- ESE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

ESCO (ESE) DEF 14ADefinitive proxy

Filed: 16 Dec 24, 1:02pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C., 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934 (AMENDMENT NO. )

| Filed by the registrant | ☒ |

| Filed by a party other than the registrant | ☐ |

Check the appropriate box:

| ☐ | Preliminary proxy statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive proxy statement | |

| ☐ | Definitive additional materials | |

| ☐ | Soliciting material pursuant to Rule 14a-12 |

ESCO TECHNOLOGIES INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| ESCO Technologies Inc. 9900A Clayton Road St. Louis, MO 63124 Bryan Sayler Chief Executive Officer and President |

| December 16, 2024

I am pleased to invite you to attend our 2025 Annual Meeting of Shareholders of ESCO Technologies Inc., to be held on Tuesday, February 4, 2025 at the Innisbrook Resort, 36750 U.S. Highway North, Palm Harbor, Florida 34684, at 8:00 a.m. Eastern Standard Time.

The accompanying Notice of Annual Meeting and Proxy Statement describe the items of business that will be discussed and voted on at the Meeting. We value your input and encourage you to review this material as well as our Annual Report for fiscal 2024 and to vote your shares of common stock. You have a choice of voting online, by telephone, by returning the enclosed proxy card by mail, or at the Meeting.

Our technology-oriented businesses provide highly engineered solutions serving industrial markets. We have a highly-skilled workforce and a long history of product innovation focused on building the next generation of solutions for our customers.

In 2024 we delivered record revenue, earnings, orders and ending backlog. Revenue exceeded $1 billion for the first time, GAAP EPS increased 10 percent, and ending backlog increased 14% during the year as we continue to see strong demand across our aerospace, defense, utility and renewables end markets. Our differentiated solutions in markets with long-term secular growth drivers have us well positioned going forward. We are excited for the future as we look to build on recent momentum by continuing to execute on our growth strategy in order to deliver long-term value for our shareholders.

On behalf of the Board of Directors and all of us at ESCO, thank you for your ongoing support.

Sincerely,

Bryan Sayler Chief Executive Officer and President |

NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

St. Louis, Missouri

December 16, 2024

To the Shareholders of ESCO Technologies Inc.:

The 2025 Annual Meeting of the shareholders of ESCO Technologies Inc. will be held on Tuesday, February 4, 2025 at the Innisbrook Resort, 36750 U.S. Highway North, Palm Harbor, Florida 34684, beginning at 8:00 a.m. Eastern Standard Time, for the following purposes:

| 1. | To elect David A. Campbell and Penelope M. Conner, and to re-elect Gloria L. Valdez, to the Board of Directors of the Company for three-year terms expiring at the 2028 Annual Meeting; |

| 2. | An advisory vote to approve the compensation of the Company’s executive officers; and |

| 3. | To ratify the appointment of the Company’s independent registered public accounting firm for the 2025 fiscal year. |

| Your Board of Directors recommends that you vote:

● FOR each nominee for director, and

● FOR Proposals 2 and 3.

|

Shareholders of record at the close of business on November 27, 2024 are entitled to vote at the Meeting.

Information about each of the above Proposals, as well as instructions for voting and additional relevant information concerning the Company, are set forth in the accompanying Proxy Statement and in the “Important Notice Regarding the Availability of Proxy Materials” sent to all shareholders entitled to vote at the Meeting beginning on or about December 16, 2024.

By Order Of The Board Of Directors,

David M. Schatz

Senior Vice President, General Counsel and Secretary

This Notice, the Proxy Statement attached to this Notice and our Annual Report to Shareholders for the fiscal year ended September 30, 2024 are available electronically at www.envisionreports.com/ESE and on our website at www.escotechnologies.com.

Even if you plan to attend the Meeting in person, PLEASE VOTE:

● Electronically via the Internet at www.investorvote.com/ESE; or

● By telephone within the United States, U.S. territories or Canada at 1 800 652 VOTE (8683); or

● If you requested paper or e-mail copies of the proxy materials, please complete, sign, date and return the proxy card.

|

NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC.

Proxy Statement Table of Contents

NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC.

Proxy Statement Summary

This Proxy Statement relates to the 2025 Annual Meeting of the shareholders of ESCO Technologies Inc., sometimes referred to herein as the Company, we, our or us. Our stock is listed on the New York Stock Exchange (NYSE), where our ticker symbol is “ESE”.

This Proxy Statement is provided pursuant to the rules of the Securities and Exchange Commission (SEC) in connection with our Management’s solicitation of votes for the Meeting.

This Summary highlights certain information relating to the Meeting and the items to be voted on at the Meeting. For additional information, including important business, compensation and corporate governance matters, please refer to the following sections of this Proxy Statement and to our 2024 Annual Report on Form 10-K. Unless otherwise noted, all references to 2024 in this Proxy Statement refer to our fiscal year ended September 30, 2024.

MEETING INFORMATION

| Date and Time | Location | Record Date | Voting |

| Tuesday, February 4, 2025 at 8:00 a.m. Eastern Standard Time | Innisbrook Resort, 36750 U.S. Highway North, Palm Harbor, Florida 34684 | Close of business on November 27, 2024 | Shareholders of record as of the record date are entitled to vote. Each share of common stock is entitled to one vote on each of the director nominees and one vote on all other matters to be considered at the Meeting. |

How to Vote

| Via the Internet | By Telephone | By Mail | At the Meeting |

|  |  |  |

| Go to www.investorvote.com/ESE | 1-800-652-VOTE (8563) in the U.S. or Canada | Follow the instructions on your proxy card | Attend in person and vote by ballot |

PROPOSALS AND BOARD RECOMMENDATIONS

| Proposal | See Page | Required Vote (See “Voting” on page 6) | Board’s Voting Recommendation |

| 1. Election of Directors | 8 | To be elected, a nominee must receive a majority of the votes cast | FOR each director nominee |

| 2. Say on Pay – Advisory Vote to Approve Executive Compensation | 23 | To be approved, this proposal must receive a majority of the votes cast | FOR |

| 3. Ratification of Appointment of Independent Registered Public Accounting Firm | 48 | To be approved, this proposal must receive a majority of the votes cast | FOR |

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROXY STATEMENT SUMMARY | 1 |

Management is not aware of any other matters that will be presented at the Meeting. However, if any other proposal is properly presented for a vote at the Meeting, other than the election of directors and the other proposals described in this Proxy Statement, the proxy holders will vote on it in their own discretion.

NOMINEES FOR DIRECTOR

The following table provides summary information about our director nominees, each of whom is a current director of the Company:

| Nominee | Primary Occupation | Independent | Board Committees | Key Attributes/Qualifications |

| David A. Campbell | President and Chief Executive Officer and Chairman of the Board of Evergy, Inc., a public utility holding company based in Kansas City | Yes | Audit | Extensive strategic, operational and executive experience in the energy field |

| Penelope M. Conner | Executive Vice President, Customer Experience and Energy Strategy of Eversource Energy, a public utility holding company based in New England serving Connecticut, Massachusetts and New Hampshire | Yes | Governance | Nearly four decades of operational, financial and leadership experience in the electric and gas utility sector, with demonstrated performance in high-quality customer service, strategy development and capital allocation |

| Gloria L. Valdez | Retired Deputy Assistant Secretary of the Navy within the Office of the Assistant Secretary of the Navy (ASN) for Research, Development and Acquisition | Yes | Compensation, Governance | Over three decades of strategic and operational experience in the defense markets as well as management and financial expertise |

DIRECTOR DIVERSITY AND TENURE

Diversity is one of the factors that our Governance Committee considers in identifying the pool of director search candidates. The Board appreciates the benefits diversity brings and strives to assemble a Board with not only a variety of business and professional backgrounds, but also diversity in areas such as race, ethnicity and gender.

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROXY STATEMENT SUMMARY | 2 |

COMPANY OVERVIEW AND BUSINESS HIGHLIGHTS

We are:

| ● | A global provider of highly engineered filtration and fluid control products and integrated propulsion systems for the aviation, navy, space and process markets worldwide, as well as composite-based products and solutions for navy, defense and industrial customers; |

| ● | An industry leader in radio frequency shielding and electromagnetic compatibility test products; and |

| ● | A leading provider of diagnostic instruments, software and services for the benefit of industrial power users and the electric utility and renewable energy industries. |

We conduct our business through a number of wholly-owned direct and indirect subsidiaries. Our business is focused on generating predictable and profitable long-term growth through continued innovation and expansion of our product offerings across each of our business segments.

In 2024, strong demand across our core end-markets drove record orders and sales. We leveraged that growth to deliver improved profit margins and diluted EPS that increased 10 percent to $3.94 per share. With a solid balance sheet and substantial liquidity, we remain well positioned to fund both future investments to drive organic growth and acquisitions to add to our technology-driven portfolio of products and services.

The following are only selected measures of Company performance. For complete financial information, please see the audited financial statements included in our 2024 Annual Report to Shareholders.

| Net Sales | Net Earnings | Diluted Earnings Per Share | |||

| $1,027M | $101.9M | $3.94 | |||

| Record Sales / +7% over prior year | +10% over prior year | +10% over prior year | |||

| Entered Orders | Net Cash Provided | Leverage Ratio | |||

| by Operating Activities | |||||

| $1,133M | $128M | 0.45X | |||

| Record Orders & Ending Backlog Orders +10% / Backlog +14% over prior year | +66% over prior year | $623M of liquidity at year end |

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROXY STATEMENT SUMMARY | 3 |

GOVERNANCE HIGHLIGHTS

| All directors other than the CEO are independent |

| All committee chairs are independent |

| Each director attended at least 75% of Board and committee meetings |

| Independent directors hold executive sessions during each Board meeting |

| Board conducts self-assessments annually |

| The full Board exercises oversight responsibility for material risks, and delegates oversight of other risks to the appropriate committees |

| Four of our nine directors are diverse in gender and/ or ethnicity |

| Robust clawback policy for executive compensation plans |

| Competitive share ownership guidelines for directors and executive officers |

| Executive compensation driven by pay for performance |

| Annual shareholder vote on executive compensation |

| Executive officers and directors may not hedge or pledge company shares |

| Independent directors review CEO performance annually |

| Average tenure of independent directors is 6 years |

| Median age of independent directors is 64 years |

EXECUTIVE COMPENSATION HIGHLIGHTS

Our compensation objective is to develop and maintain an industry-competitive compensation program that attracts, retains, motivates and rewards our executive officers and other senior officers and key executives. The compensation program is designed to emphasize performance-based compensation in alignment with our business strategy.

Our compensation programs are designed to maximize shareholder value by allocating a significant portion of executive compensation to performance-based pay that is dependent on the achievement of our performance goals. Our annual cash incentive program and equity-based Performance Share Unit awards (PSUs) utilize a variety of key strategic and financial performance metrics and are designed to reward positive financial performance and limit unnecessary risk taking. Stock ownership guidelines align the interests of executives and shareholders by ensuring that executives bear the economic risk of share ownership.

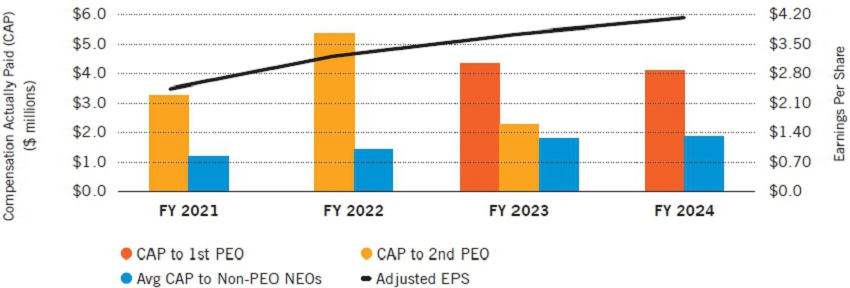

For 2024, our Human Resources and Compensation Committee used the performance metrics “Adjusted EPS” and “Adjusted Cash Flow from Operating Activities,” to determine cash incentive plan compensation earned during fiscal 2024 and thereby incent the participants and align cash incentive compensation with business objectives. Adjusted EPS and Adjusted Cash Flow from Operating Activities are non-GAAP measures, and the metrics used in the calculation of the 2024 adjustment differed somewhat from those used to calculate the 2023 adjustment; for a detailed description and a reconciliation to the nearest GAAP measure, see 2024 Cash Incentive Metrics in the Compensation Discussion and Analysis section.

Our long-term equity incentive (LTI) program includes Restricted Share Units (RSUs) which fully vest over a period of 3 to 3½ years and, since fiscal 2022, PSUs with a 3-year performance period, as described in the Compensation Discussion and Analysis section below.

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROXY STATEMENT SUMMARY | 4 |

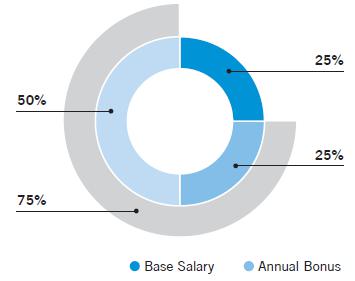

The following charts summarize the 2024 pay mix for the CEO and the other named executive officers, with 75% of the CEO’s target direct compensation at risk and 60% of the average of the other named executive officers’ target direct compensation at risk. Target direct compensation is defined as the sum of the executive officer’s base salary, annual cash incentive award, and annual long term incentive awards, in each case calculated at the target level approved by the Committee.

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROXY STATEMENT SUMMARY | 5 |

Voting

Whether or not you expect to be present in person at the Meeting, please vote in advance using one of the voting methods described in the Important Notice Regarding the Availability of Proxy Materials sent to the shareholders on or about December 16, 2024, which contained instructions on how to access the proxy materials and vote electronically via the Internet, by telephone, by mail, or in person. That Notice also contained instructions on how to request a paper or e-mail copy of the proxy materials, including the Company’s 2024 Annual Report to Shareholders, this Proxy Statement, and a proxy card. The 2024 Annual Report to Shareholders and this Proxy Statement are also available for review on the Company’s website, www.escotechnologies.com.

| ● | You may vote on each proposal, by proxy or by voting in person or via the Internet or by telephone, in which case your shares will be voted in accordance with your choices. |

| ● | You may abstain from voting on any one or more proposals, or withhold authority to vote for any one or more directors, which will have the effect described under Required Vote below. |

| ● | You may return a properly executed proxy form without indicating your preferences, in which case the proxies will vote the shares according to the Board’s recommendations. |

You will have the right to revoke your proxy at any time before it is voted by giving written notice of revocation to the Secretary of the Company, or by duly executing and delivering a proxy bearing a later date, or by attending the Meeting and casting a contrary vote in person.

HOW TO VOTE

| Via the Internet | By Telephone | By Mail | At the Meeting |

|  |  |  |

| Go to www.investorvote.com/ESE | 1-800-652-VOTE (8563) in the U.S. or Canada | Follow the instructions on your proxy card | Attend in person and vote by ballot |

REQUIRED VOTE

At the Meeting, shareholders will be entitled to cast one vote for each share held by them of record on the record date. There is no cumulative voting with respect to the election of directors. The Company has no non-voting shares.

The affirmative vote of the holders of a majority of the shares represented in person or by proxy at the Meeting and entitled to vote on the matter in question will be required to elect directors, to approve each of the individual proposals described in this Proxy Statement, and to approve any other matters properly brought before the Meeting.

The Company’s Corporate Governance Guidelines provide that an incumbent director who fails to obtain a majority vote must promptly offer his or her resignation to the Chair, and the remaining directors shall meet to consider whether it is in the best interests of the Company to accept the resignation or to permit the incumbent to remain on the Board for such period of time as the Board may determine or until a successor is elected and qualified.

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | VOTING | 6 |

Shares represented by proxies which are marked “Withhold” authority to vote for the election of one or more of the nominees for election as directors or marked “Abstain” on any one or more of the other individual proposals described in this Proxy Statement will be counted for the purpose of determining the number of shares represented by proxy at the Meeting, but proxies so marked will have the same effect as if the shares were voted against such nominee or nominees or such proposals.

Under the Rules of the NYSE, the proposal to approve the appointment of independent registered public accountants is considered a “discretionary” item, which means that brokerage firms may vote in their discretion on this matter on behalf of clients who have not furnished voting instructions at least 10 days before the date of the Meeting. In contrast, the election of directors and the other items on the Meeting agenda are “non-discretionary” items, which means that brokerage firms that have not received voting instructions from their clients on these proposals may not vote on them. These so-called “broker non-votes” will, if the underlying shares are otherwise represented at the Meeting, be considered to be present for purposes of determining a quorum, but will be treated as not entitled to vote on such non-discretionary or matters; they will therefore not be considered in determining the number of votes necessary for approval and will have no effect on the outcome of the votes for directors or the other matters to be considered at the Meeting.

If your shares are held by a broker, it is important that you provide voting instructions to your broker so that your votes will be counted.

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | VOTING | 7 |

Proposal 1: Election of Directors

| The Board of Directors recommends a vote FOR all nominees. |

The Board is divided into three classes, with the terms of office of each class ending in successive years. The terms of Class II directors Penelope M. Conner, Leon J. Olivier and Gloria L. Valdez will expire at the Meeting. However, because Mr. Olivier has reached the age of 75 he is ineligible to stand for re-election under the Board’s director retirement policy and will retire from the Board effective with the election of directors at the 2025 Annual Meeting. Accordingly, with the consent of director David A. Campbell, whose current term would not have expired until 2027, the Board has reclassified Mr. Campbell from Class I into Class II and has nominated Mr. Campbell, Ms. Conner and Ms. Valdez for election to new three-year terms expiring at the 2028 Annual Meeting. The Board also decided to reduce the number of directors from nine to eight upon the expiration of Mr. Olivier’s term. As a result, after the 2025 Annual Meeting the Board will have three directors with terms expiring in 2028, two directors with terms expiring in 2027, and three directors with terms expiring in 2026.

If elected, the nominees would serve until the expiration of their terms and until their successors have been elected and qualified. Proxies cannot be voted for more than the number of Board nominees. Should any one or more of the nominees become unable or unwilling to serve (which is not expected), the proxies unless marked to the contrary will be voted for such other person or persons as the Board may recommend.

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROPOSAL 1 | 8 |

| NOMINEES FOR TERMS ENDING IN 2028 |

● Age 56

● Director since 2024

● Board Committees: Audit

● Qualifies as an audit committee financial expert under SEC rules | David A. Campbell

Mr. Campbell’s extensive strategic, operational and executive experience in the energy field makes him well-qualified to provide high-level strategic, financial and operational guidance to the Company.

Principal Occupation and Business Experience

2021–Present: President and Chief Executive Officer and Chairman of the Board (since May 2024) of Evergy, Inc. (public utility holding company)

2019–2021: Executive Vice President and Chief Financial Officer of Vistra Corp. (integrated retail electricity and power generation company)

2014–2019: Chief Executive Officer, InfraREIT, Inc.

2013–2014: President and Chief Operating Officer, Bluescape Resources Company, LLC

2004–2013: Various executive positions with Vistra Corp. and predecessors (TXU Inc. to 2006, Energy Future Holdings Corp. 2006–2013)

1995–2004: Positions of increasing responsibility, including Partner, Corporate Finance and Strategy, with McKinsey and Company, Inc.

Other Public Company Directorships Within Past Five Years

2021–Present: Evergy, Inc. (public utility holding company)

Other Experience and Education

J.D. magna cum laude from Harvard Law School; M.Phil. International Relations, Oxford University; B.A. summa cum laude with Distinction in History from Yale University. Currently serves or has served on a number of boards including the Edison Electric Institute, the Electric Power Research Institute, and the Leadership Council of the Yale School of the Environment |

● Age 61

● Director since 2024

● Board Committees: Governance | Penelope M. Conner

Ms. Conner’s nearly four decades of operational, financial and leadership experience in the electric and gas utility sector, with demonstrated performance in high-quality customer service, strategy development and capital allocation, allow her to provide high-level, multi-faceted insight and assistance to the Board.

Principal Occupation and Business Experience

2021–Present: Executive Vice President, Customer Experience and Energy Strategy at Eversource Energy (public utility holding company)

2002–2021: Various other executive positions with Eversource Energy

1986–2002: Positions of increasing responsibility from 1986 to 1998 at Duke Energy Corporation, culminating as General Manager for Process Integration, and then from 1998 to 2002 at Tampa Electric Company as its Director of Customer Service

Other Experience and Education

B.S. summa cum laude in Industrial Engineering from North Carolina State University. Registered professional engineer in North and South Carolina; Member of Boston University’s Institute for Global Sustainability and the American Council for an Energy Efficient Economy |

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROPOSAL 1 | 9 |

● Age 62

● Director since 2019

● Board Committees: Compensation, Governance | Gloria L. Valdez

Ms. Valdez’s extensive strategic and operational experience in the defense markets as well as her management and financial expertise allow her to provide the Board with valuable assistance and high-level strategic insight.

Principal Occupation and Business Experience

2021–2024: Member of the Naval Shipbuilding Expert Advisory Panel providing advice to the Commonwealth of Australia on its National Naval Shipbuilding Enterprise

2015–2018: Deputy Assistant Secretary of the Navy within the Office of the Assistant Secretary of the Navy (ASN) for Research, Development and Acquisition (executive oversight of all naval shipbuilding programs, major ship conversions, and maintenance, modernization and disposal of in-service ships)

1986–2015: Served in a number of other civilian positions within the Navy Department including as Executive Director for the Program Executive Office for submarines (responsible for civilian management, design, acquisition and construction for submarine platform and undersea systems), Director of the Investment and Development division within the Office of the ASN for Financial Management and Comptroller, and Director for Naval and Commercial Construction in the Office of the ASN for Ship Programs; also served as Budget Director for U.S. Immigration and Customs Enforcement within the Department of Homeland Security

Other Experience and Education

M.S. in management from Florida Institute of Technology; B.S. in Mechanical Engineering from the University of New Mexico; sponsor of the Virginia Class submarine USS Vermont (SSN 792) commissioned in 2020 |

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROPOSAL 1 | 10 |

| DIRECTORS CONTINUING IN OFFICE |

● Age 63

● Director since 2017

● Term expires 2026

● Board Committees: Audit (Chair), Compensation

● Qualifies as an audit committee financial expert under SEC rules | Patrick M. Dewar

Mr. Dewar’s extensive strategic, financial and operational experience in the aerospace and defense markets makes him well-qualified to assist in guiding Company strategy at the highest levels.

Principal Occupation and Business Experience

2016–Present: Chief Executive of The Trenton Group, LLC (investment and strategy consulting firm focused on security, aerospace and defense technology companies)

2013–2016: Executive Vice President of Lockheed Martin International and Chairman of Lockheed Martin Global, Inc.

2010–2013: Senior Vice President, Strategy and Business Development for Lockheed Martin Corporation

Prior to 2010: Held various positions with Lockheed Martin and GE Aerospace

Other Public Company Directorships Within Past Five Years

2018–Present: Butler America Aerospace, LLC, a subsidiary of HCL Technologies Ltd. (provider of engineering, design IT and support services primarily to US aerospace and defense markets)

Other Experience and Education

M.S. in Electrical Engineering, Drexel University; B.S. in Engineering, Swarthmore College. Member of the Council on Foreign Relations; senior adviser to numerous investment firms on aerospace and defense matters |

● Age 64

● Director since 2022

● Term expires 2027

● Board Committees: Audit, Governance

● Qualifies as an audit committee financial expert under SEC rules | Janice L. Hess

Ms. Hess’s four decades of experience includes operational, financial, business transformations and organizational effectiveness, as well as demonstrated performance in growing traditional, adjacent and emerging markets similar to those served by the Company, making her well-qualified to assist the Board in guiding Company strategy at the highest levels.

Principal Occupation and Business Experience

2014–2022: President, Engineered Systems Segment of Teledyne Technologies Incorporated (diversified multinational company providing enabling technologies for industrial growth markets requiring advanced technology and high reliability; the Engineered Systems Segment provides innovative systems engineering and integration and advanced technology development, and is a U.S. Government contractor serving defense, space, energy and maritime markets)

2000–2014: Held a number of other positions with Teledyne, including Executive Vice President and Chief Financial Officer of Engineered Systems

1984–2000: Held positions of increasing responsibility with Intergraph Corporation (now Hexagon AB, a multinational corporation), including Vice President, Finance and Administration and Chief Financial Officer, Computer Systems

Other Experience and Education

B.S.B.A. from Auburn University; staff accountant with PricewaterhouseCoopers LLP from 1981 to 1983 |

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROPOSAL 1 | 11 |

● Age 71

● Director since 2014

● Term expires 2026

● Board Committees: Audit, Compensation (Chair)

● Qualifies as an audit committee financial expert under SEC rules | Vinod M. Khilnani

As a former public company executive, Mr. Khilnani brings to the Board of Directors a wealth of management experience and business knowledge regarding operational, financial and corporate governance issues, as well as extensive international experience with global operations.

Principal Occupation and Business Experience

2013: Executive Chairman of the Board of Directors of CTS Corporation (designer, manufacturer and seller of electronic components and sensors)

2009–2013: Chairman and Chief Executive Officer of CTS

2007–2009: President and Chief Executive Officer of CTS

2001–2007: Senior VP and CFO of CTS

Other Public Company Directorships Within Past Five Years

2009–Present: Materion Corporation (manufacturer of highly engineered advanced materials, performance alloys and composites, and precision coatings for global markets)

2013–2023: 1st Source Corporation (bank holding company)

2014–2021: Gibraltar Industries (manufacturer and distributor of products for the building markets)

Other Experience and Education

M.B.A. from the University of New York at Albany; B.A. in Business Administration from Delhi University |

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROPOSAL 1 | 12 |

● Age 64

● Director since 2014

● Term expires 2026

● Chair of the Board

● Board Committees: Executive (Chair), Compensation, Governance | Robert J. Phillippy

Along with his experience as chief executive officer of a publicly held technology company, Mr. Phillippy brings to the Board of Directors extensive experience in mergers and acquisitions as well as in new product innovation and international business development; and as independent Chair of the Board he provides valuable insights and perspectives regarding all areas of the Company’s business.

Principal Occupation and Business Experience

2016–Present: Executive consultant to technology companies on a range of strategic, operational and organizational issues

2007–2016: President, Chief Executive Officer and a director of Newport Corporation (developer, manufacturer and supplier of lasers, optics and photonics technologies, products and systems for scientific research, microelectronics, defense and security, life and health sciences and industrial markets worldwide)

2004–2007: President and Chief Operating Officer of Newport Corporation

1996–2004: Held various executive management positions with Newport Corporation

1984–1996: Held various sales and marketing management positions at Square D Company (now Schneider Electric) (electrical equipment manufacturer)

Other Public Company Directorships Within Past Five Years

2018–Present: Materion Corporation (manufacturer of highly engineered advanced materials, performance alloys and composites, and precision coatings for global markets)

2018–Present: Kimball Electronics Inc. (manufacturing solutions provider of durable electronics and other products for a variety of industries globally)

Other Experience and Education

M.B.A. from Northwestern University’s Kellogg School of Management; B.S. in Electrical Engineering from the University of Texas at Austin |

● Age 58

● Director since 2023

● Term expires 2027

● Board Committees: Executive | Bryan H. Sayler

Mr. Sayler’s nearly 30 years of experience at the Company across several of its core businesses, including his current position as Chief Executive Officer and President, is reflected in his proven track record of aligning strategy and business objectives as well as strong financial results and M&A outcomes, making him uniquely qualified to provide the Board of Directors with valuable insights and perspectives concerning all areas of the Company’s business.

Principal Occupation and Business Experience

2023–Present: Chief Executive Officer, President and a director of the Company

1995–2022: Held various positions of increasing responsibility within the Company, including as President of the Utility Solutions Group and Doble Engineering from 2016– 2022

Other Experience and Education

B.A. in Pre-Seminary from Southeastern College; M.B.A. from Baylor University |

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROPOSAL 1 | 13 |

| BOARD OF DIRECTORS |

Responsibilities

The Company’s Board of Directors is ultimately responsible for the conduct of the business of the Company in accordance with ethical and honorable business practices and applicable laws, to justify the confidence that the shareholders have placed in the Company by their investment in its shares. Among the Board’s core responsibilities are to:

| ● | Oversee the conduct of the Company’s business in order to evaluate whether the business is being properly managed |

| ● | Review and, where appropriate, approve the Company’s major strategic and financial plans and goals, and evaluate results compared to those plans and goals |

| ● | Oversee the Company’s global risk management framework |

| ● | Review and approve significant indebtedness, significant capital allocations including dividends and stock repurchase plans, and significant transactions not arising in the ordinary course of business |

| ● | Review management’s determinations of principal considerations related to the auditing and accounting principles and practices used in the preparation of the Company’s financial statements; review and approve the Company’s financial controls and reporting systems; and review and approve the Company’s financial statements and financial reporting |

| ● | Select individuals for election to the Board and evaluate the performance of the Board and Board committees |

| ● | Select, evaluate and compensate the CEO and monitor the same decisions with respect to other executive officers; approve and evaluate compensation plans for senior management in conjunction with the Compensation Committee |

| ● | Oversee the conduct of the Company’s Environmental, Social and Governance (ESG) program including annually reviewing the Governance Committee’s ESG program assessment |

Composition and Recent Changes

In February 2024, director James M. Stolze retired from the Board, and in August 2024, the Board elected new directors David A. Campbell and Penelope M. Conner. Because of their positions as executives of energy companies, Mr. Campbell’s and Ms. Conner’s elections were subject to clearance by the Federal Energy Regulatory Commission, which was obtained in September 2024 and October 2024, respectively.

The Board is currently comprised of nine directors divided into three classes, with the terms of office of each class ending in successive years. In anticipation of director Leon J. Olivier’s retirement at the 2025 Annual Meeting, the Board decided to move Mr. Campbell (with his consent) into Mr. Olivier’s class and to decrease the size of the Board from nine to eight members effective with the expiration of Mr. Olivier’s term.

Independence

Mr. Sayler is the only Board member who is a member of the Company’s management. The Board of Directors has affirmatively determined that none of the eight non-management directors has any material relationship with the Company other than in his or her capacity as a director and shareholder, and that therefore all of those directors are, and at all times during their service in fiscal 2024 were, independent as defined under the Company’s Corporate Governance Guidelines and the listing standards of the NYSE.

Meetings

The Board of Directors held five meetings during fiscal 2024. All of the directors attended, either in person or by video conference call, at least 75% of the meetings of the Board and of each of the committees on which they served which were held during their periods of service. The Company’s policy requires that all directors attend the Annual Meeting of Shareholders, except for absences due to causes beyond the reasonable control of the director. All of the directors serving at the time of the 2024 Annual Meeting attended the meeting.

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROPOSAL 1 | 14 |

| DIVERSITY AND TENURE |

Diversity is one of the factors that the Governance Committee considers in identifying the pool of director search candidates. The Board appreciates the benefits diversity brings and strives to assemble a Board with not only a variety of business and professional backgrounds, but also diversity in areas such as race, ethnicity and gender.

| COMMITTEES |

The members of the Board of Directors are appointed to various committees. The standing committees of the Board are the Executive Committee, the Audit and Finance Committee (Audit Committee), the Nominating and Corporate Governance Committee (Governance Committee), and the Human Resources and Compensation Committee (Compensation Committee).

Each Committee operates under a written charter adopted by the Board of Directors. The charters are posted on the Company’s website, www.escotechnologies.com, under the Investor Center/Committees & Charters tab, and a copy of each Committee’s charter is available in print to any shareholder who requests it.

Executive Committee

| CURRENT MEMBERS | ● May exercise the powers of the Board between Board meetings, subject to limitations specified in the committee charter |

| ● Phillippy | ● May not: |

| ● Sayler | ● Declare dividends |

| No meetings in fiscal 2024 | ● Amend the Bylaws |

| ● Approve, propose or recommend for approval any action requiring approval by the shareholders | |

| ● Elect directors or fill vacancies on the Board | |

| ● Change the membership or composition of committees |

Audit Committee

The Audit Committee assists the Board in fulfilling its oversight responsibilities for the integrity of the Company’s financial statements; the Company’s compliance with legal and regulatory requirements; the qualifications, independence and performance of the Company’s independent public accounting firm (the Accounting Firm); and the performance of the Company’s internal audit function.

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROPOSAL 1 | 15 |

CURRENT MEMBERS

● Dewar (Chair)

● Campbell

● Hess

● Khilnani

Four meetings in fiscal 2024 | ● Appoints, retains and oversees the Accounting Firm and its performance of the annual audit

● Annually evaluates the qualifications, independence and performance of the Accounting Firm

● Reviews the scope of the Accounting Firm’s work and approves its annual audit fees and any non-audit service fees

● Reviews the Company’s internal controls with the Accounting Firm and the internal audit executive, and reviews with the Accounting Firm any problems it may have encountered during the annual audit

● Discusses the Company’s Form 10-K and 10-Q reports with management and the Accounting Firm before filing; reviews and discusses earnings press releases

● Discusses major financial risk exposures with management

● Reviews management’s assessment and oversight of information security, cybersecurity and IT risks, breaches (if any), and any preventive or remedial actions taken on a quarterly basis

● Reviews the annual internal audit plan and associated resource allocation

● Evaluates the performance of the Company’s internal audit executive and the results of the annual internal audit

● Reviews the Company’s reports to shareholders with management and the Accounting Firm and receives certain assurances from management

● Issues the Committee Report required to be included in this Proxy Statement pursuant to the regulations of the SEC (see Audit and Finance Committee Report on page 49) |

The Board of Directors has determined that all members of the Committee are financially literate and have accounting or related financial management expertise, as those terms are defined under the Company’s Corporate Governance Guidelines and the applicable listing standards of the NYSE, and are also “audit committee financial experts” within the meaning of Item 407(d)(5)(ii) of SEC Regulation S-K.

Governance Committee

The Governance Committee assists the Board in fulfilling its Corporate Governance responsibilities.

CURRENT MEMBERS

● Olivier (Chair)

● Conner

● Hess

● Phillippy

● Valdez

Four meetings in fiscal 2024 | ● Identifies individuals qualified to become Board members and recommends them for election to the Board at the Annual Meeting of shareholders or for appointment to fill vacancies occurring between Annual Meetings (see Director Candidates and Nominations below)

● Reviews the size of the Board and recommends any appropriate changes to the Board

● Reviews the composition of Board committees and recommends any appropriate changes to the Board

● Develops and recommends to the Board effective corporate governance guidelines

● Reviews the Company’s corporate governance and compliance programs

● Assists the Board in its oversight of the Company’s ESG program and annually provides an assessment of the program for the Board

● Oversees the Company’s ethics programs

● Reviews any conflicts of interest involving Related Persons, and oversees and administers the Company’s policy on Related Person transactions

● Leads the Board in its annual review of the Board’s performance |

Director Candidates and Nominations

To be considered for nomination to the Board, candidates must be persons of the highest integrity, have extensive and varied business experience and have demonstrated their ability to interact effectively with associates and peers. They preferably will also have experience and expertise in business areas related to the Company and its technologies, industries and customers. In addition, the Committee will seek out candidates with the ability to interact constructively with the existing Board membership, in order to enable the Board to act in the long-term interests of the Company’s shareholders. While the Committee has not established specific minimum qualifications for candidates, it may establish specific membership criteria as appropriate from time to time if the Board determines there is a need for specific skills and industry experience.

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROPOSAL 1 | 16 |

Although the Committee does not have a formal policy on diversity, it seeks the most qualified candidates without regard to race, color, national origin, gender, religion, disability or sexual orientation. However, the Committee appreciates the benefits that diversity, including gender diversity, brings to a board of directors, and both the Committee and the full Board are committed to requiring the inclusion of women and underrepresented minorities in the initial pool of director search candidates.

The Committee may identify new candidates for nomination based on recommendations from Company management, employees, non-management directors, shareholders and other third parties. It also has the authority to engage third party search firms to identify candidates, and it has done so from time to time. Consideration of a new candidate typically involves the Committee’s review of information pertaining to such candidate and a series of internal discussions, and may proceed to interviews with the candidate. New candidates are evaluated based on the above-described criteria in light of the specific needs of the Board and the Company at the time. Incumbent directors whose terms are set to expire are evaluated based on the above-described criteria, as well as a review of their overall past performance on the Board of Directors.

The Committee will consider director candidates recommended by shareholders, and will evaluate such individuals in the same manner as other candidates proposed to the Committee. All candidates must meet the legal, regulatory and exchange requirements applicable to members of the Board of Directors. Shareholders who wish to recommend individuals for consideration as director candidates for the 2026 Annual Meeting of Shareholders should notify the Committee no later than August 31, 2025 in order to allow time for their recommendations to be considered by the Committee. Submissions are to be addressed to the Nominating and Corporate Governance Committee, c/o David M. Schatz, Corporate Secretary, ESCO Technologies Inc., 9900A Clayton Road, St. Louis, MO 63124-1186, which submissions will then be forwarded to the Committee. The Committee is not obligated to nominate any such individual for election.

Compensation Committee

The Compensation Committee’s basic responsibility is to assure that the Company’s directors, key executives and other senior officers are compensated in a manner consistent with and in furtherance of Company strategy, competitive practices, and the requirements of the appropriate regulatory bodies.

CURRENT MEMBERS

● Khilnani (Chair)

● Dewar

● Phillippy

● Valdez

Four meetings in fiscal 2024 | ● Reviews and approves corporate goals and objectives relevant to the compensation of the Chief Executive Officer; evaluates the Chief Executive Officer’s performance in light of these goals and objectives, and determines the Chief Executive Officer’s compensation based upon the evaluation in conjunction with the full Board

● Approves and evaluates the compensation plans for senior management

● Reviews, approves and evaluates incentive compensation plans, equity-based plans and other compensation plans, to ensure that they provide compensation and incentives consistent with the strategy of the Company and competitive practice

● Reviews and approves the compensation of the Company’s non-management directors in conjunction with the full Board

● Reviews, approves and evaluates material benefit programs, including new programs and material changes to existing programs

● Reviews the performance and development of, and succession planning for, Company senior management

● Oversees the Company’s Charitable Contributions Program

● Reviews and discusses with management the Company’s annual Compensation Discussion and Analysis, and recommends its inclusion in the Company’s annual proxy statement and the Company’s Form 10-K filed with the SEC (see Compensation Committee Report on page 24) |

Compensation Committee Interlocks and Insider Participation.

During fiscal 2024, none of the members of the Compensation Committee (i) was an officer or employee of the Company; (ii) was formerly an officer of the Company; or (iii) had any other relationship requiring disclosure under any paragraph of Item 404 or under Item 407(e)(4) of SEC Regulation S-K. In addition, during fiscal 2023, none of the Company’s executive officers served as a member of the board of directors or compensation committee of any entity that had one or more executive officers serving as a member of the Company’s Board of Directors or the Compensation Committee.

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROPOSAL 1 | 17 |

| CORPORATE GOVERNANCE INFORMATION |

The Board’s Role in Risk Oversight

The Company’s management is responsible for managing the Company’s risks on a day-to-day basis, and has adopted an ongoing enterprise risk management process that it uses to identify and assess Company risks. Management has identified risks in four general areas: Financial and Reporting; Legal and Compliance; Operational; and Strategic. Periodically, management advises the Board and the appropriate Board committee of the risks identified; management’s assessment of those risks at the business unit and corporate levels; its plans for the management of these identified risks or the mitigation of their effects; and the results of the implementation of those plans.

While the Board as a whole has responsibility for and is involved in the oversight of management’s risk management processes, plans and controls, some of the identified risks are given further review by the Board committee most closely associated with the identified risks. For example, the Audit Committee provides additional review of the risks in the areas of accounting and auditing, liquidity, credit, tax, information security and cybersecurity. Similarly, the Compensation Committee provides additional review of risks in the area of compensation and benefits and human resource planning. The Governance Committee devotes additional time to the review of risks associated with corporate governance, ethics, legal and ESG issues.

Governance Policies and Management Oversight

The Board of Directors has adopted Corporate Governance Guidelines to guide its actions, as well as a Code of Conduct applicable to all of the Company’s directors, officers and employees. Additionally, the Board has adopted a Code of Ethics for Senior Financial Officers applicable to the Company’s Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, Controller and persons performing similar duties. These documents are posted on the Company’s web site, www.escotechnologies.com, under the Investor Center/Governance Documents tab, and a copy of any of these documents is also available in print to any shareholder who requests it.

Insider Trading and Clawback Policies

In furtherance of the Corporate Governance Guidelines and the Code of Conduct, and in coordination with applicable securities-related laws and regulations, the Board of Directors has adopted robust policies regarding Insider Trading, including prohibitions against hedging and (for certain senior Company officials) pledging transactions involving Company stock, and policies permitting the Company to “claw back” all or part of the values of certain Company equity awards to executives or senior personnel in certain cases. Further information about these policies is set forth under Insider Trading Policy; Anti-Hedging and Anti-Pledging Policies and Clawback Policy beginning on page 34.

Cybersecurity

Global information technology security threats and targeted computer crime are increasing in frequency and sophistication. As these risks increase, the Company has enhanced its use of technologies and internal controls to protect our systems, networks and data. The Company’s cybersecurity program includes employee training and testing, information security policies and procedures, third-party monitoring of our networks and systems, and maintenance of backup and other protective systems. Governmental authorities, including the United States government, have increasingly focused on cybersecurity requirements for government contractors. The Company’s subsidiaries that serve in these capacities are increasingly focused on cybersecurity as they seek to comply with the US Department of Defense Cybersecurity Maturity Model Certification (CMMC) program and related governmental mandates.

The Audit Committee annually reviews the major financial risk exposures including cyber security and policies or controls management has implemented to manage and mitigate risks, and quarterly reviews management’s assessment and oversight of cybersecurity and information technologies risks and any required remediation actions. The full Board annually reviews the Company’s cybersecurity initiatives.

Succession Planning

The Compensation Committee of the Board conducts an annual review of the Company’s long-term succession plan for the CEO. Having this succession plan in place enabled the Board to name Mr. Sayler as the successor to Victor L. Richey as CEO in late 2022 promptly after Mr. Richey notified the Board of his decision to retire. Additionally, the Board has in place an emergency succession plan for the CEO in order to minimize the uncertainty associated with an emergency succession event.

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROPOSAL 1 | 18 |

Independence and Related Person Determinations

All of the Company’s directors except Mr. Sayler are and will be independent of Company management. Additionally, all of the members of the Audit Committee, the Compensation Committee and the Governance Committee are independent as defined by the New York Stock Exchange and set forth in the Company’s Corporate Governance Guidelines.

The Company has implemented a written policy not only to ensure that all non-management directors meet the independence standards defined under the Company’s Corporate Governance Guidelines and the listing standards of the NYSE but to ensure that all Company transactions in which a “Related Person” has or will have a direct or indirect interest will be at arm’s length and on terms generally available to an unaffiliated third-party under the same or similar circumstances. “Related Persons” include the Company’s directors, director nominees and executive officers, holders of 5% or more of the Company’s stock, and the immediate family members of each. The policy contains procedures requiring Related Persons to notify the Company of any such transaction and for the Governance Committee to review the material facts of the proposed transaction and determine whether to approve or disapprove the transaction. The Committee will consider whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third-party under the same or similar circumstances. If advance Committee approval is not feasible or is not obtained, the policy requires submission of the transaction to the Committee after the fact, and the Committee is empowered to approve, ratify, amend, rescind or terminate the transaction. In such event, the Committee will also request the General Counsel to evaluate the Company’s controls and procedures to ascertain whether any changes to the policy are recommended.

The Company has developed and implemented processes and controls to obtain information about Related Person transactions for the purpose of determining, based on the facts and circumstances, whether a Related Person has a direct or indirect material interest in the transaction. Pursuant to these processes and controls, all directors and executive officers must annually complete, sign and submit a Directors’ and Officers’ Questionnaire and a Conflict of Interest Questionnaire that are designed to identify Related Person transactions and both actual and potential conflicts of interest, and are required to update their responses in the event of any changes. Additionally, the holders of 5% or more of the Company’s shares (all of whom are institutional investors), are annually requested to respond to certain questions designed to identify direct or indirect material interests by such 5% or more shareholder in any transactions with the Company.

Based on its review and processes, the Company has determined that except for the matters described in the following paragraphs there has been no transaction since the beginning of the Company’s 2024 fiscal year, and there is no transaction currently proposed, in which the Company was or is to be a participant and in which any Related Person had or will have a direct or indirect material interest.

One of the Company’s directors, David A. Campbell, is the President, Chief Executive Officer and Chairman of the Board of Evergy, Inc. (Evergy), which through its operating subsidiaries is a customer of the Company’s subsidiary Doble Engineering Company and its subsidiaries and affiliates (together, Doble). Accordingly, the Board has affirmatively considered whether this relationship might affect Mr. Campbell’s independence as a director of the Company. The Board determined that Doble, among other things, sells and leases equipment and software to Evergy, repairs and calibrates the equipment and maintains the software, and provides testing, training and consulting services to Evergy, all in the ordinary course of their respective businesses; that the total amount of these transactions was less than $932,000 during 2023 (the last year for which information was available for Evergy), which is approximately 0.096% of the Company’s 2023 revenues and approximately 0.04% of Evergy’s spend for 2023; that Mr. Campbell was not personally involved in these transactions; and that all transactions between Doble and Evergy are intended to be and have been consistent with Doble’s normal commercial terms offered to its customers.

In addition, another of the Company’s directors, Penelope M. Conner, is the Executive Vice President of Customer Experience and Energy Strategy of Eversource Energy (Eversource), which through its operating subsidiaries is a customer of Doble. Accordingly, the Board has affirmatively considered whether this relationship might affect Ms. Conner’s independence as a director of the Company. The Board determined that Doble, among other things, sells and leases equipment and software to Eversource, repairs and calibrates the equipment and maintains the software, and provides testing, training and consulting services to Eversource, all in the ordinary course of their respective businesses; that the total amount of these transactions was less than $3,578,000 during 2023 (the last year for which information was available for Eversource), which is approximately 0.369% of the Company’s 2023 revenues and approximately 0.076% of Eversource’s spend for 2023; that Ms. Conner was not personally involved in these transactions; and that all transactions between Doble and Eversource are intended to be and have been consistent with Doble’s normal commercial terms offered to its customers.

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROPOSAL 1 | 19 |

Based on its review and consideration of these facts, Mr. Campbell’s and Ms. Conner’s oral and written representations and the Federal Energy Regulatory Commission’s approval of Mr. Campbell’s and Ms. Conner’s directorships, the Board determined that the relationships between the Company and Evergy and between the Company and Eversource are not material, that the relationships will not affect Mr. Campbell’s or Ms. Conner’s independent judgment on matters affecting the Company, and that Mr. Campbell and Ms. Conner are each independent under the standards of both the New York Stock Exchange and the Company’s Corporate Governance Guidelines.

Communications with Directors

Interested parties desiring to communicate concerns regarding the Company to the Chair of the Board or to the non management Directors as a group may direct correspondence to: Mr. Robert J. Phillippy, Chair, ESCO Technologies Board of Directors, ESCO Technologies Inc., 9900A Clayton Road, St. Louis, MO 63124-1186. Alternatively, interested parties who wish to communicate with an individual director or any group of directors may write to such director(s) at ESCO Technologies Inc., 9900A Clayton Road, St. Louis, MO 63124-1186, Attn: Secretary. All such letters will be forwarded promptly to the relevant director(s).

| DIRECTOR COMPENSATION |

The responsibilities and the substantial time commitment of a director at a public company require that the Company provide reasonable compensation to incentivize the directors’ performance and ensure their willingness to continue to serve. The Company strives to engage and retain well-qualified directors with significant experience at companies of similar size and complexity. To ensure this is achieved, the Company regularly reviews the compensation provided to its directors. The Company’s non-employee directors are compensated pursuant to the Sub-Plan for Compensation of Non-Employee Directors under the 2018 Omnibus Incentive Plan (the Director Compensation Plan) based upon their respective levels of Board participation and responsibilities. The Compensation Committee obtains competitive market and peer data and periodically retains a compensation consultant to evaluate the competitiveness of its director compensation. The Committee approves the directors’ compensation, but any changes are ratified by the full Board. As an employee of the Company, Mr. Sayler does not receive compensation for his service as a director.

The annual compensation for non-employee directors is based on a calendar year and is paid or awarded, as the case may be, on and as of the first NYSE trading day after each Annual Meeting of Shareholders.

Components of 2024 and 2025 Director Compensation

| Cash Compensation | 2024 | 2025 | ||||

| Annual Retainer (all non-management directors) | $ | 50,0001 | $ | 50,000 | ||

| Chair of the Board | 85,000 | 85,000 | ||||

| Committee Chairs: | ||||||

| ● Audit | 12,500 | 17,500 | ||||

| ● Compensation | 10,000 | 15,000 | ||||

| ● Governance | 8,000 | 12,000 | ||||

| Equity Compensation | 2024 | 2025 | ||||

| Restricted Share Award (all non-management directors) | $ | 180,0001 | $ | 180,000 | ||

| 1 | For their service as directors during the latter part of calendar 2024, Ms. Conner and Mr. Campbell each received a prorated initial cash retainer of $25,000 and a prorated initial equity award of whole shares valued at approximately $90,000 on the respective effective dates of their elections as directors. |

The annual equity award consists of a number of restricted share units (RSUs) equal to $180,000 divided by the NYSE closing price of the common stock on the award date, rounded to the nearest whole share and vesting one year after the award date. The equity award for calendar 2024 was made on February 8, 2024 and will vest on February 8, 2025. Based on the NYSE closing stock price of $103.84 on the award date it amounted to 1,733 RSUs per director.

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROPOSAL 1 | 20 |

The partial-year calendar 2024 equity award to Mr. Campbell was made on October 16, 2024, based on the NYSE closing stock price of $124.57 on September 25, 2024, the effective date of his election; rounded to the nearest whole share it amounted to 722 RSUs. The partial-year 2024 equity award to Ms. Conner was made on November 6, 2024, based on the NYSE closing stock price of $127.89 on October 25, 2024, the effective date of her election; rounded to the nearest whole share it amounted to 704 RSUs. Like the full-year annual awards, each award will vest one year after the award date. Mr. Campbell elected to defer receipt of his 2024 equity award and cash retainer as described below.

During the vesting period, each director’s RSU account accrues an additional number of unvested RSUs equivalent to the quarterly dividends that would have been paid on a like number of shares of common stock, divided by the NYSE closing price on the dividend date; and on the vesting date the director’s accrued and vested RSUs are converted into whole shares of common stock, plus cash equal to the value of any fractional shares based on the NYSE closing price on the vesting date, and are distributed and paid to the director, or if the director has elected to defer their compensation as described below, the RSUs are retained in the director’s deferred compensation account as vested common stock equivalents until the elected distribution date.

2025 Compensation

The Compensation Committee reviewed the non-management directors’ annual compensation program in August 2024, and based on its recommendations the Board determined to increase the annual compensation of the Committee Chairs for calendar 2025 as stated in the table above.

Election to Defer Compensation

Directors may elect in advance to defer receipt of all of their cash compensation and/or all of their stock compensation. If deferral is elected, the deferred amounts are credited to the director’s deferred compensation account in common stock equivalents. If cash compensation is deferred, the number of common stock equivalents credited is equal to the amount deferred divided by the NYSE closing price of the common stock as of the date on which the deferral occurs (or if that is not a trading day, then the last preceding trading day). If stock compensation is deferred, the number of common stock equivalents credited is equal to the number of shares whose receipt is deferred. Common stock equivalents in the director’s deferred compensation account have no voting rights, but earn dividend equivalents on each dividend payment date equal to the dividends payable on a like number of shares of common stock; and the dividend equivalents earned are credited to the director’s deferred compensation account as additional common stock equivalents valued at the NYSE closing price on the dividend date. A director’s deferred compensation account becomes distributable when the director leaves the Board, or at such other date as may be specified by the director consistent with the terms of the Director Compensation Plan; distribution will be accelerated in certain circumstances, including a change in control of the Company. The account is distributable at the election of the director either in cash or in shares; however, any stock portion which has been deferred may only be distributed in shares. For fiscal 2024, Mr. Campbell, Mr. Dewar, Ms. Hess and Mr. Olivier elected to defer receipt of their cash compensation and stock compensation and Ms. Valdez elected to defer receipt of her cash compensation, as described in the footnotes to the Fiscal 2024 Compensation table below. In addition, Mr. Phillippy’s and Ms. Valdez’s cash and stock compensation from certain prior years continued to be deferred pursuant to prior deferral elections which they had terminated as to future compensation.

Director Stock Ownership Guidelines

Directors are subject to stock ownership guidelines. Under these guidelines, within five years after their appointment to the Board each non-management director is expected to acquire and hold shares or common stock equivalents having a total cash value equal to at least five times the annual cash retainer. All directors currently exceed the ownership guidelines except for Mr. Campbell and Ms. Conner, who are on track to reach the guideline amount in 2026.

Fiscal 2024 Compensation

The following table sets forth the compensation of the Company’s non-management directors for fiscal 2024, including former director James M Stolze, who retired at the February 2024 Annual Meeting. Ms. Conner did not begin her service as a director until October 2025 and therefore received no compensation for fiscal 2024. As an executive officer, Mr. Sayler did not receive any additional compensation for his service as a director; his compensation is described under Proposal 2: Advisory Vote on Executive Compensation beginning on page 23.

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROPOSAL 1 | 21 |

| Change in | |||||||

| Pension Value | |||||||

| and Nonqualified | |||||||

| Non-Equity | Deferred | ||||||

| Name | Fees Earned or Paid in Cash | Stock Awards1 | Option Awards | Incentive Plan Compensation | Compensation Earnings2,3 | All Other Compensation | Total |

| David A. Campbell | $ 25,0004 | $ 89,940 | — | — | $ 0 | — | $ 114,940 |

| Patrick M. Dewar | 62,5005 | 180,522 | — | — | 5,687 | — | 248,709 |

| Janice L. Hess | 50,0006 | 180,522 | — | — | 1,369 | — | 231,891 |

| Vinod M. Khilnani | 60,0787 | 180,522 | — | — | 0 | — | 240,600 |

| Leon J. Olivier | 58,0008 | 180,522 | — | — | 10,884 | — | 249,406 |

| Robert J. Phillippy | 135,0789 | 180,522 | — | — | 6,071 | — | 321,671 |

| James M. Stolze | 12,57810 | 0 | — | — | 3,055 | — | 15,633 |

| Gloria L. Valdez | 50,14011 | 180,522 | — | — | 2,569 | — | 233,231 |

| 1 | Dollar amounts for the directors other than Mr. Campbell and Mr. Stolze represent (i) the aggregate fair values of the 1,733 RSUs awarded to the respective directors on February 8, 2024, based on the NYSE closing price of the underlying common stock of $103.84 on that date; plus (ii) the values of the dividend equivalents accrued on the respective directors’ unvested RSUs held during fiscal 2024 as of the respective dividend dates. The dollar amount for Mr. Campbell represents the aggregate fair value of the 722 RSUs deemed earned by Mr. Cambell on September 25, 2024, the effective date of his election as a director, but not issued until fiscal 2025. See Components of 2024 and 2025 Director Compensation above. In view of his retirement in February 2024, Mr. Stolze did not receive an equity award in fiscal 2024. |

| 2 | Dollar amounts represent the values of the dividend equivalents accrued as of the respective dividend dates during fiscal 2024 on the elective deferred stock compensation accounts of Mr. Dewar, Ms. Hess, Mr. Olivier, Mr. Phillippy, Mr. Stolze and Ms. Valdez. See Components of 2024 and 2025 Director Compensation above. |

| 3 | Includes, for Mr. Stolze, the change in actuarial present value of his accumulated benefits under the Directors’ Extended Compensation Plan, a plan for non-management directors who began Board service prior to April 2001. Under the plan, Mr. Stolze was eligible to receive for life an annual benefit of $20,000 beginning after his service as a director ceased; however, as permitted by the plan and in compliance with section 409(a) of the Internal Revenue Code, Mr. Stolze elected to receive the actuarial equivalent of the benefit in a single lump sum after retirement. Accordingly, following his retirement in February 2024, Mr. Stolze received a lump-sum payment of $172,266 in satisfaction of his benefit entitlement. Because Mr. Stolze elected to receive his benefit in the form of a lump sum, the present value was calculated based on the August 2023 417(e) lump sum segment rates and the 2023 417(e) IRS prescribed mortality table. From September 30, 2023 to his actual payment as of April 1, 2024, Mr. Stolze’s pension values decreased in the amount of ($602). Pursuant to SEC regulations, the amount in the table does not include this decrease. |

| 4 | Represents a prorated calendar 2024 cash retainer of $25,000, deemed earned by Mr. Campbell on September 25, 2024, the effective date of his election as a director, but not paid until fiscal 2025. |

| 5 | Represents cash retainer of $50,000 and Audit Committee Chair fee of $12,500; however, Mr. Dewar elected to defer receipt of his retainer and committee chair fee and to receive in lieu of cash a total of approximately 602 RSUs having the same aggregate value on their issue date. |

| 6 | Represents cash retainer of $50,000; however, Ms. Hess elected to defer receipt of her retainer and to receive in lieu of cash a total of approximately 482 RSUs having the same aggregate value on their issue date. |

| 7 | Represents cash retainer of $50,000, committee chair fee of $10,000, and $78 in cash from the redemption of fractional RSUs upon vesting. |

| 8 | Represents cash retainer of $50,000 and committee chair fee of $8,000; however, Mr. Olivier elected to defer receipt of his retainer and committee chair fee and to receive in lieu of cash a total of approximately 559 RSUs having the same aggregate value on their issue date. |

| 9 | Represents cash retainer of $50,000, Board Chair fee of $85,000 and $78 in cash from the redemption of fractional RSUs upon vesting. |

| 10 | Represents a prorated cash retainer of $12,500 and $78 in cash from the redemption of fractional RSUs upon vesting. |

| 11 | Represents cash retainer of $50,000 and $78 in cash from the redemption of fractional RSUs upon vesting, and $62 in cash from the redemption of fractional shares upon distribution of previously deferred shares; however, Ms. Valdez elected to defer receipt of her retainer and to receive in lieu of cash a total of approximately 482 RSUs having the same aggregate value on their issue date. |

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROPOSAL 1 | 22 |

Proposal 2: Advisory Vote to Approve Executive Compensation

The Board of Directors recommends a vote FOR this Proposal.

Pursuant to Section 14(a) of the Securities Exchange Act of 1934, the Board of Directors is again soliciting an advisory (non-binding) shareholder vote, commonly referred to as “Say-on-Pay”, to approve the compensation of the executive officers whose compensation is disclosed in this Proxy Statement (the named executive officers or NEOs). At our 2024 Annual Meeting, over 98% of the shares represented and entitled to vote on the Say on Pay proposal, and over 91% of all outstanding shares, were voted in support of the Say-on-Pay proposal. Based on the preference of over 93% of the votes cast on the frequency of the Say-on-Pay proposals in 2023, we plan to continue to hold a Say-on-Pay vote every year.

The Board of Directors strongly endorses our executive compensation program and recommends that the shareholders vote in favor of the following Resolution:

“RESOLVED, that the Company’s shareholders approve, on an advisory basis, the compensation of the named executive officers as disclosed in the Company’s Proxy Statement for the 2025 Annual Meeting of Shareholders pursuant to the executive compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the Summary Compensation Table, and the other related tables and narrative disclosure.”

Shareholders are encouraged to review the Compensation Discussion and Analysis section below as well as the Summary Compensation Table and the other related tables and narrative disclosure referred to in the proposed Resolution, which provide details about our executive compensation program as well as specific information about the compensation of our named executive officers.

This vote is not intended to address any specific item of compensation, but rather the overall compensation of the named executive officers as described in this Proxy Statement. Although the vote is non-binding, the Board of Directors and the Compensation Committee value the opinions of the shareholders, and to the extent there is a significant vote against the above resolution the Company will consider the shareholders’ concerns and the Committee will evaluate what actions (if any) may be necessary to address those concerns.

SUMMARY OF EXECUTIVE COMPENSATION PROGRAM

Our executive compensation program is designed to attract, motivate, and retain executive officers who are critical to our success. The Committee believes that the program constitutes a balanced, competitive approach to compensation that supports our compensation objectives through performance-based compensation that aligns the interests of executives with those of our shareholders.

The Compensation Committee reviews our compensation program at least annually to ensure that it achieves the desired goals of aligning our executive compensation structure with shareholders’ interests and current market practices.

| NOTICE OF 2025 ANNUAL MEETING & PROXY STATEMENT ● ESCO TECHNOLOGIES INC. | PROPOSAL 2 | 23 |

What We Do

| ✔ | Pay for performance philosophy |

| ✔ | Significant portion of compensation is at-risk |

| ✔ | Competitive stock ownership guidelines |

| ✔ | Robust clawback policy |

| ✔ | Double-trigger change-in-control equity vesting |

| ✔ | Independent compensation consultant |

What We Don’t Do

| ✘ | No excessive perquisites |

| ✘ | No tax gross-ups on perquisites |

| ✘ | No tax gross-ups on change in control severance |

| ✘ | No hedging or pledging of Company stock |

| ✘ | No repricing or exchange of equity-based awards without shareholder approval |

COMPENSATION COMMITTEE REPORT