UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05361

Variable Insurance Products Fund V

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | December 31 |

|

|

Date of reporting period: | December 31, 2023 |

Item 1.

Reports to Stockholders

Fidelity® Variable Insurance Products:

VIP Target Volatility Portfolio

Annual Report

December 31, 2023

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Fidelity® Variable Insurance Products are separate account options which are purchased through a variable insurance contract.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2024 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. Performance numbers are net of all underlying fund operating expenses, but do not include any insurance charges imposed by your insurance company's separate account. If performance information included the effect of these additional charges, the total returns would have been lower. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns |

| | | | |

Periods ended December 31, 2023 | Past 1 year | Past 5 years | Past 10 years |

| Service Class | 14.14% | 6.99% | 5.41% |

| Service Class 2 | 13.93% | 6.84% | 5.25% |

| $10,000 Over 10 Years |

| |

Let's say hypothetically that $10,000 was invested in VIP Target Volatility Portfolio - Service Class, a class of the fund, on December 31, 2013. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period. |

|

|

Market Recap:

For 2023, continued global economic expansion and a slowing in the pace of inflation contributed to a favorable backdrop for risk assets. After struggling throughout much of 2022, risk assets strongly rebounded the past year, with U.S. large-cap stocks leading, driven partly by a narrow set of companies in the information technology and communication services sectors amid excitement for generative artificial intelligence. Assets broadly gained in the final two months of 2023 after investor sentiment largely shifted to a view that policy interest rates had peaked in most countries following one of the most dramatic monetary tightening cycles on record by the U.S. Federal Reserve and other central banks.

International equities rose 15.82% for the 12 months, according to the MSCI ACWI (All Country World Index) ex USA Index. Each of the six regions advanced, with Europe ex U.K. (+23%) and Japan (+21%) leading, whereas Asia Pacific ex Japan (+7%) lagged by the widest margin. Each of the 11 sectors also advanced, with tech (+37%) and industrials (+24%) leading the way. Financials (+17%) also topped the return of the broad index. Conversely, consumer staples (+5%) lagged most, followed by real estate (+6%).

U.S. stocks gained 26.06% for the year, as measured by the Dow Jones U.S. Total Stock Market Index, as all but two sectors rose. Information technology (+60%), communication services (+53%) and consumer discretionary (+41%) led by the widest margins. Conversely, utilities (-7%) and energy (0%) lagged most. Growth stocks broadly outpaced value, while larger-caps topped small-caps. Commodities returned -7.91%, according to the Bloomberg Commodity Index Total Return.

U.S. taxable investment-grade bonds returned 5.53% for the 12 months, per the Bloomberg U.S. Aggregate Bond Index, as the Fed slowed the pace of, and eventually paused, interest rate increases, allowing bond prices to stabilize. Since March 2022, the Fed has hiked its benchmark interest rate 11 times, by 5.25 percentage points, while allowing up to billions in bonds to mature each month without investing the proceeds. U.S. investment-grade corporate bonds (+8.18%) topped short-term U.S. Treasuries (+5.15%), while commercial mortgage-backed securities returned (+5.42%) and agencies gained (+5.13%) also advanced. Outside the index, leveraged loans (+13.72%), U.S. high-yield bonds (+13.47%), emerging-markets debt (+10.45%) and Treasury Inflation-Protected Securities (+3.90%) all gained.

Comments from Lead Portfolio Manager Avishek Hazrachoudhury:

For the year, the fund's share classes gained about 14%, trailing the 15.22% advance of the VIP Target Volatility Composite benchmark. Volatility management is the determinative factor in managing the fund's asset class positioning. We were successful in keeping the fund's volatility relatively close to its target in 2023 and moderately above that of the benchmark. Relative to the Composite benchmark, asset allocation detracted the past year, whereas security selection aided relative performance. Our equity allocation strategy worked against the fund's relative return, hampered by the underperformance of low-volatility and value-oriented funds. Outsized exposure to international developed- and emerging-markets (EM) stocks also was detrimental from an equity allocation standpoint. Turning to the fund's fixed-income investments, underweighting investment-grade bonds was advantageous, while adjustments made to the fund's cash allocation during the year hurt. Elsewhere, out-of-benchmark stakes in long-term U.S. Treasuries and Treasury Inflation-Protected Securities detracted from performance. In terms of security selection, U.S. and EM stocks meaningfully contributed, led by strong relative performance from Fidelity® Contrafund, Fidelity® VIP Stock Selector All Cap Fund and Fidelity® Emerging Markets Fund. Within the fund's fixed-income sleeve, Fidelity® Total Bond Fund outperformed and added considerable value.

Note to shareholders:

On May 1, 2023, Jon Loehrke assumed co-management responsibilities for the fund, succeeding Geoff Stein.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

The information in the following tables is based on the direct Investments of the Fund.

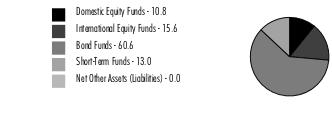

Asset Allocation (% of Fund's net assets) |

|

|

| Portfolio Composition (% of Fund's net assets) |

| |

|

Short-Term Investments and Net Other Assets (Liabilities) - (6.1)% |

|

Showing Percentage of Net Assets

| Equity Funds - 76.9% |

| | | Shares | Value ($) |

| Domestic Equity Funds - 43.7% | | | |

| Fidelity Contrafund (a) | | 265,753 | 4,275,973 |

| Fidelity Enhanced Large Cap Value ETF (a)(b) | | 202,241 | 5,430,171 |

| Fidelity Equity-Income Fund (a) | | 36,445 | 2,458,571 |

| Fidelity Hedged Equity Fund (a) | | 88,487 | 982,202 |

| Fidelity Low-Priced Stock Fund (a) | | 95,286 | 4,199,234 |

| Fidelity U.S. Low Volatility Equity Fund (a) | | 91,297 | 975,054 |

| Fidelity Value Discovery Fund (a) | | 52,994 | 1,860,079 |

| iShares S&P 500 Index ETF | | 11,149 | 5,325,097 |

| VIP Stock Selector All Cap Portfolio Investor Class (a) | | 5,850,192 | 60,022,974 |

TOTAL DOMESTIC EQUITY FUNDS | | | 85,529,355 |

| International Equity Funds - 33.2% | | | |

| Fidelity Canada Fund (a) | | 34,016 | 2,193,677 |

| Fidelity Emerging Markets Fund (a) | | 417,466 | 14,932,757 |

| Fidelity Enhanced International ETF (a) | | 258,607 | 6,853,086 |

| Fidelity International Value Fund (a) | | 832,522 | 8,175,363 |

| Fidelity Japan Smaller Companies Fund (a) | | 112,679 | 1,698,068 |

| Fidelity Overseas Fund (a) | | 234,153 | 14,119,442 |

| iShares Core MSCI EAFE ETF (b) | | 197,992 | 13,928,737 |

| iShares Core MSCI Emerging Markets ETF | | 58,901 | 2,979,213 |

TOTAL INTERNATIONAL EQUITY FUNDS | | | 64,880,343 |

| TOTAL EQUITY FUNDS (Cost $138,286,081) | | | 150,409,698 |

| | | | |

| Fixed-Income Funds - 21.7% |

| | | Shares | Value ($) |

| Fixed-Income Funds - 21.7% | | | |

| Fidelity Long-Term Treasury Bond Index Fund (a) | | 46,557 | 471,623 |

| Fidelity Total Bond Fund (a) | | 4,006,828 | 38,425,479 |

| Fidelity U.S. Bond Index Fund (a) | | 344,523 | 3,593,376 |

| | | | |

| TOTAL FIXED-INCOME FUNDS (Cost $43,912,030) | | | 42,490,478 |

| | | | |

| Money Market Funds - 7.5% |

| | | Shares | Value ($) |

| Cash Equivalents - 7.5% | | | |

| Fidelity Cash Central Fund 5.40% (c) | | 2,728,900 | 2,729,446 |

| Fidelity Securities Lending Cash Central Fund 5.40% (c)(d) | | 11,835,291 | 11,836,475 |

TOTAL CASH EQUIVALENTS | | | 14,565,921 |

| Money Market Funds - 0.0% | | | |

| Fidelity Investments Money Market Government Portfolio Institutional Class 5.29% (a)(e) | | 1,745 | 1,745 |

| TOTAL MONEY MARKET FUNDS (Cost $14,567,666) | | | 14,567,666 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 106.1% (Cost $196,765,777) | 207,467,842 |

NET OTHER ASSETS (LIABILITIES) - (6.1)% | (11,863,494) |

| NET ASSETS - 100.0% | 195,604,348 |

| | |

Security Type Abbreviations

Legend

| (b) | Security or a portion of the security is on loan at period end. |

| (c) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

| (d) | Investment made with cash collateral received from securities on loan. |

| (e) | The rate quoted is the annualized seven-day yield of the fund at period end. |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.40% | 15,853,188 | 43,527,437 | 56,651,179 | 127,382 | - | - | 2,729,446 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 5.40% | - | 181,018,597 | 169,182,122 | 6,939 | - | - | 11,836,475 | 0.0% |

| Total | 15,853,188 | 224,546,034 | 225,833,301 | 134,321 | - | - | 14,565,921 | |

| | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amounts in the dividend income column for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Affiliated Underlying Funds

Fiscal year to date information regarding the Fund's investments in affiliated Underlying Funds is presented below. Exchanges between classes of the same affiliated Underlying Funds may occur. If an Underlying Funds changes its name, the name presented below is the name in effect at period end.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) |

| Fidelity Canada Fund | 702,492 | 1,866,268 | 496,127 | 62,176 | (19,844) | 140,888 | 2,193,677 |

| Fidelity Contrafund | 2,775,982 | 1,212,024 | 730,718 | 168,396 | 55,809 | 962,876 | 4,275,973 |

| Fidelity Emerging Markets Fund | 7,376,518 | 8,920,924 | 2,536,051 | 147,480 | (84,568) | 1,255,934 | 14,932,757 |

| Fidelity Enhanced International ETF | 2,030,136 | 5,514,828 | 1,205,162 | 171,114 | (23,643) | 536,927 | 6,853,086 |

| Fidelity Enhanced Large Cap Value ETF | 4,319,140 | 1,604,235 | 836,676 | 147,197 | (10,451) | 353,923 | 5,430,171 |

| Fidelity Equity-Income Fund | 2,007,814 | 774,972 | 447,417 | 96,395 | (4,622) | 127,824 | 2,458,571 |

| Fidelity Hedged Equity Fund | 529,557 | 1,538,295 | 1,194,368 | 15,195 | 7,696 | 101,022 | 982,202 |

| Fidelity Inflation-Protected Bond Index Fund | 4,690,184 | 18,018 | 4,782,757 | 852 | (301,472) | 376,027 | - |

| Fidelity International Value Fund | 2,504,800 | 6,646,953 | 1,776,517 | 144,352 | 2,042 | 798,085 | 8,175,363 |

| Fidelity Investments Money Market Government Portfolio Institutional Class 5.29% | 34,037,513 | 206,816 | 34,242,584 | 184,604 | - | - | 1,745 |

| Fidelity Japan Smaller Companies Fund | 1,474,271 | 46,515 | - | 46,516 | - | 177,282 | 1,698,068 |

| Fidelity Long-Term Treasury Bond Index Fund | 8,099,354 | 276,744 | 7,516,623 | 219,554 | (2,783,664) | 2,395,812 | 471,623 |

| Fidelity Low-Priced Stock Fund | 3,315,574 | 1,771,262 | 742,038 | 640,036 | (43,401) | (102,163) | 4,199,234 |

| Fidelity Overseas Fund | 3,578,785 | 12,074,352 | 2,788,893 | 101,577 | (43,818) | 1,299,016 | 14,119,442 |

| Fidelity Total Bond Fund | 36,492,823 | 13,102,507 | 12,674,966 | 1,472,112 | (1,259,346) | 2,764,461 | 38,425,479 |

| Fidelity U.S. Bond Index Fund | 23,436,960 | 4,931,584 | 25,284,161 | 393,351 | (1,728,470) | 2,237,463 | 3,593,376 |

| Fidelity U.S. Low Volatility Equity Fund | 2,650,714 | 65,897 | 1,825,397 | 36,614 | 126,537 | (42,697) | 975,054 |

| Fidelity Value Discovery Fund | 1,595,535 | 616,158 | 345,719 | 89,904 | (8,551) | 2,656 | 1,860,079 |

| VIP Stock Selector All Cap Portfolio Investor Class | 38,665,768 | 20,087,682 | 10,007,933 | 361,675 | (354,132) | 11,631,589 | 60,022,974 |

| | 180,283,920 | 81,276,034 | 109,434,107 | 4,499,100 | (6,473,898) | 25,016,925 | 170,668,874 |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of December 31, 2023, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Equity Funds | 150,409,698 | 150,409,698 | - | - |

|

| Fixed-Income Funds | 42,490,478 | 42,490,478 | - | - |

|

| Money Market Funds | 14,567,666 | 14,567,666 | - | - |

| Total Investments in Securities: | 207,467,842 | 207,467,842 | - | - |

| Statement of Assets and Liabilities |

| | | | December 31, 2023 |

| | | | | |

| Assets | | | | |

| Investment in securities, at value (including securities loaned of $11,605,440) - See accompanying schedule: | | | | |

Unaffiliated issuers (cost $20,909,502) | $ | 22,233,047 | | |

Fidelity Central Funds (cost $14,565,921) | | 14,565,921 | | |

Other affiliated issuers (cost $161,290,354) | | 170,668,874 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $196,765,777) | | | $ | 207,467,842 |

| Receivable for investments sold | | | | 128,223 |

| Receivable for fund shares sold | | | | 2,321 |

| Dividends receivable | | | | 173,890 |

| Distributions receivable from Fidelity Central Funds | | | | 23,261 |

Total assets | | | | 207,795,537 |

| Liabilities | | | | |

| Payable for investments purchased | $ | 171,471 | | |

| Payable for fund shares redeemed | | 132,563 | | |

| Accrued management fee | | 24,054 | | |

| Distribution and service plan fees payable | | 23,886 | | |

| Other affiliated payables | | 2,740 | | |

| Collateral on securities loaned | | 11,836,475 | | |

| Total Liabilities | | | | 12,191,189 |

| Net Assets | | | $ | 195,604,348 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 190,819,113 |

| Total accumulated earnings (loss) | | | | 4,785,235 |

| Net Assets | | | $ | 195,604,348 |

| | | | | |

| Net Asset Value and Maximum Offering Price | | | | |

| Service Class : | | | | |

Net Asset Value, offering price and redemption price per share ($1,352,130 ÷ 116,433 shares) | | | $ | 11.61 |

| Service Class 2 : | | | | |

Net Asset Value, offering price and redemption price per share ($194,252,218 ÷ 16,800,461 shares) | | | $ | 11.56 |

| Statement of Operations |

| | | | Year ended December 31, 2023 |

| Investment Income | | | | |

| Dividends: | | | | |

| Unaffiliated issuers | | | $ | 785,315 |

| Affiliated issuers | | | | 3,542,121 |

| Interest | | | | 7,273 |

| Income from Fidelity Central Funds (including $6,939 from security lending) | | | | 134,321 |

| Total Income | | | | 4,469,030 |

| Expenses | | | | |

| Management fee | $ | 394,654 | | |

| Transfer agent fees | | 39,037 | | |

| Distribution and service plan fees | | 491,400 | | |

| Independent trustees' fees and expenses | | 718 | | |

| Total expenses before reductions | | 925,809 | | |

| Expense reductions | | (296,146) | | |

| Total expenses after reductions | | | | 629,663 |

| Net Investment income (loss) | | | | 3,839,367 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | 1,282,728 | | |

| Affiliated issuers | | (6,473,898) | | |

| Futures contracts | | (342,532) | | |

| Capital gain distributions from underlying funds: | | | | |

| Affiliated issuers | | 956,979 | | |

| Total net realized gain (loss) | | | | (4,576,723) |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | 1,386,077 | | |

| Affiliated issuers | | 25,016,925 | | |

| Futures contracts | | (26,960) | | |

| Total change in net unrealized appreciation (depreciation) | | | | 26,376,042 |

| Net gain (loss) | | | | 21,799,319 |

| Net increase (decrease) in net assets resulting from operations | | | $ | 25,638,686 |

| Statement of Changes in Net Assets |

| |

| | Year ended December 31, 2023 | | Year ended December 31, 2022 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 3,839,367 | $ | 3,077,291 |

| Net realized gain (loss) | | (4,576,723) | | (849,043) |

| Change in net unrealized appreciation (depreciation) | | 26,376,042 | | (43,088,392) |

| Net increase (decrease) in net assets resulting from operations | | 25,638,686 | | (40,860,144) |

| Distributions to shareholders | | (3,856,525) | | (7,999,885) |

| | | | | |

| Share transactions - net increase (decrease) | | (28,701,243) | | (15,299,295) |

| Total increase (decrease) in net assets | | (6,919,082) | | (64,159,324) |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 202,523,430 | | 266,682,754 |

| End of period | $ | 195,604,348 | $ | 202,523,430 |

| | | | | |

| | | | | |

Financial Highlights

| VIP Target Volatility Portfolio Service Class |

| |

| Years ended December 31, | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 10.39 | $ | 12.76 | $ | 13.05 | $ | 12.40 | $ | 10.86 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | .23 | | .17 | | .13 | | .14 | | .20 |

| Net realized and unrealized gain (loss) | | 1.24 | | (2.13) | | 1.46 | | .97 | | 1.81 |

| Total from investment operations | | 1.47 | | (1.96) | | 1.59 | | 1.11 | | 2.01 |

| Distributions from net investment income | | (.25) | | (.27) | | - C | | (.18) | | (.19) |

| Distributions from net realized gain | | - | | (.14) | | (1.88) | | (.29) | | (.28) |

| Total distributions | | (.25) | | (.41) | | (1.88) | | (.46) D | | (.47) |

| Net asset value, end of period | $ | 11.61 | $ | 10.39 | $ | 12.76 | $ | 13.05 | $ | 12.40 |

Total Return E,F | | 14.14% | | (15.53)% | | 12.16% | | 9.13% | | 18.81% |

Ratios to Average Net Assets B,G,H | | | | | | | | | | |

| Expenses before reductions | | .32% | | .35% | | .41% | | .40% | | .42% |

| Expenses net of fee waivers, if any | | .17% | | .20% | | .26% | | .25% | | .27% |

| Expenses net of all reductions | | .17% | | .20% | | .26% | | .25% | | .27% |

| Net investment income (loss) | | 2.10% | | 1.52% | | .93% | | 1.12% | | 1.72% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 1,352 | $ | 1,210 | $ | 1,486 | $ | 1,519 | $ | 1,434 |

Portfolio turnover rate I | | 61% | | 50% | | 64% | | 57% | | 65% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CAmount represents less than $.005 per share.

DTotal distributions per share do not sum due to rounding.

ETotal returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

FTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

GFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

HExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

IAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| VIP Target Volatility Portfolio Service Class 2 |

| |

| Years ended December 31, | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 10.35 | $ | 12.71 | $ | 13.02 | $ | 12.37 | $ | 10.83 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | .21 | | .15 | | .11 | | .12 | | .18 |

| Net realized and unrealized gain (loss) | | 1.23 | | (2.11) | | 1.46 | | .97 | | 1.81 |

| Total from investment operations | | 1.44 | | (1.96) | | 1.57 | | 1.09 | | 1.99 |

| Distributions from net investment income | | (.23) | | (.26) | | - C | | (.16) | | (.16) |

| Distributions from net realized gain | | - | | (.14) | | (1.88) | | (.29) | | (.28) |

| Total distributions | | (.23) | | (.40) | | (1.88) | | (.44) D | | (.45) D |

| Net asset value, end of period | $ | 11.56 | $ | 10.35 | $ | 12.71 | $ | 13.02 | $ | 12.37 |

Total Return E,F | | 13.93% | | (15.65)% | | 12.03% | | 8.99% | | 18.65% |

Ratios to Average Net Assets B,G,H | | | | | | | | | | |

| Expenses before reductions | | .47% | | .50% | | .56% | | .56% | | .57% |

| Expenses net of fee waivers, if any | | .32% | | .35% | | .41% | | .40% | | .42% |

| Expenses net of all reductions | | .32% | | .35% | | .41% | | .40% | | .42% |

| Net investment income (loss) | | 1.95% | | 1.37% | | .78% | | .97% | | 1.57% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 194,252 | $ | 201,313 | $ | 265,197 | $ | 269,141 | $ | 290,145 |

Portfolio turnover rate I | | 61% | | 50% | | 64% | | 57% | | 65% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CAmount represents less than $.005 per share.

DTotal distributions per share do not sum due to rounding.

ETotal returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

FTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

GFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

HExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

IAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

For the period ended December 31, 2023

1. Organization.

VIP Target Volatility Portfolio (the Fund) is a fund of Variable Insurance Products Fund V (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. Shares of the Fund may only be purchased by insurance companies for the purpose of funding variable annuity or variable life insurance contracts. The Fund offers the following classes of shares: Service Class shares and Service Class 2 shares. All classes have equal rights and voting privileges, except for matters affecting a single class.

2. Investments in Fidelity Central Funds.

Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Schedule of Investments lists any Fidelity Central Funds held as an investment as of period end, but does not include the underlying holdings of each Fidelity Central Fund. An investing fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the investing fund. These strategies are consistent with the investment objectives of the investing fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the investing fund.

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense RatioA |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

A Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including investment valuation policies) of those funds, and are not covered by the Report of Independent Registered Public Accounting Firm, are available on the Securities and Exchange Commission website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The Fund's Schedule of Investments lists any underlying mutual funds or exchange-traded funds (ETFs) but does not include the underlying holdings of these funds. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Fund uses a third party pricing service approved by the Board of Trustees (the Board) to value its investments. The Board of Trustees (the Board) has designated the Fund's investment adviser as the valuation designee responsible for the fair valuation function and performing fair value determinations as needed. The investment adviser has established a Fair Value Committee (the Committee) to carry out the day-to-day fair valuation responsibilities and has adopted policies and procedures to govern the fair valuation process and the activities of the Committee. In accordance with these fair valuation policies and procedures, which have been approved by the Board, the Fund attempts to obtain prices from one or more third party pricing services or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with the policies and procedures. Factors used in determining fair value vary by investment type and may include market or investment specific events, transaction data, estimated cash flows, and market observations of comparable investments. The frequency that the fair valuation procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee manages the Fund's fair valuation practices and maintains the fair valuation policies and procedures. The Fund's investment adviser reports to the Board information regarding the fair valuation process and related material matters. The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - unadjusted quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Investments in open-end mutual funds are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing services or from brokers who make markets in such securities. U.S. government and government agency obligations are valued by pricing services who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing services. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

ETFs are valued at their last sale price or official closing price as reported by a third party pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day but the exchange reports a closing bid level, ETFs are valued at the closing bid and would be categorized as Level 1 in the hierarchy. In the event there was no closing bid, ETFs may be valued by another method that the Board believes reflects fair value in accordance with the Board's fair value pricing policies and may be categorized as Level 2 in the hierarchy.

Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded and are categorized as Level 1 in the hierarchy.

The aggregate value of investments by input level as of December 31, 2023 is included at the end of the Fund's Schedule of Investments.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost. Income and capital gain distributions from any underlying mutual funds or exchange-traded funds (ETFs) are recorded on the ex-dividend date. Interest income is accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of a fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of a fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred, as applicable. Certain expense reductions may also differ by class, if applicable. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expenses included in the accompanying financial statements reflect the expenses of that fund and do not include any expenses associated with any underlying mutual funds or exchange-traded funds (ETFs). Although not included in a fund's expenses, a fund indirectly bears its proportionate share of these expenses through the net asset value of each underlying mutual fund or exchange-traded fund (ETF). Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of December 31, 2023, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to the short-term gain distributions from the underlying mutual funds or exchange-traded funds (ETFs), futures transactions, capital loss carryforwards and losses deferred due to wash sales and excise tax regulations.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $12,679,984 |

| Gross unrealized depreciation | (2,515,703) |

| Net unrealized appreciation (depreciation) | $10,164,281 |

| Tax Cost | $197,303,561 |

The tax-based components of distributable earnings as of period end were as follows:

| Capital loss carryforward | $(5,379,046) |

| Net unrealized appreciation (depreciation) on securities and other investments | $10,164,281 |

Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. The capital loss carryforward information presented below, including any applicable limitation, is estimated as of fiscal period end and is subject to adjustment.

| Long-term | $(5,379,046) |

| Total capital loss carryforward | $(5,379,046) |

The tax character of distributions paid was as follows:

| | December 31, 2023 | December 31, 2022 |

| Ordinary Income | $3,856,525 | $ 5,091,250 |

| Long-term Capital Gains | - | 2,908,635 |

| Total | $3,856,525 | $ 7,999,885 |

4. Derivative Instruments.

Risk Exposures and the Use of Derivative Instruments. The Fund's investment objectives allow for various types of derivative instruments, including futures contracts. Derivatives are investments whose value is primarily derived from underlying assets, indices or reference rates and may be transacted on an exchange or over-the-counter (OTC). Derivatives may involve a future commitment to buy or sell a specified asset based on specified terms, to exchange future cash flows at periodic intervals based on a notional principal amount, or for one party to make one or more payments upon the occurrence of specified events in exchange for periodic payments from the other party.

Derivatives were used to increase returns and to manage exposure to certain risks as defined below. The success of any strategy involving derivatives depends on analysis of numerous economic factors, and if the strategies for investment do not work as intended, the objectives may not be achieved.

Derivatives were used to increase or decrease exposure to the following risk(s):

| | |

| Equity Risk | Equity risk relates to the fluctuations in the value of financial instruments as a result of changes in market prices (other than those arising from interest rate risk or foreign exchange risk), whether caused by factors specific to an individual investment, its issuer, or all factors affecting all instruments traded in a market or market segment. |

Funds are also exposed to additional risks from investing in derivatives, such as liquidity risk and counterparty credit risk. Liquidity risk is the risk that a fund will be unable to close out the derivative in the open market in a timely manner. Counterparty credit risk is the risk that the counterparty will not be able to fulfill its obligation to a fund. Counterparty credit risk related to exchange-traded contracts may be mitigated by the protection provided by the exchange on which they trade.

Investing in derivatives may involve greater risks than investing in the underlying assets directly and, to varying degrees, may involve risk of loss in excess of any initial investment and collateral received and amounts recognized in the Statement of Assets and Liabilities. In addition, there may be the risk that the change in value of the derivative contract does not correspond to the change in value of the underlying instrument.

Futures Contracts. A futures contract is an agreement between two parties to buy or sell a specified underlying instrument for a fixed price at a specified future date. Futures contracts were used to manage exposure to the stock market.

Upon entering into a futures contract, a fund is required to deposit either cash or securities (initial margin) with a clearing broker in an amount equal to a certain percentage of the face value of the contract. Futures contracts are marked-to-market daily and subsequent daily payments are made or received by a fund depending on the daily fluctuations in the value of the futures contracts and are recorded as unrealized appreciation or (depreciation). This receivable and/or payable, if any, is included in daily variation margin on futures contracts in the Statement of Assets and Liabilities. Realized gain or (loss) is recorded upon the expiration or closing of a futures contract. The net realized gain (loss) and change in net unrealized appreciation (depreciation) on futures contracts during the period is presented in the Statement of Operations.

Any open futures contracts at period end are presented in the Schedule of Investments under the caption "Futures Contracts". The notional amount at value reflects each contract's exposure to the underlying instrument or index at period end, and is representative of volume of activity during the period unless an average notional amount is presented. Any securities deposited to meet initial margin requirements are identified in the Schedule of Investments. Any cash deposited to meet initial margin requirements is presented as segregated cash with brokers for derivative instruments in the Statement of Assets and Liabilities.

5. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities and in-kind transactions, as applicable, are noted in the table below.

| | Purchases ($) | Sales ($) |

| VIP Target Volatility Portfolio | 117,917,302 | 132,731,110 |

6. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company LLC (the investment adviser) provides the Fund with investment management related services. For these services the Fund pays a monthly management fee to the investment adviser. The management fee is computed at an annual rate of .20% of the Fund's average net assets. Under the management contract, the investment adviser pays all other fund-level operating expenses, except the compensation of the independent Trustees and certain other expenses such as interest expense.

During the period, the investment adviser waived a portion of its management fee as described in the Expense Reductions note.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate 12b-1 Plans for each Service Class of shares. Each Service Class pays Fidelity Distributors Company LLC (FDC), an affiliate of the investment adviser, a service fee. For the period, the service fee is based on an annual rate of .10% of Service Class' average net assets and .25% of Service Class 2's average net assets.

For the period, total fees, all of which were re-allowed to insurance companies for the distribution of shares and providing shareholder support services, were as follows:

| Service Class | $1,279 |

| Service Class 2 | 490,121 |

| | $491,400 |

During the period, the investment adviser or its affiliates waived a portion of these fees.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company LLC (FIIOC), an affiliate of the investment adviser, is the Fund's transfer, dividend disbursing, and shareholder servicing agent. FIIOC receives an asset-based fee with respect to each class. Each class pays a fee for transfer agent services, typesetting and printing and mailing of shareholder reports, excluding mailing of proxy statements, equal to an annual rate of .14% of class-level average net assets invested in underlying mutual funds or exchange-traded funds (ETFs) that are not managed by the investment adviser or its affiliates. For the period, transfer agent fees for each class were as follows:

| | Amount | % of Class-Level Average Net Assets |

| Service Class | $254 | .02 |

| Service Class 2 | 38,783 | .02 |

| | $39,037 | |

Interfund Trades. Funds may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Any interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note. During the period, there were no interfund trades.

7. Committed Line of Credit.

Certain Funds participate with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The commitment fees on the pro-rata portion of the line of credit are borne by the investment adviser. During the period, there were no borrowings on this line of credit.

8. Security Lending.

Funds lend portfolio securities from time to time in order to earn additional income. Lending agents are used, including National Financial Services (NFS), an affiliate of the investment adviser. Pursuant to a securities lending agreement, NFS will receive a fee, which is capped at 9.9% of a fund's daily lending revenue, for its services as lending agent. A fund may lend securities to certain qualified borrowers, including NFS. On the settlement date of the loan, a fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of a fund and any additional required collateral is delivered to a fund on the next business day. A fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund may apply collateral received from the borrower against the obligation. A fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. Any loaned securities are identified as such in the Schedule of Investments, and the value of loaned securities and cash collateral at period end, as applicable, are presented in the Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Affiliated security lending activity, if any, was as follows:

| | Total Security Lending Fees Paid to NFS | Security Lending Income From Securities Loaned to NFS | Value of Securities Loaned to NFS at Period End |

| VIP Target Volatility Portfolio | $748 | $- | $- |

9. Expense Reductions.

The investment adviser contractually agreed to waive the Fund's management fee in an amount equal to .05% of the Fund's average net assets until April 30, 2025. During the period, the Fund's management fee was reduced by $98,663.

In addition, FMR has contractually agreed to reimburse .10% of class-level expenses for Service Class and Service Class 2. During the period, this reimbursement reduced the Fund's Service Class and Service Class 2's expenses by the following amounts:

| | Reimbursement |

Service Class | $1,279 |

Service Class 2 | 196,048 |

Through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses. During the period, custodian credits reduced the Fund's expenses by $156.

10. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| | Year ended December 31, 2023 | Year ended December 31, 2022 |

| VIP Target Volatility Portfolio | | |

| Distributions to shareholders | | |

| Service Class | $29,104 | $48,196 |

| Service Class 2 | 3,827,421 | 7,951,689 |

Total | $3,856,525 | $7,999,885 |

11. Share Transactions.

Transactions for each class of shares were as follows and may contain in-kind transactions:

| | Shares | Shares | Dollars | Dollars |

| | Year ended December 31, 2023 | Year ended December 31, 2022 | Year ended December 31, 2023 | Year ended December 31, 2022 |

| VIP Target Volatility Portfolio | | | | |

| Service Class | | | | |

| Reinvestment of distributions | 16 | 28 | $190 | $312 |

| Shares redeemed | (12) | (11) | (133) | (117) |

| Net increase (decrease) | 4 | 17 | $57 | $195 |

| Service Class 2 | | | | |

| Shares sold | 537,799 | 964,447 | $5,874,801 | $10,906,554 |

| Reinvestment of distributions | 330,520 | 710,765 | 3,827,421 | 7,951,689 |

| Shares redeemed | (3,516,533) | (3,095,355) | (38,403,522) | (34,157,733) |

| Net increase (decrease) | (2,648,214) | (1,420,143) | $(28,701,300) | $(15,299,490) |

12. Other.

A fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the fund. In the normal course of business, a fund may salso enter into contracts that provide general indemnifications. A fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against a fund. The risk of material loss from such claims is considered remote.

At the end of the period, certain otherwise unaffiliated shareholders were owners of record of more than 10% of the outstanding shares as follows:

| Fund | Number ofUnaffiliated Shareholders | Unaffiliated Shareholders % |

| VIP Target Volatility Portfolio | 1 | 93% |

13. Risk and Uncertainties.

Many factors affect a fund's performance. Developments that disrupt global economies and financial markets, such as pandemics, epidemics, outbreaks of infectious diseases, war, terrorism, and environmental disasters, may significantly affect a fund's investment performance. The effects of these developments to a fund will be impacted by the types of securities in which a fund invests, the financial condition, industry, economic sector, and geographic location of an issuer, and a fund's level of investment in the securities of that issuer. Significant concentrations in security types, issuers, industries, sectors, and geographic locations may magnify the factors that affect a fund's performance.

To the Board of Trustees of Variable Insurance Products Fund V and Shareholders of VIP Target Volatility Portfolio

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of VIP Target Volatility Portfolio (one of the funds constituting Variable Insurance Products Fund V, referred to hereafter as the "Fund") as of December 31, 2023, the related statement of operations for the year ended December 31, 2023, the statement of changes in net assets for each of the two years in the period ended December 31, 2023, including the related notes, and the financial highlights for each of the five years in the period ended December 31, 2023 (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2023, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended December 31, 2023 and the financial highlights for each of the five years in the period ended December 31, 2023 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2023 by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

Boston, Massachusetts

February 9, 2024

We have served as the auditor of one or more investment companies in the Fidelity group of funds since 1932.

The Trustees, Members of the Advisory Board (if any), and officers of the trust and fund, as applicable, are listed below. The Board of Trustees governs the fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee the fund's activities, review contractual arrangements with companies that provide services to the fund, oversee management of the risks associated with such activities and contractual arrangements, and review the fund's performance. If the interests of the fund and an underlying Fidelity® fund were to diverge, a conflict of interest could arise and affect how the Trustees and Members of the Advisory Board fulfill their fiduciary duties to the affected funds. FMR has structured the fund to avoid these potential conflicts, although there may be situations where a conflict of interest is unavoidable. In such instances, FMR, the Trustees, and Members of the Advisory Board would take reasonable steps to minimize and, if possible, eliminate the conflict. Each of the Trustees oversees 314 funds.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. Each Trustee who is not an interested person (as defined in the 1940 Act) of the trust and the fund is referred to herein as an Independent Trustee. Each Independent Trustee shall retire not later than the last day of the calendar year in which his or her 75th birthday occurs. The Independent Trustees may waive this mandatory retirement age policy with respect to individual Trustees. Officers and Advisory Board Members hold office without limit in time, except that any officer or Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

The fund's Statement of Additional Information (SAI) includes more information about the Trustees. To request a free copy, call Fidelity at 1-877-208-0098.

Experience, Skills, Attributes, and Qualifications of the Trustees. The Governance and Nominating Committee has adopted a statement of policy that describes the experience, qualifications, attributes, and skills that are necessary and desirable for potential Independent Trustee candidates (Statement of Policy). The Board believes that each Trustee satisfied at the time he or she was initially elected or appointed a Trustee, and continues to satisfy, the standards contemplated by the Statement of Policy. The Governance and Nominating Committee also engages professional search firms to help identify potential Independent Trustee candidates who have the experience, qualifications, attributes, and skills consistent with the Statement of Policy. From time to time, additional criteria based on the composition and skills of the current Independent Trustees, as well as experience or skills that may be appropriate in light of future changes to board composition, business conditions, and regulatory or other developments, have also been considered by the professional search firms and the Governance and Nominating Committee. In addition, the Board takes into account the Trustees' commitment and participation in Board and committee meetings, as well as their leadership of standing and ad hoc committees throughout their tenure.

In determining that a particular Trustee was and continues to be qualified to serve as a Trustee, the Board has considered a variety of criteria, none of which, in isolation, was controlling. The Board believes that, collectively, the Trustees have balanced and diverse experience, qualifications, attributes, and skills, which allow the Board to operate effectively in governing the fund and protecting the interests of shareholders. Information about the specific experience, skills, attributes, and qualifications of each Trustee, which in each case led to the Board's conclusion that the Trustee should serve (or continue to serve) as a trustee of the fund, is provided below.

Board Structure and Oversight Function. Abigail P. Johnson is an interested person and currently serves as Chairman. The Trustees have determined that an interested Chairman is appropriate and benefits shareholders because an interested Chairman has a personal and professional stake in the quality and continuity of services provided to the fund. Independent Trustees exercise their informed business judgment to appoint an individual of their choosing to serve as Chairman, regardless of whether the Trustee happens to be independent or a member of management. The Independent Trustees have determined that they can act independently and effectively without having an Independent Trustee serve as Chairman and that a key structural component for assuring that they are in a position to do so is for the Independent Trustees to constitute a substantial majority for the Board. The Independent Trustees also regularly meet in executive session. Michael E. Kenneally serves as Chairman of the Independent Trustees and as such (i) acts as a liaison between the Independent Trustees and management with respect to matters important to the Independent Trustees and (ii) with management prepares agendas for Board meetings.

Fidelity® funds are overseen by different Boards of Trustees. The fund's Board oversees Fidelity's investment-grade bond, money market, asset allocation and certain equity funds, and other Boards oversee Fidelity's alternative investment, high income and other equity funds. The asset allocation funds may invest in Fidelity® funds that are overseen by such other Boards. The use of separate Boards, each with its own committee structure, allows the Trustees of each group of Fidelity® funds to focus on the unique issues of the funds they oversee, including common research, investment, and operational issues. On occasion, the separate Boards establish joint committees to address issues of overlapping consequences for the Fidelity® funds overseen by each Board.

The Trustees operate using a system of committees to facilitate the timely and efficient consideration of all matters of importance to the Trustees, the fund, and fund shareholders and to facilitate compliance with legal and regulatory requirements and oversight of the fund's activities and associated risks. The Board, acting through its committees, has charged FMR and its affiliates with (i) identifying events or circumstances the occurrence of which could have demonstrably adverse effects on the fund's business and/or reputation; (ii) implementing processes and controls to lessen the possibility that such events or circumstances occur or to mitigate the effects of such events or circumstances if they do occur; and (iii) creating and maintaining a system designed to evaluate continuously business and market conditions in order to facilitate the identification and implementation processes described in (i) and (ii) above. Because the day-to-day operations and activities of the fund are carried out by or through FMR, its affiliates, and other service providers, the fund's exposure to risks is mitigated but not eliminated by the processes overseen by the Trustees. While each of the Board's committees has responsibility for overseeing different aspects of the fund's activities, oversight is exercised primarily through the Operations and Audit Committees. In addition, an ad hoc Board committee of Independent Trustees has worked with FMR to enhance the Board's oversight of investment and financial risks, legal and regulatory risks, technology risks, and operational risks, including the development of additional risk reporting to the Board. Appropriate personnel, including but not limited to the fund's Chief Compliance Officer (CCO), FMR's internal auditor, the independent accountants, the fund's Treasurer and portfolio management personnel, make periodic reports to the Board's committees, as appropriate, including an annual review of Fidelity's risk management program for the Fidelity® funds. The responsibilities of each standing committee, including their oversight responsibilities, are described further under "Standing Committees of the Trustees."

Interested Trustees*:

Correspondence intended for a Trustee who is an interested person may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

Abigail P. Johnson (1961)

Year of Election or Appointment: 2009

Trustee

Chairman of the Board of Trustees

Ms. Johnson also serves as Trustee of other Fidelity® funds. Ms. Johnson serves as Chairman (2016-present), Chief Executive Officer (2014-present), and Director (2007-present) of FMR LLC (diversified financial services company), President of Fidelity Financial Services (2012-present) and President of Personal, Workplace and Institutional Services (2005-present). Ms. Johnson is Chairman and Director of Fidelity Management & Research Company LLC (investment adviser firm, 2011-present). Previously, Ms. Johnson served as Chairman and Director of FMR Co., Inc. (investment adviser firm, 2011-2019), Vice Chairman (2007-2016) and President (2013-2016) of FMR LLC, President and a Director of Fidelity Management & Research Company (2001-2005), a Trustee of other investment companies advised by Fidelity Management & Research Company, Fidelity Investments Money Management, Inc. (investment adviser firm), and FMR Co., Inc. (2001-2005), Senior Vice President of the Fidelity® funds (2001-2005), and managed a number of Fidelity® funds. Ms. Abigail P. Johnson and Mr. Arthur E. Johnson are not related.

Jennifer Toolin McAuliffe (1959)

Year of Election or Appointment: 2016

Trustee

Ms. McAuliffe also serves as Trustee of other Fidelity® funds and as Trustee of Fidelity Charitable (2020-present). Previously, Ms. McAuliffe served as Co-Head of Fixed Income of Fidelity Investments Limited (now known as FIL Limited (FIL)) (diversified financial services company), Director of Research for FIL's credit and quantitative teams in London, Hong Kong and Tokyo and Director of Research for taxable and municipal bonds at Fidelity Investments Money Management, Inc. Ms. McAuliffe previously served as a member of the Advisory Board of certain Fidelity® funds (2016). Ms. McAuliffe was previously a lawyer at Ropes & Gray LLP and an international banker at Chemical Bank NA (now JPMorgan Chase & Co.). Ms. McAuliffe also currently serves as director or trustee of several not-for-profit entities.

Christine J. Thompson (1958)

Year of Election or Appointment: 2023

Trustee

Ms. Thompson also serves as a Trustee of other Fidelity® funds. Ms. Thompson serves as Leader of Advanced Technologies for Investment Management at Fidelity Investments (2018-present). Previously, Ms. Thompson served as Chief Investment Officer in the Bond group at Fidelity Management & Research Company (2010-2018) and held various other roles including Director of municipal bond portfolio managers and Portfolio Manager of certain Fidelity® funds.

* Determined to be an "Interested Trustee" by virtue of, among other things, his or her affiliation with the trust or various entities under common control with FMR.

+ The information includes the Trustee's principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to the Trustee's qualifications to serve as a Trustee, which led to the conclusion that the Trustee should serve as a Trustee for the fund.

Independent Trustees:

Correspondence intended for an Independent Trustee may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

Elizabeth S. Acton (1951)

Year of Election or Appointment: 2013

Trustee

Ms. Acton also serves as Trustee of other Fidelity® funds. Prior to her retirement, Ms. Acton served as Executive Vice President, Finance (2011-2012), Executive Vice President, Chief Financial Officer (2002-2011) and Treasurer (2004-2005) of Comerica Incorporated (financial services). Prior to joining Comerica, Ms. Acton held a variety of positions at Ford Motor Company (1983-2002), including Vice President and Treasurer (2000-2002) and Executive Vice President and Chief Financial Officer of Ford Motor Credit Company (1998-2000). Ms. Acton currently serves as a member of the Board and Audit and Finance Committees of Beazer Homes USA, Inc. (homebuilding, 2012-present). Ms. Acton previously served as a member of the Advisory Board of certain Fidelity® funds (2013-2016).

Laura M. Bishop (1961)

Year of Election or Appointment: 2023

Trustee

Ms. Bishop also serves as Trustee or Member of the Advisory Board of other Fidelity® funds. Prior to her retirement, Ms. Bishop held a variety of positions at United Services Automobile Association (2001-2020), including Executive Vice President and Chief Financial Officer (2014-2020) and Senior Vice President and Deputy Chief Financial Officer (2012-2014). Ms. Bishop currently serves as a member of the Audit Committee and Compensation and Personnel Committee (2021-present) of the Board of Directors of Korn Ferry (global organizational consulting). Previously, Ms. Bishop served as a Member of the Advisory Board of certain Fidelity® funds (2022-2023).

Ann E. Dunwoody (1953)

Year of Election or Appointment: 2018

Trustee

General Dunwoody also serves as Trustee of other Fidelity® funds. General Dunwoody (United States Army, Retired) was the first woman in U.S. military history to achieve the rank of four-star general and prior to her retirement in 2012 held a variety of positions within the U.S. Army, including Commanding General, U.S. Army Material Command (2008-2012). General Dunwoody currently serves as a member of the Board, Chair of Nomination Committee and a member of the Corporate Governance Committee of Kforce Inc. (professional staffing services, 2016-present) and a member of the Board of Automattic Inc. (software engineering, 2018-present). Previously, General Dunwoody served as President of First to Four LLC (leadership and mentoring services, 2012-2022), a member of the Advisory Board and Nominating and Corporate Governance Committee of L3 Technologies, Inc. (communication, electronic, sensor and aerospace systems, 2013-2019) and a member of the Board and Audit and Sustainability and Corporate Responsibility Committees of Republic Services, Inc. (waste collection, disposal and recycling, 2013-2016). General Dunwoody also serves on several boards for non-profit organizations, including as a member of the Board, Chair of the Nomination and Governance Committee and a member of the Audit Committee of the Noble Reach Foundation (formerly Logistics Management Institute) (consulting non-profit, 2012-present) and a member of the Board of ThanksUSA (military family education non-profit, 2014-present). Previously, General Dunwoody served as a member of the Board of Florida Institute of Technology (2015-2022) and a member of the Council of Trustees for the Association of the United States Army (advocacy non-profit, 2013-2021). General Dunwoody previously served as a member of the Advisory Board of certain Fidelity® funds (2018).

John Engler (1948)

Year of Election or Appointment: 2014

Trustee

Mr. Engler also serves as Trustee of other Fidelity® funds. Previously, Mr. Engler served as Governor of Michigan (1991-2003), President of the Business Roundtable (2011-2017) and interim President of Michigan State University (2018-2019). Previously, Mr. Engler served as a member of the Board of Stride, Inc. (formerly K12 Inc.) (technology-based education company, 2012-2022), a member of the Board of Universal Forest Products (manufacturer and distributor of wood and wood-alternative products, 2003-2019) and Trustee of The Munder Funds (2003-2014). Mr. Engler previously served as a member of the Advisory Board of certain Fidelity® funds (2014-2016).

Robert F. Gartland (1951)

Year of Election or Appointment: 2010

Trustee

Mr. Gartland also serves as Trustee of other Fidelity® funds. Prior to his retirement, Mr. Gartland held a variety of positions at Morgan Stanley (financial services, 1979-2007), including Managing Director (1987-2007) and Chase Manhattan Bank (1975-1978). Mr. Gartland previously served as Chairman and an investor in Gartland & Mellina Group Corp. (consulting, 2009-2019), as a member of the Board of National Securities Clearing Corporation (1993-1996) and as Chairman of TradeWeb (2003-2004).

Robert W. Helm (1957)

Year of Election or Appointment: 2023

Trustee

Mr. Helm also serves as Trustee or Member of the Advisory Board of other Fidelity® funds. Mr. Helm was formerly Deputy Chairman (2003-2020), partner (1991-2020) and an associate (1984-1991) of Dechert LLP (formerly Dechert Price & Rhoads). Mr. Helm currently serves on boards and committees of several not-for-profit organizations, including as a Trustee and member of the Executive Committee of the Baltimore Council on Foreign Affairs, a member of the Board of Directors of the St. Vincent de Paul Society of Baltimore and a member of the Life Guard Society of Mt. Vernon. Previously, Mr. Helm served as a Member of the Advisory Board of certain Fidelity® funds (2021-2023).

Michael E. Kenneally (1954)

Year of Election or Appointment: 2009

Trustee

Chairman of the Independent Trustees

Mr. Kenneally also serves as Trustee of other Fidelity® funds and was Vice Chairman (2018-2021) of the Independent Trustees of certain Fidelity® funds. Prior to retirement in 2005, he was Chairman and Global Chief Executive Officer of Credit Suisse Asset Management, the worldwide fund management and institutional investment business of Credit Suisse Group. Previously, Mr. Kenneally was an Executive Vice President and the Chief Investment Officer for Bank of America. In this role, he was responsible for the investment management, strategy and products delivered to the bank's institutional, high-net-worth and retail clients. Earlier, Mr. Kenneally directed the organization's equity and quantitative research groups. He began his career as a research analyst and then spent more than a dozen years as a portfolio manager for endowments, pension plans and mutual funds. He earned the Chartered Financial Analyst (CFA) designation in 1991.

Mark A. Murray (1954)