Robinhood Financial LLC - Held NMS Stocks and Options Order Routing Public Report Generated on Mon Apr 22 2024 11:11:18 GMT-0400 (Eastern Daylight Time) 1st Quarter, 2024 January 2024 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 13.28 37.42 40.76 8.53 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 43.99 38.79 41.20 47.28 48.65 119,430.48 60.2032 147,937.55 46.7919 63,714.27 53.6867 69,317.02 41.8178 Virtu Americas, LLC 36.81 33.05 38.76 35.47 40.53 82,697.66 79.8156 108,401.98 59.0669 47,656.40 75.6124 54,089.88 39.8655 G1 Execution Services, LLC 7.53 14.69 9.49 4.73 1.14 56,254.30 90.8434 32,426.03 44.9715 6,413.58 36.0344 1,942.03 64.3340 Jane Street Capital 6.89 5.93 5.57 9.69 0.76 42,288.99 59.5296 50,945.34 43.9718 27,429.49 53.1609 1,359.45 34.1696 Material Aspects: CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Virtu Americas, LLC:

Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. G1 Execution Services, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Jane Street Capital: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. January 2024 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 11.79 38.87 45.08 4.26 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 49.61 42.03 47.29 52.73 58.91 850,049.23 17.8720 992,903.18 8.8657 454,595.17 8.9282 251,536.32 16.6525 Jane Street Capital 20.43 19.23 20.46 22.19 4.75 608,386.80 12.0722 671,729.14 5.7151 349,678.70 6.0823 21,778.55 11.4373

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 18.41 15.90 17.33 19.88 19.69 373,312.52 12.0254 428,821.71 6.1221 224,456.74 6.1219 120,388.22 11.7719 Two Sigma Securities, LLC 6.74 12.74 8.44 2.95 14.77 296,726.26 11.0209 182,202.75 5.6042 39,611.54 7.3251 31,597.26 12.0305 Material Aspects: CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Jane Street Capital: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Virtu Americas, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Two Sigma Securities, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. January 2024

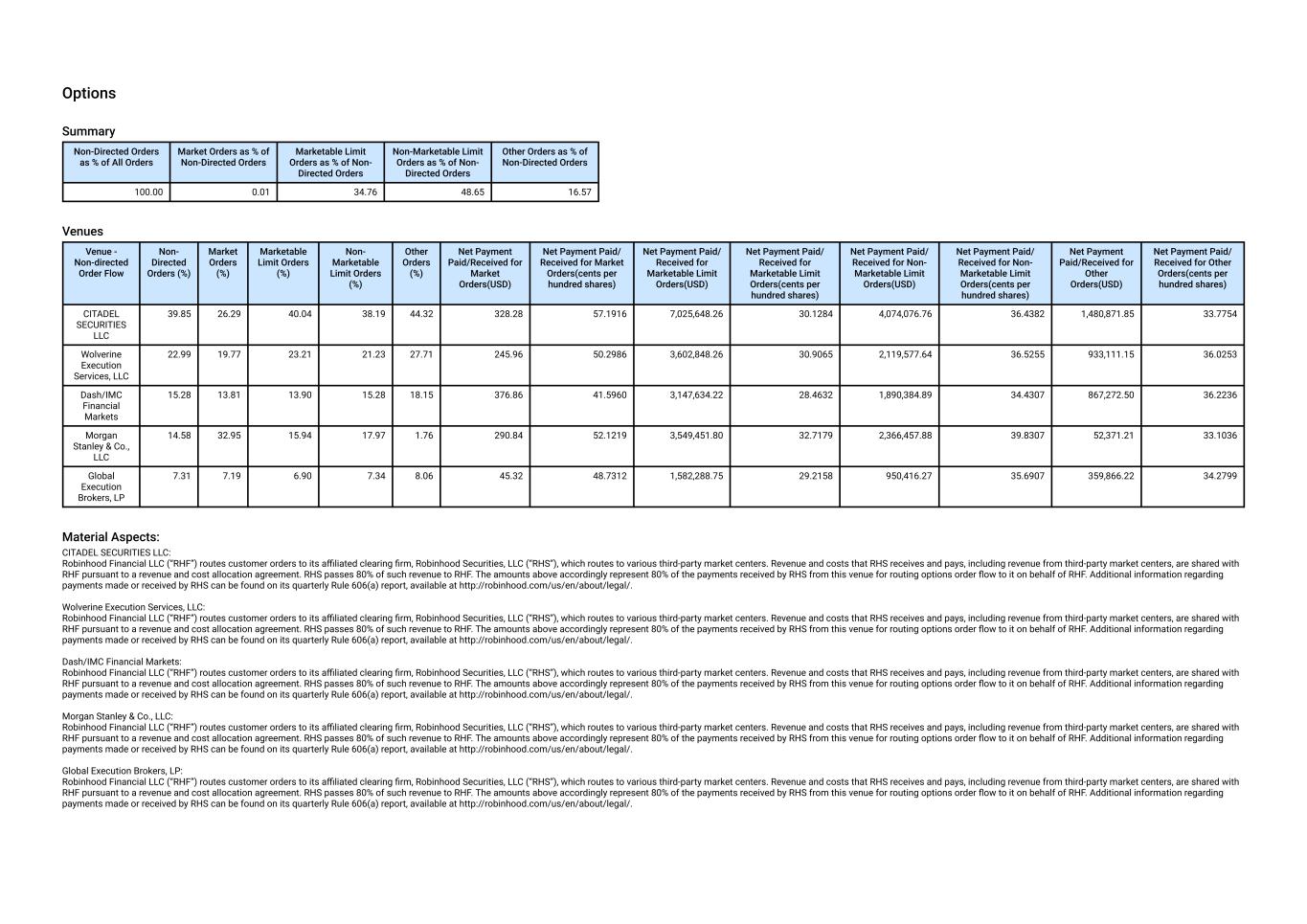

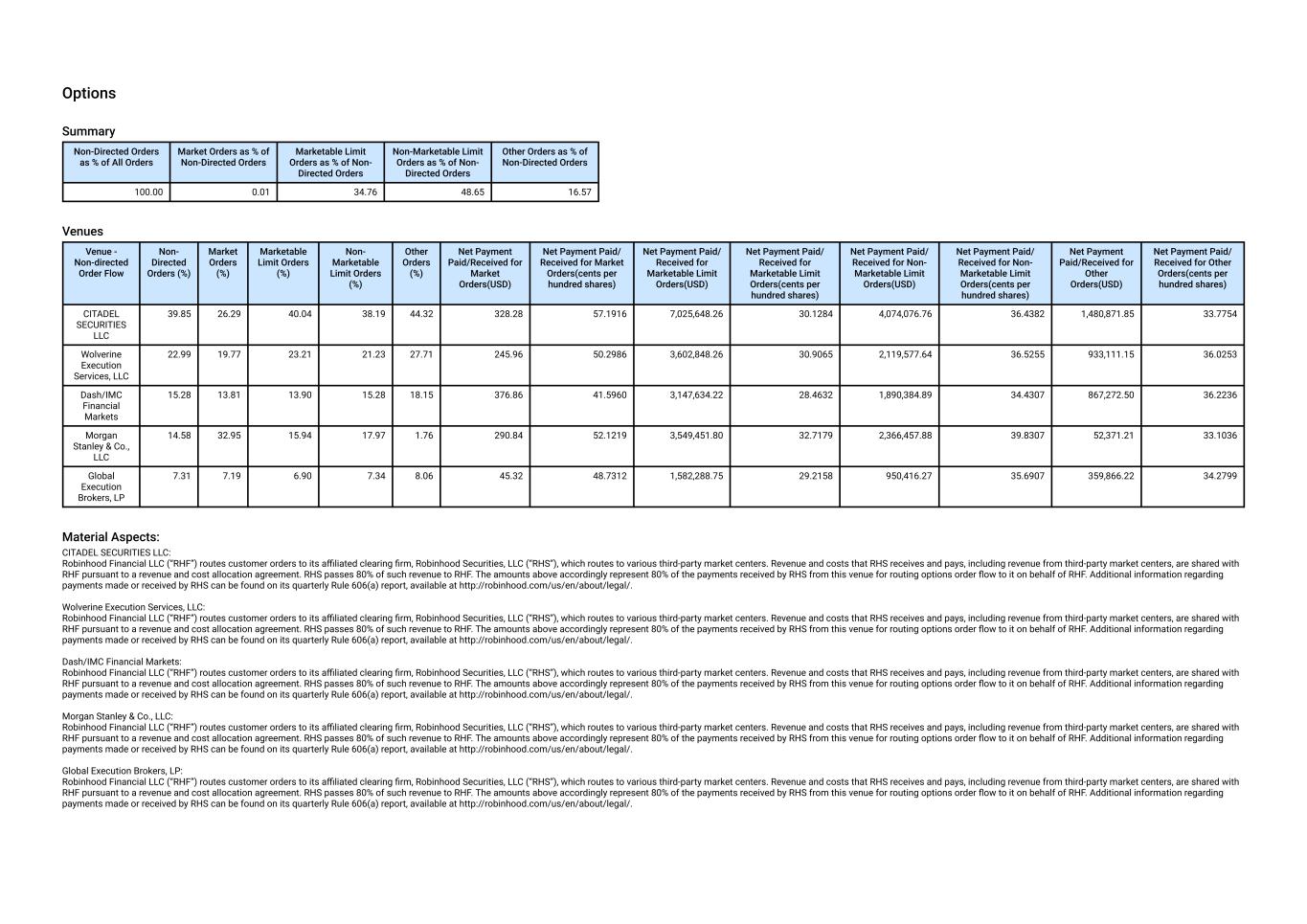

Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 0.01 34.76 48.65 16.57 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 39.85 26.29 40.04 38.19 44.32 328.28 57.1916 7,025,648.26 30.1284 4,074,076.76 36.4382 1,480,871.85 33.7754 Wolverine Execution Services, LLC 22.99 19.77 23.21 21.23 27.71 245.96 50.2986 3,602,848.26 30.9065 2,119,577.64 36.5255 933,111.15 36.0253 Dash/IMC Financial Markets 15.28 13.81 13.90 15.28 18.15 376.86 41.5960 3,147,634.22 28.4632 1,890,384.89 34.4307 867,272.50 36.2236 Morgan Stanley & Co., LLC 14.58 32.95 15.94 17.97 1.76 290.84 52.1219 3,549,451.80 32.7179 2,366,457.88 39.8307 52,371.21 33.1036 Global Execution Brokers, LP 7.31 7.19 6.90 7.34 8.06 45.32 48.7312 1,582,288.75 29.2158 950,416.27 35.6907 359,866.22 34.2799 Material Aspects: CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Wolverine Execution Services, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Dash/IMC Financial Markets: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Morgan Stanley & Co., LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Global Execution Brokers, LP: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/.

February 2024 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 13.93 37.99 38.17 9.92 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 54.29 52.13 56.88 51.28 59.00 155,942.80 122.0270 194,915.28 83.6481 90,596.90 102.9556 138,209.34 60.8823 CITADEL SECURITIES LLC 27.86 23.91 25.22 31.41 29.84 136,399.98 92.3607 164,493.04 67.5951 88,852.57 77.8595 123,819.54 58.2863 Jane Street Capital 7.51 6.45 6.50 10.64 0.80 63,995.82 83.2212 71,991.93 58.8909 47,463.07 66.5564 2,120.07 53.9155 Two Sigma Securities, LLC 5.67 8.79 5.53 3.61 9.75 37,930.02 90.0504 19,873.67 38.5398 5,658.46 32.5487 2,688.16 64.5795 Material Aspects: Virtu Americas, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Jane Street Capital:

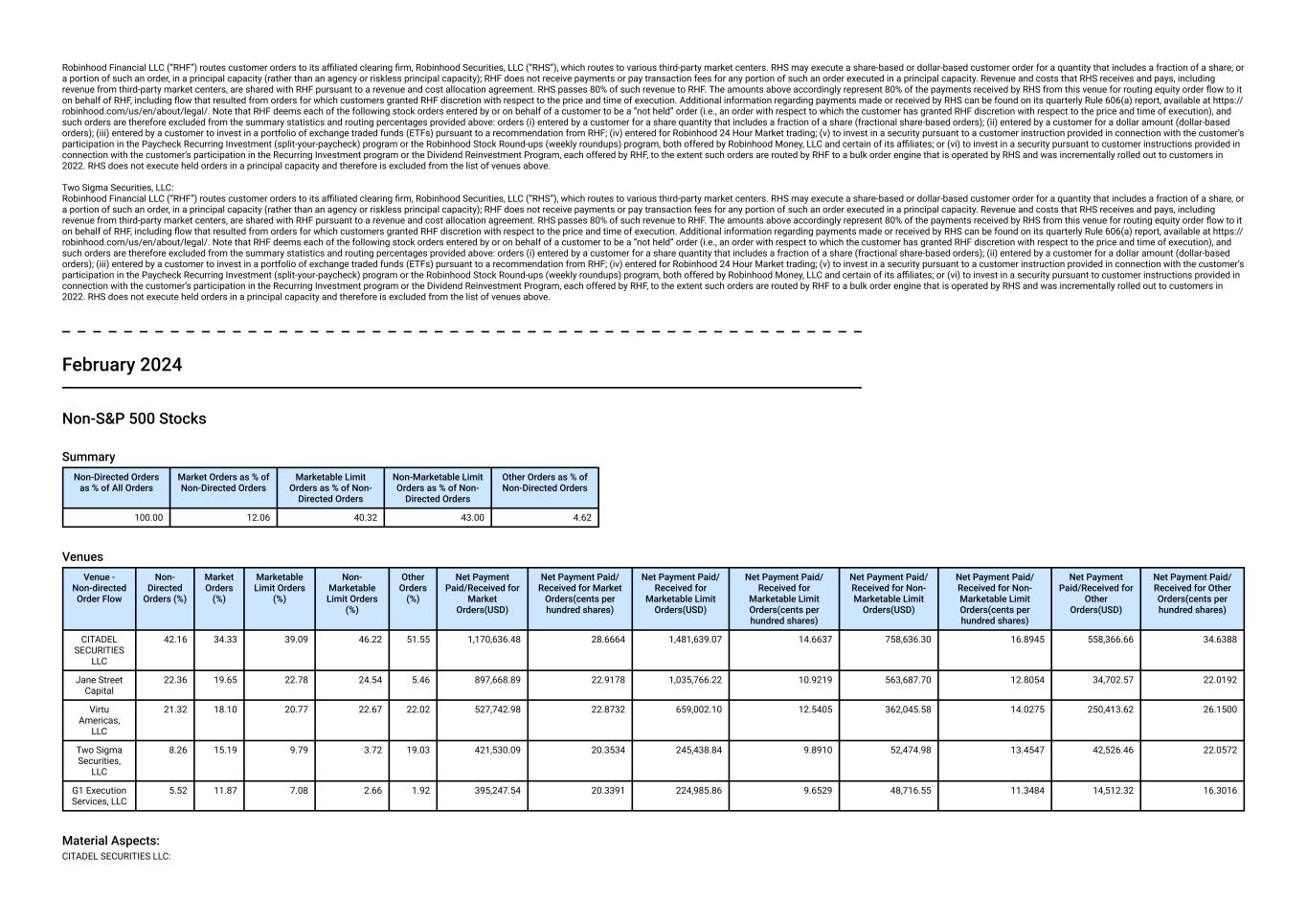

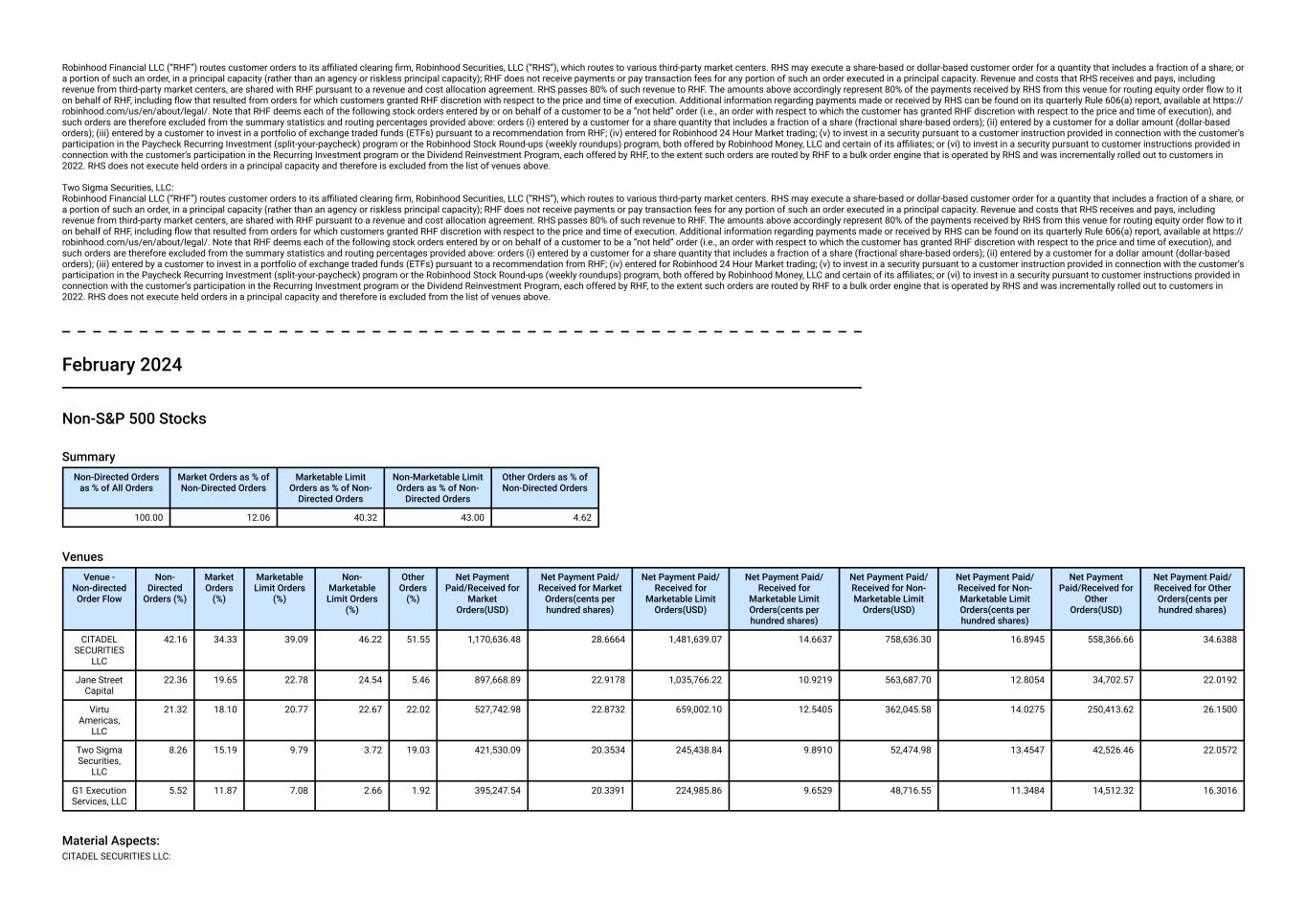

Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Two Sigma Securities, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. February 2024 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 12.06 40.32 43.00 4.62 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 42.16 34.33 39.09 46.22 51.55 1,170,636.48 28.6664 1,481,639.07 14.6637 758,636.30 16.8945 558,366.66 34.6388 Jane Street Capital 22.36 19.65 22.78 24.54 5.46 897,668.89 22.9178 1,035,766.22 10.9219 563,687.70 12.8054 34,702.57 22.0192 Virtu Americas, LLC 21.32 18.10 20.77 22.67 22.02 527,742.98 22.8732 659,002.10 12.5405 362,045.58 14.0275 250,413.62 26.1500 Two Sigma Securities, LLC 8.26 15.19 9.79 3.72 19.03 421,530.09 20.3534 245,438.84 9.8910 52,474.98 13.4547 42,526.46 22.0572 G1 Execution Services, LLC 5.52 11.87 7.08 2.66 1.92 395,247.54 20.3391 224,985.86 9.6529 48,716.55 11.3484 14,512.32 16.3016 Material Aspects: CITADEL SECURITIES LLC:

Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Jane Street Capital: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Virtu Americas, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Two Sigma Securities, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. G1 Execution Services, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. February 2024 Options Summary

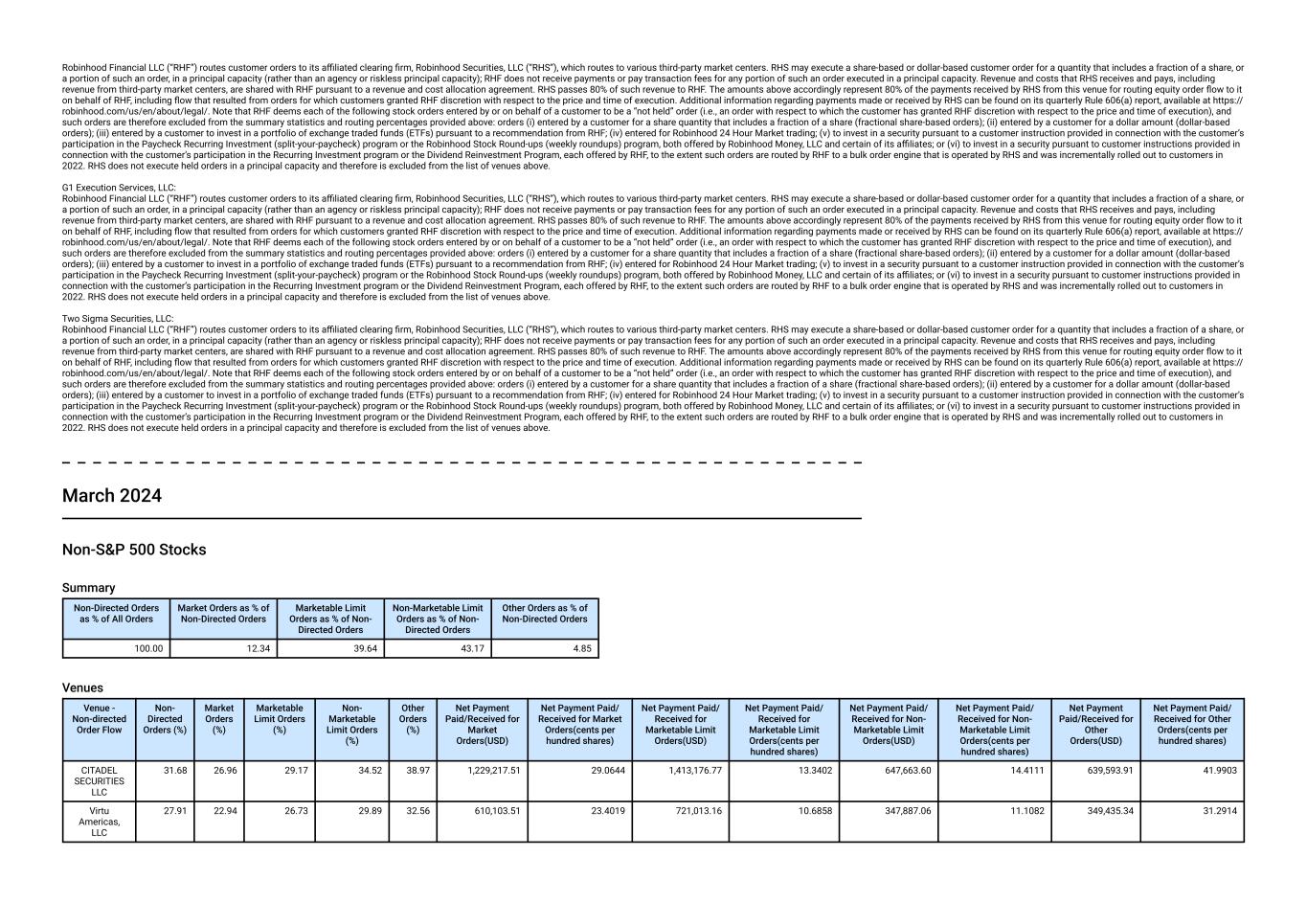

Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 0.01 33.46 50.46 16.07 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 41.75 34.37 43.29 39.61 45.28 593.09 58.6637 8,829,758.76 33.1611 5,624,448.62 42.0610 1,670,795.02 36.4899 Wolverine Execution Services, LLC 18.85 17.72 18.32 17.85 23.10 372.08 77.8410 3,796,811.34 33.7853 2,532,021.30 42.2765 1,053,167.24 41.4100 Dash/IMC Financial Markets 16.12 22.40 14.95 15.89 19.26 439.68 30.2810 3,754,060.22 31.5933 2,588,191.02 40.4852 1,003,363.22 41.2454 Morgan Stanley & Co., LLC 14.74 16.07 15.81 18.16 1.76 594.69 33.9241 3,662,410.09 34.6211 2,819,089.66 45.4208 56,126.78 37.2115 Global Execution Brokers, LP 8.54 9.44 7.63 8.49 10.61 310.94 33.2201 2,339,303.18 29.6940 1,574,630.29 39.2895 655,949.46 37.3756 Material Aspects: CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Wolverine Execution Services, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Dash/IMC Financial Markets: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Morgan Stanley & Co., LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Global Execution Brokers, LP: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. March 2024 S&P 500 Stocks

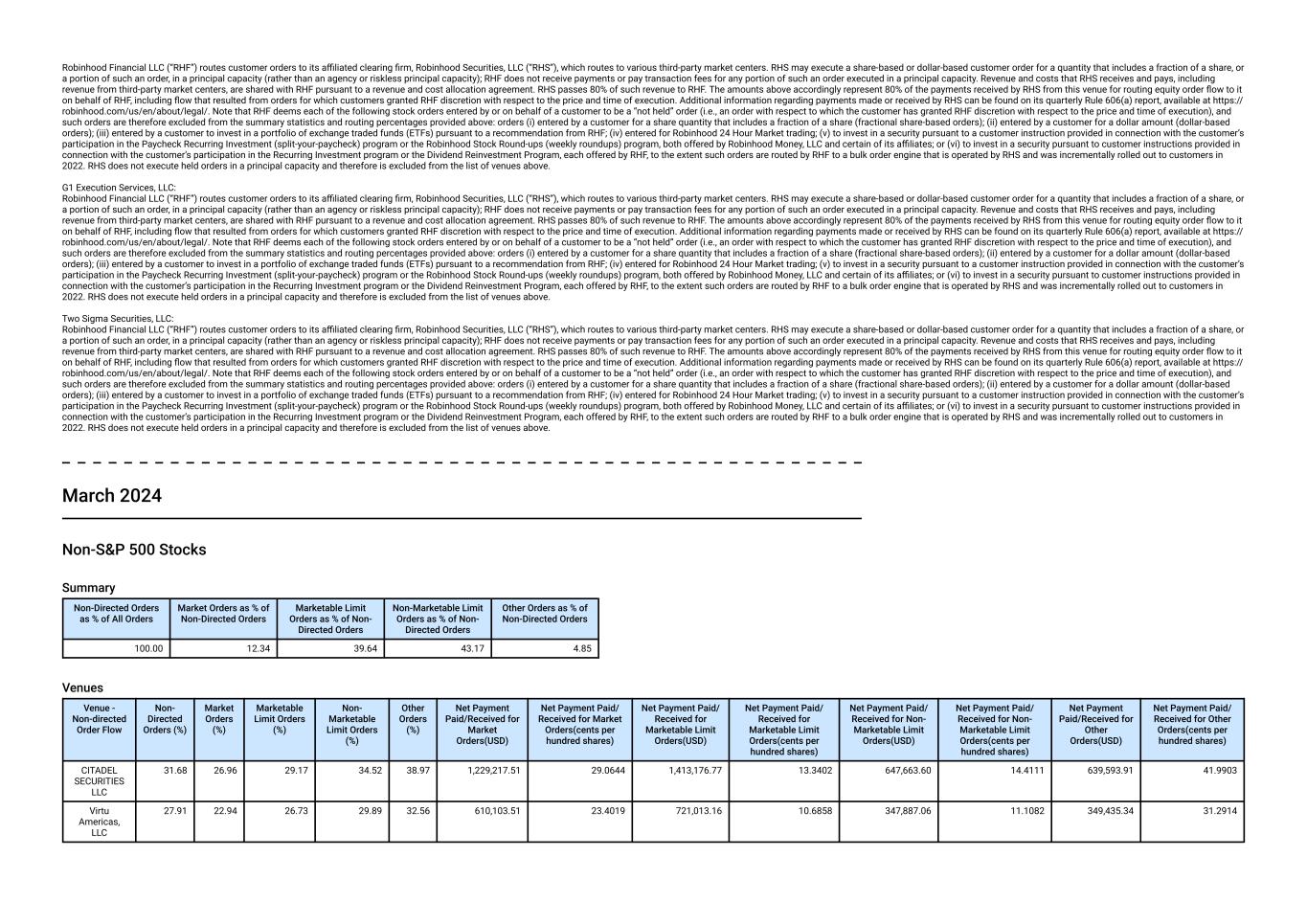

Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 14.45 38.40 35.56 11.60 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 61.00 54.60 62.09 60.82 65.93 191,863.18 158.7912 205,883.17 99.4163 77,515.74 114.6326 178,835.62 73.2208 CITADEL SECURITIES LLC 19.27 17.79 17.75 20.90 21.19 150,635.37 122.0136 152,221.46 75.4965 60,102.58 76.7234 138,025.19 68.9947 Jane Street Capital 7.07 6.64 6.33 10.17 0.58 66,267.52 97.2112 65,865.06 60.7282 32,655.93 57.7618 2,034.83 48.1507 G1 Execution Services, LLC 6.19 11.24 7.89 4.03 0.91 83,647.18 176.7528 45,036.83 79.0141 9,914.66 74.6860 3,870.42 129.5547 Two Sigma Securities, LLC 5.95 8.72 5.34 3.70 11.37 46,888.66 125.0649 21,943.02 54.9792 5,255.58 42.8683 4,281.69 108.2971 Material Aspects: Virtu Americas, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Jane Street Capital: