UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08837

THE SELECT SECTOR SPDR® TRUST

(Exact name of registrant as specified in charter)

One Iron Street, Boston, Massachusetts 02210

(Address of principal executive offices) (zip code)

Sean O’Malley, Esq.

Senior Vice President and General Counsel

c/o SSGA Funds Management, Inc.

One Iron Street

Boston, Massachusetts 02210

(Name and address of agent for service)

Copy to:

W. John McGuire, Esq.

Morgan, Lewis, & Bockius, LLP

1111 Pennsylvania Avenue, NW

Washington, D.C. 20004

Registrant’s telephone number, including area code: (617) 664-1465

Date of fiscal year end: September 30

Date of reporting period: September 30, 2023

Item 1. Report to Shareholders.

(a) The Reports to Shareholders are attached herewith.

The Select Sector SPDR Trust

Annual Report

September 30, 2023

Select Sector SPDR Funds

The Select Sector SPDR Trust consists of eleven separate investment portfolios (each a “Select Sector SPDR Fund” or a “Fund” and collectively the “Select Sector SPDR Funds” or the “Funds”).

Select Sector SPDR Funds are “index funds” that unbundle the benchmark S&P 500® and give you ownership in particular sectors or groups of industries that are represented by a specified Select Sector Index. Through a single share, investors can buy or sell any of eleven major industry sectors that make up the S&P 500®, in the same way as they would buy or sell a share of stock. Select Sector SPDR Fund shares are different from the shares of conventional mutual funds. Select Sector SPDR Funds trade on NYSE Arca, Inc.

Eleven Select Sector SPDR Funds

Shares are available for exchange trading in the following Funds of The Select Sector SPDR Trust:

| The Communication Services Select Sector SPDR Fund | XLC |

| The Consumer Discretionary Select Sector SPDR Fund | XLY |

| The Consumer Staples Select Sector SPDR Fund | XLP |

| The Energy Select Sector SPDR Fund | XLE |

| The Financial Select Sector SPDR Fund | XLF |

| The Health Care Select Sector SPDR Fund | XLV |

| The Industrial Select Sector SPDR Fund | XLI |

| The Materials Select Sector SPDR Fund | XLB |

| The Real Estate Select Sector SPDR Fund | XLRE |

| The Technology Select Sector SPDR Fund | XLK |

| The Utilities Select Sector SPDR Fund | XLU |

Each of these Funds is designed to, before expenses, correspond generally to the price and yield performance of a Select Sector Index. Each Fund’s portfolio is comprised principally of shares of constituent companies in the S&P 500®. Each stock in the S&P 500® is allocated to one Select Sector Index. The combined companies of the eleven Select Sector Indexes represent all of the companies in the S& P 500®. Each Select Sector SPDR Fund can be expected to move up or down in value with its underlying Select Sector Index. Investors cannot invest directly in an index. Funds focused on a single sector generally experience greater price fluctuations than the overall stock market.

Objective

Select Sector SPDR Funds are designed to provide investors with an affordable way to invest in a portfolio of equity securities in a sector or group of industries in a single trade. Select Sector SPDR Funds allow you to tailor asset allocations to fit your particular investment needs or goals. One Fund may complement another; individual Select Sector SPDR Funds can be used to increase exposure to certain industries that may be outperforming the market or to hedge other holdings in your portfolio. Although an individual Select Sector SPDR Fund may bear a higher level of risk than a broad-market fund, because of less diversification, sector investments may also offer opportunities for returns greater than an investment in the entire constituents of the S&P 500®.

The information contained in this report is intended for the general information of shareholders of the Trust. This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current Trust prospectus which contains important information concerning the Trust. You may obtain a current prospectus from the Distributor, ALPS Portfolio Solutions Distributor, Inc., by calling 1-866-SECTOR-ETF (1-866-732-8673). Please read the prospectus carefully before you invest.

† S&P 500: the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged, index of common stock prices.

[This Page Intentionally Left Blank]

Notes to Performance Summaries (Unaudited)

The performance chart of a Fund’s total return at net asset value (“NAV”), the total return based on market price and its benchmark index is provided for comparative purposes only and represents the periods noted. A Fund’s per share NAV is the value of one share of a Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of a Fund and the market return is based on the market price per share of a Fund. The market price used to calculate the market return is determined by using the midpoint between the highest bid and the lowest offer on the exchange on which the shares of a Fund are listed for trading, as of the time that a Fund’s NAV is calculated. NAV and market returns assume that dividends and capital gain distributions have been reinvested in a Fund at NAV. Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included market returns would be lower.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, a Fund’s performance is negatively impacted by these deductions. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

The Communication Services Select Sector Index includes companies that have been identified as Communication Services companies by the Global Industry Classification Standard (GICS® ), including securities of companies from the following industries: diversified telecommunication services; wireless telecommunication services; media; entertainment; and interactive media & services.

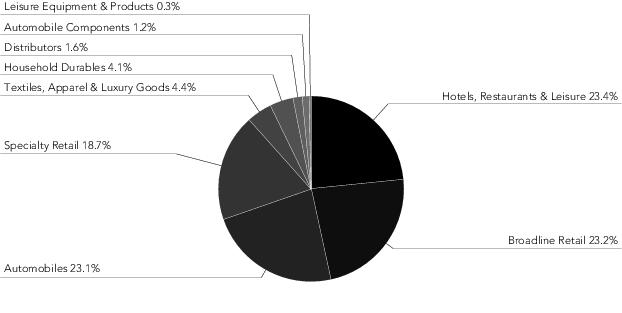

The Consumer Discretionary Select Sector Index seeks to provide an effective representation of the consumer discretionary sector of the S&P 500 Index. The Index includes companies from the following industries: retail (specialty, multiline, internet and direct marketing); hotels, restaurants and leisure; textiles, apparel and luxury goods; household durables; automobiles; auto components; distributors; leisure products; and diversified consumer services.

The Consumer Staples Select Sector Index seeks to provide an effective representation of the consumer staple sector of the S&P 500 Index. The Index includes companies from the following industries: food and staples retailing; household products; food products; beverages; tobacco; and personal products.

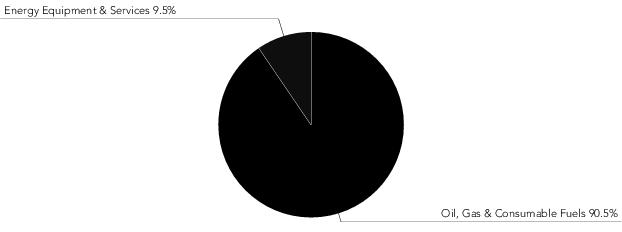

The Energy Select Sector Index seeks to provide an effective representation of the energy sector of the S&P 500 Index. The Index includes companies from the following industries: oil, gas and consumable fuels; and energy equipment and services.

The Financials Select Sector Index seeks to provide an effective representation of the financial sector of the S&P 500 Index. The Index includes companies from the following industries: diversified financial services; insurance; banks; capital markets; mortgage real estate investment trusts ("REITs"); consumer finance; and thrifts and mortgage finance.

The Health Care Select Sector Index seeks to provide an effective representation of the health care sector of the S&P 500 Index. The Index includes companies from the following industries: pharmaceuticals; health care equipment and supplies; health care providers and services; biotechnology; life sciences tools and services; and health care technology.

The Industrials Select Sector Index seeks to provide an effective representation of the industrial sector of the S&P 500 Index. The Index includes companies from the following industries: aerospace and defense; industrial conglomerates; marine; transportation infrastructure; machinery; road and rail; air freight and logistics; commercial services and supplies; professional services; electrical equipment; construction and engineering; trading companies and distributors; airlines; and building products.

The Materials Select Sector Index seeks to provide an effective representation of the materials sector of the S&P 500 Index. The Index includes companies from the following industries: chemicals; metals and mining; paper and forest products; containers and packaging; and construction materials.

The Real Estate Select Sector Index seeks to provide an effective representation of the real estate sector of the S&P 500 Index. The Index includes companies from the following industries: real estate management and development and REITs, excluding mortgage REITs.

See accompanying notes to financial statements.

1

Notes to Performance Summaries (Unaudited) (continued)

The Technology Select Sector Index seeks to provide an effective representation of the technology sector of the S&P 500 Index. The Index includes companies from the following industries: technology hardware, storage, and peripherals; software; communications equipment; semiconductors and semiconductor equipment; IT services; and electronic equipment, instruments and components.

The Utilities Select Sector Index seeks to provide an effective representation of the utilities sector of the S&P 500 Index. The Index includes companies from the following industries: electric utilities; water utilities; multi-utilities; independent power producers and renewable electricity producers; and gas utilities.

The S&P 500 Index includes five hundred (500) selected companies, all of which are listed on national stock exchanges and spans over 25 separate industry groups.

See accompanying notes to financial statements.

2

THE COMMUNICATION SERVICES SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Communication Services Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Communication Services Select Sector Index. The Fund’s benchmark is the Communication Services Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2023 (the “Reporting Period”), the total return for the Fund was 38.24%, and the Index was 38.38%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Cash, security misweights, transaction costs and compounding (the exponential growth of outperformance or underperformance) also contributed to the difference between the Fund’s performance and that of the Index.

The Fund started out the Reporting Period in neutral territory the last quarter of 2022. While the overall S&P 500 Index gained over 8% during this period, Communication Services was close to flat with return of 0.43%. The markets were reacting to the latest U.S. Federal Reserve (the “Fed”) rumors, moving back and forth as investors evaluated various indicators. After four consecutive 75 bps rate increases, the Fed tightened by only 50 bps at December’s meeting. The Fund enjoyed a strong shift in the new year with positive returns over 21%. Netflix played a strong role in these returns as they reported the addition of millions of net new global subscribers, in conjunction with announcing they will be cracking down on password sharing and opting people who have been borrowing accounts to create their own.

Despite ongoing market volatility, communication services stocks still performed strongly in the third quarter of the Reporting Period The Fund enjoyed positive returns of over 12%, outperforming the broader S&P 500 Index for the second quarter in a row. The overall U.S. market continued to be driven significantly by a select group of stocks known as the ‘Magnificent Seven”. Two of these seven names include Google, parent of Alphabet Inc. and Facebook, parent of Meta Platforms, Inc. which are the two largest weights in the Communication Services Index. This group of stocks were partly responsible for the majority of the market rally due to optimism around artificial intelligence (AI). Google’s internet search dominance and YouTube unit also continued to remain sources of great interest. While S&P 500 Index finished slightly in the red for the final quarter of the Reporting Period, Communication Services narrowly managed a fourth consecutive quarterly return just over 1%, but was still one of three top sectors to positively impact overall market performance.

The Fund did not invest in derivatives during the Reporting Period.

On an individual security level, the top positive contributors to the Fund’s performance during the Reporting Period were Meta Platforms Inc, Alphabet Inc. Class A, and Alphabet Inc. Class C. The top negative contributors to the Fund’s performance during the Reporting Period were Walt Disney Company, Lumen Technologies, and Match Group, Inc..

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

3

The Communication Services Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2023

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Communication Services Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Communication Services Select Sector Index | S&P 500 Index | |

| | | ONE YEAR | | 38.24% | 38.17% | 38.38% | 21.62% | | 38.24% | 38.17% | 38.38% | 21.62% | |

| | | FIVE YEARS | | 39.91% | 39.88% | 40.62% | 60.44% | | 6.95% | 6.94% | 7.05% | 9.92% | |

| | | SINCE INCEPTION (1) | | 37.42% | 37.42% | 38.16% | 69.42% | | 6.20% | 6.20% | 6.31% | 10.49% | |

| | | | | | | | | | | | | |

| (1) | For the period June 18, 2018 to September 30, 2023. |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

* Inception date.

The total expense ratio for The Communication Services Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2023.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.ssga.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

4

The Communication Services Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Meta Platforms, Inc. Class A | 3,091,791,940 | 23.6% | |

| | Alphabet, Inc. Class A | 1,586,259,010 | 12.1 | |

| | Alphabet, Inc. Class C | 1,359,548,729 | 10.4 | |

| | AT&T, Inc. | 626,081,904 | 4.8 | |

| | Charter Communications, Inc. Class A | 624,925,284 | 4.7 | |

| | TOTAL | 7,288,606,867 | 55.6% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

5

THE CONSUMER DISCRETIONARY SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Consumer Discretionary Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Consumer Discretionary Select Sector Index. The Fund’s benchmark is the Consumer Discretionary Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2023 (the “Reporting Period”), the total return for the Fund was 14.08%, and the Index was 14.16%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Cash, security misweights, transaction costs and compounding (the exponential growth of outperformance or underperformance) also contributed to the difference between the Fund’s performance and that of the Index.

The Fund started out the period with negative returns the last quarter of 2022. While the overall S&P 500 Index gained over 8% during this period, Consumer Discretionary was the laggard, underperforming by over 9%. The markets were reacting to the latest U.S. Federal Reserve (the “Fed”) rumors, moving back and forth as investors evaluated various indicators. After four consecutive 75 bps rate increases, the Fed tightened by only 50 bps at December’s meeting. The Fund started out 2023 year strongly with returns over 16% for the first quarter of the calendar year. Employers added more than half a million jobs in January and the U.S. housing markets were showing signs of stabilizing or even rebounding. Consumer’s resiliency was clear as retail sales rose 3% that same month, helping consumer discretionary stocks to even finish January as the top performing sector.

Despite ongoing market volatility, consumer discretionary stocks still performed strongly in the third quarter of the Reporting Period. Higher-income consumers continued to spend on luxury items and middle-income consumers continued to be influenced from internet and social media branding. Travel companies also benefited from continued demand for “revenge travel” bookings post pandemic. In June, the Fed even decided against what would have been an 11th consecutive interest rate increase and went for a hawkish pause. Unfortunately, the final quarter of the Reporting Period resulted in negative returns for the sector once again. A downgrade of the U.S. credit rating combined with record high mortgage interest rates and continued regional bank downgrades had a strong impact on returns. Overall consumer spending continued to fall and consumer confidence declined in September for the second consecutive month.

The Fund did not invest in derivatives during the Reporting Period.

On an individual security level, the top positive contributors to the Fund’s performance during the Reporting Period were Amazon.com, Booking Holdings Inc, and TJX Companies Inc. The top negative contributors to the Fund’s performance during the Reporting Period were Tesla, Inc., Dollar General Corporation, and Advance Auto Parts.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

6

The Consumer Discretionary Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2023

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Consumer Discretionary Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Consumer Discretionary Select Sector Index | S&P 500 Index | |

| | | ONE YEAR | | 14.08% | 14.08% | 14.16% | 21.62% | | 14.08% | 14.08% | 14.16% | 21.62% | |

| | | FIVE YEARS | | 44.30% | 44.32% | 45.10% | 60.44% | | 7.61% | 7.61% | 7.73% | 9.92% | |

| | | TEN YEARS | | 199.74% | 199.64% | 203.87% | 208.21% | | 11.60% | 11.60% | 11.76% | 11.91% | |

| | | | | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for The Consumer Discretionary Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2023.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.ssga.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

7

The Consumer Discretionary Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Amazon.com, Inc. | 3,857,223,135 | 22.1% | |

| | Tesla, Inc. | 3,486,766,407 | 20.0 | |

| | McDonald's Corp. | 773,885,822 | 4.5 | |

| | Home Depot, Inc. | 753,991,934 | 4.3 | |

| | Lowe's Cos., Inc. | 696,368,336 | 4.0 | |

| | TOTAL | 9,568,235,634 | 54.9% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

8

THE CONSUMER STAPLES SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Consumer Staples Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Consumer Staples Select Sector Index. The Fund’s benchmark is the Consumer Staples Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2023 (the “Reporting Period”), the total return for the Fund was 5.84%, and the Index was 5.94%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees, expenses and cash drag contributed to the difference between the Fund’s performance and that of the Index.

The prior twelve months were characterized by a risk on market environment with the U.S. securities markets broadly higher for the most part. The Consumer Staples sector did not do as well in this environment posting a modest gain owing in part to its defensive nature. One of the causes was the rapid rise in the Federal Funds rate which negatively impacted this sector as the sector’s dividend yield was now relatively less attractive. Higher interest rates also contributed to rising input costs which led to profitability challenges for a number of the constituents. Concerns also grew during the Reporting Period regarding the increasingly challenged consumer as pandemic related savings were being eroded. Additionally, several constituents indicated revenue challenges associated with higher degrees of shrinkage. Finally, worries persisted regarding the impact of a stronger Dollar on profitability. On a positive side, continued easing of supply chains helped this sector with expectations of further improvements on the input side. In general, the firms that have pricing power and can pass on higher input costs to the end consumers were the best performing stocks within this sector during this Reporting Period.

The Fund did not invest in derivatives during the Reporting Period.

On an individual security level, the top positive contributors to the Fund’s performance on an absolute basis during the Reporting Period were Molson Coors Beverage Co., Church & Dwight Co., Mondelez International, Inc.. The top negative contributors to the Fund’s performance on an absolute basis during the Reporting Period were Dollar General Corp., Estee lauder Companies Inc, and Target Corp..

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

9

The Consumer Staples Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2023

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Consumer Staples Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Consumer Staples Select Sector Index | S&P 500 Index | |

| | | ONE YEAR | | 5.84% | 5.79% | 5.94% | 21.62% | | 5.84% | 5.79% | 5.94% | 21.62% | |

| | | FIVE YEARS | | 45.68% | 45.69% | 46.65% | 60.44% | | 7.82% | 7.82% | 7.96% | 9.92% | |

| | | TEN YEARS | | 124.97% | 124.96% | 128.22% | 208.21% | | 8.45% | 8.44% | 8.60% | 11.91% | |

| | | | | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for The Consumer Staples Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2023.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.ssga.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

10

The Consumer Staples Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Procter & Gamble Co. | 2,354,116,076 | 14.5% | |

| | Costco Wholesale Corp. | 1,714,144,571 | 10.6 | |

| | PepsiCo, Inc. | 1,596,959,123 | 9.8 | |

| | Walmart, Inc. | 1,562,750,397 | 9.7 | |

| | Mondelez International, Inc. Class A | 745,627,423 | 4.6 | |

| | TOTAL | 7,973,597,590 | 49.2% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

11

THE ENERGY SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Energy Select Sector SPDR Fund (the "Fund") seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Energy Select Sector Index. The Fund’s benchmark is the Energy Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2023 (the “Reporting Period”), the total return for the Fund was 30.31%, and the Index was 30.41%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Cumulative security misweights between the fund and the index and fund expenses contributed to the difference between the Fund’s performance and that of the Index.

Oil Prices, inflation, and interest rates were primary drivers of Fund performance during the Reporting Period.

The energy sector is coming off strong performance in the previous reporting period and again delivered strong performance this Reporting Period. Most of the performance came during Q4 2022 and Q3 2023 where the quarterly performance produced double digit returns and proved to be the leading sector in the S&P 500 Index. Entering into this Reporting Period, there was much concern around global inflation and with energy prices. With the backdrop of the continued war in Ukraine, there was concern over supply and the resulting energy prices. However, the mild winter in 2022 helped ease concerns and natural gas prices came down in Q4 2022. However, there was volatility around crude oil prices. In Q4 2022 and Q3 2023, West Texas Intermediate crude oil was up 4.9% and 31.7% (highest since Q1 2022) respectively. In Q3 2023, Crude oil prices were supported by OPEC+ production cuts that squeezed global crude supply. Tighter-than-expected crude supplies in the U.S. also weighed on oil prices. The cuts by OPEC, plus additional voluntary cuts by Saudi Arabia and Russia, was expected to reduce global production by 1.3 million barrels a day through the end of the year. All of this having a boosting effect on crude oil prices which helped drive profits for the large oil companies who were able to pass them on to consumers.

The Fund used equity index futures in order to expose cash and receivables to the market during the Reporting Period. The Fund’s use of futures helped the Fund track the Index.

On an individual security level, the top positive contributors to the Fund’s performance during the Reporting Period were Exxon Mobil Corporation, Chevron Corporation, and Schlumberger N.V. The top negative contributors to the Fund’s performance during the Reporting Period were Devon Energy Corporation, EQT Corporation, and Kinder Morgan Inc.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

12

The Energy Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2023

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Energy Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Energy Select Sector Index | S&P 500 Index | |

| | | ONE YEAR | | 30.31% | 30.28% | 30.41% | 21.62% | | 30.31% | 30.28% | 30.41% | 21.62% | |

| | | FIVE YEARS | | 53.17% | 53.21% | 53.99% | 60.44% | | 8.90% | 8.91% | 9.02% | 9.92% | |

| | | TEN YEARS | | 59.93% | 59.92% | 61.74% | 208.21% | | 4.81% | 4.81% | 4.93% | 11.91% | |

| | | | | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for The Energy Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2023.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.ssga.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

13

The Energy Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Exxon Mobil Corp. | 9,162,459,596 | 23.5% | |

| | Chevron Corp. | 7,269,975,758 | 18.6 | |

| | EOG Resources, Inc. | 1,793,528,761 | 4.6 | |

| | ConocoPhillips | 1,720,682,848 | 4.4 | |

| | Schlumberger NV | 1,707,840,842 | 4.4 | |

| | TOTAL | 21,654,487,805 | 55.5% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

14

THE FINANCIAL SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Financial Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Financial Select Sector Index. The Fund’s benchmark is the Financial Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2023 (the “Reporting Period”), the total return for the Fund was 11.67%, and the Index was 11.73%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees, expenses and cash drag contributed to the difference between the Fund’s performance and that of the Index.

There were a number of factors that contributed to this Fund’s return during the Reporting Period. The combination of declining loan growth and an inverted yield curve raised significant worries regarding potential revenue challenges for the banking segment. Additionally, this sector continued to be impacted by a heightened regulatory environment with a particular focus on ESG and lending standards. Recession concerns continued to resonate in the marketplace bringing with it worries regarding an uptick of bad debt being on balance sheets although by some measures firms and consumers were better positioned relative to other sizable market down turns. The dramatic uptick in the Federal Funds rate led to sizable shifts in deposit bases as customers much more aggressively sought yield and safety. This in turn contributed to the collapse of several regional banks, most notably Signature Bank, SVB Financial Group and First Republic Bank, in the first quarter of 2023. Rising interest rates were not a negative for all constituents as there were expectations that insurance companies would be better positioned in regard to revenue and investment returns.

The Fund did not invest in derivatives during the Reporting Period.

On an individual security level, the top positive contributors to the Fund’s performance on an absolute basis during the Reporting Period were Everest group LTD., JP Morgan Chase & Co., and Aflac Inc.. The top negative contributors to the Fund’s performance on an absolute basis during the Reporting Period were Signature Bank, SVB Financial Group, and First Republic Bank.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

15

The Financial Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2023

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Financial Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Financial Select Sector Index | S&P 500 Index | |

| | | ONE YEAR | | 11.67% | 11.61% | 11.73% | 21.62% | | 11.67% | 11.61% | 11.73% | 21.62% | |

| | | FIVE YEARS | | 33.37% | 33.43% | 34.10% | 60.44% | | 5.93% | 5.94% | 6.04% | 9.92% | |

| | | TEN YEARS | | 149.23% | 149.27% | 152.07% | 208.21% | | 9.56% | 9.56% | 9.69% | 11.91% | |

| | | | | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for The Financial Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2023.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.ssga.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

16

The Financial Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Berkshire Hathaway, Inc. Class B | 4,237,650,561 | 13.9% | |

| | JPMorgan Chase & Co. | 2,795,590,856 | 9.1 | |

| | Visa, Inc. Class A | 2,451,553,995 | 8.0 | |

| | Mastercard, Inc. Class A | 2,185,058,171 | 7.1 | |

| | Bank of America Corp. | 1,255,628,017 | 4.1 | |

| | TOTAL | 12,925,481,600 | 42.2% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

17

THE HEALTH CARE SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Health Care Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Health Care Select Sector Index. The Fund’s benchmark is the Health Care Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2023 (the “Reporting Period”), the total return for the Fund was 8.10%, and the Index was 8.18%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees, expenses and cash drag contributed to the difference between the Fund’s performance and that of the Index.

During the Reporting Period, the medical impact of the COVID-19 pandemic fortunately waned although this positive outcome did negatively impact the profitability of a number of the constituents. Still, the policy and medical responses to the pandemic continued to have a significant impact on many of the constituents of this Fund. This was most notably manifested on the demand side as the medical community works down the backlog of deferred medical procedures. Additionally, market expectations are for a much higher run rate of government spending on healthcare and research than the historical norm. This change was heavily influenced by the pandemic and the responses to the pandemic. Another positive for this sector was a decline in regulatory concerns during the Reporting Period. Also, secular trends such as the continuing increased health care demands associated with the ongoing aging of the American population continue to make a positive contribution to many of this Fund’s constituents. This demographic trend is anticipated to lead to continued strong growth in the medical products, pharmaceuticals and medical services markets. Additionally, the return for many of the constituents of this Fund were helped by the sector’s continued dramatic innovation success as evidenced by a much quicker than anticipated response to the COVID-19 pandemic. This spirit and success at innovation has positively contributed to the Fund. Although, this has been offset during the Reporting Period by ongoing patent expirations. Finally though slower than recent periods, mergers and acquisitions both completed and anticipated contributed to this Fund’s return. Conversely, the Fund, owing to its defensive nature, was incrementally hurt by a “risk on” market environment.

The Fund did not invest in derivatives during the Reporting Period.

On an individual security level, the top positive contributors to the Fund’s performance on an absolute basis during the Reporting Period were Zimmer Biomet Holdings, Hologic Inc, and Cigna Group. The top negative contributors to the Fund’s performance on an absolute basis during the Reporting Period were Insulet Corp., Catalent Inc., and ResMed Inc..

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

18

The Health Care Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2023

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Health Care Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Health Care Select Sector Index | S&P 500 Index | |

| | | ONE YEAR | | 8.10% | 8.05% | 8.18% | 21.62% | | 8.10% | 8.05% | 8.18% | 21.62% | |

| | | FIVE YEARS | | 47.52% | 47.56% | 48.40% | 60.44% | | 8.09% | 8.09% | 8.21% | 9.92% | |

| | | TEN YEARS | | 199.09% | 199.11% | 203.14% | 208.21% | | 11.58% | 11.58% | 11.73% | 11.91% | |

| | | | | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for The Health Care Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2023.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.ssga.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

19

The Health Care Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | UnitedHealth Group, Inc. | 3,662,120,537 | 9.7% | |

| | Eli Lilly & Co. | 3,358,469,780 | 8.9 | |

| | Johnson & Johnson | 2,940,837,858 | 7.8 | |

| | AbbVie, Inc. | 2,063,002,176 | 5.5 | |

| | Merck & Co., Inc. | 2,048,422,917 | 5.4 | |

| | TOTAL | 14,072,853,268 | 37.3% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

20

THE INDUSTRIAL SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Industrial Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Industrial Select Sector Index. The Fund’s benchmark is the Industrial Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2023 (the “Reporting Period”), the total return for the Fund was 24.50%, and the Index was 24.58%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees and expenses contributed to the difference between the Fund’s performance and that of the Index.

With inflation showing signs of slowing down in the U.S., the Index rallied over the first two months of the Reporting Period (up over 21%), but the momentum came to a premature end in December as investors worried about weakening economic growth amid continued hawkish messaging by central banks. The industrials sector tends to benefit from a stronger economy which can lead to increased demand for capital goods and transportation and like the broad market, has been sensitive to the inflationary environment. The Index showed lackluster performance over the next six months, declining almost 4%, as investor sentiment declined amid evidence of a pullback in consumer spending and increased risk of recession as well as supply chain concerns. The Index gained almost 14% over June and July as the U.S. economy grew at a faster-than-expected pace in the second quarter of 2023, before declining 8% in the following months to end the Reporting Period up about 24.5%.

The Fund used index equity futures in order to equitize cash and dividend receivables during the Reporting Period. The Fund’s use of futures helped the Fund track the Index.

On an individual security level, the top positive contributors to the Fund’s performance on an absolute basis during the Reporting Period were General Electric Company, Caterpillar Inc., and Boeing Company. The top negative contributors to the Fund’s performance on an absolute basis during the Reporting Period were Generac Holdings, 3M Company, and L3Harris Technologies Inc..

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

21

The Industrial Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2023

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Industrial Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Industrial Select Sector Index | S&P 500 Index | |

| | | ONE YEAR | | 24.50% | 24.38% | 24.58% | 21.62% | | 24.50% | 24.38% | 24.58% | 21.62% | |

| | | FIVE YEARS | | 41.22% | 41.21% | 42.16% | 60.44% | | 7.15% | 7.15% | 7.29% | 9.92% | |

| | | TEN YEARS | | 163.67% | 163.61% | 167.50% | 208.21% | | 10.18% | 10.18% | 10.34% | 11.91% | |

| | | | | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for The Industrial Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2023.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.ssga.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

22

The Industrial Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Caterpillar, Inc. | 672,267,414 | 4.7% | |

| | Union Pacific Corp. | 599,057,671 | 4.1 | |

| | Honeywell International, Inc. | 592,074,704 | 4.1 | |

| | General Electric Co. | 580,772,767 | 4.0 | |

| | United Parcel Service, Inc. Class B | 544,189,399 | 3.8 | |

| | TOTAL | 2,988,361,955 | 20.7% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

23

THE MATERIALS SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Materials Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Materials Select Sector Index. The Fund’s benchmark is the Materials Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2023 (the “Reporting Period”), the total return for the Fund was 17.97%, and the Index was 18.05%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Cumulative security misweights between the Fund and the Index and Fund expenses contributed to the difference between the Fund’s performance and that of the Index.

Inflation, higher interest rates, and recession worries were primary drivers of Fund performance during the Reporting Period.

Companies in the materials sector are cyclical by nature, and in general respond to the state of the economy. In general, they tend to move in the same direction as broader markets. This materials sector is composed of companies in the Chemicals, Construction Materials, Containers & Packaging, and Metals & Mining.

Over the Reporting Period, the U.S. economy remained resilient despite the backdrop of inflation and the growing concerns of a recession. In the U.S., stocks rose with the S&P 500 Index up over 21% during the Reporting Period. Over the same period, materials sector stocks fell in line with the broader U.S. economy and the Index returned over 18%.

This Reporting Period’s market environment was significantly influenced by the U.S. Federal Reserve (the “Fed”), as its efforts to combat the highest U.S. inflation in nearly 40 years took center stage, as did the immediate downstream effects of these large rate increases and speculation on when and if those rate increases would have to be halted, or even reversed.

The Reporting Period began with markets reacting to the latest Fed rumors, moving back and forth as investors evaluated various indicators. When signs appeared that the global economy was beginning to cool, however, markets counterintuitively began to rise again, fueled by speculation that the Fed would have to roll back its tightening measures. A surging energy sector that was benefitting from higher energy prices also helped. After four consecutive 75 bps rate increases, the Fed tightened by only 50 bps at December’s meeting. However, the Fed reiterated that it would maintain its staunchly hawkish stance, capping some market exuberance but maintaining the market’s gains for the quarter.

As 2023 began, markets moved higher as investors interpreted inflation, GDP and headline unemployment numbers as net positives, despite some weakening corporate earnings. But the sudden collapse of Silicon Valley Bank and the deposit vulnerability it exposed in regional banks—driven by depositors chasing higher yields available in money market funds and the like—significantly rattled investors. Fortunately, when regulatory bailouts appeared to limit bank failures and contain the financial contagion, the markets recovered with surprising strength connected to newfound enthusiasm for tech companies and all things AI-related.

Markets continued to climb after June’s U.S. inflation number came in at only 3%, which was its slowest pace in more than two years and which reinvigorated investors on the idea that a soft landing might indeed be possible. But a downgrade of the United States’ credit rating on August 1st put an end to the euphoria. That, combined with record high mortgage interest rates, additional regional bank downgrades and concerns about the Chinese property market and its impact on China’s overall economy, put newfound fear into investor sentiment.

The Fund used equity index futures in order to expose cash and receivables to the market during the Reporting Period. The Fund’s use of futures helped the Fund track the Index.

On an individual security level, the top positive contributors to the Fund’s performance during the Reporting Period were Linde PLC, Freeport-McMoRan, and Air Products and Chemicals. The top negative contributors to the Fund’s performance during the Reporting Period were Albemarle Corp., Mosaic Co., and International Flavors & Fragrances, Inc..

See accompanying notes to financial statements.

24

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

THE MATERIALS SELECT SECTOR SPDR FUND (continued)

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

25

The Materials Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2023

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Materials Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Materials Select Sector Index | S&P 500 Index | |

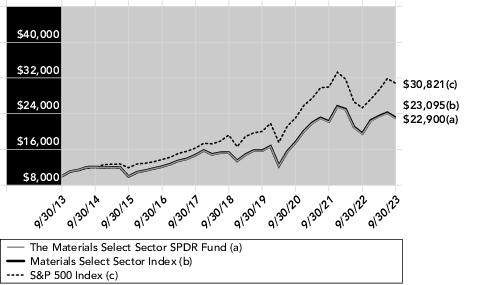

| | | ONE YEAR | | 17.97% | 17.90% | 18.05% | 21.62% | | 17.97% | 17.90% | 18.05% | 21.62% | |

| | | FIVE YEARS | | 50.37% | 50.41% | 50.84% | 60.44% | | 8.50% | 8.51% | 8.57% | 9.92% | |

| | | TEN YEARS | | 129.00% | 129.00% | 130.95% | 208.21% | | 8.64% | 8.64% | 8.73% | 11.91% | |

| | | | | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for The Materials Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2023.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.ssga.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

26

The Materials Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Linde PLC | 1,017,615,422 | 20.6% | |

| | Air Products & Chemicals, Inc. | 352,602,596 | 7.1 | |

| | Sherwin-Williams Co. | 337,959,613 | 6.8 | |

| | Freeport-McMoRan, Inc. | 299,422,740 | 6.1 | |

| | Ecolab, Inc. | 240,687,586 | 4.9 | |

| | TOTAL | 2,248,287,957 | 45.5% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

27

THE REAL ESTATE SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Real Estate Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Real Estate Select Sector Index. The Fund’s benchmark is the Real Estate Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2023 (the “Reporting Period”), the total return for the Fund was –1.81%, and the Index was –1.84%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees and expenses and cash drag contributed to the difference between the Fund’s performance and that of the Index.

Real estate was one of the worst performing sectors in the S&P 500 Index over the Reporting Period. The market environment was significantly influenced by the U.S. Federal Reserve, as its efforts to combat the highest U.S. inflation in nearly 40 years took center stage. As real estate is capital intensive, the rising interest rate environment has had a profound impact on the sector. Rising interest rates have an adverse impact on the cost of capital; financing costs increase making it more expensive for REITs to take on new debt and to refinance existing debt obligations.

Telecom Tower REITs was the worst performing sub-industry and declined over 20% over the Reporting Period. American Tower Corp (AMT), a leading independent owner, operator and developer of wireless and broadcast communications real estate, was once the largest constituent in the Index but fell second to the industrial REIT Prologis over the course on the Reporting Period as sentiment for AMT declined. Data center REITs advanced over 25% over the Reporting Period and was the top performing sub-industry. Data center REITs such as Equinix (EQIX) continued to report strong fundamentals despite a challenging macroeconomic environment.

The Fund used index equity futures in order to equitize cash and dividend receivables during the Reporting Period. The Fund’s use of futures helped the Fund track the Index.

On an individual security level, the top positive contributors to the Fund’s performance on an absolute basis during the Reporting Period were Equinix, Inc. REIT, Prologis, Inc. REIT and Welltower, Inc. REIT. The top negative contributors to the Fund’s performance on an absolute basis during the Reporting Period were American Tower Corp. REIT, Crown Castle, Inc., and SBA Communications Corp. REIT.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

28

The Real Estate Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2023

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Real Estate Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Real Estate Select Sector Index | S&P 500 Index | |

| | | ONE YEAR | | – 1.81% | – 1.82% | – 1.84% | 21.62% | | – 1.81% | – 1.82% | – 1.84% | 21.62% | |

| | | FIVE YEARS | | 23.40% | 23.45% | 24.05% | 60.44% | | 4.30% | 4.30% | 4.40% | 9.92% | |

| | | SINCE INCEPTION (1) | | 49.81% | 49.88% | 51.19% | 149.01% | | 5.19% | 5.20% | 5.32% | 12.11% | |

| | | | | | | | | | | | | |

| (1) | For the period October 7, 2015 to September 30, 2023. |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

* Inception date.

The total expense ratio for The Real Estate Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2023.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.ssga.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

29

The Real Estate Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Prologis, Inc. REIT | 495,815,594 | 12.1% | |

| | American Tower Corp. REIT | 366,648,511 | 8.9 | |

| | Equinix, Inc. REIT | 325,040,568 | 7.9 | |

| | Welltower, Inc. REIT | 203,242,373 | 5.0 | |

| | Public Storage REIT | 199,441,423 | 4.9 | |

| | TOTAL | 1,590,188,469 | 38.8% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

30

THE TECHNOLOGY SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Technology Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Technology Select Sector Index. The Fund’s benchmark is the Technology Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2023 (the “Reporting Period”), the total return for the Fund was 39.34%, and the Index was 39.46%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Management fees, cash drag, and cumulative effects of individual security misweights contributed to the difference between the Fund’s performance and that of the Index.

The Fund had positive performance in three of the four quarters of the Reporting Period. Performance in the first, second and third quarters of the Reporting Period were positive. The positive performance was driven by better optimism around AI, inflation numbers, hopes of a halt in interest rate hikes by the U.S. Federal Reserve, positive corporate earnings, stabilization measures by regulators to head off panic in the banking sector and expectations that inflation could moderate without negative impacts to unemployment. Performance in the fourth quarter of the Reporting Period was negative on the prospects of a high interest rate regime persisting.

The Fund used index futures contracts in order to equitize cash and receivables during the Reporting Period. The Fund’s use of index futures contracts helped the Fund track the Index.

On an individual security level, the top positive contributors to the Fund’s performance on an absolute basis during the Reporting Period were Microsoft Corp., Apple Inc. and NVIDIA Corp.. The top negative contributors to the Fund’s performance on an absolute basis during the Reporting Period were PayPal Holdings, Inc., Fidelity National Information Services, Inc., and Enphase Energy, Inc..

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

31

The Technology Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2023

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Technology Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Technology Select Sector Index | S&P 500 Index | |

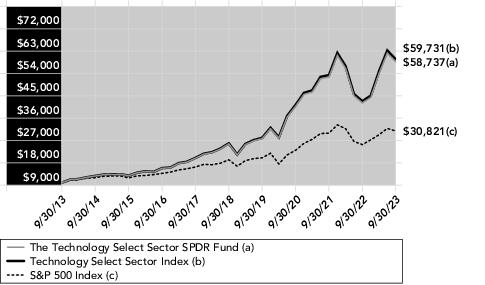

| | | ONE YEAR | | 39.34% | 39.32% | 39.46% | 21.62% | | 39.34% | 39.32% | 39.46% | 21.62% | |

| | | FIVE YEARS | | 129.44% | 129.39% | 131.12% | 60.44% | | 18.07% | 18.06% | 18.24% | 9.92% | |

| | | TEN YEARS | | 487.37% | 487.18% | 497.31% | 208.21% | | 19.37% | 19.36% | 19.57% | 11.91% | |

| | | | | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for The Technology Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2023.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.ssga.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

32

The Technology Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of September 30, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Apple, Inc. | 11,054,702,518 | 23.2% | |

| | Microsoft Corp. | 10,867,332,256 | 22.9 | |

| | NVIDIA Corp. | 2,148,550,022 | 4.5 | |

| | Broadcom, Inc. | 2,045,046,601 | 4.3 | |

| | Adobe, Inc. | 1,386,651,124 | 2.9 | |

| | TOTAL | 27,502,282,521 | 57.8% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of September 30, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

33

THE UTILITIES SELECT SECTOR SPDR FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

The Utilities Select Sector SPDR Fund (the “Fund”) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Utilities Select Sector Index. The Fund’s benchmark is the Utilities Select Sector Index (the “Index”).

For the 12-month period ended September 30, 2023 (the “Reporting Period”), the total return for the Fund was –7.02%, and the Index was –7.02%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns.

This was a very challenging market environment during the Reporting Period as evidenced by the Fund declining in three of the four quarters. This Fund’s returns were negatively impacted by a general “risk on” market environment as investors became less enamored with the relative defensive nature of this sector. The prior twelve months have been marked by reduced investor appetite for funds with relatively higher dividend yields such as the Utilities Sector which has historically from a sector perspective had one of the higher dividend yields. A primary driver of this was the dramatic increases during the Reporting Period in the Federal Funds rate which has lessened the attractiveness of the sector’s dividend yield. The rise in interest costs has also raised profitability concerns for many of this sector’s constituents as Utilities capital intensive nature tend to be very sensitive to interest rate changes. The Reporting Period was also marked generally by more mild weather conditions which contributed to demand concerns from an energy usage perspective and the accompanying impact on revenue.

The Fund did not invest in derivatives during the Reporting Period.

On an individual security level, the top positive contributors to the Fund’s performance on an absolute basis during the Reporting Period were Constellation Energy Corp., PG & E Corp., and Pinnacle West Capital Corp.. The top negative contributors to the Fund’s performance on an absolute basis during the Reporting Period were Dominion Energy, AES Corp., and NextEra Energy, Inc..

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

34

The Utilities Select Sector SPDR Fund

Performance Summary (Unaudited)

Performance as of September 30, 2023

| | | | | | | | | | | | | |

| | | | | Cumulative Total Return | | Average Annual Total Return | | |

| | | | | Net

Asset

Value | Market

Value | Utilities Select Sector Index | S&P 500 Index | | Net

Asset

Value | Market

Value | Utilities Select Sector Index | S&P 500 Index | |

| | | ONE YEAR | | – 7.02% | – 7.09% | – 7.02% | 21.62% | | – 7.02% | – 7.09% | – 7.02% | 21.62% | |

| | | FIVE YEARS | | 30.94% | 30.98% | 31.66% | 60.44% | | 5.54% | 5.55% | 5.66% | 9.92% | |

| | | TEN YEARS | | 119.55% | 119.54% | 122.66% | 208.21% | | 8.18% | 8.18% | 8.33% | 11.91% | |

| | | | | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for The Utilities Select Sector SPDR Fund as stated in the Fees and Expenses table of the most recent prospectus is 0.10%. Please see the financial highlights for the total expense ratio for the fiscal period ended September 30, 2023.