Dated May 3, 2022

Filed Pursuant to Rule 433

Registration No. 333-264390

Supplementing the Preliminary Prospectus Supplement dated

May 3, 2022 (to Prospectus dated April 20, 2022)

Dime Community Bancshares, Inc. (NASDAQ: DCOM) May 2022

Forward-Looking Statements 2 This presentation contains a number of forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). These statements may be identified by use of words such as “annualized,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “likely,” “seek,” “may,” “outlook,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar terms and phrases, including references to assumptions. Forward-looking statements are based upon various assumptions and analyses made by Dime Community Bancshares, Inc. (together with its direct and indirect subsidiaries, the “Company”), in light of management’s experience and its perception of historical trends, current conditions and expected future developments, as well as other factors it believes appropriate under the circumstances. These statements speak only as of the date on which such statements are made, are not guarantees of future performance and are subject to risks, uncertainties and other factors (many of which are beyond the Company’s control) that could cause actual conditions or results to differ materially from those expressed or implied by such forward-looking statements. Accordingly, you should not place undue reliance on such statements. These factors include, without limitation, the following: • the timing and occurrence or non-occurrence of events may be subject to circumstances beyond the Company’s control; • there may be increases in competitive pressure among financial institutions and from non-financial institutions; • the net interest margin is subject to material short-term fluctuation based upon market rates; • changes in deposit flows, loan demand or real estate values may affect the business of the Company; • changes in the quality and composition of our loan or investment portfolios; • unanticipated or significant increases in loan losses may negatively affect the Company’s financial condition or results of operations; • changes in accounting principles, policies or guidelines may cause the Company’s financial condition to be perceived differently; • changes in corporate and/or individual income tax laws may adversely affect the Company's business or financial condition or results of operations; • general economic conditions, either nationally or locally in some or all areas in which the Company conducts business, or conditions in the securities markets or the banking industry, may be different than the Company currently anticipates; • legislative, regulatory or policy changes may adversely affect the Company’s business or results of operations; • technological changes may be more difficult or expensive than the Company anticipates; • there may be failures or breaches of information technology security systems; • success or consummation of new business initiatives or the integration of any acquired entities may be more difficult or expensive than the Company anticipates; • litigation or other matters before regulatory agencies, whether currently existing or commencing in the future, may delay the occurrence or non-occurrence of events longer than the Company anticipates; and • the risks referred to in the section entitled "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2021 as updated by our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Further, given its ongoing and dynamic nature, it is difficult to predict what effects the COVID-19 pandemic will have on our business and results of operations. The pandemic and related local and national economic disruption may, among other effects, result in a decline in demand for our products and services; increased levels of loan delinquencies, problem assets and foreclosures; branch closures, work stoppages and unavailability of personnel; and increased cybersecurity risks, as employees work remotely. Except as otherwise required by the law, the Company disclaims any obligation to update any forward-looking statements to reflect events or circumstances after the date of this document.

Additional Information 3 No Offer or Solicitation This presentation is neither an offer to sell nor a solicitation of an offer to purchase any securities of the Company. There will be no sale of securities in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities of any such jurisdiction. Any offer to sell or solicitation of an offer to purchase securities of the Company will be made only pursuant to a prospectus supplement and prospectus filed with the SEC. The Company has filed a registration statement (including a prospectus) (File No. 333-264390) and a preliminary prospectus supplement with the SEC for the offering to which this presentation relates. Before making an investment decision, you should read the prospectus and preliminary prospectus supplement and other documents that the Company has filed with the SEC for additional information about the Company and the offering. You may obtain these documents for free by visiting the SEC’s website at www.sec.gov. Alternatively, the Company or Piper Sandler Companies will arrange to send you copies of the prospectus and preliminary prospectus supplement if you request by contacting fsg- dcm@psc.com. These securities are not insured or guaranteed by the FDIC or any other governmental agency or public or private insurer. Neither the SEC nor any other regulator has approved or disproved of the securities of the Company or passed on the adequacy or accuracy of this presentation. Any representation to the contrary is a criminal offense. Use of Non-GAAP Financial Measures This presentation contains one or more non-GAAP financial measures determined by methods other than in accordance with generally accepted accounting principles. We use such non- GAAP financial measures, including efficiency ratio, as adjusted, to provide meaningful supplemental information regarding our performance. We believe these non-GAAP measures and ratios are beneficial in assessing our operating results and related trends, and when planning and forecasting future periods. These non-GAAP disclosures should be considered in addition to, and not as a substitute for or preferable to, financial results determined in accordance with GAAP. The non-GAAP financial measures we use may differ from the non-GAAP financial measures other financial institutions use to measure their results of operations. A reconciliation of any non-GAAP financial measures used in this presentation to the most directly comparable GAAP financial measure is included at the end of this presentation. Third Party Sources Certain information contained in this presentation and oral statements made during this presentation relate to or are based on publications and data obtained from third party sources. While the Company believes these sources to be reliable as of the date of this presentation, the Company has not independently verified such information, and makes no representation as to its accuracy, adequacy, fairness or completeness.

4 Terms of Planned Offering Active Bookrunner Passive Bookrunners Issuer (Ticker) Dime Community Bancshares, Inc. (NASDAQ: DCOM) Security Fixed-to-Float Rate Subordinated Notes due 2032 Amount $160 Million Expected Security Rating ¹ Moody’s: Baa3 with a “Stable” Outlook Kroll: BBB- with a “Positive” Outlook Issuance Type SEC Registered Term 10 Years Call Date 5 Years Use of Proceeds General corporate purposes, which may include, but are not limited to, the repayment of the Company’s outstanding subordinated notes 1 A rating is not a recommendation to buy, sell or hold securities. Ratings may be subject to revision or withdrawal at any time by the assigning rating organization. Each rating should be evaluated independently of any other rating.

Investment Highlights 1. Leading market share and best-in-class deposit franchise with significant scarcity value 2. Operates in an attractive, high-density market for business customers 3. Strong financial performance following completion of merger 4. Well positioned for rising rates and continued opportunity to transform balance sheet over time 5. Superior asset quality through various cycles 6. Skilled acquiror with significant M&A Experience. Poised to capitalize on recent large transactions in our footprint 7. Strong corporate governance New York’s Premier Business Bank 5

History A community bank built on perseverance, character, customer service and community reinvestment 1864 1910 2021 The Dime Savings Bank of Williamsburg is founded approximately 6 months after President Lincoln delivers Gettysburg Address, and approximately 1 year before the US is reunited after the Civil War The Bridgehampton National Bank is incorporated in the same week the Boy Scouts of America is incorporated by W.D. Boyce Dime Community Bank and BNB Bank complete a Merger of Equals amidst the COVID- 19 pandemic and combine to loan almost $2 billion of Paycheck Protection Program (“PPP”) loans to customers and businesses in need 6

Leading Market Share and Significant Scarcity Value • Dime ranks #1 by deposit market share on Greater Long Island amongst community banks (1)(2) • Ubiquitous brand and coverage spanning entire footprint • Only publicly-traded community bank with over $1.0 billion of Tier 1 capital headquartered on Greater Long Island » In the “sweet spot” to uniquely serve middle market clients with our capabilities, customer focus and capital base 1 Greater Long Island defined as Kings, Queens, Nassau, and Suffolk Counties. 2 Community Banks defined as Banks with assets less than $20 billion. Source: S&P Global From Montauk to Manhattan Source: S&P Global. Data as of June 30 th, 2021. 7 #1 Community Bank on Greater Long Island by Deposit Market Share Rank Institution Branches D e p o s i ts ($B) Market Share 1 Dime 57 $10.6 24.3% 2 Apple 45 $6.8 15.6% 3 Flushing 22 $5.9 13.6% 4 Ridgewood 27 $4.5 10.4% 5 First of Long Island 46 $3.3 7.6%

8 Best-in-Class Deposit Franchise Non - Int Bearing DDA, 38% Savings, MMDA & NOW, 54 % Time, 8% $10.5B Total Cost of Deposits: Vs “Footprint Banks” * Our goal is to operate with a DDA % > 40% Cost of Deposits: 0.11% Maspeth FSLA 0.00% 0.20% 0.40% Source: S&P Global – financial data as of most recent quarter reported * “Footprint Banks” defined as Banks with less than $100B of assets and >$500M of deposits operating in any one of the Greater Long Island counties (Kings, Queens, Nassau, Suffolk). 0.60% Ridgewo od Alma Apple NYCB Investors Flushing First of Long Island Signature Dime Note: Financial data as of or for the quarter ended December 31, 2021

9 $1,449 $3,920 1 12/31/2016 12/31/2021 Proven Track Record of DDA Growth Noninterest Bearing Deposits ($ in millions) Our management team has a proven track record of growing DDA organically 1 Represents sum of Legacy Dime Community Bancshares, Inc. & Legacy Bridge Bancorp, Inc. on a combined basis.

10 We Operate in An Attractive Market with Significant Opportunities for Market Share Gains $328 $222 $350 $300 $250 $200 $150 $100 $50 $0 • Combined population of ~ 8 million for Kings, Queens, Nassau, and Suffolk would represent the 14th largest state in the country 1 • $328 Billion of total deposits in Greater Long Island marketplace 2 Total Deposits in Market ($Billions) Total: Greater Long Island Market Share of Banks with >$100B of Assets Significant opportunity to continue to gain market share from bigger banks Source: S&P Global. Data as of June 30 th, 2021. 1 Source: Untied States Census Bureau 2 Greater Long Island defined as Kings, Queens, Nassau, and Suffolk Counties.

$111,616 $70,412 0 20,000 40,000 60,000 80,000 100,000 120,000 Dime's Greater LI Footprint 1 United States Median Household Income Our Footprint is Characterized by Above Average Wealth and Significant Business Density • Median household income in our deposit footprint is well above national average • The business density across our footprint provides us a unique opportunity • The attractive demographics of our footprint allows us to operate successfully as a pureplay in-market community commercial bank 0 11 30 20 10 40 60 50 70 90 80 Greater Long Island Source: S&P Global United States # Businesses/Square Mile Source: S&P Global 1 Median household income is weighted by Dime’s deposits in each county in Greater Long Island.

Highly Responsive Customer Focused Platform As Demonstrated by PPP Performance PPP Originations • Participating in PPP was a firmwide priority in FY 2020 and FY 2021 • We were the leading provider of PPP amongst community banks in our footprint • Serviced existing relationships and generated significant number of new business relationships and customer touchpoints. Testament to our status as a highly responsive community commercial bank • Sold 2021 PPP Originations in Q2 2021 and recorded $20.7mm of revenue associated with the recognition of deferred fees 0 2 ,0 00 4 ,0 00 6 ,0 00 8 ,0 00 202 0 2021 # PPP Loans Funded 1 $0 12 $ 5 00 $ 1, 000 $ 1, 500 $ 2, 000 202 0 2021 $ PPP Loans Funded ($Millions) 1 1 2020 represents the sum of Legacy Dime Community Bank and Legacy BNB Bank on a combined basis.

13 Strong Financial Performance Following Completion of Merger 1 1 The merger was completed on February 1 st , 2021 2 See Appendix for reconciliation of non-GAAP adjusted ratios - 11.6% 22.0% 16.0% 16.7% 17.5% 18.0% 14.6% 14.7% Q1-2021 Q2-2021 Q3-2021 Q4-2021 ROATCE Adusted ROATCE 3.14% 3.12% 3.20% 3.14% 3.26% 3.23% 3.10% 3.17% Q1-2021 Q4-2021 Q2-2021 NIM Q3-2021 Adjusted NIM 2 44.7% 54.3% 48.0% 47.5% 46.9% 49.9% 48.2% 1.55% 117.5% 1.52% 1.56% 1.57% Q3-2021 Q4-2021 Adjusted Efficiency Ratio 2 Q1-2021 Q2-20 1 21 Efficiency Ratio Adjusted Opex / Avg. Assets 2 - 0.79% 1.61% 1.22% 1.29% 1. 28% 1.37% 5% 1.14% 1.1 1.67% 1.74% 1.65% 1.66% Q1 -2021 Q2-2021 Q3-2021 Q4-2021 ROAA Adjusted ROAA Adjusted PTPP ROAA 2 Return on Average Assets 2 Return on Average Tangible Common Equity 2 Net Interest Margin (“NIM”) Efficiency Ratio

14 Well-Positioned for Rising Rates Well Balanced Loan Portfolio 1 Adjustable-Rate $4.7 51% ($ billions) Variabl e- Rate $2.4 26% Fixed-Rate $2.1 23% $9.2B Total Trends in Cost of Total Deposits 0.17% 0.13% 0.11% 0.25% 0.25% 0.10% Q1 2021 Q2 2021 Q3 2021 Q4 2021 0. 1 5% 0. 2 0% 0. 3 0% Net Interest Income Sensitivity 1 Variable Rate Loan Detail 1 Gradual Change in Interest Rates of: Year - One Year - Two +100 Basis Points 0.1% 4.1% +200 Basis Points 0.6% 8.8% % Change in Net Interest Income Variable Rate Loan Portfolio ($ millions) Outstanding Balance % of Total Variable Balance Floating Freely - No Floor $1,198 50% Floating Freely - Floor $113 5% 0-25 bps to Float Freely $291 12% 26-50 bps to Float Freely $93 4% 51-75 bps to Float Freely $432 18% 76-100 bps to Float Freely $61 3% 101+ bps to Float Freely $228 9% Total $2,417 100% 1 As of 12/31/2021 Instantaneous Rate Shock Scenarios Year - One Year - Two +100 Basis Points 1.5% 5.9% +200 Basis Points 3.5% 11.9% % Change in Net Interest Income

15 $325 $236 $68 $72 $0 $ 5 0 $ 1 00 $ 1 50 $ 2 00 $ 2 50 $ 3 00 $ 3 50 Q1 2022 Q2 2022 Q3 2022 Q4 2022 • We continue to have opportunities to reprice our CD book lower $526 $868 12/31/16 12/31/21 C&I (% of Loans) 2 9% C&I less PPP ($ in millions) Continued Opportunity to Transform Balance Sheet • We expect to lower the contribution of multi- family loans and replace with relationship- based commercial loans which are accompanied with a greater level of associated deposits Loan Portfolio Mix 1 1 12/31/16 represents sum of Legacy Dime Community Bank and Legacy BNB Bank on a combined basis. 2 % of loans excludes $66 million of remaining SBA PPP Loans at December 31, 2021. CD Maturities ($ in millions) WAR: 0.29% WAR: 0.76% WAR: 0.69% $5,110 $3,356 12/31/16 12/31/21 Multifamily (% of Loans) 2 Multifamily ($ in millions) 62% 37% 12/31/16 12/31/21 6% 12/31/16 12/31/21 WAR: 0.45%

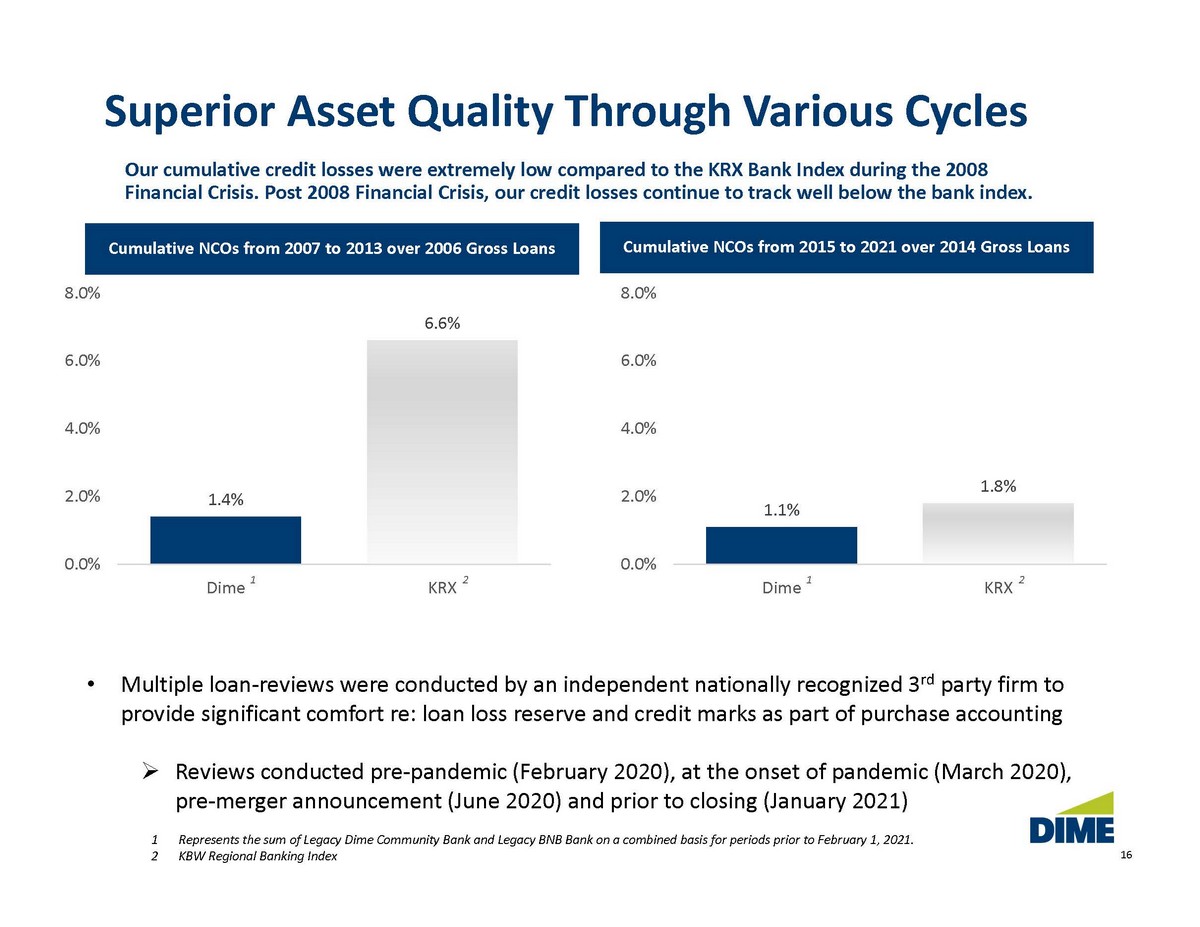

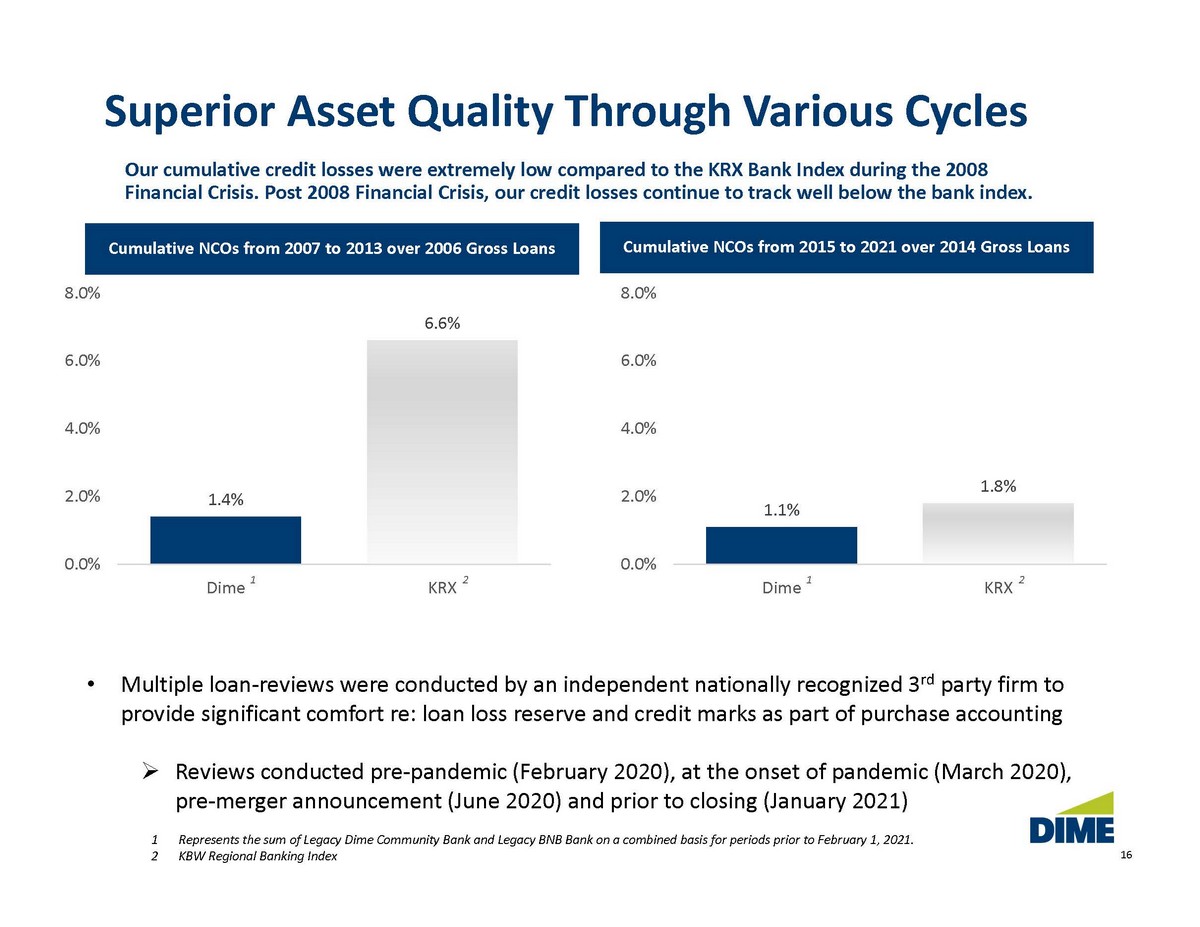

16 Superior Asset Quality Through Various Cycles Our cumulative credit losses were extremely low compared to the KRX Bank Index during the 2008 Financial Crisis. Post 2008 Financial Crisis, our credit losses continue to track well below the bank index. Cumulative NCOs from 2007 to 2013 over 2006 Gross Loans Cumulative NCOs from 2015 to 2021 over 2014 Gross Loans • Multiple loan-reviews were conducted by an independent nationally recognized 3 rd party firm to provide significant comfort re: loan loss reserve and credit marks as part of purchase accounting » Reviews conducted pre-pandemic (February 2020), at the onset of pandemic (March 2020), pre-merger announcement (June 2020) and prior to closing (January 2021) 1 Represents the sum of Legacy Dime Community Bank and Legacy BNB Bank on a combined basis for periods prior to February 1, 2021. 2 KBW Regional Banking Index 1.4% 6.6% 0.0% 2.0% 4.0% 6.0% 8.0% Dime 1 KRX 2 1.1% 1.8% 0.0% 2.0% 4.0% 6.0% 8.0% Dime 1 KRX 2

Overview of Loan Portfolio NPAs and 90 Days Past Due / Total Assets 0.34% 0.28% 0.33% 0.36% 0.00% 0.25% One-to-four family and coop/condo $669 52% 0.75% Multifamily and residential mixed-use 3 , 356 54% Commercial mixed-use 290 41% 0.50% 1.00% Q1 2021 Q2 2021 Q3 2021 Q4 2021 NCOs / Average Loans 0.19% 17 0.04% 0.18% 0.00% 0.00% 0.25% 0.50% 0.75% 1.00% Q1 2021 Q2 2021 Q3 2021 Q4 2021 Loan Portfolio by Asset Class (12/31/21) ($ in millions) Balance LTV Pure CRE: Retail $1,047 53% Office 813 58% Warehouse/Industrial 763 56% Hotels 240 57% Educational 124 49% Medical Facility 121 63% Commercial Condo 110 48% Other 438 48% Total Pure CRE $3,656 54% Acquisition, Development and Construction $323 C&I 868 Other Loans 17 SBA PPP $66 Total $9,245

Skilled Acquiror with Significant M&A Experience Avi Reddy CFO (Former M&A banker at Evercore, Barclays and Lehman Brothers) Kevin O'Connor CEO (Part of numerous M&A transactions at North Fork) Stuart Lubow President & COO (Sale of Community National, Garden State, Community State) 18 x Closed merger transaction on February 1, 2021. Completed systems integration over the weekend of April 17, 2021 x Grew DDA by approximately $967 million between closing of merger transaction and year-end 2021 x Operated the Company at a post-merger core efficiency ratio of approximately 48% compared to the announced 50% benchmark at the close of merger transaction x With our core systems conversion completed almost 1 year ago, we are poised to capitalize on disruption from recent mergers in our footprint. None of the acquirors are headquartered in our footprint or locally managed ▪ Recently announced the hiring of Robert Maichin as EVP, Head of Middle Market Lending

Strong Corporate Governance 19 x Significant Insider Ownership (15% of shares outstanding) x Annual election of entire slate of Board of Directors x Shareholder representation on Board of Directors (Basswood) x CEO & Chairman roles are split x Lead Director is Independent

Recent Developments: First Quarter 2022 Results • Net income to common stockholders of $32.7 million or $0.82 per diluted common share • Non-interest bearing deposits to total deposits ratio increased to 37.9% at March 31, 2022 • The cost of deposits declined to 10 basis points during the first quarter of 2022 • The NIM was 3.19% for the first quarter of 2022, representing a 5 basis point linked quarter increase • Total loans held for investment, net, excluding PPP loans, increased by 2% on an annualized basis versus the linked quarter • Non-interest expenses were $49.9 million, down 2% versus the linked quarter • Non-interest expenses to average assets was 1.64%, unchanged versus the linked quarter • Non-performing assets and loans 90 days past due and accruing of $37.1 million, representing a 14% decline versus the linked quarter • Non-performing assets and loans 90 days past due and accruing represented only 0.31% of total assets as of March 31, 2022 • A credit loss recovery of $1.6 million was recorded during the first quarter of 2022. The credit loss recovery was associated with the improvement in forecasted macroeconomic conditions as well as a reduction in reserves on individually evaluated loans. Profitability & Growth Asset Quality • All regulatory capital ratios remain strong with linked quarter increases for all categories – Consolidated Common Equity Tier 1 Ratio of 9.56% at 3/31/22 versus 9.49% at 12/31/21 – Consolidated Tier 1 Risk-Based Ratio of 10.76% at 3/31/22 versus 10.69% at 12/31/21 – Consolidated Total Capital Ratio of 13.48% at 3/31/22 versus 13.45% at 12/31/21 – Consolidated Tier 1 Leverage Ratio of 8.65% at 3/31/22 versus 8.46% at 12/31/21 Capital 20

Appendix 21

Current Outstanding Subordinated Debt Schedule 22 Term / Structure Maturity Call Date Amount ($000) Front -E nd Coupon Bac k - E nd Coupon Current Coupon 10yr NC 5 9/30/2025 9/30/2020 $40,000 5.25% 3mL + 360bps 4.74% 10yr NC 5 6/15/2027 6/15/2022 $115,000 4.50% 3mL + 266bps 4.50% 15yr NC 10 9/30/2030 9/30/2025 $40,000 5.75% 3mL + 345bps 5.75% Total / Weighted. Avg. 10/11/2027 10/11/2022 $195,000 4.91% 3mL + 301bps 4.80%

Double Leverage & Interest Coverage Note: Assumes a $160 million gross offering, a 4.75% coupon, a gross spread of 1.25%, and other expenses of $433,250 Source: S&P Capital IQ Pro, Company filings Offering Assumptions Debt Refinancing Assumptions Gross Proceeds ($000): Coupon: Gross Spread: Other Expenses ($000): Net Proceeds ($000) % Downstreamed $160 , 000 5 . 00 % 1.25% $433 $157 , 567 0.0% Tranche 1 (Q 1 ) : 4 . 74 % Tranche 2 (Q 2 ) : 4 . 50 % Total Sub . Debt Called Weighted Avg . Coupon $40 , 000 $115 , 000 $155 , 000 4 . 56 % Double Leverage Equity Investment in Subsidiaries Consolidated Equity 2021Q4 $1 , 366 , 797 1 , 192 , 620 Current Double Leverage Ratio 114.6% Portion of Debt Downstreamed to Bank Pro Forma Equity Investment in Subsidiaries $ 0 $1,366,797 P ro F o rm a C on s o l ida t ed Equ ity $1,192,620 P ro F o rm a D oub le L e v e r a g e 114 .6% Interest Coverage 2021Q4 $2 , 861 2 , 26 5 $5 , 126 51 , 168 $1 , 821 Total Deposit Interest Borrowings & Other Interest Total Interest Expense Pre-tax Income Preferred Dividend Interest Coverage (including deposit expense) Interest Coverage (excluding deposit expense) 7.35x 11.15x New Holding Company Subordinated Debt Expense (5.00%) Assumed Repayment of Holding Company Subordinated Debt (4.56%) 2,000 1,767 Pro Forma Interest Coverage (including deposit expense) Pro Forma Interest Coverage (excluding deposit expense) 7.14x 10.63x 23

Strong Capital Ratios Note: Pro forma assumes a $160 million gross offering, a gross spread of 1.25%, risk-weighting on new assets of 20%, and other expenses of $433,250 Source: S&P Capital IQ Pro, Company filings 8 .4 6% 9 . 49% 1 0. 6 9 % 1 3 .4 5% 8 . 35% 9. 4 6 % 1 0 .6 5% 15 . 05% 8. 4 5 % 9 .4 8% 1 0 .6 8% 1 3. 6 6 % Leverage Ratio CET1 Ratio Standalone Pro Forma for Sub Debt Tier 1 Ratio Total Capital Ratio Pro Forma for Sub Debt Refi Consolidated Capital Ratios at December 31, 2021 24

Sources of Holding Company and Bank Liquidity 25 • Cash at the Holding Company was approximately $27.4 million as of December 31, 2021 • Dime Community Bancshares, Inc.’s principal source of funds to service debt is cash dividends from Dime Community Bank • As of December 31, 2021 the dividend capacity from Dime Community Bank was $146.3 million • Dime Community Bank had only $26.9 million of FHLB Advances and other short-term borrowings outstanding at December 31, 2021 • Remaining FHLB borrowing capacity was $3.18 billion as of December 31, 2021

26 Return on Avg. Assets & Return on Avg. Tangible Common Equity 1 Adjustments to net income are taxed at the Company's statutory tax rate of approximately 31% unless otherwise noted. 2 Certain merger expenses and transaction costs are non-taxable expense. Return on Average Assets - as reported 1 . 1 4 % 1.22% 1 . 61% ( 0 . 79 %) Reported net income/(loss) $35,357 $38,395 $51,278 ($21 , 03 4 ) Adjustments to net income (1) Provision for credit losses - Non - PCD loans (double - count) - - - 20 , 278 Gain on sale of PPP loans - - (20,697) - Net gain on sale of securities and other assets ( 975) - - ( 71 0 ) Loss on termination of derivatives - - - 16 , 505 Severance - - 1,875 - Loss on extinguishment of debt - - 157 1 , 594 Curtailment loss - - - 1 , 543 Merger expenses and transaction costs (2) 2 , 5 74 2,472 1,836 37 , 942 Branch restructuring (1,118) 4,518 1,659 - Income tax effect of adjustments and other tax adjustments ( 234) (2,191) 4,852 (21 , 848) Adjusted net income (non - GAAP) $35,604 $43,194 $40,960 $34 , 270 Average Assets (as reported) $12,419,184 $12,584,372 $12,756,909 $1 0 , 666 , 619 Adjusted Return on Average Assets (non - GAAP) 1 . 1 5 % 1.37% 1 . 28% 1 . 2 9 % Reconciliation of Adjusted ROATCE Three Months Ended December 31, 2021 September 30, 2021 June 30, 2021 March 31, 2021 Return on Average Tangible Common Equity - as reported (non-GAAP) 14 . 6 % 16 . 0% 22.0% 11 . 6% Reported net income/(loss) available to common stockholders $33,536 $36,573 $49,456 ($22 , 85 5 ) Adjustments to net income (1) Provision for credit losses - Non - PCD loans (double - count) - - - 20 , 278 Gain on sale of PPP loans - - (20,697) - Net gain on sale of securities and other assets ( 975) - - ( 71 0 ) Loss on termination of derivatives - - - 16 , 505 Severance - - 1,875 - Loss on extinguishment of debt - - 157 1 , 594 Curtailment loss - - - 1 , 543 Merger expenses and transaction costs (2) 2 , 5 74 2,472 1,836 37 , 942 Branch restructuring (1,118) 4,518 1,659 - Income tax effect of adjustments and other tax adjustments ( 234) (2,191) 4,852 (21 , 848) Amortization of Intangible assets, net of tax 4 96 488 570 244 Adjusted net income available to common stockholders (non - GAAP) $34,279 $41,860 $39,708 $32 , 693 Average Tangible Common Equity $931,503 $929,131 $908,797 $780 , 976 Adjusted Return on Average Tangible Common Equity (non - GAAP) 14 . 7 % 18 . 0% 17.5% 16 . 7% Reconciliation of Adjusted ROAA Three Months Ended December 31, 2021 September 30, 2021 June 30, 2021 March 31, 2021

27 Pre-Tax Pre-Provision Net Revenue / Average Assets 1 The reported pre-tax pre-provision net revenue is a non-GAAP measure calculated by adding GAAP net interest income and GAAP non-interest income/(loss) less GAAP non-interest expense. 2 The adjusted pre-tax pre-provision net revenue is a non-GAAP measure calculated by adding pre-tax pre-provision net revenue less the net gain on sale of PPP loans, net gain/(loss) on sale of securities and other assets, termination of derivatives, severance, loss on extinguishment of debt, curtailment, merger expenses and transaction costs, and branch restructuring. December 31, 2021 September 30, 2021 June 30, 2021 March 31, 2021 Net interest income $91,686 $94,828 $93,254 $77,841 Non - interest income/(loss) 10,179 9,728 29,544 (7,383) Total revenues 101,865 104,556 122,798 70,458 Non - interest expense 50,829 56,783 54,882 82,805 Pre - tax pre - provision net revenue (non - GAAP) (1) $51,036 $47,773 $67,916 ($12,347) Adjustments: Gain on Sale of PPP Loans - - ($20,697) - Net gain on sale of securities and other assets ( $ 9 75) - - ($710) Loss on termination of derivatives - - - $16,505 Severance - - $1,875 - Loss on extinguishment of debt - - $157 $1,594 Curtailment loss - - - $1,543 Merger expenses and transaction costs 2 , 5 7 4 2,472 1,836 37,942 Branch restructuring (1,118) 4,518 1,659 - Adjusted pre - tax pre - provision net revenue (non - GAAP) (2) $51,517 $54,763 $52,746 $44,527 Average Assets (as reported): $12,419,184 $12,584,372 $12,756,909 $10,666,619 Adjusted Pre-Tax Pre Provision Net Revenue/Avg. Assets (non-GAAP) 1 . 6 6 % 1 . 74% 1.65% 1 . 6 7% Three Months Ended Reconciliation of Pre - tax Pre - provision Net Revenue ($000) Reconciliation of Adjusted Pre-tax Pre-provision Net Revenue ($000)

28 Net Interest Margin (1) NIM represents net interest income as reported divided by average interest-earning assets as reported. (2) Adjusted NIM excluding PPP and PAA represents adjusted net interest income excluding PPP loans and purchase accounting accretion, divided by adjusted average interest-earning assets, excluding PPP loans. December 31, 2021 September 30, 2021 June 30, 2021 March 31, 2021 NIM - as reported (1) 3 . 1 4 % 3 . 20% 3 . 12% 3 . 14% Net interest income - as reported $ 9 1 , 686 $94 , 8 2 8 $9 3 , 254 $77 , 8 4 1 Less: Net interest income on PPP loans ( 539) ( 2 , 5 02) ( 5 , 375) ( 4 , 0 9 2 ) Less: Purchase Accounting Accretion on loans ("PAA") 625 ( 2 , 5 41) ( 1 , 925) ( 1 , 3 3 3 ) Adjusted net interest income excluding PPP loans and PAA on loans, (non-GAAP) $ 9 1 , 772 $89 , 7 8 5 $8 5 , 954 $72 , 4 1 6 Average interest-earning assets - as reported $11 , 5 8 2 , 086 $1 1 , 765 , 2 9 8 $11 , 99 0 , 107 $1 0 , 057 , 5 9 8 Average PPP loan balances ( 9 6 , 065) ( 266 , 4 72) ( 1 , 28 2 , 347) ( 1 , 020 , 9 1 0) Adjusted average interest-earning assets excluding PPP loans, (non-GAAP) $11 , 4 8 6 , 021 $1 1 , 498 , 8 2 6 $10 , 70 7 , 760 $9 , 036 , 6 8 8 Adjusted NIM excluding PPP loans and PAA on loans, (non-GAAP) (2) 3 . 1 7 % 3 . 10% 3 . 23% 3 . 26% Reconciliation of Adjusted Net Interest Margin Three Months Ended

29 Efficiency Ratio & Operating Expense to Average Assets 1 The reported efficiency ratio is a non-GAAP measure calculated by dividing GAAP non-interest expense by the sum of GAAP net interest income and GAAP non-interest (loss) income. 2 The adjusted efficiency ratio is a non-GAAP measure calculated by dividing adjusted non-interest expense by the sum of GAAP net interest income and adjusted non-interest income. December 31, 2021 September 30, 2021 June 30, 2021 March 31, 2021 Efficiency ratio - as reported (non - GAAP) (1) 49 . 9% 54 . 3% 44 . 7% 117 . 5% Non - interest expense - as reported $50 , 829 $ 56 , 783 $ 54 , 882 $ 8 2 , 8 0 5 Less: Severance - - (1 , 875) - Merger expenses and transaction costs ( 2 , 5 7 4 ) ( 2 , 47 2 ) (1 , 836) (37 , 942) Branch restructuring 1 , 118 ( 4 , 51 8 ) (1 , 659) - Loss on extinguishment of debt - - (15 7 ) (1 , 594) Curtailment loss - - - (1 , 543) Amortization of other intangible assets (71 5 ) (71 5 ) (83 5 ) (357) Adjusted non - interest expense (non - GAAP) 48 , 658 49 , 078 48 , 520 41 , 369 Net interest income - as reported 91 , 686 94 , 828 93 , 254 77 , 841 Non - interest income/(loss) - as reported 10 , 179 9 , 728 29 , 544 (7 , 383) Less: Gain on sale of PPP loans - - (20 , 697) - Net gain on sale of securities and other assets (97 5 ) - - (710) Loss on termination of derivatives - - - 16 , 505 Adjusted non - interest income (non - GAAP) 9 , 204 9 , 728 8 , 847 8 , 412 Adjusted total revenues for adjusted efficiency ratio (non - GAAP) $ 100 , 890 $10 4 , 5 5 6 $10 2 , 1 0 1 $86 , 253 Adjusted efficiency ratio (non - GAAP) (2) 48 . 2% 46 . 9% 47 . 5% 48 . 0% Reconciliation of Adjusted Efficiency Ratio Three Months Ended December 31, 2021 September 30, 2021 June 30, 2021 March 31, 2021 Operating expense as a % of average assets - as reported 1 . 6 4 % 1 . 80% 1 . 7 2 % 3 . 11% Loss on extinguishment of debt - - - - 0 . 06% Curtailment loss - - - - 0 . 06% Severance - - - 0 . 06% - Merger expenses and transaction costs - 0 . 08% - 0 . 08% - 0 . 06% - 1 . 43% Branch restructuring 0 . 0 3 % - 0 . 14% - 0 . 05% - Amortization of other intangible assets - 0 . 0 2% - 0 . 02% - 0 . 0 3% - 0 . 01% Adjusted operating expense as a % of average assets (non - GAAP) 1 . 5 7 % 1 . 56% 1 . 5 2 % 1 . 55% Reconciliation of Operating Expense as a % of Average Assets Three Months Ended Reconciliation of Adjusted Operating Expense as a % of Average Assets