Filed Pursuant To Rule 433

Registration No. 333-275079

November 4, 2024

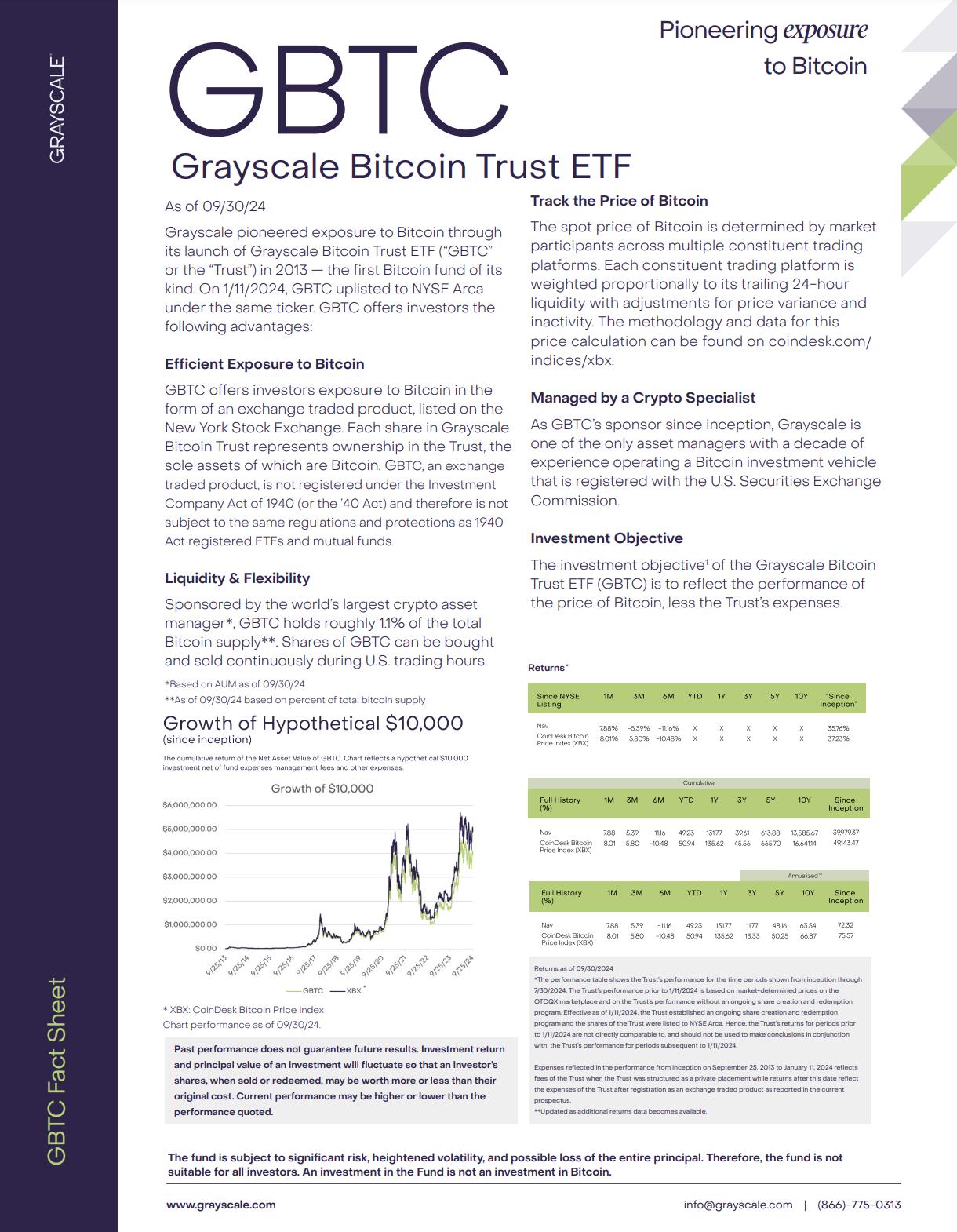

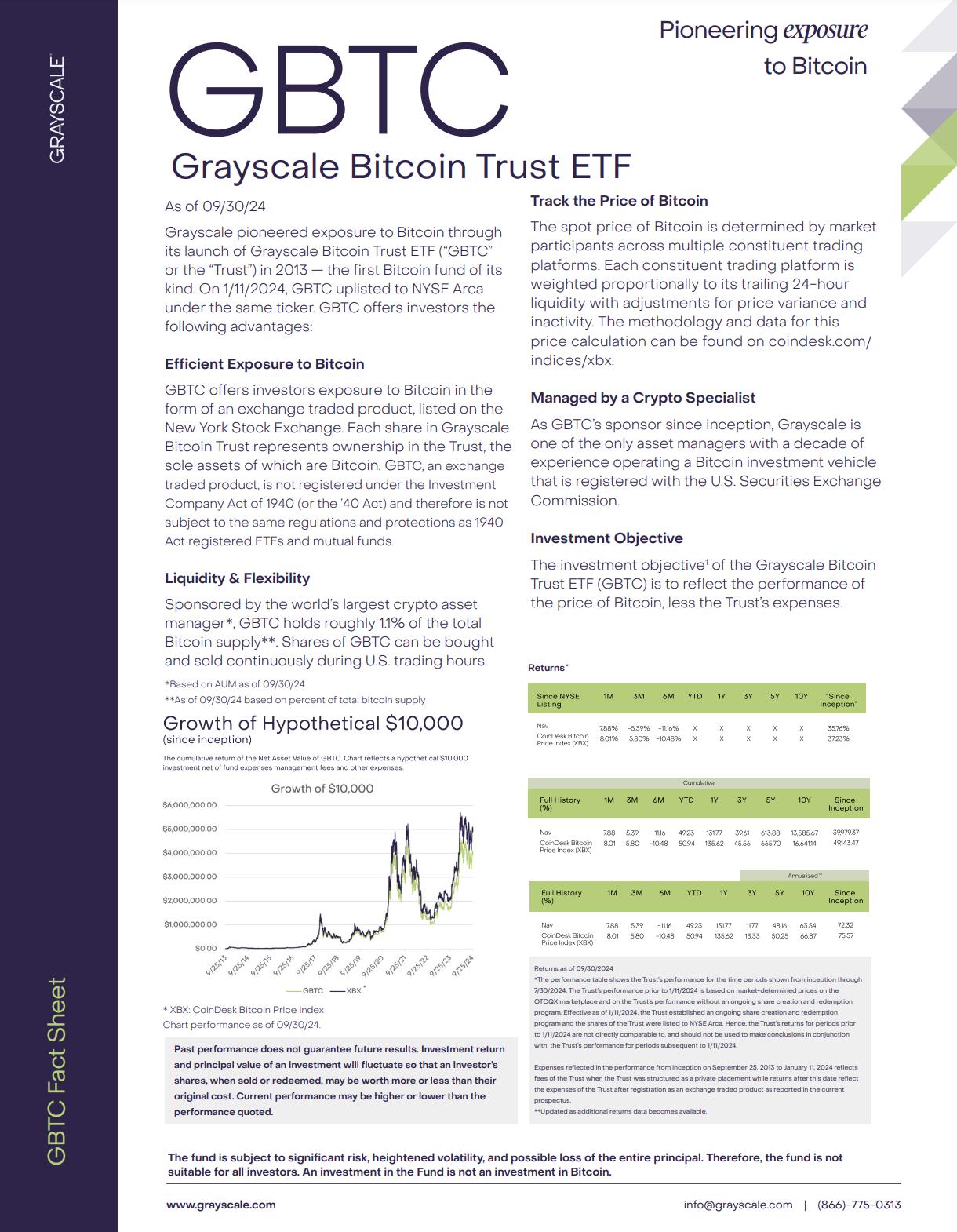

GBTC Grayscale Bitcoin Trust ETF Growth of Hypothetical $10,000 (since inception) The cumulative return of the Net Asset Value of GBTC. Chart reflects a hypothetical $10,000 investment net of fund expenses management fees and other expenses. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. www.grayscale.com info@grayscale.com | (866)-775-0313 Pioneering exposure to Bitcoin GBTC Fact Sheet Chart performance as of 09/30/24. The fund is subject to significant risk, heightened volatility, and possible loss of the entire principal. Therefore, the fund is not suitable for all investors. An investment in the Fund is not an investment in Bitcoin. As of 09/30/24 Grayscale pioneered exposure to Bitcoin through its launch of Grayscale Bitcoin Trust ETF (“GBTC” or the “Trust”) in 2013 — the first Bitcoin fund of its kind. On 1/11/2024, GBTC uplisted to NYSE Arca under the same ticker. GBTC offers investors the following advantages: Efficient Exposure to Bitcoin GBTC offers investors exposure to Bitcoin in the form of an exchange traded product, listed on the New York Stock Exchange. Each share in Grayscale Bitcoin Trust represents ownership in the Trust, the sole assets of which are Bitcoin. GBTC, an exchange traded product, is not registered under the Investment Company Act of 1940 (or the ’40 Act) and therefore is not subject to the same regulations and protections as 1940 Act registered ETFs and mutual funds. Liquidity & Flexibility Sponsored by the world’s largest crypto asset manager*, GBTC holds roughly 1.1% of the total Bitcoin supply**. Shares of GBTC can be bought and sold continuously during U.S. trading hours. *Based on AUM as of 09/30/24 **As of 09/30/24 based on percent of total bitcoin supply Track the Price of Bitcoin The spot price of Bitcoin is determined by market participants across multiple constituent trading platforms. Each constituent trading platform is weighted proportionally to its trailing 24-hour liquidity with adjustments for price variance and inactivity. The methodology and data for this price calculation can be found on coindesk.com/ indices/xbx. Managed by a Crypto Specialist As GBTC’s sponsor since inception, Grayscale is one of the only asset managers with a decade of experience operating a Bitcoin investment vehicle that is registered with the U.S. Securities Exchange Commission. Investment Objective The investment objective1 of the Grayscale Bitcoin Trust ETF (GBTC) is to reflect the performance of the price of Bitcoin, less the Trust’s expenses. * XBX: CoinDesk Bitcoin Price Index * Returns as of 09/30/2024 *The performance table shows the Trust’s performance for the time periods shown from inception through 7/30/2024. The Trust’s performance prior to 1/11/2024 is based on market-determined prices on the OTCQX marketplace and on the Trust’s performance without an ongoing share creation and redemption program. Effective as of 1/11/2024, the Trust established an ongoing share creation and redemption program and the shares of the Trust were listed to NYSE Arca. Hence, the Trust’s returns for periods prior to 1/11/2024 are not directly comparable to, and should not be used to make conclusions in conjunction with, the Trust’s performance for periods subsequent to 1/11/2024. Expenses reflected in the performance from inception on September 25, 2013 to January 11, 2024 reflects fees of the Trust when the Trust was structured as a private placement while returns after this date reflect the expenses of the Trust after registration as an exchange traded product as reported in the current prospectus. **Updated as additional returns data becomes available.

GBTC Grayscale Bitcoin Trust ETF Growth of Hypothetical $10,000 (since inception) The cumulative return of the Net Asset Value of GBTC. Chart reflects a hypothetical $10,000 investment net of fund expenses management fees and other expenses. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. www.grayscale.com info@grayscale.com | (866)-775-0313 Pioneering exposure to Bitcoin GBTC Fact Sheet Chart performance as of 09/30/24. The fund is subject to significant risk, heightened volatility, and possible loss of the entire principal. Therefore, the fund is not suitable for all investors. An investment in the Fund is not an investment in Bitcoin. As of 09/30/24 Grayscale pioneered exposure to Bitcoin through its launch of Grayscale Bitcoin Trust ETF (“GBTC” or the “Trust”) in 2013 — the first Bitcoin fund of its kind. On 1/11/2024, GBTC uplisted to NYSE Arca under the same ticker. GBTC offers investors the following advantages: Efficient Exposure to Bitcoin GBTC offers investors exposure to Bitcoin in the form of an exchange traded product, listed on the New York Stock Exchange. Each share in Grayscale Bitcoin Trust represents ownership in the Trust, the sole assets of which are Bitcoin. GBTC, an exchange traded product, is not registered under the Investment Company Act of 1940 (or the ’40 Act) and therefore is not subject to the same regulations and protections as 1940 Act registered ETFs and mutual funds. Liquidity & Flexibility Sponsored by the world’s largest crypto asset manager*, GBTC holds roughly 1.1% of the total Bitcoin supply**. Shares of GBTC can be bought and sold continuously during U.S. trading hours. *Based on AUM as of 09/30/24 **As of 09/30/24 based on percent of total bitcoin supply Track the Price of Bitcoin The spot price of Bitcoin is determined by market participants across multiple constituent trading platforms. Each constituent trading platform is weighted proportionally to its trailing 24-hour liquidity with adjustments for price variance and inactivity. The methodology and data for this price calculation can be found on coindesk.com/ indices/xbx. Managed by a Crypto Specialist As GBTC’s sponsor since inception, Grayscale is one of the only asset managers with a decade of experience operating a Bitcoin investment vehicle that is registered with the U.S. Securities Exchange Commission. Investment Objective The investment objective1 of the Grayscale Bitcoin Trust ETF (GBTC) is to reflect the performance of the price of Bitcoin, less the Trust’s expenses. * XBX: CoinDesk Bitcoin Price Index * Returns as of 09/30/2024 *The performance table shows the Trust’s performance for the time periods shown from inception through 7/30/2024. The Trust’s performance prior to 1/11/2024 is based on market-determined prices on the OTCQX marketplace and on the Trust’s performance without an ongoing share creation and redemption program. Effective as of 1/11/2024, the Trust established an ongoing share creation and redemption program and the shares of the Trust were listed to NYSE Arca. Hence, the Trust’s returns for periods prior to 1/11/2024 are not directly comparable to, and should not be used to make conclusions in conjunction with, the Trust’s performance for periods subsequent to 1/11/2024. Expenses reflected in the performance from inception on September 25, 2013 to January 11, 2024 reflects fees of the Trust when the Trust was structured as a private placement while returns after this date reflect the expenses of the Trust after registration as an exchange traded product as reported in the current prospectus. **Updated as additional returns data becomes available.

Grayscale Bitcoin Trust ETF (the “Trust”) has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Trust has filed with the SEC for more complete information about the Trust and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Trust or any authorized participant will arrange to send you the prospectus (when available) if you request it by calling (833) 903 - 2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101.