UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22649

iShares U.S. ETF Trust

(Exact name of registrant as specified in charter)

c/o: State Street Bank and Trust Company

100 Summer Street, 4th Floor, Boston, MA 02110

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 670-2000

Date of fiscal year end: July 31, 2021

Date of reporting period: July 31, 2021

| Item 1. | Reports to Stockholders. |

(a) The Report to Shareholders is attached herewith.

| | |

| | JULY 31, 2021 |

iShares U.S. ETF Trust

| · | | iShares Evolved U.S. Consumer Staples ETF | IECS | Cboe BZX |

| · | | iShares Evolved U.S. Discretionary Spending ETF | IEDI | Cboe BZX |

| · | | iShares Evolved U.S. Financials ETF | IEFN | Cboe BZX |

| · | | iShares Evolved U.S. Healthcare Staples ETF | IEHS | Cboe BZX |

| · | | iShares Evolved U.S. Innovative Healthcare ETF | IEIH | Cboe BZX |

| · | | iShares Evolved U.S. Media and Entertainment ETF | IEME | Cboe BZX |

| · | | iShares Evolved U.S. Technology ETF | IETC | Cboe BZX |

The Markets in Review

Dear Shareholder,

The 12-month reporting period as of July 31, 2021 was a remarkable period of adaptation and recovery, as the global economy dealt with the implications of the coronavirus (or “COVID-19”) pandemic. The United States, along with most of the world, began the reporting period emerging from a severe recession, prompted by pandemic-related restrictions that disrupted many aspects of daily life. However, easing restrictions and robust government intervention led to a strong rebound, and the economy grew at a significant pace for the reporting period, eventually regaining the output lost from the pandemic.

Equity prices rose with the broader economy, as strong fiscal and monetary support, as well as the development of vaccines, made investors increasingly optimistic about the economic outlook. The implementation of mass vaccination campaigns and passage of two additional fiscal stimulus packages further boosted stocks, and many equity indices neared or surpassed all-time highs late in the reporting period. In the United States, returns of small-capitalization stocks, which benefited the most from the resumption of in-person activities, outpaced large-capitalization stocks. International equities also gained, as both developed and emerging markets rebounded substantially.

The 10-year U.S. Treasury yield (which is inversely related to bond prices) had fallen sharply prior to the beginning of the reporting period, which meant bonds were priced for extreme risk avoidance and economic disruption. Despite expectations of doom and gloom, the economy expanded rapidly, stoking inflation concerns in early 2021, which led to higher yields and a negative overall return for most U.S. Treasuries. In the corporate bond market, support from the U.S. Federal Reserve (the “Fed”) assuaged credit concerns and led to solid returns for high-yield corporate bonds, although investment-grade corporates declined slightly.

The Fed remained committed to accommodative monetary policy by maintaining near zero interest rates and by reiterating that inflation could exceed its 2% target for a sustained period without triggering a rate increase. In response to rising inflation late in the period, the Fed changed its market guidance, raising the likelihood of less bond purchasing and the possibility of higher rates in 2023.

Looking ahead, we believe that the global expansion will continue to broaden as Europe and other developed market economies gain momentum, although the delta variant remains a threat, particularly in emerging markets. While we expect inflation to remain elevated in the medium-term as the expansion continues, we believe the recent uptick owes more to temporary supply disruptions than a lasting change in fundamentals. The change in Fed policy also means that moderate inflation is less likely to be followed by interest rate hikes that could threaten the economic expansion.

Overall, we favor a moderately positive stance toward risk, with an overweight in equities. Sectors that are better poised to manage the transition to a lower-carbon world, such as technology and healthcare, are particularly attractive in the long-term. U.S. small-capitalization stocks and European equities are likely to benefit from the continuing vaccine-led restart. We are underweight long-term credit, but inflation-protected U.S. Treasuries, Asian fixed income, and Chinese government bonds offer potential opportunities. We believe that international diversification and a focus on sustainability can help provide portfolio resilience, and the disruption created by the coronavirus appears to be accelerating the shift toward sustainable investments.

In this environment, our view is that investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit iShares.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock, Inc.

Rob Kapito

President, BlackRock, Inc.

| | | | |

Total Returns as of July 31, 2021 |

| | | 6-Month | | 12-Month |

U.S. large cap equities

(S&P 500® Index) | | 19.19% | | 36.45% |

U.S. small cap equities

(Russell 2000® Index) | | 7.86 | | 51.97 |

International equities

(MSCI Europe, Australasia, Far East Index) | | 10.83 | | 30.31 |

Emerging market equities

(MSCI Emerging Markets Index) | | (2.76) | | 20.64 |

3-month Treasury bills

(ICE BofA 3-Month U.S. Treasury Bill Index) | | 0.02 | | 0.08 |

U.S. Treasury securities

(ICE BofA 10-Year U.S. Treasury Index) | | (0.59) | | (5.12) |

U.S. investment grade bonds

(Bloomberg Barclays U.S. Aggregate Bond Index) | | 0.21 | | (0.70) |

Tax-exempt municipal bonds (S&P Municipal Bond Index) | | 1.38 | | 3.47 |

U.S. high yield bonds (Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index) | | 3.66 | | 10.62 |

Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | |

| 2 | | THIS PAGE IS NOT PART OF YOUR FUND REPORT |

Table of Contents

Market Overview

iShares U.S. ETF Trust

Domestic Market Overview

U.S. stocks advanced for the 12 months ended July 31, 2021 (“reporting period”), when the Russell 3000® Index, a broad measure of U.S. equity market performance, returned 38.73%. Stocks continued to recover from the initial impact of the coronavirus pandemic, ending the reporting period near all-time highs. Supportive fiscal and monetary stimulus in combination with the development and distribution of effective coronavirus vaccines fueled economic recovery and drove strong stock market gains.

Two fiscal stimulus bills passed by Congress in December 2020 and in March 2021 provided significant relief in the form of direct payments to individuals, tax credits, aid to state and local governments, and assistance for homeowners and renters. Personal incomes rose significantly following the stimulus payments, and consumer spending recovered sharply, surpassing pre-pandemic levels by the end of the reporting period.

Action by the U.S. Federal Reserve (“the Fed”) also played a notable role in the recovery. Monetary policy remained accommodative, with short-term interest rates maintained near zero to encourage lending and stimulate economic activity. The Fed further acted to stabilize bond markets by continuing an unlimited, open-ended, bond-buying program for U.S. Treasuries and mortgage-backed securities. In August 2020, the Fed revised its long-standing inflation policy, allowing inflation to exceed the 2% target to stimulate the economy. However, the Fed announced late in the reporting period that it would begin reducing its portfolio of corporate debt, with plans to complete sales of its holdings by the end of 2021.

Development and distribution of coronavirus vaccines also boosted stocks. In November 2020, stocks rallied as several manufacturers announced that they had developed vaccines with high effectiveness rates. Widespread vaccine distribution got underway in 2021, and by the end of the reporting period more than 345 million vaccine doses were distributed in the U.S., and nearly 50% of the population was fully vaccinated. The ongoing vaccination program bolstered investors’ optimism that the economy could continue to grow as everyday life normalized.

The rebound in economic activity as pandemic-related restrictions eased and consumer spending increased led to strong economic growth during the reporting period. The U.S. economy grew at a record annualized pace of 33.8% in the third quarter of 2020, as activity rebounded from the pandemic-induced recession in the first half of 2020. Growth continued at a slower pace for the rest of the reporting period, finally surpassing pre-pandemic output levels in the second quarter of 2021.

Strong economic growth and rising consumer spending led to higher inflation, particularly in the second half of the reporting period. Investors’ inflation expectations increased significantly in early 2021, and year-over-year inflation reached 5.4% in June 2021, the highest level in more than 12 years. However, some analysts maintained that the rise in inflation was at least partially due to temporary disruptions in supply chains. The Fed stated in July 2021 that it believed inflation pressure was largely transitory and reaffirmed that it would allow inflation to run above its 2% goal for some time.

Despite substantial progress toward recovery, challenges remained. Although unemployment declined significantly during the reporting period, decreasing from 8.4% to 5.4%, the total number of employed workers remained well below pre-pandemic levels despite a rise in job openings. Furthermore, a rise in coronavirus cases near the end of the reporting period due to the more-contagious Delta variant raised concerns about the pace of economic recovery and led the U.S. to maintain certain travel restrictions.

| | |

| 4 | | 2 0 2 1 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of July 31, 2021 | | iShares® Evolved U.S. Consumer Staples ETF |

Investment Objective

The iShares Evolved U.S. Consumer Staples ETF (the “Fund”) seeks to provide access to U.S. companies with consumer staples exposure, as classified using a proprietary classification system. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index.

Performance

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | | | | | | | | | | |

| | | | | |

| | | 1 Year | | | Since Inception | | | | | | 1 Year | | | Since Inception | |

| |

| | | | | |

Fund NAV | | | 20.76% | | | | 12.27% | | | | | | | | 20.76% | | | | 47.61% | |

Fund Market | | | 20.65 | | | | 12.23 | | | | | | | | 20.65 | | | | 47.42 | |

S&P Total Market IndexTM | | | 38.93 | | | | 17.52 | | | | | | | | 38.93 | | | | 71.98 | |

| |

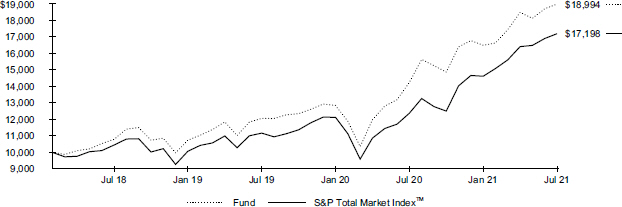

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 3/21/18. The first day of secondary market trading was 3/23/18.

The S&P Total Market IndexTM is an unmanaged index designed to track the broad equity market, including large-, mid-, small-, and micro-cap stocks.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 19 for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | |

| | | | | | | |

| Beginning

Account Value

(02/01/21) |

| |

| Ending

Account Value

(07/31/21) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(02/01/21) |

| |

| Ending

Account Value

(07/31/21) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | |

| $ | 1,000.00 | | | $ | 1,136.70 | | | $ | 0.95 | | | | | | | $ | 1,000.00 | | | $ | 1,023.90 | | | $ | 0.90 | | | | 0.18% | |

| | |

| | (a) | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (181 days) and divided by the number of days in the year (365 days). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Shareholder Expenses” on page 19 for more information. | |

| | |

| Fund Summary as of July 31, 2021 (continued) | | iShares® Evolved U.S. Consumer Staples ETF |

Portfolio Management Commentary

Consumer staples stocks rose during the reporting period as demand for essentials rose sharply during the coronavirus pandemic. Despite vaccine rollouts and record personal savings prompting a resurgence in nonessential spending during the second half of the reporting period, many consumer staples companies continued to benefit from uncertainties related to the COVID-19 delta variant. The tendency for consumer staples companies to be non-cyclical and offer reliable dividends, along with an increase in remote work, provided additional appeal for the sector.

Soda and beverage companies contributed the most to the Fund’s return, including Coca-Cola and PepsiCo, which rebounded with strong earnings and revenue growth. Sales of many carbonated beverages dropped significantly early in the reporting period, however new marketing strategies and e-commerce initiatives, along with restaurant re-openings helped the industry to recover from pandemic-related declines. While consumers’ shift away from traditional carbonated soft drinks began before the pandemic, expanded product offerings, including naturally flavored beverages and sparkling waters, helped companies pivot toward customers’ growing health and wellness preferences.

Consumer food companies, such as Mondelez International and Hershey Foods, also contributed to the Fund’s return, with both companies posting increased net revenues and improving operating incomes. Investors expected both companies to benefit from new product launches and consumers’ return to social gatherings.

Stocks of tobacco product manufacturers, including Altria and Philip Morris International, advanced as they announced strong quarterly earnings. Elevated stress levels related to the pandemic, coupled with working from home, which enabled more smoke breaks, drove an increase in tobacco usage. However, global cigarette use declined overall, prompting large tobacco manufacturers to invest in alternative products such as electronic cigarettes.

The Fund’s evolved investment process looks beyond the traditional sector definitions by applying machine learning and natural language processing to group individual companies with related business activity. During the reporting period, the evolved process identified several consumer staples companies with similar businesses that have traditionally been categorized in other sectors. For example, the Fund held positions in Starbucks, McDonalds, and Chipotle Mexican Grill, which are typically classified as companies in the consumer discretionary sector. These global quick service restaurant companies rebounded quickly from losses related to pandemic restrictions, effectively utilizing their digital, drive-through, and take-out services.

Portfolio Information

ALLOCATION BY SECTOR

| | | | |

| | |

| Sector | |

| Percent of

Total Investments |

(a) |

| |

Beverages | | | 30.9 | % |

Food | | | 22.9 | |

Retail | | | 13.5 | |

Agriculture | | | 11.7 | |

Cosmetics & Personal Care | | | 10.2 | |

Packaging & Containers | | | 2.8 | |

Pharmaceuticals | | | 1.9 | |

Real Estate Investment Trusts | | | 1.8 | |

Household Products & Wares | | | 1.8 | |

Chemicals | | | 1.1 | |

Other (each representing less than 1%) | | | 1.4 | |

| | (a) | Excludes money market funds. | |

TEN LARGEST HOLDINGS

| | | | |

| | |

| Security | |

| Percent of

Total Investments |

(a) |

| |

Coca-Cola Co. (The) | | | 11.8 | % |

PepsiCo Inc. | | | 10.6 | |

Procter & Gamble Co. (The) | | | 7.9 | |

Philip Morris International Inc. | | | 5.1 | |

Starbucks Corp. | | | 4.7 | |

Mondelez International Inc., Class A | | | 4.6 | |

McDonald’s Corp. | | | 4.6 | |

Altria Group Inc. | | | 4.0 | |

General Mills Inc. | | | 3.0 | |

Monster Beverage Corp. | | | 2.8 | |

| | |

| 6 | | 2 0 2 1 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of July 31, 2021 | | iShares® Evolved U.S. Discretionary Spending ETF |

Investment Objective

The iShares Evolved U.S. Discretionary Spending ETF (the “Fund”) seeks to provide access to U.S. companies with discretionary spending exposure, as classified using a proprietary classification system. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index.

Performance

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | | | | | | | | | | |

| | | | | |

| | | 1 Year | | | Since Inception | | | | | | 1 Year | | | Since Inception | |

| |

| | | | | |

Fund NAV | | | 33.32% | | | | 21.01% | | | | | | | | 33.32% | | | | 89.94% | |

Fund Market | | | 33.33 | | | | 21.00 | | | | | | | | 33.33 | | | | 89.89 | |

S&P Total Market IndexTM | | | 38.93 | | | | 17.52 | | | | | | | | 38.93 | | | | 71.98 | |

| |

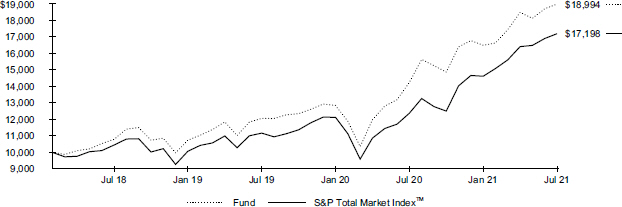

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 3/21/18. The first day of secondary market trading was 3/23/18.

The S&P Total Market IndexTM is an unmanaged index designed to track the broad equity market, including large-, mid-, small-, and micro-cap stocks.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 19 for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | |

| | | | | | | |

| Beginning

Account Value

(02/01/21) |

| |

| Ending

Account Value

(07/31/21) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(02/01/21) |

| |

| Ending

Account Value

(07/31/21) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | |

| $ | 1,000.00 | | | $ | 1,151.50 | | | $ | 0.96 | | | | | | | $ | 1,000.00 | | | $ | 1,023.90 | | | $ | 0.90 | | | | 0.18% | |

| | |

| | (a) | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (181 days) and divided by the number of days in the year (365 days). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Shareholder Expenses” on page 19 for more information. | |

| | |

| Fund Summary as of July 31, 2021 (continued) | | iShares® Evolved U.S. Discretionary Spending ETF |

Portfolio Management Commentary

Stocks related to U.S. discretionary spending advanced strongly for the reporting period, as the rollout of COVID-19 vaccination programs and easing pandemic-related restrictions boosted consumer demand. U.S. consumer spending rose as government stimulus checks, higher wages, and record household savings motivated Americans to spend more on nonessential goods and services.

Home improvement stores such as Home Depot and Lowe’s advanced strongly, as the robust housing market and stay-at-home consumers tackling do-it-yourself projects drove sales higher. Home Depot and Lowe’s also benefited from improving their e-commerce platforms, contributing to higher sales to consumers impacted by pandemic-related restrictions.

In addition to strong online sales, big box merchandise stores such as Target increased sales as consumers sought a safer in-person shopping experience during the pandemic by frequenting one-stop destinations that offer a wider variety of goods. Target posted strong earnings growth during the reporting period and gained market share against competitors.

The restaurant industry also gained as stimulus checks and easing pandemic restrictions encouraged consumers to dine out, driving the stock price of chains such as McDonald’s and Starbucks to record highs during the reporting period. The shift toward online shopping benefited the retail shoe industry, most notably Nike, which posted robust revenue gains, boosted by its e-commerce division. Sales of Nike’s athleisure clothing lines grew with home-bound consumers seeking a more casual, comfortable wardrobe.

The Fund’s evolved investment process looks beyond the traditional sector definitions by applying machine learning and natural language processing to group individual companies with related business activity. During the reporting period, the evolved process identified several companies with similar businesses that have traditionally been categorized in other sectors. For example, the Fund held positions in several warehouse general merchandise chains such as Costco and Walmart, which are generally classified as companies in the consumer staples sector. Sales surged for Costco as consumers stocked up on essential goods, such as toilet paper, cleaning supplies, and food, during the pandemic. This helped offset lost sales from Costco’s discretionary offerings such as travel services, the photo department, and its food court.

Portfolio Information

ALLOCATION BY SECTOR

| | | | |

| | |

| Sector | |

| Percent of

Total Investments |

(a) |

| |

Retail | | | 51.4 | % |

Internet | | | 20.5 | |

Apparel | | | 7.8 | |

Computers | | | 5.2 | |

Cosmetics & Personal Care | | | 4.3 | |

Lodging | | | 2.1 | |

Commercial Services | | | 1.5 | |

Food | | | 1.4 | |

Other (each representing less than 1%) | | | 5.8 | |

| | (a) | Excludes money market funds. | |

TEN LARGEST HOLDINGS

| | | | |

| | |

| Security | |

| Percent of

Total Investments |

(a) |

| |

Amazon.com Inc. | | | 16.4 | % |

Home Depot Inc. (The) | | | 7.7 | |

Walmart Inc. | | | 5.4 | |

Apple Inc. | | | 5.3 | |

Costco Wholesale Corp. | | | 5.0 | |

Nike Inc., Class B | | | 4.5 | |

Target Corp. | | | 3.8 | |

Procter & Gamble Co. (The) | | | 2.9 | |

McDonald’s Corp. | | | 2.8 | |

Lowe’s Companies Inc. | | | 2.8 | |

| | |

| 8 | | 2 0 2 1 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of July 31, 2021 | | iShares® Evolved U.S. Financials ETF |

Investment Objective

The iShares Evolved U.S. Financials ETF (the “Fund”) seeks to provide access to U.S. companies with financials exposure, as classified using a proprietary classification system. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index.

Performance

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | | | | | | | | | | |

| | | | | |

| | | 1 Year | | | Since Inception | | | | | | 1 Year | | | Since Inception | |

| |

| | | | | |

Fund NAV | | | 54.68% | | | | 9.14% | | | | | | | | 54.68% | | | | 34.22% | |

Fund Market | | | 54.61 | | | | 9.14 | | | | | | | | 54.61 | | | | 34.21 | |

S&P Total Market IndexTM | | | 38.93 | | | | 17.52 | | | | | | | | 38.93 | | | | 71.98 | |

| |

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 3/21/18. The first day of secondary market trading was 3/23/18.

Certain sectors and markets performed exceptionally well based on market conditions during the one-year period. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such exceptional returns will be repeated.

The S&P Total Market IndexTM is an unmanaged index designed to track the broad equity market, including large-, mid-, small-, and micro-cap stocks.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 19 for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | |

| | | | | | | |

| Beginning

Account Value

(02/01/21) |

| |

| Ending

Account Value

(07/31/21) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(02/01/21) |

| |

| Ending

Account Value

(07/31/21) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | |

| $ | 1,000.00 | | | $ | 1,258.30 | | | $ | 1.06 | | | | | | | $ | 1,000.00 | | | $ | 1,023.90 | | | $ | 0.95 | | | | 0.19% | |

| | |

| | (a) | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (181 days) and divided by the number of days in the year (365 days). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Shareholder Expenses” on page 19 for more information. | |

| | |

| Fund Summary as of July 31, 2021 (continued) | | iShares® Evolved U.S. Financials ETF |

Portfolio Management Commentary

Financials stocks advanced for the reporting period amid improving economic growth, rising inflation, and higher long-term interest rates. The banking industry was the leading contributor to the Fund’s performance. Constrained net interest margins (the difference between what a bank pays its depositors and earns from lending) due to low interest rates, weak demand for loans, and rising provisions for credit losses related to the coronavirus pandemic weighed on bank stocks early in the reporting period. However, fiscal stimulus, infrastructure spending, rising long-term yields, and a recovery of a portion of provisions for pandemic-related loan losses amid lower-than-expected loan defaults drove a strong recovery in bank stocks.

Large banks contributed the most to the Fund’s performance. For example, Wells Fargo benefited from cost reductions, analyst upgrades, and oversight reforms after incurring large legal liabilities from a false-accounts scandal. The continued economic recovery, strong financial markets, and growth in quarterly revenue added to the positive environment for Wells Fargo. Smaller banks also contributed. Investor sentiment for Truist Financial rose in response to solid quarterly earnings, driven by a significant increase in fee income, particularly in the company’s insurance business.

Financial services companies contributed significantly to the Fund’s return, as strength in capital markets activity benefited companies such as Morgan Stanley and Goldman Sachs. Asset managers also contributed. For example, Blackstone Group benefited from strong quarterly earnings due to higher asset sales across its real estate, private equity, and credit businesses.

The Fund’s evolved investment process looks beyond traditional sector definitions by applying machine learning and natural language processing to group individual companies with related business activity. During the reporting period, the evolved process identified several financials companies with similar businesses that have traditionally been categorized in other sectors. Among these were several information technology companies, including Fidelity National Information Services, a provider of technology solutions for merchants, banks, and capital markets firms, and Mastercard, which provides credit card services to banks. Both companies benefited from continued growth in the adoption of digital financial services and e-commerce. The process also identified healthcare companies, such as UnitedHealth Group, which advanced due to strength in its healthcare data analytics services unit.

Portfolio Information

ALLOCATION BY SECTOR

| | | | |

| | |

| Sector | |

| Percent of

Total Investments |

(a) |

| |

Banks | | | 43.1 | % |

Insurance | | | 23.1 | |

Diversified Financial Services | | | 17.0 | |

Commercial Services | | | 4.7 | |

Software | | | 2.9 | |

Health Care - Services | | | 2.7 | |

Pharmaceuticals | | | 1.8 | |

Savings & Loans | | | 1.2 | |

Private Equity | | | 1.1 | |

Other (each representing less than 1%) | | | 2.4 | |

| | (a) | Excludes money market funds. | |

TEN LARGEST HOLDINGS

| | | | |

| | |

| Security | |

| Percent of

Total Investments |

(a) |

| |

Wells Fargo & Co. | | | 5.1 | % |

Bank of America Corp. | | | 4.8 | |

JPMorgan Chase & Co. | | | 4.5 | |

Morgan Stanley | | | 3.3 | |

Goldman Sachs Group Inc. (The) | | | 3.2 | |

Citigroup Inc. | | | 2.9 | |

Berkshire Hathaway Inc., Class B | | | 2.7 | |

American Express Co. | | | 2.2 | |

Charles Schwab Corp. (The) | | | 2.2 | |

U.S. Bancorp | | | 2.2 | |

| | |

| 10 | | 2 0 2 1 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of July 31, 2021 | | iShares® Evolved U.S. Healthcare Staples ETF |

Investment Objective

The iShares Evolved U.S. Healthcare Staples ETF (the “Fund”) seeks to provide access to U.S. companies with healthcare staples exposure, as classified using a proprietary classification system. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index.

Performance

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | | | | | | | | | | |

| | | | | |

| | | 1 Year | | | Since Inception | | | | | | 1 Year | | | Since Inception | |

| |

| | | | | |

Fund NAV | | | 31.06% | | | | 19.41% | | | | | | | | 31.06% | | | | 81.66% | |

Fund Market | | | 31.05 | | | | 19.42 | | | | | | | | 31.05 | | | | 81.70 | |

S&P Total Market IndexTM | | | 38.93 | | | | 17.52 | | | | | | | | 38.93 | | | | 71.98 | |

| |

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 3/21/18. The first day of secondary market trading was 3/23/18.

The S&P Total Market IndexTM is an unmanaged index designed to track the broad equity market, including large-, mid-, small-, and micro-cap stocks.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 19 for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | |

| | | | | | | |

| Beginning

Account Value

(02/01/21) |

| |

| Ending

Account Value

(07/31/21) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(02/01/21) |

| |

| Ending

Account Value

(07/31/21) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | |

| $ | 1,000.00 | | | $ | 1,146.30 | | | $ | 0.96 | | | | | | | $ | 1,000.00 | | | $ | 1,023.90 | | | $ | 0.90 | | | | 0.18% | |

| | |

| | (a) | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (181 days) and divided by the number of days in the year (365 days). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Shareholder Expenses” on page 19 for more information. | |

| | |

| Fund Summary as of July 31, 2021 (continued) | | iShares® Evolved U.S. Healthcare Staples ETF |

Portfolio Management Commentary

U.S. healthcare staples stocks advanced strongly for the reporting period, bolstered by anticipation that successful development and distribution of COVID-19 vaccines would drive resumption of elective medical procedures requiring instruments and devices. In this environment, initial public offerings and merger and acquisition activity of medical device companies rose, supported by low interest rates and optimism about a return to normal driven by vaccine distribution.

Healthcare equipment stocks contributed the most to the Fund’s return, reinforced by demand for testing and medical equipment used to treat coronavirus patients. For example, despite an overall decline in medical procedures during the pandemic, Medtronic gained due to strong demand for its minimally invasive technologies such as ventilators and pulse oximeters used to treat coronavirus patients. Similarly, Abbott Laboratories posted strong profit growth amid surging sales of coronavirus diagnostic tests to both healthcare providers and individuals. In addition, the company’s diverse revenue drivers, which include diabetes testing equipment and devices for treating heart defects, benefited from resumed demand after the pandemic’s restrictions were lifted.

Managed healthcare companies like UnitedHealth Group and Anthem also provided a tailwind to the fund’s return. Despite higher pandemic-related costs, managed care companies benefited from patients delaying medical treatment during the pandemic, which reduced expenses and led to substantive profit growth. Life sciences tools and services stocks also contributed to the fund’s performance. Thermo Fisher Scientific’s revenue growth was supported by strong sales of COVID-19 diagnostic tests and raw materials for vaccine production. In addition, the company provides specialty refrigeration for global vaccine distribution, which further bolstered its gains. Illumina, a maker of genetic sequencing and diagnostics technologies, advanced amid identification of a new COVID-19 variant through genetic sequencing and genomics.

The Fund’s evolved investment process looks beyond traditional sector definitions by applying machine learning and natural language processing to group individual companies with related business activities. More specifically, the evolved investment process identified several companies with healthcare-related businesses in the healthcare real estate investment trust (“REIT”) industry. Senior care facilities like Welltower and Ventas advanced amid ongoing improvement in demand for senior care residences, declining COVID-19 infections, and high resident vaccination rates.

Portfolio Information

ALLOCATION BY SECTOR

| | | | |

| | |

| Sector | |

| Percent of

Total Investments |

(a) |

| |

Health Care - Products | | | 49.7 | % |

Health Care - Services | | | 24.2 | |

Pharmaceuticals | | | 17.1 | |

Biotechnology | | | 4.3 | |

Electronics | | | 1.2 | |

Real Estate Investment Trusts | | | 1.1 | |

Other (each representing less than 1%) | | | 2.4 | |

TEN LARGEST HOLDINGS

| | | | |

| | |

| Security | |

| Percent of

Total Investments |

(a) |

| |

UnitedHealth Group Inc. | | | 12.0 | % |

Abbott Laboratories | | | 7.9 | |

Medtronic PLC | | | 6.1 | |

Thermo Fisher Scientific Inc. | | | 4.7 | |

Danaher Corp. | | | 4.5 | |

Johnson & Johnson | | | 4.4 | |

Intuitive Surgical Inc. | | | 4.1 | |

Stryker Corp. | | | 3.2 | |

CVS Health Corp. | | | 2.7 | |

Edwards Lifesciences Corp. | | | 2.6 | |

| | (a) | Excludes money market funds. | |

| | |

| 12 | | 2 0 2 1 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of July 31, 2021 | | iShares® Evolved U.S. Innovative Healthcare ETF |

Investment Objective

The iShares Evolved U.S. Innovative Healthcare ETF (the “Fund”) seeks to provide access to U.S. companies with innovative healthcare exposure, as classified using a proprietary classification system. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index.

Performance

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | | | | | | | | | | |

| | | | | |

| | | 1 Year | | | Since Inception | | | | | | 1 Year | | | Since Inception | |

| |

| | | | | |

Fund NAV | | | 22.81% | | | | 14.15% | | | | | | | | 22.81% | | | | 56.10% | |

Fund Market | | | 22.67 | | | | 14.11 | | | | | | | | 22.67 | | | | 55.92 | |

S&P Total Market IndexTM | | | 38.93 | | | | 17.52 | | | | | | | | 38.93 | | | | 71.98 | |

| |

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 3/21/18. The first day of secondary market trading was 3/23/18.

The S&P Total Market IndexTM is an unmanaged index designed to track the broad equity market, including large-, mid-, small-, and micro-cap stocks.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 19 for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | |

| | | | | | | |

| Beginning

Account Value

(02/01/21) |

| |

| Ending

Account Value

(07/31/21) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(02/01/21) |

| |

| Ending

Account Value

(07/31/21) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | |

| $ | 1,000.00 | | | $ | 1,071.60 | | | $ | 0.92 | | | | | | | $ | 1,000.00 | | | $ | 1,023.90 | | | $ | 0.90 | | | | 0.18% | |

| | |

| | (a) | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (181 days) and divided by the number of days in the year (365 days). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Shareholder Expenses” on page 19 for more information. | |

| | |

| Fund Summary as of July 31, 2021 (continued) | | iShares® Evolved U.S. Innovative Healthcare ETF |

Portfolio Management Commentary

U.S. innovative healthcare stocks advanced during the reporting period in an environment that rewarded increased spending on research and development, cross-company collaboration, improved efficiency, and increased speed to market as companies raced to deliver COVID-19 treatments and vaccines. Biotechnology initial public offerings reached all-time highs and merger and acquisition activity remained brisk amid low interest rates as companies sought to diversify their product pipelines.

Biotechnology companies contributed the most to the Fund’s return. For example, Moderna, which was among the first COVID-19 vaccine developers to receive emergency use authorization (“EUA”) from the Food and Drug Administration (“FDA”) and other global healthcare agencies, drove the industry’s return. Expectations that studies of vaccine safety and effectiveness for children would yield positive results further bolstered the company’s gains. Expanded agreements to increase global vaccine supply also supported Moderna’s profit growth.

Outside of the COVID-19 space, companies manufacturing therapeutics for chronic conditions also bolstered performance of the biotechnology industry. AbbVie, which makes Botox and the psoriasis and rheumatoid arthritis treatment Humira, the world’s top selling drug, surpassed revenue and profit expectations as patients resumed office visits after the pandemic’s restrictions were lifted. Rare diseases and immunology company Alexion Pharmaceuticals also posted strong gains after an acquisition by multinational pharmaceuticals manufacturer AstraZeneca.

The pharmaceuticals industry contribution was also driven by positive developments in COVID-19 treatments and vaccines. For example, Eli Lilly received FDA EUA for its monoclonal antibody treatment. In addition, the company sought accelerated approval for a new Alzheimer’s drug and has a late-stage obesity and diabetes treatment in its pipeline. Johnson & Johnson’s and Pfizer’s contributions came from successful development of COVID-19 vaccines.

The Fund’s evolved investment process looks beyond traditional sector definitions by applying machine learning and natural language processing to group individual companies with related business activity. As of the end of the reporting period, the Fund’s portfolio consisted primarily of biotechnology and pharmaceuticals companies that emphasize innovation, but also included companies in diverse industries such as tools and services for life sciences and semiconductors. For example, Universal Display Corporation makes organic light emitting diodes that are used in medical imaging and diagnostics equipment.

Portfolio Information

ALLOCATION BY SECTOR

| | | | |

| | |

| Sector | |

| Percent of

Total Investments |

(a) |

| |

Pharmaceuticals | | | 49.6 | % |

Biotechnology | | | 44.5 | |

Health Care - Products | | | 3.7 | |

Health Care - Services | | | 2.0 | |

Other (each representing less than 1%) | | | 0.2 | |

TEN LARGEST HOLDINGS

| | | | |

| | |

| Security | |

| Percent of

Total Investments |

(a) |

| |

Johnson & Johnson | | | 9.8 | % |

Moderna Inc. | | | 7.8 | |

Pfizer Inc. | | | 6.4 | |

Eli Lilly & Co. | | | 6.1 | |

AbbVie Inc. | | | 5.8 | |

Merck & Co. Inc. | | | 5.7 | |

Bristol-Myers Squibb Co. | | | 4.7 | |

Gilead Sciences Inc. | | | 4.4 | |

Amgen Inc. | | | 4.1 | |

Regeneron Pharmaceuticals Inc. | | | 3.6 | |

| | (a) | Excludes money market funds. | |

| | |

| 14 | | 2 0 2 1 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of July 31, 2021 | | iShares® Evolved U.S. Media and Entertainment ETF |

Investment Objective

The iShares Evolved U.S. Media and Entertainment ETF (the “Fund”) seeks to provide access to U.S. companies with media and entertainment exposure, as classified using a proprietary classification system. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index.

Performance

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | | | | | | | | | | |

| | | | | |

| | | 1 Year | | | Since Inception | | | | | | 1 Year | | | Since Inception | |

| |

| | | | | |

Fund NAV | | | 43.02% | | | | 15.03% | | | | | | | | 43.02% | | | | 60.15% | |

Fund Market | | | 42.78 | | | | 14.98 | | | | | | | | 42.78 | | | | 59.94 | |

S&P Total Market IndexTM | | | 38.93 | | | | 17.52 | | | | | | | | 38.93 | | | | 71.98 | |

| |

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 3/21/18. The first day of secondary market trading was 3/23/18.

Certain sectors and markets performed exceptionally well based on market conditions during the one-year period. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such exceptional returns will be repeated.

The S&P Total Market IndexTM is an unmanaged index designed to track the broad equity market, including large-, mid-, small-, and micro-cap stocks.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 19 for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | |

| | | | | | | |

| Beginning

Account Value

(02/01/21) |

| |

| Ending

Account Value

(07/31/21) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(02/01/21) |

| |

| Ending

Account Value

(07/31/21) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | |

| $ | 1,000.00 | | | $ | 1,076.20 | | | $ | 0.93 | | | | | | | $ | 1,000.00 | | | $ | 1,023.90 | | | $ | 0.90 | | | | 0.18% | |

| | |

| | (a) | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (181 days) and divided by the number of days in the year (365 days). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Shareholder Expenses” on page 19 for more information. | |

| | |

| Fund Summary as of July 31, 2021 (continued) | | iShares® Evolved U.S. Media and Entertainment ETF |

Portfolio Management Commentary

U.S. media and entertainment stocks advanced significantly during the reporting period amid a recovery in consumer spending. Demand for home-based entertainment products, such as streaming services and video games, remained high even as the economy continued to reopen. However, the reopening also strongly benefited companies offering in-person experiences, such as theme parks and live entertainment.

Broadcast media stocks contributed the most to the Fund’s performance, driven by increased subscribership for streaming services. Viacom CBS, a mass media company, posted strong earnings following an increase in subscriptions for its streaming services Paramount+, Showtime, and Pluto TV. Higher advertising and affiliate revenue further supported Viacom CBS’s earnings. Growth in usage of internet-based streaming services also helped cable providers such as Comcast. Internet subscriptions grew, as did subscribers to Comcast’s streaming service, Peacock, which was buoyed by interest in new media offerings and the summer Olympic games.

Entertainment media companies contributed significantly to the Fund’s return. A streaming and television interface company, Roku, increased revenues substantially, particularly licensing sales in its software and services division. Roku’s shift toward software and services, which has higher profit margins, sharply increased the company’s overall profitability. Entertainment conglomerate The Walt Disney Company was another notable contributor to the Fund’s return, supported by a marked increase in subscribers for its streaming services, which include Disney+, Hulu, and ESPN+. The return of in-person entertainment provided tailwinds for The Walt Disney Company’s theme park division, where revenues rebounded amid high demand for live entertainment experiences.

The Fund’s evolved investment process looks beyond the traditional sector definitions by applying machine learning and natural language processing to group individual companies with related business activity. During the reporting period, the evolved process identified several media and entertainment companies with similar businesses that have traditionally been categorized in other sectors. For example, Hasbro Inc., a toy and game manufacturer in the consumer discretionary sector, contributed to the Fund’s return. The success of new television series such as Cruel Summer and The Rookie drove significant revenue increases for the company. Strong toy sales also boosted earnings, particularly toys related to recent Marvel shows and movies.

Portfolio Information

ALLOCATION BY SECTOR

| | | | |

| | |

| Sector | |

| Percent of

Total Investments |

(a) |

| |

Media | | | 55.8 | % |

Internet | | | 20.0 | |

Software | | | 10.3 | |

Entertainment | | | 5.9 | |

Toys, Games & Hobbies | | | 2.7 | |

Commercial Services | | | 1.6 | |

Real Estate Investment Trusts | | | 1.0 | |

Other (each representing less than 1%) | | | 2.7 | |

TEN LARGEST HOLDINGS

| | | | |

| | |

| Security | |

| Percent of

Total Investments |

(a) |

| |

Roku Inc. | | | 5.4 | % |

Walt Disney Co. (The) | | | 5.1 | |

Comcast Corp., Class A | | | 5.1 | |

ViacomCBS Inc., Class B | | | 4.8 | |

Charter Communications Inc., Class A | | | 4.6 | |

Fox Corp., Class A | | | 4.4 | |

Liberty Broadband Corp., Class C | | | 4.4 | |

Twitter Inc. | | | 3.9 | |

Netflix Inc. | | | 3.8 | |

Activision Blizzard Inc. | | | 3.5 | |

| | (a) | Excludes money market funds. | |

| | |

| 16 | | 2 0 2 1 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of July 31, 2021 | | iShares® Evolved U.S. Technology ETF |

Investment Objective

The iShares Evolved U.S. Technology ETF (the “Fund”) seeks to provide access to U.S. companies with technology exposure, as classified using a proprietary classification system. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index.

Performance

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | | | | | | | | | | |

| | | | | |

| | | 1 Year | | | Since Inception | | | | | | 1 Year | | | Since Inception | |

| |

| | | | | |

Fund NAV | | | 40.24% | | | | 28.92% | | | | | | | | 40.24% | | | | 135.03% | |

Fund Market | | | 40.20 | | | | 28.94 | | | | | | | | 40.20 | | | | 135.19 | |

S&P Total Market IndexTM | | | 38.93 | | | | 17.52 | | | | | | | | 38.93 | | | | 71.98 | |

| |

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 3/21/18. The first day of secondary market trading was 3/23/18.

Certain sectors and markets performed exceptionally well based on market conditions during the one-year period. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such exceptional returns will be repeated.

The S&P Total Market IndexTM is an unmanaged index designed to track the broad equity market, including large-, mid-, small-, and micro-cap stocks.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 19 for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | |

| | | | | | | |

| Beginning

Account Value

(02/01/21) |

| |

| Ending

Account Value

(07/31/21) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(02/01/21) |

| |

| Ending

Account Value

(07/31/21) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | |

| $ | 1,000.00 | | | $ | 1,205.10 | | | $ | 0.98 | | | | | | | $ | 1,000.00 | | | $ | 1,023.90 | | | $ | 0.90 | | | | 0.18% | |

| | |

| | (a) | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (181 days) and divided by the number of days in the year (365 days). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Shareholder Expenses” on page 19 for more information. | |

| | |

| Fund Summary as of July 31, 2021 (continued) | | iShares® Evolved U.S. Technology ETF |

Portfolio Management Commentary

U.S. technology stocks advanced robustly during the reporting period as the coronavirus pandemic continued to accelerate technological trends. Software sales grew as cloud computing solutions supported working and schooling from home. Although government scrutiny increased over the power and reach of technology firms, makers of devices that improved connectivity during the pandemic advanced significantly. The increasing popularity of both online gaming and cryptocurrency also drove chipmakers higher.

The software industry contributed the most to the Fund’s return as people across the world adopted cloud-based work and school, while entertainment and networking from home also contributed. Microsoft Corporation drove contribution among software stocks, advancing due to sharply rising use of its “commercial cloud,” which includes both its Azure cloud infrastructure and online versions of its Office software. Users of Microsoft’s customer management suite Dynamics 365 soared, and its productivity (Teams), networking (LinkedIn) and personal computing (Windows OS and Xbox) units also advanced. Hardware technology companies also bolstered returns. Apple Inc. gained amid strong sales growth of iPhones as consumers in China and the U.S. increased spending on personal electronics. The company also launched AirTag to help customers keep track of keys and wallets and a podcast subscription service to expand and enhance its customer experience and build brand loyalty.

Semiconductors stocks were another source of strength, driven by higher demand for the chips used in both gaming and mining cryptocurrency. Nvidia built its market share amid industry-wide shortages by selling its chips to data centers that use them for speech and image recognition.

The Fund’s evolved investment process looks beyond the traditional sector definitions by applying machine learning and natural language processing to group individual companies with related business activity. During the reporting period, the evolved process identified several technology companies with similar businesses that have traditionally been categorized in other sectors. For instance, the Fund held a position in Google’s parent company Alphabet Inc., and in Facebook, both traditionally categorized as communications services stocks. Google’s sales to retail and other advertisers increased while customers were at home, driving Alphabet’s growth. Facebook also surged ahead on higher ad sales during the pandemic.

Portfolio Information

ALLOCATION BY SECTOR

| | | | |

| | |

| Sector | |

| Percent of

Total Investments |

(a) |

| |

Software | | | 31.4 | % |

Internet | | | 26.8 | |

Computers | | | 16.5 | |

Semiconductors | | | 10.5 | |

Diversified Financial Services | | | 4.7 | |

Commercial Services | | | 4.7 | |

Telecommunications | | | 2.0 | |

Other (each representing less than 1%) | | | 3.4 | |

TEN LARGEST HOLDINGS

| | | | |

| | |

| Security | |

| Percent of

Total Investments |

(a) |

Microsoft Corp. | | | 16.1 | % |

Apple Inc. | | | 12.1 | |

Facebook Inc., Class A | | | 6.1 | |

Amazon.com Inc. | | | 5.9 | |

Alphabet Inc., Class A | | | 5.2 | |

Alphabet Inc., Class C | | | 5.1 | |

NVIDIA Corp. | | | 3.5 | |

Visa Inc., Class A | | | 2.2 | |

Adobe Inc. | | | 2.2 | |

salesforce.com Inc. | | | 1.8 | |

| | (a) | Excludes money market funds | |

| | |

| 18 | | 2 0 2 1 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

About Fund Performance

Past performance is not an indication of future results. Financial markets have experienced extreme volatility and trading in many instruments has been disrupted. These circumstances may continue for an extended period of time and may continue to affect adversely the value and liquidity of the fund’s investments. As a result, current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at iShares.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are redeemed or sold in the market. Performance for certain funds may reflect a waiver of a portion of investment advisory fees. Without such a waiver, performance would have been lower.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. Beginning August 10, 2020, the price used to calculate market return (“Market Price”) is the closing price. Prior to August 10, 2020, Market Price was determined by using the midpoint between the highest bid and the lowest ask on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of a fund may not trade in the secondary market until after the fund’s inception, for the period from inception to the first day of secondary market trading in shares of the fund, the NAV of the fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

Shareholder Expenses

As a shareholder of your Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of fund shares and (2) ongoing costs, including management fees and other fund expenses. The expense example, which is based on an investment of $1,000 invested at the beginning of the period (or from the commencement of operations if less than 6 months) and held through the end of the period, is intended to help you understand your ongoing costs (in dollars and cents) of investing in your Fund and to compare these costs with the ongoing costs of investing in other funds.

Actual Expenses – The table provides information about actual account values and actual expenses. Annualized expense ratios reflect contractual and voluntary fee waivers, if any. To estimate the expenses that you paid on your account over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period.”

Hypothetical Example for Comparison Purposes – The table also provides information about hypothetical account values and hypothetical expenses based on your Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions and other fees paid on purchases and sales of fund shares. Therefore, the hypothetical examples are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | |

ABOUT FUND PERFORMANCE / SHAREHOLDER EXPENSES | | 19 |

| | |

Schedule of Investments July 31, 2021 | | iShares® Evolved U.S. Consumer Staples ETF (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | |

Common Stocks | | | | | | | | |

| | |

| Agriculture — 11.5% | | | | | | |

Altria Group Inc. | | | 12,151 | | | $ | 583,734 | |

Archer-Daniels-Midland Co. | | | 4,336 | | | | 258,946 | |

Bunge Ltd. | | | 821 | | | | 63,734 | |

Darling Ingredients Inc.(a) | | | 783 | | | | 54,082 | |

Fresh Del Monte Produce Inc. | | | 152 | | | | 4,691 | |

Philip Morris International Inc. | | | 7,473 | | | | 747,972 | |

Universal Corp./VA | | | 112 | | | | 5,842 | |

Vector Group Ltd. | | | 339 | | | | 4,529 | |

| | | | | | | | |

| | | | | | | 1,723,530 | |

| | |

| Beverages — 30.6% | | | | | | |

Boston Beer Co. Inc. (The), Class A, NVS(a) | | | 63 | | | | 44,730 | |

Brown-Forman Corp., Class A | | | 335 | | | | 22,408 | |

Brown-Forman Corp., Class B, NVS | | | 2,517 | | | | 178,506 | |

Celsius Holdings Inc.(a) | | | 285 | | | | 19,559 | |

Coca-Cola Co. (The) | | | 30,661 | | | | 1,748,597 | |

Coca-Cola Consolidated Inc. | | | 46 | | | | 18,361 | |

Constellation Brands Inc., Class A | | | 884 | | | | 198,317 | |

Keurig Dr Pepper Inc. | | | 7,096 | | | | 249,850 | |

MGP Ingredients Inc. | | | 99 | | | | 5,905 | |

Molson Coors Beverage Co., Class B(a) | | | 1,350 | | | | 66,001 | |

Monster Beverage Corp.(a) | | | 4,431 | | | | 417,932 | |

National Beverage Corp. | | | 270 | | | | 12,253 | |

PepsiCo Inc. | | | 9,988 | | | | 1,567,617 | |

Primo Water Corp. | | | 1,357 | | | | 22,431 | |

| | | | | | | | |

| | | | | | | 4,572,467 | |

| | |

| Chemicals — 1.1% | | | | | | |

Balchem Corp. | | | 146 | | | | 19,694 | |

Ecolab Inc. | | | 128 | | | | 28,266 | |

International Flavors & Fragrances Inc. | | | 588 | | | | 88,576 | |

Mosaic Co. (The) | | | 325 | | | | 10,150 | |

Sensient Technologies Corp. | | | 216 | | | | 18,831 | |

| | | | | | | | |

| | | | | | | 165,517 | |

|

| Commercial Services — 0.1% | |

Medifast Inc. | | | 53 | | | | 15,132 | |

WW International Inc.(a)(b) | | | 162 | | | | 4,980 | |

| | | | | | | | |

| | | | | | | 20,112 | |

| | |

| Computers — 0.1% | | | | | | |

ExlService Holdings Inc.(a) | | | 89 | | | | 10,077 | |

| | | | | | | | |

|

| Cosmetics & Personal Care — 10.0% | |

Colgate-Palmolive Co. | | | 3,935 | | | | 312,833 | |

Coty Inc., Class A(a) | | | 1,840 | | | | 16,063 | |

Edgewell Personal Care Co. | | | 150 | | | | 6,162 | |

Procter & Gamble Co. (The) | | | 8,196 | | | | 1,165,717 | |

| | | | | | | | |

| | | | | | | 1,500,775 | |

|

| Distribution & Wholesale — 0.1% | |

Core-Mark Holding Co. Inc. | | | 207 | | | | 8,909 | |

| | | | | | | | |

|

| Diversified Financial Services — 0.0% | |

Jefferies Financial Group Inc. | | | 2 | | | | 66 | |

| | | | | | | | |

|

| Electrical Components & Equipment — 0.1% | |

Energizer Holdings Inc. | | | 380 | | | | 16,283 | |

| | | | | | | | |

| | |

| Food — 22.7% | | | | | | |

B&G Foods Inc. | | | 693 | | | | 19,903 | |

BellRing Brands Inc., Class A(a) | | | 250 | | | | 8,267 | |

Beyond Meat Inc.(a) | | | 350 | | | | 42,945 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | |

| Food (continued) | | | | | | |

Calavo Growers Inc. | | | 99 | | | $ | 5,578 | |

Cal-Maine Foods Inc. | | | 180 | | | | 6,280 | |

Campbell Soup Co. | | | 2,001 | | | | 87,484 | |

Conagra Brands Inc. | | | 4,886 | | | | 163,632 | |

Flowers Foods Inc. | | | 1,071 | | | | 25,233 | |

General Mills Inc. | | | 7,483 | | | | 440,449 | |

Hain Celestial Group Inc. (The)(a) | | | 936 | | | | 37,356 | |

Hershey Co. (The) | | | 1,578 | | | | 282,273 | |

Hormel Foods Corp. | | | 2,195 | | | | 101,804 | |

Hostess Brands Inc.(a) | | | 585 | | | | 9,413 | |

Ingredion Inc. | | | 454 | | | | 39,866 | |

J&J Snack Foods Corp. | | | 117 | | | | 19,232 | |

JM Smucker Co. (The) | | | 1,123 | | | | 147,237 | |

John B Sanfilippo & Son Inc. | | | 81 | | | | 7,481 | |

Kellogg Co. | | | 2,838 | | | | 179,816 | |

Kraft Heinz Co. (The) | | | 5,437 | | | | 209,161 | |

Lamb Weston Holdings Inc. | | | 1,078 | | | | 71,978 | |

Lancaster Colony Corp. | | | 153 | | | | 30,274 | |

McCormick & Co. Inc./MD, NVS | | | 1,927 | | | | 162,196 | |

Mondelez International Inc., Class A | | | 10,747 | | | | 679,855 | |

Performance Food Group Co.(a) | | | 549 | | | | 25,155 | |

Pilgrim’s Pride Corp.(a) | | | 270 | | | | 5,981 | |

Post Holdings Inc.(a) | | | 618 | | | | 63,246 | |

Sanderson Farms Inc. | | | 108 | | | | 20,179 | |

Seaboard Corp. | | | 1 | | | | 4,110 | |

Simply Good Foods Co. (The)(a) | | | 646 | | | | 24,212 | |

Sprouts Farmers Market Inc.(a) | | | 405 | | | | 9,955 | |

Sysco Corp. | | | 2,867 | | | | 212,731 | |

Tootsie Roll Industries Inc. | | | 139 | | | | 4,780 | |

TreeHouse Foods Inc.(a) | | | 576 | | | | 25,574 | |

Tyson Foods Inc., Class A | | | 2,455 | | | | 175,434 | |

U.S. Foods Holding Corp.(a) | | | 947 | | | | 32,520 | |

United Natural Foods Inc.(a) | | | 198 | | | | 6,558 | |

| | | | | | | | |

| | | | | | | 3,388,148 | |

| | |

| Health Care - Products — 0.1% | | | | | | |

Neogen Corp.(a) | | | 486 | | | | 21,170 | |

| | | | | | | | |

|

| Holding Companies - Diversified — 0.1% | |

Cannae Holdings Inc.(a) | | | 268 | | | | 8,911 | |

| | | | | | | | |

|

| Household Products & Wares — 1.8% | |

ACCO Brands Corp. | | | 2 | | | | 18 | |

Church & Dwight Co. Inc. | | | 1,033 | | | | 89,437 | |

Clorox Co. (The) | | | 507 | | | | 91,711 | |

Helen of Troy Ltd.(a)(b) | | | 45 | | | | 10,053 | |

Kimberly-Clark Corp. | | | 481 | | | | 65,281 | |

WD-40 Co. | | | 21 | | | | 5,103 | |

| | | | | | | | |

| | | | | | | 261,603 | |

| | |

| Housewares — 0.2% | | | | | | |

Newell Brands Inc. | | | 238 | | | | 5,890 | |

Scotts Miracle-Gro Co. (The) | | | 126 | | | | 22,297 | |

| | | | | | | | |

| | | | | | | 28,187 | |

| | |

| Machinery — 0.4% | | | | | | |

AGCO Corp. | | | 207 | | | | 27,347 | |

Middleby Corp. (The)(a) | | | 153 | | | | 29,298 | |

| | | | | | | | |

| | | | | | | 56,645 | |

| | |

| Manufacturing — 0.1% | | | | | | |

John Bean Technologies Corp. | | | 108 | | | | 15,831 | |

| | | | | | | | |

| | |

| 20 | | 2 0 2 1 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

| | |

Schedule of Investments (continued) July 31, 2021 | | iShares® Evolved U.S. Consumer Staples ETF (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Packaging & Containers — 2.8% | |

Amcor PLC | | | 1,383 | | | $ | 15,987 | |

AptarGroup Inc. | | | 35 | | | | 4,512 | |

Ball Corp. | | | 2,141 | | | | 173,164 | |

Berry Global Group Inc.(a) | | | 557 | | | | 35,810 | |

Crown Holdings Inc. | | | 820 | | | | 81,803 | |

Graphic Packaging Holding Co. | | | 1,732 | | | | 33,202 | |

O-I Glass Inc.(a) | | | 702 | | | | 10,383 | |

Packaging Corp. of America | | | 95 | | | | 13,443 | |

Sealed Air Corp. | | | 219 | | | | 12,428 | |

Silgan Holdings Inc. | | | 333 | | | | 13,493 | |

Sonoco Products Co. | | | 378 | | | | 24,113 | |

| | | | | | | | |

| | | | | | | 418,338 | |

| | |

| Pharmaceuticals — 1.9% | | | | | | |

Elanco Animal Health Inc.(a) | | | 1,321 | | | | 48,177 | |

Herbalife Nutrition Ltd.(a) | | | 413 | | | | 21,038 | |

Perrigo Co. PLC | | | 118 | | | | 5,668 | |

Prestige Consumer Healthcare Inc.(a) | | | 198 | | | | 10,405 | |

Zoetis Inc. | | | 965 | | | | 195,605 | |

| | | | | | | | |

| | | | | | | 280,893 | |

|

| Real Estate Investment Trusts — 1.8% | |

Americold Realty Trust | | | 757 | | | | 29,409 | |

Equinix Inc. | | | 294 | | | | 241,201 | |

| | | | | | | | |

| | | | | | | 270,610 | |

| | |

| Retail — 13.4% | | | | | | |

BJ’s Restaurants Inc.(a) | | | 55 | | | | 2,232 | |

Casey’s General Stores Inc. | | | 99 | | | | 19,573 | |

Cheesecake Factory Inc. (The)(a) | | | 126 | | | | 5,703 | |

Chipotle Mexican Grill Inc., Class A(a) | | | 135 | | | | 251,565 | |

Cracker Barrel Old Country Store Inc. | | | 45 | | | | 6,128 | |

Darden Restaurants Inc. | | | 159 | | | | 23,195 | |

Domino’s Pizza Inc. | | | 34 | | | | 17,867 | |

Freshpet Inc.(a) | | | 236 | | | | 34,562 | |

Jack in the Box Inc. | | | 81 | | | | 8,818 | |

McDonald’s Corp. | | | 2,773 | | | | 673,035 | |

Shake Shack Inc., Class A(a) | | | 91 | | | | 9,149 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | |

| Retail (continued) | | | | | | |

Starbucks Corp. | | | 5,745 | | | $ | 697,615 | |

Texas Roadhouse Inc. | | | 76 | | | | 7,005 | |

Wendy’s Co. (The) | | | 639 | | | | 14,831 | |

Wingstop Inc. | | | 81 | | | | 13,876 | |

Yum China Holdings Inc. | | | 1,207 | | | | 75,063 | |

Yum! Brands Inc. | | | 1,048 | | | | 137,697 | |

| | | | | | | | |

| | | | | | | 1,997,914 | |

| | |

| Toys, Games & Hobbies — 0.1% | | | | | | |

Mattel Inc.(a) | | | 609 | | | | 13,227 | |

| | | | | | | | |

| | |

Total Common Stocks — 99.0%

(Cost: $13,479,153) | | | | | | | 14,779,213 | |

| | | | | | | | |

| | |

Short-Term Investments | | | | | | | | |

| | |

| Money Market Funds — 1.0% | | | | | | |

BlackRock Cash Funds: Institutional, SL Agency Shares, 0.06%(c)(d)(e) | | | 15,200 | | | | 15,208 | |

BlackRock Cash Funds: Treasury, SL Agency Shares, 0.00%(c)(d) | | | 140,000 | | | | 140,000 | |

| | | | | | | | |

| | | | | | | 155,208 | |

| | | | | | | | |

| | |

Total Short-Term Investments — 1.0%

(Cost: $155,204) | | | | | | | 155,208 | |

| | | | | | | | |

| | |

Total Investments in Securities — 100.0%

(Cost: $13,634,357) | | | | | | | 14,934,421 | |

| | |

Other Assets, Less Liabilities — (0.0)% | | | | | | | (914 | ) |

| | | | | | | | |

| | |

Net Assets — 100.0% | | | | | | $ | 14,933,507 | |

| | | | | | | | |

| (a) | Non-income producing security. |

| (b) | All or a portion of this security is on loan. |

| (c) | Affiliate of the Fund. |

| (d) | Annualized 7-day yield as of period-end. |

| (e) | All or a portion of this security was purchased with cash collateral received from loaned securities. |

Affiliates

Investments in issuers considered to be affiliate(s) of the Fund during the year ended July 31, 2021 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Affiliated Issuer | | Value at

07/31/20 | | | Purchases

at Cost | | | Proceeds

from Sales | | | Net Realized

Gain (Loss) | | | Change in

Unrealized

Appreciation

(Depreciation) | | | Value at

07/31/21 | | | Shares

Held at

07/31/21 | | | Income | | | Capital

Gain

Distributions

from

Underlying

Funds | |

BlackRock Cash Funds: Institutional, SL Agency Shares | | $ | 162,457 | | | $ | — | | | $ | (147,161 | )(a) | | $ | 53 | | | $ | (141 | ) | | $ | 15,208 | | | | 15,200 | | | $ | 929 | (b) | | $ | — | |

BlackRock Cash Funds: Treasury, SL Agency Shares | | | 66,000 | | | | 74,000 | (a) | | | — | | | | — | | | | — | | | | 140,000 | | | | 140,000 | | | | 62 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | $ | 53 | | | $ | (141 | ) | | $ | 155,208 | | | | | | | $ | 991 | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (a) | Represents net amount purchased (sold). | |

| | (b) | All or a portion represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities. | |

Fair Value Measurements

Various inputs are used in determining the fair value of financial instruments. For description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, refer to the Notes to Financial Statements.

| | |

SCHEDULE OF INVESTMENTS | | 21 |

| | |

Schedule of Investments (continued) July 31, 2021 | | iShares® Evolved U.S. Consumer Staples ETF |

Fair Value Measurements (continued)

The following table summarizes the value of the Fund’s investments according to the fair value hierarchy as of July 31, 2021. The breakdown of the Fund’s investments into major categories is disclosed in the Schedule of Investments above.

| | | | | | | | | | | | | | | | |

| |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| |

Investments | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | |

Common Stocks | | $ | 14,779,213 | | | $ | — | | | $ | — | | | $ | 14,779,213 | |

Money Market Funds | | | 155,208 | | | | — | | | | — | | | | 155,208 | |

| | | | | | | | | | | | | | | | |

| | $ | 14,934,421 | | | $ | — | | | $ | — | | | $ | 14,934,421 | |

| | | | | | | | | | | | | | | | |

See notes to financial statements.

| | |

| 22 | | 2 0 2 1 I SHARES ANNUAL REPORT TO SHAREHOLDERS |

| | |

Schedule of Investments July 31, 2021 | | iShares® Evolved U.S. Discretionary Spending ETF (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | |

| Common Stocks | | | | | | |

| | |

| Advertising — 0.1% | | | | | | |

Interpublic Group of Companies Inc. (The) | | | 539 | | | $ | 19,059 | |

| | | | | | | | |

| | |

| Airlines — 0.1% | | | | | | |

Alaska Air Group Inc.(a) | | | 260 | | | | 15,088 | |

JetBlue Airways Corp.(a) | | | 690 | | | | 10,205 | |

| | | | | | | | |

| | | | | | | 25,293 | |

| | |

| Apparel — 7.7% | | | | | | |

Capri Holdings Ltd.(a) | | | 658 | | | | 37,052 | |

Carter’s Inc. | | | 350 | | | | 34,209 | |

Columbia Sportswear Co. | | | 180 | | | | 17,932 | |