UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08846

Tributary Funds, Inc.

Tributary Capital Management, LLC

1620 Dodge Street

Omaha, Nebraska 68197

Karen Shaw

Apex Fund Services

Three Canal Plaza, Suite 600

Portland, ME 04101

Registrant’s telephone number, including area code: (800) 662-4203

Date of fiscal year end: March 31

Date of reporting period: April 1, 2024 – September 30, 2024

ITEM 1. REPORT TO SHAREHOLDERS.

(a) A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act, as amended (“Act”), is attached hereto.

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about the Tributary Balanced Fund for the period of April 1, 2024, to September 30, 2024. You can find additional information about the Fund at www.tributaryfunds.com/resources/. You can also request this information by contacting us at (800) 662-4203.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $48 | 0.94% |

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| Institutional Class | 23.62% | 9.55% | 8.15% |

| Russell 3000 Index | 35.19% | 15.26% | 12.83% |

| Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index | 9.45% | 1.26% | 1.96% |

Composite Index (60% Russell 3000® Index, 40% Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index) | 24.43% | 9.83% | 8.65% |

Effective August 29, 2024, the Fund changed its primary benchmark index from the Composite Index (60% Russell 3000® Index, 40% Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index) to the Russell 3000® Index due to regulatory requirements. The Fund retained the Composite Index (60% Russell 3000® Index, 40% Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index) as a secondary benchmark index because the Composite Index (60% Russell 3000® Index, 40% Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index) more closely reflects the market sectors in which the Fund invests.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $84,764,683 |

| # of Portfolio Holdings | 211 |

| Portfolio Turnover Rate | 10% |

| Investment Advisory Fees (Net of fees waived) | $449,227 |

Sector Weightings

(% total investments)

| Value | Value |

|---|

| Information Technology | 20.4% |

| Government Securities | 13.4% |

| Financials | 12.6% |

| Consumer Discretionary | 8.2% |

| Industrials | 7.7% |

| Health Care | 7.1% |

| Asset Backed Securities | 6.3% |

| Communication Services | 6.1% |

| Consumer Staples | 3.8% |

| Non-Agency Commercial Mortgage Backed Securities | 2.8% |

| Short-Term Investments | 2.6% |

| Energy | 2.4% |

| Materials | 1.8% |

| Real Estate | 1.7% |

| Utilities | 1.6% |

| Non-Agency Residential Mortgage Backed Securities | 1.0% |

| U.S. Government Mortgage Backed Securities | 0.5% |

Top Ten Holdings

(% of net assets)

| Apple, Inc. | 4.58% |

| Microsoft Corp. | 4.37% |

| NVIDIA Corp. | 4.05% |

| U.S. Treasury Note/Bond | 3.83% |

| U.S. Treasury Note/Bond | 3.65% |

| U.S. Treasury Note | 2.68% |

| Alphabet, Inc., Class C | 2.52% |

| Amazon.com, Inc. | 2.40% |

| Meta Platforms, Inc., Class A | 1.87% |

* excluding cash equivalents

Additional information is available by scanning the QR code or at www.tributaryfunds.com/resources/, including its:

prospectus

financial information

holdings

proxy information

Semi-Annual Shareholder Report - September 30, 2024

Semi-Annual Shareholder Report - September 30, 2024

: Institutional Plus Class

This semi-annual shareholder report contains important information about the Tributary Balanced Fund for the period of April 1, 2024, to September 30, 2024. You can find additional information about the Fund at www.tributaryfunds.com/resources/. You can also request this information by contacting us at (800) 662-4203.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Plus | $40 | 0.76% |

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| Institutional Plus Class | 23.83% | 9.74% | 8.35% |

| Russell 3000 Index | 35.19% | 15.26% | 12.83% |

| Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index | 9.45% | 1.26% | 1.96% |

Composite Index (60% Russell 3000® Index, 40% Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index) | 24.43% | 9.83% | 8.65% |

Effective August 29, 2024, the Fund changed its primary benchmark index from the Composite Index (60% Russell 3000® Index, 40% Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index) to the Russell 3000® Index due to regulatory requirements. The Fund retained the Composite Index (60% Russell 3000® Index, 40% Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index) as a secondary benchmark index because the Composite Index (60% Russell 3000® Index, 40% Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index) more closely reflects the market sectors in which the Fund invests.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $84,764,683 |

| # of Portfolio Holdings | 211 |

| Portfolio Turnover Rate | 10% |

| Investment Advisory Fees (Net of fees waived) | $449,227 |

Sector Weightings

(% total investments)

| Value | Value |

|---|

| Information Technology | 20.4% |

| Government Securities | 13.4% |

| Financials | 12.6% |

| Consumer Discretionary | 8.2% |

| Industrials | 7.7% |

| Health Care | 7.1% |

| Asset Backed Securities | 6.3% |

| Communication Services | 6.1% |

| Consumer Staples | 3.8% |

| Non-Agency Commercial Mortgage Backed Securities | 2.8% |

| Short-Term Investments | 2.6% |

| Energy | 2.4% |

| Materials | 1.8% |

| Real Estate | 1.7% |

| Utilities | 1.6% |

| Non-Agency Residential Mortgage Backed Securities | 1.0% |

| U.S. Government Mortgage Backed Securities | 0.5% |

Top Ten Holdings

(% of net assets)

| Apple, Inc. | 4.58% |

| Microsoft Corp. | 4.37% |

| NVIDIA Corp. | 4.05% |

| U.S. Treasury Note/Bond | 3.83% |

| U.S. Treasury Note/Bond | 3.65% |

| U.S. Treasury Note | 2.68% |

| Alphabet, Inc., Class C | 2.52% |

| Amazon.com, Inc. | 2.40% |

| Meta Platforms, Inc., Class A | 1.87% |

* excluding cash equivalents

Additional information is available by scanning the QR code or at www.tributaryfunds.com/resources/, including its:

prospectus

financial information

holdings

proxy information

Semi-Annual Shareholder Report - September 30, 2024

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about the Tributary Income Fund for the period of April 1, 2024, to September 30, 2024. You can find additional information about the Fund at www.tributaryfunds.com/resources/. You can also request this information by contacting us at (800) 662-4203.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $31 | 0.61% |

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| Institutional Class | 11.96% | 0.34% | 1.87% |

| Bloomberg Barclays U.S. Aggregate Bond Index | 11.57% | 0.33% | 1.84% |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $175,004,121 |

| # of Portfolio Holdings | 201 |

| Portfolio Turnover Rate | 8% |

| Investment Advisory Fees (Net of fees waived) | $819,318 |

Sector Weightings

(% total investments)

| Value | Value |

|---|

| U.S. Government Mortgage Backed Securities | 29.5% |

| Corporate Bonds | 26.5% |

| U.S. Treasury Securities | 23.9% |

| Asset Backed Securities | 7.5% |

| Non-Agency Residential Mortgage Backed Securities | 7.5% |

| Non-Agency Commercial Mortgage Backed Securities | 3.7% |

| Municipals | 0.8% |

| Short-Term Investments | 0.6% |

Top Ten Holdings

(% of net assets)

| U.S. Treasury Note/Bond | 8.35% |

| U.S. Treasury Bond | 5.24% |

| U.S. Treasury Note/Bond | 3.84% |

| U.S. Treasury Note/Bond | 3.42% |

| U.S. Treasury Note/Bond | 1.97% |

| Federal Home Loan Mortgage Corp. | 1.54% |

| Federal National Mortgage Association | 1.47% |

| Federal Home Loan Mortgage Corp. | 1.11% |

| Federal National Mortgage Association | 1.10% |

| Federal National Mortgage Association | 1.10% |

* excluding cash equivalents

Additional information is available by scanning the QR code or at www.tributaryfunds.com/resources/, including its:

prospectus

financial information

holdings

proxy information

Semi-Annual Shareholder Report - September 30, 2024

Semi-Annual Shareholder Report - September 30, 2024

: Institutional Plus Class

This semi-annual shareholder report contains important information about the Tributary Income Fund for the period of April 1, 2024, to September 30, 2024. You can find additional information about the Fund at www.tributaryfunds.com/resources/. You can also request this information by contacting us at (800) 662-4203.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Plus | $25 | 0.49% |

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| Institutional Plus Class | 12.13% | 0.49% | 2.02% |

| Bloomberg Barclays U.S. Aggregate Bond Index | 11.57% | 0.33% | 1.84% |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $175,004,121 |

| # of Portfolio Holdings | 201 |

| Portfolio Turnover Rate | 8% |

| Investment Advisory Fees (Net of fees waived) | $819,318 |

Sector Weightings

(% total investments)

| Value | Value |

|---|

| U.S. Government Mortgage Backed Securities | 29.5% |

| Corporate Bonds | 26.5% |

| U.S. Treasury Securities | 23.9% |

| Asset Backed Securities | 7.5% |

| Non-Agency Residential Mortgage Backed Securities | 7.5% |

| Non-Agency Commercial Mortgage Backed Securities | 3.7% |

| Municipals | 0.8% |

| Short-Term Investments | 0.6% |

Top Ten Holdings

(% of net assets)

| U.S. Treasury Note/Bond | 8.35% |

| U.S. Treasury Bond | 5.24% |

| U.S. Treasury Note/Bond | 3.84% |

| U.S. Treasury Note/Bond | 3.42% |

| U.S. Treasury Note/Bond | 1.97% |

| Federal Home Loan Mortgage Corp. | 1.54% |

| Federal National Mortgage Association | 1.47% |

| Federal Home Loan Mortgage Corp. | 1.11% |

| Federal National Mortgage Association | 1.10% |

| Federal National Mortgage Association | 1.10% |

* excluding cash equivalents

Additional information is available by scanning the QR code or at www.tributaryfunds.com/resources/, including its:

prospectus

financial information

holdings

proxy information

Semi-Annual Shareholder Report - September 30, 2024

Semi-Annual Shareholder Report - September 30, 2024

Tributary Nebraska Tax-Free Fund

: Institutional Plus Class

This semi-annual shareholder report contains important information about the Tributary Nebraska Tax-Free Fund for the period of April 1, 2024, to September 30, 2024. You can find additional information about the Fund at www.tributaryfunds.com/resources/. You can also request this information by contacting us at (800) 662-4203.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Plus | $23 | 0.45% |

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| Institutional Plus Class | 8.66% | 0.90% | 1.80% |

| Bloomberg Barclays Municipal Bond Index | 10.37% | 1.39% | 2.52% |

| Bloomberg Barclays 1-15 Year Municipal Blend Index (1-17) | 8.47% | 1.46% | 2.24% |

Effective August 29, 2024, the Fund changed its primary benchmark index from the Bloomberg Barclays 1-15 Year Municipal Blend Index to the Bloomberg Barclays Municipal Bond Index due to regulatory requirements. The Fund retained the Bloomberg Barclays 1-15 Year Municipal Blend Index as a secondary benchmark index because the Bloomberg Barclays 1-15 Year Municipal Blend Index more closely reflects the market sectors in which the Fund invests.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $54,010,440 |

| # of Portfolio Holdings | 169 |

| Portfolio Turnover Rate | 9% |

| Investment Advisory Fees (Net of fees waived) | $190,689 |

Sector Weightings

(% total investments)

| Value | Value |

|---|

| Municipals | 96.3% |

| U.S. Government Mortgage Backed Securities | 2.3% |

| Short-Term Investments | 1.4% |

Top Ten Holdings

(% of net assets)

| Douglas County Hospital Authority No. 2 | 2.15% |

| Omaha Public Power District | 1.85% |

| Loup River Public Power District | 1.81% |

| Omaha School District | 1.47% |

| Papillion-La Vista School District No. 27 | 1.45% |

| Douglas County School District No. 59 | 1.39% |

| Gretna Public Schools | 1.34% |

| Village of Boys Town NE | 1.31% |

| Douglas County School District No. 59 | 1.30% |

* excluding cash equivalents

Additional information is available by scanning the QR code or at www.tributaryfunds.com/resources/, including its:

prospectus

financial information

holdings

proxy information

Semi-Annual Shareholder Report - September 30, 2024

Semi-Annual Shareholder Report - September 30, 2024

Tributary Short-Intermediate Bond Fund

This semi-annual shareholder report contains important information about the Tributary Short-Intermediate Bond Fund for the period of April 1, 2024, to September 30, 2024. You can find additional information about the Fund at www.tributaryfunds.com/resources/. You can also request this information by contacting us at (800) 662-4203.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $33 | 0.65% |

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| Institutional Class | 7.95% | 1.84% | 1.86% |

| Bloomberg Barclays U.S. Aggregate Bond Index | 11.57% | 0.33% | 1.84% |

| Bloomberg Barclays 1-3 Year US Government/Credit Index | 7.19% | 1.70% | 1.64% |

| Bloomberg Barclays U.S. Government/Credit 1-5 Year Index | 8.10% | 1.54% | 1.77% |

Effective August 29, 2024, the Fund changed its primary benchmark index from the Bloomberg Barclays 1-3 Year US Government/Credit Index to the Bloomberg Barclays U.S. Aggregate Bond Index due to regulatory requirements. The Fund retained the Bloomberg Barclays 1-3 Year US Government/Credit Index as a secondary benchmark index because the Bloomberg Barclays 1-3 Year US Government/Credit Index more closely reflects the market sectors in which the Fund invests.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $222,695,353 |

| # of Portfolio Holdings | 215 |

| Portfolio Turnover Rate | 21% |

| Investment Advisory Fees (Net of fees waived) | $865,660 |

Sector Weightings

(% total investments)

| Value | Value |

|---|

| Asset Backed Securities | 30.0% |

| Corporate Bonds | 29.4% |

| U.S. Treasury Securities | 22.0% |

| Non-Agency Commercial Mortgage Backed Securities | 10.7% |

| Non-Agency Residential Mortgage Backed Securities | 4.7% |

| U.S. Government Mortgage Backed Securities | 1.8% |

| Municipals | 0.9% |

| Short-Term Investments | 0.3% |

| Preferred Stocks | 0.2% |

Top Ten Holdings

(% of net assets)

| U.S. Treasury Note | 10.24% |

| U.S. Treasury Note/Bond | 5.64% |

| U.S. Treasury Note | 3.23% |

| U.S. Treasury Note/Bond | 2.54% |

| DLLAD, LLC | 1.08% |

| Wells Fargo & Co. | 1.02% |

| Bank of America Corp. | 1.02% |

| Morgan Stanley | 1.01% |

| Goldman Sachs Group, Inc. | 1.00% |

| AT&T, Inc. | 1.00% |

* excluding cash equivalents

Additional information is available by scanning the QR code or at www.tributaryfunds.com/resources/, including its:

prospectus

financial information

holdings

proxy information

Semi-Annual Shareholder Report - September 30, 2024

Semi-Annual Shareholder Report - September 30, 2024

Tributary Short-Intermediate Bond Fund

: Institutional Plus Class

This semi-annual shareholder report contains important information about the Tributary Short-Intermediate Bond Fund for the period of April 1, 2024, to September 30, 2024. You can find additional information about the Fund at www.tributaryfunds.com/resources/. You can also request this information by contacting us at (800) 662-4203.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Plus | $23 | 0.45% |

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| Institutional Plus Class | 8.28% | 2.02% | 2.06% |

| Bloomberg Barclays U.S. Aggregate Bond Index | 11.57% | 0.33% | 1.84% |

| Bloomberg Barclays 1-3 Year US Government/Credit Index | 7.19% | 1.70% | 1.64% |

| Bloomberg Barclays U.S. Government/Credit 1-5 Year Index | 8.10% | 1.54% | 1.77% |

Effective August 29, 2024, the Fund changed its primary benchmark index from the Bloomberg Barclays 1-3 Year US Government/Credit Index to the Bloomberg Barclays U.S. Aggregate Bond Index due to regulatory requirements. The Fund retained the Bloomberg Barclays 1-3 Year US Government/Credit Index as a secondary benchmark index because the Bloomberg Barclays 1-3 Year US Government/Credit Index more closely reflects the market sectors in which the Fund invests.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $222,695,353 |

| # of Portfolio Holdings | 215 |

| Portfolio Turnover Rate | 21% |

| Investment Advisory Fees (Net of fees waived) | $865,660 |

Sector Weightings

(% total investments)

| Value | Value |

|---|

| Asset Backed Securities | 30.0% |

| Corporate Bonds | 29.4% |

| U.S. Treasury Securities | 22.0% |

| Non-Agency Commercial Mortgage Backed Securities | 10.7% |

| Non-Agency Residential Mortgage Backed Securities | 4.7% |

| U.S. Government Mortgage Backed Securities | 1.8% |

| Municipals | 0.9% |

| Short-Term Investments | 0.3% |

| Preferred Stocks | 0.2% |

Top Ten Holdings

(% of net assets)

| U.S. Treasury Note | 10.24% |

| U.S. Treasury Note/Bond | 5.64% |

| U.S. Treasury Note | 3.23% |

| U.S. Treasury Note/Bond | 2.54% |

| DLLAD, LLC | 1.08% |

| Wells Fargo & Co. | 1.02% |

| Bank of America Corp. | 1.02% |

| Morgan Stanley | 1.01% |

| Goldman Sachs Group, Inc. | 1.00% |

| AT&T, Inc. | 1.00% |

* excluding cash equivalents

Additional information is available by scanning the QR code or at www.tributaryfunds.com/resources/, including its:

prospectus

financial information

holdings

proxy information

Semi-Annual Shareholder Report - September 30, 2024

Semi-Annual Shareholder Report - September 30, 2024

Tributary Small Company Fund

This semi-annual shareholder report contains important information about the Tributary Small Company Fund for the period of April 1, 2024, to September 30, 2024. You can find additional information about the Fund at www.tributaryfunds.com/resources/. You can also request this information by contacting us at (800) 662-4203.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $61 | 1.17% |

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| Institutional Class | 25.68% | 9.95% | 9.38% |

Russell 2000® Index | 26.76% | 9.39% | 8.78% |

Russell 2000® Value Index | 25.88% | 9.29% | 8.22% |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $795,269,291 |

| # of Portfolio Holdings | 61 |

| Portfolio Turnover Rate | 13% |

| Investment Advisory Fees (Net of fees waived) | $3,566,168 |

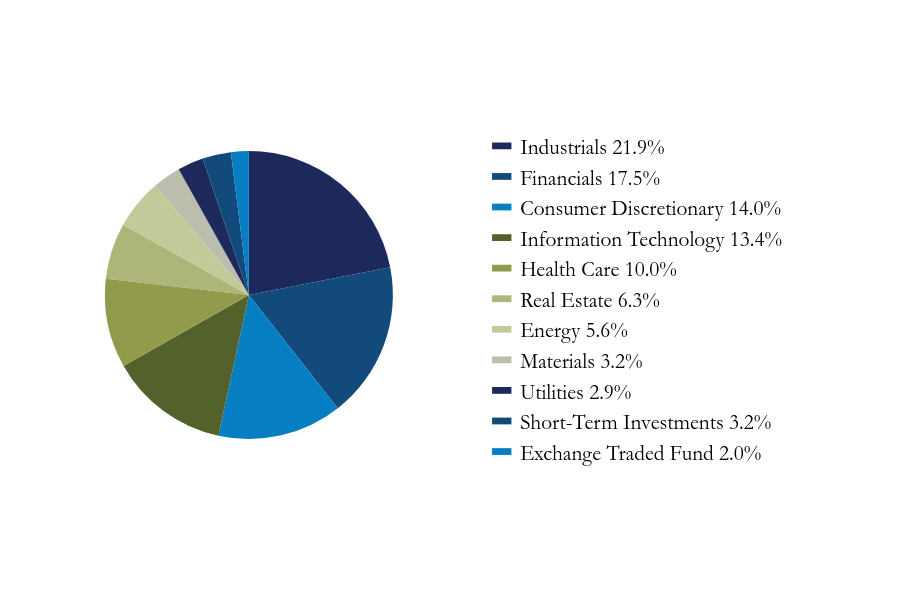

Sector Weightings

(% total investments)

| Value | Value |

|---|

| Industrials | 21.9% |

| Financials | 17.5% |

| Consumer Discretionary | 14.0% |

| Information Technology | 13.4% |

| Health Care | 10.0% |

| Real Estate | 6.3% |

| Energy | 5.6% |

| Materials | 3.2% |

| Utilities | 2.9% |

| Short-Term Investments | 3.2% |

| Exchange Traded Fund | 2.0% |

Top Ten Holdings

(% of net assets)

| Boot Barn Holdings, Inc. | 2.91% |

| Integer Holdings Corp. | 2.90% |

| CSW Industrials, Inc. | 2.78% |

| ICF International, Inc. | 2.46% |

| Patrick Industries, Inc. | 2.33% |

| Enpro, Inc. | 2.33% |

| Moelis & Co., Class A | 2.32% |

| Selective Insurance Group, Inc. | 2.28% |

| Addus HomeCare Corp. | 2.20% |

* excluding cash equivalents

Additional information is available by scanning the QR code or at www.tributaryfunds.com/resources/, including its:

prospectus

financial information

holdings

proxy information

Semi-Annual Shareholder Report - September 30, 2024

Semi-Annual Shareholder Report - September 30, 2024

Tributary Small Company Fund

: Institutional Plus Class

This semi-annual shareholder report contains important information about the Tributary Small Company Fund for the period of April 1, 2024, to September 30, 2024. You can find additional information about the Fund at www.tributaryfunds.com/resources/. You can also request this information by contacting us at (800) 662-4203.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Plus | $50 | 0.95% |

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| Institutional Plus Class | 25.92% | 10.20% | 9.61% |

Russell 2000® Index | 26.76% | 9.39% | 8.78% |

Russell 2000® Value Index | 25.88% | 9.29% | 8.22% |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $795,269,291 |

| # of Portfolio Holdings | 61 |

| Portfolio Turnover Rate | 13% |

| Investment Advisory Fees (Net of fees waived) | $3,566,168 |

Sector Weightings

(% total investments)

| Value | Value |

|---|

| Industrials | 21.9% |

| Financials | 17.5% |

| Consumer Discretionary | 14.0% |

| Information Technology | 13.4% |

| Health Care | 10.0% |

| Real Estate | 6.3% |

| Energy | 5.6% |

| Materials | 3.2% |

| Utilities | 2.9% |

| Short-Term Investments | 3.2% |

| Exchange Traded Fund | 2.0% |

Top Ten Holdings

(% of net assets)

| Boot Barn Holdings, Inc. | 2.91% |

| Integer Holdings Corp. | 2.90% |

| CSW Industrials, Inc. | 2.78% |

| ICF International, Inc. | 2.46% |

| Patrick Industries, Inc. | 2.33% |

| Enpro, Inc. | 2.33% |

| Moelis & Co., Class A | 2.32% |

| Selective Insurance Group, Inc. | 2.28% |

| Addus HomeCare Corp. | 2.20% |

* excluding cash equivalents

Additional information is available by scanning the QR code or at www.tributaryfunds.com/resources/, including its:

prospectus

financial information

holdings

proxy information

Semi-Annual Shareholder Report - September 30, 2024

Semi-Annual Shareholder Report - September 30, 2024

Tributary Small/Mid Cap Fund

This semi-annual shareholder report contains important information about the Tributary Small/Mid Cap Fund for the period of April 1, 2024, to September 30, 2024. You can find additional information about the Fund at www.tributaryfunds.com/resources/. You can also request this information by contacting us at (800) 662-4203.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $48 | 0.93% |

Average Annual Total Returns

| | One Year | Five Year | Since Inception 08/2/19 |

|---|

| Institutional Class | 25.78% | 12.17% | 12.54% |

| Russell 2500 Index | 26.17% | 10.43% | 10.13% |

| Russell 2500 Value Index | 26.59% | 9.99% | 10.14% |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $14,492,867 |

| # of Portfolio Holdings | 57 |

| Portfolio Turnover Rate | 9% |

| Investment Advisory Fees (Net of fees waived) | $111,033 |

Sector Weightings

(% total investments)

| Value | Value |

|---|

| Industrials | 23.4% |

| Financials | 16.4% |

| Information Technology | 14.4% |

| Consumer Discretionary | 14.0% |

| Health Care | 9.7% |

| Real Estate | 6.3% |

| Energy | 4.8% |

| Materials | 3.6% |

| Consumer Staples | 3.3% |

| Utilities | 2.0% |

| Communication Services | 1.2% |

| Short-Term Investments | 0.9% |

Top Ten Holdings

(% of net assets)

| Burlington Stores, Inc. | 3.13% |

| Tractor Supply Co. | 2.93% |

| Tetra Tech, Inc. | 2.82% |

| Stifel Financial Corp. | 2.82% |

| Ollie's Bargain Outlet Holdings, Inc. | 2.50% |

| Revvity, Inc. | 2.46% |

| ICF International, Inc. | 2.45% |

| Carlisle Cos., Inc. | 2.43% |

| Littelfuse, Inc. | 2.29% |

| Jones Lang LaSalle, Inc. | 2.20% |

* excluding cash equivalents

Additional information is available by scanning the QR code or at www.tributaryfunds.com/resources/, including its:

prospectus

financial information

holdings

proxy information

Semi-Annual Shareholder Report - September 30, 2024

Semi-Annual Shareholder Report - September 30, 2024

Tributary Small/Mid Cap Fund

: Institutional Plus Class

This semi-annual shareholder report contains important information about the Tributary Small/Mid Cap Fund for the period of April 1, 2024, to September 30, 2024. You can find additional information about the Fund at www.tributaryfunds.com/resources/. You can also request this information by contacting us at (800) 662-4203.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Plus | $46 | 0.90% |

Average Annual Total Returns

| | One Year | Five Year | Since Inception 08/1/19 |

|---|

| Institutional Plus Class | 25.84% | 12.30% | 12.68% |

| Russell 2500 Index | 26.17% | 10.43% | 9.91% |

| Russell 2500 Value Index | 26.59% | 9.99% | 9.96% |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

| Total Net Assets | $14,492,867 |

| # of Portfolio Holdings | 57 |

| Portfolio Turnover Rate | 9% |

| Investment Advisory Fees (Net of fees waived) | $111,033 |

Sector Weightings

(% total investments)

| Value | Value |

|---|

| Industrials | 23.4% |

| Financials | 16.4% |

| Information Technology | 14.4% |

| Consumer Discretionary | 14.0% |

| Health Care | 9.7% |

| Real Estate | 6.3% |

| Energy | 4.8% |

| Materials | 3.6% |

| Consumer Staples | 3.3% |

| Utilities | 2.0% |

| Communication Services | 1.2% |

| Short-Term Investments | 0.9% |

Top Ten Holdings

(% of net assets)

| Burlington Stores, Inc. | 3.13% |

| Tractor Supply Co. | 2.93% |

| Tetra Tech, Inc. | 2.82% |

| Stifel Financial Corp. | 2.82% |

| Ollie's Bargain Outlet Holdings, Inc. | 2.50% |

| Revvity, Inc. | 2.46% |

| ICF International, Inc. | 2.45% |

| Carlisle Cos., Inc. | 2.43% |

| Littelfuse, Inc. | 2.29% |

| Jones Lang LaSalle, Inc. | 2.20% |

* excluding cash equivalents

Additional information is available by scanning the QR code or at www.tributaryfunds.com/resources/, including its:

prospectus

financial information

holdings

proxy information

Semi-Annual Shareholder Report - September 30, 2024

(b) Not applicable.

ITEM 2. CODE OF ETHICS.

Not applicable.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

ITEM 6. INVESTMENTS.

(a) Included as part of financial statements filed under Item 7(a).

(b) Not applicable.

ITEM 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

(a)

Semi-Annual

Financials

and

Other

Information

September

30,

2024

Tributary

Short-Intermediate

Bond

Fund

Institutional

Class:

FOSIX

Institutional

Plus

Class:

FOSPX

Tributary

Income

Fund

Institutional

Class:

FOINX

Institutional

Plus

Class:

FOIPX

Tributary

Nebraska

Tax-Free

Fund

Institutional

Plus

Class:

FONPX

Tributary

Balanced

Fund

Institutional

Class:

FOBAX

Institutional

Plus

Class:

FOBPX

Tributary

Small/Mid

Cap

Fund

Institutional

Class:

FSMCX

Institutional

Plus

Class:

FSMBX

Tributary

Small

Company

Fund

Institutional

Class:

FOSCX

Institutional

Plus

Class:

FOSBX

Investors

should

carefully

consider

the

investment

objectives,

risks,

charges

and

expenses

of

the

Tributary

Funds.

Mutual

funds

involve

risk

including

loss

of

principal.

This

and

other

important

information

about

the

Tributary

Funds

is

contained

in

the

prospectus,

which

can

be

obtained

by

calling

1-800-662-4203

or

by

visiting

www.tributaryfunds.com.

The

prospectus

should

be

read

carefully

before

investing.

The

Tributary

Funds

are

distributed

by

Northern

Lights

Distributors,

LLC

member

FINRA.

Northern

Lights

Distributors,

LLC

(the

“Distributor”)

and

the

Tributary

Funds’

investment

adviser

are

not

affiliated.

Notice

to

Investors

Shares

of

Tributary

Funds:

Are

Not

FDIC

Insured

May

Lose

Value

Have

No

Bank

Guarantee

Semi-Annual

Financials

and

Other

Information

2024

Schedules

of

Portfolio

Investments

4

Statements

of

Assets

and

Liabilities

26

Statements

of

Operations

28

Statements

of

Changes

in

Net

Assets

30

Financial

Highlights

32

Notes

to

Financial

Statements

34

Additional

Fund

Information

42

SCHEDULES

OF

PORTFOLIO

INVESTMENTS

September

30,

2024

(Unaudited)

SHORT-INTERMEDIATE

BOND

FUND

Semi-Annual

Financials

and

Other

Information

2024

See

accompanying

Notes

to

Financial

Statements.

1

Principal

Amount

Security

Description

Value

Non-U.S.

Government

Agency

Asset

Backed

Securities

-

45.2%

Asset

Backed

Securities

-

29.9%

$

830,249

AFG

ABS

I,

LLC,

6.30%,

09/16/30(a)

$

834,292

1,351,361

AMSR

Trust,

1.63%,

07/17/37(a)

1,319,246

675,000

Auxilior

Term

Funding,

LLC,

5.84%,

03/15/27(a)

682,214

1,404,505

Auxilior

Term

Funding,

LLC,

6.18%,

12/15/28(a)

1,417,776

1,259,678

AXIS

Equipment

Finance

Receivables

XI,

LLC,

5.30%,

06/21/28(a)

1,263,424

100,000

Bankers

Healthcare

Group

Securitization

Trust

2024-1CON,

6.49%,

04/17/35(a)

103,031

754,196

Bankers

Healthcare

Group

Securitization

Trust

2024-1CON,

5.81%,

04/17/35(a)

771,179

1,585,000

BofA

Auto

Trust,

5.31%,

06/17/30(a)

1,635,448

1,500,000

Capteris

Equipment

Finance,

LLC,

5.58%,

07/20/32(a)

1,526,477

1,295,000

CarMax

Auto

Owner

Trust,

5.50%,

01/16/29

1,330,674

566,734

Cascade

Funding

Mortgage

Trust,

4.00%,

10/25/68(a)(b)

561,344

670,000

CCG

Receivables

Trust,

4.99%,

03/15/32(a)

673,847

1,957,415

CCG

Receivables

Trust,

6.28%,

04/14/32(a)

1,991,875

2,064,242

CF

Hippolyta

Issuer,

LLC,

1.69%,

07/15/60(a)

1,997,389

2,040,000

Chase

Auto

Owner

Trust,

5.59%,

06/25/29(a)

2,125,072

300,000

Cherry

Securitization

Trust,

5.70%,

04/15/32(a)

299,989

1,965,000

Citizens

Auto

Receivables

Trust,

5.84%,

01/18/28(a)

1,993,660

600,000

CNH

Equipment

Trust,

5.74%,

10/15/27(c)

599,894

320,919

Commonbond

Student

Loan

Trust,

2.55%,

05/25/41(a)

302,214

259,498

Commonbond

Student

Loan

Trust,

3.87%,

02/25/46(a)

248,705

97,738

CoreVest

American

Finance,

Ltd.,

1.83%,

03/15/50(a)

96,967

297,630

CoreVest

American

Finance,

Ltd.,

1.17%,

12/15/52(a)

287,676

194,007

CP

EF

Asset

Securitization

II,

LLC,

7.48%,

03/15/32(a)

197,198

1,900,000

Dell

Equipment

Finance

Trust,

5.65%,

01/22/29(a)

1,920,102

2,400,000

DLLAD,

LLC,

4.79%,

01/20/28(a)

2,415,577

1,335,000

DLLAD,

LLC,

5.30%,

07/20/29(a)

1,371,205

Principal

Amount

Security

Description

Value

$

573,406

ELFI

Graduate

Loan

Program,

LLC,

1.73%,

08/25/45(a)

$

519,267

1,324,821

First

Help

Financial,

LLC,

5.69%,

02/15/30(a)

1,342,270

1,701,580

FirstKey

Homes

Trust,

1.34%,

08/17/37(a)

1,654,232

1,275,000

Foundation

Finance

Trust,

4.60%,

03/15/50(a)

1,277,456

1,420,000

GreatAmerica

Leasing

Receivables

Funding,

LLC,

4.98%,

01/18/28(a)

1,440,424

1,125,000

GreenSky

Home

Improvement

Trust,

5.67%,

06/25/59(a)

1,141,861

435,000

GreenSky

Home

Improvement

Trust,

5.55%,

06/25/59(a)

446,137

1,240,000

GreenState

Auto

Receivables

Trust,

5.19%,

01/16/29(a)

1,257,398

850,000

Honda

Auto

Receivables

Owner

Trust,

5.67%,

06/21/28

869,750

1,000,000

HPEFS

Equipment

Trust,

5.35%,

10/20/31(a)

1,021,757

1,000,000

Huntington

Auto

Trust,

5.23%,

01/16/29(a)

1,020,324

1,029,662

Iowa

Student

Loan

Liquidity

Corp.,

6.06%,

08/25/70(c)

1,025,749

246,826

LAD

Auto

Receivables

Trust,

5.68%,

10/15/26(a)

247,031

1,865,000

LAD

Auto

Receivables

Trust,

6.12%,

09/15/27(a)

1,879,791

800,000

M&T

Equipment

2024-LEAF1

Notes,

4.94%,

08/18/31(a)

810,539

670,000

MMAF

Equipment

Finance,

LLC,

4.95%,

07/14/31(a)

680,468

339,325

Navient

Student

Loan

Trust,

6.81%,

10/15/31(a)(c)

340,120

925,371

Navient

Student

Loan

Trust,

0.97%,

12/16/69(a)

818,131

876,664

NMEF

Funding,

LLC,

6.57%,

06/17/30(a)

889,597

870,000

NMEF

Funding,

LLC,

5.15%,

12/15/31(a)

874,649

663,966

NMEF

Funding,

LLC,

6.07%,

06/15/29(a)

668,397

794,661

North

Texas

Higher

Education

Authority,

Inc.,

5.54%,

09/25/61(c)

788,205

1,130,066

Oak

Street

Investment

Grade

Net

Lease

Fund,

1.48%,

01/20/51(a)

1,072,712

1,950,000

OCCU

Auto

Receivables

Trust,

6.23%,

06/15/28(a)

1,985,977

880,000

Octane

Receivables

Trust,

5.80%,

07/20/32(a)

892,022

1,000,000

PEAC

Solutions

Receivables,

LLC,

4.65%,

10/20/31(a)

999,781

SCHEDULES

OF

PORTFOLIO

INVESTMENTS

September

30,

2024

(Unaudited)

SHORT-INTERMEDIATE

BOND

FUND

Semi-Annual

Financials

and

Other

Information

2024

See

accompanying

Notes

to

Financial

Statements.

Principal

Amount

Security

Description

Value

$

423,099

PenFed

Auto

Receivables

Owner

Trust,

3.96%,

04/15/26(a)

$

422,296

1,250,000

Porsche

Financial

Auto

Securitization

Trust,

5.79%,

01/22/29(a)

1,266,816

1,948,163

Progress

Residential

Trust,

1.05%,

04/17/38(a)

1,864,114

1,500,000

Purchasing

Power

Funding,

LLC,

5.89%,

08/15/28(a)

1,521,774

1,310,000

SBNA

Auto

Receivables

Trust,

5.32%,

12/15/28(a)

1,323,186

507,432

SLM

Student

Loan

Trust,

6.62%,

10/25/24(c)

504,016

430,083

SLM

Student

Loan

Trust,

7.27%,

04/15/29(c)

431,571

237,443

SLM

Student

Loan

Trust,

7.32%,

07/25/28(c)

237,881

25,735

SMB

Private

Education

Loan

Trust,

2.70%,

05/15/31(a)

25,676

499,520

Sofi

Professional

Loan

Program

Trust,

1.03%,

08/17/43(a)

441,022

248,701

Sofi

Professional

Loan

Program

Trust,

3.59%,

01/25/48(a)

244,973

658,731

SoFi

Professional

Loan

Program

Trust,

1.14%,

02/15/47(a)

579,490

310,661

Sofi

Professional

Loan

Program,

LLC,

3.09%,

08/17/48(a)

303,474

221,799

Tricon

American

Homes

Trust,

2.75%,

03/17/38(a)

216,338

68,115

UNIFY

Auto

Receivables

Trust,

0.98%,

07/15/26(a)

68,006

1,380,000

Vantage

Data

Centers

Issuer,

LLC,

1.65%,

09/15/45(a)

1,334,703

1,085,000

Verdant

Receivables,

LLC,

5.68%,

12/12/31(a)

1,110,290

860,000

Wingspire

Equipment

Finance,

LLC,

4.99%,

09/20/32(a)

866,147

66,692,293

Non-Agency

Commercial

Mortgage

Backed

Securities

-

10.6%

933,341

BANK

2019-BNK16,

3.93%,

02/15/52

931,157

507,490

Barclays

Commercial

Mortgage

Trust,

3.04%,

11/15/52

505,641

940,000

BX

Trust,

6.16%,

09/15/36(a)(c)

931,187

807,309

BX

Trust,

6.06%,

11/15/38(a)(c)

802,768

194,308

BX

Trust,

5.91%,

01/15/34(a)(c)

193,458

1,100,000

BXHPP

Trust,

5.86%,

08/15/36(a)(c)

1,056,344

753,630

Cantor

Commercial

Real

Estate

Lending,

3.62%,

05/15/52

737,243

565,879

CFCRE

Commercial

Mortgage

Trust,

3.37%,

06/15/50

557,370

1,990,431

FirstKey

Homes

Trust,

4.25%,

07/17/38(a)

1,974,436

Principal

Amount

Security

Description

Value

$

1,800,000

Goldman

Sachs

Mortgage

Securities

Corp.

Trust,

6.16%,

10/15/36(a)(c)

$

1,784,608

421,632

Goldman

Sachs

Mortgage

Securities

Trust

Interest

Only

REMIC,

0.09%,

08/10/44(a)(b)

4

85,343

Harvest

Commercial

Capital

Loan

Trust,

3.29%,

09/25/46(a)(b)

84,504

166,976

JPMBB

Commercial

Mortgage

Securities

Trust,

3.32%,

03/17/49

165,019

15,670

JPMDB

Commercial

Mortgage

Securities

Trust,

2.04%,

11/13/52

15,638

65,781

Key

Commercial

Mortgage

Securities

Trust,

1.25%,

09/16/52(a)

65,623

1,770,220

KNDR

2021-KIND

A,

6.16%,

08/15/38(a)(c)

1,741,991

838,877

MHC

Commercial

Mortgage

Trust,

6.01%,

04/15/38(a)(c)

835,207

539,041

ReadyCap

Commercial

Mortgage

Trust

CLO,

6.91%,

01/25/37(a)(c)

538,374

1,375,000

SREIT

Trust,

5.79%,

07/15/36(a)(c)

1,368,125

578,755

Sutherland

Commercial

Mortgage

Trust,

2.86%,

04/25/41(a)(b)

548,957

366,467

Sutherland

Commercial

Mortgage

Trust,

1.55%,

12/25/41(a)(b)

337,443

922,823

Tricon

Residential

Trust,

3.86%,

04/17/39(a)

905,786

1,267,236

TRTX

Issuer,

Ltd.

CLO,

6.73%,

02/15/39(a)(c)

1,258,683

1,450,000

VASA

Trust,

6.11%,

07/15/39(a)(c)

1,341,250

868,705

Velocity

Commercial

Capital

Loan

Trust,

1.40%,

05/25/51(a)(b)

750,215

811,820

Velocity

Commercial

Capital

Loan

Trust,

6.58%,

04/25/54(a)(b)

828,685

1,150,000

Wells

Fargo

Commercial

Mortgage

Trust,

5.48%,

07/15/35(a)(b)

1,158,199

2,145,000

WSTN

Trust,

6.52%,

07/05/37(a)(b)

2,195,935

23,613,850

Non-Agency

Residential

Mortgage

Backed

Securities

-

4.7%

679,912

Angel

Oak

Mortgage

Trust,

3.35%,

01/25/67(a)(b)

646,244

192,017

BRAVO

Residential

Funding

Trust,

6.03%,

11/25/69(a)(c)

191,293

367,297

BRAVO

Residential

Funding

Trust,

6.03%,

01/25/70(a)(c)

366,155

232,998

BRAVO

Residential

Funding

Trust,

2.50%,

05/26/59(a)(b)

226,272

373,329

Brean

Asset

Backed

Securities

Trust,

1.40%,

10/25/63(a)(b)

335,104

43,465

Cascade

Funding

Mortgage

Trust,

2.80%,

06/25/69(a)(b)

43,329

306,195

Citigroup

Mortgage

Loan

Trust,

4.25%,

01/25/53(a)

300,658

SCHEDULES

OF

PORTFOLIO

INVESTMENTS

September

30,

2024

(Unaudited)

SHORT-INTERMEDIATE

BOND

FUND

Semi-Annual

Financials

and

Other

Information

2024

See

accompanying

Notes

to

Financial

Statements.

Principal

Amount

Security

Description

Value

$

360,590

Citigroup

Mortgage

Loan

Trust,

3.50%,

01/25/66(a)(b)

$

351,154

34,605

Citigroup

Mortgage

Loan

Trust

REMIC,

4.00%,

01/25/35(a)(b)

33,756

1,146

Credit

Suisse

First

Boston

Mortgage

Securities

Corp.

REMIC,

5.00%,

01/05/25

1,075

137,631

Credit

Suisse

Mortgage

Trust,

2.50%,

07/25/28(a)(b)

131,415

154,898

Credit-Based

Asset

Servicing

&

Securitization,

LLC

REMIC

(USD

1

Month

LIBOR

+

1.13%),

6.09%,

02/25/33(c)

157,139

112,038

CSMLT

Trust,

2.97%,

10/25/30(a)(b)

107,286

404,660

Finance

of

America

HECM

Buyout,

2.69%,

02/25/32(a)(b)

398,417

504,569

Finance

of

America

Structured

Securities

Trust,

1.50%,

04/25/51(a)

494,531

89,537

Freddie

Mac

Whole

Loan

Securities,

3.67%,

09/25/45(b)

88,467

628,116

JPMorgan

Mortgage

Trust,

3.00%,

06/25/29(a)(b)

611,874

217,519

MFRA

Trust,

2.79%,

08/25/49(a)(b)

207,451

212,302

MFRA

Trust,

0.85%,

01/25/56(a)(b)

202,614

460,674

MFRA

Trust,

3.91%,

04/25/66(a)(d)

452,134

233,336

New

Residential

Mortgage

Loan

Trust,

4.50%,

05/25/58(a)(b)

230,866

21,151

New

Residential

Mortgage

Loan

Trust

REMIC,

3.75%,

11/25/54(a)(b)

20,165

34,784

New

Residential

Mortgage

Loan

Trust

REMIC,

3.75%,

05/28/52(a)(b)

33,412

57,824

New

Residential

Mortgage

Loan

Trust

REMIC,

3.75%,

08/25/55(a)(b)

55,602

377,486

Oceanview

Mortgage

Loan

Trust,

1.73%,

05/28/50(a)(b)

347,036

1,701,013

RCKT

Mortgage

Trust,

6.14%,

04/25/44(a)(b)

1,721,358

11,679

Residential

Accredit

Loans,

Inc.

Trust

REMIC,

5.65%,

01/05/25(c)

8,875

5,085

Residential

Asset

Securitization

Trust

REMIC,

3.75%,

01/05/25

5,092

121,640

RMF

Buyout

Issuance

Trust,

1.26%,

11/25/31(a)(b)

120,476

650,000

Towd

Point

Mortgage

Trust,

3.75%,

10/25/56(a)(b)

637,971

615,263

Towd

Point

Mortgage

Trust,

2.75%,

06/25/57(a)(b)

596,539

138,821

Towd

Point

Mortgage

Trust,

3.25%,

07/25/58(a)(b)

136,330

460,750

Towd

Point

Mortgage

Trust,

2.25%,

02/25/60(a)(b)

446,019

Principal

Amount

Security

Description

Value

$

790,095

Towd

Point

Mortgage

Trust,

2.25%,

11/25/61(a)(b)

$

736,705

10,442,814

Total

Non-U.S.

Government

Agency

Asset

Backed

Securities

(Cost

$101,328,857)

100,748,957

Corporate

Bonds

-

29.4%

Communication

Services

-

2.6%

2,304,000

AT&T,

Inc.,

1.70%,

03/25/26

2,217,758

1,420,000

Meta

Platforms,

Inc.,

3.50%,

08/15/27

1,408,384

835,000

Netflix,

Inc.,

4.38%,

11/15/26

841,108

738,000

Verizon

Communications,

Inc.,

1.68%,

10/30/30

631,297

575,000

Verizon

Communications,

Inc.,

4.13%,

03/16/27

574,174

5,672,721

Consumer

Discretionary

-

4.0%

250,000

AMC

Networks,

Inc.,

4.25%,

02/15/29

180,810

300,000

Carnival

Corp.,

4.00%,

08/01/28(a)

289,745

2,100,000

Dollar

General

Corp.,

3.88%,

04/15/27

2,072,233

1,000,000

Ford

Motor

Credit

Co.,

LLC,

4.54%,

08/01/26

991,495

900,000

Ford

Motor

Credit

Co.,

LLC,

5.80%,

03/08/29

914,789

575,000

Harley-Davidson

Financial

Services,

Inc.,

5.95%,

06/11/29(a)

588,919

1,211,000

Levi

Strauss

&

Co.,

3.50%,

03/01/31(a)

1,097,591

198,000

Mileage

Plus

Holdings,

LLC/Mileage

Plus

Intellectual

Property

Assets,

Ltd.,

6.50%,

06/20/27(a)

200,462

1,200,000

Newell

Brands,

Inc.,

5.70%,

04/01/26

1,202,945

1,100,000

Tapestry,

Inc.,

7.00%,

11/27/26

1,138,091

435,000

Warnermedia

Holdings,

Inc.,

4.05%,

03/15/29

412,091

9,089,171

Consumer

Staples

-

0.8%

1,350,000

Campbell

Soup

Co.,

5.20%,

03/19/27

1,385,376

440,000

Land

O'Lakes

Capital

Trust

I,

7.45%,

03/15/28(a)

433,073

10,000

Mars,

Inc.,

0.88%,

07/16/26(a)

9,433

1,827,882

Energy

-

2.2%

950,000

Energy

Transfer

LP,

5.63%,

05/01/27(a)

953,281

1,755,000

Energy

Transfer

LP,

4.95%,

05/15/28

1,781,181

1,245,000

Occidental

Petroleum

Corp.,

5.00%,

08/01/27

1,262,134

800,000

Range

Resources

Corp.,

4.88%,

05/15/25

795,972

4,792,568

SCHEDULES

OF

PORTFOLIO

INVESTMENTS

September

30,

2024

(Unaudited)

SHORT-INTERMEDIATE

BOND

FUND

Semi-Annual

Financials

and

Other

Information

2024

See

accompanying

Notes

to

Financial

Statements.

Principal

Amount

Security

Description

Value

Financials

-

12.9%

$

530,000

AerCap

Ireland

Capital

DAC/AerCap

Global

Aviation

Trust,

3.50%,

01/15/25

$

527,445

2,300,000

Bank

of

America

Corp.,

3.71%,

04/24/28(b)

2,266,700

784,000

CBRE

Services,

Inc.,

4.88%,

03/01/26

787,618

1,145,000

CBRE

Services,

Inc.,

5.50%,

04/01/29

1,194,045

1,295,000

Citigroup,

Inc.,

5.17%,

02/13/30(b)

1,330,277

930,000

Citigroup,

Inc.,

1.46%,

06/09/27(b)

886,041

550,000

Enact

Holdings,

Inc.,

6.25%,

05/28/29

571,045

2,260,000

Goldman

Sachs

Group,

Inc.,

3.62%,

03/15/28(b)

2,223,476

1,100,000

Intercontinental

Exchange,

Inc.,

3.75%,

12/01/25

1,093,200

1,000,000

JPMorgan

Chase

&

Co.,

3.54%,

05/01/28(b)

981,919

1,285,000

JPMorgan

Chase

&

Co.,

5.04%,

01/23/28(b)

1,306,493

1,410,000

KeyCorp,

MTN,

2.25%,

04/06/27

1,333,658

440,000

Morgan

Stanley,

2.19%,

04/28/26(b)

433,110

2,155,000

Morgan

Stanley,

5.45%,

07/20/29(b)

2,239,256

418,000

NNN

REIT,

Inc.,

4.00%,

11/15/25

415,166

1,047,000

NNN

REIT,

Inc.,

3.60%,

12/15/26

1,033,618

1,750,000

Regions

Financial

Corp.,

5.72%,

06/06/30(b)

1,812,876

2,031,000

The

Charles

Schwab

Corp.

(callable

at

100

beginning

06/01/25),

5.38%,

06/01/65(b)(e)

2,027,595

1,960,000

Truist

Financial

Corp.,

MTN,

4.87%,

01/26/29(b)

1,980,898

1,465,000

U.S.

Bancorp,

5.78%,

06/12/29(b)

1,535,371

540,000

U.S.

Bancorp,

5.73%,

10/21/26(b)

546,702

2,245,000

Wells

Fargo

&

Co.,

4.81%,

07/25/28(b)

2,271,217

28,797,726

Health

Care

-

0.2%

370,000

Little

Co.

of

Mary

Hospital

of

Indiana,

Inc.,

1.58%,

11/01/24

368,742

Industrials

-

2.4%

575,000

Clean

Harbors,

Inc.,

4.88%,

07/15/27(a)

566,840

2,125,000

Huntington

Ingalls

Industries,

Inc.,

3.84%,

05/01/25

2,110,081

2,065,000

RTX

Corp.,

3.50%,

03/15/27

2,034,947

625,000

The

Boeing

Co.,

6.30%,

05/01/29(a)

657,554

5,369,422

Information

Technology

-

0.7%

1,240,000

Hewlett

Packard

Enterprise

Co.,

4.40%,

09/25/27

1,241,347

200,000

NCR

Atleos

Corp.,

9.50%,

04/01/29(a)

220,174

1,461,521

Materials

-

1.6%

1,740,000

Albemarle

Corp.,

4.65%,

06/01/27

1,747,664

Principal

Amount

Security

Description

Value

$

1,785,000

The

Mosaic

Co.,

5.38%,

11/15/28

$

1,848,967

3,596,631

Utilities

-

2.0%

1,550,000

Duke

Energy

Corp.,

4.85%,

01/05/27

1,574,851

625,000

Duke

Energy

Corp.,

3.15%,

08/15/27

607,227

650,000

FirstEnergy

Corp.,

3.90%,

07/15/27

643,248

1,550,000

Florida

Power

&

Light

Co.,

4.40%,

05/15/28

1,568,487

4,393,813

Total

Corporate

Bonds

(Cost

$64,523,415)

65,370,197

Government

&

Agency

Obligations

-

24.6%

GOVERNMENT

SECURITIES

-

22.8%

Municipals

-

0.9%

325,000

City

of

Blair

NE

Water

System

Revenue,

Nebraska

RB,

6.10%,

05/15/27

325,540

1,425,000

Nebraska

Cooperative

Republican

Platte

Enhancement

Project,

Nebraska

RB,

1.62%,

12/15/26

1,353,492

235,000

Nebraska

Cooperative

Republican

Platte

Enhancement

Project,

Nebraska

RB,

1.80%,

12/15/27

219,630

170,000

Scotts

Bluff

County

School

District

No.

32,

Nebraska

GO,

1.10%,

12/01/26

160,114

2,058,776

U.S.

Treasury

Securities

-

21.9%

23,540,000

U.S.

Treasury

Note,

2.25%,

02/15/27

22,813,570

7,050,000

U.S.

Treasury

Note,

4.13%,

07/31/28

7,186,869

5,930,000

U.S.

Treasury

Note/Bond,

0.50%,

02/28/26

5,664,077

500,000

U.S.

Treasury

Note/Bond,

4.63%,

09/15/26

508,965

12,900,000

U.S.

Treasury

Note/Bond,

2.75%,

02/15/28

12,561,375

48,734,856

U.S.

GOVERNMENT

MORTGAGE

BACKED

SECURITIES

-

1.8%

Federal

Home

Loan

Mortgage

Corp.

-

1.0%

210,271

Federal

Home

Loan

Mortgage

Corp.,

3.50%,

10/25/46

192,786

198,004

Federal

Home

Loan

Mortgage

Corp.,

3.75%,

12/15/54(d)

195,545

629,641

Federal

Home

Loan

Mortgage

Corp.,

3.00%,

11/25/57(b)

597,282

1,225,000

Federal

Home

Loan

Mortgage

Corp.,

2.11%,

12/15/25

1,199,072

273,788

Federal

Home

Loan

Mortgage

Corp.

Interest

Only

REMIC,

4.00%,

09/15/45

45,448

61,999

Federal

Home

Loan

Mortgage

Corp.

Interest

Only

REMIC,

4.00%,

11/15/43

3,291

SCHEDULES

OF

PORTFOLIO

INVESTMENTS

September

30,

2024

(Unaudited)

SHORT-INTERMEDIATE

BOND

FUND

Semi-Annual

Financials

and

Other

Information

2024

See

accompanying

Notes

to

Financial

Statements.

Principal

Amount

Security

Description

Value

$

74,071

Federal

Home

Loan

Mortgage

Corp.

Interest

Only

REMIC,

4.00%,

08/15/45

$

7,849

70,562

Federal

Home

Loan

Mortgage

Corp.

REMIC,

3.50%,

06/15/50

70,104

2,311,377

Federal

National

Mortgage

Association

-

0.0%

39,481

Federal

National

Mortgage

Association

#AJ4087,

3.00%,

10/01/26

38,907

147,082

Federal

National

Mortgage

Association

Interest

Only,

2.72%,

01/25/39(b)

785

39,692

Government

National

Mortgage

Association

-

0.8%

1,206,984

Government

National

Mortgage

Association

#511039,

6.30%,

12/15/40

1,203,834

129,260

Government

National

Mortgage

Association

#559220,

7.00%,

01/15/33

129,025

91,060

Government

National

Mortgage

Association

#610022,

5.60%,

08/15/34

90,769

327,738

Government

National

Mortgage

Association

REMIC,

5.50%,

07/16/34

332,636

1,756,264

Total

Government

&

Agency

Obligations

(Cost

$54,457,587)

54,900,965

Shares

Security

Description

Value

Preferred

Stocks

-

0.2%

Financials

-

0.2%

400

U.S.

Bancorp,

Series A

(callable

at

1,000

beginning

10/30/24),

16.82%(b)(e)

339,476

Total

Preferred

Stocks

(Cost

$410,420)

339,476

Short-Term

Investments

-

0.3%

Investment

Company

-

0.3%

750,290

BlackRock

Liquidity

Funds

T-Fund

Portfolio,

Institutional

Shares,

4.83%(f)

750,290

Total

Short-Term

Investments

(Cost

$750,290)

750,290

Investments,

at

value

-

99.7%

(Cost

$221,470,569)

222,109,885

Other

assets

in

excess

of

liabilities

-

0.3%

585,468

NET

ASSETS

-

100.0%

$

222,695,353

(a)

144a

Security,

which

is

exempt

from

registration

under

the

Securities

Act

of

1933.

The

Sub-Adviser

has

deemed

this

security

to

be

liquid

based

on

procedures

approved

by

Tributary

Funds’

Board

of

Directors.

As

of

September

30,

2024,

the

aggregate

value

of

these

liquid

securities

were

$96,805,573

or

43.5%

of

net

assets.

(b)

Variable

rate

security,

the

interest

rate

of

which

adjusts

periodically

based

on

changes

in

current

interest

rates.

Rate

represented

is

as

of

September

30,

2024.

(c)

Floating

rate

security.

Rate

presented

is

as

of

September

30,

2024.

(d)

Debt

obligation

initially

issued

at

one

coupon

rate

which

converts

to

higher

coupon

rate

at

a

specified

date.

Rate

presented

is

as

of

September

30,

2024.

(e)

Perpetual

maturity

security.

(f)

Dividend

yield

changes

daily

to

reflect

current

market

conditions.

Rate

was

the

quoted

yield

as

of

September

30,

2024.

ABS

Asset

Backed

Security

CLO

Collateralized

Loan

Obligation

GO

General

Obligation

LIBOR

London

Interbank

Offered

Rate

LLC

Limited

Liability

Company

LP

Limited

Partnership

MTN

Medium

Term

Note

RB

Revenue

Bond

REIT

Real

Estate

Investment

Trust

REMIC

Real

Estate

Mortgage

Investment

Conduit

SCHEDULES

OF

PORTFOLIO

INVESTMENTS

September

30,

2024

(Unaudited)

Semi-Annual

Financials

and

Other

Information

2024

See

accompanying

Notes

to

Financial

Statements.

Principal

Amount

Security

Description

Value

Non-U.S.

Government

Agency

Asset

Backed

Securities

-

18.7%

Asset

Backed

Securities

-

7.5%

$

960,000

Aligned

Data

Centers

Issuer,

LLC,

1.94%,

08/15/46(a)

$

909,873

1,131,250

ARM

Master

Trust,

2.43%,

11/15/27(a)

1,116,337

547,489

Capital

Automotive,

1.44%,

08/15/51(a)

513,864

852,915

CF

Hippolyta

Issuer,

LLC,

1.53%,

03/15/61(a)

801,272

315,278

Commonbond

Student

Loan

Trust,

1.17%,

09/25/51(a)

265,137

519,708

CoreVest

American

Finance,

Ltd.,

1.17%,

12/15/52(a)

502,326

430,503

CoreVest

American

Finance,

Ltd.,

1.36%,

08/15/53(a)

414,022

404,586

EDvestinU

Private

Education

Loan

Issue

No.

3,

LLC,

1.80%,

11/25/45(a)

371,557

915,000

FRTKL

2021-SFR1,

1.57%,

09/17/38(a)

861,201

844,578

Home

Partners

of

America

Trust,

2.20%,

01/17/41(a)

766,178

288,899

Navient

Student

Loan

Trust,

6.81%,

10/15/31(a)(b)

289,576

419,477

Navient

Student

Loan

Trust,

1.11%,

02/18/70(a)

373,281

237,371

Nelnet

Student

Loan

Trust,

1.63%,

04/20/62(a)

221,996

425,132

Nelnet

Student

Loan

Trust,

1.36%,

04/20/62(a)

393,917

809,368

Progress

Residential

Trust,

1.52%,

07/17/38(a)

770,941

600,000

Purchasing

Power

Funding,

LLC,

5.89%,

08/15/28(a)

608,709

435,000

Sabey

Data

Center

Issuer,

LLC,

1.88%,

06/20/46(a)

410,576

410,949

SLM

Student

Loan

Trust,

6.62%,

10/25/24(b)

408,182

581,764

SLM

Student

Loan

Trust,

7.27%,

04/15/29(b)

583,777

15,105

SMB

Private

Education

Loan

Trust,

2.70%,

05/15/31(a)

15,071

595,000

Stack

Infrastructure

Issuer,

LLC,

1.88%,

03/26/46(a)

568,514

1,151,006

Tricon

American

Homes

Trust,

1.48%,

11/17/39(a)

1,061,144

932,000

Vantage

Data

Centers

Issuer,

LLC,

1.65%,

09/15/45(a)

901,408

13,128,859

Principal

Amount

Security

Description

Value

Non-Agency

Commercial

Mortgage

Backed

Securities

-

3.7%

$

1,150,000

Banc

of

America

Merrill

Lynch

Commercial

Mortgage

Securities

Trust,

3.65%,

03/10/37(a)(c)

$

1,112,322

790,000

BX

Trust,

6.16%,

09/15/36(a)(b)

782,594

667,117

CD

Commercial

Mortgage

Trust,

4.21%,

08/15/51

663,572

390,000

Goldman

Sachs

Mortgage

Securities

Trust,

6.10%,

11/15/36(a)(b)

386,709

638,636

Goldman

Sachs

Mortgage

Securities

Trust

Interest

Only

REMIC,

0.09%,

08/10/44(a)(c)

6

1,065,000

Hudson

Yards

Mortgage

Trust,

3.23%,

07/10/39(a)

984,844

600,924

MHC

Commercial

Mortgage

Trust,

6.06%,

05/15/38(a)(b)

598,295

610,908

Sutherland

Commercial

Mortgage

Trust,

2.86%,

04/25/41(a)(c)

579,455

282,703

Sutherland

Commercial

Mortgage

Trust,

1.55%,

12/25/41(a)(c)

260,313

608,565

Tricon

Residential

Trust,

3.86%,

04/17/39(a)

597,329

451,011

Velocity

Commercial

Capital

Loan

Trust,

6.58%,

04/25/54(a)(c)

460,381

6,425,820

Non-Agency

Residential

Mortgage

Backed

Securities

-

7.5%

257,460

BRAVO

Residential

Funding

Trust,

6.03%,

11/25/69(a)(b)

256,489

1,038,210

Brean

Asset

Backed

Securities

Trust,

1.40%,

10/25/63(a)(c)

931,909

212,083

Citigroup

Mortgage

Loan

Trust,

4.25%,

01/25/53(a)

208,248

295,607

Citigroup

Mortgage

Loan

Trust,

3.50%,

01/25/66(a)(c)

287,872

238,861

Citigroup

Mortgage

Loan

Trust

REMIC,

4.00%,

01/25/35(a)(c)

232,997

71,101

Citigroup

Mortgage

Loan

Trust,

Inc.

REMIC,

6.50%,

07/25/34

72,354

14,145

Credit

Suisse

First

Boston

Mortgage

Securities

Corp.

REMIC,

5.75%,

04/25/33

14,033

1,146

Credit

Suisse

First

Boston

Mortgage

Securities

Corp.

REMIC,

5.00%,

01/05/25

1,075

707,209

Credit

Suisse

Mortgage

Trust,

3.25%,

04/25/47(a)(c)

642,275

782,985

Credit

Suisse

Mortgage

Trust,

2.50%,

11/25/56(a)(c)

706,531

SCHEDULES

OF

PORTFOLIO

INVESTMENTS

September

30,

2024

(Unaudited)

Semi-Annual

Financials

and

Other

Information

2024

See

accompanying

Notes

to

Financial

Statements.

Principal

Amount

Security

Description

Value

$

154,898

Credit-Based

Asset

Servicing

&

Securitization,

LLC

REMIC

(USD

1

Month

LIBOR

+

1.13%),

6.09%,

02/25/33(b)

$

157,139

107,729

CSMLT

Trust,

2.97%,

10/25/30(a)(c)

103,159

763,108

Finance

of

America

Structured

Securities

Trust,

1.50%,

04/25/51(a)

747,927

619,861

Flagstar

Mortgage

Trust,

2.50%,

04/25/51(a)(c)

555,865

632,312

Flagstar

Mortgage

Trust,

2.50%,

07/25/51(a)(c)

566,903

93,409

Freddie

Mac

Whole

Loan

Securities,

3.67%,

09/25/45(c)

92,292

905,049

Hundred

Acre

Wood

Trust,

2.50%,

07/25/51(a)(c)

814,630

783,425

Mello

Mortgage

Capital

Acceptance,

2.50%,

08/25/51(a)(c)

699,957

489,023

MFRA

Trust,

3.91%,

04/25/66(a)(d)

479,958

268,875

New

Residential

Mortgage

Loan

Trust,

4.00%,

12/25/57(a)(c)

262,433

205,443

New

Residential

Mortgage

Loan

Trust,

3.50%,

10/25/59(a)(c)

194,321

148,310

New

Residential

Mortgage

Loan

Trust

REMIC,

3.75%,

11/25/54(a)(c)

141,397

88,542

New

Residential

Mortgage

Loan

Trust

REMIC,

3.75%,

05/28/52(a)(c)

85,049

267,592

New

Residential

Mortgage

Loan

Trust

REMIC,

3.75%,

08/25/55(a)(c)

257,309

594,409

Onslow

Bay

Financial

LLC,

3.00%,

02/25/52(a)(c)

542,056

1,305,456

Provident

Funding

Mortgage

Trust,

2.50%,

04/25/51(a)(c)

1,167,986

759,774

Provident

Funding

Mortgage

Trust,

2.50%,