UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-05603

| Name of Fund: | | BlackRock Strategic Global Bond Fund, Inc. |

| Fund Address: | | 100 Bellevue Parkway, Wilmington, DE 19809 |

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Strategic Global Bond Fund, Inc., 50 Hudson Yards, New York, NY 10001

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 12/31/2023

Date of reporting period: 12/31/2023

Item 1 – Report to Stockholders

(a) The Report to Shareholders is attached herewith.

| | |

| | DECEMBER 31, 2023 |

BlackRock Strategic Global Bond Fund, Inc.

BlackRock Funds IV

| · | | BlackRock Systematic Multi-Strategy Fund |

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

The Markets in Review

Dear Shareholder,

The combination of continued economic growth and cooling inflation provided a supportive backdrop for investors during the 12-month reporting period ended December 31, 2023. Significantly tighter monetary policy helped to rein in inflation, and the Consumer Price Index decelerated substantially in the first half of the year before stalling between 3% and 4% in the second half. A moderating labor market helped ease inflationary pressure, although wages continued to grow. Wage and job growth powered robust consumer spending, backstopping the economy. On October 7, 2023, Hamas launched a horrific attack on Israel. The ensuing war will have a significant humanitarian impact and could lead to heightened economic and market volatility. We see geopolitics as a structural market risk going forward. See our geopolitical risk dashboard at blackrock.com for more details.

Equity returns were robust during the period, as interest rates stabilized and the economy proved to be more resilient than many investors expected. The U.S. economy continued to show strength, and growth further accelerated in the third quarter of 2023. Large-capitalization U.S. stocks posted particularly substantial gains, supported by the performance of a few notable technology companies and small-capitalization U.S. stocks also advanced. Meanwhile, international developed market equities and emerging market stocks posted solid gains.

The 10-year U.S. Treasury yield ended 2023 where it began despite an eventful year that saw significant moves in bond markets. Overall, U.S. Treasuries gained as investors began to anticipate looser financial conditions. The corporate bond market benefited from improving economic sentiment, although high-yield corporate bond prices fared significantly better than investment-grade bonds as demand from yield-seeking investors remained strong.

The U.S. Federal Reserve (the “Fed”), attempting to manage persistent inflation, raised interest rates four times during the 12-month period, but paused its tightening in the second half of the period. The Fed also wound down its bond-buying programs and incrementally reduced its balance sheet by not replacing securities that reach maturity.

Supply constraints appear to have become an embedded feature of the new macroeconomic environment, making it difficult for developed economies to increase production without sparking higher inflation. Geopolitical fragmentation and an aging population risk further exacerbating these constraints, keeping the labor market tight and wage growth high. Although the Fed has stopped tightening for now, we believe that the new economic regime means that the Fed will need to maintain high rates for an extended period despite the market’s hopes for interest rate cuts, as reflected in the recent rally. In this new regime, we anticipate greater volatility and dispersion of returns, creating more opportunities for selective portfolio management.

We believe developed market equities have priced in an optimistic scenario for rate cuts, which we view as premature, so we prefer an underweight stance in the near term. Nevertheless, we are overweight on Japanese stocks as shareholder-friendly policies generate increased investor interest. We also believe that stocks with an AI tilt should benefit from an investment cycle that is set to support revenues and margins. In credit, there are selective opportunities in the near term despite tighter credit and financial conditions. For fixed income investing with a six- to twelve-month horizon, we see the most attractive investments in short-term U.S. Treasuries, U.S. mortgage-backed securities, and hard-currency emerging market bonds.

Overall, our view is that investors need to think globally, position themselves to be prepared for a decarbonizing economy, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | |

| Total Returns as of December 31, 2023 |

| | | 6-Month | | 12-Month |

U.S. large cap equities

(S&P 500® Index) | | 8.04% | | 26.29% |

U.S. small cap equities

(Russell 2000® Index) | | 8.18 | | 16.93 |

International equities

(MSCI Europe, Australasia,

Far East Index) | | 5.88 | | 18.24 |

Emerging market equities

(MSCI Emerging Markets Index) | | 4.71 | | 9.83 |

3-month Treasury bills

(ICE BofA 3-Month

U.S. Treasury Bill Index) | | 2.70 | | 5.02 |

U.S. Treasury securities

(ICE BofA 10-Year

U.S. Treasury Index) | | 1.11 | | 2.83 |

U.S. investment grade bonds

(Bloomberg U.S. Aggregate Bond Index) | | 3.37 | | 5.53 |

Tax-exempt municipal bonds

(Bloomberg Municipal Bond Index) | | 3.63 | | 6.40 |

U.S. high yield bonds

(Bloomberg U.S. Corporate

High Yield 2% Issuer Capped Index) | | 7.65 | | 13.44 |

Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | |

| 2 | | T H I S P A G E I S N O T P A R T O F Y O U R F U N D R E P O R T |

Table of Contents

| | |

| Fund Summary as of December 31, 2023 | | BlackRock Strategic Global Bond Fund, Inc. |

Investment Objective

BlackRock Strategic Global Bond Fund, Inc.’s (the “Fund”) investment objective is to seek high current income by investing in a global portfolio of fixed income securities denominated in various currencies, including multi-national currency units.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended December 31, 2023, all of the Fund’s share classes outperformed its primary benchmark, the Bloomberg Global Aggregate Bond Index. For the same period, all of the Fund’s share classes outperformed its custom benchmark, comprised of 80% Bloomberg Global Aggregate ex EM Bond Index and 20% Bloomberg EM ex Korea Bond Index, with the exception of its Investor C shares which performed in line. The following discussion of relative performance pertains to the Fund’s primary benchmark.

What factors influenced performance?

The Fund’s positioning with respect to U.S. interest rates aided return as the short end of the Treasury yield curve declined over the period. Exposure to emerging market credit spreads and currencies also contributed positively to performance relative to the benchmark. Holdings of structured products including commercial mortgage-backed securities, non-agency residential mortgage-backed securities, collateralized loan obligations and asset-backed securities added to performance as well. Finally, allocations to U.S. investment grade and high yield corporate bonds proved additive.

Positioning with respect to overseas developed market interest rates and currencies detracted from the Fund’s relative performance over the period, along with positioning in emerging market interest rates.

The Fund held derivatives during the period for risk management purposes as well as to manage exposures with the goal of generating positive active return. The use of derivatives modestly contributed to performance as the Fund tactically managed the portfolio’s duration and currency exposures throughout the reporting period.

The Fund’s reported cash position largely reflects the use of short-term derivatives held for risk management purposes as well as to manage exposures. The Fund’s cash position had no material impact on performance.

Describe recent portfolio activity.

After tactically reducing duration in January 2023, primarily in the front-end of the yield curve, the Fund added duration out on the curve given more balanced risk/reward levels, while tactically rotating across high quality spread assets. The Fund lowered its risk profile slightly in February 2023, reducing U.S. investment grade and high yield credit exposures as spreads became less attractive, while adding to agency mortgage-backed securities (“MBS”) given the sector’s favorable interest rate risk profile. Outside the United States, the Fund continued to increase its long European sovereign position while remaining overweight the U.S. dollar relative to the euro and Japanese yen. The Fund also tactically increased exposure to emerging market debt in local rate and select hard currency markets.

In the second quarter of 2023, the Fund’s duration was tactically reduced, resulting in a modestly below-benchmark stance. The Fund continued to increase its sensitivity to changes in credit spreads by selectively adding to global investment grade corporate bonds, particularly within defensive sectors, as spreads appeared attractive. The Fund modestly trimmed its overweight to agency MBS. In addition, the Fund opportunistically added to U.S. high yield corporate bonds while maintaining a cautious stance with respect to lower quality issues within the asset class. Outside the United States, the Fund maintained essentially neutral exposure to European sovereign bonds while continuing to selectively increase the emerging markets debt allocation.

Over the second half of the reporting period, the Fund maintained a duration underweight versus the benchmark, while tactically rotating out of the long-end of the U.S. yield curve and into intermediate maturities. The Fund initially rotated out of U.S. investment grade corporate bonds in favor of European credit given more attractive all-in yields when swapped back to U.S. dollars. As the period progressed the Fund added back to its U.S. investment grade corporate position. In addition, the Fund added slightly to its European sovereign allocation on the view that global central bank policies had reached restrictive levels and were likely to reverse course. From a currency standpoint, the Fund tactically increased and then trimmed its overweight in the U.S. dollar, while maintaining underweights in the euro and Japanese yen given challenged macro dynamics. Lastly, the Fund maintained a cautious stance within U.S. high yield corporate bonds while favoring emerging market local debt.

Describe portfolio positioning at period end.

At period end, the Fund’s duration was modestly underweight relative to the benchmark with a preference for intermediate maturities where values were more attractive. The Fund favored U.S. and European investment grade corporate bonds along with agency MBS for exposure to high quality assets. In terms of currency exposures, the Fund was overweight the U.S. dollar at the expense of the euro and Japanese yen given the Fed’s past policy tightening. Outside the United States, the Fund had allocations to European sovereign bonds and emerging markets debt, most notably exposure to local rates in Mexico and Brazil along with select hard currency bonds. The Fund was cautiously positioned within U.S. high yield corporate bonds and held a substantial allocation to high quality structured products.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 4 | | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

| Fund Summary as of December 31, 2023 (continued) | | BlackRock Strategic Global Bond Fund, Inc. |

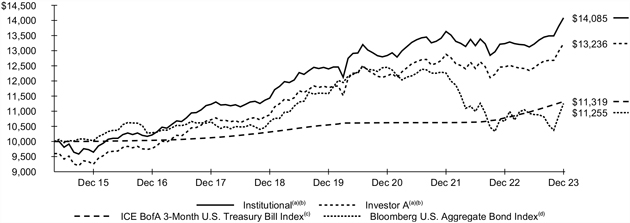

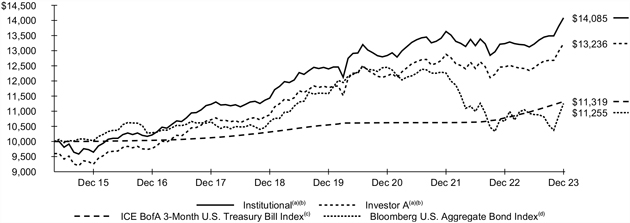

GROWTH OF $10,000 INVESTMENT

| | (a) | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees. Institutional Shares do not have a sales charge. |

| | (b) | The Fund mainly invests in bonds and other fixed income securities that periodically pay interest or dividends. The Fund’s total returns prior to September 1, 2015 are the returns of the Fund when it followed different investment strategies under the name BlackRock World Income Fund, Inc. |

| | (c) | An unmanaged index that is a measure of global investment grade debt from certain local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. |

Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Average Annual Total Returns(a)(b) | |

| | | | | | | | | | | 1 Year | | | | | 5 Years | | | | | 10 Years | |

| | | Standardized

30-Day Yields | | | Unsubsidized

30-Day Yields | | | | | Without

Sales

Charge | | | With

Sales

Charge | | | | | Without

Sales

Charge | | | With

Sales

Charge | | | | | Without

Sales

Charge | | | With

Sales

Charge | |

Institutional | | | 4.50 | % | | | 4.28 | % | | | | | 6.95 | % | | | N/A | | | | | | 1.23 | % | | | N/A | | | | | | 1.37 | % | | | N/A | |

Investor A | | | 4.07 | | | | 3.80 | | | | | | 6.69 | | | | 2.42 | % | | | | | 1.01 | | | | 0.19 | % | | | | | 1.12 | | | | 0.71 | % |

Investor C | | | 3.52 | | | | 3.35 | | | | | | 5.89 | | | | 4.89 | | | | | | 0.26 | | | | 0.26 | | | | | | 0.51 | | | | 0.51 | |

Class K | | | 4.55 | | | | 4.44 | | | | | | 7.01 | | | | N/A | | | | | | 1.28 | | | | N/A | | | | | | 1.41 | | | | N/A | |

Bloomberg Global Aggregate Bond Index | | | — | | | | — | | | | | | 5.72 | | | | N/A | | | | | | (0.32 | ) | | | N/A | | | | | | 0.38 | | | | N/A | |

Custom Benchmark(c) | | | — | | | | — | | | | | | 5.91 | | | | N/A | | | | | | (0.15 | ) | | | N/A | | | | | | 0.49 | | | | N/A | |

| | (a) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” for a detailed description of share classes, including any related sales charges and fees, and how performance was calculated for certain share classes. |

| | (b) | The Fund’s total returns prior to September 1, 2015 are the returns of the Fund when it followed different investment strategies under the name BlackRock World Income Fund, Inc. |

| | (c) | A customized performance benchmark comprised of 80% Bloomberg Global Aggregate ex EM Bond Index and 20% Bloomberg EM ex Korea Bond Index. |

N/A — Not applicable as the share class and index do not have a sales charge.

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | Hypothetical 5% Return | | | | | | | | | | |

| | | | | | | | | Expenses Paid During the Period | | | | | | | | Including Interest Expense and Fees | | | | | Excluding Interest Expense and Fees | | | | | | Annualized Expense Ratio | |

| | |

| Beginning

Account Value (07/01/23) |

| |

| Ending

Account Value (12/31/23) |

| |

| Including

Interest Expense and Fees |

(a) | |

| Excluding

Interest Expense and Fees |

| | | |

| Beginning

Account Value (07/01/23) |

| |

| Ending

Account Value (12/31/23) |

| |

| Expenses

Paid

Duringthe Period |

(a) | | | |

| Ending

Account Value (12/31/23) |

| |

| Expenses

Paid During the Period |

| | | | | |

| Including

Interest

Expense

and Fees |

| |

| Excluding

Interest Expense and Fees |

|

Institutional | | $ | 1,000.00 | | | $ | 1,053.70 | | | $ | 2.82 | | | $ | 2.81 | | | | | $ | 1,000.00 | | | $ | 1,022.46 | | | $ | 2.78 | | | | | $ | 1,022.47 | | | $ | 2.77 | | | | | | | | 0.55 | % | | | 0.54 | % |

Investor A | | | 1,000.00 | | | | 1,052.40 | | | | 4.11 | | | | 4.10 | | | | | | 1,000.00 | | | | 1,021.20 | | | | 4.05 | | | | | | 1,021.21 | | | | 4.04 | | | | | | | | 0.80 | | | | 0.79 | |

Investor C | | | 1,000.00 | | | | 1,050.50 | | | | 7.99 | | | | 7.98 | | | | | | 1,000.00 | | | | 1,017.41 | | | | 7.86 | | | | | | 1,017.43 | | | | 7.85 | | | | | | | | 1.55 | | | | 1.54 | |

Class K | | | 1,000.00 | | | | 1,054.00 | | | | 2.57 | | | | 2.55 | | | | | | 1,000.00 | | | | 1,022.71 | | | | 2.53 | | | | | | 1,022.72 | | | | 2.52 | | | | | | | | 0.50 | | | | 0.49 | |

| | (a) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| | |

| Fund Summary as of December 31, 2023 (continued) | | BlackRock Strategic Global Bond Fund, Inc. |

Expense Example (continued)

See “Disclosure of Expenses” for further information on how expenses were calculated.

Portfolio Information

PORTFOLIO COMPOSITION

| | | | |

| Asset Type(a) | | Percent of Total Investments | |

Corporate Bonds | | | 37.5 | % |

Foreign Agency Obligations | | | 22.2 | |

U.S. Government Sponsored Agency Securities | | | 17.0 | |

Non-Agency Mortgage-Backed Securities | | | 8.2 | |

Asset-Backed Securities | | | 7.3 | |

U.S. Treasury Obligations | | | 2.0 | |

Investment Companies | | | 1.9 | |

Other* | | | 3.9 | |

GEOGRAPHIC ALLOCATION

| | | | |

| Country/Geographic Region(a) | | Percent of Total Investments | |

United States | | | 56.4 | % |

United Kingdom | | | 5.4 | |

Mexico | | | 3.6 | |

China | | | 3.5 | |

Spain | | | 3.1 | |

France | | | 2.9 | |

Japan | | | 2.9 | |

Cayman Islands | | | 2.8 | |

Germany | | | 2.3 | |

Brazil | | | 2.1 | |

Netherlands | | | 1.9 | |

Italy | | | 1.5 | |

South Africa | | | 1.1 | |

Colombia | | | 1.1 | |

Switzerland | | | 1.0 | |

Other# | | | 8.4 | |

| (a) | Excludes short-term securities. |

| # | Includes holdings within countries/geographic regions that are less than 1.0% of total investments. Please refer to the Schedule of Investments for such countries/geographic regions. |

| * | Includes one or more investment categories that individually represents less than 1.0% of the Fund’s total investments. Please refer to the Schedule of Investments for details. |

| | |

| 6 | | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

| Fund Summary as of December 31, 2023 | | BlackRock Systematic Multi-Strategy Fund |

Investment Objective

BlackRock Systematic Multi-Strategy Fund’s (the “Fund”) investment objective is to seek total return comprised of current income and capital appreciation.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended December 31, 2023, all of the Fund’s share classes outperformed its primary benchmark, the ICE BofA 3-Month U.S. Treasury Bill Index. For the same period, all of the Fund’s share classes outperformed its secondary benchmark, the Bloomberg U.S. Aggregate Bond Index, with the exception of the Fund’s Investor C shares which performed in line. The following discussion of relative performance pertains to the Fund’s primary benchmark.

What factors influenced performance?

The Fund’s Directional Asset Allocation (“DAA”) strategy contributed to performance during the reporting period. The DAA strategy takes long-only positions in fixed-income assets to capture market upside while seeking to balance interest rate risk and credit risk. The largest gains came from yield on the Fund’s fixed income holdings, as the higher level of interest rates led to more attractive opportunities for income generation. The strategy also benefited positively from duration (interest rate sensitivity) in the fourth quarter of 2023 as the bond market rallied.

The Fund’s Macro and Defensive Equity Long/Short strategies detracted in 2023, with each posting small losses. In the Macro strategy, a long position in U.S. interest rates versus a short position in Europe was the largest detractor. The Defensive Equity Long/Short strategy struggled in the first half of the period due to several rapid shifts in investor sentiment. However, the strategy delivered a gain in the third quarter of 2023 when both stocks and bonds sold off.

The Fund held derivatives as part of its investment strategy. The portfolio management team uses derivatives to obtain exposure to and/or take outright views on interest rates, credit risk and/or foreign exchange positions. The standalone performance of derivatives used to manage risk may not necessarily portray the total performance impact of the affected position. The use of U.S. Treasury futures, currency forwards, options, and swaps contributed to performance in 2023.

The Fund continued to use leveraged strategies, which involve holding cash in order to back investments in to-be-announced mortgage derivative securities. The use of these and other derivatives had a positive impact on performance. Despite having a reported cash position that exceeded 5%, the Fund’s investable cash position was negative due to unsettled forward transactions on derivatives. This did not have a material effect on results.

Describe recent portfolio activity.

The Fund entered 2023 in a defensive positioning. The investment adviser remained cautious in the first half of the period given persistent inflation and strong economic data that signaled the potential for more restrictive Fed policy. Throughout the second half of the period, the investment adviser gradually added to higher-risk asset classes such as high yield bonds and dividend paying stocks as fears about inflation and a possible recession waned. In the fourth quarter of 2023, the investment adviser reduced exposure to the U.S. Treasury curve steepener trade (which seeks to capitalize on outperformance for short-term bonds relative to longer-term issues) and modestly increased overall portfolio duration (interest rate sensitivity). Specifically, it trimmed the Fund’s allocation to short-term bonds and added to its weighting in intermediate-term issues.

Describe portfolio positioning at period end.

At the close of the period, the investment adviser had an optimistic view on the fixed-income markets given further signs of cooling inflation and a growing likelihood of interest rate cuts. The investment adviser increased the Fund’s duration to 2.5 years in an effort to capture the potential for further gains in the bond market. With that said, the Fund generally strove to produce a fixed-income-like return profile with less reliance on duration through its unique Defensive Equity Long/Short strategy, which seeks to provide downside protection and typically performs well when risk assets sell off.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Fund Summary as of December 31, 2023 (continued) | | BlackRock Systematic Multi-Strategy Fund |

GROWTH OF $10,000 INVESTMENT

The Fund commenced operation on May 19, 2015.

| | (a) | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees. Institutional Shares do not have a sales charge. |

| | (b) | The Fund invests in a range of global asset classes, with a focus on fixed and floating rate debt securities and equity securities. On September 17, 2018, the Fund acquired all of the assets, subject to the liabilities, of BlackRock Alternative Capital Strategies Fund, a series of BlackRock FundsSM (the “Predecessor Fund”), through a tax-free reorganization (the “Board Reorganization”). The Predecessor Fund is the performance and accounting survivor of the Board Reorganization. |

| | (c) | An unmanaged index that measures returns of 3-month Treasury Bills. On March 1, 2021, the Fund began to compare its performance benchmark to a custom 4pm pricing variant of the ICE BofA 3-Month U.S. Treasury Bill Index (the “Index”). Index data prior to March 1, 2021 is for the Index’s standard pricing time of 3pm. Index data from March 1, 2021 through November 30, 2023 is for the custom 4pm pricing variant of the Index. Index returns beginning on December 1, 2023 reflect the Index’s new standard pricing time of 4pm. The change of the Index’s standard pricing time from 3pm to 4pm resulted in the discontinuation of the custom 4pm pricing variant used from March 1, 2021 through November 30, 2023. |

| | (d) | A broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. |

Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns(a)(b) | |

| | | 1 Year | | | | | 5 Years | | | | | Since Inception(c) | |

| | | Without

Sales

Charge | | | With

Sales

Charge | | | | | Without

Sales

Charge | | | With

Sales

Charge | | | | | Without

Sales

Charge | | | With

Sales

Charge | |

Institutional | | | 6.44 | % | | | N/A | | | | | | 4.26 | % | | | N/A | | | | | | 4.05 | % | | | N/A | |

Investor A | | | 6.19 | | | | 1.94 | % | | | | | 4.00 | | | | 3.16 | % | | | | | 3.80 | | | | 3.31 | % |

Investor C | | | 5.48 | | | | 4.48 | | | | | | 3.26 | | | | 3.26 | | | | | | 3.08 | | | | 3.08 | |

Class K | | | 6.59 | | | | N/A | | | | | | 4.31 | | | | N/A | | | | | | 4.09 | | | | N/A | |

ICE BofA 3-Month U.S. Treasury Bill Index | | | 5.02 | | | | N/A | | | | | | 1.88 | | | | N/A | | | | | | 1.45 | | | | N/A | |

Bloomberg U.S. Aggregate Bond Index | | | 5.53 | | | | N/A | | | | | | 1.10 | | | | N/A | | | | | | 1.38 | | | | N/A | |

| | (a) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” for a detailed description of share classes, including any related sales charges and fees, and how performance was calculated for certain share classes. |

| | (b) | On September 17, 2018, the Fund acquired all of the assets, subject to the liabilities, of the Predecessor Fund, through the Board Reorganization. The Predecessor Fund is the performance and accounting survivor of the Board Reorganization. |

| | (c) | The Fund commenced operations on May 19, 2015. |

N/A — Not applicable as the share class and index do not have a sales charge.

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

| | |

| 8 | | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

| Fund Summary as of December 31, 2023 (continued) | | BlackRock Systematic Multi-Strategy Fund |

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | Hypothetical 5% Return | | | | | | |

| | |

| Beginning

Account Value

(07/01/23) |

| |

| Ending

Account Value

(12/31/23) |

| |

| Expenses

Paid During

the Period(a) |

| | | |

| Beginning

Account Value

(07/01/23) |

| |

| Ending

Account Value

(12/31/23) |

| |

| Expenses

Paid During

the Period(a) |

| | | |

| Annualized

Expense

Ratio |

|

Institutional | | $ | 1,000.00 | | | $ | 1,065.50 | | | $ | 4.93 | | | | | $ | 1,000.00 | | | $ | 1,020.43 | | | $ | 4.82 | | | | | | 0.95 | % |

Investor A | | | 1,000.00 | | | | 1,064.10 | | | | 6.32 | | | | | | 1,000.00 | | | | 1,019.08 | | | | 6.18 | | | | | | 1.21 | |

Investor C | | | 1,000.00 | | | | 1,060.40 | | | | 9.93 | | | | | | 1,000.00 | | | | 1,015.56 | | | | 9.72 | | | | | | 1.91 | |

Class K | | | 1,000.00 | | | | 1,065.90 | | | | 4.34 | | | | | | 1,000.00 | | | | 1,021.01 | | | | 4.24 | | | | | | 0.83 | |

| | (a) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). | |

See “Disclosure of Expenses” for further information on how expenses were calculated.

Portfolio Information

PORTFOLIO COMPOSITION

| | | | |

| Asset Type(a) | | Percent of

Net Assets | |

Corporate Bonds | | | 62.3 | % |

Non-Agency Mortgage-Backed Securities | | | 21.0 | |

U.S. Government Sponsored Agency Securities | | | 12.4 | |

Common Stocks | | | 7.9 | |

Asset-Backed Securities | | | 2.5 | |

U.S. Treasury Obligations | | | 0.5 | |

Money Market Funds | | | 0.1 | |

Capital Trusts | | | 0.1 | (b) |

TBA Sale Commitments | | | (0.2 | ) |

Liabilities in Excess of Other Assets | | | (6.6 | ) |

INDUSTRY ALLOCATION

| | | | | | | | | | | | |

| | | Percent of Total Investments(c) | |

| Industry | | Long | | | Short | | | Total | |

Financials | | | 12.3 | % | | | 2.8 | % | | | 15.1 | % |

Consumer Discretionary | | | 7.4 | | | | 3.6 | | | | 11.0 | |

Industrials | | | 6.8 | | | | 3.6 | | | | 10.4 | |

Energy | | | 5.9 | | | | 2.1 | | | | 8.0 | |

Health Care | | | 5.6 | | | | 2.2 | | | | 7.8 | |

Consumer Staples | | | 4.1 | | | | 2.4 | | | | 6.5 | |

Information Technology | | | 4.6 | | | | 1.6 | | | | 6.2 | |

Materials | | | 3.4 | | | | 2.4 | | | | 5.8 | |

Communication Services | | | 4.0 | | | | 1.1 | | | | 5.1 | |

Utilities | | | 3.9 | | | | 1.1 | | | | 5.0 | |

Real Estate | | | 1.3 | | | | 1.6 | | | | 2.9 | |

Other(d) | | | 16.2 | | | | — | | | | 16.2 | |

| | | 75.5 | % | | | 24.5 | % | | | 100.0 | % |

| | | | | | | | | | | | |

| (a) | Excludes underlying investment in total return swaps. |

| (b) | Rounds to less than 0.1% of net assets. |

| (c) | Total investments include the gross values of long and short equity securities of the underlying derivative contracts utilized by the Fund and excludes short-term securities and TBA sale commitments. |

| (d) | Consist of Asset-Backed Securities (1.1%), Non-Agency Mortgaged-Backed Securities (9.5%) and U.S. Government Sponsored Agency Obligations (5.6%). |

About Fund Performance

Institutional and Class K Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors. Class K Shares performance shown prior to the Class K Shares inception date of November 13, 2015 for BlackRock Strategic Global Bond Fund, Inc,.and September 29, 2020 for BlackRock Systematic Multi-Strategy Fund is that of the respective Fund’s Institutional Shares. The performance of each Fund’s Class K Shares would be substantially similar to that of each Fund’s Institutional Shares because Class K Shares and Institutional Shares invest in the same portfolio of securities and performance would only differ to the extent that Class K Shares and Institutional Shares have different expenses. The actual returns of Class K Shares would have been higher than those of Institutional Shares because Class K Shares have lower expenses than Institutional Shares.

Investor A Shares are subject to a maximum initial sales charge (front-end load) of 4.00% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. These shares are generally available through financial intermediaries.

Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares are generally available through financial intermediaries. These shares automatically convert to Investor A Shares after approximately eight years.

Past performance is not an indication of future results. Financial markets have experienced extreme volatility and trading in many instruments has been disrupted. These circumstances may continue for an extended period of time and may continue to affect adversely the value and liquidity of each Fund’s investments. As a result, current performance may be lower or higher than the performance data quoted. Refer to blackrock.com to obtain performance data current to the most recent month-end. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Figures shown in the performance table(s) assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend date or payable date, as applicable. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), each Fund’s investment adviser, has contractually and/or voluntarily agreed to waive and/or reimburse a portion of each Fund’s expenses. Without such waiver(s) and/or reimbursement(s), each Fund’s performance would have been lower. With respect to each Fund’s voluntary waiver(s), if any, the Manager is under no obligation to waive and/or reimburse or to continue waiving and/or reimbursing its fees and such voluntary waiver(s) may be reduced or discontinued at any time. With respect to each Fund’s contractual waiver(s), if any, the Manager is under no obligation to continue waiving and/or reimbursing its fees after the applicable termination date of such agreement. See the Notes to Financial Statements for additional information on waivers and/or reimbursements.

The standardized 30-day yield includes the effects of any waivers and/or reimbursements. The unsubsidized 30-day yield excludes the effects of any waivers and/or reimbursements.

Disclosure of Expenses

Shareholders of each Fund may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses, and other fund expenses. The expense examples shown (which are based on a hypothetical investment of $1,000 invested at the beginning of the period and held through the end of the period) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. Annualized expense ratios reflect contractual and voluntary fee waivers, if any. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| | |

| 10 | | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

The Benefits and Risks of Leveraging

The Funds may utilize leverage to seek to enhance returns and net asset value (“NAV”). However, there is no guarantee that these objectives can be achieved in all interest rate environments.

In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is normally lower than the income earned by each Fund on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of each Fund (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, each Fund’s shareholders benefit from the incremental net income.

The interest earned on securities purchased with the proceeds from leverage is distributed to each Fund’s shareholders, and the value of these portfolio holdings is reflected in each Fund’s per share NAV. However, in order to benefit shareholders, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the leverage. If interest and other ongoing costs of leverage exceed a Fund’s return on assets purchased with leverage proceeds, income to shareholders is lower than if the Funds had not used leverage.

Furthermore, the value of each Fund’s portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can also influence the value of portfolio investments. As a result, changes in interest rates can influence each Fund’s NAV positively or negatively in addition to the impact on each Fund’s performance from leverage. Changes in the direction of interest rates are difficult to predict accurately, and there is no assurance that a Fund’s leveraging strategy will be successful.

The use of leverage also generally causes greater changes in each Fund’s NAV and dividend rates than comparable portfolios without leverage. In a declining market, leverage is likely to cause a greater decline in the NAV of a Fund’s shares than if the Fund were not leveraged. In addition, each Fund may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of the leverage instruments, which may cause the Fund to incur losses. The use of leverage may limit a Fund’s ability to invest in certain types of securities or use certain types of hedging strategies. Each Fund incurs expenses in connection with the use of leverage, all of which are borne by each Fund’s shareholders and may reduce income.

Derivative Financial Instruments

The Funds may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. Pursuant to Rule 18f-4 under the 1940 Act, among other things, the Funds must either use derivative financial instruments with embedded leverage in a limited manner or comply with an outer limit on fund leverage risk based on value-at-risk. The Funds’ successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Funds’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| | |

T H E B E N E F I T S A N D R I S K S O F L E V E R A G I N G / D E R I V A T I V E F I N A N C I A L I N S T R U M E N T S | | 11 |

| | |

Schedule of Investments December 31, 2023 | | BlackRock Strategic Global Bond Fund, Inc. (Percentages shown are based on Net Assets) |

| | |

| | | | | | | | |

| Security | | Par

(000) | | | Value | |

|

Asset-Backed Securities | |

| | |

| Cayman Islands(a)(b) — 2.5% | | | | | | |

AGL CLO Ltd., Series 2020-3A, Class A, (3-mo. CME Term SOFR + 1.56%), 6.96%, 01/15/33 | | | USD 250 | | | $ | 250,257 | |

Allegro CLO VI Ltd., Series 2017-2A, Class A, (3-mo. CME Term SOFR + 1.39%), 6.79%, 01/17/31 | | | 331 | | | | 330,939 | |

ALM Ltd., Series 2020-1A, Class A2, (3-mo. CME Term SOFR + 2.11%), 7.51%, 10/15/29 | | | 250 | | | | 250,128 | |

Apidos CLO XXXVI, Series 2021-36A, Class B, (3-mo. CME Term SOFR + 1.86%), 7.28%, 07/20/34 | | | 250 | | | | 248,805 | |

Ares XXXVII CLO Ltd., Series 2015-4A, Class A1R, (3-mo. CME Term SOFR + 1.43%), 6.83%, 10/15/30 | | | 355 | | | | 355,744 | |

Bain Capital Credit CLO Ltd., Series 2017-1A, Class A1R, (3-mo. CME Term SOFR + 1.23%), 6.65%, 07/20/30 | | | 473 | | | | 471,845 | |

Benefit Street Partners CLO VIII Ltd., Series 2015-8A, Class A1AR, (3-mo. CME Term SOFR + 1.36%), 6.78%, 01/20/31 | | | 422 | | | | 422,155 | |

Carlyle Global Market Strategies CLO Ltd., Series 2014- 3RA, Class A1B, (3-mo. CME Term SOFR + 1.56%), 6.95%, 07/27/31 | | | 1,000 | | | | 996,287 | |

Cayuga Park CLO Ltd., Series 2020-1A, Class B1R, (3-mo. CME Term SOFR + 1.91%), 7.31%, 07/17/34 | | | 250 | | | | 249,030 | |

CBAM Ltd., Series 2017-1A, Class A1, (3-mo. CME Term SOFR + 1.51%), 6.93%, 07/20/30 | | | 302 | | | | 302,049 | |

CIFC Funding Ltd. | | | | | | | | |

Series 2014-3A, Class A1R2, (3-mo. CME Term SOFR + 1.46%), 6.87%, 10/22/31 | | | 1,500 | | | | 1,499,940 | |

Series 2014-5A, Class A1R2, (3-mo. CME Term SOFR + 1.46%), 6.86%, 10/17/31 | | | 2,000 | | | | 2,003,160 | |

Series 2018-2A, Class A2, (3-mo. CME Term SOFR + 1.86%), 7.28%, 04/20/31 | | | 250 | | | | 249,953 | |

Dryden Senior Loan Fund | | | | | | | | |

Series 2015-37A, Class AR, (3-mo. CME Term SOFR + 1.36%), 6.76%, 01/15/31 | | | 708 | | | | 709,397 | |

Series 2017-49, Class AR, (3-mo. CME Term SOFR + 1.21%), 6.61%, 07/18/30 | | | 676 | | | | 676,184 | |

Elmwood CLO IV Ltd., Series 2020-1A, Class A, (3-mo. CME Term SOFR + 1.50%), 6.90%, 04/15/33 | | | 500 | | | | 500,381 | |

Generate CLO Ltd., Series 2A, Class AR, (3-mo. CME Term SOFR + 1.41%), 6.82%, 01/22/31 | | | 558 | | | | 557,688 | |

Jamestown CLO XV Ltd., Series 2020-15A, Class A, (3-mo. CME Term SOFR + 1.60%), 7.00%, 04/15/33 | | | 1,000 | | | | 999,342 | |

Madison Park Funding XI Ltd., Series 2013-11A, Class AR2, (3-mo. CME Term SOFR + 1.16%), 6.57%, 07/23/29 | | | 923 | | | | 922,578 | |

Mariner CLO LLC, Series 2016-3A, Class CR, (3-mo. CME Term SOFR + 2.31%), 7.72%, 07/23/29 | | | 250 | | | | 249,878 | |

Neuberger Berman Loan Advisers CLO Ltd., | | | | | | | | |

Series 2021- 46A, Class B, (3-mo. CME Term SOFR + 1.91%), 7.33%, 01/20/36 | | | 250 | | | | 248,855 | |

OCP CLO Ltd., Series 2013-4A, Class BRR, (3-mo. CME Term SOFR + 2.16%), 7.56%, 04/24/29 | | | 250 | | | | 249,880 | |

Octagon Investment Partners 36 Ltd., Series 2018-1A, Class A1, (3-mo. CME Term SOFR + 1.23%), 6.63%, 04/15/31 | | | 711 | | | | 710,527 | |

OHA Credit Funding Ltd. | | | | | | | | |

Series 2019-3A, Class BR, (3-mo. CME Term SOFR + 1.91%), 7.33%, 07/02/35 | | | 1,000 | | | | 1,000,111 | |

| | | | | | | | |

| Security | | Par

(000) | | | Value | |

| | |

| Cayman Islands (continued) | | | | | | |

OHA Credit Funding Ltd. (continued) | | | | | | | | |

Series 2020-5A, Class A2A, (3-mo. CME Term SOFR + 1.71%), 7.11%, 04/18/33 | | | USD 300 | | | $ | 297,886 | |

Park Avenue Institutional Advisers CLO Ltd., | | | | | | | | |

Series 2017-1A, Class DR, (3-mo. CME Term SOFR + 7.07%), 12.45%, 02/14/34 | | | 250 | | | | 232,520 | |

RR Ltd., Series 2018-3A, Class A2R2, (3-mo. CME Term SOFR + 1.66%), 7.06%, 01/15/30 | | | 1,125 | | | | 1,114,941 | |

RRX Ltd., Series 2021-4A, Class A2, (3-mo. CME Term SOFR + 2.11%), 7.51%, 07/15/34 | | | 250 | | | | 250,902 | |

Symphony CLO XIX Ltd., Series 2018-19A, Class A, (3-mo. CME Term SOFR + 1.22%), 6.62%, 04/16/31 | | | 477 | | | | 476,758 | |

TICP CLO XII Ltd., Series 2018-12A, Class BR, (3-mo. CME Term SOFR + 1.91%), 7.31%, 07/15/34 | | | 325 | | | | 323,156 | |

Trestles CLO Ltd., Series 2017-1A, Class A1R, (3-mo. CME Term SOFR + 1.25%), 6.63%, 04/25/32 | | | 250 | | | | 249,249 | |

Trimaran CAVU Ltd. | | | | | | | | |

Series 2019-1A, Class B, (3-mo. CME Term SOFR + 2.46%), 7.88%, 07/20/32 | | | 250 | | | | 250,704 | |

Series 2019-1A, Class C1, (3-mo. CME Term SOFR + 3.41%), 8.83%, 07/20/32 | | | 500 | | | | 500,008 | |

Venture CLO Ltd., Series 2020-39A, Class A1, (3-mo. CME Term SOFR + 1.54%), 6.94%, 04/15/33 | | | 335 | | | | 333,898 | |

Whitebox CLO I Ltd., Series 2019-1A, Class CR, (3-mo. CME Term SOFR + 3.31%), 8.71%, 07/24/32 | | | 500 | | | | 492,507 | |

| | | | | | | | |

| | | | | | | 18,977,642 | |

|

| Denmark — 0.0% | |

Red & Black Auto Germany UG, Series 8, Class B, (1-mo. EURIBOR + 0.75%), 4.58%, 09/15/30(a)(c) | | | EUR 67 | | | | 73,183 | |

| | | | | | | | |

|

| France(a)(c) — 0.1% | |

FCT Autonoria DE, Series 2023-DE, Class B, (1-mo. EURIBOR + 1.15%), 5.03%, 01/26/43 | | | 90 | | | | 99,348 | |

Ginkgo Personal Loans, Series 2023-PL1, Class A1, (1-mo. EURIBOR + 0.79%), 4.67%, 09/23/44 | | | 300 | | | | 331,809 | |

| | | | | | | | |

| | | | | | | 431,157 | |

|

| Germany — 0.0% | |

Red & Black Auto Germany UG, Series 10, Class B, (1-mo. EURIBOR + 1.20%), 5.03%, 09/15/32(a)(c) | | | 100 | | | | 110,671 | |

| | | | | | | | |

|

| Ireland(a)(c) — 0.1% | |

Avoca CLO XXII DAC, Series 22X, Class B1, (3-mo. EURIBOR + 1.30%), 5.27%, 04/15/35 | | | 100 | | | | 105,464 | |

Cairn CLO XVI DAC, Series 2023-16X, Class D, (3-mo. EURIBOR + 5.20%), 1.00%, 01/15/37(d) | | | 100 | | | | 110,395 | |

CIFC European Funding CLO I DAC, Series 1X, Class DR, (3-mo. EURIBOR + 3.20%), 7.17%, 07/15/32 | | | 100 | | | | 106,253 | |

CVC Cordatus Loan Fund IV DAC, Series 4X, Class BR1, (3-mo. EURIBOR + 1.30%), 5.26%, 02/22/34 | | | 100 | | | | 105,387 | |

Henley CLO IV DAC, Series 4X, Class B1, (3-mo. EURIBOR + 1.35%), 5.31%, 04/25/34 | | | 100 | | | | 106,128 | |

| | | | | | | | |

| | | | | | | 533,627 | |

| | |

12 | | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

Schedule of Investments (continued) December 31, 2023 | | BlackRock Systematic Multi-Strategy Fund (Percentages shown are based on Net Assets) |

| | |

| | | | | | | | |

| Security | | Par

(000) | | | Value | |

|

| Italy(a)(c) — 0.1% | |

AutoFlorence SRL, Series 3, Class A, (1-mo. EURIBOR + 0.95%), 4.83%, 12/25/46 | | | EUR 500 | | | $ | 554,180 | |

Koromo Italy SRL, Series 1, Class A, (1-mo. EURIBOR + 0.80%), 4.68%, 02/26/35 | | | 206 | | | | 228,144 | |

| | | | | | | | |

| | | | | | | 782,324 | |

| | |

| Netherlands — 0.0% | | | | | | |

Domi BV, Series 2023-1, Class A, (3-mo. EURIBOR + 1.12%), 5.12%, 02/15/55(a)(c) | | | 140 | | | | 156,267 | |

| | | | | | | | |

| | |

| Spain — 0.0% | | | | | | |

Autonoria Spain FT, Series 2021-SP, Class B, (1-mo. EURIBOR + 0.80%), 4.68%, 01/31/39(a)(c) | | | 110 | | | | 120,798 | |

| | | | | | | | |

| | |

| United Kingdom(a)(c) — 0.2% | | | | | | |

Atlas Funding PLC, Series 2013-1, Class B, (3-mo. LIBOR GBP + 1.90%), 7.10%, 01/20/61 | | | GBP 100 | | | | 127,980 | |

Hermitage PLC, Series 2023-1, Class B, (3-mo. LIBOR GBP + 2.45%), 7.65%, 09/21/33 | | | 100 | | | | 128,328 | |

PCL Funding VI PLC, Series 2022-1, Class A, (3-mo. LIBOR GBP + 1.40%), 6.60%, 07/15/26 | | | 500 | | | | 638,460 | |

PCL Funding VIII PLC, Series 2023-1, Class A, (3-mo. LIBOR GBP + 1.18%), 6.38%, 05/15/28 | | | 400 | | | | 511,128 | |

Polaris PLC, Series 2023-1, Class B, (3-mo. LIBOR GBP + 2.75%), 7.95%, 02/23/61 | | | 160 | | | | 204,685 | |

| | | | | | | | |

| | | | | | | 1,610,581 | |

| | |

| United States — 3.7% | | | | | | |

AccessLex Institute, Series 2007-A, Class A3, (3-mo. CME Term SOFR + 0.56%), 5.94%, 05/25/36(a) | | | USD 53 | | | | 51,494 | |

Anchorage Capital CLO Ltd.(a)(b) | | | | | | | | |

Series 2014-3RA, Class A, (3-mo. CME Term SOFR + 1.31%), 6.70%, 01/28/31 | | | 302 | | | | 301,483 | |

Series 2014-4RA, Class A, (3-mo. CME Term SOFR + 1.31%), 6.70%, 01/28/31 | | | 294 | | | | 293,309 | |

Apidos CLO XII, Series 2013-12A, Class AR, (3-mo. CME Term SOFR + 1.34%), 6.74%, 04/15/31(a)(b) | | | 487 | | | | 488,187 | |

Aqua Finance Trust, Series 2021-A, Class A, 1.54%, 07/17/46(b) | | | 48 | | | | 42,505 | |

BA Credit Card Trust, Series 2023-A2, Class A2, 4.98%, 11/15/28 | | | 364 | | | | 368,235 | |

BHG Securitization Trust(b) | | | | | | | | |

Series 2021-A, Class A, 1.42%, 11/17/33 | | | 66 | | | | 62,301 | |

Series 2021-A, Class B, 2.79%, 11/17/33 | | | 100 | | | | 89,677 | |

Chenango Park CLO Ltd., Series 2018-1A, Class A2, (3-mo. CME Term SOFR + 1.81%), 7.21%, 04/15/30(a)(b) | | | 1,018 | | | | 1,016,899 | |

CIFC Funding Ltd.(a)(b) | | | | | | | | |

Series 2013-1A, Class A2R, (3-mo. CME Term SOFR + 2.01%), 7.41%, 07/16/30 | | | 1,000 | | | | 1,001,904 | |

Series 2018-1A, Class A, (3-mo. CME Term SOFR + 1.26%), 6.66%, 04/18/31 | | | 393 | | | | 392,927 | |

College Avenue Student Loans LLC, Series 2023-B, Class A1A, 6.50%, 06/25/54(b) | | | 389 | | | | 405,748 | |

Dryden CLO Ltd., Series 2017-53A, Class A, (3-mo. CME Term SOFR + 1.38%), 6.78%, 01/15/31(a)(b) | | | 562 | | | | 563,852 | |

Eaton Vance CLO Ltd., Series 2018-1A, Class A2, (3-mo. CME Term SOFR + 1.71%), 7.11%, 10/15/30(a)(b) | | | 250 | | | | 247,200 | |

ELFI Graduate Loan Program LLC, Series 2023-A, Class A, 6.37%, 02/04/48(b) | | | 705 | | | | 722,038 | |

Ford Credit Floorplan Master Owner Trust, Series 19-4, Class B, 2.64%, 09/15/26 | | | 591 | | | | 576,234 | |

| | | | | | | | |

| Security | | Par

(000) | | | Value | |

| | |

| United States (continued) | | | | | | |

Foundation Finance Trust(b) | | | | | | | | |

Series 2021-2A, Class A, 2.19%, 01/15/42 | | | USD 148 | | | $ | 134,517 | |

Series 2023-2A, Class A, 6.53%, 06/15/49 | | | 362 | | | | 368,825 | |

Goldman Home Improvement Trust Issuer Trust, Series 2022-GRN2, Class A, 6.80%, 10/25/52(b) | | | 102 | | | | 103,557 | |

GoodLeap Sustainable Home Solutions Trust(b) | | | | | | | | |

Series 2021-3CS, Class A, 2.10%, 05/20/48 | | | 240 | | | | 184,853 | |

Series 2022-3CS, Class A, 4.95%, 07/20/49 | | | 121 | | | | 110,735 | |

Series 2023-1GS, Class A, 5.52%, 02/22/55 | | | 113 | | | | 109,875 | |

Gracie Point International Funding(a)(b) | | | | | | | | |

Series 2022-2A, Class A, (30-day Avg SOFR + 2.75%), 8.09%, 07/01/24 | | | 144 | | | | 144,542 | |

Series 2022-2A, Class B, (30-day Avg SOFR + 3.35%), 8.69%, 07/01/24 | | | 154 | | | | 154,761 | |

Series 2022-3A, Class A, (30-day Avg SOFR + 3.25%), 8.58%, 11/01/24 | | | 110 | | | | 110,646 | |

Series 2023-2, Class A, (3-mo. SOFR + 2.25%), 7.60%, 03/01/27 | | | 1,109 | | | | 1,108,928 | |

Hipgnosis Music Assets LP, Series 2022-1, Class A, 5.00%, 05/16/62(b) | | | 385 | | | | 359,031 | |

LCM Ltd., Series 26A, Class A1, (3-mo. CME Term SOFR + 1.33%), 6.75%, 01/20/31(a)(b) | | | 442 | | | | 442,286 | |

Lendmark Funding Trust, Series 2022-1A, Class A, 5.12%, 07/20/32(b) | | | 301 | | | | 298,444 | |

Loanpal Solar Loan Ltd., Series 2020-2GF, Class A, 2.75%, 07/20/47(b) | | | 81 | | | | 63,938 | |

Mariner Finance Issuance Trust(b) | | | | | | | | |

Series 2020-AA, Class B, 3.21%, 08/21/34 | | | 104 | | | | 99,219 | |

Series 2022-AA, Class A, 6.45%, 10/20/37 | | | 250 | | | | 251,732 | |

Series 2023-A, Class A, 6.70%, 10/22/35 | | | 1,468 | | | | 1,498,431 | |

Series 2023-A, Class B, 7.11%, 10/22/35 | | | 789 | | | | 808,493 | |

Mercury Financial Credit Card Master Trust, Series 2022- 1A, Class A, 2.50%, 09/21/26(b) | | | 483 | | | | 469,755 | |

Mosaic Solar Loan Trust(b) | | | | | | | | |

Series 2022-2A, Class A, 4.38%, 01/21/53 | | | 83 | | | | 77,866 | |

Series 2022-3A, Class A, 6.10%, 06/20/53 | | | 89 | | | | 89,999 | |

Series 2023-1A, Class A, 5.32%, 06/20/53 | | | 208 | | | | 204,629 | |

Series 2023-4, Class A, 6.40%, 05/20/53 | | | 271 | | | | 279,280 | |

Navient Private Education Loan Trust, Series 2014-AA, Class A3, (1-mo. Term SOFR + 1.71%), 7.08%, 10/15/31(a)(b) | | | 936 | | | | 937,990 | |

Navient Private Education Refi Loan Trust(a)(b) | | | | | | | | |

Series 2020-CA, Class A2B, (1-mo. Term SOFR + 1.71%), 7.08%, 11/15/68 | | | 573 | | | | 576,564 | |

Series 2021-DA, Class A, (Prime - 1.99%), 6.51%, 04/15/60 | | | 297 | | | | 285,550 | |

Navient Student Loan Trust(b) | | | | | | | | |

Series 2023-B, Class A1B, (30-day Avg SOFR + 1.70%), 7.04%, 03/15/72(a) | | | 290 | | | | 290,812 | |

Series 2023-BA, Class A1A, 6.48%, 03/15/72 | | | 202 | | | | 205,200 | |

Nelnet Student Loan Trust(b) | | | | | | | | |

Series 2021-DA, Class B, 2.90%, 04/20/62 | | | 450 | | | | 375,251 | |

Series 2021-DA, Class C, 3.50%, 04/20/62 | | | 100 | | | | 77,778 | |

Series 2023-PL1, Class A1A, (30-day Avg SOFR + 2.25%), 7.57%, 11/25/53(a) | | | 199 | | | | 198,399 | |

OneMain Financial Issuance Trust(b) | | | | | | | | |

Series 2019-2A, Class A, 3.14%, 10/14/36 | | | 100 | | | | 93,546 | |

Series 2020-2A, Class B, 2.21%, 09/14/35 | | | 1,132 | | | | 1,012,063 | |

Series 2022-2A, Class A, 4.89%, 10/14/34 | | | 280 | | | | 276,425 | |

Series 2022-2A, Class B, 5.24%, 10/14/34 | | | 380 | | | | 373,894 | |

Series 2022-3A, Class A, 5.94%, 05/15/34 | | | 682 | | | | 683,542 | |

| | |

S C H E D U L E O F I N V E S T M E N T S | | 13 |

| | |

Schedule of Investments (continued) December 31, 2023 | | BlackRock Strategic Global Bond Fund, Inc. (Percentages shown are based on Net Assets) |

| | |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

| |

| United States (continued) | | | | |

OneMain Financial Issuance Trust(b) (continued) | | | | | | | | |

Series 2023-2A, Class D, 7.52%, 09/15/36 | | | USD 552 | | | $ | 564,665 | |

PFS Financing Corp., Series 2022-D, Class D, 4.90%, 08/15/27(b) | | | 1,134 | | | | 1,110,969 | |

Regional Management Issuance Trust(b) | | | | | | | | |

Series 2020-1, Class A, 2.34%, 10/15/30 | | | 74 | | | | 72,256 | |

Series 2021-1, Class B, 2.42%, 03/17/31 | | | 256 | | | | 232,998 | |

Series 2021-2, Class B, 2.35%, 08/15/33 | | | 990 | | | | 835,520 | |

Series 2022-1, Class A, 3.07%, 03/15/32 | | | 389 | | | | 370,832 | |

Series 2022-2B, Class A, 7.10%, 11/17/32 | | | 325 | | | | 327,992 | |

Republic Finance Issuance Trust(b) | | | | | | | | |

Series 2021-A, Class A, 2.30%, 12/22/31 | | | 600 | | | | 568,682 | |

Series 2021-A, Class B, 2.80%, 12/22/31 | | | 136 | | | | 124,202 | |

Series 2021-A, Class C, 3.53%, 12/22/31 | | | 100 | | | | 89,695 | |

Series 2021-A, Class D, 5.23%, 12/22/31 | | | 800 | | | | 676,710 | |

Rockford Tower CLO Ltd., Series 2017-3A, Class A, (3-mo. CME Term SOFR + 1.45%), 6.87%, 10/20/30(a)(b) | | | 348 | | | | 347,775 | |

RR Ltd., Series 2018-3A, Class A1R2, (3-mo. CME Term SOFR + 1.35%), 6.75%, 01/15/30(a)(b) | | | 321 | | | | 321,744 | |

Service Experts Issuer LLC, Series 2021-1A, Class A, 2.67%, 02/02/32(b) | | | 225 | | | | 208,629 | |

Shackleton CLO Ltd., Series 2013-3A, Class AR, (3-mo. CME Term SOFR + 1.38%), 6.78%, 07/15/30(a)(b) | | | 248 | | | | 247,396 | |

Steele Creek CLO Ltd., Series 2017-1A, Class A, (3-mo. CME Term SOFR + 1.51%), 6.91%, 10/15/30(a)(b) | | | 343 | | | | 342,792 | |

Tiaa CLO III Ltd., Series 2017-2A, Class A, (3-mo. CME Term SOFR + 1.41%), 6.81%, 01/16/31(a)(b) | | | 340 | | | | 339,488 | |

TICP CLO XV Ltd., Series 2020-15A, Class A, (3-mo. CME Term SOFR + 1.54%), 6.96%, 04/20/33(a)(b) | | | 1,750 | | | | 1,750,372 | |

Voya CLO Ltd., Series 2017-4A, Class A1, (3-mo. CME Term SOFR + 1.39%), 6.79%, 10/15/30(a)(b) | | | 313 | | | | 313,059 | |

| | | | | | | | |

| | | | | | | 28,331,125 | |

| | | | | | | | |

| |

Total Asset-Backed Securities — 6.7%

(Cost: $51,117,686) | | | | 51,127,375 | |

| | | | | | | | |

| | |

| | | | Shares | | | | | |

|

| Common Stocks | |

|

| China — 0.0% | |

BYD Co. Ltd., Class H | | | 3,796 | | | | 104,711 | |

| | | | | | | | |

| | |

| Italy — 0.0% | | | | | | |

UniCredit SpA | | | 3,002 | | | | 81,744 | |

| | | | | | | | |

| | |

| Japan — 0.1% | | | | | | |

Mitsubishi UFJ Financial Group, Inc. | | | 26,860 | | | | 230,516 | |

Mizuho Financial Group, Inc. | | | 9,960 | | | | 169,896 | |

Sumitomo Mitsui Financial Group, Inc. | | | 4,640 | | | | 225,781 | |

| | | | | | | | |

| | | | | | | 626,193 | |

| | |

| Netherlands — 0.0% | | | | | | |

Shell PLC | | | 3,233 | | | | 106,376 | |

Shell PLC, ADR | | | 211 | | | | 13,884 | |

| | | | | | | | |

| | | | | | | 120,260 | |

| | |

| United Kingdom — 0.0% | | | | | | |

Genius Sports Ltd. (e) | | | 21,560 | | | | 133,241 | |

| | | | | | | | |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| United States — 0.7% | |

Advanced Micro Devices, Inc. (e) | | | 786 | | | $ | 115,864 | |

Amazon.com, Inc. (e) | | | 400 | | | | 60,776 | |

Boyd Gaming Corp. | | | 941 | | | | 58,916 | |

Cheniere Energy, Inc. | | | 845 | | | | 144,250 | |

Chesapeake Energy Corp. | | | 631 | | | | 48,549 | |

Delta Air Lines, Inc. | | | 1,050 | | | | 42,241 | |

Element Solutions, Inc. | | | 6,664 | | | | 154,205 | |

Eli Lilly & Co. | | | 274 | | | | 159,720 | |

Ford Motor Co. | | | 6,904 | | | | 84,160 | |

General Dynamics Corp. | | | 573 | | | | 148,791 | |

General Motors Co. | | | 2,381 | | | | 85,525 | |

Golden Entertainment, Inc. | | | 1,691 | | | | 67,522 | |

HCA Healthcare, Inc. | | | 322 | | | | 87,159 | |

Intel Corp. | | | 630 | | | | 31,657 | |

Invesco S&P 500 Equal Weight ETF | | | 6,817 | | | | 1,075,723 | |

JPMorgan Chase & Co. | | | 378 | | | | 64,298 | |

KLA Corp. | | | 217 | | | | 126,142 | |

Las Vegas Sands Corp. | | | 1,990 | | | | 97,928 | |

Lennar Corp., Class A | | | 126 | | | | 18,779 | |

Lessen Holdings, Inc. (e)(f) | | | 10,022 | | | | 65,198 | |

Lockheed Martin Corp. | | | 124 | | | | 56,202 | |

M/I Homes, Inc. (e) | | | 939 | | | | 129,338 | |

Marathon Petroleum Corp. | | | 1,806 | | | | 267,938 | |

McDonald’s Corp. | | | 821 | | | | 243,435 | |

MGM Resorts International | | | 1,500 | | | | 67,020 | |

Micron Technology, Inc. | | | 1,929 | | | | 164,621 | |

Mr. Cooper Group, Inc. (e) | | | 2,113 | | | | 137,599 | |

Northrop Grumman Corp. | | | 311 | | | | 145,592 | |

NVIDIA Corp. | | | 163 | | | | 80,721 | |

Phillips 66 | | | 1,269 | | | | 168,955 | |

Rockwell Automation, Inc. | | | 531 | | | | 164,865 | |

RXO, Inc. (e) | | | 372 | | | | 8,653 | |

Sarcos Technology & Robotics Corp. | | | 305 | | | | 220 | |

Schlumberger NV | | | 1,184 | | | | 61,615 | |

Space Exploration Technologies Corp., A Shares, | | | | | | | | |

(Acquired 08/21/23, Cost: $85,374) (e)(f)(g) | | | 1,054 | | | | 85,374 | |

Space Exploration Technologies Corp., C Shares, | | | | | | | | |

(Acquired 08/21/23, Cost: $91,692) (e)(f)(g) | | | 1,132 | | | | 91,692 | |

Transocean Ltd. (e) | | | 44,647 | | | | 283,508 | |

Uber Technologies, Inc. (e) | | | 1,371 | | | | 84,412 | |

Valero Energy Corp. | | | 856 | | | | 111,280 | |

Volato Group, Inc., Class A, (Acquired 12/03/23, Cost: $20) (f)(g) | | | 4,080 | | | | 16,442 | |

Walmart, Inc. | | | 277 | | | | 43,669 | |

Wells Fargo & Co. | | | 2,289 | | | | 112,665 | |

| | | | | | | | |

| | | | | | | 5,263,219 | |

| | | | | | | | |

| | |

Total Common Stocks — 0.8%

(Cost: $5,914,865) | | | | | | | 6,329,368 | |

| | | | | | | | |

| | |

| | | Par (000) | | | | |

| | |

Corporate Bonds | | | | | | | | |

| | |

| Argentina — 0.0% | | | | | | |

Generacion Mediterranea SA/Central Termica Roca SA, 9.88%, 12/01/27(b) | | | USD 111 | | | | 96,598 | |

| | |

14 | | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

Schedule of Investments (continued) December 31, 2023 | | BlackRock Strategic Global Bond Fund, Inc. (Percentages shown are based on Net Assets) |

| | |

| | | | | | | | |

| Security | | Par Shares | | | Value | |

| | |

| Argentina (continued) | | | | | | |

YPF SA | | | | | | | | |

8.50%, 06/27/29(c) | | USD | 30 | | | $ | 27,102 | |

7.00%, 12/15/47(b) | | | 74 | | | | 55,493 | |

| | | | | | | | |

| | | | | | | 179,193 | |

| |

| Australia — 0.3% | | | | |

FMG Resources August 2006 Pty. Ltd., 4.38%, 04/01/31(b) | | | 127 | | | | 116,143 | |

FMG Resources August Pty. Ltd., 6.13%, 04/15/32(b) | | | 268 | | | | 269,931 | |

Mineral Resources Ltd., 9.25%, 10/01/28(b) | | | 95 | | | | 101,058 | |

Oceana Australian Fixed Income Trust, A Note Upsize(f) | | | | | | | | |

12.00%, 08/31/25 | | AUD | 166 | | | | 112,985 | |

12.50%, 08/31/26 | | | 248 | | | | 169,101 | |

12.50%, 08/31/27 | | | 414 | | | | 282,487 | |

Origin Energy Finance Ltd., 1.00%, 09/17/29(c) | | EUR | 854 | | | | 820,464 | |

| | | | | | | | |

| | | | | | | 1,872,169 | |

| |

| Austria — 0.1% | | | | |

ams-OSRAM AG(c) | | | | | | | | |

2.13%, 11/03/27(h) | | | 100 | | | | 86,798 | |

10.50%, 03/30/29 | | | 100 | | | | 119,751 | |

Suzano Austria GmbH, 5.00%, 01/15/30 | | USD | 200 | | | | 192,125 | |

| | | | | | | | |

| | | | | | | 398,674 | |

| |

| Belgium(c) — 0.2% | | | | |

FLUVIUS System Operator CVBA, 3.88%, 03/18/31 | | EUR | 700 | | | | 800,691 | |

KBC Group NV | | | | | | | | |

1.13%, 01/25/24 | | | 400 | | | | 440,758 | |

(1-year UK Government Bond + 0.92%), 1.25%, 09/21/27(a) | | GBP | 100 | | | | 115,893 | |

| | | | | | | | |

| | | | | | | 1,357,342 | |

| |

| Brazil(b) — 0.1% | | | | |

Azul Secured Finance LLP, 11.93%, 08/28/28 | | USD | 209 | | | | 215,793 | |

CSN Resources SA, 5.88%, 04/08/32 | | | 200 | | | | 172,562 | |

Embraer Netherlands Finance BV, 7.00%, 07/28/30 | | | 200 | | | | 208,978 | |

MC Brazil Downstream Trading SARL, 7.25%, 06/30/31 | | | 310 | | | | 240,379 | |

| | | | | | | | |

| | | | | | | 837,712 | |

| |

| Canada — 0.3% | | | | |

Bausch & Lomb Escrow Corp., 8.38%, 10/01/28(b) | | | 17 | | | | 17,934 | |

Brookfield Residential Properties, Inc./Brookfield Residential U.S. LLC, 5.00%, 06/15/29(b) | | | 65 | | | | 57,697 | |

Garda World Security Corp.(b) | | | | | | | | |

9.50%, 11/01/27 | | | 61 | | | | 61,497 | |

7.75%, 02/15/28 | | | 31 | | | | 32,073 | |

HR Ottawa LP, 11.00%, 03/31/31(b) | | | 1,942 | | | | 2,027,635 | |

Toronto-Dominion Bank, 2.88%, 04/05/27(c) | | GBP | 100 | | | | 120,847 | |

| | | | | | | | |

| | | | | | | 2,317,683 | |

| |

| Cayman Islands — 0.1% | | | | |

Melco Resorts Finance Ltd., 5.38%, 12/04/29(c) | | USD | 200 | | | | 176,000 | |

Sands China Ltd., 5.65%, 08/08/28 | | | 200 | | | | 197,300 | |

Shelf Drilling North Sea Holdings Ltd., 10.25%, 10/31/25(b) | | | 127 | | | | 127,000 | |

Transocean Titan Financing Ltd., 8.38%, 02/01/28(b) | | | 55 | | | | 57,062 | |

Transocean, Inc., 8.75%, 02/15/30(b) | | | 55 | | | | 57,566 | |

| | | | | | | | |

| | | | | | | 614,928 | |

| |

| Chile — 0.1% | | | | |

Empresa Nacional del Petroleo, 3.75%, 08/05/26(c) | | | 200 | | | | 189,476 | |

Kenbourne Invest SA, 6.88%, 11/26/24(b) | | | 225 | | | | 155,742 | |

| | | | | | | | |

| | | | | | | 345,218 | |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

| |

| China — 0.0% | | | | |

Fantasia Holdings Group Co. Ltd., 11.88%, 06/01/23(c)(e)(i) | | USD | 200 | �� | | $ | 4,500 | |

| | | | | | | | |

| |

| Colombia — 0.1% | | | | |

ABRA Global Finance, (6.00% Cash and 5.50% PIK),

11.50%, 03/02/28(b)(j) | | | 287 | | | | 215,024 | |

Avianca Midco 2 PLC, 9.00%, 12/01/28(b) | | | 205 | | | | 179,420 | |

Ecopetrol SA | | | | | | | | |

4.13%, 01/16/25 | | | 65 | | | | 63,253 | |

8.88%, 01/13/33 | | | 82 | | | | 88,893 | |

| | | | | | | | |

| | | | | | | 546,590 | |

| |

| Denmark(c) — 0.5% | | | | |

Carlsberg Breweries A/S, 4.25%, 10/05/33 | | EUR | 1,022 | | | | 1,198,777 | |

Danske Bank A/S, (1-year EUR Swap + 1.25%), 4.13%, 01/10/31(a) | | | 1,978 | | | | 2,261,404 | |

| | | | | | | | |

| | | | | | | 3,460,181 | |

| |

| Dominican Republic — 0.0% | | | | |

Aeropuertos Dominicanos Siglo XXI SA, 6.75%, 03/30/29(b) | | USD | 200 | | | | 198,460 | |

| | | | | | | | |

| |

| Finland(c) — 0.0% | | | | |

Ahlstrom-Munksjo Holding 3 Oy, 3.63%, 02/04/28 | | EUR | 100 | | | | 99,632 | |

Balder Finland OYJ, 1.00%, 01/20/29 | | | 100 | | | | 83,995 | |

| | | | | | | | |

| | | | | | | 183,627 | |

| |

| France — 2.2% | | | | |

Altice France SA/France, 11.50%, 02/01/27(c)(d) | | | 100 | | | | 110,671 | |

Atos SE, 0.00%, 11/06/24(c)(h)(k) | | | 100 | | | | 88,341 | |

Banijay Entertainment SASU, 7.00%, 05/01/29(c) | | | 100 | | | | 116,191 | |

Banque Federative du Credit Mutuel SA(c) | | | | | | | | |

0.75%, 06/08/26 | | | 200 | | | | 207,729 | |

4.13%, 09/18/30 | | | 600 | | | | 695,092 | |

3.75%, 02/01/33 | | | 1,500 | | | | 1,690,067 | |

4.13%, 06/14/33 | | | 300 | | | | 347,304 | |

BNP Paribas SA | | | | | | | | |

1.88%, 12/14/27(c) | | GBP | 100 | | | | 114,675 | |

(3-mo. CME Term SOFR + 2.50%), 4.71%, 01/10/25(a)(b) | | USD | 948 | | | | 947,916 | |

(3-mo. EURIBOR + 0.73%), 0.50%, 02/19/28(a)(c) | | EUR | 2,000 | | | | 2,008,512 | |

(3-mo. EURIBOR + 1.37%), 4.25%, 04/13/31(a)(c) | | | 1,200 | | | | 1,371,048 | |

BPCE SA, 3.50%, 01/25/28(c) | | | 1,700 | | | | 1,896,710 | |

Credit Agricole Assurances SA, (5-year EURIBOR ICE Swap + 2.65%), 2.63%, 01/29/48(a)(c) | | | 100 | | | | 102,390 | |

Credit Agricole SA(c) | | | | | | | | |

1.25%, 04/14/26 | | | 200 | | | | 211,500 | |

0.38%, 04/20/28 | | | 1,800 | | | | 1,754,022 | |

Crown European Holdings SA, 3.38%, 05/15/25(c) | | | 100 | | | | 109,429 | |

Electricite de France SA(c) | | | | | | | | |

3.75%, 06/05/27 | | | 200 | | | | 225,094 | |

4.25%, 01/25/32 | | | 400 | | | | 462,945 | |

4.63%, 01/25/43 | | | 200 | | | | 232,099 | |

Engie SA(c) | | | | | | | | |

3.88%, 01/06/31 | | | 1,100 | | | | 1,255,235 | |

4.50%, 09/06/42 | | | 400 | | | | 475,034 | |

Forvia SE, 3.75%, 06/15/28(c) | | | 100 | | | | 108,037 | |

Goldstory SAS, 5.38%, 03/01/26(c) | | | 100 | | | | 109,998 | |

iliad SA(c) | | | | | | | | |

5.38%, 02/15/29 | | | 200 | | | | 226,310 | |

5.63%, 02/15/30 | | | 100 | | | | 114,082 | |

Loxam SAS(c) | | | | | | | | |

3.75%, 07/15/26 | | | 100 | | | | 108,966 | |

6.38%, 05/31/29 | | | 100 | | | | 114,259 | |

| | |

S C H E D U L E O F I N V E S T M E N T S | | 15 |

| | |

Schedule of Investments (continued) December 31, 2023 | | BlackRock Systematic Multi-Strategy Fund (Percentages shown are based on Net Assets) |

| | |

| | | | | | | | |

| Security | | Par

(000) | | | Value | |

| | |

| France (continued) | | | | | | |

Paprec Holding SA, 7.25%, 11/17/29(c) | | EUR | 100 | | | $ | 118,261 | |

Picard Groupe SAS, 3.88%, 07/01/26(c) | | | 100 | | | | 107,345 | |

RCI Banque SA, (5-year EUR Swap + 2.85%), 2.63%, 02/18/30(a)(c) | | | 200 | | | | 213,504 | |

RTE Reseau de Transport d’Electricite SADIR, 3.75%, 07/04/35(c) | | | 300 | | | | 345,925 | |

Sabena Technics Sas, (3-mo. EURIBOR + 5.00% ), (Acquired 10/28/22, Cost: $335,943), 8.93%, 09/30/29(a)(f)(g) | | | 342 | | | | 377,551 | |

Teleperformance SE, 5.75%, 11/22/31(c) | | | 200 | | | | 234,472 | |

TotalEnergies Capital International SA, 1.66%, 07/22/26(c) | | GBP | 100 | | | | 120,095 | |

Worldline SA/France(c)(h)(k) | | | | | | | | |

0.00%, 07/30/25 | | EUR | 44 | | | | 53,142 | |

0.00%, 07/30/26 | | | 233 | | | | 229,780 | |

| | | | | | | | |

| | | | | | | 17,003,731 | |

| |

| Germany — 1.8% | | | | |

Bayer AG(c) | | | | | | | | |

4.00%, 08/26/26 | | | 890 | | | | 996,153 | |

1.38%, 07/06/32 | | | 400 | | | | 360,594 | |

4.63%, 05/26/33 | | | 965 | | | | 1,111,559 | |

Cheplapharm Arzneimittel GmbH, 7.50%, 05/15/30(c) | | | 171 | | | | 200,775 | |

Commerzbank AG(a)(c) | | | | | | | | |

(3-mo. EURIBOR + 1.95%), 5.25%, 03/25/29 | | | 300 | | | | 347,691 | |

(5-year EUR Swap + 6.36%), 6.13%(l) | | | 200 | | | | 212,786 | |

(5-year EURIBOR ICE Swap + 3.70%), 6.75%, 10/05/33 | | | 100 | | | | 117,482 | |

Deutsche Bahn Finance GmbH, 4.00%, 11/23/43(c) | | | 120 | | | | 144,500 | |

Deutsche Bank AG(c) | | | | | | | | |

1.75%, 01/17/28 | | | 400 | | | | 409,145 | |

(3-mo. EURIBOR + 1.93%), 3.25%, 05/24/28(a) | | | 900 | | | | 972,037 | |

(3-mo. EURIBOR + 2.50%), 5.38%, 01/11/29(a) | | | 1,100 | | | | 1,270,467 | |

(5-year EURIBOR ICE Swap + 3.30%), 4.00%, 06/24/32(a) | | | 100 | | | | 106,035 | |

Envalior, (6-mo. EURIBOR + 9.50%), 13.63%, 03/31/31(f)(j) | | | 321 | | | | 318,470 | |

Eurogrid GmbH, 3.72%, 04/27/30(c) | | | 900 | | | | 1,012,822 | |

Fraport AG Frankfurt Airport Services Worldwide, 1.88%, 03/31/28(c) | | | 28 | | | | 29,188 | |

Gruenenthal GmbH, 3.63%, 11/15/26(c) | | | 100 | | | | 108,767 | |

HT Troplast GmbH, 9.38%, 07/15/28(c) | | | 100 | | | | 111,981 | |

IHO Verwaltungs GmbH, (4.50% PIK),

3.75%, 09/15/26(c)(j) | | | 110 | | | | 119,579 | |

LEG Immobilien SE, 0.88%, 11/28/27(c) | | | 200 | | | | 199,551 | |

Renk AG/Frankfurt am Main, 5.75%, 07/15/25(c) | | | 100 | | | | 109,573 | |

Robert Bosch GmbH, 4.38%, 06/02/43(c) | | | 400 | | | | 473,397 | |

RWE AG, 2.50%, 08/24/25(c) | | | 35 | | | | 38,095 | |

Sartorius Finance BV(c) | | | | | | | | |

4.50%, 09/14/32 | | | 600 | | | | 689,923 | |

4.88%, 09/14/35 | | | 1,000 | | | | 1,163,564 | |

Schaeffler AG, 1.88%, 03/26/24(c) | | | 10 | | | | 10,964 | |

Techem Verwaltungsgesellschaft 675 mbH, 2.00%, 07/15/25(c) | | | 100 | | | | 107,788 | |

Tele Columbus AG, 3.88%, 05/02/25(c) | | | 100 | | | | 69,880 | |

TK Elevator Midco GmbH, 4.38%, 07/15/27(c) | | | 186 | | | | 198,518 | |

Volkswagen Bank GmbH(c) | | | | | | | | |

4.25%, 01/07/26 | | | 1,300 | | | | 1,451,611 | |

4.63%, 05/03/31 | | | 400 | | | | 462,874 | |

| | | | | | | | |

| Security | | Par

(000) | | | Value | |

| | |

| Germany (continued) | | | | | | |

Volkswagen Financial Services NV, 6.50%, 09/18/27(c) | | GBP | 700 | | | $ | 931,729 | |

ZF Finance GmbH, 5.75%, 08/03/26(c) | | EUR | 100 | | | | 113,983 | |

| | | | | | | | |

| | | | | | | 13,971,481 | |

| |

| India — 0.1% | | | | |

Continuum Energy Levanter Pte. Ltd., 4.50%, 02/09/27(b) | | USD | 193 | | | | 182,281 | |

ReNew Pvt Ltd., 5.88%, 03/05/27(c) | | | 200 | | | | 190,818 | |

| | | | | | | | |

| | | | | | | 373,099 | |

| |

| Indonesia — 0.0% | | | | |

Freeport Indonesia PT, 4.76%, 04/14/27(c) | | | 200 | | | | 197,022 | |

| | | | | | | | |

| |

| Ireland(c) — 0.4% | | | | |

CRH SMW Finance DAC | | | | | | | | |

4.00%, 07/11/31 | | EUR | 200 | | | | 229,316 | |

4.25%, 07/11/35 | | | 300 | | | | 348,130 | |

Glencore Capital Finance DAC, 0.75%, 03/01/29 | | | 1,950 | | | | 1,881,740 | |

Linde PLC, 1.38%, 03/31/31 | | | 200 | | | | 198,975 | |

Virgin Media Vendor Financing Notes III DAC, 4.88%, 07/15/28 | | GBP | 100 | | | | 117,123 | |

| | | | | | | | |

| | | | | | | 2,775,284 | |

| |

| Israel — 0.0% | | | | |

Energean Israel Finance Ltd., 8.50%, 09/30/33(b)(c) | | USD | 30 | | | | 28,355 | |

Leviathan Bond Ltd., 6.75%, 06/30/30(b)(c) | | | 4 | | | | 4,100 | |

Teva Pharmaceutical Finance Netherlands II BV, 4.38%, 05/09/30 | | EUR | 100 | | | | 103,478 | |

| | | | | | | | |

| | | | | | | 135,933 | |

| |

| Italy — 0.7% | | | | |

ASTM SpA, 1.50%, 01/25/30(c) | | | 800 | | | | 767,547 | |

Azzurra Aeroporti SpA(c) | | | | | | | | |

2.13%, 05/30/24 | | | 100 | | | | 109,170 | |

2.63%, 05/30/27 | | | 100 | | | | 102,774 | |

Banco BPM SpA(a)(c) | | | | | | | | |

(3-mo. EURIBOR + 2.80%), 6.00%, 06/14/28 | | | 150 | | | | 173,229 | |

(5-year EUR Swap + 3.80%), 3.25%, 01/14/31 | | | 100 | | | | 107,359 | |

Cerved Group SpA, (3-mo. EURIBOR + 5.25%), 9.18%, 02/15/29(a)(c) | | | 100 | | | | 106,675 | |

Enel Finance International NV, 0.00%, 06/17/24(c) | | | 200 | | | | 216,787 | |

Engineering - Ingegneria Informatica - SpA, 11.13%, 05/15/28(c) | | | 100 | | | | 117,844 | |

Eni SpA(c) | | | | | | | | |

4.25%, 05/19/33 | | | 702 | | | | 812,810 | |

1.00%, 10/11/34 | | | 1,316 | | | | 1,124,507 | |

FIS Fabbrica Italiana Sintetici SpA, 5.63%, 08/01/27(c) | | | 100 | | | | 102,391 | |

IMA Industria Macchine Automatiche SpA, 3.75%, 01/15/28(c) | | | 100 | | | | 102,755 | |

Infrastrutture Wireless Italiane SpA, 1.63%, 10/21/28(c) | | | 100 | | | | 101,996 | |

Intesa Sanpaolo SpA(c) | | | | | | | | |

0.75%, 12/04/24 | | | 100 | | | | 107,387 | |

5.15%, 06/10/30 | | GBP | 100 | | | | 115,248 | |

Lottomatica SpA, (3-mo. EURIBOR + 4.00%), 7.93%, 12/15/30(a)(c) | | EUR | 100 | | | | 111,497 | |

Lottomatica SpA/Roma, (3-mo. EURIBOR + 4.13%), 8.10%, 06/01/28(a)(c) | | | 100 | | | | 111,372 | |

Nexi SpA, 0.00%, 02/24/28(c)(h)(k) | | | 100 | | | | 95,591 | |

Rekeep SpA, 7.25%, 02/01/26(c) | | | 100 | | | | 98,678 | |

Telecom Italia SpA/Milano(c) | | | | | | | | |

6.88%, 02/15/28 | | | 100 | | | | 117,317 | |

1.63%, 01/18/29 | | | 146 | | | | 138,873 | |

| | |

16 | | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

Schedule of Investments (continued) December 31, 2023 | | BlackRock Strategic Global Bond Fund, Inc. (Percentages shown are based on Net Assets) |

| | |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

| | |

| Italy (continued) | | | | | | |

UniCredit SpA(a) | | | | | | | | |

(3-mo. EURIBOR + 1.60%), 4.45%, 02/16/29(c) | | | EUR 150 | | | $ | 169,272 | |

(5-year USD ICE Swap + 4.91%), 7.30%, 04/02/34(b) | | | USD 200 | | | | 205,617 | |

| | | | | | | | |

| | | | | | | 5,216,696 | |

| |

| Jamaica(b) — 0.0% | | | | |

Digicel Group Holdings Ltd., 0.00%, 12/31/30(k) | | | 118 | | | | 24,307 | |

Digicel International Finance Ltd./Digicel international Holdings Ltd. | | | | | | | | |

(13.00% PIK), 13.00%, 12/31/25(j) | | | 56 | | | | 38,002 | |

Series 1441, 8.75%, 05/25/24 | | | 93 | | | | 86,213 | |

Digicel International Finance Ltd./Digicel International Holdings Ltd., 8.00%, 12/31/26(e)(i) | | | 37 | | | | 743 | |