UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. ___)

| | | | | | | | | | | |

| þ | Filed by the Registrant | o | Filed by a Party other than the Registrant |

| | | | | |

| Check the appropriate box: |

o | Preliminary Proxy Statement |

o | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

þ | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material under §240.14a-12 |

| | |

| INSIGHT ENTERPRISES, INC. |

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

þ | No fee required. |

o | Fee paid previously with preliminary materials. |

o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Notice of 2022 Annual Meeting of Stockholders

and

Proxy Statement

| | | | | | | | |

| | Once again, our teammates faced a challenging year, navigating the uncertainty of the macro environment yet maintaining focus on solving our clients’ biggest challenges through technology and digital solutions. In 2021, we set company records for full year net sales, gross profit, Adjusted earnings from operations and Adjusted diluted earnings per share. ▪Net sales increased 13% to $9.4 billion. ▪Gross profit increased 11% to $1.5 billion. ▪Earnings from operations increased 22% to $332.1 million and non-GAAP Adjusted* earnings from operations increased 12% to $362.5 million. ▪Diluted earnings per share increased 22% to $5.95 and non-GAAP Adjusted* diluted earnings per share increased 15% to $7.10.

With Ken Lamneck’s retirement at the end of 2021, the Company marks a transition point. Under his leadership, the Company has built a solid foundation and today, we have a differentiated portfolio of solutions. We are well positioned to help our clients accelerate their digital journeys and modernize their businesses. The future is bright for Insight. * See Appendix A for a reconciliation of each non-GAAP Adjusted financial measure to the most directly comparable GAAP measure. |

|

Dear Fellow Stockholder,

On behalf of our Board of Directors, I’m pleased to invite you to Insight’s 2022 Annual Meeting of Stockholders. The meeting will be held on Wednesday, May 18, 2022 at 10:00 a.m. MST, at our global headquarters located at 2701 E. Insight Way, Chandler, Arizona 85286. The attached Notice of Annual Meeting of Stockholders and Proxy Statement will serve as your guide to the business to be conducted at the meeting.

For Insight, 2021 was another year of record financial performance and strategic progress, as we continued to improve profitability and make significant strategic investments for the future.

For more information on Insight and to take advantage of the many stockholder resources and tools available, we encourage you to visit our Investor Relations website at http://investor.insight.com.

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we urge you to vote via the Internet, by telephone or by signing and returning a proxy card. Please vote as soon as possible so that your shares will be represented at the meeting.

| | | | | |

| Thank you for your trust in Insight and your investment in our business. |

| |

| |

| |

| Joyce A. Mullen |

| President and Chief Executive Officer |

| April 5, 2022 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| | | | | |

| When: | Where: |

| |

| Wednesday, May 18, 2022 | Insight Enterprises, Inc. |

| 10:00 a.m. MST | 2701 E. Insight Way |

| Chandler, Arizona 85286 |

We are pleased to invite you to the Insight Enterprises, Inc. 2022 Annual Meeting of Stockholders (the “Annual Meeting”).

Items of Business:

1.To elect ten directors for a term expiring at the 2023 Annual Meeting of Stockholders (or until their respective successors have been duly elected and qualified);

2.To approve, on an advisory basis, named executive officer compensation;

3.To ratify KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2022; and

4.To consider any other business that may properly come before the Annual Meeting or any adjournments or postponements of the meeting.

Record Date:

Holders of our common stock at the close of business on March 30, 2022 are entitled to notice of, and to vote at, the Annual Meeting.

How to Vote:

Your vote is important to us. Please see “Voting Information” on page 1 for instructions on how to vote your shares.

These proxy materials are first being distributed on or about April 13, 2022.

| | | | | |

| April 5, 2022 | By Order of the Board of Directors, |

| |

| |

| Samuel C. Cowley |

| Senior Vice President, General Counsel and Secretary |

| | |

Important Notice Regarding Availability of Proxy Materials for the Annual Meeting to be Held on May 18, 2022: The proxy materials relating to our 2022 Annual Meeting (notice, proxy statement, proxy card and annual report) are available at www.proxypush.com/nsit. |

PROXY STATEMENT TABLE OF CONTENTS

VOTING INFORMATION

You are entitled to vote at the Annual Meeting if you were a stockholder of Insight Enterprises, Inc. (the “Company” or “Insight”) as of the close of business on March 30, 2022, the record date for the Annual Meeting.

| | |

| Participate in the Future of Insight – Vote Today |

Please cast your vote as soon as possible on all the proposals listed below to ensure that your shares are represented.

| | | | | | | | | | | |

| More Information | Board Recommendation |

| Proposal 1 | Election of Directors | Page 19 | FOR each Director Nominee |

| Proposal 2 | Advisory Vote to Approve Named Executive Officer Compensation | Page 29 | FOR |

| Proposal 3 | Ratification of Independent Registered Public Accounting Firm | Page 63 | FOR |

| | |

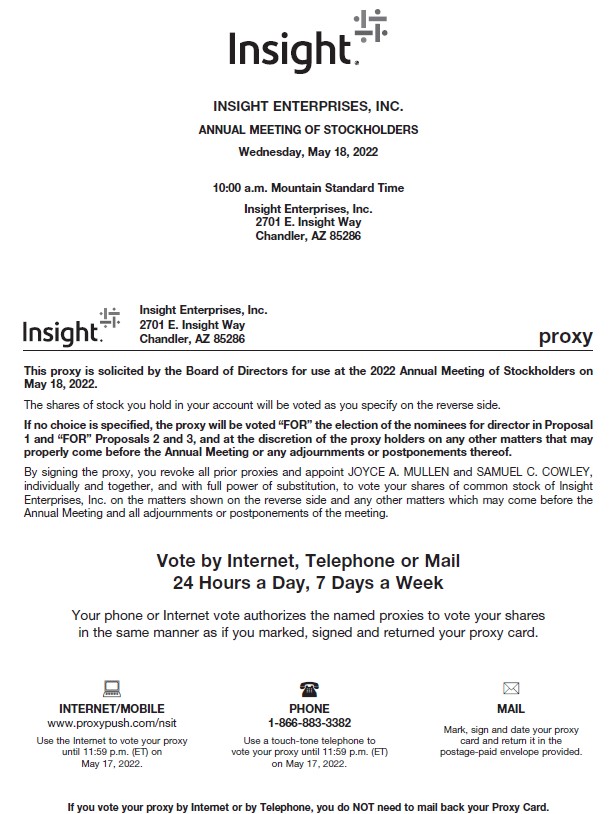

| Voting in Advance of the Annual Meeting |

Even if you plan to attend our Annual Meeting in person, please read this proxy statement with care and vote right away as described below. For stockholders of record, have your notice and proxy card in hand and follow the instructions. If you hold your shares through a broker, bank or other nominee, you will receive voting instructions from your broker, bank or other nominee, including whether telephone or Internet options are available.

| | | | | | | | |

| INTERNET / MOBILE | PHONE | MAIL |

| | |

Visit 24/7: www.proxypush.com/nsit Use the Internet to vote your proxy until 11:59 p.m. (CT) on May 17, 2022. | Dial toll free 24/7: 1-866-883-3382 Use a touch-tone telephone to vote your proxy until 11:59 p.m. (CT) on May 17, 2022. | Mark, sign and date your proxy card and return it in the postage-paid envelope provided. |

| | |

| Voting at the Annual Meeting |

You may vote in person at the Annual Meeting, which will be held on Wednesday, May 18, 2022, at 10:00 a.m. MST, at the Insight global headquarters, 2701 E. Insight Way, Chandler, Arizona 85286. If you hold your shares through a broker, bank or other nominee and would like to vote in person at the Annual Meeting, you must first obtain a proxy issued in your name from the institution that holds your shares.

| | |

| Frequently Asked Questions |

We provide answers to many frequently asked questions about the meeting and voting under “Frequently Asked Questions Concerning the Annual Meeting” beginning on page 67 of this proxy statement.

PROXY SUMMARY

This summary highlights information contained elsewhere. This summary does not contain all of the information that you should consider, and you should read carefully the entire proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2021 before voting at the Annual Meeting. Measures used in this proxy statement that are not based on U.S. generally accepted accounting principles (“GAAP”) are defined and reconciled to the most directly comparable GAAP measure in Appendix A.

Business Overview

Today, every business needs to be a technology business. We empower organizations with technology, solutions and services to help our clients maximize the value of their information technology (“IT”) today and drive digital transformation for tomorrow in North America; Europe, the Middle East and Africa (“EMEA”); and Asia-Pacific (“APAC”). As a Fortune 500-ranked global technology provider of end-to-end secure digital transformation solutions and services, we help clients innovate and optimize their operations to run smarter.

Our clients are our number-one priority, so delivering client value, which helps us earn client loyalty, is our primary goal. We expect our clients to achieve advantages by leveraging our unique capabilities to provide end-to-end secure digital transformation solutions and services. We provide technical expertise and advisory services to our clients as an industry-recognized solutions integrator. From IT strategy and design to implementation and management, we meet our clients wherever they are now and work alongside them to get them to where they want to be.

Our go-to-market framework for our cloud and digital expertise is built on over 33 years of broad IT experience combined with strategic acquisitions, new cloud and digital expertise and deep partner relationships. We are uniquely positioned to help our clients maximize the value of their technology today – and future proof their investments for tomorrow.

Each of our areas of expertise represents a discrete area of growth for our business and when connected to each other, they provide a platform for our clients to leverage our breadth of expertise to solve their most relevant business challenges. Our strategy is to increase our penetration with new and existing clients within the areas of expertise across our geographic footprint in North America, EMEA and APAC. Powered by Insight’s legacy technology supply chain expertise, we are able to support our services offerings within the hardware, software and cloud solutions from market-leading and emerging manufacturer brands. To execute our strategy, we employ centralized and field-based sales, engineering, and services resources to connect with our clients. We also invested in technical engineers, architects and software developers who create and deliver integrated IT solutions to our clients globally, a capability we believe differentiates us in the marketplace.

Our unique solution-focused go-to-market strategy is supported by a strong operational platform that includes scalable IT and e-commerce systems and processes, robust digital marketing capabilities and a culture of continuous business process transformation and automation.

We are organized in three geographic operating segments:

| | | | | | | | |

| Operating Segment | Geography | Percent of 2021 Consolidated Net Sales |

| North America | United States and Canada | 80% |

| EMEA | Europe, Middle East and Africa | 18% |

| APAC | Asia-Pacific | 2% |

2021 Business Highlights

In 2021, our global team delivered a sixth consecutive year of double-digit non-GAAP Adjusted* earnings from operations growth, focusing on improving our product mix by continuing to expand our higher margin services offerings and integrating strategic acquisitions. We believe that the strategic investments we made in our go-to-market solution areas over the last several years, as well as the investments in our sales and technical talent, have positioned us well to continue to execute on our business goals. For the full year 2021, we delivered the following consolidated financial results:

•Net sales growth of $1.1 billion, or 13%, to $9.4 billion

•Gross profit (“GP”) growth of 11%

•Non-GAAP Adjusted* earnings from operations (“EFO”) growth of 12%

•Non-GAAP Adjusted* diluted earnings per share (“EPS”) growth of 15%, to $7.10

•Non-GAAP Adjusted* return on invested capital (“ROIC”) of 14.01%(1)

(1)Calculated using a 26.0% tax rate for 2021, consistent with the ROIC reported in 2021 earnings.

* See Appendix A for a reconciliation of each non-GAAP Adjusted financial measure to the most directly comparable GAAP measure

The following chart shows how a $100 investment in the Company’s common stock on December 31, 2016 would have grown to $264 on December 31, 2021. The chart also shows Insight’s performance versus the NASDAQ US Benchmark TR Index (Market Index) ($100 investment would have grown to $230) and the NASDAQ US Benchmark Computer Hardware TR Index (Industry Index) ($100 investment would have grown to $593) over the same period, with dividends reinvested.

For further details about our performance in 2021, please see the Company’s Annual Report on Form 10-K for the year ended December 31, 2021.

Our Board of Directors

•Independent Board. Our Board of Directors is comprised entirely of independent directors, other than Joyce A. Mullen, who also serves as our President and Chief Executive Officer.

•Independent Chair of the Board and Presiding Director. Timothy A. Crown serves as our independent Chair of the Board and Anthony A. Ibargüen serves as our Presiding Director, whose primary responsibility is to fill in for the Chair if he is unable to serve.

•Independent Board Committees. All members of our Audit, Compensation and Nominating and Governance Committees are independent directors.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Board Committee Membership During 2021 |

| Name | Age | Director Since | Primary Occupation | Independent | Audit | Compensation | Nominating & Governance |

| Kenneth T. Lamneck | 67 | 2010* | President and Chief Executive Officer, Insight Enterprises, Inc. | | | | |

| Timothy A. Crown | 58 | 1994 | Investor / Entrepreneur | ✓ | | | |

| Richard E. Allen | 65 | 2012 | Investor | ✓ | × | | |

| Bruce W. Armstrong | 60 | 2016 | Operating Partner, Khosla Ventures | ✓ | | × | |

| Linda M. Breard | 52 | 2018 | Investor | ✓ | | × | |

| Catherine Courage | 47 | 2016 | Vice President, Experience for Ads and Commerce, Google, Inc. | ✓ | × | × | |

| Anthony A. Ibargüen | 63 | 2008 | Chief Executive Officer, Quench USA, Inc. | ✓ | | × | × |

| Kathleen S. Pushor | 64 | 2005 | Independent Consultant | ✓ | × | | × |

| Girish Rishi | 52 | 2017 | Chief Executive Officer of Blue Yonder | ✓ | × | | × |

* Mr. Lamneck retired as President and Chief Executive Officer and as a member of the Board effective December 31, 2021.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Board Committee Membership During 2022 |

| Name | Age | Director Since | Primary Occupation | Independent | Audit | Compensation | Nominating & Governance |

| Joyce A. Mullen | 60 | 2022 | President and Chief Executive Officer, Insight Enterprises, Inc. | | | | |

| Timothy A. Crown | 58 | 1994 | Investor / Entrepreneur | ✓ | | | |

| Richard E. Allen | 65 | 2012 | Investor | ✓ | × | | |

| Bruce W. Armstrong | 60 | 2016 | Operating Partner, Khosla Ventures | ✓ | | × | |

| Alexander L. Baum | 36 | 2022 | Partner, ValueAct Capital | ✓ | × | × | |

| Linda M. Breard | 52 | 2018 | Investor | ✓ | | × | |

| Catherine Courage | 47 | 2016 | Vice President, Experience for Ads and Commerce, Google, Inc. | ✓ | | × | × |

| Anthony A. Ibargüen | 63 | 2008 | Chief Executive Officer, Quench USA, Inc. | ✓ | | × | × |

| Kathleen S. Pushor | 63 | 2005 | Independent Consultant | ✓ | × | | × |

| Girish Rishi | 52 | 2017 | Investor | ✓ | × | | × |

Executive Compensation Highlights

CEO Pay for Performance

Our executive compensation program is focused on driving profitability growth and stockholder value creation. The Compensation Committee seeks to foster these objectives through a compensation system that focuses on variable, performance-based incentives that create a balanced focus on our short-term and long-term strategic and financial goals. As shown in the chart below, in 2021, approximately 84% of the target total direct compensation of our then President and Chief Executive Officer, Kenneth T. Lamneck, was variable and/or “at-risk” and earned only if performance goals are met.

Our Executive Compensation Practices

Our executive compensation practices include the following, each of which the Compensation Committee believes reinforces our executive compensation objectives:

| | | | | | | | |

| | Our Executive Compensation Practices |

| ✓ | | Significant percentage of target total direct compensation delivered in the form of variable compensation, which is at-risk and/or tied to performance |

| ✓ | | Long-term performance objectives aligned with the creation of stockholder value |

| ✓ | | Compensation Committee consists of independent directors only |

| ✓ | | Annual review of our compensation-related risk profile |

| ✓ | | Market comparison of executive compensation against relevant peer group information |

| ✓ | | Use of an independent compensation consultant reporting directly to the Compensation Committee and providing no services to the Company |

| ✓ | | Robust stock ownership guidelines |

| ✓ | | Clawback policy |

| ✓ | | We do not provide excessive executive perquisites |

| ✓ | | We do not provide excessive severance benefits |

| ✓ | | We do not offer tax gross-ups, except for one legacy arrangement granted years ago |

| ✓ | | We prohibit repricing of underwater stock options under our long-term incentive plan without stockholder approval |

| ✓ | | We prohibit hedging or short sales of our securities, and we prohibit pledging of our securities except in limited circumstances with pre-approval |

Extensive information regarding our executive compensation programs in place for 2021 can be found under the heading “Compensation Discussion and Analysis.”

CORPORATE GOVERNANCE

To provide a framework for effective corporate governance, our Board of Directors (the “Board of Directors” or “Board”) has adopted Corporate Governance Guidelines. These guidelines outline the operating principles of our Board of Directors, and the composition and working processes of our Board and its committees. The Nominating and Governance Committee periodically reviews our Corporate Governance Guidelines and developments in corporate governance, and recommends proposed changes to the Board for approval.

Our Corporate Governance Guidelines, along with other corporate governance documents, such as committee charters and our Code of Ethics and Business Practices, are available on our website at http://investor.insight.com/corporate-governance.

| | |

| Independence of Our Board of Directors |

Under our Corporate Governance Guidelines and the listing standards of NASDAQ, a majority of our Board members must be independent. The Board of Directors annually determines whether each of our directors is independent. In determining independence, the Board follows the independence criteria set forth in the NASDAQ listing standards and considers all relevant facts and circumstances.

Under the NASDAQ independence criteria, a director cannot be considered independent if he or she has one of the relationships specifically enumerated in the NASDAQ listing standards. In addition, the Board must affirmatively determine that a director does not have a relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The Board has affirmatively determined that each of our current directors is independent under the applicable listing standards of NASDAQ, other than our President and Chief Executive Officer, Joyce A. Mullen.

| | |

| Board of Directors Leadership Structure |

Timothy A. Crown serves as the Chair of our Board of Directors and Joyce A. Mullen serves as our President and Chief Executive Officer. The Board believes that separating the roles of Chair and Chief Executive Officer, along with the use of regular executive sessions of the independent directors, provides appropriate oversight of the Company’s strategic direction. Anthony A. Ibargüen serves as the Presiding Director of the Board and is responsible, after consultation with the full Board, for proposing revisions to the Company’s Corporate Governance Guidelines and Board procedures and for filling in when the Chair is unavailable.

Over the last several years, the Company has refreshed our Board. In 2022, the Board elected two new directors. Ms. Mullen was elected to the Board on January 1, 2022 as a replacement for Mr. Lamneck who retired effective December 31, 2021. Mr. Baum was appointed by the Board in February 2022 in connection with the execution of a Nomination and Cooperation Agreement with ValueAct Capital (the “Cooperation Agreement”). The refreshment has increased the Board’s diversity, experiences, and perspectives while lowering the average age of our directors from 58 to 56. The average tenure of members of the Board is nine years.

The Board engages in a robust self-evaluation process designed to elicit improvement in the effectiveness of the Board, its committees, and the individual directors. For the last several years, on an annual basis, the Company’s outside counsel has distributed a self-assessment questionnaire, which was followed by an interview with each director. After compiling the results, the recommendations were reviewed with the Chairs of the Board and each committee. The Chairs of the committees use the recommendations to identify areas of potential improvements for their respective committees and the Chairs of the Board and Nominating and Governance Committee provide feedback to each individual director.

| | |

| Corporate Social Responsibility |

The Company is committed to corporate social responsibility through environmental, social and governance (“ESG”) initiatives that reflect areas of greatest relevance to Insight. Those initiatives include operating with integrity, nurturing the capabilities of our employees, promoting diversity and inclusion in the workforce, data security, contributing to local communities, and reducing our environmental impact. The Company has signed the United Nations Global Compact and supports its principles of human rights, anti-discrimination, environmental responsibility, and anti-corruption. The Nominating and Governance Committee is responsible for overseeing the Company’s ESG program, priorities, and initiatives. The Company was named to Barron’s list of “100 Most Sustainable Companies” for 2022. In compiling the list, Barron’s analyzed the 1,000 largest publicly-traded companies and evaluated them across more than 230 ESG performance indicators including human capital management, data security, community engagement and the environment.

Key areas of focus for the Company’s ESG Program include:

•Business Ethics and Compliance

•Data Security

•Human Capital Development and Workforce Diversity and Inclusion

•Reducing our Environmental Impact

•Community Involvement

| | | | | | | | | | | | | | |

| ESG Highlights |

| Business Ethics and Compliance | Maintains a Global Code of Ethics and Business Practices and Global Anti-Bribery and Corruption Policy to guide employee and director conduct to foster a culture of ethics and integrity and compliance with the law.

Requires annual ethics and compliance training for employees across all levels. Maintains an Ethics Hotline for confidential reporting of suspected violations. |

|

|

|

| Data Security | Maintains a Global Data Privacy Program and Global Information Security Program as part of its information security strategy, both of which involve best practices, current tools, and policies and procedures designed to keep confidential and secure company, employee and customer information.

Regularly (at least twice annually) reports to full Board on cyber security and information security matters.

Requires quarterly cyber security compliance training for employees across all levels and regularly educates employees about cyber security defenses.

Maintains cyber security insurance. |

|

|

|

|

|

|

|

| Human Capital Development and Workforce Diversity and Inclusion | Fosters a culture that encourages leadership development and encourages employees to excel individually and deliver value to clients.

Seeks to be an employer of choice and has been recognized as a “Great Place to Work” and “Best Place to Work” in multiple locations in North America, Europe and Australia and named to Forbes “World’s Best Employers” list.

Annually conducts employee pulse surveys to track employee engagement and satisfaction. Employs equal employment opportunity hiring practices, polices and management of employees.

Committed to create a diverse workforce that provides equal opportunity regardless of race, gender, religion, national origin, sexual orientation or disability, among other categories, and fosters respect, appreciation and acceptance of all people.

Expanded diversity initiatives to ensure women and minorities are considered for leadership roles, supports many diverse resource groups, and maintains recruiting programs for diverse teammates.

Earned a perfect score on the Human Rights Campaign Foundation’s Corporate Equality Index and designated as one of Fortune’s “100 Best Workplaces for Diversity.”

Maintains an anti-harassment policy that prohibits hostility or aversion towards individuals in protected categories, and prohibits sexual harassment in any form. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | | |

| ESG Highlights (continued) |

| Human Capital Development and Workforce Diversity and Inclusion (continued) | Participant in the United Nations Global Compact and committed to policies and practices that avert human trafficking, eliminate modern slavery and other human rights violations.

Provides training for employees across all levels. |

|

|

|

| Reducing our Environmental Impact | Committed to reducing impact on the environment.

Currently evaluating Scope 1 and Scope 2 emissions to determine baseline for further reducing already low emission levels.

New global headquarters building features eco-friendly design including solar panels, energy efficient HVAC and lighting systems, and expects LEED Gold certification.

Engaged in assisting customers with hardware lifecycle and asset disposal services saving the equivalent of millions of pounds of electronic waste. |

|

|

|

|

|

|

| Community Involvement | Provide employees two paid days off per year to volunteer their time to philanthropic and volunteer causes that improve our communities throughout the world.

The Company and employees annually contribute significant funds to Ronald McDonald House charities, the Make-A-Wish Foundation and the Boys & Girls Club of Arizona.

Employees contribute significant funds to charitable causes throughout the world.

The Company and its employees support the Insight In It Together Foundation, which (i) provides financial assistance and other resources to employees and their families in times of special need and (ii) supports community organizations providing technology to support educational opportunities for under-privileged children. |

|

|

|

|

|

|

|

|

|

We annually report on some of our ESG activities in our Insight Enterprises Corporate Citizenship Report, which is available on our website at http://investor.insight.com. The Company does not make political contributions.

| | |

| Board and Committee Meetings |

Under our Corporate Governance Guidelines, our directors are expected to attend meetings of the Board and applicable committees and annual meetings of stockholders.

In 2021, the Board held 8 meetings, including regularly scheduled and special meetings. In 2021, each of the directors attended at least 75% of the aggregate of all meetings of the Board and the meetings of the committees on which he or she served (during the periods for which he or she served on the Board and such committees). In addition, all of the then serving directors attended our 2021 Annual Meeting of Stockholders.

Our Board has four committees: the Audit Committee, the Compensation Committee, the Nominating and Governance Committee and the Executive Committee. Our Board has adopted charters for each of these committees, which are available on our website at http://investor.insight.com/corporate-governance. Under the committees’ charters, the committees report regularly to the Board. Additional information on each of these committees is set forth below.

| | | | | | | | |

| Audit Committee | |

| | |

Chair (during 2021): Linda M. Breard |

| | |

Other Members of the Committee (during 2021): Richard E. Allen, Catherine Courage, Kathleen S. Pushor, Girish Rishi |

| | |

Meetings Held in 2021: 8 | | |

| | |

Chair (during 2022): Linda M. Breard |

| | |

Other Members of the Committee (during 2022): Richard E. Allen, Alexander L. Baum, Kathleen S. Pushor, Girish Rishi |

| | |

| Primary Responsibilities: | | |

| | |

| Our Audit Committee is responsible for, among other things: (1) appointing, compensating, retaining, evaluating, overseeing and terminating our independent registered public accounting firm; (2) discussing with our independent registered public accounting firm its independence; (3) reviewing with our independent registered public accounting firm the scope and results of its audit; (4) approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm; (5) overseeing the accounting and financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the U.S. Securities and Exchange Commission (“SEC”); (6) reviewing and monitoring our accounting principles, accounting policies and financial and accounting controls; (7) establishing procedures for the confidential and anonymous submission of concerns regarding questionable accounting or auditing matters; (8) reviewing and approving or ratifying related party transactions; and (9) overseeing our internal audit function. |

| | |

| Independence: | | |

| | |

| Each member of the Audit Committee (during 2021 and 2022) meets the audit committee independence requirements of NASDAQ and the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). |

| | |

| The Board has designated each of Richard E. Allen and Linda M. Breard as an “audit committee financial expert.” Each member of the Audit Committee is financially literate, knowledgeable and qualified to review financial statements. |

| | |

| | | | | | | | |

| Compensation Committee | |

| | |

Chair (during 2021): Richard E. Allen |

|

Other Members of the Committee (during 2021): Bruce W. Armstrong, Linda M. Breard, Catherine Courage, Anthony A. Ibargüen |

| | |

Meetings Held in 2021: 7 | | |

| | |

Chair (during 2022): Richard E. Allen |

| | |

Other Members of the Committee (during 2022): Bruce W. Armstrong, Alexander L. Baum, Linda M. Breard, Catherine Courage, Anthony A. Ibargüen |

| | |

| Primary Responsibilities: | | |

| | |

| Our Compensation Committee is responsible for, among other things: (1) reviewing and approving the compensation of our chief executive officer and other executive officers; (2) administering our stock plans and other incentive compensation plans; (3) periodically reviewing and recommending to the Board any changes to our incentive compensation and equity-based plans; (4) delegating authority to directors or executive officers to grant equity awards to eligible employees; (5) appointing, compensating, retaining, evaluating and overseeing outside compensation consultants, experts and other advisors; (6) reviewing trends in executive compensation; and (7) reviewing talent management and succession planning for senior executives, including internal succession candidates for the chief executive officer. |

| | |

| Independence: | | |

| | |

| Each member of the Compensation Committee (during 2021 and 2022) meets the compensation committee independence requirements of NASDAQ and the rules under the Exchange Act, meets the non-employee director requirements of Rule 16b-3 under the Exchange Act, and meets the outside director requirements under Section 162(m) of the Internal Revenue Code (“IRC”). |

|

| | | | | | | | |

| Nominating and Governance Committee |

| | |

Chair (during 2021): Bruce W. Armstrong |

|

Other Members of the Committee (during 2021): Anthony A. Ibargüen, Kathleen S. Pushor, Girish Rishi |

| | |

Meetings Held in 2021: 3 | | |

| | |

Chair (during 2022): Bruce W. Armstrong |

| | |

Other Members of the Committee (during 2022): Catherine Courage, Anthony A. Ibargüen, Kathleen S. Pushor, Girish Rishi |

| | |

| Primary Responsibilities: | | |

| | |

| Our Nominating and Governance Committee is responsible for, among other things: (1) identifying individuals qualified to become members of our Board of Directors, consistent with criteria approved by our Board; (2) overseeing the organization of our Board to discharge the Board’s duties and responsibilities properly and efficiently; (3) reviewing developments in and making recommendations regarding corporate governance matters; (4) developing and recommending to our Board a set of corporate governance guidelines and principles applicable to us; (5) managing the Board’s self-evaluation process; (6) coordinating the process for chief executive officer succession, especially involving external candidates; and (7) retaining, compensating and terminating any director search firms or other advisors. |

| | |

| Independence: | | |

| | |

| Each member of the Nominating and Governance Committee (during 2021 and 2022) meets the nominating and corporate governance committee independence requirements of NASDAQ. |

|

| | | | | | | | |

| Executive Committee |

| | |

Chair (during 2021): Timothy A. Crown |

|

Other Members of the Committee (during 2021): Anthony A. Ibargüen, Kenneth T. Lamneck |

| | |

Meetings Held in 2021: None | | |

| | |

Chair (during 2022): Timothy A. Crown |

| | |

Other Members of the Committee (during 2022): Anthony A. Ibargüen, Joyce A. Mullen |

| | |

| Primary Responsibilities: | | |

| | |

| Our Executive Committee meets, at the request of the Chair, to exercise the powers and authority of the Board during intervals between meetings of the Board. The Executive Committee shall not exercise: (1) powers delegated to other committees of the Board; and (2) powers that may not be delegated to a committee under Delaware General Corporation law, including amending the Bylaws or approving a merger of the Company. |

|

| | |

| Board of Directors Role in Strategy |

Our Board of Directors oversees the Company’s strategy. On an annual basis, the Board reviews and approves the Company’s strategic plan and is involved in the Company’s strategic planning process throughout its development. In both 2017 and 2019, the Board oversaw the engagement of an outside consultant that assisted management in evaluating the strengths and weaknesses of the Company, key trends in the industry, and opportunities for future growth of the Company. In 2020, the Board was involved in evaluating the results of a study by an outside consultant that evaluated changes in the Company’s go-to-market approach. During 2021, the Board was involved in evaluating the results of studies by outside consultants that addressed improvements in the Company’s e-commerce capabilities. Throughout the past several years, the Board has been regularly involved in addressing matters of strategic importance, including evaluating and prioritizing acquisition targets, strategic partnerships, and the strategies adopted by the Company to address industry trends and opportunities.

| | |

| Board of Directors Role in Risk Oversight |

Enterprise Risk Management Program

Our Board of Directors oversees our Enterprise Risk Management Program (“ERM Program”), which is designed to drive the identification, analysis, discussion and reporting of risks to the enterprise. The ERM Program encourages constructive dialog at the management and Board levels to proactively identify and manage enterprise risks. Under the ERM Program, which the Company continues to refine, management develops a comprehensive report of enterprise risks by conducting regular assessments of the business and supporting functions, including assessments of strategic, operational, financial reporting and legal and compliance risks, and helps to ensure appropriate response strategies are in place. As part of the Company’s ERM Program, the Company focuses on cyber security defenses including best practices for tools, policies, procedures, and training.

Enterprise risks are considered in business decision making and as part of our overall business strategy. Our management team, including our executive officers, is primarily responsible for managing the risks associated with the operations and business of the Company. Senior management provides regular updates to the full Board of Directors at least twice a year on matters covered by the ERM Policy, and reports to the full Board on any identified high priority enterprise risks.

Compensation Risk Assessment

We annually conduct an assessment of the risks associated with our compensation practices and policies. In 2021, we determined that the risks arising from such policies and practices are not reasonably likely to have a material adverse effect on the Company. In conducting the assessment, we undertook a review of our compensation philosophies, our compensation governance structure and the design and oversight of our various compensation programs. Overall, we believe that our programs include an appropriate mix of fixed and variable features, and short-term and long-term incentives with compensation-based goals aligning with corporate goals. Centralized oversight helps ensure compensation programs align with the Company’s goals and compensation philosophies and, along with other factors, operate to mitigate against the risk that such programs would encourage excessive risk-taking.

| | |

| Code of Ethics and Business Practices |

We have adopted a code of ethics and business practices, which is applicable to all of our teammates and our directors. If we make any substantive amendments to the code of ethics and business practices or grant any waiver from a provision of the code to our chief executive officer, chief financial officer (principal financial officer) or global corporate controller (principal accounting officer), we will disclose the nature of such amendment or waiver on our website or in a Current Report on Form 8-K. A copy of this code is available on our website at http://investor.insight.com/corporate-governance.

| | |

| Hedging, Short Sales and Pledging Policies |

Our Policy on Insider Trading, which applies to all teammates, Board members and consultants, includes policies on hedging, short sales and pledging of our securities. Our policy prohibits hedging transactions involving Company securities and it also prohibits short sales or other speculative transactions involving our securities. In addition, it prohibits holding Company securities in a margin account or pledging Company securities as collateral for a loan except in limited circumstances with pre-approval from our Compliance Officer, which pre-approval will only be granted when such person clearly demonstrates the financial capacity to repay the loan without resort to any pledged securities.

| | |

| Communications with the Board of Directors |

Stockholders who would like to communicate with the Board of Directors or its committees may do so by writing to them via the Company’s Corporate Secretary by mail at Insight Enterprises, Inc., 2701 E. Insight Way, Chandler, Arizona 85286. Correspondence may be addressed to the collective Board of Directors or to any of its individual members or committees at the election of the sender. Any such communication is promptly distributed to the director or directors named therein unless such communication is considered, either presumptively or in the reasonable judgment of the Company’s Corporate Secretary, to be improper for submission to the intended recipient or recipients. Examples of communications that would presumptively be deemed improper for submission include, without limitation, solicitations, communications that raise grievances that are personal to the sender, communications that relate to the pricing of the Company’s products or services, communications that do not relate directly or indirectly to the Company and communications that are frivolous in nature.

| | |

| Compensation Committee Interlocks and Insider Participation |

The members of the Compensation Committee during 2021 were Mr. Allen (Chair), Ms. Breard, Ms. Courage, and Messrs. Armstrong and Ibargüen. No member of the Compensation Committee was at any time during 2021 or at any other time an officer or employee of Insight, and no member had any relationship with Insight requiring disclosure. No executive officer of Insight has served on the board of directors or compensation committee of any other entity that has or has had one or more executive officers who served as a member of the Board or the Compensation Committee of Insight during 2021.

| | |

| Related Party Transactions |

Related Party Transaction Approval Policy

We have a written policy regarding the approval and/or ratification of related party transactions. The policy is administered by our Audit Committee and applies to any transaction or series of transactions in which the Company is a participant, the amount involved exceeds or is expected to exceed $120,000 in any calendar year and any related person has a direct or indirect interest. For purposes of the policy, “related persons” consist of the Company’s directors or executive officers, any stockholder beneficially owning more than 5% of the Company’s common stock or immediate family members of any such persons.

Under the policy, the Audit Committee will review all applicable related party transactions for approval, ratification or other action unless the transaction falls within the following categories of pre-approved transactions:

•employment of an executive officer if compensation is otherwise subject to disclosure requirements or approved by the Compensation Committee;

•director compensation subject to disclosure requirements;

•in the ordinary course of business, sales to or purchases from another company where a related party is employed or a director if the aggregate amount involved does not exceed the greater of $1 million or 2% of the other company’s total annual revenues (for sales) or $50,000 (for purchases);

•any charitable contribution, grant or endowment where the related party is employed or a director if the aggregate amount involved does not exceed the lesser of $10,000 or 2% of the charitable organization’s annual receipts;

•any transaction where the related party’s interest arises solely from the ownership of common stock and all holders of common stock received the same benefit on a pro rata basis;

•any transaction with a related party involving the rendering of services as a common or contract carrier, or public utility, at rates or charges fixed in conformity with law or governmental authority; and

•any transaction with a related party involving services as a bank depositary of funds, transfer agent, registrar, trustee under a trust indenture, or similar services.

We generally believe these transactions are not significant to investors because they comply with the Company’s standard policies and procedures or are otherwise subject to review. Any related party transaction requiring individual review will only be approved if the Audit Committee determines that such transaction will not impair the involved person’s service to, and exercise of judgment on behalf of, the Company, or otherwise create a conflict of interest that would be detrimental to the Company.

We also require that each executive officer, director and director nominee complete an annual questionnaire and report all transactions with us in which such persons (or their immediate family members) had or will have a direct or indirect material interest (except for directors’ fees). Management reviews responses to the questionnaires and, if any such transactions are disclosed, they are reviewed by the Audit Committee. The types of transactions that have been reviewed in the past typically include the purchase from, and sale of products and services to, companies for which our directors serve as executive officers or directors, including purchases of marketing services for our use and products for resale to clients and the sale of products, software and services.

Related Party Transactions

No related person had any direct or indirect material interest in any transaction with us required to be disclosed since the commencement of the 2021 fiscal year.

No Stockholder Rights Plan

The Company does not maintain a stockholder rights plan (commonly referred to as a poison pill).

PROPOSAL 1 – Election of Directors

Our Board consists of ten directors.

Upon the recommendation of the Nominating and Governance Committee, the Board has nominated the ten directors for election to new terms expiring at the 2023 Annual Meeting of Stockholders, subject to the election and qualification of their successors.

| | |

| Director Nomination Process |

The Board of Directors is responsible for nominating individuals for election to the Board and for filling vacancies on the Board that may occur between annual meetings of stockholders. The Nominating and Governance Committee is responsible for identifying and screening potential candidates and recommending qualified candidates to the Board for nomination. Third-party search firms may be and have been retained to identify individuals that meet the criteria of the Nominating and Governance Committee.

The Nominating and Governance Committee will consider director candidates recommended by stockholders in the same manner in which it evaluates candidates it identified, if such recommendations are properly submitted to the Company. Stockholders wishing to recommend nominees for election to the Board should submit their recommendations in writing to our Corporate Secretary by mail at Insight Enterprises, Inc., 2701 E. Insight Way, Chandler, Arizona 85286. See “Other Business – Stockholder Proposals and Director Nominations for the 2023 Annual Meeting” for additional information.

In selecting director candidates, the Nominating and Governance Committee and the Board of Directors consider the qualifications and skills of the candidates individually and the composition of the Board as a whole. Under our Corporate Governance Guidelines, the Nominating and Governance Committee and the Board review the following for each candidate, among other qualifications deemed appropriate, when considering the suitability of candidates for nomination as director:

•Principal employment, occupation or association involving an active leadership role

•Qualifications, attributes, skills and/or experience relevant to the Company’s business

•Ability to bring diversity to the Board, including a mix of career experience and viewpoints

•Other time commitments, including the number of other boards on which the potential candidate may serve

•Independence and absence of conflicts of interest as determined by the Board’s standards and policies, the listing standards of NASDAQ and other applicable laws, regulations and rules

•Financial literacy and expertise

•Personal qualities, including strength of character, maturity of thought process and judgment, values and ability to work collegially

| | |

| ValueAct Capital Nomination and Cooperation Agreement |

On February 15, 2022, the Board elected Alexander L. Baum as a member of the Board of Directors, to serve until the Company’s 2022 Annual Meeting and the election and qualification of his successor. Mr. Baum will serve as a member of the Audit and Compensation Committees of the Board.

Mr. Baum joined the Board pursuant to a Nomination and Cooperation Agreement (the “Agreement”), dated February 14, 2022, by and among the Company and various affiliates of ValueAct Capital (collectively, the “ValueAct Group”). The Agreement includes various terms, conditions and provisions, including that the Company will include Mr. Baum in the Board’s recommended director slate of candidates to stand for election at the 2022 annual stockholders meeting. Mr. Baum, while serving as a member of the Board of Directors, is required to (i) meet all director independence and other requirements of the Company, of stock exchange listing standards and of the Securities and Exchange Commission and related securities laws and regulations, (ii) be qualified to serve as a director under the Delaware General Corporation Law and (iii) comply with Company policies, guidelines and codes of conduct applicable to directors.

If the ValueAct Group (which currently holds approximately a 10% ownership position in the Company) ceases to hold at least 5.0% of the Company’s common stock, Mr. Baum would offer his resignation from the Board. Such offer of resignation would also be required in other circumstances set forth in the Agreement.

Under the Agreement, the ValueAct Group is subject to various restrictions, including, among other things, prohibitions on the ValueAct Group acquiring more than 15% of the Company’s outstanding shares without the Company’s consent, engaging in proxy solicitations and other stockholder-related matters and proposals, forming groups with other investors, disposing of their shares to a third party who would own more than 4.9% of the Company’s outstanding shares outside of open market sales or underwritten offerings, engaging in short sales of Company shares, and limitations on public statements regarding the Company and on interactions with third parties and employees. The ValueAct Group has agreed to vote its shares as set forth in the Agreement, including with respect to board elections. Certain non-disparagement provisions also apply to the Company and to the ValueAct Group under the Agreement. The provisions of the Agreement described above generally apply until the later of (i) one year and (ii) the date of the Company’s 2023 annual stockholders meeting if Mr. Baum is re-nominated to serve as a director at the Company’s 2023 annual stockholders meeting and he accepts the re-nomination.

| | |

| 2022 Nominees for Election to the Board of Directors |

Each of the ten director nominees listed below is currently a director of the Company. Each also has been determined by the Board to be independent, other than our President and Chief Executive Officer, Joyce A. Mullen.

The following biographies describe the business experience of each director nominee. Following the biographical information for each director nominee, we have listed the specific experience and qualifications of that nominee that strengthen the Board’s collective qualifications, skills and experience.

If elected, each of the director nominees is expected to serve for a term expiring at the Annual Meeting of Stockholders in 2023, subject to the election and qualification of his or her successor. The Board expects that each of the nominees will be available for election as a director. However, if by reason of an unexpected occurrence one or more of the nominees is not available for election, the persons named in the form of proxy have advised that they will vote for such substitute nominees as the Board may nominate.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE FOLLOWING NOMINEES FOR ELECTION AS DIRECTORS.

| | | | | | | | |

| | |

| Joyce A. Mullen | | Director of Insight Since: 2022 |

| | |

| President and Chief Executive Officer of Insight | | Other Public Company Directorships: The Toro |

| Age: 60 | | Company |

| | |

| | |

Ms. Mullen was elected as President and Chief Executive Officer and a director of Insight effective January 1, 2022. Ms. Mullen joined Insight in October 2020 as our President of the North America Region. Prior to joining Insight, Ms. Mullen spent 21 years of her career at Dell Technologies in a variety of sales, service delivery, and IT solutions roles most recently serving as President, Global Channel, Embedded & Edge Solutions and previously as Senior Vice President and General Manager, Global OEM and IOT Solutions from February 2015 to November 2017. Ms. Mullen is a member of the board of directors of The Toro Company, a publicly-held company that designs, manufactures, and markets lawn mowers, snow blowers, and irrigation system supplies for commercial and residential, agricultural, and public sector uses.

Experience and Qualifications of Particular Relevance to Insight

Ms. Mullen’s knowledge of our business, based on over 20 years of industry experience, her connections with industry leaders, and her extensive management experience, make her a valuable contributor to the Board. In addition, as our President and Chief Executive Officer, the Board believes it is appropriate for her to be a member of our Board.

| | | | | | | | |

| | |

| Timothy A. Crown | | Director of Insight Since: 1994 |

| | |

| Chair of the Board, Independent Director | | |

| Age: 58 | | |

| | |

| | |

Mr. Crown has served as a director since 1994 and assumed the position of Chair of the Board in November 2004. Mr. Crown has been a non-employee director since 2004. Mr. Crown, a co-founder of the Company, stepped down from the position of President and Chief Executive Officer in November 2004, positions he had held since January 2000 and October 2003, respectively. Mr. Crown is also an officer and director of various private companies, including companies in which he has made investments.

Experience and Qualifications of Particular Relevance to Insight

The Board believes Mr. Crown’s experience as a co-founder of the Company gives him a unique perspective on the Company’s opportunities, operations and challenges, and on the industry in which we operate. Mr. Crown’s experience in co-founding over 20 companies in the public, private and not- for-profit sectors also brings to our Board a focus on innovation and managing growth in rapidly changing environments.

| | | | | | | | |

| | |

| Richard E. Allen | | Director of Insight Since: 2012 |

| | |

| Independent Director | | |

| Age: 65 | | |

| | |

| | |

Mr. Allen has served as a director since January 2012 and is one of the Audit Committee’s designated financial experts. Mr. Allen also serves as Chair of the Compensation Committee. Mr. Allen served at J.D. Edwards & Company, a cross-industry enterprise resource planning software solutions company, from 1985 to 2004, most recently as Executive Vice President, Finance and Administration, and served as a member of its board from 1992 to 2004. Prior to each of the following companies being acquired, he also served on the board of directors of RightNow Technologies, Inc., a publicly-held cloud-based customer relationship management business to consumer solutions provider, from 2004 until January 2012, and HireRight, Inc., a publicly-held provider of comprehensive employee background checks, from 2007 to 2009. He was the chair of the audit committee and a member of the compensation committee at both RightNow and HireRight. Mr. Allen served on the board and served as the audit committee chair for several privately-held companies that are cloud-based solutions and software providers. Since 2004, he served on the board of ten other public and private companies. Mr. Allen began his business career as a certified public accountant with Coopers & Lybrand in the audit division, where he last served as a Senior Auditor.

Experience and Qualifications of Particular Relevance to Insight

The Board believes that Mr. Allen’s over 40 years of finance, accounting, business operations and board experience, including his experience with cloud-based businesses, audit committees and compensation committees, brings corporate governance and financial and industry expertise to our Board.

| | | | | | | | |

| | |

| Bruce W. Armstrong | | Director of Insight Since: 2016 |

| | |

| Independent Director | | |

| Age: 60 | | |

| | |

| | |

Mr. Armstrong has served as a director since March 2016. Mr. Armstrong also serves as Chair of the Nominating and Governance Committee. Mr. Armstrong has over 25 years of experience developing, marketing, selling, and investing in technology, with an emphasis in data warehousing and analytic applications. Since 2015, Mr. Armstrong has served as an Operating Partner at Khosla Ventures, a venture capital firm, working with enterprise technology portfolio companies. Prior to that, Mr. Armstrong was the President and Chief Executive Officer of PivotLink, a leading provider of SaaS BI applications, from 2011 to 2014; Chairman and Chief Executive Officer of Kickfire, a pioneer in next-generation data warehouse appliances focused on the open source MySQL database market, from 2008 to 2010; and President and Chief Executive Officer of publicly-traded KNOVA Software, a leading provider of search and analytic applications for unstructured data, from 2002 to 2007.

Experience and Qualifications of Particular Relevance to Insight

The Board believes that Mr. Armstrong’s extensive experience as an executive of several technology companies and his strong background in Big Data and Analytics, next generation databases, data mining and the Internet of Things, along with his service on the boards of a variety of publicly-held and private companies, bring industry expertise and governance experience to our Board.

| | | | | | | | |

| | |

| Alexander L. Baum | | Director of Insight Since: 2022 |

| | |

| Independent Director | | |

| Age: 36 | | |

| | |

| | |

Mr. Baum was appointed as a director in February 2022 in connection with entering the Cooperation Agreement with ValueAct Capital. Mr. Baum is a Partner of ValueAct Capital, one of Insight’s largest stockholders. He joined ValueAct in 2012 and has worked on several ValueAct IT and technology industry investments including Nintendo Co. LTD, Microsoft Corporation, and Adobe, Inc., among others. He has a B.A. in physics from Pomona College and is a CFA charterholder.

Experience and Qualifications of Particular Relevance to Insight

The Board believes that Mr. Baum’s deep experience in IT industry strategy and investment expertise will assist our Board as Insight continues its transformation to become an industry leading solutions integrator.

| | | | | | | | |

| | |

| Linda M. Breard | | Director of Insight Since: 2018 |

| | |

| Independent Director | | Other Public Company Directorships: PotlatchDeltic |

| Age: 52 | | Corporation |

| | |

| | |

Ms. Breard has served as a director since February 2018 and is one of the Audit Committee’s designated financial experts. Ms. Breard also serves as Chair of the Audit Committee. Ms. Breard is a certified public accountant and currently serves on the Board of Directors for PotlatchDeltic Corporation, a forest products company, where she is Chair of the audit committee and a member of the compensation committee. From February 2017 to July 2017, she served as the Executive Vice President and Chief Financial Officer of Kaiser Permanente of Washington, which provides health insurance and medical care. Prior to that, from February 2016 to January 2017, Ms. Breard was the Executive Vice President and Chief Financial Officer of Group Health Cooperative, a health maintenance organization. From 2006 to 2016, she held various positions

including Senior Vice President and Chief Financial Officer of Quantum Corporation, a leading data storage company. Prior to that, from 1998 to 2006, she served in a variety of roles for Advanced Digital Information Corporation, a publicly-traded technology company, last serving as Vice President, Global Accounting and Finance, and worked six years in public accounting before that.

Experience and Qualifications of Particular Relevance to Insight

The Board believes that Ms. Breard’s extensive background in finance, business operations and accounting, along with her audit committee service on the board of another public company, brings financial expertise and governance experience to our Board.

| | | | | | | | | | | |

| | | |

| Catherine Courage | | Director of Insight Since: 2016 |

| | | |

| Independent Director | | |

| Age: 47 | | |

| | | |

| | | |

Ms. Courage has served as a director since January 2016. Since October 2016, Ms. Courage has served as Vice President of Experience for Ads and Commerce at Google, a technology company specializing in Internet-related services and products. Prior to joining Google, Ms. Courage was Senior Vice President, Customer Experience for DocuSign, Inc., a digital transaction management cloud software company, from June 2015 to September 2016. Prior to that, she served as Senior Vice President, Customer Experience at Citrix from March 2009 to May 2015. Before that, she spent 9 years in similar roles with Salesforce.com and Oracle.

Experience and Qualifications of Particular Relevance to Insight

The Board believes that Ms. Courage’s work in brand design and customer experience and her extensive experience with leading information technology companies, are an asset to our Board, as we engage with our clients in the evolving digitally-driven marketplace.

| | | | | | | | |

| | |

| Anthony A. Ibargüen | | Director of Insight Since: 2008 |

| | |

| Independent Director | | |

| Age: 63 | | |

| | |

| | |

Mr. Ibargüen has served as a director since July 2008, and from September to December 2009, he served as our interim President and Chief Executive Officer. He has served as Chief Executive Officer of Quench USA, Inc., since October 2010. He previously served as Chief Executive Officer and member of the Board of Directors of AquaVenture Holdings LLC, which was a New York Stock Exchange listed multinational provider of water purification and treatment services and technologies, until its sale to Culligan International in March 2020. In 2018, Mr. Ibargüen was elected to serve on the Board of Directors of the Federal Reserve Bank of Philadelphia, where he is Deputy Chair and a member of the executive and management and budget committees. From 2004 to 2008, he was Chief Executive Officer of Alliance Consulting Group, a privately-held IT consulting firm, and prior to that, Mr. Ibargüen was in leadership roles at several IT industry companies, including as President and member of the Board of Directors of Tech Data Corporation, a Fortune 500 global technology distribution company.

Experience and Qualifications of Particular Relevance to Insight

The Board believes that Mr. Ibargüen’s over 25 years of experience in the IT industry and extensive knowledge of global enterprise management, finance, product distribution, value-added services and capital markets brings valuable perspective to our Board.

| | | | | | | | |

| | |

| Kathleen S. Pushor | | Director of Insight Since: 2005 |

| | |

| Independent Director | | |

| Age: 64 | | |

| | |

| | |

Ms. Pushor has served as a director since September 2005. Ms. Pushor has operated an independent consulting practice since June 2009. From 2006 through June 2009, she served as President and Chief Executive Officer of the Greater Phoenix Chamber of Commerce. From 2003 to 2005, Ms. Pushor served as Chief Executive Officer of the Arizona Lottery. From 1999 to 2002, Ms. Pushor operated an independent consulting practice in the technology distribution sector. During the period from 1998 to 2005, Ms. Pushor was a member of the board of directors of Zones, Inc., a direct marketer of IT products.

Experience and Qualifications of Particular Relevance to Insight

The Board believes that Ms. Pushor’s industry knowledge and perspective, experience as a public company director and leadership experience from her many years as a Chief Executive Officer in the public sector bring valuable insights to our Board.

| | | | | | | | |

| | |

| Girish Rishi | | Director of Insight Since: 2017 |

| | |

| Independent Director | | |

| Age: 52 | | |

| | |

| | |

Mr. Rishi has served as a director since December 2017. From January 2017 until February 2022, Mr. Rishi served as Chief Executive Officer of Blue Yonder, a provider of supply chain management software and consulting services. Previous to that, he worked at Tyco International, a security system company, where he was responsible for the firm’s global retail solutions business and North America building automation business from May 2015 to December 2016. He was a member of the Board of Directors of Digi International, Inc., a provider of machine-to-machine connectivity products and services, from June 2013 to January 2018. Previously, from October 2014 to May 2015, Mr. Rishi served as Senior Vice President, Enterprise at Zebra Technologies, which provides data capture and identification solutions. Prior to joining Zebra, he was Senior Vice President, Enterprise Solutions for Motorola Solutions, Inc., a leading provider of communications solutions that help businesses operate more efficiently. Prior to that, he served in a variety of roles for Motorola Solutions from 2005 to 2013, including Corporate Vice President, Enterprise Mobile Computing. From 2003 to 2004, Mr. Rishi was Senior Vice President, Marketing and Strategy at Matrics, Inc., a radio frequency identification company. From 1995 to 2003, he held positions of increasing responsibility at Symbol Technologies, a manufacturer and supplier of mobile data capture and delivery equipment, where he eventually led the Europe, Middle East and Africa region.

Experience and Qualifications of Particular Relevance to Insight

The Board believes that Mr. Rishi’s industry experience and knowledge, as well as his leadership experience as a Chief Executive Officer and prior experience as a public company board member, brings valuable perspective to our Board.

DIRECTOR COMPENSATION

| | |

| Elements of Director Compensation |

During 2021, the Compensation Committee asked its new independent Compensation Consultant (see “2022 Executive Compensation Program” below) to provide an assessment of the competitiveness of the Board’s director compensation program against market. The new Compensation Consultant (as defined in the Compensation Discussion and Analysis section of this proxy statement) summarized compensation data from various peer groups (see "Compensation Discussion and Analysis – Peer Groups" below) for the review. The new Compensation Consultant analyzed all elements of director compensation (e.g., annual retainers, equity compensation, committee member compensation, committee chair compensation and non-executive Chairman compensation). In addition, the new Compensation Consultant evaluated the director compensation program design to provide the Compensation Committee an understanding of how the program design compares to best practices and the market. The Board last adjusted its director compensation program in 2019. After reviewing the analysis of the new Compensation Consultant, the Board increased the cash retainer by $5,000 and increased the annual restricted stock unit (“RSU”) grant by $30,000 for 2022. At the same time, it increased the director stock ownership requirement from three times the annual retainer to five times. The adjustments to the cash retainer and RSU grant as well as the increase in stock ownership requirements were intended to further align our program with market and best practices.

The table below sets forth the elements of our 2021 and 2022 annual compensation program for our non-employee directors.

| | | | | | | | |

| Annual Compensation Elements | 2021 Amount | 2022 Amount |

| Board Retainer | $ | 80,000 | | $ | 85,000 | |

| Chair of the Board Retainer | $ | 100,000 | | $ | 100,000 | |

| Audit Committee Chair Retainer | $ | 30,000 | | $ | 30,000 | |

| Compensation Committee Chair Retainer | $ | 20,000 | | $ | 20,000 | |

| Nominating and Governance Committee Chair Retainer | $ | 15,000 | | $ | 15,000 | |

| Annual Restricted Stock Unit Grant Value | $ | 125,000 | | $ | 155,000 | |

All retainers are paid quarterly in advance and, if applicable, are prorated based upon Board or chair service during the calendar year. Joyce A. Mullen, our President and Chief Executive Officer, does not receive compensation for her Board service and Kenneth T. Lamneck, who served as our President and Chief Executive Officer in 2021, did not receive compensation for his Board service during 2021.

The annual RSU grant vests ratably over three years on the anniversary of the grant date and entitles the director to receive shares of our common stock upon vesting. In the year of appointment to the Board, a director receives a prorated portion of the annual RSU grant value based upon the number of days between appointment and the vesting date of the most recent annual grant to incumbent directors, which prorated award vests over three years on the anniversary of the grant date. RSU awards to non-employee directors fully vest upon retirement, subject to certain conditions.

| | |

| Stock Ownership Guidelines |

The Board believes that, to more closely align the interests of our non-employee directors with the interests of the Company’s other stockholders, each non-employee director should maintain a minimum level of ownership in the Company’s common stock. The Compensation Committee is responsible for periodically reviewing the stock ownership guidelines for non-employee directors and making recommendations to the Board as to any changes.

Pursuant to our guidelines in 2021, each non-employee director was required to hold shares of the Company’s common stock equal to at least three times the amount of the annual retainer to be achieved over a five-year transition period. As of December 31, 2021, all non-employee directors had attained their required ownership level. Beginning in 2022, our guidelines require each non-employee director to hold shares equal to at least five times the amount of the annual retainer to be achieved over a five-year transition period.

| | |

| 2021 Director Compensation Table |

The table below sets forth information concerning compensation of the Company’s non-employee directors in 2021.

| | | | | | | | | | | |

| Name | Fees earned or paid in cash ($) | Stock Awards ($)(1)(2) | Total ($) |

| Richard E. Allen | 103,846 | | 125,041 | | 228,887 | |

| Bruce W. Armstrong | 89,231 | | 125,041 | | 214,272 | |

| Linda M. Breard | 98,462 | | 125,041 | | 223,503 | |

| Catherine Courage | 80,000 | | 125,041 | | 205,041 | |

| Timothy A. Crown | 180,000 | | 125,041 | | 305,041 | |

| Anthony A. Ibargüen | 85,769 | | 125,041 | | 210,810 | |

| Kathleen S. Pushor | 87,692 | | 125,041 | | 212,733 | |

| Girish Rishi | 80,000 | | 125,041 | | 205,041 | |

(1)These amounts reflect the grant date fair value of the service-based RSU awards granted to our directors. On May 19, 2021, each non-employee director was granted RSUs with a grant date fair value equal to $125,041, calculated at the closing price of the Company’s common stock on the date of its 2021 Annual Meeting of Stockholders ($101.33 per share).

(2)As of December 31, 2021, the aggregate number of outstanding and unvested stock awards held by each non-employee director was as follows:

| | | | | |

| Name | Unvested Stock Awards |

| Richard E. Allen | 3,679 | |

| Bruce W. Armstrong | 3,679 | |

| Linda M. Breard | 3,679 | |

| Catherine Courage | 3,679 | |

| Timothy A. Crown | 3,679 | |

| Anthony A. Ibargüen | 3,679 | |

| Kathleen S. Pushor | 3,679 | |

| Girish Rishi | 3,679 | |

The cost of certain perquisites and other personal benefits are not included because in the aggregate they did not exceed, in the case of any non-employee director, $10,000.

STOCK OWNERSHIP

| | |

| Ownership of Our Common Stock |

The following table shows information regarding the beneficial ownership of our common stock by:

•each member of our Board of Directors, each director nominee and each of our Named Executive Officers (as defined in the Compensation Discussion and Analysis section of this proxy statement);

•all members of our Board and our executive officers as a group; and

•each person or group who is known by us to own beneficially more than 5% of our common stock.

Beneficial ownership of shares is determined under the rules of the SEC and generally includes any shares over which a person exercises sole or shared voting or investment power. Shares of common stock subject to options currently exercisable or exercisable within 60 days of March 15, 2022 and shares of restricted stock that vest within 60 days of March 15, 2022 are deemed to be outstanding and beneficially owned by the person and any group of which that person is a member, but are not deemed outstanding for the purpose of computing the percentage of beneficial ownership for any other person. Except as noted by footnote, and subject to community property laws where applicable, we believe based on the information provided to us that the persons and entities named in the table below have sole voting and investment power with respect to all shares of our common stock shown as beneficially owned by them.

Except as otherwise indicated, all stockholdings are as of March 15, 2022 and the percentage of beneficial ownership is based on 35,072,405 shares of common stock outstanding as of March 15, 2022.

Unless otherwise indicated, the address for each holder listed below is c/o Insight Enterprises, Inc., 2701 E. Insight Way, Chandler, Arizona 85286.

| | |

| Certain Beneficial Owners, Directors and Executive Officers |

| | | | | | | | | | | |

| Shares of Common Stock Beneficially Owned(1) |

| Name | Number of Shares | | Percent |

| BlackRock, Inc. | 5,596,709 | | (2) | 16.00 | % |

| FMR LLC | 5,009,062 | | (3) | 14.34 | % |

| The Vanguard Group | 3,854,055 | | (4) | 11.05 | % |

| ValueAct Capital | 3,358,585 | | (5) | 9.60 | % |

| Dimensional Fund Advisors LP | 2,335,899 | | (6) | 6.70 | % |

| Kenneth T. Lamneck | 252,238 | | (7) | * |

| Timothy A. Crown | 82,104 | | | * |

| Glynis A. Bryan | 79,612 | | | * |

| Richard E. Allen | 36,865 | | | * |

| Samuel C. Cowley | 30,343 | | | * |

| Anthony A. Ibargüen | 14,632 | | | * |

| Joyce A. Mullen | 11,316 | | | * |

| Catherine Courage | 8,985 | | | * |

| Emma de Sousa | 8,710 | | | * |

| Bruce W. Armstrong | 7,808 | | | * |

| Girish Rishi | 6,001 | | | * |

| Kathleen S. Pushor | 5,808 | | | * |

| Linda Breard | 5,575 | | | * |

| Alexander L. Baum | — | | | |

| All directors and executive officers as a group (18 persons) | 566,129 | | | 1.61% |

* Less than 1%

(1)Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to securities. In accordance with SEC rules, a person is deemed to own beneficially any shares that such person has the right to acquire within 60 days of the date of determination of beneficial ownership. Such shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person. Except as indicated by footnote, and subject to community property laws where applicable, to our knowledge the persons or entities named in the table above have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them.

(2)Share data based on information in an amendment to a Schedule 13G filed on January 27, 2022 with the SEC by BlackRock, Inc. As of December 31, 2021, the Schedule 13G indicates that BlackRock, Inc. had sole voting power with respect to 5,510,675 shares and sole dispositive power with respect to 5,596,709 shares. The address of BlackRock, Inc. is 55 East 52nd Street, New York, NY 10055.

(3)Share data based on information in an amendment to a Schedule 13G filed on February 9, 2022 with the SEC by FMR LLC. As of December 31, 2021, the Schedule 13G indicates that FMR LLC had sole voting power with respect to 327,827 shares and sole dispositive power with respect to 5,009,062 shares. The address of FMR LLC is 245 Summer Street, Boston, MA 02210.