Filed Pursuant To Rule 433

Registration No. 333-275079

November 6, 2024

Grayscale Investor Deck Q3 2024 for financial professionals only

Grayscale Investor Deck Q3 2024 for financial professionals only

about grayscale firm overview our story our history for financial professionals only

about grayscale firm overview our story our history for financial professionals only

Firm Overview Headquartered in Stamford, CT With products in the U.S. and Europe, and clients globally A decade of crypto expertise Grayscale as founded in 2013 A leading crypto asset manager With over a decade of crypto experience 100+ Diverse team of financial professionals For Financial Professionals Only

Our Story G Investor Deck | 4 Established Grayscale was founded in 2013 and has a decade of operational experience in managing crypto investment funds. Expert Grayscale combines expertise in traditional finance with a deep specialization in the crypto asset class. Pioneering Grayscale created the first publicly-traded Bitcoin US Investment fund and continues to pioneer access to investment opportunities in crypto. Our Mission As we continue our journey to bring investment opportunities to scale in this nascent asset class, we are focused on both educating investors on the crypto asset class and providing them with a range of potential solutions to help fit their investment needs. Grayscale enables investors to access the digital economy through a suite of future-forward investment products. Founded in 2013, Grayscale has over a decade of industry leading expertise as a crypto-focused asset manager. Investors, advisors, and allocators turn to Grayscale for exposure to single-asset, diversified, and thematic investment products. Grayscale Investments, LLC ("Grayscale") is the parent holding company of Grayscale Advisors, LLC, an SEC-registered investment adviser, as well as Grayscale Securities, LLC, a limited- purpose, SEC-registered broker/dealer and member of FINRA. Grayscale is not registered as an investment adviser under the Investment Advisers Act of 1940 and none of the investment products sponsored or managed by Grayscale are registered under the Investment Company Act of 1940. Invest in your share of the future For Financial Professionals Only

Our Story G Investor Deck | 4 Established Grayscale was founded in 2013 and has a decade of operational experience in managing crypto investment funds. Expert Grayscale combines expertise in traditional finance with a deep specialization in the crypto asset class. Pioneering Grayscale created the first publicly-traded Bitcoin US Investment fund and continues to pioneer access to investment opportunities in crypto. Our Mission As we continue our journey to bring investment opportunities to scale in this nascent asset class, we are focused on both educating investors on the crypto asset class and providing them with a range of potential solutions to help fit their investment needs. Grayscale enables investors to access the digital economy through a suite of future-forward investment products. Founded in 2013, Grayscale has over a decade of industry leading expertise as a crypto-focused asset manager. Investors, advisors, and allocators turn to Grayscale for exposure to single-asset, diversified, and thematic investment products. Grayscale Investments, LLC ("Grayscale") is the parent holding company of Grayscale Advisors, LLC, an SEC-registered investment adviser, as well as Grayscale Securities, LLC, a limited- purpose, SEC-registered broker/dealer and member of FINRA. Grayscale is not registered as an investment adviser under the Investment Advisers Act of 1940 and none of the investment products sponsored or managed by Grayscale are registered under the Investment Company Act of 1940. Invest in your share of the future For Financial Professionals Only

Our History Since 2013, Grayscale has pioneered modern asset management and has been a leader in the crypto investment industry. Investor Deck | 5 Innovative Bitcoin Fund Grayscale launches one of the first Bitcoin investment funds for accredited investors 2013 2015 First-Ever Ethereum Fund Grayscale launches the first-ever Ethereum investment fund for accredited investors 2017 2018 First Publicly-Traded Ethereum Fund Our Ethereum fund becomes the first publicly-available ethereum fund trading on OTC Markets 2019 2020 2021 Drop Gold Ad Campaign Grayscale launches Drop Gold, a campaign comparing Bitcoin as digital gold with traditional gold First Publicly-Traded Bitcoin Fund Our Bitcoin fund becomes the first publicly-available Bitcoin fund trading on OTC Markets Cross-Industry Sponsorships Grayscale became the first crypto-focused company to sponsor an NFL team (NY Giants), and the first to advertise in a print publication (The New York Times)First SEC-Reporting Bitcoin Fund Our Bitcoin fund becomes the first SEC-reporting Bitcoin fund, offering unprecedented transparency for investors and regulators alike 2023 First Spot Bitcoin ETP Our Bitcoin fund becomes the first spot Bitcoin ETP to begin trading in the U.S. on NYSE Arca 2024 Grayscale Wins Lawsuit Against SEC Grayscale wins our lawsuit against the SEC to turn our Bitcoin fund into a spot Bitcoin ETP For Financial Professionals Only

Our History Since 2013, Grayscale has pioneered modern asset management and has been a leader in the crypto investment industry. Investor Deck | 5 Innovative Bitcoin Fund Grayscale launches one of the first Bitcoin investment funds for accredited investors 2013 2015 First-Ever Ethereum Fund Grayscale launches the first-ever Ethereum investment fund for accredited investors 2017 2018 First Publicly-Traded Ethereum Fund Our Ethereum fund becomes the first publicly-available ethereum fund trading on OTC Markets 2019 2020 2021 Drop Gold Ad Campaign Grayscale launches Drop Gold, a campaign comparing Bitcoin as digital gold with traditional gold First Publicly-Traded Bitcoin Fund Our Bitcoin fund becomes the first publicly-available Bitcoin fund trading on OTC Markets Cross-Industry Sponsorships Grayscale became the first crypto-focused company to sponsor an NFL team (NY Giants), and the first to advertise in a print publication (The New York Times)First SEC-Reporting Bitcoin Fund Our Bitcoin fund becomes the first SEC-reporting Bitcoin fund, offering unprecedented transparency for investors and regulators alike 2023 First Spot Bitcoin ETP Our Bitcoin fund becomes the first spot Bitcoin ETP to begin trading in the U.S. on NYSE Arca 2024 Grayscale Wins Lawsuit Against SEC Grayscale wins our lawsuit against the SEC to turn our Bitcoin fund into a spot Bitcoin ETP For Financial Professionals Only

the case for crypto the modern investment landscape growth potential historical performance diversified portfolios grayscale crypto sectors for financial professionals only grayscale

the case for crypto the modern investment landscape growth potential historical performance diversified portfolios grayscale crypto sectors for financial professionals only grayscale

The Modern Investment Landscape Investor Deck | 7 Inflation, currency debasement, and declining purchasing power These forces, propelled by unprecedented central bank money printing, have led some investors to consider crypto to help build and protect their wealth. Corporate and institutional adoption of crypto Growing acceptance of crypto has shifted the conversation to how-not if-to allocate to crypto in a diversified portfolio. Demographic shifts and wealth transfer An unprecedented transfer of wealth to younger generations has created a new wave of digital-first investors and early adopters of crypto. Disruption of traditional industries Blockchain and other emerging technologies are decentralizing traditional industries, providing rare opportunity for investors to capture newly created value. G For Financial Professionals Only

The Modern Investment Landscape Investor Deck | 7 Inflation, currency debasement, and declining purchasing power These forces, propelled by unprecedented central bank money printing, have led some investors to consider crypto to help build and protect their wealth. Corporate and institutional adoption of crypto Growing acceptance of crypto has shifted the conversation to how-not if-to allocate to crypto in a diversified portfolio. Demographic shifts and wealth transfer An unprecedented transfer of wealth to younger generations has created a new wave of digital-first investors and early adopters of crypto. Disruption of traditional industries Blockchain and other emerging technologies are decentralizing traditional industries, providing rare opportunity for investors to capture newly created value. G For Financial Professionals Only

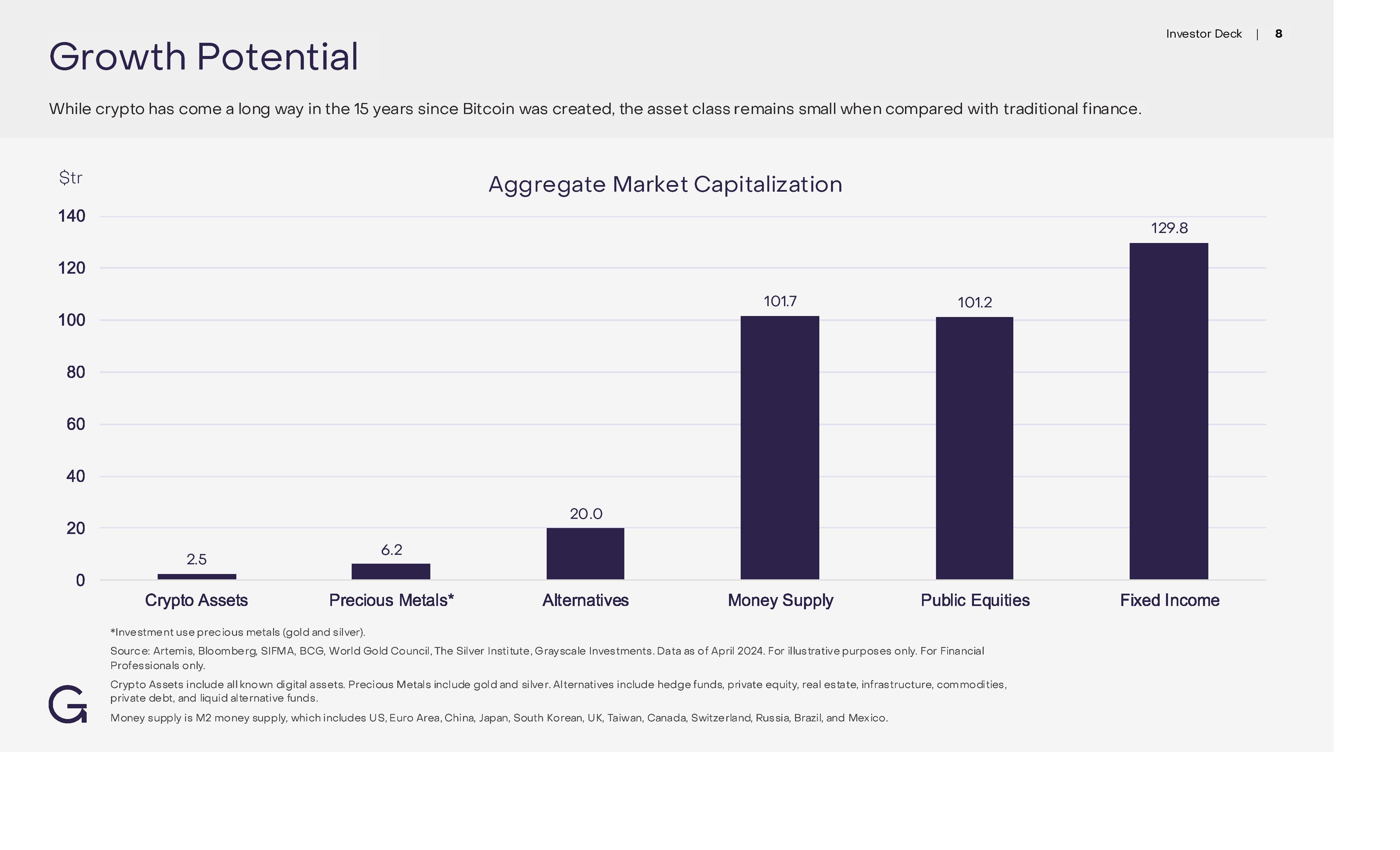

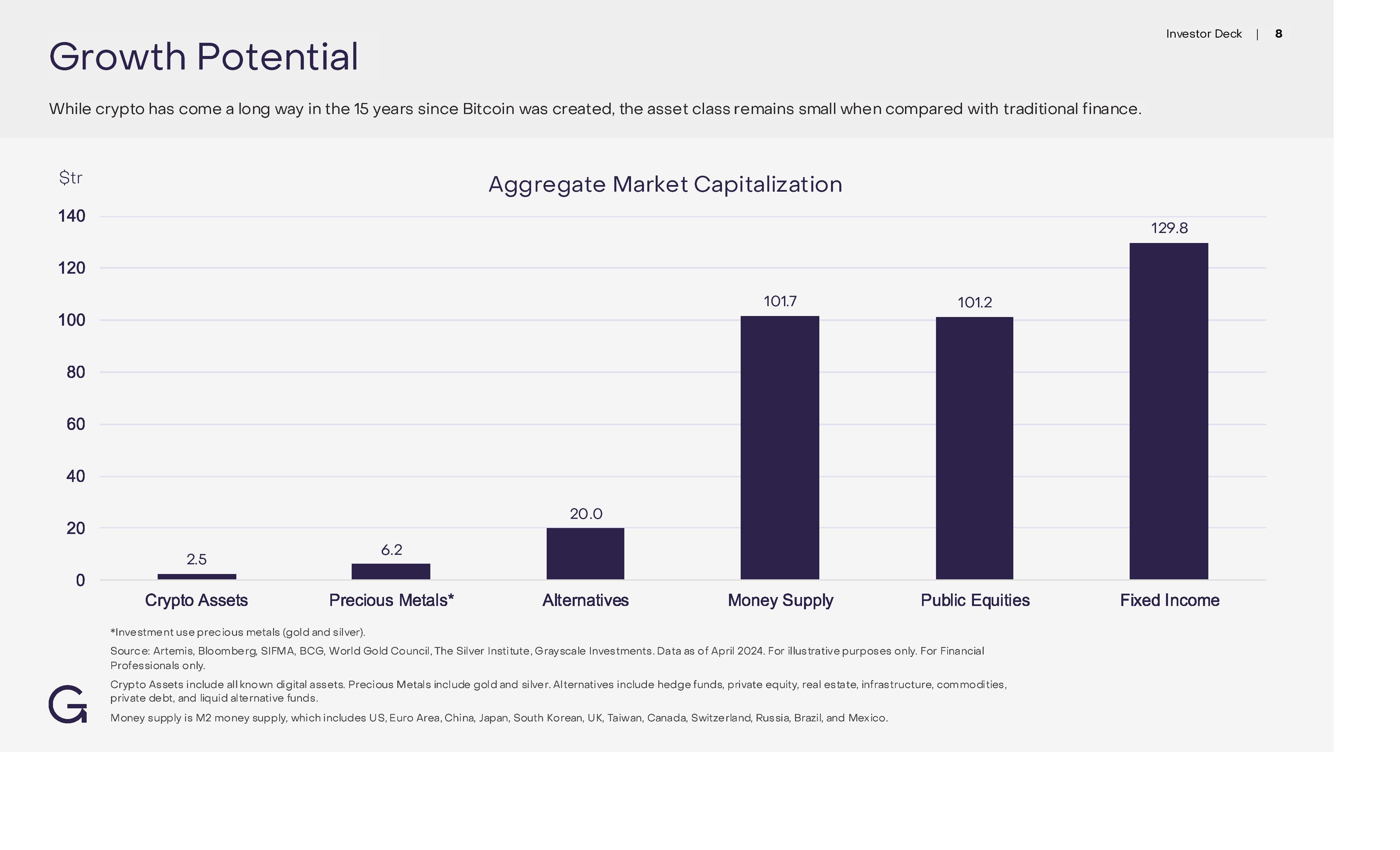

Growth Potential While crypto has come a long way in the 15 years since Bitcoin was created, the asset class remains small when compared with traditional finance. $tr 140 120 100 80 60 40 20 6.2 2.5 0 Crypto Assets Precious Metals* *Investment use precious metals (gold and silver). G Aggregate Market Capitalization 20.0 Alternatives 101.7 101.2 Money Supply Investor Deck | 8 129.8 Public Equities Fixed Income Source: Artemis, Bloomberg, SIFMA, BCG, World Gold Council, The Silver Institute, Grayscale Investments. Data as of April 2024. For illustrative purposes only. For Financial Professionals only. Crypto Assets include all known digital assets. Precious Metals include gold and silver. Alternatives include hedge funds, private equity, real estate, infrastructure, commodities, private debt, and liquid alternative funds. Money supply is M2 money supply, which includes US, Euro Area, China, Japan, South Korean, UK, Taiwan, Canada, Switzerland, Russia, Brazil, and Mexico.

Historical Performance Bitcoin was the best-performing major asset in eight of the past 11 years. Investor Deck | 9 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Average Bitcoin 428% Real Estate 27% Bitcoin 36% Bitcoin 120% Bitcoin 1375% US Treasuries 1% Bitcoin 95% Bitcoin 305% Bitcoin 60% Commodities 26% Bitcoin 157% Bitcoin 671% US Equities 32% US Equities 14% Real Estate 2% US Equities 12% EM Equities 37% US Bonds 0% US Equities 31% Gold 25% Commodities 40% Gold 0% US Equities 26% US Equities 15% Real Estate 2% US Bonds 6% US equities 1% Commodities 11% US Equities 22% Gold -2% Real Estate 29% US Equities 18% Real Estate 39% US Treasuries - 12% Gold 13% Real Estate 9% E2013 2014 2015 Commodities - 1% US Treasuries 5% US Treasuries 1% 2016 201b M Equities 11% Gold 14% Real Estate -4% EM Equities 8% EM Equities 18% US Equities 29% US Bonds - 13% Real Estate 12% EM Equities 3% US Bonds -2% Gold -1% US Bonds 1% Gold 8% Real Estate 10% US Equities -4% Gold 18% US Treasuries 8% US Bonds -2% US Equities -18% EM Equities 10% Gold 3% EM Equities -3% EM Equities -2% Gold -10% Real Estate 8% Commodities 6% Commodities - 14% Commodities 18% US Bonds 8% US Treasuries 2% EM Equities -20% US Bonds 6% US Bonds 2% US Treasuries -3% Commodities - 33% EM Equities -15% US Bonds 3% US Bonds 4% EM Equities -15% US Bonds 9% Real Estate -5% EM Equities -3% Real Estate -25% US Treasuries 4% US Treasuries 1% Gold -28% Bitcoin -58% Commodities 33% US Treasuries 1% US Treasuries 2% Bitcoin -74% US Treasuries 7% Commodities 24% Gold -4% Bitcoin -64% Commodities 4% Commodities 1% Source: Bloomberg. Data based on a range from 2013-2023. Past performance is not indicative of future results. Indexes are unmanaged and it is not possible to invest directly in an index. In descending order of returns. As of April 4, 2024. Asset Classes are represented by S&P 500 Total Return Index (US Equities), Dow Jones Real Estate Total Return Index (Real Estate), S&P/GSCI Total Return Index (Commodities), Bloomberg-Barclays US Aggregate Index (US Bonds), MSCI EM Total Return Index (EM Equities), and Bloomberg-Barclays US Treasury Index (US Treasuries). For Financial Professionals only.

Historical Performance Bitcoin was the best-performing major asset in eight of the past 11 years. Investor Deck | 9 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Average Bitcoin 428% Real Estate 27% Bitcoin 36% Bitcoin 120% Bitcoin 1375% US Treasuries 1% Bitcoin 95% Bitcoin 305% Bitcoin 60% Commodities 26% Bitcoin 157% Bitcoin 671% US Equities 32% US Equities 14% Real Estate 2% US Equities 12% EM Equities 37% US Bonds 0% US Equities 31% Gold 25% Commodities 40% Gold 0% US Equities 26% US Equities 15% Real Estate 2% US Bonds 6% US equities 1% Commodities 11% US Equities 22% Gold -2% Real Estate 29% US Equities 18% Real Estate 39% US Treasuries - 12% Gold 13% Real Estate 9% E2013 2014 2015 Commodities - 1% US Treasuries 5% US Treasuries 1% 2016 201b M Equities 11% Gold 14% Real Estate -4% EM Equities 8% EM Equities 18% US Equities 29% US Bonds - 13% Real Estate 12% EM Equities 3% US Bonds -2% Gold -1% US Bonds 1% Gold 8% Real Estate 10% US Equities -4% Gold 18% US Treasuries 8% US Bonds -2% US Equities -18% EM Equities 10% Gold 3% EM Equities -3% EM Equities -2% Gold -10% Real Estate 8% Commodities 6% Commodities - 14% Commodities 18% US Bonds 8% US Treasuries 2% EM Equities -20% US Bonds 6% US Bonds 2% US Treasuries -3% Commodities - 33% EM Equities -15% US Bonds 3% US Bonds 4% EM Equities -15% US Bonds 9% Real Estate -5% EM Equities -3% Real Estate -25% US Treasuries 4% US Treasuries 1% Gold -28% Bitcoin -58% Commodities 33% US Treasuries 1% US Treasuries 2% Bitcoin -74% US Treasuries 7% Commodities 24% Gold -4% Bitcoin -64% Commodities 4% Commodities 1% Source: Bloomberg. Data based on a range from 2013-2023. Past performance is not indicative of future results. Indexes are unmanaged and it is not possible to invest directly in an index. In descending order of returns. As of April 4, 2024. Asset Classes are represented by S&P 500 Total Return Index (US Equities), Dow Jones Real Estate Total Return Index (Real Estate), S&P/GSCI Total Return Index (Commodities), Bloomberg-Barclays US Aggregate Index (US Bonds), MSCI EM Total Return Index (EM Equities), and Bloomberg-Barclays US Treasury Index (US Treasuries). For Financial Professionals only.

G

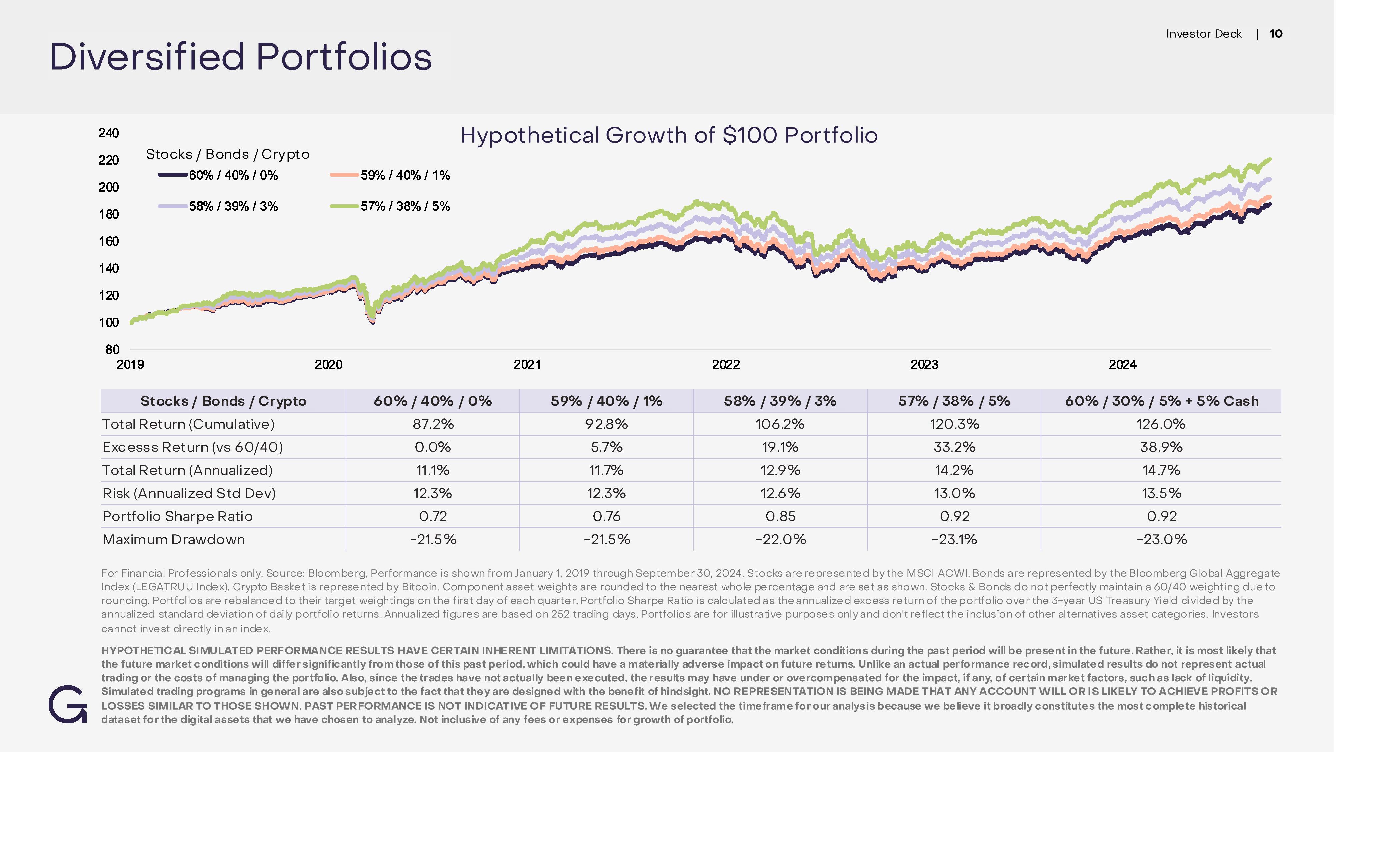

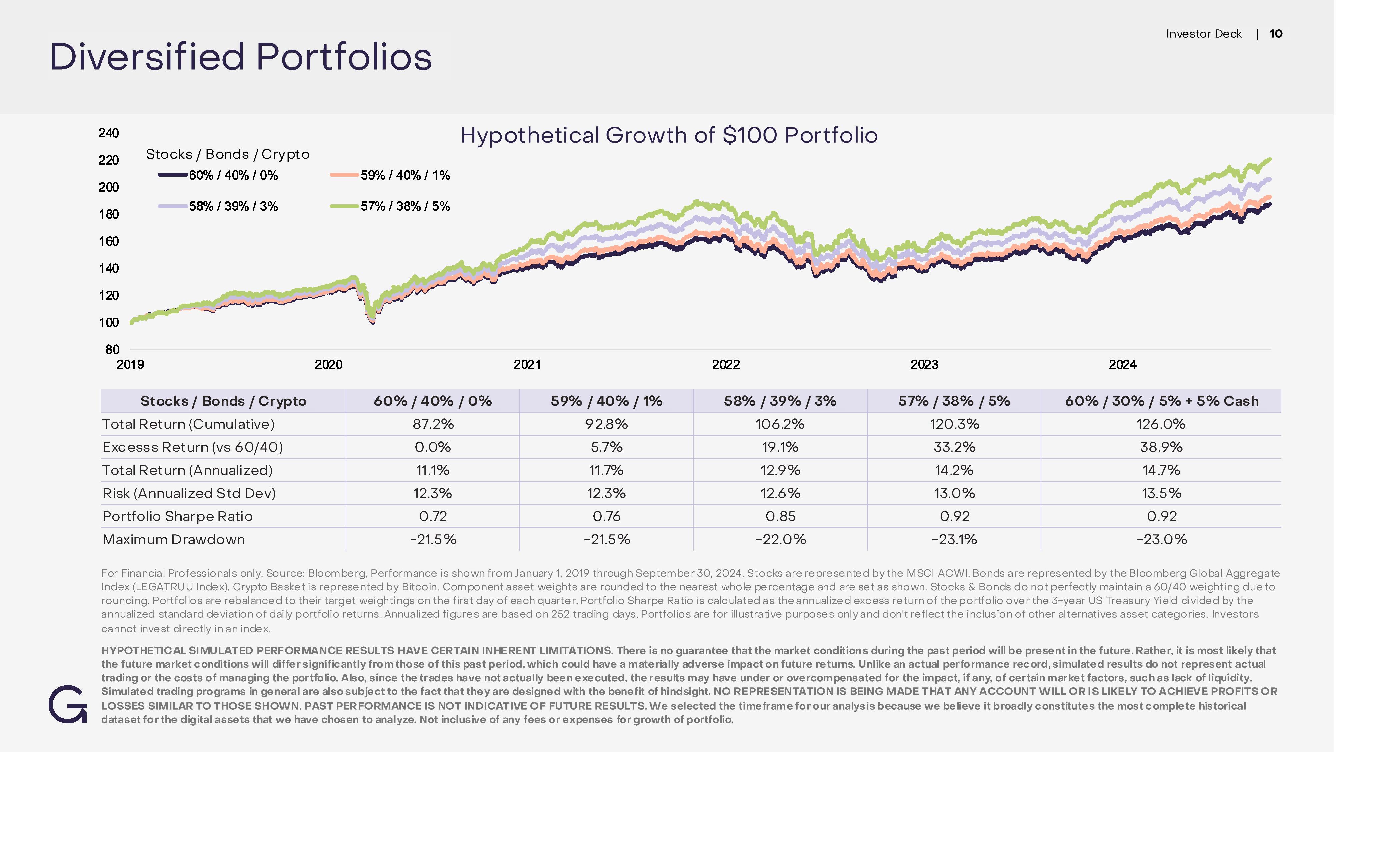

Diversified Portfolios 240 220 Stocks/Bonds / Crypto •60% / 40% / 0% 59% / 40% / 1% 200 58% / 9% / 3% 57% / 38% / 5% 180 160 140 120 100 80 2019 Hypothetical Growth of $100 Portfolio Investor Deck | 10 G Stocks / Bonds / Crypto Total Return (Cumulative) Excesss Return (vs 60/40) Total Return (Annualized) Risk (Annualized Std Dev) Portfolio Sharpe Ratio Maximum Drawdown 2020 2021 2022 2023 2024 60% / 40% / 0% 87.2% 59% / 40% / 1% 92.8% 58% / 39%/3% 106.2% 57% / 38% / 5% 60% / 30% / 5% + 5% Cash 120.3% 126.0% 0.0% 5.7% 19.1% 33.2% 38.9% 11.1% 11.7% 12.9% 14.2% 14.7% 12.3% 12.3% 12.6% 13.0% 13.5% 0.72 -21.5% 0.76 -21.5% 0.85 -22.0% 0.92 0.92 -23.1% -23.0% For Financial Professionals only. Source: Bloomberg, Performance is shown from January 1, 2019 through September 30, 2024. Stocks are represented by the MSCI ACWI. Bonds are represented by the Bloomberg Global Aggregate Index (LEGATRUU Index). Crypto Basket is represented by Bitcoin. Component asset weights are rounded to the nearest whole percentage and are set as shown. Stocks & Bonds do not perfectly maintain a 60/40 weighting due to rounding. Portfolios are rebalanced to their target weightings on the first day of each quarter. Portfolio Sharpe Ratio is calculated as the annualized excess return of the portfolio over the 3-year US Treasury Yield divided by the annualized standard deviation of daily portfolio returns. Annualized figures are based on 252 trading days. Portfolios are for illustrative purposes only and don't reflect the inclusion of other alternatives asset categories. Investors cannot invest directly in an index. HYPOTHETICAL SIMULATED PERFORMANCE RESULTS HAVE CERTAIN INHERENT LIMITATIONS. There is no guarantee that the market conditions during the past period will be present in the future. Rather, it is most likely that the future market conditions will differ significantly from those of this past period, which could have a materially adverse impact on future returns. Unlike an actual performance record, simulated results do not represent actual trading or the costs of managing the portfolio. Also, since the trades have not actually been executed, the results may have under or overcompensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. We selected the time frame for our analysis because we believe it broadly constitutes the most complete historical dataset for the digital assets that we have chosen to analyze. Not inclusive of any fees or expenses for growth of portfolio.

Diversified Portfolios 240 220 Stocks/Bonds / Crypto •60% / 40% / 0% 59% / 40% / 1% 200 58% / 9% / 3% 57% / 38% / 5% 180 160 140 120 100 80 2019 Hypothetical Growth of $100 Portfolio Investor Deck | 10 G Stocks / Bonds / Crypto Total Return (Cumulative) Excesss Return (vs 60/40) Total Return (Annualized) Risk (Annualized Std Dev) Portfolio Sharpe Ratio Maximum Drawdown 2020 2021 2022 2023 2024 60% / 40% / 0% 87.2% 59% / 40% / 1% 92.8% 58% / 39%/3% 106.2% 57% / 38% / 5% 60% / 30% / 5% + 5% Cash 120.3% 126.0% 0.0% 5.7% 19.1% 33.2% 38.9% 11.1% 11.7% 12.9% 14.2% 14.7% 12.3% 12.3% 12.6% 13.0% 13.5% 0.72 -21.5% 0.76 -21.5% 0.85 -22.0% 0.92 0.92 -23.1% -23.0% For Financial Professionals only. Source: Bloomberg, Performance is shown from January 1, 2019 through September 30, 2024. Stocks are represented by the MSCI ACWI. Bonds are represented by the Bloomberg Global Aggregate Index (LEGATRUU Index). Crypto Basket is represented by Bitcoin. Component asset weights are rounded to the nearest whole percentage and are set as shown. Stocks & Bonds do not perfectly maintain a 60/40 weighting due to rounding. Portfolios are rebalanced to their target weightings on the first day of each quarter. Portfolio Sharpe Ratio is calculated as the annualized excess return of the portfolio over the 3-year US Treasury Yield divided by the annualized standard deviation of daily portfolio returns. Annualized figures are based on 252 trading days. Portfolios are for illustrative purposes only and don't reflect the inclusion of other alternatives asset categories. Investors cannot invest directly in an index. HYPOTHETICAL SIMULATED PERFORMANCE RESULTS HAVE CERTAIN INHERENT LIMITATIONS. There is no guarantee that the market conditions during the past period will be present in the future. Rather, it is most likely that the future market conditions will differ significantly from those of this past period, which could have a materially adverse impact on future returns. Unlike an actual performance record, simulated results do not represent actual trading or the costs of managing the portfolio. Also, since the trades have not actually been executed, the results may have under or overcompensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. We selected the time frame for our analysis because we believe it broadly constitutes the most complete historical dataset for the digital assets that we have chosen to analyze. Not inclusive of any fees or expenses for growth of portfolio.

crypto products lifecycle features private placement products public quotation products grayscale for financial professionals only

crypto products lifecycle features private placement products public quotation products grayscale for financial professionals only

Investor Deck | 12 Crypto Sectors The Grayscale Crypto Sectors is a framework designed to set the standard for organizing the the crypto asset class. Our products may provide investible exposure to certain underlying assets that fall within the five crypto sectors. GRAYSCALE® Currencies Smart contract Platforms Financials Grayscale Bitcoin Cash Trust Grayscale Litecoin Trust Grayscale stellar Lumens Trust Grayscale Zcash Trust Grayscale XRP Trust Grayscale Smart Contract Platform Ex-Ethereum Fund Grayscale Solana Trust Grayscale Near Trust Grayscale Stacks Trust Grayscale Sui Trust Grayscale Avalanche Trust Grayscale Decentralized Finance (DeFi) Fund Grayscale Maker DAO Trust Grayscale AAVE Trust В X 2 M A Consumer & Culture Utilities & Services Grayscale decentraland Trust Grayscale Live peer Trust Grayscale Filecoin Trust Grayscale Basic Attention Token Trust Grayscale Chainlink Trust S Grayscale Bittensor Trust फै For Financial Professionals Only. Examples provided for illustrative purposes only. Holdings are subject to change. Indexes are unmanaged and it is not possible to invest directly in an index. G

Crypto Product Lifecycle All of Grayscale's crypto products follow a four- step lifecycle-with the ultimate goal being uplisting of the product into an ETP. Depending on their time of inception, each product will sit at a different stage of this lifecycle. Grayscale Bitcoin Trust (ticker: GBTC) was the first product to have completed this four-step lifecycle. It uplisted to NYSE Arca as the first spot Bitcoin ETP trading in the U.S. on January 11, 2024. Grayscale Bitcoin Trust ("GBTC"), an exchange traded product, is not registered under the Investment Company Act of 1940 (or the '40 Act) and therefore is not subject to the same regulations and protections as 1940 Act registered ETFs and mutual funds. GBTC is subject to significant risk and heightened volatility. GBTC is not suitable for all investors and an investor may lose all their money. G For illustrative purposes only. For Financial Professionals only. 1 Launch Private Placement 2 Obtain Public Quotation on Secondary Market 3 Become SEC Reporting 4 Uplist to ETP Investor Deck | 13

Private Placement Grayscale products first launch as private placements, allowing accredited investors to gain crypto exposure through a familiar investment vehicle structure. Shares purchased in the private placements are initially restricted for one year. Grayscale Smart Contract Platform Ex-Ethereum Fund 2 Public Quotation Grayscale pioneered obtaining public quotations for unrestricted shares of our private placements. This provides liquidity to existing private placement investors by allowing them to continue to hold their shares in their brokerage account or sell them through their broker in the public market. This also allows all investors- accredited or not-to access Grayscale products through certain brokerage or retirement accounts, regardless of investment size or holding period. Due to the lack of an ongoing redemption program, publicly traded shares may trade at premiums or discounts to the value of their underlying assets. GSOL Grayscale Solana Trust 3 Become SEC Reporting Grayscale products are the first SEC-reporting companies in the industry. The requirements of being SEC reporting exceed the standard of reporting already met by these products as OTC Markets public quotations. This also reduces the initial one-year holding period of the private placement to six months. 4 ETP Investor Deck | 14 Grayscale believes its SEC-reporting products present a strong case for uplisting when permitted by the U.S. regulatory environment. In connection with ETP uplisting, products would have ongoing creation and redemptions, and the arbitrage mechanism inherent to ETPs would help the product more closely track the value of its underlying holdings, after deduction of expenses. GBTC Grayscale Bitcoin Trust ETF Grayscale NEAR Trust Grayscale Stacks Trust Grayscale Decentralized Al Fund DEFG ETCG Grayscale Decentralized Finance (DeFi) Fund GLIV Grayscale Livepeer Trust FILG BCHG Grayscale Bitcoin Cash Trust Grayscale Ethereum Classic Trust GDLC Grayscale Digital Large Cap fund. GXLM Grayscale Stellar Lumens Trust Grayscale Horizen Trust LTCN BTC Grayscale Bitcoin Mini Trust ETF ETHE Grayscale Ethereum Trust ETF ETH Grayscale Ethereum Mini Trust ETF Grayscale Maker DAO Trust Grayscale Sui Trust Grayscale Filecoin Trust MANA HZEN Grayscale Decentraland Trust Grayscale Bittensor Trust GLNK Grayscale Avalanche Trust Grayscale Litecoin Trust Grayscale XRP Trust Grayscale AAVE Trust Grayscale Chainlink Trust GBAT Grayscale Basic attention Token Trust ZCSH Grayscale Zcash TrustGBTC, BTC, ETHE, and ETH, exchange traded products, are not registered under the Investment Company Act of 1940 (or the '40 Act) and therefore are not subject to the same regulations and protections as 1940 Act registered ETFs and mutual funds.For Financial Professionals Only

Crypto Product Features Grayscale offers single-asset, diversified, and thematic crypto investment products, designed to provide investors exposure to the asset class securely and conveniently. Key Features Accesses securities through investment accounts Enables investment through certain tax-advantaged accounts, such as certain retirement accounts (e.g., IRAS and self-directed IRAs) Allows investors exposure to crypto without the need to buy, store, and safekeep crypto directly Offers a structure that financial professionals and tax advisors are already familiar with Provides diversification into crypto through the ease of a single investment vehicle G Investor Deck | 15 For financial Professionals Only

Single Asset Crypto Products Investor Deck | 16 Private Placement Public Quotation Single Asset products Inception Date Minimum Investment Grayscale AAVE Trust 10.02.2024 $25,000 Holding Period 12+ months Ticker Annual Fees SEC Reporting1 N/A3 2.5% Grayscale Avalanche Trust 08.20.2024 $25,000 12+ months N/A3 2.5% Grayscale Basic Attention Trust 02.26.2021 $25,000 12 months GBAT 2.5% Grayscale Bitcoin Cash Trust 03.01.2018 $25,000 6 months BCHG 2.5% X Grayscale Bittensor Trust 08.07.2024 $25,000 12+ months N/A3 2.5% Grayscale Chainlink Trust 02.26.2021 $25,000 12 months GLNK 2.5% Grayscale Decentraland Trust 02.26.2021 $25,000 12 months MANA 2.5% Grayscale Ethereum Classic Trust 04.24.2017 $25,000 6 months ETCG 2.5% X Grayscale Filecoin Trust 03.15.2021 $25,000 12 months FILG 2.5% Grayscale Horizen Trust 08.06.2018 $25,000 6 months HZEN 2.5% X Grayscale Litecoin Trust 03.01.2018 $25,000 6 months LTCN 2.5% X Grayscale Livepeer Trust 03.10.2021 $25,000 12 months GLIV 2.5% Grayscale Maker TAO Trust 08.06.2024 $25,000 12+ months N/A3 2.5% Grayscale Near Trust 05.23.2024 $25,000 12+ months N/A3 2.5% Grayscale Solana Trust 11.18.2021 $25,000 12 months GSOL 2.5% Grayscale Stacks Trust 05.23.2024 $25,000 12+ months N/A3 2.5% Grayscale Stellar Lumens Trust2 12.06.2018 $25,000 6 months GXLM 2.5% X Grayscale Sui Trust 08.06.2024 $25,000 12+ months N/A3 2.5% Grayscale XRP Trust 09.05.2024 $25,000 12+ months N/A3 2.5% 10.24.2017 $25,000 6 months ZCSH 2.5% X Grayscale Zcash Trust For Financial Professionals Only 1. The Trust is a U.S. Securities and Exchange Commission (SEC) reporting company with its shares registered pursuant to Section 12(g) of the Securities Exchange Act of 1934. The Trust will file quarterly and annual reports as well as audited financial statements with the SEC. 2. "Stellar" is a trademark of the Stellar Development Foundation. The Trust is not affiliated with, endorsed by, or supported by the Stellar Development Foundation. 3. Only available through private placement. G

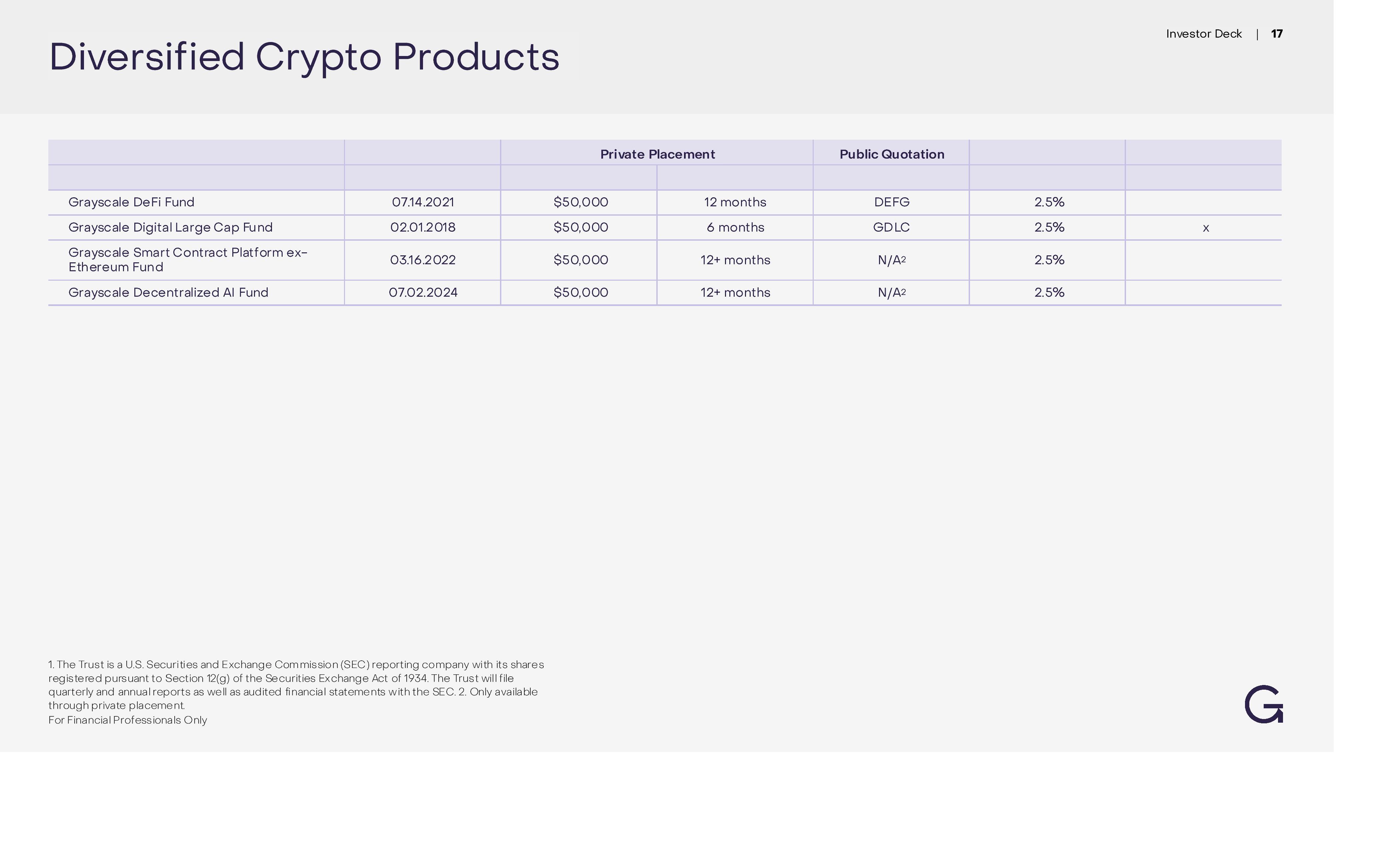

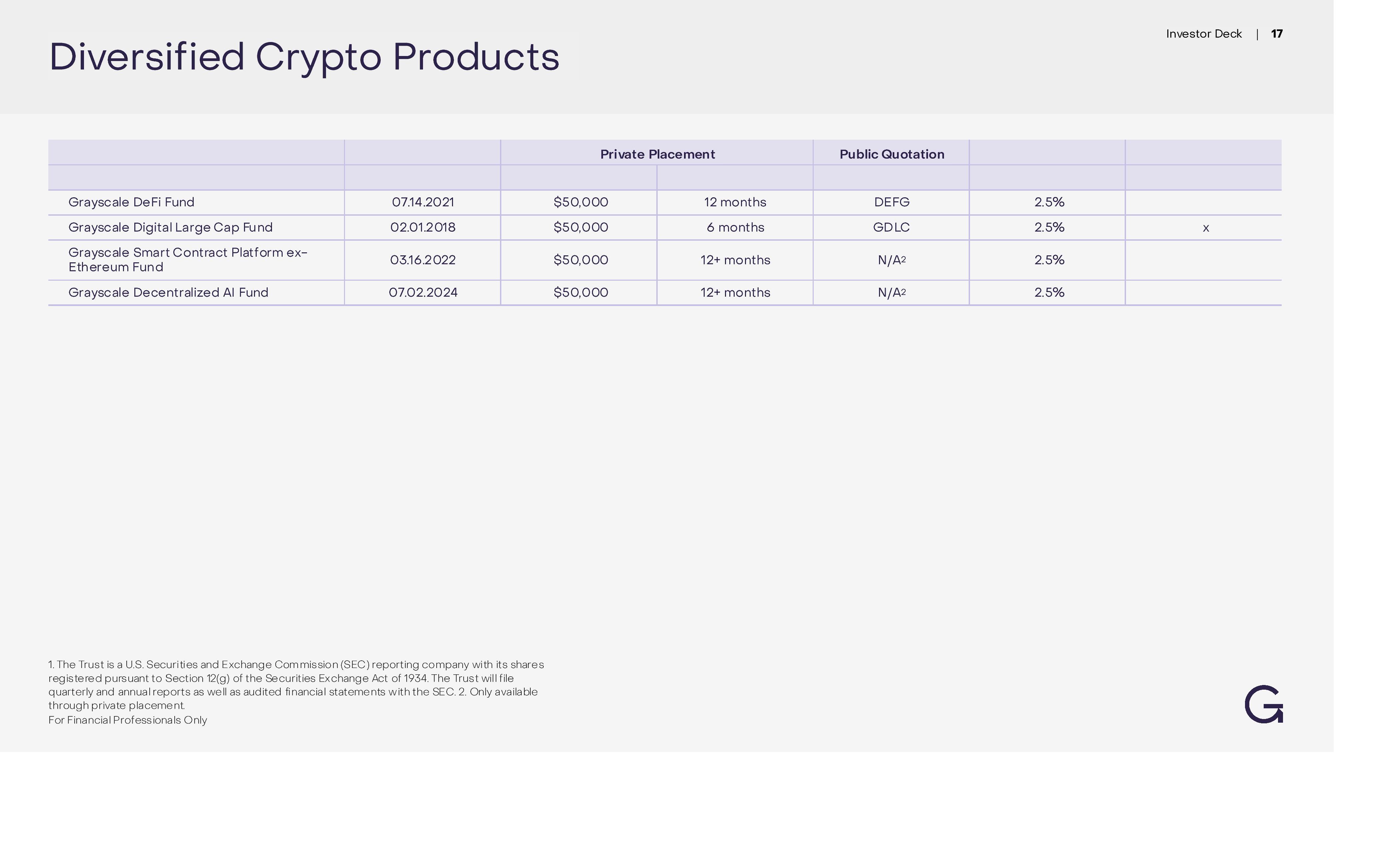

Diversified Crypto Products Private Placement Public Quotation Investor Deck | 17 Grayscale DeFi fund 07.14.2021 $50,000 12 months DEFG 2.5% Grayscale Digital Large Cap Fund 02.01.2018 $50,000 6 months GDLC 2.5% X Grayscale Smart Contract Platform ex- 03.16.2022 Ethereum Fund Grayscale Decentralized Al Fund 07.02.2024 $50,000 $50,000 12+ months N/A2 2.5% 12+ months N/A2 2.5% 1. The Trust is a U.S. Securities and Exchange Commission (SEC) reporting company with its shares registered pursuant to Section 12(g) of the Securities Exchange Act of 1934. The Trust will file quarterly and annual reports as well as audited financial statements with the SEC. 2. Only available through private placement. For Financial Professionals Only G

Important Disclosures Investor Deck | 18 Investments in the Products are speculative investments that involve high degrees of risk, including a partial or total loss of invested funds. Grayscale Products are not suitable for any investor that cannot afford loss of the entire investment. Grayscale Investments, LLC ("Grayscale") is the parent holding company of Grayscale Advisors, LLC (“GSA”), an SEC-registered investment adviser, as well Grayscale Securities, LLC (“GSS”), an SEC- registered broker/dealer and member of FINRA. Grayscale is not registered as an investment adviser under the Investment Advisers Act of 1940 and none of the investment products ("Products") sponsored or managed by Grayscale are registered under the Investment Company Act of 1940. Investments managed by GSA are registered under the Investment Company Act of 1940 and subject to the rules and regulations of the Securities Act of 1933 and Investment Advisers Act of 1940. Carefully consider each Product's investment objectives, risk factors, fees and expenses before investing. This and other information can be found in each Product's private placement memorandum, which may be obtained from Grayscale and, for each Product that is an SEC reporting company, the SEC's website, or for each Product that reports under the OTC Markets Alternative Reporting Standards, the OTC Markets website. Reports prepared in accordance with the OTC Markets Alternative Reporting Standards are not prepared in accordance with SEC requirements and may not contain all information that is useful for an informed investment decision. Read these documents carefully before investing. The shares of each Product are intended to reflect the price of the digital asset(s) held by such Product (based on digital asset(s) per share), less such Product's expenses and other liabilities. Because each Product does not currently operate a redemption program, there can be no assurance that the value of such Product's shares will reflect the value of the assets held by such Product, less such Product's expenses and other liabilities, and the shares of such Product, if traded on any secondary market, may trade at a substantial premium over, or a substantial discount to, the value of the assets held by such Product, less such Product's expenses and other liabilities, and such Product may be unable to meet its investment objective. G If the shares trade at a premium, investors who purchase shares on the secondary market will pay more for their shares than investors who purchase shares directly from authorized participants. In contrast, if the shares trade on the secondary market at a discount, investors who purchase shares directly from authorized participants will pay more for their shares than investors who purchase shares on the secondary market. This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This material is strictly for illustrative, educational, or informational purposes and is subject to change. The shares of each Product are not registered under the Securities Act of 1933 (the “Securities Act”), the Securities Exchange Act of 1934 (except for Products that are SEC reporting companies), the Investment Company Act of 1940, or any state securities laws. The Products are offered in private placements pursuant to the exemption from registration provided by Rule 506(c) under Regulation D of the Securities Act and are only available to accredited investors. As a result, the shares of each Product are restricted and subject to significant limitations on resales and transfers. Potential investors in any Product should carefully consider the long-term nature of an investment in that Product prior to making an investment decision. The shares of certain Products are also publicly quoted on OTC Markets and shares that have become unrestricted in accordance with the rules and regulations of the SEC may be bought and sold throughout the day through any brokerage account. Digital Asset Risk Disclosures Extreme volatility of trading prices that many digital assets have experienced in recent periods and may continue to experience, could have a material adverse effect on the value of the Product and the shares of each Product could lose all or substantially all of their value. Digital assets represent a new and rapidly evolving industry. The value of the Product shares depends on the acceptance of the digital assets, the capabilities and development of blockchain technologies and the fundamental investment characteristics of the digital asset. Digital asset networks are developed by a diverse set of contributors and the perception that certain high-profile contributors will no longer contribute to the network could have an adverse effect on the market price of the related digital asset. Digital assets may have concentrated ownership and large sales or distributions by holders of such digital assets could have an adverse effect on the market price of such digital assets. The value of the Product shares relates directly to the value of the underlying digital asset, the value of which may be highly volatile and subject to fluctuations due to a number of factors. A substantial direct investment in digital assets may require expensive and sometimes complicated arrangements in connection with the acquisition, security and safekeeping of the digital asset and may involve the payment of substantial acquisition fees from third party facilitators through cash payments of U.S. dollars. Because the value of the Shares is correlated with the value of digital asset(s) held by the Product, it is important to understand the investment attributes of, and the market for, the underlying digital asset. Please consult with your financial professional. The Products rely on third party service providers to perform certain functions essential to the affairs of the Product and the replacement of such service providers could pose a challenge to the safekeeping of the digital asset and to the operations of the Products. Grayscale does not store, hold, or maintain custody or control of the Products' digital assets but instead has entered into the Custodian Agreement with a third party to facilitate the security of the Products' digital assets. The Custodian controls and secures the Products' digital asset accounts, a segregated custody account to store private keys, which allow for the transfer of ownership or control of the digital asset, on the Products' behalf. If the Custodian resigns or is removed by the Sponsor or otherwise, without replacement, it could trigger early termination of the Product The Products are distributed by Grayscale Securities, LLC (Member FINRA/SIPC). SIPC coverage does not apply to crypto asset products or services discussed on the website. For Financial Professionals Only

crypto ETPs GBTC ETHE ETH BTC For financial professionals only the funds are subject to significant risks. heightened volatility and possible loss of the entire principal. Therefore, the funds are not suitable for all investors

crypto ETPs GBTC ETHE ETH BTC For financial professionals only the funds are subject to significant risks. heightened volatility and possible loss of the entire principal. Therefore, the funds are not suitable for all investors

Key Investment Themes Driving Bitcoin Adoption B Investor Deck | 20 Store of Value Bitcoin has all the properties of a strong store of value: scarcity, portability, durability, and divisibility. Scarcity is crucial for maintaining value over the long term. Medium of Exchange Bitcoin boasts several of the key characteristics of a form of money. Bitcoin is highly divisible and, in many ways, more durable than most forms of money or value. Bitcoin offers users the ability to send value anywhere in the world, at any time of day. Technological Innovation As the largest cryptocurrency by market cap, Bitcoin is often viewed as an indicator of change and improvement vs. legacy systems. For Financial Professionals Only G

GBTC Grayscale Bitcoin Trust ETF First to trade GBTC was the first spot Bitcoin exchange-traded product to commence trading in the US. Pioneering access to Bitcoin Created in 2013, GBTC has the longest operating history as the first publicly-traded Bitcoin fund in the US. High liquidity As a frequently traded spot Bitcoin ETP, GBTC is an efficient, liquid tool for investors to gain exposure to Bitcoin. Returns* Investor Deck | 21 Since NYSE 1M 3M 6M YTD 1Y 3Y 5Y 10Y Listing "Since inception" Nav CoinDesk Bitcoin Price Index (XBX) 7.88% 8.01% -5.39% -11.16% 5.80% -10.48% X X X X X X 35.76% 37.23% Cumulative Full History (%) 1M 3M 6M YTD 1Y 3Y 5Y 1ΟΥ Since Inception Nav CoinDesk Bitcoin Price Index (XBX) 7.88 5.39 8.01 5.80 -11.16 49.23 131.77 39.61 613.88 -10.48 .94 135.62 45.56 665.70 13,585.67 16,641.14 39979.37 49,143.47 Annualized ** Full History (%) 1M 3M 6M YTD 1Y 3Y 5Y 10Y Since Inception Grayscale Bitcoin Trust ETF ("GBTC"), an exchange traded product, is not registered under the Investment Company Act of 1940 (or the '40 Act) and therefore is not subject to the same regulations and protections as 1940 Act registered ETFs and mutual funds. GBTC is subject to significant risk and heightened volatility. GBTC is not suitable for all investors and an investor may lose all their money. As of 6/28/2024. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. If an active trading market for the Shares does not develop or continue to exist, the market prices and liquidity of the Shares may be adversely affected. G Pioneering access to Bitcoin Nav CoinDesk Bitcoin Price Index (XBX) 7.88 5.39 8.01 5.80 -11.16 -10.48 49.23 131.77 11.77 48.16 63.54 50.94 135.62 13.33 50.25 66.87 72.32 75.57 *The performance table shows the Trust's performance for the time periods shown from inception through 6/28/2024. The Trust's performance prior to 1/11/2024 is based on market-determined prices on the OTCQX marketplace and on the Trust's performance without an ongoing share creation and redemption program. Prior to 1/11/2024, the Trust's shares traded at both premiums and discounts to the value of the Trust's assets, less its expenses and other liabilities, which at times were substantial, in part due to the lack of an ongoing redemption program. Effective as of 1/11/2024, the Trust established an ongoing share creation and redemption program and the shares of the Trust were listed to NYSE Arca. Hence, the Trust's returns for periods prior to 1/11/2024 are not directly comparable to, and should not be used to make conclusions in conjunction with, the Trust's performance for periods subsequent to 1/11/2024. **Updated as additional returns data becomes available. For Financial Professionals only.

BTC Grayscale Bitcoin Mini Trust ETF Investor Deck | 22 Cumulative Full History 1M 3M 6M YTD 1Y 3Y 5Y 1ΟΥ (%) Since Inception Returns 8.27 X X Nav 7.87 X X CoinDesk Bitcoin Price Index XBX) 8.01 X X XXX X X X X -2.76 X X X X -2.94 X X X X -2.77 Annualized* X -2.76 X -294 X -2.77 Full History (%) 1M 3M 6M YTD 1Y 3Y 5Y 10Y Since Inception Cost Efficiency At an expense ratio of 0.15% - BTC presents investors with one of the most cost-effective options for Bitcoin exposure. Diverse Investor Base As a spin-off fund from GBTC, BTC brings with it an existing robust and diverse shareholder base. Low Share Price BTC offers one of the lowest share prices in the Bitcoin ETP landscape, allowing investors to achieve the most precision with their exposure. Price Price 8.27 X X Nav 7.87 X X CoinDesk Bitcoin 8.01 Price Index (XBX) X X X Х X X X X X X X X X X For Financial professionals Only Grayscale Bitcoin Mini Trust ETF ("BTC"), an exchange traded product, is not registered under the Investment Company Act of 1940 (or the '40 Act) and therefore is not subject to the same regulations and protections as 1940 Act registered ETFs and mutual funds. BTC is subject to significant risk and heightened volatility. BTC is not suitable for all investors and an investor may lose all their money. G Low-cost access to Bitcoin As of 6/28/2024. Trust inception date was 7/31/2024. *Updated as additional returns data becomes available. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted.

Key Investment Themes Driving Ethereum Adoption D Investor Deck | 23 Web 3.0 Infrastructure As companies increasingly incorporate blockchain into their operations and Ethereum-based applications gain traction, Ethereum offers exposure to disruptive innovations in sectors like digital commerce, finance, and supply chain management. Applications for a Modern World Boasting benefits such as programmability, accessibility, settlement efficiency, and potentially lower costs - Ethereum offers an attractive platform to build on. Today, Ethereum hosts ~ 70% of tokenized U.S. treasuries and is the dominant blockchain for decentralized finance by total value locked (TVL). Network Effects As one of the largest cryptocurrencies by market cap, Ethereum continues to be a standout in the context of users, adoption, and economic activity. Network technologies become more valuable as the number of network participants increases. For Financial Professionals Only G

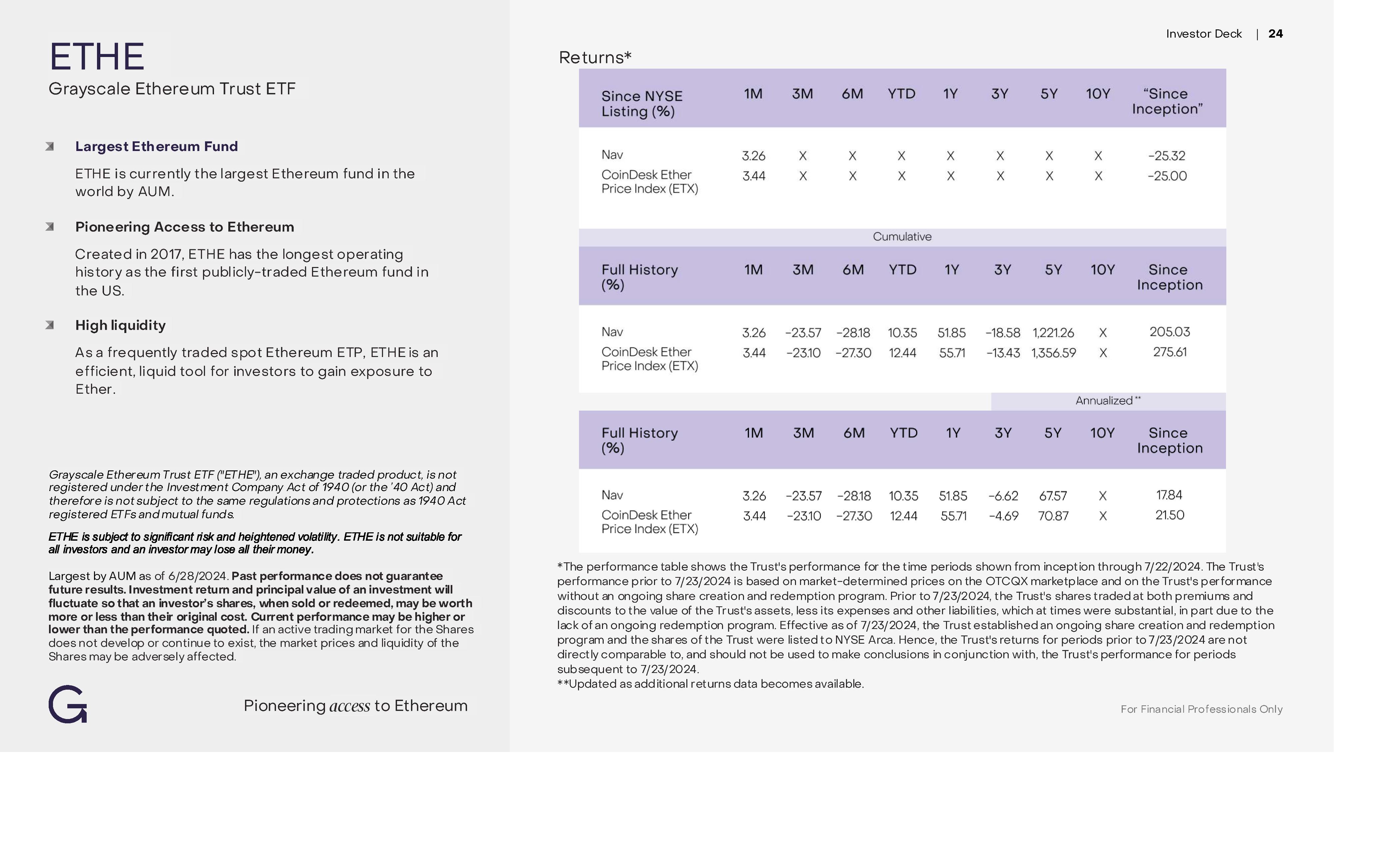

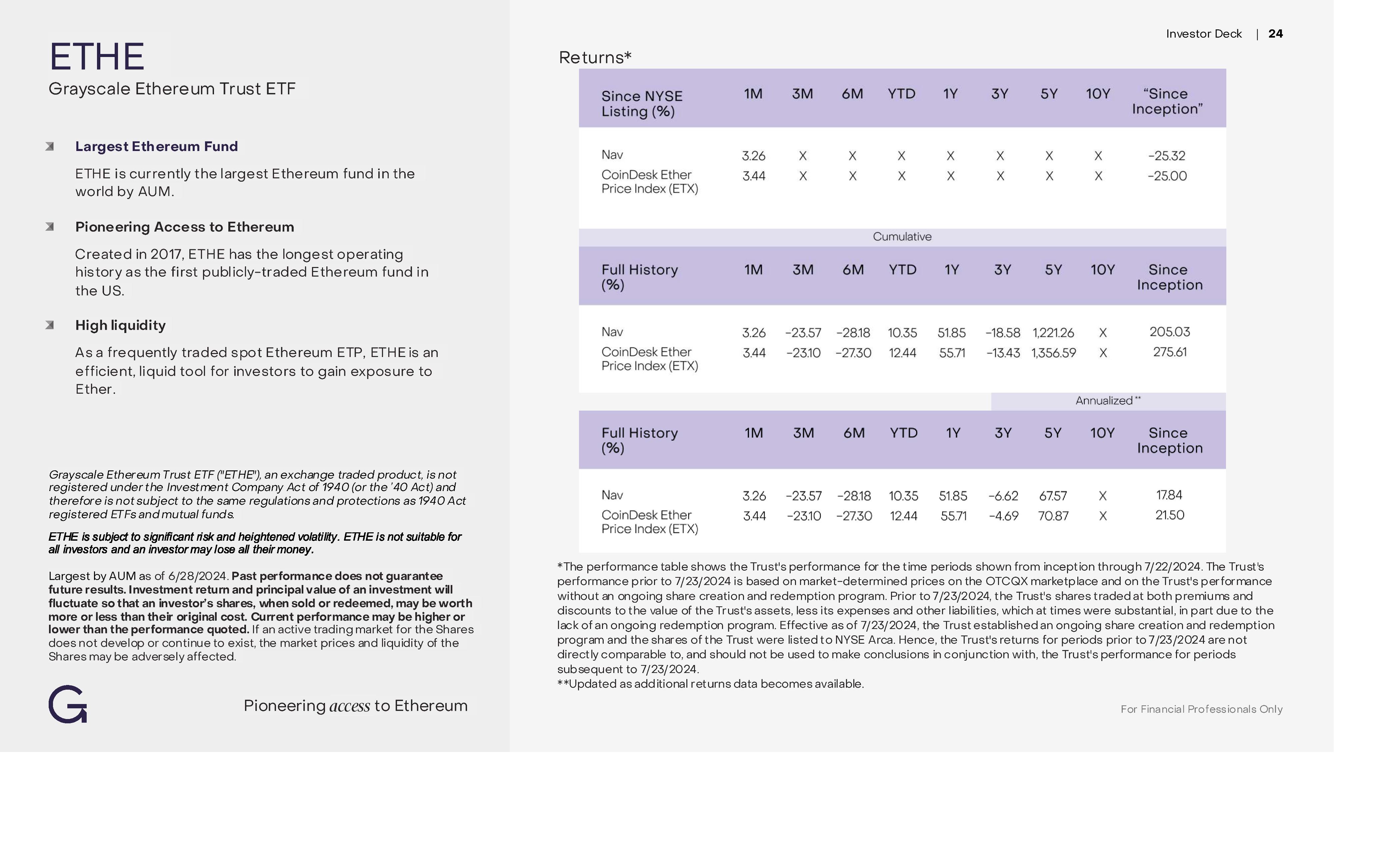

ETHE Grayscale Ethereum Trust ETF X Largest Ethereum Fund ETHE is currently the largest Ethereum fund in the world by AUM. X Pioneering Access to Ethereum Created in 2017, ETHE has the longest operating history as the first publicly-traded Ethereum fund in the US. High liquidity As a frequently traded spot Ethereum ETP, ETHE is an efficient, liquid tool for investors to gain exposure to Ether. Returns* Since NYSE Listing (%) 1M 3M 6M YTD 1Y 3Y 5Y 1ΟΥ Nav 3.26 X X X CoinDesk Ether 3.44 X X X Price Index (ETX) XX X X X X Investor Deck | 24 "Since Inception" X -25.32 X -25.00 Cumulative Full History (%) 1M 3M 6M YTD 1Y 3Y 5Y 1ΟΥ Since Inception Nav 3.26 CoinDesk Ether Price Index (ETX) 3.44 -23.57 -28.18 10.35 -23.10 -27.30 12.44 51.85 55.71 -18.58 1,221.26 X -13.43 1,356.59 X 205.03 275.61 Annualized ** Full History (%) 1M 3M 6M YTD 1Y 3Y 5Y 10Y Since Inception Grayscale Ethereum Trust ETF ("ETHE"), an exchange traded product, is not registered under the Investment Company Act of 1940 (or the '40 Act) and therefore is not subject to the same regulations and protections as 1940 Act registered ETFs and mutual funds. ETHE is subject to significant risk and heightened volatility. ETHE is not suitable for all investors and an investor may lose all their money. Largest by AUM as of 6/28/2024. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. If an active trading market for the Shares does not develop or continue to exist, the market prices and liquidity of the Shares may be adversely affected. G Pioneering access to Ethereum Nav CoinDesk Ether Price Index (ETX) 3.26 3.44 -23.57 -28.18 10.35 51.85 -6.62 67.57 -23.10 -27.30 12.44 55.71 -4.69 70.87 X X 17.84 21.50 *The performance table shows the Trust's performance for the time periods shown from inception through 7/22/2024. The Trust's performance prior to 7/23/2024 is based on market-determined prices on the OTCQX marketplace and on the Trust's performance without an ongoing share creation and redemption program. Prior to 7/23/2024, the Trust's shares traded at both premiums and discounts to the value of the Trust's assets, less its expenses and other liabilities, which at times were substantial, in part due to the lack of an ongoing redemption program. Effective as of 7/23/2024, the Trust established an ongoing share creation and redemption program and the shares of the Trust were listed to NYSE Arca. Hence, the Trust's returns for periods prior to 7/23/2024 are not directly comparable to, and should not be used to make conclusions in conjunction with, the Trust's performance for periods subsequent to 7/23/2024. **Updated as additional returns data becomes available. For Financial Professionals Only

ETH Grayscale Ethereum Mini Trust ETF Investor Deck | 25 Cumulative Full History (%) 1M 3M 6M YTD 1Y 3Y 5Y 1ΟΥ Since Inception 3.39 X X X X X X X -25.38 Nav 3.39 X X X CoinDesk Ether Price index (ETX) 3.44 X X X XX X X X -25.15 X X X -25.00 Cost Efficiency At an expense ratio of 0.15% - ETH presents investors with one of the most cost-effective options for Ether exposure. Diverse Investor Base As a spin-off fund from ETHE, ETH brings with it an existing robust and diverse shareholder base. Low Share Price ETH offers one of the lowest share prices in the Ethereum ETP landscape, allowing investors to achieve the most precision with their exposure. Price Annualized* Full History (%) 1M 3M 6M YTD 1Y 3Y 5Y 10Y Since Inception Price Nav 3.39 X X X X X X X -25.38 3.39 X X X 3.44 X -25.15 X X X X -25.00 *The Sponsor has determined to waive a portion of the Sponsor's Fee for the first 6 months beginning on the commencement of trading of the Shares on NYSE Arca, so that the fee will be 0% of the NAV of the Trust for the first $2.0 billion of the Trust's assets. If the Trust's assets exceed $2.0 billion prior to the end of the 6-month period, the Sponsor's Fee charged on assets over $2.0 billion will be 0.15%. All investors will incur the same Sponsor's Fee, which is the weighted average of those fee rates. After the 6-month waiver period is over, the Sponsor's Fee will be 0.15%. Grayscale Ethereum Mini Trust ETF ("ETH"), an exchange traded product, is not registered under the Investment Company Act of 1940 (or the '40 Act) and therefore is not subject to the same regulations and protections as 1940 Act registered ETFs and mutual funds. ETH is subject to significant risk and heightened volatility. ETH is not suitable for all investors and an investor may lose all their money. G Low-cost access to Ethereum* CoinDesk Ether Price Index (ETX) As of 7/22/2024. Trust inception date was 7/23/2024. *Updated as additional returns data becomes available. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For Financial Professionals Only

Important Disclosures Investor Deck | 26 The Grayscale Bitcoin Trust ETF ("GBTC") and the Grayscale Ethereum Trust ETF ("ETHE") have filed registration statements (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectuses in those registration statements and other documents the Trusts have filed with the SEC for more complete information about the Trusts and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Trusts or any authorized participant will arrange to send you the prospectus (when available) if you request it by calling (833)903-2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101. Please read the Grayscale Ethereum Mini Trust ETF prospectus and Grayscale Bitcoin Mini Trust ETF prospectus carefully before investing in the Trusts. Foreside Fund Services, LLC is the Marketing Agent for the Trusts. An investment in the Grayscale Bitcoin Trust ETF, Grayscale Ethereum Trust ETF, Grayscale Bitcoin Mini Trust ETF, and Grayscale Ethereum Mini Trust ETF (each a Trust and collectively the "Trusts") involves risks, including possible loss of principal. The Trusts hold Bitcoin and Ethereum; however, an investment in the Trusts is not a direct investment in Bitcoin and Ethereum. As non-diversified and single industry funds, the value of the shares may fluctuate more than shares invested in a broader range of industries. Extreme volatility, regulatory changes, and exposure to digital asset trading platforms may impact the value of Bitcoin and Ethereum, and consequently the value of the Trusts. The Trusts rely on third party service providers to perform certain functions essential to the affairs of the Trusts and the replacement of such service providers could pose a challenge to the safekeeping of the digital asset and to the operations of the Trusts. NAV per Share is not calculated in accordance with GAAP. NAV per Share is not intended to be a substitute for the Trust's Principal Market NAV per Share calculated in accordance with GAAP. For GBTC, prior to 1/11/2024, Principal Market NAV per Share was referred to as NAV per Share and NAV per share was referred to as Digital Asset Holdings per G Share. For ETHE, prior to 7/23/2024 Principal Market NAV per Share was referred to as NAV per Share and NAV per share was referred to as Digital Asset Holdings per Share. Our definitions and calculations of these non-GAAP measures may not be the same as similar measures reported by other Bitcoin or Ethereum ETPs. Please refer to the GBTC and ETHE filings with the Securities and Exchange Commission for additional information. Digital Asset Risk Disclosures Extreme volatility of trading prices that many digital assets, including Bitcoin and Ethereum, have experienced in recent periods and may continue to experience, could have a material adverse effect on the value of the Trusts and the shares could lose all or substantially all of their value. Digital assets represent a new and rapidly evolving industry. The value of the Trusts depends on the acceptance of the digital assets, the capabilities and development of blockchain technologies and the fundamental investment characteristics of the digital asset. Digital asset networks are developed by a diverse set of contributors and the perception that certain high-profile contributors will no longer contribute to the network could have an adverse effect on the market price of the related digital asset. Digital assets may have concentrated ownership and large sales or distributions by holders of such digital assets could have an adverse effect on the market price of such digital assets. The value of the Trusts relates directly to the value of the underlying digital asset, the value of which may be highly volatile and subject to fluctuations due to a number of factors. A substantial direct investment in digital assets may require expensive and sometimes complicated arrangements in connection with the acquisition, security and safekeeping of the digital asset and may involve the payment of substantial acquisition fees from third party facilitators through cash payments of U.S. dollars. Because the values of GBTC and BTC are correlated with the value of Bitcoin, it is important to understand the investment attributes of, and the market for, the underlying digital asset.. Because the values of ETHE and ETH are correlated with the value of Ether, it is important to understand the investment attributes of, and the market for, the underlying digital asset. Please consult with your financial professional. Prior to 1/11/2024, shares of GBTC were offered only in private placement transactions exempt from registration under the Securities Act of 1933, as amended (the “Securities Act") Prior to 7/23/2024, shares of ETHE were offered only in private placement transactions exempt from registration under the Securities Act of 1933, as amended (the "Securities Act"). GBTC's investment objective both before and after 1/11/2024 has remained constant, namely to reflect the value of Bitcoin held by the GBTC, less GBTC's expenses and other liabilities. However prior to 01/11/2024, GBTC did not meet its investment objective. The performance of GBTC before and after 1/11/2024 may differ significantly. ETHE's investment objective both before and after 7/23/2024 has remained constant, namely to reflect the value of Ethereum held by ETHE, less ETHE's expenses and other liabilities. However, prior to 7/23/2024, ETHE did not meet its investment objective. For Financial Professionals Only

grayscale equity ETF product for financial professionals only

grayscale equity ETF product for financial professionals only

GFOF Grayscale Future of Finance ETF Top 10 Holdings (%) GFOF offers investors the opportunity to invest in innovative businesses that are integral in evolving the financial system to build the digital economy. It does this by allowing investors to access all three pillars of the digital economy in a single fund: Financial Foundations The Drivers: companies involved in the enablement of the digital economy, such as asset managers, exchanges, and brokerages. Technology Solutions The Tools: companies providing the technology to facilitate the digital economy through data and transaction processing. MARA Holdings Inc Block Inc Coinbase Global Inc 8.06% PayPal Holdings Inc 8.03% Robinhood Markets Inc 7.71% 7.47% 7.46% 5.12% 4.70% 4.40% Terawulf Inc 4.34% Hut 8 Corp 4.06% As of 9/30/2024. Holdings are subject to change without notice. Applied Digital Corp Cipher Mining Inc Galaxy Digital Holdings Ltd X Digital Asset Infrastructure The Rails: companies directly involved in mining, energy management, and activities that power the digital asset ecosystem. G Investor Deck | 28Annualized Cumulative Performance History 1M 3M 6M YTD 1Y 3Y 5Y 10Y Since inception Since Inception Market Price,% 7.62 -1.93 1.62 7.43 84.54 X X X -9.12 -22.47 NAV Per share, % 7.97 -1.41 1.98 7.37 83.27 X X X -9.16 -22.56 Benchmark Index, %* 7.89 -1.46 1.99 7.12 82.80 X X X -9.84 -24.08 *As of 9/30/2024. Invest in the digital economy The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance, please call (833) 903-2211 or visit the Fund's website at www.grayscale.com/afof. Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV) and may trade at a discount or premium to NAV. Shares are not individually redeemable from the Fund and may be only be acquired or redeemed from the fund in creation units *Index refers to the Bloomberg Grayscale Future of Finance Index Fund Expense Ratio: 0.70% GFOF will not invest in digital assets directly or through the use of derivativesFor Financial Professionals Only

Important Disclosures Investor Deck | 29 Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the Fund, please call (833) 903-2211 or visit our website at www.grayscale.com/gfof. Read the prospectus or summary prospectus carefully before investing. Investments involve risk. Principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge. Fund Risks: The Fund is non-diversified therefore Fund's shares may rise and fall more than the value of shares of a fund that invests in securities of companies in a broader range of industries. The fund is not actively managed. Investments in foreign securities may involve risks such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. These risks are magnified in emerging markets. Investments made in small to mid-capitalization companies are subject to greater risks than large company stocks due to limited resources and inventory as well as more sensitive to adverse conditions. The Fund will not invest in digital assets directly or through the use of derivatives. The Fund also will not invest in initial coin offerings. The Fund may, however, have indirect exposure to digital assets by virtue of its investments in companies that use one or more digital assets as part of their business activities or that hold digital assets as proprietary investments. Because the Fund will not invest directly in any digital assets, it will not track price movements of any digital assets. The Bloomberg Grayscale Future of Finance Index (BGFOFN) is built using Bloomberg Intelligence's proprietary theme basket methodology. The index includes companies that Bloomberg Intelligence has projected will contribute significantly to the growth of the digital economy in three key pillars: financial foundations, digital asset infrastructure, and technology solutions. Index returns assume that dividends are reinvested and do not include the effect of management fees or expenses. It is not possible to invest directly in an index. Future of Finance Companies rely heavily on the success of the digital currency industry, the development and acceptance of which is subject to a variety of factors that are difficult to evaluate. These companies may be subject to theft, loss or destruction of cryptographic keys (required to access a user's account when transacting on blockchain). Blockchain technology is new and many of its uses may be untested. The development and acceptance of competing platforms or technologies may cause consumers or investors to use an alternative to blockchains. Digital assets that are represented on a blockchain and trade on a digital asset exchange may not necessarily benefit from viable trading markets. Digital commodities and their associated platforms are largely unregulated, and the regulatory environment is rapidly evolving. Companies that are developing financial technologies that seek to disrupt or displace established financial institutions generally face competition from much larger and more established firms. "Future of finance" is defined as the intersection of finance, technology and digital assets. GFOF is distributed by Foreside Fund Services, LLC and Grayscale Advisors, LLC is the adviser. G For Financial Professionals Only

PRIVATE FUNDS GDIF FOR FINANCIAL PROFESSIONALS ONLY GRAYSCALE

PRIVATE FUNDS GDIF FOR FINANCIAL PROFESSIONALS ONLY GRAYSCALE

GDIF: Grayscale Dynamic Income Fund GDIF allows investors to commit capital and participate in the rewards of staking without actually having to stake crypto themselves. The fund seeks to optimize income for investors in the form of staking rewards and capital appreciation from such investments. While staking can feel esoteric, Grayscale manages the various complexities and GDIF may present a unique alternative investment opportunity for certain investors. 1 2 Investors commit capital G CRO 3 Using qualitative and quantitative factors, we invest capital across a portfolio of proof-of-stake tokens We stake tokens to earn rewards (in the form of tokens) 4 11 We seek to monetize the token rewards into cash weekly 5 Investor Deck ❘31 We aim to distribute cash to investors quarterly and rebalance tokens as needed to optimize income Provided for Illustrative purposes only. For Financial Professionals only. GDIF is managed by Grayscale Advisors, LLC. GDIF is available for investment by eligible Accredited Investors who are also Qualified Purchasers (any individual, trust, or family-owned company with investments1 equal to or greater than $5 million, an investment manager with $25 million or more under management, a companyholding $25 million or more in investments, or a qualified institutional buyer under Rule 144A)

Disclosures Investor Deck 32 An investment in the Grayscale Dynamic Income Fund is speculative and involves a high degree of risk. The program is not suitable for all investors. The shares are illiquid with restrictions on transferability and resale. Each investor or prospective investor should be aware that they may be required to bear the financial risk of this investment for an indefinite period of time. An investor may lose all or a substantial part of its investment. The fund does not represent a complete investment portfolio. There can be no assurance that the investment objectives of the Fund will be achieved. The managers and portfolio structure provided herein may be subject to change. Interests in Grayscale Dynamic Income Fund LP ("GDIF" or the "Fund") are offered through Grayscale Advisors, LLC (the "Manager") and/or its placement agents. The Manager is registered with the U.S. Securities and Exchange Commission (the "SEC") under the Investment Advisers Act of 1940, as amended (the "Advisers Act"). Interests in GDIF have not been, and will not be, registered under the US. Securities Act of 1933, as amended (the "Securities Act"), or any state or other securities laws, and will be offered and sold only to “accredited investors” within the meaning of Rule 501(a) of Regulation D under the Securities Act, and in compliance with any applicable state or other securities laws. The Fund will not be registered as an investment company under the U.S. Investment Company Act of 1940, as amended (the “40 Act"), and will not be required to adhere to certain restrictions and requirements under the 40 Act, and investors will not be afforded the protections of the 40 Act. This is for informational purposes only and is not an offer, solicitation or recommendation to purchase or sell any securities or partnership interest in GDIF. The Fund is offered or sold pursuant to a Fund Private Placement Memorandum ("PPM") and related documents (such as an Agreement of Limited Partnership) that set forth detailed information regarding the Fund, including investment program and restrictions, management fees and expenses, investment risks and conflicts of interest. This material does not present a full or balanced description of the Fund, and should not be used as the exclusive basis for an investment decision. This is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal, nor shall there be any sale of any security in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of that jurisdiction. Potential investors are urged to consult a professional adviser regarding any economic, tax, legal or other consequences of entering into any transactions or investment described herein. This material may contain Fund performance information. Past performance is no guarantee of future results. Potential investors should carefully review the PPM and related documents. An investment in the Fund is not a direct investment in Digital Assets, the shares are designed to provide investors with an indirect way to gain investment exposure to Digital Assets Cybersecurity attacks and other security threats cannot be anticipated, and the solution can cause procedural changes and/or additional costs for secure online transactions. Cyber security issues can occur with the portfolio manager or with a third-party entity which handles operations for the Fund. Market conditions; supply and demand for specific cryptocurrencies; competition from similar currencies; interest rates; tax rates; government rules; regulations; fiscal policies; effects of inflation; and other risks all can impact the value, use and acceptance of cryptocurrencies. The trading prices of many Digital Assets have experienced extreme volatility in recent periods and may continue to do so. Extreme volatility in the future, including further declines in the trading prices of Digital Assets, could have a material adverse effect on the value of the Fund. Cryptocurrency and staking rewards are known to be very volatile and investor returns will be as well. The Fund may suffer losses due to staking, delegating, and other related services the Manager intends to engage in on the Fund's behalf. Smart contracts are a new technology and ongoing development may magnify initial problems, cause volatility on the networks that use smart contracts and reduce interest in them, which could have an adverse impact on the value of Digital Assets that deploy smart contracts. If the Digital Asset awards and transaction fees for recording transactions on the Digital Asset Network underlying a Fund component are not sufficiently high to incentivize miners or validators, or if certain jurisdictions continue to limit or otherwise regulate mining or validating activities, miners and validators may cease expanding processing power or demand high transaction fees, which could negatively impact the value of the Fund components and the value of the Fund interests. Participation in staking and earning staking rewards requires significant technical expertise and may involve substantial fees and/or agency costs in respect of staking through a third-party provider. Digital assets involve a new rapidly evolving industry that is subject to a variety of factors that are unknown and/or difficult to evaluate. The digital markets are susceptible to extreme price fluctuations, theft, loss and destruction and cryptocurrency exchanges are unregulated and may be more exposed to fraud and failure. An investment will involve significant risks due to the nature of this investment. Understand the conflicts of interest among the parties involved with this investment such as Grayscale, the stalking operations, and the custodian of funds. This information is disclosed in the Private Placement Memorandum (PPM). Investors should not expect to redeem shares on-demand, the Fund is considered illiquid. G For Financial Professionals Only

Hypothetical Disclosures Investor Deck | 33 Note On Hypothetical Simulated Performance Results HYPOTHETICAL SIMULATED PERFORMANCE RESULTS HAVE CERTAIN INHERENT LIMITATIONS. There is no guarantee that the market conditions during the past period will be present in the future. Rather, it is most likely that the future market conditions will differ significantly from those of this past period, which could have a materially adverse impact on future returns. Unlike an actual performance record, simulated results do not represent actual trading or the costs of managing the portfolio. Also, since the trades have not actually been executed, the results may have under or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. The hypothetical simulated performance results are based on a model that used inputs that are based on assumptions about a variety of conditions and events and provides hypothetical, not actual results. As with all mathematical models, results may vary significantly depending upon the value of the inputs given, so that a relatively minor modification of any assumption may have a significant impact on the result. Among other things, the hypothetical simulated performance calculations do not take into account all aspects of the applicable asset's characteristics under certain conditions, including characteristics that can have a significant impact on the results. Further, in evaluating the hypothetical simulated performance results herein, each prospective investor should understand that not all of the hypothetical assumptions used in the model are described herein, and conditions and events that are not accounted for by the model may have a significant adverse effect on the performance of the assets described herein. Prospective investors should consider whether the behavior of these assets should be tested based on different and/or additional assumptions from those included in the information herein. IN ADDITION TO OTHER DIFFERENCES, PROSPECTIVE INVESTORS IN A PRODUCT SHOULD NOTE THE FOLLOWING POTENTIALLY SIGNIFICANT DIFFERENCES BETWEEN THE ASSUMPTIONS MADE IN THE HYPOTHETICAL SIMULATED PERFORMANCE RESULTS INCLUDED HEREIN AND THE CONDITIONS UNDER WHICH A PRODUCT WILL PERFORM, WHICH COULD CAUSE THE ACTUAL G RETURN OF SUCH PRODUCT TO DIFFER CONSIDERABLY FROM RETURNS SET FORTH BY THE HYPOTHETICAL SIMULATED PERFORMANCE, TO BE MATERIALLY LOWER THAN THE RETURNS AND TO RESULT IN LOSSES OF SOME OR ALL OF THE INVESTMENT BY PROSPECTIVE INVESTORS: FOR EXAMPLE, EACH TRUST WILL HOLD ONLY ONE DIGITAL ASSET, WHEREAS THE HYPOTHETICAL SIMULATED PERFORMANCE RESULTS ARE INTENDED TO SHOW HYPOTHETICAL PERFORMANCE OF AN INVESTMENT MULTIPLE DIGITAL ASSETS. IN ADDITION, THE GENERAL MARKET DATA USED IN THE HYPOTHETICAL SIMULATED PERFORMANCE RESULTS DO NOT REFLECT ACTUAL TRADING ACTIVITY AND COULD NOT BE REPLICATED BY A PRODUCT IN ITS ACTUAL TRANSACTIONS. If actual trading activity was executed at levels that differed significantly from the general market data used in the hypothetical simulated performance, the actual returns achieved would have varied considerably from the results of the hypothetical simulated performances and could have been substantially lower and could result in significant losses. IN ADDITION, THE HYPOTHETICAL SIMULATED PERFORMANCE RESULTS DO NOT ASSUME ANY GAINS OR LOSSES FROM TRADING AND THEREFORE DO NOT REFLECT THE POTENTIAL LOSSES, COSTS AND RISKS POSED BY TRADING AND HOLDING ACTUAL ASSETS. The hypothetical simulated performance results do not reflect the impact the market conditions may have had upon a Product were it in existence during the historical period selected. The hypothetical simulated performance results do not reflect any fees incurred by a Product. If such amounts had been included in the hypothetical simulated performance, the results would have been lowered. AS A RESULT OF THESE AND OTHER DIFFERENCES, THE ACTUAL RETURNS OF A PRODUCT MAY BE HIGHER OR LOWER THAN THE RETURNS SET FORTH IN THE HYPOTHETICAL SIMULATED PERFORMANCE RESULTS, WHICH ARE HYPOTHETICAL AND MAY NEVER BE ACHIEVED. Reasons for a deviation may also include, but are by no means limited to, changes in regulatory and/or tax law, generally unfavorable market conditions and the Risk Factors set forth below. For Financial Professionals Only

Index Definitions Investor Deck | 34 The S&P 500 Index is a market-capitalization-weighted index that measures the performance of 500 of the largest publicly traded companies in the United States. The Dow Jones Real Estate Index tracks the performance of real estate investment trusts (REITs) and other companies that invest directly or indirectly in real estate through development, management, or ownership, including property agencies. The S&P Goldman Sachs Commodity Index is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. The Bloomberg-Barclays US Aggregate index measures the total return of investment grade fixed income securities. The MSCI Emerging Markets Index is designed to measure the financial performance of companies in fast-growing economies around the world and tracks mid-cap and large-cap stocks in 25 countries. The Bloomberg-Barclays US Treasury Index measures the total returns of nominal U.S. government notes and bonds with greater than one year remaining maturity. The MSCI ACWI captures large and mid cap representation across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries. With 2,946 constituents, the index covers approximately 85% of the global investable equity opportunity set. The CoinDesk Bitcoin Price Index (XBX) leverages real-time prices from multiple constituent exchanges to provide a representative spot price of Bitcoin in US dollars and is calculated once per second. Each constituent exchange is weighted proportionally to its trailing 24- hour liquidity with adjustments for price variance and inactivity. The CoinDesk Ether Price Index (ETX) provides a USD-denominated reference rate for the spot price of Ether (ETH). The index leverages real-time prices from multiple constituent exchanges to provide a representative spot price. G For Financial Professionals Only

Transform tomorrow grayscale info@grayscale.com www.grayscale.com 8667750313

Transform tomorrow grayscale info@grayscale.com www.grayscale.com 8667750313

Grayscale Bitcoin Trust ETF (the "Trust") has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Trust has filed with the SEC for more complete information about the Trust and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Trust or any authorized participant will arrange to send you the prospectus (when available) if you request it by calling (833) 903 - 2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101.

Grayscale Investor Deck Q3 2024 for financial professionals only

Grayscale Investor Deck Q3 2024 for financial professionals only about grayscale firm overview our story our history for financial professionals only

about grayscale firm overview our story our history for financial professionals only

Our Story G Investor Deck | 4 Established Grayscale was founded in 2013 and has a decade of operational experience in managing crypto investment funds. Expert Grayscale combines expertise in traditional finance with a deep specialization in the crypto asset class. Pioneering Grayscale created the first publicly-traded Bitcoin US Investment fund and continues to pioneer access to investment opportunities in crypto. Our Mission As we continue our journey to bring investment opportunities to scale in this nascent asset class, we are focused on both educating investors on the crypto asset class and providing them with a range of potential solutions to help fit their investment needs. Grayscale enables investors to access the digital economy through a suite of future-forward investment products. Founded in 2013, Grayscale has over a decade of industry leading expertise as a crypto-focused asset manager. Investors, advisors, and allocators turn to Grayscale for exposure to single-asset, diversified, and thematic investment products. Grayscale Investments, LLC ("Grayscale") is the parent holding company of Grayscale Advisors, LLC, an SEC-registered investment adviser, as well as Grayscale Securities, LLC, a limited- purpose, SEC-registered broker/dealer and member of FINRA. Grayscale is not registered as an investment adviser under the Investment Advisers Act of 1940 and none of the investment products sponsored or managed by Grayscale are registered under the Investment Company Act of 1940. Invest in your share of the future For Financial Professionals Only

Our Story G Investor Deck | 4 Established Grayscale was founded in 2013 and has a decade of operational experience in managing crypto investment funds. Expert Grayscale combines expertise in traditional finance with a deep specialization in the crypto asset class. Pioneering Grayscale created the first publicly-traded Bitcoin US Investment fund and continues to pioneer access to investment opportunities in crypto. Our Mission As we continue our journey to bring investment opportunities to scale in this nascent asset class, we are focused on both educating investors on the crypto asset class and providing them with a range of potential solutions to help fit their investment needs. Grayscale enables investors to access the digital economy through a suite of future-forward investment products. Founded in 2013, Grayscale has over a decade of industry leading expertise as a crypto-focused asset manager. Investors, advisors, and allocators turn to Grayscale for exposure to single-asset, diversified, and thematic investment products. Grayscale Investments, LLC ("Grayscale") is the parent holding company of Grayscale Advisors, LLC, an SEC-registered investment adviser, as well as Grayscale Securities, LLC, a limited- purpose, SEC-registered broker/dealer and member of FINRA. Grayscale is not registered as an investment adviser under the Investment Advisers Act of 1940 and none of the investment products sponsored or managed by Grayscale are registered under the Investment Company Act of 1940. Invest in your share of the future For Financial Professionals Only Our History Since 2013, Grayscale has pioneered modern asset management and has been a leader in the crypto investment industry. Investor Deck | 5 Innovative Bitcoin Fund Grayscale launches one of the first Bitcoin investment funds for accredited investors 2013 2015 First-Ever Ethereum Fund Grayscale launches the first-ever Ethereum investment fund for accredited investors 2017 2018 First Publicly-Traded Ethereum Fund Our Ethereum fund becomes the first publicly-available ethereum fund trading on OTC Markets 2019 2020 2021 Drop Gold Ad Campaign Grayscale launches Drop Gold, a campaign comparing Bitcoin as digital gold with traditional gold First Publicly-Traded Bitcoin Fund Our Bitcoin fund becomes the first publicly-available Bitcoin fund trading on OTC Markets Cross-Industry Sponsorships Grayscale became the first crypto-focused company to sponsor an NFL team (NY Giants), and the first to advertise in a print publication (The New York Times)First SEC-Reporting Bitcoin Fund Our Bitcoin fund becomes the first SEC-reporting Bitcoin fund, offering unprecedented transparency for investors and regulators alike 2023 First Spot Bitcoin ETP Our Bitcoin fund becomes the first spot Bitcoin ETP to begin trading in the U.S. on NYSE Arca 2024 Grayscale Wins Lawsuit Against SEC Grayscale wins our lawsuit against the SEC to turn our Bitcoin fund into a spot Bitcoin ETP For Financial Professionals Only