- C Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B2 Filing

Citigroup (C) 424B2Prospectus for primary offering

Filed: 23 Dec 24, 6:12am

The information in this preliminary pricing supplement is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. This preliminary pricing supplement and the accompanying product supplement, underlying supplement, prospectus supplement and prospectus are not an offer to sell these securities, nor are they soliciting an offer to buy these securities, in any state where the offer or sale is not permitted. SUBJECT TO COMPLETION, DATED DECEMBER 20, 2024 |

| Citigroup Global Markets Holdings Inc. | December , 2024 Medium-Term Senior Notes, Series N Pricing Supplement No. 2024-USNCH25121 Filed Pursuant to Rule 424(b)(2) Registration Statement Nos. 333-270327 and 333-270327-01 |

Contingent Income Callable Securities Due January , 2035

Based on the Performance of the S&P 500® Index

Principal at Risk Securities

Overview

| ▪ | The securities offered by this pricing supplement are unsecured debt securities issued by Citigroup Global Markets Holdings Inc. and guaranteed by Citigroup Inc. The securities offer the potential for quarterly contingent coupon payments at an annualized rate that, if all are paid, would produce a yield that is generally higher than the yield on our conventional debt securities of the same maturity. In exchange for this higher potential yield, you must be willing to accept the risks that (i) your actual yield may be lower than the yield on our conventional debt securities of the same maturity because you may not receive one or more, or any, contingent coupon payments and (ii) your actual yield may be negative because your payment at maturity may be significantly less than the stated principal amount of your securities, and possibly zero. Each of these risks will depend on the performance of the S&P 500® Index (the “underlying index”), as described below. Although you will be exposed to downside risk with respect to the underlying index, you will not participate in any appreciation of the underlying index or receive any dividends paid on the stocks included in the underlying index. |

| ▪ | We have the right to call the securities for mandatory redemption on any potential redemption date prior to the maturity date. |

| ▪ | Investors in the securities must be willing to accept (i) an investment that may have limited or no liquidity and (ii) the risk of not receiving any payments due under the securities if we and Citigroup Inc. default on our obligations. All payments on the securities are subject to the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc. |

| KEY TERMS | |

| Issuer: | Citigroup Global Markets Holdings Inc., a wholly owned subsidiary of Citigroup Inc. |

| Guarantee: | All payments due on the securities are fully and unconditionally guaranteed by Citigroup Inc. |

| Underlying index: | The S&P 500® Index (ticker symbol: “SPX”) |

| Aggregate stated principal amount: | $ |

| Stated principal amount: | $1,000 per security |

| Pricing date: | December , 2024 (expected to be December 30, 2024) |

| Issue date: | January , 2025 (expected to be January 3, 2025) |

| Final valuation date: | January , 2035 (expected to be January 2, 2035), subject to postponement if such date is not a scheduled trading day for the underlying index or if certain market disruption events occur with respect to the underlying index. |

| Maturity date: | Unless earlier redeemed by us, January , 2035 (expected to be January 5, 2035) |

| Contingent coupon: | On each quarterly contingent coupon payment date, unless previously redeemed by us, the securities will pay a contingent coupon equal to 1.7875% of the stated principal amount of the securities (7.15% per annum) if and only if the closing level of the underlying index on the related valuation date is greater than or equal to the coupon barrier level. If the closing level of the underlying index on any quarterly valuation date is less than the coupon barrier level, you will not receive any contingent coupon payment on the related contingent coupon payment date. |

| Payment at maturity: | Unless earlier redeemed by us, for each $1,000 stated principal amount security you hold at maturity, you will receive cash in an amount determined as follows (in addition to the final contingent coupon payment, if any): § If the final index level is greater than or equal to the downside threshold level: $1,000 § If the final index level is less than the downside threshold level: $1,000 + ($1,000 × the index return) If the final index level is less than the downside threshold level, you will receive less, and possibly significantly less, than 75.00% of the stated principal amount of your securities at maturity. |

| Initial index level: | , the closing level of the underlying index on the pricing date |

| Final index level: | The closing level of the underlying index on the final valuation date |

| Coupon barrier level: | , 75.00% of the initial index level |

| Downside threshold level: | , 75.00% of the initial index level |

| Listing: | The securities will not be listed on any securities exchange |

| Underwriter: | Citigroup Global Markets Inc. (“CGMI”), an affiliate of the issuer, acting as principal |

| Underwriting fee and issue price: | Issue price(1)(2) | Underwriting fee | Proceeds to issuer |

| Per security: | $1,000.00 | $5.00(2) | $992.50 |

| $2.50(3) |

| Total: | $ | $ | $ |

(Key Terms continued on next page)

(1) Citigroup Global Markets Holdings Inc. currently expects that the estimated value of the securities on the pricing date will be at least $910.50 per security, which will be less than the issue price. The estimated value of the securities is based on CGMI’s proprietary pricing models and our internal funding rate. It is not an indication of actual profit to CGMI or other of our affiliates, nor is it an indication of the price, if any, at which CGMI or any other person may be willing to buy the securities from you at any time after issuance. See “Valuation of the Securities” in this pricing supplement.

(2) CGMI, an affiliate of Citigroup Global Markets Holdings Inc. and the underwriter of the sale of the securities, is acting as principal and will receive an underwriting fee of $7.50 for each $1,000.00 security sold in this offering. Certain selected dealers, including Morgan Stanley Wealth Management, and their financial advisors will collectively receive from CGMI a fixed selling concession of $5.00 for each $1,000.00 security they sell. Additionally, it is possible that CGMI and its affiliates may profit from expected hedging activity related to this offering, even if the value of the securities declines. See “Use of Proceeds and Hedging” in the accompanying prospectus.

(3) Reflects a structuring fee payable to Morgan Stanley Wealth Management by CGMI of $2.50 for each security.

Investing in the securities involves risks not associated with an investment in conventional debt securities. See “Summary Risk Factors” beginning on page PS-8.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the securities or determined that this pricing supplement and the accompanying product supplement, underlying supplement, prospectus supplement and prospectus are truthful or complete. Any representation to the contrary is a criminal offense.

You should read this pricing supplement together with the accompanying product supplement, underlying supplement, prospectus supplement and prospectus, each of which can be accessed via the hyperlinks below:

| Product Supplement No. EA-04-10 dated March 7, 2023 | Underlying Supplement No. 11 dated March 7, 2023 |

Prospectus Supplement and Prospectus each dated March 7, 2023

The securities are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations of, or guaranteed by, a bank.

| Citigroup Global Markets Holdings Inc. |

Contingent Income Callable Securities Due January , 2035 Based on the Performance of the S&P 500® Index Principal at Risk Securities |

| KEY TERMS (continued) | |

| Valuation dates, potential redemption dates and contingent coupon payment dates: | The expected valuation dates, potential redemption dates and contingent coupon payment dates are set forth below:

|

| Valuation dates* | Potential redemption dates** | Contingent coupon payment dates** | |

| March 31, 2025 | N/A | April 3, 2025 | |

| June 30, 2025 | July 3, 2025 | July 3, 2025 | |

| September 30, 2025 | October 3, 2025 | October 3, 2025 | |

| December 30, 2025 | January 5, 2026 | January 5, 2026 | |

| March 30, 2026 | April 2, 2026 | April 2, 2026 | |

| June 30, 2026 | July 6, 2026 | July 6, 2026 | |

| September 30, 2026 | October 5, 2026 | October 5, 2026 | |

| December 30, 2026 | January 5, 2027 | January 5, 2027 | |

| March 30, 2027 | April 2, 2027 | April 2, 2027 | |

| June 30, 2027 | July 6, 2027 | July 6, 2027 | |

| September 30, 2027 | October 5, 2027 | October 5, 2027 | |

| December 30, 2027 | January 4, 2028 | January 4, 2028 | |

| March 30, 2028 | April 4, 2028 | April 4, 2028 | |

| June 30, 2028 | July 6, 2028 | July 6, 2028 | |

| October 2, 2028 | October 5, 2028 | October 5, 2028 | |

| January 2, 2029 | January 5, 2029 | January 5, 2029 | |

| April 2, 2029 | April 5, 2029 | April 5, 2029 | |

| July 2, 2029 | July 6, 2029 | July 6, 2029 | |

| October 1, 2029 | October 4, 2029 | October 4, 2029 | |

| December 28, 2029 | January 3, 2030 | January 3, 2030 | |

| April 1, 2030 | April 4, 2030 | April 4, 2030 | |

| July 1, 2030 | July 5, 2030 | July 5, 2030 | |

| September 30, 2030 | October 3, 2030 | October 3, 2030 | |

| December 30, 2030 | January 3, 2031 | January 3, 2031 | |

| March 31, 2031 | April 3, 2031 | April 3, 2031 | |

| June 30, 2031 | July 3, 2031 | July 3, 2031 | |

| September 30, 2031 | October 3, 2031 | October 3, 2031 | |

| December 30, 2031 | January 5, 2032 | January 5, 2032 | |

| March 30, 2032 | April 2, 2032 | April 2, 2032 | |

| June 30, 2032 | July 6, 2032 | July 6, 2032 | |

| September 30, 2032 | October 5, 2032 | October 5, 2032 | |

| December 30, 2032 | January 4, 2033 | January 4, 2033 | |

| March 30, 2033 | April 4, 2033 | April 4, 2033 | |

| June 30, 2033 | July 6, 2033 | July 6, 2033 | |

| September 30, 2033 | October 5, 2033 | October 5, 2033 | |

| December 30, 2033 | January 5, 2034 | January 5, 2034 | |

| March 30, 2034 | April 4, 2034 | April 4, 2034 | |

| June 30, 2034 | July 6, 2034 | July 6, 2034 | |

| October 2, 2034 | October 5, 2034 | October 5, 2034 | |

| January 2, 2035 (the “final valuation date”) | N/A | January 5, 2035 (the “maturity date”) |

* Each valuation date is subject to postponement if such date is not a scheduled trading day or certain market disruption events occur, as described in the accompanying product supplement. ** If the valuation date immediately preceding any contingent coupon payment date (other than the final valuation date) is postponed, that contingent coupon payment date will also be postponed so that it falls on the third business day after such valuation date, as postponed. Each potential redemption date is subject to postponement on the same basis as a contingent coupon payment date. |

| Redemption: | We may call the securities, in whole and not in part, for mandatory redemption on any potential redemption date upon not less than three business days’ notice. Following an exercise of our call right, you will receive for each security you then hold an amount in cash equal to the early redemption payment. If the securities are redeemed, no further payments will be made. |

| Early redemption payment: | The stated principal amount of $1,000 per security plus the related contingent coupon payment, if any |

| Index return: | (i) The final index level minus the initial index level, divided by (ii) the initial index level |

| CUSIP / ISIN: | 173070J95 / US173070J952 |

| December 2024 | PS-2 |

| Citigroup Global Markets Holdings Inc. |

Contingent Income Callable Securities Due January , 2035 Based on the Performance of the S&P 500® Index Principal at Risk Securities |

Additional Information

The terms of the securities are set forth in the accompanying product supplement, prospectus supplement and prospectus, as supplemented by this pricing supplement. The accompanying product supplement, prospectus supplement and prospectus contain important disclosures that are not repeated in this pricing supplement. For example, certain events may occur that could affect whether you receive a contingent coupon payment on a contingent coupon payment date as well as your payment at maturity. These events and their consequences are described in the accompanying product supplement in the sections “Description of the Securities—Consequences of a Market Disruption Event; Postponement of a Valuation Date” and “Description of the Securities—Certain Additional Terms for Securities Linked to an Underlying Index—Discontinuance or Material Modification of an Underlying Index” and not in this pricing supplement. The accompanying underlying supplement contains important disclosures regarding the underlying index that are not repeated in this pricing supplement. It is important that you read the accompanying product supplement, underlying supplement, prospectus supplement and prospectus together with this pricing supplement before deciding whether to invest in the securities. Certain terms used but not defined in this pricing supplement are defined in the accompanying product supplement.

Investment Summary

The securities provide an opportunity for investors to earn a quarterly contingent coupon payment, which is an amount equal to $17.875 (1.7875% of the stated principal amount) per security, with respect to each quarterly valuation date on which the closing level of the underlying index is greater than or equal to 75.00% of the initial index level, which we refer to as the coupon barrier level. The quarterly contingent coupon payment, if any, will be payable quarterly on the relevant contingent coupon payment date, which is the third business day after the related valuation date or, in the case of the quarterly contingent coupon payment, if any, with respect to the final valuation date, the maturity date. If the closing level of the underlying index is less than the coupon barrier level on any valuation date, investors will receive no quarterly contingent coupon payment for the related quarterly period. It is possible that the closing level of the underlying index could be below the coupon barrier level on most or all of the valuation dates so that you will receive few or no quarterly contingent coupon payments. We refer to these payments as contingent because there is no guarantee that you will receive a payment on any contingent coupon payment date. Even if the closing level of the underlying index was at or above the coupon barrier level on some quarterly valuation dates, the closing level of the underlying index may fluctuate below the coupon barrier level on others.

We may call the securities, in whole and not in part, for mandatory redemption on any potential redemption date upon not less than three business days’ notice for an early redemption payment equal to the stated principal amount plus the quarterly contingent coupon payment, if any, due on that contingent coupon payment date. Thus, the term of the securities may be limited to six months. If we redeem the securities prior to maturity, you will not receive any additional contingent coupon payments. Moreover, you may not be able to reinvest your funds in another investment that provides a similar yield with a similar level of risk. If we redeem the securities prior to maturity, it is likely to be at a time when the underlying index is performing in a manner that would otherwise have been favorable to you. On the other hand, we will be less likely to redeem the securities when the underlying index is performing unfavorably from your perspective, including when the closing level of the underlying index is below the coupon barrier level and/or when the final index level of the underlying index is expected to be below 75.00% of the initial index level, which we refer to as the downside threshold level, such that you will receive no quarterly contingent coupon payments and/or that you will suffer a significant loss on your initial investment in the securities at maturity. Thus, if we do not redeem the securities prior to maturity, it is more likely that you will receive few or no quarterly contingent coupon payments and suffer a significant loss at maturity.

If the securities have not previously been redeemed by us and the final index level is greater than or equal to the downside threshold level, you will be repaid the stated principal amount of your securities at maturity. However, if the securities have not previously been redeemed by us and the final index level is less than the downside threshold level, investors will be exposed to the decline in the closing level of the underlying index, as compared to the initial index level, on a 1-to-1 basis. Under these circumstances, the payment at maturity will be (i) the stated principal amount plus (ii) (a) the stated principal amount times (b) the index return, which means that the payment at maturity will be less than 75.00% of the stated principal amount of the securities and could be zero. Investors in the securities must be willing to accept the risk of losing their entire principal and also the risk of receiving few or no quarterly contingent coupon payments over the term of the securities. In addition, investors will not participate in any appreciation of the underlying index.

| December 2024 | PS-3 |

| Citigroup Global Markets Holdings Inc. |

Contingent Income Callable Securities Due January , 2035 Based on the Performance of the S&P 500® Index Principal at Risk Securities |

Key Investment Rationale

The securities offer investors an opportunity to earn a quarterly contingent coupon payment equal to 1.7875% of the stated principal amount with respect to each valuation date on which the closing level of the underlying index is greater than or equal to 75.00% of the initial index level, which we refer to as the coupon barrier level. The securities may be redeemed by us prior to maturity for the stated principal amount per security plus the applicable quarterly contingent coupon payment, if any, and the payment at maturity will vary depending on the final index level, as follows:

| Scenario 1 | On any potential redemption date (beginning approximately six months after the issue date), we exercise our right to call the securities.

■ The securities will be redeemed for (i) the stated principal amount plus (ii) the quarterly contingent coupon payment with respect to the related potential redemption date, if any.

■ Investors will not participate in any appreciation of the underlying index from the initial index level. |

| Scenario 2 | The securities are not redeemed prior to maturity, and the final index level is greater than or equal to the downside threshold level.

■ The payment due at maturity will be (i) the stated principal amount plus (ii) the quarterly contingent coupon payment, if any.

■ Investors will not participate in any appreciation of the underlying index from the initial index level. |

| Scenario 3 | The securities are not redeemed prior to maturity, and the final index level is less than the downside threshold level.

■ The payment due at maturity will be (i) the stated principal amount plus (ii) (a) the stated principal amount times (b) the index return.

■ Investors will lose a significant portion, and may lose all, of their principal in this scenario. |

| December 2024 | PS-4 |

| Citigroup Global Markets Holdings Inc. |

Contingent Income Callable Securities Due January , 2035 Based on the Performance of the S&P 500® Index Principal at Risk Securities |

How the Securities Work

The following diagrams illustrate potential payments on the securities. The first diagram illustrates how to determine whether a contingent coupon payment will be paid with respect to a quarterly valuation date. The second diagram illustrates how to determine the payment at maturity if the securities are not redeemed by us prior to maturity.

Diagram #1: Quarterly Contingent Coupon Payments

Diagram #2: Payment at Maturity if No Early Redemption Occurs

For more information about contingent coupon payments and the payment at maturity in different hypothetical scenarios, see “Hypothetical Examples” starting on page PS-6.

| December 2024 | PS-5 |

| Citigroup Global Markets Holdings Inc. |

Contingent Income Callable Securities Due January , 2035 Based on the Performance of the S&P 500® Index Principal at Risk Securities |

Hypothetical Examples

The examples below illustrate how to determine whether a contingent coupon will be paid with respect to a quarterly contingent coupon payment date and how to calculate the payment at maturity on the securities if we do not redeem the securities prior to maturity. You should understand that the term of the securities, and your opportunity to receive the contingent coupon payments on the securities, may be limited to as short as six months if we elect to redeem the securities prior to the maturity date, which is not reflected in the examples below. For ease of analysis, figures in the examples below may have been rounded.

The examples below are based on the following hypothetical values and do not reflect the actual initial index level, coupon barrier level or downside threshold level. For the actual initial index level, coupon barrier level and downside threshold level, see the cover page of this pricing supplement. We have used these hypothetical values, rather than the actual values, to simplify the calculations and aid understanding of how the securities work. However, you should understand that the actual payment at maturity on the securities will be calculated based on the actual initial index level, coupon barrier level and downside threshold level, and not the hypothetical values indicated below.

| Hypothetical quarterly contingent coupon payment: | $17.875 (1.7875% of the stated principal amount) per security |

| Hypothetical initial index level: | 100.00 |

| Hypothetical coupon barrier level: | 75.00, which is 75.00% of the hypothetical initial index level. |

| Hypothetical downside threshold level: | 75.00, which is 75.00% of the hypothetical initial index level. |

How to determine whether a contingent coupon is payable with respect to a quarterly contingent coupon payment date:

| Hypothetical closing level of the underlying index on a hypothetical valuation date | Hypothetical contingent coupon payment per security | |

| Example 1: | 97.00 (greater than or equal to coupon barrier level) | $17.875 |

| Example 2: | 64.00 (less than coupon barrier level) | $0.00 |

| Example 3: | 49.00 (less than coupon barrier level) | $0.00 |

Example 1: In this example, the closing level of the underlying index is greater than or equal to the coupon barrier level on the hypothetical valuation date. As a result, investors in the securities would receive the contingent coupon payment of $17.875 per security on the related contingent coupon payment date.

Examples 2 and 3: In these examples, the underlying index closes below the coupon barrier level on the hypothetical valuation date. As a result, investors would not receive any contingent coupon payment on the related contingent coupon payment date.

Investors in the securities will not receive a contingent coupon payment with respect to a contingent coupon payment date if the closing level of the underlying index is less than the coupon barrier level on the relevant valuation date, even if the closing level of that underlying index is greater than the coupon barrier level on some or all other trading days during the term of the securities.

| December 2024 | PS-6 |

| Citigroup Global Markets Holdings Inc. |

Contingent Income Callable Securities Due January , 2035 Based on the Performance of the S&P 500® Index Principal at Risk Securities |

How to determine the payment at maturity on the securities if we do not elect to redeem the securities prior to maturity:

| Hypothetical final index level of the underlying index | Hypothetical payment at maturity per security | |

| Example 4 | 114.00 (index return = 14%) | $1,017.875 |

| Example 5 | 71.00 (index return = -29%) | $710.00 |

| Example 6 | 48.00 (index return = -52%) | $480.00 |

Example 4: In this example, the final index level of the underlying index is greater than the downside threshold level. Accordingly, at maturity, you would be repaid the stated principal amount of the securities plus the quarterly contingent coupon payment of $17.875 per security, but you would not participate in the appreciation of the underlying index.

Example 5: In this example, the final index level of the underlying index is less than the downside threshold level. Accordingly, at maturity, you would receive a payment per security calculated as follows:

Payment at maturity = $1,000 + ($1,000 × the index return)

= $1,000 + ($1,000 × -29%)

= $1,000 + -$290.00

= $710.00

In this scenario, you would receive significantly less than the stated principal amount of your securities and you will not receive a quarterly contingent coupon payment at maturity. You would incur a loss based on the performance of the underlying index.

Example 6: In this example, the final index level is less than the downside threshold level. Accordingly, at maturity, you would receive a payment per security calculated as follows:

Payment at maturity = $1,000 + ($1,000 × the index return)

= $1,000 + ($1,000 × -52%)

= $1,000 + -$520.00

= $480.00

In this scenario, because the final index level of the underlying index is less than the downside threshold level, you would lose a significant portion of your investment in the securities and you will not receive a quarterly contingent coupon payment at maturity.

| December 2024 | PS-7 |

| Citigroup Global Markets Holdings Inc. |

Contingent Income Callable Securities Due January , 2035 Based on the Performance of the S&P 500® Index Principal at Risk Securities |

Summary Risk Factors

An investment in the securities is significantly riskier than an investment in conventional debt securities. The securities are subject to all of the risks associated with an investment in our conventional debt securities that are guaranteed by Citigroup Inc., including the risk that we and Citigroup Inc. may default on our obligations under the securities, and are also subject to risks associated with the underlying index. Accordingly, the securities are appropriate only for investors who are capable of understanding the complexities and risks of the securities. You should consult your own financial, tax and legal advisors as to the risks of an investment in the securities and the appropriateness of the securities in light of your particular circumstances.

The following is a summary of certain key risk factors for investors in the securities. You should read this summary together with the more detailed description of risks relating to an investment in the securities contained in the section “Risk Factors Relating to the Securities” beginning on page EA-7 in the accompanying product supplement. You should also carefully read the risk factors included in the accompanying prospectus supplement and in the documents incorporated by reference in the accompanying prospectus, including Citigroup Inc.’s most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q, which describe risks relating to the business of Citigroup Inc. more generally.

| § | You may lose a significant portion or all of your investment. Unlike conventional debt securities, the securities do not provide for the repayment of the stated principal amount at maturity in all circumstances. If we do not redeem the securities prior to maturity and the final index level is less than the downside threshold level, you will lose a significant portion or all of your investment, based on a loss of 1% of the stated principal amount of the securities for every 1% by which the final index level is less than the initial index level. There is no minimum payment at maturity on the securities, and you may lose up to all of your investment. |

| § | You will not receive any contingent coupon payment for any contingent coupon payment date on which the closing level of the underlying index on the related valuation date is less than the coupon barrier level. A contingent coupon payment will be made on a contingent coupon payment date if and only if the closing level of the underlying index on the related valuation date is greater than or equal to the coupon barrier level. If the closing level of the underlying index on any valuation date is less than the coupon barrier level, you will not receive any contingent coupon payment on the related contingent coupon payment date, and if the closing level of the underlying index is below the coupon barrier level on each valuation date, you will not receive any contingent coupon payments over the term of the securities. |

| § | Higher contingent coupon rates are associated with greater risk. The securities offer contingent coupon payments at an annualized rate that, if all are paid, would produce a yield that is generally higher than the yield on our conventional debt securities of the same maturity. This higher potential yield is associated with greater levels of expected risk as of the pricing date for the securities, including the risk that you may not receive a contingent coupon payment on one or more, or any, contingent coupon payment dates and the risk that the amount you receive at maturity may be significantly less than the stated principal amount of your securities and may be zero. The volatility of the underlying index is an important factor affecting these risks. Greater expected volatility of the underlying index as of the pricing date may result in a higher contingent coupon rate, but it also represents a greater expected likelihood as of the pricing date that the closing level of the underlying index will be less than the coupon barrier level on one or more valuation dates, such that you will not receive one or more, or any, contingent coupon payments during the term of the securities and that the final index level will be less than the downside threshold level, such that you will suffer a substantial loss of principal at maturity. |

| § | You may not be adequately compensated for assuming the downside risk of the underlying index. The potential contingent coupon payments on the securities are the compensation you receive for assuming the downside risk of the underlying index, as well as all the other risks of the securities. That compensation is effectively “at risk” and may, therefore, be less than you currently anticipate. First, the actual yield you realize on the securities could be lower than you anticipate because the coupon is “contingent” and you may not receive a contingent coupon payment on one or more, or any, of the contingent coupon payment dates. Second, the contingent coupon payments are the compensation you receive not only for the downside risk of the underlying index, but also for all of the other risks of the securities, including the risk that the securities may be redeemed by us beginning approximately six months after the issue date, interest rate risk and our credit risk. If those other risks increase or are otherwise greater than you currently anticipate, the contingent coupon payments may turn out to be inadequate to compensate you for all the risks of the securities, including the downside risk of the underlying index. We may redeem the securities at our option, which will limit your ability to receive the contingent coupon payments. We may redeem the securities on any potential redemption date upon not less than three business days’ notice. In the event that we redeem the securities, you will receive the stated principal amount of your securities and the related contingent coupon payment, if any. Thus, the term of the securities may be limited to as short as six months. If we redeem the securities prior to maturity, you will not receive any additional contingent coupon payments. Moreover, you may not be able to reinvest your funds in another investment that provides a similar yield with a similar level of risk. If we redeem the securities prior to maturity, it is likely to be at a time when the underlying index is performing in a manner that would otherwise have been favorable to you. By contrast, if the underlying index is performing unfavorably from your perspective, we are less likely to redeem the securities. If we redeem the securities, we will do so at a time that is advantageous to us and without regard to your interests. |

| § | The securities offer downside exposure to the underlying index, but no upside exposure to the underlying index. You will not participate in any appreciation in the level of the underlying index over the term of the securities. Consequently, your return on the securities will be limited to the contingent coupon payments you receive, if any, and may be significantly less than the return on the underlying index over the term of the securities. In addition, you will not receive any dividends or other distributions or any other rights with respect to the underlying index or the stocks included in the underlying index over the term of the securities. |

| December 2024 | PS-8 |

| Citigroup Global Markets Holdings Inc. |

Contingent Income Callable Securities Due January , 2035 Based on the Performance of the S&P 500® Index Principal at Risk Securities |

| § | The performance of the securities will depend on the closing level of the underlying index solely on the relevant valuation dates, which makes the securities particularly sensitive to the volatility of the underlying index. Whether the contingent coupon will be paid for any given quarter will depend on the closing level of the underlying index solely on the quarterly valuation dates, regardless of the closing level of the underlying index on other days during the term of the securities. If the securities are not redeemed by us prior to maturity, what you receive at maturity will depend solely on the closing level of the underlying index on the final valuation date, and not on any other day during the term of the securities. Because the performance of the securities depends on the closing level of the underlying index on a limited number of dates, the securities will be particularly sensitive to volatility in the closing level of the underlying index. You should understand that the underlying index has historically been highly volatile. |

| § | The securities are subject to the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc. If we default on our obligations under the securities and Citigroup Inc. defaults on its guarantee obligations, you may not receive anything owed to you under the securities. |

| § | The securities will not be listed on any securities exchange and you may not be able to sell them prior to maturity. The securities will not be listed on any securities exchange. Therefore, there may be little or no secondary market for the securities. CGMI currently intends to make a secondary market in relation to the securities and to provide an indicative bid price for the securities on a daily basis. Any indicative bid price for the securities provided by CGMI will be determined in CGMI’s sole discretion, taking into account prevailing market conditions and other relevant factors, and will not be a representation by CGMI that the securities can be sold at that price, or at all. CGMI may suspend or terminate making a market and providing indicative bid prices without notice, at any time and for any reason. If CGMI suspends or terminates making a market, there may be no secondary market at all for the securities because it is likely that CGMI will be the only broker-dealer that is willing to buy your securities prior to maturity. Accordingly, an investor must be prepared to hold the securities until maturity. |

| § | The estimated value of the securities on the pricing date, based on CGMI’s proprietary pricing models and our internal funding rate, will be less than the issue price. The difference is attributable to certain costs associated with selling, structuring and hedging the securities that are included in the issue price. These costs include (i) the selling concessions and structuring fees paid in connection with the offering of the securities, (ii) hedging and other costs incurred by us and our affiliates in connection with the offering of the securities and (iii) the expected profit (which may be more or less than actual profit) to CGMI or other of our affiliates in connection with hedging our obligations under the securities. These costs adversely affect the economic terms of the securities because, if they were lower, the economic terms of the securities would be more favorable to you. The economic terms of the securities are also likely to be adversely affected by the use of our internal funding rate, rather than our secondary market rate, to price the securities. See “The estimated value of the securities would be lower if it were calculated based on our secondary market rate” below. |

| § | The estimated value of the securities was determined for us by our affiliate using proprietary pricing models. CGMI derived the estimated value disclosed on the cover page of this pricing supplement from its proprietary pricing models. In doing so, it may have made discretionary judgments about the inputs to its models, such as the volatility of the underlying index, dividend yields on the stocks included in the underlying index and interest rates. CGMI’s views on these inputs may differ from your or others’ views, and as an underwriter in this offering, CGMI’s interests may conflict with yours. Both the models and the inputs to the models may prove to be wrong and therefore not an accurate reflection of the value of the securities. Moreover, the estimated value of the securities set forth on the cover page of this pricing supplement may differ from the value that we or our affiliates may determine for the securities for other purposes, including for accounting purposes. You should not invest in the securities because of the estimated value of the securities. Instead, you should be willing to hold the securities to maturity irrespective of the initial estimated value. |

| § | The estimated value of the securities would be lower if it were calculated based on our secondary market rate. The estimated value of the securities included in this pricing supplement is calculated based on our internal funding rate, which is the rate at which we are willing to borrow funds through the issuance of the securities. Our internal funding rate is generally lower than our secondary market rate, which is the rate that CGMI will use in determining the value of the securities for purposes of any purchases of the securities from you in the secondary market. If the estimated value included in this pricing supplement were based on our secondary market rate, rather than our internal funding rate, it would likely be lower. We determine our internal funding rate based on factors such as the costs associated with the securities, which are generally higher than the costs associated with conventional debt securities, and our liquidity needs and preferences. Our internal funding rate is not the same as the coupon that is payable on the securities. |

Because there is not an active market for traded instruments referencing our outstanding debt obligations, CGMI determines our secondary market rate based on the market price of traded instruments referencing the debt obligations of Citigroup Inc., our parent company and the guarantor of all payments due on the securities, but subject to adjustments that CGMI makes in its sole discretion. As a result, our secondary market rate is not a market-determined measure of our creditworthiness, but rather reflects the market’s perception of our parent company’s creditworthiness as adjusted for discretionary factors such as CGMI’s preferences with respect to purchasing the securities prior to maturity.

| § | The estimated value of the securities is not an indication of the price, if any, at which CGMI or any other person may be willing to buy the securities from you in the secondary market. Any such secondary market price will fluctuate over the term of the securities based on the market and other factors described in the next risk factor. Moreover, unlike the estimated value included in this pricing supplement, any value of the securities determined for purposes of a secondary market transaction will be based on our secondary market rate, which will likely result in a lower value for the securities than if our internal funding rate were used. In addition, any secondary market price for the securities will be reduced by a bid-ask spread, which may vary depending on the aggregate stated principal amount of the securities to be purchased in the secondary market transaction, and the expected cost of unwinding related hedging transactions. As a result, it is likely that any secondary market price for the securities will be less than the issue price. |

| December 2024 | PS-9 |

| Citigroup Global Markets Holdings Inc. |

Contingent Income Callable Securities Due January , 2035 Based on the Performance of the S&P 500® Index Principal at Risk Securities |

| § | The value of the securities prior to maturity will fluctuate based on many unpredictable factors. The value of your securities prior to maturity will fluctuate based on the level and volatility of the underlying index and a number of other factors, including the price and volatility of the stocks included in the underlying index, dividend yields on the stocks included in the underlying index, interest rates generally, the time remaining to maturity and our and/or Citigroup Inc.’s creditworthiness, as reflected in our secondary market rate. Changes in the level of the underlying index may not result in a comparable change in the value of your securities. You should understand that the value of your securities at any time prior to maturity may be significantly less than the issue price. |

| § | Immediately following issuance, any secondary market bid price provided by CGMI, and the value that will be indicated on any brokerage account statements prepared by CGMI or its affiliates, will reflect a temporary upward adjustment. The amount of this temporary upward adjustment will steadily decline to zero over the temporary adjustment period. See “Valuation of the Securities” in this pricing supplement. |

| § | Changes that affect the underlying index may affect the value of your securities. The sponsor of the S&P 500® Index may add, delete or substitute the stocks that constitute the underlying index or make other methodological changes that could affect the level of the underlying index. We are not affiliated with such index sponsor and, accordingly, we have no control over any changes such index sponsor may make. Such changes could be made at any time and could adversely affect the performance of the underlying index and the value of and your payment at maturity on the securities. |

| § | Governmental regulatory actions, such as sanctions, could adversely affect your investment in the securities. Governmental regulatory actions, including, without limitation, sanctions-related actions by the U.S. or a foreign government, could prohibit or otherwise restrict persons from holding the securities or underlying shares, or engaging in transactions in them, and any such action could adversely affect the value of underlying shares. These regulatory actions could result in restrictions on the securities and could result in the loss of a significant portion or all of your initial investment in the securities, including if you are forced to divest the securities due to the government mandates, especially if such divestment must be made at a time when the value of the securities has declined. |

| § | Our offering of the securities does not constitute a recommendation of the underlying index. The fact that we are offering the securities does not mean that we believe that investing in an instrument linked to the underlying index is likely to achieve favorable returns. In fact, as we are part of a global financial institution, our affiliates may have positions (including short positions) in the stocks that constitute the underlying index or in instruments related to the underlying index, and may publish research or express opinions, that in each case are inconsistent with an investment linked to the underlying index. These and other activities of our affiliates may affect the level of the underlying index in a way that has a negative impact on your interests as a holder of the securities. |

| § | The level of the underlying index may be adversely affected by our or our affiliates’ hedging and other trading activities. We expect to hedge our obligations under the securities through CGMI or other of our affiliates, who may take positions directly in the stocks included in the underlying index and other financial instruments related to the underlying index or the stocks included in the underlying index and may adjust such positions during the term of the securities. Our affiliates also trade the stocks included in the underlying index and other related financial instruments on a regular basis (taking long or short positions or both), for their accounts, for other accounts under their management or to facilitate transactions on behalf of customers. These activities could affect the level of the underlying index in a way that negatively affects the value of the securities. They could also result in substantial returns for us or our affiliates while the value of the securities declines. |

| § | We and our affiliates may have economic interests that are adverse to yours as a result of our affiliates’ business activities. Our affiliates may currently or from time to time engage in business with the issuers of the stocks included in the underlying index, including extending loans to, making equity investments in or providing advisory services to such companies. In the course of this business, we or our affiliates may acquire non-public information, which we will not disclose to you. Moreover, if any of our affiliates is or becomes a creditor of any such company, they may exercise any remedies against such company that are available to them without regard to your interests. |

| § | The calculation agent, which is an affiliate of ours, will make important determinations with respect to the securities. If certain events occur, such as market disruption events or the discontinuance of the underlying index, CGMI, as calculation agent, will be required to make discretionary judgments that could significantly affect your return on the securities. In making these judgments, the calculation agent’s interests as an affiliate of ours could be adverse to your interests as a holder of the securities. |

| § | The U.S. federal tax consequences of an investment in the securities are unclear. There is no direct legal authority regarding the proper U.S. federal tax treatment of the securities, and we do not plan to request a ruling from the Internal Revenue Service (the “IRS”). Consequently, significant aspects of the tax treatment of the securities are uncertain, and the IRS or a court might not agree with the treatment of the securities as described in “United States Federal Tax Considerations” below. If the IRS were successful in asserting an alternative treatment of the securities, the tax consequences of the ownership and disposition of the securities might be materially and adversely affected. Moreover, future legislation, Treasury regulations or IRS guidance could adversely affect the U.S. federal tax treatment of the securities, possibly retroactively. |

| December 2024 | PS-10 |

| Citigroup Global Markets Holdings Inc. |

Contingent Income Callable Securities Due January , 2035 Based on the Performance of the S&P 500® Index Principal at Risk Securities |

Non-U.S. investors should note that persons having withholding responsibility in respect of the securities may withhold on any coupon payment paid to a non-U.S. investor, generally at a rate of 30%. To the extent that we have withholding responsibility in respect of the securities, we intend to so withhold.

You should read carefully the discussion under “United States Federal Tax Considerations” and “Risk Factors Relating to the Securities” in the accompanying product supplement and “United States Federal Tax Considerations” in this pricing supplement. You should also consult your tax adviser regarding the U.S. federal tax consequences of an investment in the securities, as well as tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction.

| December 2024 | PS-11 |

| Citigroup Global Markets Holdings Inc. |

Contingent Income Callable Securities Due January , 2035 Based on the Performance of the S&P 500® Index Principal at Risk Securities |

Information About the S&P 500® Index

The S&P 500® Index consists of the common stocks of 500 issuers selected to provide a performance benchmark for the large capitalization segment of the U.S. equity markets. It is calculated and maintained by S&P Dow Jones Indices LLC.

Please refer to the section “Equity Index Descriptions— The S&P U.S. Indices” in the accompanying underlying supplement for additional information.

We have derived all information regarding the S&P 500® Index from publicly available information and have not independently verified any information regarding the S&P 500® Index. This pricing supplement relates only to the securities and not to the S&P 500® Index. We make no representation as to the performance of the S&P 500® Index over the term of the securities.

The securities represent obligations of Citigroup Global Markets Holdings Inc. (guaranteed by Citigroup Inc.) only. The sponsor of the S&P 500® Index is not involved in any way in this offering and has no obligation relating to the securities or to holders of the securities.

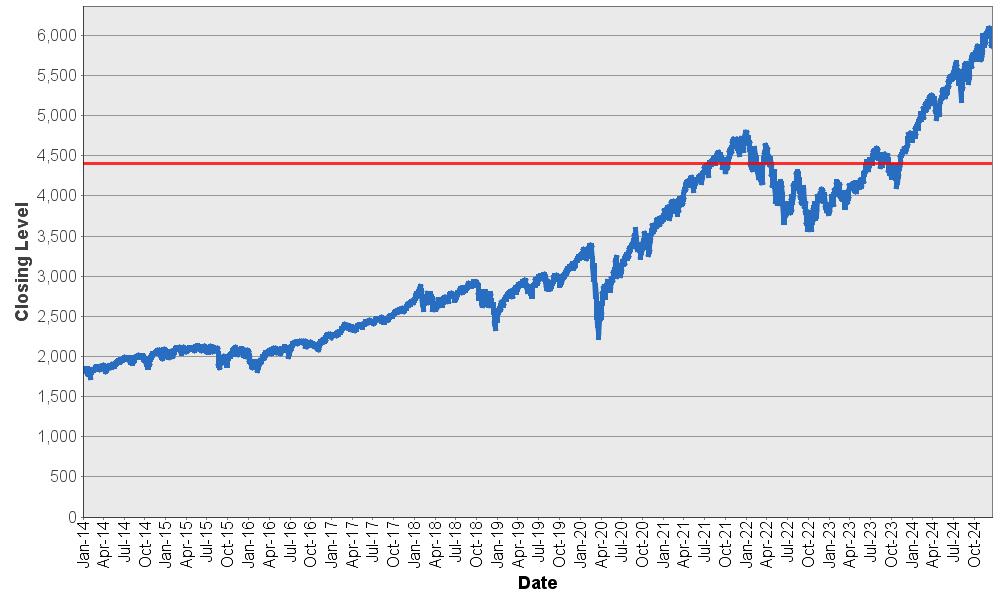

Historical Information

The closing level of the S&P 500® Index on December 19, 2024 was 5,867.08.

The graph below shows the closing level of the underlying index for each day such level was available from January 2, 2014 to December 19, 2024. We obtained the closing levels from Bloomberg L.P., without independent verification. You should not take the historical levels of the underlying index as an indication of future performance.

| S&P 500® Index – Historical Closing Levels* January 2, 2014 to December 19, 2024 |

|

* The red line indicates the hypothetical downside threshold level of 4,400.31, assuming the closing level on December 19, 2024 were the initial index level.

| December 2024 | PS-12 |

| Citigroup Global Markets Holdings Inc. |

Contingent Income Callable Securities Due January , 2035 Based on the Performance of the S&P 500® Index Principal at Risk Securities |

United States Federal Tax Considerations

You should read carefully the discussion under “United States Federal Tax Considerations” and “Risk Factors Relating to the Securities” in the accompanying product supplement and “Summary Risk Factors” in this pricing supplement.

Due to the lack of any controlling legal authority, there is substantial uncertainty regarding the U.S. federal tax consequences of an investment in the securities. In connection with any information reporting requirements we may have in respect of the securities under applicable law, we intend (in the absence of an administrative determination or judicial ruling to the contrary) to treat the securities for U.S. federal income tax purposes as prepaid forward contracts with associated coupon payments that will be treated as gross income to you at the time received or accrued in accordance with your regular method of tax accounting. In the opinion of our counsel, Davis Polk & Wardwell LLP, this treatment of the securities is reasonable under current law; however, our counsel has advised us that it is unable to conclude affirmatively that this treatment is more likely than not to be upheld, and that alternative treatments are possible. Moreover, our counsel’s opinion is based on market conditions as of the date of this preliminary pricing supplement and is subject to confirmation on the pricing date.

Assuming this treatment of the securities is respected and subject to the discussion in “United States Federal Tax Considerations” in the accompanying product supplement, the following U.S. federal income tax consequences should result under current law:

| · | Any coupon payments on the securities should be taxable as ordinary income to you at the time received or accrued in accordance with your regular method of accounting for U.S. federal income tax purposes. |

| · | Upon a sale or exchange of a security (including retirement at maturity), you should recognize capital gain or loss equal to the difference between the amount realized and your tax basis in the security. For this purpose, the amount realized does not include any coupon paid on retirement and may not include sale proceeds attributable to an accrued coupon, which may be treated as a coupon payment. Such gain or loss should be long-term capital gain or loss if you held the security for more than one year. |

We do not plan to request a ruling from the IRS regarding the treatment of the securities. An alternative characterization of the securities could materially and adversely affect the tax consequences of ownership and disposition of the securities, including the timing and character of income recognized. In addition, the U.S. Treasury Department and the IRS have requested comments on various issues regarding the U.S. federal income tax treatment of “prepaid forward contracts” and similar financial instruments and have indicated that such transactions may be the subject of future regulations or other guidance. Furthermore, members of Congress have proposed legislative changes to the tax treatment of derivative contracts. Any legislation, Treasury regulations or other guidance promulgated after consideration of these issues could materially and adversely affect the tax consequences of an investment in the securities, possibly with retroactive effect. You should consult your tax adviser regarding possible alternative tax treatments of the securities and potential changes in applicable law.

Withholding Tax on Non-U.S. Holders. Because significant aspects of the tax treatment of the securities are uncertain, persons having withholding responsibility in respect of the securities may withhold on any coupon payment paid to Non-U.S. Holders (as defined in the accompanying product supplement), generally at a rate of 30%. To the extent that we have (or an affiliate of ours has) withholding responsibility in respect of the securities, we intend to so withhold. In order to claim an exemption from, or a reduction in, the 30% withholding, you may need to comply with certification requirements to establish that you are not a U.S. person and are eligible for such an exemption or reduction under an applicable tax treaty. You should consult your tax adviser regarding the tax treatment of the securities, including the possibility of obtaining a refund of any amounts withheld and the certification requirement described above.

As discussed under “United States Federal Tax Considerations—Tax Consequences to Non-U.S. Holders” in the accompanying product supplement, Section 871(m) of the Code and Treasury regulations promulgated thereunder (“Section 871(m)”) generally impose a 30% withholding tax on dividend equivalents paid or deemed paid to Non-U.S. Holders with respect to certain financial instruments linked to U.S. equities (“U.S. Underlying Equities”) or indices that include U.S. Underlying Equities. Section 871(m) generally applies to instruments that substantially replicate the economic performance of one or more U.S. Underlying Equities, as determined based on tests set forth in the applicable Treasury regulations. However, the regulations, as modified by an IRS notice, exempt financial instruments issued prior to January 1, 2027 that do not have a “delta” of one. Based on the terms of the securities and representations provided by us as of the date of this preliminary pricing supplement, our counsel is of the opinion that the securities should not be treated as transactions that have a “delta” of one within the meaning of the regulations with respect to any U.S. Underlying Equity and, therefore, should not be subject to withholding tax under Section 871(m). However, the final determination regarding the treatment of the securities under Section 871(m) will be made as of the pricing date for the securities, and it is possible that the securities will be subject to withholding tax under Section 871(m) based on the circumstances as of that date.

A determination that the securities are not subject to Section 871(m) is not binding on the IRS, and the IRS may disagree with this treatment. Moreover, Section 871(m) is complex and its application may depend on your particular circumstances, including your other transactions. You should consult your tax adviser regarding the potential application of Section 871(m) to the securities.

We will not be required to pay any additional amounts with respect to amounts withheld.

You should read the section entitled “United States Federal Tax Considerations” in the accompanying product supplement. The preceding discussion, when read in combination with that section, constitutes the full opinion of Davis Polk & Wardwell LLP regarding the material U.S. federal tax consequences of owning and disposing of the securities.

| December 2024 | PS-13 |

| Citigroup Global Markets Holdings Inc. |

Contingent Income Callable Securities Due January , 2035 Based on the Performance of the S&P 500® Index Principal at Risk Securities |

You should also consult your tax adviser regarding all aspects of the U.S. federal income and estate tax consequences of an investment in the securities and any tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction.

Supplemental Plan of Distribution

CGMI, an affiliate of Citigroup Global Markets Holdings Inc. and the underwriter of the sale of the securities, is acting as principal and will receive an underwriting fee of $7.50 for each $1,000.00 security sold in this offering. From this underwriting fee, CGMI will pay selected dealers not affiliated with CGMI, including Morgan Stanley Wealth Management, and their financial advisors collectively a fixed selling concession of $5.00 for each $1,000.00 security they sell. In addition, Morgan Stanley Wealth Management will receive a structuring fee of $2.50 for each security they sell. For the avoidance of doubt, the fees and selling concessions described in this pricing supplement will not be rebated if the securities are redeemed prior to maturity.

The costs included in the original issue price of the securities will include a fee paid by CGMI to LFT Securities, LLC, an entity in which an affiliate of Morgan Stanley Wealth Management has an ownership interest, for providing certain electronic platform services with respect to this offering.

See “Plan of Distribution; Conflicts of Interest” in the accompanying product supplement and “Plan of Distribution” in each of the accompanying prospectus supplement and prospectus for additional information.

Valuation of the Securities

CGMI calculated the estimated value of the securities set forth on the cover page of this pricing supplement based on proprietary pricing models. CGMI’s proprietary pricing models generated an estimated value for the securities by estimating the value of a hypothetical package of financial instruments that would replicate the payout on the securities, which consists of a fixed-income bond (the “bond component”) and one or more derivative instruments underlying the economic terms of the securities (the “derivative component”). CGMI calculated the estimated value of the bond component using a discount rate based on our internal funding rate. CGMI calculated the estimated value of the derivative component based on a proprietary derivative-pricing model, which generated a theoretical price for the instruments that constitute the derivative component based on various inputs, including the factors described under “Summary Risk Factors—The value of the securities prior to maturity will fluctuate based on many unpredictable factors” in this pricing supplement, but not including our or Citigroup Inc.’s creditworthiness. These inputs may be market-observable or may be based on assumptions made by CGMI in its discretionary judgment.

The estimated value of the securities is a function of the terms of the securities and the inputs to CGMI’s proprietary pricing models. As of the date of this preliminary pricing supplement, it is uncertain what the estimated value of the securities will be on the pricing date because it is uncertain what the values of the inputs to CGMI’s proprietary pricing models will be on the pricing date.

For a period of approximately six months following issuance of the securities, the price, if any, at which CGMI would be willing to buy the securities from investors, and the value that will be indicated for the securities on any brokerage account statements prepared by CGMI or its affiliates (which value CGMI may also publish through one or more financial information vendors), will reflect a temporary upward adjustment from the price or value that would otherwise be determined. This temporary upward adjustment represents a portion of the hedging profit expected to be realized by CGMI or its affiliates over the term of the securities. The amount of this temporary upward adjustment will decline to zero on a straight-line basis over the six-month temporary adjustment period. However, CGMI is not obligated to buy the securities from investors at any time. See “Summary Risk Factors—The securities will not be listed on any securities exchange and you may not be able to sell them prior to maturity.”

© 2024 Citigroup Global Markets Inc. All rights reserved. Citi and Citi and Arc Design are trademarks and service marks of Citigroup Inc. or its affiliates and are used and registered throughout the world.

| December 2024 | PS-14 |