UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22649

iShares U.S. ETF Trust

(Exact name of registrant as specified in charter)

|

| c/o: State Street Bank and Trust Company |

| 100 Summer Street, 4th Floor, Boston, MA 02110 |

| (Address of principal executive offices) (Zip code) |

The Corporation Trust Company

1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 670-2000

Date of fiscal year end: October 31, 2022

Date of reporting period: October 31, 2022

| Item 1. | Reports to Stockholders. |

(a) The Report to Shareholders is attached herewith.

| | |

| | OCTOBER 31, 2022 |

iShares U.S. ETF Trust

| · | | BlackRock Short Maturity Bond ETF | NEAR | Cboe BZX |

| · | | BlackRock Short Maturity Municipal Bond ETF | MEAR | Cboe BZX |

| · | | BlackRock Ultra Short-Term Bond ETF | ICSH | Cboe BZX |

The Markets in Review

Dear Shareholder,

Significant economic headwinds emerged during the 12-month reporting period ended October 31, 2022, disrupting the economic recovery and strong financial markets of 2021. The U.S. economy shrank in the first half of 2022 before returning to moderate growth in the third quarter, marking a shift to a more challenging post-reopening economic environment. Changes in consumer spending patterns and a tight labor market led to elevated inflation, which reached a 40-year high. Moreover, while the foremost effect of Russia’s invasion of Ukraine has been a severe humanitarian crisis, the ongoing war continued to present challenges for both investors and policymakers.

Equity prices fell as interest rates rose, particularly weighing on relatively high-valuation growth stocks as inflation decreased the value of future cash flows and investors shifted focus to balance sheet resilience. Both large- and small-capitalization U.S. stocks fell, although declines for small-capitalization U.S. stocks were slightly steeper. Emerging market stocks and international equities from developed markets also declined significantly, pressured by rising interest rates and a strengthening U.S. dollar.

The 10-year U.S. Treasury yield rose notably during the reporting period, driving its price down, as investors reacted to higher inflation and attempted to anticipate its impact on future interest rate changes. The corporate bond market also faced inflationary headwinds, and increasing uncertainty led to higher corporate bond spreads (the difference in yield between U.S. Treasuries and similarly-dated corporate bonds).

The U.S. Federal Reserve (the “Fed”), acknowledging that inflation has been more persistent than expected, raised interest rates five times while indicating that additional rate hikes were likely. Furthermore, the Fed wound down its bond-buying programs and is accelerating the reduction of its balance sheet. As investors attempted to assess the Fed’s future trajectory, the Fed’s statements late in the reporting period led markets to believe that additional tightening is likely in the near term.

The pandemic’s restructuring of the economy brought an ongoing mismatch between supply and demand, contributing to the current inflationary regime. While growth has slowed in 2022, we believe that taming inflation requires a more dramatic economic decline to bring demand back to a lower level that is more in line with the economy’s capacity. The Fed has been raising interest rates at the fastest pace in decades, and seems set to overtighten in its effort to get inflation back to target. With this in mind, we believe the possibility of a U.S. recession in the near-term is high, and the outlook for Europe and the U.K. is also troubling. Investors should expect a period of higher volatility as markets adjust to the new economic reality and policymakers attempt to adapt to rapidly changing conditions.

In this environment, while we favor an overweight to equities in the long-term, the market’s concerns over excessive rate hikes from central banks moderate our outlook. Rising input costs and a deteriorating economic backdrop in China and Europe are likely to challenge corporate earnings, so we are underweight equities overall in the near term. However, we see better opportunities in credit, where higher spreads provide income opportunities and partially compensate for inflation risk. We believe that investment-grade corporates, local-currency emerging market debt, and inflation-protected bonds (particularly in Europe) offer strong opportunities for a six- to twelve-month horizon.

Overall, our view is that investors need to think globally, position themselves to be prepared for a decarbonizing economy, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit iShares.com for further insight about investing in today’s markets.

Rob Kapito

President, BlackRock, Inc.

Rob Kapito

President, BlackRock, Inc.

| | | | | | | | |

| Total Returns as of October 31, 2022 | |

| | | |

| | | 6-Month | | | 12-Month | |

| | |

U.S. large cap equities (S&P 500® Index) | | | (5.50 | )% | | | (14.61 | )% |

| | |

U.S. small cap equities (Russell 2000® Index) | | | (0.20 | ) | | | (18.54 | ) |

| | |

International equities (MSCI Europe, Australasia, Far East Index) | | | (12.70 | ) | | | (23.00 | ) |

| | |

Emerging market equities (MSCI Emerging Markets Index) | | | (19.66 | ) | | | (31.03 | ) |

| | |

3-month Treasury bills (ICE BofA 3-Month U.S. Treasury Bill Index) | | | 0.72 | | | | 0.79 | |

| | |

U.S. Treasury securities (ICE BofA 10-Year U.S. Treasury Index) | | | (8.24 | ) | | | (17.68 | ) |

| | |

U.S. investment grade bonds (Bloomberg U.S. Aggregate Bond Index) | | | (6.86 | ) | | | (15.68 | ) |

| | |

Tax-exempt municipal bonds (Bloomberg Municipal Bond Index) | | | (4.43 | ) | | | (11.98 | ) |

| | |

U.S. high yield bonds (Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index) | | | (4.71 | ) | | | (11.76 | ) |

|

| Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | |

| 2 | | T H I S P A G E I S N O T P A R T O F Y O U R F U N D R E P O R T |

Table of Contents

Market Overview

iShares U.S. ETF Trust

U.S. Bond Market Overview

The U.S. bond market experienced a considerable decline for the 12 months ended October 31, 2022 (the “reporting period”). The Bloomberg U.S. Aggregate Bond Index, a broad measure of U.S. fixed-income performance, returned -15.68%.

The U.S. Federal Reserve’s (Fed’s) shift toward tighter monetary policy was the primary factor driving the market downturn. Annualized consumer price inflation, which had been under 3.0% for over a decade, began to rise throughout 2021 and ultimately climbed above 6.0% in the year’s fourth calendar quarter. The inflation picture soon grew even more challenging following Russia’s invasion of Ukraine in early 2022, which—together with the resulting sanctions—further snarled global supply chains and contributed to a spike in energy prices. Inflation exceeded 8.0% in March 2022 and remained above that level through the end of the reporting period, with a peak of 9.1% in June.

The Fed moved aggressively in an effort to calm price pressures, ending its stimulative quantitative easing program and boosting interest rates from a range of 0.0%-0.25% to 3.0-3.25% in five separate increases from March to September 2022. This marked the largest move in such a short interval since 1980. In addition, the Fed appeared set to continue raising rates until inflation showed signs of returning closer to its longer-term target of 2%. Some evidence began to emerge later in the period that the Fed’s rate hikes had begun to reduce activity in certain segments of the economy, but there was still no sign that consumer price inflation had started to decline in a meaningful fashion. As a result, market prices at the end of October indicated that the central bank would not stop tightening until rates reached the 4.5-5.0% range.

These circumstances weighed heavily on bond market performance. The yield on the two-year U.S. Treasury note rose from 0.50% at the beginning of the period to 4.48% by the end of October 2022, while the 10-year yield climbed from 1.55% to 4.05%. The yield curve inverted significantly as result, meaning that short-term yields were higher those on longer-term debt. In late September, the yield curve moved to its largest inversion since 1982.

The surge in U.S. Treasury yields, together with investors’ increased aversion to risk, fueled weakness across all sectors of the bond market. Mortgage-backed securities, which were hurt by concerns about the housing market and the loss of demand stemming from Fed’s decision to end its quantitative easing policy, posted negative returns. Still, the category held up better than the broader index.

Investment-grade corporate bonds were among the worst-performing segments of the market. In addition to being adversely affected by rising Treasury yields, the asset class was pressured by a pronounced increase in yield spreads. The latter trend reflected concerns that weaker economic growth could lead to a slowdown in corporate earnings. Notably, the yield on corporate bonds—as gauged by the ICE BofA US Corporate Index—closed the period at the highest level since 2009.

High yield bonds also experienced sizable losses. As was the case with investment-grade corporates, a rise in both prevailing yields and yield spreads weighed heavily on performance. However, the category outperformed the investment-grade market due to its lower interest-rate sensitivity and higher weighting in the energy sector. Higher-rated issuers in the category—which are seen as having the least vulnerability to slowing growth—generally outperformed their lower-quality counterparts.

| | |

| 4 | | 2 0 2 2 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

| Fund Summary as of October 31, 2022 | | BlackRock Short Maturity Bond ETF |

Investment Objective

The BlackRock Short Maturity Bond ETF (the “Fund”) seeks to maximize current income by investing, under normal circumstances, at least 80% of its net assets in a portfolio of U.S. dollar-denominated investment-grade fixed income securities and maintain a weighted average maturity that is less than three years. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index.

Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since

Inception | | | | | | 1 Year | | | 5 Years | | | Since

Inception | |

Fund NAV | | | (0.75 | )% | | | 1.28 | % | | | 1.20 | % | | | | | | | (0.75 | )% | | | 6.56 | % | | | 11.51 | % |

Fund Market | | | (0.77 | ) | | | 1.27 | | | | 1.20 | | | | | | | | (0.77 | ) | | | 6.49 | | | | 11.47 | |

Bloomberg Short-Term Government/Corporate Index | | | (0.11 | ) | | | 1.23 | | | | 0.91 | | | | | | | | (0.11 | ) | | | 6.29 | | | | 8.55 | |

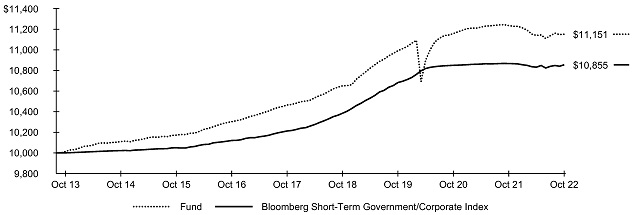

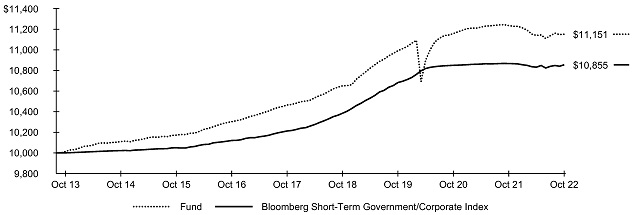

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSETVALUE)

The inception date of the Fund was September 25, 2013. The first day of secondary market trading was September 26, 2013.

The Bloomberg Short-Term Government/Corporate Index is an unmanaged index that measures the performance of government and corporate securities with less than 1 year remaining to maturity.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | | | | | Hypothetical 5% Return | | | | |

| Beginning

Account Value

(05/01/22) |

| |

| Ending

Account Value

(10/31/22) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(05/01/22) |

| |

| Ending

Account Value

(10/31/22) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | $ 1,000.00 | | | | $ 1,001.10 | | | | $ 1.26 | | | | | | | | $ 1,000.00 | | | | $ 1,023.90 | | | | $ 1.28 | | | | 0.25 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| Fund Summary as of October 31, 2022 (continued) | | BlackRock Short Maturity Bond ETF |

Portfolio Management Commentary

The annual period was characterized by high volatility and poor performance for risk assets. In the United States, inflation reached 40-year highs following the lifting of COVID-related restrictions. This prompted a dramatic response from the U.S. Federal Reserve, including 300 basis points (three percentage points) of interest-rate hikes. Short-term bonds, while having less sensitivity than the overall market, were nonetheless adversely affected by these events. However, the -0.11% return for the Bloomberg Short-Term Government/Corporate Index (the Fund’s benchmark) was well ahead of the -15.68% return versus the broader fixed-income market, as represented by the Bloomberg U.S. Aggregate Bond Index.

The Fund underperformed its benchmark. In absolute terms, the bulk of the Fund’s negative absolute return occurred in the first half of the period. In the latter half, income helped offset the effect of declining prices.

The Fund’s largest allocations were to U.S. investment-grade corporate issues and non-U.S. investment-grade corporates, respectively. Both categories experienced negative total returns as yield spreads widened to reflect mounting recession concerns, detracting from Fund performance. Toward the end of the period, the Fund increased its allocations to U.S. investment-grade corporate bonds and asset-backed securities to capitalize on higher yields.

On the positive side, the Fund benefited from its defensive positioning. About 11% of the portfolio was held in cash-like securities during the period, helping relative performance. Holdings in collateralized loan obligations (CLOs), which are better insulated against rising interest rates due to their floating-rate feature, were also beneficial.

Portfolio Information

PORTFOLIO COMPOSITION

| | | | |

| Investment Type | |

| Percent of

Total Investments |

(a) |

Corporate Bonds & Notes | | | 66.8 | % |

Asset-Backed Securities | | | 21.9 | |

Collaterized Mortgage Obligations | | | 6.8 | |

Repurchase Agreements | | | 2.5 | |

Commercial Paper | | | 2.0 | |

CREDIT QUALITY ALLOCATION

| | | | |

| Moody’s Credit Rating* | |

| Percent of

Total Investments |

(a) |

Aaa | | | 17.1 | % |

Aa | | | 3.6 | |

A | | | 30.5 | |

Baa | | | 34.4 | |

Ba | | | 0.7 | |

P-1 | | | 0.2 | |

P-2 | | | 1.1 | |

P-3 | | | 0.5 | |

Not Rated | | | 11.9 | |

| | * | Credit quality ratings shown reflect the ratings assigned by Moody’s Investors Service (“Moody’s”), a widely used independent, nationally recognized statistical rating organization. Moody’s credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of Baa or higher. Below investment grade ratings are credit ratings of Ba or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. | |

| | (a) | Excludes money market funds. | |

| | |

| 6 | | 2 0 2 2 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

| Fund Summary as of October 31, 2022 | | BlackRock Short Maturity Municipal Bond ETF |

Investment Objective

The BlackRock Short Maturity Municipal Bond ETF (the “Fund”) seeks to maximize tax-free current income by investing, under normal circumstances, at least 80% of its net assets in municipal securities such that the interest on each bond is exempt from U.S. federal income taxes and the federal alternative minimum tax. Under normal circumstances, the effective duration of the Fund’s portfolio is expected to be 1.2 years or less, as calculated by the management team, and is not expected to exceed 1.5 years. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index.

Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | 1 Year | | | 5 Years | | | Since

Inception | | | | | | 1 Year | | | 5 Years | | | Since

Inception | |

Fund NAV | | | (0.51 | )% | | | 0.81 | % | | | 0.81 | % | | | | | | | (0.51 | )% | | | 4.13 | % | | | 6.34 | % |

Fund Market | | | (0.42 | ) | | | 0.82 | | | | 0.82 | | | | | | | | (0.42 | ) | | | 4.17 | | | | 6.42 | |

Bloomberg Municipal Bond: 1 Year (1-2) Index | | | (2.20 | ) | | | 0.72 | | | | 0.73 | | | | | | | | (2.20 | ) | | | 3.64 | | | | 5.72 | |

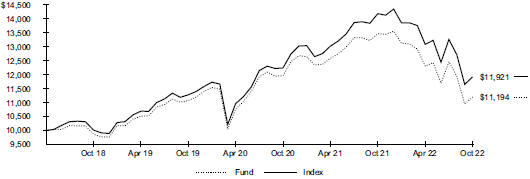

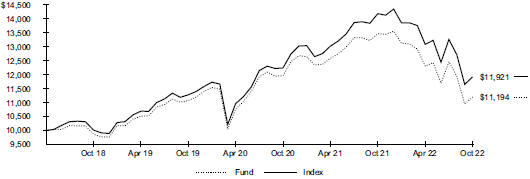

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was March 3, 2015. The first day of secondary market trading was March 5, 2015.

The Bloomberg Municipal Bond: 1 Year (1-2) Index is an unmanaged index comprised of national municipal bond issues having a maturity of at least one year and less than two years.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | |

| Beginning | | | Ending | | | Expenses | | | | | | Beginning | | | Ending | | | Expenses | | | Annualized | |

| Account Value | | | Account Value | | | Paid During | | | | | | Account Value | | | Account Value | | | Paid During | | | Expense | |

| | (05/01/22) | | | | (10/31/22) | | | | the Period | (a) | | | | | | | (05/01/22) | | | | (10/31/22) | | | | the Period | (a) | | | Ratio | |

| $ | 1,000.00 | | | $ | 1,003.70 | | | $ | 1.26 | | | | | | | $ | 1,000.00 | | | $ | 1,023.90 | | | $ | 1.28 | | | | 0.25 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| Fund Summary as of October 31, 2022 (continued) | | BlackRock Short Maturity Municipal Bond ETF |

Portfolio Management Commentary

The annual period was characterized by high volatility and poor performance for risk assets. In the United States, inflation reached 40-year highs following the lifting of COVID-related restrictions. This prompted a dramatic response from the U.S. Federal Reserve, including 300 basis points (three percentage points) of interest-rate hikes. Short-term bonds, while having less rate sensitivity than the overall fixed-income market, were nonetheless adversely affected by these events. Bonds with lower credit quality lagged, as yield spreads widened to reflect mounting concerns that the economy would fall into a recession.

The -2.17% return for the Bloomberg the Bloomberg Municipal Bond: 1 Year (1-2) Index (the Fund’s benchmark) was well ahead of the -15.68% return versus the broader fixed-income market, as represented by the Bloomberg U.S. Aggregate Bond Index.

The Fund outperformed its benchmark. The Fund invests predominately in short-term, fixed-rate, investment-grade municipal bonds and variable-rate demand notes (“VRDNs”), which are longer-maturity securities with floating-rate coupons. VRDNs produced positive total returns in the 12-month period, so the Fund’s holdings in this area contributed to relative performance. The Fund increased its allocation to VRDNs from about 43% to 60% over the reporting period to better position the portfolio for rising rates.

From a sector perspective, tobacco, utility and education bonds delivered positive returns, while transportation issues lagged. Positions in higher-quality securities generally outperformed, with AA rated issues contributing positively. On the other hand, BBB rated bonds detracted due to widening yield spreads.

Portfolio Information

CREDIT QUALITY ALLOCATION

| | | | |

| S&P Credit Rating* | |

| Percent of

Total Investments |

(a) |

AAA | | | 2.9 | % |

AA+ | | | 12.5 | |

AA | | | 8.6 | |

AA- | | | 5.3 | |

A+ | | | 5.7 | |

A | | | 5.4 | |

A- | | | 13.3 | |

BBB+ | | | 5.4 | |

BBB | | | 0.7 | |

Not Rated | | | 40.2 | |

TEN LARGEST STATES

| | | | |

| State | |

| Percent of

Total Investments |

(a) |

Texas | | | 11.1 | % |

Pennsylvania | | | 9.5 | |

New Jersey | | | 7.6 | |

New York | | | 7.4 | |

Kentucky | | | 6.6 | |

Florida | | | 6.2 | |

Louisiana | | | 5.5 | |

Wisconsin | | | 5.1 | |

Georgia | | | 4.9 | |

Iowa | | | 4.0 | |

| | * | Credit quality ratings shown reflect the ratings assigned by S&P Global Ratings, a widely used independent, nationally recognized statistical rating organization. S&P credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of BBB or higher. Below investment grade ratings are credit ratings of BB or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. | |

| | (a) | Excludes money market funds. | |

| | |

| 8 | | 2 0 2 2 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

| Fund Summary as of October 31, 2022 | | BlackRock Ultra Short-Term Bond ETF |

Investment Objective

The BlackRock Ultra Short-Term Bond ETF (the “Fund”) seeks to provide current income consistent with preservation of capital by investing, under normal circumstances, at least 80% of its net assets in a portfolio of U.S. dollar-denominated investment-grade fixed- and floating-rate debt securities and maintain a dollar-weighted average maturity that is less than 180 days. The Fund is an actively managed exchange-traded fund that does not seek to replicate the performance of a specified index.

Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | Cumulative Total Returns | |

| | | 1 Year | | | 5 Years | | | Since

Inception | | | | | | 1 Year | | | 5 Years | | | Since

Inception | |

Fund NAV | | | 0.03 | % | | | 1.49 | % | | | 1.19 | % | | | | | | | 0.03 | % | | | 7.67 | % | | | 11.10 | % |

Fund Market | | | (0.03 | ) | | | 1.48 | | | | 1.19 | | | | | | | | (0.03 | ) | | | 7.63 | | | | 11.06 | |

ICE BofA US 6-Month Treasury Bill Index | | | 0.53 | | | | 1.26 | | | | 0.91 | | | | | | | | 0.53 | | | | 6.47 | | | | 8.40 | |

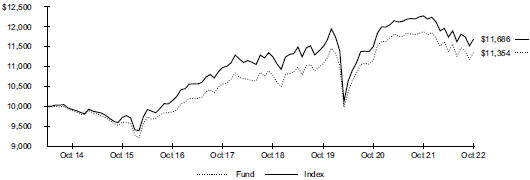

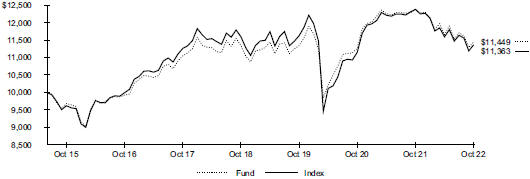

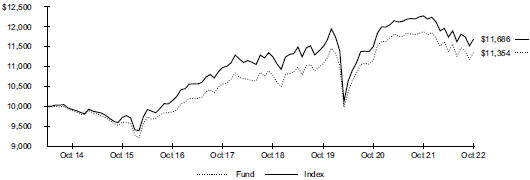

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSETVALUE)

The inception date of the Fund was December 11, 2013. The first day of secondary market trading was December 13, 2013.

On 3/1/2021 the Fund began referencing the 4pm pricing variant of the ICE BofA US 6-Month Treasury Bill Index. Historical index data prior to 3/1/2021 is for the 3pm pricing variant of the ICE BofA US 6-Month Treasury Bill Index. Index data on and after 3/1/2021 is for the 4pm pricing variant of the ICE BofA US 6-Month Treasury Bill Index.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” for more information.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | | | | | Hypothetical 5% Return | | | | |

| | | | | | | | | | | | | | |

| Beginning | | | Ending | | | Expenses | | | | | | Beginning | | | Ending | | | Expenses | | | Annualized | |

| Account Value | | | Account Value | | | Paid During | | | | | | Account Value | | | Account Value | | | Paid During | | | Expense | |

| | (05/01/22) | | | | (10/31/22) | | | | the Period | (a) | | | | | | | (05/01/22) | | | | (10/31/22) | | | | the Period | (a) | | | Ratio | |

| $ | 1,000.00 | | | $ | 1,005.30 | | | $ | 0.40 | | | | | | | $ | 1,000.00 | | | $ | 1,024.80 | | | $ | 0.41 | | | | 0.08 | % |

| | (a) | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). Other fees, such as brokerage commissions and other fees to financial intermediaries, may be paid which are not reflected in the tables and examples above. See “Disclosure of Expenses” for more information. | |

| | |

| Fund Summary as of October 31, 2022 (continued) | | BlackRock Ultra Short-Term Bond ETF |

Portfolio Management Commentary

The annual period was characterized by high volatility and poor performance for risk assets. In the United States, inflation reached 40-year highs following the lifting of COVID-related restrictions. This prompted a dramatic response from the U.S. Federal Reserve, including 300 basis points (three percentage points) of interest-rate hikes. Short-term bonds, while having less sensitivity than the overall market, were nonetheless adversely affected by these events. Bonds with lower credit quality lagged, as yield spreads widened to reflect mounting concerns that the economy would fall into a recession.

The Fund’s benchmark, the ICE BofA US 6-Month Treasury Bill Index, returned 0.53% and strongly outperformed the -15.68% return of the overall fixed-income market, as represented by the Bloomberg U.S. Aggregate Bond Index.

The Fund posted a narrow gain, with income slightly outweighing the impact of falling prices. Relative to the broader market, the Fund benefitted from its defensive positioning. It had a shorter average duration (interest-rate sensitivity) and held a large position in cash and cash equivalents. Commercial paper, which represented about 39% of the Fund’s market value on average, was the primary source of positive total returns. Certificates of deposit, repurchase agreements, and a small allocation to municipal securities were also additive to Fund performance. Positions in these areas helped offset losses from holdings in investment-grade corporate bonds.

Over the course of the year, the Fund reduced its allocations to investment-grade corporate bonds and increased its weighting in commercial paper. Within corporates, the Fund added to floating-rate notes since they are better insulated against interest-rate increases than fixed-rate securities.

Portfolio Information

PORTFOLIO COMPOSITION

| | | | |

| Investment Type | |

| Percent of

Total Investments |

(a) |

Commercial Paper | | | 39.5 | % |

Corporate Bonds & Notes | | | 36.8 | |

Certificates of Deposit | | | 15.7 | |

Repurchase Agreements | | | 3.4 | |

Municipal Debt Obligations | | | 2.4 | |

Asset-Backed Securities | | | 2.1 | |

U.S. Government & Agency Obligations | | | 0.1 | |

CREDIT QUALITY ALLOCATION

| | | | |

| Moody’s Credit Rating* | |

| Percent of

Total Investments |

(a) |

Aaa | | | 2.1 | % |

Aa | | | 8.0 | |

A | | | 23.3 | |

Baa | | | 10.2 | |

P-1 | | | 35.3 | |

P-2 | | | 17.4 | |

Not Rated | | | 3.7 | |

| | * | Credit quality ratings shown reflect the ratings assigned by Moody’s Investors Service (“Moody’s”), a widely used independent, nationally recognized statistical rating organization. Moody’s credit ratings are opinions of the credit quality of individual obligations or of an issuer’s general creditworthiness. Investment grade ratings are credit ratings of Baa or higher. Below investment grade ratings are credit ratings of Ba or lower. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. | |

| | (a) | Excludes money market funds. | |

| | |

| 10 | | 2 0 2 2 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

About Fund Performance

Past performance is not an indication of future results. Financial markets have experienced extreme volatility and trading in many instruments has been disrupted. These circumstances may continue for an extended period of time and may continue to affect adversely the value and liquidity of each Fund’s investments. As a result, current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at iShares.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are redeemed or sold in the market. Performance for certain funds may reflect a waiver of a portion of investment advisory fees. Without such a waiver, performance would have been lower.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. Beginning August 10, 2020, the price used to calculate market return (“Market Price”) is the closing price. Prior to August 10, 2020, Market Price was determined using the midpoint between the highest bid and the lowest ask on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of a fund may not trade in the secondary market until after the fund’s inception, for the period from inception to the first day of secondary market trading in shares of the fund, the NAV of the fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

Disclosure of Expenses

Shareholders of each Fund may incur the following charges: (1) transactional expenses, including brokerage commissions on purchases and sales of fund shares and (2) ongoing expenses, including management fees and other fund expenses. The expense examples shown (which are based on a hypothetical investment of $1,000 invested at the beginning of the period and held through the end of the period) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other funds.

The expense examples provide information about actual account values and actual expenses. Annualized expense ratios reflect contractual and voluntary fee waivers, if any. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in the Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as brokerage commissions and other fees paid on purchases and sales of fund shares. Therefore, the hypothetical examples are useful in comparing ongoing expenses only and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| | |

| ABOUT FUND PERFORMANCE / DISCLOSURE OF EXPENSES | | 11 |

| | |

Schedule of Investments October 31, 2022 | | BlackRock Short Maturity Bond ETF (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

|

Asset-Backed Securities | |

| | | |

ACAS CLO Ltd., 5.08%, 10/18/28 (Call 01/18/23), (3 mo. LIBOR US + 0.890%)(a)(b) | | | USD | | | | 1,617 | | | $ | 1,576,627 | |

AGL Core CLO 4 Ltd., 5.31%, 04/20/33 (Call 01/20/23), (3 mo. LIBOR US + 1.070%)(a)(b) | | | USD | | | | 1,400 | | | | 1,356,171 | |

AIG CLO Ltd., 5.36%, 04/20/32 (Call 01/20/23), (3 mo. LIBOR US + 1.120%)(a)(b) | | | USD | | | | 1,000 | | | | 973,018 | |

Ally Auto Receivables Trust, 2.67%, 04/15/25 (Call 11/15/23) | | | USD | | | | 20,041 | | | | 19,805,873 | |

American Express Credit Account Master Trust, Series 2018-9, Class A, 3.79%, 04/15/26, (1 mo. LIBOR US + 0.380%)(b) | | | USD | | | | 17,650 | | | | 17,653,025 | |

AmeriCredit Automobile Receivables Trust 2022-2, 4.20%, 12/18/25 (Call 03/18/24) | | | USD | | | | 8,903 | | | | 8,830,302 | |

Anchorage Capital CLO 4-R Ltd., Series 2014-4RA, Class A, 5.42%, 01/28/31 (Call 01/28/23), (3 mo. LIBOR US + 1.050%)(a)(b) | | | USD | | | | 4,500 | | | | 4,419,555 | |

Anchorage Capital CLO 7 Ltd., Series 2015-7A, Class AR2, 5.46%, 01/28/31 (Call 01/28/23), (3 mo. LIBOR US + 1.090%)(a)(b) | | | USD | | | | 13,840 | | | | 13,579,249 | |

Apidos CLO XII, 5.16%, 04/15/31 (Call 01/15/23), (3 mo. LIBOR US + 1.080%)(a)(b) | | | USD | | | | 500 | | | | 487,605 | |

Arbor Realty Commercial Real Estate Notes Ltd., 4.48%, 08/15/34 (Call 03/15/24), (1 mo. LIBOR US + 1.070%)(a)(b) | | | USD | | | | 14,450 | | | | 13,804,425 | |

ASSURANT CLO Ltd., Series 2018-2A, Class A, 5.28%, 04/20/31 (Call 01/20/23), (3 mo. LIBOR US + 1.040%)(a)(b) | | | USD | | | | 250 | | | | 242,779 | |

Atlas Senior Loan Fund III Ltd., Series 2013-1A, Class AR, 3.77%, 11/17/27 (Call 11/17/22), (3 mo. LIBOR US + 0.830%)(a)(b) | | | USD | | | | 5,544 | | | | 5,463,930 | |

Atrium XIII, Series 13A, Class A1, 5.50%, 11/21/30 (Call 01/23/23), (3 mo. LIBOR US + 1.180%)(a)(b) | | | USD | | | | 2,500 | | | | 2,459,023 | |

Autoflorence 2 SRL

1.64%, 12/24/44 (Call 10/24/26)(b)(c) | | | EUR | | | | 10,320 | | | | 10,087,571 | |

1.69%, 12/24/44 (Call 10/24/26)(b)(c) | | | EUR | | | | 898 | | | | 857,541 | |

Autonoria Spain FTA

1.82%, 01/25/40 (Call 03/25/28)(b)(c) | | | EUR | | | | 8,500 | | | | 8,379,962 | |

2.98%, 01/26/40 (Call 03/25/28)(b)(c) | | | EUR | | | | 500 | | | | 488,492 | |

Bain Capital Credit CLO Ltd., Series 2017-1A, Class A1R, 5.21%, 07/20/30 (Call 01/20/23), (3 mo. LIBOR US + 0.970%)(a)(b) | | | USD | | | | 3,149 | | | | 3,085,944 | |

Barings CLO Ltd. | | | | | | | | | | | | |

5.31%, 04/20/31 (Call 01/20/23), (3 mo. LIBOR US + 1.070%)(a)(b) | | | USD | | | | 550 | | | | 535,425 | |

5.41%, 01/15/33 (Call 01/15/23), (3 mo. LIBOR US + 1.330%)(a)(b) | | | USD | | | | 3,850 | | | | 3,735,114 | |

BDS 2021-FL9 Ltd., 4.51%, 11/16/38 (Call 10/16/23), (1 mo. LIBOR US + 1.070%)(a)(b) | | | USD | | | | 8,750 | | | | 8,316,272 | |

Benefit Street Partners CLO III Ltd., Series 2013-IIIA, Class A1R2, 5.24%, 07/20/29 (Call 01/20/23), (3 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 258 | | | | 254,191 | |

Benefit Street Partners CLO VIII Ltd., Series 2015-8A, Class A1AR, 5.34%, 01/20/31 (Call 01/20/23), (3 mo. LIBOR US + 1.100%)(a)(b) | | | USD | | | | 750 | | | | 732,375 | |

Benefit Street Partners Clo XII Ltd., 5.03%, 10/15/30 (Call 01/15/23), (3 mo. LIBOR US + 0.950%)(a)(b) | | | USD | | | | 1,678 | | | | 1,643,272 | |

BHG Securitization Trust, 3.75%, 06/18/35 (Call 04/17/24)(a) | | | USD | | | | 1,264 | | | | 1,244,048 | |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

| | | |

BMW Vehicle Owner Trust, 3.52%, 12/26/24 (Call 11/27/23), (30 day SOFR + 0.520%)(b) | | | USD | | | | 13,636 | | | $ | 13,631,282 | |

Capital One Prime Auto Receivables Trust, 2.71%, 06/16/25 (Call 02/15/24) | | | USD | | | | 15,385 | | | | 15,141,652 | |

Carlyle C17 CLO Ltd., Series C17A, Class A1AR, 5.44%, 04/30/31 (Call 01/30/23), (3 mo. LIBOR US + 1.030%)(a)(b) | | | USD | | | | 1,000 | | | | 975,000 | |

Carlyle Global Market Strategies CLO Ltd., Series 2014-1A, Class A1R2, 5.05%, 04/17/31 (Call 01/17/23), (3 mo. LIBOR US + 0.970%)(a)(b) | | | USD | | | | 5,234 | | | | 5,090,149 | |

Carmax Auto Owner Trust, 3.81%, 09/15/25 (Call 05/15/24) | | | USD | | | | 8,777 | | | | 8,660,188 | |

Cbam Ltd., Series 2018-7A, Class A, 5.34%, 07/20/31 (Call 01/20/23), (3 mo. LIBOR US + 1.100%)(a)(b) | | | USD | | | | 750 | | | | 723,750 | |

Cedar Funding IX CLO Ltd., 5.22%, 04/20/31 (Call 01/20/23), (3 mo. LIBOR US + 0.980%)(a)(b) | | | USD | | | | 2,130 | | | | 2,073,198 | |

Chesapeake Funding II LLC, Series 2020-1A, Class A2, 4.06%, 08/15/32 (Call 05/15/23), (1 mo. LIBOR US + 0.650%)(a)(b) | | | USD | | | | 5,271 | | | | 5,258,761 | |

CIFC Funding Ltd. | | | | | | | | | | | | |

Series 2014-2RA, Class A1, 5.37%, 04/24/30 (Call 01/24/23), (3 mo. LIBOR US + 1.050%)(a)(b) | | | USD | | | | 248 | | | | 243,005 | |

Series 2018-1A, Class A, 5.19%, 04/18/31 (Call 01/18/23), (3 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 13,000 | | | | 12,642,500 | |

Series 2018-2A, Class A1, 5.28%, 04/20/31 (Call 01/20/23), (3 mo. LIBOR US + 1.040%)(a)(b) | | | USD | | | | 1,250 | | | | 1,216,960 | |

Citibank Credit Card Issuance Trust, Series 2019-A5, Class A5, 4.19%, 04/22/26, (1 mo. LIBOR US + 0.620%)(b) | | | USD | | | | 40,505 | | | | 40,456,378 | |

College Ave Student Loans LLC, Series 2021-A, Class A1, 4.69%, 07/25/51 (Call 02/25/32), (1 mo. LIBOR US + 1.100%)(a)(b) | | | USD | | | | 216 | | | | 206,452 | |

Credit Acceptance Auto Loan Trust, Series 2021-3A, Class A, 1.00%, 05/15/30 (Call 07/15/24)(a) | | | USD | | | | 4,130 | | | | 3,878,505 | |

Diameter Capital Clo 1 Ltd., 5.32%, 07/15/36 (Call 10/15/23), (3 mo. LIBOR US + 1.240%)(a)(b) | | | USD | | | | 2,170 | | | | 2,078,550 | |

Donlen Fleet Lease Funding 2 LLC, Series 2021-2, Class A2, 0.56%, 12/11/34(a) | | | USD | | | | 8,581 | | | | 8,256,661 | |

Dowson PLC | | | | | | | | | | | | |

3.11%, 01/20/29 (Call 09/20/24)(b)(c) | | | GBP | | | | 3,079 | | | | 3,510,882 | |

3.94%, 01/20/29 (Call 04/22/25)(b)(c) | | | GBP | | | | 646 | | | | 716,789 | |

4.89%, 08/20/29 (Call 02/20/24)(b)(c) | | | GBP | | | | 1,158 | | | | 1,298,138 | |

Series 2021-2, Class A, 2.87%, 10/20/28 (Call 11/20/23), (Sterning Ovenight Index Average + 0.680%)(b)(c) | | | GBP | | | | 4,398 | | | | 5,027,201 | |

Series 2021-2, Class B, 3.39%, 10/20/28 (Call 05/20/24), (Sterning Ovenight Index Average + 1.200%)(b)(c) | | | GBP | | | | 1,600 | | | | 1,793,191 | |

Dryden 36 Senior Loan Fund, 5.10%, 04/15/29 (Call 01/15/23), (3 mo. LIBOR US + 1.020%)(a)(b) | | | USD | | | | 1,680 | | | | 1,650,797 | |

Dryden 49 Senior Loan Fund, Series 2017-49A, Class AR, 5.14%, 07/18/30 (Call 01/18/23), (3 mo. LIBOR US + 0.950%)(a)(b) | | | USD | | | | 10,688 | | | | 10,489,671 | |

Dryden 77 CLO Ltd., Series 2020-77A, Class XR, 3.98%, 05/20/34 (Call 05/20/23), (3 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 234 | | | | 233,015 | |

Dryden XXVI Senior Loan Fund, Series 2013-26A, Class AR, 4.98%, 04/15/29 (Call 01/15/23), (3 mo. LIBOR US + 0.900%)(a)(b) | | | USD | | | | 14,728 | | | | 14,456,080 | |

Dryden XXVIII Senior Loan Fund, 4.11%, 08/15/30 (Call 11/15/22), (3 mo. LIBOR US + 1.200%)(a)(b) | | | USD | | | | 3,333 | | | | 3,277,069 | |

| | |

| 12 | | 2 0 2 2 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

Schedule of Investments (continued) October 31, 2022 | | BlackRock Short Maturity Bond ETF (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

| | | |

Dutch Property Finance, Series 2021-2, Class A, 2.28%, 04/28/59

(Call 04/28/26)(b)(c) | | | EUR | | | | 5,724 | | | $ | 5,524,773 | |

Dutch Property Finance BV, 0.96%, 10/28/59 (Call 01/28/27)(b)(c) | | | EUR | | | | 7,979 | | | | 7,681,099 | |

Elevation CLO Ltd., Series 2014-2A, Class A1R, 5.36%, 10/15/29 (Call 01/15/23), (3 mo. LIBOR US + 1.230%)(a)(b) | | | USD | | | | 420 | | | | 413,297 | |

Elmwood CLO X Ltd., Series 2021-3A, Class A, 5.28%, 10/20/34 (Call 01/20/23), (3 mo. LIBOR US + 1.040%)(a)(b) | | | USD | | | | 13,000 | | | | 12,497,213 | |

Elvet Mortgages PLC, Series 2021-1, Class A, 2.56%, 10/22/63

(Call 10/22/26)(b)(c) | | | GBP | | | | 9,348 | | | | 10,567,590 | |

Enterprise Fleet Funding LLC, Series 2021-1, Class A2, 0.44%, 12/21/26 (Call 04/20/24)(a) | | | USD | | | | 7,327 | | | | 7,066,531 | |

Ford Credit Auto Owner Trust, 3.44%, 02/15/25 (Call 01/15/24) | | | USD | | | | 27,812 | | | | 27,537,284 | |

FS Rialto Issuer LLC, 4.79%, 01/19/39 (Call 04/17/24), (SOFR + 1.900%)(a)(b) | | | USD | | | | 5,000 | | | | 4,806,531 | |

Galaxy XV CLO Ltd., Series 2013-15A, Class ARR, 5.05%, 10/15/30 (Call 01/15/23), (3 mo. LIBOR US + 0.970%)(a)(b) | | | USD | | | | 670 | | | | 652,366 | |

Galaxy XXVII CLO Ltd., 3.94%, 05/16/31 (Call 11/16/22)(a)(b) | | | USD | | | | 2,730 | | | | 2,659,852 | |

Generate CLO 2 Ltd., 5.47%, 01/22/31 (Call 01/22/23)(a)(b) | | | USD | | | | 1,605 | | | | 1,572,969 | |

Gilbert Park CLO Ltd., 5.27%, 10/15/30 (Call 01/15/23), (3 mo. LIBOR US + 1.190%)(a)(b) | | | USD | | | | 250 | | | | 244,494 | |

GM Financial Automobile Leasing Trust, 2.93%, 10/21/24 (Call 01/20/24) | | | USD | | | | 18,952 | | | | 18,667,605 | |

GoldenTree Loan Opportunities IX Ltd., Series 2014-9A, Class AR2, 5.52%, 10/29/29 (Call 01/29/23), (3 mo. LIBOR US + 1.110%)(a)(b) | | | USD | | | | 15,721 | | | | 15,411,730 | |

HGI CRE CLO Ltd., 4.41%, 09/17/36 (Call 09/19/23), (1 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 5,380 | | | | 5,135,561 | |

Highbridge Loan Management, Series 3A-2014, Class A1R, 5.37%, 07/18/29 (Call 01/18/23), (3 mo. LIBOR US + 1.180%)(a)(b) | | | USD | | | | 1,087 | | | | 1,068,193 | |

Honda Auto Receivables Owner Trust, 3.81%, 03/18/25 (Call 03/18/24) | | | USD | | | | 12,396 | | | | 12,257,683 | |

Hyundai Auto Lease Securitization Trust, 3.41%, 10/15/24 (Call 11/15/23), (30 day SOFR + 0.620%)(a)(b) | | | USD | | | | 23,490 | | | | 23,485,435 | |

Hyundai Auto Receivables Trust, 3.64%, 05/15/25 (Call 04/15/24) | | | USD | | | | 10,808 | | | | 10,687,180 | |

John Deere Owner Trust, 3.73%, 06/16/25 (Call 04/15/24) | | | USD | | | | 8,735 | | | | 8,620,355 | |

KKR CLO 21 Ltd., 5.08%, 04/15/31 (Call 01/15/23), (3 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 5,590 | | | | 5,434,511 | |

KREF Ltd., 4.92%, 02/17/39 (Call 01/17/24)(a)(b) | | | USD | | | | 9,360 | | | | 9,009,000 | |

LCM 29 Ltd., Series 29A, Class AR, 5.15%, 04/15/31 (Call 01/15/23), (3 mo. LIBOR US + 1.070%)(a)(b) | | | USD | | | | 2,600 | | | | 2,528,503 | |

LoanCore Issuer Ltd., 4.71%, 11/15/38 (Call 11/15/23), (1 mo. LIBOR US + 1.300%)(a)(b) | | | USD | | | | 2,640 | | | | 2,521,379 | |

Madison Park Funding XIII Ltd., Series 2014-13A, Class AR2, 5.18%, 04/19/30 (Call 01/19/23), (3 mo. LIBOR US + 0.950%)(a)(b) | | | USD | | | | 3,775 | | | | 3,708,277 | |

Madison Park Funding XVII Ltd., Series 2015-17A, Class AR2, 5.28%, 07/21/30 (Call 01/21/23), (3 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 1,784 | | | | 1,748,624 | |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

| | | |

Madison Park Funding XXIII Ltd., Series 2017-23A, Class AR, 5.33%, 07/27/31 (Call 01/27/23), (3 mo. LIBOR US + 0.970%)(a)(b) | | | USD | | | | 13,200 | | | $ | 12,936,000 | |

Madison Park Funding XXVI Ltd., Series 2007-4A, Class AR,

5.61%, 07/29/30,

(3 mo. LIBOR US + 1.200%)(a)(b) | | | USD | | | | 4,875 | | | | 4,788,264 | |

Madison Park Funding XXXVII Ltd., 5.15%, 07/15/33 (Call 01/15/23), (3 mo. LIBOR US + 1.070%)(a)(b) | | | USD | | | | 1,750 | | | | 1,694,704 | |

Mariner CLO LLC, Series 2016-3A, Class AR2, 5.31%, 07/23/29 (Call 01/23/23), (3 mo. LIBOR US + 0.990%)(a)(b) | | | USD | | | | 951 | | | | 933,134 | |

MF1 Multifamily Housing Mortgage Loan Trust, 4.54%, 07/16/36 (Call 07/16/23), (1 mo. LIBOR US + 1.100%)(a)(b) | | | USD | | | | 4,520 | | | | 4,333,109 | |

Multifamily Housing Mortgage Loan Trust, 4.24%, 02/19/37 (Call 02/17/24)(a)(b) | | | USD | | | | 1,860 | | | | 1,788,422 | |

Navient Private Education Loan Trust | | | | | | | | | | | | |

Series 2017-A, Class A2B, 4.31%, 12/16/58 (Call 09/16/24), (1 mo. LIBOR US + 0.900%)(a)(b) | | | USD | | | | 336 | | | | 334,258 | |

Series 2020-IA, Class A1B, 4.41%, 04/15/69 (Call 05/15/31), (1 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 6,104 | | | | 5,899,653 | |

Navient Private Education Refi Loan Trust | | | | | | | | | | | | |

Series 2021-BA, Class A, 0.94%, 07/15/69 (Call 09/15/28)(a) | | | USD | | | | 5,997 | | | | 5,028,998 | |

Series 2021-DA, Class A, 4.26%, 04/15/60 (Call 05/15/32), (PRIME - 1.990%)(a)(b) | | | USD | | | | 7,421 | | | | 6,520,625 | |

Nelnet Student Loan Trust | | | | | | | | | | | | |

4.18%, 04/20/62 (Call 03/20/29), (1 mo. LIBOR US + 0.690%)(a)(b) | | | USD | | | | 2,929 | | | | 2,823,972 | |

4.23%, 04/20/62 (Call 08/20/29), (1 mo. LIBOR US + 0.740%)(a)(b) | | | USD | | | | 5,622 | | | | 5,378,625 | |

Series 2021-A, Class A1, 4.29%, 04/20/62 (Call 02/20/29), (1 mo. LIBOR US + 0.800%)(a)(b) | | | USD | | | | 7,080 | | | | 6,893,096 | |

Series 2021-BA, Class AFL, 4.27%, 04/20/62 (Call 07/20/29), (1 mo. LIBOR US + 0.780%)(a)(b) | | | USD | | | | 12,259 | | | | 11,817,611 | |

Neuberger Berman CLO Ltd., Series 2013-14A, Class AR2, 5.40%, 01/28/30 (Call 01/28/23), (3 mo. LIBOR US + 0.990%)(a)(b) | | | USD | | | | 488 | | | | 478,798 | |

Neuberger Berman Loan Advisers CLO 33 Ltd., 5.16%, 10/16/33 (Call 01/16/23), (3 mo. LIBOR US + 1.080%)(a)(b) | | | USD | | | | 2,050 | | | | 1,986,636 | |

Niagara Park Clo Ltd., 5.08%, 07/17/32 (Call 01/17/23), (3 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 2,500 | | | | 2,408,750 | |

Nissan Auto Lease Trust, 3.45%, 08/15/24 (Call 11/15/23) | | | USD | | | | 14,548 | | | | 14,379,879 | |

NLY Commercial Mortgage Trust, Series 2019-FL2, Class A, 4.71%, 02/15/36 (Call 11/15/22), (1 mo. LIBOR US + 1.300%)(a)(b) | | | USD | | | | 1,226 | | | | 1,213,921 | |

OCP CLO Ltd., Series 2017-13A, 5.04%, 07/15/30 (Call 01/15/23), (3 mo. LIBOR US + 0.960%)(a)(b) | | | USD | | | | 3,820 | | | | 3,728,003 | |

Octagon Investment Partners XVII Ltd., Series 2013-1A, Class A1R2, 5.36%, 01/25/31 (Call 01/25/23), (3 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 3,000 | | | | 2,936,579 | |

OneMain Direct Auto Receivables Trust, 4.37%, 03/14/29 (Call 09/15/25)(a)(b) | | | USD | | | | 8,825 | | | | 8,793,219 | |

OneMain Financial Issuance Trust | | | | | | | | | | | | |

3.53%, 06/16/36 (Call 06/14/26), (SOFR + 0.760%)(a)(b | | | USD | | | | 5,108 | | | | 4,687,385 | |

3.84%, 05/14/32 (Call 11/14/22)(a) | | | USD | | | | 2,893 | | | | 2,857,277 | |

| | |

S C H E D U L E O F I N V E S T M E N T S | | 13 |

| | |

Schedule of Investments (continued) October 31, 2022 | | BlackRock Short Maturity Bond ETF (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

| | | |

Palmer Square CLO Ltd. | | | | | | | | | | | | |

5.23%, 10/17/31 (Call 01/19/23),

(3 mo. LIBOR US +

1.000%)(a)(b) | | | USD | | | | 1,800 | | | $ | 1,743,566 | |

Series 2015-2, 5.34%, 07/20/30 (Call 01/20/23), (3 mo. LIBOR US + 1.100%)(a)(b) | | | USD | | | | 3,603 | | | | 3,524,968 | |

Series 2021-3A, Class A1, 5.23%, 01/15/35 (Call 01/15/24)(a)(b) | | | USD | | | | 500 | | | | 477,395 | |

Palmer Square Loan Funding Ltd., 4.08%, 01/15/31

(Call 10/15/23)(a)(b) | | | USD | | | | 5,080 | | | | 5,075,539 | |

PCL Funding V PLC, 2.94%, 10/15/25 (Call 10/15/23)(b)(c) | | | GBP | | | | 3,000 | | | | 3,400,414 | |

PCL Funding VI PLC, 3.59%, 07/15/26 (Call 07/15/24)(b)(c) | | | GBP | | | | 6,611 | | | | 7,549,270 | |

PFS Financing Corp., 3.39%, 02/15/26, (SOFR + 0.600%)(a)(b) | | | USD | | | | 22,642 | | | | 22,467,638 | |

Pikes Peak CLO 1, Series 2018-1A, Class A, 5.50%, 07/24/31 (Call 01/24/23), (3 mo. LIBOR US + 1.180%)(a)(b) | | | USD | | | | 1,500 | | | | 1,459,420 | |

Prodigy Finance CM2021-1 DAC, Series 2021-1A, Class A, 4.84%, 07/25/51 (Call 02/25/27), (1 mo. LIBOR US + 1.250%)(a)(b) | | | USD | | | | 1,424 | | | | 1,371,513 | |

Red & Black Auto Germany 8 UG, Class B, 1.60%, 09/15/30 (Call 11/15/25)(b)(c) | | | EUR | | | | 400 | | | | 385,306 | |

Red & Black Auto Italy S.r.l., Class A, 1.81%, 12/28/31 (Call 09/28/25)(b)(c) | | | EUR | | | | 12,452 | | | | 12,186,057 | |

Romark WM-R Ltd., Series 2018-1A, Class A1, 5.27%, 04/20/31 (Call 01/20/23), (3 mo. LIBOR US + 1.030%)(a)(b) | | | USD | | | | 3,879 | | | | 3,799,051 | |

RR 3 Ltd., Series 2018-3A, Class A1R2, 5.17%, 01/15/30 (Call 01/15/23), (3 mo. LIBOR US + 1.090%)(a)(b) | | | USD | | | | 2,000 | | | | 1,958,902 | |

Santander Drive Auto Receivables Trust

2.76%, 03/17/25 (Call 08/15/23) | | | USD | | | | 15,464 | | | | 15,357,487 | |

4.05%, 07/15/25 (Call 11/15/23) | | | USD | | | | 7,792 | | | | 7,736,275 | |

Satus PLC | | | | | | | | | | | | |

2.89%, 08/17/28 (Call 01/17/24), (Sterning Ovenight Index Average + 0.700%)(b)(c) | | | GBP | | | | 524 | | | | 597,791 | |

3.39%, 08/17/28 (Call 07/17/24), (Sterning Ovenight Index Average + 1.200%)(b)(c) | | | GBP | | | | 400 | | | | 453,215 | |

3.79%, 08/17/28 (Call 01/17/25), (Sterning Ovenight Index Average + 1.600%)(b)(c) | | | GBP | | | | 300 | | | | 334,838 | |

Shackleton Clo Ltd., Series 2017-11A, 4.00%, 08/15/30 (Call 11/15/22), (3 mo. LIBOR US + 1.090%)(a)(b) | | | USD | | | | 2,750 | | | | 2,697,770 | |

Shackleton CLO Ltd., Series 2015-7R, 5.23%, 07/15/31 (Call 01/15/23), (3 mo. LIBOR US + 1.150%)(a)(b) | | | USD | | | | 2,750 | | | | 2,678,804 | |

Signal Peak CLO 2 LLC, Series 2015-1A, Class AR2, 5.22%, 04/20/29 (Call 01/20/23), (3 mo. LIBOR US + 0.980%)(a)(b) | | | USD | | | | 1,351 | | | | 1,324,678 | |

Silver Creek CLO Ltd., 5.48%, 07/20/30 (Call 01/20/23), (3 mo. LIBOR US + 1.240%)(a)(b) | | | USD | | | | 6,006 | | | | 5,913,289 | |

Silverstone Master Issuer PLC, 2.48%, 01/21/70

(Call 04/21/27)(b)(c) | | | GBP | | | | 3,485 | | | | 3,906,323 | |

SLM Private Credit Student Loan Trust | | | | | | | | | | | | |

Series 2004-A, Class A3, 3.69%, 06/15/33 (Call 12/15/22), (3 mo. LIBOR US + 0.400%)(b) | | | USD | | | | 3,121 | | | | 3,035,675 | |

Series 2004-B, Class A3, 3.62%, 03/15/24 (Call 12/15/23), (3 mo. LIBOR US + 0.330%)(b) | | | USD | | | | 2,121 | | | | 2,113,180 | |

Series 2005-A, Class A4, 3.60%, 12/15/38 (Call 12/15/26), (3 mo. LIBOR US + 0.310%)(b) | | | USD | | | | 6,900 | | | | 6,534,510 | |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

| | | |

Series 2005-B, Class A4, 3.62%, 06/15/39 (Call 09/15/26), (3 mo. LIBOR US + 0.330%)(b) | | | USD | | | | 4,875 | | | $ | 4,649,147 | |

Series 2006-A, Class A5, 3.58%, 06/15/39 (Call 09/15/28), (3 mo. LIBOR US + 0.290%)(b) | | | USD | | | | 10,897 | | | | 10,207,584 | |

Series 2006-B, Class A5, 3.56%, 12/15/39 (Call 09/15/27), (3 mo. LIBOR US + 0.270%)(b) | | | USD | | | | 7,801 | | | | 7,336,079 | |

SMB Private Education Loan Trust | | | | | | | | | | | | |

4.24%, 02/16/55, (30 day SOFR + 1.450%)(a)(b) | | | USD | | | | 11,449 | | | | 11,079,701 | |

4.64%, 05/16/50, (SOFR + 1.850%)(a)(b) | | | USD | | | | 5,288 | | | | 5,258,243 | |

4.75%, 10/15/58 | | | USD | | | | 21,335 | | | | 21,012,963 | |

Series 2017-A, Class A2B, 4.31%, 09/15/34, (1 mo. LIBOR US + 0.900%)(a)(b) | | | USD | | | | 9,903 | | | | 9,765,437 | |

Series 2021-C, Class A1, 3.81%, 01/15/53, (1 mo. LIBOR US + 0.400%)(a)(b) | | | USD | | | | 371 | | | | 371,127 | |

SoFi Professional Loan Program LLC, Series 16-C, Class A1, 4.69%, 10/27/36 (Call 11/25/22), (1 mo. LIBOR US + 1.100%)(a)(b) | | | USD | | | | 363 | | | | 363,290 | |

Sound Point Clo XV Ltd., Series 2017-1A, Class ARR, 5.22%, 01/23/29 (Call 01/23/23), (3 mo. LIBOR US + 0.900%)(a)(b) | | | USD | | | | 2,124 | | | | 2,090,942 | |

Sound Point CLO XXVIII Ltd., Series 2020 3A, Class A1, 5.64%, 01/25/32 (Call 01/25/23), (3 mo. LIBOR US + 1.280%)(a)(b) | | | USD | | | | 1,250 | | | | 1,210,180 | |

Southwick Park CLO LLC, 5.30%, 07/20/32 (Call 01/20/23), (3 mo. LIBOR US + 1.060%)(a)(b) | | | USD | | | | 8,760 | | | | 8,447,705 | |

Symphony CLO XVI Ltd., Series 2015-16A, Class AR, 5.23%, 10/15/31 (Call 01/15/23), (3 mo. LIBOR US + 1.150%)(a)(b) | | | USD | | | | 500 | | | | 487,826 | |

TAGUS - Sociedade de Titularizacao de Creditos SA/Ulisses Finance No. 2, 1.64%, 09/23/38

(Call 02/23/28)(b)(c) | | | EUR | | | | 11,819 | | | | 11,635,220 | |

TCI-Symphony CLO Ltd. | | | | | | | | | | | | |

4.96%, 10/13/32 (Call 01/13/23),

(3 mo. LIBOR US + 1.020%)(a)(b) | | | USD | | | | 5,235 | | | | 5,069,056 | |

5.01%, 07/15/30 (Call 01/15/23), (3 mo. LIBOR US +

0.930%)(a)(b) | | | USD | | | | 7,958 | | | | 7,789,664 | |

TICP CLO IX Ltd., Series 2017-9A, Class A, 5.38%, 01/20/31 (Call 01/20/23), (3 mo. LIBOR US + 1.140%)(a)(b) | | | USD | | | | 500 | | | | 488,772 | |

Together Asset-Backed Securitisation PLC, 2.89%, 07/12/63 (Call 10/12/25)(b)(c) | | | GBP | | | | 2,350 | | | | 2,622,027 | |

Verizon Owner Trust, Series 2020-A, Class A1B, 3.76%, 07/22/24 (Call 04/20/23), (1 mo. LIBOR US + 0.270%)(b) | | | USD | | | | 2,536 | | | | 2,534,043 | |

Volkswagen Auto Lease Trust, 3.20%, 10/21/24 (Call 01/20/24) | | | USD | | | | 20,878 | | | | 20,536,561 | |

Voya CLO, Series 2017-2A, Class A1R, 5.06%, 06/07/30 (Call 01/15/23), (3 mo. LIBOR US + 0.980%)(a)(b) | | | USD | | | | 5,122 | | | | 5,017,154 | |

Voya CLO Ltd., 5.14%, 04/15/31 (Call 01/15/23), (3 mo. LIBOR US + 1.060%)(a)(b) | | | USD | | | | 1,250 | | | | 1,220,952 | |

Voya Ltd., Series 2012-4, 5.08%, 10/15/30 (Call 01/15/23), (3 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 13,000 | | | | 12,726,176 | |

Wellfleet CLO Ltd., Series 2016-1A, Class AR, 5.15%, 04/20/28 (Call 01/20/23), (3 mo. LIBOR US + 0.910%)(a)(b) | | | USD | | | | 828 | | | | 811,969 | |

Westlake Automobile Receivables Trust 3.36%, 08/15/25 (Call 12/15/23)(a) | | | USD | | | | 7,738 | | | | 7,634,673 | |

| | |

| 14 | | 2 0 2 2 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

Schedule of Investments (continued) October 31, 2022 | | BlackRock Short Maturity Bond ETF (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

| | | |

Series 2021-1A, Class A2A, 0.39%, 10/15/24 (Call 02/15/23)(a) | | | USD | | | | 2,447 | | | $ | 2,434,300 | |

| | | | | | | | | | | | |

| | |

Total Asset-Backed Securities — 21.0%

(Cost: $919,686,367) | | | | | | | | 890,030,231 | |

| | | | | | | | | | | | |

|

Collaterized Mortgage Obligations | |

|

Mortgage-Backed Securities — 6.5% | |

280 Park Avenue Mortgage Trust, Series 2017-280P, Class A, 4.18%, 09/15/34 (Call 11/15/22), (1 mo. LIBOR US + 0.880%)(a)(b) | | | USD | | | | 12,100 | | | | 11,766,704 | |

AREIT Trust

4.14%, 01/16/37 (Call 01/15/25)(a)(b) | | | USD | | | | 1,878 | | | | 1,791,624 | |

Series 2019-CRE3, Class A, 4.76%, 09/14/36 (Call 08/14/23),

(1 mo. LIBOR US + 1.020%)(a)(b) | | | USD | | | | 4,059 | | | | 4,042,876 | |

BAMLL Commercial Mortgage Securities Trust,

Series 2018-DSNY, Class A, 4.26%, 09/15/34,

(1 mo. LIBOR US + 0.850%)(a)(b) | | | USD | | | | 19,220 | | | | 18,714,624 | |

BBCMS-TALL Mortgage Trust,

Series 2018-TALL, Class A, 4.13%, 03/15/37,

(1 mo. LIBOR US + 0.722%)(a)(b) | | | USD | | | | 8,630 | | | | 8,111,995 | |

BX Commercial Mortgage Trust

4.10%, 10/15/38,

(1 mo. LIBOR US + 0.690%)(a)(b) | | | USD | | | | 9,063 | | | | 8,572,413 | |

4.39%, 02/15/39(a)(b) | | | USD | | | | 10,020 | | | | 9,557,185 | |

Series 2019-XL, Class A,

4.33%, 10/15/36,

(1 mo. LIBOR US + 0.920%)(a)(b) | | | USD | | | | 5,398 | | | | 5,289,335 | |

BX Trust

4.31%, 10/15/36,

(1 mo. LIBOR US + 0.890%)(a)(b) | | | USD | | | | 8,520 | | | | 7,986,659 | |

Series 2019-CALM, Class A,

4.29%, 11/15/32,

(1 mo. LIBOR US + 0.876%)(a)(b) | | | USD | | | | 1,290 | | | | 1,255,804 | |

Series 2021, Class A, 4.69%, 06/15/36,

(1 mo. LIBOR US + 1.280%)(a)(b) | | | USD | | | | 2,070 | | | | 1,959,238 | |

CEDR Commercial Mortgage Trust,

4.36%, 02/15/39(a)(b) | | | USD | | | | 5,410 | | | | 5,053,379 | |

Chase Home Lending Mortgage Trust, Series 2019-ATR2, Class A11,

4.49%, 07/25/49 (Call 01/25/26),

(1 mo. LIBOR US + 0.900%)(a)(b) | | | USD | | | | 1,133 | | | | 1,086,310 | |

Cold Storage Trust, Series 2020-ICE5, Class A, 4.31%, 11/15/37,

(1 mo. LIBOR US + 0.900%)(a)(b) | | | USD | | | | 1,843 | | | | 1,786,745 | |

Commission Mortgage Trust

3.42%, 03/10/31 (Call 03/10/23)(a) | | | USD | | | | 17,220 | | | | 17,182,559 | |

3.73%, 03/10/31 (Call 03/10/23)(a) | | | USD | | | | 10,000 | | | | 9,980,750 | |

Series 2013- GAM, Class A2,

3.37%, 02/10/28 (Call 02/10/23)(a) | | | USD | | | | 6,185 | | | | 6,105,973 | |

Credit Suisse Mortgage Capital Certificates, Series 2019-ICE4, Class A,

4.39%, 05/15/36,

(1 mo. LIBOR US + 0.980%)(a)(b) | | | USD | | | | 6,333 | | | | 6,214,042 | |

DBGS Mortgage Trust, Series 2018-5BP, Class A, 4.21%, 06/15/33 (Call 11/15/22), (1 mo. LIBOR

US + 0.645%)(a)(b) | | | USD | | | | 4,200 | | | | 4,000,221 | |

Extended Stay America Trust, Series 2021-ESH, Class A, 4.49%, 07/15/38,

(1 mo. LIBOR US + 1.080%)(a)(b) | | | USD | | | | 6,082 | | | | 5,838,021 | |

Friary No. 7 PLC, 2.36%, 10/21/70

(Call 10/21/27)(b) | | | GBP | | | | 1,544 | | | | 1,762,950 | |

GCT Commercial Mortgage Trust, Series 2021-GCT, Class A, 4.21%, 02/15/38,

(1 mo. LIBOR US + 0.800%)(a)(b) | | | USD | | | | 8,600 | | | | 8,081,223 | |

GS Mortgage Securities Corportation Trust, 4.36%, 10/15/36, (1 mo. LIBOR US + 0.950%)(a)(b) | | | USD | | | | 10,360 | | | | 9,623,515 | |

Hops Hill No. 1 PLC, 3.14%, 05/27/54

(Call 05/27/24)(b)(c) | | | GBP | | | | 2,968 | | | | 3,348,433 | |

| | | | | | | | | | | | |

| Security | | | | | Par

(000) | | | Value | |

|

Mortgage-Backed Securities (continued) | |

J.P. Morgan Chase Commercial Mortgage Securities Trust, 4.19%, 03/15/39(a)(b) | | | USD | | | | 5,540 | | | $ | 5,380,560 | |

JP Morgan Chase Commercial Mortgage Securities Trust, Series 2019-BKWD, Class A, 4.66%, 09/15/29,

(1 mo. LIBOR US + 1.000%)(a)(b) | | | USD | | | | 1,645 | | | | 1,597,592 | |

KNDL Mortgage Trust, Series 2019-KNSQ, Class A, 4.21%, 05/15/36,

(1 mo. LIBOR US + 0.800%)(a)(b) | | | USD | | | | 8,533 | | | | 8,362,341 | |

Med Trust, 4.36%, 11/15/38(a)(b) | | | USD | | | | 4,260 | | | | 4,057,320 | |

MF1 Multifamily Housing Mortgage Loan Trust

4.45%, 12/15/34, (SOFR + 1.070%)(a)(b)(d) | | | USD | | | | 1,230 | | | | 1,174,650 | |

4.75%, 12/15/34, (SOFR + 1.370%)(a)(b)(d) | | | USD | | | | 480 | | | | 456,000 | |

MHC Commercial Mortgage Trust, 4.21%, 04/15/38, (1 mo. LIBOR US + 0.801%)(a)(b) | | | USD | | | | 5,925 | | | | 5,676,382 | |

Morgan Stanley Capital I Trust | | | | | | | | | | | | |

Series 2018-BOP, Class A,

4.26%, 08/15/33,

(1 mo. LIBOR US + 0.850%)(a)(b) | | | USD | | | | 4,330 | | | | 4,242,065 | |

Series 2018-SUN, Class A,

4.31%, 07/15/35 (Call 07/15/23),

(1 mo. LIBOR US + 0.900%)(a)(b) . | | | USD | | | | 19,045 | | | | 18,449,758 | |

MSCG Trust, 4.31%, 10/15/37,

(1 mo. LIBOR US + 0.900%)(a)(b) | | | USD | | | | 5,300 | | | | 5,140,776 | |

MTN Commercial Mortgage Trust,

4.77%, 03/15/39(a)(b) | | | USD | | | | 8,930 | | | | 8,662,118 | |

Ready Capital Mortgage Financing LLC, 4.67%, 01/25/37 (Call 02/25/24),

(SOFR + 1.650%)(a)(b) | | | USD | | | | 8,560 | | | | 8,215,570 | |

RIAL Issuer Ltd.,

5.72%, 01/19/37 (Call 05/19/24)(a)(b) | | | USD | | | | 6,955 | | | | 6,728,962 | |

Taubman Centers Commercial Mortgage Trust, 5.56%, 05/15/37(a)(b) | | | USD | | | | 2,900 | | | | 2,823,755 | |

Taurus UK DAC, 2.87%, 08/17/31 (Call 08/17/26), (SOFR + 0.950%)(b)(c) | | | GBP | | | | 6,837 | | | | 7,454,332 | |

TPGI Trust, Series 2021 DGWD, Class A, 4.11%, 06/15/26, (1 mo. LIBOR US + 0.700%)(a)(b) | | | USD | | | | 6,320 | | | | 5,998,308 | |

Vita Scientia DAC, 1.82%, 02/27/33(b)(c) | | | EUR | | | | 5,708 | | | | 5,329,732 | |

Wells Fargo Commercial Mortgage Trust, Series 2017-SMP, Class A, 4.29%, 12/15/34, (1 mo. LIBOR US + 0.750%)(a)(b) | | | USD | | | | 17,280 | | | | 17,069,327 | |

| | | | | | | | | | | | |

| |

Total Collaterized Mortgage Obligations — 6.5%

(Cost: $286,921,058) | | | | 275,932,126 | |

| | | | | | | | | | | | |

|

Commercial Paper | |

Enel Finance America LLC

4.17%, 11/21/22(e) | | $ | | | | | 20,000 | | | | 19,951,467 | |

6.44%, 08/09/23(e) | | | | | | | 10,000 | | | | 9,519,660 | |

6.58%, 09/06/23(e) | | | | | | | 15,000 | | | | 14,195,550 | |

General Motors Financial Co. Inc., 4.09%, 11/14/22(e) | | | | | | | 20,000 | | | | 19,968,274 | |

HSBC USA Inc., 5.57%, 08/23/23(e) | | | | | | | 10,000 | | | | 9,562,167 | |

National Australia Bank Ltd., 4.84%, 03/15/23(e) | | | | | | | 10,000 | | | | 9,821,875 | |

| | | | | | | | | | | | |

| | |

Total Commercial Paper — 2.0%

(Cost: $83,460,375) | | | | | | | | 83,018,993 | |

| | | | | | | | | | | | |

|

Corporate Bonds & Notes | |

|

Aerospace & Defense — 0.3% | |

L3Harris Technologies Inc., 3.85%, 06/15/23 | | | | | | | | | | | | |

(Call 05/15/23) | | | | | | | 15,000 | | | | 14,865,970 | |

| | | | | | | | | | | | |

|

| Auto Manufacturers — 7.6% | |

American Honda Finance Corp., 0.88%, 07/07/23(f) | | | | | | | 10,000 | | | | 9,716,100 | |

BMW U.S. Capital LLC 0.80%, 04/01/24(a) | | | | | | | 11,565 | | | | 10,880,857 | |

| | |

S C H E D U L E O F I N V E S T M E N T S | | 15 |

| | |

Schedule of Investments (continued) October 31, 2022 | | BlackRock Short Maturity Bond ETF (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

|

Auto Manufacturers (continued) | |

3.00%, 08/12/24, (SOFR + 0.380%)(a)(b) | | $ | 21,435 | | | $ | 21,204,122 | |

3.87%, 04/01/25, (SOFR + 0.840%)(a)(b) | | | 11,100 | | | | 11,042,815 | |

Daimler Finance North America LLC

0.75%, 03/01/24(a)(f) | | | 11,005 | | | | 10,364,949 | |

1.75%, 03/10/23(a)(f) | | | 17,650 | | | | 17,465,044 | |

Daimler Trucks Finance North America LLC, 1.13%, 12/14/23(a)(f) | | | 15,000 | | | | 14,293,961 | |

General Motors Financial Co. Inc.

1.05%, 03/08/24 | | | 20,000 | | | | 18,754,349 | |

3.65%, 10/15/24, (SOFR + 0.620%)(b) | | | 15,000 | | | | 14,555,789 | |

Hyundai Capital America

0.80%, 04/03/23(a)(f) | | | 17,710 | | | | 17,355,087 | |

1.00%, 09/17/24(a)(f) | | | 18,105 | | | | 16,388,797 | |

Nissan Motor Acceptance Co. LLC,

1.13%, 09/16/24(a)(f) | | | 10,520 | | | | 9,392,907 | |

Nissan Motor Acceptance Corp.

1.05%, 03/08/24(a)(f) | | | 12,515 | | | | 11,518,423 | |

3.81%, 03/08/24,

(3 mo. LIBOR US + 0.640%)(a)(b) | | | 4,375 | | | | 4,302,926 | |

3.88%, 09/21/23(a)(f) | | | 4,000 | | | | 3,916,772 | |

Stellantis NV, 5.25%, 04/15/23 | | | 9,400 | | | | 9,364,938 | |

Toyota Motor Credit Corp.

3.68%, 12/29/23(b) | | | 15,000 | | | | 15,006,414 | |

4.40%, 09/20/24 | | | 7,125 | | | | 7,060,199 | |

Volkswagen Group of America Finance LLC

0.75%, 11/23/22(a)(f) | | | 44,345 | | | | 44,219,953 | |

0.88%, 11/22/23(a) | | | 22,000 | | | | 20,942,450 | |

3.72%, 06/07/24(a)(b) | | | 19,465 | | | | 19,401,953 | |

4.25%, 11/13/23(a) | | | 13,000 | | | | 12,843,008 | |

| | | | | | | | |

| | |

| | | | | | | 319,991,813 | |

|

| Banks — 21.7% | |

Banco Santander SA

0.70%, 06/30/24 (Call 06/30/23)(b)(f) | | | 21,200 | | | | 20,356,150 | |

3.85%, 04/12/23(f) | | | 9,291 | | | | 9,206,600 | |

5.04%, 04/12/23, (3 mo. LIBOR US + 1.120%)(b) | | | 10,000 | | | | 9,986,142 | |

Bank of America Corp.

3.00%, 12/20/23 (Call 12/20/22), | | | | | | | | |

(3 mo. LIBOR US + 0.790%)(b) | | | 72,625 | | | | 72,363,492 | |

3.55%, 03/05/24 (Call 03/05/23), | | | | | | | | |

(3 mo. LIBOR US + 0.780%)(b) | | | 30,000 | | | | 29,751,493 | |

3.86%, 07/23/24 (Call 07/23/23), | | | | | | | | |

(3 mo. LIBOR US + 0.940%)(b)(f) | | | 10,000 | | | | 9,852,480 | |

Bank of Montreal, 3.82%, 06/07/25(b) | | | 20,000 | | | | 19,826,378 | |

Banque Federative du Credit Mutuel SA,

2.13%, 11/21/22(a) | | | 20,000 | | | | 19,976,402 | |

Barclays PLC, 4.30%, 05/16/24 (Call 05/16/23), | | | | | | | | |

(3 mo. LIBOR US + 1.380%)(b) | | | 41,000 | | | | 40,496,393 | |

BPCE SA

3.60%, 01/14/25, (SOFR + 0.570%)(a)(b) | | | 3,110 | | | | 3,033,815 | |

4.48%, 09/12/23, (3 mo. LIBOR US + 1.240%)(a)(b) | | | 15,000 | | | | 14,995,080 | |

Canadian Imperial Bank of Commerce,

0.45%, 06/22/23 | | | 26,320 | | | | 25,533,290 | |

Citigroup Inc.

1.68%, 05/15/24 (Call 05/15/23),

(SOFR + 1.667%)(b) | | | 15,000 | | | | 14,672,867 | |

3.78%, 05/24/25 (Call 05/24/24),

(SOFR + 1.372%)(b) | | | 23,300 | | | | 23,272,148 | |

Credit Suisse AG/New York NY, 0.52%, 08/09/23 | | | 25,000 | | | | 23,687,500 | |

Credit Suisse Group AG, 3.80%, 06/09/23(f) | | | 8,500 | | | | 8,287,500 | |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

|

| Banks (continued) | |

Deutsche Bank AG/New York NY

2.22%, 09/18/24 (Call 09/18/23), (SOFR + 2.159%)(b) | | $ | 17,000 | | | $ | 16,106,245 | |

Series E, 3.10%, 11/08/23, (SOFR + 0.500%)(b) | | | 13,790 | | | | 13,617,211 | |

DNB Bank ASA, 3.86%, 03/28/25 (Call 03/28/24), | | | | | | | | |

(3 mo. LIBOR US + 0.390%)(a)(b)(f) | | | 15,000 | | | | 14,871,827 | |

Federation des Caisses Desjardins du Quebec, 2.71%, 05/21/24, (SOFR + 0.430%)(a)(b) | | | 20,000 | | | | 19,703,893 | |

Goldman Sachs Group Inc. (The)

0.52%, 03/08/23(f) | | | 25,000 | | | | 24,605,128 | |

1.22%, 12/06/23 (Call 12/06/22) | | | 28,860 | | | | 27,612,267 | |

4.64%, 11/29/23, (3 mo. LIBOR US + 1.600%)(b) | | | 12,060 | | | | 12,096,141 | |

0.63%, 11/17/23 (Call 11/17/22),

(SOFR + 0.538%)(b) | | | 3,000 | | | | 2,992,296 | |

HSBC Holdings PLC

0.73%, 08/17/24 (Call 08/17/23),

(SOFR + 0.534%)(b) | | | 13,500 | | | | 12,800,970 | |

3.60%, 05/25/23(f) | | | 10,000 | | | | 9,895,924 | |

4.47%, 03/11/25 (Call 03/11/24),

(3 mo. LIBOR US + 1.230%)(b) | | | 13,000 | | | | 12,808,173 | |

3.23%, 11/22/24 (Call 11/22/23),

(SOFR + 0.580%)(b) | | | 6,570 | | | | 6,342,003 | |

Huntington National Bank (The), 3.82%, 05/16/25 | | | | | | | | |

(Call 05/16/24), (SOFR + 1.190%)(b)(f) | | | 22,900 | | | | 22,722,067 | |

JPMorgan Chase & Co.

0.70%, 03/16/24 (Call 03/16/23), (SOFR + 0.580%)(b) | | | 12,000 | | | | 11,767,309 | |

1.51%, 06/01/24 (Call 06/01/23),

(SOFR + 1.455%)(b)(f) | | | 33,590 | | | | 32,795,549 | |

3.56%, 04/23/24 (Call 04/23/23),

(3 mo. LIBOR US + 0.730%)(b)(f) | | | 48,480 | | | | 48,011,198 | |

KeyBank NA/Cleveland OH, 0.43%, 06/14/24 | | | | | | | | |

(Call 06/14/23), (SOFR + 0.320%)(b) | | | 4,625 | | | | 4,478,403 | |

KeyCorp, 3.88%, 05/23/25 (Call 05/23/24)(b)(f) | | | 7,195 | | | | 6,977,401 | |

Mitsubishi UFJ Financial Group Inc., 4.68%, 07/18/25 | | | | | | | | |

(Call 07/18/24)(b) | | | 19,100 | | | | 19,138,263 | |

Mizuho Financial Group Inc.

3.55%, 03/05/23(f) | | | 20,000 | | | | 19,905,962 | |

3.63%, 05/25/24 (Call 05/25/23), | | | | | | | | |

(3 mo. LIBOR US + 0.630%)(b) | | | 10,000 | | | | 9,916,899 | |

3.95%, 03/05/23, (3 mo. LIBOR US + 0.790%)(b) | | | 3,000 | | | | 3,000,423 | |

Morgan Stanley

0.53%, 01/25/24 (Call 01/25/23), | | | | | | | | |

(SOFR + 0.455%)(b) | | | 66,100 | | | | 65,110,281 | |

0.56%, 11/10/23 (Call 11/10/22), | | | | | | | | |

(SOFR + 0.466%)(b)(f) | | | 5,500 | | | | 5,492,901 | |

3.74%, 04/24/24 (Call 04/24/23), | | | | | | | | |

(3 mo. LIBOR US + 0.847%)(b)(f) | | | 20,000 | | | | 19,803,309 | |

3.75%, 02/25/23(f) | | | 25,000 | | | | 24,902,428 | |

National Bank of Canada, 3.09%, 08/06/24, | | | | | | | | |

(SOFR + 0.490%)(b)(f) | | | 8,695 | | | | 8,518,490 | |

Natwest Group PLC, 5.19%, 06/25/24 (Call 06/25/23), (3 mo. LIBOR US + 1.550%)(b) | | | 3,000 | | | | 2,987,950 | |

Nordea Bank Abp, 3.71%, 06/06/25(a)(b)(f) | | | 19,885 | | | | 19,727,217 | |

Skandinaviska Enskilda Banken AB,

3.88%, 12/12/22, (3 mo. LIBOR US + 0.645%)(a)(b) | | | 15,000 | | | | 14,990,046 | |

Sumitomo Mitsui Financial Group Inc.,

4.88%, 10/16/23, (3 mo. LIBOR US + 0.800%)(b) | | | 4,000 | | | | 3,997,169 | |

Toronto-Dominion Bank (The), 4.29%, 09/13/24 | | | 20,330 | | | | 19,919,372 | |

| | |

| 16 | | 2 0 2 2 I S H A R E S A N N U A L R E P O R T T O S H A R E H O L D E R S |

| | |

Schedule of Investments (continued) October 31, 2022 | | BlackRock Short Maturity Bond ETF (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

|

| Banks (continued) | |

U.S. Bank NA/Cincinnati OH, 3.40%, 07/24/23 (Call 06/23/23) | | $ | 20,000 | | | $ | 19,757,573 | |

UBS AG/London, 3.05%, 08/09/24,

(SOFR + 0.450%)(a)(b) | | | 15,725 | | | | 15,592,263 | |

| | | | | | | | |

| | |

| | | | | | | 918,262,281 | |

|

| Beverages — 0.5% | |

Keurig Dr Pepper Inc., 0.75%, 03/15/24

(Call 12/01/22)(f) | | | 21,520 | | | | 20,273,537 | |

| | | | | | | | |

|

| Biotechnology — 0.6% | |

Gilead Sciences Inc.

0.75%, 09/29/23 (Call 11/14/22) | | | 23,988 | | | | 23,087,283 | |

2.50%, 09/01/23 (Call 07/01/23)(f) | | | 4,000 | | | | 3,912,395 | |

| | | | | | | | |

| | |

| | | | | | | 26,999,678 | |

|

| Building Materials — 0.2% | |

Martin Marietta Materials Inc., 0.65%, 07/15/23 (Call 12/01/22)(f) | | | 8,800 | | | | 8,511,776 | |

| | | | | | | | |

|

| Chemicals — 1.1% | |

DuPont de Nemours Inc., 4.21%, 11/15/23

(Call 10/15/23) | | | 38,000 | | | | 37,582,883 | |

International Flavors & Fragrances Inc.,

3.20%, 05/01/23 (Call 02/01/23)(f) | | | 9,000 | | | | 8,910,422 | |

| | | | | | | | |

| | |

| | | | | | | 46,493,305 | |

|

| Computers — 0.2% | |

Dell International LLC/EMC Corp.,

5.45%, 06/15/23 (Call 04/15/23) | | | 8,783 | | | | 8,768,714 | |

| | | | | | | | |

|

| Diversified Financial Services — 6.2% | |

AerCap Ireland Capital DAC/AerCap Global Aviation Trust, 1.15%, 10/29/23 | | | 35,000 | | | | 33,154,353 | |

Air Lease Corp.

0.80%, 08/18/24 (Call 07/18/24)(f) | | | 3,325 | | | | 3,027,679 | |

2.25%, 01/15/23(f) | | | 10,637 | | | | 10,564,402 | |

3.64%, 12/15/22, (3 mo. LIBOR US + 0.350%)(b) | | | 28,600 | | | | 28,579,454 | |

3.88%, 07/03/23 (Call 06/03/23)(f) | | | 6,138 | | | | 6,068,064 | |

American Express Co.

2.51%, 11/03/23, (SOFR + 0.230%)(b) | | | 6,765 | | | | 6,716,410 | |

3.38%, 05/03/24(f) | | | 15,000 | | | | 14,548,517 | |

3.40%, 02/22/24 (Call 01/22/24)(f) | | | 34,465 | | | | 33,620,777 | |

3.68%, 03/04/25 (Call 02/01/25), | | | | | | | | |

(SOFR + 0.930%)(b) | | | 8,930 | | | | 8,903,529 | |

3.69%, 02/27/23 (Call 01/27/23), | | | | | | | | |

(3 mo. LIBOR US + 0.650%)(b)(f) | | | 4,000 | | | | 3,997,286 | |

Aviation Capital Group LLC, 3.88%, 05/01/23

(Call 04/01/23)(a) | | | 19,660 | | | | 19,352,059 | |

Capital One Financial Corp.

2.60%, 05/11/23 (Call 04/11/23)(f) | | | 12,550 | | | | 12,383,151 | |

3.20%, 01/30/23 (Call 12/30/22)(f) | | | 10,000 | | | | 9,954,165 | |

3.50%, 12/06/24 (Call 12/06/23), | | | | | | | | |

(SOFR + 0.690%)(b) | | | 9,000 | | | | 8,768,160 | |

3.99%, 05/09/25 (Call 05/09/24), | | | | | | | | |

(SOFR + 1.350%)(b) | | | 22,285 | | | | 21,965,234 | |

Charles Schwab Corp. (The), 3.40%, 03/18/24 (Call 02/18/24), (SOFR + 0.500%)(b) | | | 33,050 | | | | 32,838,958 | |

Synchrony Financial, 4.38%, 03/19/24

(Call 02/19/24) | | | 6,250 | | | | 6,110,090 | |

| | | | | | | | |

| | |

| | | | | | | 260,552,288 | |

|

| Electric — 3.2% | |

Dominion Energy Inc., Series D, 3.82%, 09/15/23 (Call 11/21/22), (3 mo. LIBOR US + 0.530%)(b)(f) | | | 10,105 | | | | 10,073,469 | |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

|

| Electric (continued) | |

Duke Energy Corp., 3.07%, 06/10/23,

(SOFR + 0.250%)(b)(f) | | $ | 13,415 | | | $ | 13,329,190 | |

NextEra Energy Capital Holdings Inc.

0.65%, 03/01/23 | | | 23,495 | | | | 23,166,909 | |

2.69%, 11/03/23 (Call 12/01/22), | | | | | | | | |

(SOFR + 0.400%)(b) | | | 24,300 | | | | 24,010,769 | |

3.25%, 02/22/23 (Call 12/01/22), | | | | | | | | |

(3 mo. LIBOR US + 0.270%)(b) | | | 26,954 | | | | 26,905,652 | |

3.28%, 03/01/23, (SOFR + 0.540%)(b) | | | 5,580 | | | | 5,572,565 | |

4.20%, 06/20/24(f) | | | 6,105 | | | | 6,008,105 | |

Southern California Edison Co., 0.70%, 04/03/23(f) | | | 25,212 | | | | 24,726,088 | |

| | | | | | | | |

| | |

| | | | | | | 133,792,747 | |

|

| Food — 0.1% | |

General Mills Inc., 5.09%, 10/17/23,

(3 mo. LIBOR US + 1.010%)(b)(f) | | | 2,696 | | | | 2,709,246 | |

| | | | | | | | |

|

| Gas — 0.3% | |

Atmos Energy Corp., 0.63%, 03/09/23

(Call 11/16/22)(f) | | | 7,875 | | | | 7,761,330 | |

ONE Gas Inc., 0.85%, 03/11/23

(Call 12/01/22)(f) | | | 5,046 | | | | 4,971,396 | |

| | | | | | | | |

| | |

| | | | | | | 12,732,726 | |

|

| Health Care - Products — 1.1% | |

Baxter International Inc., 3.14%, 11/29/24(b) | | | 5,705 | | | | 5,558,887 | |

Thermo Fisher Scientific Inc.

0.80%, 10/18/23 (Call 12/01/22)(f) | | | 30,000 | | | | 28,787,479 | |

3.56%, 10/18/24 (Call 12/01/22), (SOFR + 0.530%)(b) | | | 11,980 | | | | 11,850,376 | |

| | | | | | | | |

| | |

| | | | | | | 46,196,742 | |

|

| Health Care - Services — 1.4% | |

Elevance Health Inc., 2.95%, 12/01/22 | | | | | | | | |

(Call 11/16/22)(f) | | | 4,555 | | | | 4,549,304 | |

Humana Inc., 0.65%, 08/03/23 (Call 11/08/22) | | | 55,230 | | | | 53,351,717 | |

| | | | | | | | |

| | |

| | | | | | | 57,901,021 | |

|

| Home Builders — 0.3% | |

Lennar Corp., 4.50%, 04/30/24

(Call 01/31/24)(f) | | | 11,500 | | | | 11,290,789 | |

| | | | | | | | |

|

| Household Products & Wares — 0.2% | |

Avery Dennison Corp., 0.85%, 08/15/24 | | | | | | | | |

(Call 12/01/22)(f) | | | 10,440 | | | | 9,652,769 | |

| | | | | | | | |

|

| Insurance — 0.7% | |

MassMutual Global Funding II, 3.84%, 03/21/25, (SOFR + 0.270%)(a)(b) | | | 3,996 | | | | 3,962,956 | |