| |

| SECURITIES AND EXCHANGE COMMISSION |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| |

| MANAGEMENT INVESTMENT COMPANIES |

| | |

| Investment Company Act file number: | (811-07121) |

| | |

| Exact name of registrant as specified in charter: | Putnam Asset Allocation Funds |

| | |

| Address of principal executive offices: | 100 Federal Street, Boston, Massachusetts 02110 |

| | |

| Name and address of agent for service: | Stephen Tate, Vice President |

| | |

| | Boston, Massachusetts 02110 |

| | |

| Copy to: | Bryan Chegwidden, Esq. |

| | |

| | 1211 Avenue of the Americas |

| | |

| | Boston, Massachusetts 02199 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | August 31, 2024 |

| | |

| Date of reporting period: | September 1, 2023 – August 31, 2024 |

| |

| Item 1. Report to Stockholders: |

| |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: |

| | |

Putnam Multi-Asset Income Fund | |

| Class A [PMIAX] |

| Annual Shareholder Report | August 31, 2024 |

|

This annual shareholder report contains important information about Putnam Multi-Asset Income Fund for the period September 1, 2023, to August 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 225-1581.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Class A | $89 | 0.83% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended August 31, 2024, Class A shares of Putnam Multi-Asset Income Fund returned 15.38%. The Fund compares its performance to the Putnam Multi-Asset Income Blended Benchmark, which returned 12.92% for the same period.

| |

Top contributors to performance: |

| Selection effects within these underlying funds: |

| ↑ | U.S. High Dividend Equity strategy |

| ↑ | Global Fixed Income strategy |

| ↑ | High Yield Fixed Income strategy |

There were no significant detractors to performance during the period.

| Putnam Multi-Asset Income Fund | PAGE 1 | 39362-ATSA-1024 |

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT ($9,600 AFTER MAXIMUM APPLICABLE SALES CHARGE) –

Class A 12/31/2019 — 8/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended August 31, 2024

| | |

| | 1 Year | Since Inception

(12/31/2019) |

Class A | 15.38 | 3.39 |

Class A (with sales charge) | 10.77 | 2.49 |

Bloomberg U.S. Aggregate Index | 7.30 | 0.03 |

Putnam Multi-Asset Income Blended Benchmark | 12.92 | 4.30 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

The Fund incepted on 12/31/2019 and began offering Class A shares on 2/10/2023. Returns for periods before 2/10/2023 are based on the Fund’s Class P performance, adjusted to take into account differences in class-specific operating expenses and maximum sales charges. For periods after the share class offering, performance for the specific share class is used, reflecting the applicable expenses and maximum sales charges.

The Fund changed its investment strategy as of July 12, 2022.

For current month-end performance, please call Franklin Templeton at (800) 225-1581 or visit https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of August 31, 2024)

| |

Total Net Assets | $228,496,840 |

Total Number of Portfolio Holdings* | 1,630 |

Total Management Fee Paid | $404,446 |

Portfolio Turnover Rate | 143% |

| * | Includes derivatives, if applicable. |

| Putnam Multi-Asset Income Fund | PAGE 2 | 39362-ATSA-1024 |

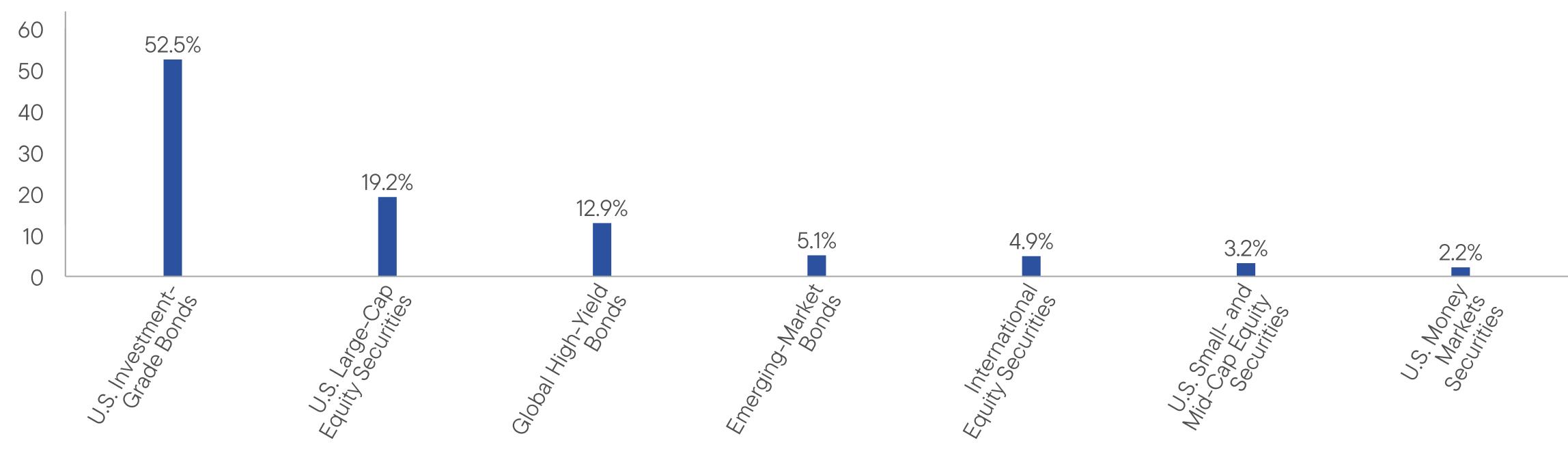

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

Portfolio Composition (% of Total Net Assets)

| U.S. Money Market Securities, if any, represent the market value weights of cash, short-term securities, and derivative notional offsets in the portfolio. Holdings and allocations may vary over time. |

HOW HAS THE FUND CHANGED?

On May 31, 2023, Franklin Resources, Inc. (“Franklin Resources”) and Great-West Lifeco Inc., the parent company of Putnam U.S. Holdings I, LLC (“Putnam Holdings”), announced that they had entered into a definitive agreement for a subsidiary of Franklin Resources to acquire Putnam Holdings in a stock and cash transaction (the “Transaction”). The Transaction was completed on January 1, 2024. As part of the Transaction, your Fund’s then-current investment advisor, Putnam Investment Management, LLC (“Putnam Management”), a wholly-owned subsidiary of Putnam Holdings, and your Fund’s sub-advisors, Putnam Investments Limited (“PIL”) and The Putnam Advisory Company, LLC (“PAC”), indirect, wholly-owned subsidiaries of Putnam Holdings, became indirect, wholly-owned subsidiaries of Franklin Resources. In connection with the Transaction, shareholders of your Fund approved a new management contract with Putnam Management and new sub-advisory contracts with PIL and PAC. The new contracts are identical to the previous contracts, except for the effective dates, initial terms, updates to fund names as necessary to reflect previous name changes, and certain non-substantive changes.

Effective July 15, 2024, Putnam Management transferred its management contract for your Fund to Franklin Advisers, Inc. (“Franklin Advisers”), and Franklin Advisers replaced Putnam Management as the investment advisor to your Fund. In connection with the transfer, your Fund’s portfolio managers, along with supporting research analysts and certain other investment staff of Putnam Management, also became employees of Franklin Advisers. Putnam Management also transferred to Franklin Advisers its sub-management agreement with PIL and sub-advisory agreement with PIL and PAC in respect of your Fund. Franklin Advisers is an indirect, wholly-owned subsidiary of Franklin Resources. In addition, effective July 15, 2024, Franklin Advisers retained Putnam Management as a sub-advisor to your Fund pursuant to a new sub-advisory agreement.

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund’s current prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by December 30, 2024, at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) 225-1581 or

funddocuments@putnam.com.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) 225-1581. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| Putnam Multi-Asset Income Fund | PAGE 3 | 39362-ATSA-1024 |

998010783941997221121810685106769447933410015106031154910284107781217152.519.212.95.14.93.22.2

| | |

Putnam Multi-Asset Income Fund | |

| Class C [PMICX] |

| Annual Shareholder Report | August 31, 2024 |

|

This annual shareholder report contains important information about Putnam Multi-Asset Income Fund for the period September 1, 2023, to August 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 225-1581.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Class C | $169 | 1.58% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended August 31, 2024, Class C shares of Putnam Multi-Asset Income Fund returned 14.50%. The Fund compares its performance to the Putnam Multi-Asset Income Blended Benchmark, which returned 12.92% for the same period.

| |

Top contributors to performance: |

| Selection effects within these underlying funds: |

| ↑ | U.S. High Dividend Equity strategy |

| ↑ | Global Fixed Income strategy |

| ↑ | High Yield Fixed Income strategy |

There were no significant detractors to performance during the period.

| Putnam Multi-Asset Income Fund | PAGE 1 | 39362-ATSC-1024 |

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – Class C 12/31/2019 — 8/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended August 31, 2024

| | |

| | 1 Year | Since Inception

(12/31/2019) |

Class C | 14.50 | 2.59 |

Class C (with sales charge) | 13.50 | 2.59 |

Bloomberg U.S. Aggregate Index | 7.30 | 0.03 |

Putnam Multi-Asset Income Blended Benchmark | 12.92 | 4.30 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

The Fund incepted on 12/31/2019 and began offering Class C shares on 2/10/2023. Returns for periods before 2/10/2023 are based on the Fund’s Class P performance, adjusted to take into account differences in class-specific operating expenses and maximum sales charges. For periods after the share class offering, performance for the specific share class is used, reflecting the applicable expenses and maximum sales charges.

The Fund changed its investment strategy as of July 12, 2022.

For current month-end performance, please call Franklin Templeton at (800) 225-1581 or visit https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of August 31, 2024)

| |

Total Net Assets | $228,496,840 |

Total Number of Portfolio Holdings* | 1,630 |

Total Management Fee Paid | $404,446 |

Portfolio Turnover Rate | 143% |

| * | Includes derivatives, if applicable. |

| Putnam Multi-Asset Income Fund | PAGE 2 | 39362-ATSC-1024 |

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

Portfolio Composition (% of Total Net Assets)

| U.S. Money Market Securities, if any, represent the market value weights of cash, short-term securities, and derivative notional offsets in the portfolio. Holdings and allocations may vary over time. |

HOW HAS THE FUND CHANGED?

On May 31, 2023, Franklin Resources, Inc. (“Franklin Resources”) and Great-West Lifeco Inc., the parent company of Putnam U.S. Holdings I, LLC (“Putnam Holdings”), announced that they had entered into a definitive agreement for a subsidiary of Franklin Resources to acquire Putnam Holdings in a stock and cash transaction (the “Transaction”). The Transaction was completed on January 1, 2024. As part of the Transaction, your Fund’s then-current investment advisor, Putnam Investment Management, LLC (“Putnam Management”), a wholly-owned subsidiary of Putnam Holdings, and your Fund’s sub-advisors, Putnam Investments Limited (“PIL”) and The Putnam Advisory Company, LLC (“PAC”), indirect, wholly-owned subsidiaries of Putnam Holdings, became indirect, wholly-owned subsidiaries of Franklin Resources. In connection with the Transaction, shareholders of your Fund approved a new management contract with Putnam Management and new sub-advisory contracts with PIL and PAC. The new contracts are identical to the previous contracts, except for the effective dates, initial terms, updates to fund names as necessary to reflect previous name changes, and certain non-substantive changes.

Effective July 15, 2024, Putnam Management transferred its management contract for your Fund to Franklin Advisers, Inc. (“Franklin Advisers”), and Franklin Advisers replaced Putnam Management as the investment advisor to your Fund. In connection with the transfer, your Fund’s portfolio managers, along with supporting research analysts and certain other investment staff of Putnam Management, also became employees of Franklin Advisers. Putnam Management also transferred to Franklin Advisers its sub-management agreement with PIL and sub-advisory agreement with PIL and PAC in respect of your Fund. Franklin Advisers is an indirect, wholly-owned subsidiary of Franklin Resources. In addition, effective July 15, 2024, Franklin Advisers retained Putnam Management as a sub-advisor to your Fund pursuant to a new sub-advisory agreement.

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund’s current prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by December 30, 2024, at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) 225-1581 or

funddocuments@putnam.com.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) 225-1581. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| Putnam Multi-Asset Income Fund | PAGE 3 | 39362-ATSC-1024 |

1034011090960698431127010685106769447933410015106031154910284107781217152.519.212.95.14.93.22.2

| | |

Putnam Multi-Asset Income Fund | |

Class Ptrue |

| Annual Shareholder Report | August 31, 2024 |

|

This annual shareholder report contains important information about Putnam Multi-Asset Income Fund for the period September 1, 2023, to August 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 225-1581.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Class P | $44 | 0.41% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended August 31, 2024, Class P shares of Putnam Multi-Asset Income Fund returned 15.85%. The Fund compares its performance to the Putnam Multi-Asset Income Blended Benchmark, which returned 12.92% for the same period.

| |

Top contributors to performance: |

| Selection effects within these underlying funds: |

| ↑ | U.S. High Dividend Equity strategy |

| ↑ | Global Fixed Income strategy |

| ↑ | High Yield Fixed Income strategy |

There were no significant detractors to performance during the period.

| Putnam Multi-Asset Income Fund | PAGE 1 | 39362-ATSP-1024 |

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – Class P 12/31/2019 — 8/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended August 31, 2024

| | |

| | 1 Year | Since Inception

(12/31/2019) |

Class P | 15.85 | 4.57 |

Bloomberg U.S. Aggregate Index | 7.30 | 0.03 |

Putnam Multi-Asset Income Blended Benchmark | 12.92 | 4.30 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

The Fund changed its investment strategy as of July 12, 2022.

For current month-end performance, please call Franklin Templeton at (800) 225-1581 or visit https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of August 31, 2024)

| |

Total Net Assets | $228,496,840 |

Total Number of Portfolio Holdings* | 1,630 |

Total Management Fee Paid | $404,446 |

Portfolio Turnover Rate | 143% |

| * | Includes derivatives, if applicable. |

| Putnam Multi-Asset Income Fund | PAGE 2 | 39362-ATSP-1024 |

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

Portfolio Composition (% of Total Net Assets)

| U.S. Money Market Securities, if any, represent the market value weights of cash, short-term securities, and derivative notional offsets in the portfolio. Holdings and allocations may vary over time. |

HOW HAS THE FUND CHANGED?

On May 31, 2023, Franklin Resources, Inc. (“Franklin Resources”) and Great-West Lifeco Inc., the parent company of Putnam U.S. Holdings I, LLC (“Putnam Holdings”), announced that they had entered into a definitive agreement for a subsidiary of Franklin Resources to acquire Putnam Holdings in a stock and cash transaction (the “Transaction”). The Transaction was completed on January 1, 2024. As part of the Transaction, your Fund’s then-current investment advisor, Putnam Investment Management, LLC (“Putnam Management”), a wholly-owned subsidiary of Putnam Holdings, and your Fund’s sub-advisors, Putnam Investments Limited (“PIL”) and The Putnam Advisory Company, LLC (“PAC”), indirect, wholly-owned subsidiaries of Putnam Holdings, became indirect, wholly-owned subsidiaries of Franklin Resources. In connection with the Transaction, shareholders of your Fund approved a new management contract with Putnam Management and new sub-advisory contracts with PIL and PAC. The new contracts are identical to the previous contracts, except for the effective dates, initial terms, updates to fund names as necessary to reflect previous name changes, and certain non-substantive changes.

Effective July 15, 2024, Putnam Management transferred its management contract for your Fund to Franklin Advisers, Inc. (“Franklin Advisers”), and Franklin Advisers replaced Putnam Management as the investment advisor to your Fund. In connection with the transfer, your Fund’s portfolio managers, along with supporting research analysts and certain other investment staff of Putnam Management, also became employees of Franklin Advisers. Putnam Management also transferred to Franklin Advisers its sub-management agreement with PIL and sub-advisory agreement with PIL and PAC in respect of your Fund. Franklin Advisers is an indirect, wholly-owned subsidiary of Franklin Resources. In addition, effective July 15, 2024, Franklin Advisers retained Putnam Management as a sub-advisor to your Fund pursuant to a new sub-advisory agreement.

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund’s current prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by December 30, 2024, at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) 225-1581 or

funddocuments@putnam.com.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) 225-1581. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| Putnam Multi-Asset Income Fund | PAGE 3 | 39362-ATSP-1024 |

104941151010201106321231710685106769447933410015106031154910284107781217152.519.212.95.14.93.22.2

| | |

Putnam Multi-Asset Income Fund | |

| Class R [PMIRX] |

| Annual Shareholder Report | August 31, 2024 |

|

This annual shareholder report contains important information about Putnam Multi-Asset Income Fund for the period September 1, 2023, to August 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 225-1581.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Class R | $116 | 1.08% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended August 31, 2024, Class R shares of Putnam Multi-Asset Income Fund returned 15.10%. The Fund compares its performance to the Putnam Multi-Asset Income Blended Benchmark, which returned 12.92% for the same period.

| |

Top contributors to performance: |

| Selection effects within these underlying funds: |

| ↑ | U.S. High Dividend Equity strategy |

| ↑ | Global Fixed Income strategy |

| ↑ | High Yield Fixed Income strategy |

There were no significant detractors to performance during the period.

| Putnam Multi-Asset Income Fund | PAGE 1 | 39362-ATSR-1024 |

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – Class R 12/31/2019 — 8/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended August 31, 2024

| | |

| | 1 Year | Since Inception

(12/31/2019) |

Class R | 15.10 | 3.13 |

Bloomberg U.S. Aggregate Index | 7.30 | 0.03 |

Putnam Multi-Asset Income Blended Benchmark | 12.92 | 4.30 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

The Fund incepted on 12/31/2019 and began offering Class R shares on 2/10/2023. Returns for periods before 2/10/2023 are based on the Fund’s Class P performance, adjusted to take into account differences in class-specific operating expenses and maximum sales charges. For periods after the share class offering, performance for the specific share class is used, reflecting the applicable expenses and maximum sales charges.

The Fund changed its investment strategy as of July 12, 2022.

For current month-end performance, please call Franklin Templeton at (800) 225-1581 or visit https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of August 31, 2024)

| |

Total Net Assets | $228,496,840 |

Total Number of Portfolio Holdings* | 1,630 |

Total Management Fee Paid | $404,446 |

Portfolio Turnover Rate | 143% |

| * | Includes derivatives, if applicable. |

| Putnam Multi-Asset Income Fund | PAGE 2 | 39362-ATSR-1024 |

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

Portfolio Composition (% of Total Net Assets)

| U.S. Money Market Securities, if any, represent the market value weights of cash, short-term securities, and derivative notional offsets in the portfolio. Holdings and allocations may vary over time. |

HOW HAS THE FUND CHANGED?

On May 31, 2023, Franklin Resources, Inc. (“Franklin Resources”) and Great-West Lifeco Inc., the parent company of Putnam U.S. Holdings I, LLC (“Putnam Holdings”), announced that they had entered into a definitive agreement for a subsidiary of Franklin Resources to acquire Putnam Holdings in a stock and cash transaction (the “Transaction”). The Transaction was completed on January 1, 2024. As part of the Transaction, your Fund’s then-current investment advisor, Putnam Investment Management, LLC (“Putnam Management”), a wholly-owned subsidiary of Putnam Holdings, and your Fund’s sub-advisors, Putnam Investments Limited (“PIL”) and The Putnam Advisory Company, LLC (“PAC”), indirect, wholly-owned subsidiaries of Putnam Holdings, became indirect, wholly-owned subsidiaries of Franklin Resources. In connection with the Transaction, shareholders of your Fund approved a new management contract with Putnam Management and new sub-advisory contracts with PIL and PAC. The new contracts are identical to the previous contracts, except for the effective dates, initial terms, updates to fund names as necessary to reflect previous name changes, and certain non-substantive changes.

Effective July 15, 2024, Putnam Management transferred its management contract for your Fund to Franklin Advisers, Inc. (“Franklin Advisers”), and Franklin Advisers replaced Putnam Management as the investment advisor to your Fund. In connection with the transfer, your Fund’s portfolio managers, along with supporting research analysts and certain other investment staff of Putnam Management, also became employees of Franklin Advisers. Putnam Management also transferred to Franklin Advisers its sub-management agreement with PIL and sub-advisory agreement with PIL and PAC in respect of your Fund. Franklin Advisers is an indirect, wholly-owned subsidiary of Franklin Resources. In addition, effective July 15, 2024, Franklin Advisers retained Putnam Management as a sub-advisor to your Fund pursuant to a new sub-advisory agreement.

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund’s current prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by December 30, 2024, at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) 225-1581 or

funddocuments@putnam.com.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) 225-1581. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| Putnam Multi-Asset Income Fund | PAGE 3 | 39362-ATSR-1024 |

10374111849745100341154910685106769447933410015106031154910284107781217152.519.212.95.14.93.22.2

| | |

Putnam Multi-Asset Income Fund | |

| Class R5 [PMILX] |

| Annual Shareholder Report | August 31, 2024 |

|

This annual shareholder report contains important information about Putnam Multi-Asset Income Fund for the period September 1, 2023, to August 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 225-1581.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Class R5 | $59 | 0.55% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended August 31, 2024, Class R5 shares of Putnam Multi-Asset Income Fund returned 15.68%. The Fund compares its performance to the Putnam Multi-Asset Income Blended Benchmark, which returned 12.92% for the same period.

| |

Top contributors to performance: |

| Selection effects within these underlying funds: |

| ↑ | U.S. High Dividend Equity strategy |

| ↑ | Global Fixed Income strategy |

| ↑ | High Yield Fixed Income strategy |

There were no significant detractors to performance during the period.

| Putnam Multi-Asset Income Fund | PAGE 1 | 39362-ATSR5-1024 |

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – Class R5 12/31/2019 — 8/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended August 31, 2024

| | |

| | 1 Year | Since Inception

(12/31/2019) |

Class R5 | 15.68 | 3.66 |

Bloomberg U.S. Aggregate Index | 7.30 | 0.03 |

Putnam Multi-Asset Income Blended Benchmark | 12.92 | 4.30 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

The Fund incepted on 12/31/2019 and began offering Class R5 shares on 2/10/2023. Returns for periods before 2/10/2023 are based on the Fund’s Class P performance, adjusted to take into account differences in class-specific operating expenses and maximum sales charges. For periods after the share class offering, performance for the specific share class is used, reflecting the applicable expenses and maximum sales charges.

The Fund changed its investment strategy as of July 12, 2022.

For current month-end performance, please call Franklin Templeton at (800) 225-1581 or visit https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of August 31, 2024)

| |

Total Net Assets | $228,496,840 |

Total Number of Portfolio Holdings* | 1,630 |

Total Management Fee Paid | $404,446 |

Portfolio Turnover Rate | 143% |

| * | Includes derivatives, if applicable. |

| Putnam Multi-Asset Income Fund | PAGE 2 | 39362-ATSR5-1024 |

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

Portfolio Composition (% of Total Net Assets)

| U.S. Money Market Securities, if any, represent the market value weights of cash, short-term securities, and derivative notional offsets in the portfolio. Holdings and allocations may vary over time. |

HOW HAS THE FUND CHANGED?

On May 31, 2023, Franklin Resources, Inc. (“Franklin Resources”) and Great-West Lifeco Inc., the parent company of Putnam U.S. Holdings I, LLC (“Putnam Holdings”), announced that they had entered into a definitive agreement for a subsidiary of Franklin Resources to acquire Putnam Holdings in a stock and cash transaction (the “Transaction”). The Transaction was completed on January 1, 2024. As part of the Transaction, your Fund’s then-current investment advisor, Putnam Investment Management, LLC (“Putnam Management”), a wholly-owned subsidiary of Putnam Holdings, and your Fund’s sub-advisors, Putnam Investments Limited (“PIL”) and The Putnam Advisory Company, LLC (“PAC”), indirect, wholly-owned subsidiaries of Putnam Holdings, became indirect, wholly-owned subsidiaries of Franklin Resources. In connection with the Transaction, shareholders of your Fund approved a new management contract with Putnam Management and new sub-advisory contracts with PIL and PAC. The new contracts are identical to the previous contracts, except for the effective dates, initial terms, updates to fund names as necessary to reflect previous name changes, and certain non-substantive changes.

Effective July 15, 2024, Putnam Management transferred its management contract for your Fund to Franklin Advisers, Inc. (“Franklin Advisers”), and Franklin Advisers replaced Putnam Management as the investment advisor to your Fund. In connection with the transfer, your Fund’s portfolio managers, along with supporting research analysts and certain other investment staff of Putnam Management, also became employees of Franklin Advisers. Putnam Management also transferred to Franklin Advisers its sub-management agreement with PIL and sub-advisory agreement with PIL and PAC in respect of your Fund. Franklin Advisers is an indirect, wholly-owned subsidiary of Franklin Resources. In addition, effective July 15, 2024, Franklin Advisers retained Putnam Management as a sub-advisor to your Fund pursuant to a new sub-advisory agreement.

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund’s current prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by December 30, 2024, at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) 225-1581 or

funddocuments@putnam.com.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) 225-1581. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| Putnam Multi-Asset Income Fund | PAGE 3 | 39362-ATSR5-1024 |

10408112709869102221182410685106769447933410015106031154910284107781217152.519.212.95.14.93.22.2

| | |

Putnam Multi-Asset Income Fund | |

| Class R6 [PMIVX] |

| Annual Shareholder Report | August 31, 2024 |

|

This annual shareholder report contains important information about Putnam Multi-Asset Income Fund for the period September 1, 2023, to August 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 225-1581.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Class R6 | $49 | 0.45% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended August 31, 2024, Class R6 shares of Putnam Multi-Asset Income Fund returned 15.81%. The Fund compares its performance to the Putnam Multi-Asset Income Blended Benchmark, which returned 12.92% for the same period.

| |

Top contributors to performance: |

| Selection effects within these underlying funds: |

| ↑ | U.S. High Dividend Equity strategy |

| ↑ | Global Fixed Income strategy |

| ↑ | High Yield Fixed Income strategy |

There were no significant detractors to performance during the period.

| Putnam Multi-Asset Income Fund | PAGE 1 | 39362-ATSR6-1024 |

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – Class R6 12/31/2019 — 8/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended August 31, 2024

| | |

| | 1 Year | Since Inception

(12/31/2019) |

Class R6 | 15.81 | 3.74 |

Bloomberg U.S. Aggregate Index | 7.30 | 0.03 |

Putnam Multi-Asset Income Blended Benchmark | 12.92 | 4.30 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

The Fund incepted on 12/31/2019 and began offering Class R6 shares on 2/10/2023. Returns for periods before 2/10/2023 are based on the Fund’s Class P performance, adjusted to take into account differences in class-specific operating expenses and maximum sales charges. For periods after the share class offering, performance for the specific share class is used, reflecting the applicable expenses and maximum sales charges.

The Fund changed its investment strategy as of July 12, 2022.

For current month-end performance, please call Franklin Templeton at (800) 225-1581 or visit https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of August 31, 2024)

| |

Total Net Assets | $228,496,840 |

Total Number of Portfolio Holdings* | 1,630 |

Total Management Fee Paid | $404,446 |

Portfolio Turnover Rate | 143% |

| * | Includes derivatives, if applicable. |

| Putnam Multi-Asset Income Fund | PAGE 2 | 39362-ATSR6-1024 |

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

Portfolio Composition (% of Total Net Assets)

| U.S. Money Market Securities, if any, represent the market value weights of cash, short-term securities, and derivative notional offsets in the portfolio. Holdings and allocations may vary over time. |

HOW HAS THE FUND CHANGED?

On May 31, 2023, Franklin Resources, Inc. (“Franklin Resources”) and Great-West Lifeco Inc., the parent company of Putnam U.S. Holdings I, LLC (“Putnam Holdings”), announced that they had entered into a definitive agreement for a subsidiary of Franklin Resources to acquire Putnam Holdings in a stock and cash transaction (the “Transaction”). The Transaction was completed on January 1, 2024. As part of the Transaction, your Fund’s then-current investment advisor, Putnam Investment Management, LLC (“Putnam Management”), a wholly-owned subsidiary of Putnam Holdings, and your Fund’s sub-advisors, Putnam Investments Limited (“PIL”) and The Putnam Advisory Company, LLC (“PAC”), indirect, wholly-owned subsidiaries of Putnam Holdings, became indirect, wholly-owned subsidiaries of Franklin Resources. In connection with the Transaction, shareholders of your Fund approved a new management contract with Putnam Management and new sub-advisory contracts with PIL and PAC. The new contracts are identical to the previous contracts, except for the effective dates, initial terms, updates to fund names as necessary to reflect previous name changes, and certain non-substantive changes.

Effective July 15, 2024, Putnam Management transferred its management contract for your Fund to Franklin Advisers, Inc. (“Franklin Advisers”), and Franklin Advisers replaced Putnam Management as the investment advisor to your Fund. In connection with the transfer, your Fund’s portfolio managers, along with supporting research analysts and certain other investment staff of Putnam Management, also became employees of Franklin Advisers. Putnam Management also transferred to Franklin Advisers its sub-management agreement with PIL and sub-advisory agreement with PIL and PAC in respect of your Fund. Franklin Advisers is an indirect, wholly-owned subsidiary of Franklin Resources. In addition, effective July 15, 2024, Franklin Advisers retained Putnam Management as a sub-advisor to your Fund pursuant to a new sub-advisory agreement.

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund’s current prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by December 30, 2024, at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) 225-1581 or

funddocuments@putnam.com.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) 225-1581. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| Putnam Multi-Asset Income Fund | PAGE 3 | 39362-ATSR6-1024 |

10409112939898102481186810685106769447933410015106031154910284107781217152.519.212.95.14.93.22.2

| | |

Putnam Multi-Asset Income Fund | |

| Class Y [PMIYX] |

| Annual Shareholder Report | August 31, 2024 |

|

This annual shareholder report contains important information about Putnam Multi-Asset Income Fund for the period September 1, 2023, to August 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 225-1581.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Class Y | $63 | 0.58% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended August 31, 2024, Class Y shares of Putnam Multi-Asset Income Fund returned 15.66%. The Fund compares its performance to the Putnam Multi-Asset Income Blended Benchmark, which returned 12.92% for the same period.

| |

Top contributors to performance: |

| Selection effects within these underlying funds: |

| ↑ | U.S. High Dividend Equity strategy |

| ↑ | Global Fixed Income strategy |

| ↑ | High Yield Fixed Income strategy |

There were no significant detractors to performance during the period.

| Putnam Multi-Asset Income Fund | PAGE 1 | 39362-ATSY-1024 |

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – Class Y 12/31/2019 — 8/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended August 31, 2024

| | |

| | 1 Year | Since Inception

(12/31/2019) |

Class Y | 15.66 | 3.65 |

Bloomberg U.S. Aggregate Index | 7.30 | 0.03 |

Putnam Multi-Asset Income Blended Benchmark | 12.92 | 4.30 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

The Fund incepted on 12/31/2019 and began offering Class Y shares on 2/10/2023. Returns for periods before 2/10/2023 are based on the Fund’s Class P performance, adjusted to take into account differences in class-specific operating expenses and maximum sales charges. For periods after the share class offering, performance for the specific share class is used, reflecting the applicable expenses and maximum sales charges.

The Fund changed its investment strategy as of July 12, 2022.

For current month-end performance, please call Franklin Templeton at (800) 225-1581 or visit https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of August 31, 2024)

| |

Total Net Assets | $228,496,840 |

Total Number of Portfolio Holdings* | 1,630 |

Total Management Fee Paid | $404,446 |

Portfolio Turnover Rate | 143% |

| * | Includes derivatives, if applicable. |

| Putnam Multi-Asset Income Fund | PAGE 2 | 39362-ATSY-1024 |

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

Portfolio Composition (% of Total Net Assets)

| U.S. Money Market Securities, if any, represent the market value weights of cash, short-term securities, and derivative notional offsets in the portfolio. Holdings and allocations may vary over time. |

HOW HAS THE FUND CHANGED?

On May 31, 2023, Franklin Resources, Inc. (“Franklin Resources”) and Great-West Lifeco Inc., the parent company of Putnam U.S. Holdings I, LLC (“Putnam Holdings”), announced that they had entered into a definitive agreement for a subsidiary of Franklin Resources to acquire Putnam Holdings in a stock and cash transaction (the “Transaction”). The Transaction was completed on January 1, 2024. As part of the Transaction, your Fund’s then-current investment advisor, Putnam Investment Management, LLC (“Putnam Management”), a wholly-owned subsidiary of Putnam Holdings, and your Fund’s sub-advisors, Putnam Investments Limited (“PIL”) and The Putnam Advisory Company, LLC (“PAC”), indirect, wholly-owned subsidiaries of Putnam Holdings, became indirect, wholly-owned subsidiaries of Franklin Resources. In connection with the Transaction, shareholders of your Fund approved a new management contract with Putnam Management and new sub-advisory contracts with PIL and PAC. The new contracts are identical to the previous contracts, except for the effective dates, initial terms, updates to fund names as necessary to reflect previous name changes, and certain non-substantive changes.

Effective July 15, 2024, Putnam Management transferred its management contract for your Fund to Franklin Advisers, Inc. (“Franklin Advisers”), and Franklin Advisers replaced Putnam Management as the investment advisor to your Fund. In connection with the transfer, your Fund’s portfolio managers, along with supporting research analysts and certain other investment staff of Putnam Management, also became employees of Franklin Advisers. Putnam Management also transferred to Franklin Advisers its sub-management agreement with PIL and sub-advisory agreement with PIL and PAC in respect of your Fund. Franklin Advisers is an indirect, wholly-owned subsidiary of Franklin Resources. In addition, effective July 15, 2024, Franklin Advisers retained Putnam Management as a sub-advisor to your Fund pursuant to a new sub-advisory agreement.

This is a summary of certain changes to the Fund since September 1, 2023. For more complete information, you may review the Fund’s current prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by December 30, 2024, at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) 225-1581 or

funddocuments@putnam.com.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) 225-1581. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| Putnam Multi-Asset Income Fund | PAGE 3 | 39362-ATSY-1024 |

10409112819879102201182110685106769447933410015106031154910284107781217152.519.212.95.14.93.22.2

| |

| (a) The fund’s principal executive, financial and accounting officers are employees of Putnam Investment Management, LLC, the Fund’s investment manager, or Franklin Templeton. As such they are subject to a comprehensive Code of Ethics adopted and administered by Putnam Investment Management, LLC and Franklin Templeton which is designed to protect the interests of the firm and its clients. The Fund has adopted a Code of Ethics which incorporates the Code of Ethics of Franklin Templeton with respect to all of its officers and Trustees who are employees of Putnam Investment Management, LLC and Franklin Templeton. For this reason, the Fund has not adopted a separate code of ethics governing its principal executive, financial and accounting officers. |

| |

| (c) In connection with the acquisition of Putnam Investments by Franklin Templeton, the Putnam Investments Code of Ethics was amended effective January 1, 2024 to reflect revised compliance processes, including: (i) Compliance with the Putnam Investments Code of Ethics will be viewed as compliance with the Franklin Templeton Code for certain Putnam employees who are dual-hatted in Franklin Templeton advisory entities (ii) Certain Franklin Templeton employees are required to hold shares of Putnam mutual funds at Putnam Investor Services, Inc. and (iii) Certain provisions of the Putnam Investments Code of Ethics are amended that are no longer needed due to organizational changes. Effective March 4, 2024, the majority of legacy Putnam employees transitioned to Franklin Templeton policies outlined in the Franklin Templeton Code. |

| |

| Item 3. Audit Committee Financial Expert: |

| |

| The Funds’ Audit, Compliance and Risk Committee is comprised solely of Trustees who are “independent” (as such term has been defined by the Securities and Exchange Commission (“SEC”) in regulations implementing Section 407 of the Sarbanes-Oxley Act (the “Regulations”)). The Trustees believe that each member of the Audit, Compliance and Risk Committee also possesses a combination of knowledge and experience with respect to financial accounting matters, as well as other attributes, that qualifies him or her for service on the Committee. In addition, the Trustees have determined that each of Mr. McGreevey and Mr. Singh qualifies as an “audit committee financial expert” (as such term has been defined by the Regulations) based on their review of his or her pertinent experience and education.The SEC has stated, and the funds’ amended and restated agreement and Declaration of Trust provides, that the designation or identification of a person as an audit committee financial expert pursuant to this Item 3 of Form N-CSR does not impose on such person any duties, obligations or liability that are greater than the duties, obligations and liability imposed on such person as a member of the Audit, Compliance and Risk Committee and the Board of Trustees in the absence of such designation or identification. |

| |

| Item 4. Principal Accountant Fees and Services: |

| |

| The following table presents fees billed in each of the last two fiscal years for services rendered to the fund by the fund’s independent auditor: |

Fiscal year ended | Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees |

August 31, 2024 | $129,926 | $ — | $19,395 | $ — |

August 31, 2023 | $139,083 | $19,500* | $15,913 | $ — |

| |

| * Fees billed to the fund for services relating to a fund merger. |

| |

| For the fiscal years ended August 31, 2024 and August 31, 2023, the fund’s independent auditor billed aggregate non-audit fees in the amounts of $1,050,192 and $277,156 respectively, to the fund, Putnam Management and any entity controlling, controlled by or under common control with Putnam Management that provides ongoing services to the fund. |

| |

| Audit Fees represent fees billed for the fund’s last two fiscal years relating to the audit and review of the financial statements included in annual reports and registration statements, and other services that are normally provided in connection with statutory and regulatory filings or engagements. |

| |

| Audit-Related Fees represent fees billed in the fund’s last two fiscal years for services traditionally performed by the fund’s auditor, including accounting consultation for proposed transactions or concerning financial accounting and reporting standards and other audit or attest services not required by statute or regulation. |

| |

| Tax Fees represent fees billed in the fund’s last two fiscal years for tax compliance, tax planning and tax advice services. Tax planning and tax advice services include assistance with tax audits, employee benefit plans and requests for rulings or technical advice from taxing authorities. |

| |

| Pre-Approval Policies of the Audit, Compliance and Risk Committee. The Audit, Compliance and Risk Committee of the Putnam funds has determined that, as a matter of policy, all work performed for the funds by the funds’ independent auditors will be pre-approved by the Committee itself and thus will generally not be subject to pre-approval procedures. |

| |

| The Audit, Compliance and Risk Committee also has adopted a policy to pre-approve the engagement by Putnam Management and certain of its affiliates of the funds’ independent auditors, even in circumstances where pre-approval is not required by applicable law. Any such requests by Putnam Management or certain of its affiliates are typically submitted in writing to the Committee and explain, among other things, the nature of the proposed engagement, the estimated fees, and why this work should be performed by that particular audit firm as opposed to another one. In reviewing such requests, the Committee considers, among other things, whether the provision of such services by the audit firm are compatible with the independence of the audit firm. |

| |

| The following table presents fees billed by the fund’s independent auditor for services required to be approved pursuant to paragraph (c)(7)(ii) of Rule 2–01 of Regulation S-X. |

Fiscal year ended | Audit-Related Fees | Tax Fees | All Other Fees | Total Non-Audit Fees |

August 31, 2024 | $ — | $861,963 | $168,834 | $1,030,797 |

August 31, 2023 | $ — | $241,743 | $ — | $241,743 |

| |

| Item 5. Audit Committee of Listed Registrants |

| |

| The registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements and Other Important Information in Item 7 below. |

| |

| Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies. |

Putnam

Multi-Asset Income

Fund

Financial Statements and Other Important Information

Annual | August 31, 2024

Table of Contents

| | Financial Statements and Other Important Information—Annual | franklintempleton.com |

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Putnam Asset Allocation Funds and Shareholders of Putnam Multi-Asset Income Fund:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the fund’s portfolio, of Putnam Multi-Asset Income Fund (one of the funds constituting Putnam Asset Allocation Funds, referred to hereafter as the “Fund”) as of August 31, 2024, the related statement of operations for the year ended August 31, 2024, the statement of changes in net assets for each of the two years in the period ended August 31, 2024, including the related notes, and the financial highlights for each of the periods indicated therein (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of August 31, 2024, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended August 31, 2024 and the financial highlights for each of the periods indicated therein in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of August 31, 2024 by correspondence with the custodian, transfer agent, agent banks and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

October 16, 2024

We have served as the auditor of one or more investment companies in the Putnam Funds family of funds since at least 1957. We have not been able to determine the specific year we began serving as auditor.

| The fund’s portfolio 8/31/24 |

| | COMMON STOCKS (27.8%)* | Shares | Value |

| | Basic materials (1.0%) | | |

| | AdvanSix, Inc. | 234 | $6,917 |

| | American Woodmark Corp. † | 159 | 14,248 |

| | Andersons, Inc. (The) | 269 | 13,711 |

| | Archer-Daniels-Midland Co. | 796 | 48,548 |

| | Arcosa, Inc. | 43 | 3,934 |

| | Atkore, Inc. | 157 | 14,653 |

| | Avient Corp. | 93 | 4,569 |

| | BASF SE (Germany) | 1,857 | 94,389 |

| | Beacon Roofing Supply, Inc. † | 46 | 4,168 |

| | BHP Group, Ltd. (ASE Exchange) (Australia) | 6,533 | 179,877 |

| | BHP Group, Ltd. (London Exchange) (Australia) | 376 | 10,323 |

| | Boise Cascade Co. | 179 | 24,276 |

| | CF Industries Holdings, Inc. | 567 | 47,112 |

| | Cie de Saint-Gobain SA (France) | 996 | 87,036 |

| | Clearwater Paper Corp. † | 106 | 3,527 |

| | Commercial Metals Co. | 77 | 4,126 |

| | Constellium SE (France) † | 1,252 | 20,996 |

| | Dole PLC (Ireland) | 864 | 13,919 |

| | Dow, Inc. | 5,948 | 318,694 |

| | DuPont de Nemours, Inc. | 595 | 50,129 |

| | Eastman Chemical Co. | 506 | 51,799 |

| | Fortescue, Ltd. (Australia) | 7,091 | 87,357 |

| | Fresh Del Monte Produce, Inc. | 313 | 9,152 |

| | Frontdoor, Inc. † | 502 | 24,136 |

| | Gibraltar Industries, Inc. † | 58 | 4,041 |

| | Holcim AG (Switzerland) | 1,116 | 108,110 |

| | Ingevity Corp. † | 261 | 10,317 |

| | Innospec, Inc. | 128 | 14,753 |

| | Janus International Group, Inc. † | 185 | 2,033 |

| | Kaiser Aluminum Corp. | 52 | 3,877 |

| | LightWave Logic, Inc. † | 684 | 2,018 |

| | Limbach Holdings, Inc. † | 91 | 5,881 |

| | LSB Industries, Inc. † | 498 | 3,949 |

| | LyondellBasell Industries NV Class A | 3,654 | 360,650 |

| | Minerals Technologies, Inc. | 294 | 22,667 |

| | Mosaic Co. (The) | 1,812 | 51,769 |

| | Mueller Industries, Inc. | 89 | 6,471 |

| | OCI NV (Netherlands) | 1,723 | 54,680 |

| | Orion SA (Luxembourg) (Luxembourg) | 256 | 4,774 |

| | PPG Industries, Inc. | 383 | 49,687 |

| | Proto Labs, Inc. † | 129 | 3,945 |

| | Rio Tinto PLC (United Kingdom) | 2,168 | 136,687 |

| | Rio Tinto, Ltd. (Australia) | 158 | 11,829 |

| | Shin-Etsu Chemical Co., Ltd. (Japan) | 3,000 | 132,805 |

| | Sterling Construction Co., Inc. † | 201 | 24,026 |

| | Sylvamo Corp. | 292 | 23,094 |

| | Tronox Holdings PLC | 299 | 4,165 |

| | Tutor Perini Corp. † | 399 | 9,564 |

| | UFP Industries, Inc. | 247 | 30,052 |

| | Weyerhaeuser Co. R | 1,561 | 47,595 |

| | Worthington Steel, Inc. | 112 | 3,965 |

| | | | 2,271,000 |

| | Capital goods (0.9%) | | |

| | ABB, Ltd. (Switzerland) | 1,535 | 88,273 |

| | Adient PLC † | 457 | 10,337 |

| | Airtac International Group (Taiwan) | 2,000 | 54,097 |

| | Alamo Group, Inc. | 23 | 4,264 |

| | Albany International Corp. Class A | 48 | 4,520 |

| | Allison Transmission Holdings, Inc. | 551 | 51,105 |

| | | | |

| | COMMON STOCKS (27.8%)* cont. | Shares | Value |

| | Capital goods cont. | | |

| | American Axle & Manufacturing Holdings, Inc. † | 2,373 | $15,258 |

| | Applied Industrial Technologies, Inc. | 104 | 21,332 |

| | Argan, Inc. | 77 | 6,107 |

| | Belden, Inc. | 258 | 27,678 |

| | Caterpillar, Inc. | 148 | 52,703 |

| | Columbus McKinnon Corp./NY | 109 | 3,729 |

| | Cummins, Inc. | 163 | 50,995 |

| | Eaton Corp. PLC | 167 | 51,257 |

| | Enviri Corp. † | 478 | 5,712 |

| | Federal Signal Corp. | 44 | 4,158 |

| | Franklin Electric Co., Inc. | 46 | 4,778 |

| | GEA Group AG (Germany) | 342 | 16,090 |

| | Gentherm, Inc. † | 80 | 4,043 |

| | Hitachi, Ltd. (Japan) | 5,500 | 135,685 |

| | Honeywell International, Inc. | 240 | 49,898 |

| | Hyster-Yale, Inc. | 125 | 7,870 |

| | Interface, Inc. | 341 | 6,438 |

| | Komatsu, Ltd. (Japan) | 3,400 | 95,140 |

| | Kone Oyj Class B (Finland) | 1,172 | 63,216 |

| | Lockheed Martin Corp. | 630 | 357,903 |

| | Luminar Technologies, Inc. † | 3,994 | 4,074 |

| | Mitsubishi Electric Corp. (Japan) | 600 | 10,108 |

| | Moog, Inc. Class A | 21 | 4,145 |

| | Mueller Water Products, Inc. Class A | 206 | 4,423 |

| | NuScale Power Corp. † | 379 | 3,119 |

| | O-I Glass, Inc. † | 328 | 4,162 |

| | Obayashi Corp. (Japan) | 1,600 | 20,576 |

| | Powell Industries, Inc. | 114 | 19,088 |

| | Ryerson Holding Corp. | 392 | 7,848 |

| | Sandvik AB (Sweden) | 778 | 16,574 |

| | Shyft Group, Inc. (The) | 344 | 4,881 |

| | Steelcase, Inc. Class A | 148 | 2,093 |

| | Stoneridge, Inc. † | 171 | 2,452 |

| | Tennant Co. | 41 | 4,004 |

| | Terex Corp. | 357 | 20,267 |

| | Vertiv Holdings Co. Class A | 8,066 | 669,720 |

| | Vinci SA (France) | 1,194 | 142,701 |

| | Watts Water Technologies, Inc. Class A | 120 | 23,604 |

| | | | 2,156,425 |

| | Communication services (0.9%) | | |

| | AT&T, Inc. | 39,780 | 791,622 |

| | Comcast Corp. Class A | 21,846 | 864,446 |

| | Credo Technology Group Holding, Ltd. † | 315 | 10,997 |

| | Crown Castle, Inc. R | 555 | 62,171 |

| | DigitalBridge Group, Inc. | 740 | 9,243 |

| | HKT Trust & HKT, Ltd. (Units) (Hong Kong) | 60,000 | 76,182 |

| | InterDigital, Inc. | 168 | 23,278 |

| | KDDI Corp. (Japan) | 2,000 | 67,474 |

| | Koninklijke KPN NV (Netherlands) | 3,682 | 15,038 |

| | Preformed Line Products Co. | 32 | 3,838 |

| | Spark NZ, Ltd. (New Zealand) | 9,643 | 21,588 |

| | Verizon Communications, Inc. | 2,468 | 103,113 |

| | Vodafone Group PLC (United Kingdom) | 82,662 | 81,026 |

| | | | 2,130,016 |

| | Conglomerates (0.6%) | | |

| | 3M Co. | 6,278 | 845,584 |

| | Marubeni Corp. (Japan) | 6,100 | 105,222 |

| | Mitsubishi Corp. (Japan) | 6,500 | 135,319 |

| | Mitsui & Co., Ltd. (Japan) | 6,200 | 134,008 |

| | Siemens AG (Germany) | 519 | 97,627 |

| | SPX Technologies, Inc. † | 36 | 5,873 |

| | | | 1,323,633 |

| | | | |

| | COMMON STOCKS (27.8%)* cont. | Shares | Value |

| | Consumer cyclicals (3.1%) | | |

| | Abercrombie & Fitch Co. Class A † | 192 | $28,333 |

| | Adecco Group AG (Switzerland) | 2,512 | 85,646 |

| | Alarm.com Holdings, Inc. † | 63 | 3,751 |

| | Amazon.com, Inc. † | 8,516 | 1,520,106 |

| | American Eagle Outfitters, Inc. | 597 | 12,286 |

| | Apogee Enterprises, Inc. | 241 | 16,094 |

| | Aristocrat Leisure, Ltd. (Australia) | 1,685 | 62,196 |

| | Arrowhead Pharmaceuticals, Inc. † | 161 | 3,837 |

| | Automatic Data Processing, Inc. | 3,094 | 853,666 |

| | Barrett Business Services, Inc. | 122 | 4,454 |

| | Bayerische Motoren Werke AG (Germany) | 1,110 | 103,013 |

| | Best Buy Co., Inc. | 618 | 62,047 |

| | Blue Bird Corp. † | 356 | 18,220 |

| | BlueLinx Holdings, Inc. † | 90 | 9,058 |

| | Booking Holdings, Inc. | 16 | 62,548 |

| | BrightView Holdings, Inc. † | 416 | 6,644 |

| | Buckle, Inc. (The) | 99 | 4,148 |

| | Caleres, Inc. | 100 | 4,213 |

| | Cimpress PLC (Ireland) † | 160 | 15,821 |

| | Daktronics, Inc. † | 486 | 7,023 |

| | Dana, Inc. | 734 | 8,287 |

| | Designer Brands, Inc. Class A | 502 | 3,333 |

| | Dick’s Sporting Goods, Inc. | 208 | 49,288 |

| | Evolution AB (Sweden) | 44 | 4,574 |

| | Expedia Group, Inc. † | 383 | 53,271 |

| | Ford Motor Co. | 63,380 | 709,222 |

| | Forestar Group, Inc. † | 330 | 10,210 |

| | G-III Apparel Group, Ltd. † | 149 | 3,944 |

| | Gap, Inc. (The) | 1,862 | 41,765 |

| | Genuine Parts Co. | 350 | 50,141 |

| | GMS, Inc. † | 241 | 20,916 |

| | Golden Entertainment, Inc. | 159 | 5,150 |

| | Goodyear Tire & Rubber Co. (The) † | 470 | 4,145 |

| | H & M Hennes & Mauritz AB Class B (Sweden) | 1,275 | 20,166 |

| | Hermes International (France) | 9 | 21,541 |

| | Home Depot, Inc. (The) | 641 | 236,209 |

| | Honda Motor Co., Ltd. (Japan) | 900 | 9,932 |

| | Host Hotels & Resorts, Inc. R | 3,004 | 53,171 |

| | Hovnanian Enterprises, Inc. Class A † | 105 | 22,704 |

| | Industria de Diseno Textil SA (Spain) | 2,853 | 154,563 |

| | International Game Technology PLC | 988 | 22,121 |

| | Isuzu Motors, Ltd. (Japan) | 1,500 | 22,774 |

| | J. Jill, Inc. | 347 | 11,288 |

| | JELD-WEN Holding, Inc. † | 753 | 10,723 |

| | KB Home | 229 | 19,170 |

| | Kering SA (France) | 36 | 10,323 |

| | Kimberly-Clark Corp. | 341 | 49,329 |

| | La Francaise des Jeux SAEM (France) | 2,162 | 88,140 |

| | Las Vegas Sands Corp. | 1,200 | 46,788 |

| | Laureate Education, Inc. | 281 | 4,333 |

| | LegalZoom.com, Inc. † | 1,164 | 7,845 |

| | Lennar Corp. Class B | 590 | 99,610 |

| | LiveRamp Holdings, Inc. † | 654 | 16,952 |

| | LVMH Moet Hennessy Louis Vuitton SA (France) | 40 | 29,773 |

| | M/I Homes, Inc. † | 167 | 26,615 |

| | Magnite, Inc. † | 664 | 9,157 |

| | MasterCraft Boat Holdings, Inc. † | 210 | 3,891 |

| | Mercedes-Benz Group AG (Germany) | 1,750 | 120,619 |

| | Meritage Homes Corp. | 51 | 10,102 |

| | Modine Manufacturing Co. † | 76 | 9,238 |

| | Netflix, Inc. † | 74 | 51,900 |

| | | | |

| | COMMON STOCKS (27.8%)* cont. | Shares | Value |

| | Consumer cyclicals cont. | | |

| | New York Times Co. (The) Class A | 908 | $49,876 |

| | Nike, Inc. Class B | 591 | 49,242 |

| | Nintendo Co., Ltd. (Japan) | 2,400 | 130,522 |

| | Owens Corning | 300 | 50,619 |

| | Pandora A/S (Denmark) | 418 | 73,214 |

| | PROG Holdings, Inc. | 458 | 21,416 |

| | Publicis Groupe SA (France) | 998 | 110,073 |

| | Red Rock Resorts, Inc. Class A | 363 | 21,156 |

| | REV Group, Inc. | 702 | 22,352 |

| | Ross Stores, Inc. | 1,204 | 181,334 |

| | Ryman Hospitality Properties, Inc. R | 242 | 25,158 |

| | Stellantis NV (Borsa Italiana Exchange) (Italy) | 899 | 15,129 |

| | Stellantis NV (Euronext Paris Exchange) (Italy) | 3,651 | 61,283 |

| | Subaru Corp. (Japan) | 800 | 15,344 |

| | Tapestry, Inc. | 1,335 | 54,695 |

| | Target Corp. | 340 | 52,231 |

| | Taylor Wimpey PLC (United Kingdom) | 54,055 | 114,846 |

| | Tesla, Inc. † | 342 | 73,226 |

| | TJX Cos., Inc. (The) | 2,780 | 326,011 |

| | Toll Brothers, Inc. | 346 | 49,848 |

| | TOPPAN Holdings, Inc. (Japan) | 500 | 15,096 |

| | Toyota Motor Corp. (Japan) | 1,200 | 22,912 |

| | Trade Desk, Inc. (The) Class A † | 511 | 53,415 |

| | Trane Technologies PLC | 158 | 57,142 |

| | TRI Pointe Homes, Inc. † | 582 | 25,864 |

| | Upbound Group, Inc. | 67 | 2,231 |

| | Urban Outfitters, Inc. † | 98 | 3,559 |

| | Visteon Corp. † | 205 | 20,752 |

| | Volkswagen AG (Preference) (Germany) | 912 | 97,064 |

| | Walmart, Inc. | 611 | 47,188 |

| | Walt Disney Co. (The) | 550 | 49,709 |

| | Wesfarmers, Ltd. (Australia) | 572 | 28,060 |

| | Williams-Sonoma, Inc. | 341 | 45,807 |

| | Xperi, Inc. † | 516 | 4,551 |

| | | | 7,007,252 |

| | Consumer staples (2.0%) | | |

| | ACCO Brands Corp. | 801 | 4,389 |

| | Auto Trader Group PLC (United Kingdom) | 2,236 | 25,115 |

| | Brink’s Co. (The) | 230 | 25,514 |

| | British American Tobacco PLC (United Kingdom) | 4,201 | 157,250 |

| | Cal-Maine Foods, Inc. | 141 | 10,158 |

| | Cargurus, Inc. † | 637 | 18,460 |

| | CK Hutchison Holdings, Ltd. (Hong Kong) | 20,000 | 109,635 |

| | Coca-Cola Co. (The) | 11,124 | 806,156 |

| | Coles Group, Ltd. (Australia) | 3,434 | 43,598 |

| | Colgate-Palmolive Co. | 495 | 52,718 |

| | CoreCivic, Inc. † | 354 | 4,878 |

| | Coursera, Inc. † | 455 | 3,686 |

| | Dave & Buster’s Entertainment, Inc. † | 123 | 3,855 |

| | DoorDash, Inc. Class A † | 1,237 | 159,214 |

| | El Pollo Loco Holdings, Inc. † | 306 | 4,241 |

| | Endeavour Group, Ltd./Australia (Australia) | 9,156 | 33,014 |

| | EverQuote, Inc. Class A † | 229 | 5,656 |

| | Heidrick & Struggles International, Inc. | 115 | 4,439 |

| | Hims & Hers Health, Inc. † | 113 | 1,664 |

| | Hudson Technologies, Inc. † | 468 | 3,847 |

| | Imperial Brands PLC (United Kingdom) | 4,319 | 123,967 |

| | Ingles Markets, Inc. Class A | 55 | 4,070 |

| | Insperity, Inc. | 43 | 4,042 |

| | Inter Parfums, Inc. | 140 | 18,038 |

| | ITOCHU Corp. (Japan) | 2,100 | 111,813 |

| | | | |

| | COMMON STOCKS (27.8%)* cont. | Shares | Value |

| | Consumer staples cont. | | |

| | Itron, Inc. † | 234 | $23,919 |

| | Japan Tobacco, Inc. (Japan) | 4,400 | 127,029 |

| | Koninklijke Ahold Delhaize NV (Netherlands) | 1,920 | 65,921 |

| | Korn Ferry | 195 | 14,245 |

| | Kraft Heinz Co. (The) | 1,413 | 50,063 |

| | ManpowerGroup, Inc. | 655 | 48,418 |

| | Maplebear, Inc. † | 1,515 | 54,373 |

| | MediaAlpha, Inc. Class A † | 1,214 | 21,609 |

| | Molson Coors Beverage Co. Class B | 881 | 47,548 |

| | Mondelez International, Inc. Class A | 707 | 50,770 |

| | Nestle SA (Switzerland) | 1,729 | 185,418 |

| | Olaplex Holdings, Inc. † | 2,987 | 6,243 |

| | Opendoor Technologies, Inc. † | 2,854 | 6,136 |

| | PepsiCo, Inc. | 280 | 48,406 |

| | Philip Morris International, Inc. | 7,492 | 923,689 |

| | Procter & Gamble Co. (The) | 1,094 | 187,665 |

| | Reckitt Benckiser Group PLC (United Kingdom) | 1,329 | 76,459 |

| | Recruit Holdings Co., Ltd. (Japan) | 2,400 | 149,669 |

| | Resideo Technologies, Inc. † | 837 | 16,874 |

| | Robert Half, Inc. | 813 | 50,951 |

| | Sally Beauty Holdings, Inc. † | 363 | 4,737 |

| | Simply Good Foods Co. (The) † | 322 | 10,172 |

| | Sumitomo Corp. (Japan) | 4,500 | 107,003 |

| | Texas Roadhouse, Inc. | 287 | 48,431 |

| | Toyota Tsusho Corp. (Japan) | 300 | 5,797 |

| | Turning Point Brands, Inc. | 188 | 7,452 |

| | Tyson Foods, Inc. Class A | 788 | 50,676 |

| | Uber Technologies, Inc. † | 4,694 | 343,272 |

| | Unilever PLC (United Kingdom) | 1,893 | 122,716 |

| | United Natural Foods, Inc. † | 298 | 4,509 |

| | Upwork, Inc. † | 1,771 | 17,072 |

| | USANA Health Sciences, Inc. † | 94 | 3,837 |

| | ZipRecruiter, Inc. Class A † | 476 | 4,546 |

| | ZOZO, Inc. (Japan) | 600 | 19,104 |

| | | | 4,644,146 |

| | Energy (1.3%) | | |

| | Aker BP ASA (Norway) | 659 | 15,787 |

| | Alpha Metallurgical Resources, Inc. | 68 | 16,262 |

| | Ampol Ltd. (Australia) | 1,056 | 20,661 |

| | Antero Midstream Corp. | 3,565 | 53,012 |

| | Baker Hughes Co. | 1,419 | 49,906 |

| | Chevron Corp. | 340 | 50,303 |

| | Civitas Resources, Inc. | 766 | 46,979 |

| | ConocoPhillips | 415 | 47,223 |

| | CONSOL Energy, Inc. † | 215 | 21,990 |

| | Coterra Energy, Inc. | 4,844 | 117,855 |

| | DCC PLC (Ireland) | 197 | 13,919 |

| | Delek US Holdings, Inc. | 170 | 3,471 |

| | Devon Energy Corp. | 10,885 | 487,430 |

| | DNOW, Inc. † | 1,039 | 13,528 |

| | Eneos Holdings, Inc. (Japan) | 4,600 | 25,023 |

| | Equinor ASA (Norway) | 1,670 | 44,810 |

| | Exxon Mobil Corp. | 3,908 | 460,910 |