,120,508,681 | |

| Number of Holdings | 87 | |

| Total Advisory Fee | $122,879 | |

Portfolio TurnoverB | 0%A | |

A Amount represents less than 1%

B Amount not annualized

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 36.8 | |

| Energy | 18.1 | |

| Industrials | 11.7 | |

| Materials | 11.2 | |

| Information Technology | 9.2 | |

| Consumer Staples | 4.3 | |

| Consumer Discretionary | 3.6 | |

| Utilities | 2.7 | |

| Communication Services | 1.3 | |

| Real Estate | 0.5 | |

| |

| Common Stocks | 99.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| Canada | 96.6 |

| Brazil | 1.4 |

| United States | 1.3 |

| Zambia | 0.4 |

| Chile | 0.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Royal Bank of Canada | 8.1 | |

| Toronto-Dominion Bank/The | 4.6 | |

| Shopify Inc Class A | 4.5 | |

| Enbridge Inc | 4.2 | |

| Brookfield Corp Class A | 3.5 | |

| Canadian Pacific Kansas City Ltd | 3.5 | |

| Canadian Natural Resources Ltd | 3.4 | |

| Bank of Montreal | 3.2 | |

| Bank of Nova Scotia/The | 3.0 | |

| Constellation Software Inc/Canada | 2.9 | |

| | 40.9 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916853.100 7628-TSRA-1224 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® SAI International Small Cap Index Fund Fidelity® SAI International Small Cap Index Fund : FSISX |

| | | |

This annual shareholder report contains information about Fidelity® SAI International Small Cap Index Fund for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® SAI International Small Cap Index Fund | $ 12 | 0.10% | |

What affected the Fund's performance this period?

•International stocks achieved a strong gain for the 12 months ending October 31, 2024. Resilient global economic growth and a slowing in the pace of inflation in certain regions, as well as a shift to global monetary easing, contributed to a favorable backdrop, despite persistent geopolitical risk.

•Against this backdrop, Europe ex U.K. gained 23% and contributed most to the fund's performance for the fiscal year, followed by Japan (+18%).

•By sector, industrials gained roughly 29% and contributed most, driven by the capital goods industry (+33%). Financials, which gained about 34%, also helped, as did consumer discretionary, which advanced 20%. The information technology sector rose 23%, while real estate gained approximately 19% and materials advanced 17%. Other contributors included the health care (+23%), consumer staples (+15%), communication services (+21%), utilities (+28%) and energy (+9%) sectors.

•Turning to individual stocks, the top contributor was Fujikura (+444%), from the capital goods group. From the same industry, IHI gained 192% and boosted the fund. In semiconductors & semiconductor equipment, Screen Holdings (+173%) helped. In materials, DS Smith gained 112% and contributed. Lastly, Banco Sabadell (+77%), from the banks industry, lifted the fund.

•Conversely, the biggest detractor was Soitec (-47%), from the semiconductors & semiconductor equipment category. From the same group, Aixtron returned roughly -43% and hindered the fund. ThyssenKrupp (-49%) and AVZ Minerals (-100%), within the materials sector, detracted. Lastly, Evotec, within the pharmaceuticals, biotechnology & life sciences group, returned -55% and detracted.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

May 27, 2021 through October 31, 2024.

Initial investment of $10,000.

Fidelity® SAI International Small Cap Index Fund | $10,000 | $10,120 | $7,053 | $7,571 |

MSCI EAFE Small Cap Index | $10,000 | $10,153 | $7,091 | $7,564 |

MSCI EAFE Index | $10,000 | $10,131 | $7,817 | $8,962 |

| | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | Life of Fund A |

| Fidelity® SAI International Small Cap Index Fund | 22.16% | -2.25% |

| MSCI EAFE Small Cap Index | 23.20% | -2.03% |

| MSCI EAFE Index | 23.25% | 2.94% |

A From May 27, 2021

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $774,291,234 | |

| Number of Holdings | 2,112 | |

| Total Advisory Fee | $747,055 | |

| Portfolio Turnover | 16% | |

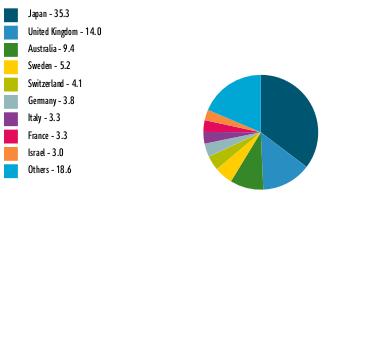

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Industrials | 23.7 | |

| Financials | 12.9 | |

| Consumer Discretionary | 12.2 | |

| Real Estate | 10.9 | |

| Materials | 9.6 | |

| Information Technology | 8.8 | |

| Consumer Staples | 6.5 | |

| Health Care | 5.4 | |

| Communication Services | 3.4 | |

| Energy | 2.6 | |

| Utilities | 2.4 | |

| |

| Common Stocks | 98.1 |

| Preferred Stocks | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| Japan | 35.3 |

| United Kingdom | 14.0 |

| Australia | 9.4 |

| Sweden | 5.2 |

| Switzerland | 4.1 |

| Germany | 3.8 |

| Italy | 3.3 |

| France | 3.3 |

| Israel | 3.0 |

| Others | 18.6 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Marks & Spencer Group PLC | 0.4 | |

| DS Smith PLC | 0.4 | |

| Fujikura Ltd | 0.4 | |

| Intermediate Capital Group PLC | 0.4 | |

| IHI Corp | 0.4 | |

| Weir Group PLC/The | 0.4 | |

| Ebara Corp | 0.4 | |

| Evolution Mining Ltd | 0.4 | |

| Diploma PLC | 0.3 | |

| Infratil Ltd | 0.3 | |

| | 3.8 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914016.100 6417-TSRA-1224 |

Item 2.

Code of Ethics

As of the end of the period, October 31, 2024, Fidelity Concord Street Trust (the trust) has adopted a code of ethics, as defined in Item 2 of Form N-CSR, that applies to its President and Treasurer and its Chief Financial Officer. A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

Item 3.

Audit Committee Financial Expert

The Board of Trustees of the trust has determined that Donald F. Donahue is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Donahue is independent for purposes of Item 3 of Form N-CSR.

Item 4.

Principal Accountant Fees and Services

Fees and Services

The following table presents fees billed by Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, “Deloitte Entities”) in each of the last two fiscal years for services rendered to Fidelity SAI International Small Cap Index Fund, Fidelity Series International Index Fund, Fidelity ZERO Extended Market Index Fund, Fidelity ZERO International Index Fund, Fidelity ZERO Large Cap Index Fund and Fidelity ZERO Total Market Index Fund (the “Fund(s)”):

Services Billed by Deloitte Entities

October 31, 2024 FeesA

| | | | |

| Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees |

Fidelity SAI International Small Cap Index Fund | $44,200 | $- | $10,200 | $1,100 |

Fidelity Series International Index Fund | $56,900 | $- | $10,000 | $1,300 |

Fidelity ZERO Extended Market Index Fund | $64,400 | $- | $8,200 | $1,400 |

Fidelity ZERO International Index Fund | $52,000 | $- | $10,000 | $1,200 |

Fidelity ZERO Large Cap Index Fund | $42,900 | $- | $8,200 | $1,000 |

Fidelity ZERO Total Market Index Fund | $39,500 | $- | $7,700 | $900 |

| | | | |

| Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees |

Fidelity SAI International Small Cap Index Fund | $45,500 | $- | $9,600 | $1,200 |

Fidelity Series International Index Fund | $57,200 | $- | $10,000 | $1,400 |

Fidelity ZERO Extended Market Index Fund | $62,100 | $- | $7,900 | $1,500 |

Fidelity ZERO International Index Fund | $52,200 | $- | $10,000 | $1,300 |

Fidelity ZERO Large Cap Index Fund | $43,000 | $- | $7,900 | $1,100 |

Fidelity ZERO Total Market Index Fund | $39,500 | $- | $7,700 | $1,000 |

A Amounts may reflect rounding.

The following table presents fees billed by PricewaterhouseCoopers LLP (“PwC”) in each of the last two fiscal years for services rendered to Fidelity SAI Canada Equity Index Fund, Fidelity SAI Global ex U.S. Low Volatility Index Fund, and Fidelity SAI Japan Stock Index Fund (the “Fund(s)”):

Services Billed by PwC

October 31, 2024 FeesA,B

| | | | |

| Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees |

Fidelity SAI Canada Equity Index Fund | $30,400 | $800 | $11,500 | $300 |

Fidelity SAI Global ex U.S. Low Volatility Index Fund | $25,000 | $700 | $9,800 | $200 |

Fidelity SAI Japan Stock Index Fund | $51,000 | $4,700 | $11,600 | $1,600 |

| | | | |

| Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees |

Fidelity SAI Canada Equity Index Fund | $- | $- | $- | $- |

Fidelity SAI Global ex U.S. Low Volatility Index Fund | $- | $- | $- | $- |

Fidelity SAI Japan Stock Index Fund | $51,300 | $4,700 | $11,600 | $1,600 |

A Amounts may reflect rounding.

B Fidelity SAI Canada Equity Index Fund commenced operations on July 11, 2024 and Fidelity SAI Global ex U.S. Low Volatility Index Fund commenced operations on July 25, 2024.

The following table(s) present(s) fees billed by Deloitte Entities and PwC that were required to be approved by the Audit Committee for services that relate directly to the operations and financial reporting of the Fund(s) and that are rendered on behalf of Fidelity Management & Research Company LLC ("FMR") and entities controlling, controlled by, or under common control with FMR (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) that provide ongoing services to the Fund(s) (“Fund Service Providers”):

Services Billed by Deloitte Entities

| | |

| October 31, 2024 A | October 31, 2023A |

Audit-Related Fees | $125,000 | $75,000 |

Tax Fees | $- | $- |

All Other Fees | $2,929,500 | $- |

A Amounts may reflect rounding.

Services Billed by PwC

| | |

| October 31, 2024 A,B | October 31, 2023A,B |

Audit-Related Fees | $9,701,800 | $8,881,200 |

Tax Fees | $61,000 | $1,000 |

All Other Fees | $35,000 | $- |

A Amounts may reflect rounding.

B May include amounts billed prior to the Fidelity SAI Canada Equity Index Fund and

Fidelity SAI Global ex U.S. Low Volatility Index Fund’s commencement of operations.

“Audit-Related Fees” represent fees billed for assurance and related services that are reasonably related to the performance of the fund audit or the review of the fund's financial statements and that are not reported under Audit Fees.

“Tax Fees” represent fees billed for tax compliance, tax advice or tax planning that relate directly to the operations and financial reporting of the fund.

“All Other Fees” represent fees billed for services provided to the fund or Fund Service Provider, a significant portion of which are assurance related, that relate directly to the operations and financial reporting of the fund, excluding those services that are reported under Audit Fees, Audit-Related Fees or Tax Fees.

Assurance services must be performed by an independent public accountant.

* * *

The aggregate non-audit fees billed by Deloitte Entities and PwC for services rendered to the Fund(s), FMR (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any Fund Service Provider for each of the last two fiscal years of the Fund(s) are as follows:

| | |

Billed By | October 31, 2024 A,B | October 31, 2023A,B |

Deloitte Entities

PwC | $3,410,200 15,372,300

| $5,867,700

14,414,200 |

A Amounts may reflect rounding.

B May include amounts billed prior to the Fidelity SAI Canada Equity Index Fund and Fidelity SAI Global ex U.S. Low Volatility Index Fund’s commencement of operations.

The trust's Audit Committee has considered non-audit services that were not pre-approved that were provided by Deloitte Entities and PwC to Fund Service Providers to be compatible with maintaining the independence of Deloitte Entities and PwC in its(their) audit of the Fund(s), taking into account representations from Deloitte Entities and PwC, in accordance with Public Company Accounting Oversight Board rules, regarding its independence from the Fund(s) and its(their) related entities and FMR’s review of the appropriateness and permissibility under applicable law of such non-audit services prior to their provision to the Fund(s) Service Providers.

Audit Committee Pre-Approval Policies and Procedures

The trust’s Audit Committee must pre-approve all audit and non-audit services provided by a fund’s independent registered public accounting firm relating to the operations or financial reporting of the fund. Prior to the commencement of any audit or non-audit services to a fund, the Audit Committee reviews the services to determine whether they are appropriate and permissible under applicable law.

The Audit Committee has adopted policies and procedures to, among other purposes, provide a framework for the Committee’s consideration of non-audit services by the audit firms that audit the Fidelity funds. The policies and procedures require that any non-audit service provided by a fund audit firm to a Fidelity fund and any non-audit service provided by a fund auditor to a Fund Service Provider that relates directly to the operations and financial reporting of a Fidelity fund (“Covered Service”) are subject to approval by the Audit Committee before such service is provided.

All Covered Services must be approved in advance of provision of the service either: (i) by formal resolution of the Audit Committee, or (ii) by oral or written approval of the service by the Chair of the Audit Committee (or if the Chair is unavailable, such other member of the Audit Committee as may be designated by the Chair to act in the Chair’s absence). The approval contemplated by (ii) above is permitted where the Treasurer determines that action on such an engagement is necessary before the next meeting of the Audit Committee.

Non-audit services provided by a fund audit firm to a Fund Service Provider that do not relate directly to the operations and financial reporting of a Fidelity fund are reported to the Audit Committee periodically.

Non-Audit Services Approved Pursuant to Rule 2-01(c)(7)(i)(C) and (ii) of Regulation S-X (“De Minimis Exception”)

There were no non-audit services approved or required to be approved by the Audit Committee pursuant to the De Minimis Exception during the Fund’s(s’) last two fiscal years relating to services provided to (i) the Fund(s) or (ii) any Fund Service Provider that relate directly to the operations and financial reporting of the Fund(s).

The Registrant has not retained, for the preparation of the audit report on the financial statements included in the Form N-CSR, a registered public accounting firm that has a branch or office that is located in a foreign jurisdiction and that the Public Company Accounting Oversight Board (the “PCAOB”) has determined that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction.

The Registrant is not a “foreign issuer,” as defined in 17 CFR 240.3b-4.

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable.

Item 7.

Financial Statements and Financial Highlights for Open-End Management Investment Companies

Fidelity ZERO® Funds

Fidelity ZERO® Extended Market Index Fund

Fidelity ZERO® International Index Fund

Fidelity ZERO® Large Cap Index Fund

Fidelity ZERO® Total Market Index Fund

Annual Report

October 31, 2024

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

The funds or securities referred to herein are not sponsored, endorsed, or promoted by Fidelity Product Services LLC (FPS), and FPS bears no liability with respect to any such funds or securities or any index on which such funds or securities are based. The prospectus contains a more detailed description of the relationship between FPS and any related funds.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2024 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

Item 7: Financial Statements and Financial Highlights for Open-End Management Investment Companies (Annual Report)

Fidelity ZERO® Extended Market Index Fund

Schedule of Investments October 31, 2024

Showing Percentage of Net Assets

| Common Stocks - 99.7% |

| | | Shares | Value ($) |

| COMMUNICATION SERVICES - 3.4% | | | |

| Diversified Telecommunication Services - 0.6% | | | |

| Anterix, Inc. (a) | | 5,376 | 174,612 |

| AST SpaceMobile, Inc. Class A, (a)(b) | | 39,464 | 939,638 |

| ATN International, Inc. | | 2,886 | 60,491 |

| Bandwidth, Inc. Class A, (a) | | 7,173 | 139,874 |

| Cogent Communications Group, Inc. | | 11,931 | 957,701 |

| Consolidated Communications Holdings, Inc. (a) | | 20,884 | 96,797 |

| Frontier Communications Parent, Inc. (a) | | 62,632 | 2,237,841 |

| Globalstar, Inc. (a) | | 214,282 | 224,996 |

| IDT Corp. Class B | | 5,804 | 272,382 |

| Iridium Communications, Inc. | | 33,493 | 982,350 |

| Liberty Global Ltd.: | | | |

| Class A | | 52,969 | 1,049,316 |

| Class C | | 41,006 | 845,544 |

| Liberty Latin America Ltd.: | | | |

| Class A (a) | | 6,834 | 66,905 |

| Class C (a) | | 38,849 | 376,058 |

| Lumen Technologies, Inc. (a) | | 287,902 | 1,839,694 |

| Shenandoah Telecommunications Co. | | 12,898 | 178,508 |

| | | | 10,442,707 |

| Entertainment - 1.0% | | | |

| AMC Entertainment Holdings, Inc. Class A (a)(b) | | 102,148 | 448,430 |

| Atlanta Braves Holdings, Inc.: | | | |

| Class A (a) | | 2,027 | 85,256 |

| Class C, (a) | | 11,459 | 452,745 |

| Cinemark Holdings, Inc. (a) | | 30,228 | 899,283 |

| Endeavor Group Holdings, Inc. (b) | | 53,799 | 1,586,533 |

| Eventbrite, Inc. (a) | | 22,923 | 73,354 |

| Lions Gate Entertainment Corp.: | | | |

| Class A (a)(b) | | 20,514 | 162,061 |

| Class B (a) | | 30,134 | 212,445 |

| Live Nation Entertainment, Inc. (a) | | 44,358 | 5,196,096 |

| Madison Square Garden Entertainment Corp. Class A (a) | | 11,706 | 488,257 |

| Madison Square Garden Sports Corp. (a) | | 4,732 | 1,053,816 |

| Marcus Corp. | | 7,064 | 133,298 |

| Playtika Holding Corp. | | 14,439 | 113,057 |

| Roku, Inc. Class A (a) | | 36,052 | 2,310,212 |

| Skillz, Inc. (a)(b) | | 2,920 | 16,848 |

| Sphere Entertainment Co. Class A (a)(b) | | 7,555 | 315,875 |

| TKO Group Holdings, Inc. (a) | | 18,838 | 2,199,713 |

| Vivid Seats, Inc. Class A (a)(b) | | 26,506 | 107,879 |

| Warner Music Group Corp. Class A | | 40,080 | 1,280,957 |

| | | | 17,136,115 |

| Interactive Media & Services - 0.5% | | | |

| Angi, Inc. Class A, (a)(b) | | 21,664 | 51,560 |

| Bumble, Inc. Class A (a) | | 25,875 | 183,195 |

| CarGurus, Inc. Class A (a) | | 24,764 | 768,179 |

| Cars.com, Inc. (a) | | 17,145 | 274,149 |

| EverQuote, Inc. Class A (a) | | 7,512 | 135,066 |

| fuboTV, Inc. (a) | | 92,941 | 161,717 |

| IAC, Inc. Class A (a) | | 19,998 | 958,904 |

| Match Group, Inc. (a) | | 72,947 | 2,628,280 |

| MediaAlpha, Inc. Class A (a) | | 9,094 | 155,780 |

| Nextdoor Holdings, Inc. Class A (a) | | 49,207 | 119,081 |

| QuinStreet, Inc. (a) | | 15,338 | 322,098 |

| Rumble, Inc. (a)(b) | | 22,681 | 132,457 |

| Shutterstock, Inc. (b) | | 6,998 | 224,566 |

| TripAdvisor, Inc. Class A (a) | | 30,952 | 496,470 |

| Vimeo, Inc. Class A (a) | | 44,461 | 212,079 |

| Yelp, Inc. Class A (a) | | 18,931 | 646,304 |

| Ziff Davis, Inc. (a) | | 12,623 | 584,066 |

| ZipRecruiter, Inc. (a) | | 22,382 | 207,481 |

| Zoominfo Technologies, Inc. (a) | | 81,833 | 904,255 |

| | | | 9,165,687 |

| Media - 1.2% | | | |

| Advantage Solutions, Inc. Class A (a) | | 15,373 | 47,041 |

| Altice U.S.A., Inc. Class A (a) | | 67,953 | 165,126 |

| AMC Networks, Inc. Class A (a) | | 8,490 | 68,769 |

| Boston Omaha Corp. (a) | | 5,918 | 87,350 |

| Cable One, Inc. (b) | | 1,319 | 450,518 |

| Cardlytics, Inc. (a)(b) | | 13,756 | 59,288 |

| Clear Channel Outdoor Holdings, Inc. (a) | | 92,116 | 135,411 |

| E.W. Scripps Co. Class A (a) | | 16,005 | 53,697 |

| EchoStar Corp. Class A (a) | | 34,160 | 856,050 |

| Entravision Communication Corp. Class A | | 18,587 | 43,122 |

| Gannett Co., Inc. (a) | | 33,874 | 158,869 |

| Gray Television, Inc. | | 23,529 | 134,351 |

| iHeartMedia, Inc. (a) | | 32,158 | 63,673 |

| Integral Ad Science Holding Corp. (a) | | 20,637 | 244,342 |

| John Wiley & Sons, Inc. Class A | | 11,673 | 575,479 |

| Liberty Broadband Corp.: | | | |

| Class A (a) | | 5,140 | 412,382 |

| Class C (a) | | 31,157 | 2,518,109 |

| Magnite, Inc. (a) | | 35,529 | 443,402 |

| National CineMedia, Inc. (a) | | 27,084 | 194,734 |

| News Corp.: | | | |

| Class A | | 108,176 | 2,947,796 |

| Class B | | 30,920 | 897,917 |

| Nexstar Media Group, Inc. | | 8,575 | 1,508,514 |

| Paramount Global: | | | |

| Class A | | 4,300 | 94,127 |

| Class B (b) | | 164,176 | 1,796,085 |

| PubMatic, Inc. Class A (a) | | 11,797 | 173,475 |

| Scholastic Corp. | | 7,059 | 175,275 |

| Sinclair, Inc. Class A | | 10,755 | 185,739 |

| Sirius XM Holdings, Inc. | | 62,373 | 1,662,864 |

| Stagwell, Inc. (a) | | 28,979 | 179,960 |

| TechTarget, Inc. (a) | | 7,313 | 211,675 |

| TEGNA, Inc. | | 46,645 | 766,377 |

| The New York Times Co. Class A | | 46,406 | 2,591,311 |

| Thryv Holdings, Inc. (a) | | 9,564 | 137,530 |

| WideOpenWest, Inc. (a) | | 13,686 | 68,293 |

| | | | 20,108,651 |

| Wireless Telecommunication Services - 0.1% | | | |

| Gogo, Inc. (a)(b) | | 17,774 | 116,420 |

| NII Holdings, Inc. (a)(b)(c) | | 10,174 | 0 |

| Spok Holdings, Inc. | | 5,801 | 90,322 |

| Telephone & Data Systems, Inc. | | 27,591 | 820,832 |

| U.S. Cellular Corp. (a) | | 4,035 | 248,960 |

| | | | 1,276,534 |

TOTAL COMMUNICATION SERVICES | | | 58,129,694 |

| CONSUMER DISCRETIONARY - 12.4% | | | |

| Automobile Components - 1.0% | | | |

| Adient PLC (a) | | 24,534 | 479,149 |

| American Axle & Manufacturing Holdings, Inc. (a) | | 33,872 | 191,377 |

| Autoliv, Inc. | | 20,678 | 1,920,573 |

| BorgWarner, Inc. | | 64,381 | 2,165,133 |

| Cooper-Standard Holding, Inc. (a) | | 4,857 | 60,955 |

| Dana, Inc. | | 36,207 | 277,708 |

| Dorman Products, Inc. (a) | | 7,715 | 879,741 |

| Fox Factory Holding Corp. (a) | | 11,769 | 423,566 |

| Garrett Motion, Inc. (a)(b) | | 34,978 | 259,887 |

| Gentex Corp. | | 65,162 | 1,975,060 |

| Gentherm, Inc. (a) | | 8,844 | 371,006 |

| Holley, Inc. (a) | | 13,801 | 35,745 |

| LCI Industries | | 7,197 | 800,882 |

| Lear Corp. | | 15,877 | 1,520,382 |

| Luminar Technologies, Inc. Class A (a)(b) | | 111,058 | 86,114 |

| Mobileye Global, Inc. Class A (a)(b) | | 28,141 | 382,999 |

| Modine Manufacturing Co. (a) | | 14,849 | 1,748,767 |

| Patrick Industries, Inc. | | 6,350 | 799,973 |

| Phinia, Inc. | | 12,363 | 575,869 |

| QuantumScape Corp. Class A (a)(b) | | 106,009 | 545,946 |

| Solid Power, Inc. (a)(b) | | 35,293 | 41,646 |

| Standard Motor Products, Inc. | | 5,735 | 184,610 |

| Stoneridge, Inc. (a) | | 7,786 | 54,424 |

| The Goodyear Tire & Rubber Co. (a) | | 80,346 | 643,571 |

| Visteon Corp. (a) | | 7,795 | 703,499 |

| XPEL, Inc. (a) | | 6,421 | 247,658 |

| | | | 17,376,240 |

| Automobiles - 0.3% | | | |

| Canoo, Inc. (a)(b) | | 17,160 | 12,990 |

| Harley-Davidson, Inc. | | 33,509 | 1,070,613 |

| Lucid Group, Inc. Class A (a)(b) | | 249,339 | 551,039 |

| Rivian Automotive, Inc. Class A (a)(b) | | 203,889 | 2,059,279 |

| Thor Industries, Inc. | | 15,056 | 1,567,028 |

| Winnebago Industries, Inc. | | 8,172 | 457,959 |

| | | | 5,718,908 |

| Broadline Retail - 0.4% | | | |

| ContextLogic, Inc. Class A (a)(b) | | 5,946 | 38,590 |

| Dillard's, Inc. Class A (b) | | 868 | 322,479 |

| Etsy, Inc. (a) | | 32,456 | 1,669,537 |

| Groupon, Inc. (a)(b) | | 6,998 | 71,799 |

| Kohl's Corp. | | 31,419 | 580,623 |

| Macy's, Inc. | | 78,251 | 1,200,370 |

| Nordstrom, Inc. | | 27,363 | 618,677 |

| Ollie's Bargain Outlet Holdings, Inc. (a) | | 17,334 | 1,591,781 |

| Qurate Retail, Inc. Series A (a) | | 99,567 | 53,209 |

| | | | 6,147,065 |

| Distributors - 0.0% | | | |

| A-Mark Precious Metals, Inc. | | 5,033 | 195,532 |

| Diversified Consumer Services - 1.2% | | | |

| ADT, Inc. | | 88,717 | 638,762 |

| Adtalem Global Education, Inc. (a) | | 10,673 | 863,659 |

| Bright Horizons Family Solutions, Inc. (a) | | 16,440 | 2,194,247 |

| Carriage Services, Inc. | | 3,663 | 136,960 |

| Chegg, Inc. (a) | | 29,030 | 46,448 |

| Coursera, Inc. (a) | | 34,518 | 239,900 |

| Duolingo, Inc. Class A (a) | | 10,603 | 3,106,361 |

| European Wax Center, Inc. Class A (a)(b) | | 9,613 | 69,117 |

| Frontdoor, Inc. (a) | | 21,678 | 1,077,180 |

| Graham Holdings Co. Class B | | 974 | 821,374 |

| Grand Canyon Education, Inc. (a) | | 8,240 | 1,129,786 |

| H&R Block, Inc. | | 39,526 | 2,360,888 |

| Laureate Education, Inc. | | 38,759 | 665,880 |

| Mister Car Wash, Inc. (a) | | 27,251 | 204,655 |

| Nerdy, Inc. Class A (a) | | 21,015 | 18,998 |

| OneSpaWorld Holdings Ltd. | | 29,865 | 522,936 |

| Perdoceo Education Corp. | | 17,496 | 391,036 |

| Service Corp. International | | 41,259 | 3,368,797 |

| Strategic Education, Inc. | | 6,903 | 600,285 |

| Stride, Inc. (a) | | 12,048 | 1,123,837 |

| Udemy, Inc. (a) | | 25,936 | 203,338 |

| Universal Technical Institute, Inc. (a) | | 12,269 | 204,156 |

| WW International, Inc. (a) | | 21,192 | 22,040 |

| | | | 20,010,640 |

| Hotels, Restaurants & Leisure - 2.9% | | | |

| Accel Entertainment, Inc. Class A (a) | | 16,151 | 178,307 |

| Aramark | | 74,587 | 2,821,626 |

| Bally's Corp. (a) | | 6,756 | 117,892 |

| BJ's Restaurants, Inc. (a) | | 6,523 | 241,938 |

| Bloomin' Brands, Inc. | | 21,310 | 353,533 |

| Bowlero Corp. Class A (b) | | 7,519 | 77,972 |

| Boyd Gaming Corp. | | 19,431 | 1,346,374 |

| Brinker International, Inc. (a) | | 12,596 | 1,293,735 |

| Caesars Entertainment, Inc. (a) | | 61,216 | 2,451,701 |

| Choice Hotels International, Inc. (b) | | 6,404 | 893,422 |

| Churchill Downs, Inc. | | 20,788 | 2,912,399 |

| Cracker Barrel Old Country Store, Inc. | | 6,251 | 297,360 |

| Dave & Buster's Entertainment, Inc. (a)(b) | | 8,920 | 329,416 |

| Denny's Corp. (a) | | 14,268 | 91,458 |

| Dine Brands Global, Inc. | | 4,484 | 136,493 |

| Dutch Bros, Inc. Class A (a) | | 32,223 | 1,067,226 |

| El Pollo Loco Holdings, Inc. (a) | | 7,148 | 87,349 |

| Everi Holdings, Inc. (a) | | 24,322 | 324,212 |

| First Watch Restaurant Group, Inc. (a)(b) | | 9,211 | 156,541 |

| Golden Entertainment, Inc. | | 6,105 | 179,334 |

| Hilton Grand Vacations, Inc. (a) | | 18,072 | 666,495 |

| Hyatt Hotels Corp. Class A | | 12,725 | 1,850,851 |

| Jack in the Box, Inc. (b) | | 5,479 | 269,841 |

| Krispy Kreme, Inc. | | 24,498 | 278,542 |

| Kura Sushi U.S.A., Inc. Class A (a)(b) | | 1,621 | 161,808 |

| Life Time Group Holdings, Inc. (a) | | 20,338 | 453,131 |

| Light & Wonder, Inc. Class A (a) | | 25,114 | 2,355,191 |

| Lindblad Expeditions Holdings (a) | | 10,812 | 102,173 |

| Marriott Vacations Worldwide Corp. | | 9,098 | 700,819 |

| Monarch Casino & Resort, Inc. | | 3,641 | 285,855 |

| Norwegian Cruise Line Holdings Ltd. (a) | | 124,473 | 3,154,146 |

| Papa John's International, Inc. | | 9,175 | 480,678 |

| Penn Entertainment, Inc. (a) | | 42,267 | 834,773 |

| Planet Fitness, Inc. (a) | | 23,931 | 1,879,062 |

| Playa Hotels & Resorts NV (a) | | 27,379 | 232,722 |

| PlayAGS, Inc. (a) | | 11,249 | 130,826 |

| Portillo's, Inc. Class A (a)(b) | | 15,773 | 203,945 |

| Potbelly Corp. (a) | | 6,845 | 50,516 |

| RCI Hospitality Holdings, Inc. | | 2,370 | 102,905 |

| Red Robin Gourmet Burgers, Inc. (a) | | 4,411 | 25,187 |

| Red Rock Resorts, Inc. | | 14,027 | 721,829 |

| Rush Street Interactive, Inc. (a) | | 22,283 | 241,102 |

| Sabre Corp. (a) | | 110,352 | 353,126 |

| Shake Shack, Inc. Class A (a) | | 11,319 | 1,377,183 |

| Six Flags Entertainment Corp. | | 26,312 | 1,036,956 |

| Soho House & Co., Inc. Class A (a)(b) | | 10,716 | 56,902 |

| Sweetgreen, Inc. Class A (a) | | 28,816 | 1,040,258 |

| Target Hospitality Corp. (a) | | 9,661 | 72,071 |

| Texas Roadhouse, Inc. | | 18,899 | 3,611,977 |

| The Cheesecake Factory, Inc. | | 13,212 | 610,659 |

| Travel+Leisure Co. | | 19,652 | 939,562 |

| United Parks & Resorts, Inc. (a) | | 8,495 | 447,092 |

| Vail Resorts, Inc. | | 10,629 | 1,761,119 |

| Viking Holdings Ltd. | | 25,783 | 1,011,983 |

| Wendy's Co. | | 48,139 | 919,936 |

| Wingstop, Inc. | | 8,295 | 2,386,389 |

| Wyndham Hotels & Resorts, Inc. | | 22,330 | 1,972,186 |

| Wynn Resorts Ltd. | | 26,432 | 2,538,001 |

| Xponential Fitness, Inc. (a) | | 6,813 | 83,459 |

| | | | 50,759,544 |

| Household Durables - 1.9% | | | |

| Beazer Homes U.S.A., Inc. (a) | | 7,902 | 243,066 |

| Cavco Industries, Inc. (a) | | 2,344 | 960,559 |

| Century Communities, Inc. | | 7,803 | 691,814 |

| Champion Homes, Inc. (a) | | 15,009 | 1,324,244 |

| Cricut, Inc. | | 13,761 | 90,547 |

| Dream Finders Homes, Inc. (a)(b) | | 7,827 | 233,636 |

| Ethan Allen Interiors, Inc. | | 6,441 | 178,222 |

| GoPro, Inc. Class A (a) | | 34,671 | 46,806 |

| Green Brick Partners, Inc. (a) | | 8,730 | 602,457 |

| Helen of Troy Ltd. (a) | | 6,442 | 410,033 |

| Hovnanian Enterprises, Inc. Class A (a) | | 1,342 | 236,246 |

| Installed Building Products, Inc. | | 6,600 | 1,431,540 |

| iRobot Corp. (a) | | 8,078 | 70,521 |

| KB Home | | 20,412 | 1,602,342 |

| La-Z-Boy, Inc. | | 11,889 | 452,376 |

| Landsea Homes Corp. Class A (a) | | 5,055 | 52,471 |

| Legacy Housing Corp. (a) | | 3,207 | 79,534 |

| Leggett & Platt, Inc. | | 38,368 | 460,416 |

| LGI Homes, Inc. (a) | | 5,841 | 593,212 |

| Lovesac (a) | | 4,290 | 125,096 |

| M/I Homes, Inc. (a) | | 7,766 | 1,177,248 |

| Meritage Homes Corp. | | 10,291 | 1,864,729 |

| Mohawk Industries, Inc. (a) | | 14,830 | 1,991,224 |

| Newell Brands, Inc. | | 117,546 | 1,034,405 |

| Purple Innovation, Inc. Class A (a) | | 16,686 | 14,899 |

| SharkNinja, Inc. | | 18,634 | 1,718,241 |

| Sonos, Inc. (a) | | 34,151 | 427,912 |

| Taylor Morrison Home Corp. (a) | | 29,541 | 2,023,559 |

| Tempur Sealy International, Inc. | | 49,081 | 2,351,471 |

| Toll Brothers, Inc. | | 29,078 | 4,258,182 |

| TopBuild Corp. (a) | | 8,491 | 3,000,550 |

| TRI Pointe Homes, Inc. (a) | | 26,508 | 1,071,718 |

| Vizio Holding Corp. (a)(b) | | 29,348 | 326,643 |

| Whirlpool Corp. | | 15,519 | 1,606,372 |

| Worthington Enterprises, Inc. | | 8,831 | 338,227 |

| ZAGG, Inc. rights (a)(c) | | 4,373 | 0 |

| | | | 33,090,518 |

| Leisure Products - 0.6% | | | |

| Acushnet Holdings Corp. (b) | | 7,886 | 483,412 |

| AMMO, Inc. (a) | | 24,261 | 26,202 |

| Brunswick Corp. | | 18,739 | 1,494,248 |

| Clarus Corp. | | 8,258 | 34,766 |

| Funko, Inc. (a)(b) | | 10,203 | 120,804 |

| Hasbro, Inc. | | 37,080 | 2,433,560 |

| JAKKS Pacific, Inc. (a) | | 2,233 | 70,451 |

| Johnson Outdoors, Inc. Class A | | 1,543 | 48,790 |

| Malibu Boats, Inc. Class A (a) | | 5,769 | 258,913 |

| MasterCraft Boat Holdings, Inc. (a) | | 4,062 | 70,516 |

| Mattel, Inc. (a) | | 96,206 | 1,960,678 |

| Peloton Interactive, Inc. Class A (a) | | 99,713 | 847,561 |

| Polaris, Inc. | | 14,821 | 1,036,136 |

| Smith & Wesson Brands, Inc. | | 12,991 | 168,298 |

| Sturm, Ruger & Co., Inc. | | 4,771 | 187,596 |

| Topgolf Callaway Brands Corp. (a) | | 40,521 | 393,459 |

| Vista Outdoor, Inc. (a) | | 16,541 | 727,308 |

| YETI Holdings, Inc. (a) | | 23,962 | 843,702 |

| | | | 11,206,400 |

| Specialty Retail - 2.9% | | | |

| 1-800-FLOWERS.com, Inc. Class A (a)(b) | | 8,197 | 68,199 |

| Abercrombie & Fitch Co. Class A (a) | | 14,475 | 1,907,660 |

| Academy Sports & Outdoors, Inc. (b) | | 20,404 | 1,037,747 |

| Advance Auto Parts, Inc. (b) | | 16,845 | 601,198 |

| America's Car Mart, Inc. (a) | | 1,611 | 62,893 |

| American Eagle Outfitters, Inc. | | 50,565 | 990,568 |

| Arhaus, Inc. Class A, (b) | | 15,150 | 128,472 |

| Arko Corp. | | 20,390 | 135,594 |

| Asbury Automotive Group, Inc. (a) | | 5,651 | 1,287,524 |

| AutoNation, Inc. (a) | | 7,403 | 1,150,944 |

| Bath & Body Works, Inc. | | 63,126 | 1,791,516 |

| Beyond, Inc. (a)(b) | | 11,340 | 72,689 |

| Boot Barn Holdings, Inc. (a) | | 8,646 | 1,076,859 |

| Build-A-Bear Workshop, Inc. | | 3,643 | 138,762 |

| Caleres, Inc. | | 9,932 | 296,470 |

| Camping World Holdings, Inc. Class A | | 12,563 | 252,014 |

| Carvana Co. Class A (a) | | 32,258 | 7,977,692 |

| Chewy, Inc. Class A (a) | | 40,053 | 1,080,229 |

| Citi Trends, Inc. (a)(b) | | 2,295 | 43,353 |

| Designer Brands, Inc. Class A (b) | | 11,955 | 62,286 |

| Destination XL Group, Inc. (a)(b) | | 14,139 | 37,822 |

| Dick's Sporting Goods, Inc. | | 16,404 | 3,211,083 |

| EVgo, Inc. Class A (a)(b) | | 28,701 | 225,016 |

| Five Below, Inc. (a) | | 15,584 | 1,477,207 |

| Floor & Decor Holdings, Inc. Class A (a) | | 30,346 | 3,127,155 |

| Foot Locker, Inc. | | 23,297 | 540,257 |