PROSPECTUS SUPPLEMENT

(to Prospectus dated November 8, 2024) | | Filed pursuant to Rule 424(b)(2)

File No. 333-283109 |

Oxford Lane Capital Corp.

$2,000,000,000

Common Stock

__________________________

We are a closed-end management investment company that has registered as an investment company under the Investment Company Act of 1940, or the “1940 Act.” Our investment objective is to maximize our portfolio’s risk-adjusted total return. We have implemented our investment objective by purchasing portions of equity and junior debt tranches of collateralized loan obligation, or “CLO,” vehicles. Structurally, CLO vehicles are entities formed to originate and/or acquire a portfolio of loans.

An investment in our securities is subject to significant risks and involves a heightened risk of total loss of investment. The price of shares of our common stock may be highly volatile and our common stock may frequently trade at a discount to our net asset value. The interests of the CLO securities in which we invest are subject to a high degree of special risks, including: CLO structures are highly complicated and may be subject to disadvantageous tax treatment; CLO vehicles are highly levered (with CLO equity securities typically being leveraged between nine and thirteen times) and are made up of below investment grade loans in which we typically have a residual interest that is much riskier than the loans that make up the CLO vehicle; and the market price for CLO vehicles may fluctuate dramatically, which may make portfolio valuations unreliable and negatively impact our net asset value and our ability to make distributions to our stockholders. Some instruments issued by CLO vehicles may not be readily marketable and may be subject to restrictions on resale. Securities issued by CLO vehicles are generally not listed on any U.S. national securities exchange and no active trading market may exist for the securities of CLO vehicles in which we may invest. Although a secondary market may exist for our investments in CLO vehicles, the market for our investments in CLO vehicles may be subject to irregular trading activity, wide bid/ask spreads and extended trade settlement periods. As a result, these types of investments may be more difficult to value. See “Risk Factors” beginning on page 15 of the accompanying prospectus and under similar headings in the documents that are incorporated by reference into this prospectus supplement and the accompanying prospectus, to read about factors you should consider, including the risk of leverage, before investing in our securities.

We have entered into an Amended and Restated Equity Distribution Agreement dated September 9, 2022, as amended by Amendment No. 1 on November 15, 2023, Amendment No. 2 on July 29, 2024 and Amendment No. 3 on November 12, 2024 (the “Equity Distribution Agreement”) with Lucid Capital Markets, LLC and Ladenburg Thalmann & Co. Inc. relating to the shares of common stock offered by this prospectus supplement and the accompanying prospectus.

The Equity Distribution Agreement provides that, after the date hereof, we may offer and sell shares of our common stock having an aggregate offering price of up to $2,000,000,000 from time to time through Lucid Capital Markets, LLC and Ladenburg Thalmann & Co. Inc., as our sales agents (each a “Distribution Agent” and together the “Distribution Agents”). Sales of our common stock, if any, under this prospectus supplement and the accompanying prospectus may be made in negotiated transactions or transactions that are deemed to be “at the market,” as defined in Rule 415 under the Securities Act of 1933, as amended, or the “Securities Act,” including sales made directly on the NASDAQ Global Select Market or similar securities exchange or sales made to or through a market maker other than on an exchange, at prices related to the prevailing market prices or at negotiated prices.

Table of Contents

The Distribution Agents will receive a commission from us of up to 2.0% of the gross sales price of any shares of our common stock sold through such Distribution Agent under the Equity Distribution Agreement. The Distribution Agents are not required to sell any specific number or dollar amount of common stock, but will use their commercially reasonable efforts consistent with their sales and trading practices to sell the shares of our common stock offered by this prospectus supplement and the accompanying prospectus. See “Plan of Distribution” beginning on page S-16 of this prospectus supplement. The sales price per share of our common stock offered by this prospectus supplement and the accompanying prospectus, less the Distribution Agent’s commission, will not be less than the net asset value per share of our common stock at the time of such sale.

Our common stock is traded on the NASDAQ Global Select Market under the symbol “OXLC.” On November 7, 2024, the last reported sales price on the NASDAQ Global Select Market for our common stock was $5.38 per share, which was at a premium of 13.03% to the net asset value per share of our common stock as of September 30, 2024. We are required to determine the net asset value per share of our common stock on a quarterly basis. Our net asset value per share of our common stock as of September 30, 2024 was $4.76.

Investing in our securities involves a high degree of risk. Before investing in our securities, you should read the discussion of the material risks of investing in our securities, including the risk of leverage, in the section titled “Risk Factors” beginning on page 15 of the accompanying prospectus or otherwise incorporated by reference herein and included in, or incorporated by reference into, this prospectus supplement and in any free writing prospectuses we have authorized for use in connection with a specific offering, and under similar headings in the other documents that are incorporated by reference into the accompanying prospectus.

Please read this prospectus supplement, the accompanying prospectus and the documents incorporated by reference to this prospectus supplement and the accompanying prospectus before investing in our securities and keep each for future reference. This prospectus supplement, the accompanying prospectus and the documents incorporated by reference to this prospectus supplement and the accompanying prospectus contain important information about us that a prospective investor should know before investing in our common stock. We are required to file annual and semi-annual reports, proxy statements and other information about us with the Securities and Exchange Commission, or “SEC.” This information is available free of charge by contacting us by mail at 8 Sound Shore Drive, Suite 255, Greenwich, CT 06830, by telephone at (203) 983-5275 or on our website at http://www.oxfordlanecapital.com. The SEC also maintains a website at http://www.sec.gov that contains such information. Information contained on our website is not incorporated by reference into this prospectus supplement or the accompanying prospectus, and you should not consider that information to be part of this prospectus supplement or the accompanying prospectus.

__________________________

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Lucid Capital Markets | | Ladenburg Thalmann |

Prospectus Supplement dated November 12, 2024

Table of Contents

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

S-i

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is the prospectus supplement, which describes the terms of this offering of common stock and also adds to and updates information contained in the accompanying prospectus. The second part is the accompanying prospectus, which gives more general information and disclosure. To the extent the information contained in this prospectus supplement differs from or is additional to the information contained in the accompanying prospectus, you should rely only on the information contained in this prospectus supplement and the documents incorporated by reference herein. Please carefully read and consider all of the information contained in this prospectus supplement and the accompanying prospectus, including the information described under the heading “Incorporation of Certain Information by Reference” in this prospectus supplement and under the headings “Incorporation of Certain Information by Reference” and “Risk Factors” included in the accompanying prospectus, respectively, before investing in our common stock.

You should rely only on the information contained in this prospectus supplement and the accompanying prospectus. Neither we nor the Distribution Agents have authorized any dealer, salesman or other person to give any information or to make any representation other than those contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus or in any free writing prospectus prepared by or on behalf of us that relates to this offering. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus supplement and the accompanying prospectus do not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction or to any person to whom it is unlawful to make such an offer or solicitation in such jurisdiction. The information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus is accurate as of their respective dates or such earlier date as indicated therein, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or any sales of the securities. Our financial condition, results of operations and prospects may have changed since those dates. To the extent required by law, we will amend or supplement the information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus to reflect any material changes subsequent to the date of this prospectus supplement and the accompanying prospectus and prior to the completion of any offering pursuant to this prospectus supplement and the accompanying prospectus.

S-ii

Table of Contents

PROSPECTUS SUPPLEMENT SUMMARY

The following summary contains basic information about this offering of shares of our common stock pursuant to this prospectus supplement and the accompanying prospectus. It is not complete and may not contain all the information that is important to you. For a more complete understanding of the offering of shares of our common stock pursuant to this prospectus supplement, we encourage you to read this entire prospectus supplement and the accompanying prospectus, including any documents incorporated by reference to this prospectus supplement or the accompanying prospectus, and the documents to which we have referred in this prospectus supplement and the accompanying prospectus. Together, these documents describe the specific terms of the shares we are offering. You should carefully read the sections entitled “Risk Factors,” “Business,” and “Incorporation of Certain Information by Reference” included in the accompanying prospectus and “Incorporation of Certain Information by Reference” in this prospectus supplement.

Except where the context requires otherwise, the terms “Oxford Lane Capital,” the “Company,” the “Fund,” “we,” “us” and “our” refer to Oxford Lane Capital Corp.; “Oxford Lane Management” and “Adviser” refer to Oxford Lane Management, LLC; “Oxford Funds” and “Administrator” refer to Oxford Funds, LLC; and “ACA” and “ACA Group” refer to ACA Group, LLC.

Overview

We are a closed-end management investment company that has registered as an investment company under the Investment Company Act of 1940, as amended, or the “1940 Act.” Our investment objective is to maximize our portfolio’s risk-adjusted total return.

We have implemented our investment objective by purchasing portions of equity and junior debt tranches of collateralized loan obligation, or “CLO,” vehicles. Substantially all of the CLO vehicles in which we may invest would be deemed to be investment companies under the 1940 Act but for the exceptions set forth in section 3(c)(1) or section 3(c)(7). Structurally, CLO vehicles are entities formed to originate and/or acquire a portfolio of loans. The loans within the CLO vehicle are limited to loans which meet established credit criteria and are subject to concentration limitations in order to limit a CLO vehicle’s exposure to a single credit. A CLO vehicle is formed by raising various classes or “tranches” of debt (with the most senior tranches being rated “AAA” to the most junior tranches typically being rated “BB” or “B”) and equity. The CLO vehicles which we focus on are collateralized primarily by senior secured loans made to companies whose debt is unrated or is rated below investment grade, or “Senior Loans,” and, to a limited extent, subordinated and/or unsecured loans and bonds (together with the Senior Loans, the “CLO Assets”). CLOs generally have very little or no exposure to real estate, mortgage loans or to pools of consumer-based debt, such as credit card receivables or auto loans. Below investment grade securities, such as the CLO securities in which we primarily invest, are often referred to as “junk.” In addition, the CLO equity and junior debt securities in which we invest are highly levered (with CLO equity securities typically being leveraged between nine and thirteen times), which significantly magnifies our risk of loss on such investments relative to senior debt tranches of CLOs. A CLO itself is highly leveraged because it borrows significant amounts of money to acquire the underlying commercial loans in which it invests. A CLO borrows money by issuing debt securities to investors (including junior debt securities of the type we intend to invest), and the CLO equity (which is also the CLO residual tranche) is the first to bear the risk on the underlying investment. Our investment strategy also includes warehouse facilities, which are financing structures intended to aggregate loans that may be used to form the basis of a CLO vehicle. Warehouse facilities typically incur leverage between four and six times prior to a CLO’s pricing. We may also invest, on an opportunistic basis, in other corporate credits of a variety of types. We expect that each of our investments will range in size from $5 million to $50 million, although the investment size may vary consistent with the size of our overall portfolio. Oxford Lane Management manages our investments and its affiliate arranges for the performance of the administrative services necessary for us to operate.

CLO vehicles, due to their high leverage, are more complicated to evaluate than direct investments in Senior Loans. Since we invest in the residual interests of CLO securities, our investments are riskier than the profile of the Senior Loans by which such CLO vehicles are collateralized. Our investments in CLO vehicles are riskier and less transparent to us and our stockholders than direct investments in the underlying Senior Loans. Our portfolio of investments may lack diversification among CLO vehicles which would subject us to a risk of significant loss if one or more of these CLO vehicles experience a high level of defaults on its underlying Senior Loans. The CLO vehicles in which we invest have debt that ranks senior to our investment. The market price for CLO vehicles may fluctuate

S-1

Table of Contents

dramatically, which would make portfolio valuations unreliable and negatively impact our net asset value and our ability to make distributions to our stockholders. Our financial results may be affected adversely if one or more of our significant equity or junior debt investments in such CLO vehicles defaults on its payment obligations or fails to perform as we expect.

Our investments in CLO vehicles may be subject to special anti-deferral provisions that could result in us incurring tax or recognizing income prior to receiving cash distributions related to such income. Specifically, the CLO vehicles in which we invest generally constitute “passive foreign investment companies,” or “PFICs.” Because we acquire investments in PFICs (including equity tranche investments in CLO vehicles that are PFICs), we may be subject to U.S. federal income tax on a portion of any “excess distribution” or gain from the disposition of such investments even if such income is distributed as a taxable dividend by us to our stockholders. See “Risk Factors — Risks Related to Our Investments” in our most recent annual or semi-annual report on Form N-CSR to read about factors you should consider before investing in our securities.

Oxford Lane Management

Our investment activities are managed by Oxford Lane Management, which is an investment adviser that has registered under the Investment Advisers Act of 1940, or the “Advisers Act.” Under our investment advisory agreement with Oxford Lane Management, which we refer to as our “Investment Advisory Agreement,” we have agreed to pay Oxford Lane Management an annual base management fee based on our gross assets, as well as an incentive fee based on our performance. See “Investment Advisory Agreement” in the accompanying prospectus.

We expect to benefit from the ability of Oxford Lane Management’s team to identify attractive opportunities, conduct diligence on and value prospective investments, negotiate terms where appropriate, and manage and monitor our portfolio. Oxford Lane Management’s investment team members have broad investment backgrounds, with prior experience at investment banks, commercial banks, unregistered investment funds and other financial services companies, and have collectively developed a broad network of contacts to provide us with our principal source of investment opportunities.

Oxford Lane Management is led by Jonathan H. Cohen, Chief Executive Officer, and Saul B. Rosenthal, President. Messrs. Cohen and Rosenthal are assisted by Joseph Kupka, who serves as a Managing Director for Oxford Lane Management. We consider Messrs. Cohen, Rosenthal and Kupka to be Oxford Lane Management’s senior investment team.

We reimburse Oxford Funds, an affiliate of Oxford Lane Management, our allocable portion of overhead and other expenses incurred by Oxford Funds in performing its obligations under an administration agreement by and among us and Oxford Funds, or the “Administration Agreement,” including rent, the fees and expenses associated with performing administrative functions, and our allocable portion of the compensation of our Chief Financial Officer and any administrative support staff, including accounting personnel. We also reimburse Oxford Funds for the costs associated with the functions performed by our Chief Compliance Officer that Oxford Funds pays on the Company’s behalf pursuant to the terms of an agreement between us and ACA. These arrangements could create conflicts of interest that our Board of Directors must monitor.

Investment Focus

Our investment objective is to maximize our portfolio’s risk-adjusted total return. Our current focus is to seek that return by investing in structured finance investments, specifically the equity and junior debt tranches of CLO vehicles, which are collateralized primarily by a diverse portfolio of Senior Loans, and which generally have very little or no exposure to real estate loans, or mortgage loans or to pools of consumer-based debt, such as credit card receivables or auto loans. As of September 30, 2024, we held equity investments in 221 different CLO structures and debt investments in 19 different CLO structures. Our investment strategy also includes investing in warehouse facilities, which are financing structures intended to aggregate Senior Loans that may be used to form the basis of a CLO vehicle. We may also invest, on an opportunistic basis, in a variety of other types of corporate credits.

The CLO investments we currently hold in our portfolio generally represent either a residual economic interest, in the case of an equity tranche, or a debt investment collateralized by a portfolio of Senior Loans and other CLO Assets. The value of our CLO investments generally depend on both the quality and nature of the underlying portfolio it references and also on the specific structural characteristics of the CLO itself.

S-2

Table of Contents

CLO Structural Elements

Structurally, CLO vehicles are entities formed to originate and/or acquire a portfolio of loans. The loans within the CLO vehicle are generally limited to loans which meet established credit criteria and are subject to concentration limitations in order to limit a CLO vehicle’s exposure to a single credit.

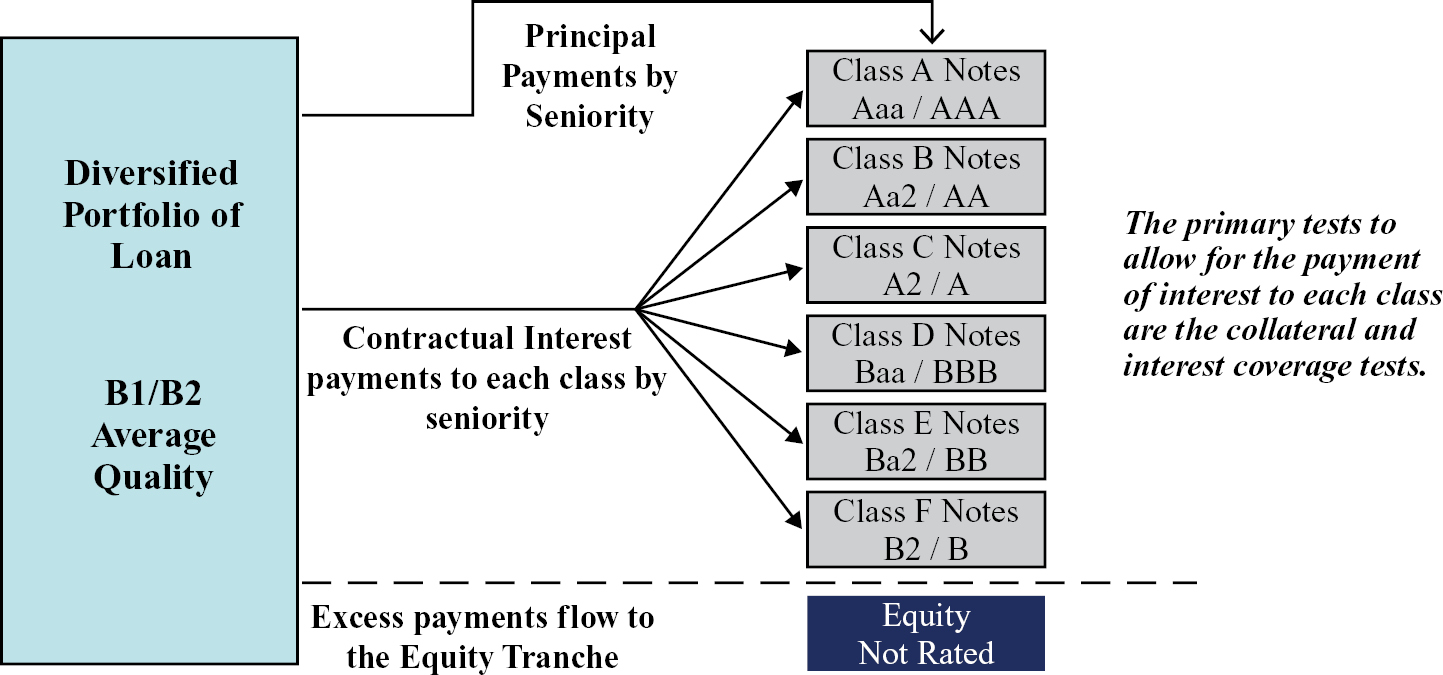

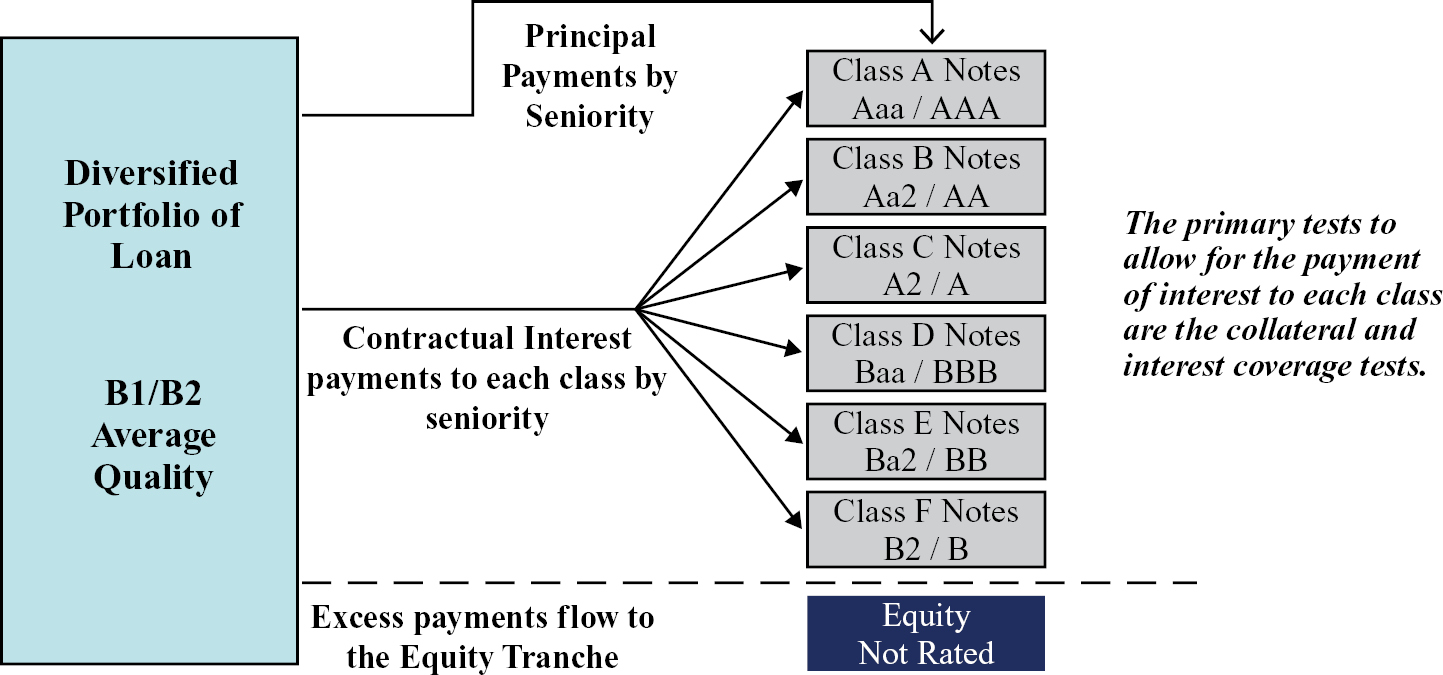

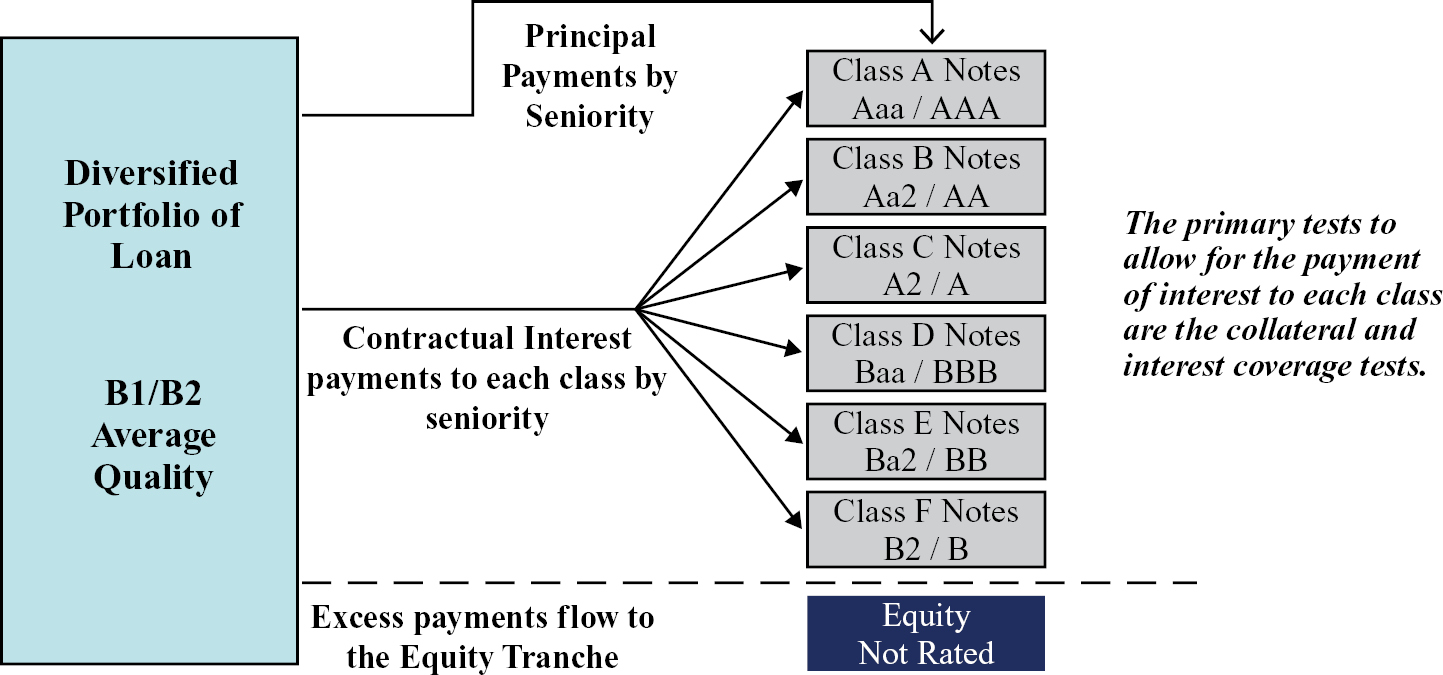

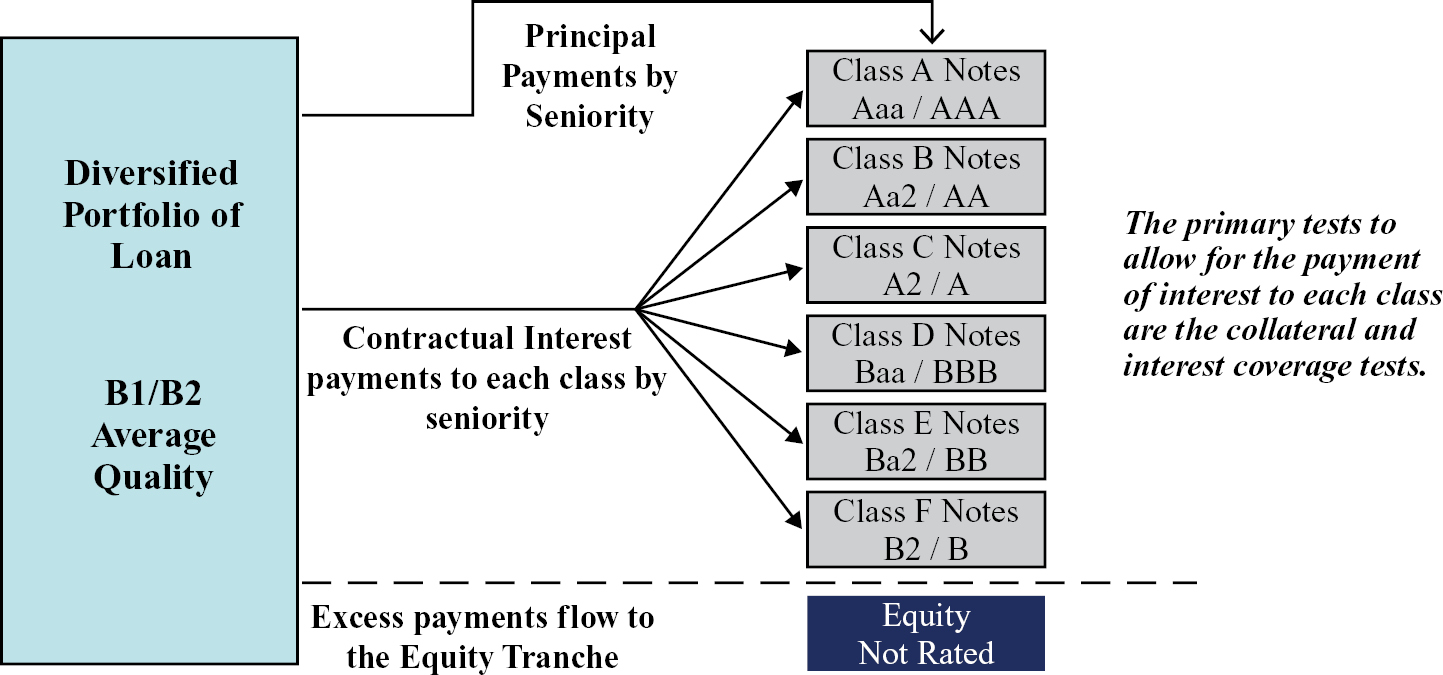

A CLO vehicle is formed by raising multiple “tranches” of debt (with the most senior tranches being rated “AAA” to the most junior tranches typically being rated “BB” or “B”) and equity. As interest payments are received, the CLO vehicle makes contractual interest payments to each tranche of debt based on their seniority. If there are funds remaining after each tranche of debt receives its contractual interest rate and the CLO vehicle meets or exceeds required collateral coverage levels (or other similar covenants) the remaining funds may be paid to the equity tranche. The contractual provisions setting out this order of payments are set out in detail in the CLO vehicle’s indenture. These provisions are referred to as the “priority of payments” or the “waterfall” and determine any other obligations that may be required to be paid ahead of payments of interest and principal on the securities issued by a CLO vehicle. In addition, for payments to be made to each tranche, after the most senior tranche of debt, there are various tests which must be complied with, which are different for each CLO vehicle.

CLO indentures typically provide for adjustments to the priority of payments in the event that certain cash flow or collateral requirements are not maintained. The collateral quality tests that may divert cash flows in the priority of payments are predominantly determined by reference to the par values of the underlying loans, rather than their current market values. Accordingly, we believe that CLO equity and junior debt investments allow investors to gain exposure to the Senior Loan market on a levered basis (with CLO equity securities typically being leveraged between nine and thirteen times) without being structurally subject to mark-to-market price fluctuations of the underlying loans. As such, although the current valuations of CLO equity and junior debt tranches are expected to fluctuate based on price changes within the loan market, interest rate movements and other macroeconomic factors, those tranches will generally be expected to continue to receive distributions from the CLO vehicle periodically so long as the underlying portfolio does not suffer defaults, realized losses or other covenant violations sufficient to trigger changes in the waterfall allocations. We therefore believe that an investment portfolio consisting of CLO equity and junior debt investments of this type has the ability to provide attractive risk-adjusted rates of return.

The diagram below is for illustrative purposes only. The CLO structure highlighted below is illustrative only and depicts structures among CLO vehicles in which we may invest may vary substantially from the illustrative example set forth below.

We typically invest in the equity tranches, which are not rated, and to a lesser extent the “B” and “BB” tranches of CLO vehicles. As of September 30, 2024, 89.0% of our portfolio on a fair value basis was invested in the equity tranches of CLO vehicles.

S-3

Table of Contents

The Syndicated Senior Loan Market

We believe that while the syndicated leveraged corporate loan market is relatively large, with Standard and Poor’s estimating the total par value outstanding at approximately $1.4 trillion as of September 2024, this market remains largely inaccessible to a significant portion of investors that are not lenders or approved institutions. The CLO market permits wider exposure to syndicated Senior Loans, but this market is almost exclusively private and predominantly institutional.

The Senior Loan market is characterized by various factors, including:

• Floating rate instruments. Senior Loans and other types of CLO Assets typically contain a floating interest rate as opposed to a fixed interest rate, which we believe provides some measure of protection against the risk of interest rate fluctuation. However, all of our CLO investments have many CLO Assets which are subject to interest rate floors and since interest rates on CLO Assets may only reset periodically and the amount of the increase following an interest rate reset may be below the interest rate floors of such CLO Assets, our ability to benefit from rate resets following an increase in interest rates may be limited.

• Frequency of interest payments. Senior Loans and other CLO Assets typically provide for scheduled interest payments no less frequently than quarterly.

Investment Opportunity

We believe that the market for CLO-related assets provides us with opportunities to generate attractive risk-adjusted returns over the long term.

The long-term and relatively low-cost capital that many CLO vehicles have secured, compared with current asset spreads, have created opportunities to purchase certain CLO equity and junior debt instruments that may produce attractive risk-adjusted returns. Additionally, given that the CLO vehicles we invest in are cash flow-based vehicles, this term financing may be beneficial in periods of market volatility.

We continue to review a large number of CLO investment opportunities in the current market environment, and we expect that the majority of our portfolio holdings, over the near to intermediate-term, will continue to be comprised of CLO debt and equity securities, with the more significant focus over the near-term likely to be on CLO equity securities.

Leverage by the Company

We may use leverage as and to the extent permitted by the 1940 Act. We are permitted to obtain leverage using any form of financial leverage instruments, including funds borrowed from banks or other financial institutions, margin facilities, notes or preferred stock and leverage attributable to reverse repurchase agreements or similar transactions. Instruments that create leverage are generally considered to be senior securities under the 1940 Act. Under the 1940 Act, we are only permitted to incur additional indebtedness to the extent our asset coverage, as defined under the 1940 Act, is at least 300% immediately after each such borrowing. With respect to our outstanding preferred stock, we will generally be required to meet an asset coverage ratio, as defined under the 1940 Act, of at least 200% immediately after each issuance of such preferred stock. In addition, our Articles Supplementary for the Term Preferred Shares (as defined below) prohibit us from declaring a common stock distribution if, at the time of declaration, our asset coverage ratio is not at least 200% after deducting the amount of such distribution. If we do not meet these asset coverage requirements, we may be required to sell a portion of our investments and, depending on the nature of our leverage, repay a portion of our indebtedness or redeem outstanding shares of preferred stock, in each case at a time when doing so may be disadvantageous. See “Regulation as a Registered Closed-End Management Investment Company” in the accompanying prospectus.

Preferred Stock

Our Board of Directors may classify any unissued shares of stock and reclassify any previously classified but unissued shares of stock of any class or series from time to time, in one or more classes or series of stock, including preferred stock. We have authorized 50 million shares of mandatorily redeemable preferred stock, at a par value of $0.01 per share, and had 8,761,706 shares issued and outstanding at September 30, 2024. As of September 30, 2024,

S-4

Table of Contents

we had the following series of preferred stock outstanding: 6.25% Series 2027 Term Preferred Shares (the “Series 2027 Term Preferred Shares”), 6.00% Series 2029 Term Preferred Shares (the “6.00% Series 2029 Term Preferred Shares”), 7.125% Series 2029 Term Preferred Shares, (the “7.125% Series 2029 Term Preferred Shares” and, together with the Series 2027 Term Preferred Shares and 6.00% Series 2029 Term Preferred Shares, the “Term Preferred Shares”), each issued in an underwritten public offering. We are required to redeem all of the outstanding Term Preferred Shares on their respective redemption dates, at a redemption price equal to $25 per share plus an amount equal to accumulated but unpaid dividends, if any, to the date of the redemption. We cannot effect any amendment, alteration, or repeal of our obligation to redeem all of the Term Preferred Shares without the prior unanimous vote or consent of the holders of such Term Preferred Shares. At any time on or after the optional redemption date, at our sole option, we may redeem the Term Preferred Shares at a redemption price per share equal to the sum of the $25 liquidation preference per share plus an amount equal to accumulated but unpaid dividends, if any, on such Term Preferred Shares. There was $88.1 million of our Series 2027 Term Preferred Shares, $67.2 million of our 6.00% Series 2029 Term Preferred Shares and $63.8 million of our 7.125% Series 2029 Term Preferred Shares issued and outstanding as of September 30, 2024. As of September 30, 2024 there were no accumulated but unpaid dividends on our Term Preferred Shares.

5.00% Unsecured Notes due 2027, (the “2027 Notes”)

On January 13, 2022, we completed an underwritten public offering, including the full exercise of the underwriters’ 30-day overallotment option, of $100.0 million in aggregate principal amount of 2027 Notes. The 2027 Notes will mature on January 31, 2027 and may be redeemed in whole or in part at any time or from time to time at our option on or after January 31, 2024. The 2027 Notes bear interest at a rate of 5.00% per year payable quarterly on March 31, June 30, September 30, and December 31, of each year, commencing March 31, 2022.

6.75% Unsecured Notes due 2031 (the “2031 Notes”)

On March 16, 2021, we completed an underwritten public offering, including the full exercise of the underwriters’ 30-day overallotment option, of $100.0 million in aggregate principal amount of the 2031 Notes. The 2031 Notes will mature on March 31, 2031 and may be redeemed in whole or in part at any time or from time to time at our option on or after March 16, 2024. The 2031 Notes bear interest at a rate of 6.75% per year payable quarterly on March 31, June 30, September 30, and December 31, of each year, commencing June 30, 2021.

8.75% Unsecured Notes due 2030 (the “2030 Notes”)

On July 8, 2024, we completed an underwritten public offering, including the full exercise of the underwriters’ 30-day overallotment option, of $115.0 million in aggregate principal amount of the 2030 Notes. The 2030 Notes will mature on June 30, 2030 and may be redeemed in whole or in part at any time or from time to time at our option on or after June 30, 2028. The 2030 Notes bear interest at a rate of 8.75% per year payable quarterly on March 31, June 30, September 30, and December 31, of each year, commencing September 30, 2024.

Subject to the limitations under the 1940 Act, we may incur additional leverage opportunistically or not at all and may choose to increase or decrease our leverage. We may use different types or combinations of leveraging instruments at any time based on the Adviser’s assessment of market conditions and the investment environment, including forms of leverage other than preferred stock, debt securities and/or credit facilities. In addition, we may also borrow amounts up to 5% of the value of our gross assets for temporary purposes without regard to asset coverage requirements described above. By leveraging our investment portfolio, we may create an opportunity for increased net income and capital appreciation. However, the use of leverage also involves significant risks and expenses, which will be borne entirely by our stockholders, and our leverage strategy may not be successful. For example, the more leverage is employed, the more likely a substantial change will occur in our net asset value per share of our common stock. See “Risk Factors — Risks Related to Our Investments — We may borrow money and/or issue preferred stock to leverage our portfolio, which would magnify the potential for gain or loss on amounts invested and will increase the risk of investing in us” in our most recent annual or semi-annual report on Form N-CSR.

Prior Sales Pursuant to the “At the Market” Offering

From June 4, 2020 to November 7, 2024, we sold a total of 249,092,428 shares of common stock pursuant to the “at-the-market” offering. The total amount of capital raised as a result of these sales of common stock was approximately $1,415.6 million and net proceeds were approximately $1,401.6 million, after deducting the sales agents’ commissions and offering expenses.

S-5

Table of Contents

Summary Risk Factors

The value of our assets, as well as the market price of our securities, will fluctuate. Our investments may be risky, and you may lose all or part of your investment in us. Investing in Oxford Lane Capital involves other risks, including the following:

Risks Relating to Our Business and Structure

• Our investment portfolio is recorded at fair value, with our Board of Directors having final responsibility for overseeing, reviewing and approving, in good faith, its estimate of fair value and, as a result, there will be uncertainty as to the value of our portfolio investments.

• Our financial condition and results of operations will depend on our ability to manage our existing portfolio and future growth effectively.

• We are dependent upon Oxford Lane Management’s key management personnel for our future success, particularly Jonathan H. Cohen and Saul B. Rosenthal.

• We operate in a highly competitive market for investment opportunities.

• Regulations governing our operation as a registered closed-end management investment company, including the asset coverage ratio requirements under the 1940 Act, affect our ability to raise additional capital and the way in which we do so. The raising of debt capital may expose us to risks, including the typical risks associated with leverage.

• We are permitted to borrow money, which magnifies the potential for gain or loss on amounts invested and may increase the risk of investing in us.

• There are significant potential conflicts of interest between Oxford Lane Management and our management team.

Risks Related to U.S. Federal Tax Regulation

• We will be subject to U.S. federal income tax at corporate rates, if we are unable to qualify for tax treatment as a RIC for U.S. federal income tax purposes.

Risks Relating to Our Investments

• Our investments in CLO vehicles are riskier and less transparent to us and our stockholders than direct investments in the underlying Senior Loans or CLO Assets.

• CLO securities and their investments are often illiquid.

• Our portfolio of investments may lack diversification among CLO vehicles which may subject us to a risk of significant loss if one or more of these CLO vehicles experience a high level of defaults on its underlying Senior Loans or CLO Assets.

• Investing in CLO vehicles, Senior Loans and other high-yield corporate credits involves a variety of risks, any of which may adversely impact our performance.

• Inflation may adversely affect our and our portfolio companies’ business, results of operations and financial condition.

Risks Relating to an Investment in Our Securities

• Common shares of closed-end management investment companies, including Oxford Lane Capital, have in the past frequently traded at discounts to their net asset values, and we cannot assure you that the market price of shares of our common stock will not decline below our net asset value per share.

• Our common stock price may be volatile and may decrease substantially.

S-6

Table of Contents

See “Risk Factors” beginning on page 15 of the accompanying prospectus, and the other information included in this prospectus supplement, including documents incorporated by reference into this prospectus supplement and the accompanying prospectus, for additional discussion of factors you should carefully consider before investing in our securities.

Operating and Regulatory Structure

Oxford Lane Capital is a Maryland corporation that is a closed-end management investment company that has registered as an investment company under the 1940 Act. As a registered closed-end fund, we are required to meet regulatory tests. See “Regulation as a Registered Closed-End Management Investment Company” in the accompanying prospectus. We may also borrow funds to make investments. In addition, we have elected to be treated for U.S. federal income tax purposes, and intend to qualify annually, as a RIC under Subchapter M of the Code. See “Certain U.S. Federal Income Tax Considerations” in the accompanying prospectus.

Our investment activities are managed by Oxford Lane Management and supervised by our Board of Directors. Oxford Lane Management is an investment adviser that is registered under the Advisers Act. Under our Investment Advisory Agreement, we have agreed to pay Oxford Lane Management an annual base management fee based on our gross assets as well as an incentive fee based on our performance. See “Investment Advisory Agreement” in the accompanying prospectus. We have also entered into an Administration Agreement with Oxford Funds, under which we have agreed to reimburse Oxford Funds for our allocable portion of overhead and other expenses incurred by Oxford Funds in performing its obligations under the Administration Agreement, including furnishing us with office facilities, equipment and clerical, bookkeeping and record keeping services at such facilities, as well as providing us with other administrative services. See “Administration Agreement” in the accompanying prospectus.

Oxford Funds also serves as the managing member of Oxford Lane Management. Messrs. Cohen and Rosenthal, in turn, serve as the managing member and non-managing member, respectively, of Oxford Funds.

Our Corporate Information

Our offices are located at 8 Sound Shore Drive, Suite 255, Greenwich, CT 06830, and our telephone number is (203) 983-5275.

Where You Can Find Additional Information

We have filed with the Securities and Exchange Commission, or “SEC,” a registration statement on Form N-2ASR together with all amendments and related exhibits under the Securities Act of 1933, as amended (the “Securities Act”). The registration statement contains additional information about us and the securities being offered by this prospectus supplement and the accompanying prospectus.

We are required to file with or submit to the SEC annual and semi-annual reports, proxy statements and other information meeting the informational requirements of the Securities Exchange Act of 1934, as amended. The SEC maintains an Internet site that contains reports, proxy and information statements and other information filed electronically by us with the SEC which are available on the SEC’s website at http://www.sec.gov. Copies of these reports, proxy and information statements and other information may be obtained, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov. This information is also available free of charge by contacting us at Oxford Lane Capital Corp., 8 Sound Shore Drive, Suite 255, Greenwich, CT 06830, by telephone at (203) 983-5275, or on our website at http://www.oxfordlanecapital.com. Information contained on our website or on the SEC’s website about us is not incorporated into this prospectus supplement or the accompanying prospectus, and you should not consider information contained on our website or on the SEC’s website to be part of this prospectus supplement or the accompanying prospectus.

S-7

Table of Contents

Recent Developments

OCTOBER 2024 FINANCIAL UPDATE

On November 8, 2024, we announced the following net asset value estimate as of October 31, 2024.

• Management’s unaudited estimate of the range of the net asset value per share of our common stock as of October 31, 2024, is between $4.82 and $4.92. This estimate is not a comprehensive statement of our financial condition or results for the month ended October 31, 2024. This estimate did not undergo the Company’s typical quarter-end financial closing procedures and was not approved by the Company’s board of directors. We advise you that our net asset value per share for the quarter ending December 31, 2024 may differ materially from this estimate, which is given only as of October 31, 2024.

• As of October 31, 2024, the Company had approximately 345.9 million shares of common stock issued and outstanding.

The fair value of the Company’s portfolio investments may be materially impacted after October 31, 2024, by circumstances and events that are not yet known. To the extent the Company’s portfolio investments are impacted by market volatility in the U.S. or worldwide, the Company may experience a material impact on its future net investment income, the fair value of its portfolio investments, its financial condition and the financial condition of its portfolio investments. Investing in our securities involves a number of significant risks. For a discussion of the additional risks applicable to an investment in our securities, please refer to the section titled “Risk Factors” in the accompanying prospectus and the section titled “Principal Risks” in our most recent annual report or semi-annual report, as applicable.

The preliminary financial data included in this prospectus supplement has been prepared by, and is the responsibility of, Oxford Lane Capital Corp.’s management. PricewaterhouseCoopers LLP has not audited, reviewed, compiled, or applied agreed-upon procedures with respect to the preliminary financial data. Accordingly, PricewaterhouseCoopers LLP does not express an opinion or any other form of assurance with respect thereto. The PricewaterhouseCoopers LLP report incorporated by reference relates to the Company’s previously issued financial statements. It does not extend to the preliminary financial data and should not be read to do so.

S-8

Table of Contents

THE OFFERING

Common stock offered by us | | Shares of our common stock having an aggregate offering price of up to $2,000,000,000. |

Common stock outstanding as of

November 7, 2024 | | 345,906,253 |

Manner of offering | | “At the market” offering that may be made from time to time through Lucid Capital Markets, LLC and Ladenburg Thalmann & Co. Inc., as sales agents using commercially reasonable efforts. See “Plan of Distribution.” |

Use of proceeds | | We intend to use the net proceeds from this offering for acquiring investments in accordance with our investment objective and strategies described in this prospectus supplement and the accompanying prospectus and/or for general working capital purposes. We may also choose to use the proceeds from this offering to pay distributions, in which case all or part of the distribution could be considered a return of capital if total distributions exceed the Company’s net investment income. Finally, we may also pay down any then existing indebtedness and/or redeem outstanding shares of our preferred stock or notes using the proceeds from this offering. We anticipate that substantially all of the net proceeds from the sale of shares pursuant to this offering will be used for the above purposes within approximately three months after the completion of any sale pursuant to this offering, depending on the availability of appropriate investment opportunities consistent with our investment objective and market conditions. See “Use of Proceeds.” |

Distributions | | To the extent that we have income available, we intend to distribute monthly distributions to our common stockholders. The amount of our distributions, if any, will be determined by our Board of Directors. Any distributions to our stockholders will be declared out of assets legally available for distribution. The specific tax characteristics of our distributions will be reported to stockholders after the end of each calendar year. See “Price Range of Common Stock” in the accompanying prospectus and our most recently filed annual or semi-annual report on Form N-CSR. |

Taxation | | We have elected to be treated for U.S. federal income tax purposes as a RIC under Subchapter M of the Code. As a RIC, we generally do not have to pay corporate-level U.S. federal income taxes on any ordinary income or capital gains that we distribute to our stockholders as dividends. To maintain our RIC tax treatment, we must meet specified source-of-income and asset diversification requirements and distribute annually at least 90% of our ordinary income and realized net short-term capital gains in excess of realized net long-term capital losses, if any. See “Price Range of Common Stock” in the accompanying prospectus and “Certain U.S. Federal Income Tax Considerations” in the accompanying prospectus. |

NASDAQ Global Select Market symbol of common stock | | “OXLC” |

Trading | | Shares of closed-end investment companies frequently trade at a discount to their net asset value. The risk that our shares may trade at a discount to our net asset value is separate and distinct from the risk that our net asset value per share may decline. We cannot predict whether our common stock will trade above, at or below net asset value. See “Principal Risks” in our most recent annual or semi-annual report on Form N-CSR, incorporated by reference herein, and under similar headings in the documents that we file with the SEC. |

S-9

Table of Contents

Risk factors | | An investment in our common stock is subject to risks and involves a heightened risk of total loss of investment. In addition, the companies in which we invest are subject to special risks. See “Principal Risks” in our most recent annual or semi-annual report on Form N-CSR, incorporated by reference herein, and under similar headings in the documents that we file with the SEC, to read about factors you should consider, including the risk of leverage, before investing in our common stock. |

S-10

Table of Contents

FEES AND EXPENSES

The following table is intended to assist you in understanding the costs and expenses that you will bear directly or indirectly. We caution you that some of the percentages indicated in the table below are estimates and may vary. Except where the context suggests otherwise, whenever this prospectus supplement and the accompanying prospectus contains a reference to fees or expenses paid by “us” or “Oxford Lane Capital,” or that “we” will pay fees or expenses, you will indirectly bear such fees or expenses as an investor in Oxford Lane Capital Corp.

Stockholder transaction expenses: | | |

Sales load (as a percentage of offering price) | | 2.00 | %(1) |

Offering expenses borne by us (as a percentage of offering price) | | 0.20 | %(2) |

Distribution reinvestment plan expenses | | — | (3) |

Total stockholder transaction expenses (as a percentage of offering price) | | 2.20 | % |

| | | | |

Annual expenses (estimated as a percentage of net assets attributable to common stock): | | |

Base management fee | | 2.69 | %(4)(5) |

Incentive fees payable under our investment advisory agreement (20% of pre incentive fee net investment income) | | 3.67 | %(6) |

Interest payments on borrowed funds | | 1.99 | %(7)(8) |

Other expenses | | 0.56 | %(9) |

Total annual expenses | | 8.91 | %(10) |

Example

The following example demonstrates the projected dollar amount of total cumulative expenses that would be incurred over various periods with respect to a hypothetical investment in our common stock. In calculating the following expense amounts, we have assumed that our annual operating expenses would remain at the levels set forth in the table above, and that we pay the transaction expenses set forth in the table above, including a sales load of 2.00% paid by you (the commission to be paid by us with respect to common stock sold by us in this offering).

| | 1 Year | | 3 Years | | 5 Years | | 10 Years |

You would pay the following expenses on a $1,000 investment, assuming a 5% annual return | | $ | 128 | | $ | 320 | | $ | 489 | | $ | 829 |

The example and the expenses in the tables above should not be considered as a representation of our future expenses, and actual expenses may be greater or less than those shown. While the example assumes, as required by the SEC, a 5.0% annual return, our performance will vary and may result in a return greater or less than 5.0%. The incentive fee under the Investment Advisory Agreement, which, assuming a 5.0% annual return, would either not be payable or would have an insignificant impact on the expense amounts shown above, is included in the example. Also, while the example assumes reinvestment of all distributions at net asset value, participants in our distribution reinvestment plan will receive a number of shares of our common stock, determined by dividing the total dollar amount of the distribution payable to a participant by the market price per share of our common stock at the close of trading on the distribution payment date, which may be at, above or below net asset value. See “Distribution Reinvestment Plan” in the accompanying prospectus for additional information regarding our distribution reinvestment plan.

S-11

Table of Contents

• no incentive fee is payable to Oxford Lane Management in any calendar quarter in which our Pre-Incentive Fee Net Investment Income does not exceed the Hurdle of 1.75%;

• 100% of our Pre-Incentive Fee Net Investment Income with respect to that portion of such Pre-Incentive Fee Net Investment Income, if any, that exceeds the Hurdle but is less than 2.1875% in any calendar quarter (8.75% annualized) is payable to Oxford Lane Management. We refer to this portion of our Pre-Incentive Fee Net Investment Income (which exceeds the Hurdle but is less than 2.1875%) as the “catch-up.” The “catch-up” is meant to provide Oxford Lane Management with 20.0% of our Pre-Incentive Fee Net Investment Income, as if a Hurdle did not apply when our Pre-Incentive Fee Net Investment Income exceeds 2.1875% in any calendar quarter; and

• 20.0% of the amount of our Pre-Incentive Fee Net Investment Income, if any, that exceeds 2.1875% in any calendar quarter (8.75% annualized) is payable to Oxford Lane Management (once the Hurdle is reached and the catch-up is achieved, 20.0% of all Pre-Incentive Fee Investment Income thereafter is allocated to Oxford Lane Management).

S-12

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, contain forward-looking statements that involve substantial risks and uncertainties. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about our business, our current and prospective portfolio investments, our industry, our beliefs, and our assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “will,” “may,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “should,” “targets,” “projects,” and variations of these words and similar expressions are intended to identify forward-looking statements.

The forward-looking statements contained in this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, involve risks and uncertainties, including statements as to:

• our future operating results, including our ability to achieve objectives;

• our business prospects and the prospects of a CLO vehicle’s portfolio companies;

• the impact of investments that we expect to make;

• our contractual arrangements and relationships with third parties;

• the dependence of our future success on the general economy and its impact on the industries in which we invest;

• market conditions and our ability to access alternative debt markets and additional debt and equity capital;

• the ability of a CLO vehicle’s portfolio companies to achieve their objectives;

• the valuation of our investments in CLOs, particularly those having no liquid trading market;

• our expected financings and investments;

• the ability of Oxford Lane Management to locate suitable investments for us and to monitor and administer our investments;

• the adequacy of our cash resources and working capital; and

• the timing of cash flows, if any, from our investments.

These statements are not guarantees of future performance and are subject to risks, uncertainties, and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, including without limitation:

• an economic downturn could impair the ability of a CLO vehicle’s portfolio companies to continue to operate, which could lead to the loss of some or all of our investment in such CLO vehicle;

• a contraction of available credit and/or an inability to access the equity markets could impair our investment activities;

• interest rate volatility could adversely affect our results, particularly if we elect to use leverage as part of our investment strategy;

• currency fluctuations could adversely affect the results of our investments in foreign companies, particularly to the extent that we receive payments denominated in foreign currency rather than U.S. dollars;

• the impact of information technology system failures, data security breaches, data privacy compliance, network disruptions and cybersecurity attacks; and

• the risks, uncertainties and other factors we identify in “Risk Factors” in the accompanying prospectus and in our filings with the SEC.

S-13

Table of Contents

Although we believe that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. Important assumptions include our ability to originate new investments, certain margins and levels of profitability and the availability of additional capital. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this prospectus supplement or the accompanying prospectus should not be regarded as a representation by us that our plans and objectives will be achieved. These risks and uncertainties include those described or identified in “Risk Factors” in the accompanying prospectus and elsewhere in this prospectus supplement and the accompanying prospectus, including any subsequent SEC filings incorporated by reference to this prospectus supplement or the accompanying prospectus. You should not place undue reliance on these forward-looking statements, which are based on information available to us as of the applicable dates of this prospectus supplement and the accompanying prospectus, including any documents incorporated by reference to this prospectus supplement or the accompanying prospectus, and while we believe such information forms, or will form, a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely on these statements.

However, we will update this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein to reflect any material changes to the information contained herein. The forward-looking statements contained in this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, are excluded from the safe harbor protection provided by Section 27A of the Securities Act.

S-14

Table of Contents

USE OF PROCEEDS

Sales of our common stock, if any, under this prospectus supplement and the accompanying prospectus may be made in negotiated transactions or transactions that are deemed to be “at the market,” as defined in Rule 415 under the Securities Act, including sales made directly on the NASDAQ Global Select Market or similar securities exchange or sales made to or through a market maker other than on an exchange, at prices related to the prevailing market prices or at negotiated prices. There is no guarantee that there will be any sales of our common stock pursuant to this prospectus supplement and the accompanying prospectus. Actual sales, if any, of our common stock under this prospectus supplement and the accompanying prospectus may be less than the amount set forth in this paragraph depending on, among other things, the market price of our common stock at the time of any such sale. As a result, the actual net proceeds we receive may be more or less than the amount of net proceeds estimated in this prospectus supplement. However, the sales price per share of our common stock offered by this prospectus supplement and the accompanying prospectus, less the Distribution Agent’s commission, will not be less than the net asset value per share of our common stock at the time of such sale. If we sell shares of our common stock with an aggregate offering price of $2.0 billion, we anticipate that our net proceeds, after deducting sales agent commissions and estimated expenses payable by us, will be approximately $1.96 billion.

We intend to use the net proceeds from this offering for acquiring investments in accordance with our investment objective and strategies described in this prospectus supplement and the accompanying prospectus and for general working capital purposes. We may choose to use the proceeds from this offering to pay distributions, in which case all or part of the distribution could be considered a return of capital if total distributions exceed the Company’s net investment income. Finally, we may also pay down any then existing indebtedness and/or redeem outstanding shares of our preferred stock or notes using the proceeds from this offering. We anticipate that substantially all of the net proceeds from the sale of shares pursuant to this offering will be used for the above purposes within approximately three months after completion of any sale pursuant to this offering, depending on the availability of appropriate investment opportunities consistent with our investment objective and market conditions. We cannot assure you we will achieve our targeted investment pace.

Pending such investments, we will invest the net proceeds primarily in cash, cash equivalents, U.S. government securities and other high-quality investments that mature in one year or less from the date of investment. The management fee payable by us will not be reduced while our assets are invested in such securities. See “Regulation as a Registered Closed-End Management Investment Company — Temporary Investments” in the accompanying prospectus for additional information about temporary investments we may make while waiting to make longer-term investments in pursuit of our investment objective.

S-15

Table of Contents

PLAN OF DISTRIBUTION

The Distribution Agents are acting as our sales agents in connection with the offer and sale of shares of our common stock pursuant to this prospectus supplement and the accompanying prospectus. Upon written instructions from us, the Distribution Agents will use their commercially reasonable efforts consistent with their normal trading and sales practices to sell, as our sales agents, our common stock under the terms and subject to the conditions set forth in the Equity Distribution Agreement.

We will instruct one or both Distribution Agents as to the amount of common stock to be sold by them. We may instruct the Distribution Agents not to sell common stock if the sales cannot be effected at or above the price designated by us in any instruction. The sales price per share of our common stock offered by this prospectus supplement and the accompanying prospectus, less the Distribution Agent’s commission, will not be less than the net asset value per share of our common stock at the time of such sale. We or the Distribution Agents may suspend the offering of shares of common stock upon proper notice and subject to other conditions.

Sales of our common stock, if any, under this prospectus supplement and the accompanying prospectus may be made in privately negotiated transactions or transactions that are deemed to be “at the market,” as defined in Rule 415 under the Securities Act, including sales made directly on the NASDAQ Global Select Market or similar securities exchange or sales made to or through a market maker other than on an exchange at prices related to the prevailing market prices or at negotiated prices.

The Distribution Agents will provide written confirmation of a sale to us no later than the opening of the trading day on the NASDAQ Global Select Market following each trading day in which shares of our common stock are sold under the Equity Distribution Agreement. Each confirmation will include the number of shares of common stock sold on the preceding day, the net proceeds to us and the compensation payable by us to the Distribution Agents in connection with the sales.

The Distribution Agents will receive a commission from us equal to the lesser of (i) 2.0% of the gross sales price per share from such sale or (ii) the difference between the gross sale price per share from such sale and the amount the Company, in its sole discretion, determines to be its minimum net amount, with respect to any shares of our common stock sold through such Distribution Agent under the Equity Distribution Agreement. Oxford Lane Management has agreed to pay to the Distribution Agents, if necessary, a supplemental payment per share that will reflect the difference between the public offering price per share and the net proceeds per share received by us in this offering such that the net proceeds per share received by us (before expenses) are not below our then current net asset value per share. We estimate that the total expenses for the offering, excluding compensation payable to the Distribution Agents under the terms of the Equity Distribution Agreement, will be approximately $429,500.

Settlement for sales of shares of common stock will occur on the trading day following the date on which such sales are made, or on some other date that is agreed upon by us and the Distribution Agents in connection with a particular transaction, in return for payment of the net proceeds to us. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

We will report at least quarterly the number of shares of our common stock sold through the Distribution Agents under the Equity Distribution Agreement and the net proceeds to us.

In connection with the sale of the common stock on our behalf, the Distribution Agents may each be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation of the Distribution Agents may be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution to the Distribution Agents against certain civil liabilities, including liabilities under the Securities Act.

The offering of our shares of common stock pursuant to the Equity Distribution Agreement will terminate upon the earlier of (i) the sale of the dollar amount of common stock subject to the Equity Distribution Agreement or (ii) the termination of the Equity Distribution Agreement. The Equity Distribution Agreement may be terminated by us in our sole discretion with respect to one or both Distribution Agents under the circumstances specified in the Equity Distribution Agreement by giving notice to the applicable Distribution Agent. In addition, each Distribution Agent may terminate its participation in the Equity Distribution Agreement under the circumstances specified in the Equity Distribution Agreement by giving notice to us.

S-16

Table of Contents

Potential Conflicts of Interest

The Distribution Agents and their affiliates are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage activities. The Distribution Agents and their affiliates have, from time to time, performed, and may in the future perform, various financial advisory and investment banking services for us, for which they received or will receive customary fees and reimbursement of expenses, including acting as underwriters for our securities offerings. In the ordinary course of their various business activities, the Distribution Agents and their affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers and such investment and securities activities may involve securities and/or instruments of our business. The Distribution Agents and their affiliates may also make investment recommendations and/or publish or express independent research views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

The principal business address of Lucid Capital Markets, LLC is 570 Lexington Avenue, 40th Floor, New York, New York 10022 and the principal business address of Ladenburg Thalmann & Co. Inc. is 640 Fifth Avenue, 4th Floor, New York, New York 10019.

S-17

Table of Contents

LEGAL MATTERS

Certain legal matters in connection with the securities offered hereby will be passed upon for us by Dechert LLP, Washington, DC. Certain legal matters in connection with the offering of the securities will be passed upon for the sales agents by Blank Rome LLP, New York, New York.

EXPERTS

The financial statements as of March 31, 2024 and for the year ended March 31, 2024 included in the accompanying prospectus have been so included in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

AVAILABLE INFORMATION

We have filed with the SEC a registration statement on Form N-2ASR together with all amendments and related exhibits under the Securities Act. The registration statement contains additional information about us and the securities being offered by this prospectus supplement and the accompanying prospectus.

We are required to file with or submit to the SEC annual and semi-annual reports, proxy statements and other information meeting the informational requirements of the Exchange Act. The SEC maintains an Internet site that contains reports, proxy and information statements and other information filed electronically by us with the SEC which are available on the SEC’s website at http://www.sec.gov. Copies of these reports, proxy and information statements and other information may be obtained, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov. This information is also available free of charge by contacting us at Oxford Lane Capital Corp., 8 Sound Shore Drive, Suite 255, Greenwich, CT 06830, by telephone at (203) 983-5275, or on our website at http://www.oxfordlanecapital.com. Information contained on our website or on the SEC’s website about us is not incorporated into this prospectus supplement, except for documents incorporated by reference to this prospectus supplement or the accompanying prospectus.

S-18

Table of Contents

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

This prospectus supplement is part of a registration statement that we have filed with the SEC (File Nos. 333-283109 and 811-22432). We are permitted to “incorporate by reference” the information in documents that we file with the SEC, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference herein is considered to be part of this prospectus supplement, and later information that we file with the SEC will automatically update and supersede this information.

We incorporate by reference the documents listed below, and any reports and other documents we subsequently file with the SEC, pursuant to Section 30(b)(2) of the 1940 Act and Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, after the date of this prospectus supplement until all of the securities offered by this prospectus supplement and the accompanying prospectus have been sold or we otherwise terminate the offering of these securities; provided, however, that any document, report, exhibit (or portion of any of the foregoing) or other information “furnished” to the SEC pursuant to the Exchange Act shall not be incorporated by reference into this prospectus supplement (unless specifically set forth in such filing):

• our Annual Report on Form N-CSR for the fiscal year ended March 31, 2024, filed with the SEC on May 17, 2024;

• our Semi-Annual Report on Form N-CSRS for the six months ended September 30, 2024, filed with the SEC on November 1, 2024;

• our Definitive Proxy Statement on Schedule 14A for the annual meeting of the stockholders, filed with the SEC on September 6, 2024;

• the description of our Common Stock referenced in our Registration Statement on Form 8-A, as filed with the SEC on January 19, 2011, including any amendment or report filed for the purpose of updating such description prior to the termination of the offering of the common stock registered hereby;

• the description of our Series 2027 Term Preferred Shares referenced in our Registration Statement on Form 8-A, as filed with the SEC on February 7, 2020 including any amendment or report filed for the purpose of updating such description prior to the termination of the offering of the preferred stock registered hereby;

• the description of our 6.75% Notes due 2031 referenced in our Registration Statement on Form 8-A, as filed with the SEC on March 16, 2021 including any amendment or report filed for the purpose of updating such description prior to the termination of the offering of the notes registered hereby;

• the description of our 6.00% Series 2029 Term Preferred Shares referenced in our Registration Statement on Form 8-A, as filed with the SEC on August 17, 2021, including any amendment or report filed for the purpose of updating such description prior to the termination of the offering of the preferred stock registered hereby;

• the description of our 5.00% Notes due 2027 referenced in our Registration Statement on Form 8-A, as filed with the SEC on January 13, 2022 including any amendment or report filed for the purpose of updating such description prior to the termination of the offering of the notes registered hereby;

• the description of our 7.125% Series 2029 Term Preferred Shares referenced in our Registration Statement on Form 8-A, as filed with the SEC on June 16, 2022, including any amendment or report filed for the purpose of updating such description prior to the termination of the offering of the preferred stock registered hereby;

• the description of our 8.75% Notes due 2030 referenced in our Registration Statement on Form 8-A, as filed with the SEC on July 8, 2024, including any amendment or report filed for the purpose of updating such description prior to the termination of the offering of the preferred stock registered hereby; and

• our Current Report on Form 8-K (other than information furnished rather than filed) filed with the SEC on July 31, 2024.

S-19

Table of Contents

Our periodic reports filed pursuant to Section 30(b)(2) of the 1940 Act and Sections 13 or 15(d) of the Exchange Act, as well as this prospectus supplement and the accompanying prospectus, are available on our website at www.oxfordlanecapital.com. Information contained on our website is not incorporated into this prospectus supplement, except for documents specifically incorporated by reference into this prospectus supplement or the accompanying prospectus. You may also request a copy of these filings (other than exhibits, unless the exhibits are specifically incorporated by reference into these documents) at no cost by writing or calling Investor Relations at the following address and telephone number:

Oxford Lane Capital Corp.

8 Sound Shore Drive

Suite 255

Greenwich, Connecticut

(203) 983-5275

You should rely only on the information incorporated by reference into or provided in this prospectus supplement or the accompanying prospectus. We have not authorized anyone to provide you with different or additional information, and you should not rely on such information if you receive it. We are not making an offer of or soliciting an offer to buy, any securities in any state or other jurisdiction where such offer or sale is not permitted. You should not assume that the information in this prospectus supplement, the accompanying prospectus or in the documents incorporated by reference herein is accurate as of any date other than the date on the front of this prospectus supplement, the accompanying prospectus or those documents.

S-20

Table of Contents

PROSPECTUS

Oxford Lane Capital Corp.

Common Stock

Preferred Stock

Subscription Rights

Debt Securities

__________________________________________

We are a closed-end management investment company that has registered as an investment company under the Investment Company Act of 1940, or the “1940 Act.” Our investment objective is to maximize our portfolio’s risk-adjusted total return. We have implemented our investment objective by purchasing portions of equity and junior debt tranches of collateralized loan obligation, or “CLO,” vehicles. Structurally, CLO vehicles are entities formed to originate and/or acquire a portfolio of loans.

An investment in our securities is subject to significant risks and involves a heightened risk of total loss of investment. The price of shares of our common stock may be highly volatile and our common stock may frequently trade at a discount to our net asset value. The interests of the CLO securities in which we invest are subject to a high degree of special risks, including: CLO structures are highly complicated and may be subject to disadvantageous tax treatment; CLO vehicles are highly levered (with CLO equity securities typically being leveraged between nine and thirteen times) and are made up of below investment grade loans in which we typically have a residual interest that is much riskier than the loans that make up the CLO vehicle; and the market price for CLO vehicles may fluctuate dramatically, which may make portfolio valuations unreliable and negatively impact our net asset value and our ability to make distributions to our stockholders. Some instruments issued by CLO vehicles may not be readily marketable and may be subject to restrictions on resale. Securities issued by CLO vehicles are generally not listed on any U.S. national securities exchange and no active trading market may exist for the securities of CLO vehicles in which we may invest. Although a secondary market may exist for our investments in CLO vehicles, the market for our investments in CLO vehicles may be subject to irregular trading activity, wide bid/ask spreads and extended trade settlement periods. As a result, these types of investments may be more difficult to value. See “Risk factors” beginning on page 15 to read about factors you should consider, including risk of leverage, before investing in our securities.

We may offer, from time to time, in one or more offerings or series, our common stock, preferred stock, subscription rights to purchase shares of our common stock or debt securities, which we refer to, collectively, as our “securities.” The preferred stock, subscription rights and debt securities offered hereby may be convertible or exchangeable into shares of our common stock. The securities may be offered at prices and on terms to be described in one or more supplements to this prospectus.

In the event we offer common stock, the offering price per share of our common stock less any underwriting discounts or commissions will generally not be less than the net asset value per share of our common stock at the time we make the offering. However, we may issue shares of our common stock pursuant to this prospectus at a price per share that is less than our net asset value per share (i) in connection with a rights offering to our existing stockholders, (ii) with the prior approval of the majority (as defined in the 1940 Act) of our common stockholders or (iii) under such other circumstances as the Securities and Exchange Commission, or the “SEC,” may permit.

Our securities may be offered directly to one or more purchasers, or through agents designated from time to time by us, or to or through underwriters or dealers. Each prospectus supplement relating to an offering will identify any agents or underwriters involved in the sale of our securities, and will disclose any applicable purchase price, fee, discount or commissions arrangement between us and our agents or underwriters or among our underwriters or the