As filed with the U.S. Securities and Exchange Commission on March 6, 2024.

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Primega Group Holdings Limited

(Exact name of registrant as specified in its charter)

| Cayman Islands | | 1540 | | Not Applicable |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (IRS Employer Identification Number) |

Room 2912, 29/F., New Tech Plaza

34 Tai Yau Street

San Po Kong

Kowloon, Hong Kong

+852 3997 3682

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

c/o Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

+212 947-7200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Ying Li, Esq. Guillaume de Sampigny, Esq. Hunter Taubman Fischer & Li LLC 950 Third Avenue, 19th Floor New York, NY 10022 +1 (212) 530-2210 | | William S. Rosenstadt, Esq.

Yarona L. Yieh, Esq.

Ortoli Rosenstadt LLP

366 Madison Avenue, 3rd Floor

New York, NY 10017

T: 212-588-0022 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act: Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”), indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

| | ● | Public Offering Prospectus. A prospectus (the “Public Offering Prospectus”) to be used for the public offering by the Registrant of 1,500,000 ordinary shares par value $0.00005 per share (“Ordinary Shares”) of the Registrant and 250,000 Ordinary Shares of the Selling Shareholder (such terms as defined in the Public Offering Prospectus) through the underwriter named on the cover page of the Public Offering Prospectus. |

| | | |

| | ● | Resale Prospectus. A prospectus (the “Resale Prospectus”) to be used for the resale by selling shareholders identified in such prospectus (the “Reselling Shareholders”) of up to 5,512,500 Ordinary Shares of the Registrant (the “Resale Shares”). The Company will not receive any proceeds from the sale of shares by the Reselling Shareholders. |

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

| | ● | the Resale Prospectus contains different outside and inside front covers; |

| | ● | the Resale Prospectus contains a different “The Offering” section in the Prospectus Summary section beginning on page Alt – 2; |

| | ● | the Resale Prospectus contains a different “Use of Proceeds” section beginning on page Alt – 3; |

| | ● | the “Capitalization” and “Dilution” sections on page 52 and page 53 of the Public Offering Prospectus are deleted from the Resale Prospectus; |

| | ● | a “Reselling Shareholder” section is included in the Resale Prospectus beginning on page Alt – 4; |

| | ● | references in the Public Offering Prospectus to the Resale Prospectus will be deleted from the Resale Prospectus; |

| | ● | the “Underwriting” section from the Public Offering Prospectus on page 114 is deleted from the Resale Prospectus and the “Reselling Shareholders Plan of Distribution” is inserted in its place; |

| | ● | the “Legal Matters” section in the Resale Prospectus on page Alt - 6 deletes the reference to counsel for the Underwriter; and |

| | ● | the outside back cover of the Public Offering Prospectus is deleted from the Resale Prospectus. |

The registrant has included in this registration statement a set of alternate pages after the back cover page of the Public Offering Prospectus (the “Alternate Pages”) to reflect the foregoing differences in the Resale Prospectus as compared to the Public Offering Prospectus. The Public Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the registrant. The Resale Prospectus will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will be used for the resale offering by the Reselling Shareholders.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | | SUBJECT TO COMPLETION, DATED MARCH 6, 2024 |

1,750,000 Ordinary Shares

Primega Group Holdings Limited

This is the initial public offering of the ordinary shares, par value US$0.00005 per ordinary share (“Ordinary Shares” or “Shares”), of Primega Group Holdings Limited (“PGHL”), an exempted company incorporated in the Cayman Islands. We are offering 1,500,000 Ordinary Shares of PGHL, representing 6.25% of the issued and outstanding Ordinary Shares following completion of this offering. Mr. Man Siu Ming, the Selling Shareholder is offering 250,000 Ordinary Shares, representing approximately 1.0% of the Ordinary Shares following completion of this offering. Dusk Moon International Limited, Moss Mist Investment Limited, Primewin Corporate Development Limited, Shun Kai Investment Development Limited and Mr. Man Siu Ming (collectively, the “Reselling Shareholders”) are also offering 5,512,500 Ordinary Shares (the “Resale Shares”) to be sold in the offering pursuant to the Resale Prospectus, representing in total approximately 23.0% of the Ordinary Shares following the completion of this offering. Following this offering and the offering of the Resale Shares by the Reselling Shareholders, approximately 30.3% of the Ordinary Shares will be held by shareholders for general trading.

Prior to this offering, there has been no public market for our Ordinary Shares. The offering price of our Ordinary Shares in this offering is expected to be between $4.00 and $6.00 per share. We have applied to list our Ordinary Shares on the Nasdaq Capital Market under the symbol “PGHL.” This offering is contingent on the listing of our Ordinary Shares on the Nasdaq Capital Market. However, there is no assurance that such application will be approved, and if our application is not approved by Nasdaq, we will not proceed with this offering.

Investors are cautioned that you are buying shares of a Cayman Islands holding company with operations in Hong Kong by its operating subsidiary.

PGHL is a holding company incorporated in the Cayman Islands with no material operations of its own, and we conduct our operations primarily in Hong Kong through our operating subsidiary, Primega Construction Engineering Co. Limited. References to the “Company,” “we,” “us,” and “our” in the prospectus are to PGHL, the Cayman Islands entity that will issue the Ordinary Shares being offered. References to “Primega Construction” are to Primega Construction Engineering Co. Limited, the entity operating the business. This is an offering of the Ordinary Shares of PGHL, the holding company in the Cayman Islands, instead of the shares of the operating subsidiary. Investors in this offering will not directly hold any equity interests in the operating subsidiary.

Investing in our Ordinary Shares is highly speculative and involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our Ordinary Shares in “Risk Factors” beginning on page 20 of this prospectus.

Our operations are primarily located in Hong Kong, a Special Administrative Region of the People’s Republic of China (“China” or the “PRC”), and therefore, we may be subject to unique risks due to uncertainty of the interpretation and the application of PRC laws and regulations. As of the date of this prospectus, we are not subject to the PRC government’s direct influence or discretion over the manner in which we conduct our business activities outside of the PRC. However, due to long-arm provisions under the current PRC laws and regulations, there remains regulatory uncertainty with respect to the implementation and interpretation of laws in China. We are also subject to the risks of uncertainty about any future actions of the PRC government or authorities in Hong Kong in this regard.

Should the PRC government choose to exercise significant oversight and discretion over the conduct of our business, they may intervene in or influence our operations. Such governmental actions:

| | ● | could result in a material change in our operations and/or the value of our securities; |

| | ● | could significantly limit or completely hinder our ability to continue our operations; |

| | ● | could significantly limit or completely hinder our ability to offer or continue to offer our securities to investors; and |

| | ● | may cause the value of our securities to significantly decline or be worthless. |

We are aware that recently, the PRC government has initiated a series of regulatory actions and new policies to regulate business operations in certain areas in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using a variable interest entity (“VIE”) structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements and regulatory actions are new, it is highly uncertain how soon the legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any. It is also highly uncertain what the potential impact such modified or new laws and regulations will have on Primega Construction’s daily business operation, its ability to accept foreign investments and the listing of our Ordinary Shares on U.S. or other foreign exchanges. The PRC government may intervene or influence our operations at any time and may exert more control over offerings conducted overseas and foreign investment in Hong Kong-based issuers. The PRC government may also intervene or impose restrictions on our ability to move out of Hong Kong to distribute earnings and pay dividends or to reinvest in our business outside of Hong Kong. Furthermore, PRC regulatory authorities may in the future promulgate laws, regulations or implementing rules that require our company or any of our subsidiaries to obtain regulatory approval from PRC authorities before this offering. These actions could result in a material change in our operations and could significantly limit or completely hinder our ability to complete this offering or cause the value of our Ordinary Shares to significantly decline or become worthless. See “Prospectus Summary — Recent Regulatory Development in the PRC” beginning on page 13.

As of the date of this prospectus, our operations in Hong Kong and our registered public offering in the United States are not subject to the review nor prior approval of the Cyberspace Administration of China (the “CAC”) nor the China Securities Regulatory Commission (the “CSRC”). Uncertainties still exist, however, due to the possibility that laws, regulations, or policies in the PRC could change rapidly in the future. In the event that (i) the PRC government expanded the categories of industries and companies whose foreign securities offerings are subject to review by the CSRC or the CAC and that we are required to obtain such permissions or approvals, or (ii) we inadvertently concluded that relevant permissions or approvals were not required or that we did not receive or maintain relevant permissions or approvals required, any action taken by the PRC government could significantly limit or completely hinder our operations in Hong Kong and our ability to offer or continue to offer our Ordinary Shares to investors and could cause the value of such securities to significantly decline or be worthless and even delisting of our Ordinary Shares. The delisting of our Ordinary Shares, or the threat of their being delisted, may materially and adversely affect the value of your investment in the future.

Furthermore, as more stringent criteria, including the Holding Foreign Companies Accountable Act (the “HFCA Act”), have been imposed by the SEC and the Public Company Accounting Oversight Board (“PCAOB”), recently, our Ordinary Shares may be prohibited from trading if our auditor cannot be fully inspected. Our auditor, ZH CPA, LLC, the independent registered public accounting firm that issues the audit report included in this prospectus, as an auditor of companies that are traded publicly in the United States and a firm registered with the PCAOB, is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess ZH CPA, LLC’s compliance with applicable professional standards. ZH CPA, LLC is headquartered in Denver, Colorado, and can be inspected by the PCAOB. On August 26, 2022, CSRC, the Ministry of Finance of the PRC (the “MOF”), and the PCAOB signed a Statement of Protocol (the “Protocol”), governing inspections and investigations of audit firms based in China and Hong Kong. The Protocol remains unpublished and is subject to further explanation and implementation. Pursuant to the fact sheet with respect to the Protocol disclosed by the SEC, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the SEC. On December 15, 2022, the PCAOB Board determined that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous determinations to the contrary. However, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB Board will consider the need to issue a new determination. On December 29, 2022, the Accelerating Holding Foreign Companies Accountable Act, or the Accelerating HFCA Act, was signed into law, which amended the HFCA Act by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three. On December 29, 2022, legislation titled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”), was signed into law by President Biden. The Consolidated Appropriations Act contained, among other things, an identical provision to Accelerating HFCA Act, which reduces the number of consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years to two. We cannot assure you whether Nasdaq or other regulatory authorities will apply additional or more stringent criteria to us. Such uncertainty could cause the market price of our Ordinary Shares to be materially and adversely affected.

Our management monitors the cash position of our operating subsidiary regularly and prepares budgets on a monthly basis to ensure it has the necessary funds to fulfill its obligations for the foreseeable future and to ensure adequate liquidity. In the event that there is a need for cash or a potential liquidity issue, it will be reported to our chief financial officer and subject to approval by our board of directors.

For PGHL to transfer cash to its subsidiaries, PGHL is permitted under the laws of the Cayman Islands and its memorandum and articles of association (as amended from time to time) to provide funding to our subsidiaries incorporated in the BVI and Hong Kong through loans or capital contributions. PGHL’s subsidiary formed under the laws of the BVI is permitted under the laws of the BVI to provide funding to our Hong Kong operating subsidiary Primega Construction subject to certain restrictions laid down in the BVI Business Companies Act 2004 (as amended) and memorandum and articles of association of PGHL’s subsidiary incorporated under the laws of the BVI. As a holding company, PGHL may rely on dividends and other distributions on equity paid by its subsidiaries for its cash and financing requirements. According to the BVI Business Companies Act 2004 (as amended), a BVI company may make dividends distribution to the extent that immediately after the distribution, the value of the company’s assets exceeds its liabilities and that such company is able to pay its debts as they fall due. According to the Companies Ordinance of Hong Kong, a Hong Kong company may only make a distribution out of profits available for distribution. If any of PGHL’s subsidiaries incur debt on its own behalf in the future, the instruments governing such debt may restrict their ability to pay dividends to PGHL. During the years ended March 31, 2023 and 2022, the six months ended September 30, 2023 and up to the date of this prospectus, PGHL did not declare or pay any dividends and there was no transfer of assets among PGHL and its subsidiaries. We do not have any current intentions to distribute further earnings. If we determine to pay dividends on any of our Ordinary Shares in the future, as a holding company, we will be dependent on receipt of funds from our Hong Kong operating subsidiary Primega Construction by way of dividend payments. See “Dividend Policy,” and “Consolidated Statements of Change in Shareholders’ Equity in the Report of Independent Registered Public Accounting Firm” for further details.

We are an “emerging growth company” as defined under the federal securities laws and, as such, will be subject to reduced public company reporting requirements. See “Prospectus Summary — Implications of Being an Emerging Growth Company and a Foreign Private Issuer” for additional information.

Upon the completion of this offering, 24,000,000 Ordinary Shares will be outstanding. PGHL will be a “controlled company” as defined under the Nasdaq Stock Market Rules because, immediately after the completion of this offering and the offering of the Resale Shares under the Resale Prospectus, the Controlling Shareholder of PGHL will own 16,737,500 of the total issued and outstanding Ordinary Shares, representing 69.7% of the total voting power.

| | | Per Share | | | Total | |

| IPO price(1) | | $ | 5.00 | | | $ | 8,750,000 | (4) |

| Underwriting discounts(2) | | $ | 0.35 | | | $ | 612,500 | |

| Proceeds, before expenses, to us(3) | | $ | 4.65 | | | $ | 6,975,000 | |

| Proceeds to the Selling Shareholder | | $ | 4.65 | | | $ | 1,162,500 | |

| (1) | Initial public offering price per Ordinary Share is assumed to be $5.00, being the mid-point of the initial public offering price range. |

| (2) | Represents underwriting discounts equal to 7% (or $0.35 per Ordinary Share). This does not include a non-accountable expense allowance equal to 1% of the total gross proceeds received by us and by the Selling Shareholder from the sale of the Ordinary Shares offered by the issuer and the Selling Shareholder in this offering payable to the underwriters. See the section titled “Underwriting” for all compensation to be paid to the underwriters. |

| (3) | Excludes fees and expenses payable to the underwriters. See the section titled “Underwriting – Discounts and Expenses”. |

| (4) | Includes $7,500,000 in gross proceeds from the sale of 1,500,000 Ordinary Shares offered by us and $1,250,000 gross proceeds from the sale of 250,000 Ordinary Shares offered by the Selling Shareholder. |

We expect our total cash expenses for this offering (including cash expenses payable to our underwriters for their out-of-pocket expenses) to be approximately US$2,425,000 exclusive of the above discounts. In addition, we will pay additional items of value in connection with this offering that are viewed by the Financial Industry Regulatory Authority (“FINRA”), as underwriting compensation. These payments will further reduce proceeds available to us before expenses. See “Underwriting.”

Neither the U.S. Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This offering is being conducted on a firm commitment basis. The underwriters are obligated to take and pay for all of the shares if any such shares are taken. Assuming the public offering price per share is US$5.00 (being the mid-point of the initial public offering price range), the total underwriting discounts payable will be US$612,500 and the total proceeds to us, before expenses, will be US$6,975,000 and the total proceeds to the Selling Shareholder, before expenses, will be US$1,162,500.

If we complete this offering, net proceeds will be delivered to us and to the Selling Shareholder on the closing date.

The underwriters expect to deliver the Ordinary Shares against payment as set forth under “Underwriting” on or about , 2024.

Eddid Securities USA Inc.

The date of this prospectus is , 2024.

TABLE OF CONTENTS

We are responsible for the information contained in this prospectus and any free writing prospectus we prepare or authorize. We have not, and the underwriters have not, authorized anyone to provide you with different information, and we and the underwriters take no responsibility for any other information others may give you. We are not, and the underwriters are not, making an offer to sell our Ordinary Shares in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or the sale of any Ordinary Shares.

For investors outside the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Ordinary Shares and the distribution of this prospectus outside the United States.

PGHL is incorporated under the laws of the Cayman Islands as an exempted company with limited liability and a majority of our outstanding securities are owned by non-U.S. residents. Under the rules of the SEC we currently qualify for treatment as a “foreign private issuer.” As a foreign private issuer, we will not be required to file periodic reports and financial statements with the SEC as frequently or as promptly as domestic registrants whose securities are registered under the Exchange Act.

Until and including , 2024 (25 days after the date of this prospectus), all dealers that buy, sell or trade our Ordinary Shares, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

CONVENTIONS THAT APPLY TO THIS PROSPECTUS

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to:

| | ● | “Articles” or “Articles of Association” are to the amended and restated articles of association of our Company (as amended from time to time) to be effective immediately upon the listing of our Ordinary Shares on the Nasdaq Capital Market, and as amended, supplemented and/or otherwise modified from time to time; |

| | | |

| | ● | “biodiesel” are to B5 biodiesel, a type of biodiesel blend consisting of 95% pure motor vehicle diesel and 5% motor vehicle biodiesel; |

| | | |

| | ● | “BVI” are to the British Virgin Islands; |

| | | |

| | ● | “C&D materials” are to construction and demolition materials, being any substance, matter or thing which is generated as a result of construction work and abandoned whether or not it has been processed or stockpiled before abandoned. It is a mixture of surplus materials arising from site clearance, excavation, construction, refurbishment, renovation, demolition and road works; |

| | | |

| | ● | “Celestial Power” are to CELESTIAL POWER GROUP LIMITED, a BVI business company limited by shares incorporated in the BVI, a direct wholly owned subsidiary of PGHL; |

| | | |

| | ● | “Companies Act” are to the Companies Act (as revised) of the Cayman Islands, as amended, supplemented or otherwise modified from time to time; |

| | | |

| | ● | “CHIT” are to the ticket, issued by the EPD (as defined below), required for disposal of C&D materials at designated waste disposal facilities for the purpose of charging for the disposal; |

| | | |

| | ● | “Company,” “we,” “us,” “our” or “PGHL” are to Primega Group Holdings Limited, an exempted Company incorporated in the Cayman Islands with limited liability on April 14, 2022, that will issue the Ordinary Shares being offered; |

| | | |

| | ● | “construction waste” are to any substance, matter or thing that is generated from construction work and abandoned, whether or not it has been processed or stockpiled before being abandoned; |

| | | |

| | ● | “Controlling Shareholder” are to the ultimate beneficial owner of the Company, Mr. Man Siu Ming. See “Management” and “Principal Shareholders” for more information; |

| | | |

| | ● | “COVID-19” are to the Coronavirus Disease 2019; |

| | | |

| | ● | “ELS” are to excavation and lateral support; |

| | | |

| | ● | “EPD” are to the Environmental Protection Department of the government of Hong Kong; |

| | | |

| | ● | “Exchange Act” are to the U.S. Securities Exchange Act of 1934, as amended; |

| | | |

| | ● | “HKD” or “HK$” are to Hong Kong dollar(s), the lawful currency of Hong Kong; |

| | | |

| | ● | “Hong Kong” are to Hong Kong Special Administrative Region of the People’s Republic of China; |

| | | |

| | ● | “Independent Third Party” are to a person or company who or which is independent of and is not a 5% owner of, does not control and is not controlled by or under common control with any 5% owner and is not the spouse or descendant (by birth or adoption) of any 5% owner of the Company; |

| | | |

| | ● | “IPO” are to an initial public offering of securities; |

| | | |

| | ● | “Macau” are to the Macau Special Administrative Region of the People’s Republic of China; |

| | | |

| | ● | “Memorandum” or “Memorandum of Association” are to the amended and restated memorandum of association of our Company (as amended from time to time) to be effective immediately upon the listing of our Ordinary Shares on the Nasdaq Capital Market, and as amended, supplemented and/or otherwise modified from time to time; |

| | | |

| | ● | “Nasdaq” are to Nasdaq Stock Market LLC; |

| | | |

| | ● | “Ordinary Shares” are to our ordinary shares, par value $0.00005 per ordinary share; |

| | | |

| | ● | “PCAOB” are to Public Company Accounting Oversight Board; |

| | | |

| | ● | “PRC” or “China” are to the People’s Republic of China including Hong Kong and Macau and, excluding, for the purpose of this prospectus, Taiwan; |

| | | |

| | ● | “pre-IPO shareholders” are to Dusk Moon International Limited, Moss Mist Investment Limited, Primewin Corporate Development Limited and Shun Kai Investment Development Limited; |

| | | |

| | ● | “Primega Construction” are to Primega Construction Engineering Co. Limited, a company incorporated under the laws of Hong Kong with limited liability, an indirect wholly owned subsidiary of PGHL and our operating subsidiary conducting business operations in Hong Kong; |

| | | |

| | ● | “public fill” are to the recyclable or reusable inert materials of C&D materials, comprising rock, concrete, asphalt, bricks, stones, and soil which can be used as fill materials in reclamation and other earth filling projects; |

| | | |

| | ● | “Reselling Shareholders” are to Dusk Moon International Limited, Moss Mist Investment Limited, Primewin Corporate Development Limited, Shun Kai Investment Development Limited and Mr. Man Siu Ming; |

| | | |

| | ● | “SEC” or “Securities and Exchange Commission” are the United States Securities and Exchange Commission; |

| | | |

| | ● | “Securities Act” are to the U.S. Securities Act of 1933, as amended; |

| | | |

| | ● | “Selling Shareholder” are to Mr. Man Siu Ming with respect to 250,000 Ordinary Shares; and |

| | | |

| | ● | “U.S. dollars” or “$” or “USD” or “dollars” are to United States dollar(s), the lawful currency of the United States. |

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

PGHL is a holding company with operations conducted in Hong Kong through its operating subsidiary in Hong Kong, Primega Construction. Primega Construction’s reporting currency is Hong Kong dollars. This prospectus contains translations of Hong Kong dollars into U.S. dollars solely for the convenience of the reader. Unless otherwise noted, all translations from Hong Kong dollars to U.S. dollars and from U.S. dollars to Hong Kong dollars in this prospectus were calculated at the noon buying rate of US$1 = HK$7.8, representing the noon buying rate in The City of New York for cable transfers of HK$ as certified for customs purposes by the Federal Reserve Bank of New York on the last trading day of September 30, 2023. We make no representation that the HKD or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or HKD, as the case may be, at any particular rate or at all. PGHL’s fiscal year ends on March 31.

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our Ordinary Shares. You should read the entire prospectus carefully, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and the related notes thereto, in each case included in this prospectus. You should carefully consider, among other things, the matters discussed in the section of this prospectus titled “Business” before making an investment decision. Unless the context otherwise requires, all references to “PGHL,” “we,” “us,” “our,” the “Company,” and similar designations refer to Primega Group Holdings Limited, an exempted Cayman Islands company and its wholly owned subsidiaries.

Overview

We are a holding company incorporated in the Cayman Islands with operations conducted by our Hong Kong subsidiary, Primega Construction.

As a holding company with no material operations of its own, we conduct our operations in Hong Kong through our operating subsidiary, Primega Construction. Primega Construction is a provider of transportation services that employs environmentally friendly practices with the aim of facilitating reuse of C&D materials and reduction of construction waste. Through Primega Construction, we operate in the Hong Kong construction industry, mainly handling transportation of materials excavated from construction sites. Primega Construction principally provides the following services in Hong Kong (i) soil and rock transportation services; (ii) diesel oil trading; and (iii) construction works, which mainly includes ELS works and bored piling. We generally provide our services as a subcontractor to other construction contractors in Hong Kong.

We generate the majority of our income from soil and rock transportation services provided by Primega Construction, which contributed 73.82%, 88.47% and 66.48% of our total revenue during the years ended March 31, 2022 and 2023 and the six months ended September 30, 2023, respectively. Primega Construction works with recyclers and other private contractors to repurpose and recycle excavated materials, reducing the volume of construction waste ending up in landfills, while lowering waste disposal fees incurred by its customers.

Competitive Strengths

We believe the following competitive strengths differentiate us from our competitors:

| | ● | We have a fleet of 43 tipper trucks and machinery and a strong network of subcontractors |

| | | |

| | ● | Stable relationships with customers |

| | | |

| | ● | Experienced and professional management team |

Our Strategies

We intend to pursue the following strategies to further expand our business:

| | ● | Grow through selected strategic acquisition of machinery |

| | | |

| | ● | Enhance our operations as a construction works subcontractor to undertake excavation works |

| | | |

| | ● | Further enhance our project management capability |

Corporate History and Structure

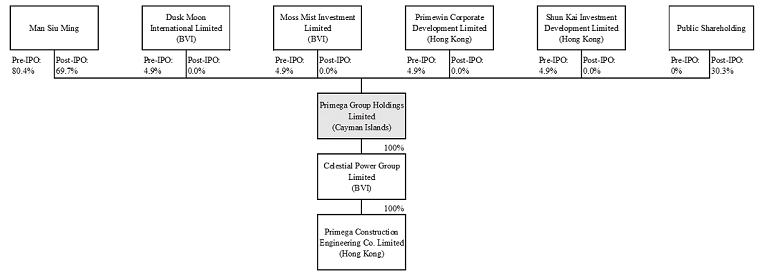

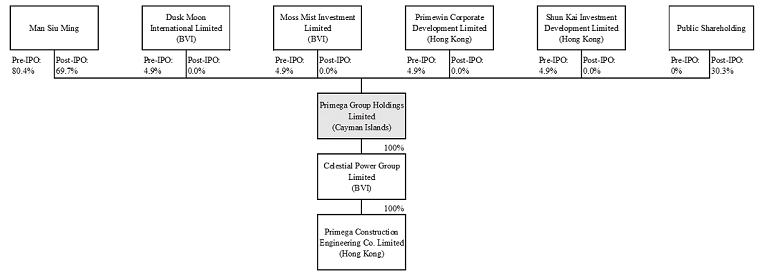

We are a holding company incorporated under the laws of the Cayman Islands on April 14, 2022. Our direct wholly-owned subsidiary is Celestial Power, a British Virgin Islands holding company incorporated on February 22, 2022. We operate our business through Primega Construction, our Hong Kong subsidiary incorporated on July 31, 2018, which is wholly owned by Celestial Power. Primega Construction is principally engaged in soil and rock transportation services in Hong Kong.

As of the date of this prospectus, our Controlling Shareholder owns 80.4% of our issued share capital.

In February 2022, Celestial Power was incorporated under the laws of the BVI as the intermediate holding company of PGHL. One (1) share of Celestial Power, representing its entire issued share capital, was allotted and issued to PGHL on May 4, 2022.

In April 2022, PGHL was incorporated under the laws of the Cayman Islands as an exempted company with limited liability, as the holding company of our BVI and Hong Kong subsidiaries.

In June 2022, as part of a reorganization, PGHL acquired, through Celestial Power, all the shares of Primega Construction from the Controlling Shareholder and became the ultimate holding company of Celestial Power and Primega Construction. On April 14, 2022, PGHL issued 11,249,999 Ordinary Shares to the Controlling Shareholder. On July 20, 2022, the Controlling Shareholder sold 551,250 Ordinary Shares each to Primewin Corporate Development Limited and Shun Kai Investment Development Limited, respectively. Primewin Corporate Development Limited and Shun Kai Investment Development Limited are wholly owned by Mr. Lau Wing Him Perry and Mr. Chan Wan Yiu, respectively. Primewin Corporate Development Limited was one of our major customers for the years ended March 31, 2021 and 2022, respectively. Mr. Chan Wan Yiu is an employee of Primega Construction, our Hong Kong operating subsidiary. On December 5, 2023, the Controlling Shareholder sold 551,250 Ordinary Shares each to Moss Mist Investment Limited and Dusk Moon International Limited, respectively. Moss Mist Investment Limited and Dusk Moon International Limited are wholly owned by Mr. Mohammad Imran Aslam and Ms. Huang Jinni, respectively.

As part of the series of reorganization transactions to be completed before the offering, a 2-for-1 share split was conducted by the Company on February 28, 2024. After the share split and as of the date of this prospectus, the authorized share capital of the Company consists of US$50,000 divided into 1,000,000,000 Ordinary Shares, par value US$0.00005 each, and the issued share capital of the Company consists of US$1,125 divided into 22,500,000 Ordinary Shares, par value of US$0.00005 each.

The chart below illustrates our corporate structure and subsidiaries as of the date of this prospectus and upon completion of this offering and the offering of the Resale Shares under the Resale Prospectus (assuming the Reselling Shareholders will sell all of the Ordinary Shares offered for sale pursuant to the Resale Prospectus):

We are offering 1,500,000 Ordinary Shares, representing 6.25% of the Ordinary Shares following completion of the offering of PGHL. Mr. Man Siu Ming, the Selling Shareholder is offering 250,000 Ordinary Shares, representing approximately 1.0% of the Ordinary Shares following completion of this offering. Dusk Moon International Limited, Moss Mist Investment Limited, Primewin Corporate Development Limited, Shun Kai Investment Development Limited and Mr. Man Siu Ming, (collectively, the “Reselling Shareholders”), are also offering 5,512,500 Ordinary Shares (the “Resale Shares”) to be sold in the offering pursuant to the Resale Prospectus, representing in total approximately 23.0% of the Ordinary Shares following the completion of this offering.

We will be a “controlled company” as defined under the Nasdaq Stock Market Rules because, immediately after the completion of this offering and the offering of the Resale Shares under the Resale Prospectus, our Controlling Shareholder will own 16,737,500 of our total issued and outstanding Ordinary Shares, representing approximately 69.7% of the total voting power.

Holding Company Structure

PGHL is a holding company incorporated in the Cayman Islands with no material operations of its own, and we conduct our operations primarily in Hong Kong through our operating subsidiary Primega Construction. This is an offering of the Ordinary Shares of PGHL, the holding company incorporated in the Cayman Islands, instead of the shares of the operating subsidiary. Investors in this offering will not directly hold any equity interests in the operating subsidiary.

As a result of our corporate structure, PGHL’s ability to pay dividends may depend upon dividends paid by our operating subsidiary. If our existing operating subsidiary or any newly formed ones incur debt on their own behalf in the future, the instruments governing their debt may restrict their ability to pay dividends to us.

Transfers of Cash To and From Our Subsidiaries

Our management monitors the cash position of our operating subsidiary, Primega Construction, regularly and prepares budgets on a monthly basis to ensure it has the necessary funds to fulfill its obligations for the foreseeable future and to ensure adequate liquidity. In the event that there is a need for cash or a potential liquidity issue, it will be reported to our Chief Financial Officer and subject to approval by our board of directors.

The ability of PGHL to transfer cash to its subsidiaries is subject to the following: PGHL is permitted under the laws of the Cayman Islands and its memorandum and articles of association (as amended from time to time) to provide funding to our subsidiaries incorporated in the BVI and Hong Kong through loans or capital contributions. PGHL’s subsidiary formed under the laws of the BVI is permitted under the laws of the BVI to provide funding to our Hong Kong operating subsidiary Primega Construction, subject to certain restrictions laid down in the BVI Business Companies Act 2004 (as amended) and memorandum and articles of association of PGHL’s subsidiary incorporated under the laws of the BVI.

The ability of Celestial Power, the direct subsidiary of PGHL, to transfer cash to PGHL is subject to the BVI Business Companies Act 2004 (as amended), pursuant to which Celestial Power may make dividends distribution only to the extent that immediately after the distribution the value of the company’s assets exceeds its liabilities and that the company is able to pay its debts as they fall due.

The ability of Primega Construction to transfer cash to Celestial Power is subject to the Companies Ordinance of Hong Kong, according to which Primega Construction may only make a distribution out of profits available for distribution.

Other than the above, we did not adopt or maintain any cash management policies and procedures as of the date of this prospectus.

During the years ended March 31, 2023 and 2022, the six months ended September 30, 2023 and up to the date of this prospectus, PGHL did not declare or pay any dividends and there was no transfer of assets among PGHL and its subsidiaries.

If we determine to pay dividends on any of our Ordinary Shares in the future, as a holding company, we will be dependent on receipt of funds from our subsidiaries by way of dividend payments. PGHL is permitted under the laws of Cayman Islands and its memorandum and articles of association (as amended from time to time) to provide funding to its subsidiaries through loans or capital contributions. Primega Construction is permitted under the laws of Hong Kong to provide funding to PGHL through dividend distributions.

We currently intend to retain all available funds and future earnings, if any, for the operation and expansion of our business and do not anticipate declaring or paying any dividends in the foreseeable future. Any future determination related to our dividend policy will be made at the discretion of our board of directors after considering our financial condition, results of operations, capital requirements, contractual requirements, business prospects and other factors the board of directors deems relevant, and subject to the restrictions contained in any future financing instruments.

There are no statutory prohibitions in the Cayman Islands on the granting of financial assistance by a company to another person for the purchase of, or subscription for, its own, its holding company’s or a subsidiary’s shares. Therefore, a company may provide financial assistance provided the directors of the company, when proposing to grant such financial assistance, discharge their duties of care and act in good faith, for a proper purpose and in the interests of the company. Such assistance should be on an arm’s-length basis. Subject to the Companies Act and our Memorandum and Articles of Association, our Company in general meeting may declare dividends in any currency to be paid to the members but no dividend shall be declared in excess of the amount recommended by our board of directors. Subject to a solvency test, as prescribed in the Companies Act, and the provisions, if any, of the company’s memorandum and articles of association, a company may pay dividends and distributions out of its share premium account. In addition, based upon English case law that is likely to be persuasive in the Cayman Islands, dividends may be paid out of profits. The Cayman Islands does not impose a withholding tax on payments of dividends to shareholders in the Cayman Islands.

According to the BVI Business Companies Act 2004 (as amended), a BVI company may make dividends distribution to the extent that immediately after the distribution, the value of the company’s assets exceeds its liabilities and that such company is able to pay its debts as they fall due.

Under Hong Kong law, dividends could only be paid out of distributable profits (that is, accumulated realized profits less accumulated realized losses) or other distributable reserves, as permitted under Hong Kong law. Dividends cannot be paid out of share capital. There are no restrictions or limitation under the laws of Hong Kong imposed on the conversion of Hong Kong dollar into foreign currencies and the remittance of currencies out of Hong Kong, nor there is any restriction on foreign exchange to transfer cash between PGHL and its subsidiaries, across borders and to U.S. investors, nor there is any restrictions and limitations to distribute earnings from our business and subsidiaries, to PGHL and U.S. investors and amounts owed. Under the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong in respect to dividends paid by us.

Enforceability of Civil Liabilities

We are incorporated under the laws of the Cayman Islands as an exempted company with limited liability. Substantially all of our assets are located outside the United States. In addition, all of our directors and officers are nationals or residents of jurisdictions other than the United States and all or a substantial portion of their assets are located outside the United States. As a result, it may be difficult for investors to effect service of process within the United States upon us or these persons or to enforce judgments obtained in U.S. courts against us or them, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state in the United States. It may also be difficult for you to enforce judgments obtained in U.S. courts based on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors.

We have appointed Cogency Global Inc. as our agent upon whom process may be served in any action brought against us under the securities laws of the United States.

Appleby, our counsel as to the laws of the Cayman Islands has advised us that there is uncertainty as to whether the courts of the Cayman Islands would (i) recognize or enforce judgments of U.S. courts obtained against us or our directors or officers predicated upon the civil liability provisions of the securities laws of the United States or any state in the United States, or (ii) entertain original actions brought in the Cayman Islands against us or our directors or officers predicated upon the securities laws of the United States or any state in the United States.

Appleby has informed us that any final and conclusive judgment for a definite sum (not being a sum payable in respect of taxes or other charges of a like nature nor a fine or other penalty) and/or certain non-monetary judgments rendered in any action or proceedings brought against our Company in a foreign court (other than certain judgments of a superior court of certain states of the Commonwealth of Australia) will be recognized as a valid judgment by the courts of the Cayman Islands without re-examination of the merits of the case. On general principles, we would expect such proceedings to be successful provided that the court which gave the judgment was competent to hear the action in accordance with private international law principles as applied in the Cayman Islands and the judgment is not contrary to public policy in the Cayman Islands, has not been obtained by fraud or in proceedings contrary to natural justice.

Substantially all of our assets are located outside the United States. In addition, all of our directors and officers are nationals or residents of jurisdictions other than the United States and all or a substantial portion of their assets are located outside the United States. As a result, it may be difficult for investors to effect service of process within the United States upon us or these persons.

| Name | | Position | | Nationality | | Residence |

| Mr. Man Siu Ming | | Director, Chairman of the board | | Chinese | | Hong Kong |

| Mr. Hui Chun Kit | | Director, Chief Executive Officer | | Chinese | | Hong Kong |

| Mr. Man Wing Pong | | Chief Financial Officer | | Chinese | | Hong Kong |

| Mr. Cheng Hin Fung Alvin | | Independent Director nominee | | Chinese | | Hong Kong |

| Mr. Suen To Wai | | Independent Director nominee | | Chinese | | Hong Kong |

| Mr. Wu Loong Cheong Paul | | Independent Director nominee | | Chinese | | Hong Kong |

CFN Lawyers, our counsel as to the laws of Hong Kong, has advised us that there is uncertainty as to whether the courts of Hong Kong would (i) recognize or enforce judgments of U.S. courts obtained against us or our directors or officers predicated upon the civil liability provisions of the securities laws of the United States or any state in the United States, or (ii) entertain original actions brought in Hong Kong against us or our directors or officers predicated upon the securities laws of the United States or any state in the United States.

A judgment of a court in the United States predicated upon U.S. federal or state securities laws may be enforced in Hong Kong at common law by bringing an action in a Hong Kong court on that judgment for the amount due thereunder, and then seeking summary judgment on the strength of the foreign judgment, provided that the foreign judgment, among other things, is (1) for a debt or a definite sum of money (not being taxes or similar charges to a foreign government taxing authority or a fine or other penalty), and (2) final and conclusive on the merits of the claim, but not otherwise. Such a judgment may not, in any event, be so enforced in Hong Kong if (a) it was obtained by fraud, (b) the proceedings in which the judgment was obtained were opposed to natural justice, (c) its enforcement or recognition would be contrary to the public policy of Hong Kong, (d) the court of the United States was not jurisdictionally competent, or (e) the judgment was in conflict with a prior Hong Kong judgment.

Hong Kong has no arrangement for the reciprocal enforcement of judgments with the United States. As a result, there is uncertainty as to the enforceability in Hong Kong, in original actions or in actions for enforcement, of judgments of U.S. courts of civil liabilities predicated solely upon the federal securities laws of the United States or the securities laws of any state or territory within the United States.

Summary of Key Risks

Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may materially and adversely affect our business, financial condition, results of operations, cash flows, and prospects that you should consider before making a decision to invest in our Ordinary Shares. These risks are discussed more fully in “Risk Factors.” These risks include, but are not limited to, the following:

Risks Relating to Doing Business in Hong Kong

| | ● | Our operations are in Hong Kong, a special administrative region of the PRC. According to the long-arm provisions under the current PRC laws and regulations, the PRC government may exercise significant oversight and discretion over the conduct of our business and may intervene in or influence our operations at any time, which could result in a material change in our operations and/or the value of our Ordinary Shares. The PRC government may intervene or impose restrictions on our ability to move money out of Hong Kong to distribute earnings and pay dividends or to reinvest in our business outside of Hong Kong. Changes in the policies, regulations, rules, and the enforcement of laws of the PRC government may also be quick with little advance notice and our assertions and beliefs of the risk imposed by the PRC legal and regulatory system cannot be certain. See “Risk Factors — Risks Relating to Doing Business in Hong Kong — Our operations are in Hong Kong, a special administrative region of the PRC. According to the long-arm provisions under the current PRC laws and regulations, the PRC government may exercise significant oversight and discretion over the conduct of our business and may intervene in or influence our operations at any time, which could result in a material change in our operations and/or the value of our Ordinary Shares. The PRC government may intervene or impose restrictions on our ability to move money out of Hong Kong to distribute earnings and pay dividends or to reinvest in our business outside of Hong Kong. Changes in the policies, regulations, rules, and the enforcement of laws of the PRC government may also be quick with little advance notice and our assertions and beliefs of the risk imposed by the PRC legal and regulatory system cannot be certain” on page 20 of this prospectus. |

| | | |

| | ● | There are uncertainties regarding the interpretation and enforcement of PRC and Hong Kong laws, rules, and regulations. See “Risk Factors — Risks Relating to Doing Business in Hong Kong — There are uncertainties regarding the interpretation and enforcement of PRC and Hong Kong laws, rules, and regulations” on page 21 of this prospectus. |

| | | |

| | ● | If the PRC government chooses to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers, such action may significantly limit or completely hinder our ability to offer or continue to offer Ordinary Shares to investors and cause the value of our Ordinary Shares to significantly decline or be worthless. See “Risk Factors — Risks Relating to Doing Business in Hong Kong — If the PRC government chooses to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers, such action may significantly limit or completely hinder our ability to offer or continue to offer Ordinary Shares to investors and cause the value of our Ordinary Shares to significantly decline or be worthless” on page 21 of this prospectus. |

| | ● | Adverse regulatory developments in China may subject us to additional regulatory review, and additional disclosure requirements and regulatory scrutiny to be adopted by the SEC in response to risks related to recent regulatory developments in China may impose additional compliance requirements for companies like us with Hong Kong-based operations, all of which could increase our compliance costs and subject us to additional disclosure requirements. See “Risk Factors — Risks Relating to Doing Business in Hong Kong — Adverse regulatory developments in China may subject us to additional regulatory review, and additional disclosure requirements and regulatory scrutiny to be adopted by the SEC in response to risks related to recent regulatory developments in China may impose additional compliance requirements for companies like us with Hong Kong-based operations, all of which could increase our compliance costs and subject us to additional disclosure requirements” on page 22 of this prospectus. |

| | | |

| | ● | We may become subject to a variety of PRC laws and other obligations regarding data security offerings that are conducted overseas and/or foreign investment in China-based issuers, and any failure to comply with applicable laws and obligations could have a material and adverse effect on our business, financial condition and results of operations and may hinder our ability to offer or continue to offer Ordinary Shares to investors and cause the value of our Ordinary Shares to significantly decline or be worthless. See “Risk Factors — Risks Relating to Doing Business in Hong Kong — We may become subject to a variety of PRC laws and other obligations regarding data security offerings that are conducted overseas and/or foreign investment in China-based issuers, and any failure to comply with applicable laws and obligations could have a material and adverse effect on our business, financial condition and results of operations and may hinder our ability to offer or continue to offer Ordinary Shares to investors and cause the value of our Ordinary Shares to significantly decline or be worthless” on page 23 of this prospectus. |

| | | |

| | ● | Although the audit report included in this prospectus is prepared by U.S. auditors who are currently inspected by the PCAOB, there is no guarantee that future audit reports will be issued by auditors inspected by the PCAOB, and, as such, in the future, investors may be deprived of the benefits of such inspection. Furthermore, trading in our Ordinary Shares may be prohibited under the HFCA Act if the SEC subsequently determines our audit work is performed by auditors that the PCAOB is unable to inspect or investigate completely, and as a result, U.S. national securities exchanges, such as the Nasdaq, may determine to delist our securities. Furthermore, on December 23, 2022 the Accelerating Holding Foreign Companies Accountable Act was enacted, which amended the HFCA Act by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, and thus, reduced the time before the securities may be prohibited from trading or delisted. See “Risk Factors — Risks Relating to Doing Business in Hong Kong — Although the audit report included in this prospectus is prepared by U.S. auditors who are currently inspected by the PCAOB, there is no guarantee that future audit reports will be issued by auditors inspected by the PCAOB, and, as such, in the future, investors may be deprived of the benefits of such inspection. Furthermore, trading in our Ordinary Shares may be prohibited under the HFCA Act if the SEC subsequently determines our audit work is performed by auditors that the PCAOB is unable to inspect or investigate completely, and as a result, U.S. national securities exchanges, such as the Nasdaq, may determine to delist our securities. Furthermore, on December 23, 2022 the Accelerating Holding Foreign Companies Accountable Act was enacted, which amended the HFCA Act by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, and thus, reduced the time before the securities may be prohibited from trading or delisted” on page 24 of this prospectus. |

| | | |

| | ● | The recent joint statement by the SEC, proposed rule changes submitted by Nasdaq, and an act passed by the U.S. Senate and the U.S. House of Representatives all call for additional and more stringent criteria to be applied to emerging market companies. These developments could add uncertainties to our offering, business operations, share price, and reputation. See “Risk Factors — Risks Relating to Doing Business in Hong Kong — The recent joint statement by the SEC, proposed rule changes submitted by Nasdaq, and an act passed by the U.S. Senate and the U.S. House of Representatives all call for additional and more stringent criteria to be applied to emerging market companies. These developments could add uncertainties to our offering, business operations, share price, and reputation” on page 26 of this prospectus. |

| | ● | The enactment of the Law of the PRC on Safeguarding National Security in the Hong Kong Special Administrative Region (the “Hong Kong National Security Law”) could impact our Hong Kong. See “Risk Factors — Risks Relating to Doing Business in Hong Kong — The enactment of the Law of the PRC on Safeguarding National Security in the Hong Kong Special Administrative Region (the “Hong Kong National Security Law”) could impact our Hong Kong subsidiary” on page 27 of this prospectus. |

| | | |

| | ● | If we become subject to the recent scrutiny, criticism, and negative publicity involving U.S.-listed China-based companies, we may have to expend significant resources to investigate and/or defend the matter, which could harm our business operations, this offering, and our reputation and could result in a loss of your investment in our Ordinary Shares, in particular if such matter cannot be addressed and resolved favorably. See “Risk Factors — Risks Relating to Doing Business in Hong Kong — If we become subject to the recent scrutiny, criticism, and negative publicity involving U.S.-listed China-based companies, we may have to expend significant resources to investigate and/or defend the matter, which could harm our business operations, this offering, and our reputation and could result in a loss of your investment in our Ordinary Shares, in particular if such matter cannot be addressed and resolved favorably” on page 27 of this prospectus. |

| | | |

| | ● | A downturn in the Hong Kong, China, or global economy, or a change in economic and political policies of China, could materially and adversely affect our business and financial condition. See “Risk Factors — Risks Relating to Doing Business in Hong Kong — A downturn in the Hong Kong, China, or global economy, or a change in economic and political policies of China, could materially and adversely affect our business and financial condition” on page 27 of this prospectus. |

| | | |

| | ● | Because our business is conducted in Hong Kong dollars and the price of our Ordinary Shares is quoted in U.S. dollars, changes in currency conversion rates may affect the value of your investments. See “Risk Factors — Risks Relating to Doing Business in Hong Kong — Because our business is conducted in Hong Kong dollars and the price of our Ordinary Shares is quoted in U.S. dollars, changes in currency conversion rates may affect the value of your investments” on page 28 of this prospectus. |

| | | |

| | ● | There are political risks associated with conducting business in Hong Kong. See “Risk Factors — Risks Relating to Doing Business in Hong Kong — There are political risks associated with conducting business in Hong Kong” on page 28 of this prospectus. |

| | | |

| | ● | The Hong Kong legal system embodies uncertainties that could limit the availability of legal protections. See “Risk Factors — Risks Relating to Doing Business in Hong Kong — The Hong Kong legal system embodies uncertainties that could limit the availability of legal protections” on page 28 of this prospectus. |

| | | |

| | ● | Changes in international trade policies, trade disputes, barriers to trade, or the emergence of a trade war may dampen growth in Hong Kong, where our clients reside. See “Risk Factors — Risks Relating to Doing Business in Hong Kong — Changes in international trade policies, trade disputes, barriers to trade, or the emergence of a trade war may dampen growth in Hong Kong, where our clients reside” on page 29 of this prospectus. |

Risks Related to Our Corporate Structure

| | ● | We rely on dividends and other distributions on equity paid by our subsidiaries to fund our cash and financing requirements we may have, and any limitation on the ability of our subsidiaries to make payments to us could have a material adverse effect on our ability to conduct our business. See “Risk Factors — Risks Related to Our Corporate Structure — We rely on dividends and other distributions on equity paid by our subsidiaries to fund our cash and financing requirements we may have, and any limitation on the ability of our subsidiaries to make payments to us could have a material adverse effect on our ability to conduct our business” on page 29 of this prospectus. |

| | | |

| | ● | Our lack of effective internal controls over financial reporting may affect our ability to accurately report our financial results or prevent fraud, which may affect the market for and the price of our Ordinary Shares. See “Risk Factors — Risks Related to Our Corporate Structure — Our lack of effective internal controls over financial reporting may affect our ability to accurately report our financial results or prevent fraud, which may affect the market for and the price of our Ordinary Shares” on page 30 of this prospectus. |

Risks Related to Our Business and Industry

| | ● | We have a concentrated customer base and any decrease in the number of projects with our major customers would adversely affect our operations and financial results. See “Risk Factors — Risks Related to Our Business and Industry — We have a concentrated customer base and any decrease in the number of projects with our major customers would adversely affect our operations and financial results” on page 30 of this prospectus. |

| | | |

| | ● | Our revenue mainly relies on successful tenders or acceptance of quotations for soil and rock transportation which are non-recurring in nature and any failure in securing projects from our existing customers and/or new customers in the future would affect our business operation and financial results. See “Risk Factors — Risks Related to Our Business and Industry — Our revenue mainly relies on successful tenders or acceptance of quotations for construction projects which are non-recurring in nature and any failure in securing projects from our existing customers and/or new customers in the future would affect our business operation and financial results” on page 31 of this prospectus. |

| | | |

| | ● | Our operating results are difficult to predict. See “Risk Factors — Risks Related to Our Business and Industry — Our operating results are difficult to predict” on page 31 of this prospectus. |

| | | |

| | ● | Fluctuations in the price or availability of biodiesel oil may adversely affect our financial results. See “Risk Factors — Risks Related to Our Business and Industry — Fluctuations in the price or availability of biodiesel oil may adversely affect our financial results” on page 31 of this prospectus. |

| | | |

| | ● | Primega Construction’s capacity to provide soil and rock transportation services is limited by availability of machinery and equipment. See “Risk Factors — Risks Related to Our Business and Industry — Primega Construction’s capacity to provide soil and rock transportation services is limited by availability of machinery and equipment” on page 31 of this prospectus. |

| | | |

| | ● | Primega Construction depends on third parties for machinery and equipment and supplies essential to operate its business. See “Risk Factors — Risks Related to Our Business and Industry — Primega Construction depends on third parties for equipment and supplies essential to operate its business” on page 31 of this prospectus. |

| | | |

| | ● | Any failure, damage or loss of Primega Construction’s machinery and equipment may adversely affect our operations and financial performance. See “Risk Factors — Risks Related to Our Business and Industry — Any failure, damage or loss of Primega Construction’s machinery and equipment may adversely affect our operations and financial performance” on page 31 of this prospectus. |

| | | |

| | ● | If leakage of biodiesel oil occurs during the transportation process, Primega Construction may be liable for related accidents and our reputation and business operation may be affected. See “Risk Factors — Risks Related to Our Business and Industry — If leakage of biodiesel oil occurs during the transportation process, Primega Construction may be liable for related accidents and our reputation and business operation may be affected” on page 31 of this prospectus |

| | | |

| | ● | Primega Construction’s ability to obtain and maintain biodiesel oil at suitable prices is essential for its biodiesel oil trading. See “Risk Factors — Risks Related to Our Business and Industry — Primega Construction’s ability to obtain and maintain biodiesel oil at suitable prices is essential for its biodiesel oil trading” on page 32 of this prospectus |

| | | |

| | ● | The construction services industry is highly schedule driven, and failure to meet the schedule requirements of contracts could adversely affect our reputation and/or expose us to financial liability. See “Risk Factors — Risks Related to Our Business and Industry — The construction services industry is highly schedule driven, and failure to meet the schedule requirements of contracts could adversely affect our reputation and/or expose us to financial liability” on page 32 of this prospectus. |

| | | |

| | ● | Failure to maintain safe work sites could result in significant losses, which could materially affect our business and reputation. See “Risk Factors — Risks Related to Our Business and Industry — Failure to maintain safe work sites could result in significant losses, which could materially affect our business and reputation” on page 32 of this prospectus. |

| | | |

| | ● | We may not be able to bill and receive the full amount of gross amounts due from customers for contract work and our revenue may fluctuate due to variation orders. See “Risk Factors — Risks Related to Our Business and Industry — We may not be able to bill and receive the full amount of gross amounts due from customers for contract work and our revenue may fluctuate due to variation orders” on page 32 of this prospectus. |

| | | |

| | ● | Primega Construction relies on its subcontractors and suppliers to help complete our projects and to supply the machinery required. See “Risk Factors — Risks Related to Our Business and Industry — Primega Construction relies on its subcontractors and suppliers to help complete our projects and to supply the machinery required” on page 33 of this prospectus. |

| | ● | As Primega Construction from time to time engage subcontractors in its work, it may bear responsibilities for any non-performance, delayed performance, sub-standard performance, or non-compliance of our subcontractors. See “Risk Factors — Risks Related to Our Business and Industry — As Primega Construction from time to time engage subcontractors in its work, it may bear responsibilities for any non-performance, delayed performance, sub-standard performance, or non-compliance of our subcontractors” on page 33 of this prospectus. |

| | | |

| | ● | There is no guarantee that safety measures and procedures implemented at construction sites could prevent the occurrence of industrial accidents of all kinds, which in turn might lead to claims in respect to employees’ compensation, personal injuries, fatal accidents, and/or property damages against us. See “Risk Factors — Risks Related to Our Business and Industry — There is no guarantee that safety measures and procedures implemented at construction sites could prevent the occurrence of industrial accidents of all kinds, which in turn might lead to claims in respect to employees’ compensation, personal injuries, fatal accidents, and/or property damages against us” on page 34 of this prospectus. |

| | | |

| | ● | Primega Construction determines the price of its quotation or tender based on the estimated time and costs to be involved in a project and the actual time and costs incurred may deviate from our estimate due to unexpected circumstances, thereby leading to cost overruns and adversely affecting our operations and financial results. See “Risk Factors — Risks Related to Our Business and Industry — Primega Construction determines the price of its quotation or tender based on the estimated time and costs to be involved in a project and the actual time and costs incurred may deviate from our estimate due to unexpected circumstances, thereby leading to cost overruns and adversely affecting our operations and financial results” on page 34 of this prospectus. |

| | | |

| | ● | Cash inflows and outflows in connection with construction projects may be irregular thus may affect our net cash flow position. See “Risk Factors — Risks Related to Our Business and Industry — Cash inflows and outflows in connection with construction projects may be irregular thus may affect our net cash flow position” on page 34 of this prospectus. |

| | | |

| | ● | Claims in connection with employees’ compensation or personal injuries may arise and affect our reputation and operations. See “Risk Factors — Risks Related to Our Business and Industry — Claims in connection with employees’ compensation or personal injuries may arise and affect our reputation and operations” on page 35 of this prospectus. |

| | ● | Any deterioration in the prevailing market conditions in the construction industry may adversely affect our performance and financial condition. See “Risk Factors — Risks Related to Our Business and Industry — Any deterioration in the prevailing market conditions in the construction industry may adversely affect our performance and financial condition” on page 35 of this prospectus. |

| | | |

| | ● | Primega Construction is dependent on its key executives, management team and professional staff. See “Risk Factors — Risks Related to Our Business and Industry — Primega Construction is dependent on its key executives, management team and professional staff” on page 35 of this prospectus. |

| | | |

| | ● | Primega Construction may be unable to obtain sufficient funding on terms acceptable, or at all. See “Risk Factors — Risks Related to Our Business and Industry — Primega Construction may be unable to obtain sufficient funding on terms acceptable, or at all” on page 36 of this prospectus. |

| | | |

| | ● | The insurance coverage of Primega Construction may be inadequate to protect it from potential losses. See “Risk Factors — Risks Related to Our Business and Industry — The insurance coverage of Primega Construction may be inadequate to protect it from potential losses” on page 36 of this prospectus. |

| | | |

| | ● | We may be subject to litigation, arbitration, or other legal proceeding risk. See “Risk Factors — Risks Related to Our Business and Industry — We may be subject to litigation, arbitration, or other legal proceeding risk” on page 36 of this prospectus. |

| | | |

| | ● | Primega Construction relies on its customers and subcontractors for the provision of machinery and equipment at construction sites. See “Risk Factors — Risks Related to Our Business and Industry — Primega Construction relies on its customers and subcontractors for the provision of machinery and equipment at construction sites” on page 36 of this prospectus. |

| | | |

| | ● | Primega Construction relies on a stable workforce to carry out its construction projects. If Primega Construction or its subcontractors experience any shortage of labor, industrial actions, strikes, or material increase in labor costs, our operations and financial results would be adversely affected. See “Risk Factors — Risks Related to Our Business and Industry — Primega Construction relies on a stable workforce to carry out its construction projects. If Primega Construction or its subcontractors experience any shortage of labor, industrial actions, strikes, or material increase in labor costs, our operations and financial results would be adversely affected” on page 37 of this prospectus. |

| | | |

| | ● | We may be unable to successfully implement our future business plans and objectives. See “Risk Factors — Risks Related to Our Business and Industry — We may be unable to successfully implement our future business plans and objectives” on page 37 of this prospectus. |

| | | |

| | ● | A sustained outbreak of the COVID-19 pandemic could have a material adverse impact on our business, operating results, and financial condition. See “Risk Factors — Risks Related to Our Business and Industry — A sustained outbreak of the COVID-19 pandemic could have a material adverse impact on our business, operating results, and financial condition” on page 37 of this prospectus. |

| | | |

| | ● | A severe or prolonged downturn in the global economy could materially and adversely affect our business and results of operations. See “Risk Factors — Risks Related to Our Business and Industry — A severe or prolonged downturn in the global economy could materially and adversely affect our business and results of operations” on page 38 of this prospectus. |

Risks Related to Our Ordinary Shares

| | ● | There has been no public market for our Ordinary Shares prior to this offering; if an active trading market does not develop you may not be able to resell our Ordinary Shares at any reasonable price. See “Risk Factors — Risks Related to Our Ordinary Shares — There has been no public market for our Ordinary Shares prior to this offering; if an active trading market does not develop you may not be able to resell our Shares at any reasonable price” on page 39 of this prospectus. |

| | | |

| | ● | The trading price of our Ordinary Shares may be volatile, which could result in substantial losses to you. See “Risk Factors — Risks Related to Our Ordinary Shares — The trading price of our Ordinary Shares may be volatile, which could result in substantial losses to you” on page 39 of this prospectus. |

| | | |