UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

Copies to:

| | |

| Robert Griffith, Esq. | | Stephen H. Bier, Esq. |

| Goldman Sachs & Co. LLC | | Dechert LLP |

| 200 West Street | | 1095 Avenue of the Americas |

| New York, New York 10282 | | New York, NY 10036 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: October 31

Date of reporting period: April 30, 2024

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds Semi-Annual Report April 30, 2024 Dividend Focus Funds Goldman Sachs Income Builder Fund Goldman Sachs Rising Dividend Growth Fund

Goldman Sachs Dividend Focus Funds

| | |

| ∎ | | GOLDMAN SACHS INCOME BUILDER FUND |

| | |

| ∎ | | GOLDMAN SACHS RISING DIVIDEND GROWTH FUND |

TABLE OF CONTENTS

Effective January 24, 2023, open-end mutual funds and exchange-traded funds are required to provide shareholders with streamlined annual and semi-annual shareholder reports (“Tailored Shareholder Reports”). Funds will be required to prepare a separate Tailored Shareholder Report for each share class of a fund that highlights key information to investors. Other information, including financial statements, will no longer appear in a fund’s shareholder report, but will be available online, delivered free of charge upon request, and filed with the Securities and Exchange Commission on a semi-annual basis on Form N-CSR. The new requirements have a compliance date of July 24, 2024.

| | | | | | |

| | | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee | | |

MARKET REVIEW

Dividend Focus Funds

The following are highlights both of key factors affecting the U.S. equity, U.S. fixed income and energy MLP markets as well as of any key changes made to the Goldman Sachs Dividend Focus Funds (the “Funds”) during the six months ended April 30, 2024 (the “Reporting Period”). A streamlined annual shareholder report covering the 12 months ended October 31, 2024 will be provided to the Funds’ shareholders, per new SEC requirements with a compliance date of July 24, 2024.

Market and Economic Review

U.S. Equities

| ∎ | Overall, U.S. equities rallied during the Reporting Period. The Standard & Poor’s 500 Index (the “S&P 500 Index”) ended the Reporting Period with a return of 20.98%. The Russell 3000® Index generated a return of 21.09%. |

| ∎ | Despite ongoing geopolitical tensions and persistent volatility, the market posted solid returns during the Reporting Period amid a backdrop of shifting expectations around the Federal Reserve’s (“Fed”) policy path forward and generally broadening market leadership. |

| ∎ | As the Reporting Period began in November 2023, the S&P 500 Index rose 9.13%, marking its best month of performance since July 2022 and breaking a streak of three consecutive monthly declines. |

| | ∎ | The month saw a broadening of market leadership following mega-cap dominance for most of 2023, as all sectors except energy were positive amid a pullback in crude oil prices, which fell to their lowest levels since July 2023. |

| | ∎ | November’s gains were chiefly driven by reinforcements to the peak federal funds rate, soft landing and disinflation traction themes and a rally in U.S. Treasuries, which had one of their best monthly performances on record. (A soft landing, in economics, is a cyclical downturn that avoids recession. It typically describes attempts by central banks to raise interest rates just enough to stop an economy from overheating and experiencing high inflation, without causing a significant increase in unemployment, or a hard landing.) |

| | ∎ | Further, November saw the most significant easing in financial conditions of any month in more than four decades. |

| ∎ | In December 2023, the S&P 500 Index increased 4.54%, marking its second consecutive monthly gain and ending the calendar year recording its ninth consecutive weekly gain. |

| | ∎ | The breadth of market gains continued to expand beyond the Magnificent Seven. (The Magnificent Seven is the group of high-performing and influential companies that drove U.S. equity performance for much of 2023.) |

| | ∎ | December’s market rally was driven by a dovish pivot in the Federal Reserve’s (“Fed”) monetary policy campaign, a decline in U.S. Treasury yields across the yield curve (or spectrum of maturities), and economic data supporting the soft landing narrative. (Dovish tends to suggest lower interest rates; opposite of hawkish.) |

| | ∎ | The Fed held interest rates unchanged, as growth of the U.S. economy slowed, the unemployment rate remained low despite abating job gains, and inflationary pressures continued to trend downwards. |

| | ∎ | Near the end of the month, there was a major shift in the Fed’s policy path expectations, with the Summary of Economic Projections median dot plot signaling 75 basis points of rate cuts in 2024. (A basis point is 1/100th of a percentage point. The Fed’s dot plot shows the interest rate projections of the members of the Federal Open Market Committee.) |

| | ∎ | U.S. economic data provided further evidence of disinflation momentum, with November’s annualized Consumer Price Index (“CPI”) dropping to its lowest level since March 2021. |

| ∎ | Market seasonality proved to be another tailwind to equities, as November and December historically represent the strongest two-month period for U.S. stocks. |

MARKET REVIEW

| ∎ | The S&P 500 Index gained 10.56% in the first quarter of 2024, closing the quarter at a new all-time high and demonstrating an improvement in market breadth as the quarter progressed. |

| | ∎ | As strength broadened beyond technology, excitement around artificial intelligence (“AI”) capabilities served as a key tailwind to market performance. |

| | ∎ | U.S. equities began the quarter with a more cautionary tone, driven by concerns regarding overvalued conditions and the Fed’s ability to match aggressive interest rate cut expectations. U.S. Treasury yields across the curve steepened, a headwind to equity valuations as traders repriced expectations throughout the quarter regarding the path of monetary policy. |

| | ∎ | Despite this defensive start, stocks reversed course as economic releases and robust labor market data continued to underpin the prevailing soft landing narrative. Market participants initially had aggressive expectations of interest rate cuts as early as March 2024, though expectations were moderated as inflation data spiked with the January and February CPI reports rising more than widely anticipated—shifting consensus timing expectations back to June 2024 for the first interest rate cut. |

| | ∎ | On the earnings front, corporate earnings were better than consensus expected with stable 2024 outlooks and optimism from the reopening of corporate buybacks as well as both sales and earnings exceeding market forecasts based on improved profit margins across most sectors. |

| ∎ | In April 2024, the S&P 500 Index fell 4.08%, notching its first monthly decline of 2024 as markets significantly repriced interest rate cut expectations for 2024, partially driven by decelerating U.S. economic growth in the first calendar quarter, a still strong labor market and persistent above-target inflation data. |

| | ∎ | The broader equity market had initially forecasted three interest rate cuts in 2024, though consensus expectations were moderated throughout the month as Fed Chair Powell cited that multiple inflation readings raised uncertainty regarding the Fed’s ability to cut rates in 2024. |

| | ∎ | Further, a slate of Fed officials stressed the risks of easing monetary policy prematurely and indicated the Fed would need to be patient given strength in then-recent economic data. They expressed the possibility of a no rate cut scenario—leaving the market pricing in just 25 basis points of rate cuts by the end of 2024. |

| | ∎ | S&P 500 constituents reported first quarter 2024 corporate earnings that were broadly better than consensus expected, with the number of reported companies exceeding analyst estimates trending above its historical 10-year average. |

| ∎ | For the Reporting Period overall, all capitalization segments within the U.S. equity market posted double-digit absolute gains, led by mid-cap stocks, as measured by the Russell Midcap® Index, followed by large-cap stocks, as measured by the Russell 1000® Index, and then small-cap stocks, as measured by the Russell 2000® Index. From a style perspective, growth stocks moderately outperformed value stocks across the capitalization spectrum. (All as measured by the FTSE Russell indices.) |

| ∎ | All 11 sectors of the S&P 500 Index generated double-digit positive total returns during the Reporting Period. The best performing sectors within the S&P 500 Index during the Reporting Period were communication services, financials, information technology and industrials. The weakest performing sectors were real estate, energy, health care and consumer staples. |

U.S. Fixed Income

| ∎ | The U.S. fixed income market recorded a positive return for the Reporting Period. |

| | ∎ | The Bloomberg U.S. Aggregate Bond Index, representing U.S. bonds of investment grade quality or better, returned 4.97%. |

| | ∎ | U.S. high yield corporate bonds, as represented by the ICE BofAML BB to B US High Yield Constrained Index, returned 8.57%. |

MARKET REVIEW

| ∎ | As the Reporting Period began in November 2023, the U.S. saw the greatest easing of financial conditions in any month during the previous 40 years. Factors behind the easing included ongoing disinflation, soft landing optimism and expectations of a dovish Fed pivot. (A soft landing, in economics, is a cyclical downturn that avoids recession. It typically describes attempts by central banks to raise interest rates just enough to stop an economy from overheating and experiencing high inflation, without causing a significant increase in unemployment, or a hard landing. Dovish suggests lower interest rates; opposite of hawkish.) |

| | ∎ | Government bond yields plunged, with the 10-year U.S. Treasury yield falling approximately 67 basis points. (A basis point is 1/100th of a percentage point.) |

| | ∎ | Spread, or non-government bond, sectors broadly advanced, with high yield corporate bonds delivering especially strong gains. |

| ∎ | In December, the Fed signaled it might have reached the peak of its current monetary policy tightening cycle, and its median dot plot projection showed 75 basis points of rate cuts in 2024. (The dot plot shows interest rate projections of the members of the Federal Open Market Committee.) |

| | ∎ | Bond yields fell during the month, with the 10-year U.S. Treasury yield dropping below 4% for the first time since August 2023. |

| | ∎ | Market projections for Fed rate cuts bolstered spread sector performance, fueling additional gains by high yield corporate bonds. |

| ∎ | During the first quarter of 2024, bond yields were, by turns, pushed up by hawkish Fed commentary and soft landing optimism and pushed down by progress on disinflation and changing investor expectations about potential Fed rate cuts. |

| | ∎ | High yield corporate bonds generated positive returns, supported by a mix of better than consensus expected corporate earnings and favorable supply/demand dynamics, including a surge of new issuance and positive investment flows into high yield corporate bond mutual funds. |

| ∎ | In April 2024, strong U.S. economic data and resilient labor markets coincided with upside inflation surprises. The combination appeared to raise the bar for Fed monetary policy easing, increasing the prospect of a prolonged period of elevated interest rates. |

| | ∎ | Bond yields rose significantly, with the two-year U.S. Treasury yield climbing above 5% for the first time since November 2023. |

| | ∎ | As interest rates rose in April, high yield corporate bonds weakened, though they held up better than most other spread sectors. |

| ∎ | During the Reporting Period overall, yields fell along the U.S. Treasury yield curve, with the yields on the longest maturities dropping the most. |

| | ∎ | The U.S. Treasury yield curve was inverted between two-year and 10-year maturities throughout the Reporting Period. (When the yield curve is inverted, two-year yields are higher than 10-year yields. Historically, an inverted U.S. Treasury yield curve often precedes an economic recession.) |

MARKET REVIEW

Energy MLPs

| ∎ | Energy equities generally outperformed energy commodities during the Reporting Period. The S&P energy sector, as represented by the S&P 500® Energy Select Sector Index (“IXE”)1, returned 11.75% and the broad midstream2 sector, as represented by the Alerian US Midstream Energy Index (“AMUS”)3, returned 18.87% during the Reporting Period. To compare, the S&P 500 Index, a measure of the broad U.S. equities market, finished the Reporting Period up 20.98%. The Bloomberg Commodity Index4 returned -0.18% for the Reporting Period, as West Texas Intermediate crude oil prices drifted solidly higher but natural gas prices were down significantly. |

| ∎ | Despite ongoing macroeconomic uncertainty for much of 2023, energy-related equities remained resilient to begin the Reporting Period in the last two months of the calendar year amid a pullback in crude oil prices, driven by heightened geopolitical tensions with the outbreak of war in the Middle East. |

| ∎ | As the Reporting Period progressed, strong midstream performance was underpinned by a supportive commodity price backdrop and a better appreciation from investors around the sector’s value proposition. |

| | ∎ | Midstream energy fundamentals were some of the most attractive they have been, with energy companies generating record amounts of free cash flow. This, in turn, gave energy companies the ability to de-lever significantly, creating less volatility in equity prices. |

| | ∎ | Management teams have been intently focused on maximizing shareholder value, i.e., they have been more disciplined on capital expenditures, stable and growing dividends, and share buyback programs. Such management focus helped drive equity price performance. |

| ∎ | During the Reporting Period, there was a growing divergence in midstream equity performance, with Master Limited Partnerships (“MLPs”) outperforming C-Corps. As a reminder, the midstream opportunity set includes companies structured as MLPs and C-Corps, with C-Corps currently representing the majority of the midstream market capitalization. We believe MLP outperformance was largely attributed to two factors. |

| | ∎ | First, MLP valuation mean reversion for MLP multiples. (Mean reversion is a financial theory positing that asset prices and historical returns eventually revert to their long-term mean or average level. Multiples is a generic term for a class of different indicators that can be used to value a security. A multiple is simply a ratio that is calculated by dividing the market or estimated value of an asset by a specific item on the financial statements.) |

| | ∎ | Second, continued consolidation in the MLP market segment, with C-Corps buying MLPs for a premium, which has benefited MLPs’ performance and created a technical tailwind for many of the smaller MLPs. Notably, MLP-only indices have reallocated consolidation proceeds to a smaller MLP universe. |

| ∎ | Overall, we believed at the end of the Reporting Period that the midstream sector presented a compelling investment opportunity amid a strong commodity price backdrop, healthy fundamentals and discounted valuations. |

Fund Changes and Highlights

No material changes were made to the Funds during the Reporting Period.

| 1 | All components of the S&P 500® Index are assigned to one of the eleven Select Sector Indices, which seek to track major economic segments and are highly liquid benchmarks. The S&P 500® Energy Select Sector Index (“IXE”) comprises those companies included in the S&P 500® Index that are classified as members of the GICS® energy sector. |

| 2 | The midstream component of the energy industry is usually defined as those companies providing products or services that help link the supply side (i.e., energy producers) and the demand side (i.e., energy end-users for any type of energy commodity. Such midstream businesses can include, but are not limited to, those that process, store, market and transport energy commodities. |

| 3 | Source: Alerian. The Alerian US Midstream Energy Index is a broad-based composite of U.S. energy infrastructure companies. The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return basis (AMUS) and on a total-return basis (AMUSX). It is not possible to invest directly in an unmanaged index. |

| 4 | The Bloomberg Commodity Index is made up of 23 exchange-traded futures on physical commodities, representing 21 commodities which are weighted to account for economic significance and market liquidity. |

FUND BASICS

Goldman Sachs Income Builder Fund

as of April 30, 2024

| | | | | | | | | | | | |

| | | | | | |

November 1, 2023–April 30, 2024 | | Fund Total

Return

(based on NAV)1 | | | | Russell 1000®

Value Index2 | | | | ICE BofAML BB to B U.S. High

Yield Constrained Index3 | | |

| | | | | | |

Class A | | 12.15% | | | | 18.42% | | | | 8.57% | | |

| | | | | | |

Class C | | 11.70 | | | | 18.42 | | | | 8.57 | | |

| | | | | | |

Institutional | | 12.30 | | | | 18.42 | | | | 8.57 | | |

| | | | | | |

Investor | | 12.30 | | | | 18.42 | | | | 8.57 | | |

| | | | | | |

Class R6 | | 12.31 | | | | 18.42 | | | | 8.57 | | |

| | | | | | |

Class P | | 12.35 | | | | 18.42 | | | | 8.57 | | |

| | 1 | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | The Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® Index companies with lower price-to-book ratios and lower expected growth values. This index is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment. The Index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics. It is not possible to invest directly in an unmanaged index. |

| | 3 | The ICE BofAML BB to B U.S. High Yield Constrained Index contains all securities in the ICE BofAML U.S. High Yield Index rated BB1 through B3, based on an average of Moody’s, S&P and Fitch, but caps issuer exposure at 2%. Index constituents are capitalization-weighted, based on their current amount outstanding, provided the total allocation to an individual issuer does not exceed 2%. Issuers that exceed the limit are reduced to 2% and the face value of each of their bonds is adjusted on a pro-rata basis. Similarly, the face values of bonds of all other issuers that fall below the 2% cap are increased on a pro-rata basis. It is not possible to invest directly in an unmanaged index. |

| | | The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

|

|

TOP TEN EQUITY HOLDINGS AS OF 4/30/24‡ |

| | | | |

| | |

Holding | | % of Net Assets | | Line of Business |

| | |

JPMorgan Chase & Co. | | 1.2% | | Banks |

Exxon Mobil Corp. | | 0.8 | | Oil, Gas & Consumable Fuels |

Progressive Corp. | | 0.8 | | Insurance |

Blackstone, Inc. | | 0.8 | | Capital Markets |

Shell PLC | | 0.8 | | Oil, Gas & Consumable Fuels |

Rio Tinto PLC | | 0.7 | | Metals & Mining |

Dell Technologies, Inc. | | 0.7 | | Technology Hardware, Storage & Peripherals |

Allstate Corp. | | 0.6 | | Insurance |

Johnson & Johnson | | 0.7 | | Pharmaceuticals |

ConocoPhillips | | 0.6 | | Oil, Gas & Consumable Fuels |

| | ‡ | The top 10 holdings may not be representative of the Fund’s future investments. |

FUND BASICS

|

|

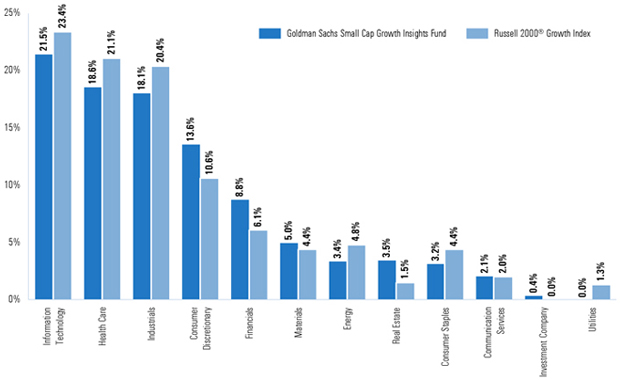

FUND’S EQUITY SECTOR ALLOCATIONS VS. BENCHMARK† |

| † | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of the total value of the Fund’s equity investments. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. Underlying sector allocations of exchange traded funds and other investment companies held by the Fund are not reflected in the graph above. |

FUND BASICS

|

|

FUND’S FIXED INCOME COMPOSITION* |

| * | The percentage shown for each investment category reflects the value of investments in that category as a percentage of the Fund’s Fixed Income investments. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| | For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance. |

FUND BASICS

Goldman Sachs Rising Dividend Growth Fund

as of April 30, 2024

| | | | |

| | |

November 1, 2023–April 30, 2024 | | Fund Total

Return

(based on NAV)1 | | S&P 500 Index2 |

| | |

Class A | | 18.09% | | 20.98% |

| | |

Class C | | 17.69 | | 20.98 |

| | |

Institutional | | 18.31 | | 20.98 |

| | |

Investor | | 18.22 | | 20.98 |

| | |

Class R6 | | 18.33 | | 20.98 |

| | |

Class R | | 17.98 | | 20.98 |

| | |

Class P | | 18.31 | | 20.98 |

| | 1 | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | The S&P 500® Index is the Standard & Poor’s 500 Composite Index of 500 stocks, an unmanaged index of common stock prices. The index figure does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | | The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

|

|

TOP TEN HOLDINGS AS OF 4/30/24± |

| | | | |

| | |

Holding | | % of Net Assets | | Line of Business |

| | |

Comcast Corp. | | 2.3% | | Media |

Energy Transfer LP | | 1.9 | | Oil, Gas & Consumable Fuels |

MPLX LP | | 1.8 | | Oil, Gas & Consumable Fuels |

Enterprise Products Partners LP | | 1.6 | | Oil, Gas & Consumable Fuels |

Texas Instruments, Inc. | | 1.6 | | Semiconductors & Semiconductor Equipment |

Intuit, Inc. | | 1.5 | | Software |

Microsoft Corp. | | 1.5 | | Software |

Oracle Corp. | | 1.5 | | Software |

Accenture PLC | | 1.5 | | IT Services |

Applied Materials, Inc. | | 1.4 | | Semiconductors & Semiconductor Equipment |

| | ± | The top 10 holdings may not be representative of the Fund’s future investments. The top 10 holdings exclude investments in money market funds. |

FUND BASICS

|

|

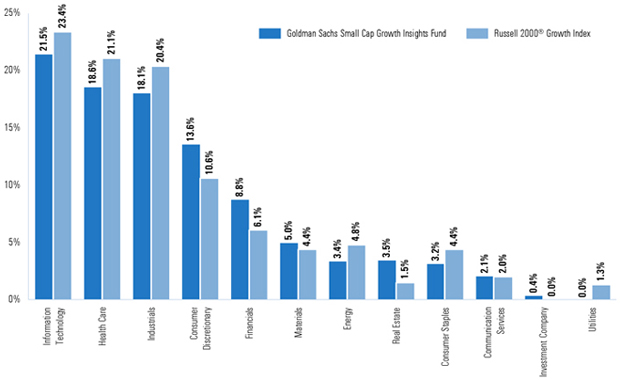

FUND VS. BENCHMARK SECTOR ALLOCATION† |

| † | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”); however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value (excluding investments in the securities lending reinvestment vehicle, if any). The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. Underlying sector allocations of exchange traded funds and other investment companies held by the Fund are not reflected in the graph above. Figures in the graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. |

| | For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance. |

FUND BASICS

Index Definitions

Russell 1000® Value Index (with dividends reinvested) is an unmanaged market capitalization weighted index of the 1000 largest U.S. companies with lower price-to-book ratios and lower forecasted growth values. The figures for the Russell 1000® Value Index do not include any deduction for fees, expenses or taxes.

ICE BofAML BB to B US High Yield Bond Index contains all securities in the ICE BofAML U.S. High Yield Index rated BB1 through B3, based on an average of Moody’s, S&P and Fitch, but caps issuer exposure at 2%. Index constituents are capitalization-weighted, based on their current amount outstanding, provided the total allocation to an individual issuer does not exceed 2%. Issuers that exceed the limit are reduced to 2% and the face value of each of their bonds is adjusted on a pro-rata basis. Similarly, the face values of bonds of all other issuers that fall below the 2% cap are increased on a pro-rata basis. It is not possible to invest directly in an unmanaged index.

S&P 500® Index is a U.S. stock market index based on the market capitalizations of 500 large companies having common stock listed on the New York Stock Exchange or NASDAQ. The S&P 500® Index components and their weightings are determined by S&P Dow Jones Indices.

S&P 500® Index Energy Select Sector Index (“IXE”) comprises those companies included in the S&P 500® Index that are classified as members of the GICS® energy sector.

Alerian US Midstream Energy Index is a broad-based composite of U.S. energy infrastructure companies. The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return basis (AMUS) and on a total-return basis (AMUSX). It is not possible to invest directly in an unmanaged index.

Russell 1000® Index measures the performance of the large-cap segment of the U.S. equity universe. The Russell 1000® Index is a subset of the Russell 3000® Index and includes approximately 1000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000® Index represents approximately 92% of the U.S. market. The Russell 1000® Index is constructed to provide a comprehensive and unbiased barometer for the large-cap segment and is completely reconstituted annually to ensure new and growing equities are reflected.

Russell 3000® Index is a market capitalization weighted equity index maintained by the FTSE Russell that provides exposure to the entire U.S. stock market. The index tracks the performance of the 3,000 largest U.S.-traded stocks which represent about 98% of all U.S incorporated equity securities. It is not possible to invest directly in an index.

Bloomberg U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds and mortgage-backed and asset-backed securities. The Index figure does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index.

GOLDMAN SACHS INCOME BUILDER FUND

|

Schedule of Investments April 30, 2024 (Unaudited) |

| | | | | | | | | | | | | | | | |

| | | Principal Amount | | | Interest

Rate | | | Maturity Date | | Value | |

| |

| | Corporate Obligations – 49.1% | |

| |

| | Advertising(a)(b) – 0.1% | |

| | Clear Channel Outdoor Holdings, Inc. | |

| | $ | | | 3,210,000 | | | | 7.875 | % | | 04/01/30 | | $ | 3,143,553 | |

| | | |

| | Aerospace & Defense(a) – 0.8% | |

| | Boeing Co. | |

| | | | | 1,875,000 | | | | 3.450 | | | 11/01/28 | | | 1,673,662 | |

| | | | | 3,432,000 | | | | 5.150 | | | 05/01/30 | | | 3,253,982 | |

| | | | | 1,652,000 | | | | 5.805 | | | 05/01/50 | | | 1,463,259 | |

| | Spirit AeroSystems, Inc. (b) | |

| | | | | 1,170,000 | | | | 9.375 | | | 11/30/29 | | | 1,266,584 | |

| | | | | 2,850,000 | | | | 9.750 | | | 11/15/30 | | | 3,153,183 | |

| | TransDigm, Inc. | |

| | | | | 3,300,000 | | | | 5.500 | | | 11/15/27 | | | 3,205,686 | |

| | | | | 2,050,000 | | | | 6.750 | (b) | | 08/15/28 | | | 2,058,487 | |

| | | | | 315,000 | | | | 4.625 | | | 01/15/29 | | | 288,616 | |

| | | | | 2,246,000 | | | | 4.875 | | | 05/01/29 | | | 2,068,521 | |

| | | | | 100,000 | | | | 7.125 | (b) | | 12/01/31 | | | 101,986 | |

| | Triumph Group, Inc. (b) | |

| | | | | 679,000 | | | | 9.000 | | | 03/15/28 | | | 702,975 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 19,236,941 | |

| | | |

| | Agriculture – 0.3% | |

| | BAT Capital Corp. (a) | |

| | | | | 7,000,000 | | | | 4.390 | | | 08/15/37 | | | 5,744,900 | |

| | MHP SE (b) | |

| | | | | 550,000 | | | | 7.750 | | | 05/10/24 | | | 536,910 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 6,281,810 | |

| | | |

| | Airlines – 0.7% | |

| | Allegiant Travel Co. (a)(b) | |

| | | | | 1,035,000 | | | | 7.250 | | | 08/15/27 | | | 1,001,331 | |

| | American Airlines, Inc./AAdvantage Loyalty IP Ltd. (b) | |

| | | | | 1,717,000 | | | | 5.750 | | | 04/20/29 | | | 1,658,261 | |

| | Delta Air Lines, Inc. (a) | |

| | | | | 3,600,000 | | | | 7.375 | | | 01/15/26 | | | 3,678,912 | |

| | Hawaiian Brand Intellectual Property Ltd./HawaiianMiles Loyalty Ltd. (a)(b) | |

| | | | | 2,155,000 | | | | 5.750 | | | 01/20/26 | | | 2,023,847 | |

| | United Airlines, Inc. (a)(b) | |

| | | | | 2,080,000 | | | | 4.625 | | | 04/15/29 | | | 1,918,134 | |

| | VistaJet Malta Finance PLC/Vista Management Holding, Inc. (a)(b) | |

| | | | | 4,145,000 | | | | 7.875 | | | 05/01/27 | | | 3,690,211 | |

| | | | | 1,295,000 | | | | 9.500 | | | 06/01/28 | | | 1,157,847 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 15,128,543 | |

| | | |

| | Auto Parts & Equipment(a) – 0.0% | |

| | Tupy Overseas SA | |

| | | | | 200,000 | | | | 4.500 | | | 02/16/31 | | | 170,875 | |

| | | |

| | Automotive(a) – 1.6% | |

| | Adient Global Holdings Ltd. (b) | |

| | | | | 2,000,000 | | | | 7.000 | | | 04/15/28 | | | 2,026,160 | |

| | Clarios Global LP/Clarios U.S. Finance Co. (b) | |

| | | | | 1,850,000 | | | | 8.500 | | | 05/15/27 | | | 1,852,350 | |

| | | |

| | | | | | | | | | | | | | | | |

| | | Principal Amount | | | Interest Rate | | | Maturity Date | | Value | |

| |

| | Corporate Obligations – (continued) | |

| |

| | Automotive(a) – (continued) | |

| | Dana, Inc. | |

| | $ | | | 2,075,000 | | | | 4.250 | % | | 09/01/30 | | $ | 1,798,403 | |

| | Dealer Tire LLC/DT Issuer LLC (b) | |

| | | | | 5,637,000 | | | | 8.000 | | | 02/01/28 | | | 5,542,975 | |

| | Ford Motor Co. | |

| | | | | 3,726,000 | | | | 3.250 | | | 02/12/32 | | | 3,003,156 | |

| | Ford Motor Credit Co. LLC | |

| | | | | 400,000 | | | | 4.687 | | | 06/09/25 | | | 393,884 | |

| | | | | 4,260,000 | | | | 3.375 | | | 11/13/25 | | | 4,090,622 | |

| | | | | 3,111,000 | | | | 4.950 | | | 05/28/27 | | | 3,005,039 | |

| | | | | 1,640,000 | | | | 3.815 | | | 11/02/27 | | | 1,519,476 | |

| | General Motors Co. | |

| | | | | 3,000,000 | | | | 6.600 | | | 04/01/36 | | | 3,080,460 | |

| | General Motors Financial Co., Inc. | |

| | | | | 1,975,000 | | | | 5.650 | | | 01/17/29 | | | 1,957,284 | |

| | | | | 4,100,000 | | | | 3.100 | | | 01/12/32 | | | 3,377,990 | |

| | Hyundai Capital America (b) | |

| | | | | 4,050,000 | | | | 5.700 | | | 06/26/30 | | | 4,021,812 | |

| | Phinia, Inc. (b) | |

| | | | | 1,345,000 | | | | 6.750 | | | 04/15/29 | | | 1,349,909 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 37,019,520 | |

| | | |

| | Banks – 5.9% | |

| | Absa Group Ltd. (a)(c) (5 yr. CMT + 5.411%) | |

| | | | | 960,000 | | | | 6.375 | | | 05/27/26 | | | 926,700 | |

| | Access Bank PLC (b) | |

| | | | | 900,000 | | | | 6.125 | | | 09/21/26 | | | 832,781 | |

| | Alfa Bank AO Via Alfa Bond Issuance PLC (d)(a) (5 yr. CMT + 4.546%) | |

| | | | | 360,000 | | | | 5.950 | | | 04/15/30 | | | — | |

| | Banca Transilvania SA (a)(c) (1 yr. EURIBOR ICE Swap + 5.580%) | |

| | EUR | | | 650,000 | | | | 8.875 | | | 04/27/27 | | | 731,833 | |

| | Banco Continental SAECA (a) | |

| | $ | | | 1,210,000 | | | | 2.750 | | | 12/10/25 | | | 1,138,156 | |

| | Banco Davivienda SA (a)(c) | |

| | (10 yr. CMT + 5.097%) | |

| | | | | 420,000 | | | | 6.650 | (b) | | 04/22/31 | | | 293,672 | |

| | (10 yr. CMT + 5.097%) | |

| | | | | 200,000 | | | | 6.650 | | | 04/22/31 | | | 139,844 | |

| | Banco de Bogota SA | |

| | | | | 740,000 | | | | 6.250 | | | 05/12/26 | | | 728,206 | |

| | Banco de Credito del Peru SA (a)(b) | |

| | | | | 650,000 | | | | 5.850 | | | 01/11/29 | | | 642,525 | |

| | Banco del Estado de Chile (a)(b)(c) (5 yr. CMT + 3.228%) | |

| | | | | 600,000 | | | | 7.950 | | | 05/02/29 | | | 604,800 | |

| | Banco do Brasil SA (a)(c) (10 yr. CMT + 4.398%) | |

| | | | | 670,000 | | | | 8.748 | | | 10/15/24 | | | 675,695 | |

| | Banco Industrial SA (a)(b)(c) (5 yr. CMT + 4.442%) | |

| | | | | 930,000 | | | | 4.875 | | | 01/29/31 | | | 892,335 | |

| | Banco Internacional del Peru SAA Interbank (a)(c) (5 yr. CMT + 3.711%) | |

| | | | | 790,000 | | | | 4.000 | | | 07/08/30 | | | 757,906 | |

| | | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 11 |

GOLDMAN SACHS INCOME BUILDER FUND

|

Schedule of Investments (continued) April 30, 2024 (Unaudited) |

| | | | | | | | | | | | | | | | |

| | | Principal Amount | | | Interest

Rate | | | Maturity Date | | Value | |

| |

| | Corporate Obligations – (continued) | |

| |

| | Banks – (continued) | |

| | Banco Mercantil del Norte SA (a)(c) | |

| | (5 yr. CMT + 4.643%) | |

| | $ | | | 340,000 | | | | 5.875 | %(b) | | 01/24/27 | | $ | 317,900 | |

| | (5 yr. CMT + 4.643%) | |

| | | | | 460,000 | | | | 5.875 | | | 01/24/27 | | | 430,100 | |

| | (5 yr. CMT + 4.967%) | |

| | | | | 690,000 | | | | 6.750 | | | 09/27/24 | | | 684,480 | |

| | Banco Santander SA | |

| | | | | 2,000,000 | | | | 3.490 | | | 05/28/30 | | | 1,759,520 | |

| | (1 yr. CMT + 1.600%) | |

| | | | | 3,600,000 | | | | 3.225 | (a)(c) | | 11/22/32 | | | 2,910,528 | |

| | Bank Hapoalim BM (a)(c) (5 yr. CMT + 2.155%) | |

| | | | | 540,000 | | | | 3.255 | | | 01/21/32 | | | 481,781 | |

| | Bank Leumi Le-Israel BM (a)(c) (5 yr. CMT + 1.631%) | |

| | | | | 520,000 | | | | 3.275 | | | 01/29/31 | | | 480,350 | |

| | Bank of America Corp. (a)(c) | |

| | (3 mo. USD Term SOFR + 4.160%) | |

| | | | | 4,000,000 | | | | 6.100 | | | 03/17/25 | | | 3,991,560 | |

| | (Secured Overnight Financing Rate + 1.630%) | |

| | | | | 1,760,000 | | | | 5.202 | | | 04/25/29 | | | 1,733,406 | |

| | Bank of New York Mellon Corp. (a)(c) (5 yr. CMT + 4.358%) | |

| | | | | 2,000,000 | | | | 4.700 | | | 09/20/25 | | | 1,955,580 | |

| | Barclays PLC (a)(c) | |

| | (1 yr. CMT + 3.000%) | |

| | | | | 4,810,000 | | | | 5.746 | | | 08/09/33 | | | 4,695,570 | |

| | (5 yr. CMT + 5.431%) | |

| | | | | 4,800,000 | | | | 8.000 | | | 03/15/29 | | | 4,722,240 | |

| | BNP Paribas SA (b) | |

| | | | | 2,700,000 | | | | 4.375 | | | 05/12/26 | | | 2,615,544 | |

| | (5 yr. CMT + 4.354%) | |

| | | | | 3,000,000 | | | | 8.500 | (a)(c) | | 08/14/28 | | | 3,099,750 | |

| | BPCE SA (b) | |

| | | | | 4,150,000 | | | | 4.625 | | | 09/12/28 | | | 3,994,209 | |

| | (Secured Overnight Financing Rate + 1.730%) | |

| | | | | 2,100,000 | | | | 3.116 | (a)(c) | | 10/19/32 | | | 1,686,825 | |

| | Citigroup, Inc. (a)(c) | |

| | (3 mo. USD Term SOFR + 3.728%) | |

| | | | | 1,250,000 | | | | 9.035 | | | 05/15/24 | | | 1,251,238 | |

| | (3 mo. USD Term SOFR + 4.779%) | |

| | | | | 1,890,000 | | | | 6.250 | | | 08/15/26 | | | 1,881,438 | |

| | (5 yr. CMT + 3.209%) | |

| | | | | 3,000,000 | | | | 7.375 | | | 05/15/28 | | | 3,067,890 | |

| | (5 yr. CMT + 3.211%) | |

| | | | | 2,147,000 | | | | 7.625 | | | 11/15/28 | | | 2,218,388 | |

| | (5 yr. CMT + 3.597%) | |

| | | | | 1,000,000 | | | | 4.000 | | | 12/10/25 | | | 954,700 | |

| | (Secured Overnight Financing Rate + 1.351%) | |

| | | | | 3,325,000 | | | | 3.057 | | | 01/25/33 | | | 2,753,699 | |

| | (Secured Overnight Financing Rate + 3.914%) | |

| | | | | 900,000 | | | | 4.412 | | | 03/31/31 | | | 839,277 | |

| | Comerica, Inc. (a)(c) (5 yr. CMT + 5.291%) | |

| | | | | 1,000,000 | | | | 5.625 | | | 07/01/25 | | | 961,450 | |

| | Credit Bank of Moscow Via CBOM Finance PLC (d) | |

| | | | | 260,000 | | | | 4.700 | (b) | | 01/29/25 | | | — | |

| | | |

| | | | | | | | | | | | | | | | |

| | | Principal Amount | | | Interest

Rate | | | Maturity Date | | Value | |

| |

| | Corporate Obligations – (continued) | |

| |

| | Banks – (continued) | |

| | (5 yr. USD Swap + 5.416%) | |

| | $ | | | 280,000 | | | | 7.500 | %(a) | | 10/05/27 | | $ | — | |

| | Deutsche Bank AG (a)(c) (5 yr. CMT + 4.524%) | |

| | | | | 800,000 | | | | 6.000 | | | 10/30/25 | | | 741,448 | |

| | Fifth Third Bancorp (a)(c) (5 yr. CMT + 4.215%) | |

| | | | | 1,000,000 | | | | 4.500 | | | 09/30/25 | | | 953,850 | |

| | First Bank of Nigeria Ltd. Via FBN Finance Co. BV (b) | |

| | | | | 200,000 | | | | 8.625 | | | 10/27/25 | | | 196,875 | |

| | Freedom Mortgage Corp. (a)(b) | |

| | | | | 1,122,000 | | | | 7.625 | | | 05/01/26 | | | 1,117,355 | |

| | | | | 2,610,000 | | | | 6.625 | | | 01/15/27 | | | 2,511,942 | |

| | Grupo Aval Ltd. (a) | |

| | | | | 1,410,000 | | | | 4.375 | | | 02/04/30 | | | 1,170,300 | |

| | Huntington Bancshares, Inc. (a)(c) (7 yr. CMT + 4.045%) | |

| | | | | 1,000,000 | | | | 4.450 | | | 10/15/27 | | | 896,690 | |

| | ING Groep NV (a)(c) (5 yr. USD Swap + 4.446%) | |

| | | | | 3,000,000 | | | | 6.500 | | | 04/16/25 | | | 2,947,050 | |

| | Intesa Sanpaolo SpA (b) | |

| | | | | 8,000,000 | | | | 5.017 | | | 06/26/24 | | | 7,979,520 | |

| | Ipoteka-Bank ATIB | |

| | | | | 710,000 | | | | 5.500 | | | 11/19/25 | | | 683,153 | |

| | Itau Unibanco Holding SA (a)(c) (5 yr. CMT + 3.981%) | |

| | | | | 500,000 | | | | 7.721 | | | 06/12/24 | | | 497,188 | |

| | JPMorgan Chase & Co. (a)(c) | |

| | (3 mo. USD Term SOFR + 2.515%) | |

| | | | | 2,666,000 | | | | 2.956 | | | 05/13/31 | | | 2,279,697 | |

| | (5 yr. CMT + 2.737%) | |

| | | | | 2,742,000 | | | | 6.875 | | | 06/01/29 | | | 2,810,523 | |

| | Macquarie Group Ltd. (a)(b)(c) (3 mo. USD LIBOR + 1.372%) | |

| | | | | 3,650,000 | | | | 3.763 | | | 11/28/28 | | | 3,402,603 | |

| | Morgan Stanley (a)(c) | |

| | | | | 2,500,000 | | | | 5.875 | | | 09/15/26 | | | 2,365,275 | |

| | (Secured Overnight Financing Rate + 1.290%) | |

| | | | | 1,950,000 | | | | 2.943 | | | 01/21/33 | | | 1,608,204 | |

| | NBK Tier 1 Financing 2 Ltd. (a)(c) (6 yr. CMT + 2.832%) | |

| | | | | 790,000 | | | | 4.500 | | | 08/27/25 | | | 759,881 | |

| | OTP Bank Nyrt (a)(c) (3 mo. EUR Euribor + 4.265%) | |

| | EUR | | | 780,000 | | | | 5.500 | | | 07/13/25 | | | 831,110 | |

| | PNC Financial Services Group, Inc. (a)(c) | |

| | (5 yr. CMT + 3.000%) | |

| | $ | | | 2,000,000 | | | | 6.000 | | | 05/15/27 | | | 1,928,540 | |

| | (5 yr. CMT + 3.238%) | |

| | | | | 3,000,000 | | | | 6.200 | | | 09/15/27 | | | 2,941,770 | |

| | (7 yr. CMT + 2.808%) | |

| | | | | 2,000,000 | | | | 6.250 | | | 03/15/30 | | | 1,884,820 | |

| | Regions Financial Corp. (a)(c) (5 yr. CMT + 5.430%) | |

| | | | | 1,000,000 | | | | 5.750 | | | 06/15/25 | | | 979,550 | |

| | Royal Bank of Canada (a)(c) (5 yr. CMT + 2.887%) | |

| | | | | 3,315,000 | | | | 7.500 | | | 05/02/84 | | | 3,316,392 | |

| | Standard Chartered PLC (a)(b)(c) (5 yr. CMT + 3.805%) | |

| | | | | 4,255,000 | | | | 4.750 | | | 01/14/31 | | | 3,408,638 | |

| | Toronto-Dominion Bank (a)(c) (5 yr. CMT + 4.075%) | |

| | | | | 2,000,000 | | | | 8.125 | | | 10/31/82 | | | 2,058,560 | |

| | | |

| | |

| 12 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS INCOME BUILDER FUND

| | | | | | | | | | | | | | | | |

| | | Principal Amount | | | Interest Rate | | | Maturity Date | | Value | |

| |

| | Corporate Obligations – (continued) | |

| |

| | Banks – (continued) | |

| | Truist Financial Corp. (a)(c) | |

| | (10 yr. CMT + 4.349%) | |

| | $ | | | 2,237,000 | | | | 5.100 | % | | 03/01/30 | | $ | 2,028,601 | |

| | (5 yr. CMT + 4.605%) | |

| | | | | 1,000,000 | | | | 4.950 | | | 09/01/25 | | | 972,760 | |

| | (Secured Overnight Financing Rate + 2.050%) | |

| | | | | 1,360,000 | | | | 6.047 | | | 06/08/27 | | | 1,366,786 | |

| | Turkiye Garanti Bankasi AS (a)(b)(c) (5 yr. CMT + 4.090%) | |

| | | | | 510,000 | | | | 8.375 | | | 02/28/34 | | | 506,653 | |

| | U.S. Bancorp (a)(c) (5 yr. CMT + 2.541%) | |

| | | | | 1,000,000 | | | | 3.700 | | | 01/15/27 | | | 858,500 | |

| | UBS Group AG (a) | |

| | | | | 1,726,000 | | | | 4.282 | (b) | | 01/09/28 | | | 1,638,354 | |

| | (5 yr. CMT + 3.098%) | |

| | | | | 4,801,000 | | | | 3.875 | (b)(c) | | 06/02/26 | | | 4,334,919 | |

| | (5 yr. CMT + 4.745%) | |

| | | | | 5,590,000 | | | | 9.250 | (b)(c) | | 11/13/28 | | | 5,969,952 | |

| | (5 yr. USD Swap + 4.590%) | |

| | | | | 4,000,000 | | | | 6.875 | (c) | | 08/07/25 | | | 3,935,040 | |

| | UniCredit SpA (a)(b)(c) (5 yr. CMT + 4.750%) | |

| | | | | 1,525,000 | | | | 5.459 | | | 06/30/35 | | | 1,401,795 | |

| | United Bank for Africa PLC | |

| | | | | 200,000 | | | | 6.750 | | | 11/19/26 | | | 190,563 | |

| | Uzbek Industrial & Construction Bank ATB | |

| | | | | 850,000 | | | | 5.750 | | | 12/02/24 | | | 835,125 | |

| | Wells Fargo & Co. (a)(c) | |

| | (5 yr. CMT + 3.453%) | |

| | | | | 1,000,000 | | | | 3.900 | | | 03/15/26 | | | 947,350 | |

| | (5 yr. CMT + 3.606%) | |

| | | | | 1,000,000 | | | | 7.625 | | | 09/15/28 | | | 1,044,230 | |

| | Yapi ve Kredi Bankasi AS (b) | |

| | | | | 510,000 | | | | 9.250 | | | 10/16/28 | | | 540,600 | |

| | (5 yr. CMT + 5.278%) | |

| | | | | 450,000 | | | | 9.250 | (a)(c) | | 01/17/34 | | | 460,828 | |

| | (5 yr. CMT + 5.499%) | |

| | | | | 470,000 | | | | 9.743 | (a)(c) | | 04/04/29 | | | 468,238 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 135,623,104 | |

| | | |

| | Beverages(a) – 0.9% | |

| | Anadolu Efes Biracilik Ve Malt Sanayii AS | |

| | | | | 420,000 | | | | 3.375 | (b) | | 06/29/28 | | | 364,219 | |

| | | | | 950,000 | | | | 3.375 | | | 06/29/28 | | | 823,828 | |

| | Anheuser-Busch Cos. LLC/Anheuser-Busch InBev Worldwide, Inc. | |

| | | | | 8,050,000 | | | | 4.700 | | | 02/01/36 | | | 7,494,791 | |

| | Becle SAB de CV | |

| | | | | 610,000 | | | | 2.500 | | | 10/14/31 | | | 471,034 | |

| | Central American Bottling Corp./CBC Bottling Holdco SL/Beliv Holdco SL (b) | |

| | | | | 680,000 | | | | 5.250 | | | 04/27/29 | | | 632,597 | |

| | Constellation Brands, Inc. | |

| | | | | 2,275,000 | | | | 2.875 | | | 05/01/30 | | | 1,962,916 | |

| | | | | 3,975,000 | | | | 2.250 | | | 08/01/31 | | | 3,180,954 | |

| | Keurig Dr Pepper, Inc. | |

| | | | | 1,055,000 | | | | 3.200 | | | 05/01/30 | | | 933,453 | |

| | | |

| | | | | | | | | | | | | | | | |

| | | Principal Amount | | | Interest

Rate | | | Maturity Date | | Value | |

| |

| | Corporate Obligations – (continued) | |

| |

| | Beverages(a) – (continued) | |

| | $ | | | 5,375,000 | | | | 4.050 | % | | 04/15/32 | | $ | 4,883,779 | |

| | | | | 308,000 | | | | 3.800 | | | 05/01/50 | | | 224,680 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 20,972,251 | |

| | | |

| | Building Materials(a) – 0.6% | |

| | Builders FirstSource, Inc. (b) | |

| | | | | 1,800,000 | | | | 5.000 | | | 03/01/30 | | | 1,682,676 | |

| | Cemex SAB de CV (c) | |

| | (5 yr. CMT + 4.534%) | |

| | | | | 800,000 | | | | 5.125 | (b) | | 06/08/26 | | | 767,640 | |

| | (5 yr. CMT + 4.534%) | |

| | | | | 460,000 | | | | 5.125 | | | 06/08/26 | | | 441,393 | |

| | (5 yr. CMT + 5.157%) | |

| | | | | 590,000 | | | | 9.125 | (b) | | 03/14/28 | | | 631,716 | |

| | CP Atlas Buyer, Inc. (b) | |

| | | | | 2,160,000 | | | | 7.000 | | | 12/01/28 | | | 1,946,419 | |

| | GCC SAB de CV (b) | |

| | | | | 860,000 | | | | 3.614 | | | 04/20/32 | | | 721,876 | |

| | Masonite International Corp. (b) | |

| | | | | 2,075,000 | | | | 5.375 | | | 02/01/28 | | | 2,076,639 | |

| | Sisecam U.K. PLC (b) | |

| | | | | 400,000 | | | | 8.625 | | | 05/02/32 | | | 405,500 | |

| | Standard Industries, Inc. (b) | |

| | | | | 1,880,000 | | | | 4.375 | | | 07/15/30 | | | 1,665,774 | |

| | | | | 4,054,000 | | | | 3.375 | | | 01/15/31 | | | 3,338,104 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 13,677,737 | |

| | | |

| | Chemicals(a) – 1.1% | |

| | Ashland, Inc. (b) | |

| | | | | 3,225,000 | | | | 3.375 | | | 09/01/31 | | | 2,679,136 | |

| | ASP Unifrax Holdings, Inc. (b) | |

| | | | | 775,000 | | | | 5.250 | | | 09/30/28 | | | 491,892 | |

| | Avient Corp. (b) | |

| | | | | 1,725,000 | | | | 7.125 | | | 08/01/30 | | | 1,747,063 | |

| | Axalta Coating Systems LLC (b) | |

| | | | | 3,100,000 | | | | 3.375 | | | 02/15/29 | | | 2,727,814 | |

| | Braskem Netherlands Finance BV (c) (5 yr. CMT + 8.220%) | |

| | | | | 480,000 | | | | 8.500 | | | 01/23/81 | | | 469,950 | |

| | Chemours Co. (b) | |

| | | | | 4,560,000 | | | | 4.625 | | | 11/15/29 | | | 3,909,562 | |

| | Huntsman International LLC | |

| | | | | 2,104,000 | | | | 4.500 | | | 05/01/29 | | | 1,962,822 | |

| | Ingevity Corp. (b) | |

| | | | | 1,305,000 | | | | 3.875 | | | 11/01/28 | | | 1,162,638 | |

| | Minerals Technologies, Inc. (b) | |

| | | | | 1,695,000 | | | | 5.000 | | | 07/01/28 | | | 1,614,742 | |

| | OCP SA | |

| | | | | 960,000 | | | | 5.125 | | | 06/23/51 | | | 694,800 | |

| | Olympus Water U.S. Holding Corp. (b) | |

| | | | | 2,500,000 | | | | 9.750 | | | 11/15/28 | | | 2,655,025 | |

| | Sasol Financing USA LLC | |

| | | | | 280,000 | | | | 4.375 | | | 09/18/26 | | | 263,900 | |

| | | | | 890,000 | | | | 5.500 | | | 03/18/31 | | | 740,091 | |

| | SNF Group SACA (b) | |

| | | | | 740,000 | | | | 3.125 | | | 03/15/27 | | | 681,399 | |

| | | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 13 |

GOLDMAN SACHS INCOME BUILDER FUND

|

Schedule of Investments (continued) April 30, 2024 (Unaudited) |

| | | | | | | | | | | | | | | | |

| | | Principal Amount | | | Interest Rate | | | Maturity Date | | Value | |

| |

| | Corporate Obligations – (continued) | |

| |

| | Chemicals(a) – (continued) | |

| | $ | | | 925,000 | | | | 3.375 | % | | 03/15/30 | | $ | 795,657 | |

| | Valvoline, Inc. (b) | |

| | | | | 885,000 | | | | 3.625 | | | 06/15/31 | | | 746,338 | |

| | WR Grace Holdings LLC (b) | |

| | | | | 1,855,000 | | | | 5.625 | | | 08/15/29 | | | 1,663,471 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 25,006,300 | |

| | | |

| | Commercial Services(a) – 1.7% | |

| | ADT Security Corp. (b) | |

| | | | | 4,387,000 | | | | 4.125 | | | 08/01/29 | | | 3,963,654 | |

| | Allied Universal Holdco LLC/Allied Universal Finance Corp. (b) | |

| | | | | 1,050,000 | | | | 6.625 | | | 07/15/26 | | | 1,047,932 | |

| | APi Group DE, Inc. (b) | |

| | | | | 5,193,000 | | | | 4.125 | | | 07/15/29 | | | 4,575,812 | |

| | | | | 575,000 | | | | 4.750 | | | 10/15/29 | | | 523,020 | |

| | APX Group, Inc. (b) | |

| | | | | 4,286,000 | | | | 5.750 | | | 07/15/29 | | | 3,980,923 | |

| | Bidvest Group U.K. PLC (b) | |

| | | | | 1,260,000 | | | | 3.625 | | | 09/23/26 | | | 1,163,137 | |

| | Garda World Security Corp. (b) | |

| | | | | 900,000 | | | | 7.750 | | | 02/15/28 | | | 909,936 | |

| | HealthEquity, Inc. (b) | |

| | | | | 1,058,000 | | | | 4.500 | | | 10/01/29 | | | 965,404 | |

| | Limak Iskenderun Uluslararasi Liman Isletmeciligi AS (b) | |

| | | | | 890,953 | | | | 9.500 | | | 07/10/36 | | | 822,183 | |

| | Mavis Tire Express Services Topco Corp. (b) | |

| | | | | 2,621,000 | | | | 6.500 | | | 05/15/29 | | | 2,429,248 | |

| | Mersin Uluslararasi Liman Isletmeciligi AS (b) | |

| | | | | 1,660,000 | | | | 8.250 | | | 11/15/28 | | | 1,706,015 | |

| | NESCO Holdings II, Inc. (b) | |

| | | | | 3,083,000 | | | | 5.500 | | | 04/15/29 | | | 2,876,347 | |

| | Techem Verwaltungsgesellschaft 674 GmbH | |

| | EUR | | | 668,191 | | | | 6.000 | | | 07/30/26 | | | 713,093 | |

| | Verisure Holding AB (b) | |

| | | | | 725,000 | | | | 3.250 | | | 02/15/27 | | | 742,857 | |

| | | | | 2,133,000 | | | | 5.500 | | | 05/15/30 | | | 2,280,800 | |

| | Verisure Midholding AB | |

| | | | | 800,000 | | | | 5.250 | (b) | | 02/15/29 | | | 822,223 | |

| | | | | 1,450,000 | | | | 5.250 | | | 02/15/29 | | | 1,490,278 | |

| | VT Topco, Inc. (b) | |

| | $ | | | 5,282,000 | | | | 8.500 | | | 08/15/30 | | | 5,468,032 | |

| | Wand NewCo 3, Inc. (b) | |

| | | | | 2,944,000 | | | | 7.625 | | | 01/30/32 | | | 2,999,229 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 39,480,123 | |

| | | |

| | Computers(a) – 0.7% | |

| | Booz Allen Hamilton, Inc. (b) | |

| | | | | 2,513,000 | | | | 3.875 | | | 09/01/28 | | | 2,328,294 | |

| | Dell International LLC/EMC Corp. | |

| | | | | 2,475,000 | | | | 5.300 | | | 10/01/29 | | | 2,448,963 | |

| | | | | 2,699,000 | | | | 8.100 | | | 07/15/36 | | | 3,145,523 | |

| | Hewlett Packard Enterprise Co. | |

| | | | | 2,730,000 | | | | 6.200 | | | 10/15/35 | | | 2,807,095 | |

| | KBR, Inc. (b) | |

| | | | | 1,161,000 | | | | 4.750 | | | 09/30/28 | | | 1,083,259 | |

| | | |

| | | | | | | | | | | | | | | | |

| | | Principal Amount | | | Interest Rate | | | Maturity Date | | Value | |

| |

| | Corporate Obligations – (continued) | |

| |

| | Computers(a) – (continued) | |

| | McAfee Corp. (b) | |

| | $ | | | 3,435,000 | | | | 7.375 | % | | 02/15/30 | | $ | 3,185,585 | |

| | Virtusa Corp. (b) | |

| | | | | 2,371,000 | | | | 7.125 | | | 12/15/28 | | | 2,130,960 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 17,129,679 | |

| | | |

| | Distribution & Wholesale(a)(b) – 0.2% | |

| | American Builders & Contractors Supply Co., Inc. | |

| | | | | 2,760,000 | | | | 3.875 | | | 11/15/29 | | | 2,419,195 | |

| | BCPE Empire Holdings, Inc. | |

| | | | | 2,436,000 | | | | 7.625 | | | 05/01/27 | | | 2,375,100 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 4,794,295 | |

| | | |

| | Diversified Financial Services – 2.6% | |

| | AerCap Holdings NV (a)(c) (5 yr. CMT + 4.535%) | |

| | | | | 1,825,000 | | | | 5.875 | | | 10/10/79 | | | 1,806,987 | |

| | AerCap Ireland Capital DAC/AerCap Global Aviation Trust (a) | |

| | | | | 3,625,000 | | | | 3.000 | | | 10/29/28 | | | 3,233,464 | |

| | AG TTMT Escrow Issuer LLC (a)(b) | |

| | | | | 1,025,000 | | | | 8.625 | | | 09/30/27 | | | 1,055,760 | |

| | Air Lease Corp. (a) | |

| | | | | 2,750,000 | | | | 3.750 | | | 06/01/26 | | | 2,639,147 | |

| | Ally Financial, Inc. | |

| | | | | 4,000,000 | | | | 8.000 | | | 11/01/31 | | | 4,332,880 | |

| | (7 yr. CMT + 3.481%) | |

| | | | | 3,415,000 | | | | 4.700 | (a)(c) | | 05/15/28 | | | 2,642,698 | |

| | American Express Co. (a)(c) (5 yr. CMT + 2.854%) | |

| | | | | 1,000,000 | | | | 3.550 | | | 09/15/26 | | | 912,670 | |

| | Aviation Capital Group LLC (a)(b) | |

| | | | | 800,000 | | | | 1.950 | | | 01/30/26 | | | 745,488 | |

| | Avolon Holdings Funding Ltd. (a)(b) | |

| | | | | 1,300,000 | | | | 3.250 | | | 02/15/27 | | | 1,197,794 | |

| | | | | 1,927,000 | | | | 2.528 | | | 11/18/27 | | | 1,699,672 | |

| | Castlelake Aviation Finance DAC (a)(b) | |

| | | | | 2,420,000 | | | | 5.000 | | | 04/15/27 | | | 2,328,403 | |

| | Charles Schwab Corp. (a)(c) | |

| | (5 yr. CMT + 3.168%) | |

| | | | | 2,875,000 | | | | 4.000 | | | 06/01/26 | | | 2,649,859 | |

| | (5 yr. CMT + 4.971%) | |

| | | | | 2,250,000 | | | | 5.375 | | | 06/01/25 | | | 2,223,765 | |

| | Discover Financial Services (a)(c) (5 yr. CMT + 5.783%) | |

| | | | | 1,000,000 | | | | 6.125 | | | 06/23/25 | | | 999,360 | |

| | Global Aircraft Leasing Co. Ltd. (a)(b)(e) (PIK 7.250%, Cash 6.500%) | |

| | | | | 2,017,883 | | | | 6.500 | | | 09/15/24 | | | 1,907,121 | |

| | Intercorp Financial Services, Inc. (a) | |

| | | | | 340,000 | | | | 4.125 | | | 10/19/27 | | | 311,100 | |

| | Jefferies Finance LLC/JFIN Co.-Issuer Corp. (a)(b) | |

| | | | | 3,829,000 | | | | 5.000 | | | 08/15/28 | | | 3,445,258 | |

| | Macquarie Airfinance Holdings Ltd. (a)(b) | |

| | | | | 355,000 | | | | 6.400 | | | 03/26/29 | | | 354,240 | |

| | | | | 1,950,000 | | | | 8.125 | | | 03/30/29 | | | 2,042,430 | |

| | Midcap Financial Issuer Trust (a)(b) | |

| | | | | 2,567,000 | | | | 6.500 | | | 05/01/28 | | | 2,323,751 | |

| | | | | 810,000 | | | | 5.625 | | | 01/15/30 | | | 680,910 | |

| | | |

| | |

| 14 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS INCOME BUILDER FUND

| | | | | | | | | | | | | | | | |

| | | Principal Amount | | | Interest Rate | | | Maturity Date | | Value | |

| |

| | Corporate Obligations – (continued) | |

| |

| | Diversified Financial Services – (continued) | |

| | Nationstar Mortgage Holdings, Inc. (a)(b) | |

| | $ | | | 2,651,000 | | | | 5.500 | % | | 08/15/28 | | $ | 2,493,345 | |

| | Navient Corp. (a) | |

| | | | | 2,388,000 | | | | 5.500 | | | 03/15/29 | | | 2,140,269 | |

| | | | | 1,715,000 | | | | 9.375 | | | 07/25/30 | | | 1,766,707 | |

| | OneMain Finance Corp. | |

| | | | | 1,602,000 | | | | 7.125 | | | 03/15/26 | | | 1,616,867 | |

| | | | | 1,643,000 | | | | 4.000 | (a) | | 09/15/30 | | | 1,383,094 | |

| | Oxford Finance LLC/Oxford Finance Co.-Issuer II, Inc. (a)(b) | |

| | | | | 1,365,000 | | | | 6.375 | | | 02/01/27 | | | 1,278,800 | |

| | Raymond James Financial, Inc. (a) | |

| | | | | 900,000 | | | | 4.650 | | | 04/01/30 | | | 867,375 | |

| | Rocket Mortgage LLC/Rocket Mortgage Co.-Issuer, Inc. (a)(b) | |

| | | | | 2,305,000 | | | | 2.875 | | | 10/15/26 | | | 2,117,742 | |

| | | | | 2,390,000 | | | | 4.000 | | | 10/15/33 | | | 1,951,005 | |

| | StoneX Group, Inc. (a)(b) | |

| | | | | 1,785,000 | | | | 7.875 | | | 03/01/31 | | | 1,805,206 | |

| | United Wholesale Mortgage LLC (a)(b) | |

| | | | | 3,195,000 | | | | 5.500 | | | 04/15/29 | | | 2,970,264 | |

| | Universe Trek Ltd. (f)(g) | |

| | | | | 400,000 | | | | 0.000 | | | 06/15/26 | | | 420,200 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 60,343,631 | |

| | | |

| | Electrical – 1.0% | |

| | Adani Electricity Mumbai Ltd. | |

| | | | | 410,000 | | | | 3.949 | | | 02/12/30 | | | 338,763 | |

| | AES Panama Generation Holdings SRL (a) | |

| | | | | 1,414,216 | | | | 4.375 | | | 05/31/30 | | | 1,185,806 | |

| | Calpine Corp. (a)(b) | |

| | | | | 4,215,000 | | | | 3.750 | | | 03/01/31 | | | 3,650,864 | |

| | Cikarang Listrindo Tbk. PT (a) | |

| | | | | 200,000 | | | | 4.950 | | | 09/14/26 | | | 191,500 | |

| | Energuate Trust (a)(b) | |

| | | | | 470,000 | | | | 5.875 | | | 05/03/27 | | | 445,031 | |

| | EnfraGen Energia Sur SA/EnfraGen Spain SA/Prime Energia SpA (a) | |

| | | | | 200,000 | | | | 5.375 | | | 12/30/30 | | | 162,398 | |

| | Eskom Holdings SOC Ltd. | |

| | | | | 430,000 | | | | 7.125 | | | 02/11/25 | | | 427,313 | |

| | | | | 220,000 | | | | 6.350 | (h) | | 08/10/28 | | | 207,900 | |

| | | | | 458,000 | | | | 8.450 | | | 08/10/28 | | | 450,558 | |

| | Inkia Energy Ltd. (a) | |

| | | | | 400,000 | | | | 5.875 | | | 11/09/27 | | | 388,368 | |

| | Lamar Funding Ltd. | |

| | | | | 470,000 | | | | 3.958 | | | 05/07/25 | | | 458,175 | |

| | LLPL Capital Pte. Ltd. | |

| | | | | 356,132 | | | | 6.875 | | | 02/04/39 | | | 343,445 | |

| | Minejesa Capital BV | |

| | | | | 241,748 | | | | 4.625 | | | 08/10/30 | | | 225,154 | |

| | Mong Duong Finance Holdings BV (a) | |

| | | | | 488,814 | | | | 5.125 | | | 05/07/29 | | | 466,206 | |

| | National Central Cooling Co. PJSC | |

| | | | | 820,000 | | | | 2.500 | | | 10/21/27 | | | 733,131 | |

| | NextEra Energy Operating Partners LP (a)(b) | |

| | | | | 2,025,000 | | | | 7.250 | | | 01/15/29 | | | 2,053,087 | |

| | | |

| | | | | | | | | | | | | | | | |

| | | Principal Amount | | | Interest Rate | | | Maturity Date | | Value | |

| |

| | Corporate Obligations – (continued) | |

| |

| | Electrical – (continued) | |

| | NRG Energy, Inc. (a) | |

| | $ | | | 2,800,000 | | | | 3.750 | %(b) | | 06/15/24 | | $ | 2,788,604 | |

| | | | | 115,000 | | | | 5.750 | | | 01/15/28 | | | 113,083 | |

| | | | | 448,000 | | | | 3.375 | (b) | | 02/15/29 | | | 393,375 | |

| | Pacific Gas & Electric Co. (a) | |

| | | | | 1,470,000 | | | | 3.500 | | | 08/01/50 | | | 944,255 | |

| | Pike Corp. (a)(b) | |

| | | | | 2,420,000 | | | | 5.500 | | | 09/01/28 | | | 2,295,467 | |

| | | | | 820,000 | | | | 8.625 | | | 01/31/31 | | | 862,074 | |

| | Sempra (a)(c) (5 yr. CMT + 4.550%) | |

| | | | | 3,335,000 | | | | 4.875 | | | 10/15/25 | | | 3,255,760 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 22,380,317 | |

| | | |

| | Electrical Components & Equipment(a)(b) – 0.1% | |

| | WESCO Distribution, Inc. | |

| | | | | 1,000,000 | | | | 6.375 | | | 03/15/29 | | | 994,340 | |

| | | | | 760,000 | | | | 6.625 | | | 03/15/32 | | | 756,238 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 1,750,578 | |

| | | |

| | Electronics(a)(b) – 0.3% | |

| | Imola Merger Corp. | |

| | | | | 6,867,000 | | | | 4.750 | | | 05/15/29 | | | 6,322,447 | |

| | TTM Technologies, Inc. | |

| | | | | 799,000 | | | | 4.000 | | | 03/01/29 | | | 715,217 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 7,037,664 | |

| | | |

| | Energy-Alternate Sources(a) – 0.0% | |

| | Greenko Wind Projects Mauritius Ltd. | |

| | | | | 380,000 | | | | 5.500 | | | 04/06/25 | | | 372,875 | |

| | | |

| | Engineering & Construction(a) – 0.7% | |

| | Aeropuerto Internacional de Tocumen SA | |

| | | | | 1,040,000 | | | | 5.125 | | | 08/11/61 | | | 733,850 | |

| | Aeropuertos Dominicanos Siglo XXI SA | |

| | | | | 1,630,000 | | | | 6.750 | | | 03/30/29 | | | 1,636,520 | |

| | Arcosa, Inc. (b) | |

| | | | | 1,221,000 | | | | 4.375 | | | 04/15/29 | | | 1,115,335 | |

| | ATP Tower Holdings LLC/Andean Tower Partners Colombia SAS/Andean Telecom Partners | |

| | | | | 950,000 | | | | 4.050 | (b) | | 04/27/26 | | | 884,687 | |

| | | | | 200,000 | | | | 4.050 | | | 04/27/26 | | | 186,250 | |

| | Dycom Industries, Inc. (b) | |

| | | | | 2,764,000 | | | | 4.500 | | | 04/15/29 | | | 2,542,742 | |

| | Global Infrastructure Solutions, Inc. (b) | |

| | | | | 4,435,000 | | | | 5.625 | | | 06/01/29 | | | 3,988,972 | |

| | | | | 1,390,000 | | | | 7.500 | | | 04/15/32 | | | 1,325,921 | |

| | IHS Holding Ltd. (b) | |

| | | | | 750,000 | | | | 5.625 | | | 11/29/26 | | | 691,172 | |

| | | | | 200,000 | | | | 6.250 | | | 11/29/28 | | | 172,250 | |

| | International Airport Finance SA | |

| | | | | 647,611 | | | | 12.000 | | | 03/15/33 | | | 686,468 | |

| | Mexico City Airport Trust | |

| | | | | 490,000 | | | | 3.875 | | | 04/30/28 | | | 456,159 | |

| | | | | 320,000 | | | | 5.500 | | | 10/31/46 | | | 262,500 | |

| | | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 15 |

GOLDMAN SACHS INCOME BUILDER FUND

|

Schedule of Investments (continued) April 30, 2024 (Unaudited) |

| | | | | | | | | | | | | | | | |

| | | Principal

Amount | | | Interest Rate | | | Maturity Date | | Value | |

| |

| | Corporate Obligations – (continued) | |

| |

| | Engineering & Construction(a) – (continued) | |

| | $ | | | 930,000 | | | | 5.500 | % | | 07/31/47 | | $ | 761,728 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 15,444,554 | |

| | | |

| | Entertainment(a) – 1.3% | |

| | Boyne USA, Inc. (b) | |

| | | | | 2,706,000 | | | | 4.750 | | | 05/15/29 | | | 2,463,326 | |

| | Cinemark USA, Inc. (b) | |

| | | | | 3,842,000 | | | | 5.250 | | | 07/15/28 | | | 3,570,140 | |

| | Cirsa Finance International SARL (b) | |

| | EUR | | | 511,000 | | | | 6.500 | | | 03/15/29 | | | 555,990 | |

| | Light & Wonder International, Inc. (b) | |

| | $ | | | 500,000 | | | | 7.000 | | | 05/15/28 | | | 501,955 | |

| | Lions Gate Capital Holdings LLC (b) | |

| | | | | 2,540,000 | | | | 5.500 | | | 04/15/29 | | | 1,932,178 | |

| | Melco Resorts Finance Ltd. (b) | |

| | | | | 1,360,000 | | | | 7.625 | | | 04/17/32 | | | 1,332,800 | |

| | Merlin Entertainments Group U.S. Holdings, Inc. (b) | |

| | | | | 1,405,000 | | | | 7.375 | | | 02/15/31 | | | 1,411,140 | |

| | Motion Bondco DAC (b) | |

| | | | | 3,250,000 | | | | 6.625 | | | 11/15/27 | | | 3,133,487 | |

| | Penn Entertainment, Inc. (b) | |

| | | | | 3,067,000 | | | | 4.125 | | | 07/01/29 | | | 2,567,355 | |

| | Resorts World Las Vegas LLC/RWLV Capital, Inc. (b) | |

| | | | | 300,000 | | | | 8.450 | | | 07/27/30 | | | 314,427 | |

| | SeaWorld Parks & Entertainment, Inc. (b) | |

| | | | | 4,880,000 | | | | 5.250 | | | 08/15/29 | | | 4,497,750 | |

| | Six Flags Entertainment Corp. (b) | |

| | | | | 1,854,000 | | | | 5.500 | | | 04/15/27 | | | 1,789,963 | |

| | Warnermedia Holdings, Inc. | |

| | | | | 2,300,000 | | | | 4.054 | | | 03/15/29 | | | 2,097,439 | |

| | | | | 4,775,000 | | | | 4.279 | | | 03/15/32 | | | 4,116,193 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 30,284,143 | |

| | | |

| | Environmental(a) – 0.6% | |

| | Covanta Holding Corp. | |

| | | | | 670,000 | | | | 5.000 | | | 09/01/30 | | | 581,734 | |

| | GFL Environmental, Inc. (b) | |

| | | | | 6,980,000 | | | | 4.000 | | | 08/01/28 | | | 6,335,816 | |

| | Madison IAQ LLC (b) | |

| | | | | 4,294,000 | | | | 4.125 | | | 06/30/28 | | | 3,982,599 | |

| | | | | 485,000 | | | | 5.875 | | | 06/30/29 | | | 450,347 | |

| | Republic Services, Inc. | |

| | | | | 2,065,000 | | | | 2.375 | | | 03/15/33 | | | 1,623,544 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 12,974,040 | |

| | | |

| | Food & Drug Retailing – 1.1% | |

| | Albertsons Cos., Inc./Safeway, Inc./New Albertsons LP/Albertsons LLC (a)(b) | |

| | | | | 2,595,000 | | | | 4.625 | | | 01/15/27 | | | 2,479,211 | |

| | | | | 1,995,000 | | | | 5.875 | | | 02/15/28 | | | 1,953,903 | |

| | | | | 502,000 | | | | 4.875 | | | 02/15/30 | | | 468,000 | |

| | Bellis Acquisition Co. PLC (a)(b) | |

| | GBP | | | 475,000 | | | | 3.250 | | | 02/16/26 | | | 583,915 | |

| | BRF GmbH | |

| | $ | | | 317,000 | | | | 4.350 | | | 09/29/26 | | | 300,357 | |

| | | |

| | | | | | | | | | | | | | | | |

| | | Principal Amount | | | Interest Rate | | | Maturity Date | | Value | |

| |

| | Corporate Obligations – (continued) | |

| |

| | Food & Drug Retailing – (continued) | |

| | H-Food Holdings LLC/Hearthside Finance Co., Inc. (a)(b) | |

| | $ | | | 2,820,000 | | | | 8.500 | % | | 06/01/26 | | $ | 201,743 | |

| | Kraft Heinz Foods Co. (a) | |

| | | | | 2,303,000 | | | | 5.000 | | | 07/15/35 | | | 2,192,986 | |

| | | | | 2,592,000 | | | | 4.375 | | | 06/01/46 | | | 2,078,240 | |

| | Performance Food Group, Inc. (a)(b) | |

| | | | | 1,150,000 | | | | 5.500 | | | 10/15/27 | | | 1,113,407 | |

| | Post Holdings, Inc. (a)(b) | |

| | | | | 5,984,000 | | | | 4.625 | | | 04/15/30 | | | 5,400,739 | |

| | Sysco Corp. (a) | |

| | | | | 5,975,000 | | | | 5.950 | | | 04/01/30 | | | 6,102,387 | |

| | U.S. Foods, Inc. (a)(b) | |

| | | | | 2,690,000 | | | | 4.750 | | | 02/15/29 | | | 2,510,927 | |

| | | | | 1,020,000 | | | | 4.625 | | | 06/01/30 | | | 928,771 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 26,314,586 | |

| | | |

| | Forest Products & Paper(a)(b) – 0.0% | |

| | Inversiones CMPC SA | |

| | | | | 200,000 | | | | 6.125 | | | 06/23/33 | | | 198,362 | |

| | | | | 310,000 | | | | 6.125 | | | 02/26/34 | | | 305,350 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 503,712 | |

| | | |

| | Gaming(a) – 0.1% | |

| | Melco Resorts Finance Ltd. | |

| | | | | 630,000 | | | | 5.625 | | | 07/17/27 | | | 594,562 | |

| | MGM Resorts International | |

| | | | | 1,832,000 | | | | 4.750 | | | 10/15/28 | | | 1,705,794 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 2,300,356 | |

| | | |

| | Hand/Machine Tools(a)(b) – 0.1% | |

| | Regal Rexnord Corp. | |

| | | | | 2,020,000 | | | | 6.300 | | | 02/15/30 | | | 2,030,787 | |

| | | |

| | Healthcare Providers & Services(a) – 1.2% | |

| | CAB SELAS (b) | |

| | EUR | | | 1,175,000 | | | | 3.375 | | | 02/01/28 | | | 1,097,780 | |

| | Catalent Pharma Solutions, Inc. (b) | |

| | $ | | | 1,005,000 | | | | 3.125 | | | 02/15/29 | | | 959,976 | |

| | | | | 603,000 | | | | 3.500 | | | 04/01/30 | | | 573,881 | |

| | Chrome Holdco SAS (b) | |

| | EUR | | | 2,100,000 | | | | 5.000 | | | 05/31/29 | | | 1,432,054 | |

| | DaVita, Inc. (b) | |

| | $ | | | 7,070,000 | | | | 3.750 | | | 02/15/31 | | | 5,821,933 | |

| | Encompass Health Corp. | |

| | | | | 1,200,000 | | | | 4.500 | | | 02/01/28 | | | 1,125,300 | |

| | LifePoint Health, Inc. (b) | |

| | | | | 4,595,000 | | | | 5.375 | | | 01/15/29 | | | 3,673,565 | |

| | Medline Borrower LP (b) | |

| | | | | 3,270,000 | | | | 3.875 | | | 04/01/29 | | | 2,927,467 | |

| | | | | 2,285,000 | | | | 5.250 | | | 10/01/29 | | | 2,127,723 | |

| | Molina Healthcare, Inc. (b) | |

| | | | | 1,893,000 | | | | 3.875 | | | 05/15/32 | | | 1,583,930 | |

| | Select Medical Corp. (b) | |

| | | | | 1,700,000 | | | | 6.250 | | | 08/15/26 | | | 1,700,272 | |

| | Tenet Healthcare Corp. | |

| | | | | 2,000,000 | | | | 6.250 | | | 02/01/27 | | | 1,993,920 | |

| | | |

| | |

| 16 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS INCOME BUILDER FUND

| | | | | | | | | | | | | | | | |

| | | Principal Amount | | | Interest Rate | | | Maturity Date | | Value | |

| |

| | Corporate Obligations – (continued) | |

| |

| | Healthcare Providers & Services(a) – (continued) | |

| | $ | | | 3,289,000 | | | | 6.125 | % | | 06/15/30 | | $ | 3,240,323 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 28,258,124 | |

| | | |

| | Home Builders – 0.7% | |

| | Brookfield Residential Properties, Inc./Brookfield Residential U.S. LLC (a)(b) | |

| | | | | 1,642,000 | | | | 4.875 | | | 02/15/30 | | | 1,421,233 | |

| | Century Communities, Inc. (a)(b) | |

| | | | | 4,550,000 | | | | 3.875 | | | 08/15/29 | | | 3,982,660 | |

| | Installed Building Products, Inc. (a)(b) | |

| | | | | 800,000 | | | | 5.750 | | | 02/01/28 | | | 775,960 | |

| | KB Home (a) | |

| | | | | 1,805,000 | | | | 7.250 | | | 07/15/30 | | | 1,849,241 | |

| | LGI Homes, Inc. (a)(b) | |

| | | | | 3,698,000 | | | | 4.000 | | | 07/15/29 | | | 3,162,123 | |

| | PulteGroup, Inc. | |

| | | | | 3,000,000 | | | | 7.875 | | | 06/15/32 | | | 3,384,330 | |

| | Taylor Morrison Communities, Inc. (a)(b) | |

| | | | | 1,301,000 | | | | 5.125 | | | 08/01/30 | | | 1,211,439 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 15,786,986 | |

| | | |

| | Home Furnishings(a)(b) – 0.1% | |

| | Tempur Sealy International, Inc. | |

| | | | | 1,515,000 | | | | 3.875 | | | 10/15/31 | | | 1,252,254 | |

| | | |

| | Household Products(a) – 0.0% | |

| | Central Garden & Pet Co. | |

| | | | | 1,380,000 | | | | 4.125 | | | 10/15/30 | | | 1,206,244 | |

| | | |

| | Housewares(a) – 0.2% | |

| | Newell Brands, Inc. | |

| | | | | 1,380,000 | | | | 7.000 | | | 04/01/46 | | | 1,120,560 | |

| | Scotts Miracle-Gro Co. | |

| | | | | 3,702,000 | | | | 4.000 | | | 04/01/31 | | | 3,122,156 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 4,242,716 | |

| | | |

| | Insurance – 1.3% | |

| | Acrisure LLC/Acrisure Finance, Inc. (a)(b) | |

| | | | | 1,550,000 | | | | 10.125 | | | 08/01/26 | | | 1,601,693 | |

| | | | | 935,000 | | | | 8.250 | | | 02/01/29 | | | 928,455 | |

| | | | | 2,230,000 | | | | 4.250 | | | 02/15/29 | | | 2,000,488 | |

| | | | | 2,490,000 | | | | 6.000 | | | 08/01/29 | | | 2,256,961 | |

| | Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer (a)(b) | |

| | | | | 1,666,000 | | | | 6.750 | | | 10/15/27 | | | 1,635,346 | |

| | | | | 5,500,000 | | | | 6.750 | | | 04/15/28 | | | 5,495,985 | |

| | American International Group, Inc. (a) | |

| | | | | 2,250,000 | | | | 3.400 | | | 06/30/30 | | | 2,005,222 | |

| | BroadStreet Partners, Inc. (a)(b) | |

| | | | | 4,594,000 | | | | 5.875 | | | 04/15/29 | | | 4,188,120 | |

| | Fidelity & Guaranty Life Holdings, Inc. (a)(b) | |

| | | | | 2,850,000 | | | | 5.500 | | | 05/01/25 | | | 2,824,492 | |

| | HUB International Ltd. (a)(b) | |

| | | | | 1,530,000 | | | | 7.375 | | | 01/31/32 | | | 1,520,988 | |

| | Markel Group, Inc. (a)(c) (5 yr. CMT + 5.662%) | |

| | | | | 1,500,000 | | | | 6.000 | | | 06/01/25 | | | 1,482,765 | |

| | | |

| | | | | | | | | | | | | | | | |

| | | Principal Amount | | | Interest Rate | | | Maturity Date | | Value | |

| |

| | Corporate Obligations – (continued) | |

| |

| | Insurance – (continued) | |

| | Prudential Financial, Inc. (a)(c) (5 yr. CMT + 3.234%) | |

| | $ | | | 1,500,000 | | | | 6.000 | % | | 09/01/52 | | $ | 1,453,845 | |

| | Sagicor Financial Co. Ltd. (a)(b) | |

| | | | | 790,000 | | | | 5.300 | | | 05/13/28 | | | 756,425 | |

| | Transatlantic Holdings, Inc. | |

| | | | | 75,000 | | | | 8.000 | | | 11/30/39 | | | 92,477 | |

| | USI, Inc. (a)(b) | |

| | | | | 1,170,000 | | | | 7.500 | | | 01/15/32 | | | 1,163,624 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 29,406,886 | |

| | | |

| | Internet(a) – 1.3% | |

| | ANGI Group LLC (b) | |

| | | | | 2,604,000 | | | | 3.875 | | | 08/15/28 | | | 2,208,947 | |

| | Booking Holdings, Inc. | |

| | | | | 2,850,000 | | | | 4.625 | | | 04/13/30 | | | 2,747,628 | |

| | Expedia Group, Inc. | |

| | | | | 1,382,000 | | | | 4.625 | | | 08/01/27 | | | 1,341,231 | |

| | | | | 3,425,000 | | | | 3.250 | | | 02/15/30 | | | 3,021,569 | |

| | Getty Images, Inc. (b) | |

| | | | | 3,720,000 | | | | 9.750 | | | 03/01/27 | | | 3,723,460 | |

| | Go Daddy Operating Co. LLC/GD Finance Co., Inc. (b) | |

| | | | | 1,305,000 | | | | 5.250 | | | 12/01/27 | | | 1,260,408 | |

| | GrubHub Holdings, Inc. (b) | |

| | | | | 3,400,000 | | | | 5.500 | | | 07/01/27 | | | 3,037,900 | |

| | ION Trading Technologies SARL (b) | |

| | | | | 1,868,000 | | | | 5.750 | | | 05/15/28 | | | 1,706,063 | |

| | Match Group Holdings II LLC (b) | |

| | | | | 1,205,000 | | | | 5.625 | | | 02/15/29 | | | 1,150,028 | |

| | | | | 918,000 | | | | 3.625 | | | 10/01/31 | | | 757,938 | |

| | Meituan | |

| | | | | 480,000 | | | | 3.050 | | | 10/28/30 | | | 404,850 | |

| | Newfold Digital Holdings Group, Inc. (b) | |

| | | | | 2,402,000 | | | | 6.000 | | | 02/15/29 | | | 1,801,284 | |

| | Prosus NV | |

| | | | | 600,000 | | | | 3.257 | | | 01/19/27 | | | 552,375 | |

| | Uber Technologies, Inc. (b) | |

| | | | | 1,800,000 | | | | 6.250 | | | 01/15/28 | | | 1,796,814 | |

| | | | | 4,090,000 | | | | 4.500 | | | 08/15/29 | | | 3,821,941 | |

| | United Group BV (b) | |

| | EUR | | | 1,225,000 | | | | 4.625 | | | 08/15/28 | | | 1,246,661 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 30,579,097 | |

| | | |

| | Investment Companies(a) – 0.3% | |

| | Icahn Enterprises LP/Icahn Enterprises Finance Corp. | |

| | $ | | | 2,577,000 | | | | 4.750 | | | 09/15/24 | | | 2,561,693 | |