UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-07123 |

| | |

| | BNY Mellon Advantage Funds, Inc. | |

| | (Exact name of Registrant as specified in charter) | |

| | | |

| | c/o BNY Mellon Investment Adviser, Inc. 240 Greenwich Street New York, New York 10286 | |

| | (Address of principal executive offices) (Zip code) | |

| | | |

| | Deirdre Cunnane, Esq. 240 Greenwich Street New York, New York 10286 | |

| | (Name and address of agent for service) | |

| |

| Registrant's telephone number, including area code: | (212) 922-6400 |

| | |

Date of fiscal year end: | 10/31 | |

| Date of reporting period: | 10/31/23 | |

| | | | | | | |

The following N-CSR relates only to the Registrant's series listed below and does not relate to any series of the Registrant with a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR will be filed for any series with a different fiscal year end, as appropriate.

BNY Mellon Dynamic Total Return Fund

BNY Mellon Global Dynamic Bond Income Fund

BNY Mellon Global Real Return Fund

FORM N-CSR

Item 1. Reports to Stockholders.

BNY Mellon Dynamic Total Return Fund

| |

ANNUAL REPORT October 31, 2023 |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.im.bnymellon.com and sign up for eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other person in the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change at any time based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund in the BNY Mellon Family of Funds are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund in the BNY Mellon Family of Funds. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

THE FUND

FOR MORE INFORMATION

Back Cover

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from November 1, 2022, through October 31, 2023, as provided by portfolio managers James Stavena, Torrey Zaches and Dimitri Curtil of Newton Investment Management North America, LLC, sub-adviser.

Market and Fund Performance Overview

For the 12-month period ended October 31, 2023, the BNY Mellon Dynamic Total Return Fund (the “fund”) produced a total return of 4.94% for Class A shares, 4.20% for Class C shares, 5.26% for Class I shares and 5.20% for Class Y shares.1 In comparison, the FTSE Three-Month U.S. Treasury Bill Index, the MSCI World Index and FTSE World Government Bond Index and a “Hybrid Index” (comprised of 60% MSCI World Index and 40% FTSE World Government Bond Index) returned 4.94%, 10.48%, .45% and 6.47%, respectively.2,3,4,5

The fund delivered a positive total return over the reporting period, with the Class I and Class Y shares outperforming the FTSE Three-Month U.S. Treasury Bill Index but underperforming the Hybrid Index. Performance benefited primarily from exposure to stocks and bonds and slightly from exposure to commodities, while exposure to currencies detracted.

The Fund’s Investment Approach

The fund seeks total return. To pursue its goal, the fund normally invests in instruments that provide investment exposure to global equity, bond, currency and commodity markets, and in fixed-income securities. The fund may invest in instruments that provide economic exposure to developed- and, to a limited extent, emerging-markets issuers.

The fund will seek to achieve investment exposure primarily through long and short positions in futures, options, forward contracts, swap agreements or exchange-traded funds (ETFs), and normally will use economic leverage as part of its investment strategy. The fund also may invest in fixed-income securities, such as bonds, notes (including structured notes) and money market instruments, including foreign government obligations and securities of supranational entities, to provide exposure to bond markets and for liquidity and income, as well as hold cash.

The fund’s sub-adviser, Newton Investment Management North America, LLC, applies a systematic investment approach designed to identify and exploit relative misvaluations across and within global capital markets. The sub-adviser updates, monitors and follows buy or sell recommendations using proprietary investment models. Among equity markets, the fund’s sub-adviser employs a bottom-up valuation approach using its proprietary models to derive market-level expected returns. For bond markets, the fund’s sub-adviser uses proprietary models to identify temporary mispricing among global bond markets. For currency markets, the fund’s sub-adviser evaluates currencies on a relative valuation basis and overweights exposure to currencies that are undervalued. For commodities, the fund’s sub-adviser seeks to identify opportunities in commodity markets by measuring and evaluating inventory and term structure, hedging and speculative activity, as well as momentum.

2

Markets Benefit as Inflation Eases

U.S. inflation—as measured by the U.S. Consumer Price Index (CPI)—continued to fall throughout the reporting period and reached a low of 3% in June 2023. Most recently, our forecasts indicate that the probability of headline CPI greater than 4% has fallen below 20%. In addition, our 12-month-point forecast for CPI is in line with that of consensus, which is 2.9%.

Equity markets reacted positively to lower inflation, but The Federal Reserve (the “Fed”) Chair Jerome Powell has noted that “there is still work to be done” to reduce inflation to the Fed’s average target of 2%. Consequently, the policy rate cuts anticipated in 2023 have been pushed out further into 2024, highlighting that policy rates will likely be “higher for longer.”

For the 12-month reporting period, risky assets outperformed cash over the period. The MSCI World Index returned 10.48%, while the FTSE Three-Month U.S. Treasury Bill Index returned 4.94%. The FTSE World Government Bond Index returned ..45%, and the Bloomberg Commodity Index returned −2.97%.

Exposure to Equities and Bonds Benefited Performance

Exposures in the fund offer investors access to a broad investment universe (global equities, global fixed income, currencies, commodities and volatility) with dynamic, active long/short exposures.

Over the reporting period, the equity, bond and commodities exposures contributed positively to performance. The fund benefited from an underweight equity exposure, which averaged around 21% over the period and added approximately 2.1% points to performance. The fund also gained from exposure to government bonds, including short positions in Canadian and European bonds. The bond positions added approximately 1.3% points to performance. Commodity exposure added a more modest contribution, with 0.1% added to performance.

On the other hand, currency exposures detracted approximately 1.5 percentage points from total return. Short exposure to the euro and long exposure to the Japanese yen were the main drivers of this underperformance.

Positioned for Low Growth and for Alpha

Newton’s Multi-Asset Solutions team sees the current environment as a new market regime, one that may usher in significantly lower market returns from traditional equities and bonds. Our models indicate positive correlations across stocks and bonds, which are likely to linger, and continue to estimate a low equity premium (1.5%). The fund takes advantage of non-traditional sources of diversification such as long and short positions. Therefore, the fund is now taking more risk in relative value strategies that are long and short rather than net long positions in traditional equities and bonds.

As we close in on year-end, and with inflation remaining well above the Fed’s target of 2%, the team anticipates a “higher for longer” period of interest rates. This is also exemplified in the Federal Open Market Committee’s most recent Summary of Economic Projections, which forecasts interest rates remaining at its high levels until at least 2024 and inflation remaining above 2% until 2026. In line with our cautious view of equities, these

3

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

“higher-for-longer” rates can feed into the increased cost of capital, erode profit margins and result in lower earnings.

Our current forecast for earnings growth for the Standard and Poor’s 500® Index6 over the next 12 months is around 3%, but with a one-in-three chance of a contraction. Given relatively flat year-over-year earnings, we anticipate guidance to be walked down in the coming months and consensus estimates to be revised lower.

In Europe, inflation peaked at 7% in April 2023 and decreased to a low of 2.9% in October. Though inflation continued to recede, there are lingering concerns around its stickiness. In an effort to lower inflation levels, The European Central Bank left rates on hold at 4% in October in the hopes that they have done enough to lower economic activity and thereby inflation. Japan experienced similar reductions in inflation rates, with the most significant change occurring between January 2023’s rate of 4.3% and February’s rate of 3.3%. The Bank of Japan also recently revised its yield curve control rate to a “more flexible” reference rate of 1% on 10-year Japan government bond yields.

At the end of the reporting period, the fund’s allocations were 9.8% to stocks, 14.2% to bonds and 12.1% to commodities. Within equities, the United States is the largest long allocation, followed by Spain and Italy. The fund added an allocation to a volatility swap during the reporting period. This alpha strategy seeks to harvest the equity volatility premium, exploiting the tendency for realized volatility to be lower than forecast volatility. This alpha stream has a low correlation to equities and bonds.

Within bonds and defensive assets, Japanese government bonds are the largest weight in the portfolio, followed closely by U.S. Treasury bonds. The largest short position is in UK gilts, followed by Canadian government bonds. There is currently no exposure to high yield bonds.

The fund continues to hold exposure to real assets, given the persistently high inflationary environment. Within currencies, the U.S. dollar is the largest long position, while the euro and emerging-markets currencies are the largest short positions.

We believe the fund will continue to play an important role in investor portfolios as a core allocation that is flexible, diverse and able to access additional liquid strategies and asset classes. As both equities and bonds continue to experience challenges, we believe the fund’s expanded toolkit will continue to help navigate what we believe may be a new regime.

November 15, 2023

1 Total return includes reinvestment of dividends and any capital gains paid and does not take into consideration the maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Share price, yield, and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. Past performance is no guarantee of future results. The fund’s returns reflect the absorption of certain fund expenses by BNY Mellon Investment Adviser pursuant to an agreement in effect through March 1, 2024, at which time it may be extended, terminated, or modified.

The fund’s investment adviser, BNY Mellon Investment Adviser, Inc., has contractually agreed, for so long as the fund invests in the subsidiary, to waive the management fee it receives from the fund in the amount equal to the management fee paid to BNY Mellon Investment Adviser, Inc., by the subsidiary.

2 Source: Lipper Inc. — Reflects reinvestment of net dividends and, where applicable, capital gain distributions. The MSCI World Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets. Investors cannot invest directly in any index.

4

3 Source: Lipper Inc. — The FTSE Three-Month U.S. Treasury Bill Index consists of the last three-month Treasury bill month-end rates. The FTSE Three-Month U.S. Treasury Bill Index measures return equivalents of yield averages. The instruments are not marked to market. Investors cannot invest directly in any index.

4 Source: Lipper Inc. — The FTSE World Government Bond Index (the “WGB Index”) measures the performance of fixed-rate, local-currency, investment-grade sovereign bonds. The WGB Index is a widely used benchmark that currently comprises sovereign debt from over 20 countries, denominated in a variety of currencies, and has more than 25 years of history available. The WGB Index provides a broad benchmark for the global sovereign, fixed-income market. Investors cannot invest directly in any index.

5 Source: FactSet —The Hybrid Index is an unmanaged hybrid index composed of 60% MSCI World Index and 40% WGB Index. Investors cannot invest directly in any index.

6 Source: Lipper Inc. — The Standard & Poor’s 500 (S&P 500) Composite Stock Price Index is a widely accepted, unmanaged index of U.S. stock market performance.

Equities are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

Bonds are subject generally to interest-rate, credit, liquidity, call, sector, and market risks, to varying degrees, all of which are more fully described in the fund’s prospectus.

Investing internationally involves special risks, including changes in currency exchange rates, political, economic, and social instability, a lack of comprehensive company information, differing auditing and legal standards, and less market liquidity. These risks generally are greater with emerging-markets countries than with more economically and politically established foreign countries.

Emerging markets tend to be more volatile than the markets of more mature economies and generally have less diverse and less mature economic structures and less stable political systems than those of developed countries. The securities of companies located in emerging markets are often subject to rapid and large changes in price. An investment in this fund should be considered only as a supplement to a complete investment program for those investors willing to accept the greater risks associated with investing in emerging-markets countries.

Commodities contain heightened risk including market, political, regulatory and natural conditions, and may not be appropriate for all investors. Derivatives and commodity-linked derivatives involve risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets.

High yield bonds involve increased credit and liquidity risk than higher-rated bonds and are considered speculative in terms of the issuer’s ability to pay interest and repay principal on a timely basis.

Short sales involve selling a security the portfolio does not own in anticipation that the security’s price will decline. Short sales may involve risk and leverage and expose the portfolio to the risk that it will be required to buy the security sold short at a time when the security has appreciated in value, thus resulting in a loss.

The fund may, but is not required to, use derivative instruments. A small investment in derivatives could have a potentially large impact on the fund’s performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets.

5

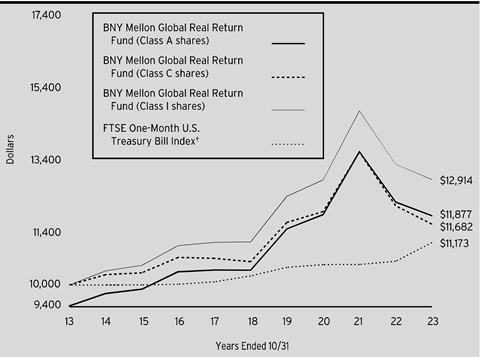

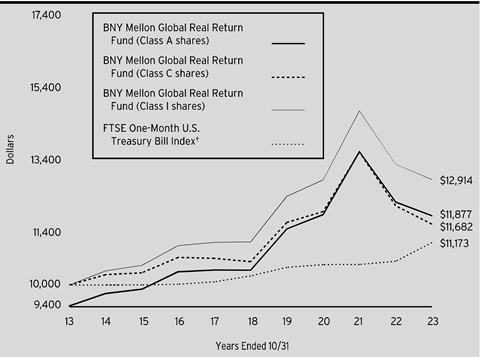

FUND PERFORMANCE (Unaudited)

Comparison of change in value of a $10,000 investment in Class A shares, Class C shares and Class I shares of BNY Mellon Dynamic Total Return Fund with a hypothetical investment of $10,000 in the MSCI World Index, FTSE Three-Month U.S. Treasury Bill Index, FTSE World Government Bond Index (the "WGB Index") and an index comprised of 60% MSCI World Index and 40% the WGB Index (the “Hybrid Index”).

† Source: FactSet

†† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a hypothetical investment of $10,000 made in each of the Class A shares, Class C shares and Class I shares of BNY Mellon Dynamic Total Return Fund on 10/31/13 to a hypothetical investment of $10,000 made on that date in each of the following: MSCI World Index, FTSE Three-Month U.S. Treasury Bill Index, the WGB Index and the Hybrid Index. Returns assume all dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes. The MSCI World Index is a free float‐adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets. The FTSE Three-Month U.S. Treasury Bill Index consists of the last three-month Treasury bill month-end rates. The FTSE Three-Month U.S. Treasury Bill Index measures returns equivalent of yield averages. The instruments are not marked to market. The WGB Index measures the performance of fixed-rate, local currency, investment-grade sovereign bonds. The WGB Index is a widely used benchmark that currently comprises sovereign debt from over 20 countries, denominated in a variety of currencies, and has more than 25 years of history available. The WGB Index provides a broad benchmark for the global sovereign fixed income market. Unlike a mutual fund, the indices are not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

Comparison of change in value of a $1,000,000 investment in Class Y shares of BNY Mellon Dynamic Total Return Fund with a hypothetical investment of $1,000,000 in the MSCI World Index, FTSE Three-Month U.S. Treasury Bill Index, FTSE World Government Bond Index (the "WGB Index") and an index comprised of 60% MSCI World Index and 40% the WGB Index (the “Hybrid Index”).

† Source: FactSet

†† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a hypothetical investment of $1,000,000 made in Class Y shares of BNY Mellon Dynamic Total Return Fund on 10/31/13 to a hypothetical investment of $1,000,000 made on that date in each of the following: MSCI World Index, FTSE Three-Month U.S. Treasury Bill Index, the WGB Index and the Hybrid Index. Returns assume all dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account all applicable fees and expenses of the fund’s Class Y shares. The MSCI World Index is a free float‐adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets. The FTSE Three-Month U.S. Treasury Bill Index consists of the last three-month Treasury bill month-end rates. The FTSE Three-Month U.S. Treasury Bill Index measures returns equivalent of yield averages. The instruments are not marked to market. The WGB Index measures the performance of fixed-rate, local currency, investment-grade sovereign bonds. The WGB Index is a widely used benchmark that currently comprises sovereign debt from over 20 countries, denominated in a variety of currencies, and has more than 25 years of history available. The WGB Index provides a broad benchmark for the global sovereign fixed income market. Unlike a mutual fund, the indices are not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

7

FUND PERFORMANCE (Unaudited) (continued)

| | | | | |

Average Annual Total Returns as of 10/31/2023 |

| | | | | |

| | | 1 Year | 5 Years | 10 Years |

Class A shares | | | | |

with maximum sales charge (5.75%) | | -1.13% | 1.85% | 2.09% |

without sales charge | | 4.94% | 3.07% | 2.69% |

Class C shares | | | | |

with applicable redemption charge † | | 3.20% | 2.29% | 1.93% |

without redemption | | 4.20% | 2.29% | 1.93% |

Class I shares | | 5.26% | 3.32% | 2.96% |

Class Y shares | | 5.20% | 3.33% | 2.97% |

MSCI World Index | | 10.48% | 8.27% | 7.53% |

FTSE Three-Month U.S. Treasury Bill Index | 4.94% | 1.80% | 1.16% |

FTSE World Government Bond Index | | .45% | -2.57% | -1.40% |

Hybrid Index | | 6.47% | 4.13% | 4.11% |

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to www.im.bnymellon.com for the fund’s most recent month-end returns.

The fund's performance shown in the graphs and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund's performance shown in the table takes into account all other applicable fees and expenses on all classes.

8

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in BNY Mellon Dynamic Total Return Fund from May 1, 2023 to October 31, 2023. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | |

Expenses and Value of a $1,000 Investment | |

Assume actual returns for the six months ended October 31, 2023 | |

| | | | | | |

| | Class A | Class C | Class I | Class Y | |

Expenses paid per $1,000† | $6.99 | $10.75 | $5.79 | $5.69 | |

Ending value (after expenses) | $996.40 | $992.90 | $998.60 | $997.90 | |

COMPARING YOUR FUND’S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | |

Expenses and Value of a $1,000 Investment | |

Assuming a hypothetical 5% annualized return for the six months ended October 31, 2023 | |

| | | | | | |

| | Class A | Class C | Class I | Class Y | |

Expenses paid per $1,000† | $7.07 | $10.87 | $5.85 | $5.75 | |

Ending value (after expenses) | $1,018.20 | $1,014.42 | $1,019.41 | $1,019.51 | |

† | Expenses are equal to the fund’s annualized expense ratio of 1.39% for Class A, 2.14% for Class C, 1.15% for Class I and 1.13% for Class Y, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

9

CONSOLIDATED STATEMENT OF INVESTMENTS

October 31, 2023

| | | | | | | | | | |

| |

Description/Number of Contracts | Exercise

Price | | Expiration Date | | Notional Amount ($) | | Value ($) | |

Options Purchased - .2% | | | | | |

Call Options - .2% | | | | | |

Standard & Poor's 500 E-mini December Future, Contracts 50 | | 4,450 | | 12/15/2023 | | 11,125,000 | | 28,126 | |

Standard & Poor's 500 E-mini 3rd Week January Future, Contracts 50 | | 4,375 | | 1/19/2024 | | 10,937,500 | | 166,875 | |

Total Options Purchased

(cost $324,670) | | 195,001 | |

Description | Annualized

Yield (%) | | Maturity Date | | Principal Amount ($) | | | |

Short-Term Investments - 81.7% | | | | | |

U.S. Government Securities | | | | | |

U.S. Treasury Bills | | 5.46 | | 2/29/2024 | | 1,500,000 | a,b | 1,473,475 | |

U.S. Treasury Bills | | 5.37 | | 11/28/2023 | | 8,367,000 | b | 8,333,835 | |

U.S. Treasury Bills | | 5.55 | | 4/18/2024 | | 40,307,000 | b | 39,300,307 | |

U.S. Treasury Bills | | 5.40 | | 2/1/2024 | | 37,033,400 | b | 36,530,384 | |

Total Short-Term Investments

(cost $85,640,503) | | 85,638,001 | |

| | 1-Day

Yield (%) | | | | Shares | | | |

Investment Companies - 11.7% | | | | | |

Registered Investment Companies - 11.7% | | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares

(cost $12,309,755) | | 5.40 | | | | 12,309,755 | c | 12,309,755 | |

Total Investments (cost $98,274,928) | | 93.6% | 98,142,757 | |

Cash and Receivables (Net) | | 6.4% | 6,655,262 | |

Net Assets | | 100.0% | 104,798,019 | |

a These securities are wholly-owned by the Subsidiary referenced in Note 1.

b Security is a discount security. Income is recognized through the accretion of discount.

c Investment in affiliated issuer. The investment objective of this investment company is publicly available and can be found within the investment company’s prospectus.

| | |

Portfolio Summary (Unaudited) † | Value (%) |

Government | 81.7 |

Investment Companies | 11.7 |

Options Purchased | .2 |

| | 93.6 |

† Based on net assets.

See notes to consolidated financial statements.

10

| | | | | | | |

Affiliated Issuers | | | |

Description | Value ($) 10/31/2022 | Purchases ($)† | Sales ($) | Value ($) 10/31/2023 | Dividends/

Distributions ($) | |

Registered Investment Companies - 11.7% | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares - 11.7% | 21,984,479 | 146,378,863 | (156,053,587) | 12,309,755 | 862,955 | |

† Includes reinvested dividends/distributions.

See notes to consolidated financial statements.

| | | | | | | |

Futures | | | |

Description | Number of

Contracts | Expiration | Notional

Value ($) | Market

Value ($) | Unrealized Appreciation (Depreciation) ($) | |

Futures Long | | |

Australian 10 Year Bond | 356 | 12/15/2023 | 25,397,983a | 24,444,745 | (953,238) | |

Cocoa | 18 | 3/13/2024 | 674,665b | 692,460 | 17,795 | |

Crude Oil | 12 | 2/20/2024 | 965,036b | 953,040 | (11,996) | |

Crude Soybean Oil | 94 | 3/14/2024 | 3,038,805b | 2,845,944 | (192,861) | |

DAX | 8 | 12/15/2023 | 3,254,432a | 3,144,885 | (109,547) | |

E-mini Russell 2000 | 54 | 12/15/2023 | 5,054,636 | 4,504,680 | (549,956) | |

FTSE/MIB Index | 34 | 12/15/2023 | 5,020,622a | 4,977,736 | (42,886) | |

Gasoline | 18 | 2/29/2024 | 1,754,567b | 1,684,292 | (70,275) | |

Hang Seng | 26 | 11/29/2023 | 2,840,407a | 2,848,113 | 7,706 | |

IBEX 35 Index | 58 | 11/17/2023 | 5,658,511a | 5,540,159 | (118,352) | |

Japanese 10 Year Mini Bond | 256 | 12/12/2023 | 24,542,408a | 24,307,122 | (235,286) | |

Lean Hog | 1 | 4/12/2024 | 32,774b | 32,080 | (694) | |

Live Cattle | 1 | 4/30/2024 | 77,394b | 74,670 | (2,724) | |

Live Cattle | 2 | 2/29/2024 | 153,559b | 147,700 | (5,859) | |

LME Primary Aluminum | 4 | 11/15/2023 | 219,820b | 224,865 | 5,045 | |

LME Primary Aluminum | 75 | 12/20/2023 | 4,289,510b | 4,213,406 | (76,104) | |

LME Primary Aluminum | 1 | 1/17/2024 | 55,828b | 56,260 | 432 | |

LME Primary Nickel | 2 | 11/15/2023 | 251,581b | 215,112 | (36,469) | |

LME Primary Nickel | 2 | 12/20/2023 | 221,286b | 216,180 | (5,106) | |

LME Refined Pig Lead | 5 | 3/20/2024 | 268,905b | 261,344 | (7,561) | |

LME Refined Pig Lead | 4 | 11/15/2023 | 213,997b | 207,525 | (6,472) | |

11

CONSOLIDATED STATEMENT OF INVESTMENTS (continued)

| | | | | | | |

Description | Number of

Contracts | Expiration | Notional

Value ($) | Market

Value ($) | Unrealized Appreciation (Depreciation) ($) | |

Futures Long (continued) | | |

LME Refined Pig Lead | 1 | 1/17/2024 | 53,378b | 52,144 | (1,234) | |

LME Refined Pig Lead | 4 | 12/20/2023 | 205,412b | 208,625 | 3,213 | |

LME Zinc | 2 | 3/20/2024 | 126,506b | 121,775 | (4,731) | |

LME Zinc | 2 | 12/20/2023 | 118,331b | 121,488 | 3,157 | |

LME Zinc | 3 | 11/15/2023 | 183,766b | 181,725 | (2,041) | |

NY Harbor ULSD | 40 | 2/29/2024 | 4,861,548b | 4,648,560 | (212,988) | |

Platinum | 29 | 1/29/2024 | 1,369,452b | 1,370,105 | 653 | |

Soybean Meal | 119 | 3/14/2024 | 4,693,277b | 4,840,920 | 147,643 | |

Sugar No.11 | 85 | 2/29/2024 | 2,543,461b | 2,578,968 | 35,507 | |

U.S. Treasury 10 Year Notes | 375 | 12/19/2023 | 39,869,201 | 39,814,455 | (54,746) | |

Futures Short | | |

ASX SPI 200 | 59 | 12/21/2023 | 6,503,240a | 6,346,624 | 156,616 | |

Brent Crude | 4 | 2/29/2024 | 347,629b | 333,640 | 13,989 | |

CAC 40 10 Euro | 2 | 11/17/2023 | 144,871a | 145,954 | (1,083) | |

Canadian 10 Year Bond | 276 | 12/18/2023 | 23,087,595a | 22,874,116 | 213,479 | |

Chicago SRW Wheat | 14 | 3/14/2024 | 422,450b | 409,675 | 12,775 | |

Coffee "C" | 11 | 3/18/2024 | 615,636b | 680,213 | (64,577) | |

Copper | 10 | 3/26/2024 | 920,160b | 921,500 | (1,340) | |

Corn No.2 Yellow | 121 | 3/14/2024 | 3,026,667b | 2,982,650 | 44,017 | |

Cotton No.2 | 28 | 3/6/2024 | 1,190,975b | 1,169,140 | 21,835 | |

DJ Euro Stoxx 50 | 8 | 12/15/2023 | 347,060a | 344,517 | 2,543 | |

Euro-Bond | 182 | 12/7/2023 | 24,839,041a | 24,840,146 | (1,105) | |

FTSE 100 | 19 | 12/15/2023 | 1,695,701a | 1,692,295 | 3,406 | |

Gold 100 oz | 1 | 2/27/2024 | 203,067b | 201,460 | 1,607 | |

Hard Red Winter Wheat | 41 | 3/14/2024 | 1,394,481b | 1,314,563 | 79,918 | |

Lean Hog | 8 | 2/14/2024 | 243,504b | 239,600 | 3,904 | |

LME Primary Aluminum | 19 | 3/20/2024 | 1,072,731b | 1,077,894 | (5,163) | |

LME Primary Aluminum | 4 | 11/15/2023 | 222,167b | 224,865 | (2,698) | |

LME Primary Aluminum | 75 | 12/20/2023 | 4,104,800b | 4,213,406 | (108,606) | |

LME Primary Nickel | 2 | 12/20/2023 | 251,766b | 216,180 | 35,586 | |

LME Primary Nickel | 3 | 3/20/2024 | 335,367b | 329,076 | 6,291 | |

LME Primary Nickel | 2 | 11/15/2023 | 230,826b | 215,112 | 15,714 | |

LME Refined Pig Lead | 4 | 12/20/2023 | 214,488b | 208,625 | 5,863 | |

LME Refined Pig Lead | 4 | 11/15/2023 | 212,362b | 207,525 | 4,837 | |

LME Zinc | 3 | 11/15/2023 | 181,718b | 181,725 | (7) | |

LME Zinc | 2 | 12/20/2023 | 125,744b | 121,488 | 4,256 | |

Long Gilt | 119 | 12/27/2023 | 13,630,665a | 13,474,527 | 156,138 | |

Low Sulphur Gas oil | 5 | 3/12/2024 | 410,769b | 410,750 | 19 | |

Natural Gas | 63 | 2/27/2024 | 2,127,711b | 2,184,840 | (57,129) | |

12

| | | | | | | |

Description | Number of

Contracts | Expiration | Notional

Value ($) | Market

Value ($) | Unrealized Appreciation (Depreciation) ($) | |

Futures Short (continued) | | |

NYMEX Palladium | 10 | 3/26/2024 | 1,146,195b | 1,131,600 | 14,595 | |

S&P/Toronto Stock Exchange 60 Index | 12 | 12/14/2023 | 2,026,046a | 1,964,305 | 61,741 | |

Silver | 3 | 3/26/2024 | 354,250b | 349,380 | 4,870 | |

Soybean | 54 | 3/14/2024 | 3,575,335b | 3,576,825 | (1,490) | |

Standard & Poor's 500 E-Mini | 11 | 12/15/2023 | 2,294,586 | 2,316,738 | (22,152) | |

Topix | 22 | 12/7/2023 | 3,388,652a | 3,271,516 | 117,136 | |

Gross Unrealized Appreciation | | 1,202,286 | |

Gross Unrealized Depreciation | | (2,966,476) | |

a Notional amounts in foreign currency have been converted to USD using relevant foreign exchange rates.

b These securities are wholly-owned by the Subsidiary referenced in Note 1.

See notes to consolidated financial statements.

| | | | | | |

Forward Foreign Currency Exchange Contracts | |

Counterparty/ Purchased

Currency | Purchased Currency

Amounts | Currency

Sold | Sold

Currency

Amounts | Settlement Date | Unrealized Appreciation (Depreciation) ($) |

Barclays Capital, Inc. |

United States Dollar | 16,245,258 | Malaysian Ringgit | 75,378,000 | 12/20/2023 | 370,039 |

Citigroup Global Markets Inc. |

Euro | 2,109,000 | United States Dollar | 2,238,353 | 12/20/2023 | (1,488) |

United States Dollar | 1,113,565 | Euro | 1,051,000 | 12/20/2023 | (1,156) |

United States Dollar | 1,000,718 | Israeli Shekel | 4,023,000 | 12/20/2023 | 2,509 |

New Zealand Dollar | 1,076,000 | United States Dollar | 643,469 | 12/20/2023 | (16,483) |

United States Dollar | 62,563 | New Zealand Dollar | 105,000 | 12/20/2023 | 1,379 |

Norwegian Krone | 2,556,000 | United States Dollar | 236,702 | 12/20/2023 | (7,550) |

South Korean Won | 359,723,000 | United States Dollar | 265,674 | 12/20/2023 | 1,446 |

Japanese Yen | 838,760,000 | United States Dollar | 5,753,393 | 12/20/2023 | (171,822) |

United States Dollar | 3,371,516 | Japanese Yen | 500,095,000 | 12/20/2023 | 43,608 |

Canadian Dollar | 1,966,000 | United States Dollar | 1,450,285 | 12/20/2023 | (31,317) |

United States Dollar | 3,957,790 | Canadian Dollar | 5,352,000 | 12/20/2023 | 94,964 |

Indonesian Rupiah | 2,199,250,000 | United States Dollar | 139,661 | 12/20/2023 | (1,266) |

13

CONSOLIDATED STATEMENT OF INVESTMENTS (continued)

| | | | | | |

Forward Foreign Currency Exchange Contracts (continued) | |

Counterparty/ Purchased

Currency | Purchased Currency

Amounts | Currency

Sold | Sold

Currency

Amounts | Settlement Date | Unrealized Appreciation (Depreciation) ($) |

Citigroup Global Markets Inc. (continued) |

United States Dollar | 233,440 | Indonesian Rupiah | 3,589,642,000 | 12/20/2023 | 7,550 |

Swiss Franc | 2,672,000 | United States Dollar | 2,980,315 | 12/20/2023 | (25,786) |

United States Dollar | 94,953 | Swiss Franc | 86,000 | 12/20/2023 | (140) |

Polish Zloty | 257,000 | United States Dollar | 59,490 | 12/20/2023 | 1,424 |

Indian Rupee | 239,247,000 | United States Dollar | 2,866,775 | 12/20/2023 | 2,858 |

United States Dollar | 316,358 | Mexican Peso | 5,711,000 | 12/20/2023 | 2,210 |

British Pound | 844,000 | United States Dollar | 1,028,268 | 12/20/2023 | (2,007) |

United States Dollar | 5,474,130 | British Pound | 4,431,000 | 12/20/2023 | 86,261 |

Australian Dollar | 1,936,000 | United States Dollar | 1,254,189 | 12/20/2023 | (23,990) |

United States Dollar | 67,487 | Australian Dollar | 105,000 | 12/20/2023 | 766 |

Brazilian Real | 317,000 | United States Dollar | 61,177 | 12/20/2023 | 1,334 |

United States Dollar | 2,740,250 | Swedish Krona | 30,080,000 | 12/20/2023 | 38,638 |

United States Dollar | 578,477 | Hungarian Forint | 214,349,000 | 12/20/2023 | (10,182) |

United States Dollar | 814,417 | Philippine Peso | 46,511,000 | 12/20/2023 | (5,338) |

Goldman Sachs & Co. LLC |

Swiss Franc | 3,020,000 | United States Dollar | 3,334,069 | 12/20/2023 | 5,257 |

United States Dollar | 16,714,510 | Swiss Franc | 14,768,941 | 12/20/2023 | 383,945 |

Chilean Peso | 1,623,628,000 | United States Dollar | 1,806,238 | 12/20/2023 | 2,324 |

United States Dollar | 163,104 | Chilean Peso | 146,141,000 | 12/20/2023 | 317 |

United States Dollar | 364,697 | Philippine Peso | 20,755,000 | 12/20/2023 | (1,109) |

United States Dollar | 949,416 | Canadian Dollar | 1,289,000 | 12/20/2023 | 19,075 |

United States Dollar | 235,853 | Hungarian Forint | 87,176,000 | 12/20/2023 | (3,555) |

British Pound | 3,957,000 | United States Dollar | 4,815,675 | 12/20/2023 | (4,165) |

United States Dollar | 410,961 | British Pound | 335,000 | 12/20/2023 | 3,618 |

14

| | | | | | |

Forward Foreign Currency Exchange Contracts (continued) | |

Counterparty/ Purchased

Currency | Purchased Currency

Amounts | Currency

Sold | Sold

Currency

Amounts | Settlement Date | Unrealized Appreciation (Depreciation) ($) |

Goldman Sachs & Co. LLC (continued) |

South Korean Won | 1,247,256,000 | United States Dollar | 925,064 | 12/20/2023 | 1,112 |

United States Dollar | 162,350 | South Korean Won | 214,534,000 | 12/20/2023 | 3,043 |

Indonesian Rupiah | 9,059,570,000 | United States Dollar | 569,140 | 12/20/2023 | 964 |

United States Dollar | 513,103 | Indonesian Rupiah | 7,992,361,000 | 12/20/2023 | 10,157 |

Australian Dollar | 2,533,000 | United States Dollar | 1,625,046 | 12/20/2023 | (15,493) |

United States Dollar | 428,521 | Australian Dollar | 666,000 | 12/20/2023 | 5,322 |

Indian Rupee | 90,948,000 | United States Dollar | 1,089,852 | 12/20/2023 | 1,018 |

United States Dollar | 512,254 | Indian Rupee | 42,722,000 | 12/20/2023 | (172) |

United States Dollar | 2,672,422 | New Zealand Dollar | 4,486,000 | 12/20/2023 | 58,428 |

Mexican Peso | 140,631,000 | United States Dollar | 7,939,373 | 12/20/2023 | (203,619) |

Polish Zloty | 350,000 | United States Dollar | 79,823 | 12/20/2023 | 3,134 |

Euro | 4,176,000 | United States Dollar | 4,432,559 | 12/20/2023 | (3,374) |

United States Dollar | 778,398 | Euro | 738,000 | 12/20/2023 | (4,346) |

Swedish Krona | 22,808,000 | United States Dollar | 2,074,937 | 12/20/2023 | (26,454) |

United States Dollar | 206,070 | Swedish Krona | 2,237,000 | 12/20/2023 | 5,156 |

Brazilian Real | 12,692,000 | United States Dollar | 2,536,117 | 12/20/2023 | (33,327) |

Japanese Yen | 163,881,000 | United States Dollar | 1,113,337 | 12/20/2023 | (22,783) |

United States Dollar | 4,243,185 | Japanese Yen | 626,532,000 | 12/20/2023 | 73,896 |

Malaysian Ringgit | 1,118,000 | United States Dollar | 237,822 | 12/20/2023 | (2,362) |

United States Dollar | 2,967,993 | Norwegian Krone | 32,019,000 | 12/20/2023 | 97,408 |

Czech Koruna | 1,520,000 | United States Dollar | 65,587 | 12/20/2023 | (192) |

United States Dollar | 312,589 | Czech Koruna | 7,281,000 | 12/20/2023 | (663) |

Israeli Shekel | 1,200,000 | United States Dollar | 313,731 | 12/20/2023 | (15,980) |

15

CONSOLIDATED STATEMENT OF INVESTMENTS (continued)

| | | | | | |

Forward Foreign Currency Exchange Contracts (continued) | |

Counterparty/ Purchased

Currency | Purchased Currency

Amounts | Currency

Sold | Sold

Currency

Amounts | Settlement Date | Unrealized Appreciation (Depreciation) ($) |

Goldman Sachs & Co. LLC (continued) |

United States Dollar | 298,235 | Israeli Shekel | 1,134,000 | 12/20/2023 | 16,861 |

HSBC Securities (USA) Inc. |

Norwegian Krone | 104,015,218 | United States Dollar | 9,752,951 | 12/20/2023 | (427,722) |

Canadian Dollar | 6,176,987 | United States Dollar | 4,563,269 | 12/20/2023 | (105,006) |

Hungarian Forint | 42,441,000 | United States Dollar | 114,617 | 12/20/2023 | 1,937 |

New Zealand Dollar | 14,436,817 | United States Dollar | 8,515,874 | 12/20/2023 | (103,534) |

Indian Rupee | 540,397,000 | United States Dollar | 6,490,475 | 12/20/2023 | (8,717) |

Indonesian Rupiah | 7,358,599,000 | United States Dollar | 478,359 | 12/20/2023 | (15,294) |

United States Dollar | 2,328,863 | Philippine Peso | 132,326,000 | 12/20/2023 | (3,380) |

United States Dollar | 8,646,234 | British Pound | 6,931,349 | 12/20/2023 | 218,068 |

United States Dollar | 3,568,917 | Swedish Krona | 39,507,915 | 12/20/2023 | 20,544 |

Merrill Lynch, Pierce, Fenner & Smith, Inc. |

United States Dollar | 12,267,231 | Israeli Shekel | 46,649,000 | 12/20/2023 | 692,427 |

United States Dollar | 162,473 | Philippine Peso | 9,209,000 | 12/20/2023 | 165 |

South African Rand | 5,225,000 | United States Dollar | 270,921 | 12/20/2023 | 8,193 |

Czech Koruna | 2,245,000 | United States Dollar | 97,803 | 12/20/2023 | (1,216) |

United States Dollar | 345,366 | Czech Koruna | 8,032,000 | 12/20/2023 | (196) |

Polish Zloty | 423,000 | United States Dollar | 97,615 | 12/20/2023 | 2,644 |

United States Dollar | 290,983 | Polish Zloty | 1,263,000 | 12/20/2023 | (8,372) |

Hungarian Forint | 2,211,801,000 | United States Dollar | 6,083,003 | 12/20/2023 | (8,814) |

Morgan Stanley & Co. LLC |

Euro | 1,479,000 | United States Dollar | 1,584,245 | 12/20/2023 | (15,576) |

United States Dollar | 19,688,899 | Euro | 18,301,365 | 12/20/2023 | 277,950 |

Brazilian Real | 452,000 | United States Dollar | 89,279 | 12/20/2023 | (147) |

Swedish Krona | 5,335,000 | United States Dollar | 479,695 | 12/20/2023 | (536) |

16

| | | | | | |

Forward Foreign Currency Exchange Contracts (continued) | |

Counterparty/ Purchased

Currency | Purchased Currency

Amounts | Currency

Sold | Sold

Currency

Amounts | Settlement Date | Unrealized Appreciation (Depreciation) ($) |

Morgan Stanley & Co. LLC (continued) |

United States Dollar | 897,420 | Swedish Krona | 9,900,000 | 12/20/2023 | 8,259 |

United States Dollar | 195,123 | Hungarian Forint | 72,301,000 | 12/20/2023 | (3,435) |

Chilean Peso | 131,561,000 | United States Dollar | 142,446 | 12/20/2023 | 4,100 |

United States Dollar | 167,149 | Chilean Peso | 153,607,000 | 12/20/2023 | (3,954) |

United States Dollar | 160,424 | Polish Zloty | 692,000 | 12/20/2023 | (3,593) |

Indonesian Rupiah | 6,017,024,000 | United States Dollar | 379,881 | 12/20/2023 | (1,239) |

United States Dollar | 97,563 | Indonesian Rupiah | 1,523,842,000 | 12/20/2023 | 1,670 |

United States Dollar | 474,319 | Norwegian Krone | 5,079,000 | 12/20/2023 | 18,974 |

Japanese Yen | 1,056,479,015 | United States Dollar | 7,292,494 | 12/20/2023 | (262,100) |

United States Dollar | 3,951,893 | Japanese Yen | 574,380,000 | 12/20/2023 | 129,652 |

South African Rand | 26,085,000 | United States Dollar | 1,370,869 | 12/20/2023 | 22,567 |

United States Dollar | 2,563,505 | Canadian Dollar | 3,464,000 | 12/20/2023 | 63,350 |

Swiss Franc | 599,000 | United States Dollar | 671,714 | 12/20/2023 | (9,378) |

United States Dollar | 129,267 | Swiss Franc | 115,000 | 12/20/2023 | 2,107 |

Philippine Peso | 29,379,000 | United States Dollar | 516,872 | 12/20/2023 | 932 |

United States Dollar | 1,797,132 | Philippine Peso | 102,142,000 | 12/20/2023 | (3,118) |

British Pound | 2,139,000 | United States Dollar | 2,623,122 | 12/20/2023 | (22,207) |

United States Dollar | 121,263 | British Pound | 98,000 | 12/20/2023 | 2,100 |

Mexican Peso | 10,193,000 | United States Dollar | 563,233 | 12/20/2023 | (2,542) |

Australian Dollar | 6,128,000 | United States Dollar | 3,949,830 | 12/20/2023 | (55,893) |

United States Dollar | 6,783,370 | Australian Dollar | 10,548,874 | 12/20/2023 | 80,261 |

Indian Rupee | 84,922,000 | United States Dollar | 1,015,975 | 12/20/2023 | 2,617 |

New Zealand Dollar | 686,000 | United States Dollar | 406,308 | 12/20/2023 | (6,576) |

17

CONSOLIDATED STATEMENT OF INVESTMENTS (continued)

| | | | | | |

Forward Foreign Currency Exchange Contracts (continued) | |

Counterparty/ Purchased

Currency | Purchased Currency

Amounts | Currency

Sold | Sold

Currency

Amounts | Settlement Date | Unrealized Appreciation (Depreciation) ($) |

Morgan Stanley & Co. LLC (continued) |

United States Dollar | 84,466 | New Zealand Dollar | 142,000 | 12/20/2023 | 1,723 |

United States Dollar | 43,363 | Czech Koruna | 993,000 | 12/20/2023 | 641 |

Malaysian Ringgit | 753,000 | United States Dollar | 160,252 | 12/20/2023 | (1,664) |

United States Dollar | 149,549 | Malaysian Ringgit | 696,000 | 12/20/2023 | 2,966 |

United States Dollar | 11,796,218 | South Korean Won | 15,578,074,000 | 12/20/2023 | 228,392 |

RBC Capital Markets, LLC |

Mexican Peso | 3,389,000 | United States Dollar | 194,951 | 12/20/2023 | (8,531) |

Gross Unrealized Appreciation | | | 3,138,260 |

Gross Unrealized Depreciation | | | (1,718,859) |

See notes to consolidated financial statements.

| | | | | | | |

OTC Total Return Swaps | |

Received

Reference

Entity | Paid

Reference

Entity | Counterparties | Maturity Date | Notional

Amount ($) | Unrealized (Depreciation) ($) |

3 Month Bank of America Shore 2D Index -Series 01 | Fixed Coupon Rate of 0.00% 3 Months Payable to Merrill Lynch, Pierce Fenner & Smith, Inc. | Merrill Lynch, Pierce, Fenner & Smith, Inc. | 1/29/24 | 27,867,970 | (4,046) |

Gross Unrealized Depreciation | (4,046) |

1 Underlying reference is the Index which is a basket of underlying securities listed within Custom Basket Table. Payment to or from Counterparties is based on the underlying components of the Basket.

See notes to consolidated financial statements.

| | | | | | | | |

Custom Basket | |

Underlying | Strike | Expiration

Date | Shares | Value | | Index (%) |

Bank of America Shore 2D Index - Series 0 | |

Cash: | |

USD | | | 30,395,058 | 30,395,058 | | 109.1% |

Futures: | |

Standard & Poor's 500 E-Mini | | | (598) | (2,520,214) | | -9.0% |

18

| | | | | | | |

Custom Basket (continued) |

Underlying | Strike | Expiration

Date | Shares | Value | | Index (%) |

Bank of America Shore 2D Index - Series 0 (continued) | |

Options: | |

S&P 500 Index Weekly Put | 4,025 | 11/01/23 | (668) | (84) | | 0.0% |

S&P 500 Index Weekly Put | 4,030 | 11/01/23 | (668) | (84) | | 0.0% |

S&P 500 Index Weekly Put | 4,035 | 11/01/23 | (668) | (84) | | 0.0% |

S&P 500 Index Weekly Put | 4,040 | 11/01/23 | (668) | (84) | | 0.0% |

S&P 500 Index Weekly Put | 4,045 | 11/01/23 | (668) | (84) | | 0.0% |

S&P 500 Index Weekly Put | 4,090 | 11/01/23 | (1,331) | (432) | | 0.0% |

S&P 500 Index Weekly Put | 4,095 | 11/01/23 | (1,331) | (499) | | 0.0% |

S&P 500 Index Weekly Put | 4,100 | 11/01/23 | (1,331) | (632) | | 0.0% |

S&P 500 Index Weekly Put | 4,105 | 11/01/23 | (1,331) | (832) | | 0.0% |

S&P 500 Index Weekly Put | 4,110 | 11/01/23 | (1,331) | (1,031) | | 0.0% |

S&P 500 Index Weekly Put | 4,055 | 11/02/23 | (665) | (466) | | 0.0% |

S&P 500 Index Weekly Put | 4,060 | 11/02/23 | (665) | (516) | | 0.0% |

S&P 500 Index Weekly Put | 4,065 | 11/02/23 | (665) | (582) | | 0.0% |

S&P 500 Index Weekly Put | 4,070 | 11/02/23 | (665) | (682) | | 0.0% |

S&P 500 Index Weekly Put | 4,075 | 11/02/23 | (665) | (782) | | 0.0% |

Total Basket Value | 27,867,970 | | |

See notes to consolidated financial statements.

19

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES

October 31, 2023

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Consolidated Statement of Investments | | | |

Unaffiliated issuers | 85,965,173 | | 85,833,002 | |

Affiliated issuers | | 12,309,755 | | 12,309,755 | |

Cash | | | | | 2,563,961 | |

Cash denominated in foreign currency | | | 6,687 | | 6,646 | |

Unrealized appreciation on forward foreign

currency exchange contracts—Note 4 | | 3,138,260 | |

Cash collateral held by broker—Note 4 | | 2,727,254 | |

Receivable from broker for swap agreements—Note 4 | | 422,855 | |

Receivable for shares of Common Stock subscribed | | 344,173 | |

Dividends receivable | | 66,491 | |

Prepaid expenses | | | | | 45,741 | |

| | | | | 107,458,138 | |

Liabilities ($): | | | | |

Due to BNY Mellon Investment Adviser, Inc. and affiliates—Note 3(c) | | 87,643 | |

Unrealized depreciation on forward foreign

currency exchange contracts—Note 4 | | 1,718,859 | |

Payable for futures variation margin—Note 4 | | 585,528 | |

Payable for shares of Common Stock redeemed | | 132,893 | |

Directors’ fees and expenses payable | | 16,350 | |

Unrealized depreciation on over-the-counter swap agreements—Note 4 | | 4,046 | |

Other accrued expenses | | | | | 114,800 | |

| | | | | 2,660,119 | |

Net Assets ($) | | | 104,798,019 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 141,039,164 | |

Total distributable earnings (loss) | | | | | (36,241,145) | |

Net Assets ($) | | | 104,798,019 | |

| | | | | | |

Net Asset Value Per Share | Class A | Class C | Class I | Class Y | |

Net Assets ($) | 27,682,108 | 3,134,916 | 72,437,794 | 1,543,201 | |

Shares Outstanding | 1,975,407 | 247,975 | 4,985,592 | 106,475 | |

Net Asset Value Per Share ($) | 14.01 | 12.64 | 14.53 | 14.49 | |

| | | | | |

See notes to consolidated financial statements. | | | | | |

20

CONSOLIDATED STATEMENT OF OPERATIONS

Year Ended October 31, 2023

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Interest | | | 4,495,754 | |

Dividends: | |

Unaffiliated issuers | | | 571,250 | |

Affiliated issuers | | | 862,955 | |

Total Income | | | 5,929,959 | |

Expenses: | | | | |

Management fee—Note 3(a) | | | 1,432,205 | |

Shareholder servicing costs—Note 3(c) | | | 211,121 | |

Professional fees | | | 135,034 | |

Subsidiary management fees—Note 3(a) | | | 134,461 | |

Registration fees | | | 64,868 | |

Distribution fees—Note 3(b) | | | 38,938 | |

Prospectus and shareholders’ reports | | | 34,840 | |

Directors’ fees and expenses—Note 3(d) | | | 26,468 | |

Chief Compliance Officer fees—Note 3(c) | | | 19,447 | |

Custodian fees—Note 3(c) | | | 7,637 | |

Loan commitment fees—Note 2 | | | 2,881 | |

Miscellaneous | | | 33,317 | |

Total Expenses | | | 2,141,217 | |

Less—reduction in expenses due to undertaking—Note 3(a) | | | (515,572) | |

Less—reduction in fees due to earnings credits—Note 3(c) | | | (5,022) | |

Net Expenses | | | 1,620,623 | |

Net Investment Income | | | 4,309,336 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments and foreign currency transactions | 209,671 | |

Net realized gain (loss) on futures | 3,269,323 | |

Net realized gain (loss) on options transactions | 469,594 | |

Net realized gain (loss) on forward foreign currency exchange contracts | (2,813,227) | |

Net realized gain (loss) on swap agreements | 532,847 | |

Net Realized Gain (Loss) | | | 1,668,208 | |

Net change in unrealized appreciation (depreciation) on investments

and foreign currency transactions | 142,815 | |

Net change in unrealized appreciation (depreciation) on futures | 911,103 | |

Net change in unrealized appreciation (depreciation) on

options transactions | (544,133) | |

Net change in unrealized appreciation (depreciation) on

forward foreign currency exchange contracts | 1,304,375 | |

Net change in unrealized appreciation (depreciation) on swap agreements | (4,046) | |

Net Change in Unrealized Appreciation (Depreciation) | | | 1,810,114 | |

Net Realized and Unrealized Gain (Loss) on Investments | | | 3,478,322 | |

Net Increase in Net Assets Resulting from Operations | | 7,787,658 | |

| | | | | | |

See notes to consolidated financial statements. | | | | | |

21

CONSOLIDATED STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | Year Ended October 31, |

| | | | 2023 | | 2022 | |

Operations ($): | | | | | | | | |

Net investment income (loss) | | | 4,309,336 | | | | (1,363,953) | |

Net realized gain (loss) on investments | | 1,668,208 | | | | (24,251,983) | |

Net change in unrealized appreciation

(depreciation) on investments | | 1,810,114 | | | | (1,417,650) | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | 7,787,658 | | | | (27,033,586) | |

Distributions ($): | |

Distributions to shareholders: | | | | | | | | |

Class A | | | (401,621) | | | | (6,080,213) | |

Class C | | | (29,406) | | | | (2,393,723) | |

Class I | | | (1,376,139) | | | | (21,247,593) | |

Class Y | | | (384,385) | | | | (15,888,539) | |

Total Distributions | | | (2,191,551) | | | | (45,610,068) | |

Capital Stock Transactions ($): | |

Net proceeds from shares sold: | | | | | | | | |

Class A | | | 4,808,573 | | | | 8,873,859 | |

Class C | | | 239,561 | | | | 188,357 | |

Class I | | | 16,422,441 | | | | 31,639,933 | |

Class Y | | | 262,589 | | | | 770,180 | |

Distributions reinvested: | | | | | | | | |

Class A | | | 324,188 | | | | 4,789,734 | |

Class C | | | 29,095 | | | | 2,362,765 | |

Class I | | | 1,137,836 | | | | 17,048,947 | |

Class Y | | | 66,616 | | | | 8,564,294 | |

Cost of shares redeemed: | | | | | | | | |

Class A | | | (8,779,691) | | | | (11,798,075) | |

Class C | | | (5,314,509) | | | | (7,225,560) | |

Class I | | | (40,345,100) | | | | (63,286,554) | |

Class Y | | | (27,978,743) | | | | (78,878,396) | |

Increase (Decrease) in Net Assets

from Capital Stock Transactions | (59,127,144) | | | | (86,950,516) | |

Total Increase (Decrease) in Net Assets | (53,531,037) | | | | (159,594,170) | |

Net Assets ($): | |

Beginning of Period | | | 158,329,056 | | | | 317,923,226 | |

End of Period | | | 104,798,019 | | | | 158,329,056 | |

22

| | | | | | | | | | |

| | | | Year Ended October 31, |

| | | | 2023 | | 2022 | |

Capital Share Transactions (Shares): | |

Class Aa | | | | | | | | |

Shares sold | | | 345,315 | | | | 593,238 | |

Shares issued for distributions reinvested | | | 23,698 | | | | 317,411 | |

Shares redeemed | | | (628,637) | | | | (808,361) | |

Net Increase (Decrease) in Shares Outstanding | (259,624) | | | | 102,288 | |

Class C | | | | | | | | |

Shares sold | | | 19,010 | | | | 14,643 | |

Shares issued for distributions reinvested | | | 2,343 | | | | 172,717 | |

Shares redeemed | | | (421,902) | | | | (528,548) | |

Net Increase (Decrease) in Shares Outstanding | (400,549) | | | | (341,188) | |

Class Ia | | | | | | | | |

Shares sold | | | 1,137,230 | | | | 2,078,847 | |

Shares issued for distributions reinvested | | | 80,413 | | | | 1,092,181 | |

Shares redeemed | | | (2,788,835) | | | | (4,241,028) | |

Net Increase (Decrease) in Shares Outstanding | (1,571,192) | | | | (1,070,000) | |

Class Ya | | | | | | | | |

Shares sold | | | 18,420 | | | | 44,781 | |

Shares issued for distributions reinvested | | | 4,718 | | | | 550,051 | |

Shares redeemed | | | (1,937,478) | | | | (5,159,107) | |

Net Increase (Decrease) in Shares Outstanding | (1,914,340) | | | | (4,564,275) | |

| | | | | | | | | |

a | During the period ended October 31, 2023, 15,628 Class Y shares representing $224,292 were exchanged for 15,590 Class I shares. During the period ended October 31, 2022, 39,868 Class Y shares representing $617,930 were exchanged for 39,787 Class I shares and 3 Class I shares representing $45 were exchanged for 3 Class A shares. | |

See notes to consolidated financial statements. | | | | | | | | |

23

CONSOLIDATED FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. These figures have been derived from the fund’s consolidated financial statements.

| | | | | | | |

| | | |

| | | Year Ended October 31, |

Class A Shares | | 2023 | 2022 | 2021 | 2020 | 2019 |

Per Share Data ($): | | | | | | |

Net asset value,

beginning of period | | 13.53 | 17.98 | 15.82 | 16.26 | 15.08 |

Investment Operations: | | | | | | |

Net investment income (loss)a | | .44 | (.11) | (.19) | (.02) | .15 |

Net realized and unrealized

gain (loss) on investments | | .22 | (1.52) | 2.35 | .08 | 1.16 |

Total from

Investment Operations | | .66 | (1.63) | 2.16 | .06 | 1.31 |

Distributions: | | | | | | |

Dividends from

net investment income | | (.18) | (.08) | - | (.17) | (.13) |

Dividends from

net realized gain on investments | | - | (2.74) | - | (.33) | - |

Total Distributions | | (.18) | (2.82) | - | (.50) | (.13) |

Net asset value, end of period | | 14.01 | 13.53 | 17.98 | 15.82 | 16.26 |

Total Return (%)b | | 4.94 | (10.75) | 13.79 | .28 | 8.82 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 1.81 | 1.72 | 1.60 | 1.58 | 1.55 |

Ratio of net expenses

to average net assets c | | 1.40 | 1.40 | 1.42 | 1.44 | 1.44 |

Ratio of net investment income (loss) to average net assets | | 3.15 | (.76) | (1.12) | (.14) | .96 |

Portfolio Turnover Rate | | - | - | 82.12 | 176.12 | 26.17 |

Net Assets,

end of period ($ x 1,000) | | 27,682 | 30,234 | 38,354 | 35,061 | 38,100 |

a Based on average shares outstanding.

b Exclusive of sales charge

c Reflected is the waiver of the Subsidiary management fee.

See notes to consolidated financial statements.

24

| | | | | | | |

| | | |

| | | Year Ended October 31, |

Class C Shares | | 2023 | 2022 | 2021 | 2020 | 2019 |

Per Share Data ($): | | | | | | |

Net asset value,

beginning of period | | 12.18 | 16.50 | 14.62 | 15.06 | 13.96 |

Investment Operations: | | | | | | |

Net investment income (loss)a | | .30 | (.20) | (.29) | (.13) | .03 |

Net realized and unrealized

gain (loss) on investments | | .21 | (1.38) | 2.17 | .06 | 1.09 |

Total from

Investment Operations | | .51 | (1.58) | 1.88 | (.07) | 1.12 |

Distributions: | | | | | | |

Dividends from

net investment income | | (.05) | - | - | (.04) | (.02) |

Dividends from

net realized gain on investments | | - | (2.74) | - | (.33) | - |

Total Distributions | | (.05) | (2.74) | - | (.37) | (.02) |

Net asset value, end of period | | 12.64 | 12.18 | 16.50 | 14.62 | 15.06 |

Total Return (%)b | | 4.20 | (11.44) | 12.93 | (.50) | 8.01 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 2.58 | 2.48 | 2.36 | 2.33 | 2.29 |

Ratio of net expenses

to average net assetsc | | 2.15 | 2.15 | 2.17 | 2.19 | 2.19 |

Ratio of net investment income (loss) to average net assets | | 2.40 | (1.51) | (1.87) | (.87) | .22 |

Portfolio Turnover Rate | | - | - | 82.12 | 176.12 | 26.17 |

Net Assets,

end of period ($ x 1,000) | | 3,135 | 7,899 | 16,334 | 22,548 | 31,771 |

a Based on average shares outstanding.

b Exclusive of sales charge

c Reflected is the waiver of the Subsidiary management fee.

See notes to consolidated financial statements.

25

CONSOLIDATED FINANCIAL HIGHLIGHTS (continued)

| | | | | | | |

| | | |

| | | Year Ended October 31, |

Class I Shares | | 2023 | 2022 | 2021 | 2020 | 2019 |

Per Share Data ($): | | | | | | |

Net asset value,

beginning of period | | 14.02 | 18.54 | 16.26 | 16.71 | 15.51 |

Investment Operations: | | | | | | |

Net investment income (loss)a | | .49 | (.08) | (.15) | .02 | .19 |

Net realized and unrealized

gain (loss) on investments | | .24 | (1.58) | 2.43 | .08 | 1.20 |

Total from

Investment Operations | | .73 | (1.66) | 2.28 | .10 | 1.39 |

Distributions: | | | | | | |

Dividends from

net investment income | | (.22) | (.12) | - | (.22) | (.19) |

Dividends from

net realized gain on investments | | - | (2.74) | - | (.33) | - |

Total Distributions | | (.22) | (2.86) | - | (.55) | (.19) |

Net asset value, end of period | | 14.53 | 14.02 | 18.54 | 16.26 | 16.71 |

Total Return (%) | | 5.26 | (10.53) | 14.02 | .53 | 9.04 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 1.56 | 1.46 | 1.34 | 1.31 | 1.29 |

Ratio of net expenses

to average net assetsb | | 1.15 | 1.15 | 1.17 | 1.19 | 1.19 |

Ratio of net investment income (loss) to average net assets | | 3.41 | (.51) | (.88) | .13 | 1.20 |

Portfolio Turnover Rate | | - | - | 82.12 | 176.12 | 26.17 |

Net Assets,

end of period ($ x 1,000) | | 72,438 | 91,928 | 141,384 | 169,485 | 324,848 |

a Based on average shares outstanding.

b Reflected is the waiver of the Subsidiary management fee.

See notes to consolidated financial statements.

26

| | | | | | | |

| | | |

| | | Year Ended October 31, |

Class Y Shares | | 2023 | 2022 | 2021 | 2020 | 2019 |

Per Share Data ($): | | | | | | |

Net asset value,

beginning of period | | 13.99 | 18.50 | 16.23 | 16.69 | 15.53 |

Investment Operations: | | | | | | |

Net investment income (loss)a | | .49 | (.08) | (.15) | .03 | .20 |

Net realized and unrealized

gain (loss) on investments | | .23 | (1.57) | 2.42 | .07 | 1.19 |

Total from

Investment Operations | | .72 | (1.65) | 2.27 | .10 | 1.39 |

Distributions: | | | | | | |

Dividends from

net investment income | | (.22) | (.12) | - | (.23) | (.23) |

Dividends from

net realized gain on investments | | - | (2.74) | - | (.33) | - |

Total Distributions | | (.22) | (2.86) | - | (.56) | (.23) |

Net asset value, end of period | | 14.49 | 13.99 | 18.50 | 16.23 | 16.69 |

Total Return (%) | | 5.20 | (10.54) | 14.05 | .54 | 9.13 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 1.46 | 1.35 | 1.26 | 1.22 | 1.22 |

Ratio of net expenses

to average net assetsb | | 1.15 | 1.15 | 1.17 | 1.17 | 1.15 |

Ratio of net investment income (loss) to average net assets | | 3.40 | (.51) | (.86) | .18 | 1.25 |

Portfolio Turnover Rate | | - | - | 82.12 | 176.12 | 26.17 |

Net Assets,

end of period ($ x 1,000) | | 1,543 | 28,268 | 121,851 | 239,102 | 564,884 |

a Based on average shares outstanding.

b Reflected is the waiver of the Subsidiary management fee.

See notes to consolidated financial statements.

27

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

BNY Mellon Dynamic Total Return Fund (the “fund”) is a separate diversified series of BNY Mellon Advantage Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering seven series, including the fund. The fund’s investment objective is to seek total return. BNY Mellon Investment Adviser, Inc. (the “Adviser”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Newton Investment Management North America, LLC (the “Sub-Adviser”), an indirect wholly-owned subsidiary of BNY Mellon and an affiliate of the Adviser, serves as the fund’s sub-adviser.

Effective March 31, 2023, the Sub-Adviser, entered into a sub-sub-investment advisory agreement with its affiliate, Newton Investment Management Limited (“NIM”), to enable NIM to provide certain advisory services to the Sub-Adviser for the benefit of the fund, including, but not limited to, portfolio management services. NIM is subject to the supervision of the Sub-Adviser and the Adviser. NIM is also an affiliate of the Adviser. NIM, located at 160 Queen Victoria Street, London, EC4V, 4LA, England, was formed in 1978. NIM is an indirect subsidiary of BNY Mellon.

The fund may gain investment exposure to global commodity markets through investments in DTR Commodity Fund Ltd., (the “Subsidiary”), a wholly-owned and controlled subsidiary of the fund organized under the laws of the Cayman Islands. The Subsidiary has the ability to invest in commodities and securities consistent with the investment objective of the fund. The Adviser serves as investment adviser for the Subsidiary, the Sub-Adviser serves as the Subsidiary’s sub-investment advisor and Citibank N.A. serves as the Subsidiary’s custodian. The financial statements have been consolidated and include the accounts of the fund and the Subsidiary. Accordingly, all inter-company transactions and balances have been eliminated. A subscription agreement was entered into between the fund and the Subsidiary, comprising the entire issued share capital of the Subsidiary, with the intent that the fund will remain the sole shareholder and retain all rights. Under the Amended and Restated Memorandum and Articles of Association, shares issued by the Subsidiary confer upon a shareholder the right to receive notice of, to attend and to vote at general meetings of the Subsidiary and shall confer upon the shareholder rights in a winding-up or repayment of capital and the right to participate in the

28

profits or assets of the Subsidiary. The following summarizes the structure and relationship of the Subsidiary at October 31, 2023:

| | | | |

| | Subsidiary Activity |

Consolidated fund Net Assets ($) | | 104,798,019 | |

Subsidiary Percentage of fund Net Assets | | 12.08% | |

Subsidiary Financial Statement Information ($) | | | |

Total Assets | | 12,959,136 | |

Total Liabilities | | 303,264 | |

Net Assets | | 12,655,872 | |

Total Income | | 466,843 | |

Total Expenses | | 161,572 | |

Net Investment Income | | 305,271 | |

Net Realized Gain (Loss) | | (179,626) | |

Net Change in Unrealized Appreciation (Depreciation) | | (149,970) | |

Net Realized and Unrealized Gain (Loss) on Investments | | (329,596) | |

Net (Decrease) in Net Assets Resulting from Operations | | (24,325) | |

BNY Mellon Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Adviser, is the distributor of the fund’s shares. The fund is authorized to issue 600 million shares of $.001 par value Common Stock. The fund currently has authorized four classes of shares: Class A (200 million shares authorized), Class C (100 million shares authorized), Class I (150 million shares authorized) and Class Y (150 million shares authorized). Class A and Class C shares are sold primarily to retail investors through financial intermediaries and bear Distribution and/or Shareholder Services Plan fees. Class A shares generally are subject to a sales charge imposed at the time of purchase. Class A shares bought without an initial sales charge as part of an investment of $1 million or more may be charged a contingent deferred sales charge (“CDSC”) of 1.00% if redeemed within one year. Class C shares are subject to a CDSC imposed on Class C shares redeemed within one year of purchase. Class C shares automatically convert to Class A shares eight years after the date of purchase, without the imposition of a sales charge. Class I shares are sold primarily to bank trust departments and other financial service providers (including BNY Mellon and its affiliates), acting on behalf of customers having a qualified trust or an investment account or relationship at such institution, and bear no Distribution or Shareholder Services Plan fees. Class Y shares are sold at net asset value per share generally to institutional investors, and bear no Distribution or Shareholder Services Plan fees. Class I and Class Y shares are offered without a front-end sales charge or CDSC. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

29

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the SEC under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund is an investment company and applies the accounting and reporting guidance of the FASB ASC Topic 946 Financial Services-Investment Companies. The fund’s consolidated financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

30

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

The Company’s Board of Directors (the “Board”) has designated the Adviser as the fund’s valuation designee to make all fair value determinations with respect to the fund’s portfolio investments, subject to the Board’s oversight and pursuant to Rule 2a-5 under the Act.

Registered investment companies that are not traded on an exchange are valued at their net asset value and are generally categorized within Level 1 of the fair value hierarchy.

Investments in debt securities, excluding short-term investments (other than U.S. Treasury Bills), futures, options and forward foreign currency exchange contracts (“forward contracts”), are valued each business day by one or more independent pricing services (each, a “Service”) approved by the Board. Investments for which quoted bid prices are readily available and are representative of the bid side of the market in the judgment of a Service are valued at the mean between the quoted bid prices (as obtained by a Service from dealers in such securities) and asked prices (as calculated by a Service based upon its evaluation of the market for such securities). Securities are valued as determined by a Service, based on methods which include consideration of the following: yields or prices of securities of comparable quality, coupon, maturity and type; indications as to values from dealers; and general market conditions. The Services are engaged under the general supervision of the Board. These securities are generally categorized within Level 2 of the fair value hierarchy. U.S. Treasury Bills are valued at the mean price between quoted bid prices and asked prices by a Service. These securities are generally categorized within Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to accurately reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but

31

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For securities where observable inputs are limited, assumptions about market activity and risk are used and such securities are generally categorized within Level 3 of the fair value hierarchy.

Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange.

Forward contracts are valued at the forward rate and are generally categorized within Level 2 of the fair value hierarchy. Futures and options, which are traded on an exchange, are valued at the last sales price on the securities exchange on which such securities are primarily traded or at the last sales price on the national securities market on each business day and are generally categorized within Level 1 of the fair value hierarchy. Investments in swap agreements are valued each business day by a Service. Swaps agreements are valued by a Service by using a swap pricing model which incorporates among other factors, default probabilities, recovery rates, credit curves of the underlying issuer and swap spreads on interest rates and are generally categorized within Level 2 of the fair value hierarchy.

The following is a summary of the inputs used as of October 31, 2023 in valuing the fund’s investments:

| | | | | | | |

| | Level 1-Unadjusted Quoted Prices | Level 2- Other Significant Observable Inputs | | Level 3-Significant Unobservable Inputs | Total | |

Assets ($) | | |

Investments in Securities:† | | |

Investment Companies | 12,309,755 | - | | - | 12,309,755 | |

U.S. Treasury Securities | - | 85,638,001 | | - | 85,638,001 | |

32

| | | | | | | |

| | Level 1-Unadjusted Quoted Prices | Level 2- Other Significant Observable Inputs | | Level 3-Significant Unobservable Inputs | Total | |

Assets ($) (continued) | | |