Filed Pursuant To Rule 433

Registration No. 333-275079

November 4, 2024

Grayscale all products summary q3 2024

Our Story Invest in your share of the future Grayscale enables investors to access the digital economy through a suite of future-forward investment products. Founded in 2013, Grayscale has a over a decade of industry leading expertise as a crypto-focused asset manager. Investors, advisors, and allocators turn to Grayscale for single asset, diversified, and thematic exposure. Certain Grayscale products are distributed by Grayscale Securities, LLC. All Products—2 For Financial Professional Use Only

Crypto ETP Products Our crypto ETPs allow investors to gain passive, long-only exposure to crypto with the added protections of the ETP wrapper. By utilizing a spot crypto ETP, investors avoid the challenges of buying and storing crypto directly in a single and convenient solution. Crypto ETP Product name Ticker Inception Date Grayscale Bitcoin Trust ETF GBTC Private Placement Launch: 9/25/2013 ETP Uplisting: 1/11/2024 Grayscale Ethereum Trust ETF ETHE Private Placement Launch: 12/14/2017 ETP Uplisting: 7/23/2024 Grayscale Ethereum Mini Trust ETF ETH ETPLaunch:7/23/2024 Grayscale Bitcoin Mini Trust ETF BTC ETP Launch: 7/31/2024 All Products—3 For Financial Professional Use Only GBTC, ETHE, ETH, and BTC (collectively the "Trusts"), exchange traded products, are not registered under the Investment Company Act of 1940 (or the ’40 Act) and therefore are not subject to the same regulations and protections as 1940 Act registered ETFs and mutual funds. The Trusts are subject to significant risk. An investor may lose all their money. The Trusts are subject to heightened volatility. The Trusts are not suitable for all investors. An investment in the Trusts is not an investment in the underlying cryptocurrency.

Crypto ETP Products–Disclosure The Grayscale Bitcoin Trust ETF ("GBTC") and the Grayscale Ethereum Trust ETF ("ETHE")(collectively the “Trusts”) have filed registration statements (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectuses in those registration statements and other documents the Trusts have filed with the SEC for more complete information about the Trusts and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Trusts or any authorized participant will arrange to send you the prospectus (when available) if you request it by calling (833)903-2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101. Please read the Grayscale Ethereum Mini Trust ETF ("ETH") prospectus and Grayscale Bitcoin Mini Trust ETF ("BTC") prospectus carefully before investing in the Trusts. Foreside Fund Services, LLC is the Marketing Agent for GBTC, ETHE, BTC, and ETH (the "Trusts"). The Trusts holds Bitcoin or Ether; however, an investment in the Trusts are not a direct investment in Bitcoin or Ether. As non-diversified and single industry funds, the value of the shares may fluctuate more than shares invested in a broader range of industries. An investment in the Trusts involves risks, including possible loss of principal. Extreme volatility, regulatory changes, and exposure to digital asset trading platforms may impact the value of Bitcoin and Ether, and consequently the value of the Trusts. The Trusts rely on third party service providers to perform certain functions essential to the affairs of the Trusts and the replacement of such service providers could pose a challenge to the safekeeping of the digital asset and to the operations of the Trusts. NAV per Share is not calculated in accordance with GAAP. NAV per Share is not intended to be a substitute for the Trust’s Principal Market NAV per Share calculated in accordance with GAAP. For GBTC, prior to 1/11/2024, Principal Market NAV per Share was referred to as NAV per Share and NAV per share was referred to as Digital Asset Holdings per Share. For ETHE, prior to 7/23/2024 Principal Market NAV per Share was referred to as NAV per Share and NAV per share was referred to as Digital Asset Holdings per Share. Our definitions and calculations of these non-GAAP measures may not be the same as similar measures reported by other spot Bitcoin or Ether ETPs. Please refer to the GBTC and ETHE filings with the Securities and Exchange Commission for additional information. All Products - 4 For Financial Professional Use Only There is no guarantee that a market for the shares will be available which will adversely impact the liquidity of the Trust. The value of the Trust relates directly to the value of the underlying digital asset, the value of which may be highly volatile and subject to fluctuations due to a number of factors. Digital Asset Risk Disclosures Extreme volatility of trading prices that many digital assets, including Bitcoin and Ether, have experienced in recent periods and may continue to experience, could have a material adverse effect on the value of the Trusts and the shares could lose all or substantially all of their value. Digital assets represent a new and rapidly evolving industry. The value of the Trusts depends on the acceptance of the digital assets, the capabilities and development of blockchain technologies and the fundamental investment characteristics of the digital asset. Digital asset networks are developed by a diverse set of contributors and the perception that certain high-profile contributors will no longer contribute to the network could have an adverse effect on the market price of the related digital asset. Digital assets may have concentrated ownership and large sales or distributions by holders of such digital assets could have an adverse effect on the market price of such digital assets. The value of the Trusts relates directly to the value of the underlying digital asset, the value of which may be highly volatile and subject to fluctuations due to a number of factors.

Crypto ETP Products – Disclosure All Products — 5 For Financial Professional Use Only A substantial direct investment in digital assets may require expensive and sometimes complicated arrangements in connection with the acquisition, security and safekeeping of the digital asset and may involve the payment of substantial acquisition fees from third party facilitators through cash payments of U.S. dollars. Because the values of GBTC and BTC are correlated with the value of Bitcoin, it is important to understand the investment attributes of, and the market for, the underlying digital asset. . Because the values of ETHE and ETH are correlated with the value of Ether, it is important to understand the investment attributes of, and the market for, the underlying digital asset. Please consult with your financial professional. Prior to 1/11/2024, shares of GBTC were offered only in private placement transactions exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”). GBTC’s investment objective both before and after 1/11/2024 has remained constant, namely to reflect the value of Bitcoin held by the Trust, less the Trust’s expenses and other liabilities. However prior to 01/11/2024, the Trust did not meet its investment objective. The performance of GBTC before and after 1/11/2024 may differ significantly. Prior to 7/23/2024, shares of ETHE were offered only in private placement transactions exempt from registration under the Securities Act. ETHE’s investment objective both before and after 7/23/2024 has remained constant, namely to reflect the value of Ether held by the Trust, less the Trust’s expenses and other liabilities. However, prior to 7/23/2024, ETHE did not meet its investment objective. The performance of ETHE before and after 7/23/2024 may differ significantly.

Equity ETF Products All Products — 6 Our Equity ETF offers investors the opportunity to invest in innovative businesses that we believe are integral in evolving the financial system to build the digital economy. It does this by allowing investors to access all three pillars of the digital economy in a single fund: financial foundations, technology solutions, and digital asset infrastructure. Equity ETF Product name Ticker Inception Date Grayscale Future of Finance ETF GFOF 2/1/2022 For Financial Professional Use Only

Equity ETF Products – Disclosure All Products — 7 Grayscale Advisors, LLC (“GSA”) is the adviser of GFOF. Investments managed by GSA are registered under the Investment Company Act of 1940 and subject to the rules and regulations of the Securities Act of 1933 and Investment Advisers Act of 1940. Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the Fund, please call (833) 903-2211 or visit our website at etfs.grayscale.com/gfof. Read the prospectus or summary prospectus carefully before investing. Investments involve risk. Principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. GFOF is non-diversified therefore shares may rise and fall more than the value of shares of a fund that invests in securities of companies in a broader range of industries. GFOF is not actively managed. Investments in foreign securities may involve risks such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. These risks are magnified in emerging markets. Investments made in small to mid-capitalization companies are subject to greater risks than large company stocks due to limited resources and inventory, as well as being more sensitive to adverse conditions. GFOF also will not invest in initial coin offerings. It may, however, have indirect exposure to digital assets by virtue of its investments in companies that use one or more digital assets as part of their business activities or that hold digital assets as proprietary investments. Because GFOF will not invest directly in any digital assets, it will not track price movements of any digital assets. The Bloomberg Grayscale Future of Finance Index (BGFOFN) is built using Bloomberg Intelligence’s proprietary theme basket methodology. The index includes companies that Bloomberg Intelligence has projected will contribute significantly to the growth of the digital economy in three key pillars: financial foundations, digital asset infrastructure, and technology solutions. Index returns assume that dividends are reinvested and do not include the effect of management fees or expenses. It is not possible to invest directly in an index. Future of Finance companies rely heavily on the success of the digital currency industry, the development and acceptance of which is subject to a variety of factors that are difficult to evaluate. These companies may be subject to theft, loss or destruction of cryptographic keys (required to access a user’s account when transacting on blockchain). Blockchain technology is new and many of its uses may be untested. For Financial Professional Use Only The development and acceptance of competing platforms or technologies may cause consumers or investors to use an alternative to blockchains. Digital assets that are represented on a blockchain-and trade on a digital asset exchange may not necessarily benefit from viable trading markets. Digital commodities and their associated platforms are largely unregulated, and the regulatory environment is rapidly evolving. Companies that are developing financial technologies that seek to disrupt or displace established financial institutions generally face competition from much larger and more established firms. “Future of finance” is defined as the intersection of finance, technology and digital assets. GFOF is distributed by Foreside Fund Services, LLC and Grayscale Advisors, LLC is the adviser. For Professional Use Only

Crypto Private Placement Products All Products — 8 Our private placements offer accredited investors exposure to a broad array of crypto protocols through a familiar investment structure without the challenges of buying, storing, and safekeeping the tokens directly. Investors, advisors, and allocators turn to Grayscale for exposure to single asset, diversified, and thematic investment products. Each private placement is at a different phase of our four-stage product lifecycle and are opened periodically for new subscriptions at net asset value (NAV).Private Placements – Phase 1 Periodically, private placement products are open and available for subscription at NAV by accredited investors. We intend to progress them through the four-phase Grayscale product lifecycle. Product Name Inception Date Minimum Investment Grayscale Smart Contract Platform ex-Ethereum Fund 3/16/2022 $50,000 Grayscale Near Trust 5/22/2024 $25,000 Grayscale Stacks Trust 5/22/2024 $25,000 Grayscale Bittensor Trust 6/10/2024 $25,000 Grayscale Decentralized AI Fund 7/2/2024 $50,000 Grayscale Sui Trust 8/1/2024 $25,000 Grayscale MakerDAO Trust 8/8/2024 $25,000 Grayscale Avalanche Trust Grayscale XRP Trust Grayscale Aave Trust 8/20/2024 9/5/2024 10/3/2024 $25,000 $25,000 $25,000 For Financial Professional Use Only

Crypto Private Placement Products / Continued All Products — 9 Private Placements – Phase 2: Public Quotation These products are periodically available for subscription at NAV by accredited investors. Private placements in this phase must be held for a minimum of one year before investors may obtain liquidity on the public market. NAV per Share is calculated daily at 4 pm ET, based on the applicable Index or Reference Rate. If you would like to see how NAV is calculated, please refer to the applicable Product’s disclosure language in its private placement memorandum. Additionally, since these products are quoted on OTC Markets, all investors, accredited or not, may access these products on the secondary market regardless, at prices dictated by the market. Product Name Ticker Inception Date Minimum Investment Grayscale Basic Attention Token Trust GBAT 2/26/2021 $50,000 Grayscale Chainlink Trust GLNK 2/26/2021 $50,000 Grayscale Decentraland Trust MANA 2/26/2021 $50,000 Grayscale Livepeer Trust GLIV 3/10/2021 $50,000 Grayscale Filecoin Trust FILG 3/15/2021 $50,000 Grayscale Decentralized Finance (DeFi) Fund DEFG 7/14/2021 $50,000 Grayscale Solana Trust GSOL 11/18/2021 $50,000 For Financial Professional Use Only

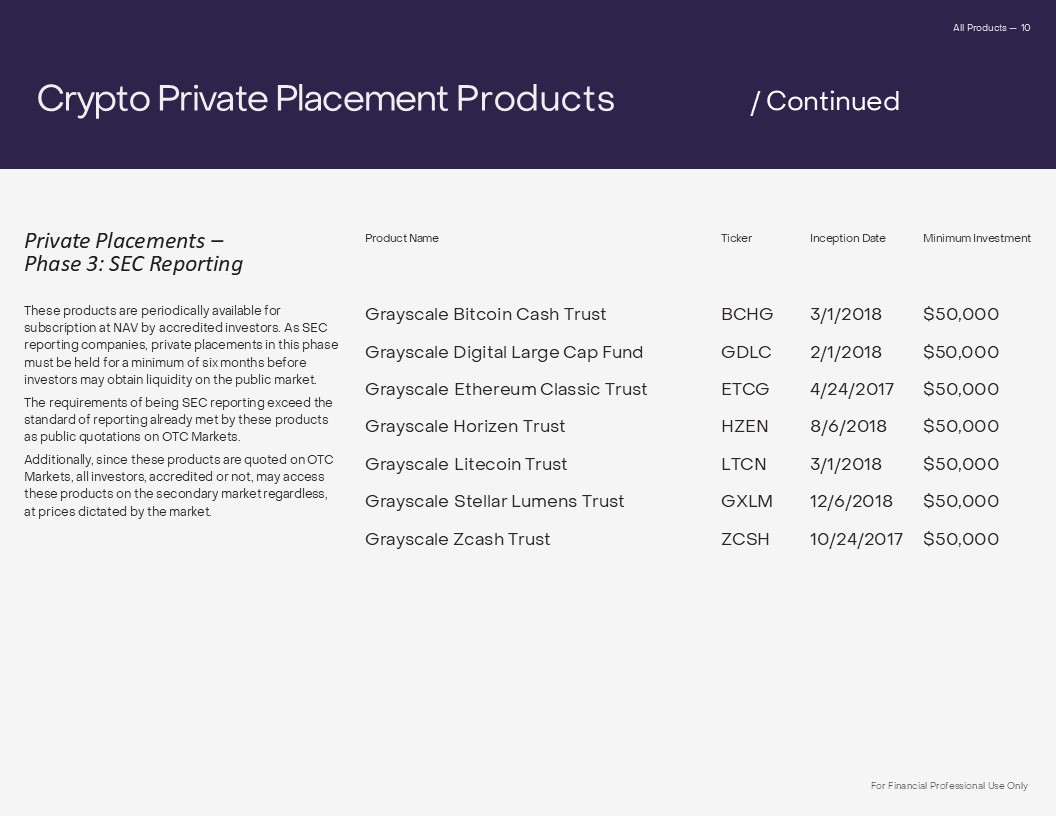

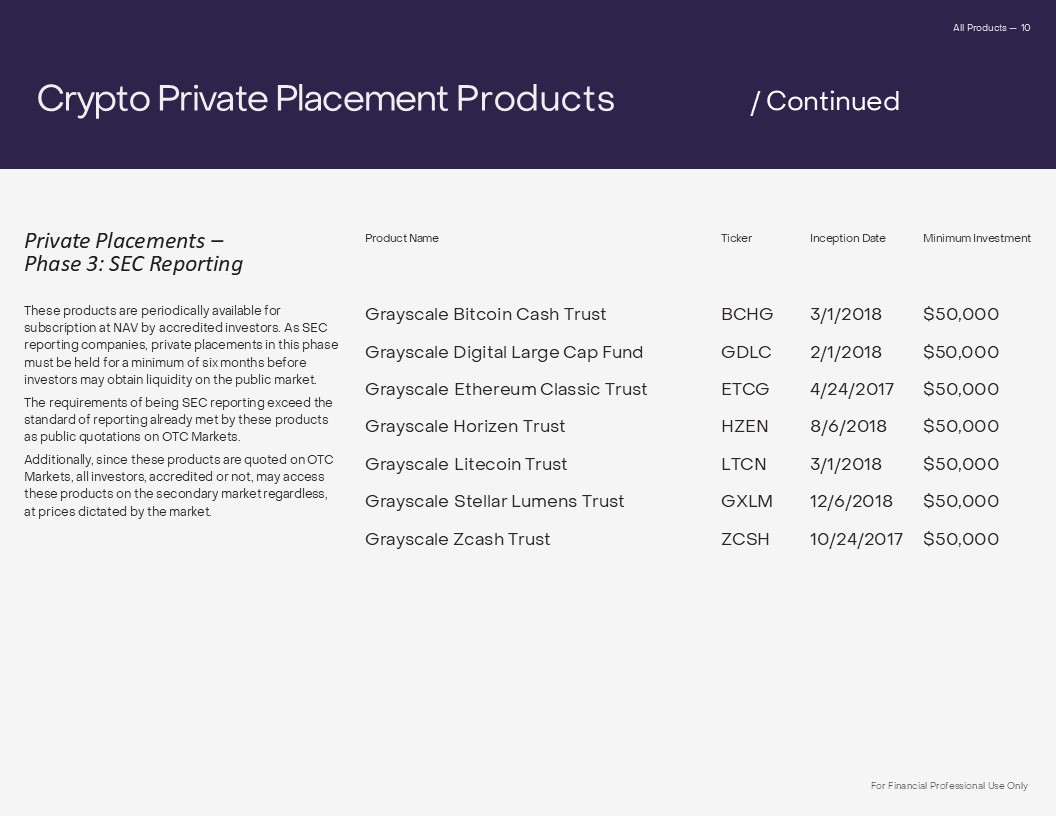

All Products — 10 Private Placements – Phase 3: SEC Reporting These products are periodically available for subscription at NAV by accredited investors. As SEC reporting companies, private placements in this phase must be held for a minimum of six months before investors may obtain liquidity on the public market. The requirements of being SEC reporting exceed the standard of reporting already met by these products as public quotations on OTC Markets. Additionally, since these products are quoted on OTC Markets, all investors, accredited or not, may access these products on the secondary market regardless, at prices dictated by the market. Product Name Ticker Inception Date Minimum Investment Grayscale Bitcoin Cash Trust BCHG 3/1/2018 $50,000 Grayscale Digital Large Cap Fund GDLC 2/1/2018 $50,000 Grayscale Ethereum Classic Trust ETCG 4/24/2017 $50,000 Grayscale Horizen Trust HZEN 8/6/2018 $50,000 Grayscale Litecoin Trust LTCN 3/1/2018 $50,000 Grayscale Stellar Lumens Trust GXLM 12/6/2018 $50,000 Grayscale Zcash Trust ZCSH 10/24/2017 $50,000 Crypto Private Placement Products /Continued For Financial Professional Use Only

All Products — 11 Private Placement Products – Disclosure Grayscale Investments, LLC (“Grayscale”) is the parent holding company of Grayscale Advisors, LLC (“GSA”), an SEC-registered investment adviser, as well Grayscale Securities, LLC (“GSS”), an SEC-registered broker/dealer and member of FINRA. Grayscale is not registered as an investment adviser under the Investment Advisers Act of 1940 and none of the investment products (“Products”) sponsored or managed by Grayscale are registered under the Investment Company Act of 1940. Investments in the Products are speculative investments that involve high degrees of risk, including a partial or total loss of invested funds. The Products are not suitable for any investor that cannot afford loss of the entire investment. Carefully consider investment objectives, risk factors, fees and expenses before investing. This and other information can be found in each Product’s private placement memorandum, which may be obtained from Grayscale and, for each Product that is an SEC reporting company, the SEC’s website, or for each Product that reports under the OTC Markets Alternative Reporting Standards, the OTC Markets website. Reports prepared in accordance with the OTC Markets Alternative Reporting Standards are not prepared in accordance with SEC requirements and may not contain all information that is useful for an informed investment decision. Read these documents carefully before investing. The shares of each Product are intended to reflect the price of the digital asset(s) held by such Product (based on digital asset(s) per share), less such Product’s expenses and other liabilities. Because each Product does not currently operate a redemption program, there can be no assurance that the value of such Product’s shares will reflect the value of the assets held by such Product, less such Product’s expenses and other liabilities, and the shares of such Product, if traded on any secondary market, may trade at a substantial premium over, or a substantial discount to, the value of the assets held by such Product, less such Product’s expenses and other liabilities, and such Product may be unable to meet its investment objective. If the shares trade at a premium, investors who purchase shares on the secondary market will pay more for their shares than investors who purchase shares directly from authorized participants. In contrast, if the shares trade on the secondary market at a discount, investors who purchase shares directly from authorized participants will pay more for their shares than investors who purchase shares on the secondary market. Grayscale intends to attempt to have shares of its Products quoted on a secondary market. However, there is no guarantee that we will be successful. Although the shares of certain products have been approved for trading on a secondary market, investors in the new products should not assume that the shares will ever obtain such an approval due to a variety of factors, including questions regulators, such as the SEC, FINRA, or other regulatory bodies may have regarding such products. As a result, shareholders of such products should be prepared to bear the risk of investment in the shares indefinitely. The shares of each Product are not registered under the Securities Act of 1933, the Securities Exchange Act of 1934 (except for Products that are SEC reporting companies), the Investment Company Act of 1940, or any state securities laws. The Products are offered in private placements pursuant to the exemption from registration provided by Rule 506(c) under Regulation D of the Securities Act of 1933 and are only available to accredited investors. As a result, the shares of each Product are restricted and subject to significant limitations on resales and transfers. Potential investors in any Product should carefully consider the long-term nature of an investment in that Product prior to making an investment decision. The shares of certain Products are also publicly quoted on OTC Markets and shares that have become unrestricted in accordance with the rules and regulations of the SEC may be bought and sold throughout the day through any brokerage account. Grayscale's private placements are only available to Accredited Investors as defined in rule 501(a) of Regulation D under the Securities Act of 1933, as amended. Most individuals are not Accredited Investors. An individual must earn more than $200,000 a year (or $300,000 per year with a spouse or spousal equivalent), have a net worth over $1 million either alone or together with a spouse or spousal equivalent, excluding their primary residence, or hold in good standing their Series 7, Series 65, or Series 82 professional certifications. Entities must have $5 million in liquid assets or all beneficial owners must be Accredited Investors. Except as noted below, Grayscale does not store, hold, or maintain custody or control of any Product’s digital assets, but instead has entered into a Custodian Agreement on behalf of each Product with Coinbase Custody Trust Company, LLC (the “Custodian”), a third party to facilitate the security of each Product’s digital assets. The Custodian controls and secures each Product’s digital asset account, a segregated custody account to store private keys, which allow for the transfer of ownership or control of the digital asset, on each Product’s behalf. If the Custodian resigns or is removed by Grayscale or otherwise, without replacement, it could trigger early termination of such Product. Grayscale Investments, LLC currently serves as a key maintainer for any Product’s TAO holdings. For Financial Professional Use Only

All Products — 12 Crypto Private Funds Our private fund represents an alternative investment opportunity for experienced investors who are interested in exploring differentiated exposure to the emerging crypto asset class. Our private fund is available to eligible Accredited Investors who are also Qualified Purchasers. Crypto Private Fund This product is offered as a private fund through Grayscale Advisors. This is available only to eligible Accredited Investors who are also Qualified Purchasers. Product name launch date minimum investment grayscale dynamic income fund 10/2/2023 $250,000 For Financial Professional Use Only

All Products — 13 Crypto Private Funds – Disclosure An investment in the Grayscale Dynamic Income Fund ("GDIF" or the "Fund") is speculative and involves a high degree of risk. The program is not suitable for all investors. The shares are illiquid with restrictions on transferability and resale. Each investor or prospective investor should be aware that they may be required to bear the financial risk of this investment for an indefinite period of time. An investor may lose all or a substantial part of its investment. The Fund does not represent a complete investment portfolio. There can be no assurance that the investment objectives of the Fund will be achieved. The managers and portfolio structure provided herein may be subject to change. Interests in Grayscale Dynamic Income Fund LP (“GDIF” or the “Fund”) are offered through Grayscale Advisors, LLC (the “Manager”) and/or its placement agents. The Manager is registered with the U.S. Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). Interests in GDIF have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or any state or other securities laws, and will be offered and sold only to “accredited investors” within the meaning of Rule 501(a) of Regulation D under the Securities Act, and in compliance with any applicable state or other securities laws. GDIF is available for investment by eligible Accredited Investors who are also Qualified Purchasers (any individual, trust, or family-owned company with investments1 equal to or greater than $5 million, an investment manager with $25 million or more under management, a company holding $25 million or more in investments, or a qualified institutional buyer under Rule 144A) The Fund will not be registered as an investment company under the U.S. Investment Company Act of 1940, as amended (the “40 Act”), and will not be required to adhere to certain restrictions and requirements under the 40 Act, and investors will not be afforded the protections of the 40 Act. This is for informational purposes only and is not an offer, solicitation or recommendation to purchase or sell any securities or partnership interest in GDIF. The Fund is offered or sold pursuant to a Fund Private Placement Memorandum (“PPM”) and related documents (such as an Agreement of Limited Partnership) that set forth detailed information regarding the Fund, including investment program and restrictions, management fees and expenses, investment risks and conflicts of interest. This material does not present a full or balanced description of the Fund, and should not be used as the exclusive basis for an investment decision. Potential investors are urged to consult a professional adviser regarding any economic, tax, legal or other consequences of entering into any transactions or investment described herein. Potential investors should carefully review the PPM and related documents. An investment in the Fund is not a direct investment in Digital Assets, the shares are designed to provide investors with an indirect way to gain investment exposure to Digital Assets. Cybersecurity attacks and other security threats cannot be anticipated, and the solution can cause procedural changes and/or additional costs for secure online transactions. Cyber security issues can occur with the portfolio manager or with a third-party entity which handles operations for the Fund. Market conditions; supply and demand for specific cryptocurrencies; competition from similar currencies; interest rates; tax rates; government rules; regulations; fiscal policies; effects of inflation; and other risks all can impact the value, use and acceptance of cryptocurrencies. The trading prices of many Digital Assets have experienced extreme volatility in recent periods and may continue to do so. Extreme volatility in the future, including further declines in the trading prices of Digital Assets, could have a material adverse effect on the value of the Fund.

All Products — 14 Crypto Private Funds – Disclosure Cryptocurrency and staking rewards are known to be very volatile and investor returns will be as well. The Fund may suffer losses due to staking, delegating, and other related services the Manager intends to engage in on the Fund’s behalf. Smart contracts are a new technology and ongoing development may magnify initial problems, cause volatility on the networks that use smart contracts and reduce interest in them, which could have an adverse impact on the value of Digital Assets that deploy smart contracts. If the Digital Asset awards and transaction fees for recording transactions on the Digital Asset Network underlying a Fund component are not sufficiently high to incentivize miners or validators, or if certain jurisdictions continue to limit or otherwise regulate mining or validating activities, miners and validators may cease expanding processing power or demand high transaction fees, which could negatively impact the value of the Fund components and the value of the Fund interests. Participation in staking and earning staking rewards requires significant technical expertise and may involve substantial fees and/ or agency costs in respect of staking through a third-party provider. Digital assets involve a new rapidly evolving industry that is subject to a variety of factors that are unknown and/or difficult to evaluate. The digital markets are susceptible to extreme price fluctuations, theft, loss and destruction and cryptocurrency exchanges are unregulated and may be more exposed to fraud and failure. An investment will involve significant risks due to the nature of this investment. Digital assets involve a new rapidly evolving industry that is subject to a variety of factors that are unknown and/or difficult to evaluate. The digital markets are susceptible to extreme price fluctuations, theft, loss and destruction and cryptocurrency exchanges are unregulated and may be more exposed to fraud and failure. An investment will involve significant risks due to the nature of this investment. Understand the conflicts of interest among the parties involved with this investment such as Grayscale, the stalking operations, and the custodian of funds. This information is disclosed in the Private Placement Memorandum (PPM). Investors should not expect to redeem shares on-demand, the Fund is considered illiquid.

All Products — 15 Important Information and Risk Factors Important Information Investments in digital assets are speculative investments that involve high degrees of risk, including a partial or total loss of invested funds. Digital assets are not suitable for any investor that cannot afford loss of the entire investment. This brochure is for informational purposes only and is not an offer, solicitation or recommendation to purchase or sell any securities. This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. It is strictly for illustrative, educational, or informational purposes and is subject to change. Potential investors are urged to consult a professional adviser regarding any economic, tax, legal or other consequences of entering into any transactions or investment described herein. The funds discussed in this brochure rely on third party service providers to perform certain functions essential to the affairs of the funds and the replacement of such service providers could pose a challenge to the safekeeping of the digital asset and to the operations of the funds. Extreme volatility of trading prices that many digital assets have experienced in recent periods and may continue to experience, could have a material adverse effect on the value of the funds discussed herein and the shares could lose all or substantially all of their value. Digital assets represent a new and rapidly evolving industry. The value of the funds discussed here depend on the acceptance of the digital assets, the capabilities and development of blockchain technologies and the fundamental investment characteristics of the digital asset Digital asset networks are developed by a diverse set of contributors and the perception that certain high-profile contributors will no longer contribute to the network could have an adverse effect on the market price of the related digital asset. Digital assets may have concentrated ownership and large sales or distributions by holders of such digital assets could have an adverse effect on the market price of such digital assets. A substantial direct investment in digital assets may require expensive and sometimes complicated arrangements in connection with the acquisition, security and safekeeping of the digital asset and may involve the payment of substantial acquisition fees from third party facilitators through cash payments of U.S. dollars. Because the value of the private placement shares is correlated with the value of digital asset(s) held by the private placements, it is important to understand the investment attributes of, and the market for, the underlying digital asset. Risk Factors for Investing in Digital Assets For financial professionals only

Grayscale 866.775.0313 sales@grayscale.com

Grayscale Bitcoin Trust ETF (the “Trust”) has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Trust has filed with the SEC for more complete information about the Trust and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Trust or any authorized participant will arrange to send you the prospectus (when available) if you request it by calling (833) 903 - 2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101.