As filed with the Securities and Exchange Commission on April 9, 2024

Commission File No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

__________________________________

JACKSON NATIONAL LIFE INSURANCE COMPANY

(Exact Name of registrant as specified in its charter)

__________________________________

| | | | | | | | | | | | | | |

| Michigan | | 6311 | | 38-1659835 |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

1 Corporate Way, Lansing, Michigan 48951

(517) 381-5500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

__________________________________

Scott J. Golde, Esq.

Senior Vice President and General Counsel

Jackson National Life Insurance Company

1 Corporate Way, Lansing, MI 48951

(517) 381-5500

(Name and Address of Agent for Service)

Copy to:

Alison Samborn, Esq.

Assistant Vice President, Insurance Legal & Product Development

Jackson National Life Insurance Company

1 Corporate Way, Lansing, MI 48951

__________________________________

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register addition securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. □

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. □

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. □

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. □

| | | | | | | | | | | | | | |

| Large accelerated filer □ | Accelerated filer □ | Non-accelerated filer x

| Smaller reporting company □ | Emerging growth company □ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. □

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

THE INFORMATION IN THE PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

JACKSON MARKET LINK PRO®

SINGLE PREMIUM DEFERRED INDEX-LINKED ANNUITY

Issued by

Jackson National Life Insurance Company®

The date of this prospectus is April 29, 2024. This prospectus contains information about the Contract and Jackson National Life Insurance Company (“Jackson®”) that you should know before investing. This prospectus is a disclosure document and describes all of the Contract’s material features, benefits, rights, and obligations of annuity purchasers under the Contract. The description of the Contract’s material provisions in this prospectus is current as of the date of this prospectus. If certain material provisions under the Contract are changed after the date of this prospectus, in accordance with the Contract, those changes will be described in a supplemented prospectus. It is important that you also read the Contract and endorsements, which may reflect additional non-material state variations. Jackson's obligations under the Contract are subject to our financial strength and claims-paying ability. The information in this prospectus is intended to help you decide if the Contract will meet your investment and financial planning needs.

Index-linked annuity contracts are complex insurance and investment vehicles. Before you invest, be sure to discuss the Contract’s features, benefits, risks and fees with your financial professional in order to determine whether the Contract is appropriate for you based upon your financial situation and objectives. Please carefully read this prospectus and any related documents and keep everything together for future reference.

This prospectus describes the Indexes, Terms, Crediting Methods, and Protection Options that we currently offer under the Contract. We reserve the right to limit the number of Contracts that you may purchase. We also reserve the right to refuse any Premium payment. Please confirm with us or your financial professional that you have the most current prospectus that describe the availability and any restrictions on the Crediting Methods and Protection Options.

The Jackson Market Link Pro Contract is an individual single Premium deferred registered index-linked annuity Contract issued by Jackson. The Contract provides for the potential accumulation of retirement savings and partial downside protection in adverse market conditions. The Contract is a long-term, tax-deferred annuity designed for retirement or other long-term investment purposes. It is available for use in Non-Qualified plans, Qualified plans, Tax-Sheltered annuities, Traditional IRAs, and Roth IRAs.

The Contract may not be appropriate for you if you plan to take withdrawals from an Index Account Option prior to the end of the Index Account Option Term, especially if you plan to take ongoing withdrawals such as Required Minimum Distributions. We apply an Interim Value adjustment to amounts removed from an Index Account Option during the Index Account Option Term, and if this adjustment is negative, you could lose up to 100% of your investment. Withdrawals could also result in significant reductions to your Contract Value and the death benefit (perhaps by more than the amount withdrawn), as well as to the Index Adjustment credited at the end of the Index Account Option Term. Withdrawals may also be subject to income taxes and income tax penalties if taken before age 59 1/2. If you do intend to take ongoing withdrawals under the Contract, particularly from an Index Account Option during the Index Account Option Term, you should consult with a financial professional.

Crediting Methods such as the Cap and Performance Trigger could limit positive Index gain. The Contract currently offers 10% and 20% Floor, and 10% and 20% Buffer Protection Options, which could expose you to 80-90% loss due to poor Index performance. Crediting Method and Protection Option rates could change in the future. The Floor and Buffer Protection Options will always be at least 5%.

Jackson is located at 1 Corporate Way, Lansing Michigan, 48951. The telephone number is 1-800-644-4565. Jackson is the principal underwriter for these Contracts. Jackson National Life Distributors LLC (“JNLD”), located at 300 Innovation Drive, Franklin, Tennessee 37067, serves as the distributor of the Contracts. You can contact our Jackson Customer Care Center at P.O. Box 24068, Lansing Michigan 48909-4068; 1-800-644-4565; www.jackson.com.

An investment in this Contract is subject to risk including the possible loss of principal and that loss can become greater in the case of an early withdrawal due to charges and adjustments imposed on those withdrawals. See “Risk Factors” beginning on page 9 for more information. | | |

| Neither the SEC nor any state securities commission has approved or disapproved these securities or passed upon the adequacy of this prospectus. It is a criminal offense to represent otherwise. We do not intend for this prospectus to be an offer to sell or a solicitation of an offer to buy these securities in any state where this is not permitted. |

| | |

| • Not FDIC/NCUA insured • Not Bank/CU guaranteed • May lose value • Not a deposit • Not insured by any federal agency |

| | | | | |

| TABLE OF CONTENTS |

| SUMMARY | |

| GLOSSARY | |

| RISK FACTORS | |

| Risk of Loss | |

| Liquidity | |

| Limitations on Transfers | |

| Reallocations | |

| Loss of Contract Value | |

| No Ownership of Underlying Securities | |

| Tracking Index Performance | |

| Limits on Investment Return | |

| Buffers and Floors | |

| Elimination/Suspension/Replacements/Substitutions/Changes to Indexes/Crediting Methods/Terms | |

| Issuing Company | |

| Effects of Withdrawals, Annuitization, or Death | |

| Business Continuity and Cybersecurity Risk | |

| THE ANNUITY CONTRACT | |

| State Variations | |

| Owner | |

| Annuitant | |

| Beneficiary | |

| Assignment | |

| PREMIUM | |

| Minimum Premium | |

| Maximum Premium | |

| Allocations of Premium | |

| Free Look | |

| CONTRACT OPTIONS | |

| Fixed Account | |

| Index Account | |

| ADDITIONAL INFORMATION ABOUT THE INDEX ACCOUNT OPTIONS | |

| Indexes | |

| Protection Options | |

| Crediting Methods | |

| Cap | |

| Performance Trigger | |

| TRANSFERS AND REALLOCATIONS | |

| Transfer Requests | |

| Automatic Reallocations | |

| Automatic Reallocation of Index Account Option Value to a New Index Account Option or the Fixed Account | |

| ACCESS TO YOUR MONEY | |

| WITHDRAWAL CHARGE | |

| Waiver of Withdrawal Charge | |

| | | | | |

| INCOME PAYMENTS | |

| Income Options | |

| DEATH BENEFIT | |

| Payout Options | |

| Pre-Selected Payout Options | |

| Spousal Continuation Option | |

| Death of Owner On or After the Income Date | |

| Death of Annuitant | |

| Stretch Contracts | |

| TAXES | |

| CONTRACT OWNER TAXATION | |

| Tax-Qualified and Non-Qualified Contracts | |

| Non-Qualified Contracts - General Taxation | |

| Non-Qualified Contracts - Aggregation of Contracts | |

| Non-Qualified Contracts - Withdrawals and Income Payments | |

| Non-Qualified Contracts - Required Distributions | |

| Non-Qualified Contracts - 1035 Exchanges | |

| Tax-Qualified Contracts - Withdrawals and Income Payments | |

| Withdrawals - Roth IRAs | |

| Death Benefits | |

| Assignment | |

| Withholding | |

| Annuity Purchases by Nonresident Aliens and Foreign Corporations | |

| Definition of Spouse | |

| Transfers, Assignments or Exchanges of a Contract | |

| Tax Law Changes | |

| JACKSON TAXATION | |

| OTHER INFORMATION | |

| General Account | |

| Unregistered Separate Account | |

| Distribution of Contracts | |

| Modification of Your Contract | |

| Confirmation of Transactions | |

| State Variations | |

| Legal Proceedings | |

| JACKSON NATIONAL LIFE INSURANCE COMPANY | |

| FORWARD-LOOKING STATEMENTS - CAUTIONARY LANGUAGE | |

| RISKS RELATED TO OUR BUSINESS AND INDUSTRY | |

| OUR BUSINESS | |

| Overview | |

| Our Product Offerings | |

| Retail Annuities | |

| Institutional Products | |

| Closed Life and Annuities Blocks | |

| | | | | |

| Distribution and Operations | |

| Risk Management | |

| Reinsurance | |

| Regulation | |

| Corporate Responsibility | |

| Human Capital Resources | |

| Cybersecurity | |

| Properties | |

| Information about our Executive Officers | |

| Security Ownership of Certain Beneficial Owners | |

| Certain Relationships and Related Persons Transactions | |

| Executive Compensation | |

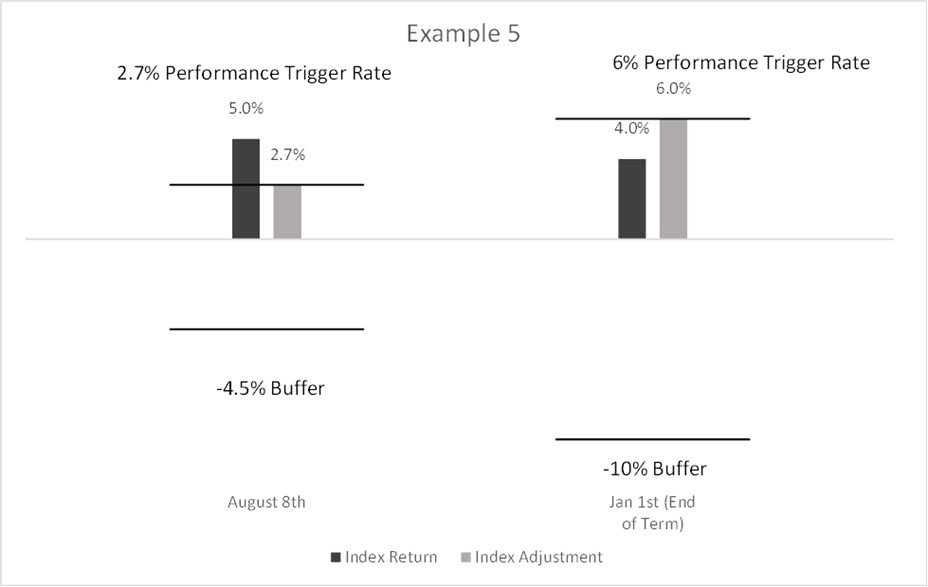

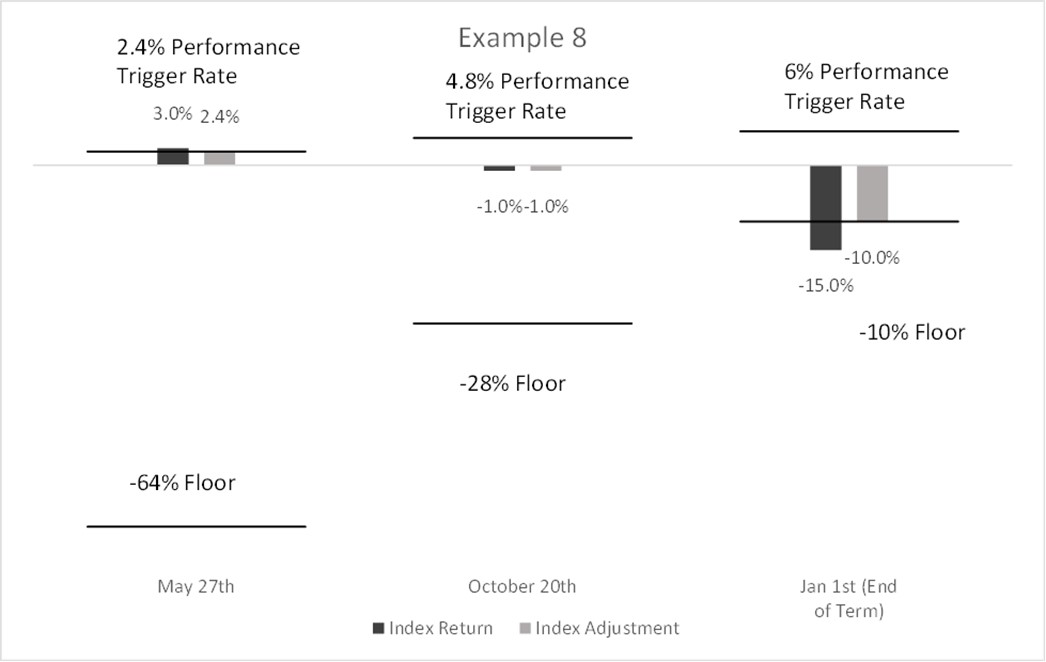

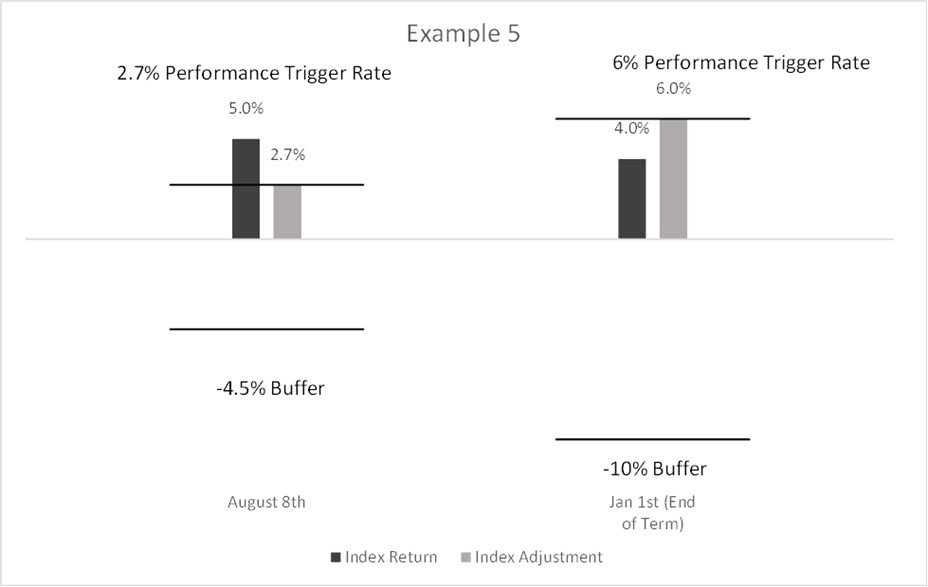

| APPENDIX A (CALCULATION EXAMPLES) | |

| APPENDIX B (STATE VARIATIONS) | |

| APPENDIX C (INDEX DISCLOSURES) | |

| APPENDIX D (MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS and FINANCIAL STATEMENTS) | |

SUMMARY

Jackson Market Link Pro is a Registered Index-Linked Annuity (“RILA”) contract. The Contract is an SEC registered, tax deferred annuity that permits you to link your investment to an Index (or multiple Indexes) over a defined period of time ("term"). If the Index Return is positive, the Contract credits any gains in that Index to your Index Account Option Value, subject to the Crediting Method you choose: Cap, or Performance Trigger. If the Index Return is negative, the Contract credits losses, which may be either absorbed or offset, subject to the Protection Option you choose: a stated Buffer or Floor.

The Contract currently offers five Indexes that can be tracked in any combination, which allow for the ability to diversify among different asset classes and investment strategies. There is also a one-year Fixed Account available.

At the end of an Index Account Option Term, we will credit an Index Adjustment (which may be positive, negative, or equal to zero) based on the Index Return, Crediting Method, and Protection Option of the Index Account Option selected. Prior to the end of an Index Account Option Term, the Index Account Option Value is equal to the Interim Value, which is the greater of the Index Account Option Value at the beginning of the term adjusted for any withdrawals plus the Index Adjustment subject to prorated Index Adjustment Factors,or zero.

Indexes: Each Index is comprised of or defined by certain securities or by a combination of certain securities and other investments. Please refer to the section titled “Indexes” for a description of each of the Indexes offered on this Contract. The Indexes currently offered on the Contract are the S&P 500, Russell 2000, MSCI Emerging Markets, MSCI EAFE, and the MSCI KLD 400 Social Index.

Crediting Methods: Each Crediting Method provides the opportunity to receive an Index Adjustment based on any positive Index Return at the end of the Index Account Option Term. The Crediting Methods currently offered on the Contract are the Cap, subject to a stated Cap Rate; and Performance Trigger, subject to a stated Performance Trigger Rate Crediting Methods. Current Cap Rates and Performance Trigger Rates are provided at the time of application, and to existing owners and financial professionals at any time, upon request. Crediting methods must be elected before the start of the Term and will apply for the duration of the Term.

•Cap

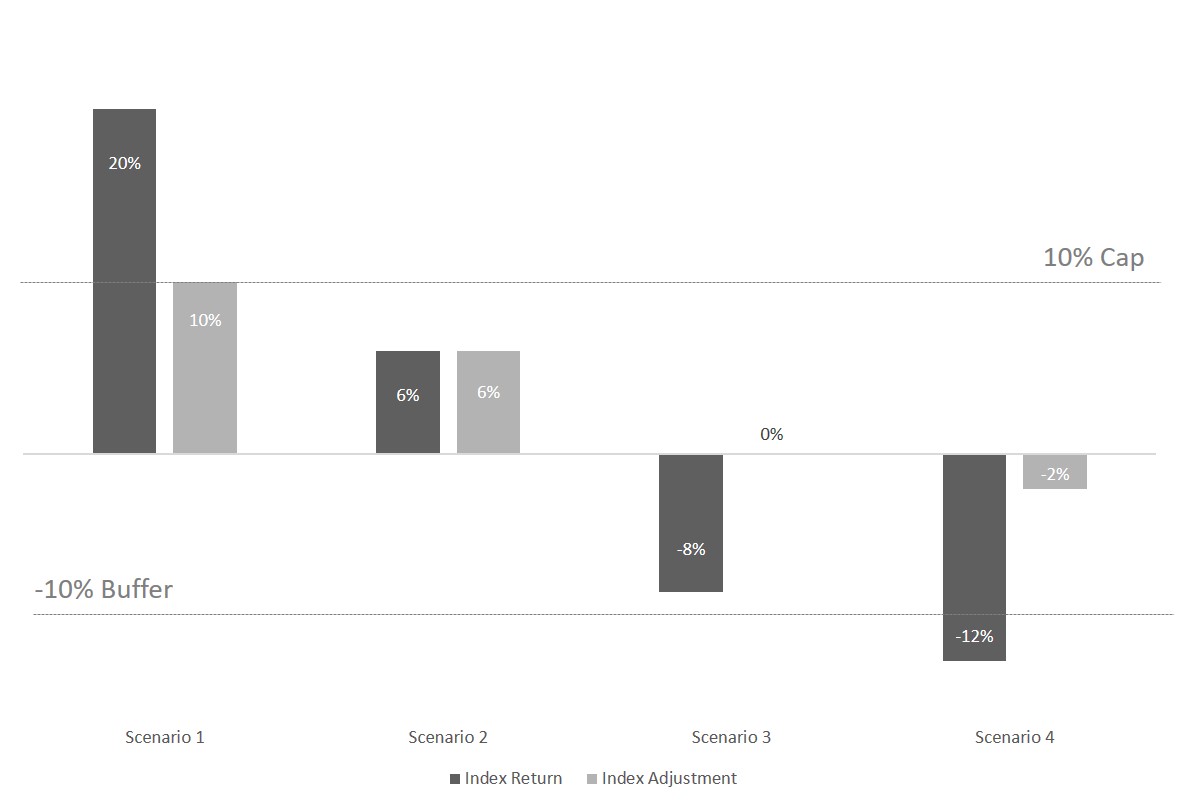

•This Crediting Method provides a positive Index Adjustment equal to any positive Index Return, subject to a stated Cap Rate.

•The Cap Rate is the maximum amount of positive Index Adjustment you may receive. This means if the Index Return is in excess of the Cap Rate, your positive Index Adjustment will be limited by (and equal to) the Cap Rate.

•A Cap Rate is not a guarantee of any positive return.

•Performance Trigger

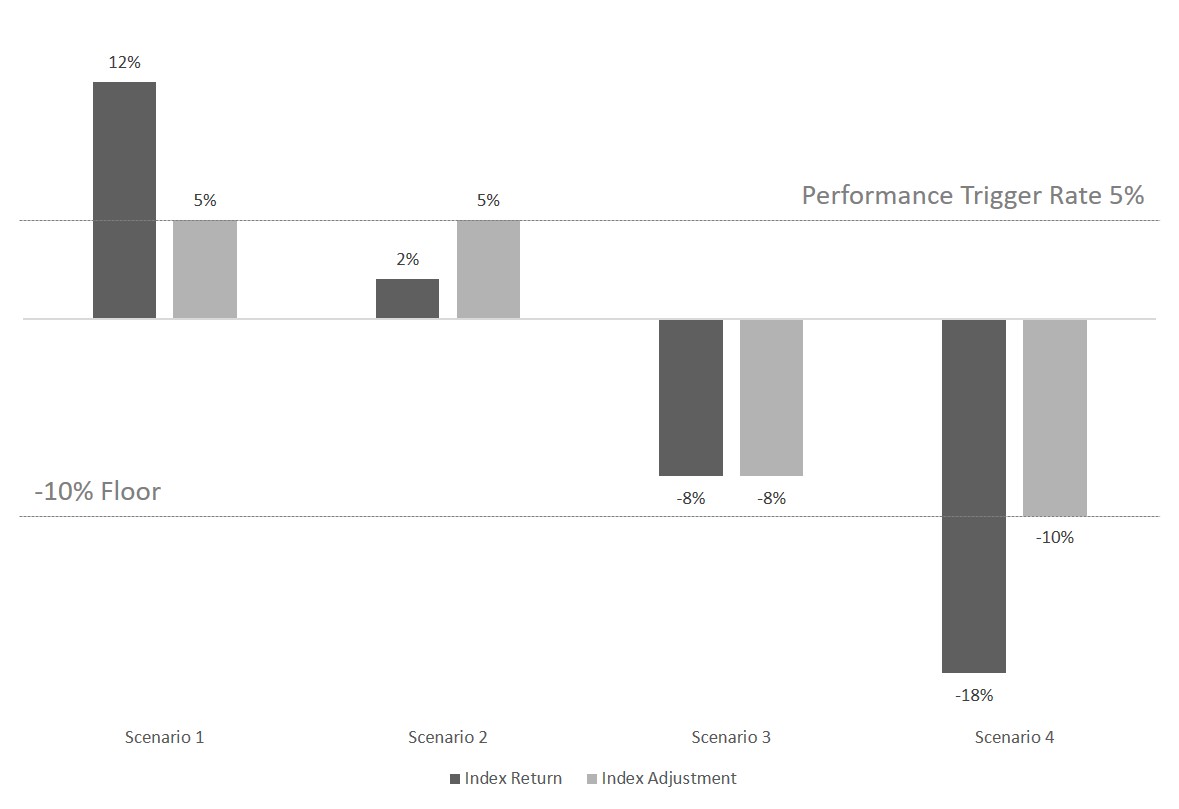

•This Crediting Method provides a positive Index Adjustment equal to a stated Performance Trigger Rate if the Index Return is zero or positive.

•The Performance Trigger Rate equals the positive Index Adjustment that you will receive if the Index Return is zero or positive, regardless of whether the actual Index Return is higher or lower than the stated Performance Trigger Rate.

•A Performance Trigger Rate is not a guarantee of any positive return.

Protection Options: The Protection Options provide a level of downside protection if the Index Return is negative. You may choose either a Buffer or Floor Protection Option. Current Buffer and Floor rates are provided at the time of application.

•A Buffer protects from loss up to a specific amount (typically 10% or 20%). You only incur a loss if the Index declines more than the stated Buffer percentage. For example, if an Index declines 15% and you chose a 10% Buffer, you would incur a loss of 5% for that Index Account Option Term. Available Buffer rates are guaranteed to be no less than 5% or more than 50%.

•A Floor protects from loss after a specific threshold. If the Index declines, you incur a loss up to the stated Floor percentage, beyond which, you are protected by any further loss for that Index Account Option Term. For example, if you chose a 10% Floor and the Index declines 15%, you would lose 10% for that Index Account Option Term. Available Floor rates are guaranteed to be no less than 5% or more than 50%.

Index Account Option Terms: The Contract currently offers two term lengths: a 1-Year term and a 6-Year term depending on the Crediting Method and Protection Option you choose.

As of the date of this prospectus, you may currently select the following combination of Crediting Methods, Protection Options, and Index Account Option Terms with any of the available Indexes:

| | | | | | | | | | | | | | |

| Crediting Methods | Protection Options* | Term Length |

| Buffer | Floor | 1-Year | 6-Year |

| Cap | 10%, 20% | 10%, 20% | ü | ü |

| Performance Trigger | 10% | 10% | ü | N/A |

* Protection Option rates listed above are the rates currently available as of the date of this prospectus. These rates may be changed from time to time, so you should contact your financial professional or the Jackson Service Center for current rate availability.

The available Crediting Method and Protection Option rates are the new business and renewal rates effective as of the first day of an Index Account Option Term and will not change until the end of your Index Account Option Term. The rate for a particular Index Account Option Term may be higher or lower than the rate for previous or future Index Account Option Terms. We post all rates online at Jackson.com/RatesJMLP. The rates for Contract Value reallocations at the end of an Index Account Option Term are posted at least 30 days before the end of any Index Account Option Term. At least 30 days prior to any Index Account Option Term Anniversary, we will send you written notice reminding you of how you may obtain the rates for the next Index Account Option Term. You may provide reallocation instructions in writing using our Reallocation Form or a Letter of Instruction, or over the phone if you have authorized telephone transactions. If you do not provide timely allocation instructions by close of business on the Index Account Option Term Anniversary of an expiring Index Account Option Term as to how you would like your Index Account Option Value allocated for your next Index Account Option Term, we will generally (i) renew the Index Account Option into the same Index Account Option Term, if available; or (ii) if the same Crediting Method, Protection Option, or Index you elected is not available, we will reallocate the Index Account Option Value(s) to the Fixed Account. See "Automatic Reallocations" beginning on page 26. Such reallocation instructions must be sent to us in written form acceptable to the Company, or via telephone if you have authorized telephone transactions on your account.

We reserve the right to delete or add Index Account Options, Indexes, Crediting Methods, Protection Options, and Index Account Option Terms in the future. There will always be more than one Index Account Option available, and those options will always be identical or similar to one of the options disclosed in this prospectus.

It is possible that an Index may be replaced during an Index Account Option Term. If an Index is replaced during an Index Account Option Term, we will provide you with notice of the substituted Index, and Index Return for the Index Account Option Term will be calculated by adding the Index Return for the original Index from the beginning of the term up until the date of replacement, to the Index Return from the substituted Index starting on the date of replacement through the end of the Index Account Option Term. While any substituted Index will need to be approved by regulators prior to replacing your Index, it is possible that you may experience lower Index Return under a substituted Index than you would have if that Index had not been replaced. For more information about replacing Indexes, please see "Replacing an Index" on page 19. We also reserve the right to remove, add or change the combinations in which we offer Indexes, Crediting Methods, Protection Options and Index Account Option Terms in the future. All Indexes, Crediting Methods, Protection Options, and Index Account Option Terms we currently offer may not be available through every selling broker-dealer.

Fixed Account: You also have the option to invest all or a portion of your Contract Value into a Fixed Account. Amounts allocated to the Fixed Account earn compounded interest at a fixed rate for the duration of the term. Currently, we offer a one-year term for amounts allocated to the Fixed Account and at the end of the one-year term, you will have the option of reallocating those amounts to Index Account Options, or to continue with the amounts in the Fixed Account. The credited interest rate on the Fixed Account is set annually and can be changed as each one-year term resets on the Contract Anniversary, subject to a guaranteed minimum interest rate.

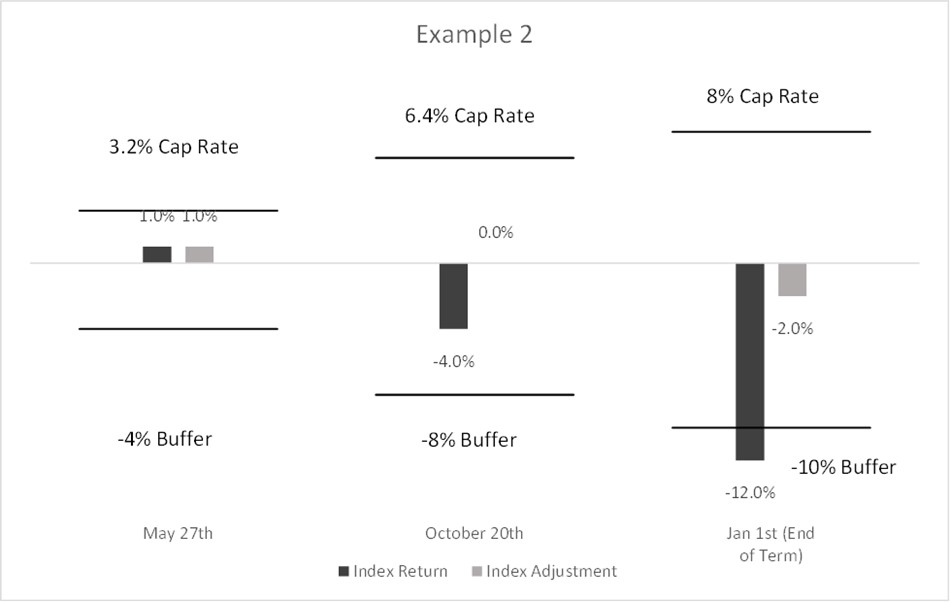

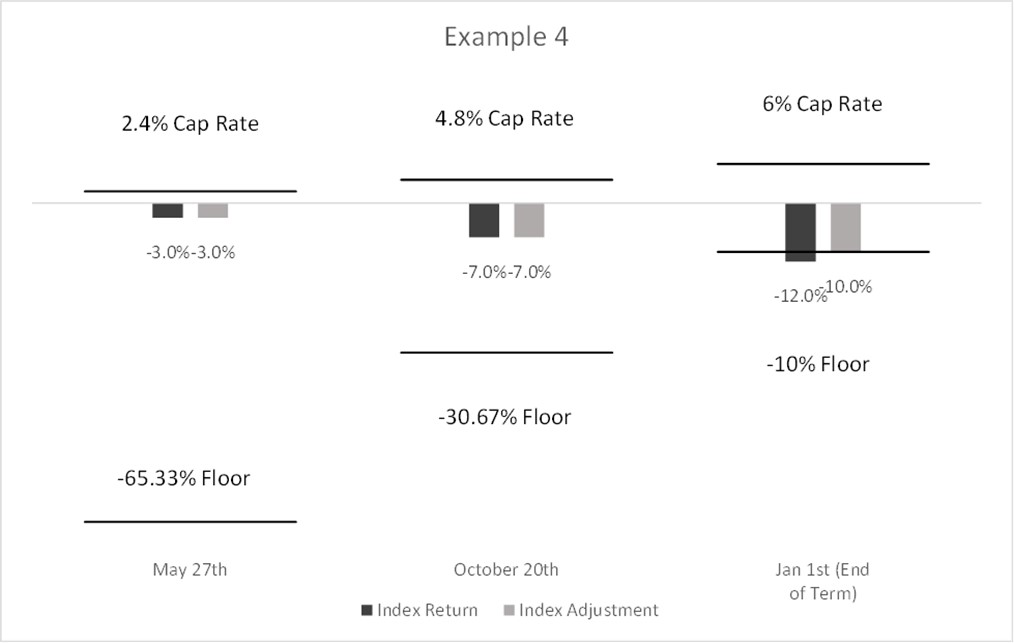

Interim Value Adjustment: Because the Index Account Options are designed to credit an Index Adjustment by measuring the change in the Index Return from the beginning of the Index Account Option Term to the end of the Index Account Option Term, an Interim Value calculation is necessary to determine the daily value of your Index Account Option on any given Business Day for purposes of Intra-Term Performance Locks or withdrawals prior to the end of the Index Account Option Term by measuring the change in your Index Return from the beginning of the Index Account Option Term to the date of the withdrawal. (withdrawals in this context include partial or total withdrawals from the Contract, automatic withdrawals, free looks, required minimum distributions ("RMD"), income payments, and the Contract Value element of death benefit payments).

Please note that any withdrawal taken in the first six years after issue may also be assessed withdrawal charges in addition to the Interim Value adjustment.

In calculating the Interim Value Adjustment, we use prorated Index Adjustment Factors, which in some instances may serve to reduce any positive Index Adjustment, as well as increase any negative Index Adjustment we credit when compared to the Index Adjustment you would have received if you had waited until the end of your Index Account Option Term to take your withdrawal. This is because the Index Adjustment Factors are prorated by the time elapsed during the Index Account Option Term and the application of the Interim Value Proration Factor. In other words, the values are determined by multiplying the Index Adjustment Factor by the number of days elapsed so far during the Index Account Option Term, then dividing by the total number of days in the Index Account Option Term, and then multiplying by the Interim Value Proration Factor. The proration of the Floor protection option is calculated differently than the rest of the Index Adjustment Factors. The prorated Floor is calculated as one minus the full-term Floor divided by the Interim Value Proration Factor, then that value is subtracted from one, then the result is multiplied by the number of days elapsed so far during the Index Account Option Term divided by the total number of days in the Index Account Option Term. For an example illustrating the proration of Index Adjustment Factors, please see Interim Value on page 17. Any negative adjustment could be significant and impact the amount of Contract Value available for future withdrawals. In addition to Interim Value adjustments, withdrawals taken in the first six Contract Years may also be subject to Withdrawal Charges, which could further reduce the amount you receive when requesting a withdrawal.

Each time you take a withdrawal from an Index Account Option before the end of your Index Account Option Term, we will recalculate your Index Account Option Value, based on an Interim Value adjustment, which could be zero, positive or negative. The Index Account Option Value is reduced proportionally to the Contract Value for each withdrawal. This means if you withdraw 10% of your Contract Value, your Index Account Option Value will also be reduced by 10%. If an Interim Value Adjustment is positive, your Index Account Option Value will be decreased by less than the amount of the withdrawal; in other words, on less than a dollar for dollar basis If an Interim Value Adjustment is negative, your Index Account Option Value will be decreased by more than the amount of the withdrawal; in other words, on more than a dollar for dollar basis.

Any interest credited to the Contract, whether from allocations to the Index Account Options or the Fixed Account, is backed by the creditworthiness and claims-paying ability of Jackson National Life Insurance Company.

You are permitted to make transfers and withdrawals under the terms of the Contract. Full and partial transfers among Index Account Options or between Index Account Options and the Fixed Account are permissible only at the end of the Index Account Option Term or Fixed Account term. Withdrawals taken during the first six years of the Contract may be subject to Withdrawal Charges and withdrawals taken from Index Account Options may be subject to an Interim Value adjustment. Depending on the Crediting Method, Protection Option, Index selected, Interim Value Proration Factor, and the amount of time that has elapsed in the Index Account Option Term, this adjustment could be substantial. For more information on the Interim Value adjustment and how it may affect your Contract please see "Interim Value" beginning on page 17. Registered Index Linked Annuities are long term investments, subject to a potentially substantial loss of principal. Working with a financial professional, you should carefully consider which Indexes, Crediting Methods, and Protection Options (or combinations thereof) are right for you based on your risk tolerance, investment objectives, and other relevant factors. Not all options may be suitable for all investors, including the overall purchase of a RILA.

Contract Overview

| | | | | |

| Contract | Individual single premium deferred registered index-linked annuity contract |

| Minimum Premium | $25,000 |

| Issue Ages | 0 - 85 |

| Contract Value | The sum of the Fixed Account Value and the Index Account Value. |

| Index Account Options | Each Index Account Option is defined by an Index, a Crediting Method, a Protection Option, and a Term length. The Crediting Method and Protection Option you choose define the parameters under which the positive or negative Index Adjustment will be credited. |

| Index Account Option Term | Terms currently available under the Contract are 1 and 6 years in length. |

| | | | | |

| Index | The Indexes currently offered under the Contract are: - S&P 500 Index - Russell 2000 Index - MSCI EAFE Index - MSCI Emerging Markets Index - MSCI KLD 400 Social Index |

| Crediting Method | The Crediting Methods currently offered under the Contract are: - Cap - Performance Trigger |

| Protection Options | The Protection Options currently offered under the Contract are: - Buffer - Floor |

| Fixed Account | A Contract Option which provides a declared amount of interest over a stated period. |

| Interim Value | The daily value of your Index Account Option on any given Business Day prior to the end of an Index Account Option Term. The Interim Value is calculated using prorated Index Adjustment Factors based on the elapsed portion of the Index Account Option Term and the Interim Value Proration Factor. |

| Transfers | You may request a transfer to or from the Fixed Account and to or from the Index Account Options. You may also request transfers among the available Index Account Options. Transfers among Index Account Options or between Index Account Options and the Fixed Account are permissible only at the end of the Index Account Option Term or Fixed Account term. The effective date of such transfers is the first day of the Fixed Account term and/or an Index Account Option Term into which a transfer is made. |

| Access to Your Money | You may withdraw some or all of your money at any time prior to the Income Date. For any withdrawal from an Index Account Option, an Interim Value adjustment as of the date of the withdrawal will apply and may substantially reduce your Index Account Option Value. In addition, a withdrawal taken in excess of the Free Withdrawal amount may be subject to additional Withdrawal Charges. |

| Withdrawal Charge | A percentage charge applied to withdrawals in excess of the Free Withdrawal amount, including partial and total withdrawals, and income payments commenced within the first Contract Year. .

Withdrawal Charges apply during the first six years of the Contract as follows:

Number of Complete Contract Years since Issue Date Withdrawal Charge Percentage 0…………………………………………………..8.00% 1…………………………………………………..8.00% 2…………………………………………………..7.00% 3…………………………………………………..6.00% 4…………………………………………………. 5.00% 5…………………………………………………..4.00% 6 or more………………………………………....…...0.00%

For more information about Withdrawal Charges, including details about when you may be entitled to a waiver of Withdrawal Charges, please see the section titled “WITHDRAWAL CHARGE" on page 28. |

| Death Benefit | For Owners 75 or younger at the Issue Date of the Contract, the standard death benefit (known as the Return of Premium death benefit) is the greater of the Contract Value or the Premium you paid into the Contract (reduced proportionately by the percentage reduction in the Index Account Option Value and the Fixed Account Value for each partial withdrawal (including any applicable Withdrawal Charge)).

For Owners age 76 or older at the Issue Date of the Contract, the standard death benefit is the Contract Value. |

| | | | | |

| Income Options | You can choose to begin taking income from your Contract at any time, but all of the Contract Value must be annuitized. Withdrawal Charges (if you begin taking income in the first Contract Year) will apply, and we will use your Interim Value (if you begin taking income on any day other than the Index Account Option Term Anniversary) to calculate your income payments. You may choose from the following annuitization options:

- Life Income - Joint Life and Survivor Income - Life Income with Guaranteed Payments for 10 Years or 20 Years - Life Income for a Specified Period

Once an income option has been selected, and payments begin, the income option may not be changed. No withdrawals will be permitted once the contract is in the income phase. For more information about income options, please see the section titled "Income Options" on page 30. |

| Charges and Expenses | You will bear the following charges and expenses:

- Withdrawal Charges during the first six Contract Years; and - Premium and Other Taxes.

Additionally, if you take a withdrawal before the end of your Term (including automatic withdrawals, Required Minimum Distributions, income payments, death benefit payments, and Free Looks), we will also calculate an Interim Value Adjustment (in addition to any applicable Withdrawal Charge), which may serve to limit amounts credited to less than the amount of the Index Return on the date of the withdrawal. Also, in the case of a withdrawal before the end of the Term where the Index Return is negative, less protection is provided the earlier in the Term the withdrawal occurs. Please note that the Contract also imposes Caps that can limit amounts credited to less than the amount of the Index Return on the date of the withdrawal. |

| Free Look Provision | You may cancel the Contract within a certain time period after receiving it by returning the Contract to us or to the financial professional who sold it to you. This is known as a “Free Look.” We will return either your Premium Payment or Contract Value, depending on your state, and we will not deduct a Withdrawal Charge. Free Looks are subject to Interim Value adjustments. |

GLOSSARY

These terms are capitalized when used throughout this prospectus because they have special meaning. In reading this prospectus, please refer back to this glossary if you have any questions about these terms.

Adjusted Index Return - the percentage change in an Index value measured from the start of an Index Account Option Term to the end of the Index Account Option Term, adjusted based on the Cap Rate, Performance Trigger Rate, Buffer or Floor, as applicable. On any day during an Index Account Option Term, prior to the end of the Term, the percentage change in the Index value measured from the start of the Index Account Option Term and the current Index value as of that day, adjusted based on the applicable prorated Crediting Method (e.g. Cap Rate/Performance Trigger Rate). If the Index return is negative, we apply the prorated Floor or prorated Buffer Protection Option that you have elected.

Annuitant – the natural person on whose life annuity payments for this Contract are based. The Contract allows for the naming of joint Annuitants. Any reference to the Annuitant includes any joint Annuitant.

Beneficiary – the natural person or legal entity designated to receive any Contract benefits upon the Owner’s death. The Contract allows for the naming of multiple Beneficiaries.

Buffer - one of the two Protection Options offered and an Index Adjustment Factor. A Buffer is the amount of negative Index price change before a negative Index Adjustment is credited to the Index Account Option Value at the end of an Index Account Option Term, expressed as a percentage. A Buffer protects from loss up to a stated amount. You only incur a loss if the Index declines more than the stated Buffer percentage during the Index Account Option Term (though it is possible to incur a loss in excess of the stated Buffer percentage if you make a withdrawal prior to the end of the Index Account Option Term).

Business Day - any day that the New York Stock Exchange is open for business during the hours in which the New York Stock Exchange is open. Each Business Day ends when the New York Stock Exchange closes (usually 4:00 p.m. Eastern time).

Cap Rate ("CR") or Cap - one of two currently available Crediting Methods, and an Index Adjustment Factor. The Cap Rate is the maximum positive Index Adjustment, expressed as a percentage, that will be credited to an Index Account Option under the Cap Crediting Method at the end of each Index Account Option Term.

Contract - the single premium deferred Index-linked annuity contract and any optional endorsements you may have selected.

Contract Anniversary - each one-year anniversary of the Issue Date.

Contract Option - one of the options offered by the Company under this Contract. The Contract Options for this product are the Fixed Account and Index Account.

Contract Value - the sum of the allocations to the Fixed Account and the Index Account.

Contract Year - the succeeding twelve months from a Contract’s Issue Date and every anniversary. The first Contract Year (Contract Year 0-1) starts on the Contract’s Issue Date and extends to, but does not include, the first Contract Anniversary. Subsequent Contract Years start on an anniversary date and extend to, but do not include, the next anniversary date.

For example, if the Issue Date is January 15, 2023, then the end of Contract Year 1 would be January 14, 2024, and January 15, 2024, which is the first Contract Anniversary, begins Contract Year 2.

Crediting Method - the general term used to describe a method of crediting the applicable positive Index Adjustment at the end of an Index Account Option Term.

Fixed Account - a Contract Option in which amounts earn a declared rate of interest for a one year period.

Fixed Account Minimum Interest Rate - the minimum interest rate applied to the Fixed Account, guaranteed for the life of the Contract .

Fixed Account Value - the value of the portion of the Premium allocated to the Fixed Account. The Fixed Account Value is equal to Premium allocated to the Fixed Account, plus interest credited daily at never less than the Fixed Account Minimum Interest Rate for the Contract per annum, less any partial withdrawals including any Withdrawal Charges on such withdrawals, and any amounts transferred out of the Fixed Account.

Floor - one of the two Protection Options offered and an Index Adjustment Factor. A Floor is the maximum negative Index Adjustment that will be credited to the Index Account Option Value at the end of the Index Account Option Term, expressed as a percentage. A Floor protects from loss after a stated threshold. If the Index declines during the Index Account Option Term, you incur a loss up to the stated Floor percentage, and are protected from any further loss beyond the Floor during that Index Account Option Term (though it is possible to incur a loss

in excess of the stated Floor percentage if you make a withdrawal prior to the end of the Index Account Option Term).

Free Withdrawal - the maximum amount that may be withdrawn each year free of any otherwise applicable Withdrawal Charge. The Free Withdrawal amount is equal to 10% of Remaining Premium during each Contract Year that would otherwise incur a Withdrawal Charge, less earnings. If an RMD is applicable and exceeds 10% of Remaining Premium, the Free Withdrawal amount is equal to the RMD, less earnings.

Good Order - when our administrative requirements, including all information, documentation and instructions deemed necessary by us, in our sole discretion, are met in order to issue a Contract or execute any requested transaction pursuant to the terms of the Contract.

Income Date - t he date on which income payments are scheduled to begin as described in the Income Payments section of the prospectus.

Index - a benchmark used to determine the positive or negative Index Adjustment credited, if any, for a particular Index Account Option.

Index Account - a Contract Option in which amounts are credited positive or negative index-linked interest for a specified period.

Index Account Option - an option within the Index Account for allocation of Premium, defined by its term, Index, Crediting Method, and Protection Option.

Index Account Option Term - the selected duration of an Index Account Option.

Index Account Option Term Anniversary - the Business Day concurrent with or immediately following the end of an Index Account Option Term.

Index Account Option Value - the value of the portion of Premium allocated to an Index Account Option.

Index Account Value - the sum of the Index Account Option Values.

Index Adjustment - an adjustment to Index Account Option Value at the end of each Index Account Option Term, or at the time of withdrawal of Index Account Option Value. Index Adjustments can be zero, positive, or negative, depending on the performance of the selected Index, Crediting Method, and Protection Option. The Index Adjustment is equal to the Adjusted Index Return.

Index Adjustment Factor(s) - the parameters used to determine the amount of an Index Adjustment. These parameters are specific to the applicable Crediting Method

and Protection Option. Cap Rates, Performance Trigger Rates, Buffers, and Floors are all Index Adjustment Factors.

Index Return - the percentage change in an Index value measured from the start of an Index Account Option Term to the end of the Index Account Option Term.

Interim Value - the Index Account Option Value during the Index Account Option Term. The Interim Value will never be less than zero. On each day of the Index Account Option Term prior to the end of the Index Account Option Term, the Interim Value is the greater of the Index Account Option Value on the first day of the term (which equals any Premium or Contract Value allocated to the Index Account Option on that day) reduced for any withdrawals (including Required Minimum Distributions, income payments, death benefit payments, and Free Looks), including any Withdrawal Charges, in the same proportion as the Interim Value was reduced on the date of the withdrawal, plus the prorated Index Adjustment subject to prorated Index Adjustment Factors and the Interim Value Proration Factor ("IVPF"), or zero. The Interim Value uses your prorated Index Adjustment Factors (based on the elapsed portion of the Index Account Option Term) and the Interim Value Proration Factor prior to the end of the Index Account Option Term. The Interim Value is calculated on each date of the Index Account Option Term, other than the first and last days, and is the amount of Index Account Option Value available for withdrawal prior to the end of the Index Account Option Term.

Interim Value Proration Factor ("IVPF") - the percentage applied to the prorated Index Adjustment Factors in the calculation of Interim Value at the time of a withdrawal prior to the end of the Index Account Option Term. The IVPF equals 100% during the Withdrawal Charge period. After the Withdrawal Charge period ends, the IVPF is reset annually on the Index Account Option Anniversary and may vary by Crediting Method and Protection Option combination. The IVPF is guaranteed to be at least 50% after the Withdrawal Charge period ends.

Issue Date - the date your Contract is issued.

Jackson, JNL, we, our, or us – Jackson National Life Insurance Company. (We do not capitalize “we,” “our,” or “us” in the prospectus.)

Latest Income Date ("LID") - the date on which you will begin receiving income payments. The Latest Income Date is the Contract Anniversary on which the Owner will be 95 years old, or such date allowed by the Company on a non-discriminatory basis or as required by an applicable qualified plan, law or regulation.

Owner, you or your – the natural person or legal entity entitled to exercise all rights and privileges under the Contract. Usually, but not always, the Owner is the

Annuitant. The Contract allows for the naming of joint Owners. (We do not capitalize “you” or “your” in the prospectus.) Any reference to the Owner includes any joint Owner.

Performance Trigger Rate ("PTR") - one of two currently available Crediting Methods, and an Index Adjustment Factor. The PTR is the amount of positive Index Adjustment, expressed as a percentage, that will be credited to an Index Account Option under the Performance Trigger Crediting Method at the end of each Index Account Option Term if the performance criteria are met.

Premium - consideration paid into the Contract by or on behalf of the Owner.

Protection Options - the general term used to describe the Floor and Buffer Index Adjustment Factors. Protection Options provide varying levels of partial protection against the risk of loss of Index Account Option Value when Index Return is negative.

Remaining Premium - total Premium paid into the Contract, reduced by withdrawals of Premium, including Withdrawal Charges, before withdrawals are adjusted for any applicable charges.

Withdrawal Charge - a charge that is applied to withdrawals in excess of the Free Withdrawal during the first six years of the Contract, expressed as a percentage of Remaining Premium.

Withdrawal Value - the amount payable upon a total withdrawal of Contract Value. The Withdrawal Value is equal to the Contract Value, subject to any applicable positive or negative Interim Value adjustment, less any applicable Withdrawal Charge.

RISK FACTORS

The purchase of the Contract and the features you elect involve certain risks. You should carefully consider the following factors, in addition to considerations listed elsewhere in this prospectus, prior to purchasing the Contract.

Risk of Loss. An investment in an index-linked annuity is subject to the risk of loss. You may lose money, including the loss of principal.

Liquidity. We designed the Contract to be a long-term investment that you may use to help save for retirement. If you take withdrawals from your Contract during the withdrawal charge period, withdrawal charges may apply. In addition, each time you take a withdrawal prior to the end of the Index Account Option term, we will recalculate your Index Account Option Value, based on an Interim Value adjustment, which could be positive or negative. In doing so, we use prorated Index Adjustment Factors and your Interim Value Proration Factor(s), both of which serve to reduce any positive Index Adjustment, as well as increase any negative Index Adjustment we credit. Any negative adjustment could be significant and impact the amount of Contract Value available for future withdrawals. In addition, amounts withdrawn from this Contract may also be subject to taxes and a 10% additional federal tax penalty if taken before age 59½. If you plan on taking withdrawals that will be subject to withdrawal charges and/or taking withdrawals before age 59½, this Contract may not be appropriate for you.

Limitations on Transfers. You can transfer Contract Value among the Index Account Options and the Fixed Account only at designated times (on the Index Account Option Term Anniversary for amounts invested in Index Account Options, and Contract Anniversaries for amounts invested in the Fixed Account). You cannot transfer out of a current Index Account Option to another Index Account Option (or to the Fixed Account) until the Index Account Option Term Anniversary and you cannot transfer out of the Fixed Account to an Index Account Option until the Contract Anniversary. In all cases, the amount transferred can only be transferred to a new Index Account Option or Fixed Account. This may limit your ability to react to market conditions. You should consider whether the inability to reallocate Contract Value during the elected investment terms is consistent with your financial needs and risk tolerance. For more information about transfers, please see the section titled "Transfers and Reallocations" on page 25.

Reallocations. You should understand that a new Cap Rate and Performance Trigger Rate will go into effect on the Index Account Option Term Anniversary for all new Index Account Option Terms. Such rates could be lower, higher, or equal to your current Crediting Method percentage rate. We post all rates online at Jackson.com/RatesJMLP. The rates for Contract Value reallocations at the end of an Index Account Option Term are posted at least 30 days before the end of any Index Account Option Term. At least 30 days prior to any Index Account Option Term Anniversary, we will send you written notice reminding you of how you may obtain the rates for the next Index Account Option Term. You may provide reallocation instructions in writing using our Reallocation Form or a Letter of Instruction, or over the phone if you have authorized telephone transactions. If you do not provide timely allocation instructions by close of business on the Index Account Option Term Anniversary of an expiring Index Account Option Term as to how you would like your Index Account Option Value allocated for your next Index Account Option Term, we will generally (i) renew the Index Account Option into the same Index Account Option Term, if available; or (ii) if the same Crediting Method, Protection Option, or Index you elected is not available, we will reallocate the Index Account Option Value(s) to the Fixed Account. See "Automatic Reallocations" beginning on page 26. Such reallocation instructions must be sent to us in written form acceptable to the Company, or via telephone if you have authorized telephone transactions on your account. For more information on how rates are set and communicated, please see the subsection titled "Crediting Methods" under "Additional Information About the Index Account Options" beginning on page 21. This will occur even if the Fixed Account and/or specific Index Account Option is no longer appropriate for your investment goals. For more information about transfers, please see the section titled "Transfers and Reallocations" on page 25.

Loss of Contract Value. There is a risk of substantial loss of Contract Value (except for amounts allocated to the Fixed Account) due to any negative Index Return that exceeds the Buffer or is within the Floor amount. If any negative Index Return exceeds the Buffer or is within the Floor you have elected at the end of the Index Account Option Term, you will realize the amount of loss associated with your elected Protection Option. Buffers and Floors are not cumulative, and their protection does not extend beyond the length of any given Index Account Option Term. If you keep amounts allocated to an Index Account Option over multiple Index Account Option Terms in which negative Index Adjustments are made, the total combined loss of Index Account Option Value over those multiple Index Account Option Terms may exceed the stated limit of any applicable Protection Option for a single Index Account Option Term.

No Ownership of Underlying Securities. You have no ownership rights in the securities that comprise an Index. Purchasing the Contract is not equivalent to purchasing shares in a mutual fund that invests in securities comprising the Indexes

nor is it equivalent to directly investing in such securities. You will not have any ownership interest or rights in the securities, such as voting rights, or the right to receive dividend payments, or other distributions. Index returns would be higher if they included the dividends from the component securities.

Tracking Index Performance. When you allocate money to an Index Account Option, the value of your investment depends in part on the performance of the applicable Index. The performance of an Index is based on changes in the values of the securities or other investments that comprise or define the Index. The securities comprising or defining the Indexes are subject to a variety of investment risks, many of which are complicated and interrelated. These risks may affect capital markets generally, specific market segments, or specific issuers. The performance of the Indexes may fluctuate, sometimes rapidly and unpredictably. Negative Index Return may cause you to realize investment losses. The historical performance of an Index or an Index Account Option does not guarantee future results. It is impossible to predict whether an Index will perform positively or negatively over the course of a term.

While you will not directly invest in an Index, if you choose to allocate amounts to an Index Account Option, you are indirectly exposed to the investment risks associated with the applicable Index as the Contract performance tracks the Index Return and then your elected Crediting Methods and Protection Options are applied based on that performance. Because each Index is comprised or defined by a collection of equity securities, each Index is exposed to market fluctuations that may cause the value of a security to change, sometimes rapidly and unpredictably.

Limits on Investment Return.

•Cap Rate. If you elect a Cap Crediting Method, the highest possible return that you may achieve on your investment is equal to the Cap Rate, or "Cap". The Cap therefore limits the positive Index Adjustment, if any, that may be credited to your Contract for a given Index Account Option Term. The Caps do not guarantee a certain amount of minimum Index Adjustment credited. Any Index Adjustment based on a Cap Crediting Method may be less than the positive return of the Index. This is because any positive return of the Index that we credit to your Index Account Option Value is subject to a maximum in the form of a Cap, even when the positive Index Return is greater.

•Performance Trigger Rates. If you elect a Performance Trigger Crediting Method, the highest possible return that you may achieve is equal to the Performance Trigger Rate. The Performance Trigger Rate therefore limits the positive Index Adjustment, if any, that may be credited to your Contract for a given Index Account Option Term. The Performance Trigger Rates do not guarantee a minimum Index Adjustment amount. Any Index Adjustment credited for a Performance Trigger Crediting Method may be less than the positive return of the Index. This is because any positive return of the Index that we credit to your Index Account Option Value is always equal to the Performance Trigger Rate, even when the positive Index Return is greater.

Cap and Performance Trigger Rates are not annual rates. For Index Account Option Terms that are longer than one year, the rates would be lower on an annual basis.

In addition, each time you take a withdrawal, we will recalculate your Index Account Option Value, based on an Interim Value adjustment, which could be zero, positive or negative. In doing so, we prorate the Cap and Performance Trigger based on the number of days that elapsed in the Term and the application of the Interim Value Proration Factor, which means you will not experience the full advantage of the stated Cap or Performance Trigger Rate. This could serve to decrease any positive Index Adjustment we credit.

New rates go into effect at the start of each new Index Account Option Term. Such rates could be lower, higher, or equal to the current rate. If a new rate is unacceptable to you, you will have to reallocate your Contract Value to a different Index Account Option or to the Fixed Account. There is a risk that these other investment options will also not be satisfactory to you.

Buffers and Floors. If you allocate money to an Index Account Option, Index fluctuations may cause an Index Adjustment to be negative at the end of the Index Account Option Term despite the application of the Buffer or Floor Protection Option that you elect.

•If you elect a Floor, a negative Index Return will always result in a negative Index Adjustment up to the Floor but not in excess of the Floor.

•If you elect a Buffer, a negative Index Return will result in a negative Index Adjustment if the negative Index Return exceeds the Buffer.

In choosing between a Buffer and a Floor, you should consider that the maximum amount of principal you can lose with a Buffer is greater than the maximum amount of principal you can lose with a Floor. Conversely, because of the greater downside risk you assume with a Buffer Protection Option, they tend to offer greater opportunities for upside growth (for example, higher Cap rates may be available with Buffer Protection Options).

If we credit your Contract with a negative Index Adjustment, your Index Account Option Value will be reduced. Buffers and Floors are not cumulative, and their protection does not extend beyond the length of any given Index Account Option Term. Any portion of your Contract Value allocated to an Index Account Option will benefit from the protection of either the Buffer or Floor for that Index Account Option Term only. A new Buffer or Floor will be applied to subsequent Index Account Option Terms. You assume the risk that you will incur a loss and that the amount of the loss could be significant. You also bear the risk that sustained negative Index Return may result in a zero or negative Index Adjustment being credited to your Index Account Option Value over multiple Index Account Option Terms.

In addition, each time you take a withdrawal, we will recalculate your Index Account Option Value, based on an Interim Value adjustment, which could be zero, positive or negative. In doing so, we prorate the Buffer or Floor based on the number of days that elapsed in the Term and the application of the Interim Value Proration Factor, which means you will not have the full protection of the stated Buffer or Floor. This could serve to increase any negative Index Adjustment we credit.

If an Index Account Option Value is credited with a negative Index Adjustment for multiple Index Account Option Terms, the total combined loss of Index Account Option Value over those multiple Index Account Option Terms may exceed the stated limit of any applicable Buffer or Floor for a single Index Account Option Term.

Buffers and Floors are not annual rates. For Index Account Option Terms that are longer than one year, the rates would be lower on an annual basis.

Elimination, Suspension, Replacements, Substitutions, and Changes to Indexes, Crediting Methods, and Terms. We may replace an Index if it is discontinued or if there is a substantial change in the calculation of the Index, or if hedging instruments become difficult to acquire or the cost of hedging becomes excessive. If we substitute an Index, the performance of the new Index may differ from the original Index, and you may not be able to achieve the level of Index Return you anticipated. If an Index is replaced during an Index Account Option Term, the Index Return for the Index Account Option Term will be calculated by adding the Index Return for the original Index from the beginning of the term up until the date of replacement, to the Index Return from the substituted Index starting on the date of replacement through the end of the Index Account Option Term, as follows:

Example: Assume that you allocate Contract Value to a 6-Year Index Account Option with the S&P 500 Index and the index value is $1,000 at the beginning of the term. After 2 years, the S&P 500 Index is discontinued and replaced by the MSCI EAFE Index. On the day of the replacement, the S&P 500 Index is $1,100, so the Index Return as of that date is 10%. The MSCI EAFE index value on the day of the replacement is 2,000. Going forward, your Index Return for the remainder of the Index Account Option Term will be equal to 10% plus the calculated return of the MSCI EAFE Index from the replacement date. This means that one year later, on your third Contract Anniversary, if the MSCI EAFE Index is $1,900, your Index Return would be 10% + (-5%) = 5%.

A substitution of an Index during an Index Account Option Term will not cause a change in the Crediting Method, Protection Option, or Index Account Option Term length.

Changes to the Cap Rates and Performance Trigger Rates, if any, occur at the beginning of the next Index Account Option Term. The guaranteed maximum Floor and guaranteed minimum Buffer will not change for the life of your Contract. Available Floor and Buffer Rates are guaranteed never to be less than 5% or more than 50%.

We may also add or remove an Index, Index Account Option Term, Crediting Method, or Protection Option during the time that you own the Contract. You bear the risk that we may eliminate an Index Account Option or certain Index Account Option features and replace them with new options and features that are not acceptable to you. We will not add any Index, Index Account Option Term, Crediting Method, or Protection Option until the new Index or Crediting Method has been approved by the insurance department in your state. Any addition, substitution, or removal of an Index, Crediting Method, Protection Option, or Index Account Option Term will be communicated to you in writing.

Issuing Company. No company other than Jackson has any legal responsibility to pay amounts that Jackson owes under the Contract. The amounts you invest are not placed in a registered separate account, and your rights under the Contract to invested assets and the returns on those assets are subject to the claims paying ability of Jackson. You should review and be comfortable with the financial strength of Jackson for its claims-paying ability.

Effects of Withdrawals, Annuitization, or Death. If a withdrawal is taken, including a required minimum distribution ("RMD") during the Index Account Option Term, it could be subject to Withdrawal Charges as well as an Interim Value adjustment that could reduce your Index Account Option Value. Such reduction could be significant. The Interim Value adjustment may result in an Index Adjustment that is less than the Index Adjustment you would have received if you had held the investment until the end of the Index Account Option Term. If you take a withdrawal when the Index Return is negative, your remaining Contract Value may be significantly less than if you waited to take the withdrawal when the Index Return was positive. In addition, partial and total withdrawals taken during the first six Contract Years which exceed the Free Withdrawal amount, may be subject to a Withdrawal Charge. Amounts applied to income payments on an Income Date that is within one year of the Contract's Issue Date may also be subject to a Withdrawal Charge.

All withdrawals, including RMDs, will be taken proportionately from each of your Index Account Options and Fixed Account unless otherwise specified. Withdrawals can also reduce the Death Benefit. Any Return of Premium death benefit will be reduced in a pro-rated amount. Pro rata reductions can be greater than the actual dollar amount of your withdrawal.

In addition, since all withdrawals reduce the Contract Value, withdrawals will also reduce the amount that can be taken as income since such amount is determined by the Contract Value on the Income Date. The Latest Income Date for this contract is age 95.

If your Contract Value falls below the minimum contract value remaining as a result of a withdrawal (as stated in your Contract), we may terminate your Contract.

There are administrative rules that must be followed when taking an RMD withdrawal. Notice of an RMD is required at the time of your withdrawal request, and there is an administrative form for providing such notice. The administrative form allows you to elect one time or automatic RMD withdrawals. Eligible withdrawals that are specified as RMDs may only be taken based on the value of the Contract to which the endorsement applies, even where the Internal Revenue Code allows taking multiple contracts’ RMDs from a single contract. You, as Owner, are responsible for complying with the Internal Revenue Code’s RMD requirements. If you fail to take your full RMD for a year, you will be subject to a 25% excise tax on any shortfall. This excise tax is reduced to 10% if a distribution of the shortfall is made within two years and prior to the date the excise tax is assessed or imposed by the IRS. If your requested RMD exceeds our calculation of the RMD for your Contract, your request will not be eligible for the waiver of any applicable charges (i.e., withdrawal charges) and we will impose those charges, which will be reflected in the confirmation of the transaction.

Business Continuity and Cybersecurity Risk. We and our service providers and business partners are subject to certain risks, including those resulting from information system failures, cybersecurity incidents, public heath crises such as the coronavirus (COVID-19) pandemic, and other disaster events. Such events can adversely impact us and our operations. These risks are common to all insurers and financial service providers. These risks include, among other things, the theft, misuse, corruption and destruction of electronic information, interference with or denial of service, attacks on systems or websites, and other operational disruptions that could severely impede our ability to conduct our business or administer the Contract.

Such events could also adversely affect us by resulting in regulatory fines, litigation, financial losses, and reputational damage. Cybersecurity incidents may also impact the issuers of securities in which the underlying funds invest, which may cause the funds underlying your Contract to lose value. Although we take efforts to protect our systems from cybersecurity incidents, there can be no assurance that we or our service providers will be able to avoid cybersecurity incidents affecting Contract owners in the future. It is also possible that a cybersecurity incident could persist for an extended period of time without detection.

Additionally, our third-party service providers and other third-parties related to our business (such as financial intermediaries or, in the case of our variable products, underlying funds) are subject to similar risks. Successful implementation and execution of their business continuity policies and procedures are largely beyond our control. Disruptions to their business operations may impair our own business operations.

As of the date of this prospectus, we do not believe that we have experienced a material cyber-attack or other cybersecurity incident. However in 2023, we were notified of a data security incident involving the MOVEit file transfer system used by numerous financial services companies. A third-party vendor uses that software on our behalf to, among other things, identify the deaths of insured persons and annuitants under life insurance policies and annuity contracts. According to that third party vendor, an unknown actor exploited a MOVEit software flaw to access the vendor’s systems and download certain data. Our assessment indicated that personally identifiable information relating to approximately 850,000 of Jackson’s customers was

obtained by that unknown actor from the third party vendor’s systems. This MOVEit vulnerability has now been rectified. Separately, Jackson experienced unauthorized access to two servers as a result of the MOVEit flaw; however, the scope and nature of the data accessed on those servers was significantly less than the third party vendor impact. Our assessment was that a subset of information relating to certain partner organizations and individuals, including certain customers of Jackson, was obtained from the two affected servers. We notified affected customers as required by law, and we continue to assess and investigate the overall impact of the incidents. At this time, we do not believe the incidents or related litigation will have a material adverse effect on the business, operations, or financial results of Jackson.

THE ANNUITY CONTRACT

Your Contract is a contract between you, the Owner, and us. The Contract is an individual single Premium deferred index-linked annuity. Your Contract and any endorsements are the formal contractual agreement between you and the Company. This prospectus is a disclosure document and describes all of the Contract’s material features, benefits, rights, and obligations of annuity purchasers under the Contract.

Your Contract is intended to help facilitate your retirement savings on a tax-deferred basis, or other long-term investment purposes, and provides for a death benefit. Purchases under tax-qualified plans should be made for other than tax deferral reasons. Tax-qualified plans provide tax deferral that does not rely on the purchase of an annuity contract. We will not issue a Contract to someone older than age 85.

Your Premium and Contract Value may be allocated to:

•the Fixed Account, in which amounts earn a declared rate of interest for a certain period,

•the Index Account, in which amounts may be allocated to the Index Account Options, which are currently available with a variety of Crediting Methods and term lengths, and certain Protection Options, all of which may be credited with a zero, positive or negative Index Adjustment based upon the performance of a specified Index.

Your Contract, like all deferred annuity contracts, has two phases:

•the accumulation phase, when your Premium may accumulate value based upon the Index Adjustment and/or Fixed Account interest credited, and

•the income phase, when we make income payments to you.

As the Owner, you can exercise all the rights under your Contract. In general, joint Owners jointly exercise all the rights under the Contracts. In some cases, such as telephone and internet transactions, joint Owners may authorize each joint Owner to act individually. On jointly owned Contracts, correspondence and required documents will be sent to the address of record of the primary Owner.

State Variations. This prospectus describes the material rights and obligations under the Contract. There may be some variations to the general description in this prospectus, where required by specific state laws. Please refer to your Contract for specific variations applicable to you. Any state variations will be included in your Contract and any endorsements to your Contract. For a list of material state variations, please refer to Appendix B.

Owner. As Owner, you may exercise all ownership rights under the Contract. Usually, but not always, the Owner is the Annuitant. The Contract allows for the naming of joint Owners. Only two joint Owners are allowed per Contract. Any reference to the Owner includes any joint Owner. Joint Owners have equal ownership rights, and as such, each Owner must authorize any exercise of Contract rights unless the joint Owners instruct us in writing to act upon authorization of an individual joint Owner.

Ownership Changes. To the extent allowed by state law, we reserve the right to refuse ownership changes at any time on a non-discriminatory basis, as required by applicable law or regulation. You may request to change the Owner or joint Owner of this Contract by sending a signed, dated request to our Customer Care Center at the address provided on the front cover of the prospectus. The change of ownership will not take effect until it is approved by us, unless you specify another date, and will be subject to any payments made or actions taken by us prior to our approval. We will use the oldest Owner's age for all Contract

purposes. No person whose age exceeds the maximum issue age allowed by Jackson as of the Issue Date of the Contract may be designated as a new Owner.

Jackson assumes no responsibility for the validity or tax consequences of any ownership change. If you make an ownership change, you may have to pay taxes. We encourage you to seek legal and/or tax advice before requesting any ownership change.

Annuitant. The Annuitant is the natural person on whose life income payments for this Contract are based. If the Contract is owned by a natural person, you may change the Annuitant at any time before you begin taking income payments by sending a written, signed and dated request to the Customer Care Center at the address provided on the front cover of the prospectus. Contracts owned by legal entities are not eligible for Annuitant changes. The Annuitant change will take effect on the date you signed the change request, unless you specify otherwise, subject to any payments made or actions taken by us prior to receipt of the request in Good Order. We reserve the right to limit the number of joint Annuitants to two. If the Contract is owned by a legal entity, the Annuitant(s) will be entitled to the benefits of the waivers of Withdrawal Charges due to terminal illness or extended care, as described more fully in your Contract.

Beneficiary. The Beneficiary is the natural person or legal entity designated to receive any Contract benefits upon the first Owner's death. The Contract allows for the naming of multiple Beneficiaries. You may change the Beneficiary(ies) by sending a written, signed and dated request to the Customer Care Center at the address provided on the front cover of the prospectus. If an irrevocable Beneficiary was previously designated, that Beneficiary must consent in writing to any change. The Beneficiary change will take effect on the date you signed the change request, subject to any payments made or actions taken by us prior to receipt of the request in Good Order.

Assignment. To the extent allowed by state law, we reserve the right to refuse assignments at any time on a non-discriminatory basis, as required by applicable law or regulation. You may request to assign this Contract by sending a signed, dated request to our Customer Care Center at the address provided on the front cover of the prospectus. The assignment will take effect on the date we approve it, unless you specify another date, subject to any payments made or actions taken by us prior to our approval. Your right to assign the Contract is subject to the interest of any assignee or irrevocable Beneficiary. If the Contract is issued pursuant to a qualified plan, it may not be assigned except under such conditions as may be allowed under the plan and applicable law. Generally, an assignment or pledge of a non-qualified annuity is treated as a distribution.

Jackson assumes no responsibility for the validity or tax consequences of any assignment. We encourage you to seek legal and/or tax advice before requesting any assignment.

PREMIUM

Minimum Premium:

•$25,000 under most circumstances

Maximum Premium:

•The maximum Premium payment you may make without our prior approval is $1 million.

We reserve the right to waive minimum and maximum Premium amounts in a non-discriminatory manner. Our right to restrict Premium to a lesser maximum amount may affect the benefits under your Contract.

Allocations of Premium. You may allocate Premium to any available Indexed Account Option or Fixed Account. Each allocation must be a whole percentage between 0% and 100%. The minimum amount you may allocate to an Indexed Account Option or Fixed Account is $100.

We will issue your Contract and allocate your Premium payment within two Business Days (days when the New York Stock Exchange is open) after we receive your complete Premium payment and all information that we require for the purchase of a Contract in Good Order. We reserve the right to reject a Premium payment that is comprised of multiple payments paid to us over a period of time. If we permit you to make multiple payments as part of your Premium payment, the Contract will not be issued until all such payments are received in Good Order. We reserve the right to hold such multiple payments in a non-interest bearing account until the Issue Date. If we do not receive all information required to issue your Contract, we will

contact you to get the necessary information. If for some reason we are unable to complete this process within five Business Days, we will return your money. Each Business Day ends when the New York Stock Exchange closes (usually 4:00 p.m. Eastern time). No Premium will be accepted after the Contract has been issued.

Free Look. You may cancel your Contract by returning it to your financial professional or to us within ten days after receiving it. In some states, the Free Look period may be longer. Please see the front page of your Contract for the Free Look period that applies to your Contract. In general, if you cancel your Contract during this period, we will return:

•Premiums paid to the Fixed Account, less

•any withdrawals from the Fixed Account, plus

•the Index Account Value.

We will determine the Index Account Value as of the date we receive the Contract. In some states, we are required to return Premium payments only. We will pay the applicable free look proceeds within seven days of a request in Good Order. In some states, we are required to hold the Premiums of a senior citizen in the Fixed Account during the free look period, unless we are specifically directed to allocate the Premium to the Index Account.

CONTRACT OPTIONS

The Contract is divided into two general categories for allocation of your Premium and Contract Value: the Fixed Account, where amounts earn a declared rate of interest for an annually renewable one-year term, and the Index Account, where amounts earn index-linked interest ("Index Adjustment") for a specified term based upon the performance of a selected Index.

Fixed Account. The Fixed Account is an annually renewable account in which amounts you allocate earn a declared rate of interest. Fixed Account interest rates are guaranteed for one year from the date you allocate amounts into the Fixed Account and are subject to change on each Contract Anniversary thereafter. In no event will the interest rate credited to amounts allocated to the Fixed Account be less than the Fixed Account Minimum Interest Rate, as discussed below.

Fixed Account Value. The Fixed Account Value is equal to (1) the value of Premium and any amounts transferred into the Fixed Account; (2) plus interest credited daily at a rate not less than the Fixed Account Minimum Interest Rate, per annum; (3) less any gross partial withdrawals, including any Withdrawal Charges on such withdrawals; (4) less any amounts transferred out of the Fixed Account.