- AMD Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Advanced Micro Devices (AMD) DEF 14ADefinitive proxy

Filed: 25 Mar 24, 4:20pm

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under Rule 14a-12 |

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

ADVANCED MICRO DEVICES, INC.

2485 AUGUSTINE DRIVE

SANTA CLARA, CALIFORNIA 95054

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

You are cordially invited to attend our 2024 annual meeting of stockholders (our “Annual Meeting”) to be held on Wednesday, May 8, 2024 at 9:00 a.m. Pacific Time. Our Annual Meeting will be held virtually via the Internet at www.virtualshareholdermeeting.com/AMD2024. You will not be able to attend the Annual Meeting in person.

We are holding our Annual Meeting to:

| • | Elect the nine director nominees named in this proxy statement; |

| • | Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the current fiscal year; |

| • | Approve on a non-binding, advisory basis the compensation of our named executive officers (“Say-on-Pay”), as disclosed in this proxy statement pursuant to the compensation disclosure rules of the U.S. Securities and Exchange Commission (the “SEC”); |

| • | Vote on the stockholder proposal described in this proxy statement, if properly presented at our Annual Meeting; and |

| • | Transact any other business that properly comes before our Annual Meeting or any adjournment or postponement thereof. |

We are pleased to provide access to our proxy materials over the Internet under the SEC’s “notice and access” rules. As a result, we are mailing to our stockholders (other than those who previously requested printed or emailed materials on an ongoing basis) a Notice of Internet Availability of Proxy Materials (the “Notice”) instead of printed copies of our proxy materials. The Notice contains instructions on how to access our proxy materials on the Internet, how to vote on the Internet and how you can receive printed or emailed copies of our proxy materials at no charge. We believe that providing our proxy materials over the Internet will lower our Annual Meeting’s cost and environmental impact, while increasing the ability of our stockholders to access the information that they need.

Stockholders of record at the close of business on March 13, 2024 and holders of proxies for those stockholders may attend and vote at our Annual Meeting. To attend our Annual Meeting via the Internet, you must log in to www.virtualshareholdermeeting.com/AMD2024 using the 16-digit control number on the Notice, proxy card or voting instruction form that accompanied the proxy materials.

For additional details on Internet and telephone voting and the virtual meeting, please see pages 1-6 of the Proxy Statement.

Sincerely,

Ava M. Hahn

Senior Vice President, General Counsel and Corporate

Secretary

This notice of annual meeting is dated March 25, 2024 and will first be distributed and

made available to the stockholders of Advanced Micro Devices, Inc. on or about March 25, 2024.

YOUR VOTE IS IMPORTANT AND WE ENCOURAGE YOU TO VOTE PROMPTLY

Important notice regarding Internet availability of proxy materials: This proxy statement and our

Annual Report on Form 10-K for the fiscal year ended December 30, 2023 are available at

www.proxyvote.com and on the Investor Relations pages of our website at www.amd.com or ir.amd.com.

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

TABLE OF CONTENTS

| Page | ||||

| 1 | ||||

| 7 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 18 | ||||

Former Directorships in Public Companies in the Last Five Years | 18 | |||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 24 | ||||

| 25 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 32 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 36 | |||

| 38 | ||||

| 44 | ||||

| 44 | ||||

Response to 2023 “Say On Pay” Vote and Stockholder Engagement Process | 48 | |||

| 50 | ||||

| 51 | ||||

| 56 | ||||

| 63 | ||||

| 64 | ||||

| 65 | ||||

| 67 | ||||

| 68 | ||||

| 69 | ||||

| 69 | ||||

| 71 | ||||

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Table of Contents (continued)

| Page | ||||

| 73 | ||||

| 75 | ||||

| 76 | ||||

| 77 | ||||

| 85 | ||||

| 86 | ||||

| 89 | ||||

| 90 | ||||

| 91 | ||||

ITEM 2—RATIFICATION OF THE APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 92 | |||

| 92 | ||||

| 92 | ||||

| 93 | ||||

| 93 | ||||

| 94 | ||||

| 95 | ||||

| 95 | ||||

ITEM 4—STOCKHOLDER PROPOSAL REQUESTING A STOCKHOLDER RIGHT TO CALL A SPECIAL MEETING | 96 | |||

| 96 | ||||

| 99 | ||||

| 99 | ||||

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

ADVANCED MICRO DEVICES, INC.

PROXY STATEMENT

2024 ANNUAL MEETING OF STOCKHOLDERS

QUESTIONS AND ANSWERS

In this proxy statement, the words “AMD,” the “Company,” “we,” “ours,” “us” and similar terms refer to Advanced Micro Devices, Inc. and its consolidated subsidiaries, unless the context indicates otherwise. Information presented in this Proxy Statement is based on our 2023 fiscal calendar, which ended December 30, 2023.

| 1. | Q: | WHY DID I RECEIVE A NOTICE IN THE MAIL REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS INSTEAD OF A FULL SET OF PROXY MATERIALS? | ||||

| A: | In accordance with rules adopted by the SEC, commonly referred to as “Notice and Access,” we may furnish proxy materials by providing access to the documents on the Internet, instead of mailing printed copies. Most stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice was mailed on or about March 25, 2024 to stockholders of record on March 13, 2024 (the “Record Date”) who have not previously requested to receive printed or emailed materials on an ongoing basis. The Notice instructs you as to how you may access our proxy materials on the Internet and how to vote on the Internet.

You may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis by following the instructions in the Notice. Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you and will reduce the environmental impact of our annual meetings. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it. | ||||

| 2. | Q: | WHY AM I RECEIVING PROXY MATERIALS? | ||||

| A: | Our board of directors (the “Board”) is providing these materials to you in connection with the Board’s solicitation of proxies for use at our Annual Meeting, which will take place on Wednesday, May 8, 2024 at 9:00 a.m. Pacific Time virtually at www.virtualshareholdermeeting.com/AMD2024. Our stockholders as of the close of business on the Record Date are invited to attend or participate in our Annual Meeting and are requested to vote on the items described in this proxy statement. This proxy statement includes information that we are required to provide to you under SEC rules and is designed to assist you in voting your shares. | ||||

| 3. | Q: | WHAT IS INCLUDED IN THE PROXY MATERIALS? | ||||

| A: | The proxy materials for our Annual Meeting include the Notice, this proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 30, 2023 (our “Annual Report”). If you received a printed copy of these materials, the proxy materials also include a proxy card or voting instruction form. | ||||

| 4. | Q: | HOW CAN I ACCESS THE PROXY MATERIALS OVER THE INTERNET? | ||||

| A: | The Notice, proxy card and voting instruction form contain instructions on how you may access our proxy materials on the Internet and how to vote on the Internet. Our proxy materials are also available at www.proxyvote.com and the Investor Relations page of our website at www.amd.com or ir.amd.com. | ||||

| 5. | Q: | WHO IS SOLICITING MY VOTE? | ||||

| A: | This proxy solicitation is being made by the Board of Advanced Micro Devices, Inc. We have retained MacKenzie Partners, Inc., professional proxy solicitors, to assist us with this proxy solicitation. We will pay the entire cost of this solicitation, including MacKenzie’s fees and expenses, which we expect to be approximately $25,000. | ||||

| ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement | 1 |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Questions and Answers (continued)

| 6. | Q: | WHO IS ENTITLED TO VOTE? | ||||

| A: | Stockholders as of the close of business on the Record Date are entitled to vote on all items properly presented at our Annual Meeting. On the Record Date, 1,616,140,033 shares of our common stock were outstanding. Every stockholder is entitled to one vote for each share of common stock held on the Record Date. A list of these stockholders will be available during regular business hours at our headquarters, located at 2485 Augustine Drive, Santa Clara, California 95054, from our Corporate Secretary at least ten days before our Annual Meeting. The list of stockholders will also be available during our Annual Meeting on our virtual meeting website. | ||||

| 7. | Q: | WHAT AM I BEING ASKED TO VOTE ON? | ||||

| A: | You may vote on: | ||||

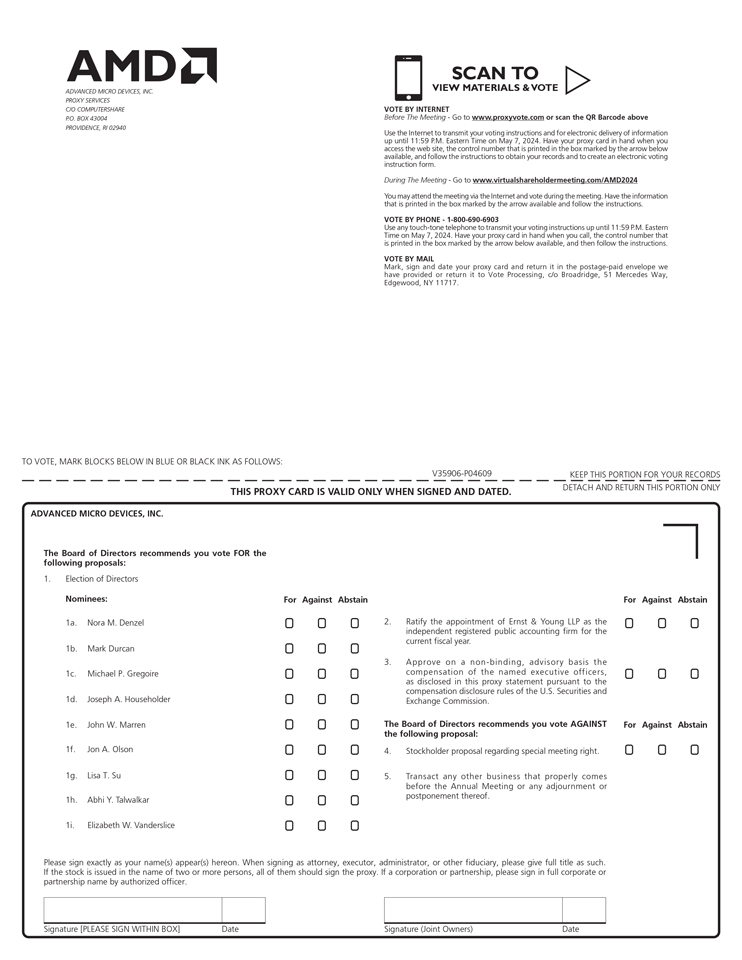

| • | Proposal 1: Election of the nine director nominees named in this proxy statement. | |||||

| • | Proposal 2: Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the current fiscal year. | |||||

| • | Proposal 3: Approval on a non-binding, advisory basis of the compensation of our named executive officers (“Say-On-Pay”). | |||||

| • | Proposal 4: A stockholder proposal requesting a stockholder right to call a special meeting. | |||||

| • | Such other business as may properly come before our Annual Meeting or any adjournment or postponement of our Annual Meeting. | ||||

| 8. | Q: | HOW DOES THE BOARD RECOMMEND I VOTE ON THE PROPOSALS? | ||||

| A: | The Board recommends that you vote: | ||||

| • | FOR each of the nine director nominees named in this proxy statement. | |||||

| • | FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the current fiscal year. | |||||

| • | FOR the Say-On-Pay proposal. | |||||

| • | AGAINST the stockholder proposal described in this proxy statement. | ||||

| 9. | Q: | WHAT IS THE DIFFERENCE BETWEEN HOLDING SHARES AS A STOCKHOLDER OF RECORD AND AS A BENEFICIAL OWNER? | ||||

| A: | Most of our stockholders hold their shares as a beneficial owner through a broker or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered, with respect to those shares, the stockholder of record, and the Notice was sent directly to you. As the stockholder of record, you have the right to grant your voting proxy directly to AMD or to vote at our Annual Meeting. If you requested to receive printed proxy materials, we have enclosed a proxy card for you to use, as described in the Notice and under Question 10 below. You may also vote on the Internet, or by telephone, as described in the Notice and under Question 10 below. You are also invited to attend our Annual Meeting via the Internet.

Beneficial Owner. If your shares are held in an account in the name of a brokerage firm, bank, broker-dealer, trust or other similar organization (i.e., in street name), like the vast majority of our stockholders, you are considered the beneficial owner of shares held in street name, and the Notice should be forwarded to you by that organization. As the beneficial owner, you have the right to direct your broker or other nominee how to vote your shares, and you are also invited to attend our Annual Meeting via the Internet, as described in the Notice and under Question 10 below. | ||||

| 2 | ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Questions and Answers (continued)

| 10. | Q: | CAN I ATTEND THE ANNUAL MEETING VIA THE INTERNET? CAN I VOTE AT THE ANNUAL MEETING? | ||||

| A: | Stockholders may attend our Annual Meeting via the Internet at www.virtualshareholdermeeting.com/AMD2024. Stockholders will not be able to attend the Annual Meeting in person.

Access to the Annual Meeting. The live audio webcast of the Annual Meeting will begin promptly at 9:00 am Pacific Time. Online access to the audio webcast will open approximately 15 minutes prior to the start of the Annual Meeting to allow time for our stockholders to log in and test their devices’ audio system. We encourage our stockholders to access the meeting in advance of the designated start time.

Log-in Instructions. To attend the Annual Meeting, stockholders will need to log in to www.virtualshareholdermeeting.com/AMD2024 using the 16-digit control number on the Notice, proxy card or voting instruction form.

Submitting Questions Prior to or at the Annual Meeting. An online portal will be available to our stockholders at www.proxyvote.com on or about March 25, 2024 prior to the Annual Meeting. By accessing this portal, stockholders will be able to submit questions and vote in advance of the Annual Meeting. Stockholders may also submit questions and vote on the day of, or during, the Annual Meeting on www.virtualshareholdermeeting.com/AMD2024. To demonstrate proof of stock ownership, you will need to enter the 16-digit control number received with your Notice, proxy card or voting instruction form to submit questions and vote at our Annual Meeting. We intend to answer questions submitted before and during the meeting that are pertinent to the Company and the items being brought before stockholder vote at the Annual Meeting, as time permits, and in accordance with the Rules of Conduct for the Annual Meeting.

Technical Assistance. We have retained Broadridge Financial Solutions (“Broadridge”) to host our virtual annual meeting and to distribute, receive, count and tabulate proxies. If you encounter any difficulties while accessing the virtual meeting during the check-in or meeting time, a technical assistance phone number will be made available on the virtual meeting registration page 15 minutes prior to the start of the meeting. | ||||

| 11. | Q: | IF I AM A STOCKHOLDER OF RECORD, HOW DO I VOTE? | ||||

| A: | If you are a stockholder of record you may vote by proxy. You can vote by proxy over the Internet by following the instructions provided in the Notice, or, if you requested to receive printed proxy materials, you can vote by mail, telephone (from the United States and Canada) or the Internet pursuant to instructions provided on the proxy card provided to you with your printed proxy materials.

You may also vote while attending our Annual Meeting via the Internet, as described in Question 10 above. Even if you plan to attend our Annual Meeting via the Internet, we recommend that you also submit your proxy as described above so that your vote will be counted if you later decide not to attend our Annual Meeting. | ||||

| 12. | Q: | IF I AM A BENEFICIAL OWNER, HOW DO I VOTE? | ||||

| A: | If you are a beneficial owner, you may submit your voting instructions by following the instructions provided in the Notice, or, if you requested to receive printed proxy materials, you can submit your voting instructions by following the instructions in the voting instruction form provided to you by your broker or other nominee. We urge you to instruct your broker or other nominee on how to vote on your behalf. As described more fully under Question 14, your broker or other nominee cannot vote on certain items without your instructions.

You may also vote while attending our Annual Meeting via the Internet, as described in Question 10 above. Even if you plan to attend our Annual Meeting via the Internet, we recommend that you also submit your voting instructions as described above so that your vote will be counted if you later decide not to attend our Annual Meeting. | ||||

| 13. | Q: | WHAT IF I AM A STOCKHOLDER OF RECORD AND DO NOT SPECIFY A CHOICE FOR A MATTER WHEN RETURNING A PROXY CARD OR VOTING BY TELEPHONE OR THE INTERNET? | ||||

| A: | If you are a stockholder of record and you return a properly executed proxy card or vote by proxy over the Internet but do not mark the boxes showing how you wish to vote, your shares will be voted in accordance with the recommendations of the Board, as specified in Question 8 above. With respect to any other matter that properly comes before our Annual Meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, at their own discretion. | ||||

| ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement | 3 |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Questions and Answers (continued)

| 14. | Q: | WHAT IF I AM A BENEFICIAL OWNER AND DO NOT GIVE VOTING INSTRUCTIONS TO MY BROKER OR OTHER NOMINEE? WHAT IS A BROKER NON-VOTE? | ||||

| A: | As a beneficial owner, in order to ensure your shares are voted, you must provide voting instructions to your broker or other nominee by the deadline provided in the materials you receive from your broker or other nominee. If you do not provide voting instructions to your broker or other nominee, whether your shares can be voted by such person depends on the type of item being considered for vote.

Non-Discretionary Items. The election of directors, the Say-on-Pay proposal, and the stockholder proposal are non-discretionary items and may not be voted on by brokers or other nominees who have not received specific voting instructions from beneficial owners. A broker non-vote occurs when your broker or other nominee has not received instructions from you as to how to vote your shares on a proposal and does not have discretionary authority to vote your shares on that proposal.

Discretionary Items. The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the current fiscal year is a discretionary item. Generally, brokers and other nominees that do not receive voting instructions from beneficial owners may vote on these proposals in their discretion. | ||||

| 15. | Q: | CAN I CHANGE MY VOTE AFTER I HAVE VOTED? | ||||

| A: | Yes. You may revoke or change your vote at any time before the voting concludes at our Annual Meeting. You may vote by proxy again on the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to our Annual Meeting will be counted), by signing and returning a new proxy card with a later date or by attending our Annual Meeting via the Internet and voting at the meeting. However, your attendance at our Annual Meeting via the Internet will not automatically revoke your proxy unless you vote again at our Annual Meeting or specifically request in writing that your prior proxy be revoked. | ||||

| 16. | Q: | WHAT IS A “QUORUM”? | ||||

| A: | For the purposes of our Annual Meeting, a “quorum” is the presence, in person or by proxy, by the holders of a majority of the voting power of the outstanding shares entitled to vote at our Annual Meeting. There must be a quorum for our Annual Meeting to be held. Both abstentions and broker non-votes are counted for the purpose of determining the presence of a quorum. | ||||

| 17. | Q: | WHAT IS THE VOTING REQUIREMENT FOR EACH PROPOSAL TO PASS? | ||||

| A: | Election of Directors. Each of the nine director nominees will be elected if each of them receives the affirmative vote of a majority of the votes cast. A majority of the votes cast means that the number of votes cast “for” a director must exceed the number of votes cast “against” that director. Abstentions and broker non-votes will have no effect on the outcome of these elections. Each director nominee has submitted a written resignation that will be effective if he or she does not receive a majority of the votes cast for such director and the resignation is accepted by the Nominating and Corporate Governance Committee, another authorized committee of the Board, or the Board.

Ratification of the Appointment of our Independent Registered Public Accounting Firm. Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm requires the affirmative vote of a majority of the shares of our common stock entitled to vote and present in person or represented by proxy at the Annual Meeting. Abstentions have the same effect as a vote against this proposal. Because brokers and other nominees have discretionary authority to vote on the ratification, we do not expect any broker non-votes in connection with this item.

Say-On-Pay Proposal. Approval, on an advisory basis, of the compensation of our named executive officers as disclosed in this proxy statement pursuant to the compensation disclosure rules of the SEC, requires the affirmative vote of a majority of the shares of our common stock entitled to vote and present in person or represented by proxy at the Annual Meeting. Because your vote is advisory, it will not be binding on the Board, the Compensation and Leadership Resources Committee (the “Compensation Committee”) or us. However, the Board and the Compensation Committee will review the voting results and take them into consideration when making future decisions about our executive compensation program. Abstentions have the same effect as a vote against this proposal. Broker non-votes will have no effect on the outcome of this proposal. | ||||

| 4 | ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Questions and Answers (continued)

|

|

|

| Stockholder Proposal. Approval of the stockholder proposal requires the affirmative vote of a majority of the shares of our common stock entitled to vote and present in person or represented by proxy at the Annual Meeting. Abstentions have the same effect as a vote against this proposal. Broker non-votes will have no effect on the outcome of this proposal. | ||

| 18. | Q: | WHERE CAN I FIND THE VOTING RESULTS OF THE ANNUAL MEETING? | ||||

| A: | We will announce preliminary voting results at our Annual Meeting and publish voting results in a Current Report on Form 8-K, which will be filed with the SEC within four business days after our Annual Meeting. If the official results are not available at that time, we will provide preliminary voting results in the Form 8-K and the final voting results in an amendment to the Form 8-K as soon as they become available. | ||||

| 19. | Q: | IS MY VOTE CONFIDENTIAL? | ||||

| A: | Proxy cards, ballots and voting tabulations that identify individual stockholders are mailed or returned directly to Broadridge and handled in a manner that protects your voting privacy. Your vote will not be disclosed except as needed to permit Broadridge to tabulate and certify the vote and as required by law. | ||||

| 20. | Q: | HOW WILL VOTING ON ANY BUSINESS NOT DESCRIBED IN THIS PROXY STATEMENT BE CONDUCTED? | ||||

| A: | We do not know of any business to be considered at our Annual Meeting other than the items described in this proxy statement. If any other business is presented at our Annual Meeting, your proxy gives authority to each of Dr. Lisa T. Su, our Chair, President and Chief Executive Officer, and Ava M. Hahn, our Senior Vice President, General Counsel and Corporate Secretary, to vote on such matters at their discretion. | ||||

| 21. | Q: | WHEN ARE THE STOCKHOLDER PROPOSALS AND DIRECTOR NOMINATIONS FOR THE 2025 ANNUAL MEETING DUE? | ||||

| A: | For stockholder proposals to be considered for inclusion in the proxy statement for our 2025 annual meeting of stockholders, they must be submitted in writing to Advanced Micro Devices, Inc., 2485 Augustine Drive, Santa Clara, California 95054, Attention: Corporate Secretary and received by us on or before November 22, 2024.

In addition, for directors to be nominated or other stockholder proposals to be properly presented at our 2025 annual meeting of stockholders (but not included in our proxy materials), a separate notice of any nomination or proposal must be received by us between January 8, 2025 and February 7, 2025. If our 2025 annual meeting of stockholders is not held within 30 days of May 8, 2025, to be timely, the stockholder’s notice must be received by us no later than the close of business on the tenth day following the earlier of the day on which the first public announcement of the date of the 2025 annual meeting of stockholders was made or the notice of our 2025 annual meeting of stockholders is mailed. The public announcement of an adjournment or postponement of our 2025 annual meeting of stockholders will not trigger a new time period (or extend any time period) for the giving of a stockholder’s notice as described in this proxy statement.

Our bylaws also provide a proxy access right permitting certain of our stockholders who have beneficially owned 3% or more of our common stock continuously for at least three years to submit director nominations via our proxy materials for up to 20% of the directors then serving. Notice of proxy access director nominations for the 2025 annual meeting of stockholders must be delivered to our principal executive offices at Advanced Micro Devices, Inc., 2485 Augustine Drive, Santa Clara, California 95054, Attention: Corporate Secretary, no earlier than October 23, 2024 and no later than the close of business on November 22, 2024. In addition, the notice must set forth the information required by our bylaws with respect to each proxy access director nomination that a stockholder intends to present at the 2025 annual meeting of stockholders.

See “Consideration of Stockholder Nominees for Director” below for additional information regarding a stockholder’s notice of a nomination and proxy access. | ||||

| ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement | 5 |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Questions and Answers (continued)

| 22. | Q: | WHAT IS HOUSEHOLDING AND HOW DO I OBTAIN A SEPARATE SET OF PROXY MATERIALS IF I SHARE AN ADDRESS WITH OTHER STOCKHOLDERS? | ||||

| A: | We have adopted a procedure called “householding,” which has been approved by the SEC. Under this procedure, we will deliver only one copy of the Notice and, if applicable, our printed proxy materials to stockholders of record who share the same address (if they appear to be members of the same family) unless we have received contrary instructions from an affected stockholder. A separate proxy card for each stockholder of record will be included in the printed materials. This procedure reduces our printing costs, mailing costs and fees. Upon written or oral request, we will promptly deliver a separate copy of the Notice or, if applicable, the printed proxy materials to any stockholder at a shared address to which a single copy of any of those documents was delivered.

To receive a separate copy of the Notice or Annual Report or, if applicable, the printed proxy materials, contact us at 1(408) 749-4000 or at Advanced Micro Devices, Inc., 2485 Augustine Drive, Santa Clara, California 95054, Attention: Corporate Secretary, or by email to Corporate.Secretary@amd.com. If you would like to revoke your householding consent, please contact Broadridge at 1(866) 540-7095. | ||||

| 6 | ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement contains forward-looking statements concerning Advanced Micro Devices, Inc. that involve risks, uncertainties and assumptions, which are made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current expectations and beliefs and involve numerous risks and uncertainties that could cause actual results to differ materially from expectations. Forward-looking statements are commonly identified by words such as “would,” “intends,” “believes,” “expects,” “may,” “will,” “should,” “seeks,” “plans,” “pro forma,” “estimates,” “anticipates,” or the negative of these words and phrases, other variations of these words and phrases or comparable terminology. Investors are cautioned that the forward-looking statements in this proxy statement are based on current beliefs, assumptions and expectations, speak only as of the date of this proxy statement and involve risks and uncertainties that could cause actual results to differ materially from current expectations. Investors are urged to review in detail the risks and uncertainties in our SEC filings, including but not limited to, our Annual Report on Form 10-K for the year ended December 30, 2023.

| ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement | 7 |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

ITEM 1—ELECTION OF DIRECTORS

Our Board currently consists of nine members. On the recommendation of the Nominating and Corporate Governance Committee, the Board has nominated the following nine nominees: Ms. Nora M. Denzel, Mr. Mark Durcan, Mr. Michael P. Gregoire, Mr. Joseph A. Householder, Mr. John W. Marren, Mr. Jon A. Olson, Dr. Lisa T. Su, Mr. Abhi Y. Talwalkar, and Ms. Elizabeth W. Vanderslice for election to the Board at the Annual Meeting. All directors are elected annually and serve a one-year term until our next annual meeting or until such director’s successor is appointed. Proxies cannot be voted for a greater number of persons than the number of nominees named in this proxy statement.

The Board expects all nominees named below to be available for election. If a nominee declines or is unable to act as a director, your proxy may vote for any substitute nominee proposed by the Board. Your proxy will vote FOR the election of these nominees, unless you instruct otherwise. Directors are strongly encouraged to attend annual meetings of our stockholders. All of the directors attended the 2023 Annual Meeting of Stockholders.

Director Experience, Skills and Qualifications

Our goal is to assemble a Board that operates cohesively and works with management in a constructive way to deliver long-term value to our stockholders. We believe that the nominees set forth below, all of whom are currently directors of AMD, possess valuable experience necessary to guide us in the best interests of our stockholders. Our current Board consists of individuals with proven records of success in their chosen professions. They are collegial, yet independent in their thinking, and are committed to the hard work necessary to be informed about the semiconductor industry, us, and our key constituents, including our customers, stockholders and management. They possess keen intellect and the highest integrity. Most of our directors have broad technology sector experience, including expertise in semiconductor technology, innovation and strategy. Several members of our Board are current or former chief executive officers, thereby providing the Board with practical understanding of how large organizations operate, including the importance of employee development and retention. They also understand strategy and risk management and how these factors impact our operations.

Director Nominees

Certain information regarding each of the nominees is set forth below, including his or her experience, qualifications, attributes and skills that led the Nominating and Corporate Governance Committee and the Board to conclude that the individual should serve as a director on the Board, as well as his or her principal occupation. Each nominee’s former directorships on public company boards during the past five years are included in a table set forth below—“Former Directorships in Public Companies in the Last Five Years.” The age of each director is as of our Annual Meeting.

| 8 | ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Item 1—Election of Directors (continued)

Nora M. Denzel Director since March 2014 and Lead Independent Director since November 2022 Age: 61 Board Committees: Chair of Nominating and Corporate Governance Committee and Member of Innovation and Technology Committee |

Ms. Denzel served as interim Chief Executive Officer of Outerwall Inc. (an automated retail solutions provider) from January to August 2015. Prior to Outerwall, Ms. Denzel held various executive management positions from February 2008 through August 2012 at Intuit Inc. (a cloud financial management software company), including Senior Vice President of Big Data, Social Design and Marketing and Senior Vice President and General Manager of the QuickBooks Employee Management business unit. From 2000 to 2006, Ms. Denzel held several executive level positions at HP Enterprise, formerly, Hewlett-Packard Company (a technology software, services and hardware provider), including Senior Vice President and General Manager, Software Global Business Unit from May 2002 to February 2006 and Vice President of Storage Organization from August 2000 to May 2002. Prior to HP Enterprise, Ms. Denzel held executive positions at Legato Systems Inc. (a data storage management software company purchased by EMC Corporation) and International Business Machines Corporation (IBM) (an information technology company). Ms. Denzel has been a member of the board of directors of Gen Digital Inc. (formerly, NortonLifelock, Inc.) since December 2019. Formerly, Ms. Denzel was a director of SUSE S.A. from May 2021 to September 2023, a director of Telefonaktiebolaget LM Ericsson from March 2013 to March 2023, and Talend SA from 2017 to 2021. She has served for over ten years on the non-profit board of AnitaB.org which is dedicated to attracting more women into technology. She is NACD Directorship Certified and holds a Master of Business Administration degree from Santa Clara University and a Bachelor of Science degree in computer science from the State University of New York.

Director Qualifications: Ms. Denzel is a seasoned business executive with over 25 years of operational experience in key senior technology positions. She brings to the Board substantial experience in the areas of executive leadership, technology and software engineering. She also provides corporate governance insight from her past and present service on private and public company boards.

| ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement | 9 |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Item 1—Election of Directors (continued)

Mark Durcan Director since October 2017 Age: 63 Board Committees: Chair of Compensation and Leadership Resources Committee and Member of Innovation and Technology Committee |

Mr. Durcan served as an advisor of Micron Technology, Inc. (Micron Technology) (a memory and storage solutions company) from May 2017 to August 2017 and served as its Chief Executive Officer from February 2012 until his retirement in May 2017. During Mr. Durcan’s 32-year tenure at Micron Technology, he held a wide variety of senior leadership positions, including President and Chief Operating Officer from 2007 to 2012, Chief Operating Officer from 2006 to 2007, Chief Technical Officer from 1998 to 2006 and Vice President, Process Research and Development from 1996 to 1998. Mr. Durcan joined Micron Technology, in June 1984 as a Diffusion Engineer and held a series of increasingly responsible positions, including Process Integration Engineer, Process Integration Manager and Process Development Manager. Mr. Durcan holds approximately 100 U.S. patents and overseas patents. Mr. Durcan has been a member of the board of directors of Cencora (previously, AmerisourceBergen Corporation) since 2015, the Supervisory Board at ASML Holding NV, since April 2020, and the Board of Natural Intelligence Systems Inc. since 2021, a private company. He also serves as a director of St. Luke’s Medical System (a not-for-profit hospital and health care system in Idaho), and on the Board of Trustees of Rice University. Mr. Durcan served on the board of directors of Veoneer, Inc. from 2018 to April 2022. Mr. Durcan holds a Bachelor of Science degree in chemical engineering and a Master of Chemical Engineering degree from Rice University.

Director Qualifications: Mr. Durcan is a seasoned business executive with more than 32 years of experience in the semiconductor industry. He brings to the Board substantial experience in the areas of executive leadership, strategic planning, finance and corporate governance.

| 10 | ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Item 1—Election of Directors (continued)

Michael P. Gregoire Director since November 2019 Age: 58 Board Committees: Member of Compensation and Leadership Resources Committee and Nominating and Corporate Governance Committee |

Mr. Gregoire is a founding partner at Brighton Park Capital (a growth equity private equity firm). Prior to Brighton Park Capital, Mr. Gregoire served as Chairman & CEO of CA Technologies (an enterprise software company) from January 2013 to November 2018. Mr. Gregoire served as President and CEO of Taleo Corporation (Taleo) (a cloud-based talent management software company) from March 2005 to April 2012. He also served as a member of the board of directors of Taleo from April 2005 to April 2012 and as chairman of the board from May 2009 to April 2012. In addition, Mr. Gregoire served as Executive Vice President at PeopleSoft, Inc. and Executive Director at Electronic Data Systems (EDS) and has been chair of the World Economic Forum’s IT Governors Steering Committee as well as a member of the Business Roundtable’s Information and Technology Committee. Mr. Gregoire also serves on the Executive Council of TechNet (an organization of CEOs that represents the technology industry in policy issues critical to American innovation and economic competitiveness). Mr. Gregoire has been Chairman of the board of directors of Smartsheet Inc. since December 2019. He was also a member of the board of directors of Automatic Data Processing, Inc. (ADP) from 2014 to 2019. Mr. Gregoire holds a Bachelor of Science degree in physics and computing from Wilfrid Laurier University in Ontario, Canada, and a Master of Business Administration degree from California Coast University.

Director Qualifications: Mr. Gregoire is a seasoned business executive with experience as a chief executive officer, with a strong financial management and fiscal background. Mr. Gregoire brings to the Board extensive experience in executive leadership and strategy in the technology industry.

| ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement | 11 |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Item 1—Election of Directors (continued)

Joseph A. Householder Director since September 2014 Age: 68 Board Committees: Chair of Audit and Finance Committee and Member of Nominating and Corporate Governance Committee |

Mr. Householder was the President and Chief Operating Officer of Sempra Energy (a worldwide provider of energy infrastructure and gas and electric utilities and a recognized leader in sustainability, diversity and inclusion) where he oversaw Sempra Energy’s regulated U.S. utilities and the Sempra North American Infrastructure Group from May 2018 until his retirement in January 2020. Previously from 2017 to 2018, Mr. Householder served as Sempra Energy’s Corporate Group President, Infrastructure Businesses overseeing the company’s operations in midstream, liquefied natural gas and renewable energy and Mexico. From 2011 to 2016, Mr. Householder was the Executive Vice President and Chief Financial Officer of Sempra Energy. He also served as Chief Accounting Officer of Sempra Energy from 2007 to 2012. From 2006 to 2011, Mr. Householder was Senior Vice President and Controller of Sempra Energy responsible for financial reporting, accounting and controls and tax functions for all Sempra Energy companies. Prior to this role, he served as Vice President of Corporate Tax and Chief Tax Counsel for Sempra Energy. Prior to joining Sempra Energy in 2001, Mr. Householder was a partner at PricewaterhouseCoopers in the firm’s national tax office. From 1986 to 1999, he served in a number of legal and financial roles at Unocal Corporation, including ultimately as Vice President of Corporate Development and Assistant Chief Financial Officer, where he was responsible for worldwide tax planning, financial reporting and forecasting and mergers and acquisitions. Mr. Householder is Chair of the Audit Committee and a member of the Compensation Committee of REV Renewables LLC, a private company. He is NACD Directorship Certified, has completed a CERT Certificate in Cybersecurity Oversight, and holds a Bachelor of Science degree in business administration from the University of Southern California and a Juris Doctor degree from Loyola Law School.

Director Qualifications: Mr. Householder brings to the Board significant financial and operational expertise as a result of his chief financial officer experience at Sempra Energy, his experience as a partner of PricewaterhouseCoopers and his experience at Unocal Corporation.

| 12 | ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Item 1—Election of Directors (continued)

John W. Marren Director since February 2017 Age: 61 Board Committees: Member of Audit and Finance Committee |

Mr. Marren has served as Senior Managing Director, North America of Temasek (a sovereign wealth fund of the government of Singapore) since November 2017. Prior to joining Temasek, Mr. Marren was a Senior Partner and the Head of Technology Investments of TPG Capital (a private equity investment company) from 2000 until his retirement in December 2015. From 1996 through 2000, Mr. Marren was a Managing Director at Morgan Stanley (a global financial services company), most recently as Co-Head of the Technology Investment Banking Group. From 1992 to 1996, he was a Managing Director and Senior Semiconductor Research Analyst at Alex. Brown & Sons (Alex. Brown) (an investment company). While at Morgan Stanley and Alex. Brown, Mr. Marren was a frequent member of the Institutional Investor All-American Research Team, which recognizes the top research analysts on Wall Street. Prior to Alex. Brown, Mr. Marren spent seven years in the semiconductor industry working for VLSI Technology and Vitesse Semiconductor. Mr. Marren serves as a director of Impossible Foods, Inc., a private company. He is a Trustee of the University of California, Santa Barbara, and he serves on the US Olympic and Paralympic Foundation Board. Mr. Marren served on the board of directors of Poshmark, Inc. from 2018 to 2022. Mr. Marren holds a Bachelor of Science degree in electrical engineering from the University of California, Santa Barbara.

Director Qualifications: Mr. Marren brings to the Board extensive experience with financial management and technology, as well as capital market expertise as a result of his prior work at TPG Capital and Morgan Stanley. Mr. Marren also provides the Board with valuable corporate governance insight from his past and present service on private and public company boards.

| ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement | 13 |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Item 1—Election of Directors (continued)

Jon A. Olson Director since February 2022 Age: 70 Board Committees: Member of Audit and Finance Committee |

Mr. Olson joined the Board of AMD in February 2022. Prior to that date, Mr. Olson was a member of the Board of Xilinx, Inc. (Xilinx) from May 2020 until February 2022 when Xilinx was acquired by AMD. Mr. Olson previously served as the Chief Financial Officer of Xilinx from June 2005 until his retirement in July 2016. While serving as Chief Financial Officer, he also held a variety of other senior management positions at Xilinx, including most recently as Executive Vice President from May 2014 to July 2016 and, prior to that, Senior Vice President of Finance from August 2006 to May 2014 and Vice President of Finance from June 2005 to August 2006. Prior to joining Xilinx, Mr. Olson spent more than 25 years at Intel Corporation, serving in a variety of positions from 1979 to 2005, including Vice President of Finance and Enterprise Services and Director of Finance. Mr. Olson currently serves on each of the board of directors of Kulicke & Soffa (a supplier of semiconductor and electronic assembly solutions) and Rocket Lab USA, Inc. (a provider of launch and space systems). Mr. Olson previously served on the board of directors of Mellanox Technologies, Ltd. (Mellanox) (a supplier of computer networking products) from June 2018 until April 2020 when Mellanox was acquired by Nvidia Corporation. He also served on the board of directors of HomeUnion, Inc. (HomeUnion) (an online investment management platform dedicated to the residential real estate market) from November 2018 until November 2019 when HomeUnion was acquired by Mynd Property Management.

Director Qualifications: Mr. Olson’s qualifications include his more than 30 years of experience in senior roles of financial responsibility in the semiconductor industry, together with his track record of growing profitable businesses and his experience at various semiconductor and technology companies.

| 14 | ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Item 1—Election of Directors (continued)

Dr. Lisa T. Su Director since October 2014 and Chair of the Board since February 2022 Age: 54 |

Dr. Lisa T. Su is AMD’s Chair, President and Chief Executive Officer. She has served on AMD’s Board of Directors since October 2014 and was named Chair of the Board in February 2022. She has been AMD’s President and Chief Executive Officer since October 2014. Previously, from July 2014 to October 2014, she was Chief Operating Officer responsible for AMD’s business units, sales, and global operations teams. Dr. Su joined AMD in January 2012 as Senior Vice President and General Manager, Global Business Units and was responsible for driving end-to-end business execution of AMD products and solutions. Prior to joining AMD, Dr. Su served as Senior Vice President and General Manager, Networking and Multimedia at Freescale Semiconductor, Inc. (Freescale) (a semiconductor manufacturing company), responsible for global strategy, marketing and engineering for embedded communications and applications processor business. Dr. Su joined Freescale in 2007 as Chief Technology Officer, where she led technology roadmap and research and development efforts.

Dr. Su spent the previous 13 years at IBM in various engineering and business leadership positions, including Vice President of the Semiconductor Research and Development Center responsible for the strategic direction of IBM’s silicon technologies, joint development alliances and semiconductor R&D operations. Prior to IBM, she was a member of the technical staff at Texas Instruments Incorporated from 1994 to 1995.

Dr. Su has Bachelor of Science, Master of Science and Doctorate degrees in electrical engineering from the Massachusetts Institute of Technology (MIT). She has published more than 40 technical articles and was named a Fellow of the Institute of Electronics and Electrical Engineers in 2009. In 2023, Dr. Su was included in Forbes’ and Fortune’s Most Powerful Women lists and received the Distinguished Leadership Award from the Committee for Economic Development. She is a member of the American Academy of Arts & Science and is a recipient of the Grace Hopper Technical Leadership Abie Award. She holds the highest semiconductor honor, the Robert N. Noyce Medal, and in 2021 was appointed by President Biden to the President’s Council of Advisors on Science and Technology (PCAST). Dr. Su continues to serve on PCAST and is a member of the board of directors for the Semiconductor Industry Association.

Director Qualifications: As our President and Chief Executive Officer, Dr. Su brings to the Board her expertise and proven leadership in the global semiconductor industry as well as valuable insight into our operations, management and culture, providing an essential link between the management and the Board on management’s perspectives.

| ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement | 15 |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Item 1—Election of Directors (continued)

Abhi Y. Talwalkar Director since June 2017 Age: 60 Board Committees: Chair of Innovation and Technology Committee and Member of Compensation and Leadership Resources Committee |

Mr. Talwalkar was President and Chief Executive Officer of LSI Corporation (LSI) (a semiconductor and software company) from May 2005 until the completion of LSI’s merger with Avago Technologies Limited in May 2014. From 1993 to 2005, Mr. Talwalkar held a number of senior management positions at Intel Corporation (Intel) (a semiconductor company), including Corporate Vice President and Co-General Manager of the Digital Enterprise Group, which was comprised of Intel’s corporate client, server, storage, and communications businesses, and Vice President and General Manager for the Intel Enterprise Platform Group, where he focused on developing, marketing, and driving Intel business strategies for server computing. Prior to Intel, Mr. Talwalkar held senior engineering and marketing positions at Sequent Computer Systems (a multiprocessing computer systems design and manufacturer that later became a part of IBM). He also held positions at Bipolar Integrated Technology, Inc. (a VLSI bipolar semiconductor company); and Lattice Semiconductor Inc. (a service-driven developer of programmable design solutions). Mr. Talwalkar has been Chair of the board of directors of Lam Research Corporation since 2019, iRhythm Technologies since 2016, and a board member of TE Connectivity since 2017. Mr. Talwalkar was also a member of the board of directors of LSI from 2005 to 2014 and the Semiconductor Industry Association. Additionally, he was a member of the U.S. delegation for World Semiconductor Council proceedings. Mr. Talwalkar holds a Bachelor of Science degree in electrical engineering from Oregon State University.

Director Qualifications: Mr. Talwalkar brings to the Board extensive CEO experience and significant public company technology industry experience. He also provides the Board with valuable public board governance insight from his past and present board service.

| 16 | ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Item 1—Election of Directors (continued)

Elizabeth W. Vanderslice Director since February 2022 Age: 60 Board Committees: Member of Compensation and Leadership Resources Committee and Nominating and Corporate Governance Committee |

Ms. Vanderslice has served as a partner at Trewstar Corporate Board Services, a firm specializing in corporate board placements, since February 2019. She served on the board of Xilinx, Inc. from December 2000 through its acquisition by AMD in February 2022. Ms. Vanderslice also serves on the boards of AESC Group Ltd. (a private EV battery technology company), and Univers Holdings (a private global provider of energy and carbon management technology solutions and services company). From 1999 to 2001, Ms. Vanderslice served as a general manager of Lycos, Inc. (Lycos) through its acquisition. From 1996 to 1999, Ms. Vanderslice was CEO of Wired Digital, Inc. (Wired Digital), a spin-off of Wired Ventures, Inc. (Wired Ventures), and a member of the boards of both Wired Digital and Wired Ventures before leading the company’s acquisition by Lycos. Prior to joining Wired Digital in early 1995, Ms. Vanderslice served as a principal in the investment banking firm Sterling Payot Company, which raised the capital to launch Wired Magazine. She was also a Vice President at H.W. Jesse & Co. (a San Francisco investment banking firm). In addition, she worked for the IBM Corporation from 1986-1990. Ms. Vanderslice holds a Masters of Business Administration from the Harvard Business School and a Bachelor of Science degree in computer science from Boston College. She is an Aspen Institute Henry Crown Fellow and was a member of the Young Presidents’ Organization and the World Presidents’ Organization. Ms. Vanderslice has also served as a Trustee of Boston College since 2010.

Director Qualifications: Ms. Vanderslice brings over 25 years of board and general management experience in the technology industry, including 21 years as a member of the Xilinx board, CEO of an internet company, and a background in computer science and systems engineering.

| ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement | 17 |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Item 1—Election of Directors (continued)

Board Diversity Matrix

Annually, we look at and assess the composition of our Board across a broad range of criteria, including, but not limited to, industry and geographic experience, skills, education, and diversity. The demographic information presented below is based on voluntary self-identification by each director nominee.

| Identity | Denzel | Durcan | Gregoire | Householder | Marren | Olson | Su | Talwalkar | Vanderslice | |||||||||

Gender Expression | ||||||||||||||||||

Male | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||

Female | ✓ | ✓ | ✓ | |||||||||||||||

Demographic Identity | ||||||||||||||||||

African American or Black | ||||||||||||||||||

Alaskan Native or Native American | ||||||||||||||||||

Asian | ✓ | ✓ | ||||||||||||||||

Hispanic or Latinx | ||||||||||||||||||

Native Hawaiian or Pacific Islander | ||||||||||||||||||

White | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

Two or More Races or Ethnicities | ||||||||||||||||||

LGBTQ+ | ||||||||||||||||||

Undisclosed | ||||||||||||||||||

Directors who Identify as Middle Eastern: 2

Former Directorships in Public Companies in the Last Five Years

The table below sets forth the list of public companies on which our director nominees formerly served over the last five years including the name of the company and duration of service. Our director nominees do not currently serve on the boards of the companies listed below.

| Director | Name of the Company | Term of Past Directorship | ||

Nora M. Denzel | Telefonaktiebolaget LM Ericsson | 2013—2023 | ||

Talend SA | 2017—2021 | |||

SUSE S.A. | 2021—2023 | |||

Mark Durcan | Veoneer, Inc. | 2018—2022 | ||

Michael P. Gregoire | CA Technologies | 2013—2018 | ||

| Automatic Data Processing, Inc. | 2014—2019 | |||

Joseph A. Householder | Infraestructura Energetica Nova, S.A.B. de C.V. | 2013—2020 | ||

John W. Marren | Poshmark, Inc. | 2018—2022 | ||

Jon A. Olson | Mellanox Technologies, Ltd. | 2018—2020 | ||

| Xilinx, Inc. | 2020—2022 | |||

Lisa T. Su | Analog Devices, Inc. | 2012—2020 | ||

| Cisco Systems, Inc. | 2020—2023 | |||

Elizabeth W. Vanderslice | Xilinx, Inc. | 2000—2022 | ||

| 18 | ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Item 1—Election of Directors (continued)

Consideration of Stockholder Nominees for Director

The policy of the Nominating and Corporate Governance Committee is to consider properly submitted stockholder nominations for candidates to serve on the Board. Pursuant to our bylaws, stockholders who wish to nominate persons for election to the Board at our 2025 annual meeting of stockholders must (i) be a stockholder of record, both when they give us notice and at our 2025 annual meeting, (ii) be entitled to vote at our 2025 annual meeting and (iii) comply with the notice provisions in our bylaws. A stockholder’s notice must be delivered to our Corporate Secretary not less than 90 days nor more than 120 days before the anniversary date of the immediately preceding annual meeting. For our 2025 annual meeting of stockholders, the notice must be delivered between January 8, 2025 and February 7, 2025. However, if our 2025 annual meeting of stockholders is not held within 30 days of May 8, 2025, the stockholder’s notice must be delivered no later than the close of business on the tenth day following the earlier of the day on which the first public announcement of the date of our 2025 annual meeting was made or the day the notice of our 2025 annual meeting is mailed. The public announcement of an adjournment or postponement of our 2025 annual meeting of stockholders will not trigger a new time period (or extend any time period) for the giving of a stockholder notice as described in this proxy statement. Notwithstanding the foregoing, if the number of directors to be elected to the Board at an annual meeting is increased and we do not make a public announcement naming all of the nominees for director or specifying the size of the increased Board at least 100 days prior to the first anniversary of the preceding year’s annual meeting, the stockholder’s notice will be considered timely, but only with respect to nominees for any new positions created by the increase, if it is delivered to our Corporate Secretary not later than the close of business on the tenth day following the day on which we first make such public announcement.

The Chair of our Annual Meeting will determine if the procedures in the bylaws have been followed, and if not, declare that the nomination be disregarded. If the nomination was made in accordance with the procedures in our bylaws, the Nominating and Corporate Governance Committee will apply the same criteria in evaluating the nominee as it would any other Board nominee candidate and will recommend to the Board whether or not the stockholder nominee should be nominated by the Board and included in our proxy statement. These criteria are described below in the description of the Nominating and Corporate Governance Committee in the section entitled “Meetings and Committees of the Board of Directors—Board Committees.” The nominee must be willing to provide a written questionnaire, representation and agreement, if requested by us, and any other information reasonably requested by us in connection with our evaluation of the nominee’s independence.

In addition, our bylaws permit certain of our stockholders who have beneficially owned 3% or more of our outstanding common stock continuously for at least three years to submit nominations to be included in our proxy materials for up to 20% of the total number of directors then serving, provided that the stockholder(s) and the nominee(s) satisfy the requirements specified in the bylaws. Notice of proxy access director nominations must be delivered to our principal executive offices at Advanced Micro Devices, Inc., 2485 Augustine Drive, Santa Clara, California 95054, Attention: Corporate Secretary, no earlier than 150 days or no later than 120 days prior to the first anniversary of the date the proxy materials were released in connection with the preceding year’s annual meeting. For our 2025 annual meeting of stockholders, the notice must be delivered between October 23, 2024, and no later than the close of business on November 22, 2024.

In addition to satisfying the foregoing requirements under our bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act.

Communications with the Board or Non-Management Directors

Anyone who wishes to communicate with our Board or with non-management directors may send their communications in writing to Advanced Micro Devices, Inc., 2485 Augustine Drive, Santa Clara, California 95054, Attention: Corporate Secretary or send an email to Corporate.Secretary@amd.com. Our Corporate Secretary will forward all of these communications to our Chair of the Board.

| ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement | 19 |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Item 1—Election of Directors (continued)

Required Vote

At our Annual Meeting, our directors will be elected using a majority vote standard with respect to uncontested elections, such as this election. This standard requires that each director receive the affirmative vote of a majority of the votes cast. A majority of the votes cast means that the number of votes cast “for” a director must exceed the number of votes cast “against” that director. Abstentions and broker non-votes will have no effect on the outcome of these director elections. Each director nominee has submitted a written resignation that will be effective if he or she does not receive a majority of the votes cast for such director and the resignation is accepted by the Nominating and Corporate Governance Committee, another authorized Board committee or the Board.

Recommendation of the Board Directors

The Board of Directors unanimously recommends that you vote FOR each of the director nominees. Unless you vote otherwise, your proxy will vote FOR the proposed nominees.

| 20 | ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

CORPORATE GOVERNANCE

The Board has adopted the Governance Principles to address significant corporate governance matters. The Governance Principles provide a framework for our corporate governance matters and include topics such as Board and Board committee composition and evaluation. The Nominating and Corporate Governance Committee is responsible for reviewing the Governance Principles and recommending any changes to the Governance Principles to the Board.

Independence of Directors

The Governance Principles provide that a substantial majority of the members of the Board must meet the criteria for independence as required by applicable law and the listing rules of the Nasdaq Stock Market (“Nasdaq”). Among other criteria, no director qualifies as independent unless the Board determines that the director has no direct material relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. On an annual basis, the Board undertakes a review of director independence. The Board determined that all directors who served during fiscal 2023 and all of our director nominees, other than Dr. Su, are independent in accordance with SEC and Nasdaq rules.

In making its independence determinations, the Board reviewed direct and indirect transactions and relationships between each director, or any member of his or her immediate family, and us or one of our subsidiaries or affiliates based on information provided by the director, our records and publicly available information. All of the reviewed transactions and arrangements were entered into in the ordinary course of business and none of the transactions or arrangements involved an amount that (i) exceeded the greater of 5% of the recipient entity’s revenues or $200,000 with respect to transactions where a director or any member of his or her immediate family or spouse served in any capacity other than as a director of a publicly held corporation or (ii) exceeded $10,000 with respect to professional or consulting services provided by entities at which our directors serve as professors or employees.

The Board determined that none of our directors currently has or has had any direct or indirect material interest in any transactions and arrangements that would interfere with their exercise of independent judgment as members of the Board. The Board also determined that each of the members of the Audit and Finance, Nominating and Corporate Governance and Compensation and Leadership Resources Committees are independent in accordance with SEC and Nasdaq rules.

Compensation Committee Interlocks and Insider Participation

For fiscal 2023, the Compensation and Leadership Resources Committee (the “Compensation Committee”) was comprised of Ms. Vanderslice and Messrs. Durcan, Gregoire and Talwalkar. None of the members of the Compensation Committee is or has been an executive officer or employee of AMD. In addition, none of our executive officers serves on the board of directors or compensation committee of a company which has an executive officer who serves on our Board or Compensation Committee.

Board Leadership Structure

The Governance Principles permit the roles of Chair of the Board and Chief Executive Officer to be filled by the same or different individuals, based on our needs, best practices and the interests of our stockholders. This allows the Board flexibility to determine whether the two roles should be combined or separated based upon our needs and the Board’s assessment of its leadership from time to time. The Board has the experience of functioning effectively either way.

Dr. Su, our President and Chief Executive Officer, serves as our Chair of the Board. Ms. Denzel, who is independent in accordance with SEC and Nasdaq rules, serves as our Lead Independent Director. The Board concluded that appointing Dr. Su to the role of Chair of the Board is the most appropriate leadership structure for AMD and best positions AMD to be innovative, compete successfully, and advance stockholder interests in the current environment. The Board believes that Dr. Su’s leadership of AMD’s business strategy, day-to-day operations, and risk management practices gained through multiple leadership positions (including as our President and Chief Executive Officer since October 2014) enables her to provide effective leadership to the Board. The Board consists entirely of independent directors, other than Dr. Su, and continues to exercise a strong, independent oversight function, with fully independent committees and a Lead Independent Director.

| ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement | 21 |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Corporate Governance (continued)

Ms. Denzel, as Lead Independent Director, facilitates the Board’s oversight of management, promotes communication between management and our Board, engages with stockholders as required, and leads consideration of key governance matters. Ms. Denzel brings a wealth of diverse experience to our Board as Lead Independent Director. She has significant governance, risk management, and financial experience given her prior service as a public company CEO and various Senior Vice-President roles of a Fortune 50 company, which are relevant in her role as Lead Independent Director. The education and experience Ms. Denzel acquired through her board service at eight public companies over the past decade is useful in her oversight. In addition, she has demonstrated her commitment to exemplary board governance by earning a CERT Certificate in Cybersecurity Oversight conferred by Carnegie Mellon University and the National Association of Corporate Directors (“NACD”) and earning NACD Directorship Certification® in 2020. She currently serves on the board of the NACD and was named to the NACD Directorship 100™ List which recognizes the most influential corporate directors in 2020.

Ms. Denzel’s expertise, strong corporate governance experience, leadership skills and deep commitment to serve as Lead Independent Director, well positions Ms. Denzel to provide assertive, independent leadership and oversight to the Board. Ms. Denzel retains significant authority as Lead Independent Director and has broad powers and responsibilities. As Lead Independent Director, Ms. Denzel fulfills the following functions:

| • | coordinates the activities of our independent directors; |

| • | calls meetings of the independent directors and chairs the executive sessions of the independent directors; |

| • | ensures there is full and candid communication between the independent directors and other members of the Board and AMD’s management; |

| • | sets and approves the agendas with the Chair of the Board, for each Board meeting, approves meeting schedules to ensure sufficient time for discussion of all agenda items, and determines who attends Board meetings, including management and outside advisors; |

| • | consults with the Chair of the Board and committee chairs regarding topics of the Board; |

| • | leads the Board’s annual CEO performance evaluation; |

| • | leads annual performance evaluation of the Board; |

| • | coordinates the Board’s oversight of CEO succession planning; |

| • | is available for consultation and meets with stockholders or other stakeholders; |

| • | authorizes retention of outside counsel and other consultants or advisors who report directly to the Board; and |

| • | performs other functions and duties as our independent directors may require from time to time. |

Ms. Denzel also chairs the Nominating and Corporate Governance Committee, and provides input on the Board’s governance processes, including developing recommendations for Board succession planning, committee structure and composition. The Board recognizes the importance of the Company’s leadership structure to our shareholders and will continue to review, discuss and determine the leadership structure of the Board, including the Chair, that best meets AMD’s evolving needs.

Risk Oversight

The Board’s role in risk oversight is consistent with our leadership structure, with our Chief Executive Officer and other members of management having responsibility for day-to-day risk management activities and processes, and our Board and its committees being actively involved in overseeing our risk management process. We engage in activities that seek to take calculated risks that protect the value of our existing assets and create new or future value. The Board and management consider “risk” for these purposes to be the possibility of an undesired occurrence that could threaten the viability of the Company, result in a material destruction of our assets or stockholder value, or materially impact our long-term performance. Examples of the types of risks faced by us include:

| • | business-specific risks related to our ability to develop new products and services, our strategic position and competition in key existing and new markets, our operational execution and infrastructure, our relationships with our third-party manufacturing suppliers and competition in the microprocessor and graphics markets; |

| • | macroeconomic risks, such as adverse global economic conditions and global geo-political events; and |

| • | “event” risks, such as the impact of COVID-19, natural disasters and cybersecurity threats. |

| 22 | ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Corporate Governance (continued)

Management is responsible for day-to-day risk management activities and processes. Members of senior management participate in the identification and assessment of the inherent risks that potentially could impact our business and develop processes and controls designed to monitor and mitigate those risks. Our Chief Executive Officer has ultimate responsibility for management of our business, including identification of enterprise- level risks and the risk management program and processes. The Company has a dedicated enterprise risk management function that closely works with our Board, Chief Executive Officer and senior management to assess risks, track the mitigation strategies of each relevant risk and highlight emerging risks that could pose a significant threat to the business. We also have a Chief Compliance Officer who reports directly to our General Counsel. The Chief Compliance Officer is responsible for the Company’s global corporate compliance program, consisting of comprehensive legal and regulatory policies and procedures, that includes employee training on how to implement and comply with them.

In fulfilling its oversight role, the Board focuses on understanding the nature of our enterprise risks, including risks in our operations, finance and strategy, organization, compliance and external exposures as well as the adequacy of our risk assessment and risk management processes. The Board has implemented a risk oversight model and periodically receives reports and updates from management and the enterprise risk management function. The risk oversight model includes an assessment of the impact, likelihood, and velocity of each identified risk to aid in strategic decision making. At least annually, the Board discusses with management the appropriate level of risk relative to our strategy and objectives and reviews with management our existing risk management processes and their effectiveness. The Board also receives periodic management updates on our operations, organization, financial position and results and strategy and, as appropriate, discusses and provides feedback with respect to risks related to these topics. The existence and efficacy of risk mitigation and control plans and processes are further validated by the Company’s internal audit function. In addition, the Board receives full reports from the following Board committee chairs regarding each committee’s considerations and actions related to the specific risk topics over which the committee has oversight:

| • | The Audit and Finance Committee assists the Board in overseeing our enterprise risk management process, including the Company’s financial and information technology (including security and cybersecurity) risk exposures; reviews our portfolio of risk; discusses with management significant financial, reporting, regulatory and legal compliance risks in conjunction with enterprise risk exposures as well as risks associated with our capital structure; and reviews our policies with respect to risk assessment and risk management and the actions management has taken to limit, monitor and control financial and enterprise risk exposure. The Audit and Finance Committee meets with members of our Internal Audit department and the enterprise risk management function to discuss any issues that warrant attention including the periodic review of emerging risks that are actively monitored. The Audit and Finance Committee also regularly reviews the adequacy of the Company’s financial disclosures including those relating to risk. On an annual basis, the Audit and Finance Committee receives a report from its independent cybersecurity advisor. In addition, our company’s Chief Compliance Officer attends all quarterly Audit and Finance Committee meetings. |

| • | The Compensation and Leadership Resources Committee oversees risk management as it relates to our compensation policies and practices applicable to all employees. It reviews with management whether our compensation programs may create incentives for our employees to take excessive or inappropriate risks which could be reasonably likely to have a material adverse effect on us. For additional details, see “Executive Compensation Policies and Practices,” below. Additionally, the Compensation Committee oversees organizational risks, including leadership succession, talent capacity, capabilities, attraction, retention and culture and regularly engages with outside advisors to benchmark best practices for compensation program design and effectiveness. |

| • | The Nominating and Corporate Governance Committee considers potential risks related to the effectiveness of the Board, including succession planning for the Board, committee structure and composition, our overall governance and Board structure and matters related to environmental and social issues. |

| • | The Innovation and Technology Committee assists the Board in its oversight responsibilities relating to technical and market risks associated with product development and investment, sourcing strategy, as well as risk mitigation policies and procedures relating to products based on new technology or significant innovations to existing technology. |

| ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement | 23 |

2024 NOTICE OF MEETING AND PROXY STATEMENT

|

Corporate Governance (continued)

Code of Ethics

The Board has adopted a code of ethics that applies to all directors and employees entitled the “Worldwide Standards of Business Conduct,” which is designed to help directors and employees resolve ethical issues encountered in the business environment. The Worldwide Standards of Business Conduct covers topics such as conflicts of interest, compliance with laws (including anti-corruption laws), fair dealing, protecting our property and confidentiality of our information and encourages the reporting of any behavior not in accordance with the Worldwide Standards of Business Conduct.

The Board has also adopted a “Code of Ethics” for our executive officers and all other senior finance executives. The Code of Ethics covers topics such as financial reporting, conflicts of interest and compliance with laws, rules, regulations and our policies.

| 24 | ADVANCED MICRO DEVICES, INC. | 2024 Proxy Statement |