UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08837

THE SELECT SECTOR SPDR® TRUST

(Exact name of registrant as specified in charter)

One Iron Street, Boston, Massachusetts 02210

(Address of principal executive offices) (zip code)

Sean O’Malley, Esq.

Senior Vice President and General Counsel

c/o SSGA Funds Management, Inc.

One Iron Street

Boston, Massachusetts 02210

(Name and address of agent for service)

Copy to:

W. John McGuire, Esq.

Morgan, Lewis, & Bockius, LLP

1111 Pennsylvania Avenue, NW

Washington, D.C. 20004

Registrant’s telephone number, including area code: (617) 664-1465

Date of fiscal year end: September 30

Date of reporting period: September 30, 2022

Item 1. Report to Shareholders.

(a) The Reports to Shareholders are attached herewith.

The Select Sector SPDR Trust

Annual Report

September 30, 2022

Select Sector SPDR Funds

The Select Sector SPDR Trust consists of eleven separate investment portfolios (each a “Select Sector SPDR Fund” or a “Fund” and collectively the “Select Sector SPDR Funds” or the “Funds”).

Select Sector SPDR Funds are “index funds” that unbundle the benchmark S&P 500®† and give you ownership in particular sectors or groups of industries that are represented by a specified Select Sector Index. Through a single share, investors can buy or sell any of eleven major industry sectors that make up the S&P 500®, in the same way as they would buy or sell a share of stock. Select Sector SPDR Fund shares are different from the shares of conventional mutual funds. Select Sector SPDR Funds trade on NYSE Arca, Inc.

Eleven Select Sector SPDR Funds

Shares are available for exchange trading in the following Funds of The Select Sector SPDR Trust:

| The Communication Services Select Sector SPDR Fund | XLC |

| The Consumer Discretionary Select Sector SPDR Fund | XLY |

| The Consumer Staples Select Sector SPDR Fund | XLP |

| The Energy Select Sector SPDR Fund | XLE |

| The Financial Select Sector SPDR Fund | XLF |

| The Health Care Select Sector SPDR Fund | XLV |

| The Industrial Select Sector SPDR Fund | XLI |

| The Materials Select Sector SPDR Fund | XLB |

| The Real Estate Select Sector SPDR Fund | XLRE |

| The Technology Select Sector SPDR Fund | XLK |

| The Utilities Select Sector SPDR Fund | XLU |

Each of these Funds is designed to, before expenses, correspond generally to the price and yield performance of a Select Sector Index. Each Fund’s portfolio is comprised principally of shares of constituent companies in the S&P 500®. Each stock in the S&P 500® is allocated to one Select Sector Index. The combined companies of the eleven Select Sector Indexes represent all of the companies in the S& P 500®. Each Select Sector SPDR Fund can be expected to move up or down in value with its underlying Select Sector Index. Investors cannot invest directly in an index. Funds focused on a single sector generally experience greater price fluctuations than the overall stock market.

Objective

Select Sector SPDR Funds are designed to provide investors with an affordable way to invest in a portfolio of equity securities in a sector or group of industries in a single trade. Select Sector SPDR Funds allow you to tailor asset allocations to fit your particular investment needs or goals. One Fund may complement another; individual Select Sector SPDR Funds can be used to increase exposure to certain industries that may be outperforming the market or to hedge other holdings in your portfolio. Although an individual Select Sector SPDR Fund may bear a higher level of risk than a broad-market fund, because of less diversification, sector investments may also offer opportunities for returns greater than an investment in the entire constituents of the S&P 500®.

The information contained in this report is intended for the general information of shareholders of the Trust. This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current Trust prospectus which contains important information concerning the Trust. You may obtain a current prospectus from the Distributor, ALPS Portfolio Solutions Distributor, Inc., by calling 1-866-SECTOR-ETF (1-866-732-8673). Please read the prospectus carefully before you invest.

† S&P 500: the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged, index of common stock prices.

[This Page Intentionally Left Blank]

Notes to Performance Summaries (Unaudited)

The performance chart of a Fund’s total return at net asset value (“NAV”), the total return based on market price and its benchmark index is provided for comparative purposes only and represents the periods noted. A Fund’s per share NAV is the value of one share of a Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of a Fund and the market return is based on the market price per share of a Fund. The market price used to calculate the market return is determined by using the midpoint between the highest bid and the lowest offer on the exchange on which the shares of a Fund are listed for trading, as of the time that a Fund’s NAV is calculated. NAV and market returns assume that dividends and capital gain distributions have been reinvested in a Fund at NAV. Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included market returns would be lower.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, a Fund’s performance is negatively impacted by these deductions. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

The Communication Services Select Sector Index includes companies that have been identified as Communication Services companies by the Global Industry Classification Standard (GICS® ), including securities of companies from the following industries: diversified telecommunication services; wireless telecommunication services; media; entertainment; and interactive media & services.

The Consumer Discretionary Select Sector Index seeks to provide an effective representation of the consumer discretionary sector of the S&P 500 Index. The Index includes companies from the following industries: retail (specialty, multiline, internet and direct marketing); hotels, restaurants and leisure; textiles, apparel and luxury goods; household durables; automobiles; auto components; distributors; leisure products; and diversified consumer services.

The Consumer Staples Select Sector Index seeks to provide an effective representation of the consumer staple sector of the S&P 500 Index. The Index includes companies from the following industries: food and staples retailing; household products; food products; beverages; tobacco; and personal products.

The Energy Select Sector Index seeks to provide an effective representation of the energy sector of the S&P 500 Index. The Index includes companies from the following industries: oil, gas and consumable fuels; and energy equipment and services.

The Financials Select Sector Index seeks to provide an effective representation of the financial sector of the S&P 500 Index. The Index includes companies from the following industries: diversified financial services; insurance; banks; capital markets; mortgage real estate investment trusts ("REITs"); consumer finance; and thrifts and mortgage finance.

The Health Care Select Sector Index seeks to provide an effective representation of the health care sector of the S&P 500 Index. The Index includes companies from the following industries: pharmaceuticals; health care equipment and supplies; health care providers and services; biotechnology; life sciences tools and services; and health care technology.

The Industrials Select Sector Index seeks to provide an effective representation of the industrial sector of the S&P 500 Index. The Index includes companies from the following industries: aerospace and defense; industrial conglomerates; marine; transportation infrastructure; machinery; road and rail; air freight and logistics; commercial services and supplies; professional services; electrical equipment; construction and engineering; trading companies and distributors; airlines; and building products.

The Materials Select Sector Index seeks to provide an effective representation of the materials sector of the S&P 500 Index. The Index includes companies from the following industries: chemicals; metals and mining; paper and forest products; containers and packaging; and construction materials.

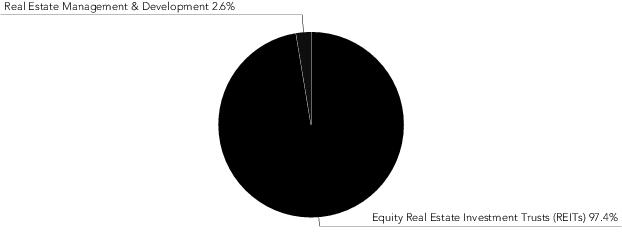

The Real Estate Select Sector Index seeks to provide an effective representation of the real estate sector of the S&P 500 Index. The Index includes companies from the following industries: real estate management and development and REITs, excluding mortgage REITs.

See accompanying notes to financial statements.

1

Notes to Performance Summaries (Unaudited) (continued)

The Technology Select Sector Index seeks to provide an effective representation of the technology sector of the S&P 500 Index. The Index includes companies from the following industries: technology hardware, storage, and peripherals; software; communications equipment; semiconductors and semiconductor equipment; IT services; and electronic equipment, instruments and components.

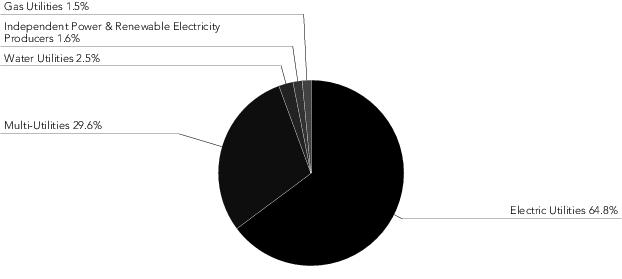

The Utilities Select Sector Index seeks to provide an effective representation of the utilities sector of the S&P 500 Index. The Index includes companies from the following industries: electric utilities; water utilities; multi-utilities; independent power producers and renewable electricity producers; and gas utilities.

The S&P 500 Index includes five hundred (500) selected companies, all of which are listed on national stock exchanges and spans over 25 separate industry groups.

See accompanying notes to financial statements.

2

THE COMMUNICATION SERVICES SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Communication Services Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Communication Services Select Sector Index. The Fund’s benchmark is the Communication Services Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2022 (the “Reporting Period”), the total return for the Fund was –39.71%, and the Index was –39.69%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Cash, security misweights, transaction costs and compounding (the exponential growth of outperformance or underperformance) also contributed to the difference between the Fund’s performance and that of the Index.

It was a difficult year for Communication Services as all four quarters of the Reporting Period had negative returns. The final quarter of 2021 ended only slightly in the red as top name Alphabet did enjoy gains from strengthening internet advertising business as people were spending more time using the google search function to shop online leading up to and during the holiday season. The first quarter of 2022, Facebook owner Meta Platforms retreated after the social media company revealed a weaker-than-anticipated forecast, thanks to Apple’s privacy changes and greater competition for users from rival social media platforms like TikTok., Meta also warned about extended slowing revenue growth over the Reporting Period due to heightened competition for users and shifts in online activity toward features like short videos, which generate less revenue.

Walt Disney Co. managed to enjoy increased subscription growth for its flagship Disney+ streaming service despite increased competition in an already crowded digital media market. Disney also saw record income from its theme parks and resorts as the worst of the pandemic subsided. Twitter shares benefited late spring as well on Elon Musk’s disclosed 9% stake in the social media company. Toward the end of the Reporting Period, Warner Bros. Discovery, the new company that combined Discovery with AT&T’s WarnerMedia earlier in 2022, laid out ambitious plans to expand, such as combined streaming service for HBO Max and Discovery+. Unfortunately, these successes were far outweighed by the continued struggles of the top names in the Communication Services Index. Meta Platforms and Alphabet fell by 60% and 28%, respectively, during the Reporting Period. Netflix also continued to lose subscribers to growing competitive streaming services. Overall, every name in the Index suffered negative returns for the Reporting Period, except for one. T-Mobile returned +5% for the Reporting Period as the company grabbed the 5G lead over Verizon, as the costly integration for the Sprint deal neared a close.

The Fund did not invest in derivatives during the Reporting Period.

On an individual security level, the top positive contributors to the Fund’s performance during the Reporting Period were News Corp. Class B, Discovery Inc. Class C and T-Mobile Inc. The top negative contributors to the Fund’s performance during the Reporting Period were Alphabet Inc. Class C, Alphabet Inc. Class A and Meta Platforms Inc. Class A.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

3

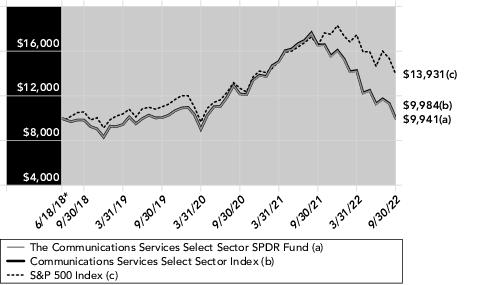

The Communication Services Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2022

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Communication Services Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Communication Services Select Sector Index | S&P 500 Index | |

| | | ONE YEAR | | – 39.71% | – 39.67% | – 39.69% | – 15.47% | | – 39.71% | – 39.67% | – 39.69% | – 15.47% | |

| | | SINCE INCEPTION (1) | | – 0.59% | – 0.54% | – 0.16% | 39.31% | | – 0.14% | – 0.13% | – 0.04% | 8.04% | |

| | | | | | | | | | | | | |

| (1) | For the period June 18, 2018 to September 30, 2022. |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

* Inception date.

The total expense ratio for The Communication Services Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2022.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.ssga.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

4

The Communication Services Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30, 2022

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Meta Platforms, Inc. Class A | 1,340,924,490 | 17.7% | |

| | Alphabet, Inc. Class A | 911,071,128 | 12.1 | |

| | Alphabet, Inc. Class C | 818,964,452 | 10.8 | |

| | T-Mobile US, Inc. | 349,998,545 | 4.6 | |

| | Activision Blizzard, Inc. | 342,617,449 | 4.5 | |

| | TOTAL | 3,763,576,064 | 49.7% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30, 2022*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

5

THE CONSUMER DISCRETIONARY SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Consumer Discretionary Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Consumer Discretionary Select Sector Index. The Fund’s benchmark is the Consumer Discretionary Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2022 (the “Reporting Period”), the total return for the Fund was –20.06%, and the Index was –20.01%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Cash, security misweights, transaction costs and compounding (the exponential growth of outperformance or underperformance) also contributed to the difference between the Fund’s performance and that of the Index.

The Fund started out the Reporting Period with positive returns the last quarter of 2021. Consumer confidence in the U.S. improved in December, helping out year-end sales during the holiday season. Increased confidence also suggested economic growth momentum will continue in 2022 despite the persistent inflation.

During the last three quarters of the Reporting Period, Amazon shares rallied in February after the e-commerce giant surprised investors with a near doubling in profit over the holiday period, especially after warning of supply chain problems. Shortly thereafter, Amazon announced a 20:1 stock split was slated for June 2022 along with a $10 billion stock repurchase plan. Travel and leisure groups started to regain some profitability in April following the major slump caused by the COVID-19 pandemic. Profit outlook for automotive companies even started to slowly improve.

Unfortunately, positive momentum was seriously trumped by negative news from Tesla, the Fund’s second largest weighted name, in the second quarter of 2022, helping the overall Fund’s performance to fall over 25%. Tesla had a difficult few months, thanks to concerns over inflation and possible recession. In addition, the zero-tolerance COVID-19 lockdown measures in Beijing weighed on Tesla’s ongoing supply-chain problems and surging raw material costs. CEO Elon Musk’s high-profile Twitter takeover bid also added to concern that he would sell off holdings to pay for this potential acquisition. Finally, the Fund was able to manage a small positive uptick toward the end of the Reporting Period, as names like Dollar Tree and Dollar General surged after the discount variety store chains revealed better-than-expected profits.

The Fund did not invest in derivatives during the Reporting Period.

On an individual security level, the top positive contributors to the Fund’s performance during the Reporting Period were Dollar General Corp., O’Reilly Automotive and Autozone, Inc. The top negative contributors to the Fund’s performance during the Reporting Period were Nike Inc. Class B, Tesla and Amazon.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

6

The Consumer Discretionary Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2022

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Consumer Discretionary Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Consumer Discretionary Select Sector Index | S&P 500 Index | |

| | | ONE YEAR | | – 20.06% | – 20.05% | – 20.01% | – 15.47% | | – 20.06% | – 20.05% | – 20.01% | – 15.47% | |

| | | FIVE YEARS | | 66.51% | 66.60% | 67.59% | 55.55% | | 10.74% | 10.75% | 10.88% | 9.24% | |

| | | TEN YEARS | | 245.53% | 245.63% | 250.93% | 202.44% | | 13.20% | 13.20% | 13.38% | 11.70% | |

| | | | | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for The Consumer Discretionary Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2022.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.ssga.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

7

The Consumer Discretionary Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30, 2022

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Amazon.com, Inc. | 3,154,805,303 | 22.4% | |

| | Tesla, Inc. | 3,062,314,964 | 21.7 | |

| | Home Depot, Inc. | 670,102,078 | 4.7 | |

| | McDonald's Corp. | 647,235,622 | 4.6 | |

| | Lowe's Cos., Inc. | 574,151,322 | 4.1 | |

| | TOTAL | 8,108,609,289 | 57.5% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30, 2022*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

8

THE CONSUMER STAPLES SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Consumer Staples Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Consumer Staples Select Sector Index. The Fund’s benchmark is the Consumer Staples Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2022 (the “Reporting Period”), the total return for the Fund was –0.63%, and the Index was –0.49%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Expenses and cash contributed to the difference between the Fund’s performance and that of the Index.

The Reporting Period was a volatile period for the securities markets as significantly heightened geopolitical issues, lingering and growing higher inflation readings, dramatic increases in the Federal Funds rate and declining consumer sentiment surveys collectively impacted market returns. The Consumer Staples Sector (the “Sector”) did relatively well in this environment posting a very modest decline. This Sector was helped by its relatively defensive nature as though consumers may delay some discretionary purchases the nature of this segment generally precludes appreciably delaying purchases. Slight easing of supply chains also helped this sector with continuing expectations of further improvements on the input side. In a reversal from the prior period, firms who’s business model involved supplying restaurants were helped by a more mobile consumer as the impacts from COVID-19 modestly waned in terms of foot traffic. In general, the firms that have pricing power and can pass on higher input costs to the end consumers were the best performing stocks within this sector during this Reporting Period. The markets “risk off” mindset during the last two quarters of the Reporting Period also contributed to this fund’s returns.

The Fund did not invest in derivatives during the Reporting Period.

On an individual security level, the top positive contributors to the Fund’s performance during the Reporting Period were Coca-Cola Company, General Mills, Inc. and PepsiCo, Inc. The top negative contributors to the Fund’s performance during the Reporting Period were Procter & Gamble Company, Walgreens Boots Alliance, Inc. and Estee Lauder Companies Inc. Class A.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

9

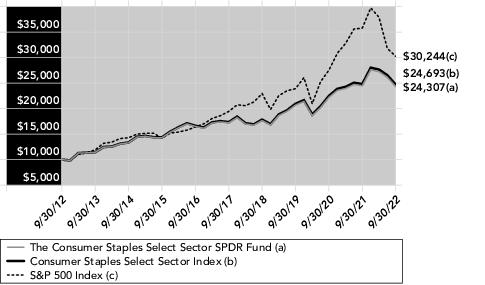

The Consumer Staples Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2022

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Consumer Staples Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Consumer Staples Select Sector Index | S&P 500 Index | |

| | | ONE YEAR | | – 0.63% | – 0.57% | – 0.49% | – 15.47% | | – 0.63% | – 0.57% | – 0.49% | – 15.47% | |

| | | FIVE YEARS | | 41.37% | 41.48% | 42.31% | 55.55% | | 7.17% | 7.19% | 7.31% | 9.24% | |

| | | TEN YEARS | | 143.07% | 143.24% | 146.93% | 202.44% | | 9.29% | 9.30% | 9.46% | 11.70% | |

| | | | | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for The Consumer Staples Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2022.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.ssga.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

10

The Consumer Staples Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30, 2022

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Procter & Gamble Co. | 2,098,652,740 | 14.5% | |

| | PepsiCo, Inc. | 1,567,382,365 | 10.8 | |

| | Coca-Cola Co. | 1,516,786,764 | 10.5 | |

| | Costco Wholesale Corp. | 1,455,261,279 | 10.1 | |

| | Walmart, Inc. | 679,026,062 | 4.7 | |

| | TOTAL | 7,317,109,210 | 50.6% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30, 2022*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

11

THE ENERGY SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Energy Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Energy Select Sector Index. The Fund’s benchmark is the Energy Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2022 (the “Reporting Period”), the total return for the Fund was 44.34%, and the Index was 44.49%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Cumulative security misweights between the Fund and the Index and Fund expenses contributed to the difference between the Fund’s performance and that of the Index.

The energy sector proved to be the strongest sector over the last 12 months far outpacing Utilities as the only other positive performing sector which returned over 5%. Much of the strong performance in energy can be attributed to general inflation, higher oil prices, and the Russia-Ukraine war that exacerbated supply chain and inflation problems.

Within the last 12 months, the U.S. Federal Reserve took a more hawkish turn and began fighting inflation with its first rate hikes since 2018. Inflation has remained persistent as the U.S. Federal Reserve continues to raise interest rates. With gas prices peaking in the middle of the summer months, the U.S. government released oil reserves helping to relieve pressure and reduce gas price.

The Fund used index futures contracts in order to equitize cash and receivables during the Reporting Period. The Fund’s use of index futures contracts helped the Fund track the Index.

On an individual security level, the top positive contributors to the Fund’s performance during the Reporting Period were Occidental Petroleum Corporation, Exxon Mobil Corporation, and Chevron Corporation. The top negative contributors to the Fund’s performance during the Reporting Period were E-mini SP 500 Energy (CME) Dec 21, E-mini SP 500 Energy (CME) Jun 22 and Baker Hughes Company Class A.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

12

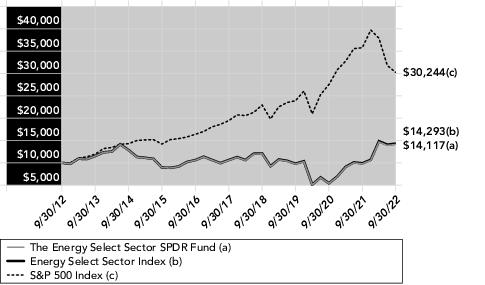

The Energy Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2022

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Energy Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Energy Select Sector Index | S&P 500 Index | |

| | | ONE YEAR | | 44.34% | 44.42% | 44.49% | – 15.47% | | 44.34% | 44.42% | 44.49% | – 15.47% | |

| | | FIVE YEARS | | 33.58% | 33.64% | 34.47% | 55.55% | | 5.96% | 5.97% | 6.10% | 9.24% | |

| | | TEN YEARS | | 41.17% | 41.31% | 42.93% | 202.44% | | 3.51% | 3.52% | 3.64% | 11.70% | |

| | | | | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for The Energy Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2022.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.ssga.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

13

The Energy Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30, 2022

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Exxon Mobil Corp. | 7,640,126,683 | 22.8% | |

| | Chevron Corp. | 6,556,871,802 | 19.6 | |

| | ConocoPhillips | 1,510,057,709 | 4.5 | |

| | EOG Resources, Inc. | 1,496,393,298 | 4.5 | |

| | Pioneer Natural Resources Co. | 1,490,246,722 | 4.4 | |

| | TOTAL | 18,693,696,214 | 55.8% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30, 2022*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

14

THE FINANCIAL SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Financial Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Financial Select Sector Index. The Fund’s benchmark is the Financial Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2022 (the “Reporting Period”), the total return for the Fund was –17.67%, and the Index was –17.65%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Expenses and cash contributed to the difference between the Fund’s performance and that of the Index.

There were a number of factors that contributed to this Fund’s decline during the Reporting Period. The combination of declining loan growth and an inverted yield curve raised significant worries regarding potential revenue challenges for the banking segment. Additionally, this sector continued to be impacted by a heightened regulatory environment with a particular focus on ESG and lending standards. As markets declined during the Reporting Period, revenue concerns increased for the firms with an asset management business focus. Along with declining markets, recession concerns rose significantly bringing with it worries regarding an uptick of bad debt being on balance sheets although by many measures firms and consumers were better positioned relative to other sizable market down turns. Rising interest rates were not a negative for all constituents as there were expectations that insurance companies would be better positioned in regard to revenue and investment returns.

The Fund did not invest in derivatives during the Reporting Period.

On an individual security level, the top positive contributors to the Fund’s performance during the Reporting Period were Progressive Corporation, Arthur J. Gallagher & Co. and M&T Bank Corporation. The top negative contributors to the Fund’s performance during the Reporting Period were JPMorgan Chase & Co., Bank of America Corp. and Citigroup Inc.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

15

The Financial Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2022

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Financial Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Financial Select Sector Index | S&P 500 Index | |

| | | ONE YEAR | | – 17.67% | – 17.59% | – 17.65% | – 15.47% | | – 17.67% | – 17.59% | – 17.65% | – 15.47% | |

| | | FIVE YEARS | | 29.69% | 29.81% | 30.50% | 55.55% | | 5.34% | 5.36% | 5.47% | 9.24% | |

| | | TEN YEARS | | 190.01% | 190.27% | 193.74% | 202.44% | | 11.24% | 11.24% | 11.38% | 11.70% | |

| | | | | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for The Financial Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2022.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.ssga.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

16

The Financial Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30, 2022

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Berkshire Hathaway, Inc. Class B | 3,906,129,039 | 14.5% | |

| | JPMorgan Chase & Co. | 2,483,914,840 | 9.2 | |

| | Bank of America Corp. | 1,711,196,145 | 6.3 | |

| | Wells Fargo & Co. | 1,236,532,569 | 4.6 | |

| | Charles Schwab Corp. | 889,505,883 | 3.3 | |

| | TOTAL | 10,227,278,476 | 37.9% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30, 2022*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

17

THE HEALTH CARE SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Health Care Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Health Care Select Sector Index. The Fund’s benchmark is the Health Care Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2022 (the “Reporting Period”), the total return for the Fund was –3.47%, and the Index was –3.37%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Expenses and cash contributed to the difference between the Fund’s performance and that of the Index.

The COVID-19 pandemic and the policy and medical response to it continued to have an appreciable impact on many of the constituents of this Fund during the Reporting Period. This was most notably manifested on the demand side as the medical community continues to work down the backlog of deferred medical procedures. Additionally, market expectations are for a much higher run rate of government spending on healthcare and research than the historical norm. This change was heavily influenced by the pandemic and the responses to the pandemic. Another positive for this sector was a decline in regulatory concerns during the Reporting Period. Also, secular trends such as the continuing increased health care demands associated with the ongoing aging of the American population continue to make a positive contribution to many of this Fund’s constituents. This demographic trend is anticipated to lead to continued strong growth in the medical products, pharmaceuticals and medical services markets. Additionally, the return for many of the constituents of this Fund were helped by the sector’s continued dramatic innovation success as evidenced by a much quicker than anticipated response to the COVID-19 pandemic. This spirit and success at innovation has positively contributed to the Fund in the past and breakthroughs associated with the recent pandemic response are expected to contribute to returns in the future. Finally though slower than recent periods, mergers and acquisitions both completed and anticipated contributed to this Fund’s return.

The Fund did not invest in derivatives during the Reporting Period.

On an individual security level, the top positive contributors to the Fund’s performance during the Reporting Period were AbbVie, Inc., UnitedHealth Group Incorporated and Eli Lilly and Company. The top negative contributors to the Fund’s performance during the Reporting Period were Moderna, Inc., Intuitive Surgical, Inc. and Medtronic Plc.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

18

The Health Care Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2022

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Health Care Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Health Care Select Sector Index | S&P 500 Index | |

| | | ONE YEAR | | – 3.47% | – 3.38% | – 3.37% | – 15.47% | | – 3.47% | – 3.38% | – 3.37% | – 15.47% | |

| | | FIVE YEARS | | 61.16% | 61.31% | 62.25% | 55.55% | | 10.01% | 10.04% | 10.16% | 9.24% | |

| | | TEN YEARS | | 255.21% | 255.62% | 260.63% | 202.44% | | 13.51% | 13.53% | 13.69% | 11.70% | |

| | | | | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for The Health Care Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2022.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.ssga.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

19

The Health Care Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30, 2022

| | | | |

| | Description | Market Value | % of Net Assets | |

| | UnitedHealth Group, Inc. | 3,710,878,873 | 10.4% | |

| | Johnson & Johnson | 3,373,879,307 | 9.4 | |

| | Eli Lilly & Co. | 2,003,166,831 | 5.6 | |

| | Pfizer, Inc. | 1,929,242,832 | 5.4 | |

| | AbbVie, Inc. | 1,864,038,529 | 5.2 | |

| | TOTAL | 12,881,206,372 | 36.0% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30, 2022*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

20

THE INDUSTRIAL SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Industrial Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Industrial Select Sector Index. The Fund’s benchmark is the Industrial Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2022 (the “Reporting Period”), the total return for the Fund was –13.95%, and the Index was –13.87%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees and expenses contributed to the difference between the Fund’s performance and that of the Index.

After a promising first fiscal quarter (+8.6%), the Index retreated for the rest of the Reporting Period leading to an overall loss of 13.95% for the fiscal year and giving back much of the previous fiscal year’s 29% gain. The good times early in the Reporting Period led by humanity’s re-emergence from the COVID-19 pandemic gave way to conflict, global inflation, and supply chain shortcomings that were primary drivers of Fund’s performance during the Reporting Period. The slide started as the calendar turned to 2022. Investor sentiment was weighed down by concerns around the Russia-Ukraine war and the tightening stance adopted by the U.S. Federal Reserve in the wake of surging inflation. The third fiscal quarter was the primary source for the overall return losing 14.8% alone during that three month stretch. During that quarter, energy and commodity prices were pushed to extreme levels as a result of the war and the trickle effect of higher fuel prices led to increased supply chain disruptions.

The Fund used index futures contracts in order to equitize cash and receivables during the Reporting Period. The Fund’s use of index futures contracts helped the Fund track the Index.

On an individual security level, the top positive contributors to the Fund’s performance during the Reporting Period were Waste Management, Inc., Northrop Grumman Corp. and Lockheed Martin Corporation. The top negative contributors to the Fund’s performance during the Reporting Period were 3M Company, Boeing Company and General Electric Company.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

21

The Industrial Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2022

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Industrial Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Industrial Select Sector Index | S&P 500 Index | |

| | | ONE YEAR | | – 13.95% | – 13.84% | – 13.87% | – 15.47% | | – 13.95% | – 13.84% | – 13.87% | – 15.47% | |

| | | FIVE YEARS | | 27.53% | 27.66% | 28.51% | 55.55% | | 4.98% | 5.01% | 5.14% | 9.24% | |

| | | TEN YEARS | | 174.67% | 174.98% | 179.02% | 202.44% | | 10.63% | 10.64% | 10.81% | 11.70% | |

| | | | | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for The Industrial Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2022.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.ssga.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

22

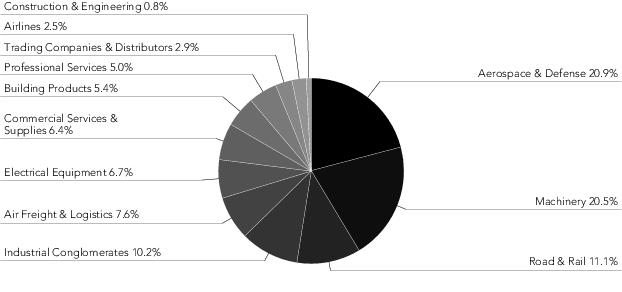

The Industrial Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30, 2022

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Union Pacific Corp. | 568,364,946 | 5.1% | |

| | Raytheon Technologies Corp. | 564,644,903 | 5.1 | |

| | United Parcel Service, Inc. Class B | 552,290,398 | 5.0 | |

| | Honeywell International, Inc. | 525,493,160 | 4.7 | |

| | Deere & Co. | 433,841,307 | 3.9 | |

| | TOTAL | 2,644,634,714 | 23.8% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30, 2022*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

23

THE MATERIALS SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Materials Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Materials Select Sector Index. The Fund’s benchmark is the Materials Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2022 (the “Reporting Period”), the total return for the Fund was –12.23%, and the Index was –12.15%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Cumulative security misweights between the Fund and the Index and Fund expenses contributed to the difference between the Fund’s performance and that of the Index.

Global economic activity continued to expand in the fourth quarter of 2021, albeit at a measurably moderate pace, with several factors contributing to multiple headwinds. Supply chain bottlenecks continued to persist and sapped growth momentum during the quarter. Rising COVID-19 cases toward the end of the quarter triggered disruption to services and created further bottlenecks related to labor, transportation and goods. Key central banks across regions pivoted to a hawkish stance amid persistent high inflation, thereby increasing the risk to growth momentum in early 2022.

On the fiscal front, the U.S. Congress passed a bipartisan infrastructure bill, whereas the more ambitious “build back better” spending bill did not find enough support in the Senate. On the monetary policy front, global central banks, led by the U.S. Federal Reserve, turned mostly hawkish by varying degrees. The U.S. Federal Reserve abandoned its notion of ‘transitory inflation’, as inflation is now expected to persist longer than expected and announced that it would double the pace of tapering, paving the way for a rate hike in early 2022. With fiscal stimulus in place, this proved to be the only quarter for the Reporting Period where the Fund generated positive returns. During this quarter, the Fund was up 15.1%.

Global economic growth and equity markets faced multiple headwinds in the first quarter of 2022. Commodity prices accelerated the trend as western countries imposed strict sanctions on Russia’s economy. Hawkish pivot by western central banks amid rising inflation also weighed on stocks and bonds. The Russia-Ukraine war further exacerbated the supply chain and inflation problems at the end of February.

On the monetary policy front, the major central banks adopted a more hawkish tone in the quarter amid stubbornly high inflation. The U.S. Federal Reserve delivered its first rate hike since 2018 but surprised the markets, signaling a much more hawkish pivot with expectations of six further 25 bp hikes this year. With the back drop of rising inflation and continued supply disruptions and the Fund dropped –2.4% for the quarter.

Persistent inflation pressure forced central banks to accelerate tightening, risking a hard landing. Incoming data from key developed markets pointed toward broad-based deceleration in economic activities. However, China’s rebound helped soften the pace of the global slowdown. Geopolitical risks remained elevated amid the ongoing Russia-Ukraine war and continued escalations between the United States (U.S.) and China over Taiwan.

Markets remained volatile in the second quarter of 2022 and equities and bonds posted sharp declines. Concerns over persistent inflation, hawkish central bank actions and the ongoing Russia-Ukraine war weighed heavily on sentiment. Combined, this help drive performance down for the quarter. The Fund returned –15.9% during this quarter.

Global markets declined and growth stumbled in the third quarter of 2022 as inflation remained persistently high, geopolitical tensions escalated, and central banks raised aggressively, signaling larger-than-expected future hikes. After the Fund rallied early in the quarter, risk assets declined in August and September as central banks struggled with inflation amid slowing economic growth. This again weighed on performance for the Fund. For the quarter, the Fund returned –7.1%.

The Fund used index futures contracts in order to equitize cash and receivables during the Reporting Period. The Fund’s use of index futures contracts helped the Fund track the Index.

See accompanying notes to financial statements.

24

THE MATERIALS SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED) (continued)

On an individual security level, the top positive contributors to the Fund’s performance during the Reporting Period were Albemarle Corporation, Corteva Inc, and CF Industries Holdings, Inc. The top negative contributors to the Fund’s performance during the Reporting Period were Ball Corporation, Ecolab Inc. and Sherwin-Williams Company.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

25

The Materials Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2022

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Materials Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Materials Select Sector Index | S&P 500 Index | |

| | | ONE YEAR | | – 12.23% | – 12.14% | – 12.15% | – 15.47% | | – 12.23% | – 12.14% | – 12.15% | – 15.47% | |

| | | FIVE YEARS | | 32.35% | 32.51% | 32.82% | 55.55% | | 5.77% | 5.79% | 5.84% | 9.24% | |

| | | TEN YEARS | | 127.29% | 127.62% | 129.74% | 202.44% | | 8.56% | 8.57% | 8.67% | 11.70% | |

| | | | | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for The Materials Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2022.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.ssga.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

26

The Materials Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30, 2022

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Linde PLC | 833,406,752 | 17.7% | |

| | Air Products & Chemicals, Inc. | 320,191,330 | 6.8 | |

| | Sherwin-Williams Co. | 299,552,321 | 6.4 | |

| | Corteva, Inc. | 254,745,211 | 5.4 | |

| | Freeport-McMoRan, Inc. | 242,426,338 | 5.2 | |

| | TOTAL | 1,950,321,952 | 41.5% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30, 2022*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

27

THE REAL ESTATE SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Real Estate Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Real Estate Select Sector Index. The Fund’s benchmark is the Real Estate Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2022 (the “Reporting Period”), the total return for the Fund was –16.46%, and the Index was –16.37%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees contributed to the difference between the Fund’s performance and that of the Index.

Fueled by the expansion of global activity, the real estate sector advanced nearly 17% over the first quarter of the Reporting Period and was the top performing sector in the S&P 500 Index. At the start of 2022 however, the sector along with the rest of the equity markets began to face multiple headwinds, rising COVID-19 cases, supply chain bottlenecks that sapped growth momentum and the pivot to a hawkish stance by key central banks. Amid persistent high inflation, central banks raised interest rates aggressively. Signs of higher interest rates weighed on the housing market – home prices were observed to be 40% higher compared with the start of 2020 and the number of home sales declined as 30-year mortgage rates topped 6%. These headwinds weighed on the real estate sector and the Fund declined over 30% over the last three quarters of the Reporting Period.

All sub-industries posted negative returns over the Reporting Period. Within the Specialized REITs sub-industry, self-storage REITs tend to have low economic sensitivity and performed well as demand remained strong. The Real Estate Services sub-industry performed the worst. After observing strong growth over the prior year, the stock price of CBRE Group showed weakness from the headwinds and declined over 30%.

The Fund used index equity futures in order to equitize cash and dividend receivables during the Reporting Period. The Fund’s use of index futures helped the Fund track the Index.

On an individual security level, the top positive contributors to the Fund’s performance during the Reporting Period were Public Storage, Extra Space Storage Inc. and Duke Realty Corporation. The top negative contributors to the Fund’s performance during the Reporting Period were Prologis, Inc., Equinix, Inc. and American Tower Corporation.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

28

The Real Estate Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2022

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Real Estate Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Real Estate Select Sector Index | S&P 500 Index | |

| | | ONE YEAR | | – 16.46% | – 16.42% | – 16.37% | – 15.47% | | – 16.46% | – 16.42% | – 16.37% | – 15.47% | |

| | | FIVE YEARS | | 31.79% | 31.88% | 32.62% | 55.55% | | 5.68% | 5.69% | 5.81% | 9.24% | |

| | | SINCE INCEPTION (1) | | 52.57% | 52.66% | 54.01% | 104.75% | | 6.23% | 6.24% | 6.38% | 10.81% | |

| | | | | | | | | | | | | |

| (1) | For the period October 7, 2015 to September 30, 2021. |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

* Inception date.

The total expense ratio for The Real Estate Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2022.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.ssga.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

29

The Real Estate Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30, 2022

| | | | |

| | Description | Market Value | % of Net Assets | |

| | American Tower Corp. REIT | 542,577,602 | 11.8% | |

| | Prologis, Inc. REIT | 408,294,942 | 8.8 | |

| | Crown Castle, Inc. REIT | 339,755,668 | 7.4 | |

| | Equinix, Inc. REIT | 281,207,192 | 6.1 | |

| | Public Storage REIT | 251,159,242 | 5.4 | |

| | TOTAL | 1,822,994,646 | 39.5% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30, 2022*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

30

THE TECHNOLOGY SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Technology Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Technology Select Sector Index. The Fund’s benchmark is the Technology Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2022 (the “Reporting Period”), the total return for the Fund was –19.82%, and the Index was –19.73%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Management fees, cash drag, and cumulative effects of individual security misweights contributed to the difference between the Fund’s performance and that of the Index.

The Fund had positive performance in one of the four quarters of the Reporting Period. Performance in the first quarter of the Reporting Period was positive due to the signing of the $1.2 trillion bipartisan Infrastructure Investment and Jobs Act, strong earnings growth, and progress in the fight against COVID-19 despite the emergence of the highly infectious Omicron variant. Performance in the last three quarters of the Reporting Period was negative on the back of rising inflation, tighter monetary policy, declining consumer sentiment, ongoing supply chain issues, the Russia-Ukraine war and recessionary fears despite lower levels of unemployment and positive earnings were primary drivers of the Fund’s overall performance during the Reporting Period.

The Fund used index futures contracts in order to equitize cash and receivables during the Reporting Period. The Fund’s use of index futures contracts helped the Fund track the Index.

On an individual security level, the top positive contributors to the Fund’s performance during the Reporting Period were Xilinx, Inc., Automatic Data Processing, Inc. and Enphase Energy, Inc. The top negative contributors to the Fund’s performance during the Reporting Period were PayPal Holdings, Inc. and Microsoft Corporation and Apple Inc.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

31

The Technology Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2022

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Technology Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Technology Select Sector Index | S&P 500 Index | |

| | | ONE YEAR | | – 19.82% | – 19.77% | – 19.73% | – 15.47% | | – 19.82% | – 19.77% | – 19.73% | – 15.47% | |

| | | FIVE YEARS | | 112.63% | 112.74% | – 114.43% | 55.55% | | 16.29% | 16.30% | 16.48% | 9.24% | |

| | | TEN YEARS | | 346.79% | 347.01% | 354.78% | 202.54% | | 16.15% | 16.15% | 16.35% | 11.70% | |

| | | | | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for The Technology Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2022.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.ssga.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

32

The Technology Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30, 2022

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Apple, Inc. | 8,308,046,125 | 23.3% | |

| | Microsoft Corp. | 8,099,263,092 | 22.7 | |

| | NVIDIA Corp. | 1,417,350,975 | 4.0 | |

| | Visa, Inc. Class A | 1,354,390,809 | 3.8 | |

| | Mastercard, Inc. Class A | 1,131,256,642 | 3.2 | |

| | TOTAL | 20,310,307,643 | 57.0% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30, 2022*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

33

THE UTILITIES SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Utilities Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Utilities Select Sector Index. The Fund’s benchmark is the Utilities Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2022 (the “Reporting Period”), the total return for the Fund was 5.46%, and the Index was 5.58%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Expenses and cash contributed to the difference between the Fund’s performance and that of the Index.

Despite a challenging market environment especially during the last two quarters of the Reporting Period, this Fund was still able to generate a positive return. One factor that positively contributed to this Fund’s return was a pickup in electricity demand owing to both more extreme weather conditions and a continued uptick in activity as the COVID-19 pandemic’s impact waned appreciably during the Reporting Period. Another positive contributing factor was the government’s continued support for green energy initiatives. This Fund’s returns were also buoyed by a general “risk off” market environment as investors seemed to appreciate the relative defensive nature of this sector. The last two quarters have been marked by increased investor appetite for funds with comparatively higher dividend yields which has helped this Fund as the Utilities Sector has historically from a sector perspective had one of the higher dividend yields. This Reporting Period saw dramatic increases in the Federal Funds rate which has typically hurt this Fund but in this case the relative predictability of the constituents’ businesses has over shadowed profitability concerns associated with higher interest rates. There’s also an expectation that higher input costs can be passed on to the end users in the current inflationary environment.

The Fund did not invest in derivatives during the Reporting Period.

On an individual security level, the top positive contributors to the Fund’s performance during the Reporting Period were Exelon Corporation, Sempra Energy, and Southern Company. The top negative contributors to the Fund’s performance during the Reporting Period were Public Service Enterprise Group Inc, American Water Works Company, Inc. and PPL Corporation.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

34

The Utilities Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2022

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Utilities Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Utilities Select Sector Index | S&P 500 Index | |

| | | ONE YEAR | | 5.46% | 5.60% | 5.58% | – 15.47% | | 5.46% | 5.60% | 5.58% | – 15.47% | |

| | | FIVE YEARS | | 44.89% | 44.05% | 45.75% | 55.55% | | 7.70% | 7.72% | 7.83% | 9.24% | |

| | | TEN YEARS | | 152.13% | 152.42% | 156.22% | 202.44% | | 9.69% | 9.70% | 9.87% | 11.70% | |

| | | | | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for The Utilities Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2022.