UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-05823

DOMINI INVESTMENT TRUST

(Exact Name of Registrant as Specified in Charter)

180 Maiden Lane, Suite 1302, New York, New York 10038

(Address of Principal Executive Offices)

Carole M. Laible

Domini Impact Investments LLC

180 Maiden Lane, Suite 1302

New York, New York 10038

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code: 212-217-1100

Date of Fiscal Year End: July 31

Date of Reporting Period: July 31, 2022

| Item 1. | Reports to Stockholders. |

| | (a) | A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 follows. |

Annual Report 2022

July 31, 2022

Domini Impact Equity FundSM

Domini International Opportunities FundSM

Domini Sustainable Solutions FundSM

Domini Impact International Equity FundSM

Domini Impact Bond FundSM

Thousands of starfish washed ashore.

A little girl began placing them back in the water

so they wouldn’t die.

“Don’t bother, dear,” her mother said,

“it won’t make a difference.”

The girl stopped for a moment and

looked at the starfish in her hand.

“It will make a difference to this one.”

| | | | |

| | Sign up for Domini news and impact updates at domini.com/subscribe | |  |

Table of Contents

LETTER TO SHAREHOLDERS

Dear Fellow Shareholder,

The news hasn’t been easy. To get out of the present gloom, it’s helpful to look toward the future — and reflect on the past. In times like these, a historical perspective can be comforting. We know markets rise and fall, that pandemics come and go, that laws change, and that wars do end.

While we can’t control everything, we can have our say in some things. We can choose where we shop, what companies we support, and who we vote for. We can also choose to leverage finance as a force for positive change in the world. The whole goal of our industry is to ensure that investors work toward a livable planet, inhabited by people who care. So as we continue our work, engaging companies and inspiring investors and organizations, it’s important to keep our long-term mission in mind.

We recently adapted our Impact Investment Standards to enhance our approach to corporate climate change policies and practices, cyberwarfare, and company efforts to address systemic racism. In doing so, we stay true to our core goals but make enhancements and modernizations in response to a changing world.

Throughout our 30-year impact investing journey, our twin goals of universal human dignity and ecological sustainability have guided us and grown us. In our annual essay, we discuss how as investors, climate change is an urgent matter. That’s why we’re taking a close look at the future of corporate climate action. We believe companies’ climate transition plans should contain bold, credible action based on science-based targets and the needs of their community. You’ll learn more about how we evaluate companies and our key performance indicators for corporate climate action plans in our essay entitled “A Transformational Climate Transition”.

Thank you for being part of our Domini community. We’re investing for good because we believe the world has the potential to be greener and greater. Together, we can make a difference. There truly is strength in numbers.

| | |

Carole Laible CEO | |

Amy Domini Founder and Chair |

2

A TRANSFORMATIONAL CLIMATE TRANSITION

On August 16, President Biden signed the Inflation Reduction Act into law. The surprise deal, which came after a year debate, represents a level of climate action that has eluded U.S. policy makers for decades and sends a signal to the global community that the U.S. is on board. The law is complex and our work is just beginning — but it is bold action and an unmistakable step in the right direction.

Capitol Hill, of course, isn’t the only place where climate action takes place. It can’t be. Years of Congressional gridlock has meant that communities, companies, and their investors have become key drivers of climate action. The new legislation has created a new sense of momentum and optimism for everyone working on the climate crisis. As we embark on this crucial opportunity to restructure our economy, we cannot afford to replicate the problems of the past. We need an ambitious, substantive climate response that puts equity at its very center. There’s no time for delay — and we know companies around the world are building solutions that our investments can help bring to scale.

At Domini, climate change has long been central to our investment approach and to our vision of ourselves as impact investors. We can help create a better future through our choices, and so can each individual.

What We Look At

Our core goals are universal human dignity and ecological sustainability. They’ve shaped how we analyze, invest in, and seek to influence companies since day one. There are certain lines of business that we believe are fundamentally misaligned with our goals. Our response? We don’t invest in them, plain and simple.

Steering clear of fossil fuels

We do not invest in companies in the GICS Energy Sector1 and those involved in oil and natural gas exploration and production. Further, we avoid companies that provide significant services to energy, such as energy transporters, as well as coal mining and utility companies with significant power generation coming from coal. We don’t invest in utilities that have either announced plans for new coal-fired power plants or started new construction after the Paris Agreement was adopted in 2015.

1 The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by Domini Impact Investments.

3

The finer points

Excluding fossil fuels is an essential first step in building portfolios geared for a more sustainable economy. But most research questions aren’t so cut-and-dry. Whether a company is contributing towards a greener future often depends on their business model, their climate transition plans, and their efforts to center the needs of their communities, customers, and other stakeholders.

Effectively analyzing those points means getting down to the details — so we’ve evolved our Impact Investment Standards accordingly. We go beyond the assessment of greenhouse gas emissions reductions. We look for evidence that companies are aiming to lower their climate impact by shifting their capital expenditure to energy efficiency, renewable energy, recycling and circular economy initiatives, business transformation, physical risk mitigation, and a just transition. These plans should incorporate thorough assessments of risks and opportunities across their markets and industries, and recognize the intersection between environmental issues and social justice in the low-carbon transition.

Here’s a closer look at some of the finer points:

| | |

| | Science-based targets |

| |

| | Corporate climate goals must be rigorous. We look to see whether companies’ goals reflect the best available climate science, rather than what’s easily achievable. The Science Based Targets Initiative (SBTi) is helping make the process more standardized, establishing necessary pathways for each sector to meet the Paris Agreement’s 2050 global temperature targets and working with companies to set and validate aligned climate goals. |

| |

| | Moving away from inadequate solutions |

| |

| | Carbon offsets generally aim to balance out emissions by funding a carbon-negative project (e.g., reforestation) somewhere else. At Domini, we understand that offsets will play a role in the climate transition — especially for industries that are fundamentally harder to decarbonize. At the same time, we’re aware that some companies may use carbon offsets to delay or avoid real emissions reductions. Many offset projects lack clear methodologies and monitoring systems — and often infringe on local communities’ rights or fail to reach their promised emissions targets. Companies need to steer clear of climate projects that do more for their image than for our planet and communities. |

4

| | |

| | Rethinking business, regenerating nature |

| |

| | It’s crucial that companies go beyond minimizing harms, and instead develop business models that benefit the environment. Our research team sees this in terms of value creator companies, a lens which originated as part of our Forest Project. We go beyond asking companies to be neutral with respect to forests, and instead focus on identifying those that have aligned their business strategies with solutions for shared value creation that we can help to accelerate. |

The circular economy is also central to addressing climate change because it will help companies reduce emissions and minimize their impact on ecosystems. We look for companies that are beginning to re-conceptualize their products so that all components can be reused, repaired, or reincorporated into nature. You can read our deep dive on circular approaches to learn more.

|

Climate Action Now: Enphase Enphase produces microinverters and battery storage systems. Its innovations have bolstered the role of solar energy in the climate transition. It is a long-standing partner of the non-profit GRID Alternatives and is helping offset $220 million in energy costs for families in low-income housing. Further, Enphase has worked to make its manufacturing processes more efficient, recycling 90% of its total electronic waste each year. |

Thinking Big, Working Collaboratively

As impact investors, our main focus is identifying companies that are helping create a more sustainable future. But our scope isn’t limited just to corporate climate action. We know that companies’ climate work intersects with local environmental justice challenges, federal climate policy, and much more. We strive to make an impact at these intersections.

5

A shifting narrative

It’s critical that governments, companies, and individuals do a better job of protecting the most vulnerable communities and seeking their input to shape the climate transition. But climate action hasn’t always worked that way. Ten — even five — years ago, many initiatives seriously under-valued environmental justice, or ignored it entirely. Community organizers, activists, and Indigenous leaders have been instrumental in changing that. Today, climate justice is increasingly a guiding principle in climate initiatives, policy design, and sustainable investing. The Inflation Reduction Act includes a major focus on revitalizing communities that are marginalized, underserved, and overburdened by pollution.

Justice through collaboration

Historically marginalized communities and communities of color have long bore the brunt of climate change and other environmental fallout. Now, as the global economy pivots towards sustainability, we have an opportunity to prevent this kind of harmful inequity. Domini knows that a company’s climate transition plan is not effective unless it upholds and strengthens climate justice, which means understanding the needs of their workers, neighbors, and local leaders and taking their priorities into account. Equitable climate action helps reduce global carbon emissions while also ensuring job security and safely reducing the local air and water pollution that has historically burdened underserved communities.

|

Engaging On Equity: National Grid |

Our recent engagement with the global utility National Grid PLC highlights the need for climate action that is both ambitious and intersectional. We expressed support for its net zero emissions commitment, but also urged the company to center the needs of stakeholders most likely to be impacted: workers and community groups. We sought insights from union representatives and local environmental advocates in Massachusetts and New York, where National Grid has a presence. These experts helped us identify areas for continued improvement: making sure stakeholders are at the table, prioritizing racial justice, and building trust with community partners. |

6

Policy as a foundation

Good climate policy puts companies and investors in a better position to drive progress. The Inflation Reduction Act, for example, will invest $369 billion in renewable energy and other climate tech.2 It extends key subsidies for businesses and offers consumer tax credits. Well-designed policies, in the U.S. and around the world, serve as a foundation upon which climate-forward companies can grow and investors can invest in a greener world. That’s why we believe it is so important to understand the policy landscape and, when possible, engage on key issues.

Better information for better decisions

Investors and other stakeholders need to know how companies are addressing climate change. As global disclosure frameworks on sustainability continue to expand, they are honing in on key climate information. Recently, the U.S. Securities and Exchange Commission proposed new requirements that would enhance how companies disclose information on climate-related risks. We submitted a comment to the SEC, writing in support of the proposal and discussing how we use relevant climate information in our investment analysis, engagement work, and proxy voting.

Climate engagements and partnerships

Collective action is one of our best mechanisms for encouraging progress at the company level. We’re part of Climate Action 100+, which has brought together over 700 investors to engage companies that represent 80% of global industrial emissions.3 We also frequently work with other partners including Ceres, ShareAction, and the Finance for Biodiversity Pledge to engage on topics like climate benchmarks, decarbonization plans, deforestation, and much more. Collaborating with partners helps us reach more of our portfolio companies and increase our leverage in engagements by bringing together more investors.

2 https://www.whitehouse.gov/briefing-room/speeches-remarks/2022/08/16/remarks-by-president-biden-at-signing-of-h-r-5376- the -inflation-reduction-act-of-2022/

3 https://www.climateaction100.org/whos-involved/companies/

7

|

Engaging Through Partnerships: Koninklijke DSM |

Many everyday products — like plastics, fertilizers, and even clothing — are made using fossil fuels. That is why we work with ShareAction and other investors to engage with chemicals companies on their decarbonization strategies. Recently, we dialogued with Koninklijke DSM, a Dutch company that produces chemicals, medicine, nutrients, and other materials. DSM has some of the most ambitious climate goals in its industry. We acknowledged the company’s climate commitment and innovations, and worked to support DSM’s transition toward using bio-based and natural inputs instead of fossil fuel-based materials. |

Doing Our Part

Decades of research and activism on climate change have given us a clear sense of the path forward. And in recent months, we’ve gained a newfound momentum. Now, it’s time to put it all together. No single individual, community, company, or government has all the tools to combat climate change. But we all have something.

At Domini, we know what part of the solution we have to offer. We work hard to exercise our levers for change — our exclusions that ensure we avoid harmful industries; our research that helps us identify forward-thinking companies with thorough climate transition plans; our engagement work that strives to improve corporate climate action. And we’re incredibly fortunate that our shareholders allow us to do this on their behalf — whether they’ve been with us for 20 years or 20 days. Impact investors are working hard to do their part: investing thoughtfully, with the goal of making our world a better place to live.

“The global climate crisis is urgent and enormous. The future itself is at risk. But meeting the challenge isn’t impossible. We can help give ourselves the breathing room we need to cope with global warming and transition to a more sustainable way of life. It’s not too late.”

–Amy Domini

8

An investment in the Domini Funds is not a bank deposit and not insured. Investing involves risk, including possible loss of principal. The market value of Fund investments will fluctuate.

The Domini Impact Equity Fund is subject to certain risks including impact investing, portfolio management, information, market, recent events, and mid- to large-cap companies risks. The Domini International Opportunities Fund is subject to certain risks including foreign investing, geographic focus, country, currency, impact investing, and portfolio management risks. The Domini Sustainable Solutions Fund is subject to certain risks including sustainable investing, portfolio management, information, market, recent events, mid- to large-cap companies and small-cap companies risks. The Domini Impact International Equity Fund is subject to certain risks including foreign investing, emerging markets, geographic focus, country, currency, impact investing, and portfolio management risks. Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity. These risks may be heightened in connection with investments in emerging market countries. The Domini Impact Bond Fund is subject to certain risks including impact investing, portfolio management, style, information, market, recent events, interest rate and credit risks.

The Adviser’s evaluation of environmental and social factors in its investment selections and the timing of the Subadviser’s implementation of the Adviser’s investment selections will affect the Funds’ exposure to certain issuers, industries, sectors, regions, and countries and may impact the relative financial performance of a Fund depending on whether such investments are in or out of favor. The value of your investment may decrease if the Adviser’s or Subadviser’s judgement about Fund investments does not produce the desired results. There is a risk that information used by the Adviser to evaluate environmental and social factors, may not be readily available or complete, which could negatively impact the Adviser’s ability to evaluate such factors and Fund performance.

As of 7/31/2022, Enphase Energy represented 1.07%, 0.28% and 6.44% of the Domini Impact Equity Fund’s portfolio, Domini International Opportunities Fund’s portfolio, and the Domini Sustainable Solutions Fund’s portfolio, respectively. As of 7/31/2022, National Grid PLC represented 0.19% and 0.70% of the Domini Impact Equity Fund’s portfolio and Domini International Opportunities Fund’s portfolio, respectively. As of 7/31/2022, Koninklijke DSM represented 0.39% of the Domini International Opportunities Fund’s portfolio. The composition of each Fund’s portfolio is subject to change. The Domini Funds maintain portfolio holdings disclosure policies that govern the timing and circumstances of disclosure to shareholders and third parties of information regarding the portfolio investments held by the Funds.

This report is not authorized for distribution to prospective investors of the Domini Funds referenced herein unless preceded or accompanied by a current prospectus for the relevant Fund. Nothing herein is to be considered a recommendation concerning the merits of any noted company, or an offer of sale or solicitation of an offer to buy shares of any Fund or company referenced herein. Such offering is only made by prospectus, which includes details as to the offering price and other material information. Carefully consider the Funds’ investment objectives, risk factors and charges and expenses before investing. This and other important information can be found in the Funds’ prospectus, which may be obtained by calling 1-800-582-6757 or at domini.com.

The Domini Funds are only offered for sale in the United States. DSIL Investment Services LLC, Distributor, Member FINRA. Domini Impact Investments LLC is the Funds’ Adviser. The Funds are subadvised by unaffiliated entities. 9/22

9

DOMINI IMPACT EQUITY FUND

Performance Commentary (Unaudited)

The Fund invests in a diversified portfolio of primarily mid- to large-cap U.S. equities. Domini makes all security selections and investment decisions, combining two unique strategies: “Core” and “Thematic Solutions.” Core seeks to provide diversified exposure to the U.S. equity market through a broad selection of companies that demonstrate strong environmental and social performance relative to their peers. Thematic Solutions seeks to provide opportunistic exposure to solution-oriented companies helping to address sustainability challenges, as determined by Domini’s environmental, social, and financial research and analysis. As of July 31, 2022, 94.9% of the Fund’s portfolio was allocated to its Core strategy and 5.1% was allocated to its Thematic Solutions strategy (excluding cash).

SSGA Funds Management, Inc. (SSGA FM), an SEC-registered investment adviser, serves as Subadviser to the Fund, responsible for purchasing and selling securities to implement Domini’s investment instructions and for managing the Fund’s short-term investments. SSGA FM is unaffiliated with the Domini Funds, other than with respect to the provision of submanagement services.

Portfolio Performance:

The Domini Impact Equity Fund Investor shares returned -12.65% for the twelve-month period ended July 31, 2022, underperforming the S&P 500 Index (the “benchmark”) return of -4.64%.

A confluence of events created an extremely challenging environment for equity investors over the last year. Supply-chain constraints and pent-up consumer demand emerging from the pandemic created inflationary pressures that the Federal Reserve and other major central banks initially believed to be largely transitory in nature. However, Russia’s full-scale invasion of Ukraine after months of posturing contributed to a global rise in food and energy prices, and U.S. inflation soared to its fastest pace in over fifty years. To combat this, the Fed pivoted to a much more aggressive monetary tightening and rate-hike cycle than had been anticipated, and investor fears of an economic slowdown and potential recession mounted, driving a sharp selloff in risk assets. As market liquidity dried up, equity valuation multiples contracted, particularly within more growth-oriented sectors and among smaller-capitalization stocks.

These conditions were especially difficult for the Domini Funds, including the Domini Impact Equity Fund, as our Impact Investment Standards generally lead us to favor growth and innovation. The Fund’s lack of exposure to the Energy sector, which the Domini Funds do not invest in due to our exclusionary standards on fossil fuels, was a significant drag on results relative to the benchmark. Energy stocks were the best performing sector of the market over the twelve-month period, returning 67.4% within the S&P 500, driven by

10

higher prices and supply shortages exacerbated by the war in Ukraine. Our underweight to Utilities — which was the next strongest sector in the S&P 500 with a return of 15.6% — also detracted. Several of the Fund’s alternative energy investments helped mitigate some of this impact, with top contributors including overweight positions in solar microinverter company Enphase Energy (+49.9%) and electric vehicle manufacturer Tesla (+29.7%).

Despite these and other individual strong performers, overall security selection was the primary driver of the Fund’s underperformance for the period. Selection was particularly weak in the Information Technology sector, but also detracted in Health Care and Industrials. This was partially offset by stronger selection in Communication Services, where the Fund benefitted from not owning Facebook parent Meta Platforms (-55.3%), which was not approved for investment by Domini.

Many of the largest detractors from relative results included non-benchmark stocks held under the Fund’s Thematic Solutions “digital divide” theme, including video conferencing services provider Zoom Video Communications, eSignature company DocuSign, and online learning platform Chegg, which declined 72.5%, 80.0%, and 78.0%, respectively, during the periods they were held by the Fund. (The Fund sold its positions in both DocuSign and Chegg and reduced its position in Zoom before the end of the period). Shopify, an e-commerce company held in the Fund’s Core strategy, was also a top detractor, declining 76.8%. Many of these stocks had been top performers earlier in the pandemic but saw their gains reversed as investor focus shifted to inflation and higher interest rates.

While this was a difficult year for the Fund, it did experience some relief late in the period, as better-than-expected corporate earnings and signs that inflation could be nearing a peak contributed to a strong summer rally, with beaten-down technology stocks taking the lead. We believe that the anomalous underperformance of growth-oriented equities experienced over the last twelve months is extremely unlikely to persist. As we continue to monitor macroeconomic conditions and central bank policy — and look for signs of a sustained market recovery — our focus remains on investing in quality companies that demonstrate peer-relative environmental and social leadership and deliver needed solutions. We maintain strong conviction in our long-term investment approach and believe our Impact Investment Standards will help us create sustainable, long-term value for our Funds’ shareholders, our planet, and our global community.

11

The table and bar chart below provide information as July 31, 2022, about the ten largest holdings of the Domini Impact Equity Fund and its portfolio holdings by industry sector:

TEN LARGEST HOLDING (Unaudited)

| | | | | | | | | | |

| | | | |

| SECURITY DESCRIPTION | | % NET

ASSETS | | | SECURITY DESCRIPTION | | % NET

ASSETS | |

| | | | |

| Apple, Inc. | | | 8.8% | | | NVIDIA Corp. | | | 1.6% | |

| | | | |

| Microsoft Corp. | | | 7.5% | | | Visa, Inc. Class A | | | 1.2% | |

| | | | |

| Alphabet, Inc. Class A | | | 4.7% | | | Proctor & Gamble Co. (The) | | | 1.2% | |

| | | | |

| Amazon.com, Inc. | | | 4.3% | | | Home Depot, Inc. (The) | | | 1.1% | |

| | | | |

| Tesla, Inc. | | | 2.7% | | | Mastercard, Inc. Class A | | | 1.1% | |

PORTFOLIO HOLDINGS BY INDUSTRY SECTOR (% OF NET ASSETS) (Unaudited)

The holdings mentioned above are described in the Fund’s Portfolio of Investments as of 7/31/2022, included herein. The composition of the Fund’s portfolio is subject to change.

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by Domini Impact Investments. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification nor shall any such party have any liability therefrom.

12

| | | | |

| | | |

| DOMINI IMPACT EQUITY FUND | | | | |

| | |

AVERAGE ANNUAL TOTAL RETURNS

As of 7/31/2022 (Unaudited) | | Investor shares | | S&P 500 |

| | |

| 1 Year | | -12.65% | | -4.64% |

| | |

| 5 Year | | 10.77% | | 12.83% |

| | |

| 10 Year | | 10.98% | | 13.80% |

COMPARISON OF $10,000 INVESTMENT IN THE DOMINI IMPACT EQUITY FUND INVESTOR SHARES (DSEFX) AND S&P 500 (Unaudited)

NOTE: The Fund’s current investment strategy commenced on December 1, 2018, with SSGA Funds Management, Inc. as its subadviser. Performance information for periods prior to December 1, 2018, reflects the investment strategies employed during those periods.

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. The returns reflect any applicable expense waivers in effect during the periods shown. Without such waivers, Fund performance would be lower. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost. Call 1-800-582-6757 or visit www.domini.com for performance information current to the most recent month-end, which may be lower or higher than the performance data quoted. A 2.00% redemption fee applied on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. The redemption fee was waived by the Fund’s Board of Trustees and was no longer imposed by the Fund effective August 16, 2021. Quoted performance data does not reflect the deduction of this fee, which would reduce the performance quoted. See the prospectus for further information.

Per the prospectus dated November 30, 2021, the Fund’s Investor share annual operating expenses totaled 1.09% (gross and net). The Fund’s adviser has contractually agreed to waive certain fees and/or reimburse certain ordinary operating expenses in order to limit Investor share expenses to 1.09% through November 30, 2022, absent an earlier modification approved by the Funds’ Board of Trustees.

The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Fund is based on the Fund’s net asset values and assumes all dividend and capital gains were reinvested.

An investment in the Fund is not a bank deposit and is not insured. The Fund is subject to certain risks, including loss of principal, impact investing, portfolio management, information, market, recent events, and mid- to large-cap companies risks. You may lose money.

The Standard & Poor’s 500 Index (S&P 500) is an unmanaged index of common stocks. Investors cannot invest directly in the S&P 500.

13

| | | | | | |

| | | | |

| DOMINI IMPACT EQUITY FUND | | | | | | |

| | | |

AVERAGE ANNUAL TOTAL RETURNS

As of 7/31/2022 (Unaudited) | | Class A shares (with

4.75% maximum

Sales Charge) | | Class A shares

(without Sales

Charge) | | S&P 500 |

| | | |

| 1 Year | | -16.82% | | -12.67% | | -4.64% |

| | | |

| 5 Year | | 9.69% | | 10.77% | | 12.83% |

| | | |

| 10 Year | | 10.43% | | 10.97% | | 13.80% |

COMPARISON OF $10,000 INVESTMENT IN THE DOMINI IMPACT EQUITY FUND CLASS A SHARES (DSEPX) (WITH 4.75% MAXIMUM SALES CHARGE) AND S&P 500 (Unaudited)

NOTE: The Fund’s current investment strategy commenced on December 1, 2018, with SSGA Funds Management, Inc. as its subadviser. Performance information for periods prior to December 1, 2018, reflects the investment strategies employed during those periods.

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. The returns reflect any applicable expense waivers in effect during the periods shown. Without such waivers, Fund performance would be lower. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost. Call 1-800-762-6814 or visit www.domini.com for performance information current to the most recent month-end, which may be lower or higher than the performance data quoted. A 2.00% redemption fee applied on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. The redemption fee was waived by the Fund’s Board of Trustees and was no longer imposed by the Fund effective August 16, 2021. Quoted performance data does not reflect the deduction of this fee, which would reduce the performance quoted. See the prospectus for further information.

Per the prospectus dated November 30, 2021, the Fund’s Class A share annual operating expenses totaled 1.31% /1.09% (gross/net). The Fund’s adviser has contractually agreed to waive certain fees and/or reimburse certain ordinary operating expenses in order to limit Class A share expenses to 1.09% through November 30, 2022, absent an earlier modification approved by the Funds’ Board of Trustees.

The table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Fund is based on the Fund’s net asset values and assumes all dividend and capital gains were reinvested.

An investment in the Fund is not a bank deposit and is not insured. The Fund is subject to certain risks, including loss of principal, impact investing, portfolio management, information, market, recent events, and mid- to large-cap companies risks. You may lose money.

The Standard & Poor’s 500 Index (S&P 500) is an unmanaged index of common stocks. Investors cannot invest directly in the S&P 500.

14

| | | | |

| | | |

| DOMINI IMPACT EQUITY FUND | | | | |

| | |

AVERAGE ANNUAL TOTAL RETURNS

As of 7/31/2022 (Unaudited) | | Institutional shares | | S&P 500 |

| | |

| 1 Year | | -12.36% | | -4.64% |

| | |

| 5 Year | | 11.15% | | 12.83% |

| | |

| 10 Year | | 11.38% | | 13.80% |

COMPARISON OF $500,000 INVESTMENT IN THE DOMINI IMPACT EQUITY FUND INSTITUTIONAL SHARES (DIEQX) AND S&P 500 (Unaudited)

NOTE: The Fund’s current investment strategy commenced on December 1, 2018, with SSGA Funds Management, Inc. as its subadviser. Performance information for periods prior to December 1, 2018, reflects the investment strategies employed during those periods.

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. The returns reflect any applicable expense waivers in effect during the periods shown. Without such waivers, Fund performance would be lower. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost. Call 1-800-762-6814 or visit www.domini.com for performance information current to the most recent month-end, which may be lower or higher than the performance data quoted. A 2.00% redemption fee applied on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. The redemption fee was waived by the Fund’s Board of Trustees and was no longer imposed by the Fund effective August 16, 2021. Quoted performance data does not reflect the deduction of this fee, which would reduce the performance quoted. See the prospectus for further information.

Per the prospectus dated November 30, 2021, the Fund’s Institutional share annual operating expenses totaled 0.74% (gross and net). The Fund’s adviser has contractually agreed to waive certain fees and/or reimburse certain ordinary operating expenses in order to limit Institutional share expenses to 0.74% through November 30, 2022, absent an earlier modification approved by the Funds’ Board of Trustees.

The table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Fund is based on the Fund’s net asset values and assumes all dividend and capital gains were reinvested.

An investment in the Fund is not a bank deposit and is not insured. The Fund is subject to certain risks, including loss of principal, impact investing, portfolio management, information, market, recent events, and mid- to large-cap companies risks. You may lose money.

The Standard & Poor’s 500 Index (S&P 500) is an unmanaged index of common stocks. Investors cannot invest directly in the S&P 500.

15

| | | | |

| | | |

| DOMINI IMPACT EQUITY FUND | | | | |

| | |

AVERAGE ANNUAL TOTAL RETURNS

As of 7/31/2022 (Unaudited) | | Class Y shares | | S&P 500 |

| | |

| 1 Year | | -12.42% | | -4.64% |

| | |

| 5 Year | | 11.10% | | 12.83% |

| | |

| 10 Year | | 11.31% | | 13.80% |

COMPARISON OF $10,000 INVESTMENT IN THE DOMINI IMPACT EQUITY FUND CLASS Y SHARES (DSFRX) AND S&P 500 (Unaudited)

NOTE: The Fund’s current investment strategy commenced on December 1, 2018, with SSGA Funds Management, Inc. as its subadviser. Performance information for periods prior to December 1, 2018, reflects the investment strategies employed during those periods.

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. The returns reflect any applicable expense waivers in effect during the periods shown. Without such waivers, Fund performance would be lower. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost. Call 1-800-762-6814 or visit www.domini.com for performance information current to the most recent month-end, which may be lower or higher than the performance data quoted. A 2.00% redemption fee applied on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. The redemption fee was waived by the Fund’s Board of Trustees and was no longer imposed by the Fund effective August 16, 2021. Quoted performance data does not reflect the deduction of this fee, which would reduce the performance quoted. See the prospectus for further information.

Per the prospectus dated November 30, 2021, the Fund’s Class Y share annual operating expenses totaled 1.05%/0.80% (gross/net). The Fund’s adviser has contractually agreed to waive certain fees and/or reimburse certain ordinary operating expenses in order to limit Class Y share expenses to 0.80% through November 30, 2022, absent an earlier modification approved by the Funds’ Board of Trustees.

The table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Fund is based on the Fund’s net asset values and assumes all dividend and capital gains were reinvested.

An investment in the Fund is not a bank deposit and is not insured. The Fund is subject to certain risks, including loss of principal, impact investing, portfolio management, information, market, recent events, and mid- to large-cap companies risks. You may lose money.

The Standard & Poor’s 500 Index (S&P 500) is an unmanaged index of common stocks. Investors cannot invest directly in the S&P 500.

16

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS

July 31, 2022

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| Long Term Investments – 94.8% | | | | | | |

| Common Stocks – 94.8% | | | | | | |

| Communication Services – 8.8% | | | | | | |

Alphabet, Inc., Class A (a) | | | 370,900 | | | $ | 43,143,088 | |

Altice USA, Inc., Class A (a) | | | 8,300 | | | | 87,233 | |

AT&T, Inc. | | | 233,185 | | | | 4,379,214 | |

Charter Communications, Inc., Class A (a) | | | 2,558 | | | | 1,105,312 | |

Comcast Corp., Class A | | | 145,421 | | | | 5,456,196 | |

Electronic Arts, Inc. | | | 9,318 | | | | 1,222,801 | |

Lumen Technologies, Inc. | | | 33,100 | | | | 360,459 | |

Netflix, Inc. (a) | | | 14,238 | | | | 3,202,126 | |

New York Times Co. (The), Class A | | | 62,327 | | | | 1,991,348 | |

Omnicom Group, Inc. | | | 6,700 | | | | 467,928 | |

Pinterest, Inc., Class A (a) | | | 19,300 | | | | 375,964 | |

Roku, Inc. (a) | | | 4,000 | | | | 262,080 | |

SoftBank Group Corp. ADR | | | 70,183 | | | | 1,464,719 | |

Spotify Technology SA (a) | | | 3,900 | | | | 440,778 | |

Take-Two Interactive Software, Inc. (a) | | | 3,481 | | | | 462,033 | |

TELUS Corp. | | | 45,694 | | | | 1,050,962 | |

T-Mobile US, Inc. (a) | | | 20,600 | | | | 2,947,036 | |

Verizon Communications, Inc. | | | 127,995 | | | | 5,912,089 | |

Walt Disney Co. (The) (a) | | | 59,593 | | | | 6,322,818 | |

| | | | | | | | |

| | | | | | | 80,654,184 | |

| | | | | | | | |

| | |

| Consumer Discretionary – 11.6% | | | | | | |

Amazon.com, Inc. (a) | | | 288,880 | | | | 38,984,356 | |

Aptiv PLC (a) | | | 8,600 | | | | 902,054 | |

Best Buy Co., Inc. | | | 6,349 | | | | 488,810 | |

BorgWarner, Inc. | | | 8,400 | | | | 323,064 | |

Bright Horizons Family Solutions, Inc. (a) | | | 2,000 | | | | 187,340 | |

Chipotle Mexican Grill, Inc. (a) | | | 817 | | | | 1,277,968 | |

Cie Generale des Etablissements Michelin SCA ADR | | | 43,600 | | | | 607,348 | |

Dollar General Corp. | | | 7,400 | | | | 1,838,382 | |

eBay, Inc. | | | 18,000 | | | | 875,340 | |

Etsy, Inc. (a) | | | 4,300 | | | | 445,996 | |

Garmin, Ltd. | | | 5,246 | | | | 512,115 | |

Gildan Activewear, Inc. | | | 6,800 | | | | 199,376 | |

Home Depot, Inc. (The) | | | 33,751 | | | | 10,157,026 | |

Lowe’s Cos., Inc. | | | 21,241 | | | | 4,068,289 | |

MercadoLibre, Inc. (a) | | | 1,550 | | | | 1,261,250 | |

NIKE, Inc., Class B | | | 40,949 | | | | 4,705,859 | |

NIO, Inc. ADR (a) | | | 51,000 | | | | 1,006,230 | |

NVR, Inc. (a) | | | 100 | | | | 439,310 | |

Sony Group Corp. ADR | | | 40,455 | | | | 3,454,452 | |

Starbucks Corp. | | | 36,667 | | | | 3,108,628 | |

Tapestry, Inc. | | | 8,000 | | | | 269,040 | |

Target Corp. | | | 15,051 | | | | 2,459,032 | |

Tesla, Inc. (a) | | | 27,933 | | | | 24,900,873 | |

TJX Cos., Inc. | | | 35,700 | | | | 2,183,412 | |

Ulta Beauty, Inc. (a) | | | 1,598 | | | | 621,478 | |

17

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

July 31, 2022

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| | |

| Consumer Discretionary (Continued) | | | | | | |

VF Corp. | | | 11,800 | | | $ | 527,224 | |

Williams-Sonoma, Inc. | | | 2,200 | | | | 317,724 | |

| | | | | | | | |

| | | | | | | 106,121,976 | |

| | | | | | | | |

| | |

| Consumer Staples – 5.9% | | | | | | |

Campbell Soup Co. | | | 6,491 | | | | 320,331 | |

Church & Dwight Co., Inc. | | | 7,712 | | | | 678,424 | |

Clorox Co. (The) | | | 4,100 | | | | 581,544 | |

Colgate-Palmolive Co. | | | 27,225 | | | | 2,143,696 | |

Costco Wholesale Corp. | | | 14,403 | | | | 7,796,344 | |

Estee Lauder Cos., Inc. (The), Class A | | | 6,977 | | | | 1,905,419 | |

General Mills, Inc. | | | 19,399 | | | | 1,450,851 | |

Haleon PLC ADR (a) | | | 82,125 | | | | 577,339 | |

JM Smucker Co. (The) | | | 3,346 | | | | 442,743 | |

Keurig Dr Pepper, Inc. | | | 27,600 | | | | 1,069,224 | |

Kimberly-Clark Corp. | | | 10,918 | | | | 1,438,883 | |

Kraft Heinz Co. (The) | | | 22,223 | | | | 818,473 | |

Kroger Co. (The) | | | 21,311 | | | | 989,683 | |

Lamb Weston Holdings, Inc. | | | 4,900 | | | | 390,334 | |

L’Oreal SA ADR | | | 39,100 | | | | 2,959,870 | |

McCormick & Co., Inc. | | | 8,800 | | | | 768,680 | |

Mondelez International, Inc., Class A | | | 44,947 | | | | 2,878,406 | |

PepsiCo, Inc. | | | 44,931 | | | | 7,861,128 | |

Procter & Gamble Co. (The) | | | 78,325 | | | | 10,880,126 | |

SunOpta, Inc. (a) | | | 260,887 | | | | 2,301,023 | |

Sysco Corp. | | | 16,403 | | | | 1,392,615 | |

Unilever PLC ADR | | | 81,685 | | | | 3,974,792 | |

Walgreens Boots Alliance, Inc. | | | 23,048 | | | | 913,162 | |

| | | | | | | | |

| | | | | | | 54,533,090 | |

| | | | | | | | |

| | |

| Financials – 9.6% | | | | | | |

Aflac, Inc. | | | 19,015 | | | | 1,089,560 | |

AGNC Investment Corp. | | | 18,200 | | | | 229,502 | |

Allstate Corp. | | | 8,800 | | | | 1,029,336 | |

American Express Co. | | | 18,048 | | | | 2,779,753 | |

Annaly Capital Management, Inc. | | | 47,900 | | | | 329,552 | |

Aon PLC, Class A | | | 6,600 | | | | 1,920,864 | |

Banco do Brasil SA ADR | | | 49,300 | | | | 341,156 | |

Bank of America Corp. | | | 228,454 | | | | 7,724,030 | |

Bank of Montreal | | | 21,231 | | | | 2,138,386 | |

Bank of New York Mellon Corp. (The) | | | 24,200 | | | | 1,051,732 | |

Bank of Nova Scotia (The) | | | 37,066 | | | | 2,259,173 | |

BlackRock, Inc. | | | 4,734 | | | | 3,167,898 | |

Canadian Imperial Bank of Commerce | | | 28,300 | | | | 1,431,697 | |

Capital One Financial Corp. | | | 12,618 | | | | 1,385,835 | |

Cboe Global Markets, Inc. | | | 3,300 | | | | 407,154 | |

Charles Schwab Corp. (The) | | | 49,578 | | | | 3,423,361 | |

Chubb, Ltd. | | | 12,887 | | | | 2,431,004 | |

Cincinnati Financial Corp. | | | 5,111 | | | | 497,505 | |

18

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

July 31, 2022

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| | |

| Financials (Continued) | | | | | | |

Citigroup, Inc. | | | 61,508 | | | $ | 3,192,265 | |

CME Group, Inc. | | | 11,598 | | | | 2,313,569 | |

Comerica, Inc. | | | 4,154 | | | | 323,057 | |

Commerce Bancshares, Inc. | | | 3,700 | | | | 257,113 | |

Discover Financial Services | | | 9,000 | | | | 909,000 | |

DNB Bank ASA ADR | | | 28,740 | | | | 567,037 | |

East West Bancorp, Inc. | | | 49,344 | | | | 3,541,912 | |

Equitable Holdings, Inc. | | | 13,200 | | | | 375,276 | |

Everest Re Group, Ltd. | | | 1,300 | | | | 339,755 | |

FactSet Research Systems, Inc. | | | 1,200 | | | | 515,616 | |

Fifth Third Bancorp | | | 21,956 | | | | 749,139 | |

First Republic Bank | | | 5,800 | | | | 943,718 | |

Hartford Financial Services Group, Inc. (The) | | | 10,493 | | | | 676,484 | |

Huntington Bancshares, Inc. | | | 47,600 | | | | 632,604 | |

Intercontinental Exchange, Inc. | | | 17,995 | | | | 1,835,310 | |

Invesco, Ltd. | | | 13,803 | | | | 244,865 | |

KeyCorp | | | 30,900 | | | | 565,470 | |

London Stock Exchange Group PLC ADR | | | 44,000 | | | | 1,076,240 | |

M&T Bank Corp. | | | 5,900 | | | | 1,046,955 | |

MarketAxess Holdings, Inc. | | | 1,300 | | | | 352,014 | |

Marsh & McLennan Cos., Inc. | | | 16,330 | | | | 2,677,467 | |

MetLife, Inc. | | | 19,900 | | | | 1,258,675 | |

Moody’s Corp. | | | 5,114 | | | | 1,586,618 | |

Morgan Stanley | | | 44,359 | | | | 3,739,464 | |

MSCI, Inc. | | | 2,505 | | | | 1,205,757 | |

Nasdaq, Inc. | | | 3,600 | | | | 651,240 | |

Northern Trust Corp. | | | 6,600 | | | | 658,548 | |

PNC Financial Services Group, Inc. (The) | | | 13,349 | | | | 2,215,133 | |

Principal Financial Group, Inc. | | | 8,100 | | | | 542,214 | |

Progressive Corp. (The) | | | 19,058 | | | | 2,192,813 | |

Prudential Financial, Inc. | | | 12,161 | | | | 1,215,978 | |

Raymond James Financial, Inc. | | | 5,950 | | | | 585,897 | |

Regions Financial Corp. | | | 31,528 | | | | 667,763 | |

S&P Global, Inc. | | | 11,058 | | | | 4,168,092 | |

T Rowe Price Group, Inc. | | | 7,411 | | | | 915,036 | |

Toronto-Dominion Bank (The) | | | 57,517 | | | | 3,736,879 | |

Travelers Cos., Inc. (The) | | | 7,716 | | | | 1,224,529 | |

Truist Financial Corp. | | | 43,102 | | | | 2,175,358 | |

US Bancorp | | | 43,416 | | | | 2,049,235 | |

W R Berkley Corp. | | | 6,700 | | | | 418,951 | |

Zions Bancorp NA | | | 5,000 | | | | 272,750 | |

| | | | | | | | |

| | | | | | | 88,253,294 | |

| | | | | | | | |

| | |

| Health Care – 13.0% | | | | | | |

AbbVie, Inc. | | | 57,452 | | | | 8,244,936 | |

ABIOMED, Inc. (a) | | | 1,400 | | | | 410,214 | |

Agilent Technologies, Inc. | | | 9,600 | | | | 1,287,360 | |

Alcon, Inc. | | | 15,762 | | | | 1,230,855 | |

Align Technology, Inc. (a) | | | 2,500 | | | | 702,425 | |

19

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

July 31, 2022

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| | |

| Health Care (Continued) | | | | | | |

Alnylam Pharmaceuticals, Inc. (a) | | | 4,100 | | | $ | 582,364 | |

Amgen, Inc. | | | 17,419 | | | | 4,310,680 | |

AstraZeneca PLC ADR | | | 96,900 | | | | 6,417,687 | |

Becton Dickinson and Co. | | | 9,251 | | | | 2,260,112 | |

Biogen, Inc. (a) | | | 4,667 | | | | 1,003,685 | |

BioMarin Pharmaceutical, Inc. (a) | | | 6,300 | | | | 542,115 | |

Bio-Rad Laboratories, Inc., Class A (a) | | | 700 | | | | 394,282 | |

Bio-Techne Corp. | | | 1,300 | | | | 500,864 | |

Bristol-Myers Squibb Co. | | | 69,601 | | | | 5,135,162 | |

Catalent, Inc. (a) | | | 5,500 | | | | 622,050 | |

Cooper Cos., Inc. (The) | | | 1,600 | | | | 523,200 | |

CSL, Ltd. ADR | | | 31,300 | | | | 3,184,462 | |

Danaher Corp. | | | 21,615 | | | | 6,300,124 | |

DENTSPLY SIRONA, Inc. | | | 7,516 | | | | 271,779 | |

DexCom, Inc. (a) | | | 15,510 | | | | 1,273,061 | |

Edwards Lifesciences Corp. (a) | | | 20,072 | | | | 2,018,039 | |

Genmab A/S ADR (a) | | | 20,500 | | | | 730,210 | |

Gilead Sciences, Inc. | | | 40,946 | | | | 2,446,523 | |

GSK PLC ADR | | | 75,700 | | | | 3,192,269 | |

Guardant Health, Inc. (a) | | | 3,300 | | | | 165,561 | |

Henry Schein, Inc. (a) | | | 4,200 | | | | 331,086 | |

Hologic, Inc. (a) | | | 53,882 | | | | 3,846,097 | |

IDEXX Laboratories, Inc. (a) | | | 2,719 | | | | 1,085,370 | |

Illumina, Inc. (a) | | | 5,049 | | | | 1,094,017 | |

Incyte Corp. (a) | | | 5,800 | | | | 450,544 | |

Inspire Medical Systems, Inc. (a) | | | 5,173 | | | | 1,081,105 | |

Insulet Corp. (a) | | | 2,300 | | | | 569,940 | |

Intuitive Surgical, Inc. (a) | | | 11,700 | | | | 2,692,989 | |

Koninklijke Philips NV | | | 29,076 | | | | 603,036 | |

Lonza Group AG ADR | | | 24,000 | | | | 1,448,640 | |

Masimo Corp. (a) | | | 1,800 | | | | 260,244 | |

Merck & Co., Inc. | | | 81,935 | | | | 7,320,073 | |

Mettler-Toledo International, Inc. (a) | | | 690 | | | | 931,314 | |

Moderna, Inc. (a) | | | 11,200 | | | | 1,837,808 | |

Neurocrine Biosciences, Inc. (a) | | | 3,100 | | | | 291,803 | |

Novo Nordisk A/S ADR | | | 53,878 | | | | 6,253,081 | |

Organon & Co. | | | 8,823 | | | | 279,866 | |

PerkinElmer, Inc. | | | 4,000 | | | | 612,680 | |

Pfizer, Inc. | | | 182,970 | | | | 9,241,815 | |

QIAGEN N.V. (a) | | | 7,600 | | | | 377,264 | |

Quest Diagnostics, Inc. | | | 3,715 | | | | 507,357 | |

Regeneron Pharmaceuticals, Inc. (a) | | | 3,442 | | | | 2,002,177 | |

ResMed, Inc. | | | 4,646 | | | | 1,117,456 | |

Sanofi ADR (a) | | | 70,316 | | | | 3,494,705 | |

Seagen, Inc. (a) | | | 12,149 | | | | 2,186,577 | |

STERIS PLC | | | 3,300 | | | | 744,645 | |

Stryker Corp. | | | 10,828 | | | | 2,325,313 | |

Teleflex, Inc. | | | 1,500 | | | | 360,690 | |

Thermo Fisher Scientific, Inc. | | | 12,788 | | | | 7,652,467 | |

20

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

July 31, 2022

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| | |

| Health Care (Continued) | | | | | | |

Veeva Systems, Inc., Class A (a) | | | 4,506 | | | $ | 1,007,451 | |

Vertex Pharmaceuticals, Inc. (a) | | | 8,243 | | | | 2,311,420 | |

Waters Corp. (a) | | | 1,963 | | | | 714,591 | |

West Pharmaceutical Services, Inc. | | | 2,300 | | | | 790,188 | |

| | | | | | | | |

| | | | | | | 119,573,828 | |

| | | | | | | | |

| | |

| Industrials – 5.5% | | | | | | |

ABB, Ltd. ADR | | | 54,500 | | | | 1,655,165 | |

Allegion PLC | | | 3,100 | | | | 327,670 | |

Ameresco, Inc., Class A (a) | | | 37,626 | | | | 2,152,960 | |

AO Smith Corp. | | | 4,500 | | | | 284,715 | |

Assa Abloy AB ADR | | | 62,342 | | | | 733,142 | |

Brambles, Ltd. ADR | | | 23,000 | | | | 370,990 | |

Carrier Global Corp. | | | 27,300 | | | | 1,106,469 | |

Central Japan Railway Co ADR | | | 56,900 | | | | 665,730 | |

CH Robinson Worldwide, Inc. | | | 4,200 | | | | 464,940 | |

Cintas Corp. | | | 2,800 | | | | 1,191,372 | |

Copart, Inc. (a) | | | 7,100 | | | | 909,510 | |

CoStar Group, Inc. (a) | | | 12,910 | | | | 937,137 | |

Cummins, Inc. | | | 4,541 | | | | 1,004,969 | |

Deere & Co. | | | 9,145 | | | | 3,138,381 | |

Donaldson Co., Inc. | | | 4,000 | | | | 217,640 | |

Emerson Electric Co. | | | 19,026 | | | | 1,713,672 | |

Expeditors International of Washington, Inc. | | | 5,300 | | | | 563,125 | |

FANUC Corp. ADR | | | 64,000 | | | | 1,099,520 | |

Fastenal Co. | | | 18,458 | | | | 948,003 | |

Fortune Brands Home & Security, Inc. | | | 4,000 | | | | 278,720 | |

Generac Holdings, Inc. (a) | | | 2,100 | | | | 563,430 | |

Graco, Inc. | | | 5,700 | | | | 382,812 | |

Hubbell, Inc. | | | 1,800 | | | | 394,236 | |

IAA, Inc. (a) | | | 4,400 | | | | 166,012 | |

IDEX Corp. | | | 2,600 | | | | 542,750 | |

Illinois Tool Works, Inc. | | | 8,852 | | | | 1,839,091 | |

Ingersoll Rand, Inc. | | | 12,869 | | | | 640,876 | |

JB Hunt Transport Services, Inc. | | | 2,800 | | | | 513,156 | |

JetBlue Airways Corp. (a) | | | 10,288 | | | | 86,625 | |

Lennox International, Inc. | | | 1,000 | | | | 239,530 | |

Masco Corp. | | | 8,100 | | | | 448,578 | |

Nidec Corp. ADR | | | 66,256 | | | | 1,148,879 | |

Nordson Corp. | | | 1,800 | | | | 415,782 | |

Old Dominion Freight Line, Inc. | | | 3,200 | | | | 971,232 | |

Otis Worldwide Corp. | | | 13,800 | | | | 1,078,746 | |

Owens Corning | | | 3,133 | | | | 290,554 | |

Pentair PLC | | | 5,500 | | | | 268,895 | |

Plug Power, Inc. (a) | | | 19,000 | | | | 405,460 | |

RELX PLC ADR | | | 62,300 | | | | 1,839,096 | |

Robert Half International, Inc. | | | 3,600 | | | | 284,904 | |

Rockwell Automation, Inc. | | | 3,772 | | | | 962,916 | |

Schneider Electric SE ADR | | | 90,800 | | | | 2,510,620 | |

21

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

July 31, 2022

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| | |

| Industrials (Continued) | | | | | | |

Siemens AG ADR | | | 53,736 | | | $ | 2,995,244 | |

Siemens Energy AG ADR | | | 14,900 | | | | 245,850 | |

Snap-on, Inc. | | | 1,700 | | | | 380,885 | |

Stanley Black & Decker, Inc. | | | 4,754 | | | | 462,707 | |

Toro Co. (The) | | | 3,700 | | | | 318,163 | |

Trane Technologies PLC | | | 7,707 | | | | 1,132,852 | |

Trex Co., Inc. (a) | | | 4,000 | | | | 258,080 | |

United Parcel Service, Inc., Class B | | | 23,993 | | | | 4,675,996 | |

United Rentals, Inc. (a) | | | 2,300 | | | | 742,141 | |

Vestas Wind Systems A/S ADR | | | 98,600 | | | | 852,890 | |

Westinghouse Air Brake Technologies Corp. | | | 5,691 | | | | 531,938 | |

Wolters Kluwer NV ADR | | | 8,300 | | | | 900,965 | |

WW Grainger, Inc. | | | 1,470 | | | | 798,989 | |

Xylem, Inc. | | | 5,800 | | | | 533,774 | |

| | | | | | | | |

| | | | | | | 50,588,484 | |

| | | | | | | | |

| | |

| Information Technology – 34.6% | | | | | | |

Accenture PLC, Class A | | | 21,500 | | | | 6,584,590 | |

Adobe, Inc. (a) | | | 15,361 | | | | 6,299,853 | |

Advanced Micro Devices, Inc. (a) | | | 52,850 | | | | 4,992,739 | |

Analog Devices, Inc. | | | 16,911 | | | | 2,908,016 | |

Apple, Inc. | | | 498,096 | | | | 80,945,581 | |

Applied Materials, Inc. | | | 28,802 | | | | 3,052,436 | |

ASML Holding NV ADR | | | 12,900 | | | | 7,410,276 | |

Atlassian Corp. PLC, Class A (a) | | | 4,600 | | | | 962,872 | |

Autodesk, Inc. (a) | | | 16,747 | | | | 3,622,711 | |

Automatic Data Processing, Inc. | | | 13,668 | | | | 3,295,628 | |

Broadcom, Inc. | | | 12,813 | | | | 6,861,105 | |

Cadence Design Systems, Inc. (a) | | | 8,784 | | | | 1,634,527 | |

Cisco Systems, Inc. | | | 124,391 | | | | 5,643,620 | |

Crowdstrike Holdings, Inc., Class A (a) | | | 6,900 | | | | 1,266,840 | |

Dropbox, Inc., Class A (a) | | | 8,400 | | | | 191,016 | |

Enphase Energy, Inc. (a) | | | 32,803 | | | | 9,321,957 | |

First Solar, Inc. (a) | | | 2,900 | | | | 287,593 | |

Fiserv, Inc. (a) | | | 19,300 | | | | 2,039,624 | |

Five9, Inc. (a) | | | 2,300 | | | | 248,676 | |

Infineon Technologies AG ADR | | | 40,000 | | | | 1,094,000 | |

Intel Corp. | | | 133,779 | | | | 4,857,515 | |

International Business Machines Corp. | | | 29,366 | | | | 3,840,779 | |

Intuit, Inc. | | | 9,022 | | | | 4,115,566 | |

KLA Corp. | | | 4,810 | | | | 1,844,827 | |

Lam Research Corp. | | | 4,500 | | | | 2,252,295 | |

Mastercard, Inc., Class A | | | 27,852 | | | | 9,853,759 | |

Micron Technology, Inc. | | | 36,300 | | | | 2,245,518 | |

Microsoft Corp. | | | 243,661 | | | | 68,405,389 | |

NetApp, Inc. | | | 7,008 | | | | 499,881 | |

NortonLifeLock, Inc. | | | 18,400 | | | | 451,352 | |

NVIDIA Corp. | | | 78,408 | | | | 14,241,245 | |

Okta, Inc. (a) | | | 5,000 | | | | 492,250 | |

22

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

July 31, 2022

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| | |

| Information Technology (Continued) | | | | | | |

Palo Alto Networks, Inc. (a) | | | 12,018 | | | $ | 5,998,184 | |

Paychex, Inc. | | | 10,431 | | | | 1,338,089 | |

Paycom Software, Inc. (a) | | | 1,700 | | | | 561,833 | |

PayPal Holdings, Inc. (a) | | | 37,600 | | | | 3,253,528 | |

QUALCOMM, Inc. | | | 36,600 | | | | 5,309,196 | |

Roper Technologies, Inc. | | | 3,457 | | | | 1,509,568 | |

Salesforce, Inc. (a) | | | 31,434 | | | | 5,784,485 | |

ServiceNow, Inc. (a) | | | 6,500 | | | | 2,903,290 | |

Shopify, Inc., Class A (a) | | | 36,600 | | | | 1,274,778 | |

Snowflake, Inc., Class A (a) | | | 8,500 | | | | 1,274,235 | |

Splunk, Inc. (a) | | | 5,200 | | | | 540,332 | |

STMicroelectronics NV, Class Y | | | 81,036 | | | | 3,074,506 | |

Synopsys, Inc. (a) | | | 4,943 | | | | 1,816,553 | |

Texas Instruments, Inc. | | | 30,152 | | | | 5,393,891 | |

Twilio, Inc., Class A (a) | | | 5,600 | | | | 474,880 | |

Visa, Inc., Class A | | | 53,300 | | | | 11,305,463 | |

VMware, Inc., Class A | | | 6,696 | | | | 778,075 | |

WEX, Inc. (a) | | | 1,516 | | | | 251,974 | |

Workday, Inc., Class A (a) | | | 6,500 | | | | 1,008,150 | |

Zoom Video Communications, Inc., Class A (a) | | | 13,431 | | | | 1,394,944 | |

| | | | | | | | |

| | | | | | | 317,009,990 | |

| | | | | | | | |

| | |

| Materials – 2.2% | | | | | | |

Air Liquide SA ADR | | | 84,810 | | | | 2,329,731 | |

Air Products and Chemicals, Inc. | | | 7,159 | | | | 1,777,079 | |

AptarGroup, Inc. | | | 2,100 | | | | 226,296 | |

Avery Dennison Corp. | | | 2,600 | | | | 495,196 | |

CRH PLC ADR | | | 24,400 | | | | 941,596 | |

Ecolab, Inc. | | | 8,248 | | | | 1,362,322 | |

International Paper Co. | | | 12,300 | | | | 526,071 | |

Linde PLC (a) | | | 16,130 | | | | 4,871,260 | |

Mondi PLC ADR | | | 8,000 | | | | 302,480 | |

Nitto Denko Corp. ADR | | | 9,817 | | | | 315,420 | |

Novozymes A/S ADR | | | 6,937 | | | | 443,364 | |

Nucor Corp. | | | 8,592 | | | | 1,166,794 | |

PPG Industries, Inc. | | | 7,642 | | | | 988,034 | |

RPM International, Inc. | | | 4,300 | | | | 388,720 | |

Sherwin-Williams Co. (The) | | | 7,792 | | | | 1,885,196 | |

Smurfit Kappa Group PLC ADR | | | 8,400 | | | | 305,928 | |

Steel Dynamics, Inc. | | | 5,700 | | | | 443,916 | |

Vulcan Materials Co. | | | 4,344 | | | | 718,193 | |

Westrock Co. | | | 7,885 | | | | 334,009 | |

| | | | | | | | |

| | | | | | | 19,821,605 | |

| | | | | | | | |

| | |

| Real Estate – 2.9% | | | | | | |

Alexandria Real Estate Equities, Inc. | | | 5,286 | | | | 876,313 | |

American Tower Corp. | | | 14,909 | | | | 4,037,804 | |

Boston Properties, Inc. | | | 4,946 | | | | 450,877 | |

CBRE Group, Inc., Class A (a) | | | 10,122 | | | | 866,646 | |

23

DOMINI IMPACT EQUITY FUND

PORTFOLIOOF INVESTMENTS (continued)

July 31, 2022

| | | | | | | | |

| SECURITY | | SHARES | | | VALUE | |

| | |

| Real Estate (Continued) | | | | | | |

Crown Castle International Corp. | | | 14,022 | | | $ | 2,533,214 | |

Digital Realty Trust, Inc. | | | 9,192 | | | | 1,217,480 | |

Duke Realty Corp. | | | 12,900 | | | | 807,024 | |

Equinix, Inc. | | | 2,931 | | | | 2,062,662 | |

Equity LifeStyle Properties, Inc. | | | 5,700 | | | | 419,064 | |

Essex Property Trust, Inc. | | | 2,200 | | | | 630,366 | |

Extra Space Storage, Inc. | | | 4,200 | | | | 795,984 | |

Federal Realty OP LP | | | 2,500 | | | | 264,025 | |

Kilroy Realty Corp. | | | 3,700 | | | | 200,466 | |

Mid-America Apartment Communities, Inc. | | | 3,800 | | | | 705,774 | |

Prologis, Inc. | | | 24,095 | | | | 3,194,033 | |

Public Storage | | | 4,977 | | | | 1,624,543 | |

Realty Income Corp. | | | 19,321 | | | | 1,429,561 | |

SBA Communications Corp. | | | 3,407 | | | | 1,144,037 | |

Simon Property Group, Inc. | | | 10,600 | | | | 1,151,584 | |

UDR, Inc. | | | 10,169 | | | | 492,180 | |

Ventas, Inc. | | | 13,063 | | | | 702,528 | |

WP Carey, Inc. | | | 6,300 | | | | 562,590 | |

Zillow Group, Inc., Class A (a) | | | 7,100 | | | | 248,500 | |

| | | | | | | | |

| | | | | | | 26,417,255 | |

| | | | | | | | |

| | |

| Utilities – 0.7% | | | | | | |

Alliant Energy Corp. | | | 8,600 | | | | 523,998 | |

Consolidated Edison, Inc. | | | 11,461 | | | | 1,137,733 | |

Eversource Energy | | | 11,458 | | | | 1,010,825 | |

Fortis, Inc. | | | 15,700 | | | | 741,982 | |

National Grid PLC ADR | | | 23,519 | | | | 1,637,158 | |

Orsted AS ADR | | | 17,900 | | | | 692,372 | |

SSE PLC ADR | | | 34,800 | | | | 748,548 | |

| | | | | | | | |

| | | | | | | 6,492,616 | |

| | | | | | | | |

| | |

| Total Investments – 94.8% (Cost $539,940,073) (b) | | | | | 869,466,322 | |

| | |

| Other Assets, less liabilities – 5.2% | | | | | 47,278,813 | |

| | | | | | | | |

| | |

| Net Assets – 100.0% | | | | | $916,745,135 | |

| | | | | | | | |

(a) Non-income producing security.

(b) The aggregate cost for federal income tax purposes is $542,144,816. The aggregate gross unrealized appreciation is $375,309,016 and the aggregate gross unrealized depreciation is $47,987,510, resulting in net unrealized appreciation of $327,321,506.

Abbreviations

ADR — American Depositary Receipt

SEE NOTES TO FINANCIAL STATEMENTS

24

DOMINI INTERNATIONAL OPPORTUNITIES FUND

The Fund invests in a diversified portfolio of primarily mid- to large-cap international equities. Domini makes all security selections and investment decisions, combining two unique strategies: “Core” and “Thematic Solutions.” Core seeks to provide diversified exposure to developed international equity markets through a broad selection of companies that demonstrate strong environmental and social performance relative to their peers. Thematic Solutions seeks to provide opportunistic exposure to solution-oriented companies helping to address sustainability challenges, as determined by Domini’s environmental, social, and financial research and analysis. As of July 31, 2022, 94.4% of the Fund’s portfolio was allocated to its Core strategy and 5.6% was allocated to its Thematic Solutions strategy (excluding cash).

SSGA Funds Management, Inc. (SSGA FM), an SEC-registered investment adviser, serves as Subadviser to the Fund, responsible for purchasing and selling securities to implement Domini’s investment instructions and for managing the Fund’s short-term investments. SSGA FM is unaffiliated with the Domini Funds, other than with respect to the provision of submanagement services.

Portfolio Performance:

The Domini International Opportunities Fund Investor shares returned -17.88% for the twelve-month period ended July 31, 2022, underperforming the MSCI EAFE Index (net) (the “benchmark”)* return of -14.32%.

A confluence of events created an extremely challenging environment for equity investors over the last year. Supply-chain constraints and pent-up consumer demand emerging from the pandemic created global inflationary pressures that most major central banks initially believed to be largely transitory in nature. However, Russia’s full-scale invasion of Ukraine after months of posturing contributed to a global rise in food and energy prices, and inflation rapidly accelerated across most developed markets. As most major central banks around the world moved to rein in surging inflation by tightening monetary policy and raising interest rates, fears of a global economic slowdown and potential recession gripped investors and drove a sharp selloff in risk assets. As market liquidity dried up, equity valuation multiples contracted, particularly within more growth-oriented sectors and among smaller-capitalization stocks. Widening interest rate differentials and a move to safe-haven U.S. assets caused the U.S. dollar to strengthen against most currencies, creating additional headwinds to investing in internationally.

* MSCI EAFE Index (net) returns reflect reinvested dividends net of withholding taxes but reflect no deduction for fees, expenses, or other taxes.

25

These conditions were especially difficult for the Domini Funds, including the Domini International Opportunities Fund, as our Impact Investment Standards generally lead us to favor growth and innovation. The Fund’s lack of exposure to the Energy sector, which the Domini Funds do not invest in due to our exclusionary standards on fossil fuels, was the single largest drag on benchmark-relative results. Energy was the only sector to generate positive returns for the twelve-month period, returning 27.8% for the benchmark, driven by higher prices and supply shortages exacerbated by the war in Ukraine. The Fund’s overweight to Information Technology, which was the weakest sector for the benchmark, also detracted. Several of the Fund’s alternative energy investments helped mitigate some of this impact, with top contributors including non-benchmark positions in solar microinverter company Enphase Energy (+49.9%) and Chinese electric vehicle manufacturer BYD (+18.3%).

Despite these and other individual strong performers, overall security selection detracted from relative results, largely attributable to weaker selection in Industrials and Consumer Discretionary but partially offset by positive selection in Health Care. From a geographic perspective, selection in Europe was the primary detractor — particularly in the Netherlands, the United Kingdom, and Norway — but stronger in Switzerland.

The top individual contributor to relative results was an overweight position in Swiss pharmaceutical company Novartis, which returned 10.7% over the period after it was purchased by the Fund, followed by an overweight position Danish pharmaceutical company Novo Nordisk, which returned 28.4%. The top individual detractors for the period were non-benchmark positions Latin American e-commerce company MercadoLibre and Chinese electric vehicle manufacturer NIO, which declined 48.1% and 55.8%, respectively. Netherlands-based semiconductor equipment manufacturer ASML, which was the Fund’s largest position over the period, was also a significant detractor, declining 24.6%.

While this was a difficult year for the Fund, it did experience some relief late in the period, as better-than-expected corporate earnings and signs that inflation could be nearing a peak contributed to a strong summer rally, with beaten-down technology stocks taking the lead. We believe that the anomalous underperformance of growth-oriented equities experienced over the last twelve months is extremely unlikely to persist. As we continue to monitor macroeconomic conditions and central bank policy — and look for signs of a sustained market recovery — our focus remains on investing in quality companies that demonstrate peer-relative environmental and social leadership and deliver needed solutions. We maintain strong conviction in our long-term investment approach and believe our Impact Investment Standards will help us create sustainable, long-term value for our Funds’ shareholders, our planet, and our global community.

26

The table and bar charts below provide information as July 31, 2022, about the ten largest holdings of the Domini International Opportunities Fund and its portfolio holdings by industry sector and country:

TEN LARGEST HOLDINGS (Unaudited)

| | | | | | | | | | |

| | | | |

| SECURITY DESCRIPTION | | % NET

ASSETS | | | SECURITY DESCRIPTION | | % NET

ASSETS | |

| | | | |

| ASML Holding NV | | | 3.0% | | | Linde PLC | | | 2.1% | |

| | | | |

| AstraZeneca PLC | | | 2.6% | | | Unilever PLC | | | 1.6% | |

| | | | |

| Novartis AG | | | 2.6% | | | AIA Group, Ltd | | | 1.6% | |

| | | | |

| Novo Nordisk A/S Class B | | | 2.6% | | | Toronto-Dominion Bank (The) | | | 1.5% | |

| | | | |

| Toyota Motor Corp. | | | 2.3% | | | Sanofi | | | 1.4% | |

PORTFOLIO HOLDINGS BY INDUSTRY SECTOR (% OF NET ASSETS) (Unaudited)

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by Domini Impact Investments. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification nor shall any such party have any liability therefrom.

27

PORTFOLIO HOLDINGS BY COUNTRY (% OF NET ASSETS) (Unaudited)

The holdings mentioned above are described in the Fund’s Portfolio of Investments as of 7/31/2022 included herein. The composition of the Fund’s portfolio is subject to change.

* Other countries include Ireland 0.9%, Italy 0.8%, Brazil 0.5%, Belgium 0.5%, Norway 0.5%, South Africa 0.4%, New Zealand 0.3%, Austria 0.3%, Luxembourg 0.1% and Hungary 0.1%.

28

| | | | |

| | |

| DOMINI INTERNATIONAL OPPORTUNITIES FUND | | |

| | |

AVERAGE ANNUAL TOTAL RETURNS

As of 7/31/2022 (Unaudited) | | Investor shares | | MSCI EAFE |

| | |

| 1 Year | | -17.88 | | -14.32 |

| | |

| 5 Year | | N/A | | N/A |

| | |

| 10 Year | | N/A | | N/A |

| | |

| Since Inception (11/30/2020) | | -5.25% | | -1.76% |

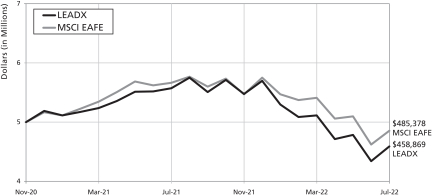

COMPARISON OF $10,000 INVESTMENT IN THE DOMINI INTERNATIONAL OPPORTUNITIES FUND INVESTOR SHARES (RISEX) AND MSCI EAFE (Unaudited)

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. The returns reflect any applicable expense waivers in effect during the periods shown. Without such waivers, Fund performance would be lower. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost. Call 1-800-582-6757 or visit www.domini.com for performance information current to the most recent month-end, which may be lower or higher than the performance data quoted A 2.00% redemption fee applied on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. The redemption fee was waived by the Fund’s Board of Trustees and was no longer imposed by the Fund effective August 16, 2021. Quoted performance data does not reflect the deduction of this fee, which would reduce the performance quoted. See the prospectus for further information.

Per the prospectus dated November 30, 2021, the Fund’s Investor share annual operating expenses totaled 4.88%/1.40% (gross/net). The Fund’s adviser has contractually agreed to waive certain fees and/or reimburse certain ordinary operating expenses in order to limit Investor share expenses to 1.40% through November 30, 2022, absent an earlier modification approved by the Funds’ Board of Trustees.

The table and graph do not reflect the deduction of fees and taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return is based on the Fund’s net asset values and assumes all dividends and capital gains were reinvested.

An investment in the Fund is not a bank deposit and is not insured. The Fund is subject to certain risks, including loss of principal, foreign investing, geographic focus, country, currency, impact investing, portfolio management and information risks. Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity. You may lose money.

The Morgan Stanley Capital International Europe Australasia Far East Index (net) (MSCI EAFE) is an unmanaged index of common stocks. MSCI EAFE includes the reinvestment of dividends net of withholding tax, but does not reflect other fees, expenses or taxes. It is not available for direct investment.

29

| | | | |

| | |

| DOMINI INTERNATIONAL OPPORTUNITIES FUND | | |

| | |

AVERAGE ANNUAL TOTAL RETURNS

As of 7/31/2022 (Unaudited) | | Institutional shares | | MSCI EAFE |

| | |

| 1 Year | | -17.65 | | -14.32 |

| | |

| 5 Year | | N/A | | N/A |

| | |

| 10 Year | | N/A | | N/A |

| | |

| Since Inception (11/30/2020) | | -5.02% | | -1.76% |

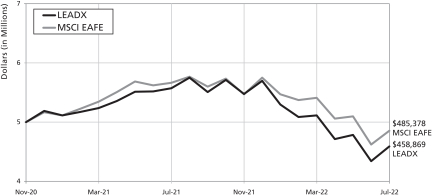

COMPARISON OF $500,000 INVESTMENT IN THE DOMINI INTERNATIONAL OPPORTUNITIES FUND INSTITUTIONAL SHARES (LEADX) AND MSCI EAFE (Unaudited)

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. The returns reflect any applicable expense waivers in effect during the periods shown. Without such waivers, Fund performance would be lower. Investment return, principal value, and yield will fluctuate. Your shares, when redeemed, may be worth more or less than their original cost. Call 1-800-762-6814 or visit www.domini.com for performance information current to the most recent month-end, which may be lower or higher than the performance data quoted. A 2.00% redemption fee applied on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. The redemption fee was waived by the Fund’s Board of Trustees and was no longer imposed by the Fund effective August 16, 2021. Quoted performance data does not reflect the deduction of this fee, which would reduce the performance quoted. See the prospectus for further information.

Per the prospectus dated November 30, 2021, the Fund’s Institutional share annual operating expenses totaled 2.00%/1.15% (gross/net). The Fund’s adviser has contractually agreed to waive certain fees and/or reimburse certain ordinary operating expenses in order to limit Institutional share expenses to 1.15% through November 30, 2022, absent an earlier modification approved by the Funds’ Board of Trustees.

The table and graph do not reflect the deduction of fees and taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return is based on the Fund’s net asset values and assumes all dividends and capital gains were reinvested.

An investment in the Fund is not a bank deposit and is not insured. The Fund is subject to certain risks, including loss of principal, foreign investing, geographic focus, country, currency, impact investing, portfolio management and Information risks. Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity. You may lose money.

The Morgan Stanley Capital International Europe Australasia Far East Index (net) (MSCI EAFE) is an unmanaged index of common stocks. MSCI EAFE includes the reinvestment of dividends net of withholding tax, but does not reflect other fees, expenses or taxes. It is not available for direct investment.

30

DOMINI INTERNATIONAL OPPORTUNITIES FUND

PORTFOLIOOF INVESTMENTS

July 31, 2022

| | | | | | | | | | |

| COUNTRY/SECURITY | | INDUSTRY | | SHARES | | | VALUE | |

| | | | | | | | | | |

| Long Term Investments – 94.8% | | | | | | | | |

| Common Stocks – 94.8% | | | | | | | | |

Australia – 3.4% | | | | | | | | | | |

Allkem, Ltd. (a) | | Materials | | | 1,675 | | | $ | 13,494 | |

APA Group | | Utilities | | | 3,334 | | | | 27,301 | |

ASX, Ltd. | | Diversified Financials | | | 536 | | | | 33,272 | |

Brambles, Ltd. | | Commercial & Professional Services | | | 4,107 | | | | 33,013 | |

Cochlear, Ltd. | | Health Care Equipment & Services | | | 538 | | | | 80,987 | |

CSL, Ltd. | | Pharmaceuticals, Biotechnology & Life Sciences | | | 1,363 | | | | 277,173 | |

Dexus | | Real Estate | | | 3,012 | | | | 20,215 | |