Letter to

Q1 2024 | May 7, 2024

First Quarter 2024 Financial Highlights

| | | | | | | | | | | | | | | | | |

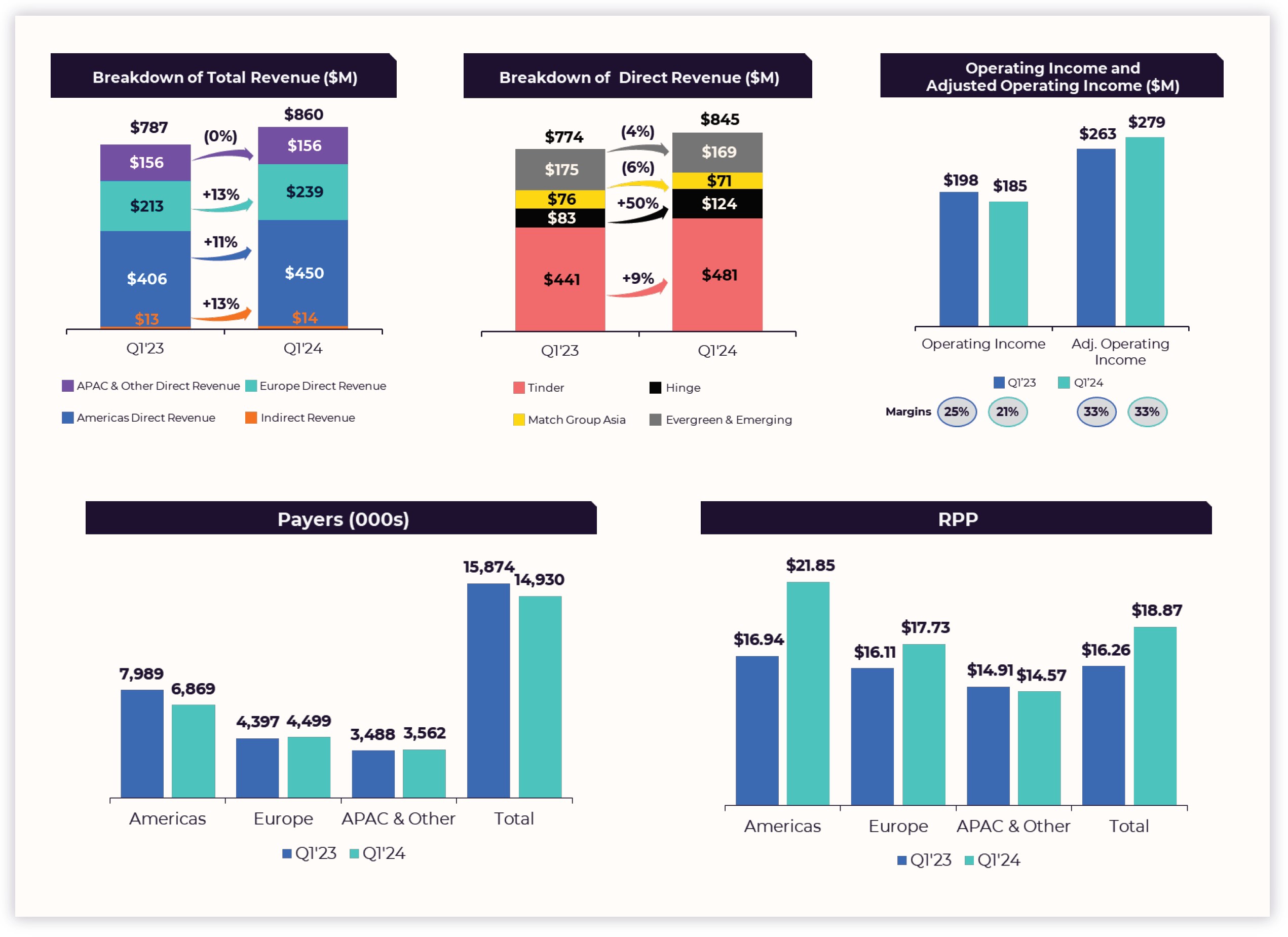

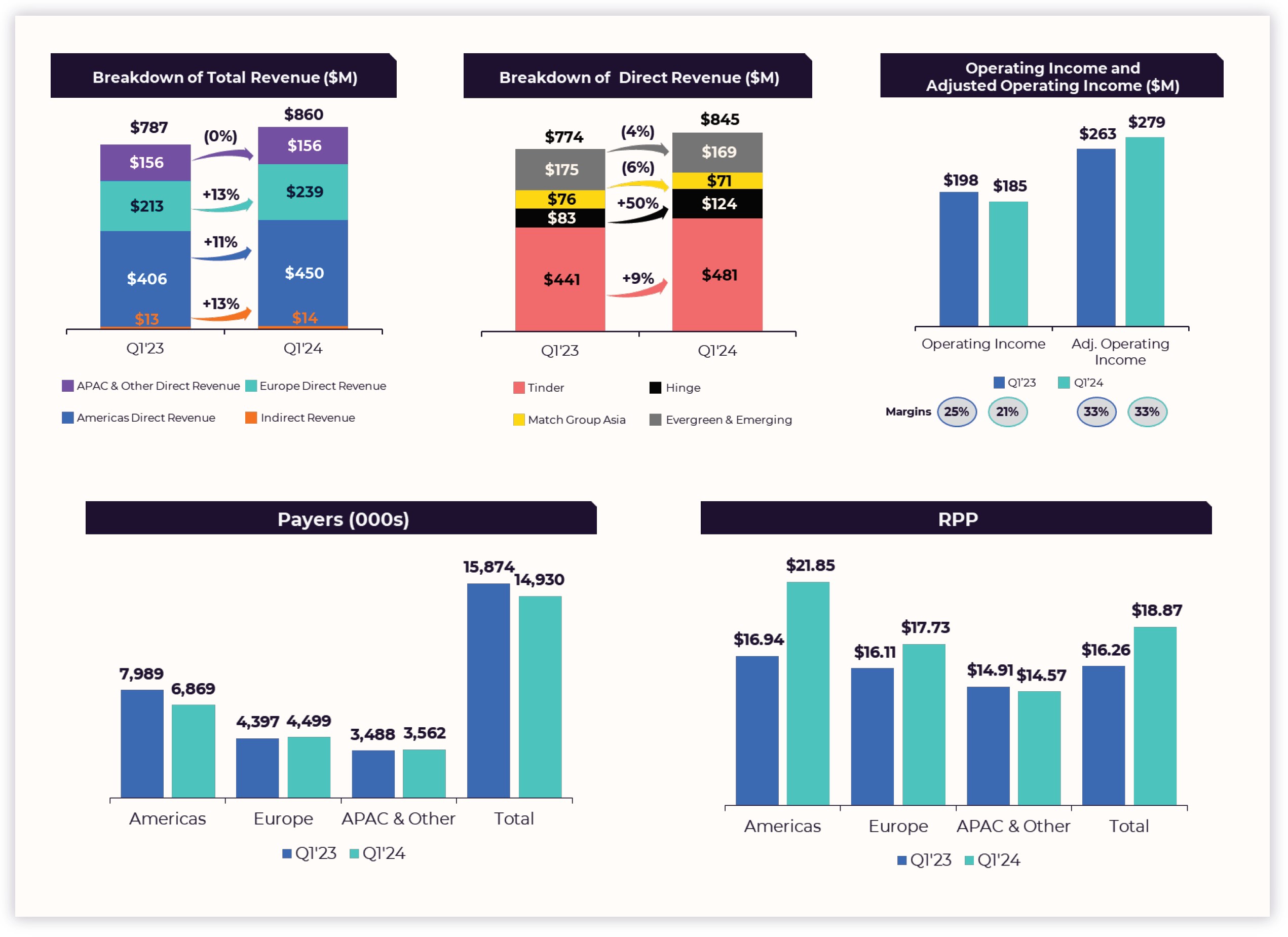

| • | | Total Revenue grew 9% over the prior year quarter to $860 million. On a foreign exchange (“FX”) neutral (“FXN”) basis, Total Revenue was up 12% over the prior year quarter to $880 million. | • | | Operating income was $185 million, a decrease of 7% over the prior year quarter, representing an operating margin of 21%. |

| |

| | | |

| | | |

| | | |

| | | | |

| | | • | | Adjusted Operating Income was $279 million, an increase of 6% over the prior year quarter, representing an Adjusted Operating Income Margin of 33%. |

| • | | Tinder Direct Revenue was up 9% (12% FXN), while collectively our other brands’ Direct Revenue was up 9% over the prior year quarter. Within our other brands, Hinge Direct Revenue was up 50% versus the prior year quarter. | |

| | |

| | | |

| | | |

| | | | |

| | • | | Operating Cash Flow and Free Cash Flow were $284 million and $267 million, respectively, year-to-date as of March 31, 2024. |

| | |

| | | |

| | | | |

| • | | Payers declined 6% to 14.9 million over the prior year quarter. | | |

| | | |

| | • | | Repurchased $198 million1 of our stock in the quarter, or roughly 6 million shares, deploying approximately 75% of free cash flow. |

| | | |

| • | | RPP increased 16% over the prior year quarter to $18.87. | | |

| | |

| | | |

1

11 On a trade date basis

Dear Shareholders,

Match Group started the year with a strong quarter. We are pleased with our Q1 financial results and the progress our teams are making against their key product and marketing initiatives for 2024. Hinge continued to perform exceptionally well in Q1, with sustained monthly active user (“MAU”) growth in all markets and Direct Revenue growth of 50% year-over-year (“Y/Y”), ahead of our expectations. Match Group Asia and our Evergreen & Emerging businesses continued to perform in-line with our expectations.

Our largest brand, Tinder, also performed well in Q1 with Y/Y Direct Revenue growth of 9% (12% FXN), but continues to face headwinds, leading to our expectations for Y/Y Direct Revenue growth for the rest of the year to become more muted. Tinder continues to see pressure on MAU and is also facing increasing pressure on à la carte (“ALC”) revenue, due in part to weaker consumer discretionary spending. Tinder is re-doubling its efforts to address these headwinds with ALC product adjustments and the introduction of new ALC features over the coming quarters.

Tinder is executing with focus and urgency on its strategy of improving ecosystem health and building a better product experience, especially for women and Gen Z. While these initiatives are having mixed short-term impacts on Tinder’s metrics, we firmly believe that these are the right things to do for the long-term health and success of the business. While building a better Tinder takes time, we expect to begin seeing some signs of improvement in the coming quarters, including positive sequential Payer net additions in Q3 and slowing user declines in the back half of the year.

We believe that product innovation and new experiences will allow the Company to capture the significant market opportunity we see, enabling us to deliver tremendous value for our shareholders. In Tinder we have a highly profitable business and a focused strategy to improve trends. In Hinge we have the fastest growing major brand in the category, which we expect will increasingly impact overall Company results. Match Group expects to generate nearly $1.1 billion of free cash flow (“FCF”) in 2024. We are aggressively returning a large portion to shareholders, and we plan to continue doing so moving forward. We appreciate your continued support and the hard work of our teams as we execute our strategy.

| | | | | |

| |

| Bernard Kim (“BK”) | Gary Swidler |

| Chief Executive Officer | President &

Chief Financial Officer |

Business Trends

Q1 2024 Performance

In the first quarter, Total Revenue grew 9% Y/Y to $860 million as RPP rose 16% Y/Y, partially offset by a 6% decrease in Payers. On an FXN basis, Total Revenue was $880 million, up 12% Y/Y.

Tinder® Direct Revenue increased 9% Y/Y to $481 million, up 12% Y/Y FXN. RPP continued to rise, up 20% Y/Y to $16.52, driven by the continued impact of revenue initiatives, including price optimizations and weekly subscription packages. Tinder Payers declined 9% Y/Y to just under 10 million, due to the continuing effects of last year’s price optimizations and MAU declines. Tinder Payers were down ~255,000 on a sequential basis. Subscription revenue grew 17% Y/Y while ALC revenue, which comprises approximately 20% of Tinder’s Direct Revenue, fell 13% Y/Y primarily due to MAU declines and lower purchase volumes per user.

Hinge® Direct Revenue grew 50% Y/Y to $124 million, driven by a 14% Y/Y increase in RPP to $28.96 and a 31% Y/Y increase in Payers to 1.4 million. Hinge continued to resonate with users in English-speaking and Western European markets, with total downloads across all markets growing approximately 20% Y/Y in Q1. Additionally, Hinge ranked among the top two most downloaded dating apps in the majority of its core English-speaking and European expansion markets2.

Our Match Group Asia (“MG Asia”) businesses’ Direct Revenue declined 6% Y/Y to $71 million (up 7% Y/Y FXN). Direct Revenue growth at Azar® was more than offset by continued declines at Pairs™ and Hakuna®.

Evergreen & Emerging (“E&E”) Direct Revenue was down 4% Y/Y to $169 million. Our Evergreen brands’ Direct Revenue declined 9% Y/Y, largely consistent with the rate in recent quarters, as we continued to focus on achieving operational efficiencies. Declines at the Evergreen brands were partially offset by ongoing strength at our Emerging brands, where Direct Revenue grew 23% Y/Y collectively.

Our Q1 Operating Income was $185 million, down 7% Y/Y, representing a margin of 21%, and Adjusted Operating Income (“AOI”) was $279 million, up 6% Y/Y, representing a 33% margin.

Selling and marketing expense was up nearly $30 million, 20% Y/Y, primarily at Tinder and Hinge. Operating Income was further impacted by increased stock-based compensation expense due to increased hiring activity, unusually high forfeitures in the prior year period and other factors, and Depreciation, which increased due to higher depreciation of capitalized software at several businesses including Tinder and Hyperconnect®.

2 Source: Sensor Tower. Combined downloads across Apple App Store and Google Play Store. Among all dating apps, as defined by Match Group.

Evolving Tinder’s Product Experience

Tinder pioneered an entirely new way of online dating. Getting started was fast, the Swipe® feature was fun, and word-of-mouth was strong. This innovative and enjoyable experience led to explosive viral growth around the world. Today, Tinder serves approximately 50 million MAU in 190 countries and 45+ languages – a scale that no other app in the category has ever reached.

Tinder has been facing pressures over the past several quarters on both its user and Payer bases. Some of these pressures have been due to deliberate actions we have taken, including trust & safety efforts, as well as our decision to exit two countries. Tinder has been working to reignite growth in both users and Payers, and we continue to expect positive sequential Payer net additions in Q3 and slowing user declines in the back half of the year.

To reignite growth, Tinder is executing on its four-pronged strategy: 1) redefine dating for the next generation; 2) win with women; 3) improve monetization optimization and localization; and 4) build a widely loved brand. To improve the quality of its ecosystem, mid-last year Tinder made changes to its community guidelines and moderation practices which better enabled the removal of users who are not on the app for its intended purpose. Our analysis shows that these actions have improved the ecosystem, but contributed to Tinder’s MAU declines over the past nine months. There has been a noticeable improvement in authenticity scores3 and overall product experience, which gives us confidence that this was the right long-term decision for the business.

To keep improving trust & safety, Tinder recently launched Share My Date, which allows users to share their date plans directly with family or friends. Later this Summer, Tinder plans to begin requiring face photos, coupled with its AI Photo Selector feature, which we believe will dramatically improve profile quality and user trust, particularly among women.

3 Reflects responses to an in-App survey question that asks users about their perception of the realness of profiles seen on the platform.

Later this year, Tinder also plans to begin testing a variety of new features designed to drive better recommendations and outcomes for women, and introduce new methods of discovery, including integrating richer taste-based signals, which will better leverage the ‘Explore’ section of the app. Tinder also plans to test a feature that leverages technology to further help verify the authenticity of a Tinder profile, which we believe could meaningfully enhance user trust & safety on the platform and the perception of Tinder in the marketplace.

Tinder plans to deploy new technologies, including artificial intelligence (“AI”), across the dating journey to improve onboarding, recommendations, and the post-match experience. Given its global scale, world-class talent, and deep understanding of its target audience, we are confident that Tinder is well-positioned to take advantage of new AI technologies to improve the app experience.

Tinder has best-in-class monetization capabilities and continues to implement optimizations to drive revenue. To address the pressures on ALC revenue, Tinder is expediting its plans to improve the efficacy of its current ALC features and introduce new offerings at affordable price points that would allow more users to tap into valuable features, some which have previously only been available to subscribers. We expect significant changes to Tinder’s ALC offerings over the coming quarters.

We are also continuing with a consistent drumbeat of brand marketing in core markets to increase awareness about the innovative features and safer community we’re building for our users. We expect to launch two new campaigns: one this Spring highlighting Tinder’s new Share My Date feature, and a new iteration of the It Starts with a Swipe™ campaign this Summer.

Grow Hinge to a ~$1 Billion Revenue Business

Over the last several years Hinge’s well-regarded product experience and strong brand have attracted new users in both core English-speaking and European expansion markets. Hinge has grown into a sizable business, with well over 10 million MAU, and we anticipate more than half a billion dollars of Direct Revenue in 2024. In Q1, Hinge was one of the top three most downloaded4 apps in all 17 of its target markets.

Marketing has been a key driver of user growth. Hinge recently unveiled its fifth Designed to be Deleted® marketing campaign, which features real user success stories. The campaign cheekily brings dark humor and deeper storytelling to what happens to the beloved Hingie icon in the afterlife, once a match is made on the app.

Given its momentum, we have confidence that Hinge is well on its way to becoming a $1 billion business. We expect that Hinge will continue to attract new users in its existing markets, enter new ones, and gradually roll out additional monetization features that align with the Hinge experience. And we believe there is ample opportunity to increase the percentage of MAU who are Payers at Hinge, given that it is just over half of Tinder’s current level.

To maintain its position as the brand of choice for intentioned daters, Hinge plans to continue innovating on a multi-pronged product strategy that prioritizes user outcomes and safety. To help further build user trust, Hinge recently launched Hidden WordsTM, which enables daters to create a personalized list of words, phrases, or emojis that they don't want to see in their incoming messages. Hinge is also embedding AI across the user journey, including assisted profile creation, an improved matching algorithm with warm introductions, and differentiated cues that encourage responsiveness for incoming matches.

4 Source: Sensor Tower. Combined downloads across Apple App Store and Google Play Store. Rank is among all dating apps, as defined by Match Group.

Nurture Other Growth Vectors

In addition to Tinder and Hinge, we have several other growth vectors across the portfolio that are gaining traction. Inside E&E, a wide variety of demographically focused Emerging brands are steadily building momentum. These niche brands can generate attractive returns because they leverage a common tech backbone and other central capabilities at E&E. From 2020 to 2023, our Emerging brands’ Direct Revenue grew at an annual compound growth rate of over 70% through a combination of user, Payer, and RPP growth and we believe these brands can collectively begin to offset the declines at the Evergreen brands as soon as next year.

At Hyperconnect, we’re expanding the Azar 1:1 live video chat app into new geographies. We have recently begun to make a push into Europe, where Azar has become a top three most downloaded5 social discovery app in several markets through March ’24. Since Azar users can be single or in a relationship, we believe this app opens a larger market opportunity for Match Group and can help address the global loneliness epidemic.

5 Source: Sensor Tower. Combined downloads across Apple App Store and Google Play Store. Rank

is among all social discovery apps, as defined by Match Group.

Continued Financial Discipline

Match Group has historically been financially prudent, and we plan to maintain that discipline as we invest in long-term growth and complex, relatively costly new technology such as AI. Our strategy includes leveraging our best talent across the Company and intentionally utilizing AI talent based in our lower-cost markets for innovation efforts across the portfolio. We intend to methodically test our innovations to ensure we are achieving the expected progress and returns. We have clear KPIs for our initiatives and intend to pull back or re-calibrate when we don’t see the results we had contemplated.

We remain focused on delivering our previously stated 2024 margin target of 36% or better while we invest in marketing and product innovation at Tinder, Hinge, and in new experiences.

In E&E, the cost savings generated by consolidating tech platforms will help fund growth initiatives elsewhere in the Company, as well as speed product development and time to market for our E&E brands. We’ve already consolidated two of our smaller brands onto a single tech platform. We expect to consolidate two more by the end of 2024 and the final two by the end of 2025.

We’re approaching these consolidations cautiously to minimize disruption to our users and limit the risk inherent in any tech re-platforming. We anticipate ~$60 million of annual cost savings from these platform consolidations once fully phased-in in 2026, compared to spend levels prior to undertaking these efforts.

Strong Capital Returns for Shareholders

We believe that consistently returning capital to shareholders is an important part of our long-term value creation. In our Q4 ’23 Shareholder Letter, we stated that we expect 2024 capital return levels to exceed our targeted minimum of 50% of FCF. In Q1, we deployed approximately 75% of our FCF to repurchase approximately $200 million of stock6, or roughly 6 million shares. With our net leverage ending Q1 at 2.3x7, below our 3x target, and ~$800 million remaining in our share buyback authorization, we expect to deploy a similar or higher percentage of our FCF for repurchases over the remainder of the year. We don’t anticipate acquisitions in the near-term given our strategic and operational focus.

6 On a trade date basis.

7 Leverage is calculated utilizing the non-GAAP measure Adjusted Operating Income as the denominator. For a reconciliation of the non-GAAP measure for each period presented, see page 20.

Financial Outlook

Q2 2024

For Q2, we expect Total Revenue of $850 to $860 million, up 2% to 4% Y/Y, or 5% to 6% FXN, compared to Q2 ’23.

For Tinder, we expect Direct Revenue of $475 to $480 million, flat to up 1% Y/Y, or 3% to 4% FXN, compared to Q2 ’23. We expect similar Y/Y Tinder Payer growth in Q2 ’24 as in Q1 ’24. We continue to believe that Tinder will deliver positive sequential Payer net additions in Q3 ’24.

Across our other brands, we expect Direct Revenue to be $360 to $365 million, representing 5% to 7% Y/Y growth, or 8% to 10% FXN. Within our other brands, we expect Hinge Direct Revenue of $125 to $130 million, representing 38% to 44% Y/Y growth. We expect Indirect Revenue to be approximately $15 million in the quarter.

For Q2, we expect AOI of $300 to $305 million, roughly flat Y/Y, with an AOI margin of 35% at the mid-point of the ranges.

| | | | | | | | | | | | | | |

| | Total Revenue | | Adjusted Operating Income |

| Q2 2024 | | $850 to $860 million | | $300 to $305 million |

| | | | |

| | | | |

| | | | |

| | | | |

Full Year 2024

We expect Tinder Y/Y Direct Revenue growth for the remaining quarters of 2024 to be in the low single digits, leading to low-to-mid full year Y/Y Direct Revenue growth. Given the outlook for Tinder, we expect Match Group to deliver Y/Y Total Revenue growth near the lower end of our previously stated 6% to 9% range for full year ‘24, absent material outperformance versus our current expectations by Hinge or other of our brands.

We also continue to expect to deliver AOI margins of at least 36% and FCF generation of nearly $1.1 billion for the full year.

Conference Call

Match Group will audiocast a conference call to answer questions regarding its first quarter financial results on Wednesday, May 8, 2024 at 8:30 a.m. Eastern Time. This call will include the disclosure of certain information, including forward-looking information, which may be material to an investor’s understanding of Match Group’s business. The live audiocast will be open to the public on Match Group’s investor relations website at https://ir.mtch.com.

Financial Results

Revenue and Key Drivers | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | Change |

| | | | | |

| (In thousands, except RPP) | | |

| Revenue | | | | | |

| Direct Revenue: | | | | | |

| Americas | $ | 450,247 | | | $ | 405,927 | | | 11% |

| Europe | 239,359 | | | 212,516 | | | 13% |

| APAC and Other | 155,693 | | | 155,995 | | | —% |

| Total Direct Revenue | 845,299 | | | 774,438 | | | 9% |

| Indirect Revenue | 14,348 | | | 12,686 | | | 13% |

| Total Revenue | $ | 859,647 | | | $ | 787,124 | | | 9% |

| | | | | |

| Direct Revenue | | | | | |

| Tinder | $ | 481,487 | | | $ | 441,146 | | | 9% |

| Hinge | 123,753 | | | 82,753 | | | 50% |

| MG Asia | 71,459 | | | 75,661 | | | (6)% |

| Evergreen and Emerging | 168,600 | | | 174,878 | | | (4)% |

| Total Direct Revenue | $ | 845,299 | | | $ | 774,438 | | | 9% |

| | | | | |

| Payers | | | | | |

| Americas | 6,869 | | | 7,989 | | | (14)% |

| Europe | 4,499 | | | 4,397 | | | 2% |

| APAC and Other | 3,562 | | | 3,488 | | | 2% |

| Total Payers | 14,930 | | | 15,874 | | | (6)% |

| | | | | |

| | | | | |

| | | | | |

| Revenue Per Payer (“RPP”) | | | | | |

| Americas | $ | 21.85 | | | $ | 16.94 | | | 29% |

| Europe | $ | 17.73 | | | $ | 16.11 | | | 10% |

| APAC and Other | $ | 14.57 | | | $ | 14.91 | | | (2)% |

| Total RPP | $ | 18.87 | | | $ | 16.26 | | | 16% |

| | | | | |

| | | | | |

Operating Income and Adjusted Operating Income

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | Change |

| | | | | |

| (In thousands) | | |

| Operating Income | $ | 184,738 | | | $ | 198,289 | | | (7)% |

| Operating Income Margin | 21 | % | | 25 | % | | (3.7) points |

| Adjusted Operating Income | $ | 279,446 | | | $ | 262,521 | | | 6% |

| Adjusted Operating Income Margin | 33 | % | | 33 | % | | (0.8) points |

Operating Costs and Expenses

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q1 2024 | | % of Revenue | | Q1 2023 | | % of Revenue | | Change |

| | | | | | | | | |

| (In thousands) | | |

| Cost of revenue | $ | 256,742 | | | 30% | | $ | 240,010 | | | 30% | | 7% |

| Selling and marketing expense | 165,301 | | | 19% | | 137,359 | | | 17% | | 20% |

| General and administrative expense | 106,241 | | | 12% | | 90,611 | | | 12% | | 17% |

| Product development expense | 115,737 | | | 13% | | 98,186 | | | 12% | | 18% |

| Depreciation | 20,521 | | | 2% | | 10,552 | | | 1% | | 94% |

| Amortization of intangibles | 10,367 | | | 1% | | 12,117 | | | 2% | | (14)% |

| Total operating costs and expenses | $ | 674,909 | | | 79% | | $ | 588,835 | | | 75% | | 15% |

Liquidity and Capital Resources

During the three months ended March 31, 2024, we generated operating cash flow of $284 million and Free Cash Flow of $267 million, both of which were favorably impacted by the timing of a cash receipt from an app store.

During the quarter ended March 31, 2024, we repurchased 5.6 million shares of our common stock for $197.6 million on a trade date basis at an average price of $35.18. As of May 3, 2024, $800 million in aggregate value of shares of Match Group stock remains available under our previously announced share repurchase program.

In March 2024, we amended our revolving credit facility to reduce borrowing availability from $750 million to $500 million and extended the maturity date to March 20, 2029, with provisions for a springing maturity under certain conditions.

As of March 31, 2024, we had $921 million in cash and cash equivalents and short-term investments and $3.9 billion of long-term debt, $3.5 billion of which is fixed rate debt, including $1.2 billion of Exchangeable Senior Notes. Our $500 million revolving credit facility was undrawn as of March 31, 2024. Match Group’s trailing twelve-month leverage8 as of March 31, 2024 is 3.0x on a gross basis and 2.3x on a net basis.

Income Taxes

We recorded an income tax provision of $31 million in the first quarter of 2024, which equated to an effective tax rate of 20%. In the first quarter of 2023, the income tax provision was $42 million, which equated to an effective tax rate of 26%.

8 Leverage is calculated utilizing the non-GAAP measure Adjusted Operating Income as the denominator. For a reconciliation of the non-GAAP measure for each period presented, see page 20.

GAAP Financial Statements

Consolidated Statement of Operations | | | | | | | | | | | | | | | |

| | | | Three Months Ended March 31, |

| | | | | | 2024 | | 2023 |

| | | | | | | |

| | | | | | (In thousands, except per share data) |

| Revenue | | | | | $ | 859,647 | | | $ | 787,124 | |

| Operating costs and expenses: | | | | | | | |

| Cost of revenue (exclusive of depreciation shown separately below) | | | | | 256,742 | | | 240,010 | |

| Selling and marketing expense | | | | | 165,301 | | | 137,359 | |

| General and administrative expense | | | | | 106,241 | | | 90,611 | |

| Product development expense | | | | | 115,737 | | | 98,186 | |

| Depreciation | | | | | 20,521 | | | 10,552 | |

| Amortization of intangibles | | | | | 10,367 | | | 12,117 | |

| Total operating costs and expenses | | | | | 674,909 | | | 588,835 | |

| Operating income | | | | | 184,738 | | | 198,289 | |

| Interest expense | | | | | (40,353) | | | (39,351) | |

| | | | | | | |

| Other income, net | | | | | 9,474 | | | 3,392 | |

| Earnings before income taxes | | | | | 153,859 | | | 162,330 | |

| Income tax provision | | | | | (30,625) | | | (41,639) | |

| Net earnings | | | | | 123,234 | | | 120,691 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net (earnings) loss attributable to noncontrolling interests | | | | | (36) | | | 118 | |

| Net earnings attributable to Match Group, Inc. shareholders | | | | | $ | 123,198 | | | $ | 120,809 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net earnings per share attributable to Match Group, Inc. shareholders: | | | | | | | |

| Basic | | | | | $ | 0.46 | | | $ | 0.43 | |

| Diluted | | | | | $ | 0.44 | | | $ | 0.42 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic shares outstanding | | | | | 268,142 | | | 279,260 | |

| Diluted shares outstanding | | | | | 286,211 | | | 296,650 | |

| | | | | | | |

| Stock-based compensation expense by function: | | | | | | | |

| Cost of revenue | | | | | $ | 1,711 | | | $ | 1,317 | |

| Selling and marketing expense | | | | | 2,838 | | | 1,913 | |

| General and administrative expense | | | | | 24,211 | | | 13,117 | |

| Product development expense | | | | | 35,060 | | | 25,216 | |

| Total stock-based compensation expense | | | | | $ | 63,820 | | | $ | 41,563 | |

Consolidated Balance Sheet | | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| | | |

| (In thousands) |

| ASSETS | | | |

| Cash and cash equivalents | $ | 914,929 | | | $ | 862,440 | |

| Short-term investments | 5,938 | | | 6,200 | |

| Accounts receivable, net | 225,129 | | | 298,648 | |

| | | |

| | | |

| Other current assets | 103,879 | | | 104,023 | |

| | | |

| Total current assets | 1,249,875 | | | 1,271,311 | |

| | | |

| | | |

| Property and equipment, net | 187,749 | | | 194,525 | |

| Goodwill | 2,286,283 | | | 2,342,612 | |

| Intangible assets, net | 287,527 | | | 305,746 | |

| Deferred income taxes | 249,660 | | | 259,803 | |

| | | |

| Other non-current assets | 142,359 | | | 133,889 | |

| | | |

| TOTAL ASSETS | $ | 4,403,453 | | | $ | 4,507,886 | |

| | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| LIABILITIES | | | |

| | | |

| | | |

| Accounts payable | $ | 21,193 | | | $ | 13,187 | |

| Deferred revenue | 198,543 | | | 211,282 | |

| | | |

| | | |

| Accrued expenses and other current liabilities | 299,154 | | | 307,299 | |

| | | |

| Total current liabilities | 518,890 | | | 531,768 | |

| | | |

| Long-term debt, net | 3,843,901 | | | 3,842,242 | |

| Income taxes payable | 24,658 | | | 24,860 | |

| Deferred income taxes | 22,072 | | | 26,302 | |

| | | |

| | | |

| Other long-term liabilities | 101,604 | | | 101,787 | |

| | | |

| | | |

| | | |

| | | |

| Commitments and contingencies | | | |

| | | |

| SHAREHOLDERS’ EQUITY | | | |

| Common stock | 292 | | | 290 | |

| | | |

| | | |

| | | |

| | | |

| Additional paid-in capital | 8,585,987 | | | 8,529,200 | |

| Retained deficit | (7,007,831) | | | (7,131,029) | |

| Accumulated other comprehensive loss | (454,933) | | | (385,471) | |

| Treasury stock | (1,231,325) | | | (1,032,538) | |

| Total Match Group, Inc. shareholders’ equity | (107,810) | | | (19,548) | |

| Noncontrolling interests | 138 | | | 475 | |

| Total shareholders’ equity | (107,672) | | | (19,073) | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 4,403,453 | | | $ | 4,507,886 | |

Consolidated Statement of Cash Flows | | | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2024 | | 2023 |

| | | |

| | (In thousands) |

| Cash flows from operating activities: | | | |

| | | |

| | | |

| Net earnings | $ | 123,234 | | | $ | 120,691 | |

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | |

| Stock-based compensation expense | 63,820 | | | 41,563 | |

| Depreciation | 20,521 | | | 10,552 | |

| Amortization of intangibles | 10,367 | | | 12,117 | |

| Deferred income taxes | 6,777 | | | 11,711 | |

| | | |

| | | |

| Other adjustments, net | 3,585 | | | 2,237 | |

| Changes in assets and liabilities | | | |

| Accounts receivable | 71,674 | | | (65,728) | |

| Other assets | 7,118 | | | (1,282) | |

| Accounts payable and other liabilities | (22,538) | | | (34,427) | |

| Income taxes payable and receivable | 11,051 | | | 19,788 | |

| Deferred revenue | (11,506) | | | 3,165 | |

| Net cash provided by operating activities | 284,103 | | | 120,387 | |

| Cash flows from investing activities: | | | |

| | | |

| Capital expenditures | (17,234) | | | (19,843) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Other, net | (8,814) | | | 53 | |

| Net cash used in investing activities | (26,048) | | | (19,790) | |

| Cash flows from financing activities: | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Proceeds from issuance of common stock pursuant to stock-based awards | 1,255 | | | 11,198 | |

| Withholding taxes paid on behalf of employees on net settled stock-based awards | (9,591) | | | (2,051) | |

| | | |

| | | |

| | | |

| Purchase of treasury stock | (188,593) | | | (112,502) | |

| | | |

| Purchase of noncontrolling interests | (737) | | | (1,577) | |

| | | |

| | | |

| Other, net | (1,953) | | | — | |

| Net cash used in financing activities | (199,619) | | | (104,932) | |

| Total cash provided (used) | 58,436 | | | (4,335) | |

| | | |

| | | |

| | | |

| | | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | (5,947) | | | 1,820 | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | 52,489 | | | (2,515) | |

| Cash, cash equivalents, and restricted cash at beginning of period | 862,440 | | | 572,516 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 914,929 | | | $ | 570,001 | |

Earnings Per Share

The following table sets forth the computation of the basic and diluted earnings per share attributable to Match Group shareholders:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Basic | | Diluted | | Basic | | Diluted |

| | | | | | | |

| (In thousands, except per share data) |

| Numerator | | | | | | | |

| Net earnings | $ | 123,234 | | | $ | 123,234 | | | $ | 120,691 | | | $ | 120,691 | |

| Net (earnings) loss attributable to noncontrolling interests | (36) | | | (36) | | | 118 | | | 118 | |

| Impact from subsidiaries’ dilutive securities | — | | | (8) | | | — | | | (30) | |

| Interest on dilutive Exchangeable Senior Notes, net of tax | — | | | 3,171 | | | — | | | 3,179 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net earnings attributable to Match Group, Inc. shareholders | $ | 123,198 | | | $ | 126,361 | | | $ | 120,809 | | | $ | 123,958 | |

| | | | | | | |

| Denominator | | | | | | | |

| Weighted average basic shares outstanding | 268,142 | | | 268,142 | | | 279,260 | | | 279,260 | |

| Dilutive securities | — | | | 4,672 | | | — | | | 3,993 | |

| Dilutive shares from Exchangeable Senior Notes, if-converted | — | | | 13,397 | | | — | | | 13,397 | |

| Denominator for earnings per share—weighted average shares | 268,142 | | | 286,211 | | | 279,260 | | | 296,650 | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Earnings per share attributable to Match Group, Inc. shareholders | $ | 0.46 | | | $ | 0.44 | | | $ | 0.43 | | | $ | 0.42 | |

Trended Metrics

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | 2022 | | 2023 | | 2024 | | | | | | | | | | | | | | Year Ended December 31, |

| | | | | | | | | | | | | | | | | | | | | | | | | | | Q1 | | Q2 | | Q3 | | Q4 | | Q1 | | Q2 | | Q3 | | Q4 | | Q1 | | | | | | | | | | | | | | | | | | | | 2022 | | 2023 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revenue (in millions, rounding differences may occur) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Direct Revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Americas | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 400.0 | | | $ | 408.7 | | | $ | 413.8 | | | $ | 406.6 | | | $ | 405.9 | | | $ | 429.9 | | | $ | 455.2 | | | $ | 453.5 | | | $ | 450.2 | | | | | | | | | | | | | | | | | | | | | $ | 1,629.1 | | | $ | 1,744.6 | |

| Europe | | | | | | | | | | | | | | | | | | | | | | | | | | | 215.3 | | | 208.5 | | | 214.8 | | | 210.3 | | | 212.5 | | | 227.7 | | | 252.0 | | | 241.2 | | | 239.4 | | | | | | | | | | | | | | | | | | | | | 848.9 | | | 933.4 | |

| APAC and Other | | | | | | | | | | | | | | | | | | | | | | | | | | | 168.5 | | | 163.0 | | | 166.6 | | | 154.2 | | | 156.0 | | | 158.5 | | | 159.6 | | | 156.1 | | | 155.7 | | | | | | | | | | | | | | | | | | | | | 652.3 | | | 630.1 | |

| Total Direct Revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | 783.8 | | | 780.2 | | | 795.1 | | | 771.1 | | | 774.4 | | | 816.1 | | | 866.8 | | | 850.8 | | | 845.3 | | | | | | | | | | | | | | | | | | | | | 3,130.2 | | | 3,308.1 | |

| Indirect Revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | 14.8 | | | 14.4 | | | 14.4 | | | 15.1 | | | 12.7 | | | 13.4 | | | 14.8 | | | 15.5 | | | 14.3 | | | | | | | | | | | | | | | | | | | | | 58.6 | | | 56.4 | |

| Total Revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 798.6 | | | $ | 794.5 | | | $ | 809.5 | | | $ | 786.2 | | | $ | 787.1 | | | $ | 829.6 | | | $ | 881.6 | | | $ | 866.2 | | | $ | 859.6 | | | | | | | | | | | | | | | | | | | | | $ | 3,188.8 | | | $ | 3,364.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Direct Revenue (in millions, rounding differences may occur) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tinder | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 441.0 | | | $ | 449.1 | | | $ | 460.2 | | | $ | 444.2 | | | $ | 441.1 | | | $ | 474.7 | | | $ | 508.5 | | | $ | 493.2 | | | $ | 481.5 | | | | | | | | | | | | | | | | | | | | | $ | 1,794.5 | | | $ | 1,917.6 | |

| Hinge | | | | | | | | | | | | | | | | | | | | | | | | | | | 65.0 | | | 67.1 | | | 74.4 | | | 77.2 | | | 82.8 | | | 90.3 | | | 107.3 | | | 116.1 | | | 123.8 | | | | | | | | | | | | | | | | | | | | | 283.7 | | | 396.5 | |

| MG Asia | | | | | | | | | | | | | | | | | | | | | | | | | | | 87.2 | | | 79.6 | | | 80.6 | | | 74.3 | | | 75.7 | | | 76.6 | | | 76.8 | | | 73.6 | | | 71.5 | | | | | | | | | | | | | | | | | | | | | 321.7 | | | 302.6 | |

| Evergreen & Emerging | | | | | | | | | | | | | | | | | | | | | | | | | | | 190.7 | | | 184.3 | | | 180.0 | | | 175.4 | | | 174.9 | | | 174.5 | | | 174.2 | | | 167.8 | | | 168.6 | | | | | | | | | | | | | | | | | | | | | 730.4 | | | 691.4 | |

| Total Direct Revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 783.8 | | | $ | 780.2 | | | $ | 795.1 | | | $ | 771.1 | | | $ | 774.4 | | | $ | 816.1 | | | $ | 866.8 | | | $ | 850.8 | | | $ | 845.3 | | | | | | | | | | | | | | | | | | | | | $ | 3,130.2 | | | $ | 3,308.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Payers (in thousands) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Americas | | | | | | | | | | | | | | | | | | | | | | | | | | | 8,159 | | | 8,225 | | | 8,233 | | | 8,059 | | | 7,989 | | | 7,717 | | | 7,494 | | | 7,117 | | | 6,869 | | | | | | | | | | | | | | | | | | | | | 8,169 | | | 7,579 | |

| Europe | | | | | | | | | | | | | | | | | | | | | | | | | | | 4,732 | | | 4,564 | | | 4,648 | | | 4,451 | | | 4,397 | | | 4,417 | | | 4,573 | | | 4,459 | | | 4,499 | | | | | | | | | | | | | | | | | | | | | 4,599 | | | 4,462 | |

| APAC and Other | | | | | | | | | | | | | | | | | | | | | | | | | | | 3,443 | | | 3,606 | | | 3,667 | | | 3,555 | | | 3,488 | | | 3,496 | | | 3,645 | | | 3,610 | | | 3,562 | | | | | | | | | | | | | | | | | | | | | 3,568 | | | 3,561 | |

| Total Payers | | | | | | | | | | | | | | | | | | | | | | | | | | | 16,334 | | | 16,395 | | | 16,548 | | | 16,065 | | | 15,874 | | | 15,630 | | | 15,712 | | | 15,186 | | | 14,930 | | | | | | | | | | | | | | | | | | | | | 16,336 | | | 15,602 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RPP | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Americas | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 16.34 | | | $ | 16.56 | | | $ | 16.75 | | | $ | 16.81 | | | $ | 16.94 | | | $ | 18.57 | | | $ | 20.25 | | | $ | 21.24 | | | $ | 21.85 | | | | | | | | | | | | | | | | | | | | | $ | 16.62 | | | $ | 19.18 | |

| Europe | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 15.17 | | | $ | 15.23 | | | $ | 15.40 | | | $ | 15.75 | | | $ | 16.11 | | | $ | 17.18 | | | $ | 18.37 | | | $ | 18.03 | | | $ | 17.73 | | | | | | | | | | | | | | | | | | | | | $ | 15.38 | | | $ | 17.43 | |

| APAC and Other | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 16.32 | | | $ | 15.06 | | | $ | 15.14 | | | $ | 14.46 | | | $ | 14.91 | | | $ | 15.11 | | | $ | 14.60 | | | $ | 14.41 | | | $ | 14.57 | | | | | | | | | | | | | | | | | | | | | $ | 15.24 | | | $ | 14.75 | |

| Total RPP | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 16.00 | | | $ | 15.86 | | | $ | 16.02 | | | $ | 16.00 | | | $ | 16.26 | | | $ | 17.41 | | | $ | 18.39 | | | $ | 18.67 | | | $ | 18.87 | | | | | | | | | | | | | | | | | | | | | $ | 15.97 | | | $ | 17.67 | |

Reconciliations of GAAP to Non-GAAP Measures

Reconciliation of Net Earnings to Adjusted Operating Income | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | | | 2024 | | 2023 |

| | | | | | | |

| | | | | (Dollars in thousands) |

| Net earnings attributable to Match Group, Inc. shareholders | | | | | $ | 123,198 | | | $ | 120,809 | |

| Add back: | | | | | | | |

| Net earnings (loss) attributable to noncontrolling interests | | | | | 36 | | | (118) | |

| | | | | | | |

| Income tax provision | | | | | 30,625 | | | 41,639 | |

| Other income, net | | | | | (9,474) | | | (3,392) | |

| Interest expense | | | | | 40,353 | | | 39,351 | |

| Operating income | | | | | 184,738 | | | 198,289 | |

| Stock-based compensation expense | | | | | 63,820 | | | 41,563 | |

| Depreciation | | | | | 20,521 | | | 10,552 | |

| Amortization of intangibles | | | | | 10,367 | | | 12,117 | |

| | | | | | | |

| Adjusted Operating Income | | | | | $ | 279,446 | | | $ | 262,521 | |

| | | | | | | |

| Revenue | | | | | $ | 859,647 | | | $ | 787,124 | |

| Operating income margin | | | | | 21 | % | | 25 | % |

| Adjusted Operating Income margin | | | | | 33 | % | | 33 | % |

Reconciliation of Net Earnings to Adjusted Operating Income used in Leverage Ratios | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Twelve months ended |

| | | | | | | | | | | | | 3/31/2024 |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | (In thousands) |

| Net earnings attributable to Match Group, Inc. shareholders | | | | | | | | | | | | | $ | 653,928 | |

| Add back: | | | | | | | | | | | | | |

| Net earnings attributable to noncontrolling interests | | | | | | | | | | | | | 87 | |

| | | | | | | | | | | | | |

| Income tax provision | | | | | | | | | | | | | 114,295 | |

| Other income, net | | | | | | | | | | | | | (25,854) | |

| Interest expense | | | | | | | | | | | | | 160,889 | |

| Operating income | | | | | | | | | | | | | 903,345 | |

| Stock-based compensation expense | | | | | | | | | | | | | 254,356 | |

| Depreciation | | | | | | | | | | | | | 71,776 | |

| Amortization of intangibles | | | | | | | | | | | | | 45,981 | |

| | | | | | | | | | | | | |

| Adjusted Operating Income | | | | | | | | | | | | | $ | 1,275,458 | |

Reconciliation of Operating Cash Flow to Free Cash Flow | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| | | |

| (In thousands) |

| Net cash provided by operating activities | $ | 284,103 | | | $ | 120,387 | |

| Capital expenditures | (17,234) | | | (19,843) | |

| Free Cash Flow | $ | 266,869 | | | $ | 100,544 | |

Reconciliation of Forecasted Operating Income to Adjusted Operating Income | | | | | | | |

| Three Months Ended June 30, 2024 |

| | | |

| | | |

| (In millions) |

| Operating income | $200 to $205 | | |

| Stock-based compensation expense | 70 | | |

| Depreciation and amortization of intangibles | 30 | | |

| Adjusted Operating Income | $300 to $305 | | |

Reconciliation of Forecasted Operating Cash Flow to Free Cash Flow | | | | | | | |

| Year Ended

December 31, 2024 |

| | | |

| | | |

| (In millions) |

| Net cash provided by operating activities | $1,105 to $1,165 | | |

| Capital expenditures | (55 to 65) | | |

| Free Cash Flow | $1,050 to $1,100 | | |

Reconciliation of GAAP Revenue to Non-GAAP Revenue, Excluding Foreign Exchange Effects

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended March 31, |

| | | | | | | | | | 2024 | | $ Change | | % Change | | 2023 |

| | | | | | | | | | | | | | | |

| | | | | | | | | | (Dollars in millions, rounding differences may occur) |

| Revenue, as reported | | | | | | | | | $ | 859.6 | | | $ | 72.5 | | | 9% | | $ | 787.1 | |

| Foreign exchange effects | | | | | | | | | 20.0 | | | | | | | |

| Revenue, excluding foreign exchange effects | | | | | | | | | $ | 879.7 | | | $ | 92.5 | | | 12% | | $ | 787.1 | |

| | | | | | | | | | | | | | | |

| Total Direct Revenue, as reported | | | | | | | | | $ | 845.3 | | | $ | 70.9 | | | 9% | | $ | 774.4 | |

| Foreign exchange effects | | | | | | | | | 19.9 | | | | | | | |

| Total Direct Revenue, excluding foreign exchange effects | | | | | | | | | $ | 865.2 | | | $ | 90.7 | | | 12% | | $ | 774.4 | |

| | | | | | | | | | | | | | | |

| Americas Direct Revenue, as reported | | | | | | | | | $ | 450.2 | | | $ | 44.3 | | | 11% | | $ | 405.9 | |

| Foreign exchange effects | | | | | | | | | 7.2 | | | | | | | |

| Americas Direct Revenue, excluding foreign exchange effects | | | | | | | | | $ | 457.5 | | | $ | 51.6 | | | 13% | | $ | 405.9 | |

| | | | | | | | | | | | | | | |

| Europe Direct Revenue, as reported | | | | | | | | | $ | 239.4 | | | $ | 26.8 | | | 13% | | $ | 212.5 | |

| Foreign exchange effects | | | | | | | | | (4.8) | | | | | | | |

| Europe Direct Revenue, excluding foreign exchange effects | | | | | | | | | $ | 234.5 | | | $ | 22.0 | | | 10% | | $ | 212.5 | |

| | | | | | | | | | | | | | | |

| APAC and Other Direct Revenue, as reported | | | | | | | | | $ | 155.7 | | | $ | (0.3) | | | —% | | $ | 156.0 | |

| Foreign exchange effects | | | | | | | | | 17.5 | | | | | | | |

| APAC and Other Direct Revenue, excluding foreign exchange effects | | | | | | | | | $ | 173.2 | | | $ | 17.2 | | | 11% | | $ | 156.0 | |

| | | | | | | | | | | | | | | |

| Tinder Direct Revenue, as reported | | | | | | | | | $ | 481.5 | | | $ | 40.3 | | | 9% | | $ | 441.1 | |

| Foreign exchange effects | | | | | | | | | 10.7 | | | | | | | |

| Tinder Direct Revenue, excluding foreign exchange effects | | | | | | | | | $ | 492.2 | | | $ | 51.1 | | | 12% | | $ | 441.1 | |

| | | | | | | | | | | | | | | |

| Hinge Direct Revenue, as reported | | | | | | | | | $ | 123.8 | | | $ | 41.0 | | | 50% | | $ | 82.8 | |

| Foreign exchange effects | | | | | | | | | (0.1) | | | | | | | |

| Hinge Direct Revenue, excluding foreign exchange effects | | | | | | | | | $ | 123.7 | | | $ | 40.9 | | | 49% | | $ | 82.8 | |

| | | | | | | | | | | | | | | |

| MG Asia Direct Revenue, as reported | | | | | | | | | $ | 71.5 | | | $ | (4.2) | | | (6)% | | $ | 75.7 | |

| Foreign exchange effects | | | | | | | | | 9.1 | | | | | | | |

| MG Asia Direct Revenue, excluding foreign exchange effects | | | | | | | | | $ | 80.6 | | | $ | 4.9 | | | 7% | | $ | 75.7 | |

| | | | | | | | | | | | | | | |

| E&E Direct Revenue, as reported | | | | | | | | | $ | 168.6 | | | $ | (6.3) | | | (4)% | | $ | 174.9 | |

| Foreign exchange effects | | | | | | | | | 0.1 | | | | | | | |

| E&E Direct Revenue, excluding foreign exchange effects | | | | | | | | | $ | 168.7 | | | $ | (6.2) | | | (4)% | | $ | 174.9 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Azar Direct Revenue, as reported | | | | | | | | | $ | 37.0 | | | $ | 1.6 | | | 4% | | $ | 35.5 | |

| Foreign exchange effects | | | | | | | | | 5.4 | | | | | | | |

| Azar Direct Revenue, excluding foreign exchange effects | | | | | | | | | $ | 42.4 | | | $ | 6.9 | | | 20% | | $ | 35.5 | |

Reconciliation of GAAP Revenue to Non-GAAP Revenue, Excluding Foreign Exchange Effects (Revenue Per Payer)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended March 31, |

| | | | | | | | | | 2024 | | $ Change | | % Change | | 2023 |

| | | | | | | | | | | | | | | |

| RPP, as reported | | | | | | | | | $ | 18.87 | | | $ | 2.61 | | | 16% | | $ | 16.26 | |

| Foreign exchange effects | | | | | | | | | 0.45 | | | | | | | |

| RPP, excluding foreign exchange effects | | | | | | | | | $ | 19.32 | | | $ | 3.06 | | | 19% | | $ | 16.26 | |

| | | | | | | | | | | | | | | |

| Americas RPP, as reported | | | | | | | | | $ | 21.85 | | | $ | 4.91 | | | 29% | | $ | 16.94 | |

| Foreign exchange effects | | | | | | | | | 0.35 | | | | | | | |

| Americas RPP, excluding foreign exchange effects | | | | | | | | | $ | 22.20 | | | $ | 5.26 | | | 31% | | $ | 16.94 | |

| | | | | | | | | | | | | | | |

| Europe RPP, as reported | | | | | | | | | $ | 17.73 | | | $ | 1.62 | | | 10% | | $ | 16.11 | |

| Foreign exchange effects | | | | | | | | | (0.35) | | | | | | | |

| Europe RPP, excluding foreign exchange effects | | | | | | | | | $ | 17.38 | | | $ | 1.27 | | | 8% | | $ | 16.11 | |

| | | | | | | | | | | | | | | |

| APAC and Other RPP, as reported | | | | | | | | | $ | 14.57 | | | $ | (0.34) | | | (2)% | | $ | 14.91 | |

| Foreign exchange effects | | | | | | | | | 1.64 | | | | | | | |

| APAC and Other RPP, excluding foreign exchange effects | | | | | | | | | $ | 16.21 | | | $ | 1.30 | | | 9% | | $ | 14.91 | |

Dilutive Securities

Match Group has various tranches of dilutive securities. The table below details these securities and their potentially dilutive impact (shares in millions; rounding differences may occur).

| | | | | | | | | | | | | | | | | | | |

| Average Exercise Price | | 5/3/2024 | | |

| Share Price | | | $31.93 | | | | | | | | |

| Absolute Shares | | | 265.7 | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Equity Awards | | | | | | | | | | | |

| Options | $17.93 | | 1.2 | | | | | | | | |

| RSUs and subsidiary denominated equity awards | | | 15.1 | | | | | | | | |

| Total Dilution - Equity Awards | | | 16.3 | | | | | | | | |

| Outstanding Warrants | | | | | | | | | | | |

| Warrants expiring on September 15, 2026 (6.6 million outstanding) | $134.76 | | — | | | | | | | | |

| Warrants expiring on April 15, 2030 (6.8 million outstanding) | $134.82 | | — | | | | | | | | |

| Total Dilution - Outstanding Warrants | | | — | | | | | | | | |

| | | | | | | | | | | |

| Total Dilution | | | 16.3 | | | | | | | | |

| % Dilution | | | 5.8% | | | | | | | | |

| Total Diluted Shares Outstanding | | | 282.0 | | | | | | | | |

______________________

The dilutive securities presentation above is calculated using the methods and assumptions described below; these are different from GAAP dilution, which is calculated based on the treasury stock method.

Options — The table above assumes the option exercise price is used to repurchase Match Group shares.

RSUs and subsidiary denominated equity awards — The table above assumes RSUs are fully dilutive. All performance-based and market-based awards reflect the expected shares that will vest based on current performance or market estimates. The table assumes no change in the fair value estimate of the subsidiary denominated equity awards from the values used for GAAP purposes at March 31, 2024.

Exchangeable Senior Notes — The Company has two series of Exchangeable Senior Notes outstanding. In the event of an exchange, each series of Exchangeable Senior Notes can be settled in cash, shares, or a combination of cash and shares. At the time of each Exchangeable Senior Notes issuance, the Company purchased call options with a strike price equal to the exchange price of each series of Exchangeable Senior Notes (“Note Hedge”), which can be used to offset the dilution of each series of the Exchangeable Senior Notes. No dilution is reflected in the table above for any of the Exchangeable Senior Notes because it is the Company’s intention to settle the Exchangeable Senior Notes with cash equal to the face amount of the notes; any shares issued would be offset by shares received upon exercise of the Note Hedge.

Warrants — At the time of the issuance of each series of Exchangeable Senior Notes, the Company also sold warrants for the number of shares with the strike prices reflected in the table above. The cash generated from the exercise of the warrants is assumed to be used to repurchase Match Group shares and the resulting net dilution, if any, is reflected in the table above.

Non-GAAP Financial Measures

Match Group reports Adjusted Operating Income, Adjusted Operating Income Margin, Free Cash Flow, and Revenue Excluding Foreign Exchange Effects, all of which are supplemental measures to U.S. generally accepted accounting principles (“GAAP”). The Adjusted Operating Income, Adjusted Operating Income Margin, and Free Cash Flow measures are among the primary metrics by which we evaluate the performance of our business, on which our internal budget is based and by which management is compensated. Revenue Excluding Foreign Exchange Effects provides a comparable framework for assessing the performance of our business without the effect of exchange rate differences when compared to prior periods. We believe that investors should have access to the same set of tools that we use in analyzing our results. These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP but should not be considered a substitute for or superior to GAAP results. Match Group endeavors to compensate for the limitations of the non-GAAP measures presented by providing the comparable GAAP measures and descriptions of the reconciling items, including quantifying such items, to derive the non-GAAP measures. We encourage investors to examine the reconciling adjustments between the GAAP and non-GAAP measures, which we describe below. Interim results are not necessarily indicative of the results that may be expected for a full year.

Definitions of Non-GAAP Measures

Adjusted Operating Income is defined as operating income excluding: (1) stock-based compensation expense; (2) depreciation; and (3) acquisition-related items consisting of (i) amortization of intangible assets and impairments of goodwill and intangible assets, if applicable, and (ii) gains and losses recognized on changes in the fair value of contingent consideration arrangements, as applicable. We believe Adjusted Operating Income is useful to analysts and investors as this measure allows a more meaningful comparison between our performance and that of our competitors. The above items are excluded from our Adjusted Operating Income measure because they are non-cash in nature. Adjusted Operating Income has certain limitations because it excludes certain expenses.

Adjusted Operating Income Margin is defined as Adjusted Operating Income divided by revenues. We believe Adjusted Operating Income Margin is useful for analysts and investors as this measure allows a more meaningful comparison between our performance and that of our competitors. Adjusted Operating Income margin has certain limitations in that it does not take into account the impact to our consolidated statement of operations of certain expenses.

Free Cash Flow is defined as net cash provided by operating activities, less capital expenditures. We believe Free Cash Flow is useful to investors because it represents the cash that our operating businesses generate, before taking into account non-operational cash movements. Free Cash Flow has certain limitations in that it does not represent the total increase or decrease in the cash balance for the period, nor does it represent the residual cash flow for discretionary expenditures. Therefore, we think it is important to evaluate Free Cash Flow along with our consolidated statement of cash flows.

We look at Free Cash Flow as a measure of the strength and performance of our businesses, not for valuation purposes. In our view, applying “multiples” to Free Cash Flow is inappropriate because it is subject to timing, seasonality and one-time events. We manage our business for cash, and we think it is of utmost importance to maximize cash – but our primary valuation metric is Adjusted Operating Income.

Revenue Excluding Foreign Exchange Effects is calculated by translating current period revenues using prior period exchange rates. The percentage change in Revenue Excluding Foreign Exchange Effects is calculated by determining the change in current period revenues over prior period revenues where current period revenues are translated using prior period exchange rates. We believe the impact of foreign exchange rates on Match Group, due to its global reach, may be an important factor in understanding period over period comparisons if movement in rates is significant. Since our results are reported in U.S. dollars, international revenues are favorably impacted as the U.S. dollar weakens relative to other currencies, and unfavorably impacted as the U.S. dollar strengthens relative to other currencies. We believe the presentation of revenue excluding foreign exchange effects in addition to reported revenue helps improve the ability to understand Match Group’s performance because it excludes the impact of foreign currency volatility that is not indicative of Match Group’s core operating results.

Non-Cash Expenses That Are Excluded From Our Non-GAAP Measures

Stock-based compensation expense consists principally of expense associated with the grants of stock options, RSUs, performance-based RSUs and market-based awards. These expenses are not paid in cash, and we include the related shares in our fully diluted shares outstanding using the treasury stock method; however, performance-based RSUs and market-based awards are included only to the extent the applicable performance or market condition(s) have been met (assuming the end of the reporting period is the end of the contingency period). To the extent stock-based awards are settled on a net basis, we remit the required tax-withholding amounts from our current funds.

Depreciation is a non-cash expense relating to our property and equipment and is computed using the straight-line method to allocate the cost of depreciable assets to operations over their estimated useful lives, or, in the case of leasehold improvements, the lease term, if shorter.

Amortization of intangible assets and impairments of goodwill and intangible assets are non-cash expenses related primarily to acquisitions. At the time of an acquisition, the identifiable definite-lived intangible assets of the acquired company, such as customer lists, trade names and technology, are valued and amortized over their estimated lives. Value is also assigned to (i) acquired indefinite-lived intangible assets, which consist of trade names and trademarks, and (ii) goodwill, which are not subject to amortization. An impairment is recorded when the carrying value of an intangible asset or goodwill exceeds its fair value. We believe that intangible assets represent costs incurred by the acquired company to build value prior to acquisition and the related amortization and impairment charges of intangible assets or goodwill, if applicable, are not ongoing costs of doing business.

Additional Definitions

Americas includes North America, Central America, South America, and the Caribbean islands.

Europe includes continental Europe, the British Isles, Iceland, Greenland, and Russia (ceased operations in June 2023), but excludes Turkey (which is included in APAC and Other).

APAC and Other includes Asia, Australia, the Pacific islands, the Middle East, and Africa.

Match Group Asia (“MG Asia”) consists of the brands primarily focused on Asia and the Middle East, including Pairs and Azar.

Evergreen & Emerging (“E&E”) consists primarily of the brands Match, Meetic, OkCupid, Plenty of Fish, and a number of demographically focused brands.

Direct Revenue is revenue that is received directly from end users of our services and includes both subscription and à la carte revenue.

Indirect Revenue is revenue that is not received directly from end users of our services, substantially all of which is advertising revenue.

Payers are unique users at a brand level in a given month from whom we earned Direct Revenue. When presented as a quarter-to-date or year-to-date value, Payers represents the average of the monthly values for the respective period presented. At a consolidated level, duplicate Payers may exist when we earn revenue from the same individual at multiple brands in a given month, as we are unable to identify unique individuals across brands in the Match Group portfolio.

Revenue Per Payer (“RPP”) is the average monthly revenue earned from a Payer and is Direct Revenue for a period divided by the Payers in the period, further divided by the number of months in the period.

Monthly Active User (“MAU”) is a unique registered user at a brand level who has visited the brand’s app or, if applicable, their website in the last 28 days as of the measurement date. At a consolidated level, duplicate users will exist within MAU when the same individual visits multiple brands in a given month.

Leverage on a gross basis is calculated as principal debt balance divided by Adjusted Operating Income for the period referenced.

Leverage on a net basis is calculated as principal debt balance less cash and cash equivalents and short-term investments divided by Adjusted Operating Income for the period referenced.

Other Information

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995

This letter and our conference call, which will be held at 8:30 a.m. Eastern Time on May 8, 2024, may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements that are not historical facts are “forward looking statements.” The use of words such as “anticipates,” “estimates,” “expects,” “plans” and “believes,” among others, generally identify forward-looking statements. These forward-looking statements include, among others, statements relating to: Match Group’s future financial performance, Match Group’s business prospects and strategy, anticipated trends, and other similar matters. These forward-looking statements are based on management’s current expectations and assumptions about future events, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Actual results could differ materially from those contained in these forward-looking statements for a variety of reasons, including, among others: our ability to maintain or grow the size of our user base, competition, the limited operating history of some of our brands, our ability to attract users to our services through cost-effective marketing and related efforts, our ability to distribute our services through third parties and offset related fees, risks relating to our use of artificial intelligence, foreign currency exchange rate fluctuations, the integrity and scalability of our systems and infrastructure (and those of third parties) and our ability to adapt ours to changes in a timely and cost-effective manner, our ability to protect our systems from cyberattacks and to protect personal and confidential user information, risks relating to certain of our international operations and acquisitions, damage to our brands' reputations as a result of inappropriate actions by users of our services, uncertainties related to the tax treatment of our separation from IAC, uncertainties related to the acquisition of Hyperconnect, including, among other things, the expected benefits of the transaction and the impact of the transaction on the businesses of Match Group, and macroeconomic conditions. Certain of these and other risks and uncertainties are discussed in Match Group’s filings with the Securities and Exchange Commission. Other unknown or unpredictable factors that could also adversely affect Match Group’s business, financial condition and results of operations may arise from time to time. In light of these risks and uncertainties, these forward-looking statements may not prove to be accurate. Accordingly, you should not place undue reliance on these forward-looking statements, which only reflect the views of Match Group management as of the date of this letter. Match Group does not undertake to update these forward-looking statements.

About Match Group

Match Group (NASDAQ: MTCH), through its portfolio companies, is a leading provider of digital technologies designed to help people make meaningful connections. Our global portfolio of brands includes Tinder®, Hinge®, Match®, Meetic®, OkCupid®, Pairs™, PlentyOfFish®, Azar®, BLK®, and more, each built to increase our users’ likelihood of connecting with others. Through our trusted brands, we provide tailored services to meet the varying preferences of our users. Our services are available in over 40 languages to our users all over the world.

Contact Us | | | | | |

Tanny Shelburne Match Group Investor Relations ir@match.com | Justine Sacco Match Group Corporate Communications matchgroupPR@match.com |

| |

Match Group 8750 North Central Expressway, Suite 1400, Dallas, TX 75231, (214) 576-9352 https://mtch.com |

1

1