Use these links to rapidly review the document

TABLE OF CONTENTS

Prospectus

TABLE OF CONTENTS 3

TABLE OF CONTENTS 4

TABLE OF CONTENTS 5

TABLE OF CONTENTS

Table of Contents

Filed Pursuant to Rule 424(b)(2)

Registration No. 333-250153-01

CALCULATION OF REGISTRATION FEE

| | | | |

| | | | |

| |

Title of each class of

securities offered

| | Maximum

aggregate offering

price

| | Amount of

registration fee

|

|---|

| |

Class B Pass Through Certificates, Series 2020-1 | | $600,000,000 | | $65,460.00 |

|

- (1)

- The filing fee of $65,460.00 is calculated in accordance with Rule 457(r) of the Securities Act of 1933.

Table of Contents

PROSPECTUS SUPPLEMENT TO PROSPECTUS, DATED NOVEMBER 17, 2020

$600,000,000

2020-1 PASS THROUGH TRUSTS

CLASS B PASS THROUGH CERTIFICATES, SERIES 2020-1

United Airlines Class B Pass Through Certificates, Series 2020-1, are being offered under this prospectus supplement. The Class A Pass Through Certificates of the same series were previously offered under a separate prospectus supplement of United Airlines, Inc. dated October 20, 2020 and were issued on October 28, 2020. The Class A certificates are not being offered under this prospectus supplement.

The Class B certificates will rank junior in right of distribution to the Class A certificates. The Class B certificates will represent interests in the Class B trust to be established in connection with this offering. The proceeds from the sale of the Class B certificates will be used by the Class B trust to acquire a Series B equipment note. The Series B equipment note will be issued by United Airlines, Inc. on a recourse basis, and will initially be secured by substantially all of United's aircraft spare parts from time to time, as well as by a designated group of 99 spare engines and 352 aircraft owned by United. Payments on the Series B equipment note held in the Class B trust will be passed through to the holders of Class B certificates.

Interest on the Series B equipment note will be payable quarterly on January 15, April 15, July 15 and October 15 of each year, beginning on April 15, 2021. Principal payments on the Series B equipment note are scheduled on January 15, April 15, July 15 and October 15 of each year, beginning on April 15, 2021.

Goldman Sachs Bank USA and, potentially, one or more other banks will provide the initial liquidity facilities for the Class B certificates in an amount sufficient to make six quarterly interest payments.

The Class B certificates will not be listed on any national securities exchange.

Investing in the Class B certificates involves risks. See "Risk Factors" beginning on page S-23.

| | | | | | | | | | | | | |

Pass Through

Certificates | | | Face Amount | | | Interest

Rate | | | Final Expected

Distribution Date | | | Price to

Public(1)

| |

| | | | | | | | | | | | | | |

Class B | | $ | 600,000,000 | | | 4.875 | % | | January 15, 2026 | | | 100 | % |

- (1)

- Plus accrued interest, if any, from the date of issuance.

The underwriters will purchase all of the Class B certificates if any are purchased. The aggregate proceeds from the sale of the Class B certificates will be $600,000,000. United will pay the underwriters a commission of $6,000,000. Delivery of the Class B certificates in book-entry form only will be made on or about February 1, 2021.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Lead Bookrunners

| | | | |

Goldman Sachs & Co. LLC

Structuring Agent | | Citigroup | | Credit Suisse |

Bookrunners

| | | | | | | | |

| BofA Securities | | Barclays | | Deutsche Bank Securities | | J.P. Morgan | | Morgan Stanley |

BBVA |

|

BNP PARIBAS |

|

Credit Agricole Securities |

|

Standard Chartered Bank |

|

Wells Fargo Securities |

The date of this prospectus supplement is January 25, 2021.

Table of Contents

CERTAIN VOLCKER RULE CONSIDERATIONS

None of the Trusts are or, immediately after the issuance of the Certificates pursuant to the Trust Supplements, will be a "covered fund" as defined in the final regulations issued December 10, 2013, implementing the "Volcker Rule" (Section 619 of the Dodd-Frank Wall Street Reform and Consumer Protection Act). In making the foregoing determination, each of the Trusts is relying on an analysis that the Trusts will not be deemed to be an "investment company" under Rule 3a-7 promulgated by the Securities and Exchange Commission (the "Commission"), under the Investment Company Act of 1940, as amended (the "Investment Company Act"), although other exemptions or exclusions under the Investment Company Act may be available to the Trusts.

PRESENTATION OF INFORMATION

These offering materials consist of two documents: (a) this Prospectus Supplement, which describes the terms of the certificates that we are currently offering, and (b) the accompanying Prospectus, which provides general information about our pass through certificates, some of which may not apply to the certificates that we are currently offering. The information in this Prospectus Supplement replaces any inconsistent information included in the accompanying Prospectus.

We have given certain capitalized terms specific meanings for purposes of this Prospectus Supplement. The "Index of Terms" attached as Appendix I to this Prospectus Supplement lists the page in this Prospectus Supplement on which we have defined each such term.

At various places in this Prospectus Supplement and the Prospectus, we refer you to other sections of such documents for additional information by indicating the caption heading of such other sections. The page on which each principal caption included in this Prospectus Supplement and the Prospectus can be found is listed in the Table of Contents below. All such cross references in this Prospectus Supplement are to captions contained in this Prospectus Supplement and not in the Prospectus, unless otherwise stated.

S-1

Table of Contents

TABLE OF CONTENTS

Prospectus Supplement

| | | | |

| | Page | |

|---|

PROSPECTUS SUPPLEMENT SUMMARY | | | S-4 | |

Summary of Terms of Certificates | | | S-4 | |

Summary of Collateral | | | S-5 | |

Summary of Appraisals | | | S-5 | |

Loan to Collateral Value Ratios | | | S-6 | |

Cash Flow Structure | | | S-7 | |

The Offering | | | S-8 | |

SUMMARY FINANCIAL AND OPERATING DATA | | | S-19 | |

Selected Operating Data | | | S-21 | |

Recent Results | | | S-22 | |

RISK FACTORS | | | S-23 | |

Risk Factors Relating to Recent Events | | | S-23 | |

Risk Factors Relating to the Class B Certificates and the Offering | | | S-26 | |

USE OF PROCEEDS | | | S-32 | |

THE COMPANY | | | S-32 | |

DESCRIPTION OF THE CERTIFICATES | | | S-33 | |

General | | | S-33 | |

Investment Company Act Exemption | | | S-34 | |

Payments and Distributions | | | S-34 | |

Pool Factors | | | S-36 | |

Reports to Certificateholders | | | S-38 | |

Indenture Defaults and Certain Rights Upon an Indenture Default | | | S-39 | |

Purchase Rights of Certificateholders | | | S-40 | |

PTC Event of Default | | | S-41 | |

Merger, Consolidation and Transfer of Assets | | | S-41 | |

Modifications of the Pass Through Trust Agreements and Certain Other Agreements | | | S-41 | |

Obligation to Purchase Equipment Notes | | | S-44 | |

Termination of the Trusts | | | S-44 | |

The Trustees | | | S-45 | |

Book-Entry; Delivery and Form | | | S-45 | |

DESCRIPTION OF THE LIQUIDITY FACILITIES | | | S-48 | |

General | | | S-48 | |

Drawings | | | S-48 | |

Replacement Liquidity Facility | | | S-52 | |

Reimbursement of Drawings | | | S-53 | |

Liquidity Events of Default | | | S-55 | |

Liquidity Provider | | | S-55 | |

DESCRIPTION OF THE INTERCREDITOR AGREEMENT | | | S-56 | |

Intercreditor Rights | | | S-56 | |

Post Default Appraisals | | | S-58 | |

Priority of Distributions | | | S-58 | |

Voting of Equipment Notes | | | S-62 | |

List of Certificateholders | | | S-62 | |

Reports | | | S-62 | |

The Subordination Agent | | | S-63 | |

DESCRIPTION OF THE COLLATERAL AND THE APPRAISALS | | | S-64 | |

The Spare Parts | | | S-64 | |

| | | | |

| | Page | |

|---|

The Spare Engines | | | S-64 | |

The Aircraft | | | S-64 | |

The Appraisals | | | S-65 | |

Semiannual LTV Test | | | S-74 | |

Certain Spare Parts Covenants | | | S-80 | |

DESCRIPTION OF THE EQUIPMENT NOTES | | | S-82 | |

General | | | S-82 | |

Subordination | | | S-82 | |

Principal and Interest Payments | | | S-82 | |

Redemption | | | S-83 | |

Limitation of Liability | | | S-84 | |

Indenture Defaults, Notice and Waiver | | | S-84 | |

Remedies | | | S-85 | |

Modification of Indenture and other Security Documents | | | S-86 | |

Indemnification | | | S-87 | |

DESCRIPTION OF THE SECURITY DOCUMENTS | | | S-88 | |

General | | | S-88 | |

Certain Provisions of the Spare Parts Security Agreement | | | S-88 | |

Certain Provisions of the Spare Engines Security Agreement | | | S-90 | |

Certain Provisions of the Indenture | | | S-93 | |

POSSIBLE ISSUANCE OF ADDITIONAL JUNIOR CERTIFICATES AND REFINANCING OF CERTIFICATES | | | S-99 | |

Issuance of Additional Junior Certificates | | | S-99 | |

Refinancing of Certificates | | | S-99 | |

Additional Liquidity Facilities | | | S-100 | |

CERTAIN U.S. FEDERAL TAX CONSEQUENCES | | | S-101 | |

General | | | S-101 | |

Tax Status of the Class B Trust | | | S-101 | |

Taxation of Class B Certificateholders Generally | | | S-102 | |

Sale or Other Disposition of the Class B Certificates | | | S-102 | |

3.8% Medicare Tax on "Net Investment Income" | | | S-103 | |

Foreign Class B Certificateholders | | | S-103 | |

Backup Withholding | | | S-104 | |

CERTAIN DELAWARE TAXES | | | S-105 | |

CERTAIN ERISA CONSIDERATIONS | | | S-106 | |

UNDERWRITING | | | S-108 | |

Selling Restrictions | | | S-110 | |

LEGAL MATTERS | | | S-114 | |

EXPERTS | | | S-114 | |

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE | | | S-115 | |

INDEX OF TERMS | | | Appendix I | |

APPRAISAL LETTERS | | | Appendix II | |

LOAN TO COLLATERAL VALUE RATIOS BY COLLATERAL GROUP | | | Appendix III | |

S-2

Table of Contents

Prospectus

| | | | |

| | Page | |

|---|

ABOUT THIS PROSPECTUS | | | 1 | |

RISK FACTORS | | | 2 | |

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS | | | 2 | |

THE COMPANY | | | 5 | |

USE OF PROCEEDS | | | 5 | |

WHERE YOU CAN FIND MORE INFORMATION | | | 5 | |

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE | | | 5 | |

LEGAL MATTERS | | | 7 | |

EXPERTS | | | 7 | |

You should rely only on the information contained in this document or to which this document refers you. We have not authorized anyone to provide you with information that is different. This document may be used only where it is legal to sell these securities. The information in this document may be accurate only on the date of this document.

S-3

Table of Contents

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information from this Prospectus Supplement and the accompanying Prospectus and may not contain all of the information that is important to you. For more complete information about the Class B Certificates and United, you should read this entire Prospectus Supplement and the accompanying Prospectus, as well as the materials filed with the Securities and Exchange Commission that are considered to be part of this Prospectus Supplement and the Prospectus. See "Incorporation of Certain Documents by Reference" in this Prospectus Supplement and the Prospectus.

Summary of Terms of Certificates

| | | | |

| | Previously Issued(1) | |

|

|---|

| | Class A Certificates | | Class B Certificates |

|---|

Aggregate Face Amount | | $2,927,475,000 | | $600,000,000 |

Interest Rate | | 5.875% | | 4.875% |

Initial Loan to Collateral Value(2) | | | | |

All Collateral (cumulative) | | 50.2% | | 60.4% |

Spares Collateral Group | | 59.2% | | 70.1% |

Tier I Aircraft Collateral Group | | 48.5% | | 58.4% |

Tier II Aircraft Collateral Group | | 43.3% | | 53.3% |

Highest Loan to Collateral Value (cumulative)(3) | | 50.2% | | 60.4% |

Expected Principal Distribution Window (in years from the Class B Issuance Date) | | 0.2 - 6.7 | | 0.2 - 5.0 |

Initial Average Life (in years from the Class B Issuance Date) | | 3.9 | | 3.2 |

Regular Distribution Dates | | January 15, April 15,

July 15 and October 15 | | January 15, April 15,

July 15 and October 15 |

Final Expected Distribution Date | | October 15, 2027 | | January 15, 2026 |

Final Maturity Date | | April 15, 2029 | | July 15, 2027 |

Minimum Denomination | | $1,000 | | $1,000 |

Section 1110 Protection | | Yes | | Yes |

Liquidity Facility Coverage | | Six quarterly interest payments | | Six quarterly interest payments |

- (1)

- The Class A Certificates were previously offered under a separate prospectus supplement of United dated October 20, 2020 and were issued on October 28, 2020. The original face amount of the Class A Certificates was $3,000,000,000. This original face amount was reduced to its current amount prior to the date hereof as a result of a scheduled payment of principal of the Series A Equipment Note on January 15, 2021. The Class A Certificates are not being offered pursuant to this Prospectus Supplement.

- (2)

- These percentages are calculated as of February 1, 2021, the expected issuance date of the Class B Certificates. In calculating these percentages, we have assumed that the aggregate appraised value of all Collateral is $5,835,642,935, the Spares Collateral Group is $1,952,344,603.29, the Tier I Aircraft Collateral Group is $1,721,386,524.17 and the Tier II Aircraft Collateral Group is $2,161,911,807.17. Such appraised value of Spare Engines and Aircraft as of the expected issuance date of the Class B Certificates has been calculated by interpolating the annual forecasted half-life appraised values and maintenance adjustments included in the appraisals on a quarterly basis to reflect Q1 2021 valuations. The appraised value of Spare Parts reflects the current market value as of August 2020. In determining these percentages, we have divided such appraised values by, in the case of all Collateral, the outstanding principal amount of the Equipment Notes and, in the case of the Spares Collateral Group, the Tier I Aircraft Collateral Group and the Tier II Aircraft Collateral Group the principal amount of the Equipment Notes allocated to such Group as follows:

| | | | | | | |

Group | | Series A

Equipment Note | | Series B

Equipment Note | |

|---|

Spares Collateral Group | | $ | 1,156,362,500 | | $ | 213,000,000 | |

Tier I Aircraft Collateral | | $ | 834,600,000 | | $ | 171,000,000 | |

Tier II Aircraft Collateral | | $ | 936,512,500 | | $ | 216,000,000 | |

See "—Loan to Collateral Value Ratios". The appraised value is only an estimate and reflects certain assumptions. See "Description of the Collateral and the Appraisals—The Appraisals".

- (3)

- See "—Loan to Collateral Value Ratios".

S-4

Table of Contents

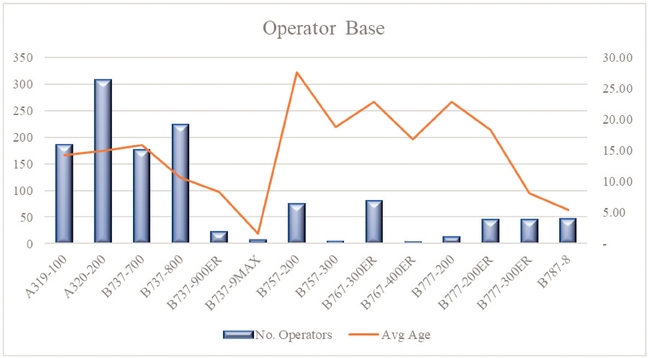

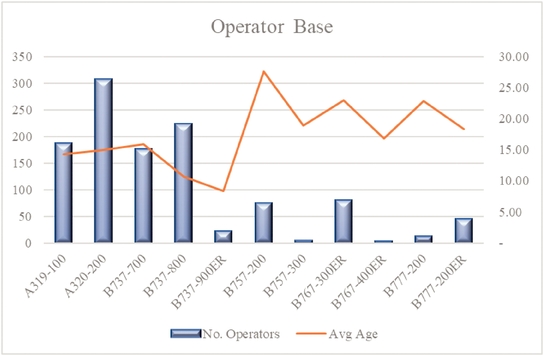

Summary of Collateral

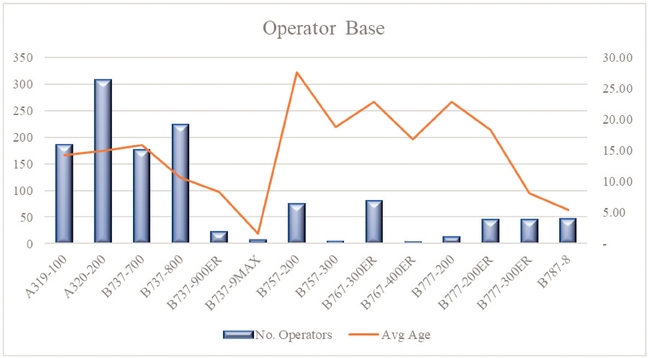

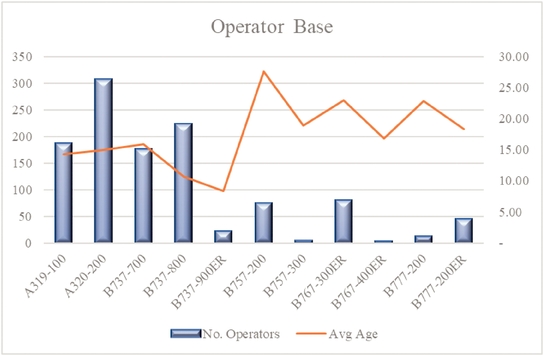

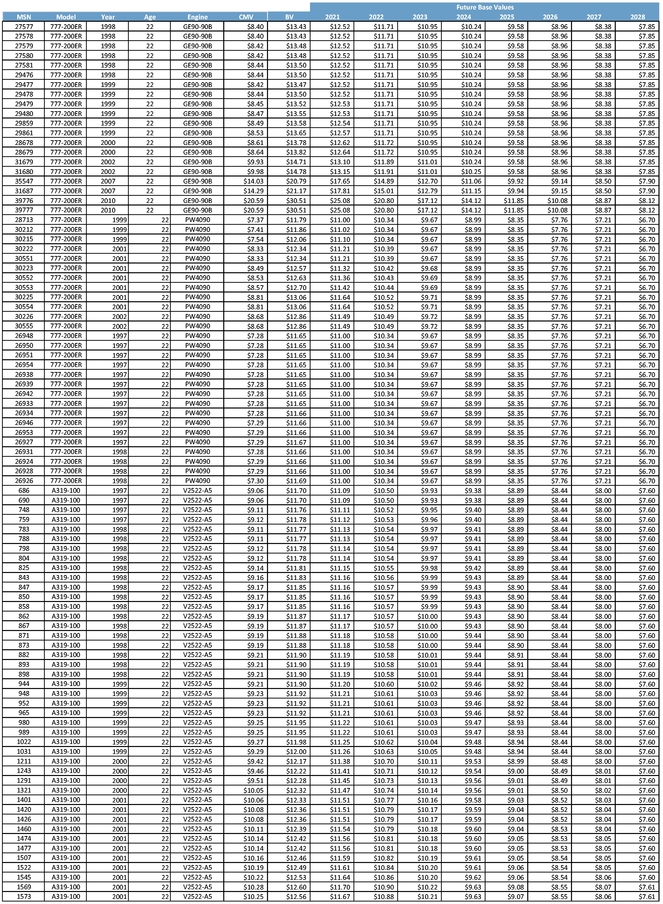

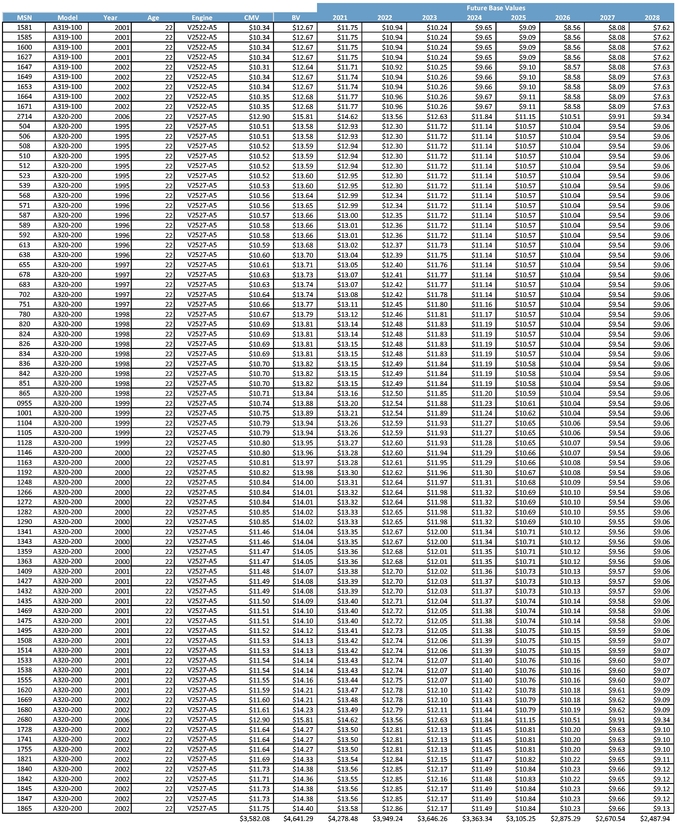

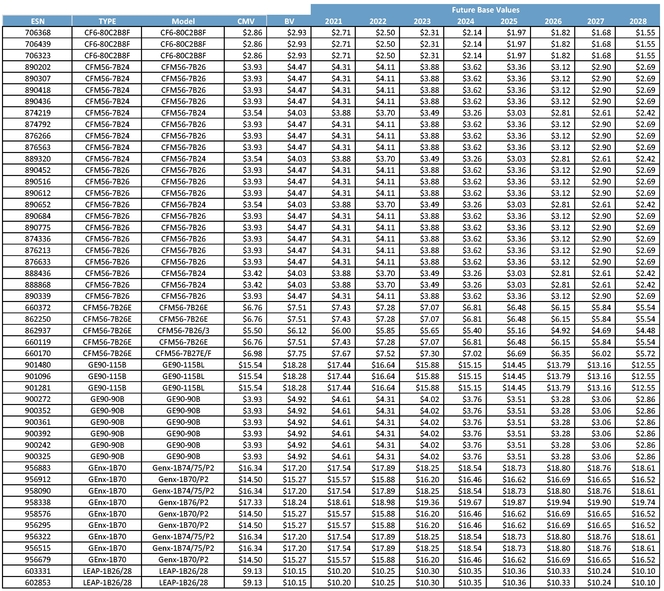

Each of the Series A Equipment Note and the Series B Equipment Note will initially be secured by substantially all of United's aircraft Spare Parts from time to time, as well as by a designated group of 99 Spare Engines and 352 Aircraft owned by United. The Spare Parts are utilized with respect to United's entire fleet of aircraft and engines. The Spare Engines consist of 15 different engine models and collectively may be installed on 14 different aircraft models. The Aircraft consist of eleven different aircraft models and were manufactured by Airbus or Boeing.

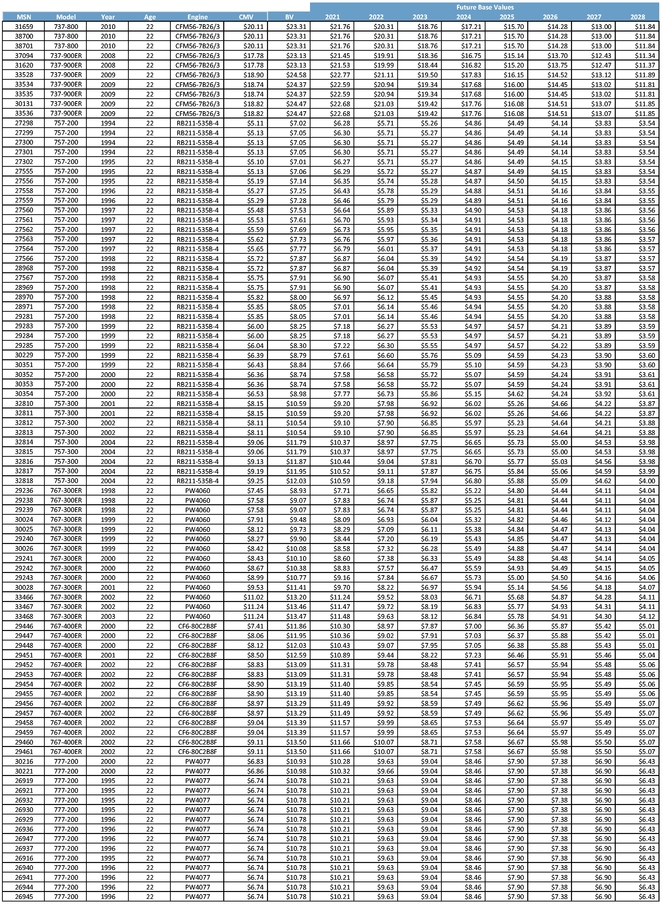

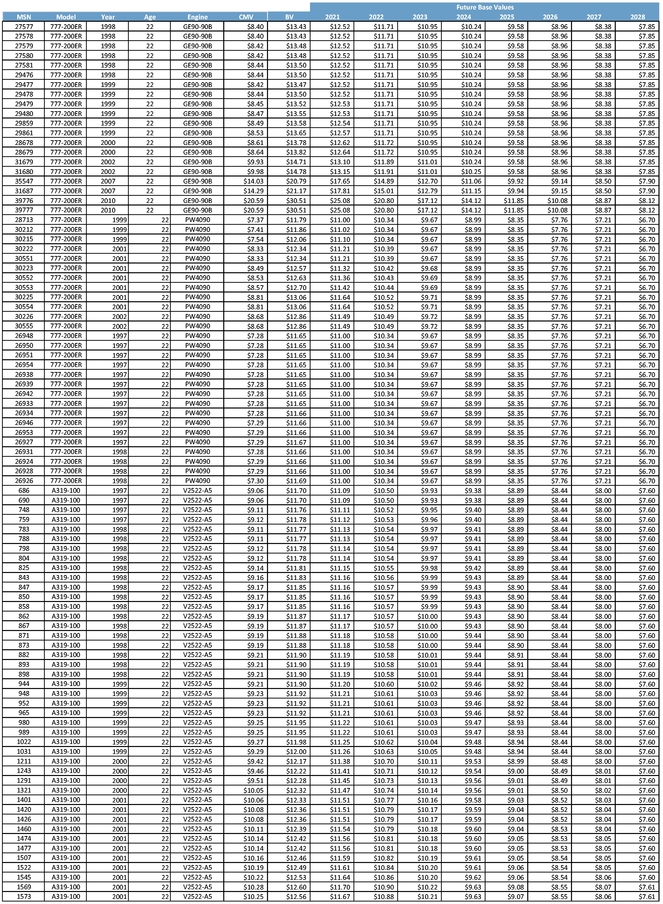

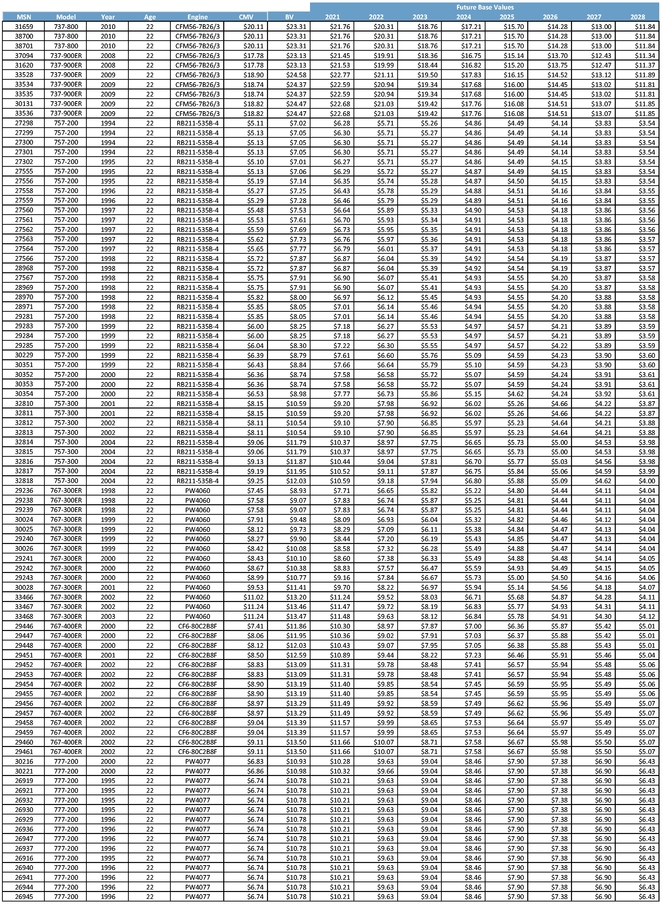

Summary of Appraisals

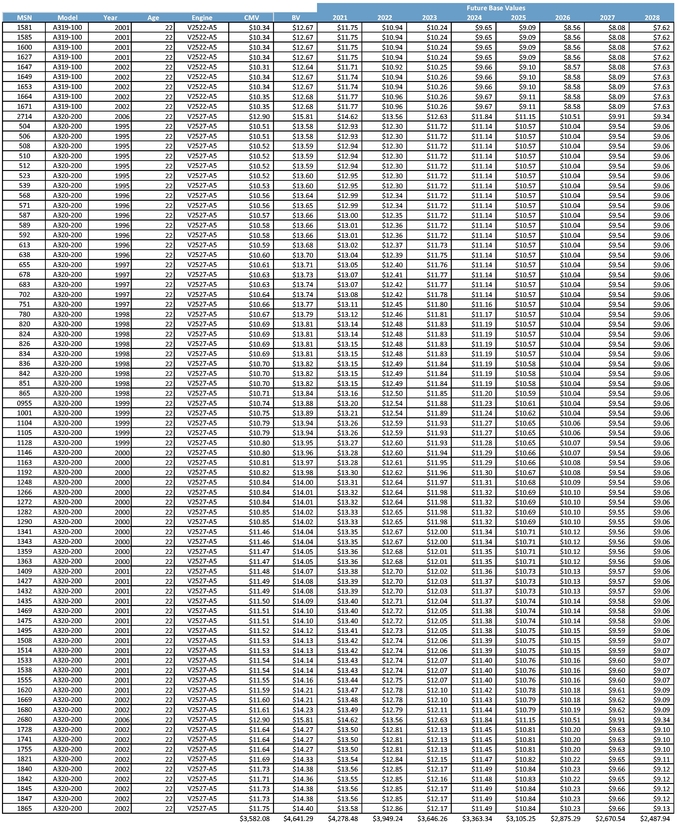

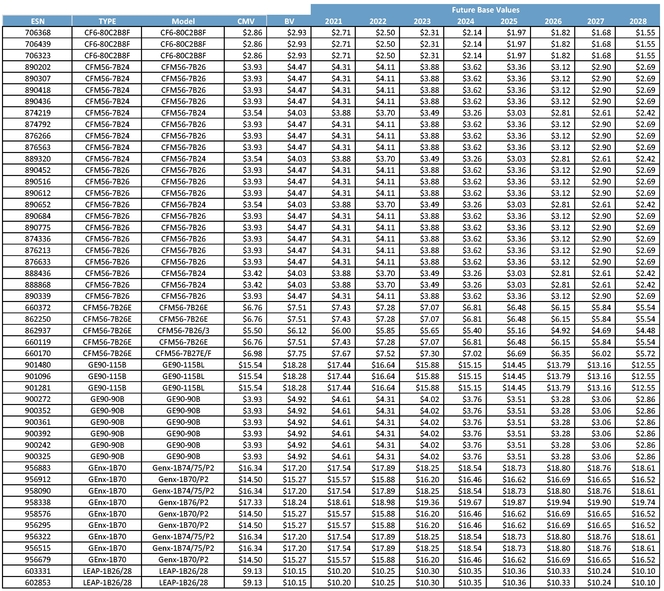

An appraisal of the Spare Parts that will initially secure the Equipment Notes has been prepared by mba. In addition, appraisals of the Spare Engines and Aircraft that will initially secure the Equipment Notes have been prepared by BK, ICF and mba, in respect of the Spare Engines and the Aircraft, and mba's appraisal includes a report on the maintenance status of such Spare Engines and Aircraft. Copies of such appraisals are annexed to this prospectus supplement as Appendix II. Based on such appraisals and maintenance report, the aggregate initial appraised value of the Collateral was approximately $5.8 billion. Appraised value of the Spare Parts represents their current market value as determined by one appraiser. Appraised value represents, with respect to each Spare Engine and each Aircraft, the lesser of the mean and the median of its appraised base value assuming half-life condition as determined by the three appraisers, adjusted for its maintenance status as provided in such maintenance report. In addition, the appraisals of the Aircraft and Spare Engines included in Appendix II provide projected future base values of such Collateral, which for the first quarter of 2021 result in an appraised value of the Collateral of approximately $5.8 billion, based on the same methodology used to calculate the initial appraised value and calculated as of the first quarter of 2021 by interpolating the annual forecasted half-life base values and maintenance adjustments determined by the appraisers.

The appraisals were based on various assumptions and methodologies, each as described in the respective appraisal. See "Risk Factors—Risk Factors Relating to the Class B Certificates and the Offering—The Appraisals are only estimates of Collateral value." For a discussion of "current market value" and "base value" see "Description of the Collateral and the Appraisals." Appraised values, including projected future values, should not be relied upon as a measure of the proceeds that could be received upon a foreclosure on the Collateral. See "Description of the Collateral and the Appraisals—The Appraisals."

S-5

Table of Contents

Loan to Collateral Value Ratios

The following table sets forth loan to Collateral value ratios ("LTVs") for each Class of Certificates as of the Class B Issuance Date and as of each Regular Distribution Date thereafter. The table should not be considered a forecast or prediction of expected or likely LTVs but simply a mathematical calculation based on one set of assumptions. See "Risk Factors—Risk Factors Relating to the Class B Certificates and the Offering—The Appraisals are only estimates of Collateral value".

| | | | | | | | | | | | | | | | |

| |

| | Outstanding Balance(3) | | LTV(4) | |

|---|

| | Assumed

Aggregate

Collateral

Value(2) | |

|---|

Regular Distribution Date(1) | | Class A

Certificates(5) | | Class B

Certificates | | Class A

Certificates | | Class B

Certificates | |

|---|

Class B Issuance Date | | $ | 5,835,642,935 | | $ | 2,927,475,000 | | $ | 600,000,000 | | | 50.2 | % | | 60.4 | % |

April 15, 2021 | | | 5,855,975,183 | | | 2,854,950,000 | | | 582,300,000 | | | 48.8 | % | | 58.7 | % |

July 15, 2021 | | | 5,876,307,432 | | | 2,782,425,000 | | | 560,550,000 | | | 47.3 | % | | 56.9 | % |

October 15, 2021 | | | 5,896,639,680 | | | 2,709,900,000 | | | 538,800,000 | | | 46.0 | % | | 55.1 | % |

January 15, 2022 | | | 5,903,417,545 | | | 2,625,212,500 | | | 518,400,000 | | | 44.5 | % | | 53.3 | % |

April 15, 2022 | | | 5,910,195,410 | | | 2,540,525,000 | | | 498,000,000 | | | 43.0 | % | | 51.4 | % |

July 15, 2022 | | | 5,916,973,274 | | | 2,455,837,500 | | | 477,600,000 | | | 41.5 | % | | 49.6 | % |

October 15, 2022 | | | 5,923,751,139 | | | 2,371,150,000 | | | 457,200,000 | | | 40.0 | % | | 47.7 | % |

January 15, 2023 | | | 5,804,664,287 | | | 2,263,600,000 | | | 434,100,000 | | | 39.0 | % | | 46.5 | % |

April 15, 2023 | | | 5,685,577,435 | | | 2,156,050,000 | | | 411,000,000 | | | 37.9 | % | | 45.2 | % |

July 15, 2023 | | | 5,566,490,582 | | | 2,048,500,000 | | | 387,900,000 | | | 36.8 | % | | 43.8 | % |

October 15, 2023 | | | 5,447,403,730 | | | 1,940,950,000 | | | 364,800,000 | | | 35.6 | % | | 42.3 | % |

January 15, 2024 | | | 5,325,312,483 | | | 1,796,912,500 | | | 333,600,000 | | | 33.7 | % | | 40.0 | % |

April 15, 2024 | | | 5,203,221,237 | | | 1,652,875,000 | | | 302,400,000 | | | 31.8 | % | | 37.6 | % |

July 15, 2024 | | | 5,081,129,990 | | | 1,508,837,500 | | | 271,200,000 | | | 29.7 | % | | 35.0 | % |

October 15, 2024 | | | 4,959,038,744 | | | 1,364,800,000 | | | 240,000,000 | | | 27.5 | % | | 32.4 | % |

January 15, 2025 | | | 3,198,150,790 | | | 1,278,643,750 | | | 230,400,000 | | | 40.0 | % | | 47.2 | % |

April 15, 2025 | | | 3,135,153,694 | | | 1,192,487,500 | | | 199,425,000 | | | 38.0 | % | | 44.4 | % |

July 15, 2025 | | | 3,072,156,597 | | | 1,106,331,250 | | | 168,450,000 | | | 36.0 | % | | 41.5 | % |

October 15, 2025 | | | 3,009,159,501 | | | 1,020,175,000 | | | 137,475,000 | | | 33.9 | % | | 38.5 | % |

January 15, 2026 | | | 2,953,520,040 | | | 976,818,750 | | | — | | | 33.1 | % | | — | |

April 15, 2026 | | | 2,897,880,579 | | | 933,462,500 | | | — | | | 32.2 | % | | — | |

July 15, 2026 | | | 2,842,241,118 | | | 890,106,250 | | | — | | | 31.3 | % | | — | |

October 15, 2026 | | | 2,786,601,656 | | | 846,750,000 | | | — | | | 30.4 | % | | — | |

January 15, 2027 | | | 2,754,200,355 | | | 803,393,750 | | | — | | | 29.2 | % | | — | |

April 15, 2027 | | | 2,721,799,053 | | | 760,037,500 | | | — | | | 27.9 | % | | — | |

July 15, 2027 | | | 2,689,397,751 | | | 716,681,250 | | | — | | | 26.6 | % | | — | |

October 15, 2027 | | | 2,656,996,450 | | | — | | | — | | | — | | | — | |

- (1)

- The Class A Certificates were originally issued on October 28, 2020, and the first Regular Distribution Date for such Certificates was January 15, 2021.

- (2)

- We have assumed that the composition of the Collateral remains the same as it was on the Class B Issuance Date through the Final Expected Distribution Date. Assumed Aggregate Collateral Value reflects the sum of the appraised values of the Spare Parts, Spare Engines and Aircraft included in the Collateral. In the case of the Spare Parts, initial and forward appraised values reflect current market value as of August 31, 2020, as appraised by mba. We have assumed that such value does not change during the term of the Certificates. In the case of the Spare Engines and Aircraft, the initial appraised values of each Spare Engine and Aircraft as of the Class A Issuance Date reflect as of September 1, 2020 the lower of the mean and median of the base values thereof as provided by BK, ICF and mba, each as adjusted for current maintenance condition as determined by mba. Forward appraised values as of any date after 2020 reflect as of September 1, 2020 the lower of the mean and median of the projected base values as appraised by BK, ICF and mba, each as adjusted for projected maintenance condition as determined by mba and calculated by interpolating the annual forecasted half-life base values and maintenance adjustments determined by the appraisers. See "Risk Factors—Risk Factors Relating to the Class B Certificates and the Offering—The Appraisals are only estimates of Collateral value". United is required to provide to the Loan Trustee a semiannual appraisal of the Collateral. See "Description of the Collateral and the Appraisals—Semiannual LTV Test".

- (3)

- Outstanding balances as of each Regular Distribution Date are shown after giving effect to distributions expected to be made on such distribution date.

- (4)

- The LTVs for each Class of Certificates were obtained for the Class B Issuance Date and each Regular Distribution Date by dividing (i) the expected outstanding balance of such Class (together, in the case of the Class B Certificates, with the expected outstanding balance of the Class A Certificates) after giving effect to the distributions expected to be made on such date, by (ii) the assumed value of the Collateral on such date based on the assumptions described above.

- (5)

- The Class A Certificates were previously offered under a separate prospectus supplement of United dated October 20, 2020 and were issued on October 28, 2020. The Class A Certificates are not being offered pursuant to this Prospectus Supplement.

S-6

Table of Contents

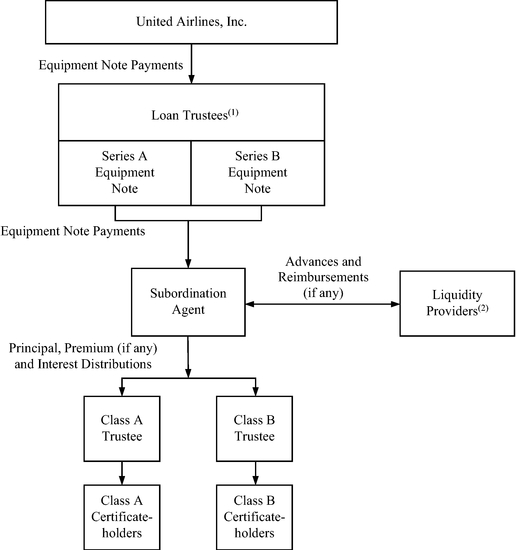

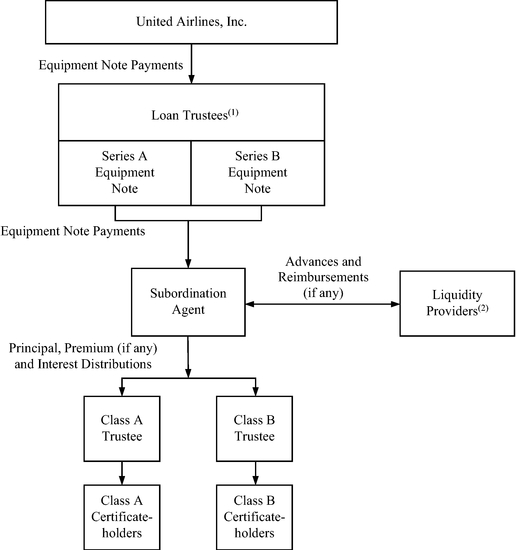

Cash Flow Structure

Set forth below is a diagram illustrating the structure for the offering of the Certificates and certain cash flows.

- (1)

- The Equipment Notes will be issued under the Indenture.

- (2)

- The Liquidity Facilities for each of the Class A Certificates and the Class B Certificates are expected to be sufficient to cover up to six consecutive quarterly interest payments with respect to such Class.

- (3)

- The proceeds of the offering of the Class B Certificates will be used by the Class B Trust to purchase the Series B Equipment Note on the Class B Issuance Date. The scheduled payments of interest on the Series B Equipment Note will be sufficient to pay accrued interest on the outstanding Class B Certificates.

S-7

Table of Contents

The Offering

| | | | |

Certificates Offered | | • Class B Pass Through Certificates, Series 2020-1. |

| | The Class A Certificates of the same series were previously offered under a separate prospectus supplement of United dated October 20, 2020 and were issued on October 28, 2020. The Class A Certificates are not being offered under this Prospectus Supplement. Each Class of Certificates will represent a fractional undivided interest in a related Trust. |

Use of Proceeds | | The proceeds from the sale of the Class B Certificates will be used by the Class B Trust to acquire the Series B Equipment Note issued under the Indenture on the Class B Issuance Date. United will use the proceeds from the sale of the Series B Equipment Note to pay fees and expenses relating to the Offering and for United's general corporate purposes. |

Subordination Agent, Trustee and Loan Trustee | | Wilmington Trust, National Association |

Liquidity Providers | | Goldman Sachs Bank USA and, potentially, one or more other Replacement Liquidity Providers |

Trust Property | | The property of the Class B Trust will include: |

| | • The Series B Equipment Note acquired by the Class B Trust. |

| | • All monies receivable under the Liquidity Facilities for the Class B Trust. |

| | • Funds from time to time deposited with the Class B Trustee in accounts relating to the Class B Trust, including payments made by United on the Series B Equipment Note held in the Class B Trust. |

Purchase of Equipment Notes | | On the Class B Issuance Date, the Class B Trust will purchase the Series B Equipment Note issued by United under the Indenture pursuant to the Series B Note Purchase Agreement. The Class A Trust has previously purchased the Series A Equipment Note issued by United under the Indenture pursuant to the Series A Note Purchase Agreement. |

Regular Distribution Dates | | January 15, April 15, July 15 and October 15, commencing on April 15, 2021. |

Record Dates | | The fifteenth day preceding the related Distribution Date. |

Distributions | | The Class B Trustee will distribute all payments of principal, premium (if any) and interest received on the Series B Equipment Note held in the Class B Trust to the holders of the Class B Certificates, subject to the subordination provisions applicable to the Class B Certificates. |

S-8

Table of Contents

| | | | |

| | Scheduled payments of principal and interest made on the Series B Equipment Note will be distributed on the applicable Regular Distribution Dates. |

| | Payments of principal, premium (if any) and interest made on the Series B Equipment Note resulting from any early redemption of the Series B Equipment Note will be distributed on a special distribution date after not less than 15 days' notice from the Class B Trustee to the applicable Class B Certificateholders. |

Subordination | | Distributions on the Certificates will be made in the following order: |

| | • First, to the holders of the Class A Certificates to pay interest on the Class A Certificates. |

| | • Second, to the holders of the Class B Certificates to pay interest on the Preferred B Pool Balance. |

| | • Third, to the holders of the Class A Certificates to make distributions in respect of the Pool Balance of the Class A Certificates. |

| | • Fourth, to the holders of the Class B Certificates to pay interest on the Pool Balance of the Class B Certificates not previously distributed under clause "Second" above. |

| | • Fifth, to the holders of the Class B Certificates to make distributions in respect of the Pool Balance of the Class B Certificates. |

Control of Loan Trustee | | The holders of at least a majority of the outstanding principal amount of Equipment Notes will be entitled to direct the Loan Trustee under the Security Documents in taking action as long as no Indenture Default is continuing thereunder. If an Indenture Default is continuing, subject to certain conditions, the "Controlling Party" will direct the Loan Trustee under the Security Documents (including in exercising remedies, such as accelerating such Equipment Notes or foreclosing the lien on the Collateral securing such Equipment Notes). |

| | The Controlling Party will be: |

| | • The Class A Trustee. |

| | • Upon payment of final distributions to the holders of Class A Certificates, the Class B Trustee. |

| | • Under certain circumstances, and notwithstanding the foregoing, the Liquidity Provider (including, if any Class C Certificates are issued, any liquidity provider for the Class C Certificates) with the largest amount owed to it. |

S-9

Table of Contents

| | | | |

| | In exercising remedies during the nine months after the earlier of (a) the acceleration of the Equipment Notes or (b) the bankruptcy of United, the Equipment Notes and the Collateral may not be sold for less than certain specified minimums. |

Right to Purchase Other Classes of Certificates | | If United is in bankruptcy and certain specified circumstances then exist: |

| | • The Class B Certificateholders will have the right to purchase all but not less than all of the Class A Certificates. |

| | • If Additional Junior Certificates have been issued, the holders of such Additional Junior Certificates will have the right to purchase all but not less than all of the Class A and Class B Certificates. |

| | The purchase price in each case described above will be the outstanding balance of the applicable Class of Certificates plus accrued and unpaid interest. |

Liquidity Facilities | | Under the Liquidity Facilities for each of the Class A and Class B Trusts, the Liquidity Providers will, if necessary, make advances in an aggregate amount sufficient to pay interest on the applicable Certificates on up to six successive quarterly Regular Distribution Dates at the interest rate for such Certificates. Drawings under the Liquidity Facilities cannot be used to pay any amount in respect of the applicable Certificates other than interest. |

| | Notwithstanding the subordination provisions applicable to the Certificates, the holders of the Certificates issued by the Class A Trust or the Class B Trust will be entitled to receive and retain the proceeds of drawings under the Liquidity Facilities for such Trust. |

| | Upon each drawing under any Liquidity Facility to pay interest on the applicable Certificates, the Subordination Agent will reimburse the applicable Liquidity Provider for the amount of such drawing. Such reimbursement obligation and all interest, fees and other amounts owing to the Liquidity Provider under each Liquidity Facility and certain other agreements will rank equally with comparable obligations relating to the other Liquidity Facilities and will rank senior to the Certificates in right of payment. |

| | If Class C Certificates are issued, such Class C Certificates may have the benefit of credit support similar to the Liquidity Facilities. See "Possible Issuance of Additional Junior Certificates and Refinancing of Certificates". |

S-10

Table of Contents

| | | | |

Issuances of Additional Classes of Certificates | | Additional pass through certificates of one or more separate pass through trusts, which will evidence fractional undivided ownership interests in equipment notes secured by the Collateral, may be issued. Any such transaction may relate to (a) the issuance of one or more new series of subordinated equipment notes with respect to all (but not less than all) of the Collateral at any time after the Class B Issuance Date or (b) the refinancing of the Series B Equipment Note or any of such other series of subordinated equipment notes at or after repayment of any such refinanced Series B Equipment Note or other equipment notes issued with respect to all (but not less than all) of the Collateral secured by such refinanced notes at any time after the Class B Issuance Date. The holders of Additional Junior Certificates relating to other series of subordinated equipment notes, if issued, will have the right to purchase all of the Class A and Class B Certificates under certain circumstances after a bankruptcy of United at the outstanding principal balance of the Certificates to be purchased plus accrued and unpaid interest and other amounts due to Certificateholders, but without a premium. Consummation of any such issuance of additional pass through certificates will be subject to satisfaction of certain conditions, including, if issued after the Class B Issuance Date, receipt of confirmation from the Rating Agencies that it will not result in a withdrawal, suspension or downgrading of the rating of any Class of Certificates that remains outstanding. See "Possible Issuance of Additional Junior Certificates and Refinancing of Certificates". |

Equipment Notes | | | | |

(a) Issuer | | United. United's executive offices are located at 233 S. Wacker Drive, Chicago, Illinois 60606. United's telephone number is (872) 825-4000. |

(b) Interest | | The Series B Equipment Note held in the Class B Trust will accrue interest at the rate per annum for the Class B Certificates set forth on the cover page of this Prospectus Supplement. Interest will be payable on January 15, April 15, July 15 and October 15 of each year, commencing on April 15, 2021. Interest is calculated on the basis of a 360-day year consisting of twelve 30-day months. |

(c) Principal | | Principal payments on the Series B Equipment Note are scheduled on January 15, April 15, July 15 and October 15 of each year, commencing on April 15, 2021. |

S-11

Table of Contents

| | | | |

(d) Redemption | | Event of Loss. If an Event of Loss occurs with respect to a Spare Engine or Aircraft, United will be required either (i) to redeem a pro rata portion of the outstanding principal amount of the Series A Equipment Note and of the Series B Equipment Note based on the Appraised Value of such Spare Engine or Aircraft compared to the Aggregate Appraised Value of all Collateral, provided that if the aggregate principal amount of Equipment Notes required to be redeemed in connection with such Event of Loss is less than $50,000,000, in lieu of such redemption United may elect to deposit cash or permitted investments with the Loan Trustee to be held as Collateral for the applicable Collateral Group until such time as the amount deposited into such account exceeds $50,000,000, at which time such amount shall be used to redeem Equipment Notes as discussed above, provided further that, such loss proceeds may be released on the same basis that the Collateral subject to the Event of Loss could have been released prior to such Event of Loss and subject to the applicable Release Threshold for the Relevant Period or (ii) to replace such Spare Engine or Aircraft under the related Security Documents. The redemption price in such case will be the principal amount of such Equipment Notes required to be redeemed, together with accrued interest, but without any premium. |

| | Optional Redemption. United may elect to redeem (i) all but not less than all of the Series A and Series B Equipment Notes or (ii) all but not less than all of the Series B Equipment Notes without redeeming the Series A Equipment Notes, in each case prior to maturity of the applicable Series of Equipment Notes. The redemption price for any optional redemption will be the unpaid principal amount of the relevant Series of Equipment Note, together with accrued interest and Make-Whole Premium. |

(e) Security | | The Equipment Notes will be secured by a security interest in all of the Collateral. This means that any proceeds from the exercise of remedies with respect to any Collateral will be available to cover, in accordance with the applicable priority of payments, payment shortfalls then due under any Equipment Note. |

S-12

Table of Contents

| | | | |

| | The security interest in a Spare Part will not apply for as long as it is installed on or being used in any aircraft, engine or other spare part so installed or being used. In addition, the security interest will not apply to a Spare Part not located at one of the designated locations specified pursuant to the Spare Parts Security Agreement. Because spare parts are regularly used, refurbished, purchased, transferred and discarded in the ordinary course of United's business, the quantity and types of spare parts included in the Collateral and the appraised value of the Spare Parts will change over time. |

(f) Substitution of Airframe or Engine | | United may elect to release any airframe(s) or engine(s) (including any Spare Engine(s)) from the security interest of the Security Documents and substitute for it one or more airframes or engines, as applicable. However, no engine may be substituted with an airframe and no airframe may be substituted with one or more engines. In addition, a widebody Aircraft may be released and substituted with any aircraft and narrowbody aircraft may be released and substituted with other narrowbody aircraft or Eligible Regional Aircraft, but not widebody aircraft. In any case, no substitute airframe or engine may be a model that (i) has been fully retired or has been announced for such retirement by United or (ii) is not then type certificated by the FAA. Any such release and substitution shall be subject to the satisfaction of the following conditions: |

| | • no Indenture Default has occurred and is continuing at the time of substitution; |

| | • no failure to comply with a Composition Test shall have occurred and be continuing at the time of substitution (unless such substitution would improve compliance, or otherwise not worsen any noncompliance, with such Composition Test); |

| | • in the case of a substitute airframe (or airframes), it has (or in the case of multiple airframes, they have, on a weighted average basis) a date of manufacture no earlier than the date of manufacture of the airframe (or airframes on a weighted average basis) being released; |

| | • in the case of a substitute airframe or engine, it has a Maintenance Adjusted Base Value (or, in the case of multiple substitute aircraft or engines, the sum of their Maintenance Adjusted Base Values is) at least equal to 110% of that of the released airframe(s) or engine(s); and |

S-13

Table of Contents

| | | | |

| | • in the case of a replacement of an airframe with one or more airframes of a different model (other than a comparable or improved model) and/or manufacturer, United will be obligated to obtain written confirmation from each Rating Agency that substituting such substitute airframe (and if applicable, any other substitute airframes) for the replaced airframe will not result in a withdrawal, suspension or downgrading of the ratings of any Class of Certificates if then rated by such Rating Agency. |

(g) Section 1110 Protection | | United's outside counsel will provide its opinion to the Class B Trustee that the benefits of Section 1110 of the U.S. Bankruptcy Code will be available with respect to the Series B Equipment Note. |

(h) Semiannual LTV Test | | On or prior to each May 15 and November 15 of each year, commencing in May 2021, United will be required to deliver to the Loan Trustee (i) an Appraisal reflecting the current market value of the Spare Parts Collateral; (ii) an Appraisal reflecting the Maintenance Adjusted Base Values of the Spare Engines Collateral; (iii) an Appraisal reflecting the Maintenance Adjusted Base Values of the Tier I Aircraft Collateral; and (iv) an Appraisal reflecting the Maintenance Adjusted Base Values of the Tier II Aircraft Collateral. United will also be required to deliver a certificate of United with a calculation demonstrating whether or not the LTV Ratio with respect to the Spares Collateral Group, the Tier I Aircraft Collateral Group or the Tier II Aircraft Collateral Group is greater than the applicable Maximum LTV Threshold. |

| | If the LTV Ratio is greater than the applicable Maximum LTV Threshold with respect to any such Collateral Group, United will be required to: |

| | (I) | | grant a security interest to the Loan Trustee in Additional Collateral with respect to such Collateral Group such that the Aggregate Appraised Value of such Collateral Group (including such Additional Collateral and after giving effect to any action taken by United pursuant to clause (II) and (III) of this sentence) is greater than or equal to the applicable Minimum Collateral Value, subject to certain conditions; |

| | (II) | | deposit cash or permitted investments with the Loan Trustee as Collateral in a sufficient amount such that the Aggregate Appraised Value of such Collateral Group after giving effect to any action taken by United pursuant to clause (I) and (III) of this sentence, is greater than or equal to the applicable Minimum Collateral Value (after giving effect to such deposit); or |

S-14

Table of Contents

| | | | |

| | (III) | | pay to the Loan Trustee an amount not less than the difference of (i) the applicable Minimum Collateral Value minus (ii) the Aggregate Appraised Value of the applicable Collateral Group after giving effect to any action taken by United pursuant to clause (I) and (II) of this sentence. Any amounts paid pursuant to clause (III) will be deemed a deposit of Cure Cash Collateral for purposes of the foregoing clauses (I) and (II) and be applied to redeem Series A and Series B Equipment Notes with the principal amount of each series to be redeemed determined on a pro rata basis based on the percentage that each Series comprises of the aggregate principal amount of all outstanding Equipment Notes. The redemption price in such case will be the principal amount of such Equipment Notes required to be redeemed, together with accrued interest, but without any premium. |

(i) Release of Collateral | | United may request that Spare Engines Collateral or Aircraft Collateral specified by United be released from the lien of the applicable Security Document on any date following the first anniversary of the Class A Issuance Date (or, in the case of a Technical Impairment, on any date following the Class A Issuance Date), subject to satisfaction of certain conditions, including (but not limited to): |

| | • United reasonably expects the Collateral to be released would not otherwise be utilized as part of its in-service fleet, that the Collateral to be released is of a model that has been retired by United or that United has announced will be retired or that the Collateral to be released is subject to a Technical Impairment; |

| | • United delivers to the Loan Trustee one Appraisal from an applicable Appraiser dated a date no earlier than 90 days prior to such Release Request Date with respect to the Aggregate Appraised Value of the Collateral to be released; and |

| | • The Aggregate Appraised Value of the Collateral to be released does not exceed, together with all other Spare Engines Collateral and Aircraft Collateral (excluding Cure Cash Collateral allocated to any such Collateral Group and based on the most recent Appraised Values of remaining applicable Collateral) released pursuant to this provision during the same Relevant Period, the applicable Release Threshold. |

S-15

Table of Contents

| | | | |

| | "Release Threshold" means, with respect to any Release Request Date, (i) from the Class A Issuance Date to, but excluding the second anniversary of the Class A Issuance Date, $100,000,000, provided that from the Class A Issuance Date to, but excluding the first anniversary of the Class A Issuance Date, only Aircraft or Spare Engines that are subject to a Technical Impairment may be released pursuant to this provision; (ii) from the second anniversary of the Class A Issuance Date to, but excluding the third anniversary of the Class A Issuance Date, $100,000,000, (iii) from the third anniversary of the Class A Issuance Date to, but excluding the fourth anniversary of the Class A Issuance Date, $50,000,000, (iv) from the fourth anniversary of the Class A Issuance Date to, but excluding the fifth anniversary thereof, $50,000,000, (v) from the fifth anniversary of the Class A Issuance Date to, but excluding the sixth anniversary thereof, $40,000,000 and (vi) following the sixth anniversary of the Class A Issuance Date to, but excluding the seventh anniversary thereof, $40,000,000 (each such period, a "Relevant Period"). Notwithstanding the foregoing, with respect to any Relevant Period after the initial Relevant Period, the Release Threshold shall be increased by the unused portion of the Release Threshold for the immediately preceding Relevant Period. |

| | If, on any date of determination, Cure Cash Collateral is held by the Loan Trustee and the amount of such Cure Cash Collateral exceeds the amount necessary for avoiding a Collateral Trigger Event for such Collateral Group (in each case if determined as of such date), upon request by United the Loan Trustee will promptly release from the lien of the Security Documents all such (or all such excess) Cure Cash Collateral and pay it to United, subject to satisfaction of certain conditions. |

| | If the Debt Balance with respect to the Tier II Aircraft Collateral is zero (which is expected to occur on the payment date occurring in October 2024), upon request by United the Loan Trustee will promptly release from the lien of the Indenture all such Tier II Aircraft Collateral, subject to satisfaction of certain conditions. Any aircraft partially allocated to both the Tier I Aircraft Collateral and the Tier II Aircraft Collateral shall thereafter automatically fully constitute Tier I Aircraft Collateral. |

S-16

Table of Contents

| | | | |

| | United may use, install, dispose of, transfer or move its Spare Parts, in each case in any manner consistent with United's ordinary course of business. Furthermore, United may remove any location from the list of "designated locations" if such location does not then contain any Spare Parts (including as a result of a concurrent permitted ordinary course disposition or transfer of any Spare Parts located therein). Any such use, installation, move, disposition, transfer or removal shall result in a release of the lien of the Security Documents, and any such installation or disposition shall be made free and clear of the lien of the Security Documents. |

(j) Certain Spare Parts Covenants | | United will be required to maintain, as of each Collateral Test Date, Spare Parts representing at least 85% (by Aggregate Appraised Value) of its spare parts then available for use in its fleet at a "designated location". |

| | If any location owned or leased by United (other than a "designated location") shall as of any Collateral Test Date hold Spare Parts representing 1.5% or more of the aggregate Appraised Value of all spare parts then available for use in its fleet, United shall use reasonable commercial efforts to cause such location to be added as a "designated location". |

| | Spare Parts associated exclusively with aircraft models that have fully exited United's fleet will be given a value of zero for purposes of calculating the LTV Ratios for the Spares Collateral Group. |

| | Spare Parts other than Rotables and Repairables in excess of 25% (by Appraised Value) of the Aggregate Appraised Value of the Spare Parts Collateral shall be deemed to have a value of zero for purposes of calculating the LTV Ratios with respect to the Spares Collateral Group and all Collateral collectively. |

| | United will be required to deliver a certificate of United reflecting certain appraised value and other information regarding its spare parts and the Spare Parts Collateral, attaching a parts inventory report and reflecting compliance with the spare parts covenants reflected above, in each case, as of the applicable Collateral Test Date. |

Certain U.S. Federal Tax Consequences | | Each person acquiring an interest in Class B Certificates generally should report on its federal income tax return its pro rata share of income from the Series B Equipment Note and other property held by the Class B Trust. See "Certain U.S. Federal Tax Consequences". |

S-17

Table of Contents

| | | | |

Certain ERISA Considerations | | Each person who acquires a Class B Certificate will be deemed to have represented that either: (a) no employee benefit plan assets have been used to purchase or hold such Class B Certificate or (b) the purchase and holding of such Class B Certificate are exempt from the prohibited transaction restrictions of ERISA and the Code pursuant to one or more prohibited transaction statutory or administrative exemptions. See "Certain ERISA Considerations". |

| | | | | | |

| |

| | S&P | | Moody's |

|---|

Threshold Rating for the Liquidity Providers for the Class A Trust | | Long Term | | BBB | | Baa2 |

Threshold Rating for the Liquidity Providers for the Class B Trust | | Long Term | | BBB– | | Baa2 |

| | |

Liquidity Provider Rating | | The Liquidity Providers meet the Liquidity Threshold Rating requirements. |

S-18

Table of Contents

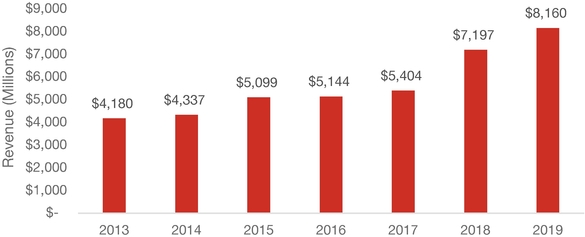

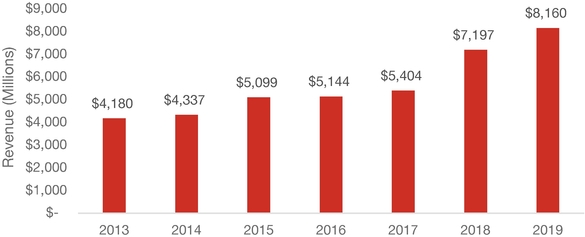

SUMMARY FINANCIAL AND OPERATING DATA

The following tables summarize certain consolidated financial and operating data with respect to United. This information was derived as follows:

Statement of operations data for the nine months ended September 30, 2020 and 2019 was derived from the unaudited consolidated financial statements of United, including the notes thereto, included in United's Quarterly Report on Form 10-Q for the quarter ended September 30, 2020. Statement of operations data for years ended December 31, 2019, 2018 and 2017 was derived from the audited consolidated financial statements of United, including the notes thereto, included in United's Annual Report on Form 10-K filed with the Commission on February 25, 2020 (the "Form 10-K").

Special charges data for the nine months ended September 30, 2020 and 2019 was derived from the unaudited consolidated financial statements of United, including the notes thereto, included in United's Quarterly Report on Form 10-Q for the quarter ended September 30, 2020. Special charges data for the years ended December 31, 2019, 2018 and 2017 was derived from the audited consolidated financial statements of United, including the notes thereto, included in the Form 10-K.

Balance sheet data as of September 30, 2020 was derived from the unaudited consolidated financial statements of United, including the notes thereto, included in United's Quarterly Report on Form 10-Q for the quarter ended September 30, 2020. Balance sheet data as of December 31, 2019 and 2018 was derived from the audited consolidated financial statements of United, including the notes thereto, included in the Form 10-K.

| | | | | | | | | | | | | | | | |

| | Nine Months Ended

September 30, | | Year Ended December 31, | |

|---|

| | 2020 | | 2019 | | 2019 | | 2018 | | 2017 | |

|---|

Statement of Operations Data(1)(in millions): | | | | | | | | | | | | | | | | |

Operating revenue | | $ | 11,943 | | $ | 32,371 | | $ | 43,259 | | $ | 41,303 | | $ | 37,784 | |

Operating expenses | | | 16,166 | | | 28,929 | | | 38,956 | | | 38,072 | | | 34,164 | |

Operating income (loss) | | | (4,223 | ) | | 3,442 | | | 4,303 | | | 3,231 | | | 3,620 | |

Net income (loss) | | | (5,171 | ) | | 2,369 | | | 3,011 | | | 2,123 | | | 2,161 | |

| | | | | | | | | | |

| | As of

September 30, | | As of December 31, | |

|---|

| | 2020 | | 2019 | | 2018 | |

|---|

Balance Sheet Data(in millions): | | | | | | | | | | |

Unrestricted cash, cash equivalents and short-term investments | | $ | 13,702 | | $ | 4,938 | | $ | 3,944 | |

Total assets | | | 61,189 | | | 52,605 | | | 49,018 | |

Debt and finance leases(2) | | | 27,295 | | | 14,818 | | | 13,792 | |

Stockholder's equity | | | 6,972 | | | 11,492 | | | 10,004 | |

(Footnotes on the next page)

| |

S-19

Table of Contents

- (1)

- Includes the following special charges (credit) and unrealized (gains) losses on investments:

| | | | | | | | | | | | | | | | | |

| |

| | Nine Months

Ended

September 30, | | Year Ended

December 31, | |

|---|

| |

| | 2020 | | 2019 | | 2019 | | 2018 | | 2017 | |

|---|

| | Special Charges (credit) (in millions): | | | | | | | | | | | | | | | | |

| | Operating: | | | | | | | | | | | | | | | | |

| | CARES Act grant credit(4) | | | (3,083 | ) | | — | | | — | | | — | | | — | |

| | Severance and benefit costs | | | 413 | | | 14 | | | 16 | | | 41 | | | 116 | |

| | Impairment of assets | | | 168 | | | 69 | | | 171 | | | 377 | | | 25 | |

| | Termination of a maintenance service agreement | | | — | | | — | | | — | | | 64 | | | — | |

| | (Gains) losses on sale of assets and other special charges, net | | | 35 | | | 33 | | | 59 | | | 5 | | | 35 | |

| | Nonoperating special charges and unrealized (gains) losses on investments: | | |

| | |

| | |

| | |

| | |

| |

| | Credit loss on BRW term loan and guarantee | | | 697 | | | — | | | — | | | — | | | — | |

| | Special termination benefits and settlement losses | | | 646 | | | — | | | — | | | — | | | — | |

| | Unrealized (gains) losses on investments | | | 295 | | | (72 | ) | | (153 | ) | | 5 | | | — | |

| | Income tax expense (benefit), net of valuation allowance related to special charges (credits) | | | 375 | | | (10 | ) | | (21 | ) | | (110 | ) | | (63 | ) |

| | Income tax adjustment(3) | | | — | | | — | | | — | | | (5 | ) | | (206 | ) |

- (2)

- Includes the current and noncurrent portions of debt and finance leases.

- (3)

- The Company recorded $5 million and $206 million of tax benefits in 2018 and 2017, respectively, due to the passage of the Tax Cuts and Jobs Act in the fourth quarter of 2017.

- (4)

- During the nine months ended September 30, 2020, the Company received approximately $5.1 billion in funding pursuant to the Payroll Support Program under the CARES Act, which consists of $3.6 billion in a grant and $1.5 billion in an unsecured loan. The Company also recorded $66 million in warrants issued to Treasury, within stockholders' equity, as an offset to the grant income. For the nine months ended September 30, 2020, the Company recognized $3.1 billion of the grant as a credit to Special charges (credit) with the remaining $453 million recorded as a deferred credit on our balance sheet. The Company expects to recognize the remainder of the grant income from the Payroll Support Program as Special charge (credit) during the fourth quarter of 2020 as the salaries and wages the grant is intended to offset are incurred.

S-20

Table of Contents

Selected Operating Data

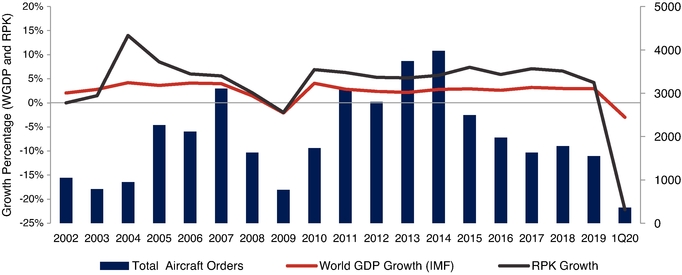

United transports people and cargo through its mainline operations, which utilize jet aircraft with at least 126 seats, and its regional operations, which utilize smaller aircraft that are operated under contract by United Express carriers. These regional operations are an extension of United's mainline network.

| | | | | | | | | | | | | | | | |

| | Nine Months Ended

September 30, | | Year Ended December 31, | |

|---|

| | 2020 | | 2019 | | 2019 | | 2018 | | 2017 | |

|---|

Consolidated Operations: | | | | | | | | | | | | | | | | |

Passengers (thousands)(1) | | | 42,911 | | | 122,137 | | | 162,443 | | | 158,330 | | | 148,067 | |

Revenue passenger miles (millions)(2) | | | 56,812 | | | 180,727 | | | 239,360 | | | 230,155 | | | 216,261 | |

Available seat miles (millions)(3) | | | 92,113 | | | 213,961 | | | 284,999 | | | 275,262 | | | 262,386 | |

Passenger load factor:(4) | | | | | | | | | | | | | | | | |

Consolidated | | | 61.7 | % | | 84.5 | % | | 84.0 | % | | 83.6 | % | | 82.4 | % |

Domestic | | | 62.7 | % | | 85.7 | % | | 85.2 | % | | 85.4 | % | | 85.2 | % |

International | | | 60.0 | % | | 82.9 | % | | 82.4 | % | | 81.3 | % | | 78.9 | % |

Passenger revenue per available seat mile (cents) | | | 10.20 | | | 13.88 | | | 13.90 | | | 13.70 | | | 13.13 | |

Total revenue per available seat mile (cents) | | | 12.97 | | | 15.13 | | | 15.18 | | | 15.00 | | | 14.40 | |

Average yield per revenue passenger mile (cents)(5) | | | 16.54 | | | 16.43 | | | 16.55 | | | 16.38 | | | 15.93 | |

Cargo revenue ton miles (millions)(6) | | | 1,876 | | | 2,440 | | | 3,329 | | | 3,425 | | | 3,316 | |

Aircraft in fleet at end of period | | | 1,319 | | | 1,348 | | | 1,372 | | | 1,329 | | | 1,262 | |

Average stage length (miles)(7) | | | 1,312 | | | 1,464 | | | 1,460 | | | 1,446 | | | 1,460 | |

Approximate employee headcount (thousands) | | | 88 | | | 95 | | | 96 | | | 92 | | | 90 | |

Average fuel price per gallon | | $ | 1.65 | | $ | 2.08 | | $ | 2.09 | | $ | 2.25 | | $ | 1.74 | |

Fuel gallons consumed (millions) | | | 1,501 | | | 3,221 | | | 4,292 | | | 4,137 | | | 3,978 | |

- (1)

- The number of revenue passengers measured by each flight segment flown.

- (2)

- The number of scheduled miles flown by revenue passengers.

- (3)

- The number of seats available for passengers multiplied by the number of scheduled miles those seats are flown.

- (4)

- Revenue passenger miles divided by available seat miles.

- (5)

- The average passenger revenue received for each revenue passenger mile flown.

- (6)

- The number of cargo revenue tons transported multiplied by the number of miles flown.

- (7)

- Average stage length equals the average distance a flight travels weighted for size of aircraft.

S-21

Table of Contents

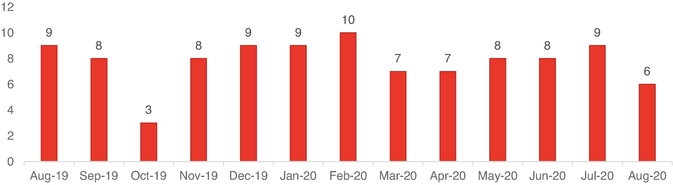

Recent Results

The following tables summarize certain consolidated financial and operating data with respect to United for the fourth quarters and full years ended December 31, 2020 and 2019.

| | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Year Ended December 31, | |

|---|

| | 2020 | | 2019 | | 2020 | | 2019 | |

|---|

Financial Data(1) (Unaudited—in millions): | | | | | | | | | | | | | |

Operating revenue | | $ | 3,412 | | $ | 10,888 | | $ | 15,355 | | $ | 43,259 | |

Net income (loss) | | | (1,896 | ) | | 642 | | | (7,067 | ) | | 3,011 | |

| | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Year Ended December 31, | |

|---|

| | 2020 | | 2019 | | 2020 | | 2019 | |

|---|

Operating Data(2): | | | | | | | | | | | | | |

Passengers (thousands) | | | 14,850 | | | 40,306 | | | 57,761 | | | 162,443 | |

Revenue passenger miles (millions) | | | 17,071 | | | 58,633 | | | 73,883 | | | 239,360 | |

Available seat miles (millions) | | | 30,691 | | | 71,038 | | | 122,804 | | | 284,999 | |

Passenger load factor | | | 55.6 | % | | 82.5 | % | | 60.2 | % | | 84.0 | % |

Passenger revenue per available seat mile (cents) | | | 7.85 | | | 13.98 | | | 9.61 | | | 13.90 | |

Cost per available seat mile (cents) | | | 18.07 | | | 14.11 | | | 17.68 | | | 13.67 | |

- (1)

- The summary of consolidated financial data is preliminary, because as of the date of this Prospectus Supplement, we have not completed our financial close process for 2020. This preliminary data is based upon our estimates and is subject to completion of our financial closing procedures. In addition, this preliminary data has not been audited or reviewed by our independent registered public accounting firm. This summary of recent results is not a comprehensive statement of our financial results or operating metrics for these periods.

- (2)

- For definitions of these operating data terms, see "Summary Financial and Operating Data—Selected Operating Data" above.

S-22

Table of Contents

RISK FACTORS

You should carefully consider the risks and uncertainties described below, together with all of the other information included in or incorporated by reference into this prospectus supplement, including the "Risk Factors" section contained in our most recent Annual Report on Form 10-K, as updated by subsequent Quarterly Reports on Form 10-Q and other reports filed by us with the Commission (which are incorporated by reference herein) before purchasing the Class B Certificates. If any of these risks actually occurs, our business, financial condition or results of operations could be materially adversely affected. As a result, the market value of the Class B Certificates could decline and you could lose part or all of your investment.

Unless the context otherwise requires, references in this "Risk Factors" section and "The Company" section to "UAL", "the Company", "we", "us" and "our" mean United Airlines Holdings, Inc. ("UAL") and its consolidated subsidiaries, including United Airlines, Inc. ("United"), and references to "United" include United's consolidated subsidiaries.

Risk Factors Relating to Recent Events

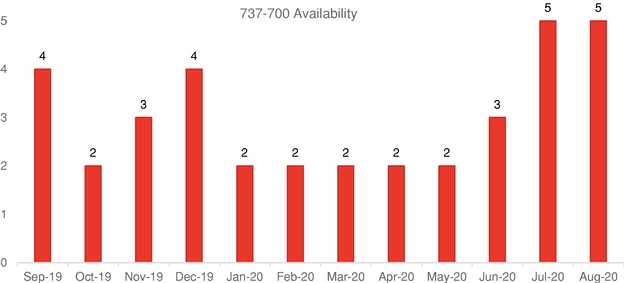

Continued restrictions on the use of the Boeing 737 MAX aircraft, and the inability to accept or integrate new aircraft into our fleet as planned, may have a material adverse effect on our business, operating results and financial condition.

On March 13, 2019, the Federal Aviation Administration (the "FAA") issued an emergency order prohibiting the operation of Boeing 737 MAX series aircraft by U.S. certificated operators (the "FAA Order"). As a result, the Company grounded all 14 Boeing 737 MAX 9 aircraft in its fleet, and The Boeing Company ("Boeing") also suspended deliveries of new Boeing 737 MAX series aircraft. On November 18, 2020, the FAA announced that it had rescinded the FAA Order and cleared the 737 MAX aircraft to fly again after a 20 month review and certification process. Several countries, following FAA's lead, have lifted the grounding of the Boeing 737 MAX aircraft—including Brazil, Canada and Mexico. Other countries, including certain countries that are part of the European aviation authority, have delayed their expected approval of the aircraft until early 2021. There are also many countries, such as China, that have no current plans to lift the aircraft's grounding and may not do so in the foreseeable future.

In 2019, the grounding affected the delivery of 16 Boeing 737 MAX aircraft that were scheduled for delivery in 2019 and were not delivered, and it also affected the timing of future Boeing 737 MAX aircraft deliveries, including the Boeing 737 MAX aircraft of which the Company planned to take delivery in 2020. The extent of the delay of future deliveries is expected to be impacted by Boeing's production rate and the pace at which Boeing can deliver aircraft, among other factors, and these factors have been and could continue to be significantly impacted by the novel coronavirus ("COVID-19") pandemic. If, for any reason, we are unable to accept deliveries of new aircraft or integrate such new aircraft into our fleet as planned, we may face higher financing and operating costs than planned, or be required to seek extensions of the terms for certain leased aircraft or otherwise delay the exit of other aircraft from our fleet. Such unanticipated extensions or delays may require us to operate existing aircraft beyond the point at which it is economically optimal to retire them, resulting in increased maintenance costs, or reductions to our schedule, thereby reducing revenues.

In response to the grounding of the Boeing 737 MAX aircraft, the Company made adjustments to its flight schedule and operations, including substituting replacement aircraft on routes originally intended to be flown by Boeing 737 MAX aircraft. In 2019 and early 2020, the grounding impacted the Company's ability to implement its strategic growth strategy, reducing the Company's scheduled capacity from its planned capacity, and resulted in increased costs as well as lower operating revenue. Continued restrictions on the use of Boeing 737 MAX aircraft in other countries could impact the aircraft's optimal use in our network. Furthermore, in 2021, like 2020, demand has been, and is expected to continue to be, significantly impacted by COVID-19, which, in addition to the previous

S-23

Table of Contents

grounding of the Boeing 737 MAX aircraft, has materially disrupted the timely execution of our plans to add capacity in 2021. The Company had discussions with Boeing regarding compensation from Boeing for the Company's financial damages related to the grounding of the airline's Boeing 737 MAX aircraft, and in March 2020, the Company entered into a confidential settlement with Boeing with respect to compensation for financial damages incurred in 2019. The settlement agreement was amended and restated in June 2020 to provide for the settlement of additional items related to aircraft delivery and to update the scheduled delivery for substantially all undelivered Boeing 737 MAX aircraft.

We are subject to many forms of environmental regulation and liability and risks associated with climate change, and may incur substantial costs as a result.

Many aspects of the Company's operations are subject to increasingly stringent federal, state, local and international laws protecting the environment, including those relating to emissions to the air, water discharges, safe drinking water and the use and management of hazardous materials and wastes. Compliance with existing and future environmental laws and regulations can require significant expenditures and violations can lead to significant fines and penalties. In addition, from time to time we are identified as a responsible party for environmental investigation and remediation costs under applicable environmental laws due to the disposal of hazardous substances generated by our operations. We could also be subject to environmental liability claims from various parties, including airport authorities, related to our operations at our owned or leased premises or the off-site disposal of waste generated at our facilities.

We may incur substantial costs as a result of changes in weather patterns due to climate change. Increases in the frequency, severity or duration of severe weather events such as thunderstorms, hurricanes, flooding, typhoons, tornados and other severe weather events could result in increases in delays and cancellations, turbulence-related injuries and fuel consumption to avoid such weather, any of which could result in significant loss of revenue and higher costs.

To mitigate climate change risks, the Carbon Offsetting and Reduction Scheme for International Aviation ("CORSIA") has been developed by the International Civil Aviation Organization ("ICAO"), a UN specialized agency. CORSIA is intended to create a single global market-based measure to achieve carbon-neutral growth for international aviation after 2020 through airline purchases of carbon offset credits. Certain CORSIA program details remain to be developed and could potentially be affected by political developments in participating countries or the results of the pilot phase of the program, and thus the impact of CORSIA cannot be fully predicted. However, CORSIA is expected to result in increased operating costs for airlines that operate internationally, including the Company.

In addition to CORSIA, in December 2020 the U.S. Environmental Protection Agency ("EPA") adopted its own aircraft and aircraft engine greenhouse gas ("GHG") emission standards, which are aligned with the 2017 ICAO airplane carbon dioxide emission standards. Other jurisdictions in which United operates have adopted or are considering GHG emission reduction initiatives, which could impact various aspects of the Company's business. While the Company has voluntarily pledged to reduce 100% of our GHG emissions by 2050, the precise nature of future requirements and their applicability to the Company are difficult to predict, and the financial impact to the Company and the aviation industry would likely be adverse and could be significant if they vary significantly from the Company's own plans and strategy with respect to reducing GHG emissions.

The United Kingdom's withdrawal from the EU may adversely impact our operations in the United Kingdom and elsewhere.

On January 31, 2020, the United Kingdom ("UK") withdrew from the European Union ("EU"), and started a transition period that ran through December 31, 2020. During that time, the EU and UK

S-24

Table of Contents

negotiated a comprehensive trade agreement that provisionally went into effect on January 1, 2021. The agreement includes an aviation chapter that preserves EU-UK air connectivity.

In connection with the UK's exit from the EU, we could face new challenges in our operations, such as instability in global financial and foreign exchange markets. This instability could result in market volatility, including in the value of the British pound and European euro, additional travel restrictions on passengers traveling between the UK and EU countries, changes to the legal status of EU-resident employees, legal uncertainty and divergent national laws and regulations. At this time, we cannot predict the precise impact that the UK's exit from the EU will have on our business generally and our UK and European operations more specifically, and no assurance can be given that our operating results, financial condition and prospects would not be adversely impacted by the result.

The Company's ability to use its net operating loss carryforwards and certain other tax attributes to offset future taxable income for U.S. federal income tax purposes may be significantly limited due to various circumstances, including certain possible future transactions involving the sale or issuance of UAL common stock, or if taxable income does not reach sufficient levels.

As of December 31, 2020, UAL reported consolidated U.S. federal net operating loss ("NOL") carryforwards of approximately $11.0 billion.

The Company's ability to use its NOL carryforwards and certain other tax attributes will depend on the amount of taxable income it generates in future periods. As a result, certain of the Company's NOL carryforwards and other tax attributes may expire before it can generate sufficient taxable income to use them in full.

In addition, the Company's ability to use its NOL carryforwards and certain other tax attributes to offset future taxable income may be limited if it experiences an "ownership change" as defined in Section 382 of the Internal Revenue Code of 1986, as amended ("Section 382"). An ownership change generally occurs if certain stockholders increase their aggregate percentage ownership of a corporation's stock by more than 50 percentage points over their lowest percentage ownership at any time during the testing period, which is generally the three-year period preceding any potential ownership change. In general, a corporation that experiences an ownership change will be subject to an annual limitation on its pre-ownership change NOLs and certain other tax attribute carryforwards equal to the value of the corporation's stock immediately before the ownership change, multiplied by the applicable long-term, tax-exempt rate posted by the U.S. Internal Revenue Services ("IRS"). Any unused annual limitation may, subject to certain limits, be carried over to later years, and the limitation may, under certain circumstances, be increased by built-in gains in the assets held by such corporation at the time of the ownership change. This limitation could cause the Company's U.S. federal income taxes to be greater, or to be paid earlier, than they otherwise would be, and could cause a portion of the Company's NOLs and certain other tax attributes to expire unused. Similar rules and limitations may apply for state income tax purposes.

For purposes of determining whether there has been an "ownership change," the change in ownership as a result of purchases by "5-percent shareholders" will be aggregated with certain changes in ownership that occurred over the three-year period ending on the date of such purchases. Potential future transactions involving the sale or issuance of UAL common stock may increase the possibility that the Company will experience a future ownership change under Section 382. Such transactions may include the exercise of warrants issued in connection with the Coronavirus Aid, Relief, and Economic Security Act (the "CARES Act") programs, the issuance of UAL common stock upon the conversion of any convertible debt that UAL may issue in the future, the repurchase of any debt with UAL common stock, any issuance of UAL common stock for cash, and the acquisition or disposition of any stock by a stockholder owning 5% or more of the outstanding shares of UAL common stock, or a combination of the foregoing. If we were to experience an "ownership change," it is possible that the Company's NOLs

S-25

Table of Contents

and certain other tax attribute carryforwards could expire before we would be able to use them to offset future income tax obligations.

On December 4, 2020, the board of directors of the Company adopted a tax benefits preservation plan (the "Plan") in order to preserve the Company's ability to use its NOLs and certain other tax attributes to reduce potential future income tax obligations. The Plan is designed to reduce the likelihood that the Company experiences an "ownership change" by deterring certain acquisitions of Company securities. There is no assurance, however, that the deterrent mechanism will be effective, and such acquisitions may still occur. In addition, the Plan may adversely affect the marketability of UAL common stock by discouraging existing or potential investors from acquiring UAL common stock or additional shares of UAL common stock because any non-exempt third party that acquires 4.9% or more of the then-outstanding shares of UAL common stock would suffer substantial dilution of its ownership interest in the Company.

Risk Factors Relating to the Class B Certificates and the Offering

The Series B Equipment Note will not be an obligation of UAL.

The Series B Equipment Note to be held for the Class B Trust will be the obligation of United. Neither UAL nor any of its subsidiaries (other than United) is required to become an obligor with respect to, or a guarantor of, the Series B Equipment Note. You should not expect UAL or any of its subsidiaries (other than United) to participate in making payments in respect of the Series B Equipment Note.

The Appraisals are only estimates of Collateral value.

One independent appraisal and consulting firm has prepared an appraisal of the Spare Parts, and three such firms have prepared appraisals of the Spare Engines and the Aircraft. In addition, one of such firms has prepared a report on the maintenance status of the Spare Engines and Aircraft for purposes of adjusting their Appraised Values based on their maintenance condition. Letters summarizing such appraisals and such maintenance report are annexed to this Prospectus Supplement as Appendix II. Such appraisals are based on varying assumptions and methodologies, which differ among the appraisers. Such appraisals and report were prepared without physical inspection of the Collateral (except in the case of the Spare Parts, for which a virtual inspection as discussed therein was conducted) based on information provided by United. In addition, the appraisals include certain assumptions regarding the equipment specifications and performance characteristics of the Spare Engines and Aircraft. However, the Security Documents relating to the Spare Engines and Aircraft permit United to make alterations and modifications to the Spare Engines and Aircraft and to remove parts therefrom, which may impact such assumptions. Also, as noted in the mba report, some Aircraft and Spare Engine Maintenance Adjusted Base Values are floored at salvage value. As such, the maintenance adjustments used for calculating Appraised Value is derived by subtracting the Half-Life Base Value from the Maintenance Adjusted Base Value. Appraisals and maintenance adjustments that are based on other assumptions and methodologies or other available information may result in valuations or adjustments that are materially different from those contained in such appraisals or maintenance reports. See "Description of the Collateral and the Appraisals—The Appraisals".